Mga Batayang Estadistika

| Nilai Portofolio | $ 1,261,076,960 |

| Posisi Saat Ini | 2,220 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

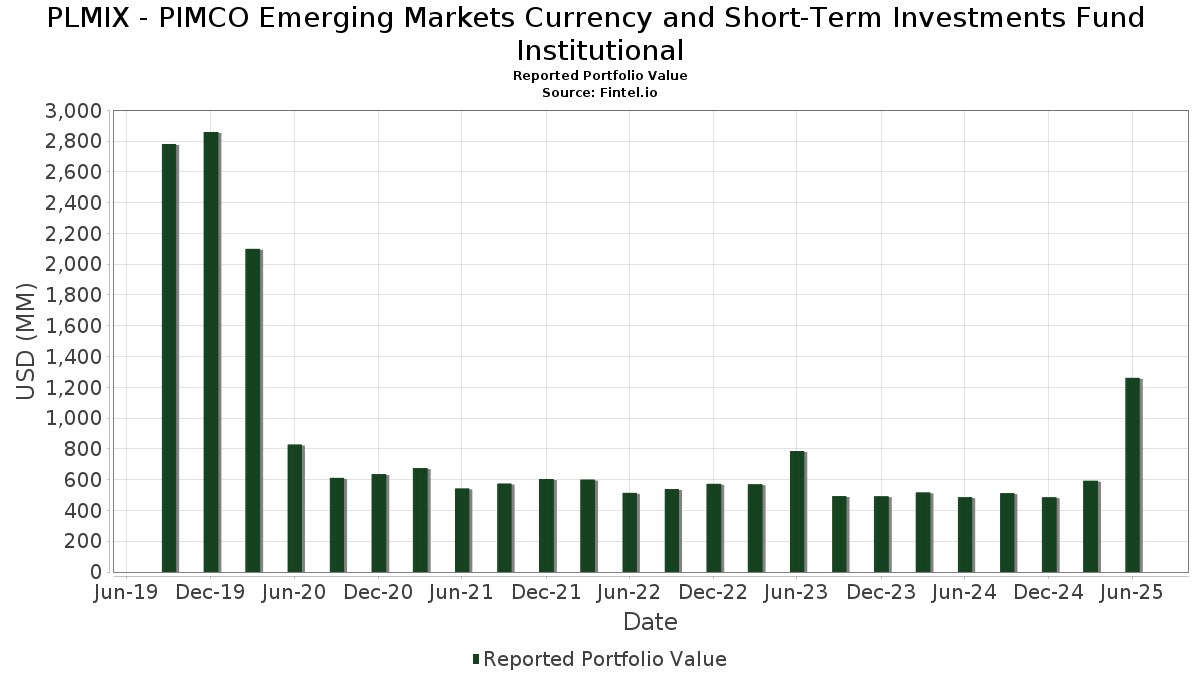

PLMIX - PIMCO Emerging Markets Currency and Short-Term Investments Fund Institutional telah mengungkapkan total kepemilikan 2,220 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,261,076,960 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PLMIX - PIMCO Emerging Markets Currency and Short-Term Investments Fund Institutional adalah PIMCO ST FLOATING NAV PORT IV MUTUAL FUND (US:US72202G3801) , Malaysia Government Bond (MY:MYBMO1700040) , Ministry Of Finance, Shachar - Corporate Bond/Note (IL:ILGOV) , PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , and Republic of South Africa Government Bond (ZA:ZAG000077470) . Posisi baru PLMIX - PIMCO Emerging Markets Currency and Short-Term Investments Fund Institutional meliputi: PIMCO ST FLOATING NAV PORT IV MUTUAL FUND (US:US72202G3801) , Malaysia Government Bond (MY:MYBMO1700040) , Ministry Of Finance, Shachar - Corporate Bond/Note (IL:ILGOV) , PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , and Republic of South Africa Government Bond (ZA:ZAG000077470) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 51.37 | 7.0254 | 7.0254 | ||

| 22.32 | 3.0523 | 3.0523 | ||

| 22.32 | 3.0523 | 3.0523 | ||

| 22.32 | 3.0523 | 3.0523 | ||

| 21.03 | 2.8762 | 2.5953 | ||

| 17.85 | 2.4418 | 2.4418 | ||

| 17.85 | 2.4418 | 2.4418 | ||

| 11.00 | 1.5044 | 1.5044 | ||

| 11.00 | 1.5044 | 1.5044 | ||

| 7.24 | 0.9906 | 0.9906 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 22.28 | 3.0477 | -13.2196 | ||

| 112.24 | 15.3504 | -2.3898 | ||

| 112.24 | 15.3504 | -2.3898 | ||

| 112.24 | 15.3504 | -2.3898 | ||

| 5.24 | 0.7167 | -2.0572 | ||

| 55.30 | 7.5634 | -1.8039 | ||

| 11.88 | 1.6251 | -1.1339 | ||

| 11.88 | 1.6251 | -1.1339 | ||

| 11.88 | 1.6251 | -1.1339 | ||

| 0.91 | 0.1247 | -0.6477 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-29 untuk periode pelaporan 2025-06-30. Investor ini belum mengungkapkan sekuritas yang diperhitungkan dalam bentuk saham, sehingga kolom terkait saham dalam tabel di bawah ini dihilangkan. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 112.24 | 8.57 | 15.3504 | -2.3898 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 112.24 | 8.57 | 15.3504 | -2.3898 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 112.24 | 8.57 | 15.3504 | -2.3898 | ||

| US72202G3801 / PIMCO ST FLOATING NAV PORT IV MUTUAL FUND | 55.30 | 1.31 | 7.5634 | -1.8039 | ||

| MYBMO1700040 / Malaysia Government Bond | 51.37 | 7.0254 | 7.0254 | |||

| ILGOV / Ministry Of Finance, Shachar - Corporate Bond/Note | 36.57 | 11.45 | 5.0019 | -0.6292 | ||

| 114090 / Grand Korea Leisure Co., Ltd. | 22.32 | 3.0523 | 3.0523 | |||

| 114090 / Grand Korea Leisure Co., Ltd. | 22.32 | 3.0523 | 3.0523 | |||

| 114090 / Grand Korea Leisure Co., Ltd. | 22.32 | 3.0523 | 3.0523 | |||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 22.28 | -76.49 | 3.0477 | -13.2196 | ||

| ZAG000077470 / Republic of South Africa Government Bond | 21.03 | 1,184.67 | 2.8762 | 2.5953 | ||

| NATIONAL BK HUNGARY BILL BILLS 07/25 0.00000 / DBT (HU0000626668) | 17.85 | 2.4418 | 2.4418 | |||

| NATIONAL BK HUNGARY BILL BILLS 07/25 0.00000 / DBT (HU0000626668) | 17.85 | 2.4418 | 2.4418 | |||

| FCT / Fincantieri S.p.A. | 15.73 | 44.46 | 2.1509 | 0.2828 | ||

| FCT / Fincantieri S.p.A. | 15.73 | 44.46 | 2.1509 | 0.2828 | ||

| PHILIPPINE GOVERNMENT BONDS 02/29 6.25 / DBT (PH0000058281) | 11.88 | -26.10 | 1.6251 | -1.1339 | ||

| PHILIPPINE GOVERNMENT BONDS 02/29 6.25 / DBT (PH0000058281) | 11.88 | -26.10 | 1.6251 | -1.1339 | ||

| PHILIPPINE GOVERNMENT BONDS 02/29 6.25 / DBT (PH0000058281) | 11.88 | -26.10 | 1.6251 | -1.1339 | ||

| DOMINICAN REPUBLIC SR UNSECURED 144A 03/37 10.5 / DBT (US25714PFD50) | 11.83 | 7.62 | 1.6186 | -0.2684 | ||

| DOMINICAN REPUBLIC SR UNSECURED 144A 03/37 10.5 / DBT (US25714PFD50) | 11.83 | 7.62 | 1.6186 | -0.2684 | ||

| DOMINICAN REPUBLIC SR UNSECURED 144A 03/37 10.5 / DBT (US25714PFD50) | 11.83 | 7.62 | 1.6186 | -0.2684 | ||

| DOMINICAN REPUBLIC SR UNSECURED 144A 03/37 10.5 / DBT (US25714PFD50) | 11.83 | 7.62 | 1.6186 | -0.2684 | ||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 11.24 | -1.77 | 1.5367 | -0.4261 | ||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 11.24 | -1.77 | 1.5367 | -0.4261 | ||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 11.24 | -1.77 | 1.5367 | -0.4261 | ||

| REPO BANK AMERICA REPO / RA (000000000) | 11.00 | 1.5044 | 1.5044 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 11.00 | 1.5044 | 1.5044 | |||

| ASIAN DEVELOPMENT BANK SR UNSECURED 02/28 6.72 / DBT (XS2761151112) | 9.23 | 0.13 | 1.2626 | -0.3194 | ||

| ASIAN DEVELOPMENT BANK SR UNSECURED 02/28 6.72 / DBT (XS2761151112) | 9.23 | 0.13 | 1.2626 | -0.3194 | ||

| ASIAN DEVELOPMENT BANK SR UNSECURED 02/28 6.72 / DBT (XS2761151112) | 9.23 | 0.13 | 1.2626 | -0.3194 | ||

| XS2291692890 / Chile Government International Bond | 8.28 | 84.53 | 1.1322 | 0.3623 | ||

| POLAND GOVERNMENT BOND BONDS 07/29 4.75 / DBT (PL0000116760) | 8.21 | -2.92 | 1.1223 | -0.3282 | ||

| POLAND GOVERNMENT BOND BONDS 07/29 4.75 / DBT (PL0000116760) | 8.21 | -2.92 | 1.1223 | -0.3282 | ||

| POLAND GOVERNMENT BOND BONDS 07/29 4.75 / DBT (PL0000116760) | 8.21 | -2.92 | 1.1223 | -0.3282 | ||

| POLAND GOVERNMENT BOND BONDS 07/29 4.75 / DBT (PL0000116760) | 8.21 | -2.92 | 1.1223 | -0.3282 | ||

| TRT061124T11 / Turkey Government Bond | 7.24 | 0.9906 | 0.9906 | |||

| EIB / EUROPEAN INVESTMENT BANK SR UNSECURED 03/21 9 | 6.15 | 0.33 | 0.8413 | -0.2109 | ||

| EIB / EUROPEAN INVESTMENT BANK SR UNSECURED 03/21 9 | 6.15 | 0.33 | 0.8413 | -0.2109 | ||

| EIB / EUROPEAN INVESTMENT BANK SR UNSECURED 03/21 9 | 6.15 | 0.33 | 0.8413 | -0.2109 | ||

| EIB / EUROPEAN INVESTMENT BANK SR UNSECURED 03/21 9 | 6.15 | 0.33 | 0.8413 | -0.2109 | ||

| US224939AA67 / Credicorp Capital Sociedad Titulizadora SA | 5.25 | 2.74 | 0.7178 | -0.1588 | ||

| MX0SGO0000M6 / Mexican Udibonos | 5.24 | -67.58 | 0.7167 | -2.0572 | ||

| US715638BE14 / Peruvian Government International Bond | 4.94 | -15.64 | 0.6750 | -0.3289 | ||

| DOMINICAN REPUBLIC SR UNSECURED REGS 06/36 10.75 / DBT (USP3579ECV76) | 4.84 | 72.38 | 0.6615 | 0.1800 | ||

| DOMINICAN REPUBLIC SR UNSECURED REGS 06/36 10.75 / DBT (USP3579ECV76) | 4.84 | 72.38 | 0.6615 | 0.1800 | ||

| DOMINICAN REPUBLIC SR UNSECURED REGS 06/36 10.75 / DBT (USP3579ECV76) | 4.84 | 72.38 | 0.6615 | 0.1800 | ||

| EIB / EUROPEAN INVESTMENT BANK SR UNSECURED 03/21 9 | 4.78 | 9.10 | 0.6541 | -0.0981 | ||

| PANAMA INFRASTRUCTURE SR SECURED 144A 04/32 0.00000 / DBT (US69828QAD97) | 4.77 | 0.89 | 0.6521 | -0.1588 | ||

| PANAMA INFRASTRUCTURE SR SECURED 144A 04/32 0.00000 / DBT (US69828QAD97) | 4.77 | 0.89 | 0.6521 | -0.1588 | ||

| PANAMA INFRASTRUCTURE SR SECURED 144A 04/32 0.00000 / DBT (US69828QAD97) | 4.77 | 0.89 | 0.6521 | -0.1588 | ||

| PANAMA INFRASTRUCTURE SR SECURED 144A 04/32 0.00000 / DBT (US69828QAD97) | 4.77 | 0.89 | 0.6521 | -0.1588 | ||

| TRT061124T11 / Turkey Government Bond | 4.63 | -2.28 | 0.6330 | -0.1797 | ||

| TRT061124T11 / Turkey Government Bond | 4.63 | -2.28 | 0.6330 | -0.1797 | ||

| TRT061124T11 / Turkey Government Bond | 4.63 | -2.28 | 0.6330 | -0.1797 | ||

| COL17CT03862 / Colombia TES | 4.40 | 939.24 | 0.6013 | 0.5286 | ||

| COL17CT03862 / Colombia TES | 4.40 | 0.00 | 0.6013 | 0.0000 | ||

| DGZ / DB Gold Short ETN | 3.93 | 0.67 | 0.5375 | -0.1324 | ||

| MX0MGO0001F1 / Mexican Bonos | 3.89 | -34.88 | 0.5313 | -0.4925 | ||

| XS1319820897 / Southern Gas Corridor CJSC | 3.75 | 0.35 | 0.5133 | -0.1285 | ||

| COL17CT02914 / Colombian TES | 3.64 | 3.70 | 0.4980 | -0.1046 | ||

| US715638BY77 / REPUBLIC OF PERU SR UNSECURED 144A 08/32 6.15 | 3.50 | -34.95 | 0.4792 | -0.4453 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 3.47 | 0.4740 | 0.4740 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 3.47 | 0.4740 | 0.4740 | |||

| SAGB / Republic of South Africa Government Bond | 3.44 | -1.43 | 0.4702 | -0.2017 | ||

| ZAG000016320 / Republic of South Africa Government Bond | 3.43 | 3.81 | 0.4697 | -0.0980 | ||

| PL0000111498 / Republic of Poland Government Bond | 3.35 | 10.01 | 0.4585 | -0.0644 | ||

| US46653KAC27 / JAB Holdings BV | 3.19 | -1.21 | 0.4368 | -0.1180 | ||

| XS1311099540 / Namibia International Bonds | 3.18 | 0.09 | 0.4345 | -0.1101 | ||

| REPUBLIC OF COTE DIVOIRE THE 2024 EUR UPSIZE TERM LOAN / LON (BA0003TP4) | 3.17 | 9.32 | 0.4334 | -0.0640 | ||

| REPUBLIC OF COTE DIVOIRE THE 2024 EUR UPSIZE TERM LOAN / LON (BA0003TP4) | 3.17 | 9.32 | 0.4334 | -0.0640 | ||

| REPUBLIC OF COTE DIVOIRE THE 2024 EUR UPSIZE TERM LOAN / LON (BA0003TP4) | 3.17 | 9.32 | 0.4334 | -0.0640 | ||

| REPUBLIC OF PANAMA EUR TERM LOAN / LON (BA000GRH5) | 3.08 | 9.95 | 0.4219 | -0.0596 | ||

| TREASURY BILL 09/25 0.00000 / DBT (US912797PW16) | 3.07 | 0.4205 | 0.4205 | |||

| TREASURY BILL 09/25 0.00000 / DBT (US912797PW16) | 3.07 | 0.4205 | 0.4205 | |||

| TREASURY BILL 09/25 0.00000 / DBT (US912797PW16) | 3.07 | 0.4205 | 0.4205 | |||

| 941WJKII0 / SOCAR TURKEY ENERJI AS EUR TERM LOAN | 2.94 | 8.81 | 0.4020 | -0.0616 | ||

| US25714PER55 / Dominican Republic Central Bank Notes | 2.83 | -42.63 | 0.3874 | -0.4596 | ||

| MX0MGO0001D6 / Mexican Bonos Desarr Fixed Rate, Series M | 2.83 | 436.17 | 0.3873 | 0.2966 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 2.75 | 0.3755 | 0.3755 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 2.75 | 0.3755 | 0.3755 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 2.75 | 0.3755 | 0.3755 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 2.67 | 0.3654 | 0.3654 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 2.67 | 0.3654 | 0.3654 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 2.67 | 0.3654 | 0.3654 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 2.67 | 0.3649 | 0.3649 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 2.67 | 0.3649 | 0.3649 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 2.67 | 0.3649 | 0.3649 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797NX17) | 2.60 | 0.3554 | 0.3554 | |||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 2.51 | 0.3429 | 0.3429 | |||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 2.51 | 0.3429 | 0.3429 | |||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 2.51 | 0.3429 | 0.3429 | |||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 2.51 | 0.3429 | 0.3429 | |||

| MX0MGO0000J5 / Mexican Bonos | 2.49 | 44.35 | 0.3406 | 0.0445 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 2.49 | 66.22 | 0.3406 | 0.0834 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 2.49 | 66.22 | 0.3406 | 0.0834 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 2.49 | 66.22 | 0.3406 | 0.0834 | ||

| FANNIE MAE FNR 2024 104 FA / ABS-MBS (US3136BUEQ99) | 2.43 | -4.25 | 0.3326 | -0.1033 | ||

| R209 / South Africa - Sovereign or Government Agency Debt | 2.33 | 0.3191 | 0.3191 | |||

| XS2034834064 / BANCO DO BRASIL SA/LONDO SR UNSECURED REGS 07/26 8.5 | 2.25 | 9.94 | 0.3071 | -0.0434 | ||

| STEPSTONE GROUP M 2 GMBH THE EUR TERM LOAN B / LON (BA000BNR8) | 2.20 | 7.27 | 0.3007 | -0.0509 | ||

| STEPSTONE GROUP M 2 GMBH THE EUR TERM LOAN B / LON (BA000BNR8) | 2.20 | 7.27 | 0.3007 | -0.0509 | ||

| STEPSTONE GROUP M 2 GMBH THE EUR TERM LOAN B / LON (BA000BNR8) | 2.20 | 7.27 | 0.3007 | -0.0509 | ||

| STEPSTONE GROUP M 2 GMBH THE EUR TERM LOAN B / LON (BA000BNR8) | 2.20 | 7.27 | 0.3007 | -0.0509 | ||

| PHILIPPINE GOVERNMENT BONDS 04/35 6.375 / DBT (PH0000060345) | 2.18 | 0.2985 | 0.2985 | |||

| DOMINICAN REPUBLIC SR UNSECURED REGS 03/37 10.5 / DBT (USP3579ECY16) | 2.14 | 57.10 | 0.2920 | 0.0587 | ||

| DOMINICAN REPUBLIC SR UNSECURED REGS 03/37 10.5 / DBT (USP3579ECY16) | 2.14 | 57.10 | 0.2920 | 0.0587 | ||

| DOMINICAN REPUBLIC SR UNSECURED REGS 03/37 10.5 / DBT (USP3579ECY16) | 2.14 | 57.10 | 0.2920 | 0.0587 | ||

| XS2304675791 / EP INFRASTRUCTUR | 2.11 | 11.81 | 0.2888 | -0.0353 | ||

| TITULOS DE TESORERIA BONDS 08/29 11 / DBT (COL17CT03995) | 2.07 | 0.2835 | 0.2835 | |||

| TITULOS DE TESORERIA BONDS 08/29 11 / DBT (COL17CT03995) | 2.07 | 0.2835 | 0.2835 | |||

| TITULOS DE TESORERIA BONDS 08/29 11 / DBT (COL17CT03995) | 2.07 | 0.2835 | 0.2835 | |||

| R2035 / South Africa - Corporate Bond/Note | 1.99 | 21.96 | 0.2720 | -0.0079 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 1.90 | 0.2601 | 0.2601 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 1.90 | 0.2601 | 0.2601 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 1.90 | 0.2601 | 0.2601 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 1.90 | 0.2601 | 0.2601 | |||

| XS2170852847 / Synlab Bondco PLC | 1.87 | 8.54 | 0.2557 | -0.0399 | ||

| XS2170852847 / Synlab Bondco PLC | 1.87 | 8.54 | 0.2557 | -0.0399 | ||

| XS2170852847 / Synlab Bondco PLC | 1.87 | 8.54 | 0.2557 | -0.0399 | ||

| XS2170852847 / Synlab Bondco PLC | 1.87 | 8.54 | 0.2557 | -0.0399 | ||

| CL0002454248 / Bonos de la Tesoreria de la Republica en pesos | 1.82 | 4.97 | 0.2485 | -0.0485 | ||

| COL17CT03615 / Colombian TES | 1.77 | 0.2428 | 0.2428 | |||

| BRVALEDBS028 / VALE SA SUBORDINATED 12/49 VAR | 1.76 | 3.91 | 0.2400 | -0.0498 | ||

| CZ0001005243 / Czech Republic Government Bond | 1.71 | 10.77 | 0.2336 | -0.0311 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 1.56 | -19.18 | 0.2127 | -0.1175 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 1.56 | -19.18 | 0.2127 | -0.1175 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 1.56 | -19.18 | 0.2127 | -0.1175 | ||

| US68267HAA59 / OneMain Financial Issuance Trust, Series 2022-S1, Class A | 1.54 | -13.96 | 0.2108 | -0.0966 | ||

| TREASURY BILL 09/25 0.00000 / DBT (US912797MH75) | 1.54 | 0.2101 | 0.2101 | |||

| TREASURY BILL 09/25 0.00000 / DBT (US912797MH75) | 1.54 | 0.2101 | 0.2101 | |||

| TREASURY BILL 09/25 0.00000 / DBT (US912797MH75) | 1.54 | 0.2101 | 0.2101 | |||

| TREASURY BILL 09/25 0.00000 / DBT (US912797MH75) | 1.54 | 0.2101 | 0.2101 | |||

| TITULOS DE TESORERIA BONDS 11/40 12.75 / DBT (COL17CT04001) | 1.51 | 0.2066 | 0.2066 | |||

| XS1697546247 / WARWICK FINANCE RESIDENTIAL MO WARW 3A PRC 144A | 1.49 | 11.65 | 0.2032 | -0.0252 | ||

| TREASURY BILL 08/25 0.00000 / DBT (US912797MG92) | 1.48 | 0.2023 | 0.2023 | |||

| REPUBLIC OF PARAGUAY SR UNSECURED 144A 03/35 8.5 / DBT (US699149BX76) | 1.45 | 2.77 | 0.1978 | -0.0438 | ||

| REPUBLIC OF PARAGUAY SR UNSECURED 144A 03/35 8.5 / DBT (US699149BX76) | 1.45 | 2.77 | 0.1978 | -0.0438 | ||

| REPUBLIC OF PARAGUAY SR UNSECURED 144A 03/35 8.5 / DBT (US699149BX76) | 1.45 | 2.77 | 0.1978 | -0.0438 | ||

| REPUBLIC OF PARAGUAY SR UNSECURED 144A 03/35 8.5 / DBT (US699149BX76) | 1.45 | 2.77 | 0.1978 | -0.0438 | ||

| CREDICORP CAPITAL SOCIED LOCAL GOVT G 144A 03/45 9.7 / DBT (US224939AB41) | 1.44 | 0.1976 | 0.1976 | |||

| S56431109 / Northam Platinum Holdings Ltd | 1.43 | 1.20 | 0.1954 | -0.0468 | ||

| CZ0001006688 / Czech Republic Government Bond | 1.40 | 0.1921 | 0.1921 | |||

| VEON AMSTERDAM TERM LOAN / LON (BA000HL48) | 1.40 | 1.52 | 0.1915 | -0.0451 | ||

| VEON AMSTERDAM TERM LOAN / LON (BA000HL48) | 1.40 | 1.52 | 0.1915 | -0.0451 | ||

| VEON AMSTERDAM TERM LOAN / LON (BA000HL48) | 1.40 | 1.52 | 0.1915 | -0.0451 | ||

| ZIRAAT TRANCHE B TERM LOAN / LON (BA0005QX5) | 1.39 | 1.76 | 0.1904 | -0.0442 | ||

| ZIRAAT TRANCHE B TERM LOAN / LON (BA0005QX5) | 1.39 | 1.76 | 0.1904 | -0.0442 | ||

| UGANDA GOVERNMENT BOND BONDS 06/39 15.8 / DBT (UG12K2306393) | 1.35 | 1.05 | 0.1840 | -0.0445 | ||

| BOUGHT CZK SOLD USD 20250822 / DFE (000000000) | 1.31 | 0.1792 | 0.1792 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 1.26 | 0.1727 | 0.1727 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 1.26 | 0.1727 | 0.1727 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 1.26 | 0.1727 | 0.1727 | |||

| XS0992645274 / Transnet SOC Ltd | 1.24 | 3.76 | 0.1701 | -0.0356 | ||

| UZBEK INDUSTRIAL AND CON UZBEK INDUSTRIAL AND CON / DBT (US917935AB44) | 1.24 | 0.00 | 0.1701 | -0.0432 | ||

| UZBEK INDUSTRIAL AND CON UZBEK INDUSTRIAL AND CON / DBT (US917935AB44) | 1.24 | 0.00 | 0.1701 | -0.0432 | ||

| UZBEK INDUSTRIAL AND CON UZBEK INDUSTRIAL AND CON / DBT (US917935AB44) | 1.24 | 0.00 | 0.1701 | -0.0432 | ||

| UZBEK INDUSTRIAL AND CON UZBEK INDUSTRIAL AND CON / DBT (US917935AB44) | 1.24 | 0.00 | 0.1701 | -0.0432 | ||

| IL0011746976 / Israel Government Bond - Fixed | 1.22 | 0.1670 | 0.1670 | |||

| TURKIYE VAKIFLAR BANKASI TAO I 2024 EUR DDTL / LON (BA0008CR7) | 1.18 | 10.16 | 0.1617 | -0.0225 | ||

| TURKIYE VAKIFLAR BANKASI TAO I 2024 EUR DDTL / LON (BA0008CR7) | 1.18 | 10.16 | 0.1617 | -0.0225 | ||

| TURKIYE VAKIFLAR BANKASI TAO I 2024 EUR DDTL / LON (BA0008CR7) | 1.18 | 10.16 | 0.1617 | -0.0225 | ||

| US35729TAD46 / FREMONT HOME LOAN TRUST FHLT 2006 C 2A2 | 1.10 | -0.90 | 0.1505 | -0.0400 | ||

| GHGGOG069915 / Ghana Government Bond | 1.10 | 60.00 | 0.1499 | 0.0323 | ||

| US93364EAD67 / WaMu Asset-Backed Certificates WaMu Series 2007-HE3 Trust | 1.09 | -1.26 | 0.1497 | -0.0405 | ||

| GHGGOG069956 / Ghana Government Bond | 1.09 | 70.85 | 0.1491 | 0.0395 | ||

| REPUBLIC OF PARAGUAY SR UNSECURED 144A 02/31 7.9 / DBT (US699149AP51) | 1.07 | -2.36 | 0.1470 | -0.0418 | ||

| XS1807306300 / Egypt Government International Bond | 1.07 | 11.72 | 0.1461 | -0.0180 | ||

| XS2214237807 / Ecuador Government International Bond | 1.06 | -21.42 | 0.1456 | -0.0869 | ||

| HU0000403696 / Hungary Government Bond | 1.05 | 0.67 | 0.1434 | -0.0054 | ||

| USP3579ECQ81 / Dominican Republic International Bond | 1.04 | 5.47 | 0.1425 | -0.0271 | ||

| PL0000115291 / Republic of Poland Government Bond | 1.01 | -50.29 | 0.1383 | -0.2555 | ||

| RAIZEN FUELS FINANCE RAIZEN FUELS FINANCE / DBT (US75102XAF33) | 0.99 | 0.1359 | 0.1359 | |||

| RAIZEN FUELS FINANCE RAIZEN FUELS FINANCE / DBT (US75102XAF33) | 0.99 | 0.1359 | 0.1359 | |||

| RAIZEN FUELS FINANCE RAIZEN FUELS FINANCE / DBT (US75102XAF33) | 0.99 | 0.1359 | 0.1359 | |||

| RAIZEN FUELS FINANCE RAIZEN FUELS FINANCE / DBT (US75102XAF33) | 0.99 | 0.1359 | 0.1359 | |||

| PHILIPPINE GOVERNMENT SR UNSECURED 05/29 6.5 / DBT (PHY6972HMC79) | 0.99 | 1.54 | 0.1354 | -0.0319 | ||

| PHILIPPINE GOVERNMENT SR UNSECURED 05/29 6.5 / DBT (PHY6972HMC79) | 0.99 | 1.54 | 0.1354 | -0.0319 | ||

| PHILIPPINE GOVERNMENT SR UNSECURED 05/29 6.5 / DBT (PHY6972HMC79) | 0.99 | 1.54 | 0.1354 | -0.0319 | ||

| OIS SGD SIBSORA/2.75000 03/19/25-5Y LCH / DIR (EZL27PYNRZ74) | 0.99 | 107.81 | 0.1348 | 0.0533 | ||

| OIS SGD SIBSORA/2.75000 03/19/25-5Y LCH / DIR (EZL27PYNRZ74) | 0.99 | 107.81 | 0.1348 | 0.0533 | ||

| US649603AA52 / NEW YORK MORTGAGE TRUST NYMT 2005 1 A | 0.94 | -23.93 | 0.1288 | -0.0836 | ||

| CL0002686989 / Bonos de la Tesoreria de la Republica en pesos | 0.91 | -79.76 | 0.1247 | -0.6477 | ||

| HUNGARY GOVERNMENT BOND BONDS 10/35 7 / DBT (HU0000406624) | 0.88 | 0.1203 | 0.1203 | |||

| HUNGARY GOVERNMENT BOND BONDS 10/35 7 / DBT (HU0000406624) | 0.88 | 0.1203 | 0.1203 | |||

| HUNGARY GOVERNMENT BOND BONDS 10/35 7 / DBT (HU0000406624) | 0.88 | 0.1203 | 0.1203 | |||

| HUNGARY GOVERNMENT BOND BONDS 10/35 7 / DBT (HU0000406624) | 0.88 | 0.1203 | 0.1203 | |||

| US12669WAA45 / Countrywide Asset-Backed Certificates | 0.88 | -2.34 | 0.1198 | -0.0342 | ||

| XS2330054953 / OAK HILL EUROPEAN CREDIT PARTN OHECP 2018 7A AR 144A | 0.84 | -5.52 | 0.1146 | -0.0376 | ||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PP64) | 0.83 | 0.1138 | 0.1138 | |||

| DOMINICAN REPUBLIC SR UNSECURED 144A 06/36 10.75 / DBT (US25714PFA12) | 0.81 | 5.61 | 0.1108 | -0.0207 | ||

| DOMINICAN REPUBLIC SR UNSECURED 144A 06/36 10.75 / DBT (US25714PFA12) | 0.81 | 5.61 | 0.1108 | -0.0207 | ||

| DOMINICAN REPUBLIC SR UNSECURED 144A 06/36 10.75 / DBT (US25714PFA12) | 0.81 | 5.61 | 0.1108 | -0.0207 | ||

| DOMINICAN REPUBLIC SR UNSECURED 144A 06/36 10.75 / DBT (US25714PFA12) | 0.81 | 5.61 | 0.1108 | -0.0207 | ||

| CORPTB9D9 / DBT (KY009A9JC5A0) | 0.80 | 2.17 | 0.1094 | -0.0250 | ||

| CORPTB9D9 / DBT (KY009A9JC5A0) | 0.80 | 2.17 | 0.1094 | -0.0250 | ||

| CORPTB9D9 / DBT (KY009A9JC5A0) | 0.80 | 2.17 | 0.1094 | -0.0250 | ||

| XS0095884424 / TRANSNET SOC LTD GOVT GUARANT REGS 03/29 10 | 0.80 | 1.92 | 0.1091 | -0.0251 | ||

| RFR USD SOFR/3.25000 06/18/25-30Y LCH / DIR (EZVR6JLJ0ZB5) | 0.79 | 0.1086 | 0.1086 | |||

| RFR USD SOFR/3.25000 06/18/25-30Y LCH / DIR (EZVR6JLJ0ZB5) | 0.79 | 0.1086 | 0.1086 | |||

| RFR USD SOFR/3.25000 06/18/25-30Y LCH / DIR (EZVR6JLJ0ZB5) | 0.79 | 0.1086 | 0.1086 | |||

| UG12K0302337 / Republic of Uganda Government Bonds | 0.78 | 0.1063 | 0.1063 | |||

| XS2357493860 / Qatar Petroleum | 0.77 | 0.78 | 0.1055 | -0.0258 | ||

| US02150TAA88 / Alternative Loan Trust 2007-OA3 | 0.76 | -1.05 | 0.1036 | -0.0277 | ||

| XS2477752260 / SOCAR Turkey Enerji AS via Steas Funding 1 DAC | 0.70 | -0.71 | 0.0951 | -0.0250 | ||

| US718286BM88 / Philippine Government International Bond | 0.69 | 0.29 | 0.0950 | -0.0237 | ||

| BOUGHT SGD SOLD USD 20250805 / DFE (000000000) | 0.69 | 0.0941 | 0.0941 | |||

| ZCS BRL 9.783 01/05/24-01/04/27 CME / DIR (EZXH1L87LCN9) | 0.67 | -5.00 | 0.0910 | -0.0291 | ||

| CIMA FINANCE LTD SECURED REGS 09/29 2.95 / DBT (XS2244822560) | 0.65 | 0.46 | 0.0894 | -0.0222 | ||

| CIMA FINANCE LTD SECURED REGS 09/29 2.95 / DBT (XS2244822560) | 0.65 | 0.46 | 0.0894 | -0.0222 | ||

| CL0002187822 / Bonos de la Tesoreria de la Republica en pesos | 0.64 | 367.88 | 0.0878 | 0.0582 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.64 | 0.0873 | 0.0873 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.64 | 0.0873 | 0.0873 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.64 | 0.0873 | 0.0873 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0.63 | 0.0861 | 0.0861 | |||

| YINSON PRODUCTION FINANC SR SECURED 144A REGS 05/29 9.6 / DBT (NO0013215509) | 0.62 | -0.64 | 0.0853 | -0.0224 | ||

| YINSON PRODUCTION FINANC SR SECURED 144A REGS 05/29 9.6 / DBT (NO0013215509) | 0.62 | -0.64 | 0.0853 | -0.0224 | ||

| COL17CT03748 / Colombian TES | 0.62 | 6.39 | 0.0843 | -0.0203 | ||

| MX0MGO0000P2 / Mexican Bonos | 0.61 | 10.71 | 0.0835 | -0.0111 | ||

| XS2291692890 / Chile Government International Bond | 0.61 | 0.66 | 0.0834 | -0.0205 | ||

| HU0000405550 / Hungary Government Bond | 0.60 | 34.23 | 0.0815 | -0.0045 | ||

| US25714PEU84 / Dominican Republic Central Bank Notes | 0.59 | -50.08 | 0.0806 | -0.1220 | ||

| CND10004R999 / CHINA GOVERNMENT BOND 2.750000% 02/17/2032 | 0.59 | 1.74 | 0.0801 | -0.0186 | ||

| RFR USD SOFR/3.50000 06/20/24-30Y LCH / DIR (EZV8ZC6L7CY8) | 0.56 | 405.45 | 0.0761 | 0.0571 | ||

| RFR USD SOFR/3.50000 06/20/24-30Y LCH / DIR (EZV8ZC6L7CY8) | 0.56 | 405.45 | 0.0761 | 0.0571 | ||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0.53 | 0.0724 | 0.0724 | |||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0.53 | 0.0724 | 0.0724 | |||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0.53 | 0.0724 | 0.0724 | |||

| RFR USD SOFR/3.25000 06/18/25-30Y CME / DIR (EZVR6JLJ0ZB5) | 0.53 | 0.0722 | 0.0722 | |||

| RFR USD SOFR/3.25000 06/18/25-30Y CME / DIR (EZVR6JLJ0ZB5) | 0.53 | 0.0722 | 0.0722 | |||

| RFR USD SOFR/3.25000 06/18/25-30Y CME / DIR (EZVR6JLJ0ZB5) | 0.53 | 0.0722 | 0.0722 | |||

| RFR USD SOFR/3.25000 06/18/25-30Y CME / DIR (EZVR6JLJ0ZB5) | 0.53 | 0.0722 | 0.0722 | |||

| RFR USD SOFR/3.25000 06/18/25-30Y CME / DIR (EZVR6JLJ0ZB5) | 0.53 | 0.0722 | 0.0722 | |||

| UZBEK INDUSTRIAL AND CON UZBEK INDUSTRIAL AND CON / DBT (US917935AA60) | 0.53 | 1.35 | 0.0721 | -0.0172 | ||

| UZBEK INDUSTRIAL AND CON UZBEK INDUSTRIAL AND CON / DBT (US917935AA60) | 0.53 | 1.35 | 0.0721 | -0.0172 | ||

| UZBEK INDUSTRIAL AND CON UZBEK INDUSTRIAL AND CON / DBT (US917935AA60) | 0.53 | 1.35 | 0.0721 | -0.0172 | ||

| XS2264871828 / Ivory Coast Government International Bond | 0.53 | 10.53 | 0.0719 | -0.0097 | ||

| STANDARD CHARTERED BANK STANDARD CHARTERED BANK / DBT (XS2954919069) | 0.51 | 1.79 | 0.0701 | -0.0163 | ||

| STANDARD CHARTERED BANK STANDARD CHARTERED BANK / DBT (XS2954919069) | 0.51 | 1.79 | 0.0701 | -0.0163 | ||

| STANDARD CHARTERED BANK STANDARD CHARTERED BANK / DBT (XS2954919069) | 0.51 | 1.79 | 0.0701 | -0.0163 | ||

| STANDARD CHARTERED BANK STANDARD CHARTERED BANK / DBT (XS2954919069) | 0.51 | 1.79 | 0.0701 | -0.0163 | ||

| FCT / Fincantieri S.p.A. | 0.51 | 0.0695 | 0.0695 | |||

| FCT / Fincantieri S.p.A. | 0.51 | 0.0695 | 0.0695 | |||

| FCT / Fincantieri S.p.A. | 0.51 | 0.0695 | 0.0695 | |||

| FCT / Fincantieri S.p.A. | 0.51 | 0.0695 | 0.0695 | |||

| FCT / Fincantieri S.p.A. | 0.51 | 0.0693 | 0.0693 | |||

| FCT / Fincantieri S.p.A. | 0.51 | 0.0693 | 0.0693 | |||

| FCT / Fincantieri S.p.A. | 0.51 | 0.0693 | 0.0693 | |||

| XS2214238441 / Ecuador Government International Bond | 0.50 | -26.33 | 0.0682 | -0.0478 | ||

| IRS CZK 4.38800 11/15/23-5Y CME / DIR (EZR8HNGCN699) | 0.49 | 76.62 | 0.0672 | 0.0194 | ||

| IRS CZK 4.38800 11/15/23-5Y CME / DIR (EZR8HNGCN699) | 0.49 | 76.62 | 0.0672 | 0.0194 | ||

| IRS CZK 4.38800 11/15/23-5Y CME / DIR (EZR8HNGCN699) | 0.49 | 76.62 | 0.0672 | 0.0194 | ||

| IRS CZK 4.38800 11/15/23-5Y CME / DIR (EZR8HNGCN699) | 0.49 | 76.62 | 0.0672 | 0.0194 | ||

| US18974BAE92 / CITIMORTGAGE ALTERNATIVE LOAN CMALT 2006 A5 1A5 | 0.49 | -0.61 | 0.0671 | -0.0175 | ||

| XS2419722678 / CANADA SQUARE MORTGAGE FUNDING CSF 6 A REGS | 0.49 | 4.49 | 0.0670 | -0.0133 | ||

| RED DORSAL FINANCE LTD SR SECURED REGS 10/31 5.875 / DBT (XS1198024827) | 0.49 | -1.21 | 0.0669 | -0.0180 | ||

| RED DORSAL FINANCE LTD SR SECURED REGS 10/31 5.875 / DBT (XS1198024827) | 0.49 | -1.21 | 0.0669 | -0.0180 | ||

| RED DORSAL FINANCE LTD SR SECURED REGS 10/31 5.875 / DBT (XS1198024827) | 0.49 | -1.21 | 0.0669 | -0.0180 | ||

| XS1268475727 / Synlab Unsecured Bondco PLC | 0.48 | 29.11 | 0.0655 | 0.0017 | ||

| RO1J9H39WKT4 / ROMANIA GOVERNMENT BOND /RON/ REGD SER 5Y 4.25000000 | 0.47 | 6.85 | 0.0641 | -0.0111 | ||

| STANDARD CHARTERED BANK SR UNSECURED 144A 11/25 0.0000 / DBT (XS2934650537) | 0.46 | 1.98 | 0.0636 | -0.0147 | ||

| STANDARD CHARTERED BANK SR UNSECURED 144A 11/25 0.0000 / DBT (XS2934650537) | 0.46 | 1.98 | 0.0636 | -0.0147 | ||

| STANDARD CHARTERED BANK SR UNSECURED 144A 11/25 0.0000 / DBT (XS2934650537) | 0.46 | 1.98 | 0.0636 | -0.0147 | ||

| STANDARD CHARTERED BANK SR UNSECURED 144A 11/25 0.0000 / DBT (XS2934650537) | 0.46 | 1.98 | 0.0636 | -0.0147 | ||

| RFR USD SOFR/3.50000 09/17/25-30Y LCH / DIR (EZ9MZMRJSYT0) | 0.46 | 58.02 | 0.0634 | 0.0130 | ||

| RFR USD SOFR/3.50000 09/17/25-30Y LCH / DIR (EZ9MZMRJSYT0) | 0.46 | 58.02 | 0.0634 | 0.0130 | ||

| US12668BXF56 / Alternative Loan Trust 2006-12CB | 0.45 | -1.31 | 0.0621 | -0.0168 | ||

| XS2337670421 / Development Bank of Kazakhstan JSC | 0.45 | -2.39 | 0.0616 | -0.0176 | ||

| COL17CT03862 / Colombia TES | 0.43 | -90.26 | 0.0587 | -0.5426 | ||

| XS2348602835 / ROCHESTER FINANCING ROFIN 3 A REGS | 0.43 | -2.29 | 0.0584 | -0.0166 | ||

| INTER AMERICAN DEVEL BK SR UNSECURED 01/29 7 / DBT (XS2749539933) | 0.40 | 0.25 | 0.0550 | -0.0139 | ||

| INTER AMERICAN DEVEL BK SR UNSECURED 01/29 7 / DBT (XS2749539933) | 0.40 | 0.25 | 0.0550 | -0.0139 | ||

| INTER AMERICAN DEVEL BK SR UNSECURED 01/29 7 / DBT (XS2749539933) | 0.40 | 0.25 | 0.0550 | -0.0139 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 0.38 | 13.35 | 0.0523 | -0.0056 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 0.38 | 13.35 | 0.0523 | -0.0056 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 0.38 | 13.35 | 0.0523 | -0.0056 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 0.38 | 13.35 | 0.0523 | -0.0056 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 0.37 | 4.26 | 0.0502 | -0.0104 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 0.37 | 4.26 | 0.0502 | -0.0104 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 0.37 | 4.26 | 0.0502 | -0.0104 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 0.37 | 4.26 | 0.0502 | -0.0104 | ||

| PTPP / PT PP (Persero) Tbk | 0.35 | 0.0481 | 0.0481 | |||

| PTPP / PT PP (Persero) Tbk | 0.35 | 0.0481 | 0.0481 | |||

| US922646AS37 / Venezuela Government International Bond | 0.35 | -2.81 | 0.0474 | -0.0139 | ||

| DEVELOPMENT BANK OF KAZA SR UNSECURED REGS 05/28 13.489 / DBT (XS2917067386) | 0.33 | -5.67 | 0.0457 | -0.0150 | ||

| XS1953916290 / Republic of Uzbekistan Bond | 0.33 | 2.48 | 0.0452 | -0.0101 | ||

| ZCS BRL 9.84 02/02/24-01/04/27 CME / DIR (EZCWPVXZ03M2) | 0.33 | -5.48 | 0.0450 | -0.0146 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.32 | 0.0437 | 0.0437 | |||

| USP3579ECS48 / Dominican Republic Government Bond | 0.32 | 0.0436 | 0.0436 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.32 | 0.0433 | 0.0433 | |||

| ZCS BRL 11.73583 06/13/24-01/04/27 CME / DIR (EZBGTQ4W27C2) | 0.32 | -19.18 | 0.0433 | -0.0240 | ||

| ZCS BRL 11.73583 06/13/24-01/04/27 CME / DIR (EZBGTQ4W27C2) | 0.32 | -19.18 | 0.0433 | -0.0240 | ||

| ZCS BRL 11.73583 06/13/24-01/04/27 CME / DIR (EZBGTQ4W27C2) | 0.32 | -19.18 | 0.0433 | -0.0240 | ||

| ZCS BRL 11.73583 06/13/24-01/04/27 CME / DIR (EZBGTQ4W27C2) | 0.32 | -19.18 | 0.0433 | -0.0240 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.31 | 0.0427 | 0.0427 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PQ48) | 0.31 | 0.0426 | 0.0426 | |||

| ZM1000004433 / Zambia Government Bond | 0.31 | 17.49 | 0.0424 | -0.0028 | ||

| COL17CT03490 / Colombian TES | 0.31 | -24.13 | 0.0418 | -0.0272 | ||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.30 | 0.0416 | 0.0416 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.30 | 0.0409 | 0.0409 | |||

| REPUBLIC OF PARAGUAY SR UNSECURED REGS 02/31 7.9 / DBT (USP75744AP07) | 0.30 | -2.30 | 0.0407 | -0.0116 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.29 | 0.0403 | 0.0403 | |||

| US25714PEW41 / Dominican Republic International Bond | 0.29 | 5.43 | 0.0399 | -0.0076 | ||

| 31750R0D0 PIMCO FXVAN PUT USD BRL 5.66000000 / DFE (EZK2H91SWGR1) | 0.29 | 0.0395 | 0.0395 | |||

| 31750R0D0 PIMCO FXVAN PUT USD BRL 5.66000000 / DFE (EZK2H91SWGR1) | 0.29 | 0.0395 | 0.0395 | |||

| 31750R0D0 PIMCO FXVAN PUT USD BRL 5.66000000 / DFE (EZK2H91SWGR1) | 0.29 | 0.0395 | 0.0395 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.29 | 0.0395 | 0.0395 | |||

| US86359LFP94 / Structured Asset Mortgage Investments II Trust 2004-AR7 | 0.29 | -1.38 | 0.0392 | -0.0107 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.29 | 0.0392 | 0.0392 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.28 | 0.0387 | 0.0387 | |||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/36 VAR / DBT (US903724CC46) | 0.28 | -3.44 | 0.0385 | -0.0115 | ||

| IRS HUF 7.33000 11/06/23-5Y CME / DIR (EZDXH6JV7790) | 0.28 | 234.52 | 0.0385 | 0.0240 | ||

| BOUGHT ILS SOLD USD 20250718 / DFE (000000000) | 0.28 | 0.0380 | 0.0380 | |||

| BOUGHT ILS SOLD USD 20250718 / DFE (000000000) | 0.28 | 0.0380 | 0.0380 | |||

| BOUGHT BRL SOLD USD 20250722 / DFE (000000000) | 0.27 | 0.0371 | 0.0371 | |||

| ZCS BRL 10.52868 09/26/23-01/02/26 CME / DIR (EZZSYPZXP459) | 0.27 | 4.67 | 0.0368 | -0.0074 | ||

| ZCS BRL 10.52868 09/26/23-01/02/26 CME / DIR (EZZSYPZXP459) | 0.27 | 4.67 | 0.0368 | -0.0074 | ||

| ZCS BRL 10.52868 09/26/23-01/02/26 CME / DIR (EZZSYPZXP459) | 0.27 | 4.67 | 0.0368 | -0.0074 | ||

| 31750QY37 PIMCO FXVAN PUT USD MXN 19.25000000 / DFE (000000000) | 0.26 | 0.0352 | 0.0352 | |||

| IRS PLN 5.10500 07/12/24-5Y CME / DIR (EZTCD6BR6T90) | 0.26 | 38.38 | 0.0351 | 0.0033 | ||

| IRS PLN 5.10500 07/12/24-5Y CME / DIR (EZTCD6BR6T90) | 0.26 | 38.38 | 0.0351 | 0.0033 | ||

| IRS PLN 5.10500 07/12/24-5Y CME / DIR (EZTCD6BR6T90) | 0.26 | 38.38 | 0.0351 | 0.0033 | ||

| IRS PLN 5.10500 07/12/24-5Y CME / DIR (EZTCD6BR6T90) | 0.26 | 38.38 | 0.0351 | 0.0033 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.26 | 0.0350 | 0.0350 | |||

| FISH POND RE LTD UNSECURED 144A 01/27 VAR / DBT (US33774EAA29) | 0.25 | -0.39 | 0.0348 | -0.0091 | ||

| FISH POND RE LTD UNSECURED 144A 01/27 VAR / DBT (US33774EAA29) | 0.25 | -0.39 | 0.0348 | -0.0091 | ||

| FISH POND RE LTD UNSECURED 144A 01/27 VAR / DBT (US33774EAA29) | 0.25 | -0.39 | 0.0348 | -0.0091 | ||

| REPUBLIC OF PARAGUAY SR UNSECURED REGS 03/35 8.5 / DBT (USP75744AS46) | 0.25 | 64.71 | 0.0345 | 0.0082 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.25 | 0.0341 | 0.0341 | |||

| RFR USD SOFR/3.75000 09/17/25-5Y LCH / DIR (EZH8V115JC41) | 0.25 | 96.83 | 0.0340 | 0.0124 | ||

| RFR USD SOFR/3.75000 09/17/25-5Y LCH / DIR (EZH8V115JC41) | 0.25 | 96.83 | 0.0340 | 0.0124 | ||

| RFR USD SOFR/3.75000 09/17/25-5Y LCH / DIR (EZH8V115JC41) | 0.25 | 96.83 | 0.0340 | 0.0124 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.25 | 0.0337 | 0.0337 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.25 | 0.0337 | 0.0337 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.25 | 0.0337 | 0.0337 | |||

| BOUGHT PLN SOLD USD 20250710 / DFE (000000000) | 0.24 | 0.0335 | 0.0335 | |||

| BOUGHT PLN SOLD USD 20250710 / DFE (000000000) | 0.24 | 0.0335 | 0.0335 | |||

| US61911GAA22 / Mortgage Equity Conversion Asset Trust 2007-FF3 | 0.24 | -20.27 | 0.0329 | -0.0188 | ||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0.24 | 0.0326 | 0.0326 | |||

| FR0013462728 / CEETRUS SA 2.75% 11/26/2026 REGS | 0.23 | 9.95 | 0.0318 | -0.0044 | ||

| US61750YAD13 / MORGAN STANLEY MORTGAGE LOAN T MSM 2006 15XS A3 | 0.23 | -2.16 | 0.0310 | -0.0088 | ||

| XS2214238102 / Ecuador Government International Bond | 0.22 | -27.18 | 0.0297 | -0.0215 | ||

| IRS PLN 0.98000 06/09/20-10Y CME / DIR (EZQXP4Y6KSH6) | 0.22 | -11.52 | 0.0295 | -0.0124 | ||

| IRS PLN 0.98000 06/09/20-10Y CME / DIR (EZQXP4Y6KSH6) | 0.22 | -11.52 | 0.0295 | -0.0124 | ||

| IRS PLN 0.98000 06/09/20-10Y CME / DIR (EZQXP4Y6KSH6) | 0.22 | -11.52 | 0.0295 | -0.0124 | ||

| IRS PLN 0.98000 06/09/20-10Y CME / DIR (EZQXP4Y6KSH6) | 0.22 | -11.52 | 0.0295 | -0.0124 | ||

| BOUGHT DOP SOLD USD 20250908 / DFE (000000000) | 0.20 | 0.0269 | 0.0269 | |||

| BOUGHT DOP SOLD USD 20250908 / DFE (000000000) | 0.20 | 0.0269 | 0.0269 | |||

| BOUGHT DOP SOLD USD 20250908 / DFE (000000000) | 0.20 | 0.0269 | 0.0269 | |||

| BOUGHT DOP SOLD USD 20250908 / DFE (000000000) | 0.20 | 0.0269 | 0.0269 | |||

| IRS ZAR 8.19500 11/01/23-3Y* CME / DIR (EZ6982GBYBP6) | 0.20 | 29.80 | 0.0268 | 0.0009 | ||

| IRS ZAR 8.19500 11/01/23-3Y* CME / DIR (EZ6982GBYBP6) | 0.20 | 29.80 | 0.0268 | 0.0009 | ||

| US46626LHB99 / JP MORGAN MORTGAGE ACQUISITION JPMAC 2006 FRE2 M1 | 0.19 | -8.06 | 0.0266 | -0.0097 | ||

| ZCS BRL 10.67143 04/15/24-01/04/27 CME / DIR (EZ5HX1Q98X18) | 0.19 | -9.81 | 0.0265 | -0.0103 | ||

| ZCS BRL 10.67143 04/15/24-01/04/27 CME / DIR (EZ5HX1Q98X18) | 0.19 | -9.81 | 0.0265 | -0.0103 | ||

| ZCS BRL 10.67143 04/15/24-01/04/27 CME / DIR (EZ5HX1Q98X18) | 0.19 | -9.81 | 0.0265 | -0.0103 | ||

| ZCS BRL 10.67143 04/15/24-01/04/27 CME / DIR (EZ5HX1Q98X18) | 0.19 | -9.81 | 0.0265 | -0.0103 | ||

| US61744CMM54 / Morgan Stanley ABS Capital I, Inc. Trust, Series 2005-NC1, Class M3 | 0.19 | 0.54 | 0.0255 | -0.0063 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.19 | 0.0254 | 0.0254 | |||

| CZ0001003859 / Czech Republic Government Bond | 0.18 | 10.18 | 0.0252 | -0.0035 | ||

| XS2432286115 / TOWER BRIDGE FUNDING TWRBG 2022 1X A REGS | 0.18 | -5.88 | 0.0241 | -0.0080 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.17 | 0.0232 | 0.0232 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.17 | 0.0232 | 0.0232 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.17 | 0.0232 | 0.0232 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.17 | 0.0232 | 0.0232 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.17 | 0.0231 | 0.0231 | |||

| 31750QAY5 PIMCO FXVAN PUT USD JPY 135.00000000 / DFE (EZC38C29Y7W6) | 0.17 | -33.99 | 0.0229 | -0.0207 | ||

| 31750QAY5 PIMCO FXVAN PUT USD JPY 135.00000000 / DFE (EZC38C29Y7W6) | 0.17 | -33.99 | 0.0229 | -0.0207 | ||

| 31750QAY5 PIMCO FXVAN PUT USD JPY 135.00000000 / DFE (EZC38C29Y7W6) | 0.17 | -33.99 | 0.0229 | -0.0207 | ||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0.17 | 0.0228 | 0.0228 | |||

| ZCS BRL 11.1325 06/03/24-01/04/27 CME / DIR (EZMNYHZSJK86) | 0.16 | -12.90 | 0.0222 | -0.0098 | ||

| ZCS BRL 11.1325 06/03/24-01/04/27 CME / DIR (EZMNYHZSJK86) | 0.16 | -12.90 | 0.0222 | -0.0098 | ||

| ZCS BRL 11.1325 06/03/24-01/04/27 CME / DIR (EZMNYHZSJK86) | 0.16 | -12.90 | 0.0222 | -0.0098 | ||

| ZCS BRL 10.87161 11/03/23-01/04/27 CME / DIR (EZ1VW476SC73) | 0.16 | 39.29 | 0.0215 | 0.0022 | ||

| ZCS BRL 10.87161 11/03/23-01/04/27 CME / DIR (EZ1VW476SC73) | 0.16 | 39.29 | 0.0215 | 0.0022 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.16 | 0.0213 | 0.0213 | |||

| ZCS BRL 10.9431 05/17/24-01/04/27 CME / DIR (EZ3GM5DC7N52) | 0.15 | -11.56 | 0.0210 | -0.0088 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.15 | 0.0209 | 0.0209 | |||

| IRS MYR R 3.86750 12/20/23-5Y GST / DIR (EZSRVSYD0RP6) | 0.15 | 744.44 | 0.0209 | 0.0177 | ||

| IRS MYR R 3.86750 12/20/23-5Y GST / DIR (EZSRVSYD0RP6) | 0.15 | 744.44 | 0.0209 | 0.0177 | ||

| IRS MYR R 3.86750 12/20/23-5Y GST / DIR (EZSRVSYD0RP6) | 0.15 | 744.44 | 0.0209 | 0.0177 | ||

| TRT061124T11 / Turkey Government Bond | 0.15 | -4.52 | 0.0204 | -0.0064 | ||

| TRT061124T11 / Turkey Government Bond | 0.15 | -4.52 | 0.0204 | -0.0064 | ||

| TRT061124T11 / Turkey Government Bond | 0.15 | -4.52 | 0.0204 | -0.0064 | ||

| IRS CZK 3.58000 10/25/24-5Y CME / DIR (EZ66NRCF4NC4) | 0.15 | 0.0203 | 0.0205 | |||

| IRS CZK 3.58000 10/25/24-5Y CME / DIR (EZ66NRCF4NC4) | 0.15 | 0.0203 | 0.0205 | |||

| IRS CZK 3.58000 10/25/24-5Y CME / DIR (EZ66NRCF4NC4) | 0.15 | 0.0203 | 0.0205 | |||

| BOUGHT THB SOLD USD 20250730 / DFE (000000000) | 0.15 | 0.0202 | 0.0202 | |||

| BOUGHT THB SOLD USD 20250730 / DFE (000000000) | 0.15 | 0.0202 | 0.0202 | |||

| BOUGHT THB SOLD USD 20250730 / DFE (000000000) | 0.15 | 0.0202 | 0.0202 | |||

| BOUGHT THB SOLD USD 20250730 / DFE (000000000) | 0.15 | 0.0202 | 0.0202 | |||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/35 VAR / DBT (US903724CF76) | 0.15 | -14.62 | 0.0200 | -0.0093 | ||

| OIS MXN TIIE1/8.65000 02/06/25-5Y* CME / DIR (EZHJ5WKVY8C5) | 0.15 | 74.70 | 0.0199 | 0.0054 | ||

| OIS MXN TIIE1/8.65000 02/06/25-5Y* CME / DIR (EZHJ5WKVY8C5) | 0.15 | 74.70 | 0.0199 | 0.0054 | ||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.14 | 0.0198 | 0.0198 | |||

| UGANDA GOVERNMENT BOND BONDS 06/43 15 / DBT (UG12L1806433) | 0.14 | 0.0195 | 0.0195 | |||

| UGANDA GOVERNMENT BOND BONDS 06/43 15 / DBT (UG12L1806433) | 0.14 | 0.0195 | 0.0195 | |||

| UGANDA GOVERNMENT BOND BONDS 06/43 15 / DBT (UG12L1806433) | 0.14 | 0.0195 | 0.0195 | |||

| UGANDA GOVERNMENT BOND BONDS 06/43 15 / DBT (UG12L1806433) | 0.14 | 0.0195 | 0.0195 | |||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/34 VAR / DBT (US903724CE02) | 0.14 | -2.08 | 0.0194 | -0.0055 | ||

| IRS ZAR 8.50000 10/17/22-5Y CME / DIR (EZX685KGS6H7) | 0.14 | 33.02 | 0.0193 | 0.0010 | ||

| IRS ZAR 8.50000 10/17/22-5Y CME / DIR (EZX685KGS6H7) | 0.14 | 33.02 | 0.0193 | 0.0010 | ||

| IRS ZAR 8.50000 10/17/22-5Y CME / DIR (EZX685KGS6H7) | 0.14 | 33.02 | 0.0193 | 0.0010 | ||

| SAUDI ARABIA GOVT EM SP BRC / DCR (EZH8RRJFBP19) | 0.14 | 6.87 | 0.0192 | -0.0033 | ||

| SAUDI ARABIA GOVT EM SP BRC / DCR (EZH8RRJFBP19) | 0.14 | 6.87 | 0.0192 | -0.0033 | ||

| ZCS BRL 13.68 06/05/25-01/02/29 CME / DIR (EZN9V94MH6H6) | 0.14 | 0.0189 | 0.0189 | |||

| ZCS BRL 13.68 06/05/25-01/02/29 CME / DIR (EZN9V94MH6H6) | 0.14 | 0.0189 | 0.0189 | |||

| BOUGHT CZK SOLD USD 20250822 / DFE (000000000) | 0.14 | 0.0185 | 0.0185 | |||

| BOUGHT CZK SOLD USD 20250822 / DFE (000000000) | 0.14 | 0.0185 | 0.0185 | |||

| BOUGHT CZK SOLD USD 20250822 / DFE (000000000) | 0.14 | 0.0185 | 0.0185 | |||

| TRT061124T11 / Turkey Government Bond | 0.13 | -2.92 | 0.0183 | -0.0053 | ||

| ZCS BRL 15.0359 01/24/25-01/02/29 CME / DIR (EZ52YT6YD0F3) | 0.13 | 350.00 | 0.0173 | 0.0124 | ||

| ZCS BRL 15.0359 01/24/25-01/02/29 CME / DIR (EZ52YT6YD0F3) | 0.13 | 350.00 | 0.0173 | 0.0124 | ||

| ZCS BRL 15.0359 01/24/25-01/02/29 CME / DIR (EZ52YT6YD0F3) | 0.13 | 350.00 | 0.0173 | 0.0124 | ||

| ZCS BRL 15.0359 01/24/25-01/02/29 CME / DIR (EZ52YT6YD0F3) | 0.13 | 350.00 | 0.0173 | 0.0124 | ||

| IRS CLP 3.00000 06/14/21-5Y CME / DIR (000000000) | 0.12 | 0.0170 | 0.0170 | |||

| ZCS BRL 14.185 02/18/25-01/02/29 CME / DIR (EZXJ7WFQQPN8) | 0.12 | -742.11 | 0.0168 | 0.0201 | ||

| ZCS BRL 14.185 02/18/25-01/02/29 CME / DIR (EZXJ7WFQQPN8) | 0.12 | -742.11 | 0.0168 | 0.0201 | ||

| ZCS BRL 14.185 02/18/25-01/02/29 CME / DIR (EZXJ7WFQQPN8) | 0.12 | -742.11 | 0.0168 | 0.0201 | ||

| ZCS BRL 14.185 02/18/25-01/02/29 CME / DIR (EZXJ7WFQQPN8) | 0.12 | -742.11 | 0.0168 | 0.0201 | ||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/36 VAR / DBT (US903724CG59) | 0.12 | -14.18 | 0.0166 | -0.0078 | ||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/36 VAR / DBT (US903724CG59) | 0.12 | -14.18 | 0.0166 | -0.0078 | ||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/36 VAR / DBT (US903724CG59) | 0.12 | -14.18 | 0.0166 | -0.0078 | ||

| OIS COP IBR/7.54000 08/09/24-7Y CME / DIR (EZFDFR904D01) | 0.12 | 5.22 | 0.0166 | -0.0033 | ||

| OIS COP IBR/7.54000 08/09/24-7Y CME / DIR (EZFDFR904D01) | 0.12 | 5.22 | 0.0166 | -0.0033 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.12 | 0.0165 | 0.0165 | |||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0.12 | 0.0165 | 0.0165 | |||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0.12 | 0.0165 | 0.0165 | |||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0.12 | 0.0165 | 0.0165 | |||

| US45660LUD99 / IndyMac INDX Mortgage Loan Trust 2005-AR16IP | 0.12 | -0.83 | 0.0164 | -0.0044 | ||

| TREASURY BILL 07/25 0.00000 / DBT (US912797LW51) | 0.12 | 0.0164 | 0.0164 | |||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 0.12 | 4.39 | 0.0164 | -0.0033 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 0.12 | 4.39 | 0.0164 | -0.0033 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 0.12 | 4.39 | 0.0164 | -0.0033 | ||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 0.12 | 4.39 | 0.0164 | -0.0033 | ||

| US92922FYJ10 / WAMU MORTGAGE PASS THROUGH CER WAMU 2004 RP1 1F 144A | 0.12 | -3.25 | 0.0164 | -0.0048 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.12 | 0.0160 | 0.0160 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.12 | 0.0160 | 0.0160 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.12 | 0.0160 | 0.0160 | |||

| BOUGHT SGD SOLD USD 20250805 / DFE (000000000) | 0.12 | 0.0159 | 0.0159 | |||

| BOUGHT SGD SOLD USD 20250805 / DFE (000000000) | 0.12 | 0.0159 | 0.0159 | |||

| BOUGHT SGD SOLD USD 20250805 / DFE (000000000) | 0.12 | 0.0159 | 0.0159 | |||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/29 VAR / DBT (US903724BZ40) | 0.12 | -4.13 | 0.0159 | -0.0050 | ||

| UKRAINE GOVERNMENT SR UNSECURED 144A 02/29 VAR / DBT (US903724BZ40) | 0.12 | -4.13 | 0.0159 | -0.0050 | ||

| RFR USD SOFR/3.25000 03/19/25-10Y CME / DIR (EZG5Z5S944W5) | 0.12 | -325.49 | 0.0158 | 0.0247 | ||

| RFR USD SOFR/3.25000 03/19/25-10Y CME / DIR (EZG5Z5S944W5) | 0.12 | -325.49 | 0.0158 | 0.0247 | ||

| US59981BAC81 / MILL CITY MORTGAGE LOAN TRUST 2019-GS1 | 0.11 | -8.13 | 0.0155 | -0.0058 | ||

| OIS COP IBR/7.99000 11/25/24-10Y CME / DIR (EZHY6HT9SK33) | 0.11 | 7.62 | 0.0155 | -0.0026 | ||

| OIS COP IBR/7.99000 11/25/24-10Y CME / DIR (EZHY6HT9SK33) | 0.11 | 7.62 | 0.0155 | -0.0026 | ||

| OIS COP IBR/7.99000 11/25/24-10Y CME / DIR (EZHY6HT9SK33) | 0.11 | 7.62 | 0.0155 | -0.0026 | ||

| XS1793329225 / Ivory Coast Government International Bond | 0.11 | 8.74 | 0.0154 | -0.0023 | ||

| BOUGHT RON SOLD USD 20250723 / DFE (000000000) | 0.11 | 0.0152 | 0.0152 | |||

| BOUGHT RON SOLD USD 20250723 / DFE (000000000) | 0.11 | 0.0152 | 0.0152 | |||

| BOUGHT RON SOLD USD 20250723 / DFE (000000000) | 0.11 | 0.0152 | 0.0152 | |||

| BOUGHT RON SOLD USD 20250723 / DFE (000000000) | 0.11 | 0.0152 | 0.0152 | |||

| IRS SEK 2.29800 10/07/24-5Y LCH / DIR (EZV79JGXBLF4) | 0.11 | -16.79 | 0.0150 | -0.0076 | ||

| IRS SEK 2.29800 10/07/24-5Y LCH / DIR (EZV79JGXBLF4) | 0.11 | -16.79 | 0.0150 | -0.0076 | ||

| ZCS BRL 13.9975 04/14/25-01/02/29 CME / DIR (EZTZ8TBRVR90) | 0.11 | 0.0150 | 0.0150 | |||

| ZCS BRL 13.9975 04/14/25-01/02/29 CME / DIR (EZTZ8TBRVR90) | 0.11 | 0.0150 | 0.0150 | |||

| ZCS BRL 13.9975 04/14/25-01/02/29 CME / DIR (EZTZ8TBRVR90) | 0.11 | 0.0150 | 0.0150 | |||

| ZCS BRL 13.9975 04/14/25-01/02/29 CME / DIR (EZTZ8TBRVR90) | 0.11 | 0.0150 | 0.0150 | |||

| BOUGHT TRY SOLD USD 20250709 / DFE (000000000) | 0.11 | 0.0150 | 0.0150 | |||

| US76110W3V68 / Residential Asset Securities Corp. Trust, Series 2005-KS8, Class M5 | 0.11 | -10.66 | 0.0149 | -0.0060 | ||

| OIS COP IBR/7.70500 07/28/23-8Y* CME / DIR (EZ21GRSX0HF0) | 0.11 | 0.93 | 0.0148 | -0.0036 | ||

| OIS COP IBR/7.70500 07/28/23-8Y* CME / DIR (EZ21GRSX0HF0) | 0.11 | 0.93 | 0.0148 | -0.0036 | ||

| OIS COP IBR/7.70500 07/28/23-8Y* CME / DIR (EZ21GRSX0HF0) | 0.11 | 0.93 | 0.0148 | -0.0036 | ||

| OIS COP IBR/7.70500 07/28/23-8Y* CME / DIR (EZ21GRSX0HF0) | 0.11 | 0.93 | 0.0148 | -0.0036 | ||

| SOLD KWD BOUGHT USD 20290502 / DFE (000000000) | 0.11 | 0.0146 | 0.0146 | |||

| SOLD KWD BOUGHT USD 20290502 / DFE (000000000) | 0.11 | 0.0146 | 0.0146 | |||

| SOLD KWD BOUGHT USD 20290502 / DFE (000000000) | 0.11 | 0.0146 | 0.0146 | |||

| SOLD KWD BOUGHT USD 20290503 / DFE (000000000) | 0.11 | 0.0146 | 0.0146 | |||

| SOLD KWD BOUGHT USD 20290503 / DFE (000000000) | 0.11 | 0.0146 | 0.0146 | |||

| SOLD KWD BOUGHT USD 20290507 / DFE (000000000) | 0.11 | 0.0146 | 0.0146 | |||

| SOLD KWD BOUGHT USD 20290507 / DFE (000000000) | 0.11 | 0.0146 | 0.0146 | |||

| SOLD KWD BOUGHT USD 20290507 / DFE (000000000) | 0.11 | 0.0146 | 0.0146 | |||

| SOLD KWD BOUGHT USD 20290507 / DFE (000000000) | 0.11 | 0.0146 | 0.0146 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.11 | 0.0146 | 0.0146 | |||

| OIS MXN TIIE1/9.37000 01/02/25-10Y* CME / DIR (EZFDDQSWBGB0) | 0.11 | 41.33 | 0.0146 | 0.0016 | ||

| OIS MXN TIIE1/9.37000 01/02/25-10Y* CME / DIR (EZFDDQSWBGB0) | 0.11 | 41.33 | 0.0146 | 0.0016 | ||

| OIS MXN TIIE1/9.37000 01/02/25-10Y* CME / DIR (EZFDDQSWBGB0) | 0.11 | 41.33 | 0.0146 | 0.0016 | ||

| OIS MXN TIIE1/9.37000 01/02/25-10Y* CME / DIR (EZFDDQSWBGB0) | 0.11 | 41.33 | 0.0146 | 0.0016 | ||

| US41161PVF79 / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2005 12 1A1A | 0.11 | -7.83 | 0.0146 | -0.0053 | ||

| US126694F294 / COUNTRYWIDE HOME LOANS CWHL 2006 OA4 A2 | 0.11 | -0.93 | 0.0145 | -0.0039 | ||

| US3623413V99 / GSMPS MORTGAGE LOAN TRUST GSMPS 2006 RP1 1AF2 144A | 0.10 | -3.74 | 0.0142 | -0.0042 | ||

| IRS CZK 3.13000 04/09/25-5Y CME / DIR (EZ20XS839X05) | 0.10 | 0.0142 | 0.0142 | |||

| IRS CZK 3.13000 04/09/25-5Y CME / DIR (EZ20XS839X05) | 0.10 | 0.0142 | 0.0142 | |||

| IRS CZK 3.13000 04/09/25-5Y CME / DIR (EZ20XS839X05) | 0.10 | 0.0142 | 0.0142 | |||

| IRS CZK 3.13000 04/09/25-5Y CME / DIR (EZ20XS839X05) | 0.10 | 0.0142 | 0.0142 | |||

| ZCS BRL 10.76768 11/03/23-01/04/27 CME / DIR (EZ1VW476SC73) | 0.10 | -9.82 | 0.0139 | -0.0054 | ||

| ZCS BRL 10.76768 11/03/23-01/04/27 CME / DIR (EZ1VW476SC73) | 0.10 | -9.82 | 0.0139 | -0.0054 | ||

| ZCS BRL 10.76768 11/03/23-01/04/27 CME / DIR (EZ1VW476SC73) | 0.10 | -9.82 | 0.0139 | -0.0054 | ||

| ZCS BRL 10.76768 11/03/23-01/04/27 CME / DIR (EZ1VW476SC73) | 0.10 | -9.82 | 0.0139 | -0.0054 | ||

| OIS MXN TIIE1/8.80000 12/18/24-5Y* CME / DIR (EZLPGB7YNJC9) | 0.10 | -3.88 | 0.0137 | -0.0042 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.10 | 0.0132 | 0.0132 | |||

| BOUGHT EGP SOLD USD 20251217 / DFE (000000000) | 0.10 | 0.0132 | 0.0132 | |||

| BOUGHT EGP SOLD USD 20251217 / DFE (000000000) | 0.10 | 0.0132 | 0.0132 | |||

| BOUGHT EGP SOLD USD 20251217 / DFE (000000000) | 0.10 | 0.0132 | 0.0132 | |||

| BOUGHT EGP SOLD USD 20251217 / DFE (000000000) | 0.10 | 0.0132 | 0.0132 | |||

| OIS COP IBR/4.04000 01/13/21-10Y CME / DIR (000000000) | 0.09 | 0.0130 | 0.0130 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.09 | 0.0127 | 0.0127 | |||

| BOUGHT RON SOLD USD 20250723 / DFE (000000000) | 0.09 | 0.0126 | 0.0126 | |||

| BOUGHT RON SOLD USD 20250723 / DFE (000000000) | 0.09 | 0.0126 | 0.0126 | |||

| BOUGHT RON SOLD USD 20250723 / DFE (000000000) | 0.09 | 0.0126 | 0.0126 | |||

| SOLD PHP BOUGHT USD 20250917 / DFE (000000000) | 0.09 | 0.0122 | 0.0122 | |||

| ZCS BRL 11.513 08/06/24-01/04/27 CME / DIR (EZR2JJYKQ737) | 0.09 | -16.19 | 0.0121 | -0.0059 | ||

| IRS ZAR 7.73000 03/12/25-5Y CME / DIR (EZTM3G2V0SP3) | 0.09 | -8,800.00 | 0.0120 | 0.0123 | ||

| IRS ZAR 7.73000 03/12/25-5Y CME / DIR (EZTM3G2V0SP3) | 0.09 | -8,800.00 | 0.0120 | 0.0123 | ||

| IRS CLP 5.00000 07/19/24-5Y CME / DIR (EZF0YHL9KRJ3) | 0.09 | -1,187.50 | 0.0120 | 0.0134 | ||

| IRS CLP 5.00000 07/19/24-5Y CME / DIR (EZF0YHL9KRJ3) | 0.09 | -1,187.50 | 0.0120 | 0.0134 | ||

| IRS CLP 5.40000 03/20/23-5Y CME / DIR (000000000) | 0.09 | 0.0118 | 0.0118 | |||

| IRS CLP 5.40000 03/20/23-5Y CME / DIR (000000000) | 0.09 | 0.0118 | 0.0118 | |||

| IRS CLP 5.40000 03/20/23-5Y CME / DIR (000000000) | 0.09 | 0.0118 | 0.0118 | |||

| IRS CLP 5.40000 03/20/23-5Y CME / DIR (000000000) | 0.09 | 0.0118 | 0.0118 | |||

| IRS PLN 4.85500 02/10/25-5Y CME / DIR (EZ8D299BBPW6) | 0.09 | 207.14 | 0.0118 | 0.0069 | ||

| IRS PLN 4.85500 02/10/25-5Y CME / DIR (EZ8D299BBPW6) | 0.09 | 207.14 | 0.0118 | 0.0069 | ||

| IRS PLN 4.85500 02/10/25-5Y CME / DIR (EZ8D299BBPW6) | 0.09 | 207.14 | 0.0118 | 0.0069 | ||

| IRS PLN 4.85500 02/10/25-5Y CME / DIR (EZ8D299BBPW6) | 0.09 | 207.14 | 0.0118 | 0.0069 | ||

| BOUGHT MYR SOLD USD 20250716 / DFE (000000000) | 0.09 | 0.0117 | 0.0117 | |||

| 31750R2W6 PIMCO FXVAN PUT USD ZAR 17.65000000 / DFE (EZG3Z2SBKQG2) | 0.08 | 0.0115 | 0.0115 | |||

| 31750R2W6 PIMCO FXVAN PUT USD ZAR 17.65000000 / DFE (EZG3Z2SBKQG2) | 0.08 | 0.0115 | 0.0115 | |||

| 31750R2W6 PIMCO FXVAN PUT USD ZAR 17.65000000 / DFE (EZG3Z2SBKQG2) | 0.08 | 0.0115 | 0.0115 | |||

| 31750R2W6 PIMCO FXVAN PUT USD ZAR 17.65000000 / DFE (EZG3Z2SBKQG2) | 0.08 | 0.0115 | 0.0115 | |||

| OIS MXN TIIE1/8.36500 04/09/25-10Y* CME / DIR (EZNKYRCD0069) | 0.08 | 0.0115 | 0.0115 | |||

| OIS MXN TIIE1/8.36500 04/09/25-10Y* CME / DIR (EZNKYRCD0069) | 0.08 | 0.0115 | 0.0115 | |||

| OIS MXN TIIE1/8.36500 04/09/25-10Y* CME / DIR (EZNKYRCD0069) | 0.08 | 0.0115 | 0.0115 | |||

| ZCS BRL 11.9275 06/13/24-01/02/29 CME / DIR (EZYKH0YGG8W8) | 0.08 | -55.85 | 0.0115 | -0.0208 | ||

| IRS PLN 4.68000 12/12/24-4Y* CME / DIR (EZPCNL2Y8H89) | 0.08 | -1,700.00 | 0.0110 | 0.0121 | ||

| IRS PLN 4.68000 12/12/24-4Y* CME / DIR (EZPCNL2Y8H89) | 0.08 | -1,700.00 | 0.0110 | 0.0121 | ||

| IRS PLN 4.68000 12/12/24-4Y* CME / DIR (EZPCNL2Y8H89) | 0.08 | -1,700.00 | 0.0110 | 0.0121 | ||

| IRS PLN 4.68000 12/12/24-4Y* CME / DIR (EZPCNL2Y8H89) | 0.08 | -1,700.00 | 0.0110 | 0.0121 | ||

| IRS CLP 5.36000 06/28/24-2Y CME / DIR (EZR4JSL1KX31) | 0.08 | 58.00 | 0.0109 | 0.0023 | ||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0.08 | 0.0109 | 0.0109 | |||

| IRS HUF 7.61000 11/03/23-5Y CME / DIR (EZ734WLQGL61) | 0.08 | 168.97 | 0.0108 | 0.0057 | ||

| IRS HUF 7.61000 11/03/23-5Y CME / DIR (EZ734WLQGL61) | 0.08 | 168.97 | 0.0108 | 0.0057 | ||

| IRS HUF 7.61000 11/03/23-5Y CME / DIR (EZ734WLQGL61) | 0.08 | 168.97 | 0.0108 | 0.0057 | ||

| IRS HUF 7.61000 11/03/23-5Y CME / DIR (EZ734WLQGL61) | 0.08 | 168.97 | 0.0108 | 0.0057 | ||

| BOUGHT CZK SOLD USD 20251218 / DFE (000000000) | 0.08 | 0.0107 | 0.0107 | |||

| BOUGHT CZK SOLD USD 20251218 / DFE (000000000) | 0.08 | 0.0107 | 0.0107 | |||

| BOUGHT CZK SOLD USD 20251218 / DFE (000000000) | 0.08 | 0.0107 | 0.0107 | |||

| BOUGHT CZK SOLD USD 20251218 / DFE (000000000) | 0.08 | 0.0107 | 0.0107 | |||

| SOLD PHP BOUGHT USD 20250917 / DFE (000000000) | 0.08 | 0.0107 | 0.0107 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.08 | 0.0105 | 0.0105 | |||

| SOLD KWD BOUGHT USD 20290508 / DFE (000000000) | 0.07 | 0.0102 | 0.0102 | |||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0.07 | 0.0101 | 0.0101 | |||

| 61NM / KENNEDY WILSON EUR REAL SR UNSECURED REGS 11/25 3.25 | 0.07 | 8.96 | 0.0101 | -0.0015 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.07 | 0.0100 | 0.0100 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.07 | 0.0100 | 0.0100 | |||

| IRS ZAR 8.87170 07/24/24-10Y CME / DIR (EZ6801CFHWZ8) | 0.07 | 227.27 | 0.0099 | 0.0061 | ||

| IRS ZAR 8.87170 07/24/24-10Y CME / DIR (EZ6801CFHWZ8) | 0.07 | 227.27 | 0.0099 | 0.0061 | ||

| IRS ZAR 8.87170 07/24/24-10Y CME / DIR (EZ6801CFHWZ8) | 0.07 | 227.27 | 0.0099 | 0.0061 | ||

| IRS ZAR 8.87170 07/24/24-10Y CME / DIR (EZ6801CFHWZ8) | 0.07 | 227.27 | 0.0099 | 0.0061 | ||

| IRS ZAR 9.29000 05/26/23-5Y CME / DIR (EZYK3FD1S420) | 0.07 | 22.03 | 0.0099 | -0.0004 | ||

| IRS ZAR 9.29000 05/26/23-5Y CME / DIR (EZYK3FD1S420) | 0.07 | 22.03 | 0.0099 | -0.0004 | ||

| IRS ZAR 9.29000 05/26/23-5Y CME / DIR (EZYK3FD1S420) | 0.07 | 22.03 | 0.0099 | -0.0004 | ||

| BOUGHT EUR SOLD USD 20251218 / DFE (000000000) | 0.07 | 0.0099 | 0.0099 | |||

| BOUGHT EUR SOLD USD 20251218 / DFE (000000000) | 0.07 | 0.0099 | 0.0099 | |||

| BOUGHT EUR SOLD USD 20251218 / DFE (000000000) | 0.07 | 0.0099 | 0.0099 | |||

| ZCS BRL 11.56 08/07/24-01/04/27 CME / DIR (EZTB85FJ4DP9) | 0.07 | -16.47 | 0.0098 | -0.0049 | ||

| ZCS BRL 11.56 08/07/24-01/04/27 CME / DIR (EZTB85FJ4DP9) | 0.07 | -16.47 | 0.0098 | -0.0049 | ||

| ZCS BRL 11.56 08/07/24-01/04/27 CME / DIR (EZTB85FJ4DP9) | 0.07 | -16.47 | 0.0098 | -0.0049 | ||

| ZM1000003898 / ZAMBIA GOVERNMENT BOND BONDS 07/25 12 | 0.07 | 18.33 | 0.0097 | -0.0007 | ||

| IRS CLP 5.50000 11/13/23-5Y CME / DIR (EZ1J9BML3CY6) | 0.07 | 33.96 | 0.0097 | 0.0006 | ||

| IRS CLP 5.50000 11/13/23-5Y CME / DIR (EZ1J9BML3CY6) | 0.07 | 33.96 | 0.0097 | 0.0006 | ||

| IRS CLP 5.50000 11/13/23-5Y CME / DIR (EZ1J9BML3CY6) | 0.07 | 33.96 | 0.0097 | 0.0006 | ||

| OIS COP IBR/7.71500 07/28/23-7Y* CME / DIR (000000000) | 0.07 | 0.0097 | 0.0097 | |||

| OIS COP IBR/7.71500 07/28/23-7Y* CME / DIR (000000000) | 0.07 | 0.0097 | 0.0097 | |||

| OIS COP IBR/7.71500 07/28/23-7Y* CME / DIR (000000000) | 0.07 | 0.0097 | 0.0097 | |||

| OIS COP IBR/7.71500 07/28/23-7Y* CME / DIR (000000000) | 0.07 | 0.0097 | 0.0097 | |||

| IRS PLN 7.31000 06/30/22-5Y CME / DIR (EZKN4XSN3YS9) | 0.07 | -33.96 | 0.0096 | -0.0086 | ||

| VOLS USDCNH .0685 09/11/2025 GLM / DIR (000000000) | 0.07 | 0.0094 | 0.0094 | |||

| BOUGHT COP SOLD USD 20251006 / DFE (000000000) | 0.07 | 0.0093 | 0.0093 | |||

| BOUGHT COP SOLD USD 20251006 / DFE (000000000) | 0.07 | 0.0093 | 0.0093 | |||

| BOUGHT COP SOLD USD 20251006 / DFE (000000000) | 0.07 | 0.0093 | 0.0093 | |||

| ZCS BRL 14.2128 02/18/25-01/02/29 CME / DIR (EZXJ7WFQQPN8) | 0.07 | -457.89 | 0.0093 | 0.0126 | ||

| ZCS BRL 14.2128 02/18/25-01/02/29 CME / DIR (EZXJ7WFQQPN8) | 0.07 | -457.89 | 0.0093 | 0.0126 | ||

| ZCS BRL 11.655 07/17/24-01/02/29 CME / DIR (EZC6N9209CZ7) | 0.07 | -47.62 | 0.0091 | -0.0126 | ||

| ZCS BRL 14.57 03/10/25-01/02/29 CME / DIR (EZ4FLTP3G5H7) | 0.07 | 0.0091 | 0.0091 | |||

| ZCS BRL 14.57 03/10/25-01/02/29 CME / DIR (EZ4FLTP3G5H7) | 0.07 | 0.0091 | 0.0091 | |||

| ZCS BRL 14.57 03/10/25-01/02/29 CME / DIR (EZ4FLTP3G5H7) | 0.07 | 0.0091 | 0.0091 | |||

| ZCS BRL 14.57 03/10/25-01/02/29 CME / DIR (EZ4FLTP3G5H7) | 0.07 | 0.0091 | 0.0091 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.07 | 0.0091 | 0.0091 | |||

| XS2214239506 / Ecuador Government International Bond | 0.07 | 0.0090 | 0.0090 | |||

| IRS HUF 6.09000 10/21/24-5Y CME / DIR (EZ31Y2719509) | 0.06 | -214.29 | 0.0089 | 0.0185 | ||

| IRS HUF 6.09000 10/21/24-5Y CME / DIR (EZ31Y2719509) | 0.06 | -214.29 | 0.0089 | 0.0185 | ||

| IRS HUF 6.09000 10/21/24-5Y CME / DIR (EZ31Y2719509) | 0.06 | -214.29 | 0.0089 | 0.0185 | ||

| IRS ZAR 7.68500 03/05/25-5Y* CME / DIR (EZTN7671NK96) | 0.06 | -1,700.00 | 0.0088 | 0.0097 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.06 | 0.0088 | 0.0088 | |||

| VOLS USDCNH .07 12/11/2025 GLM / DIR (000000000) | 0.06 | 0.0088 | 0.0088 | |||

| VOLS USDCNH .07 12/11/2025 GLM / DIR (000000000) | 0.06 | 0.0088 | 0.0088 | |||

| VOLS USDCNH .07 12/11/2025 GLM / DIR (000000000) | 0.06 | 0.0088 | 0.0088 | |||

| IRS PLN 2.95000 12/13/21-5Y CME / DIR (EZ15QPTDLH39) | 0.06 | -77.89 | 0.0087 | -0.0403 | ||

| IRS PLN 2.95000 12/13/21-5Y CME / DIR (EZ15QPTDLH39) | 0.06 | -77.89 | 0.0087 | -0.0403 | ||

| RFR USD SOFR/3.25000 12/20/23-30Y CME / DIR (EZ3BPZ7JX2D9) | 0.06 | 24.00 | 0.0085 | -0.0002 | ||

| XS1697546080 / WARWICK FINANCE RESIDENTIAL MO WARW 3A RRC 144A | 0.06 | 8.93 | 0.0085 | -0.0012 | ||

| OIS COP IBR/7.41000 08/09/24-4Y CME / DIR (EZZ7JZXFJGS9) | 0.06 | -7.69 | 0.0083 | -0.0029 | ||

| OIS COP IBR/7.41000 08/09/24-4Y CME / DIR (EZZ7JZXFJGS9) | 0.06 | -7.69 | 0.0083 | -0.0029 | ||

| OIS COP IBR/7.41000 08/09/24-4Y CME / DIR (EZZ7JZXFJGS9) | 0.06 | -7.69 | 0.0083 | -0.0029 | ||

| OIS COP IBR/7.41000 08/09/24-4Y CME / DIR (EZZ7JZXFJGS9) | 0.06 | -7.69 | 0.0083 | -0.0029 | ||

| BOUGHT THB SOLD USD 20250730 / DFE (000000000) | 0.06 | 0.0082 | 0.0082 | |||

| BOUGHT THB SOLD USD 20250730 / DFE (000000000) | 0.06 | 0.0082 | 0.0082 | |||

| BOUGHT THB SOLD USD 20250730 / DFE (000000000) | 0.06 | 0.0082 | 0.0082 | |||

| IRS CLP 5.44000 02/28/25-10Y CME / DIR (EZXMTT1MMYP4) | 0.06 | 346.15 | 0.0080 | 0.0056 | ||

| RFR USD SOFR/3.25000 06/18/25-9Y LCH / DIR (EZVYZM8DK482) | 0.06 | -203.70 | 0.0077 | 0.0170 | ||

| IRS PLN 5.05500 11/04/24-9Y* CME / DIR (000000000) | 0.06 | 0.0076 | 0.0076 | |||

| IRS PLN 5.05500 11/04/24-9Y* CME / DIR (000000000) | 0.06 | 0.0076 | 0.0076 | |||

| IRS PLN 5.05500 11/04/24-9Y* CME / DIR (000000000) | 0.06 | 0.0076 | 0.0076 | |||

| IRS PLN 5.05500 11/04/24-9Y* CME / DIR (000000000) | 0.06 | 0.0076 | 0.0076 | |||

| BOUGHT TRY SOLD USD 20250707 / DFE (000000000) | 0.05 | 0.0075 | 0.0075 | |||

| BOUGHT TRY SOLD USD 20250707 / DFE (000000000) | 0.05 | 0.0075 | 0.0075 | |||

| BOUGHT TRY SOLD USD 20250707 / DFE (000000000) | 0.05 | 0.0075 | 0.0075 | |||

| IRS CLP 5.07000 06/24/24-7Y CME / DIR (EZ7FJ48T5TR4) | 0.05 | -431.25 | 0.0072 | 0.0100 | ||

| IRS CLP 5.07000 06/24/24-7Y CME / DIR (EZ7FJ48T5TR4) | 0.05 | -431.25 | 0.0072 | 0.0100 | ||

| IRS CLP 5.07000 06/24/24-7Y CME / DIR (EZ7FJ48T5TR4) | 0.05 | -431.25 | 0.0072 | 0.0100 | ||

| IRS CLP 5.07000 06/24/24-7Y CME / DIR (EZ7FJ48T5TR4) | 0.05 | -431.25 | 0.0072 | 0.0100 | ||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0.05 | 0.0072 | 0.0072 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0.05 | 0.0072 | 0.0072 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0.05 | 0.0072 | 0.0072 | |||

| RFR USD SOFR/3.25000 06/21/23-5Y CME / DIR (EZ628FWCQP43) | 0.05 | -82.37 | 0.0071 | -0.0435 | ||

| US81377JAB98 / Securitized Asset Backed Receivables LLC Trust 2007-HE1 | 0.05 | 0.00 | 0.0069 | -0.0018 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.05 | 0.0068 | 0.0068 | |||

| BOUGHT THB SOLD USD 20250702 / DFE (000000000) | 0.05 | 0.0068 | 0.0068 | |||

| BOUGHT THB SOLD USD 20250702 / DFE (000000000) | 0.05 | 0.0068 | 0.0068 | |||

| XS2338398253 / Kaisa Group Holdings Ltd | 0.05 | 0.00 | 0.0068 | -0.0017 | ||

| IRS PLN 4.07520 03/07/22-5Y CME / DIR (EZQ3YXNVMH27) | 0.05 | -24.62 | 0.0067 | -0.0045 | ||

| IRS PLN 4.07520 03/07/22-5Y CME / DIR (EZQ3YXNVMH27) | 0.05 | -24.62 | 0.0067 | -0.0045 | ||

| IRS PLN 4.07520 03/07/22-5Y CME / DIR (EZQ3YXNVMH27) | 0.05 | -24.62 | 0.0067 | -0.0045 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.05 | 0.0067 | 0.0067 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.05 | 0.0067 | 0.0067 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.05 | 0.0067 | 0.0067 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.05 | 0.0067 | 0.0067 | |||

| BOUGHT HUF SOLD USD 20250822 / DFE (000000000) | 0.05 | 0.0067 | 0.0067 | |||

| BOUGHT TRY SOLD USD 20250718 / DFE (000000000) | 0.05 | 0.0067 | 0.0067 | |||

| BOUGHT TRY SOLD USD 20250718 / DFE (000000000) | 0.05 | 0.0067 | 0.0067 | |||

| BOUGHT TRY SOLD USD 20250721 / DFE (000000000) | 0.05 | 0.0066 | 0.0066 | |||

| BOUGHT TRY SOLD USD 20250721 / DFE (000000000) | 0.05 | 0.0066 | 0.0066 | |||

| BOUGHT TRY SOLD USD 20250721 / DFE (000000000) | 0.05 | 0.0066 | 0.0066 | |||

| BOUGHT TRY SOLD USD 20250721 / DFE (000000000) | 0.05 | 0.0066 | 0.0066 | |||

| BOUGHT TRY SOLD USD 20250806 / DFE (000000000) | 0.05 | 0.0066 | 0.0066 | |||

| BOUGHT TRY SOLD USD 20250806 / DFE (000000000) | 0.05 | 0.0066 | 0.0066 | |||

| BOUGHT TRY SOLD USD 20250806 / DFE (000000000) | 0.05 | 0.0066 | 0.0066 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.05 | 0.0065 | 0.0065 | |||

| SOLD KWD BOUGHT USD 20300509 / DFE (000000000) | 0.05 | 0.0065 | 0.0065 | |||

| SOLD KWD BOUGHT USD 20300513 / DFE (000000000) | 0.05 | 0.0064 | 0.0064 | |||

| SOLD KWD BOUGHT USD 20300513 / DFE (000000000) | 0.05 | 0.0064 | 0.0064 | |||

| SOLD KWD BOUGHT USD 20300514 / DFE (000000000) | 0.05 | 0.0064 | 0.0064 | |||

| SOLD KWD BOUGHT USD 20300513 / DFE (000000000) | 0.05 | 0.0064 | 0.0064 | |||

| SOLD KWD BOUGHT USD 20300513 / DFE (000000000) | 0.05 | 0.0064 | 0.0064 | |||

| IRS MYR R 3.50000 09/18/24-2Y BPS / DIR (EZKKQ3NGPD22) | 0.05 | 1,466.67 | 0.0064 | 0.0059 | ||

| IRS MYR R 3.50000 09/18/24-2Y BPS / DIR (EZKKQ3NGPD22) | 0.05 | 1,466.67 | 0.0064 | 0.0059 | ||

| IRS MYR R 3.50000 09/18/24-2Y BPS / DIR (EZKKQ3NGPD22) | 0.05 | 1,466.67 | 0.0064 | 0.0059 | ||

| IRS MYR R 3.50000 09/18/24-2Y BPS / DIR (EZKKQ3NGPD22) | 0.05 | 1,466.67 | 0.0064 | 0.0059 | ||

| SOLD KWD BOUGHT USD 20300516 / DFE (000000000) | 0.05 | 0.0064 | 0.0064 | |||

| SOLD KWD BOUGHT USD 20300516 / DFE (000000000) | 0.05 | 0.0064 | 0.0064 | |||

| SOLD KWD BOUGHT USD 20300515 / DFE (000000000) | 0.05 | 0.0064 | 0.0064 | |||

| SOLD KWD BOUGHT USD 20300515 / DFE (000000000) | 0.05 | 0.0064 | 0.0064 | |||

| SOLD KWD BOUGHT USD 20300515 / DFE (000000000) | 0.05 | 0.0064 | 0.0064 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.05 | 0.0064 | 0.0064 | |||

| 31750R3E5 PIMCO FXVAN PUT USD MXN 18.50000000 / DFE (EZSVF6ZJ0Y75) | 0.05 | 0.0063 | 0.0063 | |||

| US55275TAB44 / Mastr Asset Backed Securities Trust 2007-WMC1 | 0.05 | 0.00 | 0.0063 | -0.0017 | ||

| OIS COP IBR/7.96000 09/01/23-5Y CME / DIR (EZ41J51ML855) | 0.05 | -9.80 | 0.0063 | -0.0025 | ||

| OIS COP IBR/7.96000 09/01/23-5Y CME / DIR (EZ41J51ML855) | 0.05 | -9.80 | 0.0063 | -0.0025 | ||

| OIS COP IBR/7.96000 09/01/23-5Y CME / DIR (EZ41J51ML855) | 0.05 | -9.80 | 0.0063 | -0.0025 | ||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | 0.05 | 0.0063 | 0.0063 | |||

| BOUGHT TRY SOLD USD 20250723 / DFE (000000000) | 0.05 | 0.0062 | 0.0062 | |||

| US17312GAA94 / Citigroup Mortgage Loan Trust Series 2007 AHL3 | 0.05 | 0.00 | 0.0062 | -0.0016 | ||

| SOLD KWD BOUGHT USD 20290702 / DFE (000000000) | 0.04 | 0.0060 | 0.0060 | |||

| SOLD KWD BOUGHT USD 20290702 / DFE (000000000) | 0.04 | 0.0060 | 0.0060 | |||

| SOLD KWD BOUGHT USD 20290702 / DFE (000000000) | 0.04 | 0.0060 | 0.0060 | |||

| SOLD KWD BOUGHT USD 20290702 / DFE (000000000) | 0.04 | 0.0060 | 0.0060 | |||

| ZCS BRL 11.575 08/06/24-01/03/28 CME / DIR (EZN5PJX3C8Q4) | 0.04 | -37.68 | 0.0059 | -0.0059 | ||

| ZCS BRL 11.575 08/06/24-01/03/28 CME / DIR (EZN5PJX3C8Q4) | 0.04 | -37.68 | 0.0059 | -0.0059 | ||

| XS1268475727 / Synlab Unsecured Bondco PLC | 0.04 | 30.30 | 0.0059 | 0.0001 | ||

| BOUGHT TRY SOLD USD 20250714 / DFE (000000000) | 0.04 | 0.0059 | 0.0059 | |||

| BOUGHT TRY SOLD USD 20250714 / DFE (000000000) | 0.04 | 0.0059 | 0.0059 | |||

| BOUGHT TRY SOLD USD 20250714 / DFE (000000000) | 0.04 | 0.0059 | 0.0059 | |||

| BOUGHT TRY SOLD USD 20250714 / DFE (000000000) | 0.04 | 0.0059 | 0.0059 | |||

| ZCS BRL 11.59 08/06/24-01/03/28 CME / DIR (EZN5PJX3C8Q4) | 0.04 | -39.13 | 0.0059 | -0.0060 | ||

| ZCS BRL 11.59 08/06/24-01/03/28 CME / DIR (EZN5PJX3C8Q4) | 0.04 | -39.13 | 0.0059 | -0.0060 | ||

| ZCS BRL 11.59 08/06/24-01/03/28 CME / DIR (EZN5PJX3C8Q4) | 0.04 | -39.13 | 0.0059 | -0.0060 | ||

| IRS PLN 4.86500 07/18/24-5Y CME / DIR (EZ1M3PT0ZKH8) | 0.04 | 46.43 | 0.0057 | 0.0009 | ||

| IRS PLN 4.86500 07/18/24-5Y CME / DIR (EZ1M3PT0ZKH8) | 0.04 | 46.43 | 0.0057 | 0.0009 | ||

| BOUGHT TRY SOLD USD 20250711 / DFE (000000000) | 0.04 | 0.0057 | 0.0057 | |||

| BOUGHT TRY SOLD USD 20250711 / DFE (000000000) | 0.04 | 0.0057 | 0.0057 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.04 | 0.0057 | 0.0057 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.04 | 0.0057 | 0.0057 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.04 | 0.0057 | 0.0057 | |||

| RFR USD SOFR/3.50000 12/20/23-10Y CME / DIR (EZ4G8FZQ8LF2) | 0.04 | -34.92 | 0.0057 | -0.0052 | ||

| BOUGHT TRY SOLD USD 20250710 / DFE (000000000) | 0.04 | 0.0056 | 0.0056 | |||

| BOUGHT TRY SOLD USD 20250710 / DFE (000000000) | 0.04 | 0.0056 | 0.0056 | |||

| BOUGHT TRY SOLD USD 20250710 / DFE (000000000) | 0.04 | 0.0056 | 0.0056 | |||

| BOUGHT TRY SOLD USD 20250710 / DFE (000000000) | 0.04 | 0.0056 | 0.0056 | |||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0.04 | 0.0056 | 0.0056 | |||

| US933634AJ62 / WaMu Mortgage Pass-Through Certificates Series 2007-HY3 Trust | 0.04 | -2.44 | 0.0055 | -0.0016 | ||

| BOUGHT EUR SOLD USD 20250804 / DFE (000000000) | 0.04 | 0.0054 | 0.0054 | |||

| BOUGHT EUR SOLD USD 20250804 / DFE (000000000) | 0.04 | 0.0054 | 0.0054 | |||

| BOUGHT EUR SOLD USD 20250804 / DFE (000000000) | 0.04 | 0.0054 | 0.0054 | |||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0.04 | 0.0053 | 0.0053 | |||

| RO4KELYFLVK4 / Romania Government Bond | 0.04 | 8.57 | 0.0052 | -0.0009 | ||

| IRS PLN 4.92300 03/22/24-5Y CME / DIR (EZZXT546BQN6) | 0.04 | 137.50 | 0.0052 | 0.0023 | ||

| IRS PLN 4.92300 03/22/24-5Y CME / DIR (EZZXT546BQN6) | 0.04 | 137.50 | 0.0052 | 0.0023 | ||

| IRS PLN 4.92300 03/22/24-5Y CME / DIR (EZZXT546BQN6) | 0.04 | 137.50 | 0.0052 | 0.0023 | ||

| IRS PLN 4.92300 03/22/24-5Y CME / DIR (EZZXT546BQN6) | 0.04 | 137.50 | 0.0052 | 0.0023 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.04 | 0.0052 | 0.0052 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.04 | 0.0052 | 0.0052 | |||

| OIS MXN TIIE1/7.76000 04/09/25-4Y* CME / DIR (EZ8RRKWFNPF8) | 0.04 | 0.0051 | 0.0051 | |||

| US3622MAAB76 / GSAMP Trust 2007-FM1 | 0.04 | 0.00 | 0.0051 | -0.0013 | ||

| RFR USD SOFR/3.75000 12/18/24-10Y CME / DIR (EZ7K2W20N534) | 0.04 | -194.87 | 0.0051 | 0.0119 | ||

| RFR USD SOFR/3.75000 12/18/24-10Y CME / DIR (EZ7K2W20N534) | 0.04 | -194.87 | 0.0051 | 0.0119 | ||

| OIS COP IBR/7.52000 08/13/24-7Y CME / DIR (EZ5Q553XR2P1) | 0.04 | 2.78 | 0.0051 | -0.0012 | ||

| OIS COP IBR/7.52000 08/13/24-7Y CME / DIR (EZ5Q553XR2P1) | 0.04 | 2.78 | 0.0051 | -0.0012 | ||

| OIS COP IBR/7.52000 08/13/24-7Y CME / DIR (EZ5Q553XR2P1) | 0.04 | 2.78 | 0.0051 | -0.0012 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.04 | 0.0051 | 0.0051 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.04 | 0.0051 | 0.0051 | |||

| IRS CZK 3.32500 05/06/25-5Y CME / DIR (EZ452XR9BHB9) | 0.04 | 0.0051 | 0.0051 | |||

| BOUGHT PEN SOLD USD 20250707 / DFE (000000000) | 0.04 | 0.0050 | 0.0050 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.04 | 0.0049 | 0.0049 | |||

| ZCS BRL 13.43 06/12/25-01/02/29 CME / DIR (EZMJGJPSM041) | 0.04 | 0.0049 | 0.0049 | |||

| ZCS BRL 13.43 06/12/25-01/02/29 CME / DIR (EZMJGJPSM041) | 0.04 | 0.0049 | 0.0049 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.04 | 0.0049 | 0.0049 | |||

| IRS HUF 6.36250 01/31/25-5Y CME / DIR (EZQ6CLSXDMG6) | 0.03 | -169.39 | 0.0047 | 0.0132 | ||

| IRS HUF 6.36250 01/31/25-5Y CME / DIR (EZQ6CLSXDMG6) | 0.03 | -169.39 | 0.0047 | 0.0132 | ||

| IRS HUF 6.36250 01/31/25-5Y CME / DIR (EZQ6CLSXDMG6) | 0.03 | -169.39 | 0.0047 | 0.0132 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.03 | 0.0045 | 0.0045 | |||

| IRS MYR R 3.86750 12/20/23-5Y BOA / DIR (EZSRVSYD0RP6) | 0.03 | 77.78 | 0.0045 | 0.0014 | ||

| IRS MYR R 3.86750 12/20/23-5Y BOA / DIR (EZSRVSYD0RP6) | 0.03 | 77.78 | 0.0045 | 0.0014 | ||

| IRS MYR R 3.86750 12/20/23-5Y BOA / DIR (EZSRVSYD0RP6) | 0.03 | 77.78 | 0.0045 | 0.0014 | ||

| OIS COP IBR/8.02000 12/04/23-7Y CME / DIR (EZL19VT7HJ75) | 0.03 | 0.00 | 0.0045 | -0.0011 | ||

| OIS COP IBR/8.02000 12/04/23-7Y CME / DIR (EZL19VT7HJ75) | 0.03 | 0.00 | 0.0045 | -0.0011 | ||

| OIS COP IBR/8.02000 12/04/23-7Y CME / DIR (EZL19VT7HJ75) | 0.03 | 0.00 | 0.0045 | -0.0011 | ||

| BOUGHT THB SOLD USD 20250730 / DFE (000000000) | 0.03 | 0.0045 | 0.0045 | |||

| BOUGHT THB SOLD USD 20250730 / DFE (000000000) | 0.03 | 0.0045 | 0.0045 | |||

| IRS PLN 4.75000 08/02/24-5Y CME / DIR (EZ7JW0MH9YL2) | 0.03 | 60.00 | 0.0045 | 0.0009 | ||

| ZCS BRL 10.16395 07/07/23-01/02/26 CME / DIR (EZW9WMVXW804) | 0.03 | 6.67 | 0.0044 | -0.0008 | ||

| ZCS BRL 10.16395 07/07/23-01/02/26 CME / DIR (EZW9WMVXW804) | 0.03 | 6.67 | 0.0044 | -0.0008 | ||

| ZCS BRL 10.16395 07/07/23-01/02/26 CME / DIR (EZW9WMVXW804) | 0.03 | 6.67 | 0.0044 | -0.0008 | ||

| ZCS BRL 10.16395 07/07/23-01/02/26 CME / DIR (EZW9WMVXW804) | 0.03 | 6.67 | 0.0044 | -0.0008 | ||

| XS1268475727 / Synlab Unsecured Bondco PLC | 0.03 | 28.00 | 0.0044 | 0.0000 | ||

| XS1268475727 / Synlab Unsecured Bondco PLC | 0.03 | 28.00 | 0.0044 | 0.0000 | ||

| XS1268475727 / Synlab Unsecured Bondco PLC | 0.03 | 28.00 | 0.0044 | 0.0000 | ||

| XS1268475727 / Synlab Unsecured Bondco PLC | 0.03 | 28.00 | 0.0044 | 0.0000 | ||

| BOUGHT PLN SOLD USD 20250710 / DFE (000000000) | 0.03 | 0.0044 | 0.0044 | |||

| IRS ZAR 7.81000 06/20/25-5Y CME / DIR (EZN4ZF3YYBK4) | 0.03 | 0.0044 | 0.0044 | |||

| IRS ZAR 7.81000 06/20/25-5Y CME / DIR (EZN4ZF3YYBK4) | 0.03 | 0.0044 | 0.0044 | |||

| IRS ZAR 7.81000 06/20/25-5Y CME / DIR (EZN4ZF3YYBK4) | 0.03 | 0.0044 | 0.0044 | |||

| IRS ZAR 7.81000 06/20/25-5Y CME / DIR (EZN4ZF3YYBK4) | 0.03 | 0.0044 | 0.0044 | |||

| BOUGHT TRY SOLD USD 20250716 / DFE (000000000) | 0.03 | 0.0044 | 0.0044 | |||

| BOUGHT TRY SOLD USD 20250716 / DFE (000000000) | 0.03 | 0.0044 | 0.0044 | |||

| BOUGHT TRY SOLD USD 20250716 / DFE (000000000) | 0.03 | 0.0044 | 0.0044 | |||

| BOUGHT TRY SOLD USD 20250716 / DFE (000000000) | 0.03 | 0.0044 | 0.0044 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.03 | 0.0043 | 0.0043 | |||

| OIS COP IBR/7.97000 12/16/24-3Y* CME / DIR (EZLDLMHMXDS9) | 0.03 | -13.89 | 0.0043 | -0.0019 | ||

| OIS COP IBR/7.97000 12/16/24-3Y* CME / DIR (EZLDLMHMXDS9) | 0.03 | -13.89 | 0.0043 | -0.0019 | ||

| OIS COP IBR/7.97000 12/16/24-3Y* CME / DIR (EZLDLMHMXDS9) | 0.03 | -13.89 | 0.0043 | -0.0019 | ||

| OIS COP IBR/7.97000 12/16/24-3Y* CME / DIR (EZLDLMHMXDS9) | 0.03 | -13.89 | 0.0043 | -0.0019 | ||

| BOUGHT CZK SOLD USD 20250822 / DFE (000000000) | 0.03 | 0.0042 | 0.0042 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.03 | 0.0042 | 0.0042 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.03 | 0.0042 | 0.0042 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.03 | 0.0042 | 0.0042 | |||

| 31750QG94 PIMCO FXVAN PUT EUR CZK 24.65000000 / DFE (EZRPS491TRS5) | 0.03 | 20.00 | 0.0042 | -0.0003 | ||

| 31750QG94 PIMCO FXVAN PUT EUR CZK 24.65000000 / DFE (EZRPS491TRS5) | 0.03 | 20.00 | 0.0042 | -0.0003 | ||

| 31750QG94 PIMCO FXVAN PUT EUR CZK 24.65000000 / DFE (EZRPS491TRS5) | 0.03 | 20.00 | 0.0042 | -0.0003 | ||

| 31750QG94 PIMCO FXVAN PUT EUR CZK 24.65000000 / DFE (EZRPS491TRS5) | 0.03 | 20.00 | 0.0042 | -0.0003 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.03 | 0.0041 | 0.0041 | |||

| BOUGHT PEN SOLD USD 20250710 / DFE (000000000) | 0.03 | 0.0041 | 0.0041 | |||

| BOUGHT PEN SOLD USD 20250710 / DFE (000000000) | 0.03 | 0.0041 | 0.0041 | |||

| BOUGHT PEN SOLD USD 20250710 / DFE (000000000) | 0.03 | 0.0041 | 0.0041 | |||

| ZCS BRL 12.7603 10/11/24-01/02/29 CME / DIR (EZCPYVJ81JC8) | 0.03 | -63.75 | 0.0040 | -0.0097 | ||

| ZCS BRL 12.7603 10/11/24-01/02/29 CME / DIR (EZCPYVJ81JC8) | 0.03 | -63.75 | 0.0040 | -0.0097 | ||

| 31750QFP9 PIMCO FXVAN PUT EUR CZK 24.75000000 / DFE (EZXB1LYYQC54) | 0.03 | 16.00 | 0.0040 | -0.0003 | ||

| 31750QFP9 PIMCO FXVAN PUT EUR CZK 24.75000000 / DFE (EZXB1LYYQC54) | 0.03 | 16.00 | 0.0040 | -0.0003 | ||

| 31750QFP9 PIMCO FXVAN PUT EUR CZK 24.75000000 / DFE (EZXB1LYYQC54) | 0.03 | 16.00 | 0.0040 | -0.0003 | ||

| SOLD DOP BOUGHT USD 20250807 / DFE (000000000) | 0.03 | 0.0040 | 0.0040 | |||

| ISRAEL GOVT EM SP CBK / DCR (EZYH14HMXHV9) | 0.03 | -17.14 | 0.0040 | -0.0020 | ||

| XS1303929894 / Ukraine Government International Bond | 0.03 | -3.45 | 0.0040 | -0.0010 | ||

| IRS CLP 5.40000 07/03/24-10Y CME / DIR (EZ5FTMR4F6J2) | 0.03 | 366.67 | 0.0039 | 0.0029 | ||

| IRS CLP 5.40000 07/03/24-10Y CME / DIR (EZ5FTMR4F6J2) | 0.03 | 366.67 | 0.0039 | 0.0029 | ||

| IRS CLP 5.40000 07/03/24-10Y CME / DIR (EZ5FTMR4F6J2) | 0.03 | 366.67 | 0.0039 | 0.0029 | ||

| 31750R1X5 PIMCO FXVAN PUT USD COP 3825.0000000 / DFE (000000000) | 0.03 | 0.0039 | 0.0039 | |||

| BRAZIL LA BP BOA / DCR (EZJT3GV6Z522) | 0.03 | -42.86 | 0.0039 | -0.0046 | ||

| BRAZIL LA BP BOA / DCR (EZJT3GV6Z522) | 0.03 | -42.86 | 0.0039 | -0.0046 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.03 | 0.0039 | 0.0039 | |||

| OIS MXN TIIE1+24/9.29* 12/29/25-3Y* CME / DIR (EZN4CX6RFCV0) | 0.03 | 47.37 | 0.0039 | 0.0005 | ||

| OIS MXN TIIE1+24/9.29* 12/29/25-3Y* CME / DIR (EZN4CX6RFCV0) | 0.03 | 47.37 | 0.0039 | 0.0005 | ||

| OIS MXN TIIE1+24/9.29* 12/29/25-3Y* CME / DIR (EZN4CX6RFCV0) | 0.03 | 47.37 | 0.0039 | 0.0005 | ||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | 0.03 | 0.0039 | 0.0039 | |||