Mga Batayang Estadistika

| Nilai Portofolio | $ 169,007,343 |

| Posisi Saat Ini | 239 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

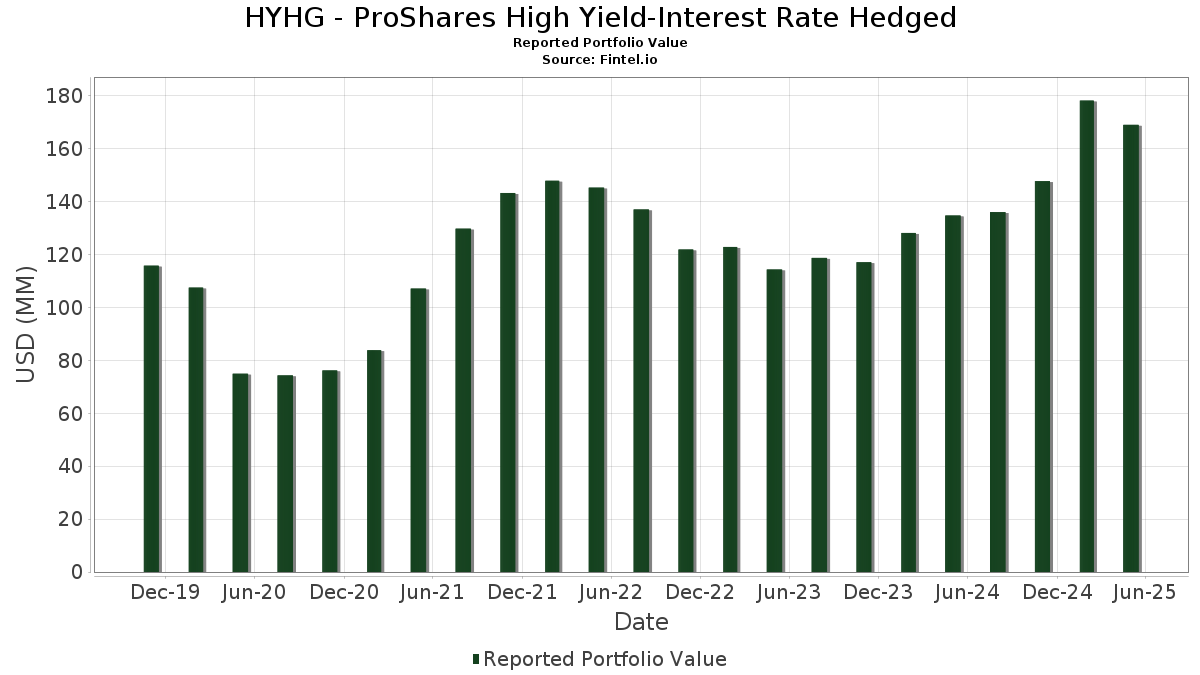

HYHG - ProShares High Yield-Interest Rate Hedged telah mengungkapkan total kepemilikan 239 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 169,007,343 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama HYHG - ProShares High Yield-Interest Rate Hedged adalah UPC Broadband Finco BV (NL:US90320BAA70) , Invesco Government & Agency Portfolio, Institutional Class (US:US8252528851) , DISH Network Corp (US:US25470MAG42) , CCO Holdings LLC / CCO Holdings Capital Corp (US:US1248EPCK74) , and MOZART DEBT MERGER SUB INC (US:US62482BAB80) . Posisi baru HYHG - ProShares High Yield-Interest Rate Hedged meliputi: UPC Broadband Finco BV (NL:US90320BAA70) , DISH Network Corp (US:US25470MAG42) , CCO Holdings LLC / CCO Holdings Capital Corp (US:US1248EPCK74) , MOZART DEBT MERGER SUB INC (US:US62482BAB80) , and Picard Midco, Inc. (US:US88632QAE35) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 3.33 | 1.9912 | 1.6868 | ||

| 1.87 | 1.1172 | 1.1172 | ||

| 1.80 | 1.0780 | 1.0780 | ||

| 1.27 | 0.7579 | 0.7579 | ||

| 1.26 | 0.7546 | 0.7546 | ||

| 1.24 | 0.7402 | 0.7402 | ||

| 1.16 | 0.6925 | 0.6925 | ||

| 1.08 | 0.6468 | 0.6468 | ||

| 1.56 | 0.9335 | 0.6454 | ||

| 1.02 | 0.6081 | 0.6081 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.45 | 0.2667 | -0.6437 | ||

| 0.60 | 0.3564 | -0.5696 | ||

| 0.28 | 0.1649 | -0.5299 | ||

| 0.07 | 0.0441 | -0.5276 | ||

| 1.01 | 0.6036 | -0.5073 | ||

| 0.19 | 0.1126 | -0.4334 | ||

| 0.49 | 0.2955 | -0.4098 | ||

| 0.00 | 0.0012 | -0.2855 | ||

| 0.50 | 0.2968 | -0.2687 | ||

| 0.12 | 0.0712 | -0.2581 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-28 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US90320BAA70 / UPC Broadband Finco BV | 3.33 | 509.89 | 1.9912 | 1.6868 | |||||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 3.05 | 1.34 | 3.05 | 1.33 | 1.8209 | 0.1480 | |||

| US25470MAG42 / DISH Network Corp | 2.45 | 7.07 | 1.4675 | 0.1910 | |||||

| US1248EPCK74 / CCO Holdings LLC / CCO Holdings Capital Corp | 2.44 | 2.05 | 1.4562 | 0.1274 | |||||

| US62482BAB80 / MOZART DEBT MERGER SUB INC | 2.12 | 0.81 | 1.2661 | 0.0967 | |||||

| US88632QAE35 / Picard Midco, Inc. | 2.11 | -14.60 | 1.2595 | -0.1134 | |||||

| US12543DBG43 / CHS/Community Health Systems Inc | 2.07 | 52.88 | 1.2360 | 0.4833 | |||||

| US853496AG21 / Standard Industries Inc/NJ | 1.95 | 93.83 | 1.1650 | 0.6055 | |||||

| US12429TAD63 / Mauser Packaging Solutions Holding Co | 1.89 | -4.74 | 1.1293 | 0.0254 | |||||

| Repurchase Agreement / RA (000000000) | 1.87 | 1.1172 | 1.1172 | ||||||

| Repurchase Agreement / RA (000000000) | 1.80 | 1.0780 | 1.0780 | ||||||

| US143658BN13 / Carnival Corp | 1.77 | 0.06 | 1.0587 | 0.0737 | |||||

| FM / First Quantum Minerals Ltd. | 1.56 | 201.93 | 0.9335 | 0.6454 | |||||

| US44332EAP16 / Hub International Ltd., Term Loan | 1.52 | -13.18 | 0.9098 | -0.0658 | |||||

| TransDigm, Inc. / DBT (US893647BU00) | 1.48 | -5.33 | 0.8823 | 0.0145 | |||||

| BHC / Bausch Health Companies Inc. | 1.47 | 96.65 | 0.8771 | 0.4617 | |||||

| AAL / American Airlines Group Inc. | 1.42 | -18.02 | 0.8462 | -0.1151 | |||||

| US92332YAB74 / Venture Global LNG, Inc. | 1.40 | -2.57 | 0.8387 | 0.0373 | |||||

| Quikrete Holdings, Inc. / DBT (US74843PAA84) | 1.34 | 164.69 | 0.8025 | 0.5202 | |||||

| Panther Escrow Issuer LLC / DBT (US69867RAA59) | 1.33 | 0.45 | 0.7931 | 0.0581 | |||||

| US29103CAA62 / Emerald Debt Merger Sub LLC | 1.30 | -27.41 | 0.7794 | -0.2202 | |||||

| US23918KAS78 / DaVita Inc | 1.29 | 0.70 | 0.7731 | 0.0588 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 1.28 | -12.35 | 0.7639 | -0.0474 | |||||

| 1261229 BC Ltd. / DBT (US68288AAA51) | 1.27 | 0.7579 | 0.7579 | ||||||

| Repurchase Agreement / RA (000000000) | 1.26 | 0.7546 | 0.7546 | ||||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 1.25 | 20.64 | 0.7484 | 0.1707 | |||||

| XYZ / Block, Inc. - Depositary Receipt (Common Stock) | 1.24 | 0.7402 | 0.7402 | ||||||

| US18912UAA07 / Cloud Software Group Inc | 1.20 | 0.17 | 0.7159 | 0.0502 | |||||

| US46284VAJ08 / Iron Mountain Inc | 1.18 | 1.11 | 0.7065 | 0.0557 | |||||

| US019579AA90 / Allied Universal Holdco LLC/Allied Universal Finance Corp/Atlas Luxco 4 Sarl | 1.17 | 0.34 | 0.7000 | 0.0508 | |||||

| MPT Operating Partnership LP / DBT (US55342UAQ76) | 1.16 | 146.19 | 0.6950 | 0.4318 | |||||

| Celanese US Holdings LLC / DBT (US15089QBA13) | 1.16 | 0.6925 | 0.6925 | ||||||

| Windstream Services LLC / DBT (US97381AAA07) | 1.14 | 0.62 | 0.6844 | 0.0514 | |||||

| US45824TBC80 / INTELSAT JACKSON HOLDINGS S.A. | 1.14 | -26.46 | 0.6832 | -0.1815 | |||||

| US640695AA01 / Neptune Bidco US Inc | 1.14 | 5.77 | 0.6802 | 0.0813 | |||||

| US88033GDK31 / Tenet Healthcare Corp | 1.13 | 0.27 | 0.6784 | 0.0485 | |||||

| US60337JAA43 / Minerva Merger Sub Inc | 1.13 | -6.38 | 0.6758 | 0.0036 | |||||

| Caesars Entertainment, Inc. / DBT (US12769GAC42) | 1.12 | 355.51 | 0.6678 | 0.5311 | |||||

| US92332YAC57 / Venture Global LNG Inc | 1.10 | -23.28 | 0.6584 | -0.1408 | |||||

| US88033GDQ01 / CORP. NOTE | 1.09 | 0.74 | 0.6546 | 0.0495 | |||||

| US82967NBJ63 / Sirius XM Radio Inc | 1.09 | -18.53 | 0.6495 | -0.0930 | |||||

| Repurchase Agreement / RA (000000000) | 1.08 | 0.6468 | 0.6468 | ||||||

| US64072TAC99 / CSC Holdings LLC | 1.08 | -4.01 | 0.6442 | 0.0192 | |||||

| POST / Post Holdings, Inc. | 1.03 | -32.77 | 0.6173 | -0.2375 | |||||

| Rogers Communications, Inc., Series NC5 / DBT (US775109DG30) | 1.03 | 105.59 | 0.6161 | 0.3371 | |||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 1.02 | 0.6081 | 0.6081 | ||||||

| Quikrete Holdings, Inc. / DBT (US74843PAB67) | 1.01 | 100.00 | 0.6068 | 0.3242 | |||||

| US25461LAA08 / DIRECTV Holdings LLC/DIRECTV Financing Co., Inc. | 1.01 | -49.42 | 0.6036 | -0.5073 | |||||

| US62886HBE09 / NCL Corp Ltd | 0.99 | 7.70 | 0.5938 | 0.0804 | |||||

| BLDR / Builders FirstSource, Inc. | 0.97 | -1.53 | 0.5782 | 0.0311 | |||||

| BRTSG8EN8 / Staples, Inc., Term Loan | 0.96 | -24.57 | 0.5730 | -0.1342 | |||||

| US911363AM11 / United Rentals North America Inc | 0.96 | 676.42 | 0.5714 | 0.5027 | |||||

| US74841CAB72 / Quicken Loans LLC / Quicken Loans Co-Issuer Inc | 0.95 | 0.95 | 0.5696 | 0.0444 | |||||

| US91327BAA89 / UNITI GROUP LP / UNITI GROUP FINANCE INC / CSL CAPITAL LLC 6.5% 02/15/2029 144A | 0.94 | 46.56 | 0.5609 | 0.2044 | |||||

| Connect Finco SARL / DBT (US20752TAB08) | 0.93 | 4.03 | 0.5561 | 0.0581 | |||||

| JetBlue Airways Corp. / DBT (US476920AA15) | 0.93 | -12.65 | 0.5534 | -0.0365 | |||||

| QSR / Restaurant Brands International Inc. | 0.92 | 0.77 | 0.5517 | 0.0421 | |||||

| US579063AB46 / Condor Merger Sub Inc | 0.92 | -9.67 | 0.5472 | -0.0168 | |||||

| US36268NAA81 / GTCR W-2 Merger Sub LLC | 0.90 | -30.78 | 0.5397 | -0.1857 | |||||

| Repurchase Agreement / RA (000000000) | 0.90 | 0.5390 | 0.5390 | ||||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0.90 | 116.43 | 0.5363 | 0.3058 | |||||

| XS1626768730 / Ecuador Government International Bond | 0.88 | 79.96 | 0.5265 | 0.2542 | |||||

| US35908MAD20 / FRONTIER COMMUNICATIONS HOLDINGS | 0.88 | 82.50 | 0.5239 | 0.2567 | |||||

| US25259KAA88 / Olympus Water US Holding Corp | 0.84 | -0.47 | 0.5034 | 0.0329 | |||||

| US638962AA84 / NCR Atleos Escrow Corp | 0.84 | 0.12 | 0.5029 | 0.0350 | |||||

| US68622TAA97 / Organon Finance 1 LLC | 0.84 | -1.29 | 0.5019 | 0.0285 | |||||

| Ryan Specialty LLC / DBT (US78351GAA31) | 0.84 | -0.12 | 0.5015 | 0.0342 | |||||

| US12511VAA61 / CDI Escrow Issuer Inc | 0.84 | -0.36 | 0.5007 | 0.0331 | |||||

| US513075BW03 / Lamar Media Corp | 0.83 | -9.15 | 0.4992 | -0.0119 | |||||

| Shift4 Payments LLC / DBT (US82453AAB35) | 0.83 | 83.04 | 0.4972 | 0.2442 | |||||

| US01883LAF04 / ALLIANT HOLD / CO-ISSUER REGD 144A P/P 7.00000000 | 0.82 | -27.51 | 0.4886 | -0.1393 | |||||

| Ardonagh Group Finance Ltd. / DBT (US039956AA59) | 0.82 | -0.49 | 0.4875 | 0.0312 | |||||

| US92840VAP76 / Vistra Operations Co. LLC | 0.80 | 0.38 | 0.4787 | 0.0349 | |||||

| US78410GAD60 / SBA Communications Corp | 0.79 | 0.63 | 0.4749 | 0.0355 | |||||

| US45258LAA52 / Imola Merger Corp | 0.79 | -0.38 | 0.4732 | 0.0309 | |||||

| US771049AA15 / RBLX 3 7/8 05/01/30 | 0.79 | 1.02 | 0.4732 | 0.0373 | |||||

| US68622TAB70 / Organon Finance 1 LLC | 0.79 | -25.05 | 0.4709 | -0.1138 | |||||

| US914906AY80 / Univision Communications, Inc. | 0.78 | -1.51 | 0.4679 | 0.0257 | |||||

| US17888HAB96 / Civitas Resources Inc | 0.78 | -6.36 | 0.4665 | 0.0026 | |||||

| WFRD / Weatherford International plc | 0.75 | -21.24 | 0.4482 | -0.0813 | |||||

| US18453HAD89 / CLEAR CHANNEL OUTDOOR HOLDINGS INC 7.5% 06/01/2029 144A | 0.75 | -5.55 | 0.4480 | 0.0062 | |||||

| Raven Acquisition Holdings LLC / DBT (US75420NAA19) | 0.75 | 0.81 | 0.4464 | 0.0340 | |||||

| US85205TAR14 / Spirit AeroSystems Inc | 0.75 | 22.53 | 0.4458 | 0.1068 | |||||

| Jane Street Group / DBT (US47077WAC29) | 0.74 | 0.68 | 0.4430 | 0.0335 | |||||

| US880349AU90 / Tenneco Inc | 0.74 | -25.73 | 0.4405 | -0.1115 | |||||

| SATS / EchoStar Corporation | 0.73 | -39.37 | 0.4369 | -0.2336 | |||||

| US92537RAA77 / THYELE 5 1/4 07/15/27 | 0.71 | 0.14 | 0.4270 | 0.0297 | |||||

| US432833AL52 / HILTON DOMESTIC OPERATING CO INC 4% 05/01/2031 144A | 0.71 | 0.85 | 0.4252 | 0.0325 | |||||

| US74166MAF32 / Prime Security Services Borrower LLC / Prime Finance Inc | 0.70 | 1.01 | 0.4185 | 0.0329 | |||||

| US914906AU68 / Univision Communications Inc | 0.69 | -0.14 | 0.4145 | 0.0279 | |||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 0.69 | 37.03 | 0.4142 | 0.1326 | |||||

| US16115QAF72 / Chart Industries Inc | 0.67 | -0.15 | 0.4027 | 0.0270 | |||||

| Belron UK Finance plc / DBT (US080782AA38) | 0.66 | 5.07 | 0.3969 | 0.0455 | |||||

| NGL Energy Operating LLC / DBT (US62922LAD01) | 0.66 | -12.99 | 0.3967 | -0.0280 | |||||

| Prime Healthcare Services, Inc. / DBT (US74165HAC25) | 0.66 | 7.68 | 0.3942 | 0.0531 | |||||

| 1011778 BC ULC / DBT (US68245XAR08) | 0.65 | -43.15 | 0.3872 | -0.2465 | |||||

| US71376LAE02 / Performance Food Group, Inc. | 0.65 | 0.94 | 0.3867 | 0.0304 | |||||

| US83283WAE30 / Smyrna Ready Mix Concrete LLC | 0.64 | -4.45 | 0.3855 | 0.0099 | |||||

| Repurchase Agreement / RA (000000000) | 0.63 | 0.3773 | 0.3773 | ||||||

| US53219LAW90 / LIFEPOINT HEALTH INC | 0.63 | 35.85 | 0.3765 | 0.1186 | |||||

| US05352TAA79 / AVANTOR FUNDING INC 4.625% 07/15/2028 144A | 0.63 | 0.64 | 0.3763 | 0.0283 | |||||

| US03969AAR14 / Ardagh Packaging Finance PLC / Ardagh Holdings USA Inc | 0.63 | 93.81 | 0.3746 | 0.1944 | |||||

| US058498AZ97 / Ball Corp | 0.62 | 0.16 | 0.3719 | 0.0266 | |||||

| US95081QAP90 / WESCO DISTRIBUTION INC | 0.62 | -0.48 | 0.3714 | 0.0237 | |||||

| US78410GAG91 / SBA Communications Corp | 0.62 | 1.48 | 0.3698 | 0.0305 | |||||

| US45074JAA25 / ITT Holdings LLC | 0.61 | -10.04 | 0.3645 | -0.0126 | |||||

| US71677KAA60 / PetSmart Inc / PetSmart Finance Corp | 0.60 | 1.52 | 0.3589 | 0.0295 | |||||

| Permian Resources Operating LLC / DBT (US71424VAB62) | 0.60 | -1.97 | 0.3574 | 0.0180 | |||||

| US71677KAB44 / PETM 7 3/4 02/15/29 | 0.60 | 22.84 | 0.3573 | 0.0864 | |||||

| US12769GAB68 / Caesars Entertainment, Inc. | 0.60 | -64.16 | 0.3564 | -0.5696 | |||||

| Allied Universal Holdco LLC / DBT (US019576AD90) | 0.59 | 0.51 | 0.3526 | 0.0259 | |||||

| US87901JAH86 / TEGNA Inc | 0.58 | -18.34 | 0.3468 | -0.0481 | |||||

| US92858RAB69 / Vmed O2 UK Financing I PLC | 0.58 | 4.71 | 0.3460 | 0.0386 | |||||

| Freedom Mortgage Holdings LLC / DBT (US35641AAA60) | 0.57 | -1.55 | 0.3427 | 0.0185 | |||||

| Lightning Power LLC / DBT (US53229KAA79) | 0.57 | -36.09 | 0.3423 | -0.1565 | |||||

| CLF / Cleveland-Cliffs Inc. | 0.57 | -27.46 | 0.3400 | -0.0962 | |||||

| Delek Logistics Partners LP / DBT (US24665FAD42) | 0.56 | -1.25 | 0.3319 | 0.0186 | |||||

| Sinclair Television Group, Inc. / DBT (US829259BH26) | 0.55 | 11.34 | 0.3290 | 0.0536 | |||||

| US389286AA34 / Gray Escrow II Inc | 0.55 | 3.00 | 0.3287 | 0.0319 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 0.54 | -10.71 | 0.3245 | -0.0139 | |||||

| Repurchase Agreement / RA (000000000) | 0.54 | 0.3234 | 0.3234 | ||||||

| US855170AA41 / Star Parent Inc | 0.54 | 31.71 | 0.3232 | 0.0946 | |||||

| Amentum Holdings, Inc. / DBT (US02352BAA35) | 0.54 | 0.00 | 0.3227 | 0.0221 | |||||

| US31556TAC36 / Fertitta Entertainment LLC / Fertitta Entertainment Finance Co Inc | 0.54 | 23.73 | 0.3214 | 0.0797 | |||||

| US92840VAH50 / VISTRA OPERATIONS CO LLC 4.375% 05/01/2029 144A | 0.53 | 1.34 | 0.3178 | 0.0257 | |||||

| US92858RAA86 / Vmed O2 UK Financing I PLC | 0.53 | -26.56 | 0.3176 | -0.0851 | |||||

| US92556HAE71 / Paramount Global | 0.53 | 0.19 | 0.3168 | 0.0227 | |||||

| CommScope LLC / DBT (US20338MAA09) | 0.52 | 0.3126 | 0.3126 | ||||||

| US205768AS39 / Comstock Resources Inc | 0.52 | 0.00 | 0.3117 | 0.0216 | |||||

| US257867BA88 / Rr Donnelley & Sons Bond | 0.52 | -2.07 | 0.3117 | 0.0152 | |||||

| US Acute Care Solutions LLC / DBT (US90367UAD37) | 0.52 | -0.57 | 0.3116 | 0.0197 | |||||

| SUN / Sunoco LP - Limited Partnership | 0.52 | 0.3115 | 0.3115 | ||||||

| NFE Financing LLC / DBT (US62909BAA52) | 0.52 | -27.11 | 0.3104 | -0.0863 | |||||

| US36168QAQ73 / GFL Environmental Inc | 0.52 | -12.65 | 0.3101 | -0.0201 | |||||

| US18972EAB11 / Clydesdale Acquisition Holdings, Inc. | 0.52 | 0.78 | 0.3100 | 0.0234 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0.52 | 0.3096 | 0.3096 | ||||||

| Ardonagh Finco Ltd. / DBT (US039853AA46) | 0.52 | 0.58 | 0.3091 | 0.0228 | |||||

| Voyager Parent LLC / DBT (US92921EAA01) | 0.52 | 0.3089 | 0.3089 | ||||||

| US55760LAB36 / Madison IAQ LLC | 0.51 | 0.19 | 0.3078 | 0.0222 | |||||

| US073685AD12 / Beacon Roofing Supply Inc 4.875% 11/01/2025 144a Bond | 0.51 | 0.3065 | 0.3065 | ||||||

| XAG7739PAK66 / CABLE and WIRELESS TERM B4 02/02/2026 | 0.51 | 0.00 | 0.3045 | 0.0212 | |||||

| POST / Post Holdings, Inc. | 0.51 | 0.3040 | 0.3040 | ||||||

| Albion Financing 1 SARL / DBT (US01330AAA43) | 0.51 | 0.3037 | 0.3037 | ||||||

| US013092AG61 / ALBERTSONS COS LLC / SAFEWAY INC / NEW ALBERTSONS INC / ALBERTSONS LLC 3.5% 03/15/2029 144A | 0.51 | 1.61 | 0.3028 | 0.0254 | |||||

| US104931AA85 / Brand Industrial Services Inc | 0.50 | -12.04 | 0.3018 | -0.0174 | |||||

| Acrisure LLC / DBT (US00489LAL71) | 0.50 | 0.00 | 0.3017 | 0.0206 | |||||

| Rogers Communications, Inc. / DBT (US775109DH13) | 0.50 | -0.20 | 0.2990 | 0.0199 | |||||

| CoreWeave, Inc. / DBT (US21873SAB43) | 0.50 | 0.2986 | 0.2986 | ||||||

| F2IC34 / Fair Isaac Corporation - Depositary Receipt (Common Stock) | 0.50 | 0.2978 | 0.2978 | ||||||

| GTN / Gray Media, Inc. | 0.50 | -7.81 | 0.2970 | -0.0026 | |||||

| US058498AW66 / Ball Corp | 0.50 | -51.13 | 0.2968 | -0.2687 | |||||

| US28228PAC59 / eG Global Finance PLC | 0.50 | -1.59 | 0.2967 | 0.0157 | |||||

| Jane Street Group / DBT (US47077WAD02) | 0.50 | 0.00 | 0.2964 | 0.0203 | |||||

| Alpha Generation LLC / DBT (US02073LAA98) | 0.49 | 0.61 | 0.2957 | 0.0219 | |||||

| US432833AN19 / HILTON DOMESTIC OPERATING CO INC 3.625% 02/15/2032 144A | 0.49 | -60.98 | 0.2955 | -0.4098 | |||||

| TransDigm, Inc. / DBT (US893647BY22) | 0.49 | 0.2950 | 0.2950 | ||||||

| Directv Financing LLC / DBT (US25461LAD47) | 0.49 | -0.82 | 0.2910 | 0.0177 | |||||

| US19260QAC15 / Coinbase Global Inc | 0.48 | 1.47 | 0.2897 | 0.0238 | |||||

| US44332PAH47 / HUB International Ltd | 0.48 | -16.87 | 0.2889 | -0.0348 | |||||

| VAL / Valaris Limited | 0.48 | -1.03 | 0.2887 | 0.0175 | |||||

| US897051AC29 / Tronox Inc | 0.48 | -5.87 | 0.2878 | 0.0029 | |||||

| Howden UK Refinance plc / DBT (US44287GAA40) | 0.48 | -22.49 | 0.2866 | -0.0579 | |||||

| Brightline East LLC / DBT (US093536AA89) | 0.47 | -20.60 | 0.2835 | -0.0490 | |||||

| US404030AJ72 / H+E EQUIPMENT SERVICES COMPANY GUAR 144A 12/28 3.875 | 0.47 | -44.18 | 0.2784 | -0.1857 | |||||

| US31556TAA79 / Fertitta Entertainment LLC / Fertitta Entertainment Finance Co Inc | 0.46 | -31.26 | 0.2776 | -0.0983 | |||||

| US12657NAA81 / CQP HOLDCO LP / BIP-V CHINOOK HOLDCO LLC 5.5% 06/15/2031 144A | 0.46 | -39.27 | 0.2775 | -0.1481 | |||||

| Wand NewCo 3, Inc. / DBT (US933940AA60) | 0.46 | -33.62 | 0.2768 | -0.1108 | |||||

| US59565JAA97 / MIDAS OPCO HOLDINGS LLC | 0.46 | -37.14 | 0.2766 | -0.1328 | |||||

| US71424VAA89 / Permian Resources Operating LLC | 0.46 | -0.22 | 0.2760 | 0.0187 | |||||

| US34960PAD33 / Fortress Transportation and Infrastructure Investors LLC | 0.46 | 0.22 | 0.2750 | 0.0197 | |||||

| OMI / Owens & Minor, Inc. | 0.46 | 0.2748 | 0.2748 | ||||||

| US29450YAA73 / EquipmentShare.com, Inc. | 0.46 | -1.51 | 0.2737 | 0.0153 | |||||

| US17302XAN66 / CITGO Petroleum Corp. | 0.46 | -1.51 | 0.2733 | 0.0150 | |||||

| Crescent Energy Finance LLC / DBT (US45344LAE39) | 0.45 | -5.62 | 0.2713 | 0.0039 | |||||

| US50190EAA29 / MAGLLC 4 7/8 05/01/29 | 0.45 | 1.12 | 0.2712 | 0.0213 | |||||

| US55916AAB08 / Magic Mergeco Inc | 0.45 | 0.00 | 0.2711 | 0.0184 | |||||

| US81761LAC63 / Service Properties Trust | 0.45 | -0.45 | 0.2676 | 0.0171 | |||||

| US983133AC37 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp | 0.45 | -0.45 | 0.2671 | 0.0176 | |||||

| United Rentals North America, Inc. / DBT (US911365BR47) | 0.45 | -72.78 | 0.2667 | -0.6437 | |||||

| US853496AH04 / Standard Industries Inc/NJ | 0.44 | -42.11 | 0.2656 | -0.1616 | |||||

| EVKG / Ever-Glory International Group, Inc. | 0.44 | -2.42 | 0.2652 | 0.0122 | |||||

| US65336YAN31 / Nexstar Broadcasting Inc | 0.44 | 1.39 | 0.2617 | 0.0217 | |||||

| US237266AJ06 / Darling Ingredients Inc | 0.44 | -0.23 | 0.2608 | 0.0174 | |||||

| US78433BAA61 / CORP. NOTE | 0.43 | 0.70 | 0.2572 | 0.0194 | |||||

| US91845AAA34 / VZ Secured Financing BV | 0.43 | -18.60 | 0.2569 | -0.0366 | |||||

| USA Compression Partners LP / DBT (US91740PAG37) | 0.43 | -1.16 | 0.2544 | 0.0150 | |||||

| US92339LAA08 / VERDE PURCHASER LLC 10.5% 11/30/2030 144A | 0.42 | -39.86 | 0.2538 | -0.1391 | |||||

| Hilcorp Energy I LP / DBT (US431318BG88) | 0.42 | -40.51 | 0.2530 | -0.1433 | |||||

| US92840JAB52 / VistaJet Malta Finance PLC / XO Management Holding Inc | 0.41 | -0.49 | 0.2427 | 0.0157 | |||||

| Aston Martin Capital Holdings Ltd. / DBT (US04625HAJ86) | 0.40 | -3.36 | 0.2415 | 0.0089 | |||||

| KeHE Distributors LLC / DBT (US487526AC91) | 0.40 | 0.25 | 0.2394 | 0.0171 | |||||

| US47232MAF95 / Jefferies Finance LLC | 0.40 | -0.99 | 0.2390 | 0.0146 | |||||

| Endo Finance Holdings, Inc. / DBT (US29281RAA77) | 0.40 | -10.00 | 0.2370 | -0.0082 | |||||

| Aethon United BR LP / DBT (US00810GAD60) | 0.39 | -32.76 | 0.2346 | -0.0904 | |||||

| RHP Hotel Properties LP / DBT (US749571AK15) | 0.39 | 0.00 | 0.2315 | 0.0161 | |||||

| Focus Financial Partners LLC / DBT (US34417VAA52) | 0.39 | 0.26 | 0.2311 | 0.0166 | |||||

| US59567LAA26 / Midcap Financial Issuer Trust | 0.38 | -1.29 | 0.2290 | 0.0126 | |||||

| US17888HAA14 / Civitas Resources Inc | 0.38 | -27.31 | 0.2264 | -0.0632 | |||||

| US553283AD43 / MPH Acquisition Holdings LLC | 0.38 | 1.07 | 0.2255 | 0.0175 | |||||

| US03969YAB48 / Ardagh Metal Packaging Finance USA LLC / Ardagh Metal Packaging Finance PLC | 0.38 | 1.62 | 0.2249 | 0.0188 | |||||

| VTLE / Vital Energy, Inc. | 0.37 | -15.90 | 0.2186 | -0.0235 | |||||

| Clydesdale Acquisition Holdings, Inc. / DBT (US18972EAD76) | 0.36 | 0.2138 | 0.2138 | ||||||

| Husky Injection Molding Systems Ltd. / DBT (US44805RAA32) | 0.36 | -45.73 | 0.2134 | -0.1521 | |||||

| US49461MAA80 / Kinetik Holdings LP | 0.35 | -0.56 | 0.2115 | 0.0139 | |||||

| US629377CR16 / NRG ENERGY INC 3.625% 02/15/2031 144A | 0.35 | -52.85 | 0.2082 | -0.2031 | |||||

| US1248EPCN14 / CORPORATE BONDS | 0.34 | -16.91 | 0.2057 | -0.0253 | |||||

| US75026JAE01 / Radiate Holdco LLC | 0.34 | 7.96 | 0.2029 | 0.0280 | |||||

| US20451RAB87 / Compass Group Diversified Holdings LLC | 0.34 | 50.45 | 0.2017 | 0.0765 | |||||

| Crescent Energy Finance LLC / DBT (US45344LAD55) | 0.33 | -40.61 | 0.1990 | -0.1124 | |||||

| Opal Bidco SAS / DBT (US68348BAA17) | 0.33 | 0.1983 | 0.1983 | ||||||

| US85236FAA12 / SRM Escrow Issuer, LLC | 0.32 | -0.63 | 0.1897 | 0.0121 | |||||

| US023771T402 / American Airlines, Inc. | 0.31 | -1.89 | 0.1865 | 0.0099 | |||||

| XS2066744231 / Carnival PLC | 0.29 | -42.94 | 0.1721 | -0.1081 | |||||

| US87901JAJ43 / TEGNA Inc | 0.29 | 1.06 | 0.1706 | 0.0132 | |||||

| US91327TAA97 / Uniti Group LP / Uniti Group Finance Inc / CSL Capital LLC | 0.28 | -77.96 | 0.1649 | -0.5299 | |||||

| US77313LAA17 / Rocket Mortgage LLC / Rocket Mortgage Co-Issuer Inc | 0.25 | -42.92 | 0.1500 | -0.0941 | |||||

| US01883LAE39 / Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer | 0.25 | -28.37 | 0.1497 | -0.0451 | |||||

| US82967NBM92 / Sirius XM Radio Inc | 0.25 | 0.81 | 0.1489 | 0.0113 | |||||

| US87422VAK44 / Talen Energy Supply, LLC | 0.23 | -60.62 | 0.1365 | -0.1861 | |||||

| US988498AP63 / Yum! Brands Inc | 0.20 | -24.24 | 0.1196 | -0.0274 | |||||

| Saks Global Enterprises LLC / DBT (US79380MAA36) | 0.19 | -80.82 | 0.1126 | -0.4334 | |||||

| US23918KAT51 / DaVita Inc | 0.18 | -67.91 | 0.1080 | -0.2046 | |||||

| ST / Sensata Technologies Holding plc | 0.16 | -63.79 | 0.0932 | -0.1452 | |||||

| US18453HAC07 / Clear Channel Outdoor Holdings Inc | 0.14 | -2.08 | 0.0846 | 0.0043 | |||||

| US988498AN16 / Yum! Brands, Inc. | 0.13 | 0.00 | 0.0804 | 0.0058 | |||||

| US12008RAP29 / Builders FirstSource Inc | 0.12 | -52.57 | 0.0721 | -0.0689 | |||||

| US644393AB64 / New Fortress Energy Inc | 0.12 | -79.86 | 0.0712 | -0.2581 | |||||

| US126307BD80 / CSC HOLDINGS LLC SR UNSECURED 144A 12/30 4.625 | 0.09 | -82.49 | 0.0561 | -0.2398 | |||||

| Repurchase Agreement / RA (000000000) | 0.09 | 0.0539 | 0.0539 | ||||||

| US852234AP86 / CORPORATE BONDS | 0.09 | 1.16 | 0.0524 | 0.0044 | |||||

| US69331CAJ71 / PG&E Corp | 0.07 | -92.88 | 0.0441 | -0.5276 | |||||

| US428040DB25 / Hertz Corp/The | 0.07 | -87.03 | 0.0390 | -0.2401 | |||||

| US15089QAM69 / Celanese US Holdings LLC | 0.06 | 0.0380 | 0.0380 | ||||||

| Performance Food Group, Inc. / DBT (US71376LAF76) | 0.03 | -90.29 | 0.0163 | -0.1387 | |||||

| US92943GAA94 / WR Grace Holdings LLC | 0.01 | -97.25 | 0.0063 | -0.1961 | |||||

| Nationstar Mortgage Holdings, Inc. / DBT (US63861CAF68) | 0.00 | -99.61 | 0.0012 | -0.2855 | |||||

| Windstream Escrow LLC / DBT (973CONAA8) | 0.00 | 0.0000 | 0.0000 | ||||||

| U.S. Treasury 10 Year Note / DIR (N/A) | -0.03 | -0.0168 | -0.0168 | ||||||

| U.S. Treasury 2 Year Note / DIR (N/A) | -0.03 | -0.0204 | -0.0204 | ||||||

| U.S. Treasury 5 Year Note / DIR (N/A) | -0.14 | -0.0812 | -0.0812 |