Mga Batayang Estadistika

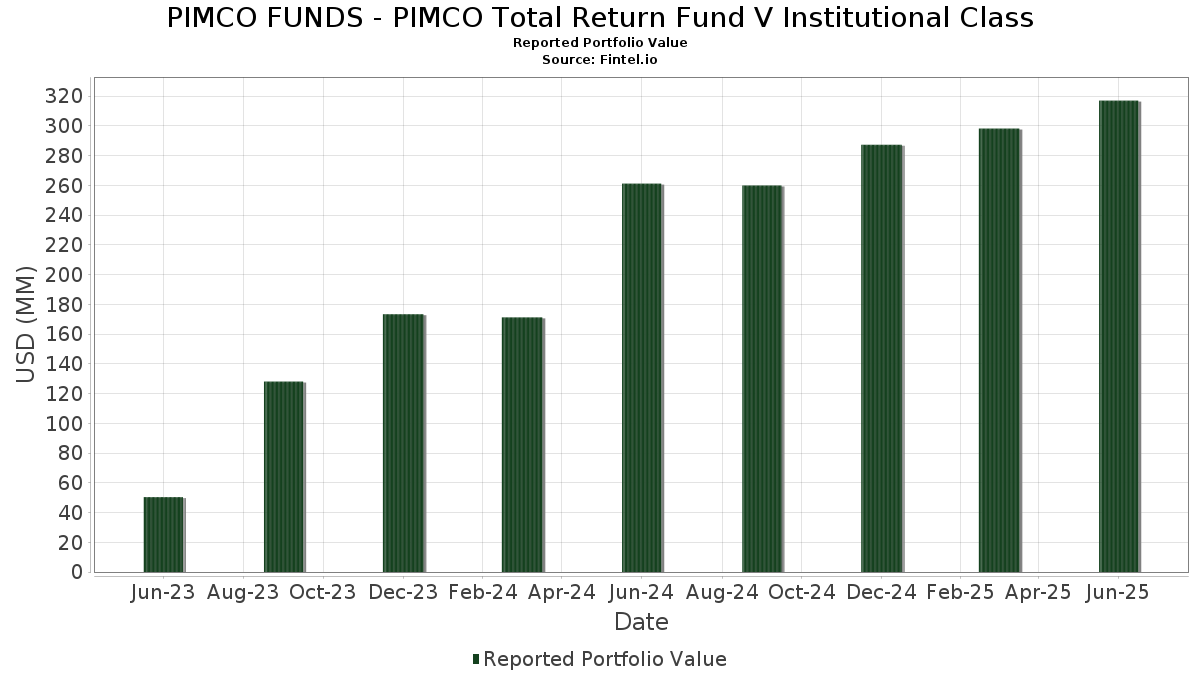

| Nilai Portofolio | $ 317,052,165 |

| Posisi Saat Ini | 541 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

PIMCO FUNDS - PIMCO Total Return Fund V Institutional Class telah mengungkapkan total kepemilikan 541 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 317,052,165 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PIMCO FUNDS - PIMCO Total Return Fund V Institutional Class adalah UMBS TBA (US:US01F0426811) , Uniform Mortgage-Backed Security, TBA (US:US01F0526800) , FNMA POOL CB6418 FN 05/53 FIXED 5 (US:US3140QSDY42) , FANNIE MAE POOL FN CB5400 (US:US3140QRAA10) , and UMBS (US:US3133KQM787) . Posisi baru PIMCO FUNDS - PIMCO Total Return Fund V Institutional Class meliputi: UMBS TBA (US:US01F0426811) , Uniform Mortgage-Backed Security, TBA (US:US01F0526800) , FNMA POOL CB6418 FN 05/53 FIXED 5 (US:US3140QSDY42) , FANNIE MAE POOL FN CB5400 (US:US3140QRAA10) , and UMBS (US:US3133KQM787) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 33.20 | 12.0873 | 12.0873 | ||

| 18.17 | 6.6144 | 6.6144 | ||

| 9.80 | 3.5695 | 3.5695 | ||

| 3.84 | 1.3977 | 1.3977 | ||

| 3.44 | 1.2525 | 1.2525 | ||

| 2.82 | 1.0281 | 0.9886 | ||

| 2.55 | 0.9300 | 0.9300 | ||

| 2.20 | 0.8017 | 0.8017 | ||

| 2.14 | 0.7787 | 0.7787 | ||

| 2.07 | 0.7521 | 0.7521 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 14.18 | 5.1638 | -9.7570 | ||

| 16.96 | 6.1733 | -0.7320 | ||

| 16.16 | 5.8827 | -0.4500 | ||

| -2.25 | -0.8207 | -0.4269 | ||

| 1.14 | 0.4166 | -0.4244 | ||

| 9.88 | 3.5984 | -0.3545 | ||

| 2.25 | 0.8202 | -0.3485 | ||

| 8.33 | 3.0326 | -0.2876 | ||

| 7.07 | 2.5743 | -0.2445 | ||

| 7.04 | 2.5625 | -0.2210 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Investor ini belum mengungkapkan sekuritas yang diperhitungkan dalam bentuk saham, sehingga kolom terkait saham dalam tabel di bawah ini dihilangkan. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|

| PARIBAS REPO / RA (000000000) | 33.20 | 12.0873 | 12.0873 | |||

| US01F0426811 / UMBS TBA | 18.17 | 6.6144 | 6.6144 | |||

| FED HM LN PC POOL RJ3036 FR 12/54 FIXED 5.5 / ABS-MBS (US3142GTLS31) | 16.96 | -3.72 | 6.1733 | -0.7320 | ||

| US TREASURY N/B 11/34 4.25 / DBT (US91282CLW90) | 16.16 | 0.04 | 5.8827 | -0.4500 | ||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 14.18 | -47.13 | 5.1638 | -9.7570 | ||

| US3140QSDY42 / FNMA POOL CB6418 FN 05/53 FIXED 5 | 9.88 | -1.96 | 3.5984 | -0.3545 | ||

| US TREASURY N/B 02/35 4.625 / DBT (US91282CMM00) | 9.80 | 3.5695 | 3.5695 | |||

| US3140QRAA10 / FANNIE MAE POOL FN CB5400 | 8.33 | -1.63 | 3.0326 | -0.2876 | ||

| US3133KQM787 / UMBS | 7.07 | -1.66 | 2.5743 | -0.2445 | ||

| US3140QSDX68 / FNMA POOL CB6417 FN 05/53 FIXED 4.5 | 7.04 | -0.85 | 2.5625 | -0.2210 | ||

| US912828Z377 / United States Treasury Inflation Indexed Bonds | 5.18 | 1.31 | 1.8854 | -0.1190 | ||

| FED HM LN PC POOL RJ0138 FR 12/53 FIXED 5.5 / ABS-MBS (US3142GQEL22) | 4.19 | -2.60 | 1.5267 | -0.1614 | ||

| US3140QSSW21 / FNMA 30YR 5% 07/01/2053#CB6832 | 4.02 | -1.13 | 1.4631 | -0.1306 | ||

| US3133KRBP82 / UMBS | 4.00 | -0.62 | 1.4580 | -0.1219 | ||

| US3142GQBU57 / FHLG 30YR 5.5% 10/01/2053#RJ0050 | 3.90 | -4.20 | 1.4214 | -0.1766 | ||

| GB00BMV7TC88 / United Kingdom Gilt | 3.84 | 1.3977 | 1.3977 | |||

| US01F0406854 / UMBS TBA | 3.44 | 1.2525 | 1.2525 | |||

| FED HM LN PC POOL RJ0639 FR 01/54 FIXED 5.5 / ABS-MBS (US3142GQV902) | 3.04 | -2.34 | 1.1079 | -0.1141 | ||

| FED HM LN PC POOL RA7870 FR 09/52 FIXED 4 / ABS-MBS (US3133KPW796) | 2.93 | -2.91 | 1.0685 | -0.1168 | ||

| US TREASURY N/B 02/55 4.625 / DBT (US912810UG12) | 2.82 | 2,723.00 | 1.0281 | 0.9886 | ||

| US21H0506723 / Ginnie Mae | 2.55 | 0.9300 | 0.9300 | |||

| FNMA POOL CB8271 FN 04/54 FIXED 5 / ABS-MBS (US3140QUFM32) | 2.51 | -3.28 | 0.9131 | -0.1035 | ||

| US01F0506844 / UMBS TBA | 2.25 | 282.99 | 0.8202 | -0.3485 | ||

| US912810TS78 / United States Treasury Note/Bond | 2.23 | -2.15 | 0.8133 | -0.0818 | ||

| US21H0426799 / Ginnie Mae | 2.20 | 0.8017 | 0.8017 | |||

| US3133KQDD51 / FHLG 30YR 4% 12/01/2052#RA8200 | 2.14 | -14.37 | 0.7794 | -0.2007 | ||

| US21H0406734 / Ginnie Mae | 2.14 | 0.7787 | 0.7787 | |||

| TSY INFL IX N/B 02/55 2.375 / DBT (US912810UH94) | 2.07 | 0.7521 | 0.7521 | |||

| US26835PAH38 / EDP Finance BV | 2.06 | 1.28 | 0.7496 | -0.0473 | ||

| US912810TR95 / United States Treasury Note/Bond | 2.04 | -3.18 | 0.7427 | -0.0834 | ||

| US912810SV17 / United States Treasury Inflation Indexed Bonds | 2.02 | -4.37 | 0.7338 | -0.0925 | ||

| US404280DZ92 / HSBC HOLDINGS PLC REGD V/R 5.88700000 | 1.93 | -0.16 | 0.7017 | -0.0552 | ||

| US06051GLG28 / Bank of America Corp | 1.84 | 0.55 | 0.6698 | -0.0474 | ||

| FED HM LN PC POOL SD8431 FR 05/54 FIXED 5.5 / ABS-MBS (US3132DWLL53) | 1.81 | -2.59 | 0.6583 | -0.0697 | ||

| US65339KBW99 / NextEra Energy Capital Holdings Inc | 1.73 | 1.29 | 0.6296 | -0.0399 | ||

| US3140QQDV47 / FNMA POOL CB4615 FN 07/52 FIXED 4.5 | 1.58 | -0.44 | 0.5760 | -0.0471 | ||

| CDX ITRAXX XOV42 5Y 35-100% SP JPM / DCR (EZ2BLZ4YH9B3) | 1.58 | 0.5756 | 0.5756 | |||

| US744573AW69 / Public Service Enterprise Group Inc | 1.57 | 0.64 | 0.5718 | -0.0402 | ||

| US456837BF96 / ING Groep NV | 1.53 | -0.20 | 0.5563 | -0.0439 | ||

| US06738ECK91 / Barclays PLC | 1.48 | 0.54 | 0.5390 | -0.0383 | ||

| US797440CE27 / SAN DIEGO GAS & ELECTRIC CO | 1.43 | 0.78 | 0.5206 | -0.0360 | ||

| GREENSKY HOME IMPROVEMENT ISSU GSKY 2025 1A A3 144A / ABS-O (US39571NAC02) | 1.43 | 1.42 | 0.5194 | -0.0323 | ||

| CDX ITRAXX XOV42 5Y 35-100% SP BPS / DCR (EZ2BLZ4YH9B3) | 1.41 | 0.5134 | 0.5134 | |||

| US3133KQQ259 / FHLG 30YR 5% 06/01/2053#RA8573 | 1.40 | -2.92 | 0.5085 | -0.0557 | ||

| FED HM LN PC POOL RJ1109 FR 03/54 FIXED 5.5 / ABS-MBS (US3142GRGT13) | 1.36 | -2.31 | 0.4938 | -0.0505 | ||

| US46647PDU75 / JPMorgan Chase & Co. | 1.33 | 0.60 | 0.4860 | -0.0342 | ||

| US912810SH23 / United States Treas Bds Bond | 1.29 | 778.91 | 0.4706 | 0.4128 | ||

| US345397A860 / Ford Motor Credit Co LLC | 1.27 | 1.19 | 0.4628 | -0.0298 | ||

| US694308KK29 / Pacific Gas and Electric Co | 1.27 | -3.64 | 0.4624 | -0.0543 | ||

| US3140QRAB92 / FNMA 30YR 4.5% 12/01/2052#CB5401 | 1.26 | -5.41 | 0.4590 | -0.0634 | ||

| US TREASURY N/B 11/54 4.5 / DBT (US912810UE63) | 1.24 | -3.28 | 0.4512 | -0.0512 | ||

| US00130HCG83 / CORP. NOTE | 1.22 | 2.26 | 0.4459 | -0.0236 | ||

| US44107TAZ93 / Host Hotels & Resorts LP | 1.21 | 1.34 | 0.4397 | -0.0276 | ||

| POST ROAD EQUIPMENT FINANCE PREF 2025 1A A2 144A / ABS-O (US73747LAB45) | 1.21 | 0.33 | 0.4396 | -0.0325 | ||

| PEAC SOLUTIONS RECEIVABLES LLC PEAC 2025 1A A2 144A / ABS-O (US69392HAB96) | 1.20 | 0.00 | 0.4387 | -0.0335 | ||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 1 A2 144A / ABS-O (US29390HAB50) | 1.20 | 0.08 | 0.4383 | -0.0332 | ||

| GREAT AMERICA LEASING RECEIVAB GALC 2025 1 A2 144A / ABS-O (US39154GAH92) | 1.20 | 0.17 | 0.4377 | -0.0329 | ||

| MF1 MULTIFAMILY HOUSING MORTGA MF1 2025 FL17 A 144A / ABS-CBDO (US55287HAA86) | 1.20 | 0.08 | 0.4363 | -0.0331 | ||

| US912810SJ88 / United States Treas Bds Bond | 1.19 | -2.77 | 0.4342 | -0.0466 | ||

| US11272BAA17 / Brookfield Finance I UK Plc | 1.19 | 0.93 | 0.4337 | -0.0291 | ||

| US74977RDK77 / Cooperatieve Rabobank UA | 1.17 | 0.95 | 0.4274 | -0.0286 | ||

| US912810TU25 / United States Treasury Note/Bond | 1.14 | -46.64 | 0.4166 | -0.4244 | ||

| US842400HD82 / Southern California Edison Co | 1.11 | 0.64 | 0.4034 | -0.0282 | ||

| US912810SF66 / Us Treasury Bond | 1.11 | -2.56 | 0.4025 | -0.0424 | ||

| US172967NS68 / CITIGROUP INC | 1.10 | 0.27 | 0.4021 | -0.0298 | ||

| US29278GAP37 / Enel Finance International NV | 1.10 | 2.24 | 0.3994 | -0.0216 | ||

| Q / Quetzal Copper Corp. | 1.08 | -18.95 | 0.3940 | -0.1298 | ||

| EUROPEAN UNION SR UNSECURED REGS 10/29 2.875 / DBT (EU000A3L1CN4) | 1.08 | 9.86 | 0.3938 | 0.0076 | ||

| US715638BY77 / REPUBLIC OF PERU SR UNSECURED 144A 08/32 6.15 | 1.08 | 6.82 | 0.3933 | -0.0034 | ||

| US46647PAM86 / JPMorgan Chase & Co | 1.08 | 0.75 | 0.3924 | -0.0270 | ||

| US225401BE76 / UBS Group AG | 1.05 | 0.48 | 0.3825 | -0.0274 | ||

| GB00BMV7TC88 / United Kingdom Gilt | 1.01 | 6.44 | 0.3673 | -0.0044 | ||

| BMW VEHICLE LEASE TRUST BMWLT 2025 1 A3 / ABS-O (US096912AD26) | 1.01 | 0.3664 | 0.3664 | |||

| US09659W2Q64 / BNP Paribas SA | 0.97 | 0.62 | 0.3538 | -0.0246 | ||

| US418751AL75 / HAT HOLDINGS I LLC/HAT REGD 144A P/P 8.00000000 | 0.94 | 0.64 | 0.3418 | -0.0240 | ||

| US67021CAP23 / NSTAR Electric Co | 0.85 | 0.95 | 0.3109 | -0.0207 | ||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.83 | 0.85 | 0.3033 | -0.0204 | ||

| US38376RHF64 / GNMA, Series 2015-H23, Class FB | 0.82 | -17.22 | 0.2975 | -0.0896 | ||

| US06051GLC14 / BANK OF AMERICA CORP | 0.81 | 0.12 | 0.2956 | -0.0223 | ||

| CITIBANK NA SR UNSECURED 11/27 VAR / DBT (US17325FBL13) | 0.81 | 0.12 | 0.2931 | -0.0221 | ||

| US74977RDJ05 / Cooperatieve Rabobank UA | 0.79 | 1.02 | 0.2888 | -0.0193 | ||

| US373334KE00 / Georgia Power Co. | 0.77 | 0.26 | 0.2798 | -0.0207 | ||

| US744533BM10 / Public Service Co. of Oklahoma, Series J | 0.76 | 2.16 | 0.2762 | -0.0151 | ||

| US00084DAW02 / ABN AMRO Bank NV | 0.75 | 1.22 | 0.2717 | -0.0176 | ||

| US49427RAQ56 / Kilroy Realty LP | 0.72 | 1.40 | 0.2639 | -0.0160 | ||

| US00130HCH66 / AES Corp/The | 0.72 | 0.42 | 0.2605 | -0.0188 | ||

| US912810SE91 / United States Treas Bds Bond | 0.71 | -2.47 | 0.2593 | -0.0272 | ||

| US44107TAY29 / Host Hotels & Resorts LP | 0.71 | 1.58 | 0.2578 | -0.0156 | ||

| US65364UAN63 / Niagara Mohawk Power Corp | 0.71 | 2.17 | 0.2573 | -0.0140 | ||

| 6902 / DENSO Corporation | 0.70 | 0.57 | 0.2549 | -0.0180 | ||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0.70 | 0.2544 | 0.2544 | |||

| JAMESTOWN CLO LTD JTWN 2021 16A AR 144A / ABS-CBDO (US47048RAL96) | 0.70 | 0.00 | 0.2541 | -0.0195 | ||

| 37 CAPITAL CLO LTD PUTNM 2023 2A AR 144A / ABS-CBDO (US883932AN54) | 0.70 | 0.14 | 0.2541 | -0.0192 | ||

| XS2100664114 / Digital Dutch Finco BV | 0.65 | 10.68 | 0.2379 | 0.0064 | ||

| BNG BANK NV SR UNSECURED 144A 02/30 4.75 / DBT (US05591F2Y50) | 0.62 | 0.65 | 0.2259 | -0.0157 | ||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | 0.61 | 0.2231 | 0.2231 | |||

| NY STATE ELECTRIC + GAS NY STATE ELECTRIC + GAS / DBT (US649840CW32) | 0.61 | 1.50 | 0.2214 | -0.0135 | ||

| SRG / Snam S.p.A. | 0.61 | 0.2204 | 0.2204 | |||

| US38239PAA57 / Goodman US Finance Five LLC | 0.60 | 0.84 | 0.2198 | -0.0149 | ||

| AMEREN MISSOURI SEC FU I SR SECURED 10/41 4.85 / DBT (US023940AA78) | 0.60 | -0.34 | 0.2169 | -0.0176 | ||

| US172967LW98 / Citigroup Inc | 0.59 | 0.68 | 0.2163 | -0.0151 | ||

| US26444HAH49 / Duke Energy Florida LLC | 0.58 | 1.40 | 0.2115 | -0.0128 | ||

| USY7280PAA13 / ReNew Wind Energy AP2 / ReNew Power Pvt Ltd other 9 Subsidiaries | 0.57 | 2.15 | 0.2075 | -0.0112 | ||

| US912810TE82 / United States Treasury Inflation Indexed Bonds | 0.55 | -4.81 | 0.2018 | -0.0265 | ||

| US TREASURY N/B 08/54 4.25 / DBT (US912810UC08) | 0.55 | -3.18 | 0.1996 | -0.0226 | ||

| AVOCA STATIC CLO AVOST 1A AR 144A / ABS-CBDO (XS2935873880) | 0.54 | 0.55 | 0.1984 | -0.0139 | ||

| US62954HBA59 / NXP BV / NXP Funding LLC / NXP USA Inc | 0.53 | 2.12 | 0.1930 | -0.0109 | ||

| US00203QAF46 / AP Moller - Maersk A/S | 0.53 | 2.13 | 0.1920 | -0.0106 | ||

| US80281LAT26 / Santander UK Group Holdings plc | 0.52 | 0.38 | 0.1901 | -0.0139 | ||

| US912810SA79 / United States Treas Bds Bond | 0.52 | 128.07 | 0.1894 | 0.0997 | ||

| US649840CU75 / New York State Electric & Gas Corp | 0.52 | 0.58 | 0.1888 | -0.0134 | ||

| PROLOGIS LP SR UNSECURED 02/33 4.2 / DBT (CA74340XCP48) | 0.52 | 5.73 | 0.1885 | -0.0034 | ||

| US80282KBF21 / Santander Holdings USA, Inc. | 0.51 | 1.99 | 0.1869 | -0.0107 | ||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0.51 | 0.99 | 0.1864 | -0.0122 | ||

| BMW US CAPITAL LLC COMPANY GUAR 144A 03/30 5.05 / DBT (US05565ECY95) | 0.51 | 1.39 | 0.1854 | -0.0117 | ||

| TSY INFL IX N/B 02/54 2.125 / DBT (US912810TY47) | 0.51 | -3.61 | 0.1851 | -0.0219 | ||

| XS2291692890 / Chile Government International Bond | 0.51 | 0.60 | 0.1849 | -0.0128 | ||

| SMURFIT WESTROCK FIN COMPANY GUAR 01/35 5.418 / DBT (US83272YAB83) | 0.51 | 0.1845 | 0.1845 | |||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 0.51 | 0.1844 | 0.1844 | |||

| MERCEDES BENZ FIN NA COMPANY GUAR 144A 11/27 4.9 / DBT (US58769JAZ03) | 0.51 | 0.1842 | 0.1842 | |||

| US25159MBK27 / DEVELOPMENT BANK OF JAPAN IN 09/26 5.125 | 0.51 | 0.00 | 0.1841 | -0.0142 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.50 | -0.40 | 0.1831 | -0.0146 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 08/26 VAR / DBT (US04685A4B40) | 0.50 | 0.00 | 0.1828 | -0.0141 | ||

| BMW VEHICLE LEASE TRUST BMWLT 2024 1 A3 / ABS-O (US05611UAD54) | 0.50 | -0.20 | 0.1827 | -0.0144 | ||

| FREDDIE MAC FHR 5560 FB / ABS-MBS (US3137HLZD77) | 0.50 | 0.1823 | 0.1823 | |||

| 37 CAPITAL CLO LTD PUTNM 2022 1A A1R 144A / ABS-CBDO (US88429PAU66) | 0.50 | 0.20 | 0.1823 | -0.0138 | ||

| US26442CAX20 / Duke Energy Carolinas LLC | 0.50 | 1.22 | 0.1817 | -0.0116 | ||

| US30227FAC41 / EXTENDED STAY AMERICA TRUST ESA 2021 ESH A1 144A | 0.50 | -0.80 | 0.1814 | -0.0156 | ||

| US92230AAA43 / VASA Trust 2021-VASA | 0.49 | 0.21 | 0.1770 | -0.0135 | ||

| TESLA SUSTAINABLE ENERGY TRUST TSET 2024 1A A2 144A / ABS-O (US88164AAB08) | 0.49 | -3.19 | 0.1767 | -0.0201 | ||

| US595620AV77 / MidAmerican Energy Co | 0.47 | 0.43 | 0.1722 | -0.0122 | ||

| US912810SC36 / United States Treas Bds Bond | 0.46 | -2.57 | 0.1658 | -0.0174 | ||

| XS2264968665 / Ivory Coast Government International Bond | 0.45 | 12.25 | 0.1635 | 0.0064 | ||

| US595620AT22 / MidAmerican Energy Co | 0.44 | 1.15 | 0.1608 | -0.0103 | ||

| US05571AAS42 / BPCE SA | 0.44 | 0.92 | 0.1601 | -0.0108 | ||

| US3140QSSU64 / UMBS | 0.43 | -1.60 | 0.1569 | -0.0146 | ||

| ARES EURO CLO ARESE 14A AR 144A / ABS-CBDO (XS2920478356) | 0.43 | -13.18 | 0.1560 | -0.0375 | ||

| US47216QAC78 / JDE PEETS BV 2.25% 09/24/2031 144A | 0.43 | 1.67 | 0.1553 | -0.0091 | ||

| US918204BC10 / VF Corp | 0.42 | -1.63 | 0.1537 | -0.0147 | ||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 0.41 | 0.74 | 0.1499 | -0.0103 | ||

| US05964HAX35 / Banco Santander SA | 0.41 | -0.24 | 0.1495 | -0.0120 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.41 | 0.74 | 0.1491 | -0.0103 | ||

| NORINCHUKIN BANK SR UNSECURED 144A 10/29 5.094 / DBT (US656029AN58) | 0.41 | 0.50 | 0.1478 | -0.0105 | ||

| STAB / Standard Chartered PLC - Preferred Security | 0.40 | 1.25 | 0.1472 | -0.0095 | ||

| US86562MCN83 / Sumitomo Mitsui Financial Group Inc | 0.40 | 1.26 | 0.1471 | -0.0093 | ||

| MUTUAL OF OMAHA GLOBAL SR SECURED 144A 10/29 4.75 / DBT (US62829D2E95) | 0.40 | 1.26 | 0.1470 | -0.0093 | ||

| US912810TP30 / US TREASURY I/L 1.5% 02-15-53 | 0.40 | -3.83 | 0.1464 | -0.0176 | ||

| HANWHA ENERGY USA HOLDN COMPANY GUAR 144A 07/28 4.375 / DBT (US41135WAC55) | 0.40 | 0.1462 | 0.1462 | |||

| US38237CAA62 / Goodleap Sustainable Home Solutions Trust 2023-3 | 0.40 | -4.76 | 0.1458 | -0.0190 | ||

| MORGAN STANLEY BANK NA SR UNSECURED 10/27 VAR / DBT (US61690U8F08) | 0.40 | 0.00 | 0.1458 | -0.0114 | ||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0.40 | 1.28 | 0.1447 | -0.0092 | ||

| US05351WAB90 / Avangrid Inc | 0.39 | 1.30 | 0.1423 | -0.0087 | ||

| TAQA / Abu Dhabi National Energy Company PJSC | 0.38 | -0.52 | 0.1395 | -0.0116 | ||

| MDLZ / Mondelez International, Inc. - Depositary Receipt (Common Stock) | 0.38 | 4.97 | 0.1386 | -0.0037 | ||

| US91282CAQ42 / USTN TII 0.125% 10/15/2025 | 0.37 | 0.54 | 0.1346 | -0.0096 | ||

| ONTARIO (PROVINCE OF) SR UNSECURED 12/34 3.8 / DBT (CA68333ZBG15) | 0.37 | 0.1336 | 0.1336 | |||

| ONCOR ELECTRIC DELIVERY SR SECURED 144A 05/31 3.5 / DBT (XS2813774770) | 0.36 | 10.12 | 0.1309 | 0.0030 | ||

| COTY34 / Coty Inc. - Depositary Receipt (Common Stock) | 0.36 | 8.79 | 0.1309 | 0.0015 | ||

| US86746BAA17 / Helios Issuer LLC, Series 2023-GRID1, Class 1A | 0.36 | -1.64 | 0.1308 | -0.0124 | ||

| FCT / Fincantieri S.p.A. | 0.36 | 11.88 | 0.1304 | 0.0048 | ||

| US637432NW12 / National Rural Utilities Cooperative Finance Corp | 0.34 | 2.13 | 0.1226 | -0.0066 | ||

| US912810SK51 / United States Treasury Note/Bond | 0.32 | -2.73 | 0.1171 | -0.0126 | ||

| FIRST HELP FINANCIAL LLC FHF 2024 1A A2 144A / ABS-O (US31568AAB26) | 0.32 | -14.85 | 0.1171 | -0.0311 | ||

| US61747YFH36 / Morgan Stanley | 0.32 | 0.32 | 0.1157 | -0.0085 | ||

| US02005NBR08 / ALLY FINANCIAL INC | 0.32 | 0.32 | 0.1152 | -0.0087 | ||

| GBDC / Golub Capital BDC, Inc. | 0.32 | 0.64 | 0.1147 | -0.0082 | ||

| US76209PAC77 / RGA GLOBAL FUNDING | 0.31 | 0.00 | 0.1146 | -0.0085 | ||

| US49427RAR30 / KILROY REALTY 2.65 11/33 | 0.31 | 0.96 | 0.1145 | -0.0076 | ||

| US63861VAJ61 / Nationwide Building Society | 0.31 | -0.32 | 0.1120 | -0.0089 | ||

| WISCONSIN POWER + LIGHT SR UNSECURED 03/34 5.375 / DBT (US976826BS59) | 0.31 | 1.32 | 0.1120 | -0.0072 | ||

| SMURFIT KAPPA TREASURY COMPANY GUAR 01/30 5.2 / DBT (US83272GAD34) | 0.31 | 0.1115 | 0.1115 | |||

| HANA BANK HANA BANK / DBT (US48723RAE53) | 0.31 | 0.00 | 0.1114 | -0.0087 | ||

| US41136TAA51 / Hanwha Q Cells Americas Holdings Corp | 0.31 | 0.33 | 0.1112 | -0.0081 | ||

| KODIT GLOBAL 2024 1 KODIT GLOBAL 2024 1 / DBT (XS2826567955) | 0.30 | -0.33 | 0.1110 | -0.0088 | ||

| US89115A2V36 / Toronto-Dominion Bank/The | 0.30 | 0.00 | 0.1108 | -0.0085 | ||

| US976656CN66 / Wisconsin Electric Power Co. | 0.30 | 1.68 | 0.1106 | -0.0066 | ||

| US500631AZ96 / Korea Electric Power Corp | 0.30 | 0.00 | 0.1104 | -0.0087 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 0.30 | 0.66 | 0.1104 | -0.0080 | ||

| US195325EL56 / Colombia Government International Bond | 0.30 | 0.00 | 0.1100 | -0.0085 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.30 | -0.66 | 0.1096 | -0.0089 | ||

| US976826BR76 / Wisconsin Power and Light Co | 0.30 | 0.67 | 0.1094 | -0.0074 | ||

| CDX ITRAXX XOV42 5Y 35-100% SP BOA / DCR (EZ2BLZ4YH9B3) | 0.30 | 0.1089 | 0.1089 | |||

| US912810RL44 / United States Treasury Inflation Indexed Bonds | 0.30 | -2.93 | 0.1087 | -0.0118 | ||

| US912810SD19 / United States Treas Bds Bond | 0.30 | 95.36 | 0.1078 | 0.0482 | ||

| US TREASURY N/B 05/44 4.625 / DBT (US912810UB25) | 0.29 | -2.33 | 0.1071 | -0.0109 | ||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | 0.29 | 0.1057 | 0.1057 | |||

| US05583JAK88 / BPCE SA | 0.29 | 1.05 | 0.1056 | -0.0072 | ||

| US83416WAA18 / Solar Star Funding LLC | 0.28 | -0.35 | 0.1029 | -0.0081 | ||

| US842400HM81 / Southern California Edison Co | 0.26 | 1.18 | 0.0942 | -0.0060 | ||

| MORGAN STANLEY BANK NA MORGAN STANLEY BANK NA / DBT (US61690U8B93) | 0.26 | 0.39 | 0.0930 | -0.0069 | ||

| US30333LAB45 / FHF Issuer Trust 2023-2 | 0.22 | -18.98 | 0.0810 | -0.0268 | ||

| US715638BE14 / Peruvian Government International Bond | 0.22 | -15.33 | 0.0805 | -0.0223 | ||

| FIRST HELP FINANCIAL LLC FHF 2024 2A A2 144A / ABS-O (US30336NAC56) | 0.22 | -15.12 | 0.0798 | -0.0216 | ||

| XS2354569407 / JDE Peet's NV | 0.22 | 10.77 | 0.0789 | 0.0022 | ||

| CDX HY44 5Y ICE / DCR (000000000) | 0.21 | 0.0782 | 0.0782 | |||

| US48020QAB32 / JONES LANG LASALLE INCORPORATED | 0.21 | 0.94 | 0.0782 | -0.0051 | ||

| US91282CGW55 / United States Treasury Inflation Indexed Bonds | 0.21 | 0.95 | 0.0777 | -0.0053 | ||

| US38141GA468 / Goldman Sachs Group Inc/The | 0.21 | 0.47 | 0.0773 | -0.0056 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.21 | 0.49 | 0.0756 | -0.0052 | ||

| US60687YCZ07 / Mizuho Financial Group Inc | 0.21 | 0.49 | 0.0756 | -0.0053 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.21 | 0.49 | 0.0756 | -0.0053 | ||

| US912810SW99 / United States Treasury Note/Bond | 0.21 | 0.0752 | 0.0752 | |||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.20 | 0.00 | 0.0745 | -0.0056 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.20 | 0.00 | 0.0743 | -0.0057 | ||

| US63983TEH41 / Nederlandse Waterschapsbank NV | 0.20 | 0.50 | 0.0732 | -0.0052 | ||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 0.20 | 0.0729 | 0.0729 | |||

| US461070AP91 / Interstate Power & Light Co. | 0.20 | 0.0722 | 0.0722 | |||

| XS2354444379 / JDE Peet's NV | 0.19 | 10.86 | 0.0709 | 0.0020 | ||

| US912810ST60 / TREASURY BOND | 0.19 | 0.0696 | 0.0696 | |||

| BRITISH COLUMBIA PROV OF UNSECURED 06/34 4.15 / DBT (CA110709AK82) | 0.15 | 4.14 | 0.0552 | -0.0018 | ||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (EZV4L1QCFM97) | 0.15 | 7.14 | 0.0548 | -0.0005 | ||

| US845743BT97 / Southwestern Public Service Co | 0.14 | -1.37 | 0.0528 | -0.0048 | ||

| FED HM LN PC POOL QG6918 FR 07/53 FIXED 3.5 / ABS-MBS (US3133C7VK01) | 0.14 | -0.69 | 0.0527 | -0.0044 | ||

| CDX HY43 5Y ICE / DCR (EZ4J83TSRL27) | 0.14 | -39.83 | 0.0518 | -0.0410 | ||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 0.14 | 0.0506 | 0.0506 | |||

| US912810SB52 / United States Treasury Inflation Indexed Bonds | 0.13 | -2.90 | 0.0488 | -0.0056 | ||

| US842400HN64 / Southern California Edison Co. | 0.13 | -4.58 | 0.0458 | -0.0059 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.12 | 0.0444 | 0.0444 | |||

| EUROPEAN UNION SR UNSECURED REGS 12/31 2.5 / DBT (EU000A3L1DJ0) | 0.12 | 10.48 | 0.0425 | 0.0010 | ||

| US105340AR47 / Brandywine Operating Partnership LP | 0.11 | 3.88 | 0.0391 | -0.0016 | ||

| US618933AA33 / MSAIC_23-3A | 0.10 | -4.67 | 0.0373 | -0.0046 | ||

| US21H0606895 / Ginnie Mae | 0.10 | 0.0369 | 0.0369 | |||

| US49427RAN26 / Kilroy Realty LP | 0.10 | 1.02 | 0.0361 | -0.0025 | ||

| US105340AQ63 / Brandywine Operating Partnership LP | 0.10 | 3.19 | 0.0355 | -0.0016 | ||

| US912810RW09 / United States Treasury Inflation Indexed Bonds | 0.10 | -3.03 | 0.0351 | -0.0040 | ||

| RFR USD SOFR/3.50000 06/20/24-30Y LCH / DIR (EZV8ZC6L7CY8) | 0.09 | 12.99 | 0.0320 | 0.0015 | ||

| EU000A3K4DG1 / European Union | 0.08 | 12.33 | 0.0300 | 0.0010 | ||

| RFR USD SOFR/3.80662 04/02/25-30Y* LCH / DIR (EZGJ99MVMFL2) | 0.08 | 0.0280 | 0.0280 | |||

| US842400GK35 / Southern California Edison Co | 0.07 | 0.0264 | 0.0264 | |||

| US912810SM18 / US TII .25 02/15/2050 (TIPS) | 0.07 | -4.00 | 0.0264 | -0.0032 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.06 | 0.0221 | 0.0221 | |||

| BMW VEHICLE LEASE TRUST BMWLT 2024 1 A2A / ABS-O (US05611UAB98) | 0.06 | -70.56 | 0.0214 | -0.0560 | ||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 0.06 | 0.0210 | 0.0210 | |||

| IRS AUD 4.50000 03/19/25-10Y LCH / DIR (EZ2NWX0YG9B5) | 0.06 | 129.17 | 0.0203 | 0.0106 | ||

| RFR USD SOFR/3.50000 12/18/24-30Y LCH / DIR (EZ4089K4KC85) | 0.05 | 42.11 | 0.0198 | 0.0045 | ||

| US880591EX64 / Tennessee Valley Authority | 0.05 | 2.00 | 0.0188 | -0.0012 | ||

| US44107TBA34 / Host Hotels & Resorts LP | 0.05 | 0.00 | 0.0185 | -0.0012 | ||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0.04 | 0.0150 | 0.0150 | |||

| LONG GILT FUTURE SEP25 IFLL 20250926 / DIR (GB00MP6FM953) | 0.04 | 0.0138 | 0.0138 | |||

| CDX ITRAXX MAIN43 5Y ICE / DCR (EZQ41P4DCR25) | 0.04 | 29.63 | 0.0130 | 0.0023 | ||

| TESLA AUTO LEASE TRUST TESLA 2024 A A2A 144A / ABS-O (US88166VAB27) | 0.03 | -71.17 | 0.0119 | -0.0319 | ||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0.03 | 0.0112 | 0.0112 | |||

| RFR USD SOFR/3.25000 06/18/25-5Y LCH / DIR (EZH1N8KH2K02) | 0.03 | 0.0095 | 0.0095 | |||

| US715638BD31 / REPUBLIC OF PERU SR UNSECURED 144A 08/31 6.95 | 0.02 | -17.24 | 0.0091 | -0.0024 | ||

| US53948NAA19 / LOANPAL SOLAR LOAN LTD LPSLT 2020-3GS A | 0.02 | 4.55 | 0.0085 | -0.0005 | ||

| IRS AUD 4.50000 09/18/24-10Y LCH / DIR (EZLG541MMLX8) | 0.02 | 120.00 | 0.0082 | 0.0041 | ||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0.02 | 0.0075 | 0.0075 | |||

| IRS AUD 4.50000 09/20/23-10Y LCH / DIR (EZGXS4F4YYN6) | 0.02 | 100.00 | 0.0068 | 0.0031 | ||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0.02 | 0.0063 | 0.0063 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.02 | 0.0058 | 0.0058 | |||

| US298785JV96 / European Investment Bank | 0.01 | 0.00 | 0.0054 | -0.0004 | ||

| US29449W7M32 / Equitable Financial Life Global Funding | 0.01 | 0.00 | 0.0053 | -0.0004 | ||

| US56501RAN61 / Manulife Financial Corp | 0.01 | 7.69 | 0.0052 | -0.0003 | ||

| US62954HAY45 / NXP BV / NXP Funding LLC / NXP USA Inc | 0.01 | 7.69 | 0.0052 | -0.0003 | ||

| US11271LAH50 / Brookfield Finance Inc | 0.01 | 0.00 | 0.0049 | -0.0003 | ||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0.01 | 0.0048 | 0.0048 | |||

| IRS AUD 4.50000 03/20/24-10Y LCH / DIR (EZJLKSMVQPQ8) | 0.01 | 100.00 | 0.0047 | 0.0023 | ||

| US015271AW93 / ALEXANDRIA REAL EST EQUITS INC 2% 05/18/2032 | 0.01 | 0.00 | 0.0045 | -0.0003 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.01 | 0.0038 | 0.0038 | |||

| RFR USD SOFR/3.64159 04/07/25-30Y* LCH / DIR (EZGJ99MVMFL2) | 0.01 | 0.0036 | 0.0036 | |||

| BOUGHT PLN SOLD USD 20250710 / DFE (000000000) | 0.01 | 0.0034 | 0.0034 | |||

| RFR USD SOFR/3.76473 12/17/24-30Y LCH / DIR (EZYDGJYHYRS1) | 0.01 | 350.00 | 0.0033 | 0.0023 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.01 | 0.0029 | 0.0029 | |||

| RFR USD SOFR/3.89548 12/23/24-30Y* LCH / DIR (EZZRF0TCXFP4) | 0.01 | -137.50 | 0.0025 | 0.0089 | ||

| 317U88SA5 PIMCO SWAPTION 3.65 CALL USD 2025080 / DIR (EZN8G3KVRYT1) | 0.01 | -53.85 | 0.0023 | -0.0029 | ||

| BOUGHT PLN SOLD USD 20250710 / DFE (000000000) | 0.01 | 0.0023 | 0.0023 | |||

| 317U8COA0 PIMCO SWAPTION 3.65 CALL USD 2025081 / DIR (000000000) | 0.01 | 0.0022 | 0.0022 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0021 | 0.0021 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.01 | 0.0021 | 0.0021 | |||

| 31750R594 PIMCO FXVAN PUT EUR USD 1.09750000 / DFE (EZXSNMVYWSL9) | 0.01 | 0.0018 | 0.0018 | |||

| 31750R5B9 PIMCO FXVAN PUT EUR USD 1.10000000 / DFE (EZ0X1GXSRXF6) | 0.00 | 0.0018 | 0.0018 | |||

| RFR USD SOFR/3.65471 04/07/25-30Y* LCH / DIR (EZGJ99MVMFL2) | 0.00 | 0.0017 | 0.0017 | |||

| 31750R5C7 PIMCO FXVAN PUT EUR USD 1.11000000 / DFE (EZ6LHMHGSW79) | 0.00 | 0.0016 | 0.0016 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0015 | 0.0015 | |||

| BOUGHT ZAR SOLD USD 20250723 / DFE (000000000) | 0.00 | 0.0015 | 0.0015 | |||

| 317U88VA1 PIMCO SWAPTION 3.65 CALL USD 2025080 / DIR (EZN8G3KVRYT1) | 0.00 | -76.92 | 0.0014 | -0.0038 | ||

| VERIZON COMMUNICATIONS INC SNR S* ICE / DCR (EZJPZK13BGC9) | 0.00 | 0.00 | 0.0014 | 0.0002 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0013 | 0.0013 | |||

| GOLDMAN SACHS GROUP INC SNR S* ICE / DCR (EZC75LZ075F3) | 0.00 | 0.0012 | 0.0012 | |||

| RFR JPY MUTK/2.00000 06/18/25-20Y LCH / DIR (EZPZ8KYD2B68) | 0.00 | -50.00 | 0.0012 | -0.0013 | ||

| 317U8D2A2 PIMCO SWAPTION 3.7 CALL USD 20250813 / DIR (EZKZHY60KQL7) | 0.00 | -62.50 | 0.0012 | -0.0020 | ||

| 31750R5R4 PIMCO FXVAN CALL USD SEK 10.20000000 / DFE (EZR5HRN9R6R0) | 0.00 | 0.0011 | 0.0011 | |||

| CAN 10YR BOND FUT SEP25 XMOD 20250918 / DIR (000000000) | 0.00 | 0.0010 | 0.0010 | |||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0010 | 0.0010 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0010 | 0.0010 | |||

| RFR GBP SONIO/3.70000 03/28/24-10Y LCH / DIR (EZFCF73KNS79) | 0.00 | -50.00 | 0.0009 | -0.0008 | ||

| MORGAN STANLEY SNR S* ICE / DCR (EZDBN83SBDY5) | 0.00 | 0.0008 | 0.0008 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0008 | 0.0008 | |||

| 317U8RKA1 PIMCO SWAPTION 3.5 CALL USD 20250721 / DIR (EZ3SGXHDXKD4) | 0.00 | -94.44 | 0.0007 | -0.0064 | ||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0007 | 0.0007 | |||

| BOUGHT MXN SOLD USD 20251217 / DFE (000000000) | 0.00 | 0.0006 | 0.0006 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | |||

| BOUGHT KRW SOLD USD 20250708 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | |||

| 317U8R0A3 PIMCO SWAPTION 3.45 CALL USD 2025071 / DIR (000000000) | 0.00 | 0.0004 | 0.0004 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | |||

| BOUGHT PLN SOLD USD 20250710 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | |||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | |||

| 31750R5N3 PIMCO FXVAN PUT EUR USD 1.11000000 / DFE (EZ7LNGTTZ444) | 0.00 | 0.0003 | 0.0003 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | |||

| BOUGHT ZAR SOLD USD 20250723 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT ZAR SOLD USD 20250723 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT TWD SOLD USD 20250707 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT MXN SOLD USD 20250818 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT MXN SOLD USD 20250818 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT PEN SOLD USD 20250707 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| 317U8PVA3 PIMCO SWAPTION 3.36 CALL USD 2025071 / DIR (EZZX1QQCQTH4) | 0.00 | -100.00 | 0.0001 | -0.0054 | ||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT PEN SOLD USD 20250825 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| IRS EUR 2.61000 03/24/25-10Y LCH / DIR (EZPS73SKDR02) | 0.00 | 0.0001 | 0.0002 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| RFR USD SOFR/3.71500 08/07/24-10Y LCH / DIR (EZ2H268MSWS8) | 0.00 | -100.00 | 0.0001 | -0.0006 | ||

| BOUGHT PEN SOLD USD 20250707 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT IDR SOLD USD 20250707 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| RFR EUR ESTRON/2.05000 11/18/24-5Y* LCH / DIR (EZ64KXLFNMN4) | 0.00 | -100.00 | 0.0001 | -0.0006 | ||

| RFR EUR ESTRON/2.05630 11/18/24-5Y* LCH / DIR (EZ64KXLFNMN4) | 0.00 | -100.00 | 0.0000 | -0.0006 | ||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT KRW SOLD USD 20250707 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| RFR EUR ESTRON/2.06280 11/14/24-5Y* LCH / DIR (EZ64KXLFNMN4) | 0.00 | -100.00 | 0.0000 | -0.0006 | ||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT ZAR SOLD USD 20250723 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| 31750QSL4 OTC EPUT FN 4.5 JUL25 92.46875 PUT / DIR (000000000) | 0.00 | -0.0000 | -0.0000 | |||

| 317U9EGA4 PIMCO SWAPTION 4.135 PUT USD 2025063 / DIR (EZXJWB9HGZH3) | 0.00 | 0.0000 | 0.0000 | |||

| 317U9EOA5 PIMCO SWAPTION 4.101 PUT USD 2025063 / DIR (EZXJWB9HGZH3) | 0.00 | 0.0000 | 0.0000 | |||

| 317U9FOA2 PIMCO SWAPTION 4.077 PUT USD 2025063 / DIR (EZXJWB9HGZH3) | 0.00 | 0.0000 | 0.0000 | |||

| 317U9IZA4 PIMCO SWAPTION 4.125 PUT USD 2025070 / DIR (EZY1VWC6W1B5) | 0.00 | -0.0000 | -0.0000 | |||

| 317U9G6A0 PIMCO SWAPTION 4.065 PUT USD 2025070 / DIR (EZJQZP36X547) | 0.00 | 0.0000 | 0.0000 | |||

| 317U9FPA1 PIMCO SWAPTION 3.677 CALL USD 202506 / DIR (EZY1GXGHBZM5) | 0.00 | 0.0000 | 0.0000 | |||

| 317U9GMA2 PIMCO SWAPTION 4.1 PUT USD 20250703 / DIR (EZ78N9X8M3Y4) | 0.00 | 0.0000 | 0.0000 | |||

| 317U9FTA7 PIMCO SWAPTION 4.05 PUT USD 20250630 / DIR (EZXJWB9HGZH3) | 0.00 | 0.0000 | 0.0000 | |||

| 317U9GBA4 PIMCO SWAPTION 2.38 CALL EUR 2025070 / DIR (EZ8HHXRGV1D7) | 0.00 | -0.0000 | -0.0000 | |||

| 317U9GEA1 PIMCO SWAPTION 4.075 PUT USD 2025070 / DIR (EZ78N9X8M3Y4) | 0.00 | -0.0000 | -0.0000 | |||

| 317U9IEA7 PIMCO SWAPTION 4.03 PUT USD 20250707 / DIR (EZY1VWC6W1B5) | -0.00 | -0.0000 | -0.0000 | |||

| 317U9JKA8 PIMCO SWAPTION 4.14 PUT USD 20250709 / DIR (EZYG54DQ9CL7) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD IDR BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| 317U9JRA1 PIMCO SWAPTION 4.12 PUT USD 20250709 / DIR (EZYG54DQ9CL7) | -0.00 | -0.0000 | -0.0000 | |||

| 317U9HMA0 PIMCO SWAPTION 4.019 PUT USD 2025070 / DIR (EZY1VWC6W1B5) | -0.00 | -0.0000 | -0.0000 | |||

| 317U9JSA0 PIMCO SWAPTION 4.122 PUT USD 2025071 / DIR (EZMLYZSNFH30) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD MXN BOUGHT USD 20250917 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT IDR SOLD USD 20250708 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| 31750QMA4 PIMCO CDSOPT PUT USD 1.0 20250716 / DCR (EZ967XY50V92) | -0.00 | -0.0000 | 0.0003 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| 31750QMB2 PIMCO CDSOPT PUT USD 0.9 20250716 / DCR (EZ967XY50V92) | -0.00 | -0.0000 | 0.0003 | |||

| 31750QN05 PIMCO CDSOPT PUT USD 0.85 20250716 / DCR (EZ967XY50V92) | -0.00 | -0.0000 | 0.0003 | |||

| 31750QN88 PIMCO CDSOPT PUT USD 0.85 20250716 / DCR (EZ967XY50V92) | -0.00 | -0.0000 | 0.0003 | |||

| SOLD IDR BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| 317U9LGA8 PIMCO SWAPTION 4.097 PUT USD 2025071 / DIR (EZHBWHSTV570) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| 317U9LLA2 PIMCO SWAPTION 4.095 PUT USD 2025071 / DIR (EZBYVN1N6JS0) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD THB BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT IDR SOLD USD 20250708 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD IDR BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| 31750QM06 PIMCO CDSOPT PUT USD 0.9 20250716 / DCR (EZ967XY50V92) | -0.00 | -0.0000 | 0.0003 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| 31750QSK6 OTC ECAL FN 4.5 JUL25 96.46875 CALL / DIR (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| 317U9M3A0 PIMCO SWAPTION 4.037 PUT USD 2025071 / DIR (EZ1JLHJ8JY10) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD KRW BOUGHT USD 20250714 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| 317U9MJA3 PIMCO SWAPTION 4.05 PUT USD 20250721 / DIR (EZPXSH8F93Y9) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD IDR BOUGHT USD 20250707 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| 317U9LFA9 PIMCO SWAPTION 2.46 CALL EUR 2025071 / DIR (EZLXC2V2MYF7) | -0.00 | -0.0000 | -0.0000 | |||

| 317U9GAA5 PIMCO SWAPTION 2.64 PUT EUR 20250703 / DIR (EZL9GW5599J4) | -0.00 | -0.0000 | -0.0000 | |||

| EURO-BOBL OPTION AUG25C 118.5 EXP 07/25/2025 / DIR (DE000F167SZ1) | -0.00 | -0.0000 | -0.0000 | |||

| 317U9MPA6 PIMCO SWAPTION 3.933 PUT USD 2025072 / DIR (EZTRLD6PX319) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD MXN BOUGHT USD 20250917 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| EURO-BUND OPTION AUG25C 132.5 EXP 07/25/2025 / DIR (DE000F1674Y7) | -0.00 | -0.0001 | -0.0001 | |||

| 317U9LEA0 PIMCO SWAPTION 2.72 PUT EUR 20250716 / DIR (EZMWVGHPD033) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD KRW BOUGHT USD 20250707 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| EURO-BOBL OPTION AUG25P 117.2 EXP 07/25/2025 / DIR (DE000F167SF3) | -0.00 | -0.0001 | -0.0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| 317U9MNA8 PIMCO SWAPTION 3.955 PUT USD 2025072 / DIR (EZTRLD6PX319) | -0.00 | -0.0001 | -0.0001 | |||

| 317U9FUA5 PIMCO SWAPTION 3.7 CALL USD 20250630 / DIR (EZY1GXGHBZM5) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| 317U9EPA4 PIMCO SWAPTION 3.701 CALL USD 202506 / DIR (EZY1GXGHBZM5) | -0.00 | -0.0001 | -0.0001 | |||

| 317U9N1A0 PIMCO SWAPTION 3.914 PUT USD 2025072 / DIR (EZBGX0TQ91B3) | -0.00 | -0.0001 | -0.0001 | |||

| 317U9N3A8 PIMCO SWAPTION 3.905 PUT USD 2025072 / DIR (EZBGX0TQ91B3) | -0.00 | -0.0001 | -0.0001 | |||

| 317U9IFA6 PIMCO SWAPTION 3.68 CALL USD 2025070 / DIR (EZJFGPMJB918) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| EURO-BUND OPTION AUG25P 129 EXP 07/25/2025 / DIR (DE000F167368) | -0.00 | -0.0001 | -0.0001 | |||

| 317U9MQA5 PIMCO SWAPTION 3.583 CALL USD 202507 / DIR (EZCLF3R2NG23) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD KRW BOUGHT USD 20250708 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | |||

| SOLD IDR BOUGHT USD 20250708 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | |||

| 317U9O6A3 PIMCO SWAPTION 3.875 PUT USD 2025072 / DIR (EZHZLXVZP143) | -0.00 | -0.0002 | -0.0002 | |||

| RFR USD SOFR/3.7165* 03/01/24-9Y* LCH / DIR (EZPPGS20SB55) | -0.00 | -100.00 | -0.0002 | -0.0025 | ||

| SOLD IDR BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | |||

| 317U9O7A2 PIMCO SWAPTION 3.525 CALL USD 202507 / DIR (EZ24N26H1YR9) | -0.00 | -0.0002 | -0.0002 | |||

| 317U9HNA9 PIMCO SWAPTION 3.669 CALL USD 202507 / DIR (EZJFGPMJB918) | -0.00 | -0.0002 | -0.0002 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | |||

| 317U9N4A7 PIMCO SWAPTION 3.555 CALL USD 202507 / DIR (EZMYNDCY8F38) | -0.00 | -0.0003 | -0.0003 | |||

| 317U9N2A9 PIMCO SWAPTION 3.564 CALL USD 202507 / DIR (EZMYNDCY8F38) | -0.00 | -0.0003 | -0.0003 | |||

| RFR USD SOFR/3.79500 08/06/24-10Y LCH / DIR (EZNY7TTVVKP4) | -0.00 | -0.0003 | -0.0005 | |||

| SOLD CHF BOUGHT USD 20250804 / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | |||

| 317U9G7A9 PIMCO SWAPTION 3.715 CALL USD 202507 / DIR (EZL4V0T519J1) | -0.00 | -0.0003 | -0.0003 | |||

| RFR USD SOFR/3.72186 03/01/24-7Y* LCH / DIR (EZBKXTPHC9Q8) | -0.00 | -0.0003 | -0.0003 | |||

| 317U9MOA7 PIMCO SWAPTION 3.605 CALL USD 202507 / DIR (EZCLF3R2NG23) | -0.00 | -0.0003 | -0.0003 | |||

| 317U9M4A9 PIMCO SWAPTION 3.637 CALL USD 202507 / DIR (EZ7SJVNDKPC9) | -0.00 | -0.0004 | -0.0004 | |||

| 317U9GFA0 PIMCO SWAPTION 3.725 CALL USD 202507 / DIR (EZ78XR7L6YX2) | -0.00 | -0.0004 | -0.0004 | |||

| RFR USD SOFR/3.75375 03/01/24-9Y* LCH / DIR (EZPPGS20SB55) | -0.00 | -120.00 | -0.0004 | -0.0027 | ||

| IRS EUR 2.35000 04/29/25-5Y LCH / DIR (EZ74X71XY4J2) | -0.00 | -0.0004 | -0.0004 | |||

| OIS CAD CAONREPO/3.0000 01/10/25-9Y* LCH / DIR (EZGTN9JZ4G83) | -0.00 | -66.67 | -0.0004 | 0.0010 | ||

| EURO-BUND FUTURE SEP25 XEUR 20250908 / DIR (DE000F1NGF53) | -0.00 | -0.0004 | -0.0004 | |||

| 317U9EHA3 PIMCO SWAPTION 3.735 CALL USD 202506 / DIR (EZY1GXGHBZM5) | -0.00 | -0.0005 | -0.0005 | |||

| 317U9LHA7 PIMCO SWAPTION 3.697 CALL USD 202507 / DIR (EZ1ZLHZPLNC3) | -0.00 | -0.0005 | -0.0005 | |||

| 317U9GNA1 PIMCO SWAPTION 3.75 CALL USD 2025070 / DIR (EZ78XR7L6YX2) | -0.00 | -0.0005 | -0.0005 | |||

| 317U9LMA1 PIMCO SWAPTION 3.695 CALL USD 202507 / DIR (EZSG2674R1G7) | -0.00 | -0.0005 | -0.0005 | |||

| 317U9MKA1 PIMCO SWAPTION 3.7 CALL USD 20250721 / DIR (EZQRZMCG5093) | -0.00 | -0.0006 | -0.0006 | |||

| RFR USD SOFR/3.71780 03/01/24-9Y* LCH / DIR (EZPPGS20SB55) | -0.00 | -120.00 | -0.0006 | -0.0028 | ||

| SOLD IDR BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0006 | -0.0006 | |||

| IRS EUR 2.40000 04/09/25-5Y LCH / DIR (EZVHX3M64G11) | -0.00 | -0.0006 | -0.0006 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0006 | -0.0006 | |||

| RFR USD SOFR/3.85000 08/05/24-10Y LCH / DIR (EZKZ3H4L0SC3) | -0.00 | -0.0006 | -0.0005 | |||

| RFR USD SOFR/3.7525* 03/01/24-9Y* LCH / DIR (EZPPGS20SB55) | -0.00 | -120.00 | -0.0006 | -0.0029 | ||

| 317U9J0A0 PIMCO SWAPTION 3.775 CALL USD 202507 / DIR (EZJFGPMJB918) | -0.00 | -0.0006 | -0.0006 | |||

| RFR USD SOFR/3.72680 03/01/24-7Y* LCH / DIR (EZBKXTPHC9Q8) | -0.00 | -0.0007 | -0.0006 | |||

| 317U9JQA2 PIMCO SWAPTION 3.77 CALL USD 2025070 / DIR (EZT76LRY6S63) | -0.00 | -0.0007 | -0.0007 | |||

| RFR USD SOFR/3.7317* 03/01/24-7Y* LCH / DIR (EZBKXTPHC9Q8) | -0.00 | -0.0007 | -0.0007 | |||

| 317U9JTA9 PIMCO SWAPTION 3.772 CALL USD 202507 / DIR (EZTK0K9DDPF2) | -0.00 | -0.0007 | -0.0007 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0007 | -0.0007 | |||

| 317U9JLA7 PIMCO SWAPTION 3.79 CALL USD 2025070 / DIR (EZT76LRY6S63) | -0.00 | -0.0008 | -0.0008 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0008 | -0.0008 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0009 | -0.0009 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0009 | -0.0009 | |||

| IRS AUD 4.00000 03/19/25-10Y LCH / DIR (EZMSCTBHCX60) | -0.00 | -80.00 | -0.0009 | 0.0032 | ||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0010 | -0.0010 | |||

| OIS CAD CAONREPO/3.00000 01/13/25-8Y* LC / DIR (EZKVS9DRRQP2) | -0.00 | -60.00 | -0.0010 | 0.0013 | ||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0010 | -0.0010 | |||

| 317U8PWA2 PIMCO SWAPTION 3.519 CALL USD 202507 / DIR (EZ1KS55XM884) | -0.00 | -89.47 | -0.0010 | 0.0068 | ||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0010 | -0.0010 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0010 | -0.0010 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0010 | -0.0010 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0010 | -0.0010 | |||

| 317U8R1A2 PIMCO SWAPTION 3.515 CALL USD 202507 / DIR (EZHRPWJDVDW8) | -0.00 | -86.67 | -0.0010 | 0.0049 | ||

| RFR USD SOFR/3.73910 03/01/24-7Y* LCH / DIR (EZBKXTPHC9Q8) | -0.00 | -0.0011 | -0.0010 | |||

| RFR USD SOFR/3.88400 03/25/25-10Y LCH / DIR (EZH2QB9TLWH9) | -0.00 | 200.00 | -0.0012 | -0.0004 | ||

| 317U8RLA0 PIMCO SWAPTION 3.489 CALL USD 202507 / DIR (EZ2BH915DBT1) | -0.00 | -81.25 | -0.0012 | 0.0053 | ||

| SOLD CHF BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0012 | -0.0012 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0013 | -0.0013 | |||

| RFR USD SOFR/3.90500 03/12/25-10Y LCH / DIR (EZ2V6Q3C4Q52) | -0.00 | 50.00 | -0.0013 | -0.0004 | ||

| RFR USD SOFR/3.90750 03/04/25-10Y LCH / DIR (EZP5RC766JJ0) | -0.00 | 50.00 | -0.0013 | -0.0004 | ||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0014 | -0.0014 | |||

| RFR USD SOFR/3.97500 03/21/25-10Y LCH / DIR (EZSTF4LLCQZ1) | -0.00 | 33.33 | -0.0017 | -0.0004 | ||

| RFR USD SOFR/3.84200 03/04/25-5Y LCH / DIR (EZSYJ06JDLK1) | -0.01 | 150.00 | -0.0018 | -0.0009 | ||

| SOLD PEN BOUGHT USD 20251103 / DFE (000000000) | -0.01 | -0.0020 | -0.0020 | |||

| 317U8D3A1 PIMCO SWAPTION 3.7565 CALL USD 20250 / DIR (EZF2KQT490F7) | -0.01 | -37.50 | -0.0020 | 0.0011 | ||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0021 | -0.0021 | |||

| IRS EUR 3.17900 11/29/23-5Y LCH / DIR (EZL4HC5NB145) | -0.01 | 66.67 | -0.0021 | -0.0008 | ||

| RFR USD SOFR/3.7626* 03/01/24-9Y* LCH / DIR (EZPPGS20SB55) | -0.01 | -220.00 | -0.0022 | -0.0045 | ||

| IRS EUR 3.25500 11/22/23-5Y LCH / DIR (EZ5V1L560G78) | -0.01 | 100.00 | -0.0023 | -0.0008 | ||

| RFR JPY MUTK/2.00000 06/18/25-30Y LCH / DIR (EZGXYMX8TZ55) | -0.01 | -0.0024 | -0.0027 | |||

| RFR USD SOFR/3.93000 03/24/25-10Y LCH / DIR (EZKR9TWV5646) | -0.01 | 40.00 | -0.0029 | -0.0007 | ||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0029 | -0.0029 | |||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0029 | -0.0029 | |||

| RFR GBP SONIO/3.50000 03/19/25-5Y LCH / DIR (EZ4P0PH8GZ40) | -0.01 | -57.89 | -0.0030 | 0.0047 | ||

| 317U88WA0 PIMCO SWAPTION 3.7075 CALL USD 20250 / DIR (EZ10PVR5LK98) | -0.01 | -42.86 | -0.0030 | 0.0025 | ||

| RFR USD SOFR/3.80740 03/01/24-4Y* LCH / DIR (EZ5FK37PXZM8) | -0.01 | -325.00 | -0.0035 | -0.0052 | ||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.01 | -0.0036 | -0.0036 | |||

| RFR USD SOFR/3.83600 05/02/25-10Y LCH / DIR (EZ9FQ1FHSFC5) | -0.01 | -0.0040 | -0.0040 | |||

| 317U8CPA9 PIMCO SWAPTION 3.739 CALL USD 202508 / DIR (EZ02MS39Q829) | -0.01 | -35.29 | -0.0042 | 0.0026 | ||

| SOLD PEN BOUGHT USD 20250814 / DFE (000000000) | -0.01 | -0.0045 | -0.0045 | |||

| 317U88TA4 PIMCO SWAPTION 3.7 CALL USD 20250804 / DIR (EZ10PVR5LK98) | -0.01 | -14.29 | -0.0047 | 0.0008 | ||

| RFR USD SOFR/3.69392 09/03/24-7Y* CME / DIR (EZPDSL9DRNN3) | -0.01 | -333.33 | -0.0052 | -0.0077 | ||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.02 | -0.0059 | -0.0059 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.02 | -0.0060 | -0.0060 | |||

| RFR JPY MUTK/1.25000 06/18/25-7Y LCH / DIR (EZ9MYT9FCQB5) | -0.02 | -0.0063 | -0.0063 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.02 | -0.0064 | -0.0064 | |||

| SOLD PEN BOUGHT USD 20251114 / DFE (000000000) | -0.02 | -0.0069 | -0.0069 | |||

| OIS CAD CAONREPO/3.7500 12/20/23-10Y LCH / DIR (EZ1777XRV3N1) | -0.02 | -20.83 | -0.0071 | 0.0025 | ||

| SOLD BRL BOUGHT USD 20250702 / DFE (000000000) | -0.02 | -0.0076 | -0.0076 | |||

| RFR USD SOFR/3.90000 09/02/25-9Y* LCH / DIR (000000000) | -0.02 | -0.0080 | -0.0080 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.02 | -0.0083 | -0.0083 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.03 | -0.0092 | -0.0092 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.03 | -0.0092 | -0.0092 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.03 | -0.0093 | -0.0093 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.03 | -0.0094 | -0.0094 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.03 | -0.0094 | -0.0094 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.03 | -0.0096 | -0.0096 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.03 | -0.0097 | -0.0097 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.03 | -0.0101 | -0.0101 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.03 | -0.0103 | -0.0103 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.03 | -0.0103 | -0.0103 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.03 | -0.0104 | -0.0104 | |||

| SOLD CAD BOUGHT USD 20250805 / DFE (000000000) | -0.03 | -0.0113 | -0.0113 | |||

| RFR USD SOFR/3.69100 03/01/24-7Y* LCH / DIR (EZBKXTPHC9Q8) | -0.03 | -0.0125 | -0.0125 | |||

| SOLD GBP BOUGHT USD 20250804 / DFE (000000000) | -0.04 | -0.0150 | -0.0150 | |||

| OIS CAD CAONREPO/3.5000 03/28/24-8Y* LCH / DIR (EZ6CFT2N3TR9) | -0.05 | -21.31 | -0.0178 | 0.0064 | ||

| RFR USD SOFR/3.75000 09/02/25-7Y* LCH / DIR (000000000) | -0.05 | -0.0180 | -0.0180 | |||

| SOLD GBP BOUGHT USD 20250702 / DFE (000000000) | -0.06 | -0.0232 | -0.0232 | |||

| IRS EUR 2.25000 09/17/25-10Y LCH / DIR (EZNLCZXFPVL3) | -0.07 | -43.33 | -0.0251 | 0.0220 | ||

| ZCS BRL 11.4071 07/09/24-01/04/27 CME / DIR (EZNTFR000L79) | -0.08 | -15.56 | -0.0279 | 0.0075 | ||

| RFR USD SOFR/3.87400 03/05/25-10Y LCH / DIR (EZMZ9H14KX59) | -0.12 | 11,700.00 | -0.0431 | -0.0424 | ||

| SOLD EUR BOUGHT USD 20250804 / DFE (000000000) | -0.12 | -0.0443 | -0.0443 | |||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0.29 | -0.1045 | -0.1045 | |||

| EW / Edwards Lifesciences Corporation | -2.25 | 218.36 | -0.8207 | -0.4269 |