Mga Batayang Estadistika

| Nilai Portofolio | $ 913,162,000 |

| Posisi Saat Ini | 112 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

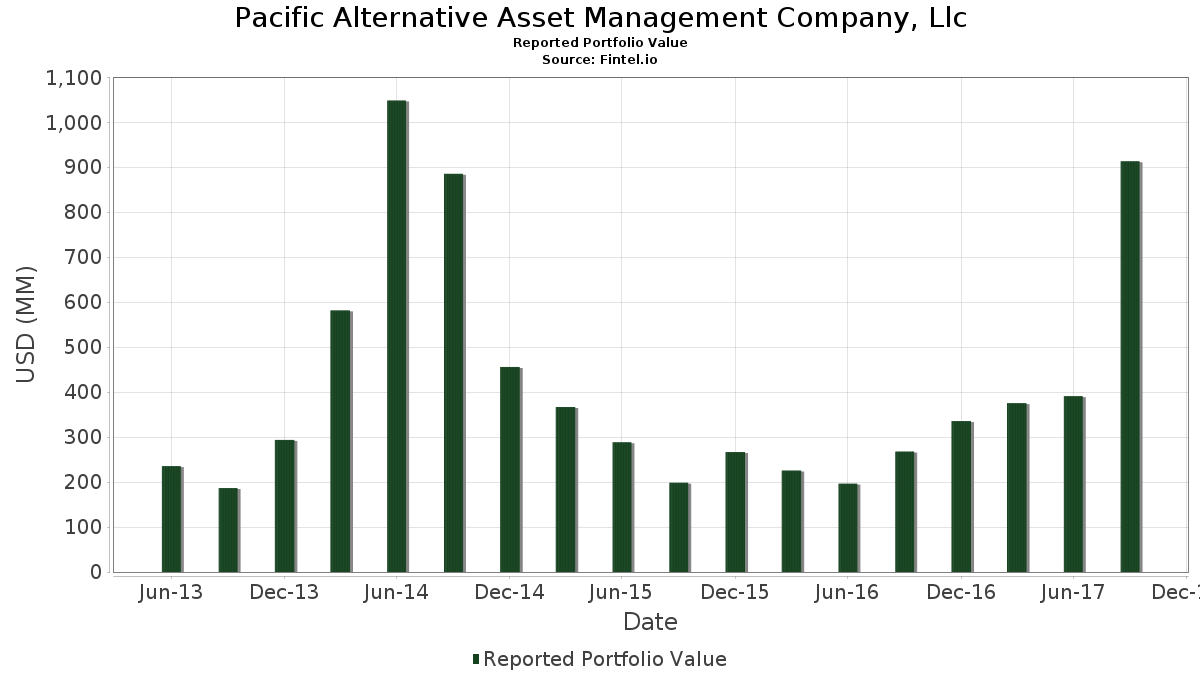

Pacific Alternative Asset Management Company, Llc telah mengungkapkan total kepemilikan 112 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 913,162,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Pacific Alternative Asset Management Company, Llc adalah NXP Semiconductors N.V. (US:NXPI) , Warner Media LLC (US:TWX) , SPDR S&P 500 ETF (US:SPY) , The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund (US:XLE) , and The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund (US:XLE) . Posisi baru Pacific Alternative Asset Management Company, Llc meliputi: The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund (US:XLE) , The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund (US:XLE) , SPDR Gold Trust (US:GLD) , SPDR Gold Trust (US:GLD) , and iShares Trust - iShares 20+ Year Treasury Bond ETF (US:TLT) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.83 | 85.48 | 9.3606 | 9.3606 | |

| 0.66 | 44.99 | 4.9269 | 4.9269 | |

| 0.64 | 43.92 | 4.8092 | 4.8092 | |

| 0.35 | 42.32 | 4.6346 | 4.6346 | |

| 0.32 | 38.52 | 4.2179 | 4.2179 | |

| 0.20 | 25.45 | 2.7872 | 2.7872 | |

| 0.19 | 23.89 | 2.6163 | 2.6163 | |

| 0.36 | 20.90 | 2.2886 | 2.2886 | |

| 0.06 | 19.22 | 2.1048 | 2.1048 | |

| 0.05 | 17.36 | 1.9012 | 1.9012 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.87 | 98.74 | 10.8128 | -8.9960 | |

| 0.21 | 53.36 | 5.8435 | -3.6267 | |

| 0.48 | 15.31 | 1.6771 | -2.8838 | |

| 0.05 | 9.36 | 1.0248 | -2.0729 | |

| 0.12 | 9.41 | 1.0309 | -1.9161 | |

| 0.44 | 27.70 | 3.0329 | -1.3661 | |

| 0.16 | 24.09 | 2.6385 | -1.2872 | |

| 0.02 | 1.98 | 0.2173 | -0.6773 | |

| 0.00 | 1.51 | 0.1656 | -0.3588 | |

| 0.00 | 0.00 | -0.3584 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2017-11-14 untuk periode pelaporan 2017-09-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NXPI / NXP Semiconductors N.V. | 0.87 | 23.41 | 98.74 | 27.51 | 10.8128 | -8.9960 | |||

| TWX / Warner Media LLC | 0.83 | 52.08 | 85.48 | 55.17 | 9.3606 | 9.3606 | |||

| SPY / SPDR S&P 500 ETF | Put | 0.21 | 38.73 | 53.36 | 44.14 | 5.8435 | -3.6267 | ||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | Call | 0.66 | 44.99 | 4.9269 | 4.9269 | ||||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | Put | 0.64 | 43.92 | 4.8092 | 4.8092 | ||||

| GLD / SPDR Gold Trust | Call | 0.35 | 42.32 | 4.6346 | 4.6346 | ||||

| GLD / SPDR Gold Trust | Put | 0.32 | 38.52 | 4.2179 | 4.2179 | ||||

| NXST / Nexstar Media Group, Inc. | 0.44 | 54.59 | 27.70 | 61.05 | 3.0329 | -1.3661 | |||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | Call | 0.20 | 25.45 | 2.7872 | 2.7872 | ||||

| IWM / iShares Trust - iShares Russell 2000 ETF | Put | 0.16 | 49.31 | 24.09 | 57.01 | 2.6385 | -1.2872 | ||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | Put | 0.19 | 23.89 | 2.6163 | 2.6163 | ||||

| VGK / Vanguard International Equity Index Funds - Vanguard FTSE Europe ETF | Put | 0.36 | 20.90 | 2.2886 | 2.2886 | ||||

| MDY / SPDR S&P MidCap 400 ETF Trust | Put | 0.06 | 19.22 | 2.1048 | 2.1048 | ||||

| MDY / SPDR S&P MidCap 400 ETF Trust | Call | 0.05 | 17.36 | 1.9012 | 1.9012 | ||||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | Put | 0.35 | 15.64 | 1.7126 | 1.7126 | ||||

| SBGI / Sinclair, Inc. | 0.48 | -11.82 | 15.31 | -14.10 | 1.6771 | -2.8838 | |||

| XRT / SPDR Series Trust - SPDR S&P Retail ETF | Put | 0.34 | 14.31 | 1.5671 | 1.5671 | ||||

| SPY / SPDR S&P 500 ETF | 0.05 | 13.81 | 1.5124 | 1.5124 | |||||

| KRE / SPDR Series Trust - SPDR S&P Regional Banking ETF | Call | 0.23 | 12.88 | 1.4103 | 1.4103 | ||||

| FEZ / SPDR Index Shares Funds - SPDR EURO STOXX 50 ETF | Put | 0.31 | 12.74 | 1.3954 | 1.3954 | ||||

| KRE / SPDR Series Trust - SPDR S&P Regional Banking ETF | Put | 0.19 | 10.87 | 1.1905 | 1.1905 | ||||

| EWZ / iShares, Inc. - iShares MSCI Brazil ETF | 0.24 | 202.11 | 9.91 | 268.96 | 1.0857 | 0.3983 | |||

| DELL / Dell Technologies Inc. | 0.12 | -35.32 | 9.41 | -18.28 | 1.0309 | -1.9161 | |||

| BAP / Credicorp Ltd. | 0.05 | -32.38 | 9.36 | -22.72 | 1.0248 | -2.0729 | |||

| AVHOQ / Avianca Holdings S.A - ADR | 1.00 | 46.33 | 7.75 | 74.70 | 0.8492 | -0.2863 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.29 | 7.61 | 0.8330 | 0.8330 | |||||

| LLL / JX Luxventure Limited | 0.04 | 119.18 | 7.56 | 147.20 | 0.8276 | 0.8276 | |||

| LAUR / Laureate Education, Inc. | 0.47 | 6.77 | 0.7417 | 0.7417 | |||||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.03 | 6.37 | 0.6977 | 0.6977 | |||||

| GLD / SPDR Gold Trust | 0.05 | 5.99 | 0.6562 | 0.6562 | |||||

| BANC / Banc of California, Inc. | 0.26 | 18.94 | 5.30 | 14.81 | 0.5808 | 0.5808 | |||

| FPH / Five Point Holdings, LLC | 0.36 | 7.25 | 4.95 | -0.88 | 0.5417 | 0.5417 | |||

| KMT / Kennametal Inc. | 0.12 | 4.94 | 0.5408 | 0.5408 | |||||

| APD / Air Products and Chemicals, Inc. | 0.03 | 111.03 | 4.91 | 123.06 | 0.5371 | 0.5371 | |||

| RSX / VanEck ETF Trust - VanEck Russia ETF | 0.22 | 4.83 | 0.5292 | 0.5292 | |||||

| US05491N1046 / BBX Capital Corporation | 0.65 | 4.82 | 0.5282 | 0.5282 | |||||

| UNVR / Univar Solutions Inc | 0.16 | 256.05 | 4.50 | 252.71 | 0.4925 | 0.4925 | |||

| TMUS / T-Mobile US, Inc. | 0.07 | 24.88 | 4.50 | 27.04 | 0.4924 | 0.4924 | |||

| JCI / Johnson Controls International plc | 0.11 | 4.32 | 0.4728 | 0.4728 | |||||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | 0.03 | 4.31 | 0.4724 | 0.4724 | |||||

| RTN / Raytheon Co. | 0.02 | 246.27 | 4.31 | 300.09 | 0.4719 | 0.4719 | |||

| ETN / Eaton Corporation plc | 0.06 | 514.53 | 4.29 | 506.65 | 0.4697 | 0.4697 | |||

| DE / Deere & Company | 0.03 | 4.27 | 0.4678 | 0.4678 | |||||

| AGCO / AGCO Corporation | 0.06 | 464.78 | 4.25 | 518.17 | 0.4657 | 0.4657 | |||

| CMI / Cummins Inc. | 0.03 | 4.24 | 0.4645 | 0.4645 | |||||

| VC / Visteon Corporation | 0.03 | -40.82 | 3.69 | -28.24 | 0.4035 | 0.4035 | |||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | Call | 0.09 | 3.55 | 0.3888 | 0.3888 | ||||

| ADNT / Adient plc | 0.04 | 154.41 | 3.51 | 226.72 | 0.3843 | 0.3843 | |||

| VGK / Vanguard International Equity Index Funds - Vanguard FTSE Europe ETF | 0.06 | 3.47 | 0.3800 | 0.3800 | |||||

| MTOR / Meritor Inc | 0.13 | 29.28 | 3.42 | 102.37 | 0.3741 | 0.3741 | |||

| GDI / Gardner Denver Holdings, Inc. | 0.12 | 305.95 | 3.41 | 416.84 | 0.3730 | 0.3730 | |||

| IIN / IntriCon Corporation | 0.28 | -5.57 | 3.35 | 39.77 | 0.3664 | 0.3664 | |||

| ENIA / Enel Americas SA - ADR | 0.33 | 3.34 | 0.3653 | 0.3653 | |||||

| HUN / Huntsman Corporation | 0.12 | 191.37 | 3.27 | 209.27 | 0.3580 | 0.3580 | |||

| WM / Waste Management, Inc. | 0.04 | 3.24 | 0.3551 | 0.3551 | |||||

| HXL / Hexcel Corporation | 0.06 | 111.13 | 3.22 | 129.60 | 0.3525 | 0.3525 | |||

| HON / Honeywell International Inc. | 0.02 | 106.77 | 3.15 | 119.83 | 0.3447 | 0.3447 | |||

| DAN / Dana Incorporated | 0.11 | 3.01 | 0.3294 | 0.3294 | |||||

| CAT / Caterpillar Inc. | 0.02 | -8.81 | 2.96 | 5.82 | 0.3244 | 0.3244 | |||

| NYRT / New York REIT, Inc. | 0.30 | 2.37 | 0.2598 | 0.2598 | |||||

| PNK / Pinnacle Entertainment, Inc. | 0.11 | 32.02 | 2.33 | 42.40 | 0.2556 | -0.1637 | |||

| DOW / Dow Inc. | 0.03 | 2.21 | 0.2416 | 0.2416 | |||||

| RTX / RTX Corporation | 0.02 | 2.18 | 0.2384 | 0.2384 | |||||

| HII / Huntington Ingalls Industries, Inc. | 0.01 | 2.16 | 0.2368 | 0.2368 | |||||

| / Delphi Technologies PLC | 0.02 | 78.65 | 2.15 | 100.65 | 0.2353 | 0.2353 | |||

| LHX / L3Harris Technologies, Inc. | 0.02 | 2.13 | 0.2334 | 0.2334 | |||||

| FTV / Fortive Corporation | 0.03 | 2.12 | 0.2319 | 0.2319 | |||||

| PNR / Pentair plc | 0.03 | 189.29 | 2.11 | 195.52 | 0.2314 | 0.2314 | |||

| DOV / Dover Corporation | 0.02 | 28.96 | 2.09 | 46.94 | 0.2287 | 0.2287 | |||

| XRT / SPDR Series Trust - SPDR S&P Retail ETF | 0.05 | 2.02 | 0.2213 | 0.2213 | |||||

| V / Visa Inc. | 0.02 | -49.45 | 1.98 | -43.27 | 0.2173 | -0.6773 | |||

| AABA / Altaba Inc | 0.03 | -68.24 | 1.96 | -61.38 | 0.2145 | 0.2145 | |||

| NYCB / Flagstar Financial, Inc. | 0.15 | 2.65 | 1.88 | 0.81 | 0.2057 | 0.2057 | |||

| ZAYO / Zayo Group Holdings, Inc. | 0.05 | -19.11 | 1.81 | -9.87 | 0.1980 | -0.3152 | |||

| CMCSA / Comcast Corporation | 0.05 | 41.79 | 1.80 | 40.19 | 0.1971 | -0.1313 | |||

| FEZ / SPDR Index Shares Funds - SPDR EURO STOXX 50 ETF | 0.04 | 1.63 | 0.1789 | 0.1789 | |||||

| BAC / Bank of America Corporation | 0.06 | -0.97 | 1.63 | 3.43 | 0.1782 | -0.2242 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.04 | -34.93 | 1.61 | -24.38 | 0.1763 | 0.1763 | |||

| XOP / SPDR Series Trust - SPDR S&P Oil & Gas Exploration & Production ETF | 0.05 | 1.59 | 0.1746 | 0.1746 | |||||

| SHW / The Sherwin-Williams Company | 0.00 | -3.01 | 1.56 | -1.08 | 0.1707 | 0.1707 | |||

| BFIN / BankFinancial Corporation | 0.10 | -32.35 | 1.53 | -27.94 | 0.1672 | 0.1672 | |||

| CHTR / Charter Communications, Inc. | 0.00 | -31.64 | 1.51 | -26.24 | 0.1656 | -0.3588 | |||

| US88104R2094 / TerraForm Power Inc. | 0.11 | 1.50 | 0.1648 | 0.1648 | |||||

| FNF / Fidelity National Financial, Inc. | 0.09 | 1.48 | 0.1622 | 0.1622 | |||||

| QSR / Restaurant Brands International Inc. | 0.02 | 74.12 | 1.22 | 77.91 | 0.1340 | 0.1340 | |||

| NLOK / NortonLifeLock Inc | 0.04 | 1.17 | 0.1277 | 0.1277 | |||||

| CIR / Circor International Inc | 0.02 | 1.14 | 0.1246 | 0.1246 | |||||

| BOX / Box, Inc. | 0.06 | -16.73 | 1.12 | -11.83 | 0.1224 | 0.1224 | |||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.01 | 1.12 | 0.1223 | 0.1223 | |||||

| MAS / Masco Corporation | 0.03 | 1.06 | 0.1165 | 0.1165 | |||||

| URI / United Rentals, Inc. | 0.01 | 1.05 | 0.1148 | 0.1148 | |||||

| VNTV / Vantiv, Inc. | 0.01 | 1.04 | 0.1135 | 0.1135 | |||||

| US28470R1023 / Eldorado Resorts, Inc. | 0.04 | -21.93 | 0.94 | 0.21 | 0.1028 | 0.1028 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.01 | 0.80 | 0.0877 | 0.0877 | |||||

| ATUS / Altice USA, Inc. | 0.03 | -12.91 | 0.80 | -26.36 | 0.0872 | 0.0872 | |||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 0.01 | -39.44 | 0.76 | -3.29 | 0.0837 | 0.0837 | |||

| CFCO / CF Corporation | 0.06 | 78.79 | 0.71 | 78.00 | 0.0780 | 0.0780 | |||

| TGNA / TEGNA Inc. | 0.05 | -7.63 | 0.71 | -14.53 | 0.0773 | 0.0773 | |||

| CACQ / Caesars Acquisition Co. | 0.03 | 0.69 | 0.0752 | 0.0752 | |||||

| HACK / Amplify ETF Trust - Amplify Cybersecurity ETF | 0.02 | 0.62 | 0.0676 | 0.0676 | |||||

| QRTEA / Qurate Retail Inc - Series A | 0.01 | -28.98 | 0.59 | -21.87 | 0.0649 | -0.1292 | |||

| CCO / Clear Channel Outdoor Holdings, Inc. | 0.11 | 90.09 | 0.51 | 82.44 | 0.0557 | 0.0557 | |||

| XME / SPDR Series Trust - SPDR S&P Metals & Mining ETF | 0.02 | 0.51 | 0.0554 | 0.0554 | |||||

| ATKR / Atkore Inc. | 0.02 | 0.45 | 0.0493 | 0.0493 | |||||

| FTR / Frontier Communications Corp. | 0.02 | -61.08 | 0.29 | -74.53 | 0.0323 | 0.0323 | |||

| I / Intelsat SA | 0.05 | -41.71 | 0.26 | -10.49 | 0.0280 | 0.0280 | |||

| SMH / VanEck ETF Trust - VanEck Semiconductor ETF | 0.00 | 0.25 | 0.0272 | 0.0272 | |||||

| US25470MAB54 / DISH Network Corp. 3.375% Bond | 0.00 | 0.23 | 0.0257 | 0.0257 | |||||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.39 | 0.00 | 0.14 | -5.44 | 0.0152 | -0.0224 | |||

| NXEO / Nexeo Solutions, Inc. | 0.11 | 0.05 | 0.0050 | 0.0050 | |||||

| WAC / Walter Investment Management Corp. | 0.06 | -31.14 | 0.03 | -57.69 | 0.0036 | 0.0036 | |||

| NIHD / NII Holdings, Inc. | 0.06 | 0.00 | 0.03 | -43.48 | 0.0028 | 0.0028 | |||

| FAST / Fastenal Company | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| COVS / Covisint Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| 698354AB3 / Pandora Media, Inc. Bond | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| GT / The Goodyear Tire & Rubber Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.1780 | ||||

| ASH / Ashland Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3584 | ||||

| CTXS / Citrix Systems, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| ATEX / Anterix Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| DOW / Dow Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| AXTA / Axalta Coating Systems Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| TIP / iShares Trust - iShares TIPS Bond ETF | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| ALSN / Allison Transmission Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| COL / Rockwell Collins, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| WSO / Watsco, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| F / Ford Motor Company | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| HD / The Home Depot, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| PPG / PPG Industries, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| 292764AB3 / EnerNOC, Inc. Bond | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 |