Mga Batayang Estadistika

| Nilai Portofolio | $ 72,912,496,593 |

| Posisi Saat Ini | 8,293 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

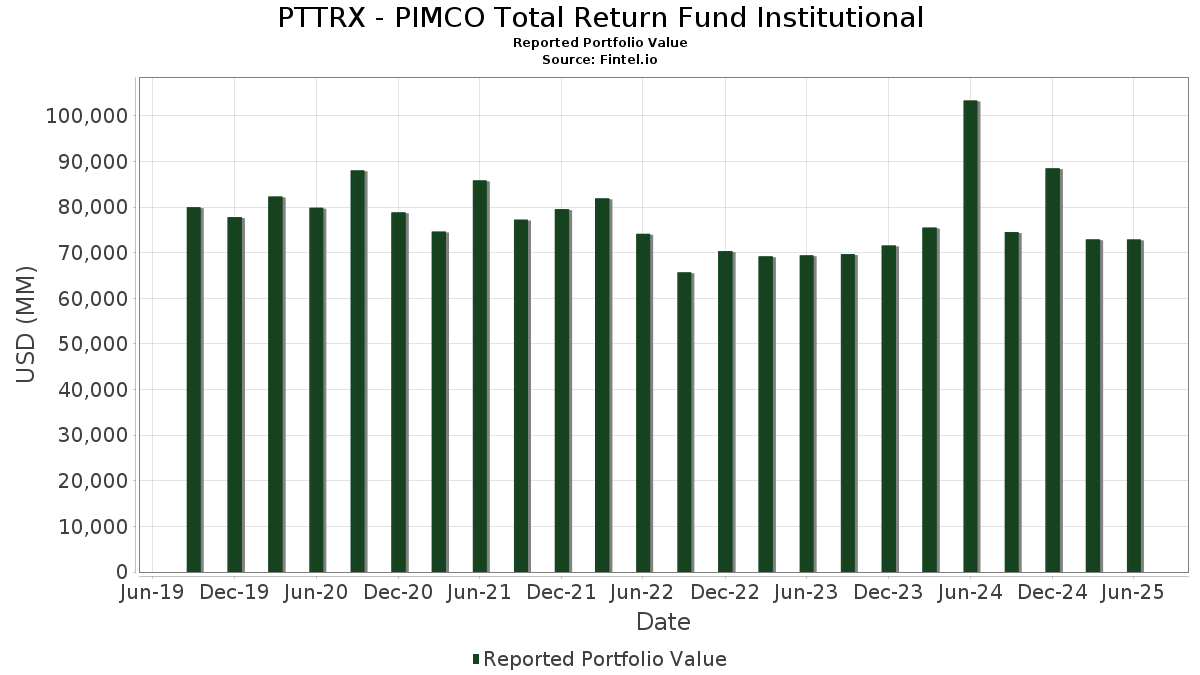

PTTRX - PIMCO Total Return Fund Institutional telah mengungkapkan total kepemilikan 8,293 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 72,912,496,593 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PTTRX - PIMCO Total Return Fund Institutional adalah UMBS TBA (US:US01F0506844) , PIMCO ST FLOATING NAV PORT IV MUTUAL FUND (US:US72202G3801) , FNMA 30YR TBA 3.0% AUG 20 TO BE ANNOUNCED 3.00000000 (US:US01F0306864) , UMBS TBA (US:US01F0306781) , and Uniform Mortgage-Backed Security, TBA (US:US01F0606834) . Posisi baru PTTRX - PIMCO Total Return Fund Institutional meliputi: UMBS TBA (US:US01F0506844) , PIMCO ST FLOATING NAV PORT IV MUTUAL FUND (US:US72202G3801) , FNMA 30YR TBA 3.0% AUG 20 TO BE ANNOUNCED 3.00000000 (US:US01F0306864) , UMBS TBA (US:US01F0306781) , and Uniform Mortgage-Backed Security, TBA (US:US01F0606834) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2,440.94 | 5.4915 | 4.2422 | ||

| 2,142.67 | 4.8205 | 3.1383 | ||

| 1,122.23 | 2.5247 | 1.9913 | ||

| 612.88 | 1.3788 | 1.3788 | ||

| 612.88 | 1.3788 | 1.3788 | ||

| 524.77 | 1.1806 | 1.1806 | ||

| 1,701.09 | 3.8270 | 0.9499 | ||

| 342.83 | 0.7713 | 0.9007 | ||

| 2.59 | 0.0058 | 0.7712 | ||

| 1,791.03 | 4.0294 | 0.6520 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2,225.34 | 5.0065 | -3.8883 | ||

| 510.76 | 1.1491 | -2.5190 | ||

| 17.00 | 0.0382 | -2.2259 | ||

| 72.46 | 0.1630 | -2.1173 | ||

| 122.93 | 0.2766 | -0.8995 | ||

| 78.50 | 0.1766 | -0.4587 | ||

| -162.40 | -0.3654 | -0.3654 | ||

| -162.40 | -0.3654 | -0.3654 | ||

| 4.48 | 0.0101 | -0.2580 | ||

| -87.16 | -0.1961 | -0.1961 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US01F0506844 / UMBS TBA | 2,440.94 | 283.28 | 5.4915 | 4.2422 | |||||

| US72202G3801 / PIMCO ST FLOATING NAV PORT IV MUTUAL FUND | 2,379.35 | 1.31 | 5.3530 | 0.1538 | |||||

| US01F0306864 / FNMA 30YR TBA 3.0% AUG 20 TO BE ANNOUNCED 3.00000000 | 2,225.34 | -50.92 | 5.0065 | -3.8883 | |||||

| US01F0306781 / UMBS TBA | 2,142.67 | 133.26 | 4.8205 | 3.1383 | |||||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 1,791.03 | 4.03 | 4.0294 | 0.6520 | |||||

| US01F0426811 / UMBS TBA | 1,701.09 | 15.98 | 3.8270 | 0.9499 | |||||

| US01F0406854 / UMBS TBA | 1,122.23 | 312.69 | 2.5247 | 1.9913 | |||||

| US912810ST60 / TREASURY BOND | 1,019.59 | -2.15 | 2.2938 | -0.0128 | |||||

| US912810RM27 / United States Treas Bds Bond | 613.68 | -2.34 | 1.3806 | -0.0105 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 612.88 | 1.3788 | 1.3788 | ||||||

| GB00BMV7TC88 / United Kingdom Gilt | 612.88 | 1.3788 | 1.3788 | ||||||

| US21H0326700 / GNMA2 30YR TBA(REG C) 3.5 TBA 07-01-50 | 524.77 | 1.1806 | 1.1806 | ||||||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 510.76 | -72.68 | 1.1491 | -2.5190 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 474.38 | 8.57 | 1.0672 | 0.1000 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 474.38 | 8.57 | 1.0672 | 0.1000 | |||||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 432.82 | -3.30 | 0.9737 | -0.0171 | |||||

| ROUNDSTONE SECURITIES RNST 2A A 144A / ABS-MBS (XS2779836308) | 423.31 | 4.06 | 0.9523 | 0.0518 | |||||

| ROUNDSTONE SECURITIES RNST 2A A 144A / ABS-MBS (XS2779836308) | 423.31 | 4.06 | 0.9523 | 0.0518 | |||||

| LEGACY MORTGAGE ASSET TRUST LMAT 2024 INV1 PT 144A / ABS-MBS (US52475VBH06) | 422.79 | -0.12 | 0.9512 | 0.0142 | |||||

| LEGACY MORTGAGE ASSET TRUST LMAT 2024 INV1 PT 144A / ABS-MBS (US52475VBH06) | 422.79 | -0.12 | 0.9512 | 0.0142 | |||||

| US912810SV17 / United States Treasury Inflation Indexed Bonds | 404.62 | -4.36 | 0.9103 | -0.0263 | |||||

| US21H0306827 / Ginnie Mae | 352.89 | 329.22 | 0.7939 | 0.6326 | |||||

| US21H0426799 / Ginnie Mae | 342.83 | -538.66 | 0.7713 | 0.9007 | |||||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 341.50 | 330.40 | 0.7683 | 0.6126 | |||||

| US912810SW99 / United States Treasury Note/Bond | 340.28 | -2.19 | 0.7655 | -0.0046 | |||||

| US21H0406817 / Ginnie Mae | 329.41 | 67.96 | 0.7411 | 0.3819 | |||||

| US912810QY73 / United States Treas Bds Bond | 320.22 | -2.07 | 0.7204 | -0.0034 | |||||

| CITIGROUP MORTGAGE LOAN TRUST CMLTI 2024 RP3 PT 144A / ABS-MBS (US173112AS24) | 282.57 | -2.18 | 0.6357 | -0.0038 | |||||

| CITIGROUP MORTGAGE LOAN TRUST CMLTI 2024 RP3 PT 144A / ABS-MBS (US173112AS24) | 282.57 | -2.18 | 0.6357 | -0.0038 | |||||

| US21H0226710 / GNII II 2.5% 07/01/2050 #TBA | 280.80 | 42.70 | 0.6317 | 0.3058 | |||||

| BANC OF AMERICA MERRILL LYNCH BAMLL 2024 LB1 AE 144A / ABS-MBS (US05494AAA79) | 265.04 | -3.68 | 0.5963 | -0.0129 | |||||

| BANC OF AMERICA MERRILL LYNCH BAMLL 2024 LB1 AE 144A / ABS-MBS (US05494AAA79) | 265.04 | -3.68 | 0.5963 | -0.0129 | |||||

| US21H0526788 / Ginnie Mae | 262.53 | 0.5906 | 0.5906 | ||||||

| US12654RAM60 / CREDIT SUISSE MORTGAGE TRUST CSMC 2018 SP3 PT 144A | 259.41 | -3.56 | 0.5836 | -0.0118 | |||||

| US12654QBH83 / CREDIT SUISSE MORTGAGE TRUST CSMC 2018 SP2 PT 144A | 256.60 | -4.75 | 0.5773 | -0.0191 | |||||

| ZAG000016320 / Republic of South Africa Government Bond | 252.13 | -25.13 | 0.5672 | -0.1783 | |||||

| US912810SJ88 / United States Treas Bds Bond | 245.47 | 26.87 | 0.5523 | 0.1240 | |||||

| US TREASURY N/B 02/55 4.625 / DBT (US912810UG12) | 242.27 | 811.44 | 0.5450 | 0.4862 | |||||

| US TREASURY N/B 02/55 4.625 / DBT (US912810UG12) | 242.27 | 811.44 | 0.5450 | 0.4862 | |||||

| US912810RN00 / United States Treas Bds Bond | 240.28 | -2.37 | 0.5406 | -0.0043 | |||||

| US21H0506723 / Ginnie Mae | 238.15 | -109,845.62 | 0.5358 | 0.5361 | |||||

| RFR USD SOFR/1.75000 12/21/22-30Y CME / DIR (EZ000VCFPMC7) | 236.59 | 6.32 | 0.5323 | 0.0397 | |||||

| RFR USD SOFR/1.75000 12/21/22-30Y CME / DIR (EZ000VCFPMC7) | 236.59 | 6.32 | 0.5323 | 0.0397 | |||||

| EW / Edwards Lifesciences Corporation | 234.71 | 36.94 | 0.5280 | 0.1424 | |||||

| US52474BAJ26 / LEGACY MORTGAGE ASSET TRUST LMAT 2018 RPL1 PT 144A | 233.74 | -0.90 | 0.5259 | 0.0037 | |||||

| US91282CCM10 / United States Treasury Inflation Indexed Bonds | 232.25 | 1.21 | 0.5225 | 0.0145 | |||||

| US21H0506806 / GNMA | 223.87 | 0.5036 | 0.5036 | ||||||

| US912810TH14 / United States Treasury Note/Bond | 223.41 | -27.15 | 0.5026 | -0.1762 | |||||

| EUROPEAN UNION SR UNSECURED REGS 10/29 2.875 / DBT (EU000A3L1CN4) | 222.72 | 9.82 | 0.5011 | 0.0521 | |||||

| EUROPEAN UNION SR UNSECURED REGS 10/29 2.875 / DBT (EU000A3L1CN4) | 222.72 | 9.82 | 0.5011 | 0.0521 | |||||

| US912810TA60 / U.S. Treasury Bonds | 219.92 | -2.05 | 0.4948 | -0.0023 | |||||

| BARROW FUNDING PLC BARRO 1A A 144A / ABS-MBS (XS2755901266) | 214.15 | -1.64 | 0.4818 | -0.0002 | |||||

| BARROW FUNDING PLC BARRO 1A A 144A / ABS-MBS (XS2755901266) | 214.15 | -1.64 | 0.4818 | -0.0002 | |||||

| Q / Quetzal Copper Corp. | 213.10 | -17.77 | 0.4794 | -0.0942 | |||||

| Q / Quetzal Copper Corp. | 213.10 | -17.77 | 0.4794 | -0.0942 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 211.87 | 6.44 | 0.4767 | 0.0360 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 211.87 | 6.44 | 0.4767 | 0.0360 | |||||

| US31418EMT46 / Fannie Mae Pool | 201.15 | -3.03 | 0.4525 | -0.0067 | |||||

| US3132DWJR51 / FHLG 30YR 5.5% 11/01/2053#SD8372 | 199.73 | -2.53 | 0.4493 | -0.0043 | |||||

| US912810RB61 / United States Treas Bds Bond | 194.51 | -2.14 | 0.4376 | -0.0024 | |||||

| US91282CDX65 / United States Treasury Inflation Indexed Bonds | 192.12 | 1.14 | 0.4322 | 0.0117 | |||||

| EW / Edwards Lifesciences Corporation | 171.40 | 39.43 | 0.3856 | 0.1091 | |||||

| EW / Edwards Lifesciences Corporation | 171.40 | 0.00 | 0.3856 | 0.0000 | |||||

| US912810TP30 / US TREASURY I/L 1.5% 02-15-53 | 166.51 | -3.87 | 0.3746 | -0.0088 | |||||

| US21H0606713 / Ginnie Mae | 166.45 | 0.3745 | 0.3745 | ||||||

| BARCLAYS CAPITAL REPO REPO / RA (000000000) | 162.40 | 0.3654 | 0.3654 | ||||||

| BARCLAYS CAPITAL REPO REPO / RA (000000000) | 162.40 | 0.3654 | 0.3654 | ||||||

| US912810RH32 / United States Treas Bds Bond | 153.18 | -2.24 | 0.3446 | -0.0023 | |||||

| US21H0206753 / GINNIE MAE II POOL 30YR TBA (JULY) | 147.21 | 173.00 | 0.3312 | 0.2419 | |||||

| US52473LAA08 / LEGACY MORTGAGE ASSET TRUST LMAT 2017 RPL2 A1 144A | 146.86 | -2.55 | 0.3304 | -0.0032 | |||||

| US3140QNGB25 / FNMA POOL CB2893 FN 02/52 FIXED 3 | 145.28 | -1.77 | 0.3269 | -0.0005 | |||||

| US12594YAA01 / CREDIT SUISSE MORTGAGE TRUST CSMC 2017 RPL2 A1 144A | 144.98 | -2.32 | 0.3262 | -0.0024 | |||||

| US12653MAM82 / CREDIT SUISSE MORTGAGE TRUST CSMC 2018 RPL4 PT 144A | 143.54 | -1.94 | 0.3229 | -0.0011 | |||||

| US90355RAC60 / UWM 2021-INV3 A3 11/51 | 143.35 | -2.47 | 0.3225 | -0.0029 | |||||

| US912810SY55 / United States Treasury Note/Bond | 142.77 | -2.02 | 0.3212 | -0.0014 | |||||

| US912810RL44 / United States Treasury Inflation Indexed Bonds | 138.16 | -2.85 | 0.3108 | -0.0040 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 137.17 | 1.77 | 0.3086 | 0.0102 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 137.17 | 1.77 | 0.3086 | 0.0102 | |||||

| US12653HAA59 / CREDIT SUISSE MORTGAGE TRUST CSMC 2018 RPL1 A1 144A | 136.98 | -1.72 | 0.3082 | -0.0004 | |||||

| US36267BAB36 / GS Mortgage-Backed Securities Trust | 135.90 | -1.61 | 0.3057 | -0.0000 | |||||

| PEP01000C5I0 / BONOS DE TESORERIA | 133.53 | 31.47 | 0.3004 | 0.0756 | |||||

| US912810SH23 / United States Treas Bds Bond | 133.33 | -2.60 | 0.3000 | -0.0031 | |||||

| US912810SD19 / United States Treas Bds Bond | 131.91 | 35.56 | 0.2968 | 0.0814 | |||||

| TSY INFL IX N/B 02/54 2.125 / DBT (US912810TY47) | 129.41 | -3.68 | 0.2912 | -0.0063 | |||||

| TSY INFL IX N/B 02/54 2.125 / DBT (US912810TY47) | 129.41 | -3.68 | 0.2912 | -0.0063 | |||||

| US654744AC50 / Nissan Motor Co Ltd | 127.10 | -1.25 | 0.2859 | 0.0010 | |||||

| CITIGROUP MORTGAGE LOAN TRUST CMLTI 2024 RP4 PT 144A / ABS-MBS (US17332EAT91) | 124.55 | -3.14 | 0.2802 | -0.0045 | |||||

| CITIGROUP MORTGAGE LOAN TRUST CMLTI 2024 RP4 PT 144A / ABS-MBS (US17332EAT91) | 124.55 | -3.14 | 0.2802 | -0.0045 | |||||

| EW / Edwards Lifesciences Corporation | 122.93 | -79.50 | 0.2766 | -0.8995 | |||||

| US11135FBP53 / SR UNSECURED 144A 11/35 3.137 | 122.52 | 1.76 | 0.2756 | 0.0091 | |||||

| US654744AB77 / Nissan Motor Co Ltd | 122.02 | 0.49 | 0.2745 | 0.0057 | |||||

| R2035 / South Africa - Corporate Bond/Note | 120.81 | 53.72 | 0.2718 | 0.0978 | |||||

| US21H0406734 / Ginnie Mae | 120.24 | -37.18 | 0.2705 | -0.1049 | |||||

| US912810SC36 / United States Treas Bds Bond | 117.12 | -2.53 | 0.2635 | -0.0025 | |||||

| US30227FAA84 / Extended Stay America Trust | 114.52 | -0.86 | 0.2576 | 0.0019 | |||||

| US62955HAA59 / NYO COMMERCIAL MORTGAGE TRUST 2021-1290 SER 2021-1290 CL A V/R REGD 144A P/P 1.17500000 | 114.22 | 0.55 | 0.2570 | 0.0055 | |||||

| J P MORGAN TERM REPO / RA (000000000) | 114.15 | 0.2568 | 0.2568 | ||||||

| J P MORGAN TERM REPO / RA (000000000) | 114.15 | 0.2568 | 0.2568 | ||||||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 112.16 | -31.39 | 0.2523 | -0.0684 | |||||

| FED HM LN PC POOL SD8431 FR 05/54 FIXED 5.5 / ABS-MBS (US3132DWLL53) | 110.63 | -2.61 | 0.2489 | -0.0026 | |||||

| FED HM LN PC POOL SD8431 FR 05/54 FIXED 5.5 / ABS-MBS (US3132DWLL53) | 110.63 | -2.61 | 0.2489 | -0.0026 | |||||

| US3133KRB291 / Freddie Mac Pool | 109.94 | -2.17 | 0.2473 | -0.0014 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 109.00 | 0.2452 | 0.2452 | ||||||

| 5831 / Shizuoka Financial Group,Inc. | 109.00 | 0.2452 | 0.2452 | ||||||

| US21H0226892 / Ginnie Mae | 107.92 | -2.06 | 0.2428 | 0.0266 | |||||

| US31418EU999 / Fannie Mae Pool | 107.35 | -2.65 | 0.2415 | -0.0026 | |||||

| US TREASURY N/B 08/54 4.25 / DBT (US912810UC08) | 107.34 | -3.25 | 0.2415 | -0.0041 | |||||

| US TREASURY N/B 08/54 4.25 / DBT (US912810UC08) | 107.34 | -3.25 | 0.2415 | -0.0041 | |||||

| US21H0306744 / Ginnie Mae | 103.86 | 0.2337 | 0.2337 | ||||||

| DUTCH MORTGAGE FINANCE DMFI 2024 1A A 144A / ABS-MBS (XS2859749504) | 102.19 | 5.43 | 0.2299 | 0.0153 | |||||

| DUTCH MORTGAGE FINANCE DMFI 2024 1A A 144A / ABS-MBS (XS2859749504) | 102.19 | 5.43 | 0.2299 | 0.0153 | |||||

| US21H0606895 / Ginnie Mae | 100.35 | 0.2258 | 0.2258 | ||||||

| US3132DWHG15 / Freddie Mac Pool | 100.17 | -2.54 | 0.2253 | -0.0022 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 99.25 | -2.73 | 0.2233 | -0.0026 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 99.25 | -2.73 | 0.2233 | -0.0026 | |||||

| US3132DWF653 / Freddie Mac Pool | 97.78 | -2.75 | 0.2200 | -0.0026 | |||||

| US912810SK51 / United States Treasury Note/Bond | 97.23 | -2.77 | 0.2187 | -0.0026 | |||||

| RFR USD SOFR/3.50000 06/20/24-30Y LCH / DIR (EZV8ZC6L7CY8) | 95.18 | 13.09 | 0.2141 | 0.0278 | |||||

| RFR USD SOFR/3.50000 06/20/24-30Y LCH / DIR (EZV8ZC6L7CY8) | 95.18 | 13.09 | 0.2141 | 0.0278 | |||||

| US31418EXU99 / Fannie Mae Pool | 94.51 | -2.20 | 0.2126 | -0.0013 | |||||

| US912810SP49 / United States Treasury Note/Bond | 92.77 | -3.24 | 0.2087 | -0.0035 | |||||

| ALIGNED DATA CENTERS INTER LP 2024 TERM LOAN / LON (BA000JN59) | 92.25 | 0.2075 | 0.2075 | ||||||

| ALIGNED DATA CENTERS INTER LP 2024 TERM LOAN / LON (BA000JN59) | 92.25 | 0.2075 | 0.2075 | ||||||

| BANC OF AMERICA MERRILL LYNCH BAMLL 2024 LB2 A 144A / ABS-MBS (US054987AA02) | 89.98 | -4.22 | 0.2024 | -0.0055 | |||||

| BANC OF AMERICA MERRILL LYNCH BAMLL 2024 LB2 A 144A / ABS-MBS (US054987AA02) | 89.98 | -4.22 | 0.2024 | -0.0055 | |||||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 88.86 | 0.1999 | 0.1999 | ||||||

| US912810SA79 / United States Treas Bds Bond | 86.82 | 178.38 | 0.1953 | 0.1263 | |||||

| US36268SAA78 / GS MORTGAGE BACKED SECURITIES GSMBS 2022 LTV2 A1 144A | 85.66 | -1.81 | 0.1927 | -0.0004 | |||||

| US67114WAA99 / ONSLOW BAY FINANCIAL LLC OBX 2022 INV2 A1 144A | 84.69 | -2.02 | 0.1905 | -0.0008 | |||||

| US78485KAA34 / STWD 2022-FL3 Ltd | 83.93 | -10.55 | 0.1888 | -0.0189 | |||||

| US715638BY77 / REPUBLIC OF PERU SR UNSECURED 144A 08/32 6.15 | 83.87 | 6.77 | 0.1887 | 0.0148 | |||||

| US912810SM18 / US TII .25 02/15/2050 (TIPS) | 83.64 | -3.93 | 0.1882 | -0.0046 | |||||

| US53946PAA84 / LoanCore 2022-CRE7 Issuer Ltd | 83.37 | -5.51 | 0.1876 | -0.0078 | |||||

| US715638BE14 / Peruvian Government International Bond | 82.73 | -15.64 | 0.1861 | -0.0310 | |||||

| US912810SE91 / United States Treas Bds Bond | 81.59 | 196.43 | 0.1836 | 0.1226 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 80.78 | 0.1817 | 0.1817 | ||||||

| 5831 / Shizuoka Financial Group,Inc. | 80.78 | 0.1817 | 0.1817 | ||||||

| US38382YB857 / Government National Mortgage Association | 79.75 | -0.44 | 0.1794 | 0.0021 | |||||

| US912810RW09 / United States Treasury Inflation Indexed Bonds | 78.92 | -3.33 | 0.1776 | -0.0032 | |||||

| US05942JAA60 / BAMLL 2023 HTL 10/27 1 | 78.92 | -19.87 | 0.1776 | -0.0405 | |||||

| US01F0226831 / FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG | 78.50 | -75.76 | 0.1766 | -0.4587 | |||||

| US36179XLE49 / GNMA | 78.28 | -2.86 | 0.1761 | -0.0023 | |||||

| XS1697686928 / WARWICK FINANCE RESIDENTIAL MO WARW 3A A 144A | 78.28 | -5.44 | 0.1761 | -0.0072 | |||||

| US3140QSLC30 / FNMA POOL CB6622 FN 06/53 FIXED 5 | 76.63 | -0.62 | 0.1724 | 0.0017 | |||||

| US38382Y3J05 / Government National Mortgage Association | 76.26 | -0.61 | 0.1716 | 0.0017 | |||||

| US3132DWDK62 / FHLMC Pool, 30 Year | 75.88 | -2.21 | 0.1707 | -0.0011 | |||||

| US52474EAL11 / LEGACY MORTGAGE ASSET TRUST LMAT 2018 RPL2 PT 144A | 74.56 | -2.20 | 0.1677 | -0.0010 | |||||

| US12653JAM53 / CREDIT SUISSE MORTGAGE TRUST CSMC 2018 RPL3 PT 144A | 74.43 | -1.66 | 0.1675 | -0.0001 | |||||

| US097023DG73 / Boeing Co/The | 74.41 | 0.61 | 0.1674 | 0.0037 | |||||

| US912810SF66 / Us Treasury Bond | 74.36 | -2.56 | 0.1673 | -0.0016 | |||||

| US03880XAA46 / Arbor Realty Collateralized Loan Obligation Ltd., Series 2022-FL1, Class A | 73.75 | -10.99 | 0.1659 | -0.0175 | |||||

| US3132DWH220 / FHLG 30YR 5.5% 08/01/2053#SD8349 | 73.59 | -2.23 | 0.1655 | -0.0011 | |||||

| US38382YJ207 / Government National Mortgage Association | 72.69 | -0.13 | 0.1635 | 0.0024 | |||||

| US01F0326821 / Fannie Mae or Freddie Mac | 72.46 | -93.77 | 0.1630 | -2.1173 | |||||

| US31418EW300 / Fannie Mae Pool | 71.95 | -2.67 | 0.1619 | -0.0018 | |||||

| US44891ABZ93 / Hyundai Capital America | 70.58 | 0.77 | 0.1588 | 0.0037 | |||||

| US172967NG21 / Citigroup Inc | 70.33 | 0.63 | 0.1582 | 0.0035 | |||||

| US44891ACK16 / Hyundai Capital America | 70.32 | -0.25 | 0.1582 | 0.0021 | |||||

| US06539WBB19 / BANK 2020-BNK25 BANK 2020-BN25 A5 | 70.10 | 1.41 | 0.1577 | 0.0047 | |||||

| ONTARIO (PROVINCE OF) SR UNSECURED 12/34 3.8 / DBT (CA68333ZBG15) | 69.88 | 0.1572 | 0.1572 | ||||||

| ONTARIO (PROVINCE OF) SR UNSECURED 12/34 3.8 / DBT (CA68333ZBG15) | 69.88 | 0.1572 | 0.1572 | ||||||

| US36260AAA43 / GS MORTGAGE BACKED SECURITIES GSMBS 2020 RPL1 A1 144A | 69.63 | -1.64 | 0.1567 | -0.0001 | |||||

| US36179W2V97 / Ginnie Mae II Pool | 69.28 | -2.87 | 0.1559 | -0.0020 | |||||

| US3133KNZE65 / FED HM LN PC POOL RA7041 FR 03/52 FIXED 3 | 67.87 | -2.02 | 0.1527 | -0.0007 | |||||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | 67.51 | 0.1519 | 0.1519 | ||||||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | 67.51 | 0.1519 | 0.1519 | ||||||

| 937CJTII1 / CASTLELAKE LP FIRST LIEN TERM LOAN | 66.96 | -3.53 | 0.1506 | -0.0030 | |||||

| US404280DR76 / HSBC Holdings PLC | 65.33 | -0.07 | 0.1470 | 0.0023 | |||||

| GS MORTGAGE BACKED SECURITIES GSMBS 2025 NQM1 PT 144A / ABS-MBS (US36271LAL36) | 65.26 | -5.37 | 0.1468 | -0.0058 | |||||

| GS MORTGAGE BACKED SECURITIES GSMBS 2025 NQM1 PT 144A / ABS-MBS (US36271LAL36) | 65.26 | -5.37 | 0.1468 | -0.0058 | |||||

| US912810RR14 / United States Treasury Inflation Indexed Bonds | 65.09 | -3.00 | 0.1464 | -0.0021 | |||||

| US36168FAE88 / GCAT Trust, Series 2022-INV2, Class A5 | 64.98 | -2.38 | 0.1462 | -0.0012 | |||||

| US912810QZ49 / United States Treas Bds Bond | 64.12 | -2.02 | 0.1442 | -0.0006 | |||||

| US31418ES506 / Fannie Mae Pool | 63.44 | -2.91 | 0.1427 | -0.0019 | |||||

| US918307AC33 / SER 2021-INV4 CL A3 V/R REGD 144A P/P 2.50000000 | 63.22 | -2.06 | 0.1422 | -0.0007 | |||||

| US097023DA04 / Boeing Co/The | 62.58 | 0.64 | 0.1408 | 0.0031 | |||||

| US465973AC95 / JP MORGAN MORTGAGE TRUST SER 2022-INV1 CL A3 V/R REGD 144A P/P 3.00000000 | 61.70 | -1.37 | 0.1388 | 0.0003 | |||||

| US912810RP57 / United States Treas Bds Bond | 61.51 | -2.40 | 0.1384 | -0.0011 | |||||

| US TREASURY N/B 11/54 4.5 / DBT (US912810UE63) | 61.20 | -3.28 | 0.1377 | -0.0024 | |||||

| US TREASURY N/B 11/54 4.5 / DBT (US912810UE63) | 61.20 | -3.28 | 0.1377 | -0.0024 | |||||

| JPMMT 2025 LTV2 JPMMT 2025 LTV2 PT 144A / ABS-MBS (955UAOII8) | 59.83 | 0.1346 | 0.1346 | ||||||

| JPMMT 2025 LTV2 JPMMT 2025 LTV2 PT 144A / ABS-MBS (955UAOII8) | 59.83 | 0.1346 | 0.1346 | ||||||

| MORGAN STANLEY BANK NA MORGAN STANLEY BANK NA / DBT (US61690U8D59) | 59.69 | -0.11 | 0.1343 | 0.0020 | |||||

| MORGAN STANLEY BANK NA MORGAN STANLEY BANK NA / DBT (US61690U8D59) | 59.69 | -0.11 | 0.1343 | 0.0020 | |||||

| 4020 / Saudi Real Estate Company | 59.67 | 1.22 | 0.1343 | 0.0037 | |||||

| 4020 / Saudi Real Estate Company | 59.67 | 1.22 | 0.1343 | 0.0037 | |||||

| US57629TBQ94 / MassMutual Global Funding II | 59.21 | -0.04 | 0.1332 | 0.0021 | |||||

| 933UGCII5 / KRE 1330 BROADWAY OWNER 2018 TERM LOAN | 58.60 | -4.86 | 0.1318 | -0.0045 | |||||

| US3132DWFQ15 / FHLG 30YR 4.5% 12/01/2052# | 58.54 | -2.12 | 0.1317 | -0.0007 | |||||

| GATEWAY LEASE CTL A WHLN03785 / ABS-O (963SPPII4) | 58.30 | 4.75 | 0.1312 | 0.0080 | |||||

| US3140QSPN58 / Federal National Mortgage Association | 58.18 | -2.17 | 0.1309 | -0.0008 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 58.04 | 1.19 | 0.1306 | 0.0036 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 58.04 | 1.19 | 0.1306 | 0.0036 | |||||

| US29444UBK16 / Equinix Inc | 58.04 | 0.76 | 0.1306 | 0.0031 | |||||

| US88258MAA36 / TEXAS NATURAL GAS SECURITIZTN FIN CORP REVENUE | 57.18 | -3.89 | 0.1286 | -0.0031 | |||||

| 944ZSGII9 / PROJECT QUASAR PLEDGCO SLU 2022 EUR TERM LOAN A1 | 56.32 | 5.27 | 0.1267 | 0.0083 | |||||

| US38382YR218 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2023-H03 CL FA V/R 5.42906000 | 55.43 | -0.97 | 0.1247 | 0.0008 | |||||

| US52473LAE20 / LEGACY MORTGAGE ASSET TRUST LMAT 2017 RPL2 B1 144A | 55.42 | 0.60 | 0.1247 | 0.0027 | |||||

| FED HM LN PC POOL SD7578 FR 04/55 FIXED 6 / ABS-MBS (US3132DVM362) | 54.93 | 0.1236 | 0.1236 | ||||||

| FED HM LN PC POOL SD7578 FR 04/55 FIXED 6 / ABS-MBS (US3132DVM362) | 54.93 | 0.1236 | 0.1236 | ||||||

| DE000DL19U23 / DEUTSCHE BANK AG SR UNSECURED REGS 01/27 1.625 | 54.63 | 9.83 | 0.1229 | 0.0128 | |||||

| US02666TAB35 / American Homes 4 Rent LP | 54.57 | 0.88 | 0.1228 | 0.0030 | |||||

| US12594YAD40 / CREDIT SUISSE MORTGAGE TRUST CSMC 2017 RPL2 B1 144A | 54.56 | 0.55 | 0.1228 | 0.0026 | |||||

| US46647PBR64 / JPMorgan Chase & Co | 54.28 | 1.01 | 0.1221 | 0.0032 | |||||

| US36265LAB36 / GS MORTGAGE BACKED SECURITIES GSMBS 2022 HP1 A2 144A | 53.18 | -2.43 | 0.1196 | -0.0010 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 53.10 | 0.17 | 0.1195 | 0.0021 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 53.10 | 0.17 | 0.1195 | 0.0021 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 52.52 | -5.79 | 0.1182 | -0.0053 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 52.52 | -5.79 | 0.1182 | -0.0053 | |||||

| US38382YNR08 / Government National Mortgage Association | 52.41 | 0.31 | 0.1179 | 0.0022 | |||||

| US36179WZA97 / Ginnie Mae II Pool | 52.40 | -3.15 | 0.1179 | -0.0019 | |||||

| US00928QAU58 / Aircastle Ltd | 51.91 | 0.86 | 0.1168 | 0.0029 | |||||

| US626207YM09 / MUNI ELEC AUTH OF GEORGIA | 51.52 | -4.02 | 0.1159 | -0.0029 | |||||

| CPPIB CAPITAL INC COMPANY GUAR REGS 06/34 4.3 / DBT (CA12593CAY71) | 51.40 | 4.07 | 0.1156 | 0.0063 | |||||

| CPPIB CAPITAL INC COMPANY GUAR REGS 06/34 4.3 / DBT (CA12593CAY71) | 51.40 | 4.07 | 0.1156 | 0.0063 | |||||

| US23345LAA70 / DOLP Trust 2021-NYC | 50.54 | 1.26 | 0.1137 | 0.0032 | |||||

| FNMA POOL MA5420 FN 07/54 FIXED 5.5 / ABS-MBS (US31418FAW77) | 50.39 | -2.78 | 0.1134 | -0.0014 | |||||

| US95000U3E14 / Wells Fargo & Co. | 49.90 | 0.52 | 0.1123 | 0.0024 | |||||

| US21H0426872 / Ginnie Mae | 49.76 | 19.14 | 0.1119 | 0.0300 | |||||

| US06051GLV94 / Bank of America Corp. | 49.05 | -0.21 | 0.1104 | 0.0015 | |||||

| US31418ET678 / Fannie Mae Pool | 48.76 | -2.61 | 0.1097 | -0.0011 | |||||

| US06540JBG67 / BANK 2020-BNK26 | 48.69 | 1.44 | 0.1095 | 0.0033 | |||||

| XS1789787568 / KIRKBY RMBS KIRK 1A A 144A | 48.68 | -2.10 | 0.1095 | -0.0006 | |||||

| US3140QSMW84 / Federal National Mortgage Association | 48.45 | -1.81 | 0.1090 | -0.0002 | |||||

| US3140QRAF07 / FNCL UMBS 4.5 CB5405 10-01-52 | 47.91 | -2.20 | 0.1078 | -0.0007 | |||||

| US90355DAV55 / UNITED WHOLESALE MORTGAGE LLC UWM 2021 INV5 A12 144A | 47.90 | -1.69 | 0.1078 | -0.0001 | |||||

| US48275EAA47 / KREF 2022-FL3 Ltd | 47.87 | -13.57 | 0.1077 | -0.0149 | |||||

| US67114KAC18 / ONSLOW BAY FINANCIAL LLC OBX 2021 INV2 A3 144A | 47.82 | -1.98 | 0.1076 | -0.0004 | |||||

| US52473LAF94 / LEGACY MORTGAGE ASSET TRUST LMAT 2017 RPL2 B2 144A | 47.75 | -0.41 | 0.1074 | 0.0013 | |||||

| US12594YAE23 / CREDIT SUISSE MORTGAGE TRUST CSMC 2017 RPL2 B2 144A | 47.22 | -0.50 | 0.1062 | 0.0012 | |||||

| US054980AA58 / BDS 2022-FL11 LLC | 47.19 | -6.05 | 0.1062 | -0.0050 | |||||

| US912810TE82 / United States Treasury Inflation Indexed Bonds | 47.18 | -4.80 | 0.1061 | -0.0036 | |||||

| PROJECT PANAMA SPV LLC CR LKD NTSER 2024 1 144A / ABS-O (US74290GAA67) | 46.96 | 0.22 | 0.1057 | 0.0019 | |||||

| PROJECT PANAMA SPV LLC CR LKD NTSER 2024 1 144A / ABS-O (US74290GAA67) | 46.96 | 0.22 | 0.1057 | 0.0019 | |||||

| US03880RAA77 / Arbor Realty Collateralized Loan Obligation Ltd | 46.92 | -15.77 | 0.1056 | -0.0178 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 46.87 | -0.55 | 0.1055 | 0.0011 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 46.87 | -0.55 | 0.1055 | 0.0011 | |||||

| US31418ER854 / FNCL UMBS 5.5 MA5010 05-01-53 | 46.61 | -3.00 | 0.1049 | -0.0015 | |||||

| US90932LAJ61 / United Airlines 2023-1 Class A Pass Through Trust | 46.45 | 0.62 | 0.1045 | 0.0023 | |||||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 46.28 | -0.34 | 0.1041 | 0.0013 | |||||

| CONSUMER LOAN FINANCE ISSUER T CLFT 2023 1A A2 144A / ABS-O (US21055PAB04) | 46.20 | 0.16 | 0.1039 | 0.0018 | |||||

| CONSUMER LOAN FINANCE ISSUER T CLFT 2023 1A A2 144A / ABS-O (US21055PAB04) | 46.20 | 0.16 | 0.1039 | 0.0018 | |||||

| CONSUMER LOAN FINANCE ISSUER T CLFT 2023 2A A2 144A / ABS-O (US210927AB51) | 46.20 | 0.14 | 0.1039 | 0.0018 | |||||

| CONSUMER LOAN FINANCE ISSUER T CLFT 2023 2A A2 144A / ABS-O (US210927AB51) | 46.20 | 0.14 | 0.1039 | 0.0018 | |||||

| CONSUMER LOAN FINANCE ISSUER T CLFT 2023 3A A2 144A / ABS-O (US210928AB35) | 46.20 | 0.18 | 0.1039 | 0.0018 | |||||

| CONSUMER LOAN FINANCE ISSUER T CLFT 2023 3A A2 144A / ABS-O (US210928AB35) | 46.20 | 0.18 | 0.1039 | 0.0018 | |||||

| XS1908327320 / PROTEUS RMBS DAC PROTE 1A AR 144A | 45.97 | -5.68 | 0.1034 | -0.0045 | |||||

| US36179XFF87 / Government National Mortgage Association (GNMA) | 45.97 | -3.56 | 0.1034 | -0.0021 | |||||

| US12653HAD98 / CREDIT SUISSE MORTGAGE TRUST CSMC 2018 RPL1 B1 144A | 45.55 | 0.39 | 0.1025 | 0.0020 | |||||

| S1MF34 / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 45.44 | 1.03 | 0.1022 | 0.0027 | |||||

| S1MF34 / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 45.44 | 1.03 | 0.1022 | 0.0027 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 45.37 | -7.40 | 0.1021 | -0.0064 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 45.37 | -7.40 | 0.1021 | -0.0064 | |||||

| USU5615XAA82 / MANHATTAN WEST | 45.32 | 1.44 | 0.1020 | 0.0031 | |||||

| US07274EAJ29 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.25% 01-21-29 | 45.27 | 1.28 | 0.1018 | 0.0029 | |||||

| US38384AV349 / GOVERNMENT NATIONAL MORTGAGE A GNR 2023 H15 FA | 45.14 | -3.79 | 0.1015 | -0.0023 | |||||

| US36179XHW92 / Ginnie Mae II Pool | 45.11 | -18.27 | 0.1015 | -0.0207 | |||||

| US05942JAB44 / BAMLL 2023 HTL 10/27 1 | 45.01 | -6.64 | 0.1013 | -0.0055 | |||||

| RIPON MORTGAGES RIPON 2025 1A B 144A / ABS-MBS (XS2982123585) | 45.01 | 6.61 | 0.1013 | 0.0078 | |||||

| RIPON MORTGAGES RIPON 2025 1A B 144A / ABS-MBS (XS2982123585) | 45.01 | 6.61 | 0.1013 | 0.0078 | |||||

| US00452AAA88 / Accident Fund Insurance Company of America | 44.93 | 0.11 | 0.1011 | 0.0017 | |||||

| US87277JAA97 / TRTX 2022-FL5 Issuer Ltd | 44.81 | -7.99 | 0.1008 | -0.0070 | |||||

| US36262RAB33 / GS Mortgage-Backed Securities Trust 2021-HP1 | 44.66 | -2.23 | 0.1005 | -0.0006 | |||||

| US74923EAA64 / Rad CLO 5 Ltd | 44.65 | -15.83 | 0.1005 | -0.0170 | |||||

| US65535HAR03 / Nomura Holdings Inc | 44.45 | 0.67 | 0.1000 | 0.0023 | |||||

| US36179W2U15 / Ginnie Mae II Pool | 44.33 | -2.93 | 0.0997 | -0.0014 | |||||

| US12595VAD91 / COMM 2018-COR3 Mortgage Trust | 44.15 | 0.55 | 0.0993 | 0.0021 | |||||

| US44891ACL98 / Hyundai Capital America | 43.92 | -0.16 | 0.0988 | 0.0014 | |||||

| US225401BC11 / UBS Group AG | 43.75 | -0.02 | 0.0984 | 0.0016 | |||||

| US25389JAT34 / Digital Realty Trust LP | 43.52 | 0.72 | 0.0979 | 0.0023 | |||||

| US06738ECJ29 / Barclays PLC | 43.25 | -0.21 | 0.0973 | 0.0014 | |||||

| SERIES 2024 1 CLN 2031 SERIES 2024 1 CLN 2031 / ABS-O (US15487CAA18) | 43.21 | 1.26 | 0.0972 | 0.0027 | |||||

| SERIES 2024 1 CLN 2031 SERIES 2024 1 CLN 2031 / ABS-O (US15487CAA18) | 43.21 | 1.26 | 0.0972 | 0.0027 | |||||

| JP MORGAN MORTGAGE TRUST JPMMT 2024 CES2 PT 144A / ABS-MBS (US46658QAN07) | 43.15 | -4.77 | 0.0971 | -0.0032 | |||||

| JP MORGAN MORTGAGE TRUST JPMMT 2024 CES2 PT 144A / ABS-MBS (US46658QAN07) | 43.15 | -4.77 | 0.0971 | -0.0032 | |||||

| US912810RJ97 / United States Treas Bds Bond | 43.14 | -2.27 | 0.0971 | -0.0007 | |||||

| US834012AA48 / SOFI ALTERNATIVE TRUST SAT 2018 A P1 144A | 43.09 | -5.49 | 0.0969 | -0.0040 | |||||

| US251526CD98 / Deutsche Bank AG/New York NY | 42.90 | -7.19 | 0.0965 | -0.0058 | |||||

| US225401AF50 / Credit Suisse Group AG | 42.74 | 0.80 | 0.0962 | 0.0023 | |||||

| US61774LBF58 / Morgan Stanley Capital I Inc | 42.74 | 1.83 | 0.0961 | 0.0032 | |||||

| US3140MMLJ58 / FNMA POOL BV7528 FN 05/52 FIXED 3 | 42.63 | -1.87 | 0.0959 | -0.0003 | |||||

| US78486BAA26 / STARWOOD COMMERCIAL MORTGAGE T STWD 2021 FL2 A 144A | 42.62 | -27.31 | 0.0959 | -0.0339 | |||||

| PERFORMER FUNDING PERFF 1A B 144A / ABS-O (XS2721092901) | 42.38 | 6.37 | 0.0953 | 0.0071 | |||||

| US902613AU26 / UBS Group AG | 42.26 | -0.18 | 0.0951 | 0.0013 | |||||

| US38382Y7K32 / GOVERNMENT NATIONAL MORTGAGE A GNR 2023 H14 FA | 42.21 | -0.79 | 0.0950 | 0.0008 | |||||

| US912834LR79 / United States Treasury Strip Coupon | 41.52 | -1.96 | 0.0934 | -0.0003 | |||||

| US31325YRN03 / Freddie Mac Strips | 41.49 | 0.31 | 0.0933 | 0.0018 | |||||

| US38141GA468 / Goldman Sachs Group Inc/The | 40.85 | 0.42 | 0.0919 | 0.0018 | |||||

| US31418EV807 / FN MA5138 | 40.54 | -2.56 | 0.0912 | -0.0009 | |||||

| US38382YM755 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2023-H02 CL FL V/R 5.45906000 | 40.48 | -2.21 | 0.0911 | -0.0006 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 40.44 | 0.72 | 0.0910 | 0.0021 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 40.44 | 0.72 | 0.0910 | 0.0021 | |||||

| US06738ECC75 / Barclays PLC | 40.33 | -0.61 | 0.0907 | 0.0009 | |||||

| ROUNDSTONE SECURITIES RNST 2A B 144A / ABS-MBS (XS2779836480) | 40.24 | 9.89 | 0.0905 | 0.0095 | |||||

| ROUNDSTONE SECURITIES RNST 2A B 144A / ABS-MBS (XS2779836480) | 40.24 | 9.89 | 0.0905 | 0.0095 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 39.94 | -0.28 | 0.0899 | 0.0012 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 39.94 | -0.28 | 0.0899 | 0.0012 | |||||

| US3140QNGC08 / Fannie Mae Pool | 39.77 | -1.94 | 0.0895 | -0.0003 | |||||

| US3140QNQY18 / FNMA 30YR 3% 03/01/2052#CB3170 | 39.58 | -1.87 | 0.0891 | -0.0002 | |||||

| FNMA POOL FS6838 FN 11/53 FIXED VAR / ABS-MBS (US3140XNS474) | 39.58 | -2.10 | 0.0890 | -0.0005 | |||||

| FNMA POOL FS6838 FN 11/53 FIXED VAR / ABS-MBS (US3140XNS474) | 39.58 | -2.10 | 0.0890 | -0.0005 | |||||

| US31418ECR99 / Fannie Mae Pool | 39.58 | -2.16 | 0.0890 | -0.0005 | |||||

| US3132DWH303 / Freddie Mac Pool | 39.53 | -3.14 | 0.0889 | -0.0014 | |||||

| US12635WAA53 / COMM 2016-787S MORTGAGE TRUST COMM 2016-787S A | 39.49 | 0.21 | 0.0888 | 0.0016 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 39.36 | 1.14 | 0.0886 | 0.0024 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 39.36 | 1.14 | 0.0886 | 0.0024 | |||||

| US928668AU66 / Volkswagen Group of America Finance LLC | 39.35 | 0.75 | 0.0885 | 0.0021 | |||||

| US95003WAA45 / Wells Fargo Commercial Mortgage Trust 2022-ONL | 39.21 | 0.92 | 0.0882 | 0.0022 | |||||

| US74727PBE07 / Qatar Government International Bond | 39.12 | -1.46 | 0.0880 | 0.0001 | |||||

| CBAMR LTD CBAMR 2019 9A AR 144A / ABS-CBDO (US14987VAN91) | 39.11 | 0.12 | 0.0880 | 0.0015 | |||||

| CBAMR LTD CBAMR 2019 9A AR 144A / ABS-CBDO (US14987VAN91) | 39.11 | 0.12 | 0.0880 | 0.0015 | |||||

| RIPON MORTGAGES RIPON 2025 1A C 144A / ABS-MBS (XS2982123668) | 39.05 | 6.68 | 0.0879 | 0.0068 | |||||

| RIPON MORTGAGES RIPON 2025 1A C 144A / ABS-MBS (XS2982123668) | 39.05 | 6.68 | 0.0879 | 0.0068 | |||||

| XS1789788533 / KIRKBY RMBS KIRK 1A B 144A | 39.00 | 6.39 | 0.0877 | 0.0066 | |||||

| CAPITAL FOUR US CLO C4US 2022 1A AR 144A / ABS-CBDO (US14016CAN65) | 38.95 | -0.07 | 0.0876 | 0.0013 | |||||

| CAPITAL FOUR US CLO C4US 2022 1A AR 144A / ABS-CBDO (US14016CAN65) | 38.95 | -0.07 | 0.0876 | 0.0013 | |||||

| US22877LAA52 / CRSNT Trust 2021-MOON | 38.93 | 0.24 | 0.0876 | 0.0016 | |||||

| FED HM LN PC POOL SD8396 FR 01/54 FIXED 6 / ABS-MBS (US3132DWKH50) | 38.85 | -5.36 | 0.0874 | -0.0035 | |||||

| FED HM LN PC POOL SD8396 FR 01/54 FIXED 6 / ABS-MBS (US3132DWKH50) | 38.85 | -5.36 | 0.0874 | -0.0035 | |||||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (EZV4L1QCFM97) | 38.79 | -23.84 | 0.0873 | -0.0255 | |||||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (EZV4L1QCFM97) | 38.79 | -23.84 | 0.0873 | -0.0255 | |||||

| US46647PCW41 / JPMorgan Chase & Co | 38.66 | 0.60 | 0.0870 | 0.0019 | |||||

| US07274EAK91 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.375% 11-21-30 | 38.59 | -7.91 | 0.0868 | -0.0059 | |||||

| 4020 / Saudi Real Estate Company | 38.54 | 0.42 | 0.0867 | 0.0018 | |||||

| US654744AD34 / Nissan Motor Co Ltd | 38.47 | -3.40 | 0.0865 | -0.0016 | |||||

| BARCLAYS MORTGAGE LOAN TRUST BARC 2024 NQM2 PT1 144A / ABS-MBS (US06745JAM71) | 38.29 | -7.99 | 0.0861 | -0.0060 | |||||

| BARCLAYS MORTGAGE LOAN TRUST BARC 2024 NQM2 PT1 144A / ABS-MBS (US06745JAM71) | 38.29 | -7.99 | 0.0861 | -0.0060 | |||||

| US65339KBR05 / NextEra Energy Capital Holdings Inc | 38.10 | -7.98 | 0.0857 | -0.0059 | |||||

| US90351DAF42 / UBS Group AG | 38.10 | 0.11 | 0.0857 | 0.0015 | |||||

| US3136A6MF80 / FANNIE MAE FNR 2012 60 JZ | 37.91 | -1.25 | 0.0853 | 0.0003 | |||||

| US682680BL63 / CORPORATE BONDS | 37.89 | 0.77 | 0.0853 | 0.0020 | |||||

| US09659W2M50 / BNP Paribas SA | 37.67 | 1.32 | 0.0847 | 0.0024 | |||||

| US62954HAZ10 / NXP BV / NXP Funding LLC / NXP USA Inc | 37.47 | 0.31 | 0.0843 | 0.0016 | |||||

| US06051GKJ75 / Bank of America Corp | 37.24 | 0.75 | 0.0838 | 0.0020 | |||||

| US912810RC45 / United States Treas Bds Bond | 37.18 | -2.13 | 0.0836 | -0.0005 | |||||

| SOFI CONSUMER LOAN PROGRAM TRU SCLP 2025 A A 144A / ABS-O (US83407UAA60) | 37.02 | 0.0833 | 0.0833 | ||||||

| SOFI CONSUMER LOAN PROGRAM TRU SCLP 2025 A A 144A / ABS-O (US83407UAA60) | 37.02 | 0.0833 | 0.0833 | ||||||

| US12653HAE71 / CREDIT SUISSE MORTGAGE TRUST CSMC 2018 RPL1 B2 144A | 36.92 | -0.53 | 0.0831 | 0.0009 | |||||

| US36267EAD31 / GS MORTGAGE-BACKED SECURITIES CORP TRUST 202 SER 2022-PJ2 CL A4 V/R REGD 144A P/P 2.50000000 | 36.91 | -3.38 | 0.0830 | -0.0015 | |||||

| US07274EAH62 / Bayer US Finance LLC | 36.90 | -0.22 | 0.0830 | 0.0011 | |||||

| FNMA POOL CB7015 FN 09/53 FIXED 5.5 / ABS-MBS (US3140QSYM74) | 36.34 | -1.77 | 0.0818 | -0.0001 | |||||

| FNMA POOL CB7015 FN 09/53 FIXED 5.5 / ABS-MBS (US3140QSYM74) | 36.34 | -1.77 | 0.0818 | -0.0001 | |||||

| FED HM LN PC POOL SD8446 FR 07/54 FIXED 5.5 / ABS-MBS (US3132DWL354) | 36.21 | -2.35 | 0.0815 | -0.0006 | |||||

| US29426VAD82 / Citigroup Commercial Mortgage Trust, Series 2022-GC48, Class A5 | 36.12 | 0.72 | 0.0813 | 0.0019 | |||||

| US31418EKT63 / FNMA 30YR 4.5% 11/52#MA4805 | 36.10 | -2.25 | 0.0812 | -0.0005 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 35.87 | 11.31 | 0.0807 | 0.0094 | |||||

| US26835PAH38 / EDP Finance BV | 35.84 | 1.30 | 0.0806 | 0.0023 | |||||

| US61747YFH36 / Morgan Stanley | 35.81 | 0.36 | 0.0806 | 0.0016 | |||||

| US29278GAW87 / Enel Finance International NV | 35.75 | 0.47 | 0.0804 | 0.0017 | |||||

| JP MORGAN MORTGAGE TRUST SERIE 07/55 9 / ABS-MBS (000000000) | 35.68 | 0.0803 | 0.0803 | ||||||

| JP MORGAN MORTGAGE TRUST SERIE 07/55 9 / ABS-MBS (000000000) | 35.68 | 0.0803 | 0.0803 | ||||||

| US29444UBL98 / Equinix, Inc. | 35.57 | 1.59 | 0.0800 | 0.0025 | |||||

| R2037 / South Africa - Sovereign or Government Agency Debt | 35.45 | 8.40 | 0.0797 | 0.0074 | |||||

| US08162UAW09 / Benchmark 2018-B8 Mortgage Trust | 35.32 | 1.02 | 0.0795 | 0.0021 | |||||

| US08163RBQ83 / Benchmark 2022-B35 Mortgage Trust | 35.24 | 0.75 | 0.0793 | 0.0018 | |||||

| US06541LBG05 / BANK 2022-BNK40 | 35.24 | 1.54 | 0.0793 | 0.0025 | |||||

| SMB PRIVATE EDUCATION LOAN TRU SMB 2023 D A1B 144A / ABS-O (US78450PAB13) | 35.06 | -5.28 | 0.0789 | -0.0031 | |||||

| SMB PRIVATE EDUCATION LOAN TRU SMB 2023 D A1B 144A / ABS-O (US78450PAB13) | 35.06 | -5.28 | 0.0789 | -0.0031 | |||||

| US80413TBC27 / Saudi Government International Bond | 34.99 | 0.27 | 0.0787 | 0.0015 | |||||

| US694308JP35 / PACIFIC GAS + ELECTRIC 1ST MORTGAGE 01/26 3.15 | 34.91 | 0.34 | 0.0785 | 0.0015 | |||||

| US88258MAB19 / Texas Natural Gas Securitization Finance Corp. | 34.88 | -0.09 | 0.0785 | 0.0012 | |||||

| US694308JG36 / Pacific Gas and Electric Co | 34.48 | 1.01 | 0.0776 | 0.0020 | |||||

| US337738BC18 / FISERV INC 2.650000% 06/01/2030 | 34.45 | 1.80 | 0.0775 | 0.0026 | |||||

| US95000U2V48 / WELLS FARGO & COMPANY REGD V/R MTN 3.52600000 | 34.42 | 0.63 | 0.0774 | 0.0017 | |||||

| US83368RBS04 / Societe Generale SA | 34.27 | 1.50 | 0.0771 | 0.0024 | |||||

| US853254CQ11 / Standard Chartered plc | 34.12 | -0.23 | 0.0768 | 0.0011 | |||||

| FED HM LN PC POOL QI4076 FR 04/54 FIXED 5.5 / ABS-MBS (US3133WAQ506) | 34.09 | -1.02 | 0.0767 | 0.0005 | |||||

| FED HM LN PC POOL QI4076 FR 04/54 FIXED 5.5 / ABS-MBS (US3133WAQ506) | 34.09 | -1.02 | 0.0767 | 0.0005 | |||||

| US53948HAA41 / LoanCore 2021-CRE6 Issuer Ltd | 34.06 | -8.69 | 0.0766 | -0.0059 | |||||

| US78432WAA18 / SFO Commercial Mortgage Trust 2021-555 | 34.01 | 0.99 | 0.0765 | 0.0020 | |||||

| ROUNDSTONE SECURITIES RNST 2A C 144A / ABS-MBS (XS2779836647) | 34.00 | 10.21 | 0.0765 | 0.0082 | |||||

| ROUNDSTONE SECURITIES RNST 2A C 144A / ABS-MBS (XS2779836647) | 34.00 | 10.21 | 0.0765 | 0.0082 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 33.99 | 0.98 | 0.0765 | 0.0020 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 33.99 | 0.98 | 0.0765 | 0.0020 | |||||

| NWIDE / Nationwide Building Society | 33.96 | 1.44 | 0.0764 | 0.0023 | |||||

| ACI1G7W13 / CPI PROPERTY GROUP SA SR UNSECURED REGS 04/27 1.625 | 33.84 | 10.35 | 0.0761 | 0.0082 | |||||

| US681936BH22 / Omega Healthcare Investors, Inc. | 33.82 | -0.13 | 0.0761 | 0.0011 | |||||

| US06738ECD58 / Barclays PLC | 33.66 | -0.07 | 0.0757 | 0.0012 | |||||

| US45262BAB99 / IMPERIAL BRANDS FIN PLC REGD 144A P/P 3.50000000 | 33.63 | 0.26 | 0.0757 | 0.0014 | |||||

| XS2330054953 / OAK HILL EUROPEAN CREDIT PARTN OHECP 2018 7A AR 144A | 33.58 | -5.53 | 0.0756 | -0.0031 | |||||

| US09659W2H65 / BNP Paribas SA | 33.57 | 0.70 | 0.0755 | 0.0017 | |||||

| XS2310127027 / CORDATUS CLO PLC CORDA 11A AR 144A | 33.50 | -7.00 | 0.0754 | -0.0044 | |||||

| XS2305383288 / DRYDEN LEVERAGED LOAN CDO DRYD 2017 27A AR 144A | 33.47 | 6.73 | 0.0753 | 0.0059 | |||||

| BMW US CAPITAL LLC COMPANY GUAR 144A 03/28 VAR / DBT (US05565ECX13) | 33.42 | -0.16 | 0.0752 | 0.0011 | |||||

| US694308JJ74 / Pacific Gas and Electric Co | 33.32 | -3.52 | 0.0750 | -0.0015 | |||||

| BANC OF AMERICA MERRILL LYNCH BAMLL 2025 HMST A 144A / ABS-MBS (US05555XAA37) | 33.29 | -2.99 | 0.0749 | -0.0011 | |||||

| BANC OF AMERICA MERRILL LYNCH BAMLL 2025 HMST A 144A / ABS-MBS (US05555XAA37) | 33.29 | -2.99 | 0.0749 | -0.0011 | |||||

| US05369AAD37 / Aviation Capital Group LLC | 33.20 | 0.25 | 0.0747 | 0.0014 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 33.12 | -1.04 | 0.0745 | 0.0004 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 33.12 | -1.04 | 0.0745 | 0.0004 | |||||

| US95001WBB37 / Wells Fargo Commercial Mortgage Trust 2019-C49 | 33.08 | 0.84 | 0.0744 | 0.0018 | |||||

| US3140QN6X50 / FNMA POOL CB3585 FN 05/52 FIXED 3 | 32.89 | -4.73 | 0.0740 | -0.0024 | |||||

| US3132DWE664 / UMBS | 32.75 | -2.14 | 0.0737 | -0.0004 | |||||

| TRINITY SQUARE TRINI 2021 1A AR 144A / ABS-MBS (XS2783078087) | 32.59 | 0.62 | 0.0733 | 0.0016 | |||||

| TRINITY SQUARE TRINI 2021 1A AR 144A / ABS-MBS (XS2783078087) | 32.59 | 0.62 | 0.0733 | 0.0016 | |||||

| PANAMA INFRASTRUCTURE SR SECURED 144A 04/32 0.00000 / DBT (US69828QAD97) | 32.59 | 0.90 | 0.0733 | 0.0018 | |||||

| PANAMA INFRASTRUCTURE SR SECURED 144A 04/32 0.00000 / DBT (US69828QAD97) | 32.59 | 0.90 | 0.0733 | 0.0018 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 32.47 | 1.22 | 0.0731 | 0.0020 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 32.47 | 1.22 | 0.0731 | 0.0020 | |||||

| FNMA POOL DB3401 FN 05/54 FIXED 5.5 / ABS-MBS (US3140ACX731) | 32.47 | -1.05 | 0.0730 | 0.0004 | |||||

| FNMA POOL DB3401 FN 05/54 FIXED 5.5 / ABS-MBS (US3140ACX731) | 32.47 | -1.05 | 0.0730 | 0.0004 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 32.42 | 12.40 | 0.0729 | 0.0091 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 32.42 | 12.40 | 0.0729 | 0.0091 | |||||

| FED HM LN PC POOL SD4674 FR 11/53 FIXED 5.5 / ABS-MBS (US3132DSFP20) | 32.39 | -2.20 | 0.0729 | -0.0004 | |||||

| FED HM LN PC POOL SD4674 FR 11/53 FIXED 5.5 / ABS-MBS (US3132DSFP20) | 32.39 | -2.20 | 0.0729 | -0.0004 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 32.39 | 1.03 | 0.0729 | 0.0019 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 32.39 | 1.03 | 0.0729 | 0.0019 | |||||

| US3132DWG982 / FNCL UMBS 5.5 SD8324 05-01-53 | 32.39 | -3.13 | 0.0729 | -0.0011 | |||||

| US74977RDR21 / Cooperatieve Rabobank UA | 32.19 | 0.70 | 0.0724 | 0.0017 | |||||

| XS1697693627 / WARWICK FINANCE RESIDENTIAL MO WARW 3A B 144A | 32.19 | 6.64 | 0.0724 | 0.0056 | |||||

| XS2109812508 / Romanian Government International Bond | 32.05 | 11.59 | 0.0721 | 0.0085 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 31.99 | 0.57 | 0.0720 | 0.0016 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 31.99 | 0.57 | 0.0720 | 0.0016 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 31.93 | 0.0718 | 0.0718 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 31.93 | 0.0718 | 0.0718 | ||||||

| US031162DP23 / Amgen Inc | 31.85 | -10.78 | 0.0716 | -0.0074 | |||||

| US08160JAE73 / Benchmark 2019-B9 Mortgage Trust | 31.77 | 1.02 | 0.0715 | 0.0019 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 31.58 | 0.0711 | 0.0711 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 31.58 | 0.0711 | 0.0711 | ||||||

| US38145GAM24 / Goldman Sachs Group Inc/The | 31.54 | -0.27 | 0.0710 | 0.0010 | |||||

| US08163PBG46 / BMARK 22-B33 A5 3.3503% 01-15-32 | 31.43 | 0.92 | 0.0707 | 0.0018 | |||||

| US42806MBJ71 / Hertz Vehicle Financing LLC | 31.38 | 0.85 | 0.0706 | 0.0017 | |||||

| US097023CY98 / BOEING CO 5.15 5/30 | 31.31 | 1.17 | 0.0704 | 0.0019 | |||||

| US83368RBQ48 / Societe Generale SA | 31.28 | -0.32 | 0.0704 | 0.0009 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 31.18 | 0.0702 | 0.0702 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 31.18 | 0.0702 | 0.0702 | ||||||

| US3133KN4P50 / FED HM LN PC POOL RA7130 FR 04/52 FIXED 3 | 31.14 | -1.20 | 0.0700 | 0.0003 | |||||

| XS2305240843 / EURO GALAXY CLO DAC EGLXY 2013 3A ARRR 144A | 31.13 | 8.78 | 0.0700 | 0.0067 | |||||

| XS2167193015 / State of Israel | 31.02 | 1.55 | 0.0698 | 0.0022 | |||||

| US86772HAA59 / Sunrun Demeter Issuer 2021-2 | 30.95 | 0.30 | 0.0696 | 0.0013 | |||||

| FANNIE MAE FNR 2025 6 FA / ABS-MBS (US3136BUTN04) | 30.80 | -7.50 | 0.0693 | -0.0044 | |||||

| FANNIE MAE FNR 2025 6 FA / ABS-MBS (US3136BUTN04) | 30.80 | -7.50 | 0.0693 | -0.0044 | |||||

| CONSUMER LOAN FINANCE ISSUER T CLFT 2023 5A A2 144A / ABS-O (US21056EAB48) | 30.76 | 0.18 | 0.0692 | 0.0012 | |||||

| CONSUMER LOAN FINANCE ISSUER T CLFT 2023 5A A2 144A / ABS-O (US21056EAB48) | 30.76 | 0.18 | 0.0692 | 0.0012 | |||||

| US3132DWJL81 / Freddie Mac Pool | 30.69 | -2.42 | 0.0690 | -0.0006 | |||||

| BANC OF AMERICA MERRILL LYNCH BAMLL 2024 LB2 B 144A / ABS-MBS (US054987AC67) | 30.66 | 3.48 | 0.0690 | 0.0034 | |||||

| BANC OF AMERICA MERRILL LYNCH BAMLL 2024 LB2 B 144A / ABS-MBS (US054987AC67) | 30.66 | 3.48 | 0.0690 | 0.0034 | |||||

| FED HM LN PC POOL SD5568 FR 05/54 FIXED 5.5 / ABS-MBS (US3132DTFH86) | 30.53 | -5.19 | 0.0687 | -0.0026 | |||||

| FED HM LN PC POOL SD5568 FR 05/54 FIXED 5.5 / ABS-MBS (US3132DTFH86) | 30.53 | -5.19 | 0.0687 | -0.0026 | |||||

| UNITED AIR 2024 1 AA PTT PASS THRU CE 08/38 5.45 / DBT (US90932WAA18) | 30.52 | 0.13 | 0.0687 | 0.0012 | |||||

| US44891ACA34 / Hyundai Capital America | 30.46 | 1.42 | 0.0685 | 0.0020 | |||||

| FREDDIE MAC FHR 5499 FH / ABS-MBS (US3137HJWY95) | 30.46 | -9.04 | 0.0685 | -0.0056 | |||||

| FREDDIE MAC FHR 5499 FH / ABS-MBS (US3137HJWY95) | 30.46 | -9.04 | 0.0685 | -0.0056 | |||||

| US07336JAD00 / Bayview MSR Opportunity Master Fund Trust, Series 2021-5, Class A1 | 30.37 | -2.03 | 0.0683 | -0.0003 | |||||

| US06054AAX72 / BANC OF AMERICA COMMERCIAL MORTGAGE TRUST 3.705% 09/15/2048 2015-UBS7 A4 | 30.34 | 0.33 | 0.0683 | 0.0013 | |||||

| STANDARD CHARTERED BK/NY SR UNSECURED 12/27 4.853 / DBT (US85325X2B15) | 30.32 | 0.67 | 0.0682 | 0.0015 | |||||

| STANDARD CHARTERED BK/NY SR UNSECURED 12/27 4.853 / DBT (US85325X2B15) | 30.32 | 0.67 | 0.0682 | 0.0015 | |||||

| XS2376688474 / OCP EURO CLO 2020-4 DAC SER 2020-4A CL AR V/R REGD 144A P/P /EUR/ 0.00000000 | 30.27 | -6.81 | 0.0681 | -0.0038 | |||||

| US902055AA09 / 225 Liberty Street Trust 2016-225L | 30.19 | 0.97 | 0.0679 | 0.0017 | |||||

| US31418EW227 / Fannie Mae Pool | 30.07 | -1.77 | 0.0677 | -0.0001 | |||||

| XS0329656101 / NEWGATE FUNDING PLC NGATE 2007 3X A2B REGS | 29.98 | -0.70 | 0.0674 | 0.0006 | |||||

| HYUNDAI CAPITAL AMERICA SR UNSECURED 144A 03/27 VAR / DBT (US44891ADS33) | 29.96 | -0.08 | 0.0674 | 0.0010 | |||||

| HYUNDAI CAPITAL AMERICA SR UNSECURED 144A 03/27 VAR / DBT (US44891ADS33) | 29.96 | -0.08 | 0.0674 | 0.0010 | |||||

| LONZ / PIMCO ETF Trust - PIMCO Senior Loan Active Exchange-Traded Fund | 0.59 | 0.00 | 29.91 | 1.21 | 0.0673 | 0.0019 | |||

| XS0767581407 / Lloyds Bank PLC | 29.91 | 3.76 | 0.0673 | 0.0035 | |||||

| PERFORMER FUNDING PERFF 1A C 144A / ABS-O (XS2721093115) | 29.89 | 6.09 | 0.0672 | 0.0049 | |||||

| PERFORMER FUNDING PERFF 1A C 144A / ABS-O (XS2721093115) | 29.89 | 6.09 | 0.0672 | 0.0049 | |||||

| US06051GHD43 / Bank of America Corp | 29.82 | 0.86 | 0.0671 | 0.0016 | |||||

| US05571AAQ85 / BPCE SA | 29.75 | -0.33 | 0.0669 | 0.0009 | |||||

| US45262BAC72 / IMPERIAL BRANDS FIN PLC COMPANY GUAR 144A 07/29 3.875 | 29.70 | 0.90 | 0.0668 | 0.0017 | |||||

| FNMA POOL MA5388 FN 06/54 FIXED 5.5 / ABS-MBS (US31418E7A27) | 29.69 | -2.60 | 0.0668 | -0.0007 | |||||

| US43289VAA17 / Hilton USA Trust 2016-SFP | 29.60 | 2.56 | 0.0666 | 0.0027 | |||||

| FED HM LN PC POOL SD8395 FR 01/54 FIXED 5.5 / ABS-MBS (US3132DWKG77) | 29.58 | -2.27 | 0.0666 | -0.0005 | |||||

| FED HM LN PC POOL SD8395 FR 01/54 FIXED 5.5 / ABS-MBS (US3132DWKG77) | 29.58 | -2.27 | 0.0666 | -0.0005 | |||||

| US64831DAB82 / NEW RESIDENTIAL MORTGAGE LOAN NRZT 2022 INV1 A2 144A | 29.56 | -2.10 | 0.0665 | -0.0003 | |||||

| XS2310758011 / HARVEST CLO HARVT 20A AR 144A | 29.53 | -0.96 | 0.0664 | 0.0004 | |||||

| US90931GAA76 / United Airlines 2020-1 Class A Pass Through Trust | 29.53 | -6.56 | 0.0664 | -0.0035 | |||||

| US06738ECM57 / BARCLAYS PLC SR UNSECURED 09/27 VAR | 29.43 | -0.30 | 0.0662 | 0.0009 | |||||

| US38145GAN07 / Goldman Sachs Group Inc/The | 29.33 | -0.22 | 0.0660 | 0.0009 | |||||

| US3140XJNP43 / Fannie Mae Pool | 29.29 | -3.50 | 0.0659 | -0.0013 | |||||

| CDX ITRAXX XOV42 5Y 35-100% SP BPS / DCR (EZ2BLZ4YH9B3) | 29.23 | 0.0658 | 0.0658 | ||||||

| CDX ITRAXX XOV42 5Y 35-100% SP BPS / DCR (EZ2BLZ4YH9B3) | 29.23 | 0.0658 | 0.0658 | ||||||

| US694308JM04 / PACIFIC GAS and ELECTRIC CO 4.55% 07/01/2030 | 29.20 | 0.85 | 0.0657 | 0.0016 | |||||

| US36263TAB89 / GS MORTGAGE-BACKED SECURITIES TRUST 2021-GR3 SER 2021-GR3 CL A2 V/R REGD 144A P/P 2.50000000 | 29.14 | -2.14 | 0.0656 | -0.0004 | |||||

| XS2357554679 / SEGOVIA EUROPEAN CLO 6 2019 SEGOV 2019 6A AR 144A | 29.11 | 8.95 | 0.0655 | 0.0063 | |||||

| US785592AX43 / Sabine Pass Liquefaction LLC | 29.06 | 1.71 | 0.0654 | 0.0021 | |||||

| US65480CAC91 / NISSAN MOTOR ACCEPTANCE SR UNSECURED 144A 09/26 1.85 | 28.82 | 0.47 | 0.0648 | 0.0013 | |||||

| XS0588909878 / TESCO PROPERTY FIN 4 PLC SR SECURED REGS 10/40 5.8006 | 28.76 | 7.56 | 0.0647 | 0.0055 | |||||

| US00217VAA89 / AREIT 2022-CRE7 LLC | 28.74 | -10.77 | 0.0647 | -0.0066 | |||||

| US64110DAK00 / NetApp Inc | 28.43 | 2.14 | 0.0640 | 0.0023 | |||||

| CONSUMER LOAN FINANCE ISSUER T CLFT 2024 A A2 / ABS-O (US21050QAB32) | 28.38 | 0.58 | 0.0639 | 0.0014 | |||||

| CONSUMER LOAN FINANCE ISSUER T CLFT 2024 A A2 / ABS-O (US21050QAB32) | 28.38 | 0.58 | 0.0639 | 0.0014 | |||||

| TSY INFL IX N/B 02/55 2.375 / DBT (US912810UH94) | 28.32 | 0.0637 | 0.0637 | ||||||

| ROUNDSTONE SECURITIES RNST 2A D 144A / ABS-MBS (XS2779836993) | 28.23 | 10.31 | 0.0635 | 0.0069 | |||||

| ROUNDSTONE SECURITIES RNST 2A D 144A / ABS-MBS (XS2779836993) | 28.23 | 10.31 | 0.0635 | 0.0069 | |||||

| US3140XGRB71 / Federal National Mortgage Association, Inc. | 28.14 | -2.20 | 0.0633 | -0.0004 | |||||

| XS2178857954 / Romanian Government International Bond | 28.07 | 10.88 | 0.0631 | 0.0071 | |||||

| US144527AC22 / CARRINGTON MORTGAGE LOAN TRUST CARR 2007 FRE1 A3 | 27.91 | -2.99 | 0.0628 | -0.0009 | |||||

| FED HM LN PC POOL SD8438 FR 06/54 FIXED 5.5 / ABS-MBS (US3132DWLT89) | 27.83 | -2.45 | 0.0626 | -0.0005 | |||||

| FED HM LN PC POOL SD8438 FR 06/54 FIXED 5.5 / ABS-MBS (US3132DWLT89) | 27.83 | -2.45 | 0.0626 | -0.0005 | |||||

| US52473LAG77 / LEGACY MORTGAGE ASSET TRUST LMAT 2017 RPL2 B3 144A | 27.68 | -0.67 | 0.0623 | 0.0006 | |||||

| XS2307738828 / JUBILEE CDO BV JUBIL 2016 17A A1RR 144A | 27.67 | 9.59 | 0.0622 | 0.0064 | |||||

| XS1908328724 / PROTEUS RMBS DAC PROTE 1A FR 144A | 27.65 | 8.25 | 0.0622 | 0.0057 | |||||

| BIRCH GROVE CLO LTD. BGCLO 19A A1RR 144A / ABS-CBDO (US09075JAU34) | 27.56 | 0.33 | 0.0620 | 0.0012 | |||||

| BIRCH GROVE CLO LTD. BGCLO 19A A1RR 144A / ABS-CBDO (US09075JAU34) | 27.56 | 0.33 | 0.0620 | 0.0012 | |||||

| US48125LRV61 / JPMorgan Chase Bank NA | 27.43 | -0.33 | 0.0617 | 0.0008 | |||||

| BNP / BNP Paribas SA | 27.42 | 0.89 | 0.0617 | 0.0015 | |||||

| BNP / BNP Paribas SA | 27.42 | 0.89 | 0.0617 | 0.0015 | |||||

| US85208NAE04 / Sprint Spectrum Co LLC / Sprint Spectrum Co II LLC / Sprint Spectrum Co III LLC | 27.42 | -7.92 | 0.0617 | -0.0042 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 27.38 | 1.80 | 0.0616 | 0.0021 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 27.38 | 1.80 | 0.0616 | 0.0021 | |||||

| US3132DWGZ05 / Freddie Mac Pool | 27.36 | -2.86 | 0.0616 | -0.0008 | |||||

| US694308JF52 / Pacific Gas and Electric Co | 27.36 | 0.97 | 0.0616 | 0.0016 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 27.22 | 0.13 | 0.0612 | 0.0011 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 27.22 | 0.13 | 0.0612 | 0.0011 | |||||

| US225401AT54 / Credit Suisse Group AG | 27.08 | -12.16 | 0.0609 | -0.0073 | |||||

| US36179T7L33 / Ginnie Mae II Pool | 26.96 | -2.82 | 0.0607 | -0.0008 | |||||

| US83206NAA54 / SMB Private Education Loan Trust 2022-B | 26.89 | -4.02 | 0.0605 | -0.0015 | |||||

| PROJECT HUDSON II FIXED TERM LOAN / ABS-MBS (BA0004RR0) | 26.88 | 0.10 | 0.0605 | 0.0010 | |||||

| PROJECT HUDSON II FIXED TERM LOAN / ABS-MBS (BA0004RR0) | 26.88 | 0.10 | 0.0605 | 0.0010 | |||||

| US404121AH82 / HCA Inc | 26.84 | -0.04 | 0.0604 | 0.0009 | |||||

| US80281LAT26 / Santander UK Group Holdings plc | 26.73 | 0.38 | 0.0601 | 0.0012 | |||||

| US50203JAA60 / LFT CRE 2021-FL1 Ltd | 26.66 | -22.53 | 0.0600 | -0.0162 | |||||

| US55285AAA51 / MF1 2022-FL9 LLC SER 2022-FL9 CL A V/R REGD 144A P/P 2.96000000 | 26.63 | -4.47 | 0.0599 | -0.0018 | |||||

| US860630AG72 / Stifel Financial Corp | 26.54 | 0.51 | 0.0597 | 0.0013 | |||||

| US404280DY28 / HSBC HOLDINGS PLC FRN SOFR+0 08/14/2027 | 26.54 | -0.39 | 0.0597 | 0.0007 | |||||

| US06279JAC36 / Bank of Ireland Group PLC | 26.49 | -0.37 | 0.0596 | 0.0007 | |||||

| US83368RBR21 / Societe Generale SA | 26.44 | 0.33 | 0.0595 | 0.0011 | |||||

| US928668CA84 / Volkswagen Group of America Finance LLC | 26.37 | -0.13 | 0.0593 | 0.0009 | |||||

| US06051GJK67 / Bank of America Corp | 26.32 | 0.87 | 0.0592 | 0.0014 | |||||

| US46647PDU75 / JPMorgan Chase & Co. | 26.29 | 0.62 | 0.0591 | 0.0013 | |||||

| US694308KL02 / Pacific Gas and Electric Co | 26.17 | 0.28 | 0.0589 | 0.0011 | |||||

| US90323WAN02 / Ursa Re Ltd | 26.16 | -1.26 | 0.0589 | 0.0002 | |||||

| US694308KB20 / Pacific Gas and Electric Co | 26.16 | 0.88 | 0.0589 | 0.0014 | |||||

| US60687YBH18 / Mizuho Financial Group Inc | 26.01 | 1.88 | 0.0585 | 0.0020 | |||||

| US404280DZ92 / HSBC HOLDINGS PLC REGD V/R 5.88700000 | 25.97 | -0.15 | 0.0584 | 0.0008 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 25.75 | 1.00 | 0.0579 | 0.0015 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 25.75 | 1.00 | 0.0579 | 0.0015 | |||||

| US456837AU72 / ING Groep NV | 25.70 | 0.82 | 0.0578 | 0.0014 | |||||

| US80282KBF21 / Santander Holdings USA, Inc. | 25.66 | 0.55 | 0.0577 | 0.0012 | |||||

| US80282KBF21 / Santander Holdings USA, Inc. | 25.66 | 0.55 | 0.0577 | 0.0012 | |||||

| US3140XKTN04 / FNMA POOL FS4156 FN 09/52 FIXED VAR | 25.62 | -0.91 | 0.0576 | 0.0004 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 25.61 | -0.04 | 0.0576 | 0.0009 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 25.61 | -0.04 | 0.0576 | 0.0009 | |||||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q029 A / ABS-MBS (US3137HHH387) | 25.60 | -0.03 | 0.0576 | 0.0009 | |||||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q029 A / ABS-MBS (US3137HHH387) | 25.60 | -0.03 | 0.0576 | 0.0009 | |||||

| US02401LAA26 / American Assets Trust LP | 25.54 | 1.52 | 0.0575 | 0.0018 | |||||

| US26884UAE91 / EPR Properties | 25.53 | 0.78 | 0.0574 | 0.0014 | |||||

| US251526CP29 / Deutsche Bank AG/New York NY | 25.53 | -12.65 | 0.0574 | -0.0073 | |||||

| XS2326512618 / HARVEST CLO HARVT 21A A1R 144A | 25.51 | 1.57 | 0.0574 | 0.0018 | |||||

| 4020 / Saudi Real Estate Company | 25.50 | 10.30 | 0.0574 | 0.0062 | |||||

| 4020 / Saudi Real Estate Company | 25.50 | 10.30 | 0.0574 | 0.0062 | |||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 25.46 | 0.00 | 0.0573 | 0.0009 | |||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 25.46 | 0.00 | 0.0573 | 0.0009 | |||||

| FED HM LN PC POOL SD8408 FR 03/54 FIXED 5.5 / ABS-MBS (US3132DWKV45) | 25.43 | -2.51 | 0.0572 | -0.0005 | |||||

| FED HM LN PC POOL SD8408 FR 03/54 FIXED 5.5 / ABS-MBS (US3132DWKV45) | 25.43 | -2.51 | 0.0572 | -0.0005 | |||||

| US780097BP50 / Natwest Group PLC | 25.26 | 0.78 | 0.0568 | 0.0013 | |||||

| US55285PAA21 / MFA 2023-NQM1 Trust | 25.26 | -3.24 | 0.0568 | -0.0010 | |||||

| US3132DWHU09 / FNCL UMBS 6.0 SD8343 07-01-53 | 25.22 | -3.51 | 0.0567 | -0.0011 | |||||

| ATHENE GLOBAL FUNDING SECURED 144A 03/27 VAR / DBT (US04685A3U30) | 25.20 | 0.11 | 0.0567 | 0.0010 | |||||

| US44891ACQ85 / Hyundai Capital America | 25.10 | -0.39 | 0.0565 | 0.0007 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 25.09 | 1.00 | 0.0564 | 0.0015 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 25.09 | 1.00 | 0.0564 | 0.0015 | |||||

| MORGAN STANLEY BANK NA SR UNSECURED 05/28 VAR / DBT (US61690U8C76) | 25.08 | -0.07 | 0.0564 | 0.0009 | |||||

| MORGAN STANLEY BANK NA SR UNSECURED 05/28 VAR / DBT (US61690U8C76) | 25.08 | -0.07 | 0.0564 | 0.0009 | |||||

| US06541RBB87 / BANK 2019-BNK23 | 25.06 | 1.58 | 0.0564 | 0.0018 | |||||

| US46647PCP99 / JPMorgan Chase & Co | 24.99 | 0.87 | 0.0562 | 0.0014 | |||||

| US60687YCL11 / Mizuho Financial Group Inc | 24.95 | 0.29 | 0.0561 | 0.0011 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 24.95 | -0.24 | 0.0561 | 0.0008 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 24.95 | -0.24 | 0.0561 | 0.0008 | |||||

| US31398N4D30 / FANNIE MAE FNR 2010 124 JZ | 24.68 | -2.93 | 0.0555 | -0.0008 | |||||

| US07274NAL73 / Bayer Us Finance Ii Llc 4.375% 12/15/2028 144a Bond | 24.67 | -12.38 | 0.0555 | -0.0068 | |||||

| US225401BB38 / Credit Suisse Group AG | 24.67 | 1.18 | 0.0555 | 0.0015 | |||||

| US694308KC03 / Pacific Gas and Electric Co | 24.59 | 0.22 | 0.0553 | 0.0010 | |||||

| CITIGROUP MORTGAGE LOAN TRUST CMLTI 2024 INV3 PT 144A / ABS-MBS (US17332ACD00) | 24.55 | -6.78 | 0.0552 | -0.0031 | |||||

| CITIGROUP MORTGAGE LOAN TRUST CMLTI 2024 INV3 PT 144A / ABS-MBS (US17332ACD00) | 24.55 | -6.78 | 0.0552 | -0.0031 | |||||

| US61690U7W40 / Morgan Stanley Bank NA | 24.51 | -0.11 | 0.0551 | 0.0008 | |||||

| US78403DAP50 / SBA Tower Trust | 24.50 | 0.84 | 0.0551 | 0.0013 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 24.35 | 0.76 | 0.0548 | 0.0013 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 24.35 | 0.76 | 0.0548 | 0.0013 | |||||

| US TREASURY N/B 05/44 4.625 / DBT (US912810UB25) | 24.23 | -2.25 | 0.0545 | -0.0004 | |||||

| US22550L2M24 / Credit Suisse AG/New York NY | 24.17 | 0.18 | 0.0544 | 0.0010 | |||||

| GS MORTGAGE BACKED SECURITIES GSMBS 2024 RPL6 PT 144A / ABS-MBS (US36272QAS66) | 24.14 | -1.43 | 0.0543 | 0.0001 | |||||

| GS MORTGAGE BACKED SECURITIES GSMBS 2024 RPL6 PT 144A / ABS-MBS (US36272QAS66) | 24.14 | -1.43 | 0.0543 | 0.0001 | |||||

| XS1908327759 / PROTEUS RMBS DAC PROTE 1A BR 144A | 23.98 | 8.45 | 0.0539 | 0.0050 | |||||

| FANNIE MAE FNR 2025 18 FM / ABS-MBS (US3136BVKH00) | 23.96 | -4.89 | 0.0539 | -0.0019 | |||||

| FANNIE MAE FNR 2025 18 FM / ABS-MBS (US3136BVKH00) | 23.96 | -4.89 | 0.0539 | -0.0019 | |||||

| FNMA POOL MA5296 FN 03/54 FIXED 5.5 / ABS-MBS (US31418E3E84) | 23.88 | -2.65 | 0.0537 | -0.0006 | |||||

| FNMA POOL MA5296 FN 03/54 FIXED 5.5 / ABS-MBS (US31418E3E84) | 23.88 | -2.65 | 0.0537 | -0.0006 | |||||

| US06540WBD48 / Bank 2019-BNK19 | 23.88 | 1.13 | 0.0537 | 0.0015 | |||||

| US055984AA69 / BSPRT ISSUER, LTD. BSPRT 2022 FL9 A 144A | 23.77 | -32.26 | 0.0535 | -0.0242 | |||||

| FANNIE MAE FNR 2025 16 FN / ABS-MBS (US3136BU6A37) | 23.76 | -4.46 | 0.0535 | -0.0016 | |||||

| FANNIE MAE FNR 2025 16 FN / ABS-MBS (US3136BU6A37) | 23.76 | -4.46 | 0.0535 | -0.0016 | |||||

| BRITISH COLUMBIA PROV OF UNSECURED 06/34 4.15 / DBT (CA110709AK82) | 23.71 | 4.34 | 0.0533 | 0.0030 | |||||

| BRITISH COLUMBIA PROV OF UNSECURED 06/34 4.15 / DBT (CA110709AK82) | 23.71 | 4.34 | 0.0533 | 0.0030 | |||||

| FANNIE MAE FNR 2025 4 FB / ABS-MBS (US3136BUU651) | 23.48 | -9.22 | 0.0528 | -0.0044 | |||||

| FANNIE MAE FNR 2025 4 FB / ABS-MBS (US3136BUU651) | 23.48 | -9.22 | 0.0528 | -0.0044 | |||||

| US36179XNC64 / Ginnie Mae II Pool | 23.48 | -3.19 | 0.0528 | -0.0009 | |||||

| US17326JAS87 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2017 RP1 PT 144A | 23.45 | -2.21 | 0.0528 | -0.0003 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 23.42 | 0.0527 | 0.0527 | ||||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 23.42 | 0.0527 | 0.0527 | ||||||

| DE000DL19VP0 / DEUTSCHE BANK AG SR UNSECURED REGS 09/26 VAR | 23.40 | 9.46 | 0.0526 | 0.0053 | |||||

| US654740BS71 / Nissan Motor Acceptance Corp | 23.32 | 1.25 | 0.0525 | 0.0015 | |||||

| US40728TAA16 / Hamilton College | 23.27 | -3.83 | 0.0524 | -0.0012 | |||||

| US30326MAA36 / FS RIALTO | 23.21 | -2.03 | 0.0522 | -0.0002 | |||||

| ACI1G4C61 / IVORY COAST SR UNSECURED 144A 10/31 5.875 | 23.21 | 9.87 | 0.0522 | 0.0055 | |||||

| XS2170187145 / Serbia International Bond | 23.01 | 10.06 | 0.0518 | 0.0055 | |||||

| FANNIE MAE FNR 2025 1 FD / ABS-MBS (US3136BUZM56) | 22.99 | -8.06 | 0.0517 | -0.0036 | |||||

| FANNIE MAE FNR 2025 1 FD / ABS-MBS (US3136BUZM56) | 22.99 | -8.06 | 0.0517 | -0.0036 | |||||

| US12659TAC99 / Credit Suisse Mortgage Capital Certificates | 22.99 | -3.41 | 0.0517 | -0.0010 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 22.95 | 0.74 | 0.0516 | 0.0012 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 22.95 | 0.74 | 0.0516 | 0.0012 | |||||

| CDX ITRAXX XOV42 5Y 35-100% SP JPM / DCR (EZ2BLZ4YH9B3) | 22.95 | 0.0516 | 0.0516 | ||||||

| CDX ITRAXX XOV42 5Y 35-100% SP JPM / DCR (EZ2BLZ4YH9B3) | 22.95 | 0.0516 | 0.0516 | ||||||

| CDX ITRAXX XOV42 5Y 35-100% SP JPM / DCR (EZ2BLZ4YH9B3) | 22.95 | 0.0516 | 0.0516 | ||||||

| US12594YAF97 / CREDIT SUISSE MORTGAGE TRUST CSMC 2017 RPL2 B3 144A | 22.94 | -3.21 | 0.0516 | -0.0009 | |||||

| US3140XGFP95 / Fannie Mae Pool | 22.94 | -2.66 | 0.0516 | -0.0006 | |||||

| US10112RBB96 / Boston Properties LP | 22.90 | -13.86 | 0.0515 | -0.0073 | |||||

| XS1884698256 / HSBC HOLDINGS PLC JR SUBORDINA 12/99 VAR | 22.81 | 6.93 | 0.0513 | 0.0041 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 22.78 | 0.83 | 0.0512 | 0.0012 | |||||

| US225401AV01 / Credit Suisse Group AG | 22.76 | 0.17 | 0.0512 | 0.0009 | |||||

| US38937LAB71 / Gray Oak Pipeline LLC | 22.71 | 1.47 | 0.0511 | 0.0015 | |||||

| BMW US CAPITAL LLC COMPANY GUAR 144A 03/27 VAR / DBT (US05565ECV56) | 22.62 | 0.23 | 0.0509 | 0.0009 | |||||

| BMW US CAPITAL LLC COMPANY GUAR 144A 03/27 VAR / DBT (US05565ECV56) | 22.62 | 0.23 | 0.0509 | 0.0009 | |||||

| US00774MAG06 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 22.58 | 0.04 | 0.0508 | 0.0008 | |||||

| US251526CE71 / DEUTSCHE BANK AG NEW YORK BNCH 2.129%/VAR 11/24/2026 | 22.57 | 0.79 | 0.0508 | 0.0012 | |||||

| FNMA POOL FS4840 FN 05/53 FIXED VAR / ABS-MBS (US3140XLLW67) | 22.54 | -2.37 | 0.0507 | -0.0004 | |||||

| FNMA POOL FS4840 FN 05/53 FIXED VAR / ABS-MBS (US3140XLLW67) | 22.54 | -2.37 | 0.0507 | -0.0004 | |||||

| US07274NAJ28 / Bayer US Finance II LLC | 22.54 | 0.17 | 0.0507 | 0.0009 | |||||

| US03027XAX84 / AMERICAN TOWER CORP SR UNSECURED 01/27 2.75 | 22.46 | 0.84 | 0.0505 | 0.0012 | |||||

| XS2350603374 / CAIRN CLO BV CRNCL 2018 10A AR 144A | 22.45 | -6.19 | 0.0505 | -0.0025 | |||||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/28 5.05 / DBT (US928668CP53) | 22.43 | 0.61 | 0.0505 | 0.0011 | |||||

| US12653HAF47 / CREDIT SUISSE MORTGAGE TRUST CSMC 2018 RPL1 B3 144A | 22.40 | 0.96 | 0.0504 | 0.0013 | |||||

| US3140QNKS04 / FNMA POOL CB3004 FN 02/52 FIXED 3 | 22.37 | -1.54 | 0.0503 | 0.0000 | |||||

| SMB PRIVATE EDUCATION LOAN TRU SMB 2023 D A1A 144A / ABS-O (US78450PAA30) | 22.36 | -4.63 | 0.0503 | -0.0016 | |||||

| SMB PRIVATE EDUCATION LOAN TRU SMB 2023 D A1A 144A / ABS-O (US78450PAA30) | 22.36 | -4.63 | 0.0503 | -0.0016 | |||||

| US21684AAC09 / Cooperatieve Rabobank UA | 22.29 | 0.20 | 0.0501 | 0.0009 | |||||

| US05610AAW80 / BX Trust, Series 2022-FOX2, Class A2 | 22.27 | -6.18 | 0.0501 | -0.0024 | |||||

| HOLCIM FINANCE US LLC COMPANY GUAR 144A 04/28 4.7 / DBT (US43475RAB24) | 22.21 | 0.0500 | 0.0500 | ||||||

| US29250NBX21 / ENBRIDGE INC SR UNSEC 6.0% 11-15-28 | 22.16 | 0.88 | 0.0499 | 0.0012 | |||||

| RFR USD SOFR/2.61740 09/30/22-25Y* LCH / DIR (EZ86651VZHW8) | 22.12 | 8.01 | 0.0498 | 0.0044 | |||||

| RFR USD SOFR/2.61740 09/30/22-25Y* LCH / DIR (EZ86651VZHW8) | 22.12 | 8.01 | 0.0498 | 0.0044 | |||||

| HYUNDAI CAPITAL AMERICA SR UNSECURED 144A 03/27 4.85 / DBT (US44891ADP93) | 22.10 | 0.45 | 0.0497 | 0.0010 | |||||

| HYUNDAI CAPITAL AMERICA SR UNSECURED 144A 03/27 4.85 / DBT (US44891ADP93) | 22.10 | 0.45 | 0.0497 | 0.0010 | |||||

| US3137F5BX63 / Freddie Mac REMICS | 22.05 | -3.40 | 0.0496 | -0.0009 | |||||

| US38382YN902 / Government National Mortgage Association | 22.01 | -0.29 | 0.0495 | 0.0007 | |||||

| US55285BAA35 / MF1 2022-FL10 LLC MF1 2022-FL10 A | 22.01 | -5.66 | 0.0495 | -0.0021 | |||||

| US31418EPD66 / Fannie Mae Pool | 21.93 | -2.74 | 0.0493 | -0.0006 | |||||

| ACA / Crédit Agricole S.A. | 21.89 | -0.26 | 0.0493 | 0.0007 | |||||

| BAMLL COML MTG SECS TR 2024 04/42 1 / ABS-MBS (US05554WAA62) | 21.85 | 3.31 | 0.0492 | 0.0023 | |||||

| BAMLL COML MTG SECS TR 2024 04/42 1 / ABS-MBS (US05554WAA62) | 21.85 | 3.31 | 0.0492 | 0.0023 | |||||

| XS2350015942 / CARLYLE GLOBAL MARKET STRATEGI CGMSE 2017 3A A1R 144A | 21.83 | -11.55 | 0.0491 | -0.0055 | |||||

| DK0009391104 / JYSKE REALKREDIT A/S /DKK/ REGD SER 321E 1.00000000 | 21.79 | 0.34 | 0.0490 | 0.0009 | |||||

| DK0009391104 / JYSKE REALKREDIT A/S /DKK/ REGD SER 321E 1.00000000 | 21.79 | 0.34 | 0.0490 | 0.0009 | |||||

| US95000U3G61 / Wells Fargo & Co | 21.78 | 0.50 | 0.0490 | 0.0010 | |||||

| XS2419216622 / Toro European CLO 7 DAC | 21.77 | 7.90 | 0.0490 | 0.0043 | |||||

| US03666HAF82 / ANTARES HOLDINGS LP | 21.77 | 0.06 | 0.0490 | 0.0008 | |||||

| US92277GAU13 / Ventas Realty LP | 21.59 | 2.18 | 0.0486 | 0.0018 | |||||

| US2620512044 / Drillco Holdings Luxembourg SA | 1.04 | 0.00 | 21.42 | -18.61 | 0.0482 | -0.0101 | |||

| T MOBILE US TRUST TMUST 2024 1A A 144A / ABS-O (US87267RAA32) | 21.37 | -0.06 | 0.0481 | 0.0007 | |||||

| T MOBILE US TRUST TMUST 2024 1A A 144A / ABS-O (US87267RAA32) | 21.37 | -0.06 | 0.0481 | 0.0007 | |||||

| FANNIE MAE FNR 2024 38 FA / ABS-MBS (US3136BR4S35) | 21.24 | -5.39 | 0.0478 | -0.0019 | |||||

| FANNIE MAE FNR 2024 38 FA / ABS-MBS (US3136BR4S35) | 21.24 | -5.39 | 0.0478 | -0.0019 | |||||

| US05377RGC25 / Avis Budget Rental Car Funding AESOP LLC | 21.13 | 0.29 | 0.0475 | 0.0009 | |||||

| US90117PAA30 / 1211 AVENUE OF THE AMERICAS TR AOTA 2015 1211 A1A1 144A | 21.11 | -2.39 | 0.0475 | -0.0004 | |||||

| US55284AAA60 / MF1 2021-FL7 Ltd | 21.10 | -36.22 | 0.0475 | -0.0258 | |||||

| US87264ABZ75 / T-Mobile USA Inc | 20.98 | 0.79 | 0.0472 | 0.0011 | |||||

| XS2716891440 / EPH Financing International AS | 20.98 | 9.66 | 0.0472 | 0.0048 | |||||

| US403950AA61 / HGI CRE CLO 2021-FL3 Ltd | 20.94 | 0.21 | 0.0471 | 0.0009 | |||||

| US46647PDW32 / JPMorgan Chase & Co | 20.91 | -0.17 | 0.0471 | 0.0007 | |||||

| 4020 / Saudi Real Estate Company | 20.90 | 9.91 | 0.0470 | 0.0049 | |||||

| 4020 / Saudi Real Estate Company | 20.90 | 9.91 | 0.0470 | 0.0049 | |||||

| ROUNDSTONE SECURITIES RNST 2A Z 144A / ABS-MBS (XS2779837371) | 20.83 | 17.83 | 0.0469 | 0.0077 | |||||

| ROUNDSTONE SECURITIES RNST 2A Z 144A / ABS-MBS (XS2779837371) | 20.83 | 17.83 | 0.0469 | 0.0077 | |||||

| US83368RAZ55 / Societe Generale SA | 20.79 | -15.54 | 0.0468 | -0.0077 | |||||

| US63861VAJ61 / Nationwide Building Society | 20.79 | -15.95 | 0.0468 | -0.0080 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 20.76 | 0.69 | 0.0467 | 0.0011 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 20.76 | 0.69 | 0.0467 | 0.0011 | |||||

| BARROW FUNDING PLC BARRO 1A B / ABS-MBS (XS2755901696) | 20.69 | 5.95 | 0.0465 | 0.0033 | |||||

| BARROW FUNDING PLC BARRO 1A B / ABS-MBS (XS2755901696) | 20.69 | 5.95 | 0.0465 | 0.0033 | |||||

| PANTHER ESCROW ISSUER PANTHER ESCROW ISSUER / DBT (US69867RAA59) | 20.68 | 1.95 | 0.0465 | 0.0016 | |||||

| PANTHER ESCROW ISSUER PANTHER ESCROW ISSUER / DBT (US69867RAA59) | 20.68 | 1.95 | 0.0465 | 0.0016 | |||||

| US31418EJ844 / Fannie Mae Pool | 20.67 | -3.71 | 0.0465 | -0.0010 | |||||

| US3140NEPU33 / FNMA POOL BX9434 FN 03/53 FIXED 5.5 | 20.65 | -3.74 | 0.0465 | -0.0010 | |||||

| US3140QR4N06 / FNMA POOL CB6228 FN 05/53 FIXED 4.5 | 20.56 | -3.55 | 0.0463 | -0.0009 | |||||

| FNMA POOL MA5354 FN 05/54 FIXED 6 / ABS-MBS (US31418E5Q96) | 20.55 | -5.14 | 0.0462 | -0.0017 | |||||

| US86562MCG33 / Sumitomo Mitsui Financial Group Inc | 20.53 | 1.46 | 0.0462 | 0.0014 | |||||

| XS2353412633 / DRYDEN EURO CLO DRYD 2017 52A AR 144A | 20.51 | 4.40 | 0.0461 | 0.0027 | |||||

| DATABRICKS INC LAST OUT TERM LOAN / LON (BA000D206) | 20.50 | 0.25 | 0.0461 | 0.0009 | |||||

| DATABRICKS INC LAST OUT TERM LOAN / LON (BA000D206) | 20.50 | 0.25 | 0.0461 | 0.0009 | |||||

| US21071BAA35 / Consumers 2023 Securitization Funding LLC | 20.46 | -0.59 | 0.0460 | 0.0005 | |||||

| XS1697546247 / WARWICK FINANCE RESIDENTIAL MO WARW 3A PRC 144A | 20.39 | 11.61 | 0.0459 | 0.0054 | |||||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 20.38 | 0.80 | 0.0458 | 0.0011 | |||||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 20.38 | 0.80 | 0.0458 | 0.0011 | |||||

| US36264RAE53 / GS MORTGAGE-BACKED SECURITIES CORP TRUST 202 SER 2022-PJ4 CL A4 V/R REGD 144A P/P 2.50000000 | 20.36 | -1.75 | 0.0458 | -0.0001 | |||||

| XS2404665460 / BNPP AM EURO CLO 2019 BV SER 2019-1A CL AR V/R REGD 144A P/P /EUR/ 0.82000000 | 20.33 | 8.70 | 0.0457 | 0.0043 | |||||

| US38239PAA57 / Goodman US Finance Five LLC | 20.32 | 0.86 | 0.0457 | 0.0011 | |||||

| US91087BAL45 / Mexico Government International Bond | 20.31 | 1.16 | 0.0457 | 0.0012 | |||||

| US912810SL35 / United States Treasury Note/Bond | 20.27 | -2.94 | 0.0456 | -0.0006 | |||||

| US650036AZ90 / NEW YORK ST URBAN DEV CORP REV NYSDEV 03/31 FIXED 2.027 | 20.26 | 1.43 | 0.0456 | 0.0014 | |||||

| US59024UAD37 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2007 MLN1 A2C | 20.17 | -4.82 | 0.0454 | -0.0015 | |||||

| US74977RDK77 / Cooperatieve Rabobank UA | 20.15 | -15.82 | 0.0453 | -0.0077 | |||||

| PERFORMER FUNDING PERFF 1A D 144A / ABS-O (XS2721093388) | 20.14 | 6.01 | 0.0453 | 0.0033 | |||||

| PERFORMER FUNDING PERFF 1A D 144A / ABS-O (XS2721093388) | 20.14 | 6.01 | 0.0453 | 0.0033 | |||||

| VIRGINIA POWER FUEL SEC SR SECURED 05/33 4.877 / DBT (US92808VAB80) | 20.14 | 0.57 | 0.0453 | 0.0010 | |||||

| VIRGINIA POWER FUEL SEC SR SECURED 05/33 4.877 / DBT (US92808VAB80) | 20.14 | 0.57 | 0.0453 | 0.0010 | |||||

| US681936BM17 / Omega Healthcare Investors Inc | 20.13 | 1.45 | 0.0453 | 0.0014 | |||||

| MORGAN STANLEY BANK NA SR UNSECURED 10/27 VAR / DBT (US61690U8F08) | 20.12 | -0.11 | 0.0453 | 0.0007 | |||||

| MORGAN STANLEY BANK NA SR UNSECURED 10/27 VAR / DBT (US61690U8F08) | 20.12 | -0.11 | 0.0453 | 0.0007 | |||||

| RIPON MORTGAGES RIPON 2025 1A D 144A / ABS-MBS (XS2982123742) | 20.11 | 6.71 | 0.0452 | 0.0035 | |||||

| RIPON MORTGAGES RIPON 2025 1A D 144A / ABS-MBS (XS2982123742) | 20.11 | 6.71 | 0.0452 | 0.0035 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 20.06 | 1.02 | 0.0451 | 0.0012 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 20.06 | 1.02 | 0.0451 | 0.0012 | |||||

| ANCHORAGE CAPITAL CLO LTD ANCHC 2015 6A AR3 144A / ABS-CBDO (US03328QBL41) | 20.04 | 0.15 | 0.0451 | 0.0008 | |||||

| ANCHORAGE CAPITAL CLO LTD ANCHC 2015 6A AR3 144A / ABS-CBDO (US03328QBL41) | 20.04 | 0.15 | 0.0451 | 0.0008 | |||||

| US902613AV09 / UBS Group AG | 20.01 | 1.18 | 0.0450 | 0.0012 | |||||

| US52472GAL86 / LEGACY MORTGAGE ASSET TRUST LMAT 2018 RPL4 PT 144A | 19.99 | -2.58 | 0.0450 | -0.0005 | |||||

| GS MORTGAGE BACKED SECURITIES GSMBS 2024 RPL7 PT 144A / ABS-MBS (US36273CAR88) | 19.94 | -3.09 | 0.0448 | -0.0007 | |||||

| GS MORTGAGE BACKED SECURITIES GSMBS 2024 RPL7 PT 144A / ABS-MBS (US36273CAR88) | 19.94 | -3.09 | 0.0448 | -0.0007 | |||||

| US225401BE76 / UBS Group AG | 19.86 | 0.50 | 0.0447 | 0.0009 | |||||

| US650036BA31 / NEW YORK ST URBAN DEV CORP REV NYSDEV 03/32 FIXED 2.127 | 19.81 | 1.38 | 0.0446 | 0.0013 | |||||

| ROUNDSTONE SECURITIES RNST 2A R / ABS-MBS (XS2779837702) | 19.78 | 13.75 | 0.0445 | 0.0060 | |||||

| US803014AB57 / Santos Finance Ltd | 19.78 | 1.91 | 0.0445 | 0.0015 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 19.66 | 1.75 | 0.0442 | 0.0015 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 19.66 | 1.75 | 0.0442 | 0.0015 | |||||

| US44409MAC01 / Hudson Pacific Properties LP | 19.65 | 18.61 | 0.0442 | 0.0075 | |||||

| US86562MCR97 / Sumitomo Mitsui Financial Group Inc | 19.57 | 0.31 | 0.0440 | 0.0008 | |||||

| US465685AQ80 / ITC Holdings Corp | 19.45 | 1.91 | 0.0438 | 0.0015 | |||||

| US95000U2S19 / Wells Fargo & Co | 19.43 | 0.97 | 0.0437 | 0.0011 | |||||

| FREDDIE MAC FHR 5513 MF / ABS-MBS (US3137HKEX87) | 19.40 | -5.18 | 0.0437 | -0.0016 | |||||

| FREDDIE MAC FHR 5513 MF / ABS-MBS (US3137HKEX87) | 19.40 | -5.18 | 0.0437 | -0.0016 | |||||

| US650036BB14 / New York State Urban Development Corp | 19.39 | 1.15 | 0.0436 | 0.0012 | |||||

| US088929AC82 / BGC Group Inc | 19.37 | 0.18 | 0.0436 | 0.0008 | |||||

| CONSUMER LOAN FINANCE ISSUER T CLFT 2024 A A1 / ABS-O (US21050QAA58) | 19.35 | -22.01 | 0.0435 | -0.0114 | |||||

| CONSUMER LOAN FINANCE ISSUER T CLFT 2024 A A1 / ABS-O (US21050QAA58) | 19.35 | -22.01 | 0.0435 | -0.0114 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 19.32 | 0.01 | 0.0435 | 0.0007 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 19.32 | 0.01 | 0.0435 | 0.0007 | |||||

| US606822CS14 / MITSUBISHI UFJ FINANCIAL GROUP INC | 19.30 | 0.32 | 0.0434 | 0.0008 | |||||

| US38380L8G12 / GOVERNMENT NATIONAL MORTGAGE A GNR 2020 H07 FA | 19.20 | -1.17 | 0.0432 | 0.0002 | |||||

| FNMA POOL FS6809 FN 02/54 FIXED VAR / ABS-MBS (US3140XNR716) | 19.12 | -2.17 | 0.0430 | -0.0003 | |||||

| FNMA POOL FS6809 FN 02/54 FIXED VAR / ABS-MBS (US3140XNR716) | 19.12 | -2.17 | 0.0430 | -0.0003 | |||||

| US05964HAQ83 / Banco Santander SA | 19.09 | 0.43 | 0.0430 | 0.0009 | |||||

| US46653QBD60 / JP MORGAN MORTGAGE TRUST 05/52 1 | 19.04 | -1.96 | 0.0428 | -0.0002 | |||||

| US29425AAD54 / Citigroup Commercial Mortgage Trust 2015-GC33 | 19.03 | -12.38 | 0.0428 | -0.0053 | |||||

| US3140QNSU77 / UMBS, 30 Year | 19.02 | -3.86 | 0.0428 | -0.0010 | |||||

| US55284JAA79 / MF1 2022-FL8 Ltd | 18.99 | -12.58 | 0.0427 | -0.0054 | |||||

| US3140FXG301 / Fannie Mae Pool | 18.95 | -3.58 | 0.0426 | -0.0009 | |||||

| US14040HCS22 / CAPITAL ONE FINANCIAL CORPORATION | 18.84 | -16.91 | 0.0424 | -0.0078 | |||||

| US23636ABC45 / Danske Bank A/S | 18.84 | 0.38 | 0.0424 | 0.0008 | |||||

| WEIR GROUP INC COMPANY GUAR 144A 05/30 5.35 / DBT (US94877DAA28) | 18.77 | 0.0422 | 0.0422 | ||||||

| WEIR GROUP INC COMPANY GUAR 144A 05/30 5.35 / DBT (US94877DAA28) | 18.77 | 0.0422 | 0.0422 | ||||||

| US31418EHK91 / Fannie Mae Pool | 18.75 | -2.30 | 0.0422 | -0.0003 | |||||

| US02377LAA26 / American Airlines Pass Through Trust, Series 2019-1, Class AA | 18.74 | 0.24 | 0.0422 | 0.0008 | |||||

| US12595EAD76 / COMM 2017-COR2 Mortgage Trust | 18.73 | 0.69 | 0.0421 | 0.0010 | |||||

| SCE.PRK / SCE Trust V - Preferred Security | 18.70 | 0.07 | 0.0421 | 0.0007 | |||||

| SCE.PRK / SCE Trust V - Preferred Security | 18.70 | 0.07 | 0.0421 | 0.0007 | |||||

| XS2304366656 / HARVEST CLO HARVT 16A ARR 144A | 18.68 | -6.83 | 0.0420 | -0.0024 | |||||

| US361841AP42 / GLP Capital LP / GLP Financing II Inc | 18.66 | 1.65 | 0.0420 | 0.0013 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 18.64 | 0.39 | 0.0419 | 0.0008 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 18.64 | 0.39 | 0.0419 | 0.0008 | |||||