Mga Batayang Estadistika

| Nilai Portofolio | $ 1,237,532 |

| Posisi Saat Ini | 122 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

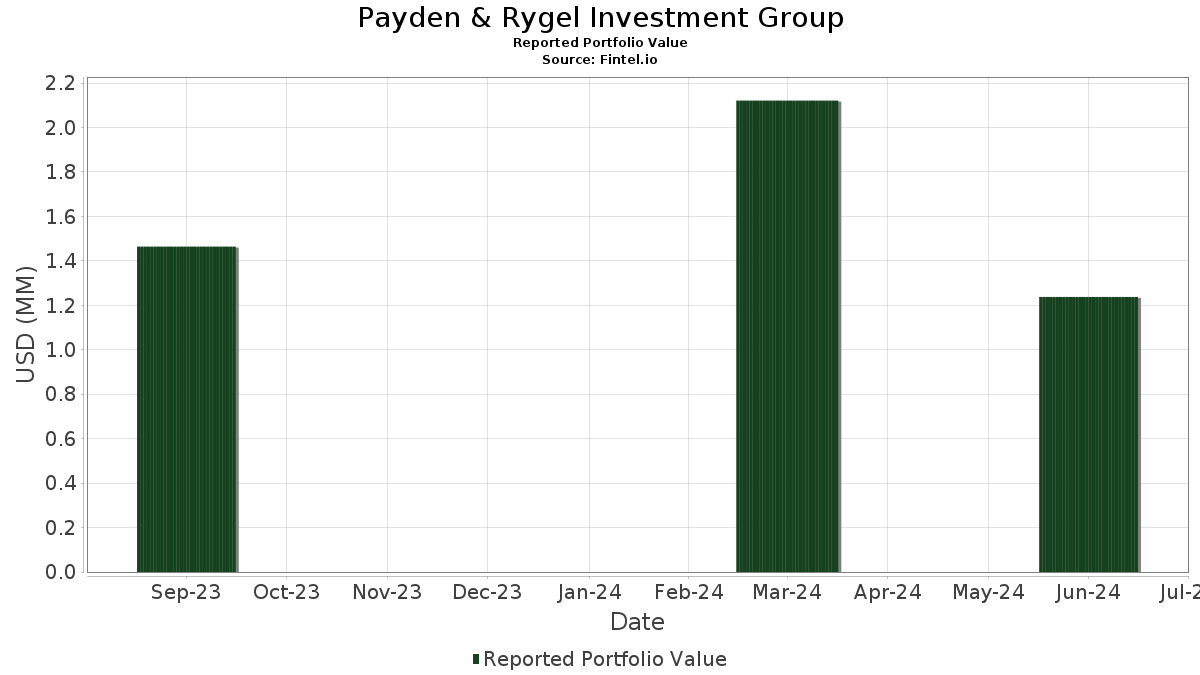

Payden & Rygel Investment Group telah mengungkapkan total kepemilikan 122 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,237,532 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Payden & Rygel Investment Group adalah Arthur J. Gallagher & Co. (US:AJG) , JPMorgan Chase & Co. (US:JPM) , Invesco Exchange-Traded Fund Trust II - Invesco NASDAQ 100 ETF (US:QQQM) , Microsoft Corporation (US:MSFT) , and Exxon Mobil Corporation (US:XOM) . Posisi baru Payden & Rygel Investment Group meliputi: Stryker Corporation (US:SYK) , ITT Inc. (US:ITT) , AvalonBay Communities, Inc. (US:AVB) , Ares Management Corporation (US:ARES) , and Vistra Corp. (US:VST) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.18 | 0.03 | 2.7937 | 2.5370 | |

| 0.14 | 0.04 | 3.0383 | 1.4621 | |

| 0.05 | 0.02 | 1.4160 | 1.4160 | |

| 0.36 | 0.03 | 2.0805 | 1.3884 | |

| 0.05 | 0.03 | 2.3220 | 1.2386 | |

| 0.12 | 0.01 | 1.2056 | 1.2056 | |

| 0.24 | 0.02 | 1.9429 | 1.1733 | |

| 0.08 | 0.03 | 2.7640 | 1.0674 | |

| 0.07 | 0.01 | 1.0665 | 1.0665 | |

| 0.06 | 0.01 | 1.0081 | 1.0081 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -26.1646 | ||

| 0.00 | 0.00 | -1.1565 | ||

| 0.01 | 0.00 | 0.0995 | -0.7855 | |

| 0.00 | 0.00 | 0.0852 | -0.7455 | |

| 0.02 | 0.00 | 0.0616 | -0.6013 | |

| 0.00 | 0.00 | -0.5946 | ||

| 0.00 | 0.00 | 0.1884 | -0.5201 | |

| 0.01 | 0.00 | 0.0603 | -0.5184 | |

| 0.02 | 0.00 | 0.3079 | -0.4001 | |

| 0.03 | 0.00 | 0.0678 | -0.2860 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2024-10-09 untuk periode pelaporan 2024-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AJG / Arthur J. Gallagher & Co. | 0.14 | 8.45 | 0.04 | 12.12 | 3.0383 | 1.4621 | |||

| JPM / JPMorgan Chase & Co. | 0.18 | -19.10 | 0.04 | -17.78 | 2.9983 | 0.8569 | |||

| QQQM / Invesco Exchange-Traded Fund Trust II - Invesco NASDAQ 100 ETF | 0.18 | 488.59 | 0.03 | 580.00 | 2.7937 | 2.5370 | |||

| MSFT / Microsoft Corporation | 0.08 | -10.52 | 0.03 | -2.86 | 2.7640 | 1.0674 | |||

| XOM / Exxon Mobil Corporation | 0.28 | -14.78 | 0.03 | -16.22 | 2.5801 | 0.7964 | |||

| MCK / McKesson Corporation | 0.05 | 14.95 | 0.03 | 27.27 | 2.3220 | 1.2386 | |||

| WMT / Walmart Inc. | 0.39 | -39.31 | 0.03 | -31.58 | 2.1119 | 0.3077 | |||

| NEE.PRN / NextEra Energy Capital Holdings, Inc. - Corporate Bond/Note | 0.36 | 58.29 | 0.03 | 78.57 | 2.0805 | 1.3884 | |||

| AVGO / Broadcom Inc. | 0.02 | -9.14 | 0.03 | 8.70 | 2.0641 | 0.9699 | |||

| DUK / Duke Energy Corporation | 0.24 | 42.12 | 0.02 | 50.00 | 1.9429 | 1.1733 | |||

| CRH / CRH plc | 0.32 | 29.96 | 0.02 | 9.52 | 1.9316 | 0.9339 | |||

| LLY / Eli Lilly and Company | 0.02 | -8.67 | 0.02 | 5.00 | 1.7719 | 0.7992 | |||

| ET / Energy Transfer LP - Limited Partnership | 1.33 | 3.95 | 0.02 | 5.00 | 1.7465 | 0.7958 | |||

| AMP / Ameriprise Financial, Inc. | 0.05 | -9.55 | 0.02 | -12.50 | 1.7329 | 0.5856 | |||

| AAPL / Apple Inc. | 0.10 | 8.66 | 0.02 | 33.33 | 1.6662 | 0.9378 | |||

| ROST / Ross Stores, Inc. | 0.14 | 45.28 | 0.02 | 42.86 | 1.6428 | 0.9764 | |||

| EMR / Emerson Electric Co. | 0.18 | -29.53 | 0.02 | -31.03 | 1.6424 | 0.2424 | |||

| LIN / Linde plc | 0.05 | -10.16 | 0.02 | -13.04 | 1.6311 | 0.5102 | |||

| MCD / McDonald's Corporation | 0.08 | -2.97 | 0.02 | -13.64 | 1.6124 | 0.5396 | |||

| LHX / L3Harris Technologies, Inc. | 0.09 | -16.21 | 0.02 | -13.64 | 1.6042 | 0.5443 | |||

| CB / Chubb Limited | 0.08 | 20.04 | 0.02 | 18.75 | 1.5927 | 0.8063 | |||

| DLR / Digital Realty Trust, Inc. | 0.13 | -7.77 | 0.02 | -5.00 | 1.5899 | 0.6370 | |||

| WFC / Wells Fargo & Company | 0.33 | -27.14 | 0.02 | -26.92 | 1.5875 | 0.3469 | |||

| VZ / Verizon Communications Inc. | 0.47 | -25.58 | 0.02 | -26.92 | 1.5739 | 0.3184 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.67 | -8.60 | 0.02 | -9.52 | 1.5675 | 0.5599 | |||

| MET / MetLife, Inc. | 0.27 | -7.48 | 0.02 | -9.52 | 1.5512 | 0.5184 | |||

| FIS * / Fidelity National Information Services, Inc. | 0.25 | 27.52 | 0.02 | 28.57 | 1.5352 | 0.8437 | |||

| COST / Costco Wholesale Corporation | 0.02 | -18.98 | 0.02 | -10.00 | 1.5248 | 0.5784 | |||

| MS / Morgan Stanley | 0.19 | -9.31 | 0.02 | -10.00 | 1.5141 | 0.5703 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.11 | -8.99 | 0.02 | -5.26 | 1.4696 | 0.5426 | |||

| SYK / Stryker Corporation | 0.05 | 0.02 | 1.4160 | 1.4160 | |||||

| ACM / AECOM | 0.20 | 24.33 | 0.02 | 13.33 | 1.4122 | 0.6747 | |||

| AMZN / Amazon.com, Inc. | 0.09 | -8.83 | 0.02 | 0.00 | 1.4034 | 0.5651 | |||

| PSX / Phillips 66 | 0.11 | 51.81 | 0.02 | 25.00 | 1.2901 | 0.7164 | |||

| ETN / Eaton Corporation plc | 0.05 | -10.16 | 0.02 | -11.76 | 1.2552 | 0.4423 | |||

| AXP / American Express Company | 0.07 | 3.08 | 0.02 | 7.14 | 1.2536 | 0.5558 | |||

| META / Meta Platforms, Inc. | 0.03 | 4.86 | 0.02 | 15.38 | 1.2308 | 0.5712 | |||

| GOOGL / Alphabet Inc. | 0.08 | -26.64 | 0.02 | -6.25 | 1.2158 | 0.4145 | |||

| ITT / ITT Inc. | 0.12 | 0.01 | 1.2056 | 1.2056 | |||||

| PLD / Prologis, Inc. | 0.13 | -31.15 | 0.01 | -44.00 | 1.2034 | 0.0209 | |||

| MRK / Merck & Co., Inc. | 0.12 | -8.80 | 0.01 | -17.65 | 1.2020 | 0.3824 | |||

| AMAT / Applied Materials, Inc. | 0.06 | -10.54 | 0.01 | 0.00 | 1.1978 | 0.5151 | |||

| KO / The Coca-Cola Company | 0.23 | -27.33 | 0.01 | -26.32 | 1.1910 | 0.2718 | |||

| TMUS / T-Mobile US, Inc. | 0.08 | -9.51 | 0.01 | 0.00 | 1.1517 | 0.4637 | |||

| V / Visa Inc. | 0.05 | -47.37 | 0.01 | -50.00 | 1.1453 | -0.2048 | |||

| HD / The Home Depot, Inc. | 0.04 | 40.59 | 0.01 | 27.27 | 1.1369 | 0.6111 | |||

| AMT / American Tower Corporation | 0.07 | 0.01 | 1.0665 | 1.0665 | |||||

| SPG / Simon Property Group, Inc. | 0.09 | 27.41 | 0.01 | 30.00 | 1.0604 | 0.5598 | |||

| NXST / Nexstar Media Group, Inc. | 0.08 | -10.69 | 0.01 | -13.33 | 1.0531 | 0.3391 | |||

| QCOM / QUALCOMM Incorporated | 0.06 | -9.86 | 0.01 | 0.00 | 1.0446 | 0.4698 | |||

| DELL / Dell Technologies Inc. | 0.09 | -8.71 | 0.01 | 9.09 | 1.0274 | 0.4841 | |||

| SPGI / S&P Global Inc. | 0.03 | -46.16 | 0.01 | -45.45 | 1.0127 | -0.0341 | |||

| AVB / AvalonBay Communities, Inc. | 0.06 | 0.01 | 1.0081 | 1.0081 | |||||

| COP / ConocoPhillips | 0.11 | -37.46 | 0.01 | -42.86 | 0.9954 | -0.0379 | |||

| EOG / EOG Resources, Inc. | 0.10 | -25.31 | 0.01 | -25.00 | 0.9845 | 0.2034 | |||

| DHI / D.R. Horton, Inc. | 0.08 | -24.93 | 0.01 | -38.89 | 0.9568 | 0.0885 | |||

| HON / Honeywell International Inc. | 0.05 | -39.62 | 0.01 | -38.89 | 0.9421 | 0.0671 | |||

| ARES / Ares Management Corporation | 0.09 | 0.01 | 0.9262 | 0.9262 | |||||

| AMGN / Amgen Inc. | 0.04 | -39.21 | 0.01 | -37.50 | 0.8887 | 0.1126 | |||

| UNP / Union Pacific Corporation | 0.04 | -29.62 | 0.01 | -33.33 | 0.8209 | 0.0812 | |||

| GE / General Electric Company | 0.06 | -1.84 | 0.01 | -9.09 | 0.8208 | 0.2821 | |||

| IBM / International Business Machines Corporation | 0.05 | -2.04 | 0.01 | -10.00 | 0.7435 | 0.2545 | |||

| ORCL / Oracle Corporation | 0.06 | -55.73 | 0.01 | -50.00 | 0.7416 | -0.1278 | |||

| EQT / EQT Corporation | 0.23 | 0.00 | 0.01 | 0.00 | 0.6814 | 0.2828 | |||

| DAL / Delta Air Lines, Inc. | 0.17 | -45.79 | 0.01 | -50.00 | 0.6421 | -0.0553 | |||

| DIS / The Walt Disney Company | 0.08 | 452.29 | 0.01 | 600.00 | 0.6084 | 0.5292 | |||

| JNJ / Johnson & Johnson | 0.04 | -51.82 | 0.01 | -57.14 | 0.5173 | -0.1606 | |||

| CME / CME Group Inc. | 0.03 | 1,142.31 | 0.01 | 0.5131 | 0.4867 | ||||

| VST / Vistra Corp. | 0.07 | 0.01 | 0.4870 | 0.4870 | |||||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.07 | -58.08 | 0.00 | -66.67 | 0.3150 | -0.1400 | |||

| PEP / PepsiCo, Inc. | 0.02 | -73.08 | 0.00 | -80.00 | 0.3079 | -0.4001 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -84.92 | 0.00 | -86.67 | 0.1884 | -0.5201 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.02 | 900.00 | 0.00 | 100.00 | 0.1797 | 0.1030 | |||

| SUSB / iShares Trust - iShares ESG Aware 1-5 Year USD Corporate Bond ETF | 0.09 | 6.92 | 0.00 | 0.00 | 0.1753 | 0.0797 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 0.1555 | 0.0671 | |||

| BAC / Bank of America Corporation | 0.04 | 0.00 | 0.00 | 0.00 | 0.1433 | 0.0636 | |||

| FDX / FedEx Corporation | 0.01 | -1.69 | 0.00 | 0.00 | 0.1405 | 0.0599 | |||

| CSCO / Cisco Systems, Inc. | 0.04 | -25.65 | 0.00 | -50.00 | 0.1358 | 0.0238 | |||

| WMB / The Williams Companies, Inc. | 0.04 | -34.64 | 0.00 | -50.00 | 0.1225 | 0.0223 | |||

| NFLX / Netflix, Inc. | 0.00 | -13.57 | 0.00 | 0.00 | 0.1042 | 0.0409 | |||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.01 | -94.01 | 0.00 | -94.44 | 0.0995 | -0.7855 | |||

| MMP / Magellan Midstream Partners L.P. | 0.02 | 0.00 | 0.00 | 0.00 | 0.0869 | 0.0362 | |||

| CRM / Salesforce, Inc. | 0.00 | -92.99 | 0.00 | -94.12 | 0.0852 | -0.7455 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -37.93 | 0.00 | -100.00 | 0.0804 | 0.0009 | |||

| WM / Waste Management, Inc. | 0.00 | 0.00 | 0.00 | 0.0793 | 0.0331 | ||||

| DE / Deere & Company | 0.00 | 0.00 | 0.00 | 0.0694 | 0.0249 | ||||

| ABBV / AbbVie Inc. | 0.01 | 0.00 | 0.00 | 0.0694 | 0.0264 | ||||

| PFE / Pfizer Inc. | 0.03 | -88.91 | 0.00 | -100.00 | 0.0678 | -0.2860 | |||

| SUSC / iShares Trust - iShares ESG Aware USD Corporate Bond ETF | 0.04 | 15.83 | 0.00 | 0.0653 | 0.0320 | ||||

| CMCSA / Comcast Corporation | 0.02 | -94.00 | 0.00 | -100.00 | 0.0616 | -0.6013 | |||

| NKE / NIKE, Inc. | 0.01 | -92.42 | 0.00 | -100.00 | 0.0603 | -0.5184 | |||

| C.WSA / Citigroup, Inc. | 0.00 | 0.00 | 0.00 | 0.0573 | 0.0219 | ||||

| BA / The Boeing Company | 0.00 | 0.00 | 0.00 | 0.0470 | 0.0179 | ||||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 0.00 | 0.00 | 0.0461 | 0.0213 | ||||

| DOV / Dover Corporation | 0.00 | 0.00 | 0.00 | 0.0391 | 0.0167 | ||||

| TXN / Texas Instruments Incorporated | 0.00 | 0.00 | 0.00 | 0.0361 | 0.0172 | ||||

| MCHP / Microchip Technology Incorporated | 0.00 | 0.00 | 0.00 | 0.0355 | 0.0152 | ||||

| RSG / Republic Services, Inc. | 0.00 | 0.00 | 0.00 | 0.0283 | 0.0120 | ||||

| MDLZ / Mondelez International, Inc. | 0.00 | -57.17 | 0.00 | 0.0242 | -0.0111 | ||||

| CVX / Chevron Corporation | 0.00 | 0.00 | 0.00 | 0.0204 | 0.0084 | ||||

| DHR / Danaher Corporation | 0.00 | 0.00 | 0.00 | 0.0202 | 0.0084 | ||||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.00 | 0.0200 | 0.0072 | ||||

| PSA / Public Storage | 0.00 | 0.00 | 0.00 | 0.0177 | 0.0073 | ||||

| AEP / American Electric Power Company, Inc. | 0.00 | 0.00 | 0.00 | 0.0177 | 0.0076 | ||||

| GNMA / iShares Trust - iShares GNMA Bond ETF | 0.00 | 0.00 | 0.00 | 0.0158 | 0.0065 | ||||

| UPS / United Parcel Service, Inc. | 0.00 | 0.00 | 0.00 | 0.0155 | 0.0057 | ||||

| VICI / VICI Properties Inc. | 0.01 | 0.00 | 0.00 | 0.0152 | 0.0060 | ||||

| EXC / Exelon Corporation | 0.01 | 0.00 | 0.00 | 0.0143 | 0.0053 | ||||

| DVN / Devon Energy Corporation | 0.00 | 0.00 | 0.00 | 0.0134 | 0.0051 | ||||

| NHP / Nationwide Health Properties Inc | 0.00 | 0.00 | 0.00 | 0.0133 | 0.0056 | ||||

| PBR / Petróleo Brasileiro S.A. - Petrobras - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.00 | 0.0120 | 0.0047 | ||||

| OVV / Ovintiv Inc. | 0.00 | 0.00 | 0.00 | 0.0114 | 0.0040 | ||||

| AR / Antero Resources Corporation | 0.00 | 0.00 | 0.00 | 0.0103 | 0.0050 | ||||

| CRK / Comstock Resources, Inc. | 0.01 | 0.00 | 0.00 | 0.0089 | 0.0042 | ||||

| IGSB / iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF | 0.00 | 0.00 | 0.00 | 0.0073 | 0.0030 | ||||

| LYB / LyondellBasell Industries N.V. | 0.00 | -82.69 | 0.00 | 0.0069 | -0.0181 | ||||

| SWN / Southwestern Energy Company | 0.01 | 0.00 | 0.00 | 0.0053 | 0.0018 | ||||

| TLH / iShares Trust - iShares 10-20 Year Treasury Bond ETF | 0.00 | 0.00 | 0.00 | 0.0048 | 0.0019 | ||||

| TELL / Tellurian Inc. | 0.04 | 0.00 | 0.00 | 0.0023 | 0.0010 | ||||

| ARCC / Ares Capital Corporation | 0.00 | 0.00 | 0.00 | 0.0019 | 0.0008 | ||||

| GILD / Gilead Sciences, Inc. | 0.00 | -93.28 | 0.00 | 0.0010 | -0.0083 | ||||

| VLY / Valley National Bancorp | 0.00 | 0.00 | 0.00 | 0.0003 | 0.0001 | ||||

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | Put | 0.00 | -100.00 | 0.00 | -100.00 | -26.1646 | |||

| SBUX / Starbucks Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.5946 | ||||

| INTC / Intel Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SPY / SPDR S&P 500 ETF | 0.00 | -100.00 | 0.00 | -100.00 | -1.1565 | ||||

| IGLB / iShares Trust - iShares 10+ Year Investment Grade Corporate Bond ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| USB / U.S. Bancorp | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PPG / PPG Industries, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ALB / Albemarle Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | -0.0087 | ||||

| VXUS / Vanguard STAR Funds - Vanguard Total International Stock ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ZTS / Zoetis Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BMY / Bristol-Myers Squibb Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CVS / CVS Health Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ABT / Abbott Laboratories | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EQIX / Equinix, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | -0.0273 | ||||

| NUE / Nucor Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CMI / Cummins Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |