Mga Batayang Estadistika

| Nilai Portofolio | $ 167,211,677 |

| Posisi Saat Ini | 109 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

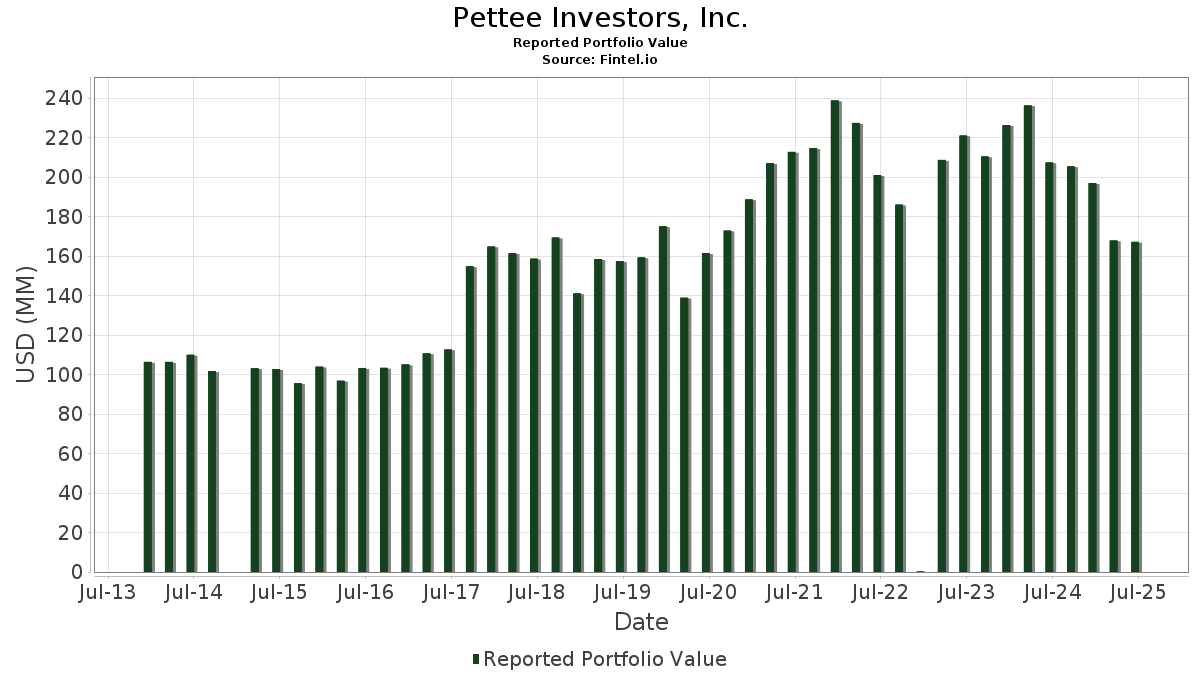

Pettee Investors, Inc. telah mengungkapkan total kepemilikan 109 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 167,211,677 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Pettee Investors, Inc. adalah JPMorgan Chase & Co. (US:JPM) , Microsoft Corporation (US:MSFT) , Johnson & Johnson (US:JNJ) , ETF Series Solutions - Hoya Capital Housing ETF (US:HOMZ) , and Apple Inc. (US:AAPL) . Posisi baru Pettee Investors, Inc. meliputi: Labcorp Holdings Inc. (US:LH) , Teledyne Technologies Incorporated (US:TDY) , Datadog, Inc. (US:DDOG) , LPL Financial Holdings Inc. (US:LPLA) , and Capital One Financial Corporation (US:COF) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 2.22 | 1.3296 | 1.3296 | |

| 0.05 | 13.22 | 7.9054 | 1.2419 | |

| 0.02 | 8.53 | 5.1011 | 1.1799 | |

| 0.01 | 4.62 | 2.7629 | 0.4704 | |

| 0.00 | 1.93 | 1.1568 | 0.3682 | |

| 0.01 | 4.37 | 2.6125 | 0.3623 | |

| 0.00 | 0.60 | 0.3591 | 0.3591 | |

| 0.00 | 0.56 | 0.3341 | 0.3341 | |

| 0.01 | 1.81 | 1.0853 | 0.3210 | |

| 0.02 | 2.59 | 1.5482 | 0.3089 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 1.03 | 0.6134 | -1.1037 | |

| 0.02 | 2.02 | 1.2090 | -0.8098 | |

| 0.03 | 1.41 | 0.8420 | -0.6228 | |

| 0.05 | 7.64 | 4.5702 | -0.4101 | |

| 0.00 | 1.00 | 0.5959 | -0.4017 | |

| 0.03 | 6.03 | 3.6034 | -0.3823 | |

| 0.01 | 0.30 | 0.1787 | -0.3788 | |

| 0.02 | 4.00 | 2.3950 | -0.3589 | |

| 0.01 | 1.12 | 0.6699 | -0.2789 | |

| 0.00 | 1.17 | 0.7006 | -0.2660 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-01 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JPM / JPMorgan Chase & Co. | 0.05 | 0.00 | 13.22 | 18.19 | 7.9054 | 1.2419 | |||

| MSFT / Microsoft Corporation | 0.02 | -2.20 | 8.53 | 29.60 | 5.1011 | 1.1799 | |||

| JNJ / Johnson & Johnson | 0.05 | -0.75 | 7.64 | -8.59 | 4.5702 | -0.4101 | |||

| HOMZ / ETF Series Solutions - Hoya Capital Housing ETF | 0.15 | 0.00 | 6.68 | -2.79 | 3.9979 | -0.0990 | |||

| AAPL / Apple Inc. | 0.03 | -2.49 | 6.03 | -9.93 | 3.6034 | -0.3823 | |||

| URI / United Rentals, Inc. | 0.01 | -0.13 | 4.62 | 20.07 | 2.7629 | 0.4704 | |||

| IBM / International Business Machines Corporation | 0.01 | -2.44 | 4.37 | 15.68 | 2.6125 | 0.3623 | |||

| ABBV / AbbVie Inc. | 0.02 | -2.21 | 4.00 | -13.37 | 2.3950 | -0.3589 | |||

| AMZN / Amazon.com, Inc. | 0.02 | -4.17 | 3.68 | 10.50 | 2.2023 | 0.2169 | |||

| GOOG / Alphabet Inc. | 0.02 | -3.77 | 3.60 | 9.26 | 2.1525 | 0.1900 | |||

| PG / The Procter & Gamble Company | 0.02 | -1.95 | 3.23 | -8.35 | 1.9308 | -0.1676 | |||

| WMT / Walmart Inc. | 0.03 | -4.36 | 3.22 | 6.53 | 1.9230 | 0.1246 | |||

| AXP / American Express Company | 0.01 | -0.65 | 2.94 | 17.80 | 1.7575 | 0.2711 | |||

| KR / The Kroger Co. | 0.04 | 0.00 | 2.94 | 5.99 | 1.7565 | 0.1052 | |||

| WM / Waste Management, Inc. | 0.01 | 0.00 | 2.91 | -1.16 | 1.7383 | -0.0137 | |||

| DHI / D.R. Horton, Inc. | 0.02 | 0.00 | 2.77 | 1.39 | 1.6542 | 0.0292 | |||

| ABT / Abbott Laboratories | 0.02 | -3.34 | 2.63 | -0.90 | 1.5746 | -0.0081 | |||

| DIS / The Walt Disney Company | 0.02 | -0.95 | 2.59 | 24.42 | 1.5482 | 0.3089 | |||

| HD / The Home Depot, Inc. | 0.01 | -4.63 | 2.55 | -4.57 | 1.5222 | -0.0672 | |||

| SPGI / S&P Global Inc. | 0.00 | -3.70 | 2.44 | -0.08 | 1.4597 | 0.0046 | |||

| LH / Labcorp Holdings Inc. | 0.01 | 2.30 | 0.0000 | ||||||

| XOM / Exxon Mobil Corporation | 0.02 | 0.00 | 2.23 | -9.37 | 1.3360 | -0.1323 | |||

| EFX / Equifax Inc. | 0.01 | 2.22 | 1.3296 | 1.3296 | |||||

| MCD / McDonald's Corporation | 0.01 | 0.00 | 2.11 | -6.47 | 1.2635 | -0.0822 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.02 | -1.39 | 2.11 | -3.26 | 1.2595 | -0.0379 | |||

| SCHW / The Charles Schwab Corporation | 0.02 | -48.81 | 2.02 | -40.35 | 1.2090 | -0.8098 | |||

| CVX / Chevron Corporation | 0.01 | 0.00 | 2.02 | -14.39 | 1.2059 | -0.1976 | |||

| HUBB / Hubbell Incorporated | 0.00 | 0.00 | 1.97 | 23.45 | 1.1809 | 0.2277 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 12.79 | 1.93 | 46.18 | 1.1568 | 0.3682 | |||

| PFE / Pfizer Inc. | 0.08 | -1.46 | 1.83 | -5.73 | 1.0930 | -0.0622 | |||

| NVDA / NVIDIA Corporation | 0.01 | -2.96 | 1.81 | 41.50 | 1.0853 | 0.3210 | |||

| ZTS / Zoetis Inc. | 0.01 | 0.00 | 1.75 | -5.31 | 1.0464 | -0.0542 | |||

| NEM / Newmont Corporation | 0.03 | 0.00 | 1.63 | 20.68 | 0.9737 | 0.1699 | |||

| PEP / PepsiCo, Inc. | 0.01 | 0.00 | 1.53 | -11.97 | 0.9150 | -0.1201 | |||

| TDY / Teledyne Technologies Incorporated | 0.00 | 1.52 | 0.0000 | ||||||

| BMY / Bristol-Myers Squibb Company | 0.03 | -24.55 | 1.41 | -42.76 | 0.8420 | -0.6228 | |||

| CLX / The Clorox Company | 0.01 | 0.00 | 1.31 | -18.48 | 0.7839 | -0.1738 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 2.01 | 1.27 | -2.98 | 0.7604 | -0.0202 | |||

| GPN / Global Payments Inc. | 0.02 | 24.07 | 1.25 | 1.46 | 0.7502 | 0.0133 | |||

| DD / DuPont de Nemours, Inc. | 0.02 | 0.00 | 1.23 | -8.18 | 0.7386 | -0.0625 | |||

| EMR / Emerson Electric Co. | 0.01 | -5.66 | 1.19 | 14.77 | 0.7115 | 0.0937 | |||

| HII / Huntington Ingalls Industries, Inc. | 0.00 | -38.98 | 1.17 | -27.81 | 0.7006 | -0.2660 | |||

| AMGN / Amgen Inc. | 0.00 | -6.99 | 1.16 | -16.63 | 0.6956 | -0.1357 | |||

| J / Jacobs Solutions Inc. | 0.01 | 0.00 | 1.16 | 8.71 | 0.6945 | 0.0582 | |||

| GE / General Electric Company | 0.00 | -1.24 | 1.15 | 27.02 | 0.6862 | 0.1480 | |||

| KRG / Kite Realty Group Trust | 0.05 | 0.00 | 1.14 | 1.33 | 0.6842 | 0.0110 | |||

| ICLR / ICON Public Limited Company | 0.01 | -15.38 | 1.12 | -29.65 | 0.6699 | -0.2789 | |||

| STX / Seagate Technology Holdings plc | 0.01 | 0.00 | 1.11 | 69.82 | 0.6668 | 0.2758 | |||

| INTC / Intel Corporation | 0.05 | -1.82 | 1.09 | -3.12 | 0.6508 | -0.0187 | |||

| BDX / Becton, Dickinson and Company | 0.01 | 0.00 | 1.07 | -24.79 | 0.6425 | -0.2087 | |||

| ORI / Old Republic International Corporation | 0.03 | 0.00 | 1.04 | -1.98 | 0.6207 | -0.0102 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.00 | 1.03 | -2.64 | 0.6184 | -0.0141 | |||

| DOV / Dover Corporation | 0.01 | -65.88 | 1.03 | -64.43 | 0.6134 | -1.1037 | |||

| WIX / Wix.com Ltd. | 0.01 | 42.42 | 1.01 | 38.24 | 0.6013 | 0.1677 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -0.09 | 1.00 | -40.50 | 0.5959 | -0.4017 | |||

| LEA / Lear Corporation | 0.01 | 0.00 | 0.99 | 7.60 | 0.5931 | 0.0443 | |||

| BK / The Bank of New York Mellon Corporation | 0.01 | 0.00 | 0.90 | 8.60 | 0.5368 | 0.0445 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 78.92 | 0.89 | 101.13 | 0.5308 | 0.2679 | |||

| MKC / McCormick & Company, Incorporated | 0.01 | -2.06 | 0.86 | -9.73 | 0.5163 | -0.0538 | |||

| HUM / Humana Inc. | 0.00 | -20.17 | 0.85 | -26.27 | 0.5059 | -0.1773 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 0.83 | -5.68 | 0.4970 | -0.0276 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.00 | 0.83 | 64.81 | 0.4962 | 0.1960 | |||

| DLB / Dolby Laboratories, Inc. | 0.01 | 0.00 | 0.82 | -7.53 | 0.4925 | -0.0381 | |||

| RIET / ETF Series Solutions - Hoya Capital High Dividend Yield ETF | 0.08 | 0.02 | 0.71 | -5.31 | 0.4264 | -0.0225 | |||

| MRK / Merck & Co., Inc. | 0.01 | 0.00 | 0.69 | -11.82 | 0.4152 | -0.0538 | |||

| AMP / Ameriprise Financial, Inc. | 0.00 | -17.24 | 0.64 | -8.70 | 0.3830 | -0.0352 | |||

| CVS / CVS Health Corporation | 0.01 | -26.07 | 0.61 | -24.69 | 0.3667 | -0.1186 | |||

| WH / Wyndham Hotels & Resorts, Inc. | 0.01 | 0.00 | 0.60 | -10.30 | 0.3598 | -0.0397 | |||

| DDOG / Datadog, Inc. | 0.00 | 0.60 | 0.3591 | 0.3591 | |||||

| GEV / GE Vernova Inc. | 0.00 | -1.24 | 0.59 | 71.59 | 0.3541 | 0.1480 | |||

| MMM / 3M Company | 0.00 | 0.00 | 0.59 | 3.72 | 0.3502 | 0.0137 | |||

| CTVA / Corteva, Inc. | 0.01 | 0.00 | 0.58 | 18.65 | 0.3463 | 0.0550 | |||

| LPLA / LPL Financial Holdings Inc. | 0.00 | 0.56 | 0.3341 | 0.3341 | |||||

| WLK / Westlake Corporation | 0.01 | 0.00 | 0.51 | -24.14 | 0.3047 | -0.0952 | |||

| CRM / Salesforce, Inc. | 0.00 | 45.71 | 0.47 | 47.96 | 0.2828 | 0.0925 | |||

| MCO / Moody's Corporation | 0.00 | 0.00 | 0.46 | 7.67 | 0.2772 | 0.0208 | |||

| Apollo Global Mgmt. LLC / (037612306) | 0.00 | 0.46 | 0.0000 | ||||||

| AKAM / Akamai Technologies, Inc. | 0.01 | 0.00 | 0.45 | -0.88 | 0.2707 | -0.0015 | |||

| COF / Capital One Financial Corporation | 0.00 | 0.44 | 0.2615 | 0.2615 | |||||

| AMAT / Applied Materials, Inc. | 0.00 | 0.00 | 0.41 | 26.07 | 0.2463 | 0.0518 | |||

| UPS / United Parcel Service, Inc. | 0.00 | 0.00 | 0.41 | -8.37 | 0.2427 | -0.0208 | |||

| FDX / FedEx Corporation | 0.00 | -4.05 | 0.40 | -10.42 | 0.2418 | -0.0274 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.00 | -2.30 | 0.40 | -21.31 | 0.2366 | -0.0627 | |||

| HBAN / Huntington Bancshares Incorporated | 0.02 | 0.00 | 0.38 | 11.61 | 0.2248 | 0.0242 | |||

| YUM / Yum! Brands, Inc. | 0.00 | 0.00 | 0.37 | -5.81 | 0.2235 | -0.0129 | |||

| NDAQ / Nasdaq, Inc. | 0.00 | 0.00 | 0.36 | 17.92 | 0.2166 | 0.0335 | |||

| BAC / Bank of America Corporation | 0.01 | 0.00 | 0.35 | 13.44 | 0.2072 | 0.0252 | |||

| PAYX / Paychex, Inc. | 0.00 | 0.00 | 0.35 | -5.74 | 0.2066 | -0.0117 | |||

| DLR / Digital Realty Trust, Inc. | 0.00 | 0.00 | 0.33 | 21.69 | 0.1981 | 0.0359 | |||

| CI / The Cigna Group | 0.00 | 0.00 | 0.32 | 0.31 | 0.1920 | 0.0016 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.31 | 23.14 | 0.1880 | 0.0355 | |||

| PKG / Packaging Corporation of America | 0.00 | 0.00 | 0.31 | -4.64 | 0.1843 | -0.0086 | |||

| BX / Blackstone Inc. | 0.00 | 0.00 | 0.30 | 7.04 | 0.1820 | 0.0126 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 0.30 | 17.44 | 0.1818 | 0.0279 | |||

| VZ / Verizon Communications Inc. | 0.01 | -66.52 | 0.30 | -68.13 | 0.1787 | -0.3788 | |||

| BUD / Anheuser-Busch InBev SA/NV - Depositary Receipt (Common Stock) | 0.00 | -7.71 | 0.29 | 2.87 | 0.1721 | 0.0057 | |||

| FAF / First American Financial Corporation | 0.00 | 0.00 | 0.26 | -6.43 | 0.1570 | -0.0102 | |||

| RTX / RTX Corporation | 0.00 | 16.56 | 0.26 | 28.00 | 0.1537 | 0.0345 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.24 | 14.22 | 0.1442 | 0.0181 | |||

| TGT / Target Corporation | 0.00 | 0.00 | 0.24 | -5.51 | 0.1438 | -0.0077 | |||

| DE / Deere & Company | 0.00 | 0.00 | 0.22 | 8.21 | 0.1344 | 0.0108 | |||

| VRSN / VeriSign, Inc. | 0.00 | 0.22 | 0.1321 | 0.1321 | |||||

| MAA / Mid-America Apartment Communities, Inc. | 0.00 | 0.00 | 0.22 | -11.65 | 0.1319 | -0.0169 | |||

| ORCL / Oracle Corporation | 0.00 | 0.22 | 0.1308 | 0.1308 | |||||

| MDLZ / Mondelez International, Inc. | 0.00 | 0.00 | 0.22 | -0.46 | 0.1290 | -0.0003 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.00 | 0.20 | 0.1201 | 0.1201 | |||||

| MTCH / Match Group, Inc. | 0.01 | 0.20 | 0.0000 | ||||||

| APLE / Apple Hospitality REIT, Inc. | 0.02 | 0.00 | 0.20 | -9.59 | 0.1186 | -0.0121 | |||

| AEGXF / Aecon Group Inc. | 0.01 | 0.00 | 0.15 | 27.35 | 0.0896 | 0.0193 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| INTU / Intuit Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DOW / Dow Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SLB / Schlumberger Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VAC / Marriott Vacations Worldwide Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DFS / Discover Financial Services | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MAS / Masco Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AWK / American Water Works Company, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |