Mga Batayang Estadistika

| Nilai Portofolio | $ 2,376,374,960 |

| Posisi Saat Ini | 836 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

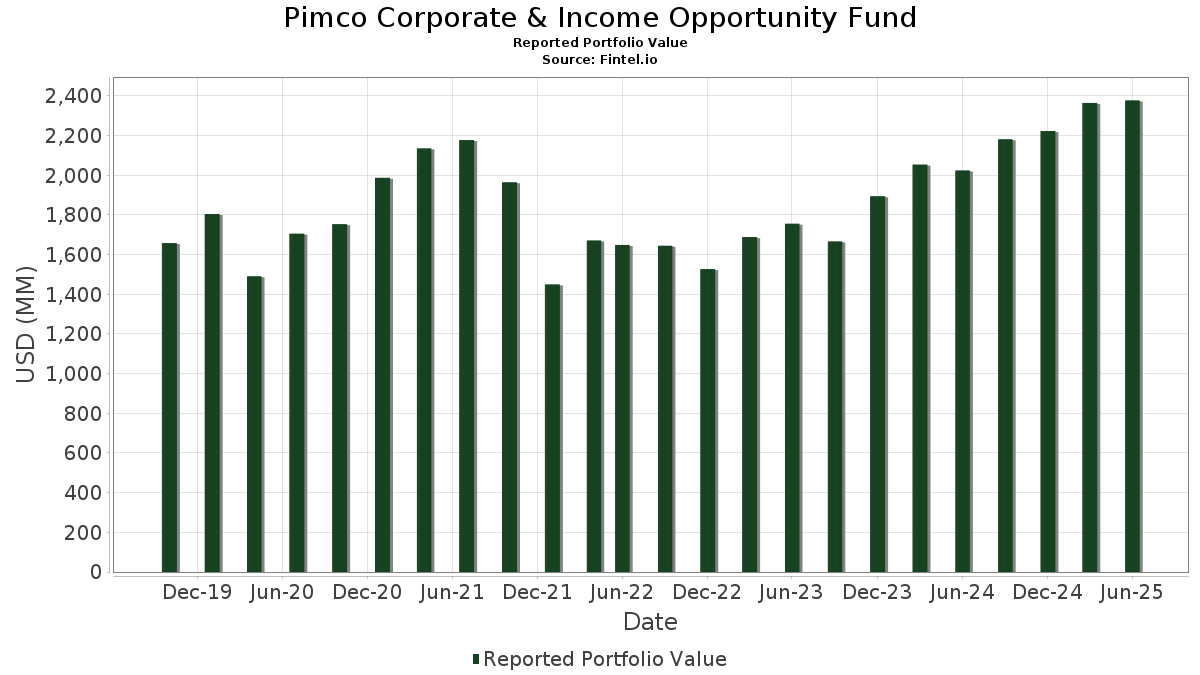

Pimco Corporate & Income Opportunity Fund telah mengungkapkan total kepemilikan 836 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 2,376,374,960 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Pimco Corporate & Income Opportunity Fund adalah PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , U.S. Renal Care, Inc., 1st Lien Term Loan C (US:US90290PAS39) , Syniverse Holdings, Inc. 2022 Term Loan (US:US87168TAB70) , COMEXPOSIUM 2019 EUR TERM LOAN B (FR:964NDFII9) , and INTELSAT JACKSON HOLDINGS S.A. (LU:US45824TBC80) . Posisi baru Pimco Corporate & Income Opportunity Fund meliputi: PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , U.S. Renal Care, Inc., 1st Lien Term Loan C (US:US90290PAS39) , Syniverse Holdings, Inc. 2022 Term Loan (US:US87168TAB70) , COMEXPOSIUM 2019 EUR TERM LOAN B (FR:964NDFII9) , and INTELSAT JACKSON HOLDINGS S.A. (LU:US45824TBC80) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 196.82 | 8.7848 | 5.2465 | ||

| 66.48 | 2.9669 | 2.9669 | ||

| 33.16 | 1.4798 | 1.4283 | ||

| 30.98 | 1.3827 | 1.2613 | ||

| 21.67 | 0.9670 | 0.9670 | ||

| 21.27 | 0.9492 | 0.9492 | ||

| 17.53 | 0.7825 | 0.7825 | ||

| 15.87 | 0.7083 | 0.7083 | ||

| 15.84 | 0.7072 | 0.7072 | ||

| 26.58 | 1.1863 | 0.6328 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| -56.30 | -2.5130 | -2.5130 | ||

| -43.33 | -1.9340 | -1.9340 | ||

| -19.02 | -0.8488 | -0.8488 | ||

| -15.17 | -0.6772 | -0.6772 | ||

| -10.71 | -0.4778 | -0.4778 | ||

| 4.65 | 0.2073 | -0.3863 | ||

| 3.41 | 0.1523 | -0.3468 | ||

| -7.52 | -0.3355 | -0.3355 | ||

| -7.48 | -0.3338 | -0.3338 | ||

| -7.48 | -0.3338 | -0.3338 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-29 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 196.82 | 159.68 | 8.7848 | 5.2465 | |||||

| PRS / Promotora de Informaciones, S.A. | 66.48 | 2.9669 | 2.9669 | ||||||

| RFRF USD SF+26.161/1.70 8/01/23-29Y* CME / DIR (EZR25S84QT07) | 60.43 | 2.67 | 2.6970 | -0.0505 | |||||

| AMSURG EQUITY EQTYAS910 / EC (902RDL901) | 1.27 | 0.00 | 57.42 | -3.43 | 2.5626 | -0.2129 | |||

| US90290PAS39 / U.S. Renal Care, Inc., 1st Lien Term Loan C | 54.95 | 1.23 | 2.4525 | -0.0813 | |||||

| US87168TAB70 / Syniverse Holdings, Inc. 2022 Term Loan | 38.96 | -3.51 | 1.7387 | -0.1460 | |||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 35.30 | 33.61 | 1.5757 | 0.3422 | |||||

| 964NDFII9 / COMEXPOSIUM 2019 EUR TERM LOAN B | 34.76 | 11.28 | 1.5516 | 0.0932 | |||||

| US45824TBC80 / INTELSAT JACKSON HOLDINGS S.A. | 33.48 | 7.31 | 1.4945 | 0.0379 | |||||

| US91889FAC59 / Valaris Ltd | 33.16 | 2,908.62 | 1.4798 | 1.4283 | |||||

| US65505PAA57 / Noble Finance II LLC | 30.98 | 1,091.50 | 1.3827 | 1.2613 | |||||

| TWITTER INC TERM LOAN / LON (US90184NAG34) | 29.08 | 34.06 | 1.2979 | 0.2853 | |||||

| COREWEAVE CMPTE ACQU CO II LLC 2024 DELAYED DRAW TERM LOAN / LON (BA0004JK4) | 27.63 | 1.88 | 1.2333 | -0.0327 | |||||

| US25470XBF15 / DISH DBS Corp. | 27.15 | 2.63 | 1.2119 | -0.0231 | |||||

| WAYFAIR LLC SR SECURED 144A 09/30 7.75 / DBT (US94419NAB38) | 26.58 | 124.16 | 1.1863 | 0.6328 | |||||

| ENVISION HEALTHCARE CORPORTION 2023 LAST OUT TERM LOAN / LON (949ABFII9) | 25.37 | 1.48 | 1.1322 | -0.0347 | |||||

| INCORA NEW EQUITY / EC (955PRF008) | 0.70 | 0.00 | 23.79 | -5.46 | 1.0616 | -0.1128 | |||

| 948FWKII5 / STEENBOK LUX FINCO 2 SARL 2023 EUR PIK TL A2 RESTRUCTURE | 23.16 | 6.45 | 1.0338 | 0.0180 | |||||

| 952YSX903 / WINDSTREAM UNITS EQUITY | 1.18 | 0.00 | 23.15 | -12.63 | 1.0335 | -0.2037 | |||

| US35564KNE54 / Freddie Mac Structured Agency Credit Risk Debt Notes | 22.88 | 33.42 | 1.0211 | 0.2206 | |||||

| OCS GROUP HOLDINGS LTD GBP TERM LOAN B / LON (BA000BQB0) | 22.54 | 6.15 | 1.0061 | 0.0148 | |||||

| DOMINICAN REPUBLIC SR UNSECURED 144A 03/37 10.5 / DBT (US25714PFD50) | 22.50 | 5.44 | 1.0044 | 0.0082 | |||||

| CENTRAL PARENT INC 2024 TERM LOAN B / LON (US15477BAE74) | 22.35 | -14.78 | 0.9974 | -0.2267 | |||||

| US00187GAD16 / AP CORE HOLDINGS II, LLC 9/1/2027 | 22.06 | -0.46 | 0.9844 | -0.0500 | |||||

| US91327AAB89 / Uniti Group LP | 22.01 | 23.45 | 0.9823 | 0.1501 | |||||

| IVANTI SOFTWARE INC 2025 1ST LIEN TERM LOAN / LON (US46583DAH26) | 21.67 | 0.9670 | 0.9670 | ||||||

| SUBCALIDORA 2 2024 EUR TERM LOAN / LON (BA0007DG2) | 21.31 | 8.94 | 0.9511 | 0.0380 | |||||

| BAUSCH HEALTH COMPANIES INC 2025 TERM LOAN B / LON (XAC6903HAB06) | 21.27 | 0.9492 | 0.9492 | ||||||

| INCORA INTERMEDIATE II SR SECURED 144A 01/30 VAR / DBT (US45338XAA37) | 20.97 | 3.16 | 0.9359 | -0.0129 | |||||

| INCORA TOP HOLDCO LLC CONV PIK PRE COMP / DBT (955PRK007) | 20.94 | -4.06 | 0.9345 | -0.0842 | |||||

| US25470XBE40 / DISH DBS Corp | 20.36 | -1.14 | 0.9088 | -0.0526 | |||||

| OIBR4 / Oi S.A. - Preferred Stock | 20.17 | -19.51 | 0.9001 | -0.2694 | |||||

| US654744AD34 / Nissan Motor Co Ltd | 19.37 | -3.41 | 0.8646 | -0.0716 | |||||

| RFRF USD SF+26.161/1.3* 8/09/23-9Y* CME / DIR (EZYBN0P9F1K0) | 18.59 | -10.89 | 0.8298 | -0.1442 | |||||

| STEPSTONE GROUP M 2 GMBH THE EUR TERM LOAN B / LON (BA000BNR8) | 18.40 | 7.31 | 0.8213 | 0.0208 | |||||

| BMPS / Banca Monte dei Paschi di Siena S.p.A. | 2.15 | 0.00 | 18.31 | 7.74 | 0.8173 | 0.0239 | |||

| RFR USD SOFR/4.50000 03/20/24-6Y* CME / DIR (000000000) | 17.53 | 0.7825 | 0.7825 | ||||||

| US345370BS81 / Ford Motor 7.7% Debs Due 5/15/2097 | 17.44 | -3.15 | 0.7785 | -0.0622 | |||||

| CTEV / Claritev Corporation | 17.38 | 9.03 | 0.7757 | 0.0316 | |||||

| US89054XAC92 / Topaz Solar Farms LLC | 17.08 | -0.13 | 0.7625 | -0.0360 | |||||

| US46115HBV87 / INTESA SANPAOLO SPA | 16.61 | 1.07 | 0.7414 | -0.0258 | |||||

| CTEV / Claritev Corporation | 16.32 | -0.82 | 0.7285 | -0.0397 | |||||

| US040114HU71 / Argentine Republic Government International Bond | 16.16 | 7.95 | 0.7215 | 0.0225 | |||||

| BRVALEDBS028 / VALE SA SUBORDINATED 12/49 VAR | 15.93 | 3.91 | 0.7111 | -0.0047 | |||||

| US71360HAB33 / PERATON CORP | 15.93 | 644.09 | 0.7111 | 0.6111 | |||||

| LU2445093128 / INTELSAT EMERGENCE SA | 0.46 | 0.00 | 15.88 | 2.41 | 0.7090 | -0.0151 | |||

| SOFTBANK VISION FUND II TRANCHE B1 TERM LOAN / LON (BA000KP88) | 15.87 | 0.7083 | 0.7083 | ||||||

| CLOVER HOLDINGS 2 LLC TERM LOAN B / LON (US18914DAB47) | 15.84 | 0.7072 | 0.7072 | ||||||

| L1MN34 / Lumen Technologies, Inc. - Depositary Receipt (Common Stock) | 15.83 | 2.51 | 0.7067 | -0.0143 | |||||

| XAF6628DAN49 / Numericable U.S. LLC, Term Loan B14 | 14.88 | 0.83 | 0.6641 | -0.0248 | |||||

| UNICORN BAY HKD FIXED TERM LOAN A / LON (BA00077Z7) | 14.70 | -11.97 | 0.6560 | -0.1234 | |||||

| USP7721BAE13 / Peru LNG Srl | 14.51 | 1.33 | 0.6475 | -0.0208 | |||||

| OBOL FRANCE 3 SAS 2024 EUR TERM LOAN B / LON (BA0006XM9) | 14.45 | 12.34 | 0.6448 | 0.0445 | |||||

| GATEWY CSINS + ENTRTINMNT LTD 2024 TERM LOAN B / LON (BA000DCX3) | 14.11 | -1.19 | 0.6298 | -0.0369 | |||||

| US92332YAC57 / Venture Global LNG Inc | 13.38 | 71.39 | 0.5974 | 0.2328 | |||||

| US04625PAA93 / ARMOR HOLDCO IN 8.5 11/29 | 12.47 | -1.33 | 0.5566 | -0.0334 | |||||

| US04965JAC71 / Atrium Hotel Portfolio Trust 2017-ATRM | 12.43 | -1.00 | 0.5547 | -0.0313 | |||||

| TRT061124T11 / Turkey Government Bond | 11.84 | -2.71 | 0.5282 | -0.0397 | |||||

| RFRF USD SF+26.161/1.75 12/15/21-10Y LCH / DIR (EZN6SV5430Y2) | 11.50 | -7.76 | 0.5135 | -0.0688 | |||||

| US81376EAD76 / SECURITIZED ASSET BACKED RECEI SABR 2006 NC2 M1 | 11.44 | 0.11 | 0.5108 | -0.0228 | |||||

| RFRF USD SF+26.161/1.7* 7/22/23-27Y* CME / DIR (EZPNTT021H26) | 11.14 | 2.19 | 0.4971 | -0.0116 | |||||

| RFRF USD SF+26.161/1.8* 8/07/23-27Y* CME / DIR (EZ258XD43XX3) | 10.96 | 2.33 | 0.4890 | -0.0108 | |||||

| US040114HV54 / Argentine Republic Government International Bond | 10.89 | 7.17 | 0.4860 | 0.0117 | |||||

| ALIGNED DATA CENTERS INTER LP 2024 TERM LOAN / LON (BA000JN59) | 10.33 | 0.4609 | 0.4609 | ||||||

| US91327TAA97 / Uniti Group LP / Uniti Group Finance Inc / CSL Capital LLC | 10.32 | -0.21 | 0.4608 | -0.0222 | |||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 10.24 | -22.32 | 0.4570 | -0.1583 | |||||

| UZBEKNEFTEGAZ SR UNSECURED 144A 05/30 8.75 / DBT (US91825MAC73) | 10.21 | 0.4555 | 0.4555 | ||||||

| XS2264968665 / Ivory Coast Government International Bond | 9.88 | 10.79 | 0.4408 | 0.0247 | |||||

| 18948EAC0 / Forward Air 9/23 Cov-Lite TLB | 8.89 | 24.20 | 0.3968 | 0.0626 | |||||

| US35729PPZ70 / FREMONT HOME LOAN TRUST FHLT 2006 2 M1 | 8.74 | 0.83 | 0.3902 | -0.0146 | |||||

| US279158AP43 / Ecopetrol SA | 8.54 | 0.3811 | 0.3811 | ||||||

| XS2348767323 / BOI Finance BV | 8.54 | 11.04 | 0.3810 | 0.0221 | |||||

| US35563CAH16 / FREDDIE MAC MILITARY HOUSING B FMMHR 2015 R1 D1 144A | 8.49 | -2.29 | 0.3789 | -0.0267 | |||||

| US71643VAB18 / Petroleos Mexicanos | 8.46 | 5.75 | 0.3775 | 0.0041 | |||||

| US87331AAB08 / TABERNA PREFERED FUNDING LTD TBRNA 2006 6A A1BF 144A | 8.31 | 1.17 | 0.3709 | -0.0125 | |||||

| JETBLUE AIRWAYS/LOYALTY JETBLUE AIRWAYS/LOYALTY / DBT (US476920AA15) | 8.26 | -1.46 | 0.3685 | -0.0226 | |||||

| US00187GAC33 / AP CORE HOLDINGS II, LLC 9/1/2027 | 8.22 | -2.41 | 0.3667 | -0.0263 | |||||

| EZ4R1WZFR6D0 / RFRF USD SF+26.161/1.2* 9/16/23-27Y* CME | 8.20 | 3.46 | 0.3661 | -0.0040 | |||||

| US29279UAB26 / ENDURE DIGITAL INC TLB 3.5 | 7.97 | 3.09 | 0.3556 | -0.0052 | |||||

| XAD7001LAC72 / SCUR-Alpha 1503 GmbH USD Term Loan B1 | 7.87 | 1.04 | 0.3512 | -0.0123 | |||||

| VIRI / Viridien Société anonyme | 7.62 | 5.51 | 0.3399 | 0.0030 | |||||

| TITANIUM 2L BONDCO S.? R.L. EO 01/31 6.25 / DBT (DE000A3L3AG9) | 7.62 | 2.85 | 0.3399 | -0.0058 | |||||

| US83368RBS04 / Societe Generale SA | 7.58 | 1.50 | 0.3383 | -0.0103 | |||||

| REPUBLIC OF EL SALVADOR REPUBLIC OF EL SALVADOR / DBT (US283875CE06) | 7.43 | 1.66 | 0.3316 | -0.0096 | |||||

| US146869AM47 / Carvana Co. | 7.31 | 6.62 | 0.3264 | 0.0062 | |||||

| GTN / Gray Media, Inc. | 7.30 | 2.44 | 0.3258 | -0.0068 | |||||

| US694308HH37 / PACIFIC GAS + ELECTRIC SR UNSECURED 02/44 4.75 | 7.24 | -2.20 | 0.3233 | -0.0225 | |||||

| XS1953916290 / Republic of Uzbekistan Bond | 7.24 | 11.93 | 0.3233 | 0.0212 | |||||

| US88880LAB99 / TOBACCO SETTLEMENT FIN AUTH WV TOBGEN 06/47 ZEROCPNOID 0 | 7.20 | -2.90 | 0.3214 | -0.0248 | |||||

| RFRF USD SF+26.161/2.00 7/15/23-27Y* CME / DIR (EZCKQSYF2CV2) | 7.03 | 2.35 | 0.3136 | -0.0069 | |||||

| VENTURE GLOBAL LNG INC VENTURE GLOBAL LNG INC / DBT (US92332YAE14) | 6.88 | 2.63 | 0.3071 | -0.0059 | |||||

| US87817JAG31 / Team Health Holdings Inc | 6.86 | 1.81 | 0.3060 | -0.0084 | |||||

| VICI / VICI Properties Inc. | 0.21 | 0.00 | 6.85 | -0.06 | 0.3059 | -0.0142 | |||

| US02156TAB08 / Altice France Holding SA | 6.83 | 18.61 | 0.3047 | 0.0360 | |||||

| BDO USA P C 2024 TERM LOAN A / LON (BA000BL33) | 6.81 | -0.01 | 0.3041 | -0.0140 | |||||

| US02156LAC54 / Altice France SA/France | 6.74 | 5.28 | 0.3008 | 0.0019 | |||||

| US87331BAB80 / TABERNA PREFERED FUNDING LTD TBRNA 2006 5A A1AD 144A | 6.63 | -1.72 | 0.2960 | -0.0190 | |||||

| US05571AAS42 / BPCE SA | 6.59 | 0.87 | 0.2943 | -0.0108 | |||||

| US35564KSQ30 / STACR_22-DNA2 | 6.45 | 0.2878 | 0.2878 | ||||||

| XS0767473852 / Russian Foreign Bond - Eurobond | 6.44 | 0.00 | 0.2874 | -0.0132 | |||||

| 936UVD902 / SYNIVERSE PFD PIK PFDJJZ917 | 6.75 | 6.25 | 6.39 | 3.38 | 0.2853 | -0.0033 | |||

| XAD7001LAB99 / SCUR ALPHA 1503 GMBH EUR TERM LOAN B1 | 6.27 | 10.77 | 0.2800 | 0.0156 | |||||

| US624284BD65 / Mountain Sts Tel & Teleg Co Debentures 7.375% 05/01/30 | 6.26 | 5.78 | 0.2792 | 0.0032 | |||||

| US92332YAD31 / Venture Global LNG Inc | 6.22 | 1.68 | 0.2778 | -0.0079 | |||||

| BURBERRY GROUP PLC COMPANY GUAR REGS 06/30 5.75 / DBT (XS2831553073) | 6.22 | 8.51 | 0.2778 | 0.0100 | |||||

| US12667LAF94 / CWL 2006-21 M1 | 6.12 | 3.03 | 0.2729 | -0.0041 | |||||

| US35564KLV97 / Freddie Mac STACR REMIC Trust 2021-DNA6 | 6.06 | -0.16 | 0.2705 | -0.0128 | |||||

| US35564KJB61 / FHLMC STACR REMIC Trust, Series 2021-DNA5, Class B2 | 5.92 | 2.35 | 0.2641 | -0.0058 | |||||

| GRYPHON DEBT MERGER SUB INC TERM LOAN B / LON (US40054QAB95) | 5.81 | 0.2591 | 0.2591 | ||||||

| US466317AG94 / JP MORGAN CHASE COMMERCIAL MOR JPMCC 2022 NLP B 144A | 5.76 | 0.73 | 0.2571 | -0.0098 | |||||

| US69547UAC27 / PAID_23-6 | 5.73 | -8.79 | 0.2558 | -0.0375 | |||||

| ARARGE3209S6 / REPUBLIC OF ARGENTINA BONDS 07/30 VAR | 5.69 | 6.60 | 0.2540 | 0.0048 | |||||

| MANUCHAR GROUP SARL MANUCHAR GROUP SARL / DBT (BE6365837184) | 5.66 | 0.2525 | 0.2525 | ||||||

| US126673P487 / CWL 2005-4 MF3 | 5.54 | -0.27 | 0.2473 | -0.0120 | |||||

| US07386VAA89 / BEAR STEARNS ASSET BACKED SECU BSABS 2007 AC3 A1 | 5.47 | -0.98 | 0.2442 | -0.0137 | |||||

| 938DREII2 / ENCINA PRIVATE CREDIT LLC NOTE | 5.43 | -0.80 | 0.2423 | -0.0132 | |||||

| COTIVITI CORPORATION 2025 2ND AMENDMENT TERM LOAN / LON (US22164MAF41) | 5.28 | 1.81 | 0.2357 | -0.0064 | |||||

| MNSH / MNSN Holdings Inc. | 0.01 | 0.00 | 5.27 | 8.15 | 0.2353 | 0.0078 | |||

| POSEIDON BIDCO SASU 2023 EUR TERM LOAN B / LON (953RGXII1) | 5.24 | 5.53 | 0.2341 | 0.0021 | |||||

| TREASURY BILL 10/25 0.00000 / DBT (US912797RD17) | 5.24 | 0.2339 | 0.2339 | ||||||

| US36321DAB38 / Galaxy US Opco, Inc., 1st Lien Term Loan | 5.23 | 4.92 | 0.2332 | -0.0077 | |||||

| MH SUB I LLC 2024 TERM LOAN B4 / LON (US45567YAP07) | 5.20 | -5.64 | 0.2322 | -0.0252 | |||||

| VIRI / Viridien Société anonyme | 5.12 | -3.98 | 0.2286 | -0.0204 | |||||

| XS0308673945 / EUROSAIL PLC ESAIL 2007 3X D1A REGS | 5.08 | 7.11 | 0.2267 | 0.0054 | |||||

| US251093S844 / City of Detroit MI | 5.03 | -2.77 | 0.2243 | -0.0170 | |||||

| GFL ENVIRONMENTAL INC 2025 TERM LOAN B / LON (US36257SAB88) | 5.01 | -15.89 | 0.2236 | -0.0544 | |||||

| H1FC34 / HF Sinclair Corporation - Depositary Receipt (Common Stock) | 4.98 | 1.01 | 0.2221 | -0.0079 | |||||

| DATABRICKS INC LAST OUT TERM LOAN / LON (BA000D206) | 4.96 | 0.24 | 0.2215 | -0.0096 | |||||

| US25470MAB54 / DISH Network Corp. 3.375% Bond | 4.94 | 0.06 | 0.2207 | -0.0100 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 4.94 | -56.45 | 0.2204 | -0.3088 | |||||

| US197677AH07 / HCA Inc | 4.92 | 3.97 | 0.2195 | -0.0013 | |||||

| DUN + BRADSTREET CORPOR THE 2025 TERM LOAN / LON (BA000K739) | 4.88 | 0.2177 | 0.2177 | ||||||

| XS2264968665 / Ivory Coast Government International Bond | 4.87 | 11.30 | 0.2172 | 0.0131 | |||||

| US17315JBM36 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2009 6 17A2 144A | 4.82 | 0.58 | 0.2152 | -0.0086 | |||||

| BAUSCH + LOMB CORPORATION 2025 TERM LOAN B / LON (XAC0787FAJ12) | 4.82 | 0.2149 | 0.2149 | ||||||

| RFRF USD SF+26.161/1.3* 08/24/23-5Y CME / DIR (EZW1ZD4JN8J3) | 4.80 | -19.52 | 0.2144 | -0.0642 | |||||

| US17322WAK09 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2014 6 3A3 144A | 4.77 | -2.67 | 0.2128 | -0.0159 | |||||

| UNITI GROUP/CSL CAPITAL COMPANY GUAR 144A 06/32 8.625 / DBT (US91327TAC53) | 4.75 | 0.2121 | 0.2121 | ||||||

| US129890AA73 / CALI Mortgage Trust 2019-101C | 4.73 | -10.78 | 0.2110 | -0.0363 | |||||

| RFR GBP SONIO/0.75000 09/21/22-10Y LCH / DIR (EZ46915873M8) | 4.72 | 0.62 | 0.2108 | -0.0083 | |||||

| TOUCAN FINCO LTD/CAN/US TOUCAN FINCO LTD/CAN/US / DBT (XS3069889643) | 4.68 | 0.2089 | 0.2089 | ||||||

| US08162RBP10 / BENCHMARK MORTGAGE TRUST BMARK 2021 B23 360C 144A | 4.68 | -3.01 | 0.2087 | -0.0164 | |||||

| REPUBLIC OF EL SALVADOR SR UNSECURED 144A 11/54 9.65 / DBT (US283875CG53) | 4.65 | 2.81 | 0.2074 | -0.0036 | |||||

| US36267QAA22 / Forward Air Corp | 4.65 | -63.47 | 0.2073 | -0.3863 | |||||

| IRS EUR 0.83000 12/09/42-10Y LCH / DIR (EZPRCT6S2FJ7) | 4.64 | 30.64 | 0.2073 | 0.0413 | |||||

| WINDSTREAMWARRANTS SLDENVWINDSTREAMWARRANTS / DE (000000000) | 4.60 | 0.2055 | 0.2055 | ||||||

| US46649JAN81 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2018-ASH8 | 4.55 | -0.94 | 0.2030 | -0.0113 | |||||

| TREASURY BILL 07/25 0.00000 / DBT (US912797LW51) | 4.53 | 0.2022 | 0.2022 | ||||||

| LTM / LATAM Airlines Group S.A. | 4.53 | 0.2021 | 0.2021 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 4.53 | 0.2020 | 0.2020 | ||||||

| OIBR4 / Oi S.A. - Preferred Stock | 4.44 | -35.72 | 0.1984 | -0.1244 | |||||

| US3137B4PY66 / FREDDIE MAC FHR 4246 SN | 4.40 | -2.05 | 0.1965 | -0.0133 | |||||

| PRIME HEALTHCARE SERVICE PRIME HEALTHCARE SERVICE / DBT (US74165HAC25) | 4.37 | 5.15 | 0.1950 | 0.0010 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 4.28 | 5.00 | 0.1912 | 0.0008 | |||||

| US20453QAA04 / Compeer Financial ACA | 4.40 | 0.00 | 4.28 | 0.00 | 0.1910 | -0.0087 | |||

| XS2138128314 / ALTICE FRANCE HOLDING S.A. | 4.25 | 28.36 | 0.1895 | 0.0351 | |||||

| IRS EUR 0.50000 09/21/22-30Y LCH / DIR (EZ0WQK0YW4M7) | 4.20 | 15.13 | 0.1875 | 0.0171 | |||||

| CRESCENT ENERGY FINANCE SR UNSECURED 144A 01/34 8.375 / DBT (US45344LAG86) | 4.11 | 0.1832 | 0.1832 | ||||||

| YINSON BERGENIA PRODUCTI YINSON BERGENIA PRODUCTI / DBT (US98585VAA61) | 3.95 | 0.1764 | 0.1764 | ||||||

| XS2264968665 / Ivory Coast Government International Bond | 3.95 | 10.36 | 0.1764 | 0.0092 | |||||

| US12564NAL64 / CLNY Trust 2019-IKPR | 3.92 | 0.87 | 0.1751 | -0.0064 | |||||

| TREASURY BILL 09/25 0.00000 / DBT (US912797PW16) | 3.83 | 0.1708 | 0.1708 | ||||||

| CHRD / Chord Energy Corporation | 3.82 | 2.69 | 0.1706 | -0.0032 | |||||

| STEPSTNE GRUP MDCO 2 GMBH THE USD TERM LOAN / LON (BA000BVC2) | 3.79 | -1.66 | 0.1693 | -0.0107 | |||||

| US92943AAE47 / WSTN 23-MAUI C 144A FRN 08-05-27 | 3.75 | -0.50 | 0.1675 | -0.0086 | |||||

| US74930PAH73 / RBSSP RESECURITIZATION TRUST RBSSP 2011 4 4A2 144A | 3.74 | 0.54 | 0.1670 | -0.0067 | |||||

| US92943AAG94 / WSTN 23-MAUI D 144A FRN 07-05-37/08-06-27 | 3.71 | -1.96 | 0.1656 | -0.0110 | |||||

| YINSON BORONIA PRODUCTIO SR SECURED 144A 07/42 8.947 / DBT (US98584XAA37) | 3.70 | 0.85 | 0.1650 | -0.0061 | |||||

| IVANTI SOFTWARE INC 2025 NEWCO TERM LOAN / LON (US46583VAB53) | 3.57 | 0.1594 | 0.1594 | ||||||

| US36298GAA76 / GSPA MONETIZATION TRUST PASS THRU CE 144A 10/29 6.422 | 3.53 | -3.92 | 0.1577 | -0.0139 | |||||

| ASTON MARTIN CAPITAL HOL ASTON MARTIN CAPITAL HOL / DBT (US04625HAJ86) | 3.51 | 0.1566 | 0.1566 | ||||||

| US281020AY36 / EDISON INTERNATIONAL | 3.50 | 0.37 | 0.1561 | -0.0065 | |||||

| FR0013524865 / Auchan Holding SA | 3.41 | -68.08 | 0.1523 | -0.3468 | |||||

| FR0014000O87 / Ubisoft Entertainment SA | 3.40 | 8.59 | 0.1518 | 0.0056 | |||||

| FLORA FOOD MANAGEMENT BV SR SECURED 144A 07/29 6.875 / DBT (XS2849520908) | 3.35 | -64.56 | 0.1497 | -0.2920 | |||||

| SPRUCE BIDCO II INC TERM LOAN / LON (BA000FPP1) | 3.33 | -0.60 | 0.1485 | -0.0077 | |||||

| US02156LAH42 / Altice France SA/France | 3.32 | 4.57 | 0.1482 | -0.0000 | |||||

| US86358ETK28 / SAIL 2005-5 M5 | 3.31 | -0.45 | 0.1479 | -0.0075 | |||||

| RFR GBP SONIO/0.75000 09/21/22-30Y LCH / DIR (EZBHYJ02MR92) | 3.30 | 8.20 | 0.1472 | 0.0049 | |||||

| US02090CAB63 / Brooks Automation, 2nd Lien Term Loan | 3.27 | -0.58 | 0.1459 | -0.0076 | |||||

| J + J VENTURES GAMING LLC 2024 TERM LOAN / LON (46604BAG3) | 3.22 | -0.22 | 0.1435 | -0.0069 | |||||

| US90355YAA55 / US Renal Care Inc | 3.21 | 0.16 | 0.1433 | -0.0064 | |||||

| RFRF USD SF+26.161/0.7* 9/16/23-8Y* CME / DIR (EZCQ8PB28P30) | 3.20 | -8.07 | 0.1429 | -0.0197 | |||||

| CA125491AG54 / CI FINANCIAL CO | 3.17 | 0.64 | 0.1413 | -0.0056 | |||||

| US25714PEU84 / Dominican Republic Central Bank Notes | 3.14 | -26.26 | 0.1403 | -0.0587 | |||||

| RFRF USD SF+26.161/1.4* 08/17/23-5Y CME / DIR (EZV3G8RXTDG6) | 3.14 | -19.47 | 0.1403 | -0.0419 | |||||

| US05969MAB54 / BANC OF AMERICA FUNDING CORPOR BAFC 2014 R8 A2 144A | 3.14 | -0.88 | 0.1402 | -0.0077 | |||||

| US78397FAC77 / SG COMMERCIAL MORTGAGE SECURIT SGCMS 2020 COVE B 144A | 3.14 | -3.24 | 0.1400 | -0.0113 | |||||

| US466287AP40 / J.P. MORGAN ALTERNATIVE LOAN T JPALT 2007 A1 2A1 | 3.14 | -0.10 | 0.1400 | -0.0066 | |||||

| CHILE ELECTRICITY LUX GOVT GUARANT 144A 10/35 5.58 / DBT (US16882LAA08) | 3.13 | -2.16 | 0.1398 | -0.0096 | |||||

| TOUCAN FINCO LTD/CAN/US SR SECURED 144A 05/30 9.5 / DBT (US89157UAA51) | 3.07 | 0.1370 | 0.1370 | ||||||

| RAIZEN FUELS FINANCE COMPANY GUAR 144A 03/54 6.95 / DBT (US75102XAC02) | 3.06 | -4.85 | 0.1368 | -0.0135 | |||||

| RFRF USD SF+26.161/2.2* 9/12/23-26Y* CME / DIR (EZKTBHXRSKN0) | 3.05 | 2.59 | 0.1363 | -0.0027 | |||||

| US92943AAJ34 / WSTN TRUST WSTN 2023 MAUI E 144A | 3.04 | -2.25 | 0.1358 | -0.0095 | |||||

| IRS EUR 0.25000 09/21/22-10Y LCH / DIR (EZG64YQ7HVJ2) | 3.04 | 5.33 | 0.1358 | 0.0010 | |||||

| US75971FAF09 / RENAISSANCE HOME EQUITY LOAN T RAMC 2007 3 AF3 | 3.01 | -1.92 | 0.1344 | -0.0089 | |||||

| US78447T1034 / SLM STUDENT LOAN TRUST SLMA 2013 M1 M1R 144A | 3.00 | -10.13 | 0.1339 | -0.0219 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 3.00 | 12.42 | 0.1338 | 0.0093 | |||||

| BAUSCH + LOMB CORP SR SECURED 144A 01/31 VAR / DBT (XS3102032110) | 2.97 | 0.1325 | 0.1325 | ||||||

| US02151AAB61 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2007 19 1A2 | 2.95 | -3.90 | 0.1319 | -0.0117 | |||||

| US89054XAD75 / Topaz Solar Farms LLC | 2.95 | -3.25 | 0.1315 | -0.0107 | |||||

| US78307ADE01 / Russian Foreign Bond - Eurobond | 2.94 | 0.00 | 0.1312 | -0.0060 | |||||

| WAYFAIR LLC SR SECURED 144A 10/29 7.25 / DBT (US94419NAA54) | 2.91 | 183.43 | 0.1298 | 0.0783 | |||||

| IRS EUR -0.15000 03/18/20-10Y LCH / DIR (EZ489JQF3VQ3) | 2.88 | 4.01 | 0.1286 | -0.0007 | |||||

| TWITTER INC 2025 FIXED TERM LOAN / LON (US90184NAK46) | 2.87 | 0.1282 | 0.1282 | ||||||

| US12564NAN21 / CLNY TRUST 2019-IKPR SER 2019-IKPR CL E V/R REGD 144A P/P 0.00000000 | 2.86 | 0.81 | 0.1277 | -0.0048 | |||||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 2.84 | 0.1266 | 0.1266 | ||||||

| US31935HAG20 / First Brands Group, LLC, Senior Secured First Lien Term Loan | 2.82 | 0.97 | 0.1259 | -0.0045 | |||||

| US20754DAJ63 / Connecticut Avenue Securities Trust 2022-R05 | 2.82 | 0.1257 | 0.1257 | ||||||

| US29279XAA81 / ENDURANCE ACQ MERGER 6% 02/15/2029 144A | 2.78 | -2.53 | 0.1240 | -0.0090 | |||||

| 953PAVII5 / FINASTRA USA INC 2023 TERM LOAN | 2.70 | -0.88 | 0.1205 | -0.0066 | |||||

| PROJECT ALPHA INTERME HLDG INC 2025 2ND LIEN INC TL / LON (BA000BKS9) | 2.69 | 0.00 | 0.1201 | -0.0055 | |||||

| US61749BAE39 / MORGAN STANLEY CAPITAL INC MSAC 2006 NC5 A2C | 2.69 | -2.29 | 0.1200 | -0.0085 | |||||

| XS2689949043 / Romania Government International Bonds | 2.67 | -6.90 | 0.1192 | -0.0147 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 2.67 | 11.30 | 0.1192 | 0.0072 | |||||

| US75970JAF30 / RENAISSANCE HOME EQUITY LOAN T RAMC 2007 1 AF3 | 2.67 | -10.95 | 0.1191 | -0.0208 | |||||

| US03766YAB92 / APIDOS CLO APID 2017 28A SUB 144A | 2.66 | -13.27 | 0.1187 | -0.0245 | |||||

| DOMINICAN REPUBLIC SR UNSECURED 144A 06/36 10.75 / DBT (US25714PFA12) | 2.65 | -3.42 | 0.1185 | -0.0099 | |||||

| AVENIR ISSUER IV IRLND SR SECURED REGS 10/27 6 / DBT (XS2933572856) | 2.63 | -36.80 | 0.1172 | -0.0767 | |||||

| WINDSTREAM SERVICES/ESCR SR SECURED 144A 10/31 8.25 / DBT (US97381AAA07) | 2.62 | 0.1170 | 0.1170 | ||||||

| TREASURY BILL 10/25 0.00000 / DBT (US912797RB50) | 2.56 | 0.1144 | 0.1144 | ||||||

| MARBLE POINT CLO XXIII LTD. MP23 2021 4A SUB 144A / ABS-CBDO (US566068AC62) | 2.50 | -14.89 | 0.1118 | -0.0256 | |||||

| US92332YAA91 / Venture Global LNG, Inc. | 2.48 | 1,128.71 | 0.1108 | 0.0987 | |||||

| US62955HAJ68 / NYO COMMERCIAL MORTGAGE TRUST NYO 2021 1290 D 144A | 2.46 | 1.24 | 0.1096 | -0.0036 | |||||

| STELLANTIS FIN US INC COMPANY GUAR 144A 03/35 6.45 / DBT (US85855CAL46) | 2.45 | 0.1093 | 0.1093 | ||||||

| US90323WAN02 / Ursa Re Ltd | 2.41 | -1.27 | 0.1074 | -0.0064 | |||||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 2.40 | 0.1072 | 0.1072 | ||||||

| TRT061124T11 / Turkey Government Bond | 2.39 | -2.25 | 0.1068 | -0.0075 | |||||

| US25714PER55 / Dominican Republic Central Bank Notes | 2.39 | -30.66 | 0.1065 | -0.0541 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 2.37 | -0.84 | 0.1056 | -0.0058 | |||||

| US15477CAA36 / Central Parent Inc / Central Merger Sub Inc | 2.36 | 0.1053 | 0.1053 | ||||||

| POLESTAR RE LTD UNSECURED 144A 01/27 VAR / DBT (US73110JAB89) | 2.30 | 0.97 | 0.1026 | -0.0037 | |||||

| US35729NAD75 / FREMONT HOME LOAN TRUST FHLT 2006 E 2A3 | 2.27 | -0.40 | 0.1012 | -0.0051 | |||||

| CAPE LOOKOUT RE LTD UNSECURED 144A 04/27 VAR / DBT (US13947LAF94) | 2.23 | -1.33 | 0.0996 | -0.0060 | |||||

| US71654QDC33 / Petroleos Mexicanos | 2.22 | 5.41 | 0.0992 | 0.0008 | |||||

| US12651QAQ29 / CSMC Trust 2017-CHOP | 2.21 | -0.23 | 0.0984 | -0.0048 | |||||

| CLOVER HOLDINGS 2 LLC REVOLVER / LON (US18914DAD03) | 2.20 | 0.0984 | 0.0984 | ||||||

| MARICOPA CNTY AZ INDL DEV AUTH MAREDU 10/29 FIXED 7.375 / DBT (US56681NJD03) | 2.18 | 0.37 | 0.0971 | -0.0041 | |||||

| US02156LAE11 / Altice France SA/France | 2.15 | 5.14 | 0.0960 | 0.0005 | |||||

| US647622AE91 / New Orleans Hotel Trust 2019-HNLA | 2.14 | 0.99 | 0.0957 | -0.0034 | |||||

| US715638BE14 / Peruvian Government International Bond | 2.11 | -15.62 | 0.0943 | -0.0226 | |||||

| US45670JAE29 / INDYMAC IMSC MORTGAGE LOAN TRU IMSC 2007 F2 2A1 | 2.09 | -10.01 | 0.0931 | -0.0151 | |||||

| 948FWLII3 / STEENBOK LUX FINCO 2 SARL 2023 EUR PIK TL B2 RESTRUCTURE | 2.07 | -21.22 | 0.0925 | -0.0303 | |||||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/29 VAR / DBT (US903724BZ40) | 2.04 | -4.62 | 0.0913 | -0.0088 | |||||

| SOFTBANK VISION FUND II TRANCHE B2 TERM LOAN / LON (BA000KP70) | 2.03 | 0.0906 | 0.0906 | ||||||

| US02156LAF85 / Altice France SA/France | 1.99 | 5.47 | 0.0886 | 0.0007 | |||||

| US694308GZ44 / Pacific Gas & Electric 4.45% Senior Notes 04/15/42 | 1.98 | -2.84 | 0.0884 | -0.0068 | |||||

| US126694A329 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 OA1 2A1 | 1.96 | 4.25 | 0.0877 | -0.0003 | |||||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/34 VAR / DBT (US903724CA89) | 1.96 | -2.78 | 0.0875 | -0.0067 | |||||

| SAMMONS FINANCIAL GROUP SAMMONS FINANCIAL GROUP / DBT (US79588TAF75) | 1.93 | 0.47 | 0.0862 | -0.0035 | |||||

| LONG WALK REINSURANCE UNSECURED 144A 01/31 VAR / DBT (US54289CAA09) | 1.93 | -0.21 | 0.0860 | -0.0041 | |||||

| US863579L482 / STRUCTURED ADJUSTABLE RATE MOR SARM 2005 23 3A1 | 1.91 | -3.82 | 0.0855 | -0.0074 | |||||

| US80000XAC39 / SANDERS RE III LTD UNSECURED 144A 04/29 VAR | 1.86 | -42.21 | 0.0832 | -0.0673 | |||||

| US93935PAH29 / WASHINGTON MUTUAL MORTGAGE PAS WMALT 2007 1 1A8 | 1.86 | 0.76 | 0.0831 | -0.0031 | |||||

| US05534AAP66 / BCAP LLC TRUST BCAP 2011 RR5 12A2 144A | 1.86 | 4.03 | 0.0830 | -0.0004 | |||||

| US542514KW34 / LONG BEACH MORTGAGE LOAN TRUST 2005-2 SER 2005-2 CL M6 V/R REGD 2.37357000 | 1.85 | 0.38 | 0.0824 | -0.0034 | |||||

| OIBR4 / Oi S.A. - Preferred Stock | 1.84 | -19.51 | 0.0823 | -0.0246 | |||||

| UNIT / Unity Group LLC | 0.42 | 0.00 | 1.83 | -14.31 | 0.0818 | -0.0180 | |||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/36 VAR / DBT (US903724CC46) | 1.83 | -3.38 | 0.0817 | -0.0067 | |||||

| US12667G2W26 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 37T1 A4 | 1.83 | -0.71 | 0.0817 | -0.0043 | |||||

| US761143AE66 / RESIDENTIAL ASSET SECURITIZATI RAST 2007 A9 A5 | 1.82 | -3.45 | 0.0813 | -0.0067 | |||||

| WINSTON RE LTD UNSECURED 144A 02/31 VAR / DBT (US975660AB76) | 1.79 | 0.17 | 0.0798 | -0.0035 | |||||

| US43289VAA17 / Hilton USA Trust 2016-SFP | 1.79 | 2.53 | 0.0797 | -0.0016 | |||||

| US3137B82L05 / FREDDIE MAC FHR 4300 SC | 1.78 | 2.12 | 0.0796 | -0.0020 | |||||

| XS2332975007 / Altice France SA/France | 1.78 | 14.74 | 0.0796 | 0.0070 | |||||

| US38122ND666 / GOLDEN ST TOBACCO SECURITIZATION CORP CA TOBACCO SETTLEMENT | 1.73 | -4.58 | 0.0772 | -0.0074 | |||||

| US465981AA63 / JP MORGAN CHASE COMMERCIAL MORTGAGE SECURITIES SER 2023-CCDC CL A REGD 144A P/P 7.23547000 | 1.70 | 0.65 | 0.0760 | -0.0030 | |||||

| US30246QAK94 / FBR Securitization Trust 2005-2 | 1.69 | 0.47 | 0.0756 | -0.0031 | |||||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/35 VAR / DBT (US903724CB62) | 1.69 | -2.26 | 0.0753 | -0.0053 | |||||

| US30247DAD30 / FIRST FRANKLIN MTG LOAN ASSET FFML 2006 FF13 A2C | 1.68 | -1.59 | 0.0748 | -0.0047 | |||||

| US409322AC83 / HAMPTON ROADS PPV LLC BONDS 144A 06/53 6.171 | 1.63 | 12.95 | 0.0728 | 0.0054 | |||||

| US02149VAH24 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2007 3T1 1A8 | 1.61 | -1.23 | 0.0719 | -0.0042 | |||||

| AU3FN0029609 / AAI Ltd | 1.59 | 97.15 | 0.0709 | 0.0333 | |||||

| XS0308725844 / EUROSAIL PLC ESAIL 2007 3X E1C REGS | 1.59 | 6.81 | 0.0707 | 0.0014 | |||||

| US46115HCD70 / Intesa Sanpaolo SpA | 1.57 | 1.22 | 0.0702 | -0.0023 | |||||

| EVERGLADES RE II LTD UNSECURED 144A 05/31 VAR / DBT (US30014LAM63) | 1.57 | -1.14 | 0.0699 | -0.0040 | |||||

| EVERGLADES RE II LTD SR UNSECURED 144A 05/31 VAR / DBT (US30014LAN47) | 1.56 | -1.52 | 0.0695 | -0.0044 | |||||

| EVERGLADES RE II LTD UNSECURED 144A 05/31 VAR / DBT (US30014LAP94) | 1.55 | -1.40 | 0.0694 | -0.0042 | |||||

| IHRT / iHeartMedia, Inc. | 1.55 | -0.26 | 0.0694 | -0.0033 | |||||

| US07387QAM24 / BEAR STEARNS ALT A TRUST BALTA 2006 8 2A1 | 1.55 | -2.58 | 0.0691 | -0.0051 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 1.52 | 12.14 | 0.0676 | 0.0045 | |||||

| US12549TAA79 / CIFC FUNDING LTD CIFC 2014 3A INC 144A | 1.50 | 1,277.06 | 0.0670 | 0.0619 | |||||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 1.45 | 0.0646 | 0.0646 | ||||||

| XS0609017917 / RUSSIAN RAIL(RZD CAP) SR UNSECURED REGS 03/31 7.487 | 1.44 | 6.27 | 0.0643 | 0.0010 | |||||

| US007036AT34 / ADJUSTABLE RATE MORTGAGE TRUST ARMT 2004 1 CB1 | 1.42 | -12.02 | 0.0634 | -0.0120 | |||||

| US69546RAC07 / PAID_21-3 | 1.41 | -26.25 | 0.0631 | -0.0264 | |||||

| US61762DAZ42 / MSBAM 13-C9 B 3.708% 05-15-46/04-15-23 | 1.41 | -3.89 | 0.0630 | -0.0056 | |||||

| RFR GBP SONIO/2.00000 03/15/23-10Y LCH / DIR (EZHLCHFHC664) | 1.41 | -3.30 | 0.0628 | -0.0051 | |||||

| USL269151217 / DRILLCO HLDG LUX S A | 0.07 | 0.00 | 1.41 | -18.58 | 0.0628 | -0.0179 | |||

| US05533JBJ16 / BCAP LLC TRUST BCAP 2010 RR11 6A2 144A | 1.39 | -1.00 | 0.0618 | -0.0035 | |||||

| INEOS FINANCE PLC SR SECURED 144A 08/30 5.625 / DBT (XS2991272068) | 1.38 | 6.09 | 0.0615 | 0.0009 | |||||

| US78444A1079 / SLM STUDENT LOAN TRUST SLMA 2007 4 R | 1.37 | -5.64 | 0.0612 | -0.0066 | |||||

| CCO / Clear Channel Outdoor Holdings, Inc. | 1.17 | 0.00 | 1.37 | 5.40 | 0.0610 | 0.0005 | |||

| US3137B8LB14 / FREDDIE MAC FHR 4319 ES | 1.36 | 1.80 | 0.0605 | -0.0017 | |||||

| BGC / BGC Group, Inc. | 1.35 | 0.82 | 0.0602 | -0.0022 | |||||

| US715638AV48 / REPUBLIC OF PERU SR UNSECURED 144A 08/37 6.9 | 1.32 | 7.04 | 0.0591 | 0.0013 | |||||

| CMA CGM SA CMA CGM SA / DBT (XS3105514908) | 1.30 | 0.0579 | 0.0579 | ||||||

| PRETIUM MORTGAGE CREDIT PARTNE PRET 2025 NPL5 A1 144A / ABS-MBS (US74143LAA44) | 1.30 | 0.0578 | 0.0578 | ||||||

| US03217CAB28 / ams-OSRAM AG | 1.28 | 3.81 | 0.0572 | -0.0004 | |||||

| OIBR3 / Oi S.A. | 10.88 | 0.00 | 1.28 | -32.76 | 0.0572 | -0.0318 | |||

| RFRF USD SF+26.161/0.500 06/16/21-5Y LCH / DIR (EZZ3FSVBNJ37) | 1.26 | -17.31 | 0.0563 | -0.0149 | |||||

| US00846NAA54 / AGFC CAPITAL TRUST I LIMITD GUARA 144A 01/67 VAR | 1.26 | -0.94 | 0.0562 | -0.0031 | |||||

| XAN5200EAB73 / Lealand Finance Company BV, Term Loan | 1.25 | 21.57 | 0.0559 | 0.0078 | |||||

| US43710EAD22 / INDYMAC RESIDENTIAL ASSET BACK INABS 2007 B 2A2 | 1.25 | -0.40 | 0.0558 | -0.0028 | |||||

| US26245TAC09 / DRYDEN SENIOR LOAN FUND DRSLF 2018 58A SUB 144A | 1.23 | -63.79 | 0.0548 | -0.1035 | |||||

| DOMINICAN REPUBLIC SR UNSECURED REGS 06/36 10.75 / DBT (USP3579ECV76) | 1.22 | 154.81 | 0.0544 | 0.0320 | |||||

| US86361QAD60 / STRUCTURED ADJUSTABLE RATE MOR SARM 2006 10 2A1 | 1.22 | -12.59 | 0.0543 | -0.0107 | |||||

| US20754LAJ89 / Connecticut Avenue Securities Trust, Series 2022-R01, Class 1B2 | 1.21 | 0.0539 | 0.0539 | ||||||

| US35729PND86 / FREMONT HOME LOAN TRUST FHLT 2005 E M1 | 1.16 | 1.13 | 0.0519 | -0.0018 | |||||

| ANTARES HOLDINGS SR UNSECURED 144A 10/29 6.35 / DBT (US03666HAH49) | 1.16 | 0.96 | 0.0519 | -0.0019 | |||||

| US12668BZD80 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 13T1 A3 | 1.15 | -7.18 | 0.0513 | -0.0065 | |||||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/35 VAR / DBT (US903724CF76) | 1.15 | -14.39 | 0.0513 | -0.0114 | |||||

| INTEGRITY RE LTD SR UNSECURED 144A 06/26 VAR / DBT (US45833UAL52) | 1.15 | -3.20 | 0.0513 | -0.0041 | |||||

| US59020U6M21 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2006 WMC2 A2D | 1.14 | -2.39 | 0.0511 | -0.0036 | |||||

| US74930PAF18 / RBSSP RESECURITIZATION TRUST RBSSP 2011 4 3A2 144A | 1.12 | 0.45 | 0.0502 | -0.0020 | |||||

| US126650BS86 / CVS PASS THROUGH TRUST PASS THRU CE 144A 01/32 7.507 | 1.12 | -4.59 | 0.0501 | -0.0048 | |||||

| FREMONT HOME LOAN TRUST FHLT 2005 B M6 / ABS-MBS (US35729PKA74) | 1.12 | 0.18 | 0.0500 | -0.0022 | |||||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/34 VAR / DBT (US903724CE02) | 1.11 | -2.37 | 0.0495 | -0.0035 | |||||

| US154915AA07 / Central Parent LLC/CDK Global II LLC/CDK Financing Co., Inc. | 1.11 | 110.44 | 0.0495 | 0.0249 | |||||

| US61751MAC82 / MORGAN STANLEY MORTGAGE LOAN T MSM 2007 10XS A2 | 1.11 | -2.72 | 0.0495 | -0.0037 | |||||

| URSA RE LTD UNSECURED 144A 02/28 VAR / DBT (US90323WAR16) | 1.11 | -0.54 | 0.0494 | -0.0025 | |||||

| 743424AA1 / Proofpoint, Inc. 1.25% Convertible Bond due 2018-12-15 | 1.10 | 0.0492 | 0.0492 | ||||||

| DATABRICKS INC DELAYED DRAW TERM LOAN / LON (BA000D1C1) | 1.10 | 0.27 | 0.0490 | -0.0021 | |||||

| INTEGRITY RE LTD SR UNSECURED 144A 06/26 VAR / DBT (US45833UAM36) | 1.09 | -4.21 | 0.0488 | -0.0045 | |||||

| NISSAN MOTOR ACCEPTANCE SR UNSECURED 144A 09/27 VAR / DBT (US65480CAJ45) | 1.09 | 0.0485 | 0.0485 | ||||||

| US12564NAJ19 / COLONY MORTGAGE CAPITAL LTD CLNY 2019 IKPR C 144A | 1.08 | 0.65 | 0.0484 | -0.0019 | |||||

| MONGOLIA INTL BOND SR UNSECURED 144A 02/30 6.625 / DBT (US60937LAJ44) | 1.08 | 0.19 | 0.0483 | -0.0021 | |||||

| US44409MAD83 / Hudson Pacific Properties LP | 1.07 | 12.24 | 0.0479 | 0.0033 | |||||

| US52524GAA04 / LEHMAN XS TRUST LXS 2007 7N 1A1A | 1.07 | -1.38 | 0.0477 | -0.0029 | |||||

| US02149VAE92 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2007 3T1 1A5 | 1.06 | 5.05 | 0.0474 | 0.0002 | |||||

| US25714PEW41 / Dominican Republic International Bond | 1.04 | 5.45 | 0.0466 | 0.0003 | |||||

| US3137F8A296 / FREDDIE MAC FHR 5060 PI | 1.04 | -2.35 | 0.0464 | -0.0033 | |||||

| US46654EAE14 / JP MORGAN CHASE COMMERCIAL MOR JPMCC 2021 NYAH C 144A | 1.04 | -1.43 | 0.0463 | -0.0028 | |||||

| US03072ST214 / Ameriquest Mortgage Securities Inc Asset-Backed Pass-Through Ctfs Ser 2005-R10 | 1.02 | 0.39 | 0.0455 | -0.0019 | |||||

| US040114HX11 / Argentine Republic Government International Bond | 1.02 | 7.51 | 0.0454 | 0.0013 | |||||

| US05533FLT65 / BCAP LLC TRUST BCAP 2011 R11 32A7 144A | 1.02 | -3.88 | 0.0453 | -0.0040 | |||||

| US17311LAJ08 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 AR5 2A2A | 1.01 | -0.79 | 0.0451 | -0.0025 | |||||

| US30767EAD13 / FARM CREDIT BK OF TEXAS JR SUBORDINA 144A 12/99 VAR | 1.00 | 0.00 | 1.00 | 0.30 | 0.0446 | -0.0019 | |||

| PRP ADVISORS, LLC PRPM 2025 3 A1 144A / ABS-MBS (US74449DAA37) | 1.00 | 0.0446 | 0.0446 | ||||||

| US62955HAA59 / NYO COMMERCIAL MORTGAGE TRUST 2021-1290 SER 2021-1290 CL A V/R REGD 144A P/P 1.17500000 | 1.00 | 0.50 | 0.0446 | -0.0018 | |||||

| US02156LAA98 / Altice France SA/France | 0.99 | 0.61 | 0.0442 | -0.0017 | |||||

| US23308LAA26 / DBGS 2021-W52 Mortgage Trust | 0.99 | -0.30 | 0.0442 | -0.0022 | |||||

| US05532LAM19 / BCAP LLC TRUST BCAP 2009 RR14 5A2 144A | 0.99 | -8.85 | 0.0442 | -0.0065 | |||||

| PRETIUM MORTGAGE CREDIT PARTNE PRET 2025 NPL4 A1 144A / ABS-MBS (US74136UAA34) | 0.99 | 0.0441 | 0.0441 | ||||||

| REPUBLIC OF GHANA SR UNSECURED 144A 07/35 VAR / DBT (US374422AP83) | 0.98 | 9.41 | 0.0436 | 0.0019 | |||||

| US92230AAA43 / VASA Trust 2021-VASA | 0.97 | 0.10 | 0.0434 | -0.0020 | |||||

| PRP ADVISORS, LLC PRPM 2025 2 A1 144A / ABS-MBS (US69382HAA32) | 0.97 | 0.0434 | 0.0434 | ||||||

| US02146XAF50 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 36T2 1A7 | 0.97 | -0.72 | 0.0431 | -0.0023 | |||||

| US466317AA25 / J.P. MORGAN CHASE COMMERCIAL MORTGAGE SECURI SER 2022-NLP CL A V/R REGD 144A P/P 1.28650000 | 0.97 | 0.84 | 0.0431 | -0.0016 | |||||

| US03072SV517 / AMERIQUEST MRTGE | 0.96 | -0.62 | 0.0430 | -0.0023 | |||||

| 61NM / KENNEDY WILSON EUR REAL SR UNSECURED REGS 11/25 3.25 | 0.96 | 9.59 | 0.0429 | 0.0020 | |||||

| US04542BNM09 / ASSET BACKED FUNDING CERTIFICA ABFC 2005 HE2 M4 | 0.96 | -1.84 | 0.0428 | -0.0028 | |||||

| US57645DAG79 / MASTR ALTERNATIVE LOANS TRUST MALT 2006 3 2A2 | 0.96 | -1.95 | 0.0426 | -0.0029 | |||||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/36 VAR / DBT (US903724CG59) | 0.95 | -14.47 | 0.0425 | -0.0095 | |||||

| US61692AAL61 / Morgan Stanley Capital I Trust, Series 2019-NUGS, Class D | 0.95 | 3.73 | 0.0422 | -0.0003 | |||||

| US23307EAA91 / DBGS 2019-1735 Mortgage Trust | 0.94 | 1.29 | 0.0421 | -0.0014 | |||||

| FORTITUDE GROUP HOLDINGS COMPANY GUAR 144A 04/30 6.25 / DBT (US34966XAA63) | 0.93 | 1.76 | 0.0413 | -0.0012 | |||||

| MOTION FINCO SARL SR SECURED 144A 02/32 8.375 / DBT (US61980LAB53) | 0.92 | -5.86 | 0.0409 | -0.0045 | |||||

| GREENSKY HOME IMPROVEMENT ISSU GSKY 2024 1 B 144A / ABS-O (US39571MAF59) | 0.92 | 0.44 | 0.0409 | -0.0017 | |||||

| US073873AK72 / BEAR STEARNS ALT A TRUST BALTA 2006 5 2A2 | 0.91 | -4.71 | 0.0407 | -0.0039 | |||||

| US542514NE09 / LONG BEACH MORTGAGE LOAN TRUST LBMLT 2005 WL2 M4 | 0.91 | -1.41 | 0.0405 | -0.0025 | |||||

| US12660WAA36 / Credit Suisse Mortgage Capital Certificates | 0.90 | -0.11 | 0.0403 | -0.0019 | |||||

| RFR USD SOFR/4.25000 03/20/24-3Y* CME / DIR (000000000) | 0.90 | 0.0400 | 0.0400 | ||||||

| NEW YORK NY NYC 02/55 FIXED 6.385 / DBT (US64966SNJ14) | 0.88 | 0.0395 | 0.0395 | ||||||

| XS2342932576 / NGD HOLDINGS BV SR SECURED 12/26 6.75 | 0.88 | 1.15 | 0.0392 | -0.0013 | |||||

| POLESTAR RE LTD UNSECURED 144A 01/28 VAR / DBT (US73110JAC62) | 0.88 | -0.23 | 0.0391 | -0.0019 | |||||

| XS1980255936 / Egypt Government International Bond | 0.88 | 19.35 | 0.0391 | 0.0048 | |||||

| US91327BAA89 / UNITI GROUP LP / UNITI GROUP FINANCE INC / CSL CAPITAL LLC 6.5% 02/15/2029 144A | 0.87 | 0.0389 | 0.0389 | ||||||

| US36255WAA36 / GS Mortgage Securities Corp II | 0.87 | -14.03 | 0.0388 | -0.0084 | |||||

| RFRF USD SF+26.161/1.1* 7/12/23-8Y* CME / DIR (EZT7YRZ0DR56) | 0.87 | -8.25 | 0.0388 | -0.0054 | |||||

| CREDICORP CAPITAL SOCIED LOCAL GOVT G 144A 03/45 9.7 / DBT (US224939AB41) | 0.86 | 0.0382 | 0.0382 | ||||||

| US35564KQZ56 / FHLMC STACR REMIC Trust, Series 2022-DNA1, Class B2 | 0.85 | 0.0381 | 0.0381 | ||||||

| US3136BAQ230 / FANNIE MAE FNR 2020 47 IN | 0.85 | -1.52 | 0.0378 | -0.0023 | |||||

| US78473NAF06 / SUNTRUST ADJUSTABLE RATE MORTG STARM 2007 1 3A2 | 0.82 | -0.24 | 0.0367 | -0.0018 | |||||

| REPUBLIC OF GHANA SR UNSECURED 144A 07/29 VAR / DBT (US374422AM52) | 0.82 | 7.35 | 0.0365 | 0.0010 | |||||

| US74958WAC01 / RESIDENTIAL FUNDING MTG SEC I RFMSI 2007 SA1 2A2 | 0.82 | -2.62 | 0.0365 | -0.0027 | |||||

| US93934FLW04 / WASHINGTON MUTUAL MORTGAGE PAS WMALT 2006 2 1A6 | 0.81 | 1.00 | 0.0363 | -0.0013 | |||||

| US02149JAR77 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 45T1 2A2 | 0.81 | -0.25 | 0.0362 | -0.0018 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.81 | 0.62 | 0.0361 | -0.0015 | |||||

| US59020U5W12 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2006 A1 2A1 | 0.81 | 1.13 | 0.0360 | -0.0012 | |||||

| US78448P1003 / SMB PRIVATE EDUCATION LOAN TRU SMB 2015 A R 144A | 0.81 | -1.59 | 0.0359 | -0.0023 | |||||

| 743424AA1 / Proofpoint, Inc. 1.25% Convertible Bond due 2018-12-15 | 0.80 | 0.13 | 0.0356 | -0.0016 | |||||

| AU3FN0029609 / AAI Ltd | 0.79 | 1.68 | 0.0352 | -0.0011 | |||||

| US02147PAR55 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 29T1 2A8 | 0.79 | -0.63 | 0.0352 | -0.0018 | |||||

| RFRF USD SF+26.161/1.4* 8/17/23-4Y* CME / DIR (EZWYVHJK0N90) | 0.79 | -23.91 | 0.0351 | -0.0132 | |||||

| US84858DAA63 / Spirit Airlines Pass Through Trust 2015-1A | 0.77 | -6.24 | 0.0342 | -0.0039 | |||||

| US0738795T17 / BEAR STEARNS ASSET BACKED SECU BSABS 2005 HE12 M4 | 0.77 | 0.13 | 0.0342 | -0.0015 | |||||

| US00909DAA19 / Air Canada 2020-2 Class A Pass Through Trust | 0.76 | -9.17 | 0.0341 | -0.0052 | |||||

| US12566VAE20 / CITIMORTGAGE ALTERNATIVE LOAN CMALT 2007 A4 1A5 | 0.76 | -4.78 | 0.0338 | -0.0033 | |||||

| US078452AA72 / BELLE HAVEN ABS CDO LTD BLHV 2006 1A A1 144A | 0.76 | -3.21 | 0.0337 | -0.0027 | |||||

| SPRUCE BIDCO II INC REVOLVER / LON (BA000FL00) | 0.75 | -0.66 | 0.0335 | -0.0017 | |||||

| USL26915AA33 / FORESEA Holding SA | 0.75 | -1.58 | 0.0333 | -0.0021 | |||||

| RFR USD SOFR/3.75000 12/20/23-5Y CME / DIR (EZQ1LP9YKNN9) | 0.75 | 386.93 | 0.0333 | 0.0261 | |||||

| XS1859337419 / Altice France SA/France | 0.74 | 10.22 | 0.0332 | 0.0017 | |||||

| US20754RAJ59 / Connecticut Avenue Securities Trust, Series 2021-R01, Class 1B2 | 0.74 | 0.0331 | 0.0331 | ||||||

| US74923WAC29 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2007 QS7 1A3 | 0.73 | 1.97 | 0.0324 | -0.0008 | |||||

| US694308HR19 / PACIFIC GAS + ELECTRIC SR UNSECURED 12/46 4 | 0.72 | -3.09 | 0.0322 | -0.0026 | |||||

| MRX / Marex Group plc | 0.72 | 1.27 | 0.0322 | -0.0011 | |||||

| US125475AA17 / CIFC FUNDING LTD CIFC 2014 2RA INC 144A | 0.72 | -21.90 | 0.0320 | -0.0108 | |||||

| US78448R1068 / SMB PRIVATE EDUCATION LOAN TRU SMB 2015 C R 144A | 0.71 | -1.80 | 0.0318 | -0.0021 | |||||

| US92978EAC84 / Wachovia Mortgage Loan Trust Series 2006-AMN1 | 0.70 | -2.51 | 0.0312 | -0.0023 | |||||

| RFR USD SOFR/3.75000 12/20/23-5Y LCH / DIR (EZQ1LP9YKNN9) | 0.69 | 353.59 | 0.0310 | 0.0238 | |||||

| RFRF USD SF+26.161/2.2* 9/11/23-26Y* CME / DIR (EZCLLPH7RD85) | 0.69 | 6.28 | 0.0310 | 0.0005 | |||||

| XS2053846262 / Altice France SA/France | 0.69 | 14.76 | 0.0309 | 0.0027 | |||||

| ASSET BACKED SECURITIES CORP H ABSHE 2005 HE8 M4 / ABS-MBS (US04541GUR19) | 0.68 | 0.45 | 0.0302 | -0.0012 | |||||

| US20753XAJ37 / Connecticut Avenue Securities Trust 2022-R03 | 0.67 | 0.0300 | 0.0300 | ||||||

| US021482AJ36 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2008 2R 5A1 | 0.67 | -1.47 | 0.0299 | -0.0018 | |||||

| US22823JAC18 / CROWN CITY CLO CCITY 2020 2A SUB 144A | 0.66 | -6.53 | 0.0294 | -0.0035 | |||||

| US93364FAL58 / WAMU MORTGAGE PASS THROUGH CER WAMU 2007 HY7 4A1 | 0.65 | -1.67 | 0.0290 | -0.0018 | |||||

| US3622MAAA93 / GSAMP TRUST GSAMP 2007 FM1 A1 | 0.64 | -0.78 | 0.0286 | -0.0015 | |||||

| US59021AAC27 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2006 FM1 A2C | 0.63 | -4.68 | 0.0282 | -0.0027 | |||||

| ALAMO RE LTD UNSECURED 144A 06/27 VAR / DBT (US011395AP50) | 0.63 | -0.48 | 0.0279 | -0.0015 | |||||

| US12668ASY28 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 J12 2A1 | 0.62 | -0.64 | 0.0277 | -0.0015 | |||||

| F+G ANNUITIES + LIFE INC F+G ANNUITIES + LIFE INC / DBT (US30190AAF12) | 0.62 | 1.15 | 0.0276 | -0.0009 | |||||

| CLOVER HOLDINGS SPV III LLC 2024 USD TERM LOAN / LON (BA000CCJ6) | 0.61 | 5.14 | 0.0274 | 0.0001 | |||||

| US36242DN748 / FFML 2005-FF2 M6 MTGE | 0.61 | -0.16 | 0.0272 | -0.0013 | |||||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 0.61 | 0.33 | 0.0272 | -0.0012 | |||||

| US93934FDF62 / WASHINGTON MUTUAL MORTGAGE PAS WMALT 2005 8 3CB1 | 0.61 | 0.33 | 0.0272 | -0.0011 | |||||

| US37638XAA72 / GLACIER FUNDING CDO GLCR 2005 3A A1 144A | 0.60 | -4.88 | 0.0270 | -0.0027 | |||||

| DAVINCIRE HOLDINGS LTD SR UNSECURED 144A 04/35 5.95 / DBT (US23879AAA51) | 0.60 | 0.33 | 0.0270 | -0.0011 | |||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0.60 | -0.99 | 0.0267 | -0.0015 | |||||

| RAIZEN FUELS FINANCE RAIZEN FUELS FINANCE / DBT (US75102XAF33) | 0.60 | 0.0266 | 0.0266 | ||||||

| US863579UU02 / STRUCTURED ADJUSTABLE RATE MOR SARM 2005 15 4A1 | 0.59 | -1.66 | 0.0264 | -0.0017 | |||||

| US14311CAA62 / CGMS 2014-1A INC MTGE 04/ PREFERRED STOCK | 0.59 | -22.12 | 0.0263 | -0.0090 | |||||

| US362290AA68 / GSR MORTGAGE LOAN TRUST GSR 2007 AR1 1A1 | 0.59 | -2.50 | 0.0261 | -0.0019 | |||||

| US2620512044 / Drillco Holdings Luxembourg SA | 0.03 | 0.00 | 0.58 | -18.66 | 0.0261 | -0.0074 | |||

| US12668BEL36 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 85CB 2A6 | 0.57 | 0.35 | 0.0253 | -0.0011 | |||||

| US007034AQ47 / ADJUSTABLE RATE MORTGAGE TRUST ARMT 2006 2 6A1 | 0.57 | 0.00 | 0.0253 | -0.0012 | |||||

| TREASURY BILL 07/25 0.00000 / DBT (US912797NX17) | 0.56 | 0.0251 | 0.0251 | ||||||

| US30246QCS03 / FBR Securitization Trust | 0.56 | 1.64 | 0.0249 | -0.0007 | |||||

| US20753YAL65 / Connecticut Avenue Securities Trust, Series 2022-R04, Class 1B2 | 0.56 | 0.0249 | 0.0249 | ||||||

| US76114GAC15 / RESIDENTIAL ASSET SECURITIZATI RAST 2006 A16 1A3 | 0.56 | -4.63 | 0.0249 | -0.0024 | |||||

| MAN GLG US CLO 2021 1 LTD GLGU 2021 1A SUB 144A / ABS-CBDO (US56166XAC39) | 0.56 | -12.44 | 0.0248 | -0.0048 | |||||

| PRS / Promotora de Informaciones, S.A. | 1.23 | 0.00 | 0.55 | 11.74 | 0.0246 | 0.0015 | |||

| ADLER FINANCING SARL SR SECURED 12/28 8.25 / DBT (DE000A4D5RA0) | 0.55 | 0.0243 | 0.0243 | ||||||

| US96106JAE91 / WESTMORELAND COAL CO PIK TERM LOAN | 0.53 | 5.33 | 0.0239 | 0.0002 | |||||

| US262051AA36 / FORESEA Holding SA | 0.53 | -1.66 | 0.0238 | -0.0015 | |||||

| US70069FKG18 / PARK PLACE SECURITIES INC PPSI 2005 WCW1 M3 | 0.53 | -5.00 | 0.0238 | -0.0024 | |||||

| US02150QAK22 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2007 HY4 4A1 | 0.52 | -4.78 | 0.0231 | -0.0023 | |||||

| TORREY PINES RE LTD UNSECURED 144A 06/32 VAR / DBT (US89141WAH51) | 0.52 | -1.15 | 0.0230 | -0.0013 | |||||

| GREENSKY HOME IMPROVEMENT ISSU GSKY 2024 1 C 144A / ABS-O (US39571MAG33) | 0.51 | 0.59 | 0.0229 | -0.0009 | |||||

| A1LL34 / Bread Financial Holdings, Inc. - Depositary Receipt (Common Stock) | 0.50 | 2.86 | 0.0225 | -0.0004 | |||||

| RFRF USD SF+26.161/1.3* 8/15/23-4Y* CME / DIR (EZG3NPY3B4Q8) | 0.50 | -121.33 | 0.0224 | 0.1323 | |||||

| HARBOUR ENERGY PLC SR UNSECURED 144A 04/35 6.327 / DBT (US411618AD32) | 0.50 | -0.20 | 0.0222 | -0.0010 | |||||

| US64352VPA34 / New Century Home Equity Loan Trust Series 2005-C | 0.49 | 0.62 | 0.0219 | -0.0009 | |||||

| DUN + BRADSTREET CORPOR THE 2025 REVOLVER / LON (BA000K747) | 0.49 | 0.0218 | 0.0218 | ||||||

| XS2404309754 / NPC UKRENERGO GOVT GUARANT REGS 11/28 6.875 | 0.49 | 3.40 | 0.0218 | -0.0002 | |||||

| IHRT / iHeartMedia, Inc. | 0.28 | 0.00 | 0.48 | 6.84 | 0.0216 | 0.0004 | |||

| US12668BMX81 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 5T2 A4 | 0.48 | -5.13 | 0.0215 | -0.0022 | |||||

| XS1710468239 / ADAGIO CLO ADAGI VI A SUB 144A | 0.48 | -15.30 | 0.0213 | -0.0050 | |||||

| US93363NAM74 / WAMU MORTGAGE PASS THROUGH CER WAMU 2006 AR12 3A3 | 0.47 | 0.86 | 0.0209 | -0.0008 | |||||

| US225470P231 / CREDIT SUISSE MORTGAGE TRUST CSMC 2006 3 2A11 | 0.46 | -1.49 | 0.0207 | -0.0013 | |||||

| US466247F570 / JP MORGAN MORTGAGE TRUST JPMMT 2006 A1 3A2 | 0.46 | -7.27 | 0.0205 | -0.0027 | |||||

| US16163FAE51 / CHASE MORTGAGE FINANCE CORPORA CHASE 2007 S1 A5 | 0.46 | -0.87 | 0.0204 | -0.0011 | |||||

| US17307GQ276 / CMLTI 2005-HE4 M5 | 0.46 | 2.47 | 0.0204 | -0.0004 | |||||

| US57643LHA70 / MASTR Asset Backed Securities Trust 2006-AM1 | 0.45 | -4.46 | 0.0201 | -0.0019 | |||||

| XS0213358608 / Greene King Finance plc, Series B1 | 0.45 | 12.25 | 0.0201 | 0.0014 | |||||

| SPRUCE BIDCO II INC JPY TERM LOAN / LON (BA000FPQ9) | 0.45 | 3.71 | 0.0200 | -0.0002 | |||||

| US29670VAA70 / Essential Properties LP | 0.44 | 2.54 | 0.0199 | -0.0004 | |||||

| US161631AK29 / CHASE MORTGAGE FINANCE CORPORA CHASE 2007 S5 1A10 | 0.44 | -1.99 | 0.0198 | -0.0013 | |||||

| SPRUCE BIDCO II INC CAD TERM LOAN / LON (BA000FPR7) | 0.44 | 5.49 | 0.0197 | 0.0001 | |||||

| MASTR ASSET BACKED SECURITIES MABS 2005 WMC1 M6 / ABS-MBS (US57643LHB53) | 0.44 | 1.39 | 0.0196 | -0.0006 | |||||

| ESKOM GG LOAN SNR EM SP DUB / DCR (000000000) | 0.44 | 0.0196 | 0.0196 | ||||||

| US14986DAJ90 / CD COMMERCIAL MORTGAGE TRUST CD 2006 CD3 AJ | 0.43 | -2.25 | 0.0194 | -0.0014 | |||||

| TORREY PINES RE LTD TORREY PINES RE LTD / DBT (US89141WAJ18) | 0.42 | -0.71 | 0.0186 | -0.0010 | |||||

| NOMURA HOME EQUITY LOAN INC NHELI 2005 FM1 M4 / ABS-MBS (US65536HAJ77) | 0.41 | 0.49 | 0.0185 | -0.0007 | |||||

| PURPLE RE LTD UNSECURED 144A 06/27 VAR / DBT (US74639NAC74) | 0.41 | -3.08 | 0.0183 | -0.0015 | |||||

| TORREY PINES RE LTD TORREY PINES RE LTD / DBT (US89141WAK80) | 0.41 | -1.45 | 0.0183 | -0.0012 | |||||

| BOOZ ALLEN HAMILTON INC COMPANY GUAR 04/35 5.95 / DBT (US09951LAD55) | 0.41 | 1.75 | 0.0182 | -0.0005 | |||||

| INTEGRITY RE III UNSECURED 144A 06/28 VAR / DBT (US45870GAE61) | 0.40 | 0.25 | 0.0180 | -0.0008 | |||||

| BEAR STEARNS ASSET BACKED SECU BSABS 2005 HE4 M3 / ABS-MBS (US073879TV07) | 0.40 | -6.32 | 0.0179 | -0.0021 | |||||

| PALM RE LTD UNSECURED 144A 06/32 VAR / DBT (US69664FAB40) | 0.40 | 0.0179 | 0.0179 | ||||||

| GREENGROVE RE LTD UNSECURED 144A 04/32 VAR / DBT (US39526JAA97) | 0.40 | -0.25 | 0.0179 | -0.0009 | |||||

| US26884UAD19 / EPR Properties | 0.40 | 1.02 | 0.0178 | -0.0007 | |||||

| US57643LJK35 / MASTR ASSET BACKED SECURITIES MABS 2005 HE1 M6 | 0.40 | 0.51 | 0.0177 | -0.0007 | |||||

| F+G ANNUITIES + LIFE INC COMPANY GUAR 10/34 6.25 / DBT (US30190AAG94) | 0.40 | 2.33 | 0.0177 | -0.0004 | |||||

| CLOVER 2024 HOLDINGS INC VERITAS G PREFERRED / EP (955EHZ901) | 0.02 | 0.00 | 0.40 | 3.67 | 0.0177 | -0.0001 | |||

| US83611PBY60 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2005 CTX1 M5 | 0.39 | 0.25 | 0.0176 | -0.0008 | |||||

| US3137AUN540 / FREDDIE MAC FHR 4102 NS | 0.39 | 0.52 | 0.0174 | -0.0007 | |||||

| US03072SK387 / AMERIQUEST MORTGAGE SECURITIES AMSI 2005 R7 M4 | 0.39 | 0.52 | 0.0174 | -0.0007 | |||||

| NEW YORK NY NYC 02/45 FIXED 6.291 / DBT (US64966SNH57) | 0.39 | 0.0173 | 0.0173 | ||||||

| RESIDENTIAL ASSET SECURITIES C RASC 2005 KS11 M5 / ABS-MBS (US76110W7H39) | 0.38 | -0.52 | 0.0171 | -0.0009 | |||||

| US05553BAG05 / BCP Trust 2021-330N | 0.38 | -2.09 | 0.0168 | -0.0011 | |||||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/30 VAR / DBT (US903724CD29) | 0.37 | -6.09 | 0.0165 | -0.0019 | |||||

| US57643LKP03 / MASTR ASSET BACKED SECURITIES MABS 2005 HE2 M4 | 0.37 | 0.55 | 0.0164 | -0.0007 | |||||

| LONGLEAF PINE RE LTD UNSECURED 144A 05/31 VAR / DBT (US54307MAA62) | 0.36 | -2.70 | 0.0161 | -0.0012 | |||||

| US44409MAB28 / Hudson Pacific Properties LP | 0.36 | 18.87 | 0.0161 | 0.0019 | |||||

| US92925VAJ98 / WAMU MORTGAGE PASS THROUGH CER WAMU 2007 HY1 3A2 | 0.36 | -0.28 | 0.0160 | -0.0008 | |||||

| US64352VKY64 / NCHET 2005-2 M6 | 0.35 | 0.28 | 0.0157 | -0.0007 | |||||

| INTEGRITY RE III UNSECURED 144A 06/27 VAR / DBT (US45870GAF37) | 0.35 | 1.15 | 0.0157 | -0.0005 | |||||

| ARMOR RE II LTD UNSECURED 144A 01/32 VAR / DBT (US04227FAF27) | 0.35 | -1.41 | 0.0157 | -0.0009 | |||||

| AMERIQUEST MORTGAGE SECURITIES AMSI 2005 R9 M3 / ABS-MBS (US03072SQ574) | 0.35 | 0.86 | 0.0156 | -0.0006 | |||||

| US87331BAA08 / TABERNA PREFERED FUNDING LTD TBRNA 2006 5A A1A 144A | 0.34 | -1.72 | 0.0153 | -0.0010 | |||||

| US040104QQ78 / Argent Securities Inc Asset-Backed Pass-Through Certificates Series 2005-W5 | 0.34 | 0.59 | 0.0153 | -0.0006 | |||||

| US84129VAG68 / SOUTH COAST FUNDING SCF 5A B 144A | 0.34 | -1.17 | 0.0152 | -0.0009 | |||||

| US12667FQ999 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2004 35T2 A5 | 0.34 | 0.30 | 0.0151 | -0.0007 | |||||

| US70069FLK11 / PARK PLACE SECURITIES INC PPSI 2005 WCW2 M4 | 0.34 | 4.32 | 0.0151 | -0.0001 | |||||

| MAGENTA SECURITY HOLDINGS LLC 2024 THIRD OUT TERM LOAN / LON (US55909UAG40) | 0.34 | -12.76 | 0.0150 | -0.0030 | |||||

| IHRTB / iHeartMedia, Inc. | 0.21 | 0.00 | 0.33 | 6.45 | 0.0148 | 0.0003 | |||

| 952NPHII6 / CREDIT SUISSE GROUP AG COCO JR SUB REGS | 0.33 | 0.00 | 0.0147 | -0.0007 | |||||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0.33 | 0.0146 | 0.0146 | ||||||

| US63718LAA26 / NPC Ukrenergo | 0.33 | 3.50 | 0.0145 | -0.0002 | |||||

| BAYOU RE LTD UNSECURED 144A 04/31 VAR / DBT (US07304LAC54) | 0.32 | -0.63 | 0.0141 | -0.0008 | |||||

| US64352VNZ03 / NEW CENTURY HOME EQUITY LOAN T NCHET 2005 C M1 | 0.32 | -3.96 | 0.0141 | -0.0013 | |||||

| COUNTRYWIDE ASSET BACKED CERTI CWL 2005 3 MV6 / ABS-MBS (US126673B925) | 0.31 | -13.61 | 0.0139 | -0.0029 | |||||

| ALAMO RE LTD UNSECURED 144A 06/26 VAR / DBT (US011395AQ34) | 0.31 | -1.27 | 0.0139 | -0.0008 | |||||

| EAST LANE RE VII LTD UNSECURED 144A 03/26 VAR / DBT (US27332EAA91) | 0.30 | 0.33 | 0.0136 | -0.0005 | |||||

| NATURE COAST RE LTD UNSECURED 144A 04/33 VAR / DBT (US63901CAE12) | 0.30 | 0.33 | 0.0135 | -0.0006 | |||||

| US93364FAC59 / WAMU MORTGAGE PASS THROUGH CER WAMU 2007 HY7 2A1 | 0.30 | -0.66 | 0.0134 | -0.0007 | |||||

| WINSTON RE LTD UNSECURED 144A 02/31 VAR / DBT (US975660AA93) | 0.30 | 0.00 | 0.0132 | -0.0006 | |||||

| US03072SA396 / AMERIQUEST MORTGAGE SECURITIES AMSI 2005 R3 M5 | 0.29 | 0.69 | 0.0130 | -0.0005 | |||||

| MAGENTA SECURITY HOLDINGS LLC 2024 SUPER PRIORITY TERM LOAN / LON (US55909UAC36) | 0.29 | -0.35 | 0.0128 | -0.0006 | |||||

| NEW CENTURY HOME EQUITY LOAN T NCHET 2005 2 M5 / ABS-MBS (US64352VKX81) | 0.29 | 1.42 | 0.0128 | -0.0004 | |||||

| 953PAWII3 / FINASTRA USA INC 2023 REVOLVER | 0.28 | 0.71 | 0.0127 | -0.0005 | |||||

| US362341XE41 / GSR MORTGAGE LOAN TRUST GSR 2005 AR7 5A1 | 0.28 | -1.05 | 0.0126 | -0.0007 | |||||

| CLOVER 2024 HOLDINGS INC VERITAS G 1 PREFERRED / EP (955EKAII3) | 0.02 | 0.00 | 0.27 | 3.80 | 0.0122 | -0.0001 | |||

| ASSET BACKED SECURITIES CORP H ABSHE 2005 HE3 M6 / ABS-MBS (US04541GQZ80) | 0.27 | 0.37 | 0.0122 | -0.0005 | |||||

| RFRF USD SF+26.161/1.00 12/16/20-10Y LCH / DIR (000000000) | 0.27 | 0.0122 | 0.0122 | ||||||

| US46629DBJ37 / JP MORGAN MORTGAGE TRUST JPMMT 2006 A7 3A3M | 0.27 | -3.94 | 0.0120 | -0.0011 | |||||

| AEGIS ASSET BACKED SECURITIES AABST 2005 2 M5 / ABS-MBS (US00764MFF95) | 0.26 | 0.76 | 0.0118 | -0.0004 | |||||

| ARMOR RE II LTD SR UNSECURED 144A 05/31 VAR / DBT (US04227FAE51) | 0.26 | -1.52 | 0.0116 | -0.0007 | |||||

| US751152AA77 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2006 QA7 1A1 | 0.25 | -1.18 | 0.0113 | -0.0006 | |||||

| VERAISON RE LTD UNSECURED 144A 03/33 VAR / DBT (US92335TAE91) | 0.25 | 0.00 | 0.0112 | -0.0005 | |||||

| MAGENTA SECURITY HOLDINGS LLC 2024 FIRST OUT TERM LOAN / LON (US55909UAE91) | 0.25 | -7.43 | 0.0111 | -0.0014 | |||||

| HESTIA RE LTD UNSECURED 144A 03/32 VAR / DBT (US42815KAC62) | 0.25 | -0.80 | 0.0110 | -0.0006 | |||||

| US78471C1099 / SOCIAL PROFESSIONAL LOAN PROGR SOFI 2017 D R1 144A | 0.25 | -7.84 | 0.0110 | -0.0015 | |||||

| HESTIA RE LTD UNSECURED 144A 03/32 VAR / DBT (US42815KAD46) | 0.25 | -1.20 | 0.0110 | -0.0006 | |||||

| US44409MAC01 / Hudson Pacific Properties LP | 0.25 | 18.36 | 0.0110 | 0.0013 | |||||

| US32052FAH91 / First Horizon Alternative Mortgage Securities Trust 2006-FA6 | 0.25 | -2.39 | 0.0110 | -0.0008 | |||||

| US059523AG55 / BANC OF AMERICA FUNDING CORPOR BAFC 2007 5 2A3 | 0.24 | -0.41 | 0.0108 | -0.0005 | |||||

| BOEING CO/THE SNR S* ICE / DCR (EZ8LJVJQFWV8) | 0.24 | 272.31 | 0.0108 | 0.0078 | |||||

| US456606JQ60 / INABS 2005-D M2 | 0.24 | 2.62 | 0.0105 | -0.0002 | |||||

| MORGAN STANLEY CAPITAL INC MSAC 2005 HE2 M6 / ABS-MBS (US61744CNG77) | 0.23 | 0.88 | 0.0103 | -0.0003 | |||||

| US004421NG42 / ACE 2005-HE3 M5 MTGE | 0.23 | 1.78 | 0.0102 | -0.0003 | |||||

| US650929AA08 / Newfold Digital Holdings Group Inc | 0.23 | -8.13 | 0.0101 | -0.0014 | |||||

| US073868BE01 / BEAR STEARNS ALT A TRUST BALTA 2006 6 32A1 | 0.23 | -1.75 | 0.0101 | -0.0007 | |||||

| US61744CPM28 / MSAC 2005-NC2 M6 MTGE | 0.23 | 0.45 | 0.0100 | -0.0005 | |||||

| ASSET BACKED SECURITIES CORP H ABSHE 2005 HE4 M6 / ABS-MBS (US04541GRQ72) | 0.22 | -11.38 | 0.0098 | -0.0018 | |||||

| RFRF USD SF+26.161/1.00 9/16/23-7Y* CME / DIR (EZ4FYS5F94M8) | 0.22 | -8.79 | 0.0098 | -0.0014 | |||||

| US64352VKE01 / NCHET 2005-1 M5 | 0.22 | 0.93 | 0.0097 | -0.0003 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.21 | 0.0095 | 0.0095 | ||||||

| US07274EAK91 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.375% 11-21-30 | 0.21 | 1.44 | 0.0095 | -0.0003 | |||||

| BONANZA RE LTD UNSECURED 144A 01/26 VAR / DBT (US09785EAN13) | 0.21 | 3.94 | 0.0094 | -0.0000 | |||||

| XAF6628DAP96 / ALTICE FRANCE S A 2023 EUR EXTENDED TL B11 | 0.21 | 9.38 | 0.0094 | 0.0004 | |||||

| US12667FJ556 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2004 30CB 2A4 | 0.21 | 0.00 | 0.0092 | -0.0004 | |||||

| US751155AQ50 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2006 QS10 A15 | 0.20 | -1.46 | 0.0090 | -0.0006 | |||||

| US71085PCE16 / People's Choice Home Loan Securities Trust Series 2005-2 | 0.20 | 1.53 | 0.0089 | -0.0003 | |||||

| US02147RAQ39 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 23CB 2A3 | 0.20 | -1.98 | 0.0089 | -0.0006 | |||||

| US126670PM41 / CWL 2005-16 MV5 | 0.20 | 0.00 | 0.0088 | -0.0004 | |||||

| US694308HL49 / PACIFIC GAS + ELECTRIC SR UNSECURED 03/45 4.3 | 0.19 | -3.48 | 0.0087 | -0.0007 | |||||

| US44409MAA45 / HUDSON PACIFIC PROPERTIE COMPANY GUAR 11/27 3.95 | 0.19 | 7.91 | 0.0086 | 0.0003 | |||||

| ENCORE CREDIT RECEIVABLES TRUS ECR 2005 1 M5 / ABS-MBS (US126673VT68) | 0.19 | -2.07 | 0.0085 | -0.0006 | |||||

| MAGENTA SECURITY HOLDINGS LLC 2024 SECOND OUT TERM LOAN / LON (US55909UAF66) | 0.18 | -8.96 | 0.0082 | -0.0012 | |||||

| US17311WAA53 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 AR4 1A1A | 0.18 | -0.55 | 0.0081 | -0.0004 | |||||

| US02149JAL08 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 45T1 1A11 | 0.18 | 0.00 | 0.0079 | -0.0004 | |||||

| US46628LAK44 / JP MORGAN MORTGAGE TRUST JPMMT 2006 A4 3A1 | 0.17 | -3.49 | 0.0074 | -0.0006 | |||||

| US07386HVV04 / BEAR STEARNS ALT A TRUST BALTA 2005 7 24A1 | 0.17 | -9.78 | 0.0074 | -0.0012 | |||||

| US12545CAB63 / COUNTRYWIDE HOME LOANS CWHL 2007 10 A2 | 0.16 | -2.40 | 0.0073 | -0.0005 | |||||

| MASTR ASSET BACKED SECURITIES MABS 2005 OPT1 M6 / ABS-MBS (US57643LHU35) | 0.16 | 1.25 | 0.0073 | -0.0002 | |||||

| US02149VAJ89 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2007 3T1 1A9 | 0.16 | -1.22 | 0.0073 | -0.0004 | |||||

| US12667FYU38 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2004 28CB 5A1 | 0.16 | -5.88 | 0.0072 | -0.0008 | |||||

| US64352VKW09 / NEW CENTURY HOME EQUITY LOAN T NCHET 2005 2 M4 | 0.16 | -7.51 | 0.0072 | -0.0009 | |||||

| MERRILL LYNCH MORTGAGE INVESTO MLMI 2005 HE1 M2 / ABS-MBS (US59020UUX17) | 0.16 | -2.50 | 0.0070 | -0.0005 | |||||

| US12667F2R58 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 1CB 2A2 | 0.16 | -1.89 | 0.0070 | -0.0005 | |||||

| USL269151134 / DRILLCO HLDG LUX SA | 0.01 | 0.00 | 0.16 | -18.75 | 0.0070 | -0.0020 | |||

| 952NPL005 / CREDIT SUISSE GROUP AG COCO JR SUB 144A | 0.16 | 0.00 | 0.0070 | -0.0003 | |||||

| US02147WAT62 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 26CB A18 | 0.15 | -1.95 | 0.0068 | -0.0005 | |||||

| US073879R596 / BEAR STEARNS ASSET BACKED SECU BSABS 2005 HE9 M2 | 0.15 | -6.83 | 0.0067 | -0.0008 | |||||

| US16163EAH18 / CHASE MORTGAGE FINANCE CORPORA CHASE 2007 S2 1A8 | 0.15 | -0.67 | 0.0067 | -0.0003 | |||||

| US35729PJF80 / Fremont Home Loan Trust 2005-1 | 0.15 | -12.43 | 0.0066 | -0.0013 | |||||

| BOUGHT TRY SOLD USD 20250701 / DFE (000000000) | 0.15 | 0.0066 | 0.0066 | ||||||

| US64352VKC45 / New Century Home Equity Loan Trust, Series 2005-1, Class M3 | 0.15 | 0.68 | 0.0066 | -0.0003 | |||||

| US07386HMW87 / BEAR STEARNS ALT A TRUST BALTA 2004 11 2A2 | 0.14 | -6.04 | 0.0063 | -0.0007 | |||||

| UBSG / UBS Group AG | 0.00 | 0.00 | 0.14 | 12.10 | 0.0062 | 0.0004 | |||

| XS0971721963 / Russian Foreign Bond - Eurobond | 0.14 | 0.00 | 0.0061 | -0.0003 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.14 | 0.0061 | 0.0061 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.14 | 0.0061 | 0.0061 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.14 | 0.0061 | 0.0061 | ||||||

| US90932JAA07 / United Airlines 2019-2 Class AA Pass Through Trust | 0.14 | -2.88 | 0.0061 | -0.0004 | |||||

| COUNTRYWIDE ASSET BACKED CERTI CWL 2005 BC1 M6 / ABS-MBS (US126673YP10) | 0.13 | 0.00 | 0.0059 | -0.0003 | |||||

| US68383NBB82 / Opteum Mortgage Acceptance Corp Asset Backed Pass-Through Certificates 2005-2 | 0.13 | -8.97 | 0.0059 | -0.0009 | |||||

| 952NPKII9 / CREDIT SUISSE GROUP AG COCO JR SUB 144A | 0.13 | 0.00 | 0.0059 | -0.0003 | |||||

| US74922TAB26 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2007 QH4 A2 | 0.13 | 2.42 | 0.0057 | -0.0001 | |||||

| US81375WDT09 / SECURITIZED ASSET BACKED RECEI SABR 2005 FR1 M2 | 0.13 | -1.55 | 0.0057 | -0.0004 | |||||

| REPUBLIC OF GHANA SR UNSECURED 144A 01/30 0.0000 / DBT (US374422AN36) | 0.13 | 8.70 | 0.0056 | 0.0002 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.12 | 0.0056 | 0.0056 | ||||||

| XAN5200EAC56 / McDermott Technology Americas Inc 2020 Make Whole Term Loan | 0.12 | 24.00 | 0.0055 | 0.0009 | |||||

| US922646AS37 / Venezuela Government International Bond | 0.12 | -3.20 | 0.0054 | -0.0004 | |||||

| IRS EUR 1.75000 03/15/23-10Y LCH / DIR (EZF8FDFX1VH6) | 0.12 | -2.50 | 0.0052 | -0.0004 | |||||

| US78473NAC74 / SUNTRUST ADJUSTABLE RATE MORTG STARM 2007 1 2A1 | 0.11 | -4.24 | 0.0051 | -0.0005 | |||||

| AEGIS ASSET BACKED SECURITIES AABST 2005 3 M4 / ABS-MBS (US00764MFU62) | 0.11 | 0.00 | 0.0048 | -0.0003 | |||||

| 952XGJII0 / EQTYWM927 WESTMORELAND MINING | 0.05 | 0.00 | 0.11 | -28.57 | 0.0047 | -0.0022 | |||

| US10924BAA52 / BRIGHTHOUSE HLDGS LLC JR SUBORDINA 144A VAR | 0.11 | 0.00 | 0.10 | -1.01 | 0.0044 | -0.0002 | |||

| XS1319592900 / CORK STREET CLO DESIGNATED ACT CRKST 1A SUB 144A | 0.10 | -26.32 | 0.0044 | -0.0018 | |||||

| US45660L4G12 / RESIDENTIAL ASSET SECURITIZATI RAST 2005 A15 5A1 | 0.10 | -9.26 | 0.0044 | -0.0007 | |||||

| US26884UAF66 / EPR Properties | 0.10 | 2.15 | 0.0043 | -0.0001 | |||||

| US12566VAN29 / CITIMORTGAGE ALTERNATIVE LOAN CMALT 2007 A4 1A13 | 0.09 | -5.10 | 0.0042 | -0.0004 | |||||

| XS0107289323 / THAMES WATER UTL | 0.09 | -4.17 | 0.0041 | -0.0004 | |||||

| RFR USD SOFR/2.30000 01/17/24-2Y LCH / DIR (EZ7DPVG1XS64) | 0.09 | 9.64 | 0.0041 | 0.0001 | |||||

| US126694H688 / COUNTRYWIDE HOME LOANS CWHL 2006 J2 1A6 | 0.09 | -10.89 | 0.0040 | -0.0007 | |||||

| US04542BMC36 / ABFC 2005-WF1 Trust | 0.09 | -1.15 | 0.0039 | -0.0002 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.09 | 0.0039 | 0.0039 | ||||||

| 952NPG907 / CREDIT SUISSE GROUP AG JR SUB REGS | 0.08 | 0.00 | 0.0037 | -0.0002 | |||||

| REPUBLIC OF GHANA SR UNSECURED 144A 07/26 0.0000 / DBT (US374422AL79) | 0.08 | 2.47 | 0.0037 | -0.0000 | |||||

| EZV2HPK2D0S5 / EQUINIX INC SNR S* SP GST | 0.08 | -10.87 | 0.0037 | -0.0006 | |||||

| 902LVFII8 / WEST MARINE NEW COMMON STOCK EQTYWM9A9 | 0.01 | 0.00 | 0.08 | 0.00 | 0.0037 | -0.0002 | |||

| ASSET BACKED FUNDING CERTIFICA ABFC 2005 HE1 M6 / ABS-MBS (US04542BKX90) | 0.08 | 1.28 | 0.0036 | -0.0001 | |||||

| MERRILL LYNCH MORTGAGE INVESTO MLMI 2005 HE1 M3 / ABS-MBS (US59020UUY99) | 0.08 | 1.33 | 0.0034 | -0.0001 | |||||

| US040114HW38 / Argentine Republic Government International Bond | 0.07 | 5.80 | 0.0033 | 0.0001 | |||||

| US126673VR03 / ENCORE CREDIT RECEIVABLES TRUS ECR 2005 1 M3 | 0.07 | 0.00 | 0.0033 | -0.0002 | |||||

| US38375GYG09 / GOVERNMENT NATIONAL MORTGAGE A GNR 2012 97 WS | 0.07 | -1.37 | 0.0032 | -0.0002 | |||||

| US004421NE93 / ACE SECURITIES CORP HOME EQUITY LOAN TRUST SERIE SER 2005-HE3 CL M3 V/R REGD 2.72338000 | 0.07 | -40.98 | 0.0032 | -0.0025 | |||||

| 952NPG006 / CREDIT SUISSE GROUP AG JR SUB 144A | 0.07 | 0.00 | 0.0032 | -0.0001 | |||||

| US70069FHW05 / PARK PLACE SECURITIES INC PPSI 2005 WHQ2 M3 | 0.07 | -38.89 | 0.0030 | -0.0021 | |||||

| US2620511053 / Drillco Holdings Luxembourg SA | 0.00 | 0.00 | 0.06 | -18.99 | 0.0029 | -0.0008 | |||

| BOUGHT TRY SOLD USD 20250813 / DFE (000000000) | 0.06 | 0.0028 | 0.0028 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.06 | 0.0028 | 0.0028 | ||||||

| US31394RFB06 / FREDDIE MAC FHR 2750 SG | 0.06 | -3.08 | 0.0028 | -0.0002 | |||||

| US90931CAA62 / United Airlines Pass Through Trust, Series 2019-1, Class AA | 0.06 | 0.00 | 0.0028 | -0.0001 | |||||

| US00908PAA57 / Air Canada 2017-1 Class AA Pass Through Trust | 0.06 | 0.00 | 0.0028 | -0.0001 | |||||

| US87331AAA25 / TABERNA PREFERED FUNDING LTD TBRNA 2006 6A A1 144A | 0.06 | 1.64 | 0.0028 | -0.0001 | |||||

| US05493AAN00 / BFLD Trust, Series 2020-EYP, Class E | 0.06 | -16.44 | 0.0028 | -0.0007 | |||||

| MASTR ASSET BACKED SECURITIES MABS 2005 HE1 M5 / ABS-MBS (US57643LJJ61) | 0.06 | -25.61 | 0.0028 | -0.0011 | |||||

| US78473TAG58 / SUNTRUST ADJUSTABLE RATE MORTG STARM 2007 2 3A3 | 0.06 | -1.67 | 0.0027 | -0.0002 | |||||

| US04542BKW18 / ABFC 2005-HE1 M5 | 0.06 | 0.00 | 0.0026 | -0.0001 | |||||

| US3137BLTL22 / Freddie Mac REMICS | 0.06 | -6.45 | 0.0026 | -0.0003 | |||||

| US93936RAB06 / WASHINGTON MUTUAL MORTGAGE PAS WMALT 2007 OA5 A1B | 0.06 | 9.62 | 0.0026 | 0.0001 | |||||

| US00764MFS17 / AEGIS ASSET BACKED SECURITIES AABST 2005 3 M2 | 0.06 | -9.68 | 0.0025 | -0.0004 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.06 | 0.0025 | 0.0025 | ||||||

| US84858WAA45 / Spirit Airlines Pass-Through Trust, Series 2017-1, Class AA | 0.06 | -1.79 | 0.0025 | -0.0002 | |||||

| BOUGHT TRY SOLD USD 20250724 / DFE (000000000) | 0.05 | 0.0024 | 0.0024 | ||||||

| BOUGHT TRY SOLD USD 20250724 / DFE (000000000) | 0.05 | 0.0024 | 0.0024 | ||||||

| US86361HAB06 / STRUCTURED ASSET MORTGAGE INVE SAMI 2006 AR7 A1BG | 0.05 | -3.64 | 0.0024 | -0.0002 | |||||

| SOLD DOP BOUGHT USD 20250721 / DFE (000000000) | 0.05 | 0.0024 | 0.0024 | ||||||

| BOUGHT TRY SOLD USD 20250807 / DFE (000000000) | 0.05 | 0.0021 | 0.0021 | ||||||

| US03072SE505 / AMERIQUEST MORTGAGE SECURITIES AMSI 2005 R5 M4 | 0.05 | -40.26 | 0.0021 | -0.0015 | |||||

| BOUGHT TRY SOLD USD 20250709 / DFE (000000000) | 0.05 | 0.0020 | 0.0020 | ||||||

| US3137B0WN07 / FREDDIE MAC FHR 4182 HS | 0.04 | 0.00 | 0.0020 | -0.0001 | |||||

| COUNTRYWIDE ASSET BACKED CERTI CWL 2005 BC1 M5 / ABS-MBS (US126673YN61) | 0.04 | -4.44 | 0.0019 | -0.0002 | |||||

| US11044MAA45 / British Airways 2020-1 Class A Pass Through Trust | 0.04 | -2.33 | 0.0019 | -0.0001 | |||||

| US38122ND823 / Golden State Tobacco Securitization Corp | 0.04 | -20.00 | 0.0018 | -0.0005 | |||||

| US3136ADJF73 / FANNIE MAE FNR 2013 32 HI | 0.04 | -11.36 | 0.0017 | -0.0003 | |||||

| US43739EAX58 / HOMEBANC MORTGAGE TRUST HMBT 2005 1 M6 | 0.04 | 0.00 | 0.0016 | -0.0001 | |||||

| MNSH / MNSN Holdings Inc. | 0.01 | 0.00 | 0.03 | -12.82 | 0.0016 | -0.0003 | |||

| 935ZXN908 / WESTMORELAND MINING HOLDINGS L COMMON | 0.04 | 0.00 | 0.03 | -42.55 | 0.0012 | -0.0010 | |||

| SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2005 CTX1 M4 / ABS-MBS (US83611PBX87) | 0.03 | -42.55 | 0.0012 | -0.0010 | |||||

| SOLD HKD BOUGHT USD 20250716 / DFE (000000000) | 0.03 | 0.0012 | 0.0012 | ||||||

| US46628SAE37 / JP MORGAN MORTGAGE ACQUISITION JPMAC 2006 WF1 A3A | 0.02 | -4.00 | 0.0011 | -0.0001 | |||||

| US03072SES05 / AMERIQUEST MORTGAGE SECURITIES AMSI 2003 2 M1 | 0.02 | -4.00 | 0.0011 | -0.0001 | |||||

| US42815KAA07 / HESTIA RE LTD UNSECURED 144A 04/25 VAR | 0.02 | -98.65 | 0.0011 | -0.0818 | |||||

| 952NPK908 / CREDIT SUISSE GROUP AG COCO JRSUB 144A | 0.02 | 0.00 | 0.0011 | -0.0000 | |||||

| XS2280833133 / Country Garden Holdings Co Ltd | 0.02 | -20.69 | 0.0011 | -0.0003 | |||||

| US66987WDE49 / NOVASTAR MORTGAGE FUNDING TRUST SERIES 2005-4 SER 2005-4 CL M1 V/R REGD 2.36800000 | 0.02 | -68.49 | 0.0011 | -0.0024 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.02 | 0.0009 | 0.0009 | ||||||

| BOUGHT TRY SOLD USD 20250811 / DFE (000000000) | 0.02 | 0.0009 | 0.0009 | ||||||

| US05493AAQ31 / BFLD Trust 2020-EYP | 0.02 | -4.76 | 0.0009 | -0.0001 | |||||

| BOUGHT TRY SOLD USD 20250818 / DFE (000000000) | 0.02 | 0.0009 | 0.0009 | ||||||

| US05493AAL44 / BFLD TRUST BFLD 2020 EYP D 144A | 0.02 | -13.64 | 0.0009 | -0.0002 | |||||

| US53944PAA03 / LNR CDO LTD LNR 2005 1A A 144A | 0.02 | -9.52 | 0.0009 | -0.0001 | |||||

| US3136FCJ802 / FANNIEMAE STRIP FNS 368 18 | 0.02 | -5.26 | 0.0008 | -0.0001 | |||||

| US38378GRT75 / GOVERNMENT NATIONAL MORTGAGE A GNR 2012 143 IJ | 0.02 | 0.00 | 0.0008 | -0.0001 | |||||

| TRT061124T11 / Turkey Government Bond | 0.02 | -5.56 | 0.0008 | -0.0001 | |||||

| ASSET BACKED SECURITIES CORP H ABSHE 2005 HE3 M5 / ABS-MBS (US04541GQY16) | 0.02 | -26.09 | 0.0008 | -0.0004 | |||||

| ISRAEL GOVT EM SP CBK / DCR (EZYH14HMXHV9) | 0.02 | -21.05 | 0.0007 | -0.0002 | |||||

| US05946XZ487 / BANC OF AMERICA FUNDING CORPOR BAFC 2005 8 3A4 | 0.02 | 0.00 | 0.0007 | -0.0001 | |||||

| XS2210960378 / Country Garden Holdings Co Ltd | 0.02 | -25.00 | 0.0007 | -0.0002 | |||||

| XS2051371222 / Country Garden Holdings Co Ltd | 0.02 | -21.05 | 0.0007 | -0.0002 | |||||

| XS2240971742 / Country Garden Holdings Co Ltd | 0.02 | -25.00 | 0.0007 | -0.0003 | |||||

| AT&T INC SNR S* ICE / DCR (EZVHX8BNGL14) | 0.01 | 7.69 | 0.0007 | 0.0000 | |||||

| BOUGHT TRY SOLD USD 20250721 / DFE (000000000) | 0.01 | 0.0006 | 0.0006 | ||||||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0006 | 0.0006 | ||||||

| US52521NAJ90 / LEHMAN MORTGAGE TRUST LMT 2007 6 1A11 | 0.01 | -43.48 | 0.0006 | -0.0005 | |||||

| BOUGHT TRY SOLD USD 20250723 / DFE (000000000) | 0.01 | 0.0006 | 0.0006 | ||||||

| BOUGHT TRY SOLD USD 20250714 / DFE (000000000) | 0.01 | 0.0006 | 0.0006 | ||||||

| TRT061124T11 / Turkey Government Bond | 0.01 | 0.00 | 0.0006 | -0.0000 | |||||

| BOUGHT TRY SOLD USD 20250711 / DFE (000000000) | 0.01 | 0.0006 | 0.0006 | ||||||

| BOUGHT TRY SOLD USD 20250710 / DFE (000000000) | 0.01 | 0.0006 | 0.0006 | ||||||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0005 | 0.0005 | ||||||

| PEMEX LCDS SP DUB / DCR (000000000) | 0.01 | 0.0005 | 0.0005 | ||||||

| US38378HFV33 / GOVERNMENT NATIONAL MORTGAGE A GNR 2012 96 KI | 0.01 | -9.09 | 0.0005 | -0.0001 | |||||

| BOEING CO/THE SNR S* ICE / DCR (EZC4SH442RJ4) | 0.01 | -10.00 | 0.0004 | -0.0001 | |||||

| BOEING CO/THE SNR S* ICE / DCR (EZHP2BRFHR54) | 0.01 | -78.12 | 0.0004 | -0.0012 | |||||

| BOUGHT TRY SOLD USD 20250729 / DFE (000000000) | 0.01 | 0.0004 | 0.0004 | ||||||

| US30162RAD35 / Exela Intermediate LLC/Exela Finance, Inc. | 0.01 | -65.00 | 0.0003 | -0.0007 | |||||

| THAMES SSNM 144A UNFUNDED COMM / DBT (955RVLII8) | 0.01 | 0.0003 | 0.0003 | ||||||

| BOUGHT PEN SOLD USD 20250711 / DFE (000000000) | 0.01 | 0.0003 | 0.0003 | ||||||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0.01 | 0.0003 | 0.0003 | ||||||

| US16162WPE39 / CHASE MORTGAGE FINANCE CORPORA CHASE 2005 A1 2A2 | 0.01 | 0.00 | 0.0002 | -0.0000 | |||||

| ISRAEL GOVT EM SP GST / DCR (EZXHZ73B1F04) | 0.01 | 150.00 | 0.0002 | 0.0001 | |||||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0002 | 0.0002 | ||||||

| US466247WT64 / JP MORGAN MORTGAGE TRUST JPMMT 2005 A7 3A1 | 0.01 | 0.00 | 0.0002 | -0.0000 | |||||

| MCDIF / Mcdermott International Ltd. | 0.00 | 0.00 | 0.01 | -28.57 | 0.0002 | -0.0001 | |||

| BOUGHT TRY SOLD USD 20250725 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| BOUGHT TRY SOLD USD 20250814 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| THAMES WATER SUPER SEN SR SECURED 144A 10/27 9.75 / DBT (XS3017976054) | 0.00 | 0.0002 | 0.0002 | ||||||

| US57109M1018 / MARLETTE FUNDING TRUST MFT 2019 3A CERT 144A | 0.00 | -76.92 | 0.0002 | -0.0005 | |||||

| THAMES WATER SUPER SEN SR SECURED 144A 10/27 9.75 / DBT (XS3060649830) | 0.00 | 0.0002 | 0.0002 | ||||||

| SOLD DOP BOUGHT USD 20250922 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| US86364LAC63 / STRUCTURED ASSET SECURITIES CO SASC 2007 WF2 A3 | 0.00 | -50.00 | 0.0001 | -0.0001 | |||||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| LU2445093987 / INTELSAT EMERGENCE SA CALL EXP17FEB27 | 0.00 | 0.00 | 0.0001 | -0.0000 | |||||

| VERITAS US INC 2024 PRIORITY TERM LOAN / LON (BA000CCH0) | 0.00 | -99.88 | 0.0001 | -0.0824 | |||||

| ISRAEL GOVT EM SP MYC / DCR (EZXHZ73B1F04) | 0.00 | 0.00 | 0.0001 | -0.0000 | |||||

| SOLD DOP BOUGHT USD 20250811 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| US70069FLH81 / Park Place Securities Inc Asset-Backed Pass-Through Certificates Series 2005-WCW | 0.00 | -90.91 | 0.0001 | -0.0005 | |||||

| SOLD DOP BOUGHT USD 20250728 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| SOLD DOP BOUGHT USD 20250728 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| ROMANIA EM SP BPS / DCR (EZGVWDZMYPZ6) | 0.00 | 0.00 | 0.0001 | -0.0000 | |||||

| US3136AEFR31 / FANNIE MAE FNR 2013 53 MI | 0.00 | 0.00 | 0.0001 | -0.0000 | |||||

| ISRAEL GOVT EM SP JPM / DCR (EZXHZ73B1F04) | 0.00 | -50.00 | 0.0001 | -0.0001 | |||||

| MNSH / MNSN Holdings Inc. | 0.05 | 0.00 | 0.00 | 0.00 | 0.0000 | -0.0000 | |||

| THAMES WATER UTIL LTD SR SECURED 144A 03/27 0.00000 / DBT (XS3002255787) | 0.00 | 0.0000 | 0.0000 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| SOLD DOP BOUGHT USD 20250711 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| LU2445094365 / INTELSAT EMERGENCE SA | 0.00 | 0.0000 | -0.0000 | ||||||

| SOLD DOP BOUGHT USD 20251120 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| 948ECV905 / STEINHOFF CVR | 97.34 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| US12489WQG23 / CREDIT BASED ASSET SERVICING A CBASS 2005 CB8 AF5 | 0.00 | 0.0000 | -0.0000 | ||||||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| US62940FAD15 / N STAR REAL ESTATE CDO LTD NSTAR 2006 8A B 144A | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT TRY SOLD USD 20250708 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| ADJ / Adler Group S.A. | 3.92 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| US92918XAA37 / Voyager Aviation Holdings LLC | 0.00 | 0.0000 | 0.0000 | ||||||

| WEST MARINE NEW WARRANT WARRWM911 / DE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||