Mga Batayang Estadistika

| Nilai Portofolio | $ 445,590,310 |

| Posisi Saat Ini | 63 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

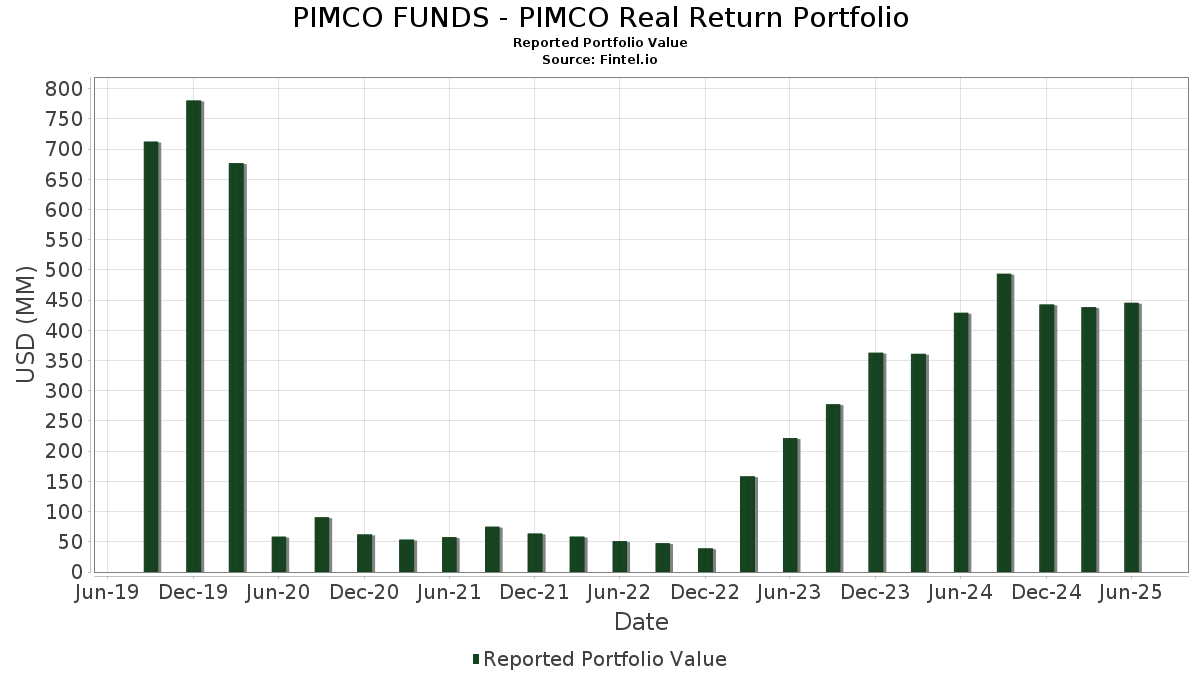

PIMCO FUNDS - PIMCO Real Return Portfolio telah mengungkapkan total kepemilikan 63 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 445,590,310 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PIMCO FUNDS - PIMCO Real Return Portfolio adalah United States Treasury Inflation Indexed Bonds (US:US912828S505) , United States Treasury Inflation Indexed Bonds (US:US9128282L36) , United States Treasury Inflation Indexed Bonds (US:US91282CCM10) , U.S. Treasury Inflation Linked Notes (US:US91282CEZ05) , and United States Treasury Inflation Indexed Bonds (US:US91282CBF77) . Posisi baru PIMCO FUNDS - PIMCO Real Return Portfolio meliputi: United States Treasury Inflation Indexed Bonds (US:US912828S505) , United States Treasury Inflation Indexed Bonds (US:US9128282L36) , United States Treasury Inflation Indexed Bonds (US:US91282CCM10) , U.S. Treasury Inflation Linked Notes (US:US91282CEZ05) , and United States Treasury Inflation Indexed Bonds (US:US91282CBF77) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 35.91 | 8.0312 | 2.0920 | ||

| 10.32 | 2.3084 | 1.1563 | ||

| 37.55 | 8.3966 | 0.3190 | ||

| 34.93 | 7.8116 | 0.3110 | ||

| 30.65 | 6.8552 | 0.3082 | ||

| 32.70 | 7.3130 | 0.2878 | ||

| 30.80 | 6.8886 | 0.2834 | ||

| 25.79 | 5.7667 | 0.2586 | ||

| 29.61 | 6.6207 | 0.2524 | ||

| 29.76 | 6.6550 | 0.2510 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| -260.52 | -58.2604 | -58.2604 | ||

| -79.96 | -17.8812 | -17.8812 | ||

| 7.86 | 1.7583 | -6.2837 | ||

| 3.43 | 0.7671 | -3.3317 | ||

| -4.30 | -0.9605 | -0.9605 | ||

| 27.74 | 6.2046 | -0.4764 | ||

| -2.07 | -0.4624 | -0.4624 | ||

| 28.93 | 6.4693 | -0.4078 | ||

| 6.21 | 1.3893 | -0.2993 | ||

| 11.27 | 2.5193 | -0.2405 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Investor ini belum mengungkapkan sekuritas yang diperhitungkan dalam bentuk saham, sehingga kolom terkait saham dalam tabel di bawah ini dihilangkan. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|

| US912828S505 / United States Treasury Inflation Indexed Bonds | 37.55 | 0.58 | 8.3966 | 0.3190 | ||

| TSY INFL IX N/B 01/34 1.75 / DBT (US91282CJY84) | 35.91 | 30.85 | 8.0312 | 2.0920 | ||

| US9128282L36 / United States Treasury Inflation Indexed Bonds | 34.93 | 0.78 | 7.8116 | 0.3110 | ||

| TSY INFL IX N/B 04/29 2.125 / DBT (US91282CKL45) | 32.70 | 0.72 | 7.3130 | 0.2878 | ||

| US91282CCM10 / United States Treasury Inflation Indexed Bonds | 31.58 | -5.39 | 7.0615 | -0.1604 | ||

| US91282CEZ05 / U.S. Treasury Inflation Linked Notes | 30.80 | 0.91 | 6.8886 | 0.2834 | ||

| US91282CBF77 / United States Treasury Inflation Indexed Bonds | 30.65 | 1.32 | 6.8552 | 0.3082 | ||

| US91282CHP95 / United States Treasury Inflation Indexed Bonds | 29.76 | 0.55 | 6.6550 | 0.2510 | ||

| US91282CFR79 / United States Treasury Inflation Indexed Bonds | 29.61 | 0.60 | 6.6207 | 0.2524 | ||

| US91282CGK18 / U.S. Treasury Inflation Linked Notes | 28.93 | -8.97 | 6.4693 | -0.4078 | ||

| US912828ZZ63 / United States Treasury Inflation Indexed Bonds | 27.74 | -10.14 | 6.2046 | -0.4764 | ||

| TSY INFL IX N/B 07/34 1.875 / DBT (US91282CLE92) | 27.54 | 0.17 | 6.1578 | 0.2092 | ||

| US91282CJH51 / US TREASURY I/L 2.375% 10-15-28 | 27.38 | 0.55 | 6.1231 | 0.2308 | ||

| US91282CGW55 / United States Treasury Inflation Indexed Bonds | 26.26 | 0.78 | 5.8732 | 0.2338 | ||

| US912828Z377 / United States Treasury Inflation Indexed Bonds | 25.79 | 1.30 | 5.7667 | 0.2586 | ||

| US9128285W63 / United States Treasury Inflation Indexed Bonds | 23.89 | 1.01 | 5.3431 | 0.2243 | ||

| US912828V491 / United States Treasury Inflation Indexed Bonds | 23.84 | 0.65 | 5.3313 | 0.2058 | ||

| US912828Y388 / United States Treasury Inflation Indexed Bonds | 23.61 | 0.95 | 5.2798 | 0.2188 | ||

| US9128283R96 / United States Treasury Inflation Indexed Bonds | 23.36 | 0.91 | 5.2237 | 0.2146 | ||

| US91282CDC29 / UNITED STATES TREASURY INFLATION INDEXED BONDS 0.12500000 | 18.08 | 0.63 | 4.0434 | 0.1554 | ||

| US91282CDX65 / United States Treasury Inflation Indexed Bonds | 17.46 | 1.14 | 3.9045 | 0.1690 | ||

| US91282CEJ62 / United States Treasury Inflation Indexed Bonds | 17.24 | 0.72 | 3.8560 | 0.1515 | ||

| US9128287D64 / United States Treasury Inflation Indexed Bonds | 16.98 | 1.25 | 3.7982 | 0.1684 | ||

| US912810RL44 / United States Treasury Inflation Indexed Bonds | 12.28 | -2.86 | 2.7469 | 0.0110 | ||

| US912810RF75 / United States Treasury Inflation Indexed Bonds | 11.27 | -11.67 | 2.5193 | -0.2405 | ||

| US912810PS15 / United States Treasury Inflation Indexed Bonds | 11.16 | 0.13 | 2.4958 | 0.0838 | ||

| TSY INFL IX N/B 01/35 2.125 / DBT (US91282CML27) | 10.65 | 0.03 | 2.3808 | 0.0776 | ||

| TSY INFL IX N/B 10/29 1.625 / DBT (US91282CLV18) | 10.32 | 93.88 | 2.3084 | 1.1563 | ||

| TSY INFL IX N/B 02/54 2.125 / DBT (US912810TY47) | 9.96 | -3.69 | 2.2265 | -0.0102 | ||

| US912810RR14 / United States Treasury Inflation Indexed Bonds | 9.41 | -3.01 | 2.1054 | 0.0051 | ||

| US912810PV44 / United States Treasury Inflation Indexed Bonds | 9.38 | 0.62 | 2.0980 | 0.0804 | ||

| US912810QV35 / United States Treasury Inflation Indexed Bonds | 8.63 | -13.46 | 1.9294 | -0.2280 | ||

| US91282CCA71 / United States Treasury Inflation Indexed Bonds | 7.86 | -78.85 | 1.7583 | -6.2837 | ||

| US912810TP30 / US TREASURY I/L 1.5% 02-15-53 | 7.27 | -13.99 | 1.6262 | -0.2032 | ||

| US912810RA88 / United States Treasury Inflation Indexed Bonds | 7.06 | -2.41 | 1.5783 | 0.0133 | ||

| US912810RW09 / United States Treasury Inflation Indexed Bonds | 6.87 | -3.33 | 1.5365 | -0.0015 | ||

| US912810SB52 / United States Treasury Inflation Indexed Bonds | 6.66 | -3.36 | 1.4905 | -0.0018 | ||

| US912810QP66 / United States Treasury Inflation Indexed Bonds | 6.21 | -20.39 | 1.3893 | -0.2993 | ||

| US912810FD55 / Usa Treasury Bonds 3 5/8% Tii 30yr Bd 4/15/28 | 5.82 | 0.19 | 1.3019 | 0.0446 | ||

| US912810SM18 / US TII .25 02/15/2050 (TIPS) | 5.06 | -3.93 | 1.1324 | -0.0082 | ||

| US912810SG40 / United States Treasury Inflation Indexed Bonds | 4.91 | -3.71 | 1.0973 | -0.0054 | ||

| US912810TE82 / United States Treasury Inflation Indexed Bonds | 4.13 | -4.80 | 0.9228 | -0.0152 | ||

| US912810SV17 / United States Treasury Inflation Indexed Bonds | 4.05 | -4.37 | 0.9059 | -0.0106 | ||

| US912810FH69 / Usa Treasury Notes 3 7/8% 30yr Notes 04/15/2029 | 3.85 | 0.34 | 0.8610 | 0.0307 | ||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 3.43 | -81.89 | 0.7671 | -3.3317 | ||

| US912810QF84 / United States Treasury Inflation Indexed Bonds | 2.20 | -1.35 | 0.4918 | 0.0093 | ||

| TSY INFL IX N/B 02/55 2.375 / DBT (US912810UH94) | 2.07 | -3.55 | 0.4619 | -0.0014 | ||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | 0.25 | 0.0554 | 0.0554 | |||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 0.18 | 0.0402 | 0.0402 | |||

| US59020UWU59 / MLCC MORTGAGE INVESTORS INC MLCC 2005 B A1 | 0.12 | -4.10 | 0.0264 | -0.0001 | ||

| US16678RAS67 / Chevy Chase Funding LLC Mortgage-Backed Certificates Series 2004-1 | 0.02 | 0.00 | 0.0050 | 0.0000 | ||

| INF SWAP US IT 3.3 06/04/2025-1Y LCH / DIR (EZ4T3WJXC5V3) | 0.00 | 0.0011 | 0.0011 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | |||

| SOLD EUR BOUGHT USD 20250804 / DFE (000000000) | -0.00 | -0.0004 | -0.0004 | |||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0008 | -0.0008 | |||

| INF SWAP US IT 2.38 10/15/24-1Y LCH / DIR (000000000) | -0.00 | -0.0009 | -0.0009 | |||

| INF SWAP US IT 2.70 01/14/25-1Y LCH / DIR (000000000) | -0.02 | -0.0036 | -0.0036 | |||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | -0.03 | -0.0070 | -0.0070 | |||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | -0.19 | -0.0420 | -0.0420 | |||

| REVERSE REPO BANK OF AMERICA REVERSE REPO / RA (000000000) | -2.07 | -0.4624 | -0.4624 | |||

| REVERSE REPO JPM CHASE / RA (000000000) | -4.30 | -0.9605 | -0.9605 | |||

| REVERSE REPO THE BANK OF NOVA REVERSE REPO / RA (000000000) | -79.96 | -17.8812 | -17.8812 | |||

| REVERSE REPO BANK OF MONTREAL REVERSE REPO / RA (000000000) | -260.52 | -58.2604 | -58.2604 |