Mga Batayang Estadistika

| Nilai Portofolio | $ 4,063,322,483 |

| Posisi Saat Ini | 719 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

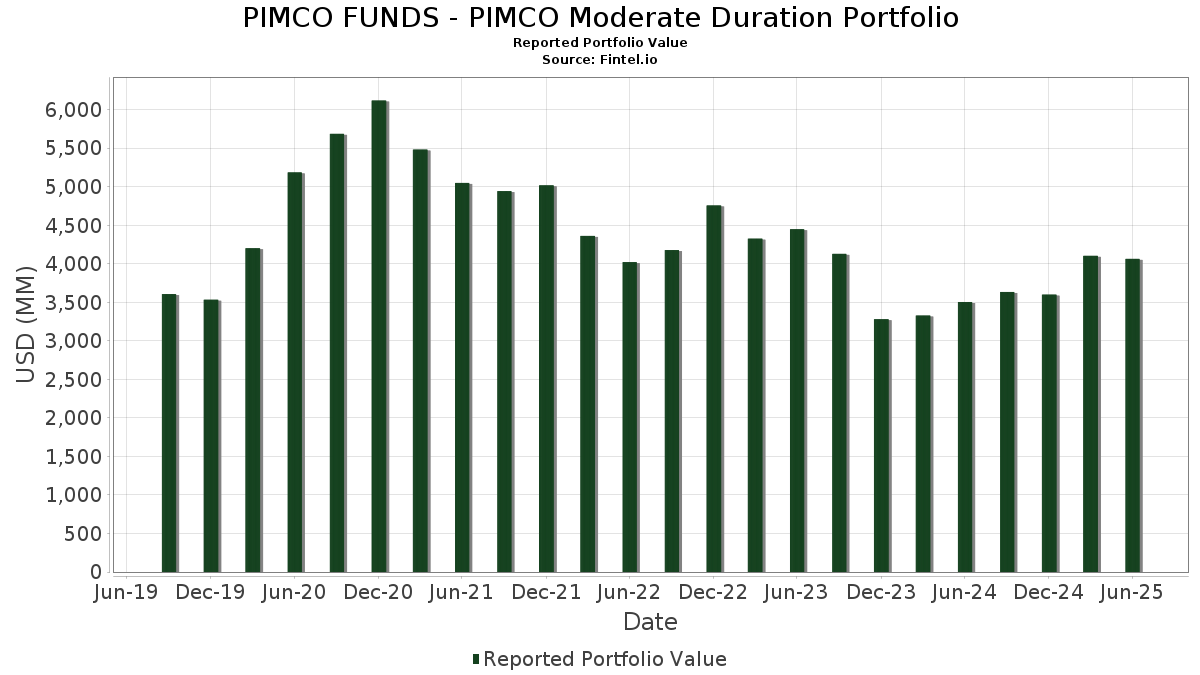

PIMCO FUNDS - PIMCO Moderate Duration Portfolio telah mengungkapkan total kepemilikan 719 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 4,063,322,483 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PIMCO FUNDS - PIMCO Moderate Duration Portfolio adalah UMBS TBA (US:US01F0406854) , U.S. Treasury Notes (US:US91282CJG78) , Ginnie Mae (US:US21H0306827) , FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG (XX:US01F0226831) , and Uniform Mortgage-Backed Security, TBA (US:US01F0626899) . Posisi baru PIMCO FUNDS - PIMCO Moderate Duration Portfolio meliputi: UMBS TBA (US:US01F0406854) , U.S. Treasury Notes (US:US91282CJG78) , Ginnie Mae (US:US21H0306827) , FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG (XX:US01F0226831) , and Uniform Mortgage-Backed Security, TBA (US:US01F0626899) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 425.50 | 11.8798 | 11.8798 | ||

| 257.81 | 7.1978 | 6.6963 | ||

| 59.39 | 1.6582 | 1.6582 | ||

| 46.51 | 1.2986 | 1.2986 | ||

| 75.18 | 2.0989 | 1.1482 | ||

| 31.05 | 0.8670 | 0.8670 | ||

| 21.33 | 0.5954 | 0.5954 | ||

| 11.55 | 0.3224 | 0.3224 | ||

| 8.84 | 0.2467 | 0.2467 | ||

| 8.71 | 0.2431 | 0.2431 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 20.34 | 0.5678 | -7.0832 | ||

| 2.16 | 0.0602 | -3.6836 | ||

| 2.71 | 0.0758 | -2.7137 | ||

| 61.38 | 1.7137 | -2.2923 | ||

| 184.19 | 5.1425 | -2.0220 | ||

| 97.47 | 2.7214 | -0.2401 | ||

| 71.43 | 1.9944 | -0.1797 | ||

| 71.84 | 2.0056 | -0.1433 | ||

| 133.30 | 3.7218 | -0.1375 | ||

| 62.57 | 1.7470 | -0.1345 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Investor ini belum mengungkapkan sekuritas yang diperhitungkan dalam bentuk saham, sehingga kolom terkait saham dalam tabel di bawah ini dihilangkan. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|

| REPO BANK AMERICA REPO / RA (000000000) | 425.50 | 11.8798 | 11.8798 | |||

| US01F0406854 / UMBS TBA | 257.81 | 1,528.08 | 7.1978 | 6.6963 | ||

| US91282CJG78 / U.S. Treasury Notes | 184.19 | -25.01 | 5.1425 | -2.0220 | ||

| US TREASURY N/B 07/31 4.125 / DBT (US91282CLD10) | 133.30 | 0.75 | 3.7218 | -0.1375 | ||

| US TREASURY N/B 07/29 4 / DBT (US91282CLC37) | 97.47 | -4.00 | 2.7214 | -0.2401 | ||

| US21H0306827 / Ginnie Mae | 75.18 | 86.24 | 2.0989 | 1.1482 | ||

| FNMA POOL CB2666 FN 01/52 FIXED 3 / ABS-MBS (US3140QM6C32) | 71.84 | -2.49 | 2.0056 | -0.1433 | ||

| FED HM LN PC POOL SD8516 FR 03/55 FIXED 6 / ABS-MBS (US3132DWN905) | 71.43 | -4.16 | 1.9944 | -0.1797 | ||

| FNMA POOL CB2429 FN 12/51 FIXED 3 / ABS-MBS (US3140QMVX96) | 62.57 | -3.00 | 1.7470 | -0.1345 | ||

| US01F0226831 / FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG | 61.38 | -54.35 | 1.7137 | -2.2923 | ||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 59.39 | 1.6582 | 1.6582 | |||

| US3132DWFF59 / Freddie Mac Pool | 49.74 | -2.31 | 1.3888 | -0.0965 | ||

| TSY INFL IX N/B 01/35 2.125 / DBT (US91282CML27) | 46.51 | 1.2986 | 1.2986 | |||

| FREDDIE MAC FHR 5513 MF / ABS-MBS (US3137HKEX87) | 33.91 | -5.18 | 0.9467 | -0.0963 | ||

| US21H0306744 / Ginnie Mae | 31.05 | 0.8670 | 0.8670 | |||

| US3132DWFE84 / Federal Home Loan Mortgage Corp. | 30.64 | -2.25 | 0.8555 | -0.0588 | ||

| FNMA POOL MA5271 FN 02/54 FIXED 5.5 / ABS-MBS (US31418E2D11) | 29.20 | -2.38 | 0.8152 | -0.0572 | ||

| US TREASURY N/B 02/35 4.625 / DBT (US91282CMM00) | 28.69 | -0.11 | 0.8010 | -0.0368 | ||

| US31418ELW83 / Fannie Mae Pool | 27.76 | -2.06 | 0.7751 | -0.0517 | ||

| US31418EHJ29 / Fannie Mae Pool | 25.95 | -2.19 | 0.7244 | -0.0493 | ||

| US3140XLQ274 / FNMA POOL FS4972 FN 05/53 FIXED VAR | 24.88 | -4.27 | 0.6948 | -0.0635 | ||

| FED HM LN PC POOL RA6486 FR 12/51 FIXED 3 / ABS-MBS (US3133KNF325) | 24.37 | -1.15 | 0.6803 | -0.0387 | ||

| US3140XGQ449 / FN FS1374 | 22.68 | -1.57 | 0.6333 | -0.0389 | ||

| US30227FAA84 / Extended Stay America Trust | 22.23 | -0.86 | 0.6208 | -0.0334 | ||

| FED HM LN PC POOL SD6652 FR 11/54 FIXED 3.5 / ABS-MBS (US3132DUL960) | 21.33 | 0.5954 | 0.5954 | |||

| US3132DWG800 / Freddie Mac Pool | 21.08 | -2.06 | 0.5886 | -0.0393 | ||

| US01F0306781 / UMBS TBA | 20.34 | -91.98 | 0.5678 | -7.0832 | ||

| US3140X6KS99 / Fannie Mae Pool | 20.03 | -2.65 | 0.5594 | -0.0409 | ||

| US31418ED649 / Fannie Mae Pool | 19.73 | -1.87 | 0.5509 | -0.0356 | ||

| US62955HAA59 / NYO COMMERCIAL MORTGAGE TRUST 2021-1290 SER 2021-1290 CL A V/R REGD 144A P/P 1.17500000 | 17.98 | 0.55 | 0.5019 | -0.0196 | ||

| FED HM LN PC POOL SD8507 FR 02/55 FIXED 6 / ABS-MBS (US3132DWNY56) | 17.97 | -3.97 | 0.5016 | -0.0441 | ||

| US3132DWGG24 / FHLG 30YR 5% 02/01/2053# | 16.41 | -2.46 | 0.4581 | -0.0325 | ||

| US61747YEK73 / Morgan Stanley | 15.63 | 0.65 | 0.4365 | -0.0166 | ||

| FNMA POOL MA5670 FN 04/55 FIXED 4 / ABS-MBS (US31418FJQ19) | 15.43 | -1.57 | 0.4309 | -0.0265 | ||

| US3132DP3W62 / FED HM LN PC POOL SD2613 FR 01/53 FIXED 4.5 | 15.39 | -1.50 | 0.4297 | -0.0261 | ||

| FED HM LN PC POOL RJ0137 FR 12/53 FIXED 5 / ABS-MBS (US3142GQEK49) | 14.53 | -1.26 | 0.4056 | -0.0236 | ||

| US3132DQFD34 / FED HM LN PC POOL SD2864 FR 03/52 FIXED 3 | 14.08 | -3.42 | 0.3931 | -0.0321 | ||

| US60687YBQ17 / Mizuho Financial Group Inc | 13.37 | 1.50 | 0.3732 | -0.0110 | ||

| FED HM LN PC POOL SD3953 FR 02/52 FIXED 3 / ABS-MBS (US3132E0MA74) | 12.68 | -2.00 | 0.3539 | -0.0234 | ||

| US05522RDG02 / BA Credit Card Trust | 12.66 | -0.03 | 0.3534 | -0.0159 | ||

| FED HM LN PC POOL QE8001 FR 08/52 FIXED 4.5 / ABS-MBS (US3133BH3J35) | 12.63 | -1.50 | 0.3526 | -0.0214 | ||

| US46647PBX33 / JPMorgan Chase & Co | 12.06 | 1.93 | 0.3367 | -0.0084 | ||

| US3140X6S774 / FANNIE MAE POOL UMBS P#FM3241 3.00000000 | 11.68 | -2.10 | 0.3261 | -0.0219 | ||

| FED HM LN PC POOL SD3478 FR 04/52 FIXED 2.5 / ABS-MBS (US3132DQ2K16) | 11.61 | -1.59 | 0.3241 | -0.0200 | ||

| US TREASURY N/B 04/30 3.875 / DBT (US91282CMZ13) | 11.55 | 0.3224 | 0.3224 | |||

| US09778PAA30 / Bon Secours Mercy Health Inc | 11.54 | 1.08 | 0.3222 | -0.0108 | ||

| US880591DM19 / Tennessee Valley Auth 7 1/8% Bonds 5/1/2030 | 11.44 | 0.32 | 0.3195 | -0.0132 | ||

| AVIS BUDGET RENTAL CAR FUNDING AESOP 2024 1A A 144A / ABS-O (US05377RHY36) | 11.31 | 0.52 | 0.3157 | -0.0124 | ||

| US06738ECE32 / Barclays PLC | 10.56 | 1.68 | 0.2948 | -0.0081 | ||

| US902613AE83 / UBS Group AG | 10.38 | 1.86 | 0.2899 | -0.0074 | ||

| WELLS FARGO COMMERCIAL MORTGAG WFCM 2024 5C2 A3 / ABS-MBS (US95003UAD28) | 10.38 | 0.57 | 0.2897 | -0.0112 | ||

| FED HM LN PC POOL SD8488 FR 01/55 FIXED 4 / ABS-MBS (US3132DWND10) | 10.31 | -1.72 | 0.2879 | -0.0181 | ||

| US02582JJZ49 / American Express Credit Account Master Trust 2023-1 | 10.05 | -0.04 | 0.2807 | -0.0127 | ||

| NISSAN AUTO LEASE TRUST NALT 2024 A A3 / ABS-O (US65481CAD65) | 10.04 | -0.06 | 0.2803 | -0.0127 | ||

| FED HM LN PC POOL RJ0049 FR 10/53 FIXED 5 / ABS-MBS (US3142GQBT84) | 10.04 | -2.02 | 0.2802 | -0.0186 | ||

| US95000U2L65 / WELLS FARGO + COMPANY SR UNSECURED 04/31 VAR | 9.95 | 1.24 | 0.2779 | -0.0089 | ||

| US3136BCVD95 / FANNIE MAE FNR 2020 77 DP | 9.80 | -0.65 | 0.2735 | -0.0141 | ||

| US639057AC29 / NatWest Group PLC | 9.73 | 0.87 | 0.2718 | -0.0097 | ||

| US17305EGW93 / CITIBANK CREDIT CARD ISSUANCE TRUST SER 2023-A1 CL A1 REGD 5.23000000 | 9.63 | -0.16 | 0.2689 | -0.0125 | ||

| CBAMR LTD CBAMR 2019 9A AR 144A / ABS-CBDO (US14987VAN91) | 9.22 | 0.12 | 0.2576 | -0.0112 | ||

| EMPIRE DISTRICT BONDCO SR SECURED 01/35 4.943 / DBT (US291918AA87) | 9.20 | 0.31 | 0.2568 | -0.0107 | ||

| US650036AV86 / NEW YORK ST URBAN DEV CORP REV NYSDEV 03/27 FIXED 1.496 | 9.03 | 0.88 | 0.2522 | -0.0090 | ||

| US88240TAA97 / Texas Electric Market Stabilization Funding N LLC | 9.00 | 0.25 | 0.2512 | -0.0106 | ||

| US3133KNYX55 / FED HM LN PC POOL RA7026 FR 03/52 FIXED 3 | 8.92 | -0.73 | 0.2489 | -0.0131 | ||

| FNMA POOL BZ3619 FN 04/30 FIXED 4.6 / ABS-MBS (US3140NYAV35) | 8.84 | 0.2467 | 0.2467 | |||

| FLORIDA POWER + LIGHT CO FLORIDA POWER + LIGHT CO / DBT (US341081GT84) | 8.80 | 0.73 | 0.2457 | -0.0091 | ||

| FNMA POOL BZ3505 FN 04/30 FIXED 4.25 / ABS-MBS (US3140NX3P67) | 8.71 | 0.2431 | 0.2431 | |||

| MASSMUTUAL GLOBAL FUNDIN MASSMUTUAL GLOBAL FUNDIN / DBT (US57629W5B21) | 8.54 | 0.48 | 0.2384 | -0.0095 | ||

| US06540AAB70 / BANK BANK 2019 BN20 ASB | 8.49 | -4.98 | 0.2370 | -0.0236 | ||

| US14041NGD75 / CAPITAL ONE MULTI-ASST EXEC TR 4.42% 05/15/2028 | 8.31 | 0.05 | 0.2320 | -0.0103 | ||

| YALE UNIVERSITY SR UNSECURED 04/32 4.701 / DBT (US98459LAD55) | 8.22 | 0.2295 | 0.2295 | |||

| US05377RHG20 / AESOP 23-6 A 144A 5.81% 12-20-29/28 | 8.22 | 0.29 | 0.2294 | -0.0096 | ||

| US42806MBW82 / HERTZ 23-2 A 144A 5.57% 09-25-29/28 | 8.18 | 0.44 | 0.2283 | -0.0092 | ||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 8.17 | -0.04 | 0.2280 | -0.0103 | ||

| NRUC / National Rural Utilities Cooperative Finance Corporation - Corporate Bond/Note | 8.13 | 0.20 | 0.2271 | -0.0097 | ||

| US14318XAC92 / CarMax Auto Owner Trust 2023-4 | 8.12 | -0.27 | 0.2266 | -0.0108 | ||

| US29003JAC80 / Elmwood CLO 15 Ltd | 8.00 | 0.00 | 0.2234 | -0.0100 | ||

| US61772WAA53 / Morgan Stanley Capital I Trust 2021-230P | 7.99 | -0.95 | 0.2231 | -0.0122 | ||

| US78403DAP50 / SBA Tower Trust | 7.87 | 0.85 | 0.2197 | -0.0079 | ||

| FNMA POOL BL6406 FN 05/27 FIXED 1.63 / ABS-MBS (US3140HYDL99) | 7.84 | 0.94 | 0.2189 | -0.0077 | ||

| BENCHMARK MORTGAGE TRUST BMARK 2025 V14 A4 / ABS-MBS (US08164BAD29) | 7.72 | 0.90 | 0.2155 | -0.0076 | ||

| US3133KJDA79 / Freddie Mac Pool | 7.66 | -1.67 | 0.2138 | -0.0133 | ||

| US3140MNA483 / UMBS | 7.64 | -1.07 | 0.2134 | -0.0120 | ||

| US539439AQ24 / Lloyds Banking Group PLC | 7.64 | 0.79 | 0.2132 | -0.0078 | ||

| VERIZON MASTER TRUST VZMT 2024 7 A 144A / ABS-O (US92348KDJ97) | 7.53 | 0.76 | 0.2102 | -0.0078 | ||

| FED HM LN PC POOL RA7346 FR 06/52 FIXED 3 / ABS-MBS (US3133KPET12) | 7.43 | -0.71 | 0.2075 | -0.0108 | ||

| US12597BAV18 / CSAIL COMMERCIAL MORTGAGE TRUS CSAIL 2019 C17 ASB | 7.30 | -5.60 | 0.2038 | -0.0217 | ||

| US3140MMYJ12 / Fannie Mae Pool | 7.29 | -1.05 | 0.2035 | -0.0114 | ||

| BMO MORTGAGE TRUST BMO 2024 5C7 A3 / ABS-MBS (US09660WAU53) | 7.23 | 0.64 | 0.2018 | -0.0077 | ||

| US3128MJ3M09 / FREDDIE MAC GOLD POOL FG G08803 | 7.22 | -2.04 | 0.2016 | -0.0134 | ||

| US86562MBP41 / Sumitomo Mitsui Financial Group Inc | 7.11 | 1.35 | 0.1985 | -0.0061 | ||

| US06738EBV65 / Barclays PLC | 7.08 | 2.09 | 0.1978 | -0.0046 | ||

| US38141GWL49 / GOLDMAN SACHS GROUP INC SR UNSECURED 06/28 VAR | 7.08 | 0.53 | 0.1976 | -0.0078 | ||

| US3140QPR749 / FANNIE MAE POOL UMBS P#CB4109 3.00000000 | 7.06 | -0.91 | 0.1970 | -0.0107 | ||

| US12528YAC75 / CF 2019 CF2 MTG TR 06/29 0 | 6.98 | -4.62 | 0.1950 | -0.0186 | ||

| PG+E RECOVERY FND LLC SR SECURED 06/35 4.838 / DBT (US71710TAG31) | 6.98 | -7.98 | 0.1949 | -0.0264 | ||

| US86944BAG86 / Sutter Health | 6.96 | 1.77 | 0.1943 | -0.0052 | ||

| US3132DWFQ15 / FHLG 30YR 4.5% 12/01/2052# | 6.86 | -2.11 | 0.1916 | -0.0129 | ||

| US64971XJD12 / NEW YORK CITY NY TRANSITIONAL NYCGEN 11/27 FIXED 2.98 | 6.83 | 0.63 | 0.1908 | -0.0073 | ||

| TRINITAS CLO LTD TRNTS 2020 14A A1R 144A / ABS-CBDO (US89641QAN07) | 6.80 | 0.12 | 0.1900 | -0.0083 | ||

| APIDOS CLO LTD APID 2012 11A AR4 144A / ABS-CBDO (US03763YBY14) | 6.80 | -0.04 | 0.1898 | -0.0086 | ||

| GM FINANCIAL REVOLVING RECEIVA GMREV 2024 2 A 144A / ABS-O (US379925AA81) | 6.75 | 0.63 | 0.1884 | -0.0072 | ||

| ATHENE GLOBAL FUNDING ATHENE GLOBAL FUNDING / DBT (US04685A4A66) | 6.73 | 0.12 | 0.1879 | -0.0082 | ||

| OCTAGON INVESTMENT PARTNERS 40 OCT40 2019 1A A1RR 144A / ABS-CBDO (US67592BAY48) | 6.66 | -0.45 | 0.1860 | -0.0092 | ||

| FED HM LN PC POOL QF7428 FR 02/53 FIXED 5 / ABS-MBS (US3133BVHD02) | 6.60 | -0.97 | 0.1843 | -0.0101 | ||

| US03444RAB42 / Andrew W Mellon Foundation/The | 6.58 | 1.29 | 0.1836 | -0.0058 | ||

| HYUNDAI AUTO LEASE SECURITIZAT HALST 2025 B A3 144A / ABS-O (US44935DAD12) | 6.55 | 0.1828 | 0.1828 | |||

| US3132DWHE66 / UMBS | 6.49 | -2.11 | 0.1811 | -0.0122 | ||

| GM FINANCIAL REVOLVING RECEIVA GMREV 2024 1 A 144A / ABS-O (US36269KAA34) | 6.45 | 0.56 | 0.1800 | -0.0070 | ||

| US3132DPFG81 / Freddie Mac Pool | 6.35 | -1.60 | 0.1774 | -0.0109 | ||

| US09659W2P81 / BNP Paribas SA | 6.32 | 1.90 | 0.1764 | -0.0044 | ||

| US3138LHW915 / FANNIE MAE POOL UMBS P#AN5171 3.29000000 | 6.32 | 0.48 | 0.1763 | -0.0070 | ||

| WOODSIDE FINANCE LTD WOODSIDE FINANCE LTD / DBT (US980236AR40) | 6.30 | -0.21 | 0.1758 | -0.0082 | ||

| US40139LBH50 / Guardian Life Global Funding | 6.28 | 0.45 | 0.1753 | -0.0070 | ||

| BMO MORTGAGE TRUST BMO 2024 5C5 A3 / ABS-MBS (US05593RAC60) | 6.26 | 1.02 | 0.1748 | -0.0060 | ||

| US3140QQKN48 / FNCL UMBS 4.5 CB4800 10-01-52 | 6.25 | -1.25 | 0.1746 | -0.0101 | ||

| AMERICAN EXPRESS CREDIT ACCOUN AMXCA 2024 2 A / ABS-MBS (US02582JKF65) | 6.25 | 0.64 | 0.1745 | -0.0067 | ||

| BIRCH GROVE CLO LTD. BGCLO 19A A1RR 144A / ABS-CBDO (US09075JAU34) | 6.22 | 0.32 | 0.1738 | -0.0072 | ||

| EAI / Entergy Arkansas, LLC - Corporate Bond/Note | 6.18 | 0.1726 | 0.1726 | |||

| US25160PAN78 / Deutsche Bank AG | 6.15 | -0.28 | 0.1718 | -0.0082 | ||

| US05377RGC25 / Avis Budget Rental Car Funding AESOP LLC | 6.12 | 0.29 | 0.1710 | -0.0071 | ||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 6.10 | 0.1703 | 0.1703 | |||

| FFH.PRH / Fairfax Financial Holdings Limited - Preferred Stock | 6.09 | 0.1699 | 0.1699 | |||

| US00138CAU27 / Corebridge Global Funding | 6.08 | -0.21 | 0.1697 | -0.0080 | ||

| NORTHWESTERN UNIVERSITY UNSECURED 12/35 4.94 / DBT (US668444AT96) | 6.04 | 0.97 | 0.1688 | -0.0059 | ||

| SAFEHOLD GL HOLDINGS LLC SAFEHOLD GL HOLDINGS LLC / DBT (US785931AA40) | 6.04 | 1.14 | 0.1686 | -0.0056 | ||

| US225401AU28 / Credit Suisse Group AG | 5.99 | 1.96 | 0.1673 | -0.0041 | ||

| US3138LMSA22 / FANNIE MAE POOL UMBS P#AN8612 3.29000000 | 5.96 | 0.76 | 0.1665 | -0.0061 | ||

| AIMCO AIMCO 2015 AA AR3 144A / ABS-CBDO (US00900LAY02) | 5.96 | 0.13 | 0.1664 | -0.0072 | ||

| SYSTEM ENERGY RESOURCES 1ST REF MORT 12/34 5.3 / DBT (US871911AV54) | 5.93 | 300.00 | 0.1656 | 0.1224 | ||

| BNH / Brookfield Finance Inc. - Corporate Bond/Note | 5.90 | 0.1648 | 0.1648 | |||

| GA GLOBAL FUNDING TRUST SECURED 144A 01/30 5.4 / DBT (US36143L2R50) | 5.86 | 0.79 | 0.1635 | -0.0060 | ||

| SAMMONS FINANCIAL GLOBAL SECURED 144A 06/30 4.95 / DBT (US79587J2C65) | 5.82 | 0.1624 | 0.1624 | |||

| US06675FBB22 / Banque Federative du Credit Mutuel SA | 5.76 | 0.51 | 0.1609 | -0.0064 | ||

| US90278MAY30 / UBS Commercial Mortgage Trust | 5.73 | -5.00 | 0.1601 | -0.0160 | ||

| US232989AD58 / DLLMT 2023-1 LLC | 5.73 | -0.09 | 0.1600 | -0.0073 | ||

| PROLOGIS TARGETED US PROLOGIS TARGETED US / DBT (US74350LAB09) | 5.72 | 0.83 | 0.1598 | -0.0058 | ||

| US087598AA60 / BETHP 2021 3ML+113 01/15/2035 144A | 5.70 | 0.14 | 0.1592 | -0.0069 | ||

| US78432WAA18 / SFO Commercial Mortgage Trust 2021-555 | 5.68 | 1.00 | 0.1585 | -0.0055 | ||

| SWEPCO STORM RECOVERY FU SR SECURED 09/41 4.88 / DBT (US870696AA94) | 5.67 | -0.47 | 0.1583 | -0.0079 | ||

| US36268DAA00 / GMREV 23-2 A 144A 5.77% 08-11-36/11-13-28 | 5.66 | 0.27 | 0.1579 | -0.0066 | ||

| JACKSON NATL LIFE GLOBAL SECURED 144A 06/28 4.7 / DBT (US46849CJP77) | 5.64 | 0.1574 | 0.1574 | |||

| US06541TAZ21 / BANK BANK 2020 BN29 ASB | 5.63 | 1.06 | 0.1572 | -0.0053 | ||

| DTE ELECTRIC CO GENL REF MOR 05/35 5.25 / DBT (US23338VAY20) | 5.60 | 0.1564 | 0.1564 | |||

| CHUBB INA HOLDINGS LLC CHUBB INA HOLDINGS LLC / DBT (US171239AL07) | 5.60 | 0.88 | 0.1563 | -0.0056 | ||

| US08162UAW09 / Benchmark 2018-B8 Mortgage Trust | 5.59 | 1.01 | 0.1560 | -0.0053 | ||

| US09659X2M33 / BNP PARIBAS SR UNSECURED REGS 09/28 VAR | 5.57 | 1.31 | 0.1555 | -0.0048 | ||

| PRINCIPAL LFE GLB FND II SECURED 144A 01/28 4.8 / DBT (US74256LFC81) | 5.57 | 0.34 | 0.1554 | -0.0064 | ||

| US03880RAA77 / Arbor Realty Collateralized Loan Obligation Ltd | 5.55 | -15.77 | 0.1549 | -0.0372 | ||

| US3132DWFB46 / Freddie Mac Pool | 5.47 | -1.79 | 0.1528 | -0.0098 | ||

| US14044EAD04 / CAPITAL ONE PRIME AUTO RECEIVABLES TRUST 2023-2 5.82% 06/15/2028 | 5.47 | -0.18 | 0.1527 | -0.0071 | ||

| US210518DV59 / CMS ENERGY CORPORATION | 5.41 | 0.82 | 0.1512 | -0.0055 | ||

| US08162YAG70 / BENCHMARK MORTGAGE TRUST BMARK 2019 B14 ASB | 5.35 | -2.62 | 0.1493 | -0.0109 | ||

| US606822BU78 / Mitsubishi UFJ Financial Group Inc | 5.33 | 2.03 | 0.1488 | -0.0035 | ||

| US59217GER65 / Metropolitan Life Global Funding I | 5.32 | 1.06 | 0.1485 | -0.0050 | ||

| BARCLAYS COMMERCIAL MORTGAGE S BBCMS 2024 5C31 A3 / ABS-MBS (US07336YAC93) | 5.29 | 0.65 | 0.1477 | -0.0056 | ||

| US61691UBC27 / Morgan Stanley Capital I Trust 2019-L3 | 5.28 | -5.61 | 0.1475 | -0.0158 | ||

| STANFORD UNIVERSITY SR UNSECURED 03/35 4.679 / DBT (US85440KAE47) | 5.27 | 0.40 | 0.1472 | -0.0060 | ||

| US126395AA04 / CSMC 2020-FACT CSMC 2020-FACT A | 5.27 | 0.30 | 0.1470 | -0.0061 | ||

| EQUITABLE AMERICA GLOBAL SECURED 144A 06/30 4.95 / DBT (US29446Q2B87) | 5.26 | 0.1468 | 0.1468 | |||

| US76209PAC77 / RGA GLOBAL FUNDING | 5.25 | 0.25 | 0.1465 | -0.0062 | ||

| FLORIDA ST BRD OF ADMIN FIN CO FLSGEN 07/34 FIXED 5.526 / DBT (US341271AH76) | 5.24 | 0.06 | 0.1463 | -0.0064 | ||

| US477143AH41 / JetBlue 2019-1 Class AA Pass Through Trust | 5.22 | -2.28 | 0.1458 | -0.0101 | ||

| VERDELITE STATIC CLO LTD BVSTAT 2024 1A A 144A / ABS-CBDO (US92338VAA98) | 5.21 | -5.93 | 0.1454 | -0.0161 | ||

| US91412GU945 / UNIV OF CALIFORNIA CA REVENUES | 5.20 | 0.35 | 0.1452 | -0.0060 | ||

| NEW YORK NY CITY TRANSITIONAL NYCGEN 05/37 FIXED OID 4.375 / DBT (US64972JLP11) | 5.20 | -0.50 | 0.1451 | -0.0072 | ||

| PACIFIC LIFE GF II SECURED 144A 08/29 4.5 / DBT (US6944PL3C15) | 5.18 | 0.86 | 0.1446 | -0.0052 | ||

| CABK / CaixaBank, S.A. | 5.17 | 0.82 | 0.1444 | -0.0052 | ||

| WIND RIVER CLO LTD WINDR 2016 1KRA A1R3 144A / ABS-CBDO (US97314DAN84) | 5.16 | -0.44 | 0.1440 | -0.0071 | ||

| US379930AE07 / GM Financial Consumer Automobile Receivables Trust 2023-4 | 5.13 | 0.06 | 0.1433 | -0.0063 | ||

| US87166PAL58 / SYNIT 23-A2 A 5.74% 10-15-29/26 | 5.09 | -0.20 | 0.1422 | -0.0066 | ||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 5.09 | 0.1421 | 0.1421 | |||

| VIRGINIA POWER FUEL SEC SR SECURED 05/33 4.877 / DBT (US92808VAB80) | 5.09 | 0.57 | 0.1420 | -0.0055 | ||

| US172967MS77 / Citigroup Inc | 5.08 | 1.84 | 0.1418 | -0.0037 | ||

| PUBLIC SERVICE COLORADO 1ST MORTGAGE 05/34 5.35 / DBT (US744448CZ26) | 5.07 | 0.89 | 0.1417 | -0.0050 | ||

| US05377RGU23 / Avis Budget Rental Car Funding AESOP LLC | 5.07 | -0.04 | 0.1414 | -0.0064 | ||

| DK0009391104 / JYSKE REALKREDIT A/S /DKK/ REGD SER 321E 1.00000000 | 5.04 | 0.90 | 0.1406 | -0.0050 | ||

| FANNIE MAE FNR 2025 52 FB / ABS-MBS (US3136BWUZ70) | 5.01 | 0.1399 | 0.1399 | |||

| US13077DMP41 / CALIFORNIA ST UNIV REVENUE | 4.99 | 1.65 | 0.1393 | -0.0039 | ||

| S1NN34 / Smith & Nephew plc - Depositary Receipt (Common Stock) | 4.90 | 20.80 | 0.1367 | 0.0185 | ||

| US3140XLSR00 / FNMA UMBS, 30 Year | 4.87 | -0.91 | 0.1361 | -0.0074 | ||

| US3137HAMH63 / Freddie Mac Multifamily Structured Pass Through Certificates | 4.87 | 0.45 | 0.1360 | -0.0054 | ||

| US404280CC17 / HSBC Holdings PLC | 4.87 | 1.18 | 0.1360 | -0.0044 | ||

| US26833BAB99 / ECMC GROUP STUDENT LOAN TRUST ECMC 2020 3A A1B 144A | 4.84 | -1.81 | 0.1350 | -0.0086 | ||

| HONDA AUTO RECEIVABLES OWNER T HAROT 2024 3 A3 / ABS-O (US43813YAC66) | 4.73 | 0.11 | 0.1320 | -0.0057 | ||

| BMO MORTGAGE TRUST BMO 2024 5C8 A3 / ABS-MBS (US09661XAC20) | 4.67 | 0.82 | 0.1305 | -0.0047 | ||

| ING / ING Groep N.V. - Depositary Receipt (Common Stock) | 4.61 | 1.54 | 0.1287 | -0.0037 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 01/30 5.38 / DBT (US04685A4G37) | 4.60 | 0.83 | 0.1285 | -0.0047 | ||

| US78486BAA26 / STARWOOD COMMERCIAL MORTGAGE T STWD 2021 FL2 A 144A | 4.59 | -27.32 | 0.1281 | -0.0560 | ||

| US88240TAB70 / Texas Electric Market Stabilization Funding N LLC | 4.53 | -0.15 | 0.1265 | -0.0059 | ||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 4.52 | 0.85 | 0.1261 | -0.0045 | ||

| US88258MAA36 / TEXAS NATURAL GAS SECURITIZTN FIN CORP REVENUE | 4.52 | -3.89 | 0.1261 | -0.0110 | ||

| ICG US CLO LTD ICG 2021 3A AR 144A / ABS-CBDO (US449249AS08) | 4.50 | 0.29 | 0.1257 | -0.0053 | ||

| ELEVATION CLO LTD AWPT 2018 3A A1R2 144A / ABS-CBDO (US28623VAN91) | 4.50 | 0.09 | 0.1257 | -0.0055 | ||

| US95001VAU44 / Wells Fargo Commercial Mortgage Trust 2019-C51 | 4.46 | 1.25 | 0.1244 | -0.0039 | ||

| US87277JAA97 / TRTX 2022-FL5 Issuer Ltd | 4.43 | -7.98 | 0.1236 | -0.0167 | ||

| US55953WAA80 / Magnetite XXXII Ltd., Series 2022-32A, Class A | 4.40 | 0.02 | 0.1230 | -0.0055 | ||

| US23346TAA97 / DTE Electric Securitization Funding II LLC | 4.38 | -0.27 | 0.1224 | -0.0058 | ||

| US54627RAM25 / LOUISIANA ST LOCAL GOVT ENVRNMNTL FACS & CMNTY DEV AUTH | 4.36 | 0.93 | 0.1216 | -0.0043 | ||

| ICG US CLO LTD ICG 2015 2RA A1R 144A / ABS-CBDO (US44933WAL37) | 4.34 | -13.10 | 0.1211 | -0.0245 | ||

| RGA GLOBAL FUNDING SECURED 144A 05/29 5.448 / DBT (US76209PAE34) | 4.34 | 0.60 | 0.1211 | -0.0046 | ||

| PRICOA GLOBAL FUNDING 1 SECURED 144A 08/31 4.65 / DBT (US74153WCV90) | 4.31 | 1.05 | 0.1204 | -0.0041 | ||

| US20268JAF03 / CommonSpirit Health | 4.31 | 1.77 | 0.1202 | -0.0032 | ||

| US55361AAU88 / MSWF Commercial Mortgage Trust 2023-2 | 4.29 | 0.56 | 0.1198 | -0.0047 | ||

| US257375AJ44 / Dominion Energy Gas Holdings LLC | 4.27 | 0.83 | 0.1192 | -0.0043 | ||

| US88880LAJ26 / TOBACCO SETTLEMENT FIN AUTH WV TOBGEN 06/27 FIXED 2.02 | 4.21 | 1.03 | 0.1175 | -0.0040 | ||

| ANCHORAGE CAPITAL CLO LTD ANCHC 2021 21A AR 144A / ABS-CBDO (US03331KAJ88) | 4.20 | 0.57 | 0.1173 | -0.0046 | ||

| PARALLEL LTD PARL 2021 1A AR 144A / ABS-CBDO (US69916HAL42) | 4.19 | 0.14 | 0.1171 | -0.0051 | ||

| US92867WAD02 / Volkswagen Auto Loan Enhanced Trust, Series 2023-1, Class A3 | 4.19 | -5.36 | 0.1169 | -0.0121 | ||

| COOPERATIEVE RABOBANK UA 144A 01/33 VAR / DBT (US74977RDU59) | 4.17 | 1.22 | 0.1163 | -0.0037 | ||

| US358266CH59 / FRESNO CNTY CA PENSN OBLG FREGEN 08/30 ZEROCPNOID 0 | 4.12 | 1.25 | 0.1149 | -0.0036 | ||

| US12595EAD76 / COMM 2017-COR2 Mortgage Trust | 4.10 | 0.69 | 0.1144 | -0.0043 | ||

| FREDDIE MAC FHR 5439 FK / ABS-MBS (US3137HF3S28) | 4.10 | -8.51 | 0.1144 | -0.0162 | ||

| US09659W2K94 / BNP Paribas SA | 4.09 | 1.71 | 0.1143 | -0.0031 | ||

| US66815L2M02 / Northwestern Mutual Global Funding | 4.08 | 0.59 | 0.1139 | -0.0044 | ||

| US37310PAE16 / GEORGETOWN UNIVERSITY SR UNSECURED 04/30 2.247 | 4.07 | 2.57 | 0.1138 | -0.0021 | ||

| NATIONAL SECS CLEARING SR UNSECURED 144A 05/30 4.7 / DBT (US637639AQ81) | 4.07 | 0.1136 | 0.1136 | |||

| COOPERAT RABOBANK UA/NY 10/29 4.494 / DBT (US21688ABH41) | 4.05 | 1.30 | 0.1130 | -0.0036 | ||

| BANK OF AMERICA AUTO TRUST BAAT 2023 2A A4 144A / ABS-O (US06054YAD94) | 4.04 | -0.15 | 0.1127 | -0.0052 | ||

| US06540WBD48 / Bank 2019-BNK19 | 4.03 | 1.10 | 0.1124 | -0.0037 | ||

| US456837AX12 / ING Groep NV | 4.01 | -0.17 | 0.1120 | -0.0052 | ||

| US902613AS79 / UBS Group AG | 4.01 | 0.20 | 0.1119 | -0.0048 | ||

| US12635RAX61 / CSAIL 2015-C4 Commercial Mortgage Trust | 4.01 | -28.01 | 0.1118 | -0.0504 | ||

| FREDDIE MAC FHR 5511 FG / ABS-MBS (US3137HKKP89) | 4.00 | -9.07 | 0.1117 | -0.0166 | ||

| US78448TAK88 / SMBC Aviation Capital Finance DAC | 4.00 | 0.60 | 0.1117 | -0.0043 | ||

| US38382A5Y79 / Ginnie Mae REMICS | 4.00 | -2.27 | 0.1116 | -0.0077 | ||

| US007944AF80 / Adventist Health System/West | 4.00 | 0.65 | 0.1116 | -0.0042 | ||

| US13077DMQ24 / CALIFORNIA ST UNIV REVENUE | 3.99 | 1.71 | 0.1113 | -0.0030 | ||

| US80281LAG05 / Santander UK Group Holdings PLC | 3.92 | 0.75 | 0.1095 | -0.0041 | ||

| US34535CAA45 / FORDR_23-2 | 3.92 | 0.59 | 0.1094 | -0.0042 | ||

| NLG GLOBAL FUNDING SECURED 144A 01/30 5.4 / DBT (US62915W2A05) | 3.91 | 1.08 | 0.1093 | -0.0036 | ||

| US00774MAV72 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 3.90 | 0.83 | 0.1088 | -0.0039 | ||

| US3137F66L68 / FREDDIE MAC FHR 5042 CA | 3.81 | -8.54 | 0.1065 | -0.0152 | ||

| US08162DAC20 / BENCHMARK MORTGAGE TRUST BMARK 2019 B13 ASB | 3.79 | 0.80 | 0.1059 | -0.0039 | ||

| US46652DAA37 / JP Morgan Chase Commercial Mortgage Securities Corp | 3.77 | -5.28 | 0.1051 | -0.0108 | ||

| US90931GAA76 / United Airlines 2020-1 Class A Pass Through Trust | 3.73 | -6.56 | 0.1043 | -0.0123 | ||

| US38122ND336 / GOLDEN ST TOBACCO SECURITIZATI GLDGEN 06/32 FIXED 3.037 | 3.73 | 0.98 | 0.1040 | -0.0036 | ||

| US12595VAD91 / COMM 2018-COR3 Mortgage Trust | 3.72 | 0.57 | 0.1037 | -0.0040 | ||

| US26829GAA67 / ECMC Group Student Loan Trust 2018-2 | 3.69 | -1.76 | 0.1031 | -0.0066 | ||

| PUBLIC SERVICE ELECTRIC SECURED 08/34 4.85 / DBT (US74456QCS30) | 3.69 | 0.60 | 0.1031 | -0.0040 | ||

| US05377RHM97 / Avis Budget Rental Car Funding AESOP LLC | 3.66 | 0.14 | 0.1023 | -0.0044 | ||

| TRANS ALLEGHENY INTERSTA SR UNSECURED 144A 01/31 5 / DBT (US893045AF16) | 3.66 | 0.1023 | 0.1023 | |||

| AERCAP IRELAND CAP/GLOBA COMPANY GUAR 09/29 4.625 / DBT (US00774MBL81) | 3.65 | 1.14 | 0.1020 | -0.0034 | ||

| US3140QNQX35 / FNMA 30YR 3% 03/01/2052#CB3169 | 3.65 | -2.51 | 0.1018 | -0.0073 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 3.63 | 0.66 | 0.1015 | -0.0038 | ||

| US3132VLPD35 / Freddie Mac Gold Pool | 3.63 | -1.52 | 0.1013 | -0.0062 | ||

| US12594MBC10 / COMM 16-COR1 A4 3.091% 10-10-49/08-10-26 | 3.63 | 1.60 | 0.1012 | -0.0029 | ||

| DRYDEN SENIOR LOAN FUND DRSLF 2021 95A AR 144A / ABS-CBDO (US262487AJ07) | 3.59 | -0.22 | 0.1003 | -0.0047 | ||

| AMEREN MISSOURI SEC FU I SR SECURED 10/41 4.85 / DBT (US023940AA78) | 3.57 | -0.39 | 0.0998 | -0.0049 | ||

| US3137FYEX00 / FREDDIE MAC FHR 5092 XA | 3.57 | -2.56 | 0.0998 | -0.0072 | ||

| US42806MCE75 / HERTZ 23-4 A 144A 6.15% 03-25-30/03-26-29 | 3.55 | 0.71 | 0.0992 | -0.0037 | ||

| MARS INC SR UNSECURED 144A 03/30 4.8 / DBT (US571676AY11) | 3.55 | 0.77 | 0.0990 | -0.0037 | ||

| US694308KF34 / Pacific Gas and Electric Co | 3.54 | 0.17 | 0.0989 | -0.0043 | ||

| US3140QNW249 / FNMA POOL CB3364 FN 04/52 FIXED 3 | 3.51 | -2.20 | 0.0980 | -0.0067 | ||

| GREYSTONE COMMERCIAL REAL ESTA GSTNE 2025 FL4 A 144A / ABS-CBDO (US39810MAA71) | 3.50 | 0.0978 | 0.0978 | |||

| OFSI FUND LTD OFSBS 2021 10A AR 144A / ABS-CBDO (US67115PAW59) | 3.50 | 0.17 | 0.0978 | -0.0042 | ||

| US14040HDC60 / Capital One Financial Corp | 3.50 | 1.45 | 0.0978 | -0.0029 | ||

| US06675FBA49 / Banque Federative du Credit Mutuel SA | 3.50 | -0.09 | 0.0978 | -0.0045 | ||

| US01026CAD39 / Alabama Economic Settlement Authority | 3.49 | 0.69 | 0.0975 | -0.0037 | ||

| US78473JAA07 / SREIT Trust 2021-IND | 3.49 | 0.61 | 0.0974 | -0.0037 | ||

| RFR USD SOFR/3.00000 02/12/25-30Y LCH / DIR (EZ5QDLRMVJ80) | 3.46 | 15.75 | 0.0966 | 0.0094 | ||

| FED HM LN PC POOL SD3942 FR 01/53 FIXED 4.5 / ABS-MBS (US3132E0LX86) | 3.46 | -1.40 | 0.0966 | -0.0057 | ||

| US90276UAU51 / UBS COMMERCIAL MORTGAGE TRUST UBSCM 2017 C6 ASB | 3.43 | -11.83 | 0.0957 | -0.0177 | ||

| BARCLAYS COMMERCIAL MORTGAGE S BBCMS 2025 C32 A4 / ABS-MBS (US07337AAC09) | 3.41 | 0.50 | 0.0952 | -0.0037 | ||

| VIRGINIA POWER FUEL SEC SR SECURED 05/29 5.088 / DBT (US92808VAA08) | 3.36 | -21.56 | 0.0939 | -0.0311 | ||

| FNMA POOL FS6035 FN 06/51 FIXED VAR / ABS-MBS (US3140XMV520) | 3.36 | -1.35 | 0.0938 | -0.0055 | ||

| US31418CZJ60 / Fannie Mae Pool | 3.30 | -3.20 | 0.0921 | -0.0073 | ||

| US3140HMN264 / Federal National Mortgage Association | 3.30 | -2.48 | 0.0921 | -0.0066 | ||

| VOYA CLO LTD VOYA 2017 3A A1RR 144A / ABS-CBDO (US92915QBG73) | 3.29 | -0.36 | 0.0918 | -0.0045 | ||

| EXTRA SPACE STORAGE LP COMPANY GUAR 06/35 5.4 / DBT (US30225VAU17) | 3.27 | 1.11 | 0.0913 | -0.0030 | ||

| T MOBILE USA INC T MOBILE USA INC / DBT (US87264ADM45) | 3.25 | 0.65 | 0.0907 | -0.0034 | ||

| ANTX / AN2 Therapeutics, Inc. | 3.24 | 0.75 | 0.0903 | -0.0034 | ||

| US88880LAH69 / TOBACCO SETTLEMENT FIN AUTH WV ASSET BACKED | 3.22 | 0.78 | 0.0900 | -0.0033 | ||

| US636274AD47 / National Grid PLC | 3.21 | 0.94 | 0.0896 | -0.0031 | ||

| JAMESTOWN CLO LTD JTWN 2021 16A AR 144A / ABS-CBDO (US47048RAL96) | 3.19 | 0.03 | 0.0891 | -0.0040 | ||

| TVC / Tennessee Valley Authority - Preferred Stock | 3.18 | 0.28 | 0.0889 | -0.0037 | ||

| US04002VAA98 / AREIT Trust, Series 2022-CRE6, Class A | 3.17 | -0.28 | 0.0886 | -0.0042 | ||

| US21071BAA35 / Consumers 2023 Securitization Funding LLC | 3.16 | -0.57 | 0.0881 | -0.0045 | ||

| US3137HAMP89 / FHLMC Multifamily Structured Pass-Through Certificates, Series KJ47, Class A2 | 3.13 | 0.45 | 0.0875 | -0.0035 | ||

| FLORIDA POWER + LIGHT CO 1ST MORTGAGE 06/34 5.3 / DBT (US341081GU57) | 3.09 | 0.72 | 0.0864 | -0.0032 | ||

| BBV / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 3.09 | 0.49 | 0.0863 | -0.0034 | ||

| US67113DAW48 / OZLM XXIV Ltd | 3.08 | -23.53 | 0.0861 | -0.0315 | ||

| BRIGHTHSE FIN GLBL FUND BRIGHTHSE FIN GLBL FUND / DBT (US10921U2L15) | 3.08 | 0.89 | 0.0859 | -0.0031 | ||

| MASSMUTUAL GLOBAL FUNDIN SECURED 144A 01/30 4.95 / DBT (US57629TBV89) | 3.07 | 1.39 | 0.0856 | -0.0026 | ||

| SAN DIEGO G + E 1ST MORTGAGE 04/35 5.4 / DBT (US797440CG74) | 3.06 | 1.36 | 0.0856 | -0.0026 | ||

| US3137FQHG16 / FREDDIE MAC FHR 4936 AP | 3.06 | -4.43 | 0.0854 | -0.0080 | ||

| US70462GAB41 / PeaceHealth Obligated Group | 3.06 | 0.69 | 0.0853 | -0.0032 | ||

| US232989AC75 / DLLMT_23-1A | 3.05 | -21.19 | 0.0852 | -0.0278 | ||

| FED HM LN PC POOL SD4115 FR 10/52 FIXED 4.5 / ABS-MBS (US3132E0SC76) | 3.05 | -1.55 | 0.0852 | -0.0052 | ||

| US92943AAA25 / WSTN_23-MAUI | 3.05 | -0.29 | 0.0850 | -0.0041 | ||

| FNMA POOL BR6304 FN 04/51 FIXED 2.5 / ABS-MBS (US3140L5AE69) | 3.04 | -2.57 | 0.0848 | -0.0061 | ||

| US743820AC66 / Providence St Joseph Health Obligated Group | 3.04 | 0.23 | 0.0847 | -0.0036 | ||

| GIB.A / CGI Inc. | 3.03 | 0.97 | 0.0846 | -0.0029 | ||

| US780097BA81 / Natwest Group PLC | 3.01 | -0.07 | 0.0840 | -0.0038 | ||

| US17108JAA16 / CHRISTUS Health | 3.00 | 0.84 | 0.0838 | -0.0030 | ||

| SMB PRIVATE EDUCATION LOAN TRU SMB 2025 A A1A 144A / ABS-O (US83207EAA47) | 3.00 | 0.0837 | 0.0837 | |||

| US05608RAA32 / BX Trust | 3.00 | 0.17 | 0.0837 | -0.0036 | ||

| MASSMUTUAL GLOBAL FUNDIN MASSMUTUAL GLOBAL FUNDIN / DBT (US57629W4T48) | 2.98 | 0.47 | 0.0833 | -0.0033 | ||

| US90931EAA29 / United Airlines Pass Through Trust, Series 2019-1, Class A | 2.97 | -0.27 | 0.0830 | -0.0040 | ||

| BANK BANK 2024 BNK48 A4 / ABS-MBS (US06541GAC15) | 2.97 | 1.06 | 0.0828 | -0.0028 | ||

| WEIR GROUP INC COMPANY GUAR 144A 05/30 5.35 / DBT (US94877DAA28) | 2.94 | 0.0821 | 0.0821 | |||

| US023770AA81 / American Airlin Bond | 2.94 | -4.27 | 0.0821 | -0.0075 | ||

| US74368CBC73 / Protective Life Global Funding | 2.94 | 0.79 | 0.0820 | -0.0030 | ||

| US694308HS91 / Pacific Gal Elec Bond | 2.93 | 0.55 | 0.0819 | -0.0032 | ||

| US62878U2A90 / NBN Co Ltd | 2.93 | 0.65 | 0.0817 | -0.0031 | ||

| US694308KP16 / PACIFIC GAS AND ELECTRIC CO SR SEC 1ST LIEN 6.95% 03-15-34 | 2.91 | -0.65 | 0.0812 | -0.0042 | ||

| US036752AP88 / Anthem Inc | 2.87 | 1.59 | 0.0803 | -0.0023 | ||

| US91412HFP38 / UNIV OF CALIFORNIA CA REVENUES UNVHGR 05/27 FIXED 1.366 | 2.86 | 1.17 | 0.0799 | -0.0026 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 2A ARV 144A / ABS-CBDO (US03329LAS07) | 2.85 | 1.21 | 0.0795 | -0.0026 | ||

| US46590LAT98 / JPMDB Commercial Mortgage Securities Trust 2016-C2 | 2.85 | 0.99 | 0.0795 | -0.0028 | ||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 2.84 | 0.0793 | 0.0793 | |||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 2.84 | 1.03 | 0.0792 | -0.0027 | ||

| US88880LAK98 / TOBACCO SETTLEMENT FIN AUTH WV TOBGEN 06/28 FIXED 2.351 | 2.83 | 1.25 | 0.0790 | -0.0025 | ||

| NEUBERGER BERMAN CLO LTD NEUB 2021 43A AR 144A / ABS-CBDO (US64134AAJ16) | 2.80 | -0.11 | 0.0781 | -0.0036 | ||

| NEUBERGER BERMAN CLO LTD NEUB 2021 45A AR 144A / ABS-CBDO (US64134MAJ53) | 2.79 | -0.21 | 0.0780 | -0.0036 | ||

| US68235PAN87 / ONE Gas Inc | 2.77 | 0.33 | 0.0772 | -0.0032 | ||

| FLATIRON CLO LTD FLAT 2019 1A AR2 144A / ABS-CBDO (US33883JAW18) | 2.75 | -8.27 | 0.0768 | -0.0107 | ||

| US05608XAA00 / BXMT LTD BXMT 2020 FL3 A 144A | 2.75 | -2.59 | 0.0767 | -0.0056 | ||

| US48129RAZ82 / JPMDB COMMERCIAL MORTGAGE SECU JPMDB 2019 COR6 ASB | 2.75 | -4.29 | 0.0767 | -0.0070 | ||

| CALIFORNIA ST CAS 09/35 FIXED 5.1 / DBT (US13063EHV11) | 2.74 | -0.11 | 0.0766 | -0.0035 | ||

| MARS INC SR UNSECURED 144A 03/32 5 / DBT (US571676AZ85) | 2.74 | 0.92 | 0.0764 | -0.0027 | ||

| US3128MJ6P03 / Federal Home Loan Mortgage Corp. | 2.73 | -2.67 | 0.0763 | -0.0056 | ||

| US26828HAA59 / ECMC Group Student Loan Trust 2018-1 | 2.72 | -1.45 | 0.0759 | -0.0046 | ||

| EW / Edwards Lifesciences Corporation | 2.71 | -96.92 | 0.0758 | -2.7137 | ||

| US95000U2S19 / Wells Fargo & Co | 2.70 | 0.97 | 0.0753 | -0.0026 | ||

| JACKSON NATL LIFE GLOBAL SECURED 144A 10/29 4.6 / DBT (US46849LVB43) | 2.70 | 0.90 | 0.0753 | -0.0027 | ||

| FNMA POOL FS6048 FN 02/53 FIXED VAR / ABS-MBS (US3140XMWJ11) | 2.70 | -3.16 | 0.0753 | -0.0059 | ||

| US3140QMRX43 / FANNIE MAE POOL UMBS P#CB2301 3.00000000 | 2.65 | -1.74 | 0.0740 | -0.0047 | ||

| US00217VAA89 / AREIT 2022-CRE7 LLC | 2.64 | -10.77 | 0.0738 | -0.0126 | ||

| US36264BAA89 / GPMT LTD. GPMT 2021 FL3 A 144A | 2.62 | -19.43 | 0.0732 | -0.0217 | ||

| US80281LAR69 / Santander UK Group Holdings PLC | 2.61 | 0.73 | 0.0730 | -0.0027 | ||

| ANCHORAGE CAPITAL CLO LTD ANCHC 2015 6A AR3 144A / ABS-CBDO (US03328QBL41) | 2.61 | 0.15 | 0.0728 | -0.0031 | ||

| US87241EAQ89 / TCW CLO 2019-1 AMR Ltd | 2.60 | 0.23 | 0.0727 | -0.0031 | ||

| FNMA POOL FS5365 FN 02/50 FIXED VAR / ABS-MBS (US3140XL6B98) | 2.58 | -2.16 | 0.0720 | -0.0049 | ||

| US38376RTJ58 / GOVERNMENT NATIONAL MORTGAGE A GNR 2016 H09 FB | 2.58 | -18.15 | 0.0720 | -0.0199 | ||

| US53948HAA41 / LoanCore 2021-CRE6 Issuer Ltd | 2.57 | -8.71 | 0.0717 | -0.0103 | ||

| US38376RUH73 / GOVERNMENT NATIONAL MORTGAGE A GNR 2016 H10 FA | 2.56 | -17.73 | 0.0715 | -0.0193 | ||

| FNMA POOL BZ3406 FN 03/30 FIXED 4.32 / ABS-MBS (US3140NXYC15) | 2.54 | 0.60 | 0.0708 | -0.0027 | ||

| USU5009LAZ32 / Kraft Heinz Foods Co | 2.53 | 0.52 | 0.0708 | -0.0028 | ||

| US06051GJL41 / Bank of America Corp | 2.53 | 1.89 | 0.0706 | -0.0018 | ||

| US78445QAE17 / SLM Private Education Loan Trust 2010-C | 2.52 | -3.92 | 0.0705 | -0.0062 | ||

| US46647PBE51 / JPMorgan Chase & Co | 2.52 | 1.61 | 0.0703 | -0.0020 | ||

| US3140N0D854 / FNCL UMBS 4.0 BW7326 09-01-52 | 2.52 | -5.38 | 0.0703 | -0.0073 | ||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | 2.51 | 0.0702 | 0.0702 | |||

| US02582JJX90 / American Express Credit Account Master Trust, Series 2022-4, Class A | 2.50 | -0.08 | 0.0699 | -0.0032 | ||

| US3140QKNN41 / Fannie Mae Pool | 2.50 | -2.38 | 0.0697 | -0.0049 | ||

| NWE / NorthWestern Energy Group, Inc. | 2.44 | 0.83 | 0.0681 | -0.0024 | ||

| FANNIE MAE FNR 2024 104 FA / ABS-MBS (US3136BUEQ99) | 2.43 | -4.25 | 0.0679 | -0.0062 | ||

| US3128MJ5Z93 / FED HM LN PC POOL G08863 FG 02/49 FIXED 4.5 | 2.41 | -3.14 | 0.0673 | -0.0053 | ||

| US36361UAL44 / Gallatin CLO VIII 2017-1 Ltd | 2.40 | -1.23 | 0.0670 | -0.0039 | ||

| FREDDIE MAC FHR 5440 F / ABS-MBS (US3137HDY795) | 2.40 | -9.82 | 0.0670 | -0.0106 | ||

| US78448YAB74 / SMB PRIVATE EDUCATION LOAN TRUST | 2.39 | -3.79 | 0.0666 | -0.0057 | ||

| US38376RR404 / GOVERNMENT NATIONAL MORTGAGE A GNR 2017 H03 HA | 2.39 | -6.03 | 0.0666 | -0.0074 | ||

| FNMA POOL BZ3419 FN 03/30 FIXED 4.32 / ABS-MBS (US3140NXYR83) | 2.37 | 0.64 | 0.0661 | -0.0025 | ||

| US26828VAA44 / ECMC Group Student Loan Trust 2017-2 | 2.37 | -1.50 | 0.0661 | -0.0040 | ||

| US76209PAB94 / RGA Global Funding | 2.35 | 0.30 | 0.0655 | -0.0027 | ||

| CHESAPEAKE FUNDING II LLC CFII 2024 1A A1 144A / ABS-O (US165183DE19) | 2.34 | -11.69 | 0.0652 | -0.0119 | ||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 2.32 | 1.76 | 0.0647 | -0.0017 | ||

| US3136ATY731 / FANNIE MAE FNR 2016 76 CF | 2.32 | -3.18 | 0.0647 | -0.0051 | ||

| US55285BAA35 / MF1 2022-FL10 LLC MF1 2022-FL10 A | 2.31 | -5.63 | 0.0646 | -0.0069 | ||

| US38376RCB06 / GNMA, Series 2015-H14, Class FA | 2.31 | -13.47 | 0.0644 | -0.0134 | ||

| US13077DMR07 / CALIFORNIA ST UNIV REVENUE CASHGR 11/30 FIXED 1.74 | 2.30 | 1.86 | 0.0642 | -0.0016 | ||

| US025816DN68 / American Express Co. | 2.29 | 0.79 | 0.0639 | -0.0023 | ||

| US38375UYN44 / Government National Mortgage Association | 2.29 | -13.83 | 0.0638 | -0.0135 | ||

| FANNIE MAE FNR 2024 77 DF / ABS-MBS (US3136BTWY58) | 2.28 | 0.0637 | 0.0637 | |||

| US694308JW85 / Pacific Gas and Electric Co | 2.28 | 0.97 | 0.0637 | -0.0022 | ||

| US98164FAD42 / WOART 23-C A3 5.15% 11-15-28 | 2.27 | -5.97 | 0.0633 | -0.0070 | ||

| 69511JD28 / PACIFICORP | 2.27 | 0.93 | 0.0633 | -0.0022 | ||

| 30064K105 / Exacttarget, Inc. | 2.25 | 1.08 | 0.0628 | -0.0021 | ||

| FNMA POOL BZ3405 FN 03/30 FIXED 4.32 / ABS-MBS (US3140NXYB32) | 2.24 | 0.63 | 0.0624 | -0.0024 | ||

| US62829D2A73 / Mutual of Omaha Cos. Global Funding | 2.23 | 0.13 | 0.0624 | -0.0027 | ||

| US3137BTTH46 / FREDDIE MAC FHR 4637 WF | 2.23 | -4.94 | 0.0623 | -0.0062 | ||

| NISSAN AUTO LEASE TRUST NALT 2024 A A4 / ABS-O (US65481CAE49) | 2.21 | 0.00 | 0.0618 | -0.0028 | ||

| ELEVATION CLO LTD AWPT 2022 16A A1AR 144A / ABS-CBDO (US28623YAU73) | 2.20 | 0.73 | 0.0615 | -0.0023 | ||

| US12434FAA57 / BX Commercial Mortgage Trust 2021-CIP | 2.20 | -3.81 | 0.0614 | -0.0053 | ||

| SUTTER HEALTH UNSECURED 08/32 5.213 / DBT (US86944BAP85) | 2.16 | 0.0603 | 0.0603 | |||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 2.16 | -98.26 | 0.0602 | -3.6836 | ||

| US31418DKK71 / Fannie Mae Pool | 2.15 | -3.29 | 0.0600 | -0.0048 | ||

| US38376RN858 / Government National Mortgage Association | 2.14 | -9.72 | 0.0596 | -0.0094 | ||

| US07274EAK91 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.375% 11-21-30 | 2.13 | 1.48 | 0.0594 | -0.0018 | ||

| US00138CAV00 / Corebridge Global Funding | 2.09 | 0.43 | 0.0584 | -0.0024 | ||

| US31351DDT54 / Freddie Mac Strips | 2.09 | -5.66 | 0.0582 | -0.0062 | ||

| US92331AAU88 / Venture XXVIII CLO Ltd | 2.08 | -41.97 | 0.0582 | -0.0466 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 2.08 | 0.73 | 0.0580 | -0.0021 | ||

| US649840CU75 / New York State Electric & Gas Corp | 2.07 | 0.53 | 0.0579 | -0.0023 | ||

| US44236PLT39 / HOUSTON TX CMNTY CLG HOUHGR 02/29 FIXED 5 | 2.07 | 0.58 | 0.0578 | -0.0022 | ||

| US3133ATPE55 / Freddie Mac Pool | 2.07 | -0.86 | 0.0577 | -0.0031 | ||

| PROTECTIVE LIFE GLOBAL SECURED 144A 01/32 5.432 / DBT (US74368CCB81) | 2.07 | 0.63 | 0.0577 | -0.0022 | ||

| CMCS34 / Comcast Corporation - Depositary Receipt (Common Stock) | 2.06 | 0.88 | 0.0576 | -0.0021 | ||

| US04002BAA35 / AREIT_23-CRE8 | 2.06 | -0.67 | 0.0576 | -0.0030 | ||

| CNO GLOBAL FUNDING CNO GLOBAL FUNDING / DBT (US18977W2D15) | 2.05 | 0.15 | 0.0574 | -0.0025 | ||

| SRG / Snam S.p.A. | 2.04 | 0.0571 | 0.0571 | |||

| US02582JKB51 / AMXCA 23-2 A 4.80% 05-15-30/28 | 2.04 | 0.99 | 0.0571 | -0.0020 | ||

| US379930AD24 / GM Financial Consumer Automobile Receivables Trust 2023-4 | 2.02 | -0.15 | 0.0565 | -0.0026 | ||

| US3137H0VQ85 / FREDDIE MAC FHR 5115 DA | 2.01 | -3.37 | 0.0561 | -0.0045 | ||

| MARATHON CLO LTD MCLO 2019 1A AAR2 144A / ABS-CBDO (US56579ABJ88) | 2.01 | -7.97 | 0.0561 | -0.0076 | ||

| US539439AT62 / Lloyds Banking Group PLC | 2.01 | 0.75 | 0.0560 | -0.0021 | ||

| US977100HA74 / WISCONSIN ST GEN FUND ANNUAL A WISGEN 05/28 FIXED 2.299 | 2.00 | 0.76 | 0.0558 | -0.0021 | ||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 2.00 | 1.42 | 0.0558 | -0.0017 | ||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2021 18A A1R 144A / ABS-CBDO (US04943EAQ44) | 2.00 | -0.10 | 0.0558 | -0.0025 | ||

| US80281LAM72 / Santander UK Group Holdings PLC | 1.99 | 0.86 | 0.0556 | -0.0020 | ||

| US61691ABL61 / Morgan Stanley Capital I Trust 2015-UBS8 | 1.99 | 0.20 | 0.0555 | -0.0023 | ||

| US694308KM84 / Pacific Gas and Electric Co. | 1.99 | 0.05 | 0.0555 | -0.0025 | ||

| FCT / Fincantieri S.p.A. | 1.97 | 1.44 | 0.0550 | -0.0016 | ||

| US91756TAR23 / UTAH ST MUNI PWR AGY PWR SPLY UTSPWR 07/28 FIXED 3.237 | 1.96 | 0.83 | 0.0546 | -0.0020 | ||

| US06051GHD43 / Bank of America Corp | 1.96 | 0.88 | 0.0546 | -0.0020 | ||

| US74533ANE46 / PUGET SOUND ENERGY INC | 1.94 | 0.67 | 0.0542 | -0.0020 | ||

| US606940AC86 / MMAF EQUIPMENT FINANCE LLC MMAF 2022 B A3 144A | 1.94 | -34.28 | 0.0541 | -0.0319 | ||

| US07335YAA47 / BDS 2021-FL10 LTD / BDS 2021-FL10 LLC 1ML+135 12/18/2036 144A | 1.93 | -18.07 | 0.0540 | -0.0149 | ||

| US07274EAL74 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.5% 11-21-33 | 1.93 | 2.06 | 0.0539 | -0.0013 | ||

| US90276VAC37 / UBS Commercial Mortgage Trust 2018-C8 | 1.92 | -8.01 | 0.0536 | -0.0073 | ||

| US38378U8L44 / Government National Mortgage Association | 1.87 | -9.66 | 0.0522 | -0.0081 | ||

| US63940CAA27 / Navient Student Loan Trust 2017-5 | 1.87 | -2.30 | 0.0522 | -0.0036 | ||

| US982674NH26 / WYANDOTTE CNTY/KANSAS CITY KS WYAUTL 09/28 FIXED 1.861 | 1.86 | 0.59 | 0.0520 | -0.0020 | ||

| F+G GLOBAL FUNDING SECURED 144A 01/30 5.875 / DBT (US30321L2J09) | 1.85 | 1.09 | 0.0517 | -0.0017 | ||

| US023761AA74 / American Airlines Pass Through Trust, Series 2017-1, Class AA | 1.85 | 0.27 | 0.0515 | -0.0021 | ||

| PROTECTIVE LIFE GLOBAL PROTECTIVE LIFE GLOBAL / DBT (US74368CBX11) | 1.82 | 0.06 | 0.0508 | -0.0022 | ||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 1.80 | 0.0503 | 0.0503 | |||

| S1YK34 / Stryker Corporation - Depositary Receipt (Common Stock) | 1.80 | 1.07 | 0.0502 | -0.0017 | ||

| US31847RAH57 / First American Financial Corp | 1.79 | 1.18 | 0.0501 | -0.0016 | ||

| US3132DWEK53 / Freddie Mac Pool | 1.79 | -2.08 | 0.0500 | -0.0033 | ||

| BARCLAYS COMMERCIAL MORTGAGE S BBCMS 2025 C32 A5 / ABS-MBS (US07337AAD81) | 1.79 | 0.45 | 0.0500 | -0.0020 | ||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 1.78 | 0.11 | 0.0496 | -0.0021 | ||

| CMS.PRB / Consumers Energy Company - Preferred Stock | 1.78 | 1.02 | 0.0496 | -0.0017 | ||

| US00500RAA32 / ACREC 2021-FL1 Ltd | 1.76 | -4.09 | 0.0491 | -0.0044 | ||

| US60687YBL20 / Mizuho Financial Group Inc | 1.75 | 1.63 | 0.0489 | -0.0014 | ||

| US14889DAJ72 / Catamaran CLO 2014-1 Ltd | 1.75 | -38.60 | 0.0488 | -0.0342 | ||

| US12551YAA10 / CIFC 2018-3A A | 1.75 | -17.40 | 0.0488 | -0.0129 | ||

| US3140X47J93 / FANNIE MAE POOL UMBS P#FM1796 3.50000000 | 1.74 | -6.41 | 0.0485 | -0.0057 | ||

| US74923EAA64 / Rad CLO 5 Ltd | 1.71 | -15.84 | 0.0478 | -0.0115 | ||

| US69291QAA31 / PFP III PFP 2022 9 A 144A | 1.68 | -21.86 | 0.0469 | -0.0158 | ||

| US3137F7YY55 / FREDDIE MAC FHR 5051 MA | 1.65 | -5.33 | 0.0462 | -0.0048 | ||

| US3140MM4J44 / FNMA 30YR 4% 08/01/2052#BV8024 | 1.64 | -2.50 | 0.0457 | -0.0033 | ||

| US38375UVD98 / GOVERNMENT NATIONAL MORTGAGE A GNR 2015 H08 FD | 1.62 | -17.97 | 0.0453 | -0.0124 | ||

| US816851BQ16 / Sempra Energy | 1.62 | 0.12 | 0.0451 | -0.0019 | ||

| US3140X5BM48 / FNMA POOL FM1843 FN 11/34 FIXED VAR | 1.59 | -3.52 | 0.0444 | -0.0037 | ||

| US3137F7TN55 / FREDDIE MAC FHR 5050 YA | 1.59 | -7.95 | 0.0443 | -0.0060 | ||

| US36143L2A26 / GA Global Funding Trust | 1.57 | 0.83 | 0.0439 | -0.0016 | ||

| US07336CAA18 / BDS 2022-FL12 LLC | 1.56 | -27.84 | 0.0437 | -0.0195 | ||

| US95000GAY08 / Wells Fargo Commercial Mortgage Trust 2016-BNK1 | 1.56 | 0.91 | 0.0436 | -0.0015 | ||

| US48252AAA97 / KKR Group Finance Co VI LLC | 1.55 | 0.65 | 0.0434 | -0.0017 | ||

| US3137H0VA34 / Freddie Mac REMICS | 1.53 | -2.73 | 0.0428 | -0.0032 | ||

| US46188BAA08 / Invitation Homes Operating Partnership LP | 1.53 | 1.73 | 0.0428 | -0.0011 | ||

| SAMMONS FINANCIAL GLOBAL SECURED 144A 01/28 5.05 / DBT (US79587J2B82) | 1.52 | 0.26 | 0.0425 | -0.0018 | ||

| OHIO EDISON CO SR UNSECURED 144A 12/29 4.95 / DBT (US677347CJ38) | 1.52 | 0.0425 | 0.0425 | |||

| US63939KAC36 / Navient Private Education Loan Trust, Series 2015-BA, Class A3 | 1.52 | -11.64 | 0.0424 | -0.0077 | ||

| GREENSAIF PIPELINES BIDC SR SECURED 144A 02/36 5.8528 / DBT (US39541EAD58) | 1.52 | -0.13 | 0.0424 | -0.0020 | ||

| US08163MAF41 / BENCHMARK MORTGAGE TRUST BMARK 2021 B31 AAB | 1.51 | 1.27 | 0.0423 | -0.0013 | ||

| US3136AUH536 / FANNIE MAE FNR 2016 100 WF | 1.50 | -2.78 | 0.0420 | -0.0031 | ||

| HSBC26C / HSBC Holdings PLC | 1.50 | 0.13 | 0.0418 | -0.0018 | ||

| US3136AUTX94 / FANNIE MAE FNR 2016 88 AF | 1.49 | -6.54 | 0.0415 | -0.0049 | ||

| US3137BNCR31 / FHLMC, REMIC, Series 4559, Class AF | 1.48 | -7.41 | 0.0412 | -0.0053 | ||

| US89240HAD70 / Toyota Lease Owner Trust, Series 2023-B, Class A3 | 1.45 | -27.75 | 0.0406 | -0.0181 | ||

| US3138EQAD40 / FNMA POOL AL7203 FN 08/45 FIXED VAR | 1.44 | -0.55 | 0.0403 | -0.0020 | ||

| US12655TBJ79 / COMM MORTGAGE TRUST | 1.44 | -5.14 | 0.0402 | -0.0041 | ||

| US06054AAW99 / BANC OF AMERICA COMMERCIAL MORTGAGE TRUST 3.441% 09/15/2048 2015-UBS7 A3 | 1.44 | -55.33 | 0.0401 | -0.0538 | ||

| US3137HAST48 / FHMS K509 A2 | 1.43 | 0.42 | 0.0399 | -0.0016 | ||

| US404280CH04 / HSBC Holdings PLC | 1.42 | 1.72 | 0.0396 | -0.0011 | ||

| US38375UXM79 / Government National Mortgage Association | 1.40 | -16.85 | 0.0391 | -0.0100 | ||

| NBN CO LTD NBN CO LTD / DBT (US62878U2J00) | 1.40 | 0.65 | 0.0390 | -0.0015 | ||

| US3137BTH385 / FREDDIE MAC FHR 4638 FA | 1.39 | -5.17 | 0.0389 | -0.0040 | ||

| US567830BU72 / MARIN CNTY CA MAR 08/26 FIXED 5.41 | 1.38 | -0.29 | 0.0387 | -0.0018 | ||

| US59447TXR93 / MICHIGAN ST FIN AUTH REVENUE MISFIN 12/26 FIXED 2.596 | 1.38 | 0.66 | 0.0384 | -0.0015 | ||

| US03076CAN65 / Ameriprise Financial Inc | 1.36 | 0.74 | 0.0380 | -0.0014 | ||

| US90932JAA07 / United Airlines 2019-2 Class AA Pass Through Trust | 1.36 | -2.52 | 0.0379 | -0.0027 | ||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | 1.35 | 0.0378 | 0.0378 | |||

| NORTHWESTERN MUTUAL GLBL SECURED 144A 01/30 4.96 / DBT (US66815L2U28) | 1.33 | 0.68 | 0.0371 | -0.0014 | ||

| US50220PAC77 / LSEGA Financing PLC | 1.32 | 1.23 | 0.0368 | -0.0012 | ||

| US90320WAG87 / UPMC | 1.31 | 1.40 | 0.0365 | -0.0011 | ||

| US3133KRLT94 / FR RA9338 | 1.31 | -21.04 | 0.0365 | -0.0118 | ||

| US63942AAB26 / Navient Private Education Loan Trust 2020-I | 1.30 | -5.25 | 0.0363 | -0.0037 | ||

| US3140XJYX57 / FNMA 30YR 4.5% 09/01/2052#FS3425 | 1.28 | -3.39 | 0.0359 | -0.0029 | ||

| US86944BAD55 / Sutter Health | 1.28 | 1.34 | 0.0358 | -0.0011 | ||

| US3136AUKR18 / Fannie Mae REMICS | 1.27 | -4.09 | 0.0353 | -0.0031 | ||

| US95002EAZ07 / WELLS FARGO COMMERCIAL MORTGAGE TRUST 2020-C55 SER 2020-C55 CL ASB REGD 2.65100000 | 1.26 | -2.86 | 0.0351 | -0.0027 | ||

| US694308KL02 / Pacific Gas and Electric Co | 1.24 | 0.24 | 0.0347 | -0.0015 | ||

| US06738EBR53 / Barclays PLC | 1.24 | 1.89 | 0.0347 | -0.0009 | ||

| AU3FN0029609 / AAI Ltd | 1.23 | 1.74 | 0.0343 | -0.0009 | ||

| US02379KAA25 / American Airlines 2021-1 Class A Pass Through Trust | 1.22 | 0.33 | 0.0342 | -0.0014 | ||

| FED HM LN PC POOL QE1102 FR 04/52 FIXED 2.5 / ABS-MBS (US3133BAGK17) | 1.22 | -2.24 | 0.0341 | -0.0023 | ||

| DK0009391104 / JYSKE REALKREDIT A/S /DKK/ REGD SER 321E 1.00000000 | 1.21 | 1.26 | 0.0336 | -0.0011 | ||

| US3128MJ3H14 / Freddie Mac Gold Pool | 1.17 | -1.60 | 0.0326 | -0.0020 | ||

| US38376RRG38 / GOVERNMENT NATIONAL MORTGAGE A GNR 2016 H07 FE | 1.16 | -11.36 | 0.0323 | -0.0058 | ||

| US58003UAA60 / MF1 Multifamily Housing Mortgage Loan Trust | 1.15 | -35.58 | 0.0321 | -0.0199 | ||

| US902055AA09 / 225 Liberty Street Trust 2016-225L | 1.15 | 0.97 | 0.0320 | -0.0011 | ||

| US91412HGF47 / UNIV OF CALIFORNIA CA REVENUES | 1.15 | 1.24 | 0.0320 | -0.0010 | ||

| US36179RNW50 / Ginnie Mae II Pool | 1.14 | -2.15 | 0.0318 | -0.0022 | ||

| US TREASURY N/B 01/32 4.375 / DBT (US91282CMK44) | 1.13 | 0.63 | 0.0314 | -0.0012 | ||

| US797440BZ64 / San Diego Gas & Electric Co., Series VVV | 1.12 | 2.29 | 0.0312 | -0.0007 | ||

| FED HM LN PC POOL RA9541 FR 07/53 FIXED 2.5 / ABS-MBS (US3133KRS626) | 1.10 | -0.81 | 0.0307 | -0.0017 | ||

| US90276RBC16 / UBS Commercial Mortgage Trust, Series 2017-C4, Class ASB | 1.10 | -11.66 | 0.0307 | -0.0056 | ||

| US64129KBE64 / Neuberger Berman CLO XV | 1.09 | -21.59 | 0.0305 | -0.0101 | ||

| US59447TXQ11 / MICHIGAN ST FIN AUTH REVENUE MISFIN 12/25 FIXED 2.466 | 1.09 | 0.46 | 0.0305 | -0.0012 | ||

| US55284AAA60 / MF1 2021-FL7 Ltd | 1.08 | -36.20 | 0.0300 | -0.0192 | ||

| US3137H02A58 / FREDDIE MAC FHR 5104 UB | 1.07 | -2.28 | 0.0299 | -0.0021 | ||

| US38376RHB50 / GOVERNMENT NATIONAL MORTGAGE A GNR 2015 H22 FD | 1.06 | -13.35 | 0.0295 | -0.0061 | ||

| PROTECTIVE LIFE GLOBAL SECURED 144A 12/28 5.467 / DBT (US74368CBV54) | 1.04 | 0.68 | 0.0289 | -0.0011 | ||

| US63942TAA34 / NAVIENT STUDENT LOAN TRUST 23-BA A1A 6.48% 03/15/2072 144A | 1.03 | -10.78 | 0.0287 | -0.0049 | ||

| US48252KAA79 / KKR CLO 21 Ltd | 1.03 | -26.05 | 0.0286 | -0.0118 | ||

| US3128MJ4W71 / Federal Home Loan Mortgage Corp. | 1.02 | -1.74 | 0.0284 | -0.0018 | ||

| US78436TAD81 / SBALT 2023-A A4 | 1.01 | -0.49 | 0.0283 | -0.0014 | ||

| HONDA AUTO RECEIVABLES OWNER T HAROT 2024 3 A4 / ABS-O (US43813YAD40) | 1.01 | 0.40 | 0.0281 | -0.0011 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 1.01 | 0.30 | 0.0281 | -0.0012 | ||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 1.00 | 0.60 | 0.0280 | -0.0011 | ||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2021 17A AR 144A / ABS-CBDO (US04942FAL31) | 1.00 | 0.40 | 0.0279 | -0.0011 | ||

| LCM LTD PARTNERSHIP LCM 36A A1R 144A / ABS-CBDO (US50190LAL27) | 1.00 | 0.10 | 0.0278 | -0.0012 | ||

| US92331LBC37 / VENTURE CDO LTD VENTR 2017 27A AR 144A | 0.97 | -42.33 | 0.0272 | -0.0221 | ||

| US80281LAQ86 / Santander UK Group Holdings PLC | 0.97 | 0.83 | 0.0271 | -0.0010 | ||

| US3136AUPW57 / Fannie Mae REMICs | 0.95 | -8.71 | 0.0267 | -0.0038 | ||

| US61747YED31 / Morgan Stanley | 0.95 | 1.71 | 0.0266 | -0.0007 | ||

| US13077DMN92 / CALIFORNIA ST UNIV REVENUE CASHGR 11/27 FIXED 1.338 | 0.94 | 1.07 | 0.0263 | -0.0009 | ||

| FANNIE MAE FNR 2025 16 FA / ABS-MBS (US3136BU5D84) | 0.94 | -5.53 | 0.0262 | -0.0028 | ||

| MAGNETITE CLO LTD MAGNE 2015 12A AR4 144A / ABS-CBDO (US55953HBD44) | 0.94 | -34.01 | 0.0262 | -0.0153 | ||

| US59333NT370 / MIAMI DADE CNTY FL SPL OBLIG MIAGEN 10/28 FIXED 1.936 | 0.93 | 1.19 | 0.0261 | -0.0008 | ||

| US3132XV2R33 / FED HM LN PC POOL Q53483 FG 01/48 FIXED 3 | 0.93 | -0.75 | 0.0260 | -0.0014 | ||

| US3140QSSW21 / FNMA 30YR 5% 07/01/2053#CB6832 | 0.93 | -1.18 | 0.0258 | -0.0015 | ||

| US3133B5CB66 / FHLG 30YR 2.5% 02/01/2052#QD7266 | 0.92 | -1.07 | 0.0258 | -0.0014 | ||

| EVERGY METRO EVERGY METRO / DBT (US30037DAD75) | 0.92 | 0.88 | 0.0257 | -0.0009 | ||

| US76913CBF59 / RIVERSIDE CNTY CA PENSN OBLG COUNTY OF RIVERSIDE CA | 0.92 | 0.33 | 0.0257 | -0.0011 | ||

| US64971M4Q23 / NEW YORK CITY NY TRANSITIONAL NEW YORK CITY TRANSITIONAL FINANCE AUTHORITY FUTUR | 0.92 | 0.33 | 0.0256 | -0.0011 | ||

| US3140QSDY42 / FNMA POOL CB6418 FN 05/53 FIXED 5 | 0.92 | -1.93 | 0.0256 | -0.0017 | ||

| US98164FAE25 / WOART 23-C A4 5.03% 11-15-29 | 0.91 | 0.00 | 0.0255 | -0.0011 | ||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2024 1A A3 144A / ABS-O (US78435VAC63) | 0.90 | -0.11 | 0.0252 | -0.0012 | ||

| US38122ND252 / Golden State Tobacco Securitization Corp | 0.90 | 1.13 | 0.0250 | -0.0008 | ||

| US90353DAW56 / UBS Commercial Mortgage Trust | 0.89 | -6.88 | 0.0250 | -0.0030 | ||

| US77587UAL61 / ROMARK CLO LTD RMRK 2017 1A A1R 144A | 0.87 | -36.96 | 0.0243 | -0.0160 | ||

| US3140XH4D62 / Fannie Mae Pool | 0.87 | -1.92 | 0.0243 | -0.0016 | ||

| US36262TAA16 / GPMT 2021-FL4 LTD | 0.87 | -2.37 | 0.0242 | -0.0017 | ||

| US126650BS86 / CVS PASS THROUGH TRUST PASS THRU CE 144A 01/32 7.507 | 0.85 | -4.60 | 0.0238 | -0.0023 | ||

| US3137FUKP89 / Freddie Mac REMICS | 0.83 | -5.46 | 0.0232 | -0.0024 | ||

| US92916MAF86 / VOYA CLO LTD VOYA 2017 1A A1R 144A | 0.82 | -24.75 | 0.0230 | -0.0089 | ||

| US95001NAW83 / Wells Fargo Commercial Mortgage Trust 2018-C45 | 0.82 | -7.11 | 0.0230 | -0.0029 | ||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 0.82 | 0.0229 | 0.0229 | |||

| US31418ED565 / FNMA 30YR 2.5% 06/01/2052#MA4623 | 0.81 | -1.57 | 0.0227 | -0.0014 | ||

| US90278PAY60 / UBS Commercial Mortgage Trust | 0.80 | -5.53 | 0.0224 | -0.0024 | ||

| US3133BT5Z95 / UMBS | 0.80 | -0.99 | 0.0224 | -0.0012 | ||

| US3133C5RV55 / FR QG5000 | 0.78 | -0.77 | 0.0217 | -0.0012 | ||

| US3132DWFL28 / Freddie Mac Pool | 0.77 | -2.05 | 0.0214 | -0.0014 | ||

| US3140XBS685 / Fannie Mae Pool | 0.76 | -1.17 | 0.0212 | -0.0012 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 1A ARV 144A / ABS-CBDO (US033296AG97) | 0.76 | -0.79 | 0.0211 | -0.0011 | ||

| US3132DWDJ99 / Freddie Mac Pool | 0.71 | -2.07 | 0.0198 | -0.0013 | ||

| US3137FUKQ62 / Freddie Mac REMICS | 0.71 | -6.70 | 0.0198 | -0.0024 | ||

| US3132DWFY49 / UMBS | 0.71 | -1.12 | 0.0198 | -0.0011 | ||

| US3140XLGV40 / FN FS4711 | 0.70 | -1.83 | 0.0195 | -0.0013 | ||

| US3132A5G331 / UMBS Pool | 0.70 | -2.11 | 0.0194 | -0.0013 | ||

| US90931LAA61 / United Airlines 2016-1 Class AA Pass Through Trust | 0.69 | 0.58 | 0.0194 | -0.0007 | ||

| US3140MWPY61 / FN BW4938 | 0.68 | -0.73 | 0.0191 | -0.0010 | ||

| US61691NAE58 / Morgan Stanley Capital I 2017-HR2 | 0.68 | 0.89 | 0.0191 | -0.0007 | ||

| US80317LAJ26 / Saranac Clo VI Ltd | 0.64 | -14.25 | 0.0180 | -0.0039 | ||

| COLUMBIA UNIVERSITY UNSECURED 10/35 4.355 / DBT (US198643AD00) | 0.64 | 0.0180 | 0.0180 | |||

| US05369AAD37 / Aviation Capital Group LLC | 0.60 | 0.34 | 0.0167 | -0.0007 | ||

| US768874SG56 / RIVERSIDE CA ELEC REVENUE | 0.59 | -1.17 | 0.0165 | -0.0009 | ||

| US3128MJXX32 / Freddie Mac Gold Pool | 0.58 | -1.69 | 0.0162 | -0.0010 | ||

| US88283LHT61 / Texas (State of) Transportation Commission State Highway Fund, Series 2010 B, RB | 0.58 | -49.16 | 0.0161 | -0.0170 | ||

| US3140MVS827 / FNCL UMBS 2.5 BW4142 07-01-52 | 0.58 | -1.20 | 0.0161 | -0.0009 | ||

| FED HM LN PC POOL RA8828 FR 04/52 FIXED 2.5 / ABS-MBS (US3133KQYZ35) | 0.56 | -1.05 | 0.0158 | -0.0009 | ||

| US31418CYL26 / Federal National Mortgage Association | 0.55 | -2.30 | 0.0154 | -0.0011 | ||

| US982674NJ81 / WYANDOTTE CNTY/KANSAS CITY KS WYAUTL 09/29 FIXED 1.961 | 0.55 | 0.55 | 0.0153 | -0.0006 | ||

| US11271LAE20 / Brookfield Finance Inc | 0.54 | 0.74 | 0.0152 | -0.0005 | ||

| US3133BJPF30 / UMBS | 0.54 | -1.10 | 0.0151 | -0.0009 | ||

| US11042CAA80 / British Airways 2021-1 Class A Pass Through Trust | 0.53 | -1.50 | 0.0147 | -0.0009 | ||

| US3140MA2S24 / FNCL UMBS 2.5 BU8884 03-01-52 | 0.52 | -2.44 | 0.0145 | -0.0010 | ||

| US90931MAA45 / United Airlines 2016-1 Class A Pass Through Trust | 0.52 | 0.58 | 0.0145 | -0.0006 | ||

| FED HM LN PC POOL QE1488 FR 04/52 FIXED 2.5 / ABS-MBS (US3133BAUM17) | 0.52 | -1.15 | 0.0145 | -0.0008 | ||

| US14315LAA26 / Carlyle Global Market Strategies CLO 2014-3-R Ltd | 0.51 | -40.16 | 0.0144 | -0.0107 | ||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2024 1A A4 144A / ABS-O (US78435VAD47) | 0.51 | 0.40 | 0.0142 | -0.0006 | ||

| US08161CAF86 / BENCHMARK MORTGAGE TRUST BMARK 2018 B2 ASB | 0.50 | -10.97 | 0.0138 | -0.0024 | ||

| TESLA SUSTAINABLE ENERGY TRUST TSET 2024 1A A2 144A / ABS-O (US88164AAB08) | 0.49 | -3.19 | 0.0136 | -0.0011 | ||

| US3140XLVT29 / Fannie Mae Pool | 0.48 | -2.23 | 0.0135 | -0.0009 | ||

| US05609CAA53 / BX Commercial Mortgage Trust 2021-21M | 0.48 | -55.56 | 0.0133 | -0.0180 | ||

| US61690FAM59 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C22 | 0.47 | -60.20 | 0.0130 | -0.0211 | ||

| US31418D4Y57 / FNMA, 30 Year | 0.46 | -2.56 | 0.0128 | -0.0009 | ||

| US3140MJ4S15 / FNCL UMBS 2.5 BV5332 04-01-52 | 0.46 | -1.93 | 0.0128 | -0.0008 | ||

| US70410DAC20 / PAWNEEE EQUIPMENT RECEIVABLES SERIES 2022 1 LLC | 0.45 | -44.99 | 0.0126 | -0.0113 | ||

| US3132XTQZ46 / FED HM LN PC POOL Q51371 FG 10/47 FIXED 3 | 0.45 | -2.83 | 0.0125 | -0.0009 | ||

| FED HM LN PC POOL QE9261 FR 09/52 FIXED 4 / ABS-MBS (US3133BKJE02) | 0.45 | -0.67 | 0.0125 | -0.0007 | ||

| US3140MEBV70 / FNMA 30YR 4% 09/01/2052#BV0951 | 0.45 | -0.67 | 0.0124 | -0.0006 | ||

| US78449VAC00 / SMB Private Education Loan Trust 2020-PT-A | 0.44 | -7.22 | 0.0122 | -0.0015 | ||

| US3140QPSK44 / FANNIE MAE POOL UMBS P#CB4121 4.00000000 | 0.42 | -2.57 | 0.0117 | -0.0008 | ||

| SUTTER HEALTH UNSECURED 08/35 5.537 / DBT (US86944BAQ68) | 0.41 | 0.0115 | 0.0115 | |||

| US3133B7XK92 / FREDDIE MAC POOL FR QD9682 | 0.41 | -15.56 | 0.0114 | -0.0027 | ||

| US3132Y3EW08 / FED HM LN PC POOL Q59148 FG 10/48 FIXED 4.5 | 0.41 | -0.98 | 0.0113 | -0.0006 | ||

| US3140QP2M86 / FANNIE MAE POOL | 0.40 | -0.74 | 0.0113 | -0.0006 | ||

| US3140MHH779 / UMBS | 0.40 | -0.98 | 0.0113 | -0.0006 | ||

| US46644YAU47 / JPMBB Commercial Mortgage Securities Trust 2015-C31 | 0.38 | -67.25 | 0.0105 | -0.0230 | ||

| US38376RQ331 / GNMA_17-H03 | 0.35 | -8.64 | 0.0098 | -0.0014 | ||

| FED HM LN PC POOL QD4256 FR 01/52 FIXED 2.5 / ABS-MBS (US3133B1WR84) | 0.34 | -1.16 | 0.0095 | -0.0005 | ||

| US3136ARPM47 / FANNIE MAE FNR 2016 11 CF | 0.34 | -3.46 | 0.0094 | -0.0007 | ||

| US3132L9F597 / Federal Home Loan Mortgage Corporation | 0.33 | -0.90 | 0.0093 | -0.0005 | ||

| US3140MWMV59 / FN BW4871 | 0.32 | -0.94 | 0.0088 | -0.0005 | ||

| US31418EKS80 / FNMA 30YR 4% 11/01/2052#MA4804 | 0.32 | -1.86 | 0.0088 | -0.0006 | ||

| US3140XGY450 / Federal National Mortgage Association, Inc. | 0.31 | -1.59 | 0.0086 | -0.0005 | ||

| US3133BNAY95 / Freddie Mac Pool | 0.30 | -0.98 | 0.0085 | -0.0005 | ||

| ACDVF4 / Air Canada 2015-2 Class AA Pass Through Trust | 0.30 | -4.43 | 0.0085 | -0.0008 | ||

| FED HM LN PC POOL QC0373 FR 04/51 FIXED 3 / ABS-MBS (US3133AJMW09) | 0.30 | -0.67 | 0.0083 | -0.0005 | ||

| US3136AQKY56 / FANNIE MAE FNR 2015 79 FE | 0.30 | -3.91 | 0.0083 | -0.0007 | ||

| US31418EE225 / Fannie Mae Pool | 0.29 | -2.37 | 0.0081 | -0.0006 | ||

| US3138WPG249 / Fannie Mae Pool | 0.28 | -3.09 | 0.0079 | -0.0006 | ||

| US3138WAPY77 / FNMA POOL AS1338 FN 12/43 FIXED 5 | 0.28 | -1.40 | 0.0079 | -0.0005 | ||

| US63941BAC90 / Navient Private Education Refi Loan Trust 2019-A | 0.27 | -21.26 | 0.0077 | -0.0025 | ||

| US61255QAJ58 / MONTEREY PK CA PENSN OBLIG | 0.27 | 1.51 | 0.0075 | -0.0002 | ||

| US3132Y0NH90 / Freddie Mac Gold Pool | 0.27 | -1.11 | 0.0075 | -0.0004 | ||

| US48251JAL70 / KKR CLO 18 Ltd | 0.27 | -32.66 | 0.0075 | -0.0041 | ||

| US3140QNHF20 / Fannie Mae Pool | 0.26 | -4.38 | 0.0073 | -0.0007 | ||

| US3132XWFR77 / FED HM LN PC POOL Q53775 FG 01/48 FIXED 3 | 0.26 | -0.78 | 0.0071 | -0.0004 | ||

| US38375B4Y56 / GNMA, Series 2013-H16, Class FA | 0.25 | -13.38 | 0.0069 | -0.0014 | ||

| US3132DWF810 / FNCL UMBS 2.5 SD8291 11-01-52 | 0.24 | -5.60 | 0.0066 | -0.0007 | ||

| US61255QAG10 / MONTEREY PK CA PENSN OBLIG MTPGEN 06/28 FIXED 1.63 | 0.23 | 1.30 | 0.0065 | -0.0002 | ||

| US61767FAY79 / MORGAN STANLEY CAPITAL I TRUST 2016-UB11 MSC 2016-UB11 ASB | 0.23 | -25.32 | 0.0064 | -0.0025 | ||

| US46643GAE08 / JPMBB Commercial Mortgage Securities Trust 2014-C24 | 0.23 | -4.24 | 0.0063 | -0.0006 | ||

| US38376RMX16 / GNMA_15-H31 | 0.22 | 0.46 | 0.0061 | -0.0003 | ||

| US31418EBS81 / FNMA UMBS, 30 Year | 0.22 | -2.26 | 0.0061 | -0.0004 | ||

| US3133AJN906 / Freddie Mac Pool | 0.22 | -1.37 | 0.0060 | -0.0004 | ||

| FED HM LN PC POOL RJ0147 FR 09/53 FIXED 2.5 / ABS-MBS (US3142GQEV04) | 0.21 | -0.95 | 0.0059 | -0.0003 | ||

| US31398NKX11 / FANNIE MAE FNR 2010 107 KF | 0.21 | -5.50 | 0.0058 | -0.0006 | ||

| US3133BH4K98 / Freddie Mac Pool | 0.20 | -0.98 | 0.0057 | -0.0003 | ||

| US3140XCUS55 / Federal National Mortgage Association, Inc. | 0.20 | -1.97 | 0.0056 | -0.0004 | ||

| US3138EQM581 / Fannie Mae Pool | 0.20 | -2.97 | 0.0055 | -0.0004 | ||

| US3138W94X50 / Fannie Mae Pool | 0.19 | -0.52 | 0.0054 | -0.0003 | ||

| US3128MJ2B52 / Freddie Mac Gold Pool | 0.17 | -1.70 | 0.0049 | -0.0003 | ||

| US3140X8C964 / Fannie Mae Pool | 0.17 | -2.26 | 0.0049 | -0.0003 | ||

| US3136AQWE64 / Fannie Mae REMICS | 0.17 | -4.47 | 0.0048 | -0.0004 | ||

| US3137A9HT60 / Freddie Mac REMICS | 0.17 | -2.86 | 0.0048 | -0.0004 | ||

| US3137A9HU34 / FREDDIE MAC FHR 3843 FG | 0.17 | -2.86 | 0.0048 | -0.0004 | ||

| US3140QCQ905 / Fannie Mae Pool | 0.14 | -2.05 | 0.0040 | -0.0002 | ||

| US3137BEH494 / Freddie Mac REMICS | 0.14 | -3.57 | 0.0038 | -0.0003 | ||

| US3140KEYF91 / Fannie Mae Pool | 0.14 | -3.57 | 0.0038 | -0.0003 | ||

| US3136AT6Z24 / Fannie Mae REMICS | 0.13 | -4.96 | 0.0038 | -0.0004 | ||

| US3136AUAW13 / FANNIE MAE FNR 2016 82 FM | 0.13 | -6.47 | 0.0036 | -0.0004 | ||

| US3138EN6K06 / Fannie Mae Pool | 0.13 | -2.31 | 0.0036 | -0.0003 | ||

| US31398RXN06 / FNMA, REMIC, Series 2010-58, Class FY | 0.12 | -2.40 | 0.0034 | -0.0002 | ||

| US3140QRUK71 / FN CB5985 | 0.12 | -1.64 | 0.0034 | -0.0002 | ||

| US3138EP2Y90 / Fannie Mae Pool | 0.12 | -4.00 | 0.0034 | -0.0003 | ||

| US3138ENQF92 / Fannie Mae Pool | 0.12 | -2.48 | 0.0033 | -0.0002 | ||

| US38376RHR03 / GNMA, Series 2015-H27, Class FA | 0.11 | -19.72 | 0.0032 | -0.0010 | ||

| US3140X7TX76 / Fannie Mae Pool | 0.11 | -1.74 | 0.0032 | -0.0002 | ||

| US31396V5C86 / FANNIE MAE REMICS SER 2007-50 CL FN V/R 1.94800000 | 0.11 | -4.42 | 0.0030 | -0.0003 | ||

| RFR USD SOFR/3.30000 12/02/24-4Y* CME / DIR (EZ2F419XN3M4) | 0.11 | -49.52 | 0.0029 | -0.0031 | ||

| US3138Y63F99 / Fannie Mae Pool | 0.10 | -4.59 | 0.0029 | -0.0003 | ||

| US31410KJE55 / Fannie Mae Pool | 0.10 | -3.74 | 0.0029 | -0.0002 | ||

| US917542QV70 / UTAH ST | 0.10 | 0.00 | 0.0027 | -0.0001 | ||

| FED HM LN PC POOL QB1701 FR 08/50 FIXED 3 / ABS-MBS (US3133A73J62) | 0.10 | -2.02 | 0.0027 | -0.0002 | ||

| US46646RAK95 / JPMDB Commercial Mortgage Securities Trust 2016-C4 | 0.09 | -13.21 | 0.0026 | -0.0005 | ||

| US3140KPDZ32 / Fannie Mae Pool | 0.09 | -2.20 | 0.0025 | -0.0002 | ||

| US31418EVM91 / Fannie Mae Pool | 0.09 | -15.38 | 0.0025 | -0.0006 | ||

| US31418RRF00 / FNMA 30YR 5.0% 05/01/2040#AD4085 | 0.08 | -1.22 | 0.0023 | -0.0001 | ||

| US31418U4W12 / Fannie Mae Pool | 0.07 | -2.67 | 0.0021 | -0.0001 | ||

| US3128MJ5B26 / FREDDIE MAC GOLD POOL FG G08841 | 0.07 | -1.35 | 0.0020 | -0.0001 | ||

| AT&T INC SNR S* ICE / DCR (EZVHX8BNGL14) | 0.07 | 7.46 | 0.0020 | 0.0001 | ||

| US38376RSG29 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2016-H06 CL FD V/R 2.91725000 | 0.07 | -20.22 | 0.0020 | -0.0006 | ||

| US3128MJUR90 / Freddie Mac Gold Pool | 0.07 | -2.90 | 0.0019 | -0.0001 | ||

| US31416TYN35 / FNMA 30YR 5.0% 07/01/2039#AA9716 | 0.07 | 0.00 | 0.0019 | -0.0001 | ||

| US31405MA645 / FANNIE MAE POOL FN 793029 | 0.07 | -2.90 | 0.0019 | -0.0001 | ||

| US3136ASK880 / FANNIE MAE FNR 2016 40 AF | 0.07 | -5.80 | 0.0018 | -0.0002 | ||

| US31419AE452 / Fannie Mae Pool | 0.07 | -2.99 | 0.0018 | -0.0001 | ||

| US3138LNGZ83 / FANNIE MAE POOL UMBS P#AN9215 3.43000000 | 0.06 | 0.00 | 0.0018 | -0.0001 | ||

| US3138WAA236 / Federal National Mortgage Association, Inc. | 0.06 | -11.27 | 0.0018 | -0.0003 | ||

| US38375UBF66 / Government National Mortgage Association | 0.06 | -13.89 | 0.0017 | -0.0004 | ||

| US3138E26J95 / FNMA POOL AJ9872 FN 01/42 FIXED 5 | 0.06 | 0.00 | 0.0017 | -0.0001 | ||

| US3132DQJG29 / FR SD2963 | 0.06 | -1.75 | 0.0016 | -0.0001 | ||

| US3138WAXY85 / Fannie Mae Pool | 0.05 | -1.85 | 0.0015 | -0.0001 | ||

| US3138WCBK85 / FNMA POOL AS2741 FN 06/44 FIXED 5 | 0.05 | 0.00 | 0.0013 | -0.0001 | ||

| US3140QPSG32 / Fannie Mae Pool | 0.05 | -2.17 | 0.0013 | -0.0001 | ||

| US31415ARP83 / FNMA POOL 981194 FN 04/38 FIXED 5.5 | 0.04 | -2.27 | 0.0012 | -0.0001 | ||

| US3128MJXR63 / Freddie Mac Gold Pool | 0.04 | -2.33 | 0.0012 | -0.0001 | ||

| US3137AA3B72 / FREDDIE MAC FHR 3838 PF | 0.04 | 0.00 | 0.0012 | -0.0001 | ||

| US3132DQYN05 / UMBS | 0.04 | 0.00 | 0.0011 | -0.0001 | ||

| US3133BSDF66 / Freddie Mac Pool | 0.04 | 0.00 | 0.0010 | -0.0001 | ||

| US3137A0MZ56 / FREDDIE MAC FHR 3688 NF | 0.04 | -2.70 | 0.0010 | -0.0001 | ||

| US3138WCBJ13 / FNMA POOL AS2740 FN 06/44 FIXED 5 | 0.03 | 0.00 | 0.0010 | -0.0001 | ||

| US31418W5L02 / Fannie Mae Pool | 0.03 | 0.00 | 0.0009 | -0.0001 | ||

| EZRRBYCX3652 / BOEING CO/THE SNR S* ICE | 0.03 | 0.00 | 0.0009 | -0.0000 | ||

| US31407Y6T10 / FNMA POOL 845182 FN 11/35 FIXED 5.5 | 0.03 | -3.03 | 0.0009 | -0.0001 | ||

| US12591QAR39 / Commercial Mortgage Trust, Series 2014-UBS4, Class A5 | 0.03 | -37.50 | 0.0009 | -0.0006 | ||

| US31418MML36 / FNMA POOL AD0362 FN 10/39 FIXED VAR | 0.03 | 0.00 | 0.0009 | -0.0000 | ||

| US3140MF2S15 / FNCL UMBS 2.5 BV2584 07-01-52 | 0.03 | 0.00 | 0.0009 | -0.0000 | ||

| US3128MJ2R05 / Freddie Mac Gold Pool | 0.03 | -3.23 | 0.0009 | -0.0001 | ||

| US31414QPG63 / FNMA POOL 973023 FN 03/38 FIXED 5 | 0.03 | -3.33 | 0.0008 | -0.0000 | ||

| US3140KHPF24 / Fannie Mae Pool | 0.03 | 0.00 | 0.0008 | -0.0000 | ||

| US31410G2B80 / FNMA POOL 889170 FN 02/38 FIXED VAR | 0.03 | 0.00 | 0.0008 | -0.0000 | ||

| US31410LNY47 / Fannie Mae Pool | 0.03 | -3.70 | 0.0007 | -0.0001 | ||

| US3140L8MQ01 / Fannie Mae Pool | 0.03 | 0.00 | 0.0007 | -0.0000 | ||

| US31416JYL96 / FNMA POOL AA1614 FN 01/39 FIXED 5.5 | 0.03 | 0.00 | 0.0007 | -0.0000 | ||

| US3138EGRE67 / FANNIE MAE POOL UMBS P#AL0484 5.50000000 | 0.02 | -4.00 | 0.0007 | -0.0000 | ||

| FED HM LN PC POOL QH3374 FR 10/53 FIXED 2.5 / ABS-MBS (US3133CFXB03) | 0.02 | -4.35 | 0.0006 | -0.0000 | ||

| US3133KQT972 / UMBS | 0.02 | 0.00 | 0.0006 | -0.0000 | ||

| US31412S3D54 / FNMA POOL 933796 FN 05/38 FIXED 5.5 | 0.02 | 0.00 | 0.0006 | -0.0000 | ||

| US3140QHNG60 / Fannie Mae Pool | 0.02 | -4.55 | 0.0006 | -0.0000 | ||

| US31418EAN04 / FN MA4512 | 0.02 | -4.55 | 0.0006 | -0.0000 | ||

| US3140MF4U43 / Fannie Mae Pool | 0.02 | 0.00 | 0.0006 | -0.0000 | ||

| EZBLK0RXQ2F2 / AT&T INC SNR S* ICE | 0.02 | -42.86 | 0.0006 | -0.0005 | ||

| US31407U2C03 / Fannie Mae Pool | 0.02 | -4.76 | 0.0006 | -0.0001 | ||

| US31418P7G43 / FNMA POOL AD2694 FN 05/40 FIXED 5 | 0.02 | -5.00 | 0.0006 | -0.0000 | ||

| US95000FAU03 / Wells Fargo Commercial Mortgage Trust 2016-C35 | 0.02 | -43.75 | 0.0005 | -0.0004 | ||

| US31394CTW28 / FANNIE MAE FNR 2005 21 FM | 0.02 | -5.26 | 0.0005 | -0.0000 | ||

| US3138EH6E71 / Fannie Mae Pool | 0.02 | -5.26 | 0.0005 | -0.0000 | ||

| US3133BBKZ13 / FHLG 30YR 2.5% 05/01/2052# | 0.02 | -20.00 | 0.0005 | -0.0001 | ||

| US31371NYW90 / Fannie Mae Pool | 0.01 | -6.67 | 0.0004 | -0.0001 | ||

| US3138EBFR12 / FNMA POOL AK6475 FN 02/42 FIXED 5 | 0.01 | -7.14 | 0.0004 | -0.0000 | ||

| US3128MJYY06 / Freddie Mac Gold Pool | 0.01 | 0.00 | 0.0004 | -0.0000 | ||

| US3138A7YK84 / FNMA POOL AH6113 FN 03/41 FIXED 5.5 | 0.01 | 0.00 | 0.0004 | -0.0000 | ||

| US12657VAA08 / CSWF 2021-SOP2 | 0.01 | -85.71 | 0.0004 | -0.0021 | ||

| US3132XUR312 / FED HM LN PC POOL Q52305 FG 11/47 FIXED 3 | 0.01 | 0.00 | 0.0003 | -0.0000 | ||

| AT&T INC SNR S* ICE / DCR (000000000) | 0.01 | 0.0002 | 0.0002 | |||

| US38375UBR05 / GOVERNMENT NATIONAL MORTGAGE A GNR 2013 H24 FB | 0.01 | -27.27 | 0.0002 | -0.0001 | ||

| US38376RRJ76 / Government National Mortgage Association | 0.01 | 0.00 | 0.0002 | -0.0000 | ||

| US31371NQJ71 / Fannie Mae Pool | 0.01 | -14.29 | 0.0002 | -0.0000 | ||

| US31371M5Q66 / FANNIE MAE POOL UMBS P#256555 5.50000000 | 0.01 | -16.67 | 0.0001 | -0.0000 | ||

| US31396AJG04 / FREDDIE MAC FHR 3034 FL | 0.01 | 0.00 | 0.0001 | -0.0000 | ||

| AT&T INC SNR S* ICE / DCR (EZHQ4Q1W91G8) | 0.00 | -25.00 | 0.0001 | -0.0000 | ||

| US3138LMVK66 / FANNIE MAE POOL UMBS P#AN8717 3.02000000 | 0.00 | 0.0000 | -0.0000 | |||

| US38376RKZ81 / Government National Mortgage Association | 0.00 | 0.0000 | -0.0000 | |||

| US38376RXJ03 / GNMA, Series 2016-H17, Class FM | 0.00 | 0.0000 | -0.0000 | |||

| US31371MMM63 / Fannie Mae Pool | 0.00 | 0.0000 | -0.0000 | |||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | -0.10 | -0.0027 | -0.0027 | |||

| RFR USD SOFR/3.62000 02/14/25-5Y LCH / DIR (EZMDBB3P1KY1) | -0.44 | -371.17 | -0.0124 | -0.0171 | ||

| RFR USD SOFR/4.01150 02/14/25-10Y LCH / DIR (EZSQMTV543V9) | -1.04 | 31.82 | -0.0292 | -0.0060 | ||

| RFR USD SOFR/3.80000 09/05/23-5Y LCH / DIR (EZ5N3TF4YV54) | -1.10 | -9,241.67 | -0.0306 | -0.0310 | ||

| RFR USD SOFR/3.75000 09/02/25-7Y* LCH / DIR (000000000) | -2.14 | -0.0598 | -0.0598 |