Mga Batayang Estadistika

| Nilai Portofolio | $ 181,960,221 |

| Posisi Saat Ini | 157 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

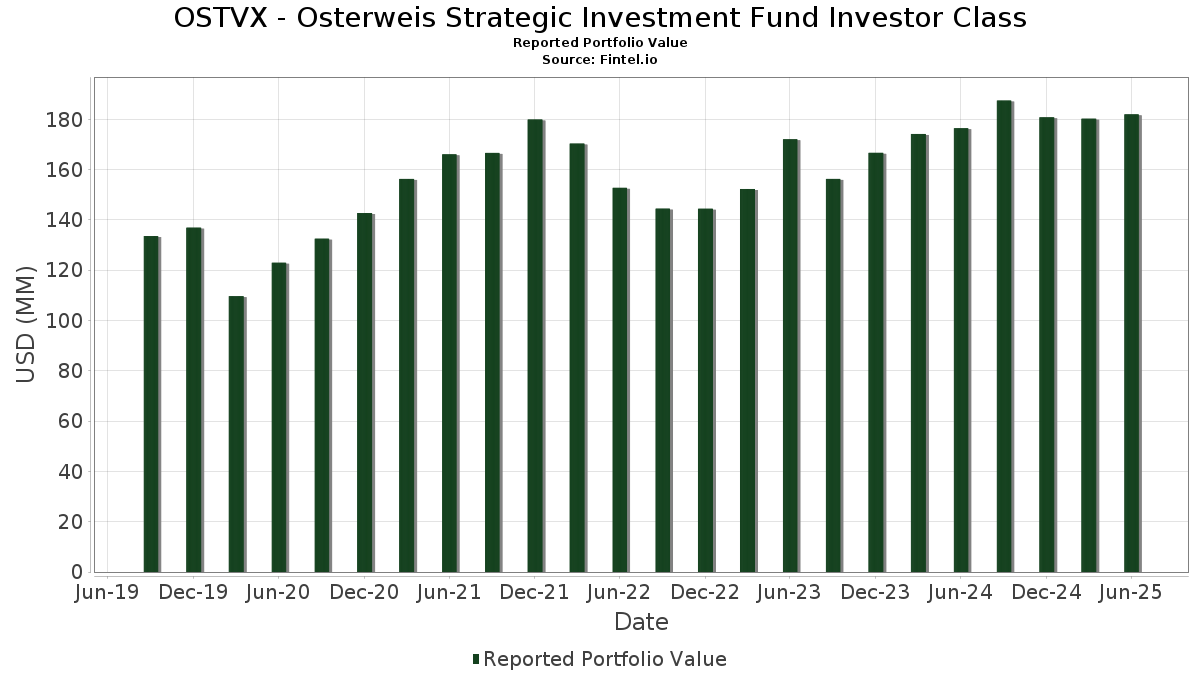

OSTVX - Osterweis Strategic Investment Fund Investor Class telah mengungkapkan total kepemilikan 157 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 181,960,221 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama OSTVX - Osterweis Strategic Investment Fund Investor Class adalah Microsoft Corporation (US:MSFT) , Alphabet Inc. (US:GOOG) , Amazon.com, Inc. (US:AMZN) , Broadcom Inc. (US:AVGO) , and Visa Inc. (US:V) . Posisi baru OSTVX - Osterweis Strategic Investment Fund Investor Class meliputi: Terreno Realty Corporation (US:TRNO) , Synopsys, Inc. (US:SNPS) , Labcorp Holdings Inc. (US:LH) , Varex Imaging Corp (US:US92214XAC02) , and American Airlines Inc/AAdvantage Loyalty IP Ltd (XX:US00253XAA90) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 5.41 | 2.9725 | 1.8414 | |

| 0.02 | 10.05 | 5.5220 | 1.8360 | |

| 0.02 | 3.18 | 1.7484 | 1.7484 | |

| 0.05 | 2.99 | 1.6397 | 1.6397 | |

| 0.00 | 2.09 | 1.1454 | 1.1454 | |

| 0.02 | 4.31 | 2.3658 | 1.0636 | |

| 0.01 | 1.83 | 1.0056 | 1.0056 | |

| 0.01 | 3.68 | 2.0192 | 0.8815 | |

| 1.04 | 0.5737 | 0.5737 | ||

| 0.03 | 6.36 | 3.4902 | 0.5719 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.91 | 2.91 | 1.5987 | -4.2360 | |

| 0.01 | 1.85 | 1.0152 | -0.7744 | |

| 0.01 | 2.21 | 1.2121 | -0.5214 | |

| 0.25 | 0.1350 | -0.2642 | ||

| 0.01 | 2.40 | 1.3203 | -0.2631 | |

| 0.11 | 0.0581 | -0.2212 | ||

| 0.03 | 3.99 | 2.1911 | -0.1847 | |

| 0.01 | 3.16 | 1.7379 | -0.1466 | |

| 0.02 | 3.56 | 1.9535 | -0.1345 | |

| 0.29 | 0.1583 | -0.1244 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-22 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.02 | 15.60 | 10.05 | 53.17 | 5.5220 | 1.8360 | |||

| GOOG / Alphabet Inc. | 0.04 | 0.00 | 7.08 | 13.55 | 3.8886 | 0.3869 | |||

| AMZN / Amazon.com, Inc. | 0.03 | 6.05 | 6.36 | 22.31 | 3.4902 | 0.5719 | |||

| AVGO / Broadcom Inc. | 0.02 | 63.22 | 5.41 | 168.72 | 2.9725 | 1.8414 | |||

| V / Visa Inc. | 0.01 | 0.00 | 4.68 | 1.32 | 2.5680 | -0.0238 | |||

| DHR / Danaher Corporation | 0.02 | 92.78 | 4.31 | 85.81 | 2.3658 | 1.0636 | |||

| LHX / L3Harris Technologies, Inc. | 0.02 | 0.00 | 4.31 | 19.84 | 2.3651 | 0.3472 | |||

| AWK / American Water Works Company, Inc. | 0.03 | 0.00 | 3.99 | -5.70 | 2.1911 | -0.1847 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 0.00 | 3.71 | 18.17 | 2.0364 | 0.2746 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | 89.74 | 3.68 | 81.44 | 2.0192 | 0.8815 | |||

| AZO / AutoZone, Inc. | 0.00 | 0.00 | 3.63 | -2.63 | 1.9959 | -0.1002 | |||

| WCN / Waste Connections, Inc. | 0.02 | 0.00 | 3.56 | -4.33 | 1.9535 | -0.1345 | |||

| EADSY / Airbus SE - Depositary Receipt (Common Stock) | 0.06 | -14.36 | 3.37 | 1.72 | 1.8491 | -0.0100 | |||

| ADI / Analog Devices, Inc. | 0.01 | -0.16 | 3.28 | 17.83 | 1.8004 | 0.2382 | |||

| FERG / Ferguson Enterprises Inc. | 0.01 | 0.00 | 3.19 | 35.91 | 1.7543 | 0.4344 | |||

| AMAT / Applied Materials, Inc. | 0.02 | 3.18 | 1.7484 | 1.7484 | |||||

| PGR / The Progressive Corporation | 0.01 | 0.00 | 3.16 | -5.69 | 1.7379 | -0.1466 | |||

| BRO / Brown & Brown, Inc. | 0.03 | 15.80 | 3.14 | 3.18 | 1.7271 | 0.0160 | |||

| LAMR / Lamar Advertising Company | 0.03 | 14.52 | 3.10 | 22.13 | 1.7036 | 0.2775 | |||

| INTU / Intuit Inc. | 0.00 | 0.00 | 2.99 | 28.30 | 1.6433 | 0.3335 | |||

| TRNO / Terreno Realty Corporation | 0.05 | 2.99 | 1.6397 | 1.6397 | |||||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 2.96 | 8.54 | 1.6269 | 0.0944 | |||

| US60934N6821 / FEDERATED U.S. TREASURY CASH RESERVES FUND INSTITUTIONAL SHARES | 2.91 | -71.98 | 2.91 | -71.99 | 1.5987 | -4.2360 | |||

| CRM / Salesforce, Inc. | 0.01 | -16.09 | 2.40 | -14.72 | 1.3203 | -0.2631 | |||

| AME / AMETEK, Inc. | 0.01 | 32.32 | 2.37 | 39.16 | 1.3039 | 0.3455 | |||

| ACN / Accenture plc | 0.01 | -25.36 | 2.21 | -28.51 | 1.2121 | -0.5214 | |||

| LIN / Linde plc | 0.00 | 0.00 | 2.09 | 0.77 | 1.1492 | -0.0170 | |||

| SNPS / Synopsys, Inc. | 0.00 | 2.09 | 1.1454 | 1.1454 | |||||

| DE / Deere & Company | 0.00 | 0.00 | 1.90 | 8.34 | 1.0416 | 0.0586 | |||

| NVDA / NVIDIA Corporation | 0.01 | -60.21 | 1.85 | -42.00 | 1.0152 | -0.7744 | |||

| LH / Labcorp Holdings Inc. | 0.01 | 1.83 | 1.0056 | 1.0056 | |||||

| KEYS / Keysight Technologies, Inc. | 0.01 | 0.00 | 1.67 | 9.42 | 0.9193 | 0.0602 | |||

| ODFL / Old Dominion Freight Line, Inc. | 0.01 | 0.00 | 1.60 | -1.90 | 0.8783 | -0.0372 | |||

| BA / The Boeing Company | 0.01 | 0.00 | 1.57 | 22.92 | 0.8602 | 0.1443 | |||

| TPC / Tutor Perini Corporation | 1.13 | 104.73 | 0.6186 | 0.3092 | |||||

| US92214XAC02 / Varex Imaging Corp | 1.11 | 119.29 | 0.6119 | 0.3263 | |||||

| HRI / Herc Holdings Inc. | 1.04 | 0.5737 | 0.5737 | ||||||

| US00253XAA90 / American Airlines Inc/AAdvantage Loyalty IP Ltd | 1.04 | 53.69 | 0.5726 | 0.1919 | |||||

| UIS / Unisys Corporation | 1.03 | 0.5681 | 0.5681 | ||||||

| US01748XAD49 / Allegiant Travel Co | 1.00 | 37.55 | 0.5497 | 0.1410 | |||||

| CROWN CASTLE INTL CORP / STIV (22823PU19) | 1.00 | 0.5491 | 0.5491 | ||||||

| FMC CORP DISC COML PAPER 4/A2 / STIV (34410WU34) | 1.00 | 0.5490 | 0.5490 | ||||||

| RYDER SYS INC / STIV (78355AUB8) | 1.00 | 0.5484 | 0.5484 | ||||||

| JABIL INC DISC COML PAPER / STIV (46652LUE5) | 1.00 | 0.5481 | 0.5481 | ||||||

| BROOKFIELD RENEWABLE PART / STIV (11284WUN1) | 1.00 | 0.5476 | 0.5476 | ||||||

| US52603BAD91 / CONV. NOTE | 0.99 | 101.42 | 0.5458 | 0.2689 | |||||

| US12685JAE55 / Cable One Inc | 0.95 | 0.5210 | 0.5210 | ||||||

| US690732AF97 / Owens & Minor Inc | 0.89 | 41.97 | 0.4908 | 0.1375 | |||||

| JetBlue Airways Corp / JetBlue Loyalty LP / DBT (US476920AA15) | 0.83 | -1.31 | 0.4543 | -0.0168 | |||||

| Global Partners LP / GLP Finance Corp / DBT (US37954FAL85) | 0.81 | 0.4463 | 0.4463 | ||||||

| US645370AB35 / New Home Co Inc/The | 0.78 | 51.66 | 0.4277 | 0.1394 | |||||

| US060335AB23 / Banijay Entertainment SASU | 0.78 | 51.36 | 0.4273 | 0.1382 | |||||

| KeHE Distributors LLC / KeHE Finance Corp / NextWave Distribution Inc / DBT (US487526AC91) | 0.78 | 0.91 | 0.4270 | -0.0058 | |||||

| DLX / Deluxe Corporation | 0.77 | 53.88 | 0.4255 | 0.1429 | |||||

| US00623PAB76 / Adams Homes, Inc. | 0.77 | 1.71 | 0.4247 | -0.0021 | |||||

| US156431AN85 / Century Aluminum Co | 0.76 | 0.79 | 0.4196 | -0.0061 | |||||

| NGL Energy Operating LLC / NGL Energy Finance Corp / DBT (US62922LAC28) | 0.76 | 51.60 | 0.4164 | 0.1357 | |||||

| US62886HBE09 / NCL Corp Ltd | 0.75 | 202.41 | 0.4138 | 0.2735 | |||||

| US98310WAM01 / Wyndham Destinations Inc Note M/w Clbl Bond | 0.75 | 0.40 | 0.4135 | -0.0081 | |||||

| US02406PAU49 / American Axle & Manufacturing Inc | 0.75 | 2.88 | 0.4121 | 0.0027 | |||||

| US69346VAA70 / Performance Food Group Inc 5.5% 10/15/2027 144A | 0.75 | 0.81 | 0.4114 | -0.0062 | |||||

| US70959WAJ27 / Penske Automotive Group Inc | 0.75 | 0.40 | 0.4108 | -0.0075 | |||||

| US37960XAA54 / Global Infrastructure Solutions Inc | 0.75 | 3.32 | 0.4106 | 0.0044 | |||||

| US96926JAC18 / William Carter Co/The | 0.75 | 0.4104 | 0.4104 | ||||||

| US90932LAG23 / United Airlines Inc | 0.75 | 0.81 | 0.4094 | -0.0057 | |||||

| US724479AQ31 / Pitney Bowes Inc | 0.74 | 2.07 | 0.4063 | -0.0003 | |||||

| US009066AB74 / CONVERTIBLE ZERO | 0.72 | 0.98 | 0.3981 | -0.0050 | |||||

| US48242WAC01 / KBR Inc | 0.72 | 0.3965 | 0.3965 | ||||||

| US20679LAB71 / Conduent Business Services LLC | 0.72 | 27.40 | 0.3936 | 0.0777 | |||||

| US25461LAA08 / DIRECTV Holdings LLC/DIRECTV Financing Co., Inc. | 0.70 | 2.80 | 0.3831 | 0.0020 | |||||

| US929566AL19 / Wabash National Corp | 0.68 | 0.89 | 0.3735 | -0.0052 | |||||

| CPI CG Inc / DBT (US12598FAC32) | 0.64 | -0.16 | 0.3518 | -0.0087 | |||||

| US911163AA17 / UNFI 6 3/4 10/15/28 | 0.62 | -0.16 | 0.3390 | -0.0080 | |||||

| US76009NAL47 / Rent-A-Center Inc/TX | 0.59 | 3.87 | 0.3245 | 0.0055 | |||||

| US192108BC19 / Coeur Mining Inc | 0.59 | 2.27 | 0.3215 | 0.0003 | |||||

| REAL ALLOY EQUITY / EC (N/A) | 0.00 | 0.58 | 0.3197 | 0.3197 | |||||

| US390607AF62 / GREAT LAKES DRDG and DOCK CORP NEW 5.25% 06/01/2029 144A | 0.58 | 6.26 | 0.3169 | 0.0118 | |||||

| US345370CX67 / Ford Motor Co | 0.58 | 0.88 | 0.3159 | -0.0046 | |||||

| 43AB / Rolls-Royce plc - Corporate Bond/Note | 0.57 | 0.35 | 0.3137 | -0.0063 | |||||

| BXMT / Blackstone Mortgage Trust, Inc. | 0.53 | 3.31 | 0.2917 | 0.0031 | |||||

| EZPW / EZCORP, Inc. | 0.53 | 3.54 | 0.2894 | 0.0038 | |||||

| MTW / The Manitowoc Company, Inc. | 0.53 | 2.33 | 0.2893 | 0.0004 | |||||

| Xerox Corp / DBT (US984121CS05) | 0.52 | 5.43 | 0.2878 | 0.0084 | |||||

| FCFS / FirstCash Holdings, Inc. | 0.52 | 2.17 | 0.2845 | -0.0003 | |||||

| Perenti Finance Pty Ltd / DBT (US71367VAB53) | 0.52 | 0.19 | 0.2842 | -0.0056 | |||||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 0.52 | 0.2834 | 0.2834 | ||||||

| Tidewater Inc / DBT (US88642RAE99) | 0.51 | 0.2827 | 0.2827 | ||||||

| US98379JAA34 / XPO Escrow Sub LLC | 0.51 | -0.19 | 0.2818 | -0.0070 | |||||

| NPO / Enpro Inc. | 0.51 | 0.2814 | 0.2814 | ||||||

| Empire Communities Corp / DBT (US29163VAG86) | 0.51 | 0.99 | 0.2812 | -0.0031 | |||||

| GT / The Goodyear Tire & Rubber Company - Depositary Receipt (Common Stock) | 0.51 | 0.2798 | 0.2798 | ||||||

| US45674GAB05 / INEOS Quattro Finance 2 Plc | 0.51 | -1.93 | 0.2785 | -0.0122 | |||||

| US36170JAB26 / GGAM Finance Ltd | 0.51 | 0.00 | 0.2776 | -0.0065 | |||||

| US143658BN13 / Carnival Corp | 0.50 | 0.80 | 0.2769 | -0.0044 | |||||

| US422704AH97 / Hecla Mining Co | 0.50 | 0.00 | 0.2769 | -0.0065 | |||||

| US69145LAC81 / OXFORD FIN LLC/CO ISS II SR UNSECURED 144A 02/27 6.375 | 0.50 | 1.62 | 0.2763 | -0.0021 | |||||

| Vistra Operations Co LLC / DBT (US92840VAT98) | 0.50 | 0.20 | 0.2761 | -0.0056 | |||||

| US222070AE41 / Coty Inc | 0.50 | 0.60 | 0.2755 | -0.0047 | |||||

| US644274AH54 / New Enterprise Stone & Lime Co Inc | 0.50 | 3.73 | 0.2754 | 0.0039 | |||||

| US303250AE41 / FAIR ISAAC CORP SR UNSECURED 144A 05/26 5.25 | 0.50 | 0.00 | 0.2750 | -0.0060 | |||||

| US42704LAA26 / Herc Holdings, Inc. | 0.50 | 0.60 | 0.2748 | -0.0046 | |||||

| US00751YAH99 / Advance Auto Parts Inc | 0.50 | 0.20 | 0.2748 | -0.0059 | |||||

| US398433AP71 / Griffon Corp | 0.50 | 2.25 | 0.2747 | -0.0000 | |||||

| US87165BAG86 / Synchrony Financial | 0.50 | 0.00 | 0.2744 | -0.0061 | |||||

| US31944TAA88 / FirstCash Inc | 0.50 | 2.89 | 0.2742 | 0.0018 | |||||

| WIX / Wix.com Ltd. | 0.50 | 1.43 | 0.2739 | -0.0019 | |||||

| US57701RAJ14 / Mattamy Group Corp | 0.50 | 2.47 | 0.2735 | 0.0007 | |||||

| US00790RAA23 / Advanced Drainage Systems Inc | 0.50 | 0.81 | 0.2722 | -0.0035 | |||||

| US48850PAA21 / Ken Garff Automotive LLC | 0.49 | 3.13 | 0.2715 | 0.0024 | |||||

| US94419LAM37 / CONV. NOTE | 0.49 | 0.41 | 0.2687 | -0.0051 | |||||

| US382550BN08 / Goodyear Tire & Rubber Co/The | 0.49 | 5.40 | 0.2684 | 0.0082 | |||||

| US83545GBD34 / Sonic Automotive Inc | 0.49 | 5.43 | 0.2665 | 0.0081 | |||||

| US82873MAA18 / Simmons Foods Inc/Simmons Prepared Foods Inc/Simmons Pet Food Inc/Simmons Feed | 0.47 | 1.75 | 0.2564 | -0.0012 | |||||

| US86722AAD54 / SunCoke Energy Inc | 0.47 | 1.31 | 0.2557 | -0.0022 | |||||

| US90290MAD39 / US FOODS INC 4.75% 02/15/2029 144A | 0.46 | 1.99 | 0.2538 | -0.0007 | |||||

| US37185LAL62 / GENESIS ENERGY LP | 0.46 | 0.44 | 0.2510 | -0.0044 | |||||

| US12467AAF57 / C&S Group Enterprises LLC | 0.45 | 7.89 | 0.2482 | 0.0133 | |||||

| US75602BAA70 / REAL HERO MERGER SUB 2 6.25% 02/01/2029 144A | 0.43 | -8.25 | 0.2387 | -0.0270 | |||||

| ENVA / Enova International, Inc. | 0.43 | 59.48 | 0.2362 | 0.0848 | |||||

| US913229AA80 / United Wholesale Mortgage LLC | 0.42 | 141.04 | 0.2295 | 0.1320 | |||||

| Adient Global Holdings Ltd / DBT (US00687YAD76) | 0.41 | 9.95 | 0.2248 | 0.0158 | |||||

| US404083AB35 / HAS Capital Income Opportunity Fund II LLC | 0.39 | 1.55 | 0.2161 | -0.0013 | |||||

| XROX / Xerox Holdings Corporation - Depositary Receipt (Common Stock) | 0.38 | 11.83 | 0.2076 | 0.0177 | |||||

| ENVA / Enova International, Inc. | 0.37 | 1.94 | 0.2025 | -0.0002 | |||||

| US00687YAB11 / Adient Global Holdings Ltd. | 0.36 | 3.14 | 0.1983 | 0.0013 | |||||

| BBALN / BBA US HOLDINGS INC COMPANY GUAR 144A 03/28 4 | 0.35 | -1.13 | 0.1924 | -0.0065 | |||||

| US20914UAF30 / Consolidated Energy Finance SA | 0.34 | 0.00 | 0.1894 | -0.0040 | |||||

| US91153LAA52 / United Shore Financial Services LLC | 0.32 | 0.31 | 0.1758 | -0.0035 | |||||

| Primo Water Holdings Inc / Triton Water Holdings Inc / DBT (US74168RAB96) | 0.29 | 1.75 | 0.1599 | -0.0010 | |||||

| Calumet Specialty Products Partners LP / Calumet Finance Corp / DBT (US131477AY72) | 0.29 | -42.74 | 0.1583 | -0.1244 | |||||

| US679295AD75 / Okta Inc | 0.29 | 1.06 | 0.1568 | -0.0017 | |||||

| STL Holding Co LLC / DBT (US861036AB75) | 0.26 | 2.34 | 0.1439 | -0.0003 | |||||

| US645370AB35 / New Home Co Inc/The | 0.26 | 0.1401 | 0.1401 | ||||||

| Champion Iron Canada Inc / DBT (US15853BAA98) | 0.25 | 0.1392 | 0.1392 | ||||||

| US95081QAP90 / WESCO DISTRIBUTION INC | 0.25 | -0.39 | 0.1391 | -0.0039 | |||||

| JAZZ / Jazz Pharmaceuticals plc | 0.25 | -30.30 | 0.1391 | -0.0650 | |||||

| US143658BR27 / Carnival Corp | 0.25 | 1.61 | 0.1388 | -0.0006 | |||||

| US131477AW17 / Calumet Specialty Products Partners LP / Calumet Finance Corp. | 0.25 | 9.69 | 0.1370 | 0.0091 | |||||

| US477839AB04 / CONV. NOTE | 0.25 | -0.40 | 0.1369 | -0.0038 | |||||

| US43734LAA44 / Home Point Capital Inc | 0.25 | 0.00 | 0.1369 | -0.0031 | |||||

| US12116LAA70 / Burford Capital Global Finance LLC | 0.25 | -0.40 | 0.1361 | -0.0035 | |||||

| CNR / Core Natural Resources, Inc. | 0.25 | -1.20 | 0.1351 | -0.0051 | |||||

| US85172FAN96 / Springleaf Finance Corp Bond | 0.25 | -65.49 | 0.1350 | -0.2642 | |||||

| US405024AB67 / Haemonetics Corp | 0.24 | 1.26 | 0.1330 | -0.0017 | |||||

| US44932FAA57 / IAC Financeco 2 Inc | 0.24 | 0.83 | 0.1330 | -0.0019 | |||||

| US302301AG16 / EZCORP Inc | 0.21 | -1.87 | 0.1158 | -0.0046 | |||||

| US98421MAB28 / Xerox Holdings Corp | 0.19 | 8.52 | 0.1053 | 0.0064 | |||||

| US143905AP21 / CSV 4 1/4 05/15/29 | 0.19 | 3.85 | 0.1039 | 0.0015 | |||||

| US451102BT32 / Icahn Enterprises LP / Icahn Enterprises Finance Corp | 0.18 | 0.00 | 0.0971 | -0.0022 | |||||

| US62886EAY41 / NCR CORPORATION NEW 5% 10/01/2028 144A | 0.17 | -27.92 | 0.0952 | -0.0400 | |||||

| US382550BF73 / Goodyear Tire Bond | 0.14 | -44.35 | 0.0760 | -0.0633 | |||||

| US71367VAA70 / Perenti Finance Pty Ltd | 0.12 | 0.00 | 0.0652 | -0.0015 | |||||

| US958102AM75 / Western Digital Corp 4.75% 02/15/2026 Bond | 0.11 | -78.87 | 0.0581 | -0.2212 | |||||

| US345370CZ16 / CONVERTIBLE ZERO | 0.10 | 1.02 | 0.0544 | -0.0007 | |||||

| CONSEN / Consolidated Energy Finance SA | 0.10 | 1.04 | 0.0534 | -0.0011 | |||||

| ADR TONGJIANG CO. ESCROW / EC (N/A) | 2.29 | 0.00 | 0.0009 | 0.0009 | |||||

| Southeastern Grocers Inc / EC (N/A) | 0.01 | 0.00 | 0.0002 | 0.0002 |