Mga Batayang Estadistika

| Nilai Portofolio | $ 55,517,534 |

| Posisi Saat Ini | 59 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

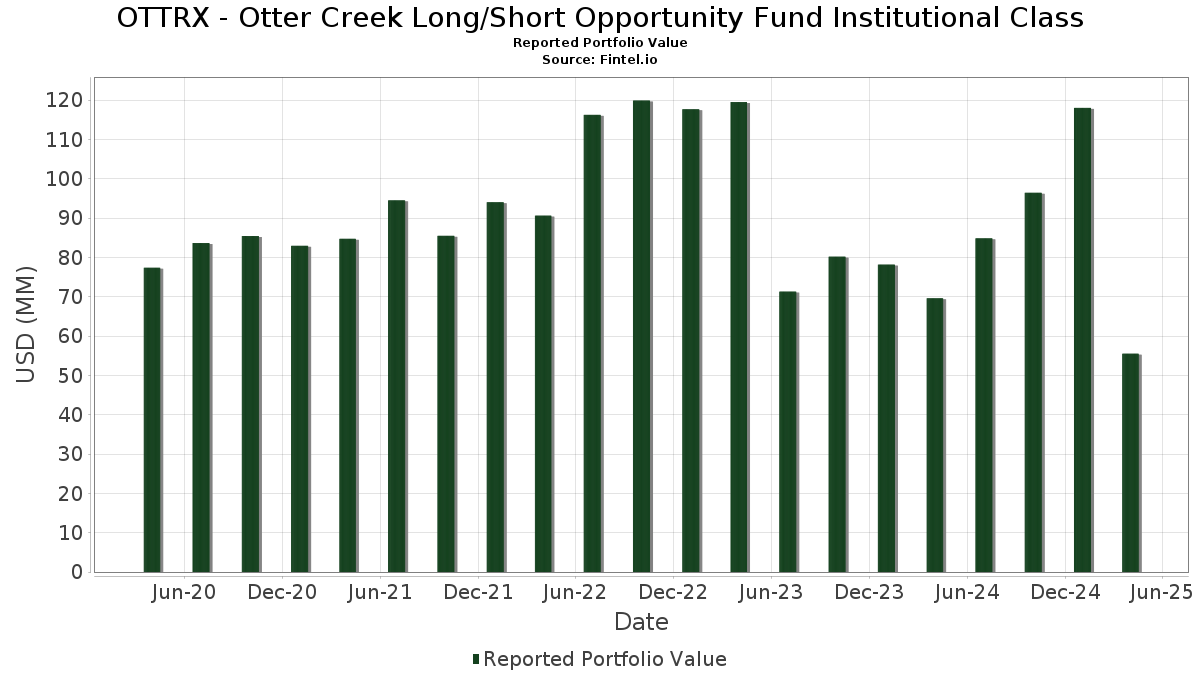

OTTRX - Otter Creek Long/Short Opportunity Fund Institutional Class telah mengungkapkan total kepemilikan 59 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 55,517,534 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama OTTRX - Otter Creek Long/Short Opportunity Fund Institutional Class adalah Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio (US:US61747C5821) , Parsons Corporation (US:PSN) , Intercontinental Exchange, Inc. (US:ICE) , F5, Inc. (US:FFIV) , and Quanta Services, Inc. (US:PWR) . Posisi baru OTTRX - Otter Creek Long/Short Opportunity Fund Institutional Class meliputi: Workday, Inc. (US:WDAY) , Take-Two Interactive Software, Inc. (US:TTWO) , Ryan Specialty Holdings, Inc. (US:RYAN) , CenterPoint Energy, Inc. (US:CNP) , and Ameren Corporation (US:AEE) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 35.66 | 35.66 | 30.9656 | 29.9271 | |

| 0.01 | 2.93 | 2.5422 | 2.5422 | |

| 0.01 | 2.64 | 2.2893 | 2.2893 | |

| 0.01 | 2.36 | 2.0449 | 2.0449 | |

| 0.00 | 0.00 | 1.9483 | ||

| 0.03 | 2.17 | 1.8828 | 1.8828 | |

| 0.00 | 0.00 | 1.8246 | ||

| 0.05 | 1.77 | 1.5355 | 1.5355 | |

| 0.01 | 3.51 | 3.0438 | 1.5259 | |

| 0.02 | 1.74 | 1.5080 | 1.5080 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.63 | 0.5449 | -4.7410 | |

| 0.00 | 0.61 | 0.5264 | -3.5279 | |

| 0.00 | 0.63 | 0.5440 | -3.4894 | |

| 0.00 | 1.16 | 1.0061 | -3.0897 | |

| -0.01 | -3.53 | -3.0678 | -3.0678 | |

| -0.02 | -3.47 | -3.0131 | -3.0131 | |

| -0.02 | -3.30 | -2.8619 | -2.8619 | |

| 0.00 | 0.62 | 0.5375 | -2.6063 | |

| -0.02 | -2.97 | -2.5794 | -2.5794 | |

| 0.02 | 1.43 | 1.2391 | -2.5072 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-27 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US61747C5821 / Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio | 35.66 | 2,058.53 | 35.66 | 2,058.72 | 30.9656 | 29.9271 | |||

| PSN / Parsons Corporation | 0.07 | 16.61 | 4.58 | -1.65 | 3.9806 | 1.0507 | |||

| ICE / Intercontinental Exchange, Inc. | 0.03 | -18.36 | 4.56 | -14.20 | 3.9573 | 0.6185 | |||

| FFIV / F5, Inc. | 0.01 | 16.67 | 3.71 | 3.90 | 3.2182 | 0.9760 | |||

| PWR / Quanta Services, Inc. | 0.01 | -13.12 | 3.66 | -17.34 | 3.1788 | 0.3951 | |||

| LHX / L3Harris Technologies, Inc. | 0.02 | 32.75 | 3.65 | 18.03 | 3.1713 | 1.1209 | |||

| VRT / Vertiv Holdings Co | 0.04 | 36.80 | 3.54 | -0.17 | 3.0766 | 0.8452 | |||

| GLW / Corning Incorporated | 0.08 | 24.42 | 3.51 | 6.01 | 3.0475 | 0.9667 | |||

| LPLA / LPL Financial Holdings Inc. | 0.01 | 33.68 | 3.51 | 58.88 | 3.0438 | 1.5259 | |||

| CRM / Salesforce, Inc. | 0.01 | -32.06 | 3.47 | -46.57 | 3.0157 | -1.0706 | |||

| VLTO / Veralto Corporation | 0.03 | -27.55 | 3.10 | -32.81 | 2.6929 | -0.2081 | |||

| CP / Canadian Pacific Kansas City Limited | 0.04 | -5.91 | 3.00 | -14.33 | 2.6051 | 0.4036 | |||

| SBAC / SBA Communications Corporation | 0.01 | -16.59 | 2.95 | -39.55 | 2.5596 | 0.0149 | |||

| J / Jacobs Solutions Inc. | 0.02 | -28.18 | 2.93 | -36.55 | 2.5476 | -0.3591 | |||

| WDAY / Workday, Inc. | 0.01 | 2.93 | 2.5422 | 2.5422 | |||||

| MMM / 3M Company | 0.02 | -40.42 | 2.76 | -45.63 | 2.3998 | -0.7952 | |||

| TTWO / Take-Two Interactive Software, Inc. | 0.01 | 2.64 | 2.2893 | 2.2893 | |||||

| AVGO / Broadcom Inc. | 0.01 | 8.00 | 2.60 | -6.04 | 2.2570 | 0.5177 | |||

| FI / Fiserv, Inc. | 0.01 | -43.61 | 2.39 | -51.83 | 2.0719 | -1.0417 | |||

| GWRE / Guidewire Software, Inc. | 0.01 | 2.36 | 2.0449 | 2.0449 | |||||

| WRB / W. R. Berkley Corporation | 0.03 | -62.46 | 2.30 | -54.27 | 2.0013 | -1.1660 | |||

| BWIN / The Baldwin Insurance Group, Inc. | 0.05 | -56.35 | 2.23 | -55.64 | 1.9402 | -1.2255 | |||

| RYAN / Ryan Specialty Holdings, Inc. | 0.03 | 2.17 | 1.8828 | 1.8828 | |||||

| CNP / CenterPoint Energy, Inc. | 0.05 | 1.77 | 1.5355 | 1.5355 | |||||

| AEE / Ameren Corporation | 0.02 | 1.74 | 1.5080 | 1.5080 | |||||

| NDAQ / Nasdaq, Inc. | 0.02 | -74.13 | 1.43 | -76.06 | 1.2391 | -2.5072 | |||

| CMPO / CompoSecure, Inc. | 0.12 | -44.83 | 1.37 | -61.98 | 1.1928 | -1.0774 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -75.22 | 1.16 | -82.23 | 1.0061 | -3.0897 | |||

| RVTY / Revvity, Inc. | 0.01 | 1.13 | 0.9828 | 0.9828 | |||||

| META / Meta Platforms, Inc. | 0.00 | -90.63 | 0.63 | -92.54 | 0.5449 | -4.7410 | |||

| AMZN / Amazon.com, Inc. | 0.00 | -87.42 | 0.63 | -90.24 | 0.5440 | -3.4894 | |||

| MSFT / Microsoft Corporation | 0.00 | -87.00 | 0.62 | -87.64 | 0.5375 | -2.6063 | |||

| GOOGL / Alphabet Inc. | 0.00 | -87.92 | 0.61 | -90.60 | 0.5264 | -3.5279 | |||

| DKNG / DraftKings Inc. | 0.01 | 0.36 | 0.3151 | 0.3151 | |||||

| LFUS / Littelfuse, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.8990 | ||||

| WSO / Watsco, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.2371 | ||||

| IOT / Samsara Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.0521 | ||||

| TXN / Texas Instruments Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | 1.2517 | ||||

| EXPO / Exponent, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.0660 | ||||

| FSS / Federal Signal Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.4820 | ||||

| MSCI / MSCI Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.9483 | ||||

| VST / Vistra Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -1.2674 | ||||

| ADI / Analog Devices, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.3186 | ||||

| AAPL / Apple Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.8246 | ||||

| FICO / Fair Isaac Corporation | Short | -0.00 | -84.25 | -0.25 | -84.32 | -0.2177 | 0.8388 | ||

| OLLI / Ollie's Bargain Outlet Holdings, Inc. | Short | -0.00 | -0.35 | -0.3040 | -0.3040 | ||||

| SFM / Sprouts Farmers Market, Inc. | Short | -0.00 | -12.50 | -0.41 | -5.53 | -0.3563 | -0.0833 | ||

| ISRG / Intuitive Surgical, Inc. | Short | -0.00 | -1.29 | -1.1197 | -1.1197 | ||||

| VRNS / Varonis Systems, Inc. | Short | -0.04 | -1.59 | -1.3763 | -1.3763 | ||||

| CDNS / Cadence Design Systems, Inc. | Short | -0.01 | 9.55 | -1.83 | 9.60 | -1.5861 | -0.5384 | ||

| DSGX / The Descartes Systems Group Inc. | Short | -0.02 | -1.89 | -1.6380 | -1.6380 | ||||

| WMT / Walmart Inc. | Short | -0.02 | 5.26 | -1.95 | 24.92 | -1.6888 | -0.6572 | ||

| ROK / Rockwell Automation, Inc. | Short | -0.01 | -14.07 | -1.98 | -20.22 | -1.7205 | -0.0752 | ||

| BMI / Badger Meter, Inc. | Short | -0.01 | -2.01 | -1.7448 | -1.7448 | ||||

| MTSI / MACOM Technology Solutions Holdings, Inc. | Short | -0.02 | 18.07 | -2.03 | -7.38 | -1.7657 | -0.3857 | ||

| FIX / Comfort Systems USA, Inc. | Short | -0.01 | 587.50 | -2.19 | 526.36 | -1.8985 | -1.6789 | ||

| KAI / Kadant Inc. | Short | -0.01 | -2.21 | -1.9211 | -1.9211 | ||||

| LOAR / Loar Holdings Inc. | Short | -0.02 | 20.00 | -2.27 | 42.79 | -1.9710 | -0.9718 | ||

| BRBR / BellRing Brands, Inc. | Short | -0.03 | -0.00 | -2.31 | -0.26 | -2.0094 | -0.5508 | ||

| TSCO / Tractor Supply Company | Short | -0.05 | 773.77 | -2.70 | 96.93 | -2.3427 | -1.3464 | ||

| FDS / FactSet Research Systems Inc. | Short | -0.01 | -0.00 | -2.78 | -8.89 | -2.4109 | -0.4953 | ||

| CSW / CSW Industrials, Inc. | Short | -0.01 | 749.67 | -2.84 | 705.38 | -2.4691 | -2.2470 | ||

| TXRH / Texas Roadhouse, Inc. | Short | -0.02 | -2.97 | -2.5794 | -2.5794 | ||||

| SMH / VanEck ETF Trust - VanEck Semiconductor ETF | Short | -0.02 | -3.30 | -2.8619 | -2.8619 | ||||

| HWKN / Hawkins, Inc. | Short | -0.03 | 46.63 | -3.45 | 67.04 | -2.9925 | -1.6955 | ||

| LECO / Lincoln Electric Holdings, Inc. | Short | -0.02 | -3.47 | -3.0131 | -3.0131 | ||||

| LII / Lennox International Inc. | Short | -0.01 | -3.53 | -3.0678 | -3.0678 | ||||

| PKB / Invesco Exchange-Traded Fund Trust - Invesco Building & Construction ETF | Short | -0.03 | -9.39 | -4.74 | 12.82 | -4.1122 | -1.1758 | ||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | Short | -0.07 | 8.82 | -5.81 | 39.19 | -5.0489 | -2.1262 |