Mga Batayang Estadistika

| Nilai Portofolio | $ 109,862,763 |

| Posisi Saat Ini | 389 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

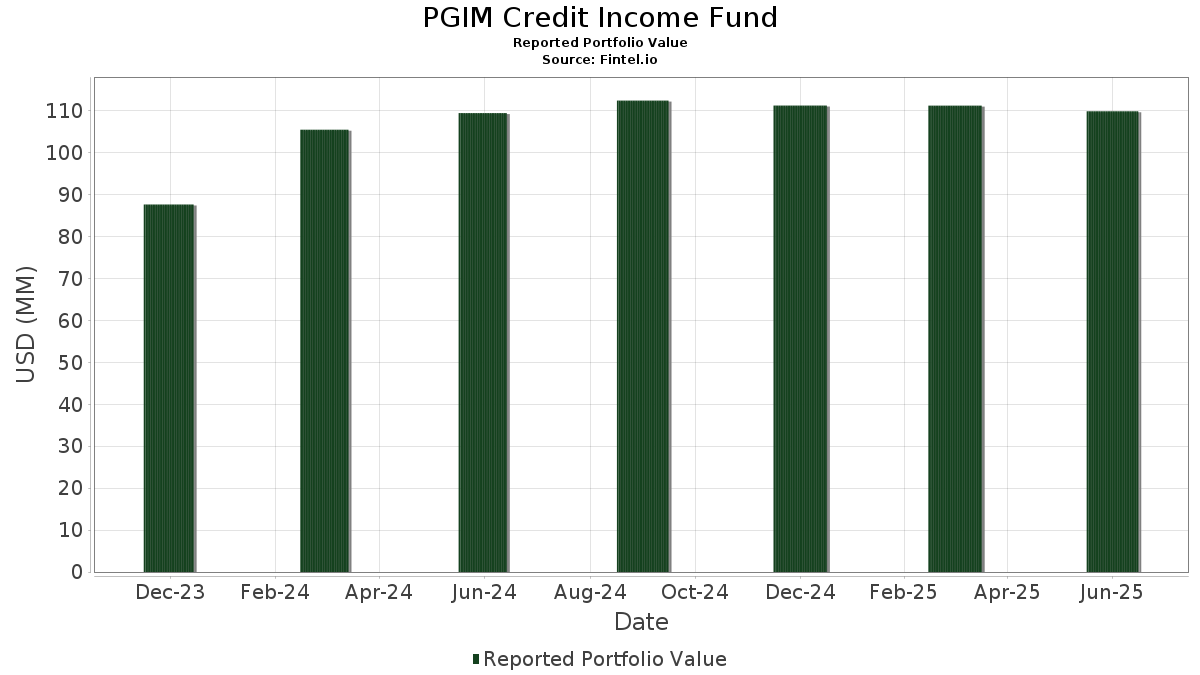

PGIM Credit Income Fund telah mengungkapkan total kepemilikan 389 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 109,862,763 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PGIM Credit Income Fund adalah Virgin Media Secured Finance PLC (GB:XS2062666602) , Vistra Corp (US:US92840MAC64) , Bombardier, Inc. (CA:US097751CA78) , NRG Energy Inc (US:US629377CU45) , and Bellis Finco PLC (GB:XS2303072883) . Posisi baru PGIM Credit Income Fund meliputi: Virgin Media Secured Finance PLC (GB:XS2062666602) , Vistra Corp (US:US92840MAC64) , Bombardier, Inc. (CA:US097751CA78) , NRG Energy Inc (US:US629377CU45) , and Bellis Finco PLC (GB:XS2303072883) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.84 | 1.7106 | 1.7106 | ||

| 1.52 | 1.52 | 1.4111 | 1.4111 | |

| 1.17 | 1.0877 | 1.0877 | ||

| 1.15 | 1.0689 | 1.0689 | ||

| 1.06 | 0.9891 | 0.9891 | ||

| 1.03 | 0.9578 | 0.9578 | ||

| 1.02 | 0.9531 | 0.9531 | ||

| 1.00 | 0.9286 | 0.9286 | ||

| 0.97 | 0.9064 | 0.9064 | ||

| 0.94 | 0.8747 | 0.8747 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| -2.31 | -2.1458 | -2.1458 | ||

| -2.08 | -1.9398 | -1.9398 | ||

| -2.07 | -1.9285 | -1.9285 | ||

| -1.69 | -1.5679 | -1.5679 | ||

| -1.58 | -1.4734 | -1.4734 | ||

| -1.39 | -1.2891 | -1.2891 | ||

| -1.36 | -1.2658 | -1.2658 | ||

| -1.15 | -1.0685 | -1.0685 | ||

| 1.01 | 0.9397 | -0.9455 | ||

| -1.01 | -0.9423 | -0.9423 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-27 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| XS2062666602 / Virgin Media Secured Finance PLC | 2.84 | 11.81 | 2.6433 | 0.2648 | |||||

| US92840MAC64 / Vistra Corp | 2.33 | 0.00 | 2.1656 | -0.0132 | |||||

| US097751CA78 / Bombardier, Inc. | 2.16 | 2.71 | 2.0140 | 0.0418 | |||||

| Tikehau US CLO III Ltd / ABS-CBDO (US88676NBA46) | 2.00 | -0.65 | 1.8625 | -0.0226 | |||||

| US629377CU45 / NRG Energy Inc | 1.99 | 0.50 | 1.8552 | -0.0024 | |||||

| HURRICANE CLEANCO LIMITED / LON (000000000) | 1.84 | 1.7106 | 1.7106 | ||||||

| PMT Credit Risk Transfer Trust 2024-2R / ABS-MBS (US69391NAA90) | 1.83 | -0.43 | 1.7068 | -0.0175 | |||||

| PMT Credit Risk Transfer Trust 2024-1R / ABS-MBS (US73015AAA51) | 1.83 | -0.49 | 1.6994 | -0.0189 | |||||

| XS2303072883 / Bellis Finco PLC | 1.81 | 12.58 | 1.6830 | 0.1793 | |||||

| Monument Clo 1 DAC / ABS-CBDO (XS2811088918) | 1.79 | 8.48 | 1.6660 | 0.1209 | |||||

| XS2615006470 / Monitchem HoldCo 3 SA | 1.71 | 9.67 | 1.5938 | 0.1311 | |||||

| US36267QAA22 / Forward Air Corp | 1.71 | 17.86 | 1.5906 | 0.2325 | |||||

| US25470MAG42 / DISH Network Corp | 1.57 | -2.24 | 1.4608 | -0.0431 | |||||

| PGIM Core Ultra Short Bond Fund / STIV (000000000) | 1.52 | 1.52 | 1.4111 | 1.4111 | |||||

| CQS US CLO 2023-3 Ltd / ABS-CBDO (US223929AJ96) | 1.51 | 0.20 | 1.4081 | -0.0056 | |||||

| Z Capital Credit Partners BSL CLO 2024-1 Ltd / ABS-CBDO (US98877JAG76) | 1.51 | 0.40 | 1.4064 | -0.0026 | |||||

| eG Global Finance PLC / DBT (XS2719998952) | 1.40 | 8.75 | 1.3069 | 0.0985 | |||||

| US95003EAE68 / WELLS FARGO COMMERCIAL MORTGAGE TRUST | 1.29 | 0.00 | 1.1976 | -0.0072 | |||||

| US983793AK61 / XPO Inc | 1.28 | 2.15 | 1.1937 | 0.0175 | |||||

| US513075BW03 / Lamar Media Corp | 1.27 | 3.10 | 1.1777 | 0.0289 | |||||

| US172967MV07 / Citigroup Inc | 1.22 | 0.75 | 1.1322 | 0.0023 | |||||

| Nassau Euro CLO IV DAC / ABS-CBDO (XS2798985599) | 1.20 | 10.22 | 1.1140 | 0.0967 | |||||

| Hayfin Emerald CLO V DAC / ABS-CBDO (XS2904563710) | 1.18 | 9.34 | 1.0997 | 0.0876 | |||||

| Barings Euro CLO 2024-1 DAC / ABS-CBDO (XS2831526186) | 1.18 | 8.85 | 1.0993 | 0.0831 | |||||

| Carlyle Euro CLO 2022-5 DAC / ABS-CBDO (XS2807510651) | 1.18 | 8.76 | 1.0982 | 0.0819 | |||||

| CONSTELLATION AUTOMOTIVE GRP LTD / DBT (000000000) | 1.17 | 1.0877 | 1.0877 | ||||||

| VOODOO SAS / DBT (000000000) | 1.15 | 1.0689 | 1.0689 | ||||||

| US04940AAL61 / Atlas Senior Loan Fund Ltd | 1.10 | 0.09 | 1.0238 | -0.0054 | |||||

| US443628AH54 / Hudbay Minerals Inc | 1.06 | 2.21 | 0.9896 | 0.0159 | |||||

| Bellis Acquisition Co PLC / DBT (XS2811958839) | 1.06 | 0.9891 | 0.9891 | ||||||

| US552953CH22 / MGM Resorts International | 1.06 | 2.51 | 0.9878 | 0.0187 | |||||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAJ99) | 1.05 | -0.09 | 0.9788 | -0.0077 | |||||

| US12769GAA85 / Caesars Entertainment Inc | 1.05 | 3.86 | 0.9768 | 0.0309 | |||||

| Taurus CMBS / ABS-MBS (XS3053366376) | 1.03 | 0.9578 | 0.9578 | ||||||

| WHARF Commercial Mortgage Trust 2025-DC / ABS-MBS (US92987LAL18) | 1.02 | 0.9531 | 0.9531 | ||||||

| Barrow Hanley CLO III Ltd / ABS-CBDO (US06875VAJ98) | 1.01 | 1.00 | 0.9425 | 0.0032 | |||||

| US431318BC74 / Hilcorp Energy I LP / Hilcorp Finance Co. | 1.01 | 1.30 | 0.9418 | 0.0067 | |||||

| KKR CLO 43 Ltd / ABS-CBDO (US48255UAS33) | 1.01 | -49.85 | 0.9397 | -0.9455 | |||||

| OFSI BSL CLO XIII Ltd / ABS-CBDO (US67118VAJ89) | 1.01 | 0.20 | 0.9386 | -0.0040 | |||||

| Genesis Sales Finance Master Trust / ABS-O (US37186XAY13) | 1.01 | -0.10 | 0.9362 | -0.0066 | |||||

| Elevation CLO 2021-12 Ltd / ABS-CBDO (US28623MBA62) | 1.00 | -0.60 | 0.9314 | -0.0112 | |||||

| Silver Rock CLO III / ABS-CBDO (US82811AAJ34) | 1.00 | -0.70 | 0.9308 | -0.0118 | |||||

| 370023103 / GGP, Inc. | 1.00 | 0.9286 | 0.9286 | ||||||

| US05592AAL44 / BPR Trust 2021-TY | 0.99 | 0.10 | 0.9246 | -0.0044 | |||||

| BX Trust 2025-DIME / ABS-MBS (US05613UAJ07) | 0.99 | 0.00 | 0.9231 | -0.0062 | |||||

| NYC Commercial Mortgage Trust 2025-3BP / ABS-MBS (US67120UAN72) | 0.99 | -0.60 | 0.9177 | -0.0115 | |||||

| US38144GAG64 / Goldman Sachs Group Inc/The | 0.98 | 0.93 | 0.9111 | 0.0023 | |||||

| BX Commercial Mortgage Trust 2024-AIRC / ABS-MBS (US12433CAG06) | 0.97 | 0.9064 | 0.9064 | ||||||

| Northwoods Capital 22 Ltd / ABS-CBDO (US66858HBG02) | 0.95 | -0.63 | 0.8843 | -0.0111 | |||||

| BX Trust 2025-TAIL / ABS-MBS (US123912AJ63) | 0.94 | 0.8747 | 0.8747 | ||||||

| US682413AG40 / ONE 2021-PARK Mortgage Trust | 0.94 | -2.19 | 0.8731 | -0.0249 | |||||

| BFLD 2024-WRHS Mortgage Trust / ABS-MBS (US05555HAN08) | 0.92 | -0.75 | 0.8603 | -0.0112 | |||||

| United States Treasury Note/Bond / DBT (US91282CLK52) | 0.91 | 0.78 | 0.8472 | 0.0014 | |||||

| NIDDA HEALTHCARE HLDG GMBH / DBT (000000000) | 0.89 | 0.8301 | 0.8301 | ||||||

| US880349AU90 / Tenneco Inc | 0.89 | 3.61 | 0.8280 | 0.0244 | |||||

| US23918KAT51 / DaVita Inc | 0.89 | 4.60 | 0.8250 | 0.0316 | |||||

| US109641AK67 / Brinker International Inc | 0.88 | 1.50 | 0.8184 | 0.0075 | |||||

| US978097AG86 / WOLVERINE WORLD WIDE REGD 144A P/P 4.00000000 | 0.87 | 5.95 | 0.8130 | 0.0412 | |||||

| Affirm Asset Securitization Trust 2024-A / ABS-O (US00834BAK35) | 0.86 | -1.49 | 0.7993 | -0.0173 | |||||

| DENALI INTERMEDIATE HLDG INC / DBT (000000000) | 0.84 | 0.7814 | 0.7814 | ||||||

| US845467AT68 / Southwestern Energy Co | 0.83 | 2.61 | 0.7679 | 0.0144 | |||||

| XS2719999844 / eG Global Finance PLC | 0.81 | 8.87 | 0.7538 | 0.0569 | |||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 0.80 | 2.29 | 0.7477 | 0.0120 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 0.80 | 0.7458 | 0.7458 | ||||||

| Preem Holdings AB / DBT (XS2493887264) | 0.80 | -54.35 | 0.7417 | -0.8929 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0.77 | 0.91 | 0.7199 | 0.0021 | |||||

| DUKES EDUCATION GROUP LTD / DBT (000000000) | 0.75 | 0.6941 | 0.6941 | ||||||

| BX Trust 2025-ROIC / ABS-MBS (US05593VAN38) | 0.74 | -1.34 | 0.6839 | -0.0138 | |||||

| Benchmark 2024-V5 Mortgage Trust / ABS-MBS (US08163XAC74) | 0.73 | -6.16 | 0.6802 | -0.0490 | |||||

| GRF / Greiffenberger AG | 0.71 | 9.43 | 0.6587 | 0.0524 | |||||

| BFLD 2024-VICT Mortgage Trust / ABS-MBS (US05555VAC37) | 0.70 | 0.29 | 0.6496 | -0.0027 | |||||

| Lugo Funding DAC / ABS-MBS (XS2930538983) | 0.69 | 9.58 | 0.6388 | 0.0523 | |||||

| US62886HBN08 / NCL Corp Ltd | 0.68 | 0.15 | 0.6358 | -0.0028 | |||||

| US983133AA70 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp 5.125% 10/01/2029 144A | 0.67 | 3.40 | 0.6231 | 0.0167 | |||||

| XS2064786754 / Ivory Coast Government International Bond | 0.67 | 9.88 | 0.6212 | 0.0526 | |||||

| BMO 2024-5C3 Mortgage Trust / ABS-MBS (US09660QAA22) | 0.65 | -6.08 | 0.6043 | -0.0425 | |||||

| HUDSON RIVER TRADING LLC / LON (US44413EAJ73) | 0.64 | 45.05 | 0.5995 | 0.1831 | |||||

| Benchmark 2024-V6 Mortgage Trust / ABS-MBS (US081927AH84) | 0.63 | -5.71 | 0.5850 | -0.0391 | |||||

| XS2340137343 / Herens Midco Sarl | 0.61 | 3.04 | 0.5693 | 0.0139 | |||||

| ASTERIX ACQUICO GMBH / LON (000000000) | 0.59 | 0.5451 | 0.5451 | ||||||

| INTERNATIONAL PARK HLDGS BV / DBT (000000000) | 0.59 | 0.5450 | 0.5450 | ||||||

| Hungary Government International Bond / DBT (US445545AX42) | 0.57 | 0.5299 | 0.5299 | ||||||

| VOYAGERPARENTLLC / LON (000000000) | 0.57 | 0.5287 | 0.5287 | ||||||

| US131347CP95 / Calpine Corp | 0.57 | 2.90 | 0.5279 | 0.0115 | |||||

| US44267DAE76 / HOWARD HUGHES CORP 4.125% 02/01/2029 144A | 0.55 | 4.19 | 0.5092 | 0.0171 | |||||

| US579063AB46 / Condor Merger Sub Inc | 0.54 | 6.48 | 0.5050 | 0.0281 | |||||

| US31935HAF47 / First Brands Group LLC, Second Lien Term Loan | 0.53 | -1.11 | 0.4968 | -0.0086 | |||||

| Ivory Coast Government International Bond / DBT (US221625AV83) | 0.53 | 0.76 | 0.4926 | 0.0010 | |||||

| US914906AU68 / Univision Communications Inc | 0.52 | 0.58 | 0.4873 | 0.0004 | |||||

| ALLTECH INC / LON (US02003DBB91) | 0.52 | 1.16 | 0.4868 | 0.0022 | |||||

| US1248EPCK74 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.51 | 5.36 | 0.4758 | 0.0213 | |||||

| US603051AE37 / Mineral Resources Ltd | 0.51 | 2.40 | 0.4757 | 0.0083 | |||||

| US63861CAE93 / Nationstar Mortgage Holdings Inc | 0.51 | 1.20 | 0.4701 | 0.0028 | |||||

| BX Commercial Mortgage Trust 2025-SPOT / ABS-MBS (US12433FAJ75) | 0.50 | -0.80 | 0.4615 | -0.0062 | |||||

| BX Commercial Mortgage Trust 2025-SPOT / ABS-MBS (US12433FAG37) | 0.50 | -0.80 | 0.4605 | -0.0072 | |||||

| US00507JAF30 / Action Environmental Group, Inc., The, Term Loan | 0.49 | -0.81 | 0.4550 | -0.0072 | |||||

| HARBOR FREIGHT TOOLS USA INC / LON (US41151PAR64) | 0.48 | 0.00 | 0.4510 | -0.0024 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.48 | 0.83 | 0.4509 | 0.0009 | |||||

| US80874DAA46 / Scientific Games Holdings LP/Scientific Games US FinCo Inc | 0.48 | 2.12 | 0.4481 | 0.0069 | |||||

| IVC ACQUISITION LTD / LON (000000000) | 0.48 | 0.4468 | 0.4468 | ||||||

| VIKCRU / Viking Cruises Ltd | 0.47 | -9.39 | 0.4405 | -0.0485 | |||||

| GFL ENVIRONMENTAL SERVIC / LON (US36257SAB88) | 0.45 | 0.4187 | 0.4187 | ||||||

| ENVISION HEALTHCARE OPERATING INC / DBT (000000000) | 0.45 | 0.4187 | 0.4187 | ||||||

| XAC8000CAB90 / Panther BF Aggregator 2 LP USD Term Loan B | 0.42 | -31.17 | 0.3948 | -0.1818 | |||||

| SANDISK CORP / LON (000000000) | 0.42 | 0.3943 | 0.3943 | ||||||

| XS1864522757 / Eskom Holdings SOC Ltd | 0.42 | 1.68 | 0.3937 | 0.0038 | |||||

| US57779EAA64 / Maxim Crane Works Holdings Capital LLC | 0.42 | 4.98 | 0.3928 | 0.0165 | |||||

| DONCASTERS US FIN LLC / DBT (000000000) | 0.42 | 0.3922 | 0.3922 | ||||||

| ARES Trust 2025-IND3 / ABS-MBS (US039955AJ85) | 0.42 | 0.3898 | 0.3898 | ||||||

| US98313RAH93 / Wynn Macau Ltd | 0.42 | 1.96 | 0.3878 | 0.0054 | |||||

| Coronado Finance Pty Ltd / DBT (US21979LAB27) | 0.41 | -19.09 | 0.3825 | -0.0938 | |||||

| Venture Global LNG Inc / DBT (US92332YAF88) | 0.41 | 3.02 | 0.3808 | 0.0088 | |||||

| US74759BAD55 / Qualitytech LP / QTS Finance Corp | 0.40 | 0.00 | 0.3717 | -0.0018 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 0.39 | 1.04 | 0.3611 | 0.0012 | |||||

| US91678HAF91 / Upstream Newco Inc | 0.39 | -6.55 | 0.3586 | -0.0277 | |||||

| BMC SOFTWARE INC / LON (US05988HAQ02) | 0.37 | 1.10 | 0.3424 | 0.0010 | |||||

| ALLIANCE LAUNDRY SYSTEMS LLC / LON (US01862LBA52) | 0.35 | 0.57 | 0.3260 | -0.0004 | |||||

| VISTA MANAGEMENT HOLDING INC / LON (US92842EAB48) | 0.35 | 0.3258 | 0.3258 | ||||||

| RED SPV LLC / LON (US75701MAE57) | 0.35 | 0.3248 | 0.3248 | ||||||

| USN15516AH53 / Braskem Netherlands Finance BV | 0.35 | -13.00 | 0.3241 | -0.0508 | |||||

| ENT / Entain Plc | 0.35 | 0.00 | 0.3234 | -0.0018 | |||||

| FOCUS FINANCIAL PARTNERS LLC / LON (US34416DBD93) | 0.35 | 0.58 | 0.3232 | -0.0001 | |||||

| GLOVES BUYER INC / LON (US37987UAG76) | 0.34 | 0.3182 | 0.3182 | ||||||

| BMO 2024-5C5 Mortgage Trust / ABS-MBS (US05593RAJ14) | 0.34 | -5.07 | 0.3137 | -0.0189 | |||||

| US89236YAB02 / TPC Group Inc 10.5% 08/01/2024 144A | 0.34 | -4.01 | 0.3118 | -0.0150 | |||||

| USP6629MAD40 / Mexico City Airport Trust | 0.33 | 0.30 | 0.3067 | -0.0010 | |||||

| US37254YAB65 / GEON PERFORMANCE SOLU LLC | 0.33 | -4.12 | 0.3034 | -0.0155 | |||||

| GATEGROUP US FINANCE INC / LON (000000000) | 0.32 | 0.3019 | 0.3019 | ||||||

| NEON MAPLE US DEBT MERGERSUB INC / LON (US69425BAB36) | 0.32 | -47.83 | 0.3016 | -0.2800 | |||||

| BELRON FINANCE 2019 LLC / LON (US08078UAM53) | 0.32 | 0.31 | 0.3011 | -0.0006 | |||||

| Star Leasing Co LLC / DBT (US854938AA54) | 0.32 | 0.2998 | 0.2998 | ||||||

| TK ELEVATOR US NEWCO INC / LON (XAD9000BAJ17) | 0.32 | 0.2965 | 0.2965 | ||||||

| 18948EAC0 / Forward Air 9/23 Cov-Lite TLB | 0.31 | 2.30 | 0.2901 | 0.0055 | |||||

| US31556TAA79 / Fertitta Entertainment LLC / Fertitta Entertainment Finance Co Inc | 0.31 | -46.01 | 0.2899 | -0.2493 | |||||

| XS1318576086 / Angolan Government International Bond | 0.31 | 0.2891 | 0.2891 | ||||||

| US71654QDL32 / Petroleos Mexicanos | 0.31 | 4.03 | 0.2885 | 0.0091 | |||||

| ROCKPOINT GAS STORAGE PA / LON (000000000) | 0.31 | 0.2846 | 0.2846 | ||||||

| MAVIS TIRE EXPRESS SERVICES TOPCO CORP / LON (US57777YAG17) | 0.30 | 0.34 | 0.2778 | -0.0007 | |||||

| JEFFERIES FINANCE LLC / LON (000000000) | 0.30 | 0.2767 | 0.2767 | ||||||

| CROSBY US ACQUISITION CORP / LON (US22739PAP18) | 0.30 | 0.00 | 0.2757 | -0.0014 | |||||

| BINGO HOLDINGS I LLC / LON (US09081AAC45) | 0.30 | 0.2746 | 0.2746 | ||||||

| GRINDING MEDIA INC / LON (US39854KAC45) | 0.29 | -1.67 | 0.2736 | -0.0072 | |||||

| ECO MATERIAL TECH INC / LON (US27888XAB38) | 0.29 | 0.2712 | 0.2712 | ||||||

| US146869AN20 / Carvana Co. | 0.29 | -0.69 | 0.2691 | -0.0034 | |||||

| XS1819680288 / Angolan Government International Bond | 0.28 | 1.80 | 0.2636 | 0.0027 | |||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.28 | 0.2612 | 0.2612 | ||||||

| DONCASTERS US FINANCE LLC / DBT (000000000) | 0.28 | 0.2566 | 0.2566 | ||||||

| MADISON IAQ LLC / LON (US55759VAD01) | 0.28 | 1.10 | 0.2566 | 0.0017 | |||||

| US04686RAB96 / Athenahealth, Inc. 2022 Term Loan B | 0.28 | 1.10 | 0.2564 | 0.0010 | |||||

| ECL ENTERTAINMENT LLC / LON (US26826TAL70) | 0.27 | 270.27 | 0.2558 | 0.1858 | |||||

| CPI HOLDCO B LLC / LON (US1261MAAC42) | 0.27 | 0.74 | 0.2554 | -0.0001 | |||||

| US45763FAT57 / Inmar Inc 2023 Term Loan | 0.27 | 0.37 | 0.2549 | -0.0003 | |||||

| TEI HOLDINGS INC / LON (US22663GAD88) | 0.27 | 37.19 | 0.2546 | 0.0681 | |||||

| GENESYS CLOUD SERVICES / LON (US39479UAY91) | 0.27 | -55.75 | 0.2542 | -0.3239 | |||||

| US11283YAG52 / Brookfield Residential Properties Inc / Brookfield Residential US LLC | 0.27 | 1.12 | 0.2531 | 0.0011 | |||||

| L1MN34 / Lumen Technologies, Inc. - Depositary Receipt (Common Stock) | 0.27 | 0.2527 | 0.2527 | ||||||

| ACRISURE LLC / LON (US00488PAV76) | 0.27 | 0.37 | 0.2517 | -0.0010 | |||||

| US67091TAA34 / OCP SA | 0.27 | 0.75 | 0.2503 | 0.0005 | |||||

| ASSUREDPARTNERS INC / LON (US04621HAW34) | 0.27 | 0.00 | 0.2481 | -0.0010 | |||||

| US04433LAA08 / Ashland LLC | 0.27 | 3.10 | 0.2479 | 0.0064 | |||||

| ARSENAL AIC PARENT LLC / LON (US04287KAG67) | 0.26 | 0.38 | 0.2464 | -0.0004 | |||||

| DONCASTERS US FINANCE LLC / LON (000000000) | 0.26 | 0.2450 | 0.2450 | ||||||

| DAVE & BUSTER'S INC / LON (US23833EAY05) | 0.26 | -25.57 | 0.2417 | -0.0849 | |||||

| SATS / EchoStar Corporation | 0.26 | 0.2391 | 0.2391 | ||||||

| GRAFTECH GLOBAL ENTERPRI / LON (000000000) | 0.26 | 0.2377 | 0.2377 | ||||||

| DISCOVERY ENERGY HOLDING / LON (US25472PAB67) | 0.25 | 1.62 | 0.2339 | 0.0022 | |||||

| LOIRE FINCO LUXEMBOURG / LON (XAL7000HAJ31) | 0.25 | 0.2330 | 0.2330 | ||||||

| US70289FAD33 / Patagonia Holdco LLC Term Loan B1 | 0.25 | -8.79 | 0.2325 | -0.0234 | |||||

| RECESS HOLDINGS INC / LON (US72811HAJ95) | 0.25 | 67.57 | 0.2316 | 0.0925 | |||||

| MRC / MRC Global Inc. | 0.25 | -0.80 | 0.2309 | -0.0031 | |||||

| PHOENIX GUARANTOR INC / LON (US71913BAK89) | 0.25 | 0.41 | 0.2307 | 0.0002 | |||||

| AZORRA SOAR TLB FINANCE LTD / LON (XAG0754AAB44) | 0.25 | -0.80 | 0.2306 | -0.0031 | |||||

| US59284MAD65 / Mexico City Airport Trust | 0.25 | 0.41 | 0.2300 | -0.0007 | |||||

| CNK / Cinemark Holdings, Inc. | 0.25 | -0.40 | 0.2295 | -0.0019 | |||||

| US00771PAJ03 / AEGION CORPORATION TERM LOAN | 0.25 | 0.41 | 0.2294 | 0.0001 | |||||

| US70932MAC10 / PennyMac Financial Services Inc | 0.25 | 3.38 | 0.2281 | 0.0061 | |||||

| BELFOR HOLDINGS INC / LON (US07768YAQ52) | 0.24 | 0.2274 | 0.2274 | ||||||

| US88037HAP91 / Tenneco Inc 2022 Term Loan B | 0.24 | 0.41 | 0.2264 | -0.0004 | |||||

| US44932EAD22 / Hyster-Yale Group Inc | 0.24 | -29.86 | 0.2258 | -0.0972 | |||||

| US64072UAM45 / CSC Holdings LLC | 0.24 | 1.26 | 0.2255 | 0.0013 | |||||

| USP05875AB84 / Autopistas del Sol SA/Costa Rica | 0.24 | -4.74 | 0.2249 | -0.0128 | |||||

| AMG / AMG Critical Materials N.V. | 0.24 | 0.2245 | 0.2245 | ||||||

| Huntington Bank Auto Credit-Linked Notes Series 2024-1 / ABS-O (US44644NAD12) | 0.24 | -13.04 | 0.2236 | -0.0347 | |||||

| WELD NORTH EDUCATION LLC / LON (US94935RAF01) | 0.24 | -2.85 | 0.2232 | -0.0072 | |||||

| US59909TAC80 / Milano Acqusition/DXC State & Local HHS First-lien Term Loan 400 2027-08-03 | 0.24 | 3.02 | 0.2231 | 0.0057 | |||||

| Benchmark 2024-V12 Mortgage Trust / ABS-MBS (US081915AB68) | 0.24 | 0.84 | 0.2229 | 0.0001 | |||||

| USP47777AB69 / Globo Comunicacao e Participacoes SA | 0.24 | 1.29 | 0.2193 | 0.0017 | |||||

| US16115QAF72 / Chart Industries Inc | 0.24 | 0.86 | 0.2193 | 0.0006 | |||||

| US53226GAK76 / LIGHTSTONE HOLDCO LLC TLB 5.75 | 0.24 | 0.2192 | 0.2192 | ||||||

| WIN WASTE INNOVATIONS HO / LON (US38723BAL53) | 0.23 | 0.2186 | 0.2186 | ||||||

| US810186AW67 / CORPORATE BONDS | 0.23 | 4.57 | 0.2135 | 0.0081 | |||||

| XS2066744231 / Carnival PLC | 0.23 | 130.30 | 0.2127 | 0.1200 | |||||

| US143658BR27 / Carnival Corp | 0.23 | -34.39 | 0.2115 | -0.1131 | |||||

| MCAFEE CORP / LON (US57906HAF47) | 0.23 | -50.22 | 0.2112 | -0.2163 | |||||

| FORTRESS INTERMEDIATE / LON (US34966LAB09) | 0.23 | -52.31 | 0.2112 | -0.2347 | |||||

| XS1793329225 / Ivory Coast Government International Bond | 0.23 | 9.18 | 0.2107 | 0.0169 | |||||

| NEWGENERATIONGASGATHERINGLLC / DBT (000000000) | 0.23 | 0.2105 | 0.2105 | ||||||

| NEW GENERATION GAS GATHERING LLC / DBT (000000000) | 0.23 | 0.2105 | 0.2105 | ||||||

| NEW GENERATION GAS GATHERING LLC / DBT (000000000) | 0.23 | 0.2105 | 0.2105 | ||||||

| US90480TAD81 / Covia Holdings Corp., Term Loan | 0.23 | 0.2094 | 0.2094 | ||||||

| Bausch & Lomb TE 12/18/30 / LON (000000000) | 0.23 | 0.2093 | 0.2093 | ||||||

| US87251RAK95 / TGP Holdings III (Traeger Grills) T/L (6/21) | 0.22 | -2.63 | 0.2074 | -0.0066 | |||||

| US279158AS81 / Ecopetrol SA | 0.22 | -38.61 | 0.2060 | -0.1313 | |||||

| EMRLD BORROWER LP / LON (US26872NAD12) | 0.22 | -52.68 | 0.2060 | -0.2317 | |||||

| USP28768AC69 / Colombia Telecomunicaciones SA ESP | 0.21 | -4.04 | 0.2000 | -0.0096 | |||||

| LD Celulose International GmbH / DBT (US50206BAA08) | 0.21 | 1.95 | 0.1951 | 0.0024 | |||||

| TRULITE GLASS & ALUMINUM SOLUTIONS LLC / LON (US89789MAB72) | 0.21 | -5.45 | 0.1937 | -0.0125 | |||||

| Cassa Depositi e Prestiti SpA / DBT (US147918AC06) | 0.21 | 0.49 | 0.1933 | 0.0002 | |||||

| INDY US HOLDCO LLC / LON (US45674PAR55) | 0.21 | 0.00 | 0.1924 | -0.0008 | |||||

| GS Mortgage Securities Corp Trust 2025-800D / ABS-MBS (US36273XAA90) | 0.21 | 0.1911 | 0.1911 | ||||||

| US46271BAB62 / IRIS HOLDINGS INC. - Initial Term Loan | 0.21 | 3.02 | 0.1908 | 0.0041 | |||||

| VIH1 / VIB Vermögen AG | 0.20 | 0.1906 | 0.1906 | ||||||

| US05508WAB19 / B&G Foods, Inc. | 0.20 | -2.86 | 0.1905 | -0.0065 | |||||

| US35906ABG22 / Frontier Communications Corp | 0.20 | 1.00 | 0.1885 | 0.0005 | |||||

| ARCHKEY HOLDINGS INC / LON (US48205CAC91) | 0.20 | 0.1884 | 0.1884 | ||||||

| XS2170852847 / Synlab Bondco PLC | 0.20 | 2.03 | 0.1875 | 0.0023 | |||||

| TIDAL WASTE & RECYCLING / LON (US88636PAK75) | 0.20 | 0.50 | 0.1865 | -0.0006 | |||||

| CROWN FINANCE US INC / LON (000000000) | 0.20 | 0.1858 | 0.1858 | ||||||

| US707569AS84 / Penn National Gaming Inc | 0.20 | 1.02 | 0.1855 | 0.0008 | |||||

| US90932LAG23 / United Airlines Inc | 0.20 | 1.02 | 0.1848 | 0.0007 | |||||

| APRO LLC / LON (US03834XAP87) | 0.20 | -0.51 | 0.1838 | -0.0016 | |||||

| US55759VAB45 / MADISON IAQ LLC | 0.20 | 1.03 | 0.1833 | 0.0008 | |||||

| US50179JAB44 / LBM Acquisition LLC Term Loan B | 0.20 | -25.48 | 0.1828 | -0.0719 | |||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 0.20 | -18.75 | 0.1823 | -0.0430 | |||||

| CAESARS ENTERTAIN INC / LON (US12768EAH99) | 0.20 | -43.31 | 0.1820 | -0.1408 | |||||

| RHP Hotel Properties LP / RHP Finance Corp / DBT (US749571AK15) | 0.20 | 3.17 | 0.1818 | 0.0042 | |||||

| COTIVITI INC / LON (US22164MAB37) | 0.19 | -43.44 | 0.1813 | -0.1406 | |||||

| US04649VBC37 / Asurion LLC, Term Loan B | 0.19 | -0.51 | 0.1807 | -0.0018 | |||||

| TRIDENT TPI HOLDINGS INC / LON (US00216EAL39) | 0.19 | 1.58 | 0.1804 | 0.0019 | |||||

| US88037HAN44 / TEN TL B 1L USD | 0.19 | 0.52 | 0.1788 | -0.0001 | |||||

| SHARP SERVICES LLC / LON (US81989LAF58) | 0.19 | 0.00 | 0.1785 | -0.0012 | |||||

| PEGASUS BIDCO BV / LON (XAN6872PAK74) | 0.19 | -1.04 | 0.1783 | -0.0026 | |||||

| US513272AD65 / Lamb Weston Holdings Inc | 0.19 | 2.15 | 0.1774 | 0.0030 | |||||

| US89787RAH57 / TruGreen Limited Partnership 2020 Term Loan | 0.19 | 0.00 | 0.1765 | -0.0009 | |||||

| NOURYON FINANCE BV / LON (XAN8232NAL19) | 0.19 | 0.00 | 0.1751 | -0.0015 | |||||

| XS2368781477 / Aydem Yenilenebilir Enerji A/S | 0.19 | 0.00 | 0.1741 | -0.0016 | |||||

| US09259GAF00 / Blackstone Mortgage Trust, Inc. 2022 Term Loan B4 | 0.18 | -49.72 | 0.1682 | -0.1674 | |||||

| PEER HOLDING III BV / LON (XAN6872NAM82) | 0.18 | 0.57 | 0.1633 | -0.0001 | |||||

| GREAT OUTDOORS GROUP LLC / LON (US07014QAP63) | 0.18 | -0.57 | 0.1631 | -0.0019 | |||||

| VT TOPCO INC / LON (US91838LAK61) | 0.17 | 0.1625 | 0.1625 | ||||||

| KRONOS ACQUISITION HOLDINGS INC / LON (US50106JAH95) | 0.17 | 2.35 | 0.1624 | 0.0030 | |||||

| US10554TAH86 / Braskem Netherlands Finance BV | 0.17 | 0.1621 | 0.1621 | ||||||

| A-AP BUYER INC / LON (US00036FAB04) | 0.17 | -0.57 | 0.1610 | -0.0022 | |||||

| SUMMER BC HOLDCO B SARL / LON (XAL8869UAG84) | 0.17 | 0.1600 | 0.1600 | ||||||

| CoreWeave Inc / DBT (US21873SAB43) | 0.17 | 0.1569 | 0.1569 | ||||||

| US13323NAA00 / Camelot Return Merger Sub Inc | 0.16 | 11.81 | 0.1502 | 0.0152 | |||||

| US55342UAM62 / MPT OPER PARTNERSHIP LP/CORP 3.5% 03/15/2031 | 0.16 | 6.00 | 0.1483 | 0.0079 | |||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 0.15 | 2.67 | 0.1435 | 0.0027 | |||||

| Five Point Operating Co LP / Five Point Capital Corp / DBT (US33834YAB48) | 0.15 | 0.00 | 0.1420 | -0.0010 | |||||

| US11565HAD89 / BROWN GROUP HOLDING, LLC | 0.15 | 102.70 | 0.1397 | 0.0714 | |||||

| VERITIV OPERATING CO / LON (US92338TAB26) | 0.15 | 0.00 | 0.1392 | -0.0003 | |||||

| MADISON SAFETY & FLOW / LON (US55822DAM39) | 0.15 | 0.1388 | 0.1388 | ||||||

| ARI / Apollo Commercial Real Estate Finance, Inc. | 0.15 | 0.1385 | 0.1385 | ||||||

| CPPIB OVM MEMBER US LLC / LON (US12673CAB00) | 0.15 | 0.00 | 0.1384 | -0.0003 | |||||

| GRANT THORNTON ADVISORS / LON (US38821UAD28) | 0.15 | 0.00 | 0.1383 | -0.0004 | |||||

| LC AHAB US BIDCO LLC / LON (US50180PAB76) | 0.15 | -67.41 | 0.1376 | -0.2847 | |||||

| GRAFTECH GLOBAL ENTERPRI / LON (000000000) | 0.15 | 0.1363 | 0.1363 | ||||||

| US377320AA45 / Glatfelter Corp | 0.15 | -2.01 | 0.1359 | -0.0037 | |||||

| US45567YAN58 / MH Sub I, LLC 2023 Term Loan | 0.15 | -2.03 | 0.1349 | -0.0042 | |||||

| NATL / NCR Atleos Corporation | 0.14 | 0.75 | 0.1257 | 0.0000 | |||||

| FGPRB / Ferrellgas Partners, L.P. | 0.00 | 0.00 | 0.13 | -21.64 | 0.1248 | -0.0354 | |||

| DS PARENT INC / LON (US23344YAG70) | 0.13 | -3.65 | 0.1237 | -0.0052 | |||||

| HERSCHEND ENTERTAINMENT CO LLC / LON (US42778EAG61) | 0.13 | 0.1170 | 0.1170 | ||||||

| BEACH ACQUISITION BIDCO / LON (000000000) | 0.13 | 0.1167 | 0.1167 | ||||||

| US91327TAA97 / Uniti Group LP / Uniti Group Finance Inc / CSL Capital LLC | 0.13 | -18.30 | 0.1163 | -0.0269 | |||||

| INNIO NORTH AMERICA HOLDING INC / LON (XAA2838LAG14) | 0.12 | 0.00 | 0.1150 | -0.0007 | |||||

| Lorca Telecom Bondco SA / DBT (XS2809218238) | 0.12 | 8.93 | 0.1141 | 0.0089 | |||||

| US469815AK08 / Jacobs Entertainment Inc | 0.12 | -16.67 | 0.1124 | -0.0224 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0.12 | 0.1103 | 0.1103 | ||||||

| NEW GENERATION GAS - UNFUNDED / DBT (000000000) | 0.11 | 0.1053 | 0.1053 | ||||||

| Champion Iron Canada Inc / DBT (US15853BAA98) | 0.11 | 0.1035 | 0.1035 | ||||||

| US25470XAY13 / DISH DBS CORP 7.75% 07/01/2026 | 0.11 | 3.74 | 0.1033 | 0.0022 | |||||

| XS2264871828 / Ivory Coast Government International Bond | 0.11 | 10.10 | 0.1021 | 0.0092 | |||||

| SHIFT4PAYMENTSLLC / LON (000000000) | 0.10 | 0.0937 | 0.0937 | ||||||

| US31935HAG20 / First Brands Group, LLC, Senior Secured First Lien Term Loan | 0.10 | 2.04 | 0.0934 | 0.0012 | |||||

| CROWN SUBSEA COMMUNICATI / LON (US22860EAJ10) | 0.10 | 0.0933 | 0.0933 | ||||||

| PEER HOLDING III BV / LON (XAN6872NAN65) | 0.10 | 0.0932 | 0.0932 | ||||||

| GRYPHON DEBT MERGER SUB / LON (000000000) | 0.10 | 0.0930 | 0.0930 | ||||||

| US11283YAB65 / Brookfield Residential Properties Inc / Brookfield Residential US Corp | 0.10 | 1.02 | 0.0925 | 0.0005 | |||||

| US11565HAB24 / Brown Group Holding, LLC Term Loan B | 0.10 | 1.02 | 0.0921 | -0.0002 | |||||

| US 5YR NOTE (CBT) / DIR (000000000) | 0.10 | 0.0919 | 0.0919 | ||||||

| PAINT INTERMEDIATE III / LON (US69575EAL39) | 0.10 | -1.01 | 0.0918 | -0.0015 | |||||

| Dcli Bidco LLC / DBT (US233104AA67) | 0.10 | 380.00 | 0.0895 | 0.0702 | |||||

| DUKES EDUCATION GROUP LTD / DBT (000000000) | 0.09 | 0.0863 | 0.0863 | ||||||

| US55342UAH77 / Mpt Operating Partnership Lp / Mpt Finance Corp 5.00% 10/15/2027 Bond | 0.09 | 2.22 | 0.0859 | 0.0014 | |||||

| US04364VAK98 / Ascent Resources Utica Holdings LLC / ARU Finance Corp | 0.09 | 0.00 | 0.0852 | -0.0006 | |||||

| MH SUB I LLC / LON (US45567YAP07) | 0.09 | -5.21 | 0.0849 | -0.0054 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0.09 | 0.0833 | 0.0833 | ||||||

| US146869AL63 / Carvana Co. | 0.09 | 0.00 | 0.0820 | -0.0009 | |||||

| DENALI INTERMEDIATE HLDG INC / DBT (000000000) | 0.08 | 0.0781 | 0.0781 | ||||||

| DUKES EDUCATION GROUP LTD / DBT (000000000) | 0.08 | 0.0778 | 0.0778 | ||||||

| WINDSTREAM SERVICES LLC / LON (US97381JAJ25) | 0.08 | 0.00 | 0.0700 | -0.0006 | |||||

| SAZERAC CO INC / LON (000000000) | 0.08 | 0.0698 | 0.0698 | ||||||

| US465966AB53 / JFL-Tiger Acquisition Co Inc Term Loan B | 0.07 | 0.0694 | 0.0694 | ||||||

| CLOSURE SYSTEMS INTERNAT / LON (US13763HAF91) | 0.07 | 0.00 | 0.0691 | -0.0004 | |||||

| Windstream Services LLC / Windstream Escrow Finance Corp / DBT (US97381AAA07) | 0.07 | 2.82 | 0.0682 | 0.0015 | |||||

| Kronos Acquisition Holdings Inc / DBT (US50106GAJ13) | 0.07 | -4.00 | 0.0674 | -0.0035 | |||||

| TalkTalk Telecom Group Ltd / DBT (XS2966240397) | 0.05 | -61.15 | 0.0512 | -0.0792 | |||||

| GBP/USD FORWARD / DFE (000000000) | 0.05 | 0.0436 | 0.0436 | ||||||

| ALTG / Alta Equipment Group Inc. | 0.05 | 6.98 | 0.0434 | 0.0024 | |||||

| DUKES EDUCATION GRP LTD / DBT (000000000) | 0.04 | 0.0377 | 0.0377 | ||||||

| DUKES EDUCATION GROUP LTD / LON (000000000) | 0.03 | 0.0322 | 0.0322 | ||||||

| BBG IG CREDIT / DE (000000000) | 0.03 | 0.0304 | 0.0304 | ||||||

| US 2YR NOTE (CBT) / DIR (000000000) | 0.03 | 0.0279 | 0.0279 | ||||||

| MPT Operating Partnership LP / MPT Finance Corp / DBT (US55342UAQ76) | 0.03 | 4.00 | 0.0244 | 0.0005 | |||||

| FERRELLGAS ESCROW LLC 3/30/31 Equity Preferred / EP (000000000) | 0.03 | 0.03 | 0.0233 | 0.0233 | |||||

| ARCHKEY HOLDINGS INC / LON (US48205CAD74) | 0.02 | 0.0218 | 0.0218 | ||||||

| DUKES EDUCATION GRP LTD / DBT (000000000) | 0.02 | 0.0199 | 0.0199 | ||||||

| US25470XBB01 / DISH DBS CORPORATION 07/28 7.375 | 0.02 | 5.88 | 0.0168 | 0.0002 | |||||

| US25470XBD66 / CORP. NOTE | 0.02 | 0.00 | 0.0155 | 0.0003 | |||||

| US53226GAL59 / LIGHTSTONE HOLDCO LLC TLC 5.75 | 0.01 | 0.0124 | 0.0124 | ||||||

| USD/EUR FORWARD / DFE (000000000) | 0.01 | 0.0116 | 0.0116 | ||||||

| DUKES EDUCATION GROUP LTD / DBT (000000000) | 0.01 | 0.0095 | 0.0095 | ||||||

| CDS PETROLEOS MEXICANOS / DCR (000000000) | 0.01 | 0.0089 | 0.0089 | ||||||

| CDS PETROLEOS MEXICANOS / DCR (000000000) | 0.01 | 0.0089 | 0.0089 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.01 | 0.0057 | 0.0057 | ||||||

| CDS CDX.NA.HY.43.V1 / DCR (000000000) | 0.00 | 0.0029 | 0.0029 | ||||||

| CDS CDX.NA.HY.42.V1 / DCR (000000000) | 0.00 | 0.0025 | 0.0025 | ||||||

| GBP/USD FORWARD / DFE (000000000) | 0.00 | 0.0018 | 0.0018 | ||||||

| EUR/USD FORWARD / DFE (000000000) | 0.00 | 0.0016 | 0.0016 | ||||||

| CDS PETROLEOS MEXICANOS / DCR (000000000) | 0.00 | 0.0007 | 0.0007 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.00 | -0.0003 | -0.0003 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.00 | -0.0003 | -0.0003 | ||||||

| CDS SOFTBANK GROUP CORP / DCR (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.00 | -0.0008 | -0.0008 | ||||||

| USD/EUR FORWARD / DFE (000000000) | -0.00 | -0.0014 | -0.0014 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.01 | -0.0137 | -0.0137 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.02 | -0.0145 | -0.0145 | ||||||

| EUR/USD FORWARD / DFE (000000000) | -0.02 | -0.0152 | -0.0152 | ||||||

| USD/GBP FORWARD / DFE (000000000) | -0.05 | -0.0438 | -0.0438 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.10 | -0.0907 | -0.0907 | ||||||

| BNP / BNP Paribas SA | -0.11 | -0.1049 | -0.1049 | ||||||

| BNP / BNP Paribas SA | -0.17 | -0.1570 | -0.1570 | ||||||

| BNP / BNP Paribas SA | -0.17 | -0.1612 | -0.1612 | ||||||

| PENN ENTERTAINMENT INC / RA (000000000) | -0.18 | -0.1682 | -0.1682 | ||||||

| CASSA DEPOSITI E PRESTITI SPA / RA (000000000) | -0.18 | -0.1691 | -0.1691 | ||||||

| BNP / BNP Paribas SA | -0.18 | -0.1710 | -0.1710 | ||||||

| SMG / The Scotts Miracle-Gro Company | -0.20 | -0.1852 | -0.1852 | ||||||

| BNP / BNP Paribas SA | -0.21 | -0.1910 | -0.1910 | ||||||

| BNP / BNP Paribas SA | -0.21 | -0.1928 | -0.1928 | ||||||

| BNP / BNP Paribas SA | -0.21 | -0.1994 | -0.1994 | ||||||

| CHART INDUSTRIES INC / RA (000000000) | -0.22 | -0.2007 | -0.2007 | ||||||

| PENNYMAC FIN SVCS INC / RA (000000000) | -0.22 | -0.2050 | -0.2050 | ||||||

| MEXICO CITY / RA (000000000) | -0.22 | -0.2065 | -0.2065 | ||||||

| FERTITTA ENTERTAINMENT / RA (000000000) | -0.23 | -0.2114 | -0.2114 | ||||||

| ASHLAND LLC / RA (000000000) | -0.24 | -0.2191 | -0.2191 | ||||||

| BNP / BNP Paribas SA | -0.25 | -0.2348 | -0.2348 | ||||||

| OCP SA / RA (000000000) | -0.26 | -0.2389 | -0.2389 | ||||||

| BNP / BNP Paribas SA | -0.26 | -0.2434 | -0.2434 | ||||||

| BNP / BNP Paribas SA | -0.27 | -0.2470 | -0.2470 | ||||||

| BNP / BNP Paribas SA | -0.27 | -0.2483 | -0.2483 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.28 | -0.2638 | -0.2638 | ||||||

| WYNN MACAU LTD / RA (000000000) | -0.36 | -0.3386 | -0.3386 | ||||||

| MAXIM CRANE WORKS HLDGS CAP / RA (000000000) | -0.38 | -0.3521 | -0.3521 | ||||||

| CCO HLDGS LLC CCO HLDGS CAP CO / RA (000000000) | -0.38 | -0.3567 | -0.3567 | ||||||

| IVORY COAST / RA (000000000) | -0.40 | -0.3767 | -0.3767 | ||||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | -0.42 | -0.3864 | -0.3864 | ||||||

| MCAFEE CORP / RA (000000000) | -0.42 | -0.3896 | -0.3896 | ||||||

| CITIGROUP INC / RA (000000000) | -0.43 | -0.4047 | -0.4047 | ||||||

| NATIONSTAR MTG HLDGS INC / RA (000000000) | -0.44 | -0.4059 | -0.4059 | ||||||

| VIKING CRUISES LTD / RA (000000000) | -0.44 | -0.4082 | -0.4082 | ||||||

| SCIENTIFIC GAMES HLDGS / RA (000000000) | -0.45 | -0.4158 | -0.4158 | ||||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | -0.47 | -0.4335 | -0.4335 | ||||||

| MINERAL RESOURCES LTD / RA (000000000) | -0.47 | -0.4349 | -0.4349 | ||||||

| HOWARD HUGHES CORP / RA (000000000) | -0.47 | -0.4373 | -0.4373 | ||||||

| CALPINE CORP / RA (000000000) | -0.48 | -0.4420 | -0.4420 | ||||||

| CORONADO FIN PTY LTD / RA (000000000) | -0.49 | -0.4541 | -0.4541 | ||||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | -0.61 | -0.5654 | -0.5654 | ||||||

| WYNN RESORTS FIN LLC / RA (000000000) | -0.61 | -0.5660 | -0.5660 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.62 | -0.5764 | -0.5764 | ||||||

| NCL CORP LTD / RA (000000000) | -0.64 | -0.5934 | -0.5934 | ||||||

| BNP / BNP Paribas SA | -0.68 | -0.6317 | -0.6317 | ||||||

| DAVITA INC / RA (000000000) | -0.71 | -0.6622 | -0.6622 | ||||||

| SOUTHWESTERN ENERGY CO / RA (000000000) | -0.74 | -0.6920 | -0.6920 | ||||||

| WOLVERINE WORLD WIDE INC / RA (000000000) | -0.75 | -0.7007 | -0.7007 | ||||||

| TENNECO INC / RA (000000000) | -0.77 | -0.7128 | -0.7128 | ||||||

| HudBay Minerals Inc. / RA (000000000) | -0.84 | -0.7780 | -0.7780 | ||||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | -0.86 | -0.8013 | -0.8013 | ||||||

| MGM RESORTS INTL / RA (000000000) | -0.91 | -0.8439 | -0.8439 | ||||||

| CAESARS ENTERTAINMENT INC / RA (000000000) | -0.92 | -0.8520 | -0.8520 | ||||||

| HILCORP ENERGY I HILCORP FIN C / RA (000000000) | -1.01 | -0.9423 | -0.9423 | ||||||

| XPO INC / RA (000000000) | -1.15 | -1.0685 | -1.0685 | ||||||

| MONTICHEM HOLDCO 3 SA / RA (000000000) | -1.36 | -1.2658 | -1.2658 | ||||||

| BNP / BNP Paribas SA | -1.39 | -1.2891 | -1.2891 | ||||||

| BELLIS FINCO PLC / RA (000000000) | -1.58 | -1.4734 | -1.4734 | ||||||

| BNP / BNP Paribas SA | -1.69 | -1.5679 | -1.5679 | ||||||

| BNP / BNP Paribas SA | -2.07 | -1.9285 | -1.9285 | ||||||

| BOMBARDIER INC / RA (000000000) | -2.08 | -1.9398 | -1.9398 | ||||||

| VIRGIN MEDIA SEC FIN PLC / RA (000000000) | -2.31 | -2.1458 | -2.1458 |