Mga Batayang Estadistika

| Nilai Portofolio | $ 42,620,842 |

| Posisi Saat Ini | 206 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

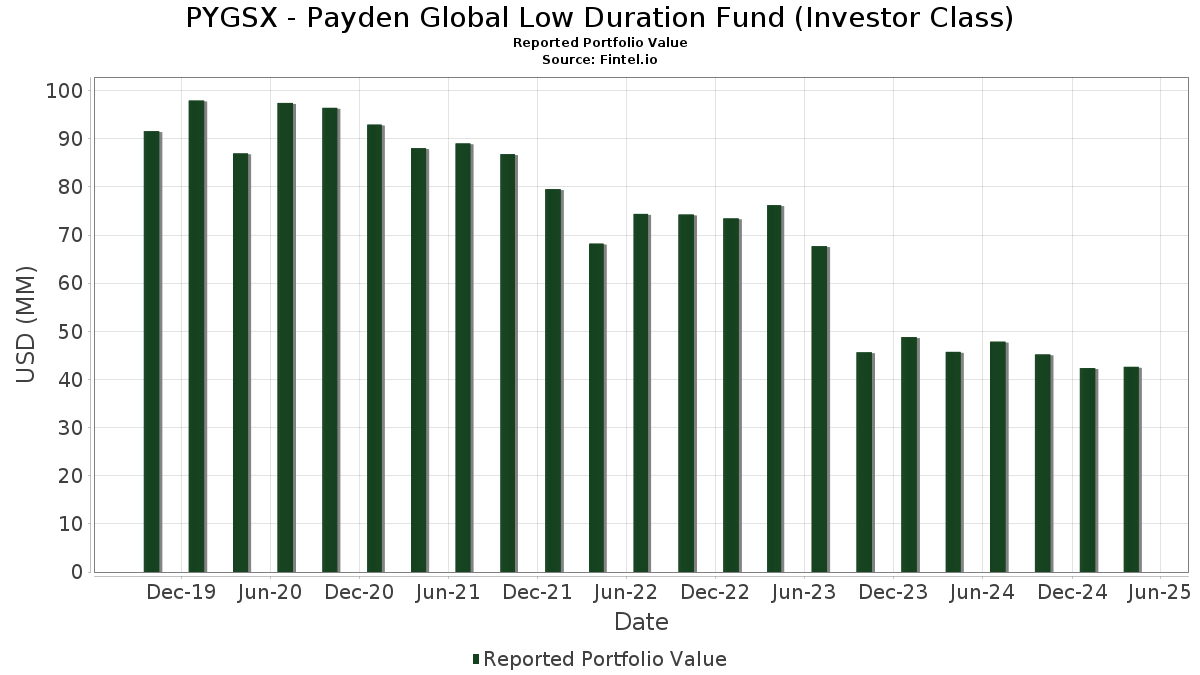

PYGSX - Payden Global Low Duration Fund (Investor Class) telah mengungkapkan total kepemilikan 206 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 42,620,842 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PYGSX - Payden Global Low Duration Fund (Investor Class) adalah Payden & Rygel Investment Group - Payden Cash Reserves Money Market Fund (US:PBHXX) , Export Development Canada (CA:US30216BJU70) , Canadian Imperial Bank of Commerce (CA:US13607GSE51) , Fannie Mae Connecticut Avenue Securities (US:US20754KAB70) , and TEXAS NATURAL GAS SECURITIZTN FIN CORP REVENUE (US:US88258MAA36) . Posisi baru PYGSX - Payden Global Low Duration Fund (Investor Class) meliputi: Export Development Canada (CA:US30216BJU70) , Canadian Imperial Bank of Commerce (CA:US13607GSE51) , Fannie Mae Connecticut Avenue Securities (US:US20754KAB70) , TEXAS NATURAL GAS SECURITIZTN FIN CORP REVENUE (US:US88258MAA36) , and Svensk Exportkredit AB (SE:US87031CAK99) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.83 | 0.83 | 2.0073 | 2.0073 | |

| 1.59 | 1.59 | 3.8601 | 1.9133 | |

| 0.63 | 1.5438 | 1.5438 | ||

| 0.58 | 1.4046 | 1.4046 | ||

| 0.50 | 1.2169 | 1.2169 | ||

| 0.35 | 0.8502 | 0.8502 | ||

| 0.30 | 0.7376 | 0.7376 | ||

| 0.30 | 0.7314 | 0.7314 | ||

| 0.30 | 0.7275 | 0.7275 | ||

| 0.25 | 0.6109 | 0.6109 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.78 | 1.8893 | -0.9487 | ||

| 0.05 | 0.1218 | -0.5947 | ||

| 0.20 | 0.4968 | -0.5872 | ||

| 0.16 | 0.3957 | -0.2015 | ||

| 0.83 | 2.0139 | -0.1746 | ||

| 0.03 | 0.0726 | -0.0511 | ||

| 0.02 | 0.0494 | -0.0437 | ||

| -0.01 | -0.0360 | -0.0360 | ||

| 0.21 | 0.5165 | -0.0318 | ||

| 0.21 | 0.5183 | -0.0305 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-25 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| United States Treasury Note/Bond / DBT (US91282CLG41) | 1.81 | 1.52 | 4.3918 | 0.1504 | |||||

| PBHXX / Payden & Rygel Investment Group - Payden Cash Reserves Money Market Fund | 1.59 | 94.34 | 1.59 | 94.49 | 3.8601 | 1.9133 | |||

| United States Treasury Note/Bond / DBT (US91282CKZ31) | 0.83 | -9.80 | 2.0139 | -0.1746 | |||||

| PAYDEN CASH RESERVES MONEY MARKET / STIV (000000000) | 0.83 | 0.83 | 2.0073 | 2.0073 | |||||

| United States Treasury Note/Bond / DBT (US91282CLL36) | 0.80 | 1.65 | 1.9485 | 0.0700 | |||||

| United States Treasury Note/Bond / DBT (US91282CME83) | 0.78 | -34.71 | 1.8893 | -0.9487 | |||||

| US30216BJU70 / Export Development Canada | 0.75 | 0.27 | 1.8172 | 0.0403 | |||||

| US13607GSE51 / Canadian Imperial Bank of Commerce | 0.71 | 2.01 | 1.7268 | 0.0671 | |||||

| US20754KAB70 / Fannie Mae Connecticut Avenue Securities | 0.70 | -0.85 | 1.7044 | 0.0185 | |||||

| United States Treasury Note/Bond / DBT (US91282CMH15) | 0.63 | 1.5438 | 1.5438 | ||||||

| United States Treasury Note/Bond / DBT (US91282CMV09) | 0.58 | 1.4046 | 1.4046 | ||||||

| US88258MAA36 / TEXAS NATURAL GAS SECURITIZTN FIN CORP REVENUE | 0.58 | -3.35 | 1.4030 | -0.0212 | |||||

| Carvana Auto Receivables Trust 2024-P1 / ABS-O (US14688NAC39) | 0.50 | 0.20 | 1.2237 | 0.0254 | |||||

| CDP Financial Inc / DBT (US125094BJ00) | 0.50 | 1.2169 | 1.2169 | ||||||

| US87031CAK99 / Svensk Exportkredit AB | 0.50 | 0.00 | 1.2143 | 0.0251 | |||||

| Dryden 113 CLO Ltd / ABS-CBDO (US26253EAZ16) | 0.50 | -0.40 | 1.2092 | 0.0177 | |||||

| PSP Capital Inc / DBT (US69376P2D61) | 0.50 | 1.43 | 1.2082 | 0.0417 | |||||

| US92212KAB26 / Vantage Data Centers LLC | 0.44 | 0.68 | 1.0787 | 0.0285 | |||||

| US12510HAK68 / Capital Automotive REIT | 0.44 | 1.15 | 1.0739 | 0.0336 | |||||

| Caisse d'Amortissement de la Dette Sociale / DBT (US12802D2P09) | 0.40 | 1.01 | 0.9793 | 0.0304 | |||||

| US05583JAN28 / BPCE SA | 0.40 | 0.00 | 0.9682 | 0.0187 | |||||

| US44891ACG04 / Hyundai Capital America | 0.39 | 0.26 | 0.9461 | 0.0193 | |||||

| US25267TAN19 / DIAMOND ISSUER SHINE 2021-1A A | 0.37 | 0.27 | 0.9117 | 0.0228 | |||||

| US22534PAE34 / Credit Agricole SA | 0.35 | 0.00 | 0.8627 | 0.0176 | |||||

| Asian Development Bank / DBT (US04517PBZ45) | 0.35 | 0.8502 | 0.8502 | ||||||

| US53947XAA00 / LoanCore 2021-CRE5 Issuer Ltd | 0.33 | -1.20 | 0.7991 | 0.0058 | |||||

| Province of British Columbia Canada / DBT (US11070TAN81) | 0.31 | 1.66 | 0.7469 | 0.0272 | |||||

| US68329AAP30 / Ontario Teachers' Finance Trust | 0.30 | 0.7376 | 0.7376 | ||||||

| Westlake Automobile Receivables Trust 2024-1 / ABS-O (US96043RAE71) | 0.30 | -0.33 | 0.7339 | 0.0131 | |||||

| OMERS Finance Trust / DBT (USC68012AH39) | 0.30 | 0.7314 | 0.7314 | ||||||

| CPPIB Capital Inc / DBT (US22411VBC19) | 0.30 | 1.69 | 0.7301 | 0.0271 | |||||

| Caisse d'Amortissement de la Dette Sociale / DBT (US12802D2R64) | 0.30 | 1.70 | 0.7287 | 0.0264 | |||||

| BNG Bank NV / DBT (XS2910505572) | 0.30 | 0.7275 | 0.7275 | ||||||

| BX Commercial Mortgage Trust 2024-XL4 / ABS-MBS (US05611VAA98) | 0.29 | -0.68 | 0.7090 | 0.0102 | |||||

| US87342RAC88 / Taco Bell Funding LLC | 0.28 | 0.00 | 0.6841 | 0.0138 | |||||

| US974153AB40 / Wingstop Funding LLC | 0.28 | 1.45 | 0.6821 | 0.0233 | |||||

| XS2711511795 / Bank Gospodarstwa Krajowego | 0.26 | 0.77 | 0.6393 | 0.0174 | |||||

| XS2706163131 / Suci Second Investment Co | 0.26 | 0.78 | 0.6319 | 0.0172 | |||||

| AU3FN0029609 / AAI Ltd | 0.25 | 0.40 | 0.6167 | 0.0161 | |||||

| US63306A4114 / National Bank of Canada into Bristol-Myers Squibb Co. | 0.25 | 0.40 | 0.6152 | 0.0125 | |||||

| Volkswagen Group of America Finance LLC / DBT (US928668CF71) | 0.25 | 0.80 | 0.6128 | 0.0151 | |||||

| UBS AG/Stamford CT / DBT (US90261AAD46) | 0.25 | 0.40 | 0.6121 | 0.0143 | |||||

| Huntington National Bank/The / DBT (US44644MAK71) | 0.25 | 0.6109 | 0.6109 | ||||||

| Asian Development Bank / DBT (US04517PCD24) | 0.25 | 0.40 | 0.6098 | 0.0161 | |||||

| US05493NAC65 / BDS 2021-FL9 Ltd | 0.25 | 0.6089 | 0.6089 | ||||||

| ARES Loan Funding III Ltd / ABS-CBDO (US04009BAN82) | 0.25 | 0.00 | 0.6058 | 0.0100 | |||||

| Neuberger Berman Loan Advisers Clo 51 Ltd / ABS-CBDO (US64135BAL36) | 0.25 | -0.80 | 0.6053 | 0.0085 | |||||

| XS2159975619 / Saudi Government International Bond | 0.25 | 0.40 | 0.6037 | 0.0149 | |||||

| BX Trust 2025-VLT6 / ABS-MBS (US12433KAC18) | 0.25 | 0.6020 | 0.6020 | ||||||

| Athene Global Funding / DBT (US04685A3T66) | 0.24 | 0.41 | 0.5931 | 0.0144 | |||||

| XS2455985569 / MDGH GMTN RSC Ltd. | 0.24 | 1.25 | 0.5916 | 0.0178 | |||||

| US168863DX33 / Republic of Chile | 0.24 | 0.83 | 0.5907 | 0.0178 | |||||

| XS2357493860 / Qatar Petroleum | 0.24 | 1.27 | 0.5838 | 0.0190 | |||||

| US775109CG49 / Rogers Communications, Inc. | 0.23 | 0.88 | 0.5589 | 0.0169 | |||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 0.23 | 0.88 | 0.5587 | 0.0158 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 0.23 | 0.88 | 0.5569 | 0.0141 | |||||

| US636180BS91 / National Fuel Gas Co | 0.23 | 0.00 | 0.5535 | 0.0123 | |||||

| United States Treasury Note/Bond / DBT (US91282CLQ23) | 0.23 | 1.80 | 0.5507 | 0.0193 | |||||

| US00914AAR32 / Air Lease Corp. | 0.23 | 0.90 | 0.5495 | 0.0160 | |||||

| US23636ABB61 / Danske Bank A/S | 0.23 | 0.90 | 0.5493 | 0.0174 | |||||

| OBX 2024-NQM12 Trust / ABS-MBS (US67448PAA12) | 0.22 | -2.62 | 0.5433 | -0.0025 | |||||

| International Bank for Reconstruction & Development / DBT (US45906M5K36) | 0.22 | 0.91 | 0.5379 | 0.0139 | |||||

| US50046PCC77 / Kommuninvest I Sverige AB | 0.22 | 0.00 | 0.5348 | 0.0115 | |||||

| US55903VBA08 / Warnermedia Holdings Inc | 0.22 | 0.92 | 0.5325 | 0.0131 | |||||

| US45866EAA55 / Intercorp Financial Services Inc | 0.22 | 1.40 | 0.5309 | 0.0181 | |||||

| BX Commercial Mortgage Trust 2024-XL5 / ABS-MBS (US05612GAC78) | 0.22 | -4.42 | 0.5257 | -0.0147 | |||||

| Palmer Square Loan Funding 2024-1 Ltd / ABS-CBDO (US69703NAA28) | 0.21 | -7.39 | 0.5183 | -0.0305 | |||||

| OBX 2024-NQM13 Trust / ABS-MBS (US67119PAP62) | 0.21 | -7.83 | 0.5165 | -0.0318 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.21 | 0.5132 | 0.5132 | ||||||

| US92212WAD20 / VAR ENERGI ASA | 0.21 | -0.47 | 0.5130 | 0.0086 | |||||

| US23636ABC45 / Danske Bank A/S | 0.21 | 0.5079 | 0.5079 | ||||||

| MT / ArcelorMittal S.A. - Depositary Receipt (Common Stock) | 0.21 | 0.48 | 0.5059 | 0.0104 | |||||

| US35564KND71 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0.21 | 31.41 | 0.5001 | 0.1278 | |||||

| US225401BC11 / UBS Group AG | 0.21 | 0.00 | 0.4995 | 0.0103 | |||||

| US00084DBA72 / ABN AMRO Bank NV | 0.20 | 0.00 | 0.4972 | 0.0095 | |||||

| United States Treasury Note/Bond / DBT (US91282CLP40) | 0.20 | -55.07 | 0.4968 | -0.5872 | |||||

| Icon Investments Six DAC / DBT (US45115AAA25) | 0.20 | 0.49 | 0.4961 | 0.0110 | |||||

| US20754LAF67 / Fannie Mae Connecticut Avenue Securities | 0.20 | -1.46 | 0.4959 | 0.0027 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 0.20 | 1.00 | 0.4957 | 0.0150 | |||||

| US69335PEY79 / PFS FINANCING CORP SER 2023-C CL A REGD 144A P/P 5.52000000 | 0.20 | 0.00 | 0.4940 | 0.0102 | |||||

| Enel Finance International NV / DBT (US29278GBD97) | 0.20 | 1.50 | 0.4940 | 0.0168 | |||||

| IMB / Imperial Brands PLC | 0.20 | 1.00 | 0.4928 | 0.0138 | |||||

| Banque Federative du Credit Mutuel SA / DBT (US06675FBC05) | 0.20 | 1.00 | 0.4914 | 0.0127 | |||||

| US639057AJ71 / NatWest Group PLC | 0.20 | -0.50 | 0.4909 | 0.0091 | |||||

| US23341CAC73 / DNB Bank ASA | 0.20 | 0.4890 | 0.4890 | ||||||

| US05610VAA08 / BSPRT 2023-FL10 Issuer Ltd | 0.20 | -0.50 | 0.4861 | 0.0080 | |||||

| US345397A605 / FORD MOTOR CREDIT CO LLC SR UNSECURED 06/25 5.125 | 0.20 | -0.50 | 0.4859 | 0.0093 | |||||

| FS Rialto 2024-FL9 Issuer LLC / ABS-CBDO (US30338WAL37) | 0.20 | -0.50 | 0.4856 | 0.0069 | |||||

| US25601B2B00 / DNB Bank ASA | 0.20 | 0.4842 | 0.4842 | ||||||

| Switch ABS Issuer LLC / ABS-O (US871044AE30) | 0.20 | 0.00 | 0.4835 | 0.0114 | |||||

| BX Trust 2024-BIO / ABS-MBS (US05612AAA43) | 0.20 | -1.00 | 0.4834 | 0.0053 | |||||

| US05608RAA32 / BX Trust | 0.20 | -1.00 | 0.4829 | 0.0061 | |||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAC99) | 0.20 | -1.49 | 0.4824 | 0.0031 | |||||

| Subway Funding LLC / ABS-O (US864300AG32) | 0.20 | 0.00 | 0.4807 | 0.0111 | |||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 0.20 | 1.03 | 0.4796 | 0.0146 | |||||

| US20268JAK97 / CommonSpirit Health | 0.20 | 0.51 | 0.4788 | 0.0118 | |||||

| CyrusOne Data Centers Issuer I LLC / ABS-O (US23284BAG95) | 0.19 | 1.05 | 0.4709 | 0.0144 | |||||

| US78403DAT72 / SBA Tower Trust | 0.19 | 1.06 | 0.4631 | 0.0143 | |||||

| US20602DAA90 / Concentrix Corp | 0.19 | 0.00 | 0.4583 | 0.0079 | |||||

| US80282KBF21 / Santander Holdings USA, Inc. | 0.19 | 0.4515 | 0.4515 | ||||||

| R2RX34 / Regal Rexnord Corporation - Depositary Receipt (Common Stock) | 0.18 | 0.00 | 0.4403 | 0.0075 | |||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 0.18 | 1.14 | 0.4315 | 0.0142 | |||||

| US78403DAP50 / SBA Tower Trust | 0.18 | 1.15 | 0.4284 | 0.0117 | |||||

| Whistler Pipeline LLC / DBT (US96337RAA05) | 0.17 | 1.18 | 0.4167 | 0.0118 | |||||

| BX Trust 2024-CNYN / ABS-MBS (US05612HAC51) | 0.17 | -0.59 | 0.4096 | 0.0055 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBN48) | 0.17 | 1.22 | 0.4036 | 0.0111 | |||||

| SANTANDER DRIVE AUTO RECEIVABLES TRUST 2024-S2 / ABS-O (US80287MAB37) | 0.16 | -7.34 | 0.3989 | -0.0235 | |||||

| US39809XAA63 / Greystone CRE Notes 2021-HC2 LTD | 0.16 | -35.20 | 0.3957 | -0.2015 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.16 | 0.3940 | 0.3940 | ||||||

| US77313LAA17 / Rocket Mortgage LLC / Rocket Mortgage Co-Issuer Inc | 0.16 | 1.27 | 0.3875 | 0.0121 | |||||

| US00774MBD65 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.15 | 0.00 | 0.3726 | 0.0073 | |||||

| Carmax Auto Owner Trust 2024-3 / ABS-O (US14319GAH48) | 0.15 | 1.33 | 0.3716 | 0.0119 | |||||

| Daimler Truck Finance North America LLC / DBT (US233853AY62) | 0.15 | 0.00 | 0.3689 | 0.0087 | |||||

| Daimler Truck Finance North America LLC / DBT (US233853BC34) | 0.15 | 0.67 | 0.3676 | 0.0090 | |||||

| US64829NAA28 / New Residential Mortgage Loan Trust 2017-4 | 0.15 | -1.97 | 0.3635 | 0.0006 | |||||

| Holcim Finance US LLC / DBT (US43475RAB24) | 0.15 | 0.3553 | 0.3553 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.14 | 0.00 | 0.3352 | 0.0080 | |||||

| US69121KAC80 / Owl Rock Capital Corp | 0.13 | 0.00 | 0.3153 | 0.0071 | |||||

| US20755DAA46 / Fannie Mae Connecticut Avenue Securities | 0.13 | -5.19 | 0.3130 | -0.0101 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0.13 | 0.3068 | 0.3068 | ||||||

| US08162CAJ99 / BENCHMARK 2018-B6 Mortgage Trust | 0.13 | -6.67 | 0.3065 | -0.0155 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 0.12 | 0.85 | 0.2902 | 0.0080 | |||||

| US03690AAD81 / Antero Midstream Corporation | 0.11 | -0.87 | 0.2788 | 0.0047 | |||||

| Santander Drive Auto Receivables Trust 2024-S1 / ABS-O (US80286UAA88) | 0.11 | -9.68 | 0.2734 | -0.0237 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.11 | 0.2700 | 0.2700 | ||||||

| US95001QAV32 / WELLS FARGO COMMERCIAL MORTGAGE TRUST 2018-C46 SER 2018-C46 CL XA V/R REGD 1.11137700 | 0.11 | -6.14 | 0.2610 | -0.0108 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 0.11 | 0.00 | 0.2587 | 0.0050 | |||||

| VB-S1 Issuer LLC - VBTEL / ABS-O (US91823ABG58) | 0.10 | 0.00 | 0.2552 | 0.0056 | |||||

| US20753VCZ94 / Connecticut Avenue Securities Trust 2020-SBT1 | 0.10 | -0.96 | 0.2525 | 0.0026 | |||||

| US35564KLU15 / Freddie Mac STACR REMIC Trust 2021-DNA6 | 0.10 | -0.97 | 0.2494 | 0.0028 | |||||

| CarMax Auto Owner Trust 2024-4 / ABS-O (US14290DAG60) | 0.10 | 1.01 | 0.2451 | 0.0069 | |||||

| Hess Midstream Operations LP / DBT (US428102AH01) | 0.10 | 0.2438 | 0.2438 | ||||||

| US37046US851 / General Motors Financial Co Inc | 0.10 | 0.2438 | 0.2438 | ||||||

| Connecticut Avenue Securities Trust 2024-R02 / ABS-MBS (US20754GAE08) | 0.10 | -0.99 | 0.2433 | 0.0016 | |||||

| Connecticut Avenue Securities Trust 2024-R06 / ABS-MBS (US20755RAC97) | 0.10 | -0.99 | 0.2432 | 0.0023 | |||||

| HIH Trust 2024-61P / ABS-MBS (US40444VAA98) | 0.10 | -1.00 | 0.2430 | 0.0029 | |||||

| Freddie Mac STACR REMIC Trust 2024-DNA3 / ABS-MBS (US35564NFA63) | 0.10 | -1.00 | 0.2425 | 0.0019 | |||||

| OBX 2025-NQM3 Trust / ABS-MBS (US67448YAC84) | 0.10 | 0.2400 | 0.2400 | ||||||

| Cross 2024-H8 Mortgage Trust / ABS-MBS (US22757GAC78) | 0.10 | -2.02 | 0.2381 | 0.0005 | |||||

| US53218DAA63 / LIFE_22-BMR2 | 0.10 | -2.04 | 0.2354 | 0.0013 | |||||

| D1RI34 / Darden Restaurants, Inc. - Depositary Receipt (Common Stock) | 0.09 | 0.00 | 0.2309 | 0.0068 | |||||

| COLT 2024-6 Mortgage Loan Trust / ABS-MBS (US19688XAA46) | 0.09 | -4.12 | 0.2274 | -0.0060 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.09 | 0.00 | 0.2255 | 0.0054 | |||||

| JP Morgan Mortgage Trust Series 2024-NQM1 / ABS-MBS (US465983AA20) | 0.09 | -6.12 | 0.2252 | -0.0107 | |||||

| Verus Securitization Trust 2024-R1 / ABS-MBS (US924926AA67) | 0.09 | -4.17 | 0.2249 | -0.0041 | |||||

| 2 YEAR U.S. TREASURY NOTE / DIR (000000000) | 0.09 | 0.2239 | 0.2239 | ||||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.09 | 1.10 | 0.2238 | 0.0057 | |||||

| Santander Drive Auto Receivables Trust 2023-S1 / ABS-O (US80286QAA76) | 0.09 | -8.08 | 0.2235 | -0.0129 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0.09 | 0.2214 | 0.2214 | ||||||

| OBX 2024-NQM14 Trust / ABS-MBS (US67119XAC83) | 0.09 | -5.38 | 0.2162 | -0.0069 | |||||

| US12529MAG33 / Cantor Commercial Real Estate Lending 2019-CF1 | 0.09 | -2.22 | 0.2141 | -0.0019 | |||||

| Glencore Funding LLC / DBT (US378272BR82) | 0.09 | 1.18 | 0.2096 | 0.0048 | |||||

| Hyundai Capital America / DBT (US44891ACT25) | 0.09 | 0.00 | 0.2082 | 0.0042 | |||||

| Santander Drive Auto Receivables Trust 2024-S3 / ABS-O (US80288CAB46) | 0.08 | -4.60 | 0.2021 | -0.0070 | |||||

| US691205AE86 / Owl Rock Technology Finance Corp | 0.08 | 0.00 | 0.2017 | 0.0050 | |||||

| US64829JAA16 / New Residential Mortgage Loan Trust 2017-1 | 0.08 | -2.41 | 0.1987 | -0.0009 | |||||

| South Bow USA Infrastructure Holdings LLC / DBT (US83007CAA09) | 0.08 | 1.27 | 0.1956 | 0.0056 | |||||

| US14040HDB87 / Capital One Financial Corp | 0.08 | 0.00 | 0.1887 | 0.0034 | |||||

| US85172FAN96 / Springleaf Finance Corp Bond | 0.08 | -1.32 | 0.1841 | 0.0017 | |||||

| US98310WAS70 / Wyndham Destinations Inc | 0.08 | -1.32 | 0.1838 | 0.0020 | |||||

| M1CH34 / Microchip Technology Incorporated - Depositary Receipt (Common Stock) | 0.08 | 1.35 | 0.1828 | 0.0043 | |||||

| US853496AC17 / Standard Industries Inc/NJ | 0.07 | 0.00 | 0.1811 | 0.0048 | |||||

| US1248EPBT92 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.07 | 1.37 | 0.1800 | 0.0045 | |||||

| US013092AF88 / Albertsons Cos Inc / Safeway Inc / New Albertsons LP / Albertsons LLC | 0.07 | 0.00 | 0.1792 | 0.0036 | |||||

| US37046US851 / General Motors Financial Co Inc | 0.07 | 0.00 | 0.1720 | 0.0034 | |||||

| M1TB34 / M&T Bank Corporation - Depositary Receipt (Common Stock) | 0.07 | 1.45 | 0.1706 | 0.0045 | |||||

| US02005NBF69 / Ally Financial Inc | 0.07 | 0.00 | 0.1704 | 0.0029 | |||||

| US70959WAJ27 / Penske Automotive Group Inc | 0.07 | 0.00 | 0.1690 | 0.0035 | |||||

| US57665RAG11 / Match Group Inc | 0.07 | 0.00 | 0.1676 | 0.0040 | |||||

| US019736AE70 / ALLISON TRANSMISSION INC 4.75% 10/01/2027 144A | 0.07 | 0.00 | 0.1672 | 0.0032 | |||||

| US88104LAE39 / TERRAFORM POWER OPERATIN | 0.07 | 1.49 | 0.1659 | 0.0050 | |||||

| US82967NBL10 / Sirius XM Radio Inc | 0.07 | 1.49 | 0.1658 | 0.0043 | |||||

| US37046US851 / General Motors Financial Co Inc | 0.07 | 0.00 | 0.1597 | 0.0032 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.07 | 0.00 | 0.1596 | 0.0038 | |||||

| Franklin BSP Capital Corp / DBT (US35250VAB09) | 0.06 | 0.1486 | 0.1486 | ||||||

| Alliant Energy Finance LLC / DBT (US01882YAF34) | 0.06 | 0.00 | 0.1479 | 0.0038 | |||||

| United States Treasury Note/Bond / DBT (US91282CLY56) | 0.06 | 0.00 | 0.1471 | 0.0040 | |||||

| PBF Holding Co LLC / PBF Finance Corp / DBT (US69318FAM05) | 0.06 | 0.1393 | 0.1393 | ||||||

| Rio Tinto Finance USA PLC / DBT (US76720AAR77) | 0.05 | 0.1226 | 0.1226 | ||||||

| US88651CAA80 / TierPoint Issuer LLC, Series 2023-1A, Class A2 | 0.05 | -83.33 | 0.1218 | -0.5947 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0.05 | 0.00 | 0.1110 | 0.0026 | |||||

| Penske Truck Leasing Co Lp / PTL Finance Corp / DBT (US709599BY93) | 0.05 | 0.00 | 0.1107 | 0.0025 | |||||

| Aviation Capital Group LLC / DBT (US05369AAR23) | 0.05 | 0.1096 | 0.1096 | ||||||

| Hilton Domestic Operating Co Inc / DBT (US432833AP66) | 0.04 | 0.0983 | 0.0983 | ||||||

| US48250NAC92 / KFC Holding Co/Pizza Hut Holdings LLC/Taco Bell of America LLC | 0.04 | 0.0971 | 0.0971 | ||||||

| US233293AR02 / DPL Inc | 0.04 | 0.00 | 0.0969 | 0.0018 | |||||

| US92840VAF94 / Vistra Operations Co LLC | 0.04 | 0.00 | 0.0965 | 0.0024 | |||||

| RIGG34 / Transocean Ltd. - Depositary Receipt (Common Stock) | 0.04 | -20.00 | 0.0883 | -0.0194 | |||||

| AAR Escrow Issuer LLC / DBT (US00253PAA66) | 0.04 | 133.33 | 0.0872 | 0.0506 | |||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0.04 | 0.0868 | 0.0868 | ||||||

| Freedom Mortgage Holdings LLC / DBT (US35641AAA60) | 0.04 | -2.78 | 0.0868 | -0.0004 | |||||

| Blue Racer Midstream LLC / Blue Racer Finance Corp / DBT (US095796AJ72) | 0.04 | 0.00 | 0.0867 | 0.0009 | |||||

| US80282KBF21 / Santander Holdings USA, Inc. | 0.04 | 0.00 | 0.0860 | 0.0014 | |||||

| XS2066744231 / Carnival PLC | 0.03 | 0.0846 | 0.0846 | ||||||

| Hess Midstream Operations LP / DBT (US428102AG28) | 0.03 | 0.00 | 0.0741 | 0.0012 | |||||

| US59001ABA97 / Meritage Homes Corp Bond | 0.03 | 0.00 | 0.0736 | 0.0021 | |||||

| S2TW34 / Starwood Property Trust, Inc. - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 0.0734 | 0.0012 | |||||

| US20754PAC41 / Connecticut Avenue Securities Trust 2019-HRP1 | 0.03 | -43.14 | 0.0726 | -0.0511 | |||||

| SM / SM Energy Company | 0.03 | -6.67 | 0.0682 | -0.0034 | |||||

| SUN / Sunoco LP - Limited Partnership | 0.03 | 0.00 | 0.0626 | 0.0009 | |||||

| Dell International LLC / EMC Corp / DBT (US24703TAL08) | 0.03 | 0.0613 | 0.0613 | ||||||

| Vistra Operations Co LLC / DBT (US92840VAT98) | 0.03 | 0.00 | 0.0611 | 0.0014 | |||||

| US80290CBG87 / SANTANDER BANK AUTO CREDIT LINKED NOTES SERIES 202 | 0.02 | -48.72 | 0.0494 | -0.0437 | |||||

| XHR LP / DBT (US98372MAE57) | 0.02 | -5.00 | 0.0480 | -0.0003 | |||||

| US80290CAS35 / Santander Bank Auto Credit-Linked Notes Series 2022-A | 0.00 | -80.00 | 0.0083 | -0.0289 | |||||

| 5 YEAR U.S. TREASURY NOTE / DIR (000000000) | -0.01 | -0.0360 | -0.0360 |