Mga Batayang Estadistika

| Nilai Portofolio | $ 337,260,835 |

| Posisi Saat Ini | 305 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

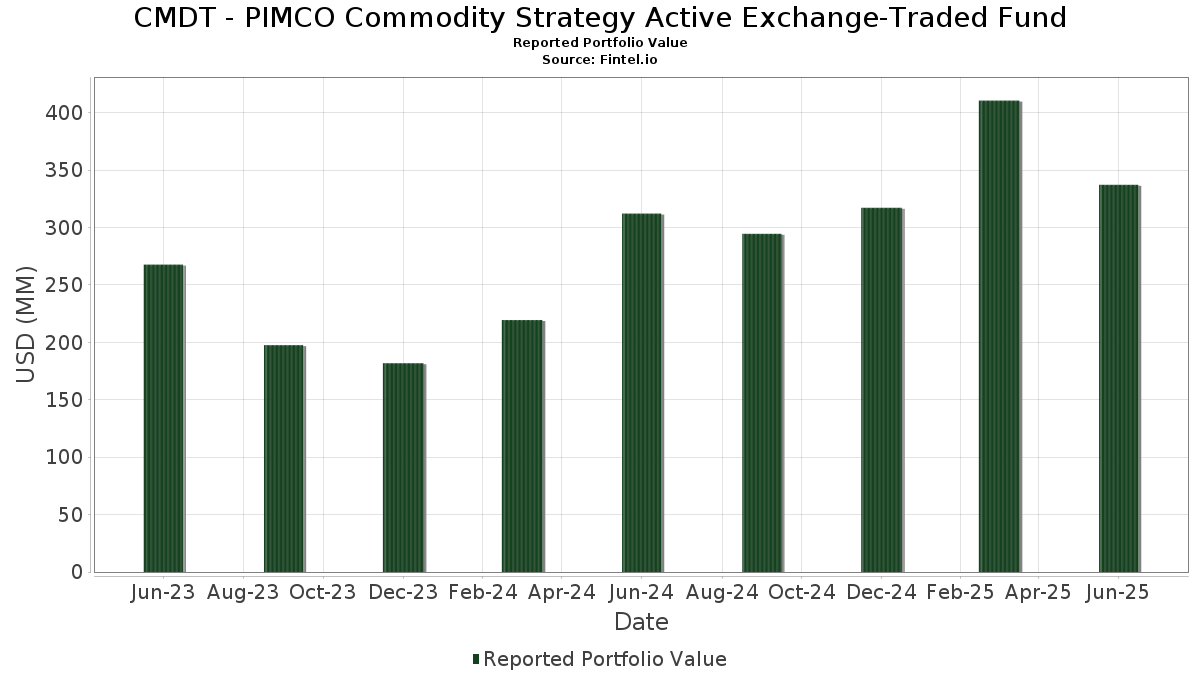

CMDT - PIMCO Commodity Strategy Active Exchange-Traded Fund telah mengungkapkan total kepemilikan 305 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 337,260,835 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama CMDT - PIMCO Commodity Strategy Active Exchange-Traded Fund adalah PIMCO ETF Trust - PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (US:MINT) , PACIFIC GAS + ELECTRIC 1ST MORTGAGE 01/26 3.15 (US:US694308JP35) , Bayer US Finance II LLC (US:US07274NAJ28) , Kraft Heinz Foods Co (US:US50077LAD82) , and Berry Global Inc (US:US08576PAH47) . Posisi baru CMDT - PIMCO Commodity Strategy Active Exchange-Traded Fund meliputi: PACIFIC GAS + ELECTRIC 1ST MORTGAGE 01/26 3.15 (US:US694308JP35) , Bayer US Finance II LLC (US:US07274NAJ28) , Kraft Heinz Foods Co (US:US50077LAD82) , Berry Global Inc (US:US08576PAH47) , and Goldman Sachs Group Inc/The (US:US38141GYG36) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 10.81 | 2.8986 | 2.8986 | ||

| 0.01 | 33.05 | 8.8653 | 1.8032 | |

| 4.90 | 1.3143 | 1.3143 | ||

| 3.99 | 1.0696 | 1.0696 | ||

| 3.69 | 0.9900 | 0.9900 | ||

| 3.68 | 0.9876 | 0.9876 | ||

| 3.20 | 0.8586 | 0.8586 | ||

| 3.00 | 0.8057 | 0.8057 | ||

| 0.00 | 11.87 | 3.1832 | 0.6475 | |

| 2.00 | 0.5366 | 0.5366 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| -3.15 | -0.8439 | -0.8439 | ||

| 1.53 | 0.4095 | -0.4824 | ||

| -1.68 | -0.4515 | -0.4515 | ||

| -1.57 | -0.4214 | -0.4214 | ||

| 0.03 | 0.0085 | -0.3925 | ||

| 0.00 | 6.54 | 1.7546 | -0.3654 | |

| -1.24 | -0.3321 | -0.3552 | ||

| -1.31 | -0.3526 | -0.3526 | ||

| -0.91 | -0.2447 | -0.2954 | ||

| -0.62 | -0.1672 | -0.1672 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-29 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GOLD CMX WR FAC 4001(BRINKS) RDR / COMM (942WEX905) | 0.01 | 0.00 | 33.05 | 5.48 | 8.8653 | 1.8032 | |||

| GOLD CMX WR FAC 2001 JPM RDR / COMM (942WEW907) | 0.00 | 0.00 | 11.87 | 5.48 | 3.1832 | 0.6475 | |||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2025 98 GF / ABS-MBS (US38381NNT18) | 10.81 | 2.8986 | 2.8986 | ||||||

| FANNIE MAE FNR 2025 18 FM / ABS-MBS (US3136BVKH00) | 10.47 | -4.89 | 2.8090 | 0.3274 | |||||

| SILVER CMX WR FAC 5001 HSBC RDR / COMM (954MDZ908) | 0.24 | 0.00 | 8.73 | 4.04 | 2.3406 | 0.4502 | |||

| MINT / PIMCO ETF Trust - PIMCO Enhanced Short Maturity Active Exchange-Traded Fund | 0.07 | 0.00 | 7.11 | -0.08 | 1.9078 | 0.3034 | |||

| PLATINUM CMX WR FAC 8888 NYMEX RDR / COMM (955GRNII3) | 0.00 | -47.35 | 6.54 | -30.46 | 1.7546 | -0.3654 | |||

| US694308JP35 / PACIFIC GAS + ELECTRIC 1ST MORTGAGE 01/26 3.15 | 5.48 | 0.33 | 1.4692 | 0.2388 | |||||

| GOLD CMX WR FAC 3002 MTB RDR / COMM (902LHM908) | 0.00 | 0.00 | 5.11 | 5.49 | 1.3701 | 0.2787 | |||

| REPO TORONTO DOMINION GRAND CAYMAN / RA (000000000) | 4.90 | 1.3143 | 1.3143 | ||||||

| US07274NAJ28 / Bayer US Finance II LLC | 4.39 | 0.18 | 1.1770 | 0.1896 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 4.39 | 1.22 | 1.1768 | 0.1999 | |||||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 3.99 | 1.0696 | 1.0696 | ||||||

| US50077LAD82 / Kraft Heinz Foods Co | 3.95 | 0.48 | 1.0591 | 0.1734 | |||||

| US08576PAH47 / Berry Global Inc | 3.93 | 0.74 | 1.0538 | 0.1750 | |||||

| US38141GYG36 / Goldman Sachs Group Inc/The | 3.86 | 0.91 | 1.0361 | 0.1735 | |||||

| A3KMYN / Air Lease Corporation - Preferred Stock | 3.69 | 0.9900 | 0.9900 | ||||||

| CNQ / Canadian Natural Resources Limited | 3.68 | 0.9876 | 0.9876 | ||||||

| GM FINANCIAL AUTOMOBILE LEASIN GMALT 2025 1 A2A / ABS-O (US36271VAB36) | 3.61 | -0.03 | 0.9670 | 0.1543 | |||||

| GOLD CMX WR FAC 8001 ASAHI RDR / COMM (955GRP907) | 0.00 | 0.00 | 3.59 | 5.49 | 0.9633 | 0.1959 | |||

| US86562MCZ14 / Sumitomo Mitsui Financial Group Inc | 3.53 | -0.08 | 0.9480 | 0.1507 | |||||

| MET LIFE GLOB FUNDING I SECURED REGS 12/25 VAR / DBT (AU3FN0057451) | 3.29 | 5.45 | 0.8829 | 0.1793 | |||||

| ILGOV / Ministry Of Finance, Shachar - Corporate Bond/Note | 3.21 | 11.46 | 0.8610 | 0.2119 | |||||

| FREDDIE MAC FHR 5557 FM / ABS-MBS (US3137HLZ217) | 3.20 | 0.8586 | 0.8586 | ||||||

| KRATON CORP KRATON CORP / DBT (US50077CAA45) | 3.04 | 0.23 | 0.8151 | 0.1318 | |||||

| FREDDIE MAC FHR 5560 FB / ABS-MBS (US3137HLZD77) | 3.00 | 0.8057 | 0.8057 | ||||||

| US404119BS74 / Hca Inc Bond | 3.00 | -0.30 | 0.8056 | 0.1267 | |||||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 3.00 | -0.20 | 0.8045 | 0.1272 | |||||

| HSBC26C / HSBC Holdings PLC | 3.00 | 0.13 | 0.8039 | 0.1292 | |||||

| US25160PAJ66 / Deutsche Bank AG/New York NY | 2.90 | -0.28 | 0.7782 | 0.1224 | |||||

| US86765BAS88 / Sunoco Logistics Partners Operations, LP | 2.89 | -0.31 | 0.7751 | 0.1218 | |||||

| FREDDIE MAC FHR 5532 FA / ABS-MBS (US3137HKPJ74) | 2.86 | -4.86 | 0.7663 | 0.0894 | |||||

| US172967MB43 / Citigroup, Inc. | 2.70 | -0.15 | 0.7242 | 0.1147 | |||||

| FREDDIE MAC FHR 5517 VF / ABS-MBS (US3137HKP400) | 2.65 | -4.81 | 0.7105 | 0.0832 | |||||

| US05367AAH68 / Aviation Capital Group LLC | 2.55 | -0.04 | 0.6845 | 0.1092 | |||||

| SWED A / Swedbank AB (publ) | 2.55 | 0.43 | 0.6843 | 0.1117 | |||||

| US65535HAR03 / Nomura Holdings Inc | 2.55 | 0.67 | 0.6831 | 0.1129 | |||||

| SHB A / Svenska Handelsbanken AB (publ) | 2.51 | 0.04 | 0.6723 | 0.1076 | |||||

| US412822AD08 / Harley-Davidson, Inc. | 2.50 | 0.44 | 0.6696 | 0.1095 | |||||

| US17327CAM55 / Citigroup Inc | 2.45 | 0.95 | 0.6574 | 0.1101 | |||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 2.32 | 5.22 | 0.6223 | 0.1252 | |||||

| ATHENE GLOBAL FUNDING SECURED 144A 08/26 VAR / DBT (US04685A4B40) | 2.31 | 0.00 | 0.6195 | 0.0990 | |||||

| US404280DZ92 / HSBC HOLDINGS PLC REGD V/R 5.88700000 | 2.03 | -0.15 | 0.5442 | 0.0862 | |||||

| US02582JKD18 / American Express Credit Account Master Trust, Series 2023-3, Class A | 2.02 | -0.10 | 0.5427 | 0.0863 | |||||

| US89233FHN15 / Toyota Motor Credit Corporation | 2.01 | 0.00 | 0.5388 | 0.0862 | |||||

| US17305EGW93 / CITIBANK CREDIT CARD ISSUANCE TRUST SER 2023-A1 CL A1 REGD 5.23000000 | 2.01 | -0.15 | 0.5381 | 0.0853 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 2.01 | -0.20 | 0.5381 | 0.0849 | |||||

| US92348KCA97 / VERIZON MASTER TRUST VZMT 2023 5 A1B | 2.00 | 0.00 | 0.5373 | 0.0858 | |||||

| ATHENE GLOBAL FUNDING SECURED 144A 07/26 VAR / DBT (US04685A4J75) | 2.00 | 0.10 | 0.5372 | 0.0862 | |||||

| US89621ABT51 / TRILLIUM CREDIT CARD TRUST II SER 2023-3A CL A V/R REGD 144A P/P 6.16523200 | 2.00 | -0.15 | 0.5368 | 0.0852 | |||||

| PACIFIC LIFE GF II SECURED 144A 02/27 VAR / DBT (US6944PL3G29) | 2.00 | 0.05 | 0.5366 | 0.0860 | |||||

| FANNIE MAE FNR 2025 54 FM / ABS-MBS (US3136BWNW23) | 2.00 | 0.5366 | 0.5366 | ||||||

| SILVER ROCK CLO LTD SLVRK 2021 2A AR 144A / ABS-CBDO (US82812LAN91) | 2.00 | -0.15 | 0.5355 | 0.0848 | |||||

| US345397B280 / FORD MTR CR CO LLC 3.375% 11/13/2025 | 1.99 | 0.51 | 0.5329 | 0.0875 | |||||

| FREDDIE MAC FHR 5534 FM / ABS-MBS (US3137HLEP37) | 1.95 | 0.5228 | 0.5228 | ||||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 1.91 | 5.17 | 0.5127 | 0.1031 | |||||

| US91159HJH49 / US Bancorp | 1.91 | -0.26 | 0.5114 | 0.0806 | |||||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2025 89 PF / ABS-MBS (US38385GMK21) | 1.89 | 0.5081 | 0.5081 | ||||||

| GOLD CMX WR FAC 4002 BRINKS2 RDR / COMM (902TJS005) | 0.00 | 0.00 | 1.89 | 5.52 | 0.5081 | 0.1033 | |||

| GOLD CMX WR FAC 6012 MALCA RDR / COMM (955GRPII8) | 0.00 | 0.00 | 1.89 | 5.52 | 0.5081 | 0.1033 | |||

| TRINITAS CLO LTD TRNTS 2017 7A A1R2 144A / ABS-CBDO (US89641CAU53) | 1.79 | -0.39 | 0.4810 | 0.0752 | |||||

| PALMER SQUARE EUROPEAN LOAN FU PSTET 2025 1A A 144A / ABS-CBDO (XS2999623775) | 1.76 | 9.24 | 0.4726 | 0.1090 | |||||

| US63306A4114 / National Bank of Canada into Bristol-Myers Squibb Co. | 1.71 | -0.18 | 0.4586 | 0.0726 | |||||

| US268317AS33 / Electricite de France SA | 1.69 | 0.30 | 0.4542 | 0.0736 | |||||

| WIND RIVER CLO LTD WINDR 2016 1KRA A1R3 144A / ABS-CBDO (US97314DAN84) | 1.69 | -0.47 | 0.4522 | 0.0706 | |||||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 1.67 | 0.4488 | 0.4488 | ||||||

| FANNIE MAE FNR 2025 24 FA / ABS-MBS (US3136BVRT74) | 1.63 | -3.03 | 0.4377 | 0.0586 | |||||

| FANNIE MAE FNR 2025 16 FN / ABS-MBS (US3136BU6A37) | 1.62 | -4.49 | 0.4334 | 0.0522 | |||||

| FANNIE MAE FNR 2025 10 AF / ABS-MBS (US3136BUTA82) | 1.61 | -3.07 | 0.4319 | 0.0574 | |||||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2021 17A AR 144A / ABS-CBDO (US04942FAL31) | 1.60 | 0.38 | 0.4291 | 0.0700 | |||||

| US576339DJ15 / MASTER CR CARD TR II 23-2A A SOFR30A+85 01/21/2027 144A | 1.60 | -0.19 | 0.4290 | 0.0678 | |||||

| LCM LTD PARTNERSHIP LCM 36A A1R 144A / ABS-CBDO (US50190LAL27) | 1.59 | 0.13 | 0.4277 | 0.0688 | |||||

| SILVER FUTURE SEP25 XCEC 20250926 / DCO (000000000) | 1.54 | 0.4139 | 0.4139 | ||||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 1.53 | -61.44 | 0.4095 | -0.4824 | |||||

| 43AB / Rolls-Royce plc - Corporate Bond/Note | 1.52 | 0.20 | 0.4088 | 0.0661 | |||||

| US65535HBG39 / Nomura Holdings Inc | 1.51 | -0.20 | 0.4044 | 0.0639 | |||||

| US44891ACQ85 / Hyundai Capital America | 1.51 | -0.40 | 0.4040 | 0.0632 | |||||

| BMW US CAPITAL LLC BMW US CAPITAL LLC / DBT (US05565ECN31) | 1.51 | 0.33 | 0.4039 | 0.0656 | |||||

| NRUC / National Rural Utilities Cooperative Finance Corporation - Corporate Bond/Note | 1.50 | 0.4027 | 0.4027 | ||||||

| US928668BY79 / Volkswagen Group of America Finance LLC | 1.50 | -0.07 | 0.4026 | 0.0640 | |||||

| US17331KAD19 / Citizens Auto Receivables Trust | 1.50 | -22.38 | 0.4013 | -0.0329 | |||||

| REGATTA XVI FUNDING LTD. REG16 2019 2A A1R 144A / ABS-CBDO (US75888TAL98) | 1.46 | -2.67 | 0.3918 | 0.0536 | |||||

| US74977RDL50 / Cooperatieve Rabobank UA | 1.45 | 0.84 | 0.3882 | 0.0647 | |||||

| US65480CAC91 / NISSAN MOTOR ACCEPTANCE SR UNSECURED 144A 09/26 1.85 | 1.43 | 0.49 | 0.3840 | 0.0629 | |||||

| GM FINANCIAL AUTOMOBILE LEASIN GMALT 2025 2 A2A / ABS-O (US362962AB80) | 1.40 | 0.3766 | 0.3766 | ||||||

| D05 / DBS Group Holdings Ltd | 1.40 | -0.07 | 0.3763 | 0.0601 | |||||

| CANYON CAPITAL CLO LTD CANYC 2019 2A AR2 144A / ABS-CBDO (US13887WAS98) | 1.40 | 0.65 | 0.3759 | 0.0622 | |||||

| MADISON PARK FUNDING LTD MDPK 2020 46A ARR 144A / ABS-CBDO (US55822AAW71) | 1.40 | 0.65 | 0.3759 | 0.0621 | |||||

| OCEAN TRAILS CLO OCTR 2021 11A AR 144A / ABS-CBDO (US67514VAL36) | 1.40 | 0.50 | 0.3756 | 0.0615 | |||||

| FREDDIE MAC FHR 5428 CF / ABS-MBS (US3137HDKQ20) | 1.40 | -6.86 | 0.3754 | 0.0369 | |||||

| PARALLEL LTD PARL 2021 1A AR 144A / ABS-CBDO (US69916HAL42) | 1.40 | 0.14 | 0.3749 | 0.0604 | |||||

| AU3FN0029609 / AAI Ltd | 1.39 | 5.24 | 0.3715 | 0.0748 | |||||

| MUFG BANK LTD SYDNEY CERT OF DEPO 02/26 VAR / DBT (AU3FN0075198) | 1.32 | 5.26 | 0.3542 | 0.0715 | |||||

| MIZUHO BANK LTD/SYDNEY CERT OF DEPO 02/26 VAR / DBT (AU3FN0075479) | 1.32 | 5.26 | 0.3541 | 0.0714 | |||||

| FREDDIE MAC FHR 5495 AF / ABS-MBS (US3137HJ2H99) | 1.31 | -4.16 | 0.3527 | 0.0436 | |||||

| FREDDIE MAC FHR 5498 FC / ABS-MBS (US3137HHWA53) | 1.31 | -5.34 | 0.3518 | 0.0396 | |||||

| COOPERAT RABOBANK UA/NY 08/26 VAR / DBT (US21688ABG67) | 1.30 | -0.15 | 0.3496 | 0.0555 | |||||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/26 VAR / DBT (US928668CD24) | 1.30 | -0.08 | 0.3488 | 0.0555 | |||||

| US03027XBB55 / American Tower Corp | 1.29 | 0.86 | 0.3463 | 0.0576 | |||||

| FANNIE MAE FNR 2024 101 FB / ABS-MBS (US3136BUFJ48) | 1.25 | -2.50 | 0.3353 | 0.0465 | |||||

| BAIN CAPITAL CREDIT CLO, LIMIT BCC 2020 2A ARR 144A / ABS-CBDO (US05683EAW21) | 1.20 | 0.08 | 0.3226 | 0.0519 | |||||

| ARES CLO LTD ARES 2013 2A AR3 144A / ABS-CBDO (US00190YBP97) | 1.20 | 0.42 | 0.3222 | 0.0526 | |||||

| 522 FUNDING CLO LTD MORGN 2020 6A A1R2 144A / ABS-CBDO (US33835AAY55) | 1.20 | 0.25 | 0.3220 | 0.0521 | |||||

| ATLANTIC AVENUE LTD MCCP 2024 3A A 144A / ABS-CBDO (US04822JAA43) | 1.20 | 0.08 | 0.3218 | 0.0517 | |||||

| US251526CE71 / DEUTSCHE BANK AG NEW YORK BNCH 2.129%/VAR 11/24/2026 | 1.19 | 0.76 | 0.3186 | 0.0530 | |||||

| ALBACORE EURO CLO ALBAC 4A AR 144A / ABS-CBDO (XS2861758642) | 1.18 | 9.17 | 0.3164 | 0.0728 | |||||

| ICG US CLO LTD ICG 2015 2RA A1R 144A / ABS-CBDO (US44933WAL37) | 1.13 | -13.11 | 0.3025 | 0.0100 | |||||

| FANNIE MAE FNR 2024 100 FA / ABS-MBS (US3136BUFY15) | 1.12 | -10.23 | 0.2991 | 0.0191 | |||||

| M+T BANK AUTO RECEIVABLES TRUS MTBAT 2024 1A A3 144A / ABS-O (US55286TAC99) | 1.11 | -0.18 | 0.2987 | 0.0473 | |||||

| FREDDIE MAC FHR 5410 FB / ABS-MBS (US3137HCUC41) | 1.10 | -3.69 | 0.2939 | 0.0374 | |||||

| FREDDIE MAC FHR 5480 FG / ABS-MBS (US3137HHUD11) | 1.08 | -9.56 | 0.2894 | 0.0208 | |||||

| ONSLOW BAY FINANCIAL LLC OBX 2024 NQM5 A1 144A / ABS-MBS (US67448NAA63) | 1.03 | -8.33 | 0.2774 | 0.0231 | |||||

| US29278GAZ19 / Enel Finance International NV | 1.01 | -0.40 | 0.2698 | 0.0423 | |||||

| US452327AN93 / Illumina Inc | 1.00 | -0.30 | 0.2694 | 0.0424 | |||||

| STAB / Standard Chartered PLC - Preferred Security | 1.00 | -0.30 | 0.2694 | 0.0422 | |||||

| MOUNTAIN VIEW CLO MVEW 2022 1A A1R 144A / ABS-CBDO (US62432UAN19) | 1.00 | 0.10 | 0.2686 | 0.0430 | |||||

| ALLEGRO CLO LTD ALLEG 2019 2A A1AR 144A / ABS-CBDO (US01750HAQ56) | 1.00 | 0.00 | 0.2685 | 0.0430 | |||||

| MORGAN STANLEY BANK NA SR UNSECURED 10/27 VAR / DBT (US61690U8F08) | 1.00 | -0.20 | 0.2684 | 0.0426 | |||||

| US24023KAK43 / DBS GROUP HOLDINGS LTD SR UNSECURED 144A 09/25 VAR | 1.00 | -0.10 | 0.2683 | 0.0427 | |||||

| US456837AU72 / ING Groep NV | 1.00 | 0.91 | 0.2682 | 0.0447 | |||||

| US31620MBV72 / Fidelity National Information Services Inc | 1.00 | 0.00 | 0.2682 | 0.0431 | |||||

| SHINHAN BANK SR UNSECURED REGS 11/25 VAR / DBT (AU3FN0073540) | 0.99 | 4.97 | 0.2663 | 0.0532 | |||||

| US225401AT54 / Credit Suisse Group AG | 0.98 | 0.93 | 0.2632 | 0.0440 | |||||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2024 H20 JF / ABS-MBS (US38383K2U57) | 0.97 | -2.51 | 0.2605 | 0.0359 | |||||

| US38383KGP12 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2023-H24 CL FA V/R 6.27507000 | 0.95 | -2.67 | 0.2538 | 0.0346 | |||||

| NORTHWOODS CAPITAL LTD WOODS 2018 12BA AR 144A / ABS-CBDO (US66858CAN74) | 0.94 | -13.82 | 0.2510 | 0.0064 | |||||

| GOLD 100 OZ FUTR AUG25 XCEC 20250827 / DCO (000000000) | 0.92 | 0.2462 | 0.2462 | ||||||

| CARLYLE GLOBAL MARKET STRATEGI CGMS 2016 3A ARRR / ABS-CBDO (US14311UBA51) | 0.90 | 0.56 | 0.2417 | 0.0396 | |||||

| CARVAL CLO LTD CARVL 2018 1A AR 144A / ABS-CBDO (US146865AJ95) | 0.89 | -3.88 | 0.2397 | 0.0303 | |||||

| FANNIE MAE FNR 2024 103 FJ / ABS-MBS (US3136BUPN40) | 0.84 | -4.52 | 0.2265 | 0.0270 | |||||

| PALMER SQUARE EUROPEAN LOAN FU PSTET 2023 2A AR 144A / ABS-CBDO (XS2878983712) | 0.82 | -11.41 | 0.2187 | 0.0113 | |||||

| US345397C502 / Ford Motor Credit Co LLC | 0.81 | -0.62 | 0.2166 | 0.0336 | |||||

| US78016EYZ41 / Royal Bank of Canada | 0.80 | 0.00 | 0.2153 | 0.0345 | |||||

| US63906EB929 / NatWest Markets PLC | 0.80 | 0.00 | 0.2152 | 0.0343 | |||||

| PROTECTIVE LIFE GLOBAL SECURED 144A 07/26 VAR / DBT (US743672AG20) | 0.80 | -0.12 | 0.2148 | 0.0343 | |||||

| AMERICAN MONEY MANAGEMENT CORP AMMC 2021 24A AR 144A / ABS-CBDO (US00177LAJ98) | 0.80 | 0.38 | 0.2147 | 0.0349 | |||||

| BACR / Barclays Bank PLC - Corporate Bond/Note | 0.80 | 0.13 | 0.2144 | 0.0344 | |||||

| ING BANK (AUSTRALIA) LTD COVERED 12/25 VAR / DBT (AU3FN0074175) | 0.79 | 5.32 | 0.2124 | 0.0428 | |||||

| CUMULUS STATIC CLO CMLST 2024 1A A 144A / ABS-CBDO (XS2797421414) | 0.73 | 1.97 | 0.1945 | 0.0342 | |||||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2024 13 FA / ABS-MBS (US38384GP876) | 0.70 | 0.1882 | 0.1882 | ||||||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 0.70 | -0.29 | 0.1877 | 0.0297 | |||||

| MIZUHO BANK LTD/SYDNEY CERT OF DEPO 08/25 VAR / DBT (AU3FN0070918) | 0.66 | 5.11 | 0.1766 | 0.0355 | |||||

| AU3CB0273407 / UBS AG/Australia | 0.66 | 6.15 | 0.1761 | 0.0368 | |||||

| LME COPPER FUTURE JUL25 XLME 20250714 / DCO (GB00FVN2W767) | 0.61 | 2,162.96 | 0.1640 | 0.1578 | |||||

| US86563VBG32 / Sumitomo Mitsui Trust Bank Ltd | 0.60 | -0.17 | 0.1622 | 0.0257 | |||||

| JACKSON NATL LIFE GLOBAL SECURED 144A 01/27 4.9 / DBT (US46849LVC26) | 0.60 | 0.33 | 0.1621 | 0.0263 | |||||

| GASOLINE RBOB FUT DEC25 XNYM 20251128 / DCO (000000000) | 0.60 | 0.1616 | 0.1616 | ||||||

| JAMESTOWN CLO LTD JTWN 2021 16A AR 144A / ABS-CBDO (US47048RAL96) | 0.60 | 0.00 | 0.1605 | 0.0257 | |||||

| US09659W2N34 / BNP Paribas SA | 0.59 | 0.86 | 0.1581 | 0.0265 | |||||

| LME ZINC FUTURE JUL25 XLME 20250714 / DCO (GB00H249H767) | 0.55 | 143.75 | 0.1464 | 0.0957 | |||||

| TREASURY BILL 10/25 0.00000 / DBT (US912797RD17) | 0.53 | 0.1429 | 0.1429 | ||||||

| STANDARD CHARTERED BK/NY SR UNSECURED 12/27 4.853 / DBT (US85325X2B15) | 0.51 | 0.59 | 0.1365 | 0.0226 | |||||

| US404280DY28 / HSBC HOLDINGS PLC FRN SOFR+0 08/14/2027 | 0.50 | -0.40 | 0.1353 | 0.0212 | |||||

| US456837AX12 / ING Groep NV | 0.50 | -0.20 | 0.1345 | 0.0213 | |||||

| TRYSAIL CLO LTD TRYSL 2022 1A A 144A / ABS-CBDO (US89856JAA43) | 0.50 | 0.20 | 0.1342 | 0.0217 | |||||

| US22822VAB71 / Crown Castle International Corp | 0.50 | 0.20 | 0.1340 | 0.0216 | |||||

| US654744AB77 / Nissan Motor Co Ltd | 0.50 | 0.61 | 0.1334 | 0.0219 | |||||

| USAA AUTO OWNER TRUST USAOT 2024 A A2 144A / ABS-O (US90327VAB45) | 0.49 | -38.25 | 0.1304 | -0.0471 | |||||

| NY HARB ULSD FUT DEC25 XNYM 20251128 / DCO (000000000) | 0.49 | 0.1303 | 0.1303 | ||||||

| CARMAX AUTO OWNER TRUST CARMX 2024 1 A2A / ABS-O (US14318WAB37) | 0.47 | -44.81 | 0.1271 | -0.0661 | |||||

| US085770AA31 / Berry Global Escrow Corp. | 0.47 | 0.00 | 0.1249 | 0.0199 | |||||

| AU3FN0058608 / UBS AG AUSTRALIA SR UNSECURED REGS 02/26 VAR | 0.46 | 5.26 | 0.1236 | 0.0251 | |||||

| JAMESTOWN CLO LTD JTWN 2022 18A AR 144A / ABS-CBDO (US47047RAN61) | 0.40 | 0.00 | 0.1074 | 0.0173 | |||||

| FREDDIE MAC FHR 5491 FL / ABS-MBS (US3137HJ5P88) | 0.37 | -4.36 | 0.1001 | 0.0120 | |||||

| LME PRI ALUM FUTR JUL25 XLME 20250714 / DCO (GB00FVN2W437) | 0.34 | -54.32 | 0.0909 | -0.0761 | |||||

| 3 MONTH SOFR FUT MAR26 XCME 20260616 / DIR (000000000) | 0.33 | 0.0892 | 0.0892 | ||||||

| RAD CLO LTD RAD 2019 4A AR 144A / ABS-CBDO (US749984AA83) | 0.31 | -16.30 | 0.0827 | -0.0003 | |||||

| US86563VBL27 / Sumitomo Mitsui Trust Bank Ltd | 0.30 | 0.00 | 0.0811 | 0.0129 | |||||

| TRINITAS CLO LTD TRNTS 2022 19A A1R 144A / ABS-CBDO (US89642FAN33) | 0.30 | 0.33 | 0.0805 | 0.0130 | |||||

| US65535HBE80 / Nomura Holdings Inc | 0.30 | 0.00 | 0.0805 | 0.0128 | |||||

| TREASURY BILL 08/25 0.00000 / DBT (US912797QK68) | 0.30 | 0.0792 | 0.0792 | ||||||

| US50189XAA37 / LCM LOAN INCOME FUND I LTD SER 1A CL A V/R REGD 144A P/P 6.61775000 | 0.28 | -34.52 | 0.0738 | -0.0209 | |||||

| US55317WAB72 / MMAF Equipment Finance LLC 2023-A | 0.27 | -32.66 | 0.0721 | -0.0177 | |||||

| US654740BS71 / Nissan Motor Acceptance Corp | 0.27 | 1.14 | 0.0714 | 0.0121 | |||||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.27 | 0.0711 | 0.0711 | ||||||

| US500945AB61 / Kubota Credit Owner Trust 2023-2 | 0.24 | -57.96 | 0.0654 | -0.0651 | |||||

| CQS US CLO LTD CQS 2021 1A AR 144A / ABS-CBDO (US12659UAL61) | 0.20 | -0.50 | 0.0537 | 0.0083 | |||||

| MIZUHO BANK LTD/SYDNEY CERT OF DEPO 09/26 VAR / DBT (AU3FN0081139) | 0.20 | 5.32 | 0.0532 | 0.0108 | |||||

| US44891ACS42 / Hyundai Capital America | 0.20 | 0.00 | 0.0530 | 0.0084 | |||||

| LOW SU GASOIL G DEC25 IFEU 20251211 / DCO (GB00H6D17608) | 0.17 | 1,620.00 | 0.0464 | 0.0441 | |||||

| LEAN HOGS FUTURE DEC25 XCME 20251212 / DCO (000000000) | 0.15 | 0.0398 | 0.0398 | ||||||

| OZLM LTD OZLM 2017 17A A1RR 144A / ABS-CBDO (US67111NAQ79) | 0.14 | -65.88 | 0.0387 | -0.0565 | |||||

| US38380LSX28 / GNMA_19-H05 | 0.14 | -6.16 | 0.0368 | 0.0038 | |||||

| WHEAT FUTURE(CBT) SEP25 XCBT 20250912 / DCO (000000000) | 0.14 | 0.0367 | 0.0367 | ||||||

| US438123AB76 / HAROT 2023-4 5.87% 06/22/2026 | 0.13 | -76.24 | 0.0360 | -0.0912 | |||||

| LME NICKEL FUTURE JUL25 XLME 20250714 / DCO (GB00H249F944) | 0.13 | 3,075.00 | 0.0343 | 0.0332 | |||||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0.10 | 0.0274 | 0.0274 | ||||||

| LME PRI ALUM FUTR JUL25 XLME 20250714 / DCO (GB00FVN2W437) | 0.10 | -86.76 | 0.0264 | -0.1406 | |||||

| LME PRI ALUM FUTR NOV25 XLME 20251117 / DCO (GB00FXYVKX86) | 0.09 | 0.0244 | 0.0244 | ||||||

| LME ZINC FUTURE NOV25 XLME 20251117 / DCO (GB00H24G1R50) | 0.09 | 0.0238 | 0.0238 | ||||||

| NY HARB ULSD FUT SEP25 XNYM 20250829 / DCO (000000000) | 0.09 | 0.0238 | 0.0238 | ||||||

| 317U8CLA3 PIMCO SWAPTION 3.6 CALL USD 20250812 / DIR (000000000) | 0.07 | 0.0193 | 0.0193 | ||||||

| LME COPPER FUTURE AUG25 XLME 20250818 / DCO (GB00FVN4SL80) | 0.07 | 0.0188 | 0.0188 | ||||||

| WTI CRUDE FUTURE DEC25 XNYM 20251120 / DCO (000000000) | 0.06 | 0.0152 | 0.0152 | ||||||

| SPACE COAST CREDIT UNION SCCU 2023 1A A2 144A / ABS-O (US805922AC52) | 0.06 | -61.54 | 0.0150 | -0.0173 | |||||

| NATURAL GAS FUTR DEC25 XNYM 20251125 / DCO (000000000) | 0.05 | 0.0145 | 0.0145 | ||||||

| LME PRI ALUM FUTR JAN26 XLME 20260119 / DCO (GB00G0JL9Y57) | 0.05 | 0.0127 | 0.0127 | ||||||

| LIVE CATTLE FUTR DEC25 XCME 20251231 / DCO (000000000) | 0.05 | 0.0122 | 0.0122 | ||||||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0.04 | 0.0117 | 0.0117 | ||||||

| GB00H47KCD10 / BRENT CRUDE FUTR DEC25 IFEU 20251031 | 0.03 | -98.26 | 0.0085 | -0.3925 | |||||

| SOYBEAN OIL FUTR JAN26 XCBT 20260114 / DCO (000000000) | 0.03 | 0.0069 | 0.0069 | ||||||

| COTTON NO.2 FUTR DEC25 IFUS 20251208 / DCO (000000000) | 0.02 | 0.0062 | 0.0062 | ||||||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0.02 | 0.0047 | 0.0047 | ||||||

| WHEAT FUTURE(CBT) DEC25 XCBT 20251212 / DCO (000000000) | 0.01 | 0.0040 | 0.0040 | ||||||

| AUST 3YR BOND FUT SEP25 XSFE 20250915 / DIR (000000000) | 0.01 | 0.0037 | 0.0037 | ||||||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0037 | 0.0037 | ||||||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0030 | 0.0030 | ||||||

| BOUGHT GBP SOLD USD 20250804 / DFE (000000000) | 0.01 | 0.0024 | 0.0024 | ||||||

| CORN FUTURE DEC25 XCBT 20251212 / DCO (000000000) | 0.01 | 0.0022 | 0.0022 | ||||||

| LME NICKEL FUTURE JAN26 XLME 20260119 / DCO (GB00H24J3T01) | 0.01 | 0.0022 | 0.0022 | ||||||

| NAT GAS EURO OPT AUG25C 5 EXP 07/28/2025 / DCO (000000000) | 0.00 | 0.0012 | 0.0012 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0008 | 0.0008 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0007 | 0.0007 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0006 | 0.0006 | ||||||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | ||||||

| BOUGHT ILS SOLD USD 20250718 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | ||||||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | ||||||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| BOUGHT ILS SOLD USD 20250718 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| 317U8CKA4 PIMCO SWAPTION 4.6 PUT USD 20250812 / DIR (EZDZRNFWMZT1) | 0.00 | -100.00 | 0.0000 | -0.0037 | |||||

| BOUGHT ILS SOLD USD 20250709 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| SOLD MXN BOUGHT USD 20250917 / DFE (000000000) | 0.00 | -0.0000 | -0.0000 | ||||||

| SOLD ILS BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| LME PRI ALUM FUTR JAN26 XLME 20260119 / DCO (GB00G0JL9Y57) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD BRL BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0005 | -0.0005 | ||||||

| SOLD CAD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0005 | -0.0005 | ||||||

| LME NICKEL FUTURE JAN26 XLME 20260119 / DCO (GB00H24J3T01) | -0.00 | -0.0005 | -0.0005 | ||||||

| SOLD EUR BOUGHT USD 20250804 / DFE (000000000) | -0.00 | -0.0008 | -0.0008 | ||||||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0010 | -0.0010 | ||||||

| WTI CRUDE FUTURE SEP25 XNYM 20250820 / DCO (000000000) | -0.00 | -0.0011 | -0.0011 | ||||||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0012 | -0.0012 | ||||||

| SOYBEAN FUTURE JAN26 XCBT 20260114 / DCO (000000000) | -0.00 | -0.0013 | -0.0013 | ||||||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0.01 | -0.0013 | -0.0013 | ||||||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0.01 | -0.0016 | -0.0016 | ||||||

| CORN FUTURE DEC26 XCBT 20261214 / DCO (000000000) | -0.01 | -0.0017 | -0.0017 | ||||||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0.01 | -0.0018 | -0.0018 | ||||||

| SOLD GBP BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0024 | -0.0024 | ||||||

| SOLD GBP BOUGHT USD 20250804 / DFE (000000000) | -0.01 | -0.0030 | -0.0030 | ||||||

| COPPER FUTURE AUG25 XCEC 20250827 / DCO (000000000) | -0.01 | -0.0040 | -0.0040 | ||||||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0040 | -0.0040 | ||||||

| SOLD GBP BOUGHT USD 20250702 / DFE (000000000) | -0.02 | -0.0046 | -0.0046 | ||||||

| COCOA FUTURE DEC25 IFUS 20251215 / DCO (000000000) | -0.02 | -0.0047 | -0.0047 | ||||||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0.02 | -0.0055 | -0.0055 | ||||||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0.02 | -0.0055 | -0.0055 | ||||||

| NATURAL GAS FUTR JAN26 XNYM 20251229 / DCO (000000000) | -0.02 | -0.0059 | -0.0059 | ||||||

| 3 MONTH SOFR FUT JUN25 XCME 20250916 / DIR (000000000) | -0.02 | -0.0061 | -0.0061 | ||||||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0.02 | -0.0065 | -0.0065 | ||||||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | -0.02 | -0.0066 | -0.0066 | ||||||

| LIVE CATTLE FUTR OCT25 XCME 20251031 / DCO (000000000) | -0.03 | -0.0071 | -0.0071 | ||||||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0.03 | -0.0089 | -0.0089 | ||||||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0.04 | -0.0102 | -0.0102 | ||||||

| SOLD BRL BOUGHT USD 20250702 / DFE (000000000) | -0.04 | -0.0118 | -0.0118 | ||||||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0.05 | -0.0122 | -0.0122 | ||||||

| SILVER FUTURE DEC25 XCEC 20251229 / DCO (000000000) | -0.05 | -0.0126 | -0.0126 | ||||||

| BRENT CRUDE FUTR SEP25 IFEU 20250731 / DCO (GB00H47KC977) | -0.05 | 327.27 | -0.0128 | -0.0101 | |||||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0.06 | -0.0152 | -0.0152 | ||||||

| GOLD 100 OZ FUTR JUL25 XCEC 20250729 / DCO (000000000) | -0.06 | -0.0158 | -0.0158 | ||||||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0.06 | -0.0159 | -0.0159 | ||||||

| SGX IRON ORE 62 SEP25 XSIM 20250930 / DCO (SGXDB0712503) | -0.06 | -0.0168 | -0.0168 | ||||||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0.06 | -0.0171 | -0.0171 | ||||||

| WTI CRUDE FUTURE SEP25 IFEU 20250819 / DCO (GB00H45VR646) | -0.07 | -0.0176 | -0.0176 | ||||||

| KC HRW WHEAT FUT DEC25 XCBT 20251212 / DCO (000000000) | -0.07 | -0.0182 | -0.0182 | ||||||

| NAT GAS EURO OPT AUG25P 3.4 EXP 07/28/2025 / DCO (000000000) | -0.08 | -0.0215 | -0.0215 | ||||||

| LME NICKEL FUTURE NOV25 XLME 20251117 / DCO (GB00H24FZF80) | -0.09 | -0.0240 | -0.0240 | ||||||

| NAT GAS EURO OPT AUG25P 3.5 EXP 07/28/2025 / DCO (000000000) | -0.10 | -0.0261 | -0.0261 | ||||||

| GASOLINE RBOB FUT SEP25 XNYM 20250829 / DCO (000000000) | -0.10 | -0.0269 | -0.0269 | ||||||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | -0.10 | -0.0275 | -0.0275 | ||||||

| RFR USD SOFR/3.75000 12/18/24-5Y LCH / DIR (EZ2V74HC3Q62) | -0.12 | 726.67 | -0.0335 | -0.0300 | |||||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0.13 | -0.0353 | -0.0353 | ||||||

| COPPER FUTURE SEP25 XCEC 20250926 / DCO (000000000) | -0.14 | -0.0373 | -0.0373 | ||||||

| RFR GBP SONIO/3.50000 03/19/25-5Y LCH / DIR (EZ4P0PH8GZ40) | -0.16 | -60.55 | -0.0427 | 0.0482 | |||||

| CA CARBON ALLOW 25DEC25 IFED 20251224 / DCO (000000000) | -0.16 | -0.0432 | -0.0432 | ||||||

| LME ZINC FUTURE NOV25 XLME 20251117 / DCO (GB00H24G1R50) | -0.17 | -0.0458 | -0.0458 | ||||||

| KC HRW WHEAT FUT SEP25 XCBT 20250912 / DCO (000000000) | -0.19 | -0.0517 | -0.0517 | ||||||

| LME ZINC FUTURE SEP25 XLME 20250915 / DCO (GB00H24CQ015) | -0.20 | -4.74 | -0.0541 | -0.0066 | |||||

| SOYBEAN FUTURE NOV25 XCBT 20251114 / DCO (000000000) | -0.21 | -0.0573 | -0.0573 | ||||||

| SOLD BRL BOUGHT USD 20250702 / DFE (000000000) | -0.24 | -0.0652 | -0.0652 | ||||||

| CORN FUTURE SEP25 XCBT 20250912 / DCO (000000000) | -0.24 | -0.0654 | -0.0654 | ||||||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | -0.25 | -0.0681 | -0.0681 | ||||||

| SOLD ILS BOUGHT USD 20250902 / DFE (000000000) | -0.25 | -0.0681 | -0.0681 | ||||||

| LME COPPER FUTURE JUL25 XLME 20250714 / DCO (GB00FVN2W767) | -0.27 | -1,100.00 | -0.0726 | -0.0788 | |||||

| LME PRI ALUM FUTR SEP25 XLME 20250915 / DCO (GB00FW35KF69) | -0.27 | -367.65 | -0.0733 | -0.0964 | |||||

| LME PRI ALUM FUTR NOV25 XLME 20251117 / DCO (GB00FXYVKX86) | -0.27 | -0.0736 | -0.0736 | ||||||

| NATURAL GAS FUTR NOV25 XNYM 20251029 / DCO (000000000) | -0.28 | -0.0763 | -0.0763 | ||||||

| GOLD 100 OZ FUTR DEC25 XCEC 20251229 / DCO (000000000) | -0.31 | -0.0830 | -0.0830 | ||||||

| LME NICKEL FUTURE NOV25 XLME 20251117 / DCO (GB00H24FZF80) | -0.31 | -0.0836 | -0.0836 | ||||||

| SUGAR 11 (WORLD) OCT25 IFUS 20250930 / DCO (000000000) | -0.32 | -0.0853 | -0.0853 | ||||||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | -0.33 | -0.0874 | -0.0874 | ||||||

| GB00H1Q11Z93 / WTI CRUDE FUTURE DEC25 IFEU 20251119 | -0.34 | 51.58 | -0.0900 | -0.0401 | |||||

| LME NICKEL FUTURE JUL25 XLME 20250714 / DCO (GB00H249F944) | -0.34 | -8,525.00 | -0.0904 | -0.0916 | |||||

| LME NICKEL FUTURE SEP25 XLME 20250915 / DCO (GB00H24CMP86) | -0.36 | 542.86 | -0.0967 | -0.0840 | |||||

| LME ZINC FUTURE SEP25 XLME 20250915 / DCO (GB00H24CQ015) | -0.45 | 112.32 | -0.1204 | -0.0728 | |||||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | -0.48 | -0.1295 | -0.1295 | ||||||

| SOYBEAN MEAL FUTR DEC25 XCBT 20251212 / DCO (000000000) | -0.51 | -0.1358 | -0.1358 | ||||||

| CARBON EMISSIONS FUTURES NDEX 20251215 / DCO (NLICE1584875) | -0.52 | 1.76 | -0.1400 | -0.0244 | |||||

| LME NICKEL FUTURE SEP25 XLME 20250915 / DCO (GB00H24CMP86) | -0.57 | 919.64 | -0.1534 | -0.1407 | |||||

| CCA VINTAGE 2026 DEC26 IFED 20261224 / DCO (000000000) | -0.62 | -0.1657 | -0.1657 | ||||||

| BRENT CRUDE FUTR MAR26 IFEU 20260130 / DCO (GB00H47KCH57) | -0.62 | -0.1672 | -0.1672 | ||||||

| LME ZINC FUTURE JUL25 XLME 20250714 / DCO (GB00H249H767) | -0.91 | -507.14 | -0.2447 | -0.2954 | |||||

| LME PRI ALUM FUTR SEP25 XLME 20250915 / DCO (GB00FW35KF69) | -1.24 | -1,313.73 | -0.3321 | -0.3552 | |||||

| RFR USD SOFR/3.62000 09/02/25-4Y* LCH / DIR (EZNQ4Z4QT3L7) | -1.31 | -0.3526 | -0.3526 | ||||||

| NATURAL GAS FUTR AUG25 XNYM 20250729 / DCO (000000000) | -1.57 | -0.4214 | -0.4214 | ||||||

| PLATINUM FUTURE JUL25 XNYM 20250729 / DCO (000000000) | -1.68 | -0.4515 | -0.4515 | ||||||

| COFFEE 'C' FUTURE DEC25 IFUS 20251218 / DCO (000000000) | -3.15 | -0.8439 | -0.8439 |