Mga Batayang Estadistika

| Nilai Portofolio | $ 957,394,721 |

| Posisi Saat Ini | 79 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

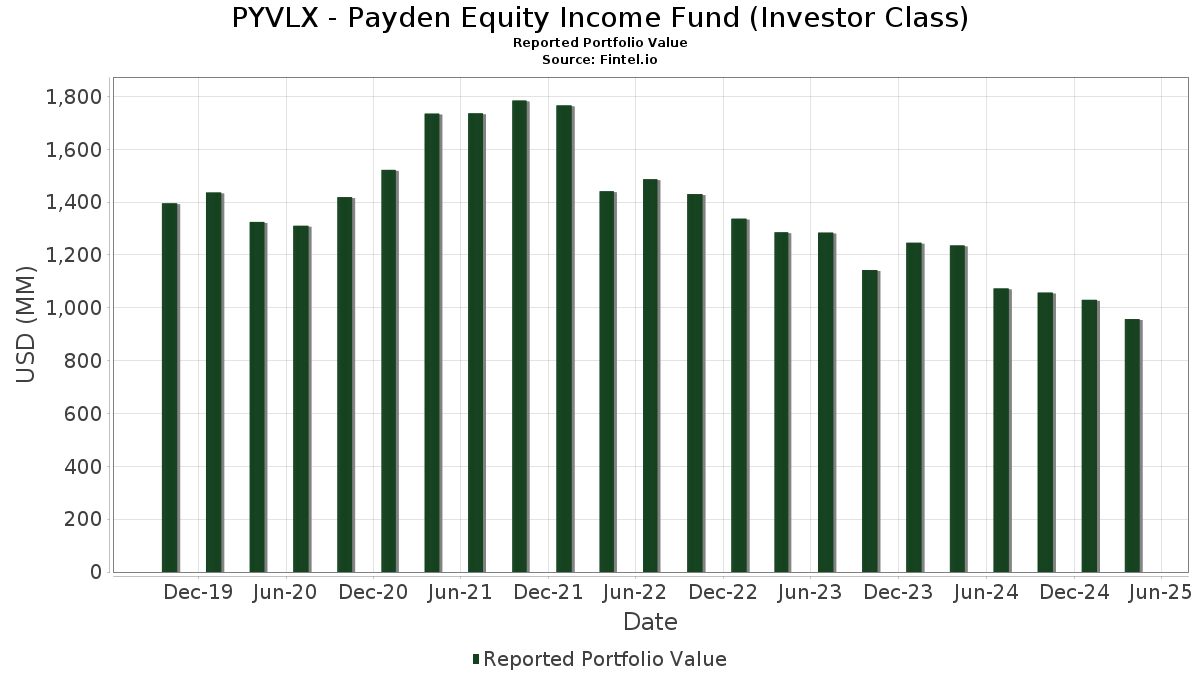

PYVLX - Payden Equity Income Fund (Investor Class) telah mengungkapkan total kepemilikan 79 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 957,394,721 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PYVLX - Payden Equity Income Fund (Investor Class) adalah Payden & Rygel Investment Group - Payden Cash Reserves Money Market Fund (US:PBHXX) , JPMorgan Chase & Co. (US:JPM) , Duke Energy Corporation (US:DUK) , Walmart Inc. (US:WMT) , and General Electric Company (US:GE) . Posisi baru PYVLX - Payden Equity Income Fund (Investor Class) meliputi: HCA Healthcare, Inc. (US:HCA) , Service Corporation International (US:SCI) , Booking Holdings Inc. (US:BKNG) , The Cigna Group (US:CI) , and Quest Diagnostics Incorporated (US:DGX) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 79.24 | 79.24 | 8.2231 | 7.1774 | |

| 0.04 | 14.84 | 1.5398 | 1.5398 | |

| 0.12 | 9.88 | 1.0248 | 1.0248 | |

| 0.12 | 18.96 | 1.9671 | 0.9549 | |

| 0.00 | 7.65 | 0.7937 | 0.7937 | |

| 0.02 | 7.51 | 0.7798 | 0.7798 | |

| 0.04 | 7.40 | 0.7675 | 0.7675 | |

| 0.10 | 7.32 | 0.7592 | 0.7592 | |

| 0.06 | 7.24 | 0.7515 | 0.7515 | |

| 0.96 | 7.16 | 0.7433 | 0.7433 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.15 | 9.74 | 1.0112 | -1.2899 | |

| 0.82 | 13.62 | 1.4138 | -1.1908 | |

| 0.07 | 10.02 | 1.0394 | -1.0820 | |

| 0.17 | 15.93 | 1.6526 | -1.0536 | |

| 0.03 | 9.46 | 0.9817 | -0.7124 | |

| 0.02 | 9.23 | 0.9580 | -0.7065 | |

| 0.03 | 9.87 | 1.0242 | -0.6938 | |

| 0.03 | 9.68 | 1.0050 | -0.5583 | |

| 0.05 | 9.89 | 1.0263 | -0.5305 | |

| 0.04 | 7.10 | 0.7368 | -0.5282 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-25 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PBHXX / Payden & Rygel Investment Group - Payden Cash Reserves Money Market Fund | 79.24 | 634.58 | 79.24 | 634.60 | 8.2231 | 7.1774 | |||

| JPM / JPMorgan Chase & Co. | 0.14 | 16.73 | 35.15 | 6.83 | 3.6478 | 0.4580 | |||

| DUK / Duke Energy Corporation | 0.23 | 0.00 | 28.04 | 8.96 | 2.9098 | 0.4150 | |||

| WMT / Walmart Inc. | 0.23 | 0.00 | 22.03 | -0.93 | 2.2858 | 0.1305 | |||

| GE / General Electric Company | 0.11 | -11.46 | 21.65 | -12.34 | 2.2462 | -0.1476 | |||

| MCK / McKesson Corporation | 0.03 | 0.00 | 20.10 | 19.85 | 2.0859 | 0.4600 | |||

| TMUS / T-Mobile US, Inc. | 0.08 | 10.10 | 19.93 | 16.70 | 2.0681 | 0.4126 | |||

| WFC / Wells Fargo & Company | 0.28 | -6.14 | 19.77 | 12.32 | 2.0515 | 0.4081 | |||

| MS / Morgan Stanley | 0.17 | 0.00 | 19.08 | -16.62 | 1.9799 | -0.2384 | |||

| PG / The Procter & Gamble Company | 0.12 | 85.37 | 18.96 | 81.56 | 1.9671 | 0.9549 | |||

| BAC / Bank of America Corporation | 0.45 | 0.00 | 17.93 | -13.86 | 1.8606 | -0.1573 | |||

| SYK / Stryker Corporation | 0.05 | 0.00 | 17.91 | -4.44 | 1.8586 | 0.0417 | |||

| SPGI / S&P Global Inc. | 0.03 | 27.07 | 16.90 | 21.86 | 1.7539 | 0.4094 | |||

| MCD / McDonald's Corporation | 0.05 | 0.00 | 16.88 | 10.72 | 1.7514 | 0.2737 | |||

| V / Visa Inc. | 0.05 | 0.00 | 16.69 | 1.08 | 1.7317 | 0.1313 | |||

| WMB / The Williams Companies, Inc. | 0.28 | 0.00 | 16.64 | 5.66 | 1.7267 | 0.2001 | |||

| CRH / CRH plc | 0.17 | -40.79 | 15.93 | -42.95 | 1.6526 | -1.0536 | |||

| AXP / American Express Company | 0.06 | 0.00 | 15.66 | -16.08 | 1.6256 | -0.1839 | |||

| D / Dominion Energy, Inc. | 0.28 | 0.00 | 14.95 | -2.18 | 1.5519 | 0.0699 | |||

| HCA / HCA Healthcare, Inc. | 0.04 | 14.84 | 1.5398 | 1.5398 | |||||

| XOM / Exxon Mobil Corporation | 0.14 | 0.00 | 14.76 | -1.13 | 1.5313 | 0.0845 | |||

| CSCO / Cisco Systems, Inc. | 0.25 | 0.00 | 14.66 | -4.74 | 1.5211 | 0.0295 | |||

| IBM / International Business Machines Corporation | 0.06 | 0.00 | 14.34 | -5.43 | 1.4881 | 0.0182 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.47 | -24.99 | 13.98 | -31.31 | 1.4512 | -0.5223 | |||

| LIN / Linde plc | 0.03 | 0.00 | 13.82 | 1.59 | 1.4345 | 0.1154 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.82 | -37.21 | 13.62 | -49.29 | 1.4138 | -1.1908 | |||

| SBGSY / Schneider Electric S.E. - Depositary Receipt (Common Stock) | 0.06 | -16.83 | 13.60 | -24.41 | 1.4115 | -0.3329 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.18 | 78.18 | 13.34 | 66.40 | 1.3839 | 0.6070 | |||

| MET / MetLife, Inc. | 0.17 | 0.00 | 12.63 | -12.88 | 1.3109 | -0.0947 | |||

| VZ / Verizon Communications Inc. | 0.27 | 0.00 | 11.71 | 11.86 | 1.2148 | 0.2003 | |||

| LLY / Eli Lilly and Company | 0.01 | 78.26 | 11.06 | 97.59 | 1.1474 | 0.6049 | |||

| GOOGL / Alphabet Inc. | 0.07 | 0.00 | 10.66 | -22.16 | 1.1057 | -0.2214 | |||

| ACM / AECOM | 0.11 | 0.00 | 10.57 | -6.44 | 1.0964 | 0.0017 | |||

| MSFT / Microsoft Corporation | 0.03 | -26.48 | 10.32 | -29.99 | 1.0705 | -0.3579 | |||

| JNJ / Johnson & Johnson | 0.06 | 75.41 | 10.14 | 80.21 | 1.0527 | 0.5070 | |||

| ITT / ITT Inc. | 0.07 | -49.55 | 10.02 | -54.23 | 1.0394 | -1.0820 | |||

| AVB / AvalonBay Communities, Inc. | 0.05 | -35.03 | 9.89 | -38.41 | 1.0263 | -0.5305 | |||

| SCI / Service Corporation International | 0.12 | 9.88 | 1.0248 | 1.0248 | |||||

| CB / Chubb Limited | 0.03 | -46.68 | 9.87 | -45.99 | 1.0242 | -0.6938 | |||

| DHR / Danaher Corporation | 0.05 | 88.08 | 9.75 | 46.99 | 1.0115 | 0.4975 | |||

| LMT / Lockheed Martin Corporation | 0.02 | 50.00 | 9.75 | 57.63 | 1.0114 | 0.4702 | |||

| NEE / NextEra Energy, Inc. | 0.15 | -56.07 | 9.74 | -58.95 | 1.0112 | -1.2899 | |||

| ETN / Eaton Corporation plc | 0.03 | -33.40 | 9.68 | -39.95 | 1.0050 | -0.5583 | |||

| KO / The Coca-Cola Company | 0.13 | -22.38 | 9.66 | -11.29 | 1.0028 | -0.0532 | |||

| META / Meta Platforms, Inc. | 0.02 | -15.38 | 9.66 | -32.59 | 1.0027 | -0.3870 | |||

| RTX / RTX Corporation | 0.08 | -22.59 | 9.64 | 11.04 | 1.0000 | 0.3273 | |||

| HD / The Home Depot, Inc. | 0.03 | -21.73 | 9.48 | -31.51 | 0.9839 | -0.3581 | |||

| ABBV / AbbVie Inc. | 0.05 | -16.81 | 9.46 | -11.74 | 0.9819 | -0.0574 | |||

| AJG / Arthur J. Gallagher & Co. | 0.03 | -49.05 | 9.46 | -45.87 | 0.9817 | -0.7124 | |||

| COST / Costco Wholesale Corporation | 0.01 | 0.00 | 9.45 | 1.49 | 0.9804 | 0.0780 | |||

| SPG / Simon Property Group, Inc. | 0.06 | -30.22 | 9.41 | -36.83 | 0.9766 | -0.4678 | |||

| AMP / Ameriprise Financial, Inc. | 0.02 | -37.97 | 9.23 | -46.24 | 0.9580 | -0.7065 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 7.65 | 0.7937 | 0.7937 | |||||

| UNH / UnitedHealth Group Incorporated | 0.02 | -25.10 | 7.61 | -43.20 | 0.7899 | -0.5091 | |||

| AMT / American Tower Corporation | 0.03 | -42.81 | 7.53 | -39.63 | 0.7813 | -0.3912 | |||

| CI / The Cigna Group | 0.02 | 7.51 | 0.7798 | 0.7798 | |||||

| MDLZ / Mondelez International, Inc. | 0.11 | -27.40 | 7.47 | -27.78 | 0.7756 | -0.1972 | |||

| AAPL / Apple Inc. | 0.04 | 0.00 | 7.44 | -9.96 | 0.7718 | -0.0289 | |||

| DGX / Quest Diagnostics Incorporated | 0.04 | 7.40 | 0.7675 | 0.7675 | |||||

| ORCL / Oracle Corporation | 0.05 | -30.31 | 7.35 | -42.33 | 0.7623 | -0.4725 | |||

| NDAQ / Nasdaq, Inc. | 0.10 | 7.32 | 0.7592 | 0.7592 | |||||

| J / Jacobs Solutions Inc. | 0.06 | 7.24 | 0.7515 | 0.7515 | |||||

| GILD / Gilead Sciences, Inc. | 0.07 | -73.38 | 7.17 | -58.70 | 0.7441 | -0.2267 | |||

| AIVAF / Aviva plc | 0.96 | 7.16 | 0.7433 | 0.7433 | |||||

| CTVA / Corteva, Inc. | 0.12 | 7.16 | 0.7430 | 0.7430 | |||||

| TJX / The TJX Companies, Inc. | 0.06 | 7.10 | 0.7371 | 0.7371 | |||||

| AMZN / Amazon.com, Inc. | 0.04 | -29.87 | 7.10 | -45.59 | 0.7368 | -0.5282 | |||

| BLK / BlackRock, Inc. | 0.01 | 7.04 | 0.7305 | 0.7305 | |||||

| PLD / Prologis, Inc. | 0.07 | 0.00 | 6.99 | -14.30 | 0.7254 | -0.0653 | |||

| AHODF / Koninklijke Ahold Delhaize N.V. | 0.17 | 6.89 | 0.7150 | 0.7150 | |||||

| GLW / Corning Incorporated | 0.15 | -60.03 | 6.70 | -46.60 | 0.6950 | -0.2716 | |||

| CRM / Salesforce, Inc. | 0.02 | 0.00 | 6.31 | -21.36 | 0.6553 | -0.1231 | |||

| AVGO / Broadcom Inc. | 0.03 | 0.00 | 4.87 | -13.02 | 0.5053 | -0.0374 | |||

| ASML / ASML Holding N.V. | 0.01 | 0.00 | 4.69 | -11.99 | 0.4862 | -0.0298 | |||

| US514666AN65 / Land O'Lakes Inc. | 2.30 | -0.61 | 0.2383 | 0.0143 | |||||

| S&P500 EMINI / DE (000000000) | 0.60 | 0.0621 | 0.0621 | ||||||

| EUR/USD FORWARD / DFE (000000000) | 0.04 | 0.0044 | 0.0044 | ||||||

| USD/GBP FORWARD / DFE (000000000) | 0.01 | 0.0007 | 0.0007 | ||||||

| MUR / Murphy Oil Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.3813 | ||||

| USD/EUR FORWARD / DFE (000000000) | -0.75 | -0.0780 | -0.0780 |