Mga Batayang Estadistika

| Nilai Portofolio | $ 626,566,387 |

| Posisi Saat Ini | 1,056 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

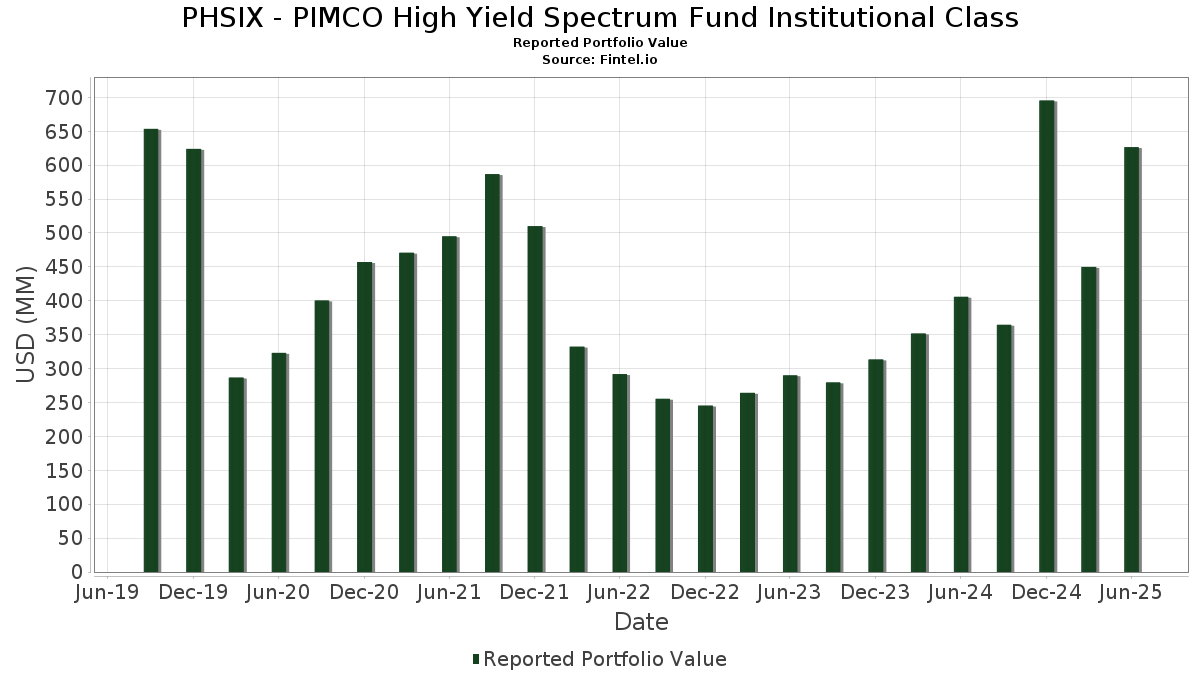

PHSIX - PIMCO High Yield Spectrum Fund Institutional Class telah mengungkapkan total kepemilikan 1,056 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 626,566,387 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PHSIX - PIMCO High Yield Spectrum Fund Institutional Class adalah PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , 1011778 BC ULC / New Red Finance Inc (CA:US68245XAM11) , CCO Holdings LLC / CCO Holdings Capital Corp (US:US1248EPCE15) , Valaris Ltd (BM:US91889FAC59) , and Electricite de France SA (FR:FR0011697028) . Posisi baru PHSIX - PIMCO High Yield Spectrum Fund Institutional Class meliputi: PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , 1011778 BC ULC / New Red Finance Inc (CA:US68245XAM11) , CCO Holdings LLC / CCO Holdings Capital Corp (US:US1248EPCE15) , Valaris Ltd (BM:US91889FAC59) , and Electricite de France SA (FR:FR0011697028) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 10.01 | 2.1943 | 2.1943 | ||

| 10.01 | 2.1943 | 2.1943 | ||

| 11.89 | 2.6062 | 1.9800 | ||

| 5.49 | 1.2038 | 1.2038 | ||

| 5.49 | 1.2038 | 1.2038 | ||

| 3.41 | 0.7468 | 0.7468 | ||

| 3.41 | 0.7468 | 0.7468 | ||

| 3.41 | 0.7468 | 0.7468 | ||

| 2.76 | 0.6039 | 0.6039 | ||

| 2.76 | 0.6039 | 0.6039 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| -1.38 | -0.3031 | -0.3031 | ||

| 1.73 | 0.3792 | -0.2778 | ||

| 0.53 | 0.1163 | -0.1955 | ||

| 0.53 | 0.1163 | -0.1955 | ||

| 0.69 | 0.1517 | -0.1549 | ||

| 0.24 | 0.0525 | -0.1339 | ||

| 0.79 | 0.1722 | -0.0753 | ||

| 0.79 | 0.1722 | -0.0753 | ||

| 0.16 | 0.0349 | -0.0602 | ||

| 0.19 | 0.0408 | -0.0602 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| DE0001174068 / CHINA UNIVERSAL EX INC | 13.28 | 20.98 | 2.9109 | 0.4575 | |||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 13.28 | 20.98 | 2.9109 | 0.4575 | |||||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 11.89 | 324.46 | 2.6062 | 1.9800 | |||||

| US TREASURY N/B 02/35 4.625 / DBT (US91282CMM00) | 10.01 | 2.1943 | 2.1943 | ||||||

| US TREASURY N/B 02/35 4.625 / DBT (US91282CMM00) | 10.01 | 2.1943 | 2.1943 | ||||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 5.49 | 1.2038 | 1.2038 | ||||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 5.49 | 1.2038 | 1.2038 | ||||||

| US TREASURY N/B 12/31 4.5 / DBT (US91282CMC28) | 5.16 | 0.59 | 1.1303 | -0.0154 | |||||

| US TREASURY N/B 12/31 4.5 / DBT (US91282CMC28) | 5.16 | 0.59 | 1.1303 | -0.0154 | |||||

| US TREASURY N/B 12/31 4.5 / DBT (US91282CMC28) | 5.16 | 0.59 | 1.1303 | -0.0154 | |||||

| US68245XAM11 / 1011778 BC ULC / New Red Finance Inc | 4.13 | 2.99 | 0.9049 | 0.0090 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 3.79 | 7.91 | 0.8314 | 0.0456 | |||||

| US TREASURY N/B 03/30 4 / DBT (US91282CMU26) | 3.41 | 0.7468 | 0.7468 | ||||||

| US TREASURY N/B 03/30 4 / DBT (US91282CMU26) | 3.41 | 0.7468 | 0.7468 | ||||||

| US TREASURY N/B 03/30 4 / DBT (US91282CMU26) | 3.41 | 0.7468 | 0.7468 | ||||||

| CANADIAN GOVERNMENT BONDS 09/29 3.5 / DBT (CA135087R895) | 2.94 | 4.69 | 0.6453 | 0.0167 | |||||

| CANADIAN GOVERNMENT BONDS 09/29 3.5 / DBT (CA135087R895) | 2.94 | 4.69 | 0.6453 | 0.0167 | |||||

| CDX HY44 5Y ICE / DCR (000000000) | 2.76 | 0.6039 | 0.6039 | ||||||

| CDX HY44 5Y ICE / DCR (000000000) | 2.76 | 0.6039 | 0.6039 | ||||||

| VENTURE GLOBAL LNG INC VENTURE GLOBAL LNG INC / DBT (US92332YAE14) | 2.50 | 2.62 | 0.5489 | 0.0035 | |||||

| VENTURE GLOBAL LNG INC VENTURE GLOBAL LNG INC / DBT (US92332YAE14) | 2.50 | 2.62 | 0.5489 | 0.0035 | |||||

| VENTURE GLOBAL LNG INC VENTURE GLOBAL LNG INC / DBT (US92332YAE14) | 2.50 | 2.62 | 0.5489 | 0.0035 | |||||

| IHO VERWALTUNGS GMBH SR SECURED REGS 11/29 6.75 / DBT (XS2905386962) | 2.34 | 17.43 | 0.5138 | 0.0677 | |||||

| IHO VERWALTUNGS GMBH SR SECURED REGS 11/29 6.75 / DBT (XS2905386962) | 2.34 | 17.43 | 0.5138 | 0.0677 | |||||

| US1248EPCE15 / CCO Holdings LLC / CCO Holdings Capital Corp | 2.24 | 4.67 | 0.4914 | 0.0128 | |||||

| US91889FAC59 / Valaris Ltd | 2.21 | 2.46 | 0.4839 | 0.0024 | |||||

| FR0011697028 / Electricite de France SA | 2.02 | 8.72 | 0.4429 | 0.0274 | |||||

| US1248EPBT92 / CCO Holdings LLC / CCO Holdings Capital Corp | 1.99 | 1.17 | 0.4373 | -0.0033 | |||||

| XS2696090286 / Pinnacle Bidco plc | 1.98 | 9.09 | 0.4342 | 0.0284 | |||||

| US852234AP86 / CORPORATE BONDS | 1.97 | 94.96 | 0.4326 | 0.2065 | |||||

| US01883LAF04 / ALLIANT HOLD / CO-ISSUER REGD 144A P/P 7.00000000 | 1.92 | 3.12 | 0.4198 | 0.0047 | |||||

| 937HEJII7 / 2021 EURO TERM LOAN | 1.89 | 9.26 | 0.4139 | 0.0275 | |||||

| ALBION FINANCING 1SARL / SR SECURED 144A 05/30 7 / DBT (US01330AAA43) | 1.87 | 0.4092 | 0.4092 | ||||||

| US904678AS85 / UniCredit SpA | 1.86 | 1.14 | 0.4088 | -0.0031 | |||||

| US65505PAA57 / Noble Finance II LLC | 1.83 | 35.85 | 0.4021 | 0.1003 | |||||

| US058498AW66 / Ball Corp | 1.78 | 54.29 | 0.3906 | 0.1323 | |||||

| US92535UAB08 / Vertiv Group Corp | 1.76 | 130.45 | 0.3850 | 0.2146 | |||||

| US74166MAF32 / Prime Security Services Borrower LLC / Prime Finance Inc | 1.75 | 2.23 | 0.3825 | 0.0009 | |||||

| ROCKET COS INC COMPANY GUAR 144A 08/30 6.125 / DBT (US77311WAA99) | 1.73 | 0.3800 | 0.3800 | ||||||

| CDX HY43 5Y ICE / DCR (EZ4J83TSRL27) | 1.73 | -41.14 | 0.3792 | -0.2778 | |||||

| XS2358483258 / Vmed O2 UK Financing I PLC | 1.73 | 12.01 | 0.3784 | 0.0339 | |||||

| ACI1DMVN6 / IQVIA INC COMPANY GUAR REGS 01/28 2.25 | 1.72 | 11.38 | 0.3777 | 0.0318 | |||||

| 1261229 BC LTD SR SECURED 144A 04/32 10 / DBT (US68288AAA51) | 1.72 | 1.48 | 0.3762 | -0.0019 | |||||

| XS2332250708 / Organon Finance 1 LLC | 1.67 | 11.65 | 0.3658 | 0.0318 | |||||

| US538034AX75 / LIVE NATION ENTERTAINMEN SR SECURED 144A 01/28 3.75 | 1.65 | 1.73 | 0.3615 | -0.0010 | |||||

| XS2483510470 / Loarre Investments Sarl | 1.64 | 9.47 | 0.3601 | 0.0248 | |||||

| JETBLUE AIRWAYS/LOYALTY JETBLUE AIRWAYS/LOYALTY / DBT (US476920AA15) | 1.63 | -1.45 | 0.3574 | -0.0124 | |||||

| US92328MAC73 / Venture Global Calcasieu Pass LLC | 1.62 | 1.63 | 0.3549 | -0.0012 | |||||

| SATS / EchoStar Corporation | 1.60 | -2.02 | 0.3502 | -0.0141 | |||||

| SATS / EchoStar Corporation | 1.60 | -2.02 | 0.3502 | -0.0141 | |||||

| SATS / EchoStar Corporation | 1.60 | -2.02 | 0.3502 | -0.0141 | |||||

| XS2262961076 / ZF Finance GmbH | 1.58 | 9.63 | 0.3469 | 0.0244 | |||||

| JANE STREET GRP/JSG FIN JANE STREET GRP/JSG FIN / DBT (US47077WAC29) | 1.58 | 2.40 | 0.3462 | 0.0015 | |||||

| RAVEN ACQUISITION HOLDIN SR SECURED 144A 11/31 6.875 / DBT (US75420NAA19) | 1.58 | 3.00 | 0.3461 | 0.0034 | |||||

| XS2062666602 / Virgin Media Secured Finance PLC | 1.57 | 11.88 | 0.3449 | 0.0305 | |||||

| MANUCHAR GROUP SARL MANUCHAR GROUP SARL / DBT (BE6365837184) | 1.50 | 0.3289 | 0.3289 | ||||||

| MANUCHAR GROUP SARL MANUCHAR GROUP SARL / DBT (BE6365837184) | 1.50 | 0.3289 | 0.3289 | ||||||

| MANUCHAR GROUP SARL MANUCHAR GROUP SARL / DBT (BE6365837184) | 1.50 | 0.3289 | 0.3289 | ||||||

| US64072TAC99 / CSC Holdings LLC | 1.50 | 157.56 | 0.3286 | 0.1984 | |||||

| PANTHER ESCROW ISSUER PANTHER ESCROW ISSUER / DBT (US69867RAA59) | 1.46 | -4.84 | 0.3190 | -0.0228 | |||||

| PANTHER ESCROW ISSUER PANTHER ESCROW ISSUER / DBT (US69867RAA59) | 1.46 | -4.84 | 0.3190 | -0.0228 | |||||

| US073685AD12 / Beacon Roofing Supply Inc 4.875% 11/01/2025 144a Bond | 1.45 | 0.3169 | 0.3169 | ||||||

| OPAL BIDCO SAS SR SECURED 144A 03/32 5.5 / DBT (XS3037643486) | 1.45 | 0.3168 | 0.3168 | ||||||

| OPAL BIDCO SAS SR SECURED 144A 03/32 5.5 / DBT (XS3037643486) | 1.45 | 0.3168 | 0.3168 | ||||||

| US89055FAB94 / TopBuild Corp | 1.44 | 2.20 | 0.3165 | 0.0009 | |||||

| US34960PAD33 / Fortress Transportation and Infrastructure Investors LLC | 1.44 | 1.48 | 0.3163 | -0.0016 | |||||

| US62482BAA08 / Mozart Debt Merger Sub Inc | 1.44 | 18.34 | 0.3156 | 0.0438 | |||||

| US914906AV42 / UNIVISION COMMUNICATIONS INC 4.5% 05/01/2029 144A | 1.41 | 2.84 | 0.3092 | 0.0027 | |||||

| US436440AP62 / Hologic Inc | 1.41 | 3.30 | 0.3088 | 0.0040 | |||||

| STONEPEAK NILE PARENT SR SECURED 144A 03/32 7.25 / DBT (US861932AA97) | 1.41 | 4.00 | 0.3081 | 0.0060 | |||||

| CLOVER HOLDINGS 2 LLC TERM LOAN B / LON (US18914DAB47) | 1.40 | 0.3077 | 0.3077 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 1.38 | 0.3035 | 0.3035 | ||||||

| US12657NAA81 / CQP HOLDCO LP / BIP-V CHINOOK HOLDCO LLC 5.5% 06/15/2031 144A | 1.38 | 6.79 | 0.3034 | 0.0137 | |||||

| US36268NAA81 / GTCR W-2 Merger Sub LLC | 1.38 | 1.92 | 0.3027 | 0.0000 | |||||

| US143658BQ44 / Carnival Corp | 1.37 | 2.31 | 0.3005 | 0.0010 | |||||

| OCS GROUP HOLDINGS LTD GBP TERM LOAN B / LON (BA000BQB0) | 1.37 | 6.20 | 0.3004 | 0.0118 | |||||

| OCS GROUP HOLDINGS LTD GBP TERM LOAN B / LON (BA000BQB0) | 1.37 | 6.20 | 0.3004 | 0.0118 | |||||

| US25260WAD39 / Diamond Foreign Asset Co / Diamond Finance LLC | 1.35 | 65.12 | 0.2969 | 0.1135 | |||||

| CERDIA FINANZ GMBH CERDIA FINANZ GMBH / DBT (US15679GAC69) | 1.35 | 31.71 | 0.2961 | 0.0668 | |||||

| CERDIA FINANZ GMBH CERDIA FINANZ GMBH / DBT (US15679GAC69) | 1.35 | 31.71 | 0.2961 | 0.0668 | |||||

| CERDIA FINANZ GMBH CERDIA FINANZ GMBH / DBT (US15679GAC69) | 1.35 | 31.71 | 0.2961 | 0.0668 | |||||

| US45827MAA53 / Intelligent Packaging Ltd Finco Inc / Intelligent Packaging Ltd Co-Issuer LLC | 1.35 | 2.74 | 0.2959 | 0.0021 | |||||

| XS2445836286 / SR SECURED REGS 02/29 6 | 1.34 | 12.95 | 0.2945 | 0.0286 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 1.32 | -5.16 | 0.2901 | -0.0218 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 1.32 | -5.16 | 0.2901 | -0.0218 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 1.32 | -5.16 | 0.2901 | -0.0218 | |||||

| TRIVIUM PACKAGING FIN SR SECURED 144A 07/30 8.25 / DBT (US89686QAD88) | 1.32 | 0.2900 | 0.2900 | ||||||

| MANUCHAR GROUP SARL SR SECURED REGS 06/27 7.25 / DBT (BE6336312788) | 1.32 | 11.10 | 0.2896 | 0.0238 | |||||

| KRAKEN OIL + GAS PARTNER KRAKEN OIL + GAS PARTNER / DBT (US50076PAA66) | 1.30 | 0.62 | 0.2856 | -0.0038 | |||||

| ECPG / Encore Capital Group, Inc. | 1.29 | 4.04 | 0.2823 | 0.0055 | |||||

| ECPG / Encore Capital Group, Inc. | 1.29 | 4.04 | 0.2823 | 0.0055 | |||||

| FR001400EHH1 / ELO SACA | 1.28 | 10.31 | 0.2815 | 0.0213 | |||||

| US02156LAF85 / Altice France SA/France | 1.28 | 5.43 | 0.2811 | 0.0093 | |||||

| XS2380124227 / Castellum AB | 1.27 | 10.05 | 0.2784 | 0.0204 | |||||

| US45688CAB37 / Ingevity Corp | 1.26 | 15.22 | 0.2772 | 0.0319 | |||||

| QUIKRETE HOLDINGS INC SR SECURED 144A 03/32 6.375 / DBT (US74843PAA84) | 1.26 | 2.19 | 0.2763 | 0.0005 | |||||

| QUIKRETE HOLDINGS INC SR SECURED 144A 03/32 6.375 / DBT (US74843PAA84) | 1.26 | 2.19 | 0.2763 | 0.0005 | |||||

| QUIKRETE HOLDINGS INC SR SECURED 144A 03/32 6.375 / DBT (US74843PAA84) | 1.26 | 2.19 | 0.2763 | 0.0005 | |||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 1.26 | 19.71 | 0.2757 | 0.0408 | |||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 1.26 | 19.71 | 0.2757 | 0.0408 | |||||

| US15138AAA88 / Centennial Resource Production LLC | 1.25 | 0.40 | 0.2743 | -0.0043 | |||||

| YINSON PRODUCTION FINANC SR SECURED 144A REGS 05/29 9.6 / DBT (NO0013215509) | 1.25 | -0.64 | 0.2734 | -0.0072 | |||||

| YINSON PRODUCTION FINANC SR SECURED 144A REGS 05/29 9.6 / DBT (NO0013215509) | 1.25 | -0.64 | 0.2734 | -0.0072 | |||||

| YINSON PRODUCTION FINANC SR SECURED 144A REGS 05/29 9.6 / DBT (NO0013215509) | 1.25 | -0.64 | 0.2734 | -0.0072 | |||||

| EFESTO BIDCO SPA/US LLC SR SECURED 144A 02/32 7.5 / DBT (US28201XAB10) | 1.22 | 3.84 | 0.2666 | 0.0047 | |||||

| BOPARAN FINANCE PLC SR SECURED 144A 11/29 9.375 / DBT (XS2928675060) | 1.21 | 14.35 | 0.2656 | 0.0289 | |||||

| US18539UAD72 / Clearway Energy Operating LLC | 1.19 | -3.01 | 0.2618 | -0.0133 | |||||

| US681639AA87 / Olympus Water US Holding Corp | 1.19 | 2.85 | 0.2607 | 0.0023 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 1.19 | 0.59 | 0.2602 | -0.0037 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 1.19 | 0.59 | 0.2602 | -0.0037 | |||||

| SUBCALIDORA 2 2024 EUR TERM LOAN / LON (BA0007DG2) | 1.18 | 8.93 | 0.2595 | 0.0166 | |||||

| US71376LAE02 / Performance Food Group, Inc. | 1.18 | 17.50 | 0.2592 | 0.0342 | |||||

| US05453GAC96 / AXALTA COATING SYSTEMS LLC 3.375% 02/15/2029 144A | 1.16 | 18.11 | 0.2545 | 0.0346 | |||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 1.16 | 63.70 | 0.2542 | 0.0959 | |||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 1.16 | 63.70 | 0.2542 | 0.0959 | |||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 1.16 | 63.70 | 0.2542 | 0.0959 | |||||

| XS1645722262 / Atlantia SpA | 1.16 | 10.70 | 0.2541 | 0.0200 | |||||

| XS2115190451 / Q-Park Holding I BV | 1.16 | 10.31 | 0.2535 | 0.0193 | |||||

| US36261NAA54 / GYP Holdings III Corp | 1.15 | 7.16 | 0.2528 | 0.0121 | |||||

| XS2470988523 / Market Bidco Finco PLC | 1.15 | 11.93 | 0.2512 | 0.0225 | |||||

| XS2103218538 / Ashland Services BV | 1.14 | 12.00 | 0.2499 | 0.0223 | |||||

| QUIKRETE HOLDINGS INC SR UNSECURED 144A 03/33 6.75 / DBT (US74843PAB67) | 1.14 | 3.65 | 0.2489 | 0.0040 | |||||

| CHRD / Chord Energy Corporation | 1.12 | 2.65 | 0.2465 | 0.0017 | |||||

| XS1793255941 / SoftBank Group Corp | 1.11 | 9.68 | 0.2435 | 0.0171 | |||||

| US12116LAC37 / Burford Capital Global Finance LLC | 1.10 | 23.62 | 0.2411 | 0.0422 | |||||

| US60855RAK68 / Molina Healthcare Inc | 1.09 | 3.90 | 0.2397 | 0.0045 | |||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 1.09 | 10.18 | 0.2397 | 0.0179 | |||||

| US12543DBK54 / CHS/CMNTY HEALTH SYSTEMS INC 4.75% 02/15/2031 144A | 1.09 | 8.13 | 0.2392 | 0.0136 | |||||

| US81180WAN11 / Seagate Hdd Cayman Bond | 1.09 | 72.58 | 0.2388 | 0.0976 | |||||

| US82873MAA18 / Simmons Foods Inc/Simmons Prepared Foods Inc/Simmons Pet Food Inc/Simmons Feed | 1.09 | 1.78 | 0.2382 | -0.0004 | |||||

| XS2615006470 / Monitchem HoldCo 3 SA | 1.08 | 9.91 | 0.2360 | 0.0171 | |||||

| US749571AG03 / RHP HOTEL PPTY/RHP FINAN REGD 144A P/P 4.50000000 | 1.08 | 13.64 | 0.2358 | 0.0242 | |||||

| US019579AA90 / Allied Universal Holdco LLC/Allied Universal Finance Corp/Atlas Luxco 4 Sarl | 1.07 | 2.50 | 0.2342 | 0.0011 | |||||

| XS2066744231 / Carnival PLC | 1.06 | 11.19 | 0.2332 | 0.0194 | |||||

| US380355AH08 / goeasy Ltd | 1.06 | 0.76 | 0.2321 | -0.0028 | |||||

| US75103AAA34 / Raising Cane's Restaurants LLC | 1.06 | -0.66 | 0.2316 | -0.0061 | |||||

| US12008RAN70 / Builders FirstSource Inc | 1.06 | 2.72 | 0.2315 | 0.0017 | |||||

| XS2243548273 / Cheplapharm Arzneimittel GmbH | 1.05 | 18.11 | 0.2302 | 0.0314 | |||||

| US42226AAA51 / HealthEquity Inc | 1.05 | 39.47 | 0.2294 | 0.0616 | |||||

| GENESIS ENERGY LP/FIN GENESIS ENERGY LP/FIN / DBT (US37185LAQ59) | 1.04 | 3.17 | 0.2281 | 0.0028 | |||||

| GENESIS ENERGY LP/FIN GENESIS ENERGY LP/FIN / DBT (US37185LAQ59) | 1.04 | 3.17 | 0.2281 | 0.0028 | |||||

| SHIFT4 PAYMENTS LLC/FIN COMPANY GUAR 144A 08/32 6.75 / DBT (US82453AAB35) | 1.04 | 0.2278 | 0.2278 | ||||||

| XYZ / Block, Inc. - Depositary Receipt (Common Stock) | 1.03 | 0.2263 | 0.2263 | ||||||

| US78442PGE07 / SLM Corp | 1.03 | 1.38 | 0.2257 | -0.0011 | |||||

| JANE STREET GRP/JSG FIN SR SECURED 144A 05/33 6.75 / DBT (US47077WAE84) | 1.03 | 0.2255 | 0.2255 | ||||||

| JANE STREET GRP/JSG FIN SR SECURED 144A 05/33 6.75 / DBT (US47077WAE84) | 1.03 | 0.2255 | 0.2255 | ||||||

| SLM CORP SR UNSECURED 01/30 6.5 / DBT (US78442PGF71) | 1.02 | 73.56 | 0.2245 | 0.0925 | |||||

| SLM CORP SR UNSECURED 01/30 6.5 / DBT (US78442PGF71) | 1.02 | 73.56 | 0.2245 | 0.0925 | |||||

| SLM CORP SR UNSECURED 01/30 6.5 / DBT (US78442PGF71) | 1.02 | 73.56 | 0.2245 | 0.0925 | |||||

| US12008RAP29 / Builders FirstSource Inc | 1.02 | 13.85 | 0.2236 | 0.0234 | |||||

| US92858RAB69 / Vmed O2 UK Financing I PLC | 1.02 | 0.2232 | 0.2232 | ||||||

| US654744AC50 / Nissan Motor Co Ltd | 1.01 | -1.27 | 0.2211 | -0.0072 | |||||

| US74759BAD55 / Qualitytech LP / QTS Finance Corp | 1.00 | 0.30 | 0.2203 | -0.0038 | |||||

| BE6329443962 / Ontex Group NV | 1.00 | 9.03 | 0.2196 | 0.0141 | |||||

| US983130AX35 / Wynn Las Vegas LLC / Wynn Las Vegas Capital Corp | 1.00 | 1.11 | 0.2195 | -0.0018 | |||||

| DE000A283WZ3 / ams AG | 1.00 | 18.76 | 0.2193 | 0.0310 | |||||

| US037411BJ37 / Apache Corp | 0.99 | -0.90 | 0.2181 | -0.0061 | |||||

| US92857WBQ24 / Vodafone Group PLC | 0.99 | 1.33 | 0.2176 | -0.0014 | |||||

| US337120AA74 / First Student Bidco Inc / First Transit Parent Inc | 0.99 | 2.49 | 0.2165 | 0.0011 | |||||

| COGENT COMMS GRP / FIN SR SECURED 144A 07/32 6.5 / DBT (US19240WAB54) | 0.99 | 0.2161 | 0.2161 | ||||||

| US60337JAA43 / Minerva Merger Sub Inc | 0.99 | 5.01 | 0.2160 | 0.0061 | |||||

| LU2445093128 / INTELSAT EMERGENCE SA | 0.03 | 0.00 | 0.98 | 2.40 | 0.2149 | 0.0009 | |||

| XS2397448346 / BCP V Modular Services Finance PLC | 0.98 | 6.21 | 0.2138 | 0.0086 | |||||

| US68245XAH26 / 1011778 BC ULC / New Red Finance Inc | 0.97 | 1.88 | 0.2137 | -0.0001 | |||||

| TWITTER INC TERM LOAN / LON (US90184NAG34) | 0.97 | -2.21 | 0.2133 | -0.0091 | |||||

| TWITTER INC TERM LOAN / LON (US90184NAG34) | 0.97 | -2.21 | 0.2133 | -0.0091 | |||||

| US013092AG61 / ALBERTSONS COS LLC / SAFEWAY INC / NEW ALBERTSONS INC / ALBERTSONS LLC 3.5% 03/15/2029 144A | 0.97 | 2.97 | 0.2131 | 0.0020 | |||||

| XS1752894292 / Banca Monte dei Paschi di Siena SpA | 0.97 | 9.62 | 0.2124 | 0.0148 | |||||

| NIDDA HEALTHCARE HOLDING SR SECURED REGS 02/30 5.625 / DBT (XS2920589699) | 0.96 | 9.44 | 0.2110 | 0.0144 | |||||

| US737446AQ74 / Post Holdings Inc | 0.96 | 2.89 | 0.2109 | 0.0019 | |||||

| NOVELIS CORP COMPANY GUAR 144A 01/30 6.875 / DBT (US670001AL04) | 0.96 | 1.92 | 0.2098 | -0.0001 | |||||

| US02156LAA98 / Altice France SA/France | 0.95 | 0.64 | 0.2073 | -0.0027 | |||||

| US89364MCA09 / TRANSDIGM INC | 0.94 | 0.53 | 0.2068 | -0.0031 | |||||

| US92332YAA91 / Venture Global LNG, Inc. | 0.93 | 1.09 | 0.2040 | -0.0016 | |||||

| XS1138360166 / Walgreens Boots Alliance Inc | 0.93 | 9.68 | 0.2038 | 0.0143 | |||||

| FREEDOM MORTGAGE HOLD FREEDOM MORTGAGE HOLD / DBT (US35641AAB44) | 0.93 | 2.43 | 0.2036 | 0.0009 | |||||

| FREEDOM MORTGAGE HOLD FREEDOM MORTGAGE HOLD / DBT (US35641AAB44) | 0.93 | 2.43 | 0.2036 | 0.0009 | |||||

| FREEDOM MORTGAGE HOLD FREEDOM MORTGAGE HOLD / DBT (US35641AAB44) | 0.93 | 2.43 | 0.2036 | 0.0009 | |||||

| AMENTUM ESCROW CORP AMENTUM ESCROW CORP / DBT (US02352BAA35) | 0.93 | 4.51 | 0.2032 | 0.0051 | |||||

| GFL ENVIRONMENTAL INC 2025 TERM LOAN B / LON (US36257SAB88) | 0.93 | 0.87 | 0.2031 | -0.0020 | |||||

| US92840VAH50 / VISTRA OPERATIONS CO LLC 4.375% 05/01/2029 144A | 0.93 | 2.66 | 0.2031 | 0.0013 | |||||

| US817565CF96 / Service Corp International/US | 0.92 | 0.2016 | 0.2016 | ||||||

| CREDIT ACCEPTANC COMPANY GUAR 144A 03/30 6.625 / DBT (US225310AS06) | 0.91 | 2.70 | 0.2001 | 0.0015 | |||||

| XS0992645274 / Transnet SOC Ltd | 0.91 | 3.75 | 0.2000 | 0.0035 | |||||

| XS0992645274 / Transnet SOC Ltd | 0.91 | 3.75 | 0.2000 | 0.0035 | |||||

| XS0992645274 / Transnet SOC Ltd | 0.91 | 3.75 | 0.2000 | 0.0035 | |||||

| AMER SPORTS COMPANY SR SECURED 144A 02/31 6.75 / DBT (US02352NAA72) | 0.91 | 1.67 | 0.1998 | -0.0005 | |||||

| AMER SPORTS COMPANY SR SECURED 144A 02/31 6.75 / DBT (US02352NAA72) | 0.91 | 1.67 | 0.1998 | -0.0005 | |||||

| US753272AA11 / Rand Parent LLC | 0.90 | 58.60 | 0.1983 | 0.0708 | |||||

| US50203TAA43 / LFS Topco LLC | 0.90 | 2.16 | 0.1974 | 0.0005 | |||||

| VEON AMSTERDAM TERM LOAN / LON (BA000HL48) | 0.90 | 1.58 | 0.1973 | -0.0008 | |||||

| VEON AMSTERDAM TERM LOAN / LON (BA000HL48) | 0.90 | 1.58 | 0.1973 | -0.0008 | |||||

| VEON AMSTERDAM TERM LOAN / LON (BA000HL48) | 0.90 | 1.58 | 0.1973 | -0.0008 | |||||

| US853496AC17 / Standard Industries Inc/NJ | 0.90 | -8.83 | 0.1970 | -0.0232 | |||||

| US25461LAA08 / DIRECTV Holdings LLC/DIRECTV Financing Co., Inc. | 0.90 | 2.87 | 0.1968 | 0.0016 | |||||

| US853496AH04 / Standard Industries Inc/NJ | 0.90 | 3.10 | 0.1967 | 0.0022 | |||||

| FORTRESS INTERMEDIATE 3 INC TERM LOAN B / LON (US34966LAB09) | 0.90 | 0.22 | 0.1965 | -0.0035 | |||||

| FORTRESS INTERMEDIATE 3 INC TERM LOAN B / LON (US34966LAB09) | 0.90 | 0.22 | 0.1965 | -0.0035 | |||||

| FORTRESS INTERMEDIATE 3 INC TERM LOAN B / LON (US34966LAB09) | 0.90 | 0.22 | 0.1965 | -0.0035 | |||||

| XS2310487074 / Ardagh Metal Packaging Finance USA LLC | 0.90 | 0.1962 | 0.1962 | ||||||

| XS2734938249 / EPHIOS SUBCO SARL /EUR/ REGD REG S 7.87500000 | 0.89 | 10.15 | 0.1952 | 0.0146 | |||||

| US30251GBC06 / FMG Resources August 2006 Pty Ltd | 0.89 | 30.97 | 0.1947 | 0.0432 | |||||

| ACRISURE LLC / FIN INC SR SECURED 144A 07/32 6.75 / DBT (US004961AA64) | 0.89 | 0.1947 | 0.1947 | ||||||

| COTIVITI CORPORATION 2024 TERM LOAN / LON (US22164MAB37) | 0.89 | 1.37 | 0.1946 | -0.0010 | |||||

| COTIVITI CORPORATION 2024 TERM LOAN / LON (US22164MAB37) | 0.89 | 1.37 | 0.1946 | -0.0010 | |||||

| CMA CGM SA CMA CGM SA / DBT (XS3105514908) | 0.88 | 0.1938 | 0.1938 | ||||||

| PEBBLEBROOK HOTEL/FINANC COMPANY GUAR 144A 10/29 6.375 / DBT (US70510LAA70) | 0.88 | 1.73 | 0.1930 | -0.0006 | |||||

| CRESCENT ENERGY FINANCE CRESCENT ENERGY FINANCE / DBT (US45344LAD55) | 0.88 | -1.35 | 0.1928 | -0.0064 | |||||

| CRESCENT ENERGY FINANCE CRESCENT ENERGY FINANCE / DBT (US45344LAD55) | 0.88 | -1.35 | 0.1928 | -0.0064 | |||||

| CRESCENT ENERGY FINANCE CRESCENT ENERGY FINANCE / DBT (US45344LAD55) | 0.88 | -1.35 | 0.1928 | -0.0064 | |||||

| US90932LAH06 / United Airlines Inc | 0.87 | 2.58 | 0.1916 | 0.0011 | |||||

| US18972EAB11 / Clydesdale Acquisition Holdings, Inc. | 0.87 | 0.81 | 0.1907 | -0.0021 | |||||

| MH SUB I LLC 2024 TERM LOAN B4 / LON (US45567YAP07) | 0.87 | -5.66 | 0.1901 | -0.0153 | |||||

| MH SUB I LLC 2024 TERM LOAN B4 / LON (US45567YAP07) | 0.87 | -5.66 | 0.1901 | -0.0153 | |||||

| MH SUB I LLC 2024 TERM LOAN B4 / LON (US45567YAP07) | 0.87 | -5.66 | 0.1901 | -0.0153 | |||||

| XS2447921896 / Castle UK Finco PLC | 0.87 | 11.04 | 0.1897 | 0.0155 | |||||

| US513075BW03 / Lamar Media Corp | 0.86 | -8.00 | 0.1893 | -0.0204 | |||||

| US513075BW03 / Lamar Media Corp | 0.86 | -8.00 | 0.1893 | -0.0204 | |||||

| USL26915AA33 / FORESEA Holding SA | 0.86 | -1.72 | 0.1876 | -0.0069 | |||||

| US45824TBC80 / INTELSAT JACKSON HOLDINGS S.A. | 0.85 | 7.30 | 0.1869 | 0.0093 | |||||

| WBAD / Walgreens Boots Alliance, Inc. - Depositary Receipt (Common Stock) | 0.85 | 3.79 | 0.1861 | 0.0034 | |||||

| IGT LOTTERY HOLDINGS BV IGT LOTTERY HOLDINGS BV / DBT (XS2893175625) | 0.84 | 10.51 | 0.1845 | 0.0143 | |||||

| IGT LOTTERY HOLDINGS BV IGT LOTTERY HOLDINGS BV / DBT (XS2893175625) | 0.84 | 10.51 | 0.1845 | 0.0143 | |||||

| US958102AR62 / Western Digital Corp | 0.84 | 5.39 | 0.1844 | 0.0060 | |||||

| FLORA FOOD MANAGEMENT BV SR SECURED 144A 07/29 6.875 / DBT (XS2849520908) | 0.84 | 8.83 | 0.1838 | 0.0116 | |||||

| CONTOURGLOBAL POWER HLDG SR SECURED 144A 02/30 5 / DBT (XS2988573080) | 0.83 | 10.92 | 0.1826 | 0.0147 | |||||

| CONTOURGLOBAL POWER HLDG SR SECURED 144A 02/30 5 / DBT (XS2988573080) | 0.83 | 10.92 | 0.1826 | 0.0147 | |||||

| CONTOURGLOBAL POWER HLDG SR SECURED 144A 02/30 5 / DBT (XS2988573080) | 0.83 | 10.92 | 0.1826 | 0.0147 | |||||

| INEOS FINANCE PLC SR SECURED 144A 08/30 5.625 / DBT (XS2991272068) | 0.83 | 6.12 | 0.1824 | 0.0072 | |||||

| US46115HBQ92 / Intesa Sanpaolo SpA | 0.83 | 2.60 | 0.1816 | 0.0010 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 0.83 | 2.48 | 0.1812 | 0.0009 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 0.83 | 2.48 | 0.1812 | 0.0009 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 0.83 | 2.48 | 0.1812 | 0.0009 | |||||

| ARIS WATER HOLDINGS LLC COMPANY GUAR 144A 04/30 7.25 / DBT (US04041NAA00) | 0.83 | 8.83 | 0.1811 | 0.0114 | |||||

| ARIS WATER HOLDINGS LLC COMPANY GUAR 144A 04/30 7.25 / DBT (US04041NAA00) | 0.83 | 8.83 | 0.1811 | 0.0114 | |||||

| PRIME HEALTHCARE SERVICE PRIME HEALTHCARE SERVICE / DBT (US74165HAC25) | 0.82 | 8.48 | 0.1796 | 0.0107 | |||||

| RFNA LP SR UNSECURED 144A 02/30 7.875 / DBT (US74984AAA07) | 0.82 | 38.11 | 0.1796 | 0.0470 | |||||

| XS2351480996 / Deuce Finco Plc | 0.82 | 7.35 | 0.1794 | 0.0090 | |||||

| TOUCAN FINCO LTD/CAN/US SR SECURED 144A 05/30 9.5 / DBT (US89157UAA51) | 0.82 | 0.1794 | 0.1794 | ||||||

| 944YFGII6 / SOFTBANK VISION FUND II FIXED TERM LOAN | 0.82 | -4.11 | 0.1790 | -0.0114 | |||||

| US81172QAA22 / Seadrill Finance Ltd. | 0.82 | 5.16 | 0.1787 | 0.0055 | |||||

| US36485MAL37 / Garda World Security Corp | 0.81 | 4.01 | 0.1767 | 0.0036 | |||||

| KASEYA INC 2025 1L TERM LOAN B / LON (US48578AAB44) | 0.80 | 0.1758 | 0.1758 | ||||||

| CLEARWATER ANALYTICS LLC 2025 TERM LOAN B / LON (US18512EAF97) | 0.80 | 0.1756 | 0.1756 | ||||||

| US45780RAA95 / Installed Building Products Inc | 0.80 | 1.27 | 0.1755 | -0.0011 | |||||

| US00253XAB73 / American Airlines Inc/AAdvantage Loyalty IP Ltd | 0.80 | 2.04 | 0.1753 | 0.0002 | |||||

| US384701AA65 / GPC Merger Sub Inc | 0.80 | 9.00 | 0.1751 | 0.0113 | |||||

| US008911BK48 / Air Canada | 0.79 | 1.28 | 0.1737 | -0.0013 | |||||

| XS2592659671 / VF Corp | 0.79 | 5.60 | 0.1736 | 0.0059 | |||||

| XS2393001891 / Grifols Escrow Issuer SA | 0.79 | 13.34 | 0.1733 | 0.0174 | |||||

| VERVE GROUP SE SR UNSECURED 144A REGS 04/29 V / DBT (SE0023848429) | 0.79 | 8.37 | 0.1732 | 0.0101 | |||||

| VERVE GROUP SE SR UNSECURED 144A REGS 04/29 V / DBT (SE0023848429) | 0.79 | 8.37 | 0.1732 | 0.0101 | |||||

| VERVE GROUP SE SR UNSECURED 144A REGS 04/29 V / DBT (SE0023848429) | 0.79 | 8.37 | 0.1732 | 0.0101 | |||||

| DCLI BIDCO LLC 2ND MORTGAGE 144A 11/29 7.75 / DBT (US233104AA67) | 0.79 | -29.09 | 0.1722 | -0.0753 | |||||

| DCLI BIDCO LLC 2ND MORTGAGE 144A 11/29 7.75 / DBT (US233104AA67) | 0.79 | -29.09 | 0.1722 | -0.0753 | |||||

| XS2341724172 / Mahle GmbH | 0.79 | 15.27 | 0.1721 | 0.0198 | |||||

| US06738ECN31 / BARCLAYS PLC 9.625%/VAR PERP | 0.78 | 1.30 | 0.1708 | -0.0012 | |||||

| FR001400EFQ6 / Electricite de France SA | 0.78 | 9.41 | 0.1708 | 0.0116 | |||||

| RFR USD SOFR/3.25000 06/18/25-30Y CME / DIR (EZVR6JLJ0ZB5) | 0.78 | 0.1703 | 0.1703 | ||||||

| US77340RAT41 / Rockies Express Pipeline LLC | 0.78 | 3.19 | 0.1701 | 0.0021 | |||||

| US45258LAA52 / Imola Merger Corp | 0.77 | 1.58 | 0.1694 | -0.0005 | |||||

| US05508WAC91 / B&G Foods Inc | 0.77 | 119.03 | 0.1690 | 0.0904 | |||||

| US74965LAB71 / RLJ Lodging Trust LP | 0.77 | 4.05 | 0.1689 | 0.0033 | |||||

| US48242WAC01 / KBR Inc | 0.77 | 1.18 | 0.1688 | -0.0014 | |||||

| US68622TAA97 / Organon Finance 1 LLC | 0.77 | 2.81 | 0.1688 | 0.0015 | |||||

| US59565JAA97 / MIDAS OPCO HOLDINGS LLC | 0.77 | 0.52 | 0.1679 | -0.0025 | |||||

| US87901JAH86 / TEGNA Inc | 0.76 | 2.83 | 0.1676 | 0.0015 | |||||

| US62886EBA55 / NCR Corp | 0.76 | 3.25 | 0.1675 | 0.0023 | |||||

| XS2431015655 / VZ Secured Financing BV | 0.76 | 12.95 | 0.1665 | 0.0161 | |||||

| FREEDOM MORTGAGE HOLD SR UNSECURED 144A 04/32 8.375 / DBT (US35641AAC27) | 0.76 | 3.41 | 0.1663 | 0.0024 | |||||

| FREEDOM MORTGAGE HOLD SR UNSECURED 144A 04/32 8.375 / DBT (US35641AAC27) | 0.76 | 3.41 | 0.1663 | 0.0024 | |||||

| US28414HAG83 / Elanco Animal Health Inc | 0.76 | 2.72 | 0.1657 | 0.0013 | |||||

| SHC / Sotera Health Company | 0.76 | 2.44 | 0.1655 | 0.0006 | |||||

| US90290PAS39 / U.S. Renal Care, Inc., 1st Lien Term Loan C | 0.75 | 1.21 | 0.1652 | -0.0012 | |||||

| US00867FAA66 / Ahead DB Holdings LLC | 0.75 | 2.73 | 0.1650 | 0.0012 | |||||

| US92328MAB90 / Venture Global Calcasieu Pass LLC | 0.74 | 1.93 | 0.1624 | -0.0001 | |||||

| US85172FAR01 / Springleaf Finance Corp 5.375% 11/15/2029 | 0.74 | 3.36 | 0.1618 | 0.0022 | |||||

| GLOBAL MEDICAL RESPONSE SR SECURED 144A 10/28 9.5 / DBT (US37960BAB18) | 0.74 | 0.68 | 0.1615 | -0.0020 | |||||

| XS2353416386 / Energizer Gamma Acquisition BV | 0.73 | 11.91 | 0.1607 | 0.0142 | |||||

| US071705AA56 / Bausch & Lomb Escrow Corp | 0.73 | 0.55 | 0.1603 | -0.0022 | |||||

| US18912UAA07 / Cloud Software Group Inc | 0.73 | 4.01 | 0.1592 | 0.0030 | |||||

| TGS / TGS ASA | 0.73 | 0.14 | 0.1590 | -0.0030 | |||||

| TGS / TGS ASA | 0.73 | 0.14 | 0.1590 | -0.0030 | |||||

| TGS / TGS ASA | 0.73 | 0.14 | 0.1590 | -0.0030 | |||||

| US432833AN19 / HILTON DOMESTIC OPERATING CO INC 3.625% 02/15/2032 144A | 0.73 | 3.42 | 0.1590 | 0.0021 | |||||

| 937WQA909 / HEALOGICS INC EQTY009S3 | 0.04 | 0.00 | 0.72 | -25.82 | 0.1588 | -0.0596 | |||

| 53219LAH2 / LifePoint Health, Inc. Bond | 0.72 | 8.23 | 0.1585 | 0.0091 | |||||

| US82967NBJ63 / Sirius XM Radio Inc | 0.72 | 2.86 | 0.1580 | 0.0015 | |||||

| FLORA FOOD MANAGEMENT BV SR SECURED REGS 07/29 6.875 / DBT (XS2848926239) | 0.72 | 8.79 | 0.1575 | 0.0100 | |||||

| FLORA FOOD MANAGEMENT BV SR SECURED REGS 07/29 6.875 / DBT (XS2848926239) | 0.72 | 8.79 | 0.1575 | 0.0100 | |||||

| FLORA FOOD MANAGEMENT BV SR SECURED REGS 07/29 6.875 / DBT (XS2848926239) | 0.72 | 8.79 | 0.1575 | 0.0100 | |||||

| CELANESE US HOLDINGS LLC COMPANY GUAR 04/30 6.5 / DBT (US15089QAZ72) | 0.72 | 3.17 | 0.1572 | 0.0017 | |||||

| US70932MAD92 / PennyMac Financial Services Inc | 0.72 | 0.1570 | 0.1570 | ||||||

| BEACON MOBILITY CORP SR SECURED 144A 08/30 7.25 / DBT (US073644AA49) | 0.72 | 0.1568 | 0.1568 | ||||||

| BEACON MOBILITY CORP SR SECURED 144A 08/30 7.25 / DBT (US073644AA49) | 0.72 | 0.1568 | 0.1568 | ||||||

| BEACON MOBILITY CORP SR SECURED 144A 08/30 7.25 / DBT (US073644AA49) | 0.72 | 0.1568 | 0.1568 | ||||||

| XS2010031214 / Virgin Media Secured Finance PLC | 0.71 | 12.26 | 0.1566 | 0.0144 | |||||

| US12429TAD63 / Mauser Packaging Solutions Holding Co | 0.71 | 3.79 | 0.1561 | 0.0026 | |||||

| XS2066744231 / Carnival PLC | 0.71 | 2.15 | 0.1561 | 0.0002 | |||||

| XS2066744231 / Carnival PLC | 0.71 | 2.15 | 0.1561 | 0.0002 | |||||

| XS2451803063 / BAYER AG 5.375%/VAR 03/25/2082 REGS | 0.71 | 11.42 | 0.1561 | 0.0132 | |||||

| LION/POLARIS LUX 4 SA SR SECURED REGS 07/29 VAR / DBT (XS2852970529) | 0.71 | 9.55 | 0.1559 | 0.0109 | |||||

| LION/POLARIS LUX 4 SA SR SECURED REGS 07/29 VAR / DBT (XS2852970529) | 0.71 | 9.55 | 0.1559 | 0.0109 | |||||

| ASCENT RESOURCES/ARU FIN SR UNSECURED 144A 07/33 6.625 / DBT (US04364VBA08) | 0.71 | 0.1558 | 0.1558 | ||||||

| ASCENT RESOURCES/ARU FIN SR UNSECURED 144A 07/33 6.625 / DBT (US04364VBA08) | 0.71 | 0.1558 | 0.1558 | ||||||

| ASCENT RESOURCES/ARU FIN SR UNSECURED 144A 07/33 6.625 / DBT (US04364VBA08) | 0.71 | 0.1558 | 0.1558 | ||||||

| CZECHOSLOVAK GROUP CZECHOSLOVAK GROUP / DBT (XS3105190147) | 0.71 | 0.1550 | 0.1550 | ||||||

| WAYFAIR LLC SR SECURED 144A 09/30 7.75 / DBT (US94419NAB38) | 0.71 | 4.28 | 0.1548 | 0.0033 | |||||

| US09739DAD21 / Boise Cascade Co | 0.71 | -12.31 | 0.1547 | -0.0251 | |||||

| VIRI / Viridien Société anonyme | 0.70 | 5.56 | 0.1541 | 0.0052 | |||||

| VIRI / Viridien Société anonyme | 0.70 | 5.56 | 0.1541 | 0.0052 | |||||

| US91832VAA26 / VOC ESCROW LTD | 0.70 | 1.90 | 0.1528 | 0.0000 | |||||

| US31556TAC36 / Fertitta Entertainment LLC / Fertitta Entertainment Finance Co Inc | 0.69 | 6.63 | 0.1518 | 0.0067 | |||||

| XS2342057143 / Allied Universal Holdco LLC/Allied Universal Finance Corp/Atlas Luxco 4 Sarl | 0.69 | -28.91 | 0.1517 | -0.1549 | |||||

| US911365BP80 / United Rentals North America Inc | 0.69 | 55.88 | 0.1511 | 0.0523 | |||||

| NEWMARK GROUP INC SR UNSECURED 01/29 7.5 / DBT (US65158NAD49) | 0.69 | 0.88 | 0.1508 | -0.0017 | |||||

| NEWMARK GROUP INC SR UNSECURED 01/29 7.5 / DBT (US65158NAD49) | 0.69 | 0.88 | 0.1508 | -0.0017 | |||||

| US024747AF43 / American Builders & Contractors Supply Co., Inc. | 0.69 | 2.39 | 0.1502 | 0.0004 | |||||

| US88033GDM96 / CORP. NOTE | 0.68 | 2.88 | 0.1489 | 0.0014 | |||||

| US1248EPCN14 / CORPORATE BONDS | 0.68 | 7.31 | 0.1481 | 0.0073 | |||||

| US02156LAC54 / Altice France SA/France | 0.67 | 5.31 | 0.1477 | 0.0046 | |||||

| US81725WAK99 / Sensata Technologies BV | 0.67 | 3.42 | 0.1461 | 0.0021 | |||||

| XS1622694617 / Heathrow Finance PLC | 0.67 | 7.94 | 0.1461 | 0.0080 | |||||

| US49461MAB63 / Kinetik Holdings LP | 0.67 | -12.73 | 0.1458 | -0.0246 | |||||

| US024747AG26 / CORP. NOTE | 0.66 | 3.12 | 0.1453 | 0.0016 | |||||

| US513075BW03 / Lamar Media Corp | 0.66 | 2.18 | 0.1442 | 0.0005 | |||||

| US88632QAE35 / Picard Midco, Inc. | 0.66 | 3.80 | 0.1439 | 0.0026 | |||||

| XS2187646901 / Virgin Media Vendor Financing Notes III DAC | 0.66 | 9.35 | 0.1437 | 0.0097 | |||||

| US12511VAA61 / CDI Escrow Issuer Inc | 0.65 | 2.52 | 0.1430 | 0.0008 | |||||

| US893647BS53 / TransDigm Inc | 0.65 | 1.41 | 0.1422 | -0.0006 | |||||

| US46115HBS58 / Intesa Sanpaolo SpA | 0.65 | 0.62 | 0.1419 | -0.0020 | |||||

| US36485MAK53 / Garda World Security Corp | 0.65 | -11.51 | 0.1417 | -0.0216 | |||||

| XS2199597456 / TK Elevator Midco GmbH | 0.64 | 9.62 | 0.1399 | 0.0097 | |||||

| US70932MAD92 / PennyMac Financial Services Inc | 0.64 | 2.08 | 0.1397 | 0.0001 | |||||

| US90346KAB52 / USI Inc/NY | 0.63 | 3.43 | 0.1389 | 0.0020 | |||||

| TREASURY BILL 09/25 0.00000 / DBT (US912797QU41) | 0.63 | 0.1388 | 0.1388 | ||||||

| US857691AH24 / Station Casinos LLC | 0.63 | 4.12 | 0.1387 | 0.0030 | |||||

| XAF6628DAN49 / Numericable U.S. LLC, Term Loan B14 | 0.63 | 0.80 | 0.1384 | -0.0016 | |||||

| VK / Vallourec S.A. | 0.63 | -14.07 | 0.1380 | -0.0256 | |||||

| VK / Vallourec S.A. | 0.63 | -14.07 | 0.1380 | -0.0256 | |||||

| VK / Vallourec S.A. | 0.63 | -14.07 | 0.1380 | -0.0256 | |||||

| MCGRAW HILL EDUCATION SR SECURED 144A 09/31 7.375 / DBT (US58064LAA26) | 0.63 | 3.81 | 0.1373 | 0.0023 | |||||

| WASTE PRO USA INC SR UNSECURED 144A 02/33 7 / DBT (US94107JAC71) | 0.62 | -11.36 | 0.1369 | -0.0205 | |||||

| WASTE PRO USA INC SR UNSECURED 144A 02/33 7 / DBT (US94107JAC71) | 0.62 | -11.36 | 0.1369 | -0.0205 | |||||

| NORTHRIVER MIDSTREAM FIN NORTHRIVER MIDSTREAM FIN / DBT (US66679NAB64) | 0.62 | 2.48 | 0.1363 | 0.0008 | |||||

| NORTHRIVER MIDSTREAM FIN NORTHRIVER MIDSTREAM FIN / DBT (US66679NAB64) | 0.62 | 2.48 | 0.1363 | 0.0008 | |||||

| NORTHRIVER MIDSTREAM FIN NORTHRIVER MIDSTREAM FIN / DBT (US66679NAB64) | 0.62 | 2.48 | 0.1363 | 0.0008 | |||||

| S2TW34 / Starwood Property Trust, Inc. - Depositary Receipt (Common Stock) | 0.62 | 4.20 | 0.1361 | 0.0029 | |||||

| XS2582796202 / Italmatch Chemicals SpA | 0.62 | 9.54 | 0.1360 | 0.0093 | |||||

| US64069JAC62 / Neptune Bidco US Inc 2022 USD Term Loan B | 0.62 | 9.38 | 0.1355 | 0.0092 | |||||

| SURGERY CENTER HOLDINGS INC 04/32 7.25 / DBT (US86881WAF95) | 0.61 | 3.03 | 0.1342 | 0.0014 | |||||

| SURGERY CENTER HOLDINGS INC 04/32 7.25 / DBT (US86881WAF95) | 0.61 | 3.03 | 0.1342 | 0.0014 | |||||

| SURGERY CENTER HOLDINGS INC 04/32 7.25 / DBT (US86881WAF95) | 0.61 | 3.03 | 0.1342 | 0.0014 | |||||

| US92047WAG69 / Valvoline Inc | 0.61 | 4.09 | 0.1341 | 0.0028 | |||||

| STEPSTONE GROUP M 2 GMBH THE EUR TERM LOAN B / LON (BA000BNR8) | 0.61 | 7.24 | 0.1332 | 0.0066 | |||||

| PRIMO / TRITON WATER HLD SR SECURED 144A 04/29 4.375 / DBT (US74168RAB96) | 0.61 | 33.19 | 0.1330 | 0.0313 | |||||

| POST / Post Holdings, Inc. | 0.60 | 2.03 | 0.1326 | 0.0002 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.60 | 2.55 | 0.1324 | 0.0006 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.60 | 2.55 | 0.1324 | 0.0006 | |||||

| MERLIN ENTERTAINMENTS GR SR SECURED 144A 02/31 7.375 / DBT (US59010UAA51) | 0.60 | -5.49 | 0.1323 | -0.0103 | |||||

| AETHON UN/AETHIN UN FIN SR UNSECURED 144A 10/29 7.5 / DBT (US00810GAD60) | 0.60 | 3.08 | 0.1323 | 0.0015 | |||||

| US35640YAJ64 / Freedom Mortgage Corp. | 0.60 | 0.67 | 0.1318 | -0.0017 | |||||

| US91845AAA34 / VZ Secured Financing BV | 0.60 | 2.39 | 0.1317 | 0.0005 | |||||

| US418751AL75 / HAT HOLDINGS I LLC/HAT REGD 144A P/P 8.00000000 | 0.60 | 0.67 | 0.1315 | -0.0017 | |||||

| US983133AA70 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp 5.125% 10/01/2029 144A | 0.60 | 3.47 | 0.1307 | 0.0019 | |||||

| KGS / Kodiak Gas Services, Inc. | 0.60 | 1.54 | 0.1305 | -0.0006 | |||||

| KGS / Kodiak Gas Services, Inc. | 0.60 | 1.54 | 0.1305 | -0.0006 | |||||

| KGS / Kodiak Gas Services, Inc. | 0.60 | 1.54 | 0.1305 | -0.0006 | |||||

| WARNERMEDIA HOLDINGS INC COMPANY GUAR 03/32 4.279 / DBT (US55903VBQ59) | 0.59 | 0.1298 | 0.1298 | ||||||

| US505742AP10 / Ladder Capital Finance Holdings LLLP / Ladder Capital Finance Corp | 0.58 | 2.28 | 0.1281 | 0.0003 | |||||

| XS2080766475 / Standard Industries Inc/NJ | 0.58 | 10.84 | 0.1279 | 0.0103 | |||||

| DE000A254QA9 / WEPA Hygieneprodukte GmbH | 0.58 | 10.44 | 0.1276 | 0.0098 | |||||

| US85205TAR14 / Spirit AeroSystems Inc | 0.58 | -0.17 | 0.1271 | -0.0026 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0.58 | 0.1269 | 0.1269 | ||||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0.58 | 0.1269 | 0.1269 | ||||||

| US442722AB08 / Howard Midstream Energy Partners LLC | 0.58 | 0.70 | 0.1267 | -0.0016 | |||||

| WINDSTREAM SERVICES/ESCR SR SECURED 144A 10/31 8.25 / DBT (US97381AAA07) | 0.58 | 2.86 | 0.1264 | 0.0011 | |||||

| US04625PAA93 / ARMOR HOLDCO IN 8.5 11/29 | 0.58 | -1.37 | 0.1262 | -0.0042 | |||||

| US654740BT54 / Nissan Motor Acceptance Corp | 0.57 | -0.52 | 0.1252 | -0.0033 | |||||

| PANAMA INFRASTRUCTURE SR SECURED 144A 04/32 0.00000 / DBT (US69828QAD97) | 0.57 | 0.89 | 0.1248 | -0.0013 | |||||

| FR0013524865 / Auchan Holding SA | 0.57 | 10.51 | 0.1247 | 0.0098 | |||||

| ASTON MARTIN CAPITAL HOL ASTON MARTIN CAPITAL HOL / DBT (US04625HAJ86) | 0.57 | 4.60 | 0.1247 | 0.0033 | |||||

| US90320BAA70 / UPC Broadband Finco BV | 0.57 | 3.85 | 0.1245 | 0.0024 | |||||

| US78410GAG91 / SBA Communications Corp | 0.57 | 3.47 | 0.1243 | 0.0018 | |||||

| TIDEWATER INC SR UNSECURED 144A 07/30 9.125 / DBT (US88642RAE99) | 0.57 | 0.1241 | 0.1241 | ||||||

| TIDEWATER INC SR UNSECURED 144A 07/30 9.125 / DBT (US88642RAE99) | 0.57 | 0.1241 | 0.1241 | ||||||

| TIDEWATER INC SR UNSECURED 144A 07/30 9.125 / DBT (US88642RAE99) | 0.57 | 0.1241 | 0.1241 | ||||||

| US00253XAA90 / American Airlines Inc/AAdvantage Loyalty IP Ltd | 0.57 | -19.97 | 0.1240 | -0.0340 | |||||

| US28504KAA51 / Electricite de France SA | 0.57 | 0.36 | 0.1239 | -0.0021 | |||||

| VENTURE GLOBAL PLAQUE SR SECURED 144A 05/33 7.5 / DBT (US922966AA47) | 0.56 | 0.1233 | 0.1233 | ||||||

| VENTURE GLOBAL PLAQUE SR SECURED 144A 05/33 7.5 / DBT (US922966AA47) | 0.56 | 0.1233 | 0.1233 | ||||||

| VENTURE GLOBAL PLAQUE SR SECURED 144A 05/33 7.5 / DBT (US922966AA47) | 0.56 | 0.1233 | 0.1233 | ||||||

| XS2294186965 / CAB SELAS | 0.56 | 10.43 | 0.1230 | 0.0093 | |||||

| US02154CAH60 / Altice Financing SA | 0.55 | -0.18 | 0.1202 | -0.0026 | |||||

| CMA CGM SA CMA CGM SA / DBT (XS2852136816) | 0.55 | 10.04 | 0.1202 | 0.0088 | |||||

| CMA CGM SA CMA CGM SA / DBT (XS2852136816) | 0.55 | 10.04 | 0.1202 | 0.0088 | |||||

| XS2391352932 / Olympus Water US Holding Corp | 0.54 | 9.04 | 0.1190 | 0.0076 | |||||

| CONTOURGLOBAL POWER HLDG SR SECURED 144A 02/30 6.75 / DBT (US21220LAB99) | 0.54 | 2.66 | 0.1187 | 0.0007 | |||||

| CONTOURGLOBAL POWER HLDG SR SECURED 144A 02/30 6.75 / DBT (US21220LAB99) | 0.54 | 2.66 | 0.1187 | 0.0007 | |||||

| CONTOURGLOBAL POWER HLDG SR SECURED 144A 02/30 6.75 / DBT (US21220LAB99) | 0.54 | 2.66 | 0.1187 | 0.0007 | |||||

| ECPG / Encore Capital Group, Inc. | 0.53 | 1.53 | 0.1167 | -0.0005 | |||||

| KRONOS INTERNATIONAL INC SR SECURED REGS 03/29 9.5 / DBT (XS2763521643) | 0.53 | -62.01 | 0.1163 | -0.1955 | |||||

| KRONOS INTERNATIONAL INC SR SECURED REGS 03/29 9.5 / DBT (XS2763521643) | 0.53 | -62.01 | 0.1163 | -0.1955 | |||||

| US84748EAF79 / SPECIALTY BUILDING TERM B 1LN 10/15/2028 | 0.52 | 0.58 | 0.1150 | -0.0015 | |||||

| VERITIV CORPORATION TERM LOAN B / LON (US92338TAB26) | 0.52 | 0.58 | 0.1150 | -0.0015 | |||||

| US82983MAB63 / Sitio Royalties Operating Partnership LP | 0.52 | 1.75 | 0.1148 | -0.0003 | |||||

| DYE + DURHAM LTD 04/29 8.625 / DBT (US267486AA63) | 0.52 | 1.55 | 0.1148 | -0.0005 | |||||

| US02007VAA89 / Allwyn Entertainment Financing UK PLC | 0.52 | 1.16 | 0.1144 | -0.0011 | |||||

| US146869AM47 / Carvana Co. | 0.52 | 6.76 | 0.1143 | 0.0050 | |||||

| US67059TAH86 / NuStar Logistics LP | 0.52 | 2.57 | 0.1136 | 0.0006 | |||||

| JEFFERSON CAPITAL HOLDIN COMPANY GUAR 144A 05/30 8.25 / DBT (US472481AC47) | 0.52 | 0.1136 | 0.1136 | ||||||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 0.52 | 0.1132 | 0.1132 | ||||||

| ACHC / Acadia Healthcare Company, Inc. | 0.52 | 3.00 | 0.1130 | 0.0013 | |||||

| ACHC / Acadia Healthcare Company, Inc. | 0.52 | 3.00 | 0.1130 | 0.0013 | |||||

| ACHC / Acadia Healthcare Company, Inc. | 0.52 | 3.00 | 0.1130 | 0.0013 | |||||

| UIS / Unisys Corporation | 0.52 | 0.1130 | 0.1130 | ||||||

| CLYDESDALE ACQUISITION SR SECURED 144A 04/32 6.75 / DBT (US18972EAD76) | 0.51 | 27.30 | 0.1125 | 0.0225 | |||||

| CLYDESDALE ACQUISITION SR SECURED 144A 04/32 6.75 / DBT (US18972EAD76) | 0.51 | 27.30 | 0.1125 | 0.0225 | |||||

| US98980BAA17 / ZipRecruiter, Inc. | 0.51 | -3.03 | 0.1124 | -0.0057 | |||||

| COREWEAVE INC COMPANY GUAR 144A 06/30 9.25 / DBT (US21873SAB43) | 0.51 | 0.1121 | 0.1121 | ||||||

| COREWEAVE INC COMPANY GUAR 144A 06/30 9.25 / DBT (US21873SAB43) | 0.51 | 0.1121 | 0.1121 | ||||||

| OLYMPUS WTR US HLDG CORP OLYMPUS WTR US HLDG CORP / DBT (US681639AD27) | 0.51 | 3.87 | 0.1119 | 0.0021 | |||||

| OLYMPUS WTR US HLDG CORP OLYMPUS WTR US HLDG CORP / DBT (US681639AD27) | 0.51 | 3.87 | 0.1119 | 0.0021 | |||||

| OLYMPUS WTR US HLDG CORP OLYMPUS WTR US HLDG CORP / DBT (US681639AD27) | 0.51 | 3.87 | 0.1119 | 0.0021 | |||||

| US81180WBD20 / Seagate HDD Cayman | 0.51 | 1.20 | 0.1115 | -0.0008 | |||||

| US63861CAD11 / Nationstar Mortgage Holdings Inc | 0.51 | 1.40 | 0.1115 | -0.0006 | |||||

| XS2582389156 / Telefonica Europe BV | 0.51 | 10.02 | 0.1108 | 0.0082 | |||||

| PRIMO / TRITON WATER HLD COMPANY GUAR 144A 04/29 6.25 / DBT (US74168RAC79) | 0.50 | 0.80 | 0.1105 | -0.0011 | |||||

| PRIMO / TRITON WATER HLD COMPANY GUAR 144A 04/29 6.25 / DBT (US74168RAC79) | 0.50 | 0.80 | 0.1105 | -0.0011 | |||||

| PRIMO / TRITON WATER HLD COMPANY GUAR 144A 04/29 6.25 / DBT (US74168RAC79) | 0.50 | 0.80 | 0.1105 | -0.0011 | |||||

| US432833AJ07 / HILTON DOMESTIC OPERATING CO INC 3.75% 05/01/2029 144A | 0.50 | 2.65 | 0.1104 | 0.0009 | |||||

| GRUPO ANTOLIN IRAUSA SA GRUPO ANTOLIN IRAUSA SA / DBT (XS2867238532) | 0.50 | 3.72 | 0.1102 | 0.0018 | |||||

| WAYFAIR LLC SR SECURED 144A 10/29 7.25 / DBT (US94419NAA54) | 0.50 | 4.38 | 0.1099 | 0.0026 | |||||

| US75606NAC39 / RealPage Inc | 0.50 | 0.00 | 0.1096 | -0.0023 | |||||

| US75606NAC39 / RealPage Inc | 0.50 | 0.00 | 0.1096 | -0.0023 | |||||

| BARNES GROUP INC 2025 TERM LOAN B / LON (US38021CAC29) | 0.50 | 0.60 | 0.1096 | -0.0015 | |||||

| BARNES GROUP INC 2025 TERM LOAN B / LON (US38021CAC29) | 0.50 | 0.60 | 0.1096 | -0.0015 | |||||

| US552953CD18 / Mgm Resorts Bond | 0.50 | 1.01 | 0.1095 | -0.0010 | |||||

| ASPIRE BAKERIES HOLDINGS LLC TERM LOAN / LON (BA00008X6) | 0.50 | -0.20 | 0.1093 | -0.0023 | |||||

| ASPIRE BAKERIES HOLDINGS LLC TERM LOAN / LON (BA00008X6) | 0.50 | -0.20 | 0.1093 | -0.0023 | |||||

| ASPIRE BAKERIES HOLDINGS LLC TERM LOAN / LON (BA00008X6) | 0.50 | -0.20 | 0.1093 | -0.0023 | |||||

| US53219LAW90 / LIFEPOINT HEALTH INC | 0.50 | 1.64 | 0.1089 | -0.0005 | |||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 0.50 | 2.69 | 0.1089 | 0.0008 | |||||

| SCIENTIFIC GAMES HOLDINGS LP 2024 USD TERM LOAN B / LON (US80875CAE75) | 0.50 | 0.20 | 0.1088 | -0.0019 | |||||

| SCIENTIFIC GAMES HOLDINGS LP 2024 USD TERM LOAN B / LON (US80875CAE75) | 0.50 | 0.20 | 0.1088 | -0.0019 | |||||

| SCIENTIFIC GAMES HOLDINGS LP 2024 USD TERM LOAN B / LON (US80875CAE75) | 0.50 | 0.20 | 0.1088 | -0.0019 | |||||

| PRIMO BRANDS CORPORATION 2025 TERM LOAN B / LON (US89678QAD88) | 0.50 | 0.81 | 0.1087 | -0.0013 | |||||

| PRIMO BRANDS CORPORATION 2025 TERM LOAN B / LON (US89678QAD88) | 0.50 | 0.81 | 0.1087 | -0.0013 | |||||

| PRIMO BRANDS CORPORATION 2025 TERM LOAN B / LON (US89678QAD88) | 0.50 | 0.81 | 0.1087 | -0.0013 | |||||

| US12543DBG43 / CHS/Community Health Systems Inc | 0.49 | 28.80 | 0.1080 | 0.0226 | |||||

| PICARD GROUPE SAS SR SECURED REGS 07/29 6.375 / DBT (XS2852970016) | 0.49 | 10.56 | 0.1079 | 0.0083 | |||||

| US85205TAK60 / Spirit AeroSystems, Inc. | 0.49 | 2.29 | 0.1078 | 0.0005 | |||||

| US02156TAB08 / Altice France Holding SA | 0.49 | 18.49 | 0.1069 | 0.0150 | |||||

| SCE.PRK / SCE Trust V - Preferred Security | 0.49 | 0.1064 | 0.1064 | ||||||

| US70052LAC72 / Park Intermediate Holdings LLC / PK Domestic Property LLC / PK Finance Co-Issuer | 0.48 | 3.64 | 0.1063 | 0.0019 | |||||

| CIDRON AIDA FINCO SARL SR SECURED 144A 10/31 7 / DBT (XS3046352665) | 0.48 | 0.1058 | 0.1058 | ||||||

| US59833DAB64 / Midwest Gaming Borrower LLC | 0.48 | 2.56 | 0.1056 | 0.0007 | |||||

| US12543DBH26 / CHS/COMMUNITY HEALTH SYS SR SECURED 144A 01/29 6 | 0.48 | 8.33 | 0.1055 | 0.0061 | |||||

| US43284MAA62 / Hilton Grand Vacations Borrower Escrow LLC / Hilton Grand Vacations Borrower Esc | 0.48 | 2.78 | 0.1055 | 0.0007 | |||||

| US98310WAS70 / Wyndham Destinations Inc | 0.48 | 0.42 | 0.1053 | -0.0017 | |||||

| ESSENDI SA SR SECURED 144A 11/31 5.5 / DBT (XS2926264875) | 0.48 | 12.15 | 0.1052 | 0.0095 | |||||

| ESSENDI SA SR SECURED 144A 11/31 5.5 / DBT (XS2926264875) | 0.48 | 12.15 | 0.1052 | 0.0095 | |||||

| US682691AC47 / OneMain Finance Corp | 0.48 | 3.68 | 0.1052 | 0.0018 | |||||

| US18064PAC32 / Clarivate Science Holdings Corp | 0.48 | 3.23 | 0.1051 | 0.0014 | |||||

| CRESCENT ENERGY FINANCE CRESCENT ENERGY FINANCE / DBT (US45344LAE39) | 0.48 | -0.83 | 0.1049 | -0.0030 | |||||

| CRESCENT ENERGY FINANCE CRESCENT ENERGY FINANCE / DBT (US45344LAE39) | 0.48 | -0.83 | 0.1049 | -0.0030 | |||||

| US043436AX21 / Asbury Automotive Group Inc | 0.48 | 0.1043 | 0.1043 | ||||||

| GOLDEN STATE FOOD LLC TERM LOAN B / LON (US38121NAC74) | 0.47 | 0.00 | 0.1040 | -0.0021 | |||||

| GOLDEN STATE FOOD LLC TERM LOAN B / LON (US38121NAC74) | 0.47 | 0.00 | 0.1040 | -0.0021 | |||||

| GOLDEN STATE FOOD LLC TERM LOAN B / LON (US38121NAC74) | 0.47 | 0.00 | 0.1040 | -0.0021 | |||||

| CELLNEX TELECOM SA SNR SE ICE / DCR (EZ848DLTLRT1) | 0.47 | 9.98 | 0.1039 | 0.0074 | |||||

| US855170AA41 / Star Parent Inc | 0.47 | 6.53 | 0.1039 | 0.0046 | |||||

| TEAMSYSTEM SPA TEAMSYSTEM SPA / DBT (XS2864287466) | 0.47 | 9.01 | 0.1036 | 0.0066 | |||||

| TEAMSYSTEM SPA TEAMSYSTEM SPA / DBT (XS2864287466) | 0.47 | 9.01 | 0.1036 | 0.0066 | |||||

| TEAMSYSTEM SPA TEAMSYSTEM SPA / DBT (XS2864287466) | 0.47 | 9.01 | 0.1036 | 0.0066 | |||||

| IPD 3 BV IPD 3 BV / DBT (XS2844404710) | 0.47 | 8.53 | 0.1034 | 0.0063 | |||||

| IPD 3 BV IPD 3 BV / DBT (XS2844404710) | 0.47 | 8.53 | 0.1034 | 0.0063 | |||||

| US00751YAF34 / Advance Auto Parts Inc | 0.47 | 0.1024 | 0.1024 | ||||||

| US05605HAB69 / BWX Technologies Inc | 0.46 | 3.35 | 0.1016 | 0.0013 | |||||

| US71677KAA60 / PetSmart Inc / PetSmart Finance Corp | 0.46 | 4.28 | 0.1016 | 0.0022 | |||||

| US682691AA80 / OneMain Finance Corp | 0.46 | 4.54 | 0.1012 | 0.0026 | |||||

| US89386MAA62 / Transocean Titan Financing Ltd | 0.46 | -0.65 | 0.1008 | -0.0026 | |||||

| US1248EPCL57 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.46 | 7.28 | 0.1002 | 0.0049 | |||||

| US780153BG60 / Royal Caribbean Cruises Ltd | 0.46 | 1.56 | 0.0999 | -0.0003 | |||||

| US90138FAC68 / Twilio Inc | 0.45 | 19.58 | 0.0992 | 0.0261 | |||||

| US536797AF03 / Lithia Motors Inc. | 0.45 | 0.0991 | 0.0991 | ||||||

| VISTA MANAGEMENT HOLDING INC 2025 TERM LOAN B / LON (US92842EAB48) | 0.45 | 0.89 | 0.0990 | -0.0010 | |||||

| TK ELEVATOR MIDCO GMBH 2025 USD TERM LOAN B / LON (XAD9000BAJ17) | 0.45 | 0.45 | 0.0990 | -0.0014 | |||||

| SM / SM Energy Company | 0.45 | 1.13 | 0.0984 | -0.0008 | |||||

| SM / SM Energy Company | 0.45 | 1.13 | 0.0984 | -0.0008 | |||||

| US126307BA42 / CSC Holdings, LLC | 0.45 | 110.38 | 0.0978 | 0.0503 | |||||

| US81104PAA75 / Scripps Escrow Inc 5.875% 07/15/2027 144A | 0.45 | 6.71 | 0.0976 | 0.0043 | |||||

| US670001AG19 / Novelis Corp | 0.44 | 1.84 | 0.0971 | -0.0002 | |||||

| VISTRA ZERO OPRTNG COMPANY LLC TERM LOAN B / LON (US92841DAB73) | 0.44 | 2.08 | 0.0970 | 0.0002 | |||||

| XS2010028426 / PAYSAFE FINANCE PLC / PAYSAFE HOLDINGS US CORP 3.000000% 06/15/2029 | 0.44 | 9.43 | 0.0967 | 0.0065 | |||||

| US29279XAA81 / ENDURANCE ACQ MERGER 6% 02/15/2029 144A | 0.44 | -2.67 | 0.0962 | -0.0044 | |||||

| US71677KAB44 / PETM 7 3/4 02/15/29 | 0.44 | 5.81 | 0.0959 | 0.0035 | |||||

| US019736AG29 / Allison Transmission Inc | 0.44 | 3.08 | 0.0955 | 0.0010 | |||||

| GSY / goeasy Ltd. | 0.43 | 47.62 | 0.0953 | 0.0294 | |||||

| TEVA PHARMACEUTICALS NE COMPANY GUAR 12/32 6 / DBT (US88167AAT88) | 0.43 | 0.0952 | 0.0952 | ||||||

| TEVA PHARMACEUTICALS NE COMPANY GUAR 12/32 6 / DBT (US88167AAT88) | 0.43 | 0.0952 | 0.0952 | ||||||

| TEVA PHARMACEUTICALS NE COMPANY GUAR 12/32 6 / DBT (US88167AAT88) | 0.43 | 0.0952 | 0.0952 | ||||||

| US389286AA34 / Gray Escrow II Inc | 0.43 | 20.06 | 0.0946 | 0.0142 | |||||

| XS2434776113 / Ctec II GmbH | 0.43 | 1.90 | 0.0939 | -0.0001 | |||||

| ENVISION HEALTHCARE CORPORTION 2023 LAST OUT TERM LOAN / LON (949ABFII9) | 0.43 | 1.43 | 0.0936 | -0.0004 | |||||

| ENVISION HEALTHCARE CORPORTION 2023 LAST OUT TERM LOAN / LON (949ABFII9) | 0.43 | 1.43 | 0.0936 | -0.0004 | |||||

| US05765WAA18 / TIBCO Software Inc | 0.43 | 4.67 | 0.0934 | 0.0024 | |||||

| US85205TAN00 / Spirit AeroSystems Inc | 0.42 | -0.70 | 0.0931 | -0.0023 | |||||

| US552704AF51 / MEG Energy Corp | 0.42 | 1.44 | 0.0931 | -0.0004 | |||||

| US65343HAA95 / Nexstar Escrow, Inc. | 0.42 | 1.19 | 0.0930 | -0.0007 | |||||

| CREDIT ACCEPTANC CREDIT ACCEPTANC / DBT (US225310AQ40) | 0.42 | 0.00 | 0.0929 | -0.0018 | |||||

| CREDIT ACCEPTANC CREDIT ACCEPTANC / DBT (US225310AQ40) | 0.42 | 0.00 | 0.0929 | -0.0018 | |||||

| US92840JAB52 / VistaJet Malta Finance PLC / XO Management Holding Inc | 0.42 | 7.11 | 0.0926 | 0.0043 | |||||

| US17302XAN66 / CITGO Petroleum Corp. | 0.42 | 2.46 | 0.0914 | 0.0004 | |||||

| US857691AG41 / STATION CASINOS LLC SR UNSECURED 144A 02/28 4.5 | 0.42 | 2.46 | 0.0914 | 0.0004 | |||||

| MARICOPA CNTY AZ INDL DEV AUTH MAREDU 10/29 FIXED 7.375 / DBT (US56681NJD03) | 0.41 | 0.49 | 0.0909 | -0.0014 | |||||

| MARICOPA CNTY AZ INDL DEV AUTH MAREDU 10/29 FIXED 7.375 / DBT (US56681NJD03) | 0.41 | 0.49 | 0.0909 | -0.0014 | |||||

| US02156LAE11 / Altice France SA/France | 0.41 | 5.09 | 0.0906 | 0.0028 | |||||

| PRAA / PRA Group, Inc. | 0.41 | -1.20 | 0.0905 | -0.0029 | |||||

| PRAA / PRA Group, Inc. | 0.41 | -1.20 | 0.0905 | -0.0029 | |||||

| PRAA / PRA Group, Inc. | 0.41 | -1.20 | 0.0905 | -0.0029 | |||||

| US893790AA34 / Transocean Aquila Ltd | 0.41 | -11.02 | 0.0903 | -0.0132 | |||||

| US893830BX61 / Transocean Inc | 0.41 | -0.96 | 0.0902 | -0.0027 | |||||

| MEDLINE BORROWER/MEDL CO SR SECURED 144A 04/29 6.25 / DBT (US58506DAA63) | 0.41 | 1.48 | 0.0902 | -0.0005 | |||||

| ELLUCIAN HOLDINGS INC SR SECURED 144A 12/29 6.5 / DBT (US289178AA37) | 0.41 | 4.06 | 0.0899 | 0.0017 | |||||

| US603051AE37 / Mineral Resources Ltd | 0.41 | 2.25 | 0.0898 | 0.0003 | |||||

| NATIONSTAR MTG HLD INC COMPANY GUAR 144A 08/29 6.5 / DBT (US63861CAG42) | 0.41 | 0.74 | 0.0896 | -0.0011 | |||||

| NATIONSTAR MTG HLD INC COMPANY GUAR 144A 08/29 6.5 / DBT (US63861CAG42) | 0.41 | 0.74 | 0.0896 | -0.0011 | |||||

| US513075BW03 / Lamar Media Corp | 0.41 | 13.97 | 0.0895 | 0.0094 | |||||

| ASCENT RESOURCES/ARU FIN SR UNSECURED 144A 10/32 6.625 / DBT (US04364VAX10) | 0.41 | 2.26 | 0.0893 | 0.0002 | |||||

| ASCENT RESOURCES/ARU FIN SR UNSECURED 144A 10/32 6.625 / DBT (US04364VAX10) | 0.41 | 2.26 | 0.0893 | 0.0002 | |||||

| US29082KAA34 / Embecta Corp | 0.41 | 0.99 | 0.0892 | -0.0009 | |||||

| XS2294495838 / Atrium Finance Issuer BV | 0.41 | 9.14 | 0.0891 | 0.0058 | |||||

| US81180WBM29 / Seagate HDD Cayman | 0.40 | 0.25 | 0.0884 | -0.0016 | |||||

| TRANSDIGM INC TRANSDIGM INC / DBT (US893647BW65) | 0.40 | 2.03 | 0.0882 | 0.0001 | |||||

| TRANSDIGM INC TRANSDIGM INC / DBT (US893647BW65) | 0.40 | 2.03 | 0.0882 | 0.0001 | |||||

| US45232TAA97 / Illuminate Buyer LLC / Illuminate Holdings IV Inc | 0.40 | 1.01 | 0.0882 | -0.0008 | |||||

| US46115HAU14 / Intesa Sanpaolo SpA | 0.40 | 0.25 | 0.0881 | -0.0015 | |||||

| OCADO GROUP PLC OCADO GROUP PLC / DBT (XS2871478058) | 0.40 | 1.78 | 0.0880 | -0.0002 | |||||

| OCADO GROUP PLC OCADO GROUP PLC / DBT (XS2871478058) | 0.40 | 1.78 | 0.0880 | -0.0002 | |||||

| OCADO GROUP PLC OCADO GROUP PLC / DBT (XS2871478058) | 0.40 | 1.78 | 0.0880 | -0.0002 | |||||

| XAG7739PAK66 / CABLE and WIRELESS TERM B4 02/02/2026 | 0.40 | 4.43 | 0.0880 | 0.0021 | |||||

| US04364VAU70 / Ascent Resources Utica Holdings LLC / ARU Finance Corp | 0.40 | 2.56 | 0.0879 | 0.0006 | |||||

| CAMELOT US ACQUISITION LLC 2025 INCREMENTAL TERM LOAN B / LON (XAL2000AAG57) | 0.40 | 0.0878 | 0.0878 | ||||||

| CAMELOT US ACQUISITION LLC 2025 INCREMENTAL TERM LOAN B / LON (XAL2000AAG57) | 0.40 | 0.0878 | 0.0878 | ||||||

| CAMELOT US ACQUISITION LLC 2025 INCREMENTAL TERM LOAN B / LON (XAL2000AAG57) | 0.40 | 0.0878 | 0.0878 | ||||||

| VIKCRU / Viking Cruises Ltd | 0.40 | 0.50 | 0.0878 | -0.0012 | |||||

| MTDR / Matador Resources Company | 0.40 | 1.01 | 0.0878 | -0.0009 | |||||

| US35906ABE73 / Frontier Communications Corp | 0.40 | 0.25 | 0.0878 | -0.0016 | |||||

| GBT US III LLC 2025 TERM LOAN B / LON (US36154HAC43) | 0.40 | 0.50 | 0.0875 | -0.0014 | |||||

| US1248EPCB75 / CCO Holdings LLC / CCO Holdings Capital Corp 5.375% 06/01/2029 144A | 0.40 | 2.84 | 0.0874 | 0.0008 | |||||

| ROCKPOINT GAS STRG PRTNRS LP 2025 TERM LOAN B / LON (BA000GQC7) | 0.40 | -33.33 | 0.0873 | -0.0463 | |||||

| ROCKPOINT GAS STRG PRTNRS LP 2025 TERM LOAN B / LON (BA000GQC7) | 0.40 | -33.33 | 0.0873 | -0.0463 | |||||

| ROCKPOINT GAS STRG PRTNRS LP 2025 TERM LOAN B / LON (BA000GQC7) | 0.40 | -33.33 | 0.0873 | -0.0463 | |||||

| MTDR / Matador Resources Company | 0.40 | 1.79 | 0.0872 | -0.0002 | |||||

| MTDR / Matador Resources Company | 0.40 | 1.79 | 0.0872 | -0.0002 | |||||

| MTDR / Matador Resources Company | 0.40 | 1.79 | 0.0872 | -0.0002 | |||||

| FTAIM / FTAI Aviation Ltd. - Preferred Stock | 0.40 | 3.40 | 0.0866 | 0.0011 | |||||

| MPT OPER PARTNERSP/FINL SR SECURED 144A 02/32 8.5 / DBT (US55342UAQ76) | 0.39 | 2.62 | 0.0861 | 0.0006 | |||||

| MPT OPER PARTNERSP/FINL SR SECURED 144A 02/32 8.5 / DBT (US55342UAQ76) | 0.39 | 2.62 | 0.0861 | 0.0006 | |||||

| MPT OPER PARTNERSP/FINL SR SECURED 144A 02/32 8.5 / DBT (US55342UAQ76) | 0.39 | 2.62 | 0.0861 | 0.0006 | |||||

| US92556HAB33 / ViacomCBS Inc | 0.39 | 1.30 | 0.0853 | -0.0007 | |||||

| VAR ENERGI ASA 11/83 1 / DBT (XS2708134023) | 0.39 | 9.60 | 0.0852 | 0.0060 | |||||

| DIRECTV FIN LLC/COINC SR SECURED 144A 02/31 10 / DBT (US25461LAD47) | 0.39 | 1.04 | 0.0852 | -0.0007 | |||||

| S2TW34 / Starwood Property Trust, Inc. - Depositary Receipt (Common Stock) | 0.39 | 3.20 | 0.0850 | 0.0010 | |||||

| ASTON MARTIN CAPITAL HOL ASTON MARTIN CAPITAL HOL / DBT (XS2788344419) | 0.38 | 6.37 | 0.0844 | 0.0036 | |||||

| US17888HAA14 / Civitas Resources Inc | 0.38 | -0.78 | 0.0843 | -0.0023 | |||||

| US74166NAA28 / ADT Corp/The | 0.38 | 2.95 | 0.0842 | 0.0007 | |||||

| US23918KAS78 / DaVita Inc | 0.38 | 4.08 | 0.0841 | 0.0017 | |||||

| US29279UAB26 / ENDURE DIGITAL INC TLB 3.5 | 0.38 | 3.23 | 0.0840 | 0.0009 | |||||

| US513075BT73 / Lamar Media Corp | 0.38 | 3.24 | 0.0838 | 0.0009 | |||||

| US131347CR51 / Calpine Corp | 0.38 | 3.84 | 0.0832 | 0.0016 | |||||

| US92857WBX74 / Vodafone Group PLC | 0.38 | 0.00 | 0.0832 | -0.0017 | |||||

| SINCLAIR TELEVISION GROU SR SECURED 144A 02/33 8.125 / DBT (US829259BH26) | 0.38 | 2.43 | 0.0831 | 0.0004 | |||||

| SINCLAIR TELEVISION GROU SR SECURED 144A 02/33 8.125 / DBT (US829259BH26) | 0.38 | 2.43 | 0.0831 | 0.0004 | |||||

| US988498AD34 / Yum Brands! 6.875% Senior Notes 11/15/37 | 0.38 | 0.00 | 0.0826 | -0.0015 | |||||

| XS2644942737 / SCIL IV LLC / SCIL USA Holdings LLC | 0.37 | 9.09 | 0.0817 | 0.0055 | |||||

| US626738AF53 / MUSA 3 3/4 02/15/31 | 0.37 | 3.94 | 0.0810 | 0.0015 | |||||

| US69354NAD84 / PRA Group Inc | 0.37 | 0.27 | 0.0809 | -0.0015 | |||||

| GLOBAL PART/GLP FINANCE COMPANY GUAR 144A 01/32 8.25 / DBT (US37954FAK03) | 0.37 | 2.22 | 0.0807 | 0.0003 | |||||

| GLOBAL PART/GLP FINANCE COMPANY GUAR 144A 01/32 8.25 / DBT (US37954FAK03) | 0.37 | 2.22 | 0.0807 | 0.0003 | |||||

| GLOBAL PART/GLP FINANCE COMPANY GUAR 144A 01/32 8.25 / DBT (US37954FAK03) | 0.37 | 2.22 | 0.0807 | 0.0003 | |||||

| US418751AD59 / HAT Holdings I LLC / HAT Holdings II LLC | 0.37 | 3.38 | 0.0805 | 0.0010 | |||||

| MOTION FINCO SARL SR SECURED 144A 02/32 8.375 / DBT (US61980LAB53) | 0.37 | -5.91 | 0.0804 | -0.0066 | |||||

| MOTION FINCO SARL SR SECURED 144A 02/32 8.375 / DBT (US61980LAB53) | 0.37 | -5.91 | 0.0804 | -0.0066 | |||||

| SVC / Service Properties Trust | 0.36 | 4.00 | 0.0799 | 0.0016 | |||||

| US146869AN20 / Carvana Co. | 0.36 | -0.55 | 0.0796 | -0.0021 | |||||

| LOTTOMATICA GROUP SPA SR SECURED 144A 01/31 4.875 / DBT (XS3047452746) | 0.36 | 0.0795 | 0.0795 | ||||||

| LOTTOMATICA GROUP SPA SR SECURED 144A 01/31 4.875 / DBT (XS3047452746) | 0.36 | 0.0795 | 0.0795 | ||||||

| LOTTOMATICA GROUP SPA SR SECURED 144A 01/31 4.875 / DBT (XS3047452746) | 0.36 | 0.0795 | 0.0795 | ||||||

| FTAIM / FTAI Aviation Ltd. - Preferred Stock | 0.36 | 1.97 | 0.0795 | -0.0000 | |||||

| ALLIANT HOLD / CO ISSUER ALLIANT HOLD / CO ISSUER / DBT (US01883LAH69) | 0.36 | 2.85 | 0.0792 | 0.0005 | |||||

| ALLIANT HOLD / CO ISSUER ALLIANT HOLD / CO ISSUER / DBT (US01883LAH69) | 0.36 | 2.85 | 0.0792 | 0.0005 | |||||

| ALLIANT HOLD / CO ISSUER ALLIANT HOLD / CO ISSUER / DBT (US01883LAH69) | 0.36 | 2.85 | 0.0792 | 0.0005 | |||||

| ESSENDI SA SR SECURED 144A 05/30 5.375 / DBT (XS3049460085) | 0.36 | 0.0791 | 0.0791 | ||||||

| FR001400HZE3 / Eramet SA | 0.36 | 8.76 | 0.0790 | 0.0049 | |||||

| HILCORP ENERGY I/HILCORP HILCORP ENERGY I/HILCORP / DBT (US431318BE31) | 0.36 | 1.70 | 0.0788 | -0.0001 | |||||

| HILCORP ENERGY I/HILCORP HILCORP ENERGY I/HILCORP / DBT (US431318BE31) | 0.36 | 1.70 | 0.0788 | -0.0001 | |||||

| HILCORP ENERGY I/HILCORP HILCORP ENERGY I/HILCORP / DBT (US431318BE31) | 0.36 | 1.70 | 0.0788 | -0.0001 | |||||

| US12543DBJ81 / CHS/CMNTY HEALTH SYSTEMS INC 6.875% 04/15/2029 144A | 0.36 | 22.95 | 0.0787 | 0.0134 | |||||

| USA COM PART/USA COM FIN COMPANY GUAR 144A 03/29 7.125 / DBT (US91740PAG37) | 0.36 | 0.56 | 0.0787 | -0.0009 | |||||

| USA COM PART/USA COM FIN COMPANY GUAR 144A 03/29 7.125 / DBT (US91740PAG37) | 0.36 | 0.56 | 0.0787 | -0.0009 | |||||

| USA COM PART/USA COM FIN COMPANY GUAR 144A 03/29 7.125 / DBT (US91740PAG37) | 0.36 | 0.56 | 0.0787 | -0.0009 | |||||

| 4755 / Rakuten Group, Inc. | 0.36 | 0.0782 | 0.0782 | ||||||

| US82967NBM92 / Sirius XM Radio Inc | 0.36 | 3.50 | 0.0780 | 0.0013 | |||||

| US25470XAY13 / DISH DBS CORP 7.75% 07/01/2026 | 0.36 | 2.60 | 0.0779 | 0.0006 | |||||

| MVFPSO / MV24 Capital BV | 0.36 | -2.47 | 0.0779 | -0.0034 | |||||

| ALFHLU / Altice France Holding SA | 0.36 | 21.16 | 0.0778 | 0.0122 | |||||

| STONEX ESCROW ISSUER LLC SECURED 144A 07/32 6.875 / DBT (US86189AAA79) | 0.35 | 0.0776 | 0.0776 | ||||||

| W2EX34 / WEX Inc. - Depositary Receipt (Common Stock) | 0.35 | 2.02 | 0.0774 | 0.0000 | |||||

| W2EX34 / WEX Inc. - Depositary Receipt (Common Stock) | 0.35 | 2.02 | 0.0774 | 0.0000 | |||||

| W2EX34 / WEX Inc. - Depositary Receipt (Common Stock) | 0.35 | 2.02 | 0.0774 | 0.0000 | |||||

| XS2275090749 / Sofima Holding SPA | 0.35 | 9.69 | 0.0770 | 0.0055 | |||||

| US98877DAD75 / ZF North America Capital Inc | 0.35 | 2.03 | 0.0770 | 0.0001 | |||||

| US92763MAA36 / Viper Energy Partners LP 5.375% 11/01/2027 144A | 0.35 | 0.86 | 0.0769 | -0.0007 | |||||

| US88033GAV23 / Tenet Healthcare Corp 6 7/8% Notes 11/15/2031 | 0.35 | 5.12 | 0.0766 | 0.0022 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 0.35 | 0.29 | 0.0763 | -0.0012 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 0.35 | 0.29 | 0.0763 | -0.0012 | |||||

| US03217CAB28 / ams-OSRAM AG | 0.35 | 3.89 | 0.0761 | 0.0014 | |||||

| XS2332975007 / Altice France SA/France | 0.35 | 14.57 | 0.0760 | 0.0084 | |||||

| YINSON BORONIA PRODUCTIO SR SECURED 144A 07/42 8.947 / DBT (US98584XAA37) | 0.34 | 0.88 | 0.0752 | -0.0008 | |||||

| YINSON BORONIA PRODUCTIO SR SECURED 144A 07/42 8.947 / DBT (US98584XAA37) | 0.34 | 0.88 | 0.0752 | -0.0008 | |||||

| YINSON BORONIA PRODUCTIO SR SECURED 144A 07/42 8.947 / DBT (US98584XAA37) | 0.34 | 0.88 | 0.0752 | -0.0008 | |||||

| TREASURY BILL 08/25 0.00000 / DBT (US912797QK68) | 0.34 | 0.0752 | 0.0752 | ||||||

| TREASURY BILL 08/25 0.00000 / DBT (US912797QK68) | 0.34 | 0.0752 | 0.0752 | ||||||

| TREASURY BILL 08/25 0.00000 / DBT (US912797QK68) | 0.34 | 0.0752 | 0.0752 | ||||||

| S2TW34 / Starwood Property Trust, Inc. - Depositary Receipt (Common Stock) | 0.34 | 2.70 | 0.0750 | 0.0005 | |||||

| S2TW34 / Starwood Property Trust, Inc. - Depositary Receipt (Common Stock) | 0.34 | 2.70 | 0.0750 | 0.0005 | |||||

| TITANIUM 2L BONDCO S.? R.L. EO 01/31 6.25 / DBT (DE000A3L3AG9) | 0.34 | 3.06 | 0.0739 | 0.0006 | |||||

| US154915AA07 / Central Parent LLC/CDK Global II LLC/CDK Financing Co., Inc. | 0.33 | -5.70 | 0.0726 | -0.0060 | |||||

| US63938CAN83 / Navient Corp | 0.33 | 3.76 | 0.0726 | 0.0011 | |||||

| XS2231331260 / ZF Finance GmbH | 0.33 | 8.22 | 0.0723 | 0.0042 | |||||

| MELCO RESORTS FINANCE MELCO RESORTS FINANCE / DBT (US58547DAH26) | 0.33 | 1.55 | 0.0721 | -0.0003 | |||||

| MELCO RESORTS FINANCE MELCO RESORTS FINANCE / DBT (US58547DAH26) | 0.33 | 1.55 | 0.0721 | -0.0003 | |||||

| MELCO RESORTS FINANCE MELCO RESORTS FINANCE / DBT (US58547DAH26) | 0.33 | 1.55 | 0.0721 | -0.0003 | |||||

| US988498AR20 / Yum! Brands, Inc. | 0.33 | 2.52 | 0.0714 | 0.0005 | |||||

| GTN / Gray Media, Inc. | 0.32 | 3.21 | 0.0707 | 0.0008 | |||||

| US983133AC37 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp | 0.32 | 3.23 | 0.0702 | 0.0007 | |||||

| US39807UAD81 / Greystar Real Estate Partners LLC | 0.32 | 1.60 | 0.0698 | -0.0003 | |||||

| US138616AM99 / Cantor Fitzgerald LP | 0.32 | 0.63 | 0.0698 | -0.0009 | |||||

| SAMHALLSBYG HOLD COMPANY GUAR REGS 09/29 1.125 / DBT (XS2962827072) | 0.32 | 14.86 | 0.0697 | 0.0078 | |||||

| SAMHALLSBYG HOLD COMPANY GUAR REGS 09/29 1.125 / DBT (XS2962827072) | 0.32 | 14.86 | 0.0697 | 0.0078 | |||||

| SAMHALLSBYG HOLD COMPANY GUAR REGS 09/29 1.125 / DBT (XS2962827072) | 0.32 | 14.86 | 0.0697 | 0.0078 | |||||

| YINSON BORONIA PRODUCTIO SR SECURED REGS 07/42 8.947 / DBT (USN9733XAA56) | 0.32 | 0.64 | 0.0694 | -0.0008 | |||||

| YINSON BORONIA PRODUCTIO SR SECURED REGS 07/42 8.947 / DBT (USN9733XAA56) | 0.32 | 0.64 | 0.0694 | -0.0008 | |||||

| YINSON BORONIA PRODUCTIO SR SECURED REGS 07/42 8.947 / DBT (USN9733XAA56) | 0.32 | 0.64 | 0.0694 | -0.0008 | |||||

| US013822AC54 / Alcoa Nederland Holding BV | 0.32 | 1.94 | 0.0691 | -0.0000 | |||||

| US013822AC54 / Alcoa Nederland Holding BV | 0.32 | 1.94 | 0.0691 | -0.0000 | |||||

| US013822AC54 / Alcoa Nederland Holding BV | 0.32 | 1.94 | 0.0691 | -0.0000 | |||||

| HUSKY INJECTION / TITAN SR SECURED 144A 02/29 9 / DBT (US44805RAA32) | 0.31 | 4.67 | 0.0688 | 0.0016 | |||||

| TRT061124T11 / Turkey Government Bond | 0.31 | -2.80 | 0.0687 | -0.0033 | |||||

| XS2355632584 / Grupo Antolin-Irausa SA | 0.31 | 10.60 | 0.0687 | 0.0054 | |||||

| US714295AA08 / Perrigo Finance Unlimited Co | 0.31 | -1.26 | 0.0686 | -0.0023 | |||||

| US44409MAA45 / HUDSON PACIFIC PROPERTIE COMPANY GUAR 11/27 3.95 | 0.31 | 8.36 | 0.0684 | 0.0040 | |||||

| RFR USD SOFR/3.25000 06/18/25-10Y CME / DIR (EZXZ4DC8KGZ4) | 0.31 | 0.0682 | 0.0682 | ||||||

| US36170JAC09 / GGAM Finance Ltd. | 0.31 | 0.65 | 0.0678 | -0.0009 | |||||

| GSY / goeasy Ltd. | 0.31 | 3.00 | 0.0678 | 0.0007 | |||||

| CLYDESDALE ACQUISITION SR SECURED 144A 01/30 6.875 / DBT (US18972EAC93) | 0.31 | 1.66 | 0.0673 | -0.0003 | |||||

| US18064PAD15 / Clarivate Science Holdings Corp | 0.31 | 5.52 | 0.0671 | 0.0023 | |||||

| XHR LP COMPANY GUAR 144A 05/30 6.625 / DBT (US98372MAE57) | 0.31 | 4.08 | 0.0671 | 0.0012 | |||||

| US18972EAA38 / Clydesdale Acquisition Holdings Inc | 0.30 | 1.00 | 0.0668 | -0.0007 | |||||

| US35906ABG22 / Frontier Communications Corp | 0.30 | 1.00 | 0.0667 | -0.0008 | |||||

| W1HR34 / Whirlpool Corporation - Depositary Receipt (Common Stock) | 0.30 | 0.0664 | 0.0664 | ||||||

| US650929AA08 / Newfold Digital Holdings Group Inc | 0.30 | -7.93 | 0.0662 | -0.0071 | |||||

| COGENT COMMS GRP / FIN COGENT COMMS GRP / FIN / DBT (US19240WAA71) | 0.30 | -0.66 | 0.0659 | -0.0016 | |||||

| FRONTIER COMMUNICATIONS CORP 2025 TERM LOAN B / LON (US35906EAU47) | 0.30 | -0.33 | 0.0655 | -0.0014 | |||||

| FRONTIER COMMUNICATIONS CORP 2025 TERM LOAN B / LON (US35906EAU47) | 0.30 | -0.33 | 0.0655 | -0.0014 | |||||

| FRONTIER COMMUNICATIONS CORP 2025 TERM LOAN B / LON (US35906EAU47) | 0.30 | -0.33 | 0.0655 | -0.0014 | |||||

| COTIVITI CORPORATION 2025 2ND AMENDMENT TERM LOAN / LON (US22164MAF41) | 0.30 | 1.71 | 0.0655 | -0.0001 | |||||

| COTIVITI CORPORATION 2025 2ND AMENDMENT TERM LOAN / LON (US22164MAF41) | 0.30 | 1.71 | 0.0655 | -0.0001 | |||||

| US126307AY37 / CSC Holdings LLC | 0.30 | 4.95 | 0.0651 | 0.0018 | |||||

| US88104LAE39 / TERRAFORM POWER OPERATIN | 0.30 | 2.41 | 0.0651 | 0.0002 | |||||

| US04686RAB96 / Athenahealth, Inc. 2022 Term Loan B | 0.30 | 1.02 | 0.0651 | -0.0008 | |||||

| XS2031926731 / BANCA MONTE DEI PASCHI S SUBORDINATED REGS 07/29 10.5 | 0.30 | 10.07 | 0.0647 | 0.0047 | |||||

| US70932MAC10 / PennyMac Financial Services Inc | 0.29 | 3.16 | 0.0645 | 0.0008 | |||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 0.29 | 1.73 | 0.0645 | -0.0002 | |||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 0.29 | 1.73 | 0.0645 | -0.0002 | |||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 0.29 | 1.73 | 0.0645 | -0.0002 | |||||

| VFH PARENT / VALOR CO VFH PARENT / VALOR CO / DBT (US91824YAA64) | 0.29 | 2.44 | 0.0645 | 0.0001 | |||||

| US451102BZ91 / CORP. NOTE | 0.29 | 1.75 | 0.0638 | -0.0001 | |||||

| US47216FAA57 / Jazz Securities DAC | 0.29 | 1.40 | 0.0636 | -0.0002 | |||||

| US00164VAF04 / AMC Networks Inc | 0.29 | 23.61 | 0.0633 | 0.0112 | |||||

| US931427AC23 / Walgreens Boots Alliance Inc | 0.29 | 5.54 | 0.0629 | 0.0021 | |||||

| US071734AQ04 / Bausch Health Cos Inc | 0.29 | 4.00 | 0.0628 | 0.0012 | |||||

| BRTSG8EN8 / Staples, Inc., Term Loan | 0.29 | 5.17 | 0.0626 | 0.0019 | |||||

| BRTSG8EN8 / Staples, Inc., Term Loan | 0.29 | 5.17 | 0.0626 | 0.0019 | |||||

| BRTSG8EN8 / Staples, Inc., Term Loan | 0.29 | 5.17 | 0.0626 | 0.0019 | |||||

| US18453HAC07 / Clear Channel Outdoor Holdings Inc | 0.28 | 9.69 | 0.0622 | 0.0045 | |||||

| US92328MAA18 / Venture Global Calcasieu Pass LLC | 0.28 | 2.17 | 0.0620 | -0.0001 | |||||

| SAMHALLSBYG HOLD COMPANY GUAR REGS 08/26 2.375 / DBT (XS2962827155) | 0.28 | 10.63 | 0.0618 | 0.0050 | |||||

| US90138FAD42 / TWILIO INC 3.875% 03/15/2031 | 0.28 | 3.70 | 0.0616 | 0.0011 | |||||

| ICAHN ENTERPRISES/FIN SR SECURED 06/30 9 / DBT (US451102CJ41) | 0.28 | -1.41 | 0.0615 | -0.0019 | |||||

| US98955DAA81 / Ziggo BV | 0.28 | 1.82 | 0.0615 | -0.0000 | |||||

| US638962AA84 / NCR Atleos Escrow Corp | 0.27 | 1.11 | 0.0601 | -0.0006 | |||||

| US89054XAC92 / Topaz Solar Farms LLC | 0.27 | -0.37 | 0.0594 | -0.0012 | |||||

| US90290MAE12 / US Foods Inc | 0.27 | 2.68 | 0.0588 | 0.0003 | |||||

| XS2388186996 / Cirsa Finance International Sarl | 0.27 | 9.05 | 0.0583 | 0.0038 | |||||

| WAND NEWCO 3 INC WAND NEWCO 3 INC / DBT (US933940AA60) | 0.26 | 2.34 | 0.0576 | 0.0004 | |||||

| US11284DAA37 / Brookfield Property REIT Inc / BPR Cumulus LLC / BPR Nimbus LLC / GGSI Sellco LL | 0.26 | -25.07 | 0.0571 | -0.0206 | |||||

| AMERICAN AIRLINES INC 2025 TERM LOAN / LON (US02376CBS35) | 0.26 | 0.0567 | 0.0567 | ||||||

| AMERICAN AIRLINES INC 2025 TERM LOAN / LON (US02376CBS35) | 0.26 | 0.0567 | 0.0567 | ||||||

| US925550AF21 / Viavi Solutions Inc | 0.26 | 2.39 | 0.0564 | 0.0001 | |||||

| MITER BRANDS ACQUISITION 04/32 6.75 / DBT (US60672JAA79) | 0.26 | 3.64 | 0.0562 | 0.0008 | |||||

| MITER BRANDS ACQUISITION 04/32 6.75 / DBT (US60672JAA79) | 0.26 | 3.64 | 0.0562 | 0.0008 | |||||

| MITER BRANDS ACQUISITION 04/32 6.75 / DBT (US60672JAA79) | 0.26 | 3.64 | 0.0562 | 0.0008 | |||||

| WINSTON RE LTD UNSECURED 144A 02/28 VAR / DBT (US975660AC59) | 0.25 | 1.60 | 0.0557 | -0.0002 | |||||

| WINSTON RE LTD UNSECURED 144A 02/28 VAR / DBT (US975660AC59) | 0.25 | 1.60 | 0.0557 | -0.0002 | |||||

| XS2081020872 / Heathrow Finance PLC | 0.25 | 7.66 | 0.0555 | 0.0028 | |||||

| NATURE COAST RE LTD UNSECURED 144A 04/33 VAR / DBT (US63901CAE12) | 0.25 | 0.40 | 0.0551 | -0.0008 | |||||

| NATURE COAST RE LTD UNSECURED 144A 04/33 VAR / DBT (US63901CAE12) | 0.25 | 0.40 | 0.0551 | -0.0008 | |||||

| NATURE COAST RE LTD UNSECURED 144A 04/33 VAR / DBT (US63901CAE12) | 0.25 | 0.40 | 0.0551 | -0.0008 | |||||

| INCORA NEW EQUITY / EC (955PRF008) | 0.01 | 0.00 | 0.25 | -5.66 | 0.0550 | -0.0043 | |||

| GREENGROVE RE LTD UNSECURED 144A 04/32 VAR / DBT (US39526JAA97) | 0.25 | 0.00 | 0.0548 | -0.0013 | |||||

| GREENGROVE RE LTD UNSECURED 144A 04/32 VAR / DBT (US39526JAA97) | 0.25 | 0.00 | 0.0548 | -0.0013 | |||||

| GREENGROVE RE LTD UNSECURED 144A 04/32 VAR / DBT (US39526JAA97) | 0.25 | 0.00 | 0.0548 | -0.0013 | |||||

| SPIRIT LOYALTY KY LTD/IP SR SECURED 144A 03/30 VAR / DBT (US84859BAC54) | 0.25 | -19.74 | 0.0545 | -0.0145 | |||||

| SPIRIT LOYALTY KY LTD/IP SR SECURED 144A 03/30 VAR / DBT (US84859BAC54) | 0.25 | -19.74 | 0.0545 | -0.0145 | |||||

| BHCCN / Bausch Health Cos Inc | 0.25 | 12.79 | 0.0542 | 0.0052 | |||||

| XS2724532333 / AMS-OSRAM AG /EUR/ REGD REG S 10.50000000 | 0.25 | 13.30 | 0.0542 | 0.0053 | |||||

| DIVERSIFIED GAS + OIL CO SR SECURED 144A REGS 04/29 9.7 / DBT (NO0013513606) | 0.25 | 0.0538 | 0.0538 | ||||||

| CAR / AVIS BUDGET FINANCE PLC /EUR/ REGD REG S 4.75000000 | 0.24 | 13.74 | 0.0526 | 0.0053 | |||||

| US13323AAB61 / Camelot Finance SA | 0.24 | -71.34 | 0.0525 | -0.1339 | |||||

| HOWARD MIDSTREAM ENERGY HOWARD MIDSTREAM ENERGY / DBT (US442722AC80) | 0.24 | 2.61 | 0.0519 | 0.0003 | |||||

| HOWARD MIDSTREAM ENERGY HOWARD MIDSTREAM ENERGY / DBT (US442722AC80) | 0.24 | 2.61 | 0.0519 | 0.0003 | |||||

| HOWARD MIDSTREAM ENERGY HOWARD MIDSTREAM ENERGY / DBT (US442722AC80) | 0.24 | 2.61 | 0.0519 | 0.0003 | |||||

| XS2417092132 / Wp/ap Telecom Holdings III BV | 0.24 | 9.81 | 0.0517 | 0.0037 | |||||

| TEAMSYSTEM SPA SR SECURED 144A 07/31 5 / DBT (XS3101364092) | 0.24 | 0.0517 | 0.0517 | ||||||

| TEAMSYSTEM SPA SR SECURED 144A 07/31 5 / DBT (XS3101364092) | 0.24 | 0.0517 | 0.0517 | ||||||

| FR0013461274 / Eramet | 0.24 | 8.80 | 0.0515 | 0.0032 | |||||

| US98919VAA35 / Front Range BidCo Inc | 0.23 | 3.08 | 0.0514 | 0.0005 | |||||

| XS1680281133 / Kronos International Inc | 0.23 | 9.95 | 0.0509 | 0.0035 | |||||

| XS2301390089 / Atlantia SpA | 0.23 | 10.19 | 0.0499 | 0.0037 | |||||

| US20903XAH61 / Consolidated Communications Inc | 0.23 | 7.58 | 0.0499 | 0.0027 | |||||

| US53079EBL74 / Liberty Mutual Group, Inc. | 0.23 | -2.99 | 0.0498 | -0.0025 | |||||

| XS2189356996 / Ardagh Packaging Finance PLC / Ardagh Holdings USA Inc | 0.23 | 13.07 | 0.0495 | 0.0048 | |||||

| XS2036387525 / Ardagh Packaging Finance PLC / Ardagh Holdings USA Inc | 0.23 | 12.50 | 0.0495 | 0.0047 | |||||

| US227046AB51 / Crocs Inc | 0.23 | 2.27 | 0.0494 | 0.0001 | |||||

| INCORA INTERMEDIATE II SR SECURED 144A 01/30 VAR / DBT (US45338XAA37) | 0.22 | 3.27 | 0.0485 | 0.0006 | |||||

| INCORA INTERMEDIATE II SR SECURED 144A 01/30 VAR / DBT (US45338XAA37) | 0.22 | 3.27 | 0.0485 | 0.0006 | |||||

| INCORA TOP HOLDCO LLC CONV PIK PRE COMP / DBT (955PRK007) | 0.22 | -4.35 | 0.0484 | -0.0030 | |||||

| WARNERMEDIA HOLDINGS INC COMPANY GUAR 03/42 5.05 / DBT (US55903VBW28) | 0.22 | 0.0484 | 0.0484 | ||||||

| BRANDYWINE OPER PARTNERS COMPANY GUAR 04/29 8.875 / DBT (US105340AS20) | 0.22 | 3.35 | 0.0475 | 0.0006 | |||||

| VTLE / Vital Energy, Inc. | 0.21 | -8.19 | 0.0469 | -0.0052 | |||||

| US22788CAA36 / CROWDSTRIKE HOLDINGS INC 3% 02/15/2029 | 0.21 | 2.90 | 0.0467 | 0.0004 | |||||

| XS2198191962 / Vertical Holdco GmbH | 0.21 | 8.72 | 0.0467 | 0.0031 | |||||

| US12543DBN93 / CHS/Community Health Systems Inc | 0.21 | 7.61 | 0.0465 | 0.0024 | |||||

| US655664AR15 / Nordstrom Inc | 0.21 | -5.43 | 0.0459 | -0.0036 | |||||

| XS2397354528 / CULLINAN HOLDCO SCSP 4.625% 10/15/2026 REGS | 0.20 | 3.55 | 0.0447 | 0.0005 | |||||

| FIEMEX ENERGIA BANC AC SR SECURED 144A 01/41 7.25 / DBT (US05974EAA82) | 0.20 | 2.54 | 0.0443 | 0.0002 | |||||

| PERMIAN RESOURC OPTG LLC COMPANY GUAR 144A 02/33 6.25 / DBT (US71424VAB62) | 0.20 | 0.0443 | 0.0443 | ||||||

| US146869AL63 / Carvana Co. | 0.20 | -0.50 | 0.0439 | -0.0010 | |||||

| US82660CAA09 / Sigma Holdco BV | 0.20 | 1.01 | 0.0439 | -0.0005 | |||||

| US398433AP71 / Griffon Corp | 0.20 | 2.56 | 0.0439 | 0.0001 | |||||

| BRTSG8EN8 / Staples, Inc., Term Loan | 0.20 | -1.48 | 0.0438 | -0.0017 | |||||

| BRTSG8EN8 / Staples, Inc., Term Loan | 0.20 | -1.48 | 0.0438 | -0.0017 | |||||

| BRTSG8EN8 / Staples, Inc., Term Loan | 0.20 | -1.48 | 0.0438 | -0.0017 | |||||

| MODENA BUYER LLC TERM LOAN / LON (US60753DAC83) | 0.20 | -1.01 | 0.0433 | -0.0012 | |||||

| CLOVER HOLDINGS 2 LLC REVOLVER / LON (US18914DAD03) | 0.20 | 0.0433 | 0.0433 | ||||||

| CLOVER HOLDINGS 2 LLC REVOLVER / LON (US18914DAD03) | 0.20 | 0.0433 | 0.0433 | ||||||

| CLOVER HOLDINGS 2 LLC REVOLVER / LON (US18914DAD03) | 0.20 | 0.0433 | 0.0433 | ||||||

| US55760LAB36 / Madison IAQ LLC | 0.20 | 3.70 | 0.0432 | 0.0009 | |||||

| TRIDENT TPI HOLDINGS INC 2024 TERM LOAN B7 / LON (US00216EAL39) | 0.20 | 1.04 | 0.0429 | -0.0002 | |||||

| TRIDENT TPI HOLDINGS INC 2024 TERM LOAN B7 / LON (US00216EAL39) | 0.20 | 1.04 | 0.0429 | -0.0002 | |||||

| TRIDENT TPI HOLDINGS INC 2024 TERM LOAN B7 / LON (US00216EAL39) | 0.20 | 1.04 | 0.0429 | -0.0002 | |||||

| US203372AX50 / CommScope Inc | 0.20 | -35.43 | 0.0429 | -0.0525 | |||||

| US62886EAZ16 / NCR CORPORATION NEW 5.25% 10/01/2030 144A | 0.19 | 0.00 | 0.0424 | -0.0008 | |||||

| XS2649696890 / Cirsa Finance International Sarl | 0.19 | -41.16 | 0.0424 | -0.0310 | |||||

| US126458AE87 / CTR Partnership LP / CareTrust Capital Corp | 0.19 | 2.14 | 0.0419 | -0.0001 | |||||

| US771049AA15 / RBLX 3 7/8 05/01/30 | 0.19 | 3.30 | 0.0414 | 0.0007 | |||||

| US53219LAU35 / LIFEPOINT HEALTH INC COMPANY GUAR 144A 01/29 5.375 | 0.19 | 6.29 | 0.0409 | 0.0016 | |||||

| US364760AP35 / Gap Inc/The | 0.19 | -58.98 | 0.0408 | -0.0602 | |||||