Mga Batayang Estadistika

| Nilai Portofolio | $ 176,914,879 |

| Posisi Saat Ini | 313 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

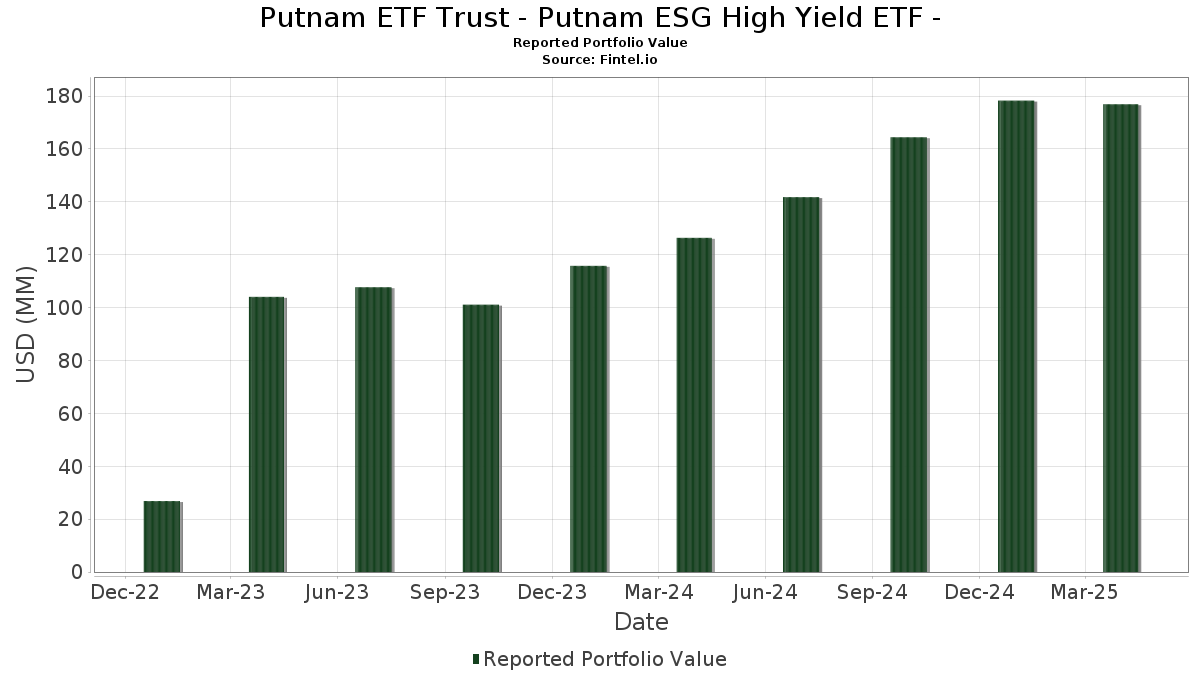

Putnam ETF Trust - Putnam ESG High Yield ETF - telah mengungkapkan total kepemilikan 313 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 176,914,879 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Putnam ETF Trust - Putnam ESG High Yield ETF - adalah SHORT TERM INV FUND (US:US74680A8696) , Wynn Resorts Finance LLC / Wynn Resorts Capital Corp (US:US983133AC37) , Boise Cascade Co (US:US09739DAD21) , CCO Holdings LLC / CCO Holdings Capital Corp. (US:US1248EPCD32) , and US Foods, Inc. (US:US90290MAH43) . Posisi baru Putnam ETF Trust - Putnam ESG High Yield ETF - meliputi: Wynn Resorts Finance LLC / Wynn Resorts Capital Corp (US:US983133AC37) , Boise Cascade Co (US:US09739DAD21) , CCO Holdings LLC / CCO Holdings Capital Corp. (US:US1248EPCD32) , US Foods, Inc. (US:US90290MAH43) , and Kevlar SpA (IT:US49272YAB92) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 9.49 | 9.49 | 5.3181 | 1.1883 | |

| 1.13 | 0.6340 | 0.6340 | ||

| 1.10 | 0.6191 | 0.6191 | ||

| 0.77 | 0.4311 | 0.4311 | ||

| 0.70 | 0.3896 | 0.3896 | ||

| 0.64 | 0.3592 | 0.3592 | ||

| 0.58 | 0.3245 | 0.3245 | ||

| 0.49 | 0.2764 | 0.2764 | ||

| 0.46 | 0.2601 | 0.2601 | ||

| 1.26 | 0.7086 | 0.2589 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.29 | 0.1628 | -0.2759 | ||

| 0.26 | 0.1469 | -0.2355 | ||

| 0.39 | 0.2214 | -0.2317 | ||

| 0.43 | 0.2432 | -0.2140 | ||

| 0.18 | 0.1003 | -0.2109 | ||

| 0.17 | 0.0977 | -0.1342 | ||

| 0.24 | 0.1365 | -0.1057 | ||

| 0.52 | 0.2902 | -0.1019 | ||

| 1.13 | 0.6326 | -0.0892 | ||

| 0.01 | 0.61 | 0.3416 | -0.0811 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-18 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US74680A8696 / SHORT TERM INV FUND | 9.49 | 28.86 | 9.49 | 28.85 | 5.3181 | 1.1883 | |||

| US983133AC37 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp | 1.95 | -1.32 | 1.0939 | -0.0152 | |||||

| US09739DAD21 / Boise Cascade Co | 1.76 | -0.28 | 0.9882 | -0.0039 | |||||

| US1248EPCD32 / CCO Holdings LLC / CCO Holdings Capital Corp. | 1.67 | 1.95 | 0.9376 | 0.0174 | |||||

| CORP. NOTE / DBT (US95081QAR56) | 1.63 | -0.49 | 0.9162 | -0.0053 | |||||

| US257867BA88 / Rr Donnelley & Sons Bond | 1.47 | 31.31 | 0.8229 | 0.1957 | |||||

| US90290MAH43 / US Foods, Inc. | 1.46 | 14.84 | 0.8160 | 0.1050 | |||||

| US49272YAB92 / Kevlar SpA | 1.38 | 0.51 | 0.7744 | 0.0035 | |||||

| CORPORATE BONDS / DBT (US911365BR47) | 1.38 | 0.95 | 0.7743 | 0.0065 | |||||

| US49461MAA80 / Kinetik Holdings LP | 1.36 | -1.52 | 0.7620 | -0.0120 | |||||

| US92332YAD31 / Venture Global LNG Inc | 1.34 | -7.71 | 0.7517 | -0.0638 | |||||

| US91835HAA05 / VM Consolidated Inc | 1.31 | -0.61 | 0.7332 | -0.0052 | |||||

| CORP. NOTE / DBT (US17027NAC65) | 1.30 | 0.39 | 0.7289 | 0.0020 | |||||

| US103304BV23 / BOYD GAMING CORP 4.75% 06/15/2031 144A | 1.30 | 0.00 | 0.7271 | -0.0007 | |||||

| CORP. NOTE / DBT (US853191AA25) | 1.28 | 0.24 | 0.7157 | 0.0014 | |||||

| PRAA / PRA Group, Inc. | 1.27 | -1.55 | 0.7109 | -0.0117 | |||||

| CORP. NOTE / DBT (US47077WAD02) | 1.26 | 57.80 | 0.7086 | 0.2589 | |||||

| BBD.A / Bombardier Inc. | 1.26 | -0.71 | 0.7041 | -0.0060 | |||||

| US184496AQ03 / Clean Harbors Inc | 1.24 | 0.41 | 0.6943 | 0.0024 | |||||

| US76774LAC19 / Ritchie Bros Holdings Inc | 1.17 | -0.43 | 0.6561 | -0.0033 | |||||

| US63861CAE93 / Nationstar Mortgage Holdings Inc | 1.15 | 3.71 | 0.6420 | 0.0227 | |||||

| FCFS / FirstCash Holdings, Inc. | 1.13 | 0.89 | 0.6345 | 0.0053 | |||||

| CORP. NOTE / DBT (US68348BAA17) | 1.13 | 0.6340 | 0.6340 | ||||||

| US579063AB46 / Condor Merger Sub Inc | 1.13 | -12.29 | 0.6326 | -0.0892 | |||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 1.10 | 0.6191 | 0.6191 | ||||||

| US060335AB23 / Banijay Entertainment SASU | 1.08 | -1.46 | 0.6066 | -0.0092 | |||||

| US36168QAQ73 / GFL Environmental Inc | 1.07 | 0.19 | 0.6009 | 0.0008 | |||||

| CORP. NOTE / DBT (US749571AK15) | 1.07 | -1.02 | 0.5983 | -0.0068 | |||||

| CORP. NOTE / DBT (US716964AA94) | 1.06 | 18.97 | 0.5943 | 0.0944 | |||||

| CORP. NOTE / DBT (US829259BH26) | 1.06 | 47.29 | 0.5941 | 0.1905 | |||||

| US670001AH91 / Novelis Corp | 1.06 | -1.49 | 0.5933 | -0.0092 | |||||

| US12429TAD63 / Mauser Packaging Solutions Holding Co | 1.05 | -1.59 | 0.5908 | -0.0100 | |||||

| US38869AAD90 / Graphic Packaging International LLC | 1.05 | 0.38 | 0.5879 | 0.0018 | |||||

| US073685AH26 / CORP. NOTE | 1.02 | 3.12 | 0.5742 | 0.0170 | |||||

| US85205TAR14 / Spirit AeroSystems Inc | 1.01 | 0.00 | 0.5683 | -0.0001 | |||||

| US87724RAJ14 / Taylor Morrison Communities Inc | 1.01 | 5.33 | 0.5653 | 0.0282 | |||||

| DVAI34 / DaVita Inc. - Depositary Receipt (Common Stock) | 1.01 | -0.40 | 0.5635 | -0.0029 | |||||

| US60337JAA43 / Minerva Merger Sub Inc | 1.00 | -1.18 | 0.5631 | -0.0071 | |||||

| US222070AG98 / Coty Inc/HFC Prestige Products Inc/HFC Prestige International US LLC | 1.00 | -0.20 | 0.5614 | -0.0014 | |||||

| US12769GAB68 / Caesars Entertainment, Inc. | 1.00 | -0.70 | 0.5598 | -0.0043 | |||||

| US92676XAF42 / Viking Cruises Ltd | 0.98 | -0.61 | 0.5518 | -0.0036 | |||||

| US30251GBE61 / FMG RESOURCES AUGUST 2006 | 0.98 | -0.81 | 0.5502 | -0.0047 | |||||

| US12769GAA85 / Caesars Entertainment Inc | 0.98 | -2.20 | 0.5491 | -0.0126 | |||||

| US21039CAA27 / Constellium SE | 0.96 | 0.32 | 0.5355 | 0.0014 | |||||

| US501797AL82 / L Brands Inc | 0.95 | -3.06 | 0.5335 | -0.0168 | |||||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 0.94 | -1.67 | 0.5282 | -0.0093 | |||||

| CORP. NOTE / DBT (US55342UAQ76) | 0.94 | 40.09 | 0.5272 | 0.1508 | |||||

| CORP. NOTE / DBT (US941130AD86) | 0.94 | -3.79 | 0.5263 | -0.0208 | |||||

| US69331CAJ71 / PG&E Corp | 0.92 | 2.45 | 0.5162 | 0.0121 | |||||

| US65249BAA70 / News Corp | 0.90 | 0.78 | 0.5043 | 0.0037 | |||||

| CORP. NOTE / DBT (US20752TAB08) | 0.89 | 4.34 | 0.4988 | 0.0205 | |||||

| US39843UAA07 / Grifols Escrow Issuer SA | 0.89 | 0.68 | 0.4962 | 0.0026 | |||||

| US12543DBM11 / CHS/Community Health Systems Inc | 0.88 | 0.11 | 0.4931 | 0.0001 | |||||

| US91845AAA34 / VZ Secured Financing BV | 0.88 | -2.45 | 0.4921 | -0.0122 | |||||

| US410345AQ54 / Hanesbrands Inc | 0.87 | -3.01 | 0.4883 | -0.0155 | |||||

| I1RM34 / Iron Mountain Incorporated - Depositary Receipt (Common Stock) | 0.87 | -0.34 | 0.4872 | -0.0019 | |||||

| US670001AE60 / Novelis Corp | 0.87 | -1.03 | 0.4853 | -0.0052 | |||||

| US87305RAK59 / TTM Technologies Inc | 0.87 | -0.92 | 0.4851 | -0.0046 | |||||

| US44332PAH47 / HUB International Ltd | 0.86 | 0.35 | 0.4829 | 0.0012 | |||||

| US01883LAF04 / ALLIANT HOLD / CO-ISSUER REGD 144A P/P 7.00000000 | 0.85 | -0.23 | 0.4783 | -0.0015 | |||||

| US88167AAS06 / Teva Pharmaceutical Finance Netherlands III BV | 0.84 | -0.82 | 0.4722 | -0.0045 | |||||

| US64072TAC99 / CSC Holdings LLC | 0.83 | -5.02 | 0.4666 | -0.0248 | |||||

| ECPG / Encore Capital Group, Inc. | 0.83 | -1.89 | 0.4656 | -0.0094 | |||||

| CORP. NOTE / DBT (US92840VAR33) | 0.82 | 0.73 | 0.4619 | 0.0028 | |||||

| US31556TAC36 / Fertitta Entertainment LLC / Fertitta Entertainment Finance Co Inc | 0.82 | 19.04 | 0.4591 | 0.0731 | |||||

| US42704LAA26 / Herc Holdings, Inc. | 0.82 | -0.73 | 0.4577 | -0.0037 | |||||

| US1248EPCQ45 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.81 | 1.77 | 0.4519 | 0.0072 | |||||

| CORP. NOTE / DBT (US472481AB63) | 0.80 | 45.82 | 0.4499 | 0.1409 | |||||

| AVNT / Avient Corporation | 0.80 | -0.75 | 0.4468 | -0.0041 | |||||

| US74166MAE66 / PRIME SECSRVC BRW / FINANC | 0.79 | 0.13 | 0.4401 | -0.0000 | |||||

| US00687YAC93 / Adient Global Holdings Ltd | 0.78 | -4.63 | 0.4388 | -0.0212 | |||||

| BANK LOAN NOTE / DBT (89364MCD4) | 0.78 | -1.77 | 0.4366 | -0.0079 | |||||

| BANK LOAN NOTE / DBT (US29280UAD54) | 0.77 | 0.4311 | 0.4311 | ||||||

| QSR / Restaurant Brands International Inc. | 0.75 | 0.54 | 0.4189 | 0.0020 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.74 | 0.00 | 0.4147 | -0.0003 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 0.74 | 0.82 | 0.4127 | 0.0030 | |||||

| US88632QAE35 / Picard Midco, Inc. | 0.74 | 1.66 | 0.4125 | 0.0069 | |||||

| US88033GDQ01 / CORP. NOTE | 0.73 | 0.00 | 0.4083 | -0.0003 | |||||

| US55760LAB36 / Madison IAQ LLC | 0.71 | -1.92 | 0.4008 | -0.0079 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0.71 | 97.49 | 0.3979 | 0.1963 | |||||

| US69867DAC20 / Panther BF Aggregator 2 LP / Panther Finance Co Inc | 0.71 | -0.14 | 0.3974 | -0.0008 | |||||

| US92840VAP76 / Vistra Operations Co. LLC | 0.71 | 0.14 | 0.3973 | 0.0003 | |||||

| US15089QAP90 / Celanese US Holdings LLC | 0.70 | 2.93 | 0.3943 | 0.0109 | |||||

| TEX / Terex Corporation | 0.70 | -3.19 | 0.3920 | -0.0132 | |||||

| US92763MAB19 / Viper Energy Partners LP | 0.70 | -0.71 | 0.3902 | -0.0031 | |||||

| US01883LAD55 / Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer | 0.70 | 0.29 | 0.3900 | 0.0011 | |||||

| CORP. NOTE / DBT (US35641AAC27) | 0.70 | 0.3896 | 0.3896 | ||||||

| US50187TAH95 / LGI Homes, Inc. | 0.69 | -4.72 | 0.3851 | -0.0193 | |||||

| US143658BN13 / Carnival Corp | 0.68 | -0.44 | 0.3829 | -0.0024 | |||||

| CORP. NOTE / DBT (US00489LAM54) | 0.68 | -1.46 | 0.3796 | -0.0058 | |||||

| US82983MAB63 / Sitio Royalties Operating Partnership LP | 0.67 | -1.17 | 0.3777 | -0.0043 | |||||

| US024747AG26 / CORP. NOTE | 0.67 | -0.15 | 0.3729 | -0.0008 | |||||

| US83001AAD46 / Six Flags Entertainment Corp | 0.66 | -1.63 | 0.3725 | -0.0063 | |||||

| US78433BAB45 / SCIH Salt Holdings Inc | 0.66 | 0.15 | 0.3706 | 0.0004 | |||||

| US65343HAA95 / Nexstar Escrow, Inc. | 0.66 | 0.46 | 0.3696 | 0.0015 | |||||

| US00867FAA66 / Ahead DB Holdings LLC | 0.65 | -2.25 | 0.3664 | -0.0086 | |||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 0.65 | -2.55 | 0.3642 | -0.0095 | |||||

| US46284VAL53 / Iron Mountain Inc | 0.65 | 0.62 | 0.3619 | 0.0020 | |||||

| US88033GDB32 / CORP. NOTE | 0.65 | 0.31 | 0.3616 | 0.0007 | |||||

| CORP. NOTE / DBT (US00489LAL71) | 0.64 | -1.38 | 0.3600 | -0.0056 | |||||

| US82453AAA51 / Shift4 Payments LLC / Shift4 Payments Finance Sub Inc | 0.64 | -0.31 | 0.3596 | -0.0013 | |||||

| CORP. NOTE / DBT (US28201XAB10) | 0.64 | 0.3592 | 0.3592 | ||||||

| US71677HAL96 / PetSmart, Inc., Term Loan B | 0.64 | -1.54 | 0.3587 | -0.0058 | |||||

| US78433BAA61 / CORP. NOTE | 0.64 | -1.24 | 0.3575 | -0.0047 | |||||

| US77289KAA34 / Rockcliff Energy II LLC | 0.63 | -3.21 | 0.3558 | -0.0120 | |||||

| CORP. NOTE / DBT (US98927UAA51) | 0.63 | -0.31 | 0.3556 | -0.0015 | |||||

| US12543DBN93 / CHS/Community Health Systems Inc | 0.63 | 0.16 | 0.3535 | 0.0006 | |||||

| US019736AG29 / Allison Transmission Inc | 0.63 | 0.64 | 0.3529 | 0.0022 | |||||

| CORP. NOTE / DBT (US94419NAA54) | 0.63 | 4.85 | 0.3517 | 0.0160 | |||||

| CORP. NOTE / DBT (US20600DAA19) | 0.63 | -0.95 | 0.3505 | -0.0037 | |||||

| US12008RAR84 / Builders FirstSource Inc | 0.62 | -0.64 | 0.3498 | -0.0026 | |||||

| US948565AD85 / Weekley Homes LLC / Weekley Finance Corp | 0.62 | 38.03 | 0.3464 | 0.0955 | |||||

| US89055FAC77 / TopBuild Corp. | 0.62 | 0.65 | 0.3459 | 0.0019 | |||||

| US038522AQ17 / Aramark Services Inc | 0.62 | 0.33 | 0.3451 | 0.0011 | |||||

| BA.PRA / The Boeing Company - Preferred Security | 0.01 | -20.97 | 0.61 | -19.12 | 0.3416 | -0.0811 | |||

| US08263DAA46 / Benteler International AG | 0.61 | -3.95 | 0.3408 | -0.0143 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.61 | -0.49 | 0.3403 | -0.0020 | |||||

| HRI / Herc Holdings Inc. | 0.59 | -3.26 | 0.3326 | -0.0116 | |||||

| US38016LAC90 / Go Daddy Operating Co LLC / GD Finance Co Inc | 0.59 | 0.85 | 0.3320 | 0.0025 | |||||

| BANK LOAN NOTE / DBT (34966LAB0) | 0.59 | 39.06 | 0.3316 | 0.0931 | |||||

| US427169AA59 / Herens Holdco Sarl | 0.59 | -4.88 | 0.3280 | -0.0175 | |||||

| BANK LOAN NOTE / DBT (N/A) | 0.58 | 0.3245 | 0.3245 | ||||||

| US45258LAA52 / Imola Merger Corp | 0.57 | 44.70 | 0.3216 | 0.0994 | |||||

| BANK LOAN NOTE / DBT (XAN8232NAL19) | 0.56 | -2.76 | 0.3160 | -0.0088 | |||||

| US25259KAA88 / Olympus Water US Holding Corp | 0.56 | -1.57 | 0.3158 | -0.0053 | |||||

| US55759VAB45 / MADISON IAQ LLC | 0.56 | -1.06 | 0.3145 | -0.0036 | |||||

| LBTYB / Liberty Global Ltd. | 0.55 | 1.47 | 0.3102 | 0.0040 | |||||

| US1248EPCB75 / CCO Holdings LLC / CCO Holdings Capital Corp 5.375% 06/01/2029 144A | 0.55 | 1.28 | 0.3102 | 0.0037 | |||||

| US82967NBC11 / Sirius XM Radio Inc | 0.55 | 0.00 | 0.3087 | -0.0001 | |||||

| US12657NAA81 / CQP HOLDCO LP / BIP-V CHINOOK HOLDCO LLC 5.5% 06/15/2031 144A | 0.54 | -0.55 | 0.3042 | -0.0015 | |||||

| US126307BM89 / CSC Holdings LLC | 0.54 | -1.28 | 0.3016 | -0.0046 | |||||

| US527298BU63 / Level 3 Financing Inc | 0.54 | -0.74 | 0.3013 | -0.0026 | |||||

| CORP. NOTE / DBT (US58064LAA26) | 0.53 | -1.85 | 0.2981 | -0.0056 | |||||

| US80874YBE95 / Scientific Games International Inc | 0.53 | -1.12 | 0.2974 | -0.0036 | |||||

| US57767XAB64 / Mav Acquisition Corp. | 0.53 | -2.60 | 0.2946 | -0.0082 | |||||

| US29254BAA52 / Encino Acquisition Partners Holdings LLC | 0.52 | -2.62 | 0.2919 | -0.0079 | |||||

| US12511VAA61 / CDI Escrow Issuer Inc | 0.52 | -0.96 | 0.2908 | -0.0030 | |||||

| US52736RBJ05 / LEVI STRAUSS and COMPANY NEW 3.5% 03/01/2031 144A | 0.52 | -26.04 | 0.2902 | -0.1019 | |||||

| US172441BF30 / Cinemark USA Inc | 0.52 | 0.00 | 0.2892 | 0.0003 | |||||

| US48020RAA32 / Jones Deslauriers Insurance Management Inc | 0.51 | -0.58 | 0.2866 | -0.0020 | |||||

| US77314EAA64 / Rocket Software Inc | 0.50 | 0.60 | 0.2814 | 0.0020 | |||||

| AMBP / Ardagh Metal Packaging S.A. | 0.50 | -0.20 | 0.2809 | -0.0009 | |||||

| BANK LOAN NOTE / DBT (US25460HAD44) | 0.50 | 72.57 | 0.2787 | 0.1167 | |||||

| US05453GAC96 / AXALTA COATING SYSTEMS LLC 3.375% 02/15/2029 144A | 0.50 | 0.81 | 0.2781 | 0.0020 | |||||

| US71677KAB44 / PETM 7 3/4 02/15/29 | 0.49 | -6.44 | 0.2771 | -0.0195 | |||||

| 743424AA1 / Proofpoint, Inc. 1.25% Convertible Bond due 2018-12-15 | 0.49 | 0.2764 | 0.2764 | ||||||

| US81180WBF77 / Seagate HDD Cayman | 0.49 | 0.00 | 0.2748 | -0.0002 | |||||

| CORP. NOTE / DBT (US12769GAD25) | 0.48 | -3.02 | 0.2697 | -0.0087 | |||||

| US78410GAD60 / SBA Communications Corp | 0.48 | 1.05 | 0.2689 | 0.0028 | |||||

| US62482BAA08 / Mozart Debt Merger Sub Inc | 0.47 | 0.00 | 0.2643 | -0.0002 | |||||

| US80874DAA46 / Scientific Games Holdings LP/Scientific Games US FinCo Inc | 0.47 | -2.31 | 0.2617 | -0.0061 | |||||

| US92676XAG25 / Viking Cruises Ltd | 0.47 | -1.27 | 0.2609 | -0.0037 | |||||

| US03768DAC11 / Apollo Commercial Real Estate Finance, Inc 2021 Incremental Term Loan B1 | 0.46 | 0.2601 | 0.2601 | ||||||

| US05765WAA18 / TIBCO Software Inc | 0.46 | 0.2560 | 0.2560 | ||||||

| US05765WAA18 / TIBCO Software Inc | 0.46 | 0.2560 | 0.2560 | ||||||

| CORP. NOTE / DBT (US94107JAC71) | 0.45 | 117.39 | 0.2522 | 0.1357 | |||||

| US682189AQ81 / ON Semiconductor Corp | 0.45 | 23.69 | 0.2520 | 0.0481 | |||||

| CORP. NOTE / DBT (US893647BW65) | 0.45 | 1.13 | 0.2519 | 0.0027 | |||||

| US18912UAA07 / Cloud Software Group Inc | 0.45 | -1.75 | 0.2516 | -0.0043 | |||||

| US62482BAB80 / MOZART DEBT MERGER SUB INC | 0.45 | -1.98 | 0.2504 | -0.0052 | |||||

| G2WR34 / Guidewire Software, Inc. - Depositary Receipt (Common Stock) | 0.44 | 1.37 | 0.2483 | 0.0031 | |||||

| CORP. NOTE / DBT (US13005HAA86) | 0.44 | -0.23 | 0.2480 | -0.0009 | |||||

| CCO / Clear Channel Outdoor Holdings, Inc. | 0.44 | 0.2472 | 0.2472 | ||||||

| CORP. NOTE / DBT (US34966MAA09) | 0.44 | -0.68 | 0.2467 | -0.0023 | |||||

| CORP. NOTE / DBT (US63861CAF68) | 0.44 | 0.69 | 0.2445 | 0.0014 | |||||

| US203372AV94 / CommScope Inc | 0.43 | -46.87 | 0.2432 | -0.2140 | |||||

| US92763MAA36 / Viper Energy Partners LP 5.375% 11/01/2027 144A | 0.43 | 0.23 | 0.2428 | 0.0002 | |||||

| US36186CBY84 / Ally Financial Inc | 0.43 | -1.14 | 0.2422 | -0.0033 | |||||

| US36170JAC09 / GGAM Finance Ltd. | 0.43 | -0.69 | 0.2419 | -0.0015 | |||||

| US85205TAK60 / Spirit AeroSystems, Inc. | 0.43 | 0.23 | 0.2414 | 0.0005 | |||||

| KGS / Kodiak Gas Services, Inc. | 0.43 | -1.39 | 0.2393 | -0.0033 | |||||

| US35640YAL11 / CORP. NOTE | 0.42 | 456.58 | 0.2376 | 0.1834 | |||||

| US92332YAB74 / Venture Global LNG, Inc. | 0.42 | -8.52 | 0.2354 | -0.0216 | |||||

| US629377CU45 / NRG Energy Inc | 0.42 | -1.42 | 0.2335 | -0.0032 | |||||

| CORP. NOTE / DBT (US94419NAB38) | 0.42 | 0.2333 | 0.2333 | ||||||

| BLDR / Builders FirstSource, Inc. | 0.41 | -1.20 | 0.2312 | -0.0032 | |||||

| US29272WAD11 / Energizer Holdings, Inc. | 0.41 | 0.00 | 0.2304 | -0.0006 | |||||

| US432891AK52 / Hilton Worldwide Finance LLC / Hilton Worldwide Finance Corp | 0.41 | 0.25 | 0.2291 | 0.0007 | |||||

| US88033GDM96 / CORP. NOTE | 0.41 | 1.00 | 0.2271 | 0.0017 | |||||

| US77313DAW11 / Rocket Software, Inc. - Term Loan B | 0.40 | -2.18 | 0.2264 | -0.0051 | |||||

| ECPG / Encore Capital Group, Inc. | 0.40 | -1.47 | 0.2251 | -0.0036 | |||||

| US588056BB60 / Mercer International Inc | 0.40 | -7.21 | 0.2240 | -0.0176 | |||||

| CSTM / Constellium SE | 0.40 | -0.25 | 0.2236 | -0.0005 | |||||

| US48020RAB15 / Jones Deslauriers Insurance Management Inc | 0.40 | -1.00 | 0.2219 | -0.0021 | |||||

| US17888HAB96 / Civitas Resources Inc | 0.39 | -51.18 | 0.2214 | -0.2317 | |||||

| US82967NBM92 / Sirius XM Radio Inc | 0.39 | -0.51 | 0.2191 | -0.0009 | |||||

| US227046AA78 / CROCS INC 4.25% 03/15/2029 144A | 0.39 | -0.26 | 0.2188 | -0.0006 | |||||

| US87724RAA05 / Taylor Morrison Communities Inc | 0.38 | -0.26 | 0.2142 | -0.0009 | |||||

| US75606DAS09 / CORP. NOTE | 0.38 | -3.32 | 0.2126 | -0.0074 | |||||

| US85172FAR01 / Springleaf Finance Corp 5.375% 11/15/2029 | 0.38 | -1.31 | 0.2119 | -0.0033 | |||||

| US05368VAA44 / Avient Corp | 0.38 | -0.79 | 0.2116 | -0.0016 | |||||

| CORP. NOTE / DBT (US670001AL04) | 0.37 | -0.82 | 0.2049 | -0.0020 | |||||

| CORP. NOTE / DBT (US472481AC47) | 0.36 | 0.2033 | 0.2033 | ||||||

| US87261QAC78 / TMS International Corp/DE | 0.36 | -2.17 | 0.2026 | -0.0047 | |||||

| CORP. NOTE / DBT (US44963BAF58) | 0.36 | 45.31 | 0.2000 | 0.0621 | |||||

| CORP. NOTE / DBT (US74843PAB67) | 0.36 | 0.1999 | 0.1999 | ||||||

| BANK LOAN NOTE / DBT (N/A) | 0.35 | 0.1986 | 0.1986 | ||||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 0.35 | -2.50 | 0.1972 | -0.0048 | |||||

| CORP. NOTE / DBT (US25461LAD47) | 0.35 | 0.1966 | 0.1966 | ||||||

| CORP. NOTE / DBT (US449691AG96) | 0.35 | 0.00 | 0.1963 | -0.0002 | |||||

| US69007TAC80 / OUTFRONT MEDIA CAP LLC/C SR UNSECURED 144A 03/30 4.625 | 0.35 | 0.1945 | 0.1945 | ||||||

| RRR / Red Rock Resorts, Inc. | 0.34 | -1.17 | 0.1896 | -0.0023 | |||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0.34 | 0.1887 | 0.1887 | ||||||

| CORP. NOTE / DBT (US29254BAB36) | 0.34 | -4.27 | 0.1886 | -0.0084 | |||||

| US505742AM88 / LADDER CAP FIN LLLP/CORP SR UNSECURED 144A 02/27 4.25 | 0.34 | 0.30 | 0.1886 | 0.0002 | |||||

| NBR / Nabors Industries Ltd. | 0.34 | -28.36 | 0.1885 | -0.0746 | |||||

| US707569AS84 / Penn National Gaming Inc | 0.33 | -0.89 | 0.1877 | -0.0014 | |||||

| SM / SM Energy Company | 0.33 | -0.90 | 0.1862 | -0.0019 | |||||

| XAL2000DAC82 / Connect Finco Sarl Term Loan B | 0.33 | 2.80 | 0.1850 | 0.0049 | |||||

| BANK LOAN NOTE / DBT (N/A) | 0.33 | 0.1849 | 0.1849 | ||||||

| US69346EAG26 / BANK LOAN NOTE | 0.33 | -9.12 | 0.1845 | -0.0191 | |||||

| US366651AE76 / Gartner Inc | 0.33 | 0.62 | 0.1834 | 0.0006 | |||||

| US531968AA36 / Light & Wonder International, Inc. | 0.32 | -1.52 | 0.1815 | -0.0027 | |||||

| US131347CQ78 / Calpine Corp | 0.32 | 0.63 | 0.1808 | 0.0012 | |||||

| CORP. NOTE / DBT (US60672JAA79) | 0.32 | -1.23 | 0.1796 | -0.0022 | |||||

| US18453HAC07 / Clear Channel Outdoor Holdings Inc | 0.32 | -10.64 | 0.1793 | -0.0211 | |||||

| US201723AR41 / Commercial Metals Co | 0.32 | -0.31 | 0.1785 | -0.0004 | |||||

| CORP. NOTE / DBT (US74843PAA84) | 0.32 | 0.1777 | 0.1777 | ||||||

| APO.PRA / Apollo Global Management, Inc. - Preferred Stock | 0.00 | -10.96 | 0.31 | -27.91 | 0.1738 | -0.0674 | |||

| US69357VAA35 / PMHC II Inc | 0.30 | -17.21 | 0.1704 | -0.0351 | |||||

| US12513GBF54 / CDW LLC / CDW Finance Corp | 0.30 | 0.33 | 0.1699 | 0.0004 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 0.30 | -4.13 | 0.1698 | -0.0069 | |||||

| US983133AA70 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp 5.125% 10/01/2029 144A | 0.30 | -0.33 | 0.1677 | -0.0009 | |||||

| XS2066744231 / Carnival PLC | 0.30 | 0.1671 | 0.1671 | ||||||

| CCO / Clear Channel Outdoor Holdings, Inc. | 0.29 | -62.92 | 0.1628 | -0.2759 | |||||

| CORP. NOTE / DBT (US90290MAJ09) | 0.29 | 0.70 | 0.1624 | 0.0011 | |||||

| BANK LOAN NOTE / DBT (N/A) | 0.29 | 0.1600 | 0.1600 | ||||||

| US62957HAJ41 / Nabors Industries, Inc. | 0.28 | -6.60 | 0.1587 | -0.0113 | |||||

| US89386MAA62 / Transocean Titan Financing Ltd | 0.28 | -12.69 | 0.1584 | -0.0228 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 0.28 | -1.40 | 0.1580 | -0.0020 | |||||

| US588056BC44 / CORP. NOTE | 0.28 | -5.39 | 0.1577 | -0.0090 | |||||

| US36268NAA81 / GTCR W-2 Merger Sub LLC | 0.28 | 0.72 | 0.1569 | 0.0012 | |||||

| CORP. NOTE / DBT (US83002YAA73) | 0.28 | -1.42 | 0.1557 | -0.0020 | |||||

| US780153BJ00 / Royal Caribbean Cruises Ltd | 0.28 | 0.00 | 0.1543 | -0.0002 | |||||

| US92332YAC57 / Venture Global LNG Inc | 0.27 | -7.12 | 0.1540 | -0.0118 | |||||

| US227046AB51 / Crocs Inc | 0.27 | -0.75 | 0.1497 | -0.0008 | |||||

| US749571AJ42 / RHP Hotel Properties LP / RHP Finance Corp | 0.26 | -0.76 | 0.1470 | -0.0014 | |||||

| US69007TAG94 / Outfront Media Capital LLC / Outfront Media Capital Corp | 0.26 | -61.53 | 0.1469 | -0.2355 | |||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0.26 | 0.1460 | 0.1460 | ||||||

| US12543DBL38 / CHS/CMNTY HEALTH SYSTEMS INC 6.125% 04/01/2030 144A | 0.26 | 4.07 | 0.1435 | 0.0055 | |||||

| US49865NAT72 / KLOECKNER PENTAPLAST TERM B 1LN 02/04/2026 | 0.25 | 1.20 | 0.1429 | 0.0016 | |||||

| BANK LOAN NOTE / DBT (N/A) | 0.25 | 0.1404 | 0.1404 | ||||||

| US085770AB14 / Berry Global Inc | 0.25 | -0.40 | 0.1401 | -0.0004 | |||||

| XAC8000CAB90 / Panther BF Aggregator 2 LP USD Term Loan B | 0.25 | 0.1399 | 0.1399 | ||||||

| US845467AS85 / Southwestern Energy Co | 0.25 | 1.22 | 0.1393 | 0.0015 | |||||

| US12543DBG43 / CHS/Community Health Systems Inc | 0.24 | 0.83 | 0.1368 | 0.0005 | |||||

| MTW / The Manitowoc Company, Inc. | 0.24 | -43.62 | 0.1365 | -0.1057 | |||||

| US23918KAS78 / DaVita Inc | 0.24 | 0.00 | 0.1357 | -0.0001 | |||||

| CORP. NOTE / DBT (US44963BAG32) | 0.24 | -4.40 | 0.1343 | -0.0061 | |||||

| US432833AF84 / Hilton Domestic Operating Co Inc | 0.24 | 1.29 | 0.1319 | 0.0015 | |||||

| US740212AM74 / Precision Drilling Corp | 0.23 | -7.14 | 0.1316 | -0.0100 | |||||

| XS2066744231 / Carnival PLC | 0.23 | -0.85 | 0.1307 | -0.0015 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0.01 | 0.00 | 0.23 | 3.15 | 0.1287 | 0.0036 | |||

| PCG.PRX / PG&E Corporation - Preferred Security | 0.23 | 0.00 | 0.1282 | -0.0002 | |||||

| US28504KAA51 / Electricite de France SA | 0.22 | -1.32 | 0.1257 | -0.0020 | |||||

| US82967NBJ63 / Sirius XM Radio Inc | 0.22 | 0.91 | 0.1240 | 0.0007 | |||||

| US57767XAA81 / Mav Acquisition Corp | 0.22 | -0.45 | 0.1237 | -0.0007 | |||||

| CORP. NOTE / DBT (US29281RAA77) | 0.20 | -2.88 | 0.1138 | -0.0033 | |||||

| US78397UAA88 / SCIL IV LLC / SCIL USA Holdings LLC | 0.20 | -0.51 | 0.1107 | -0.0006 | |||||

| CORP. NOTE / DBT (US84749AAC18) | 0.19 | -7.84 | 0.1055 | -0.0094 | |||||

| US62886HBN08 / NCL Corp Ltd | 0.18 | -1.08 | 0.1028 | -0.0015 | |||||

| BANK LOAN NOTE / DBT (US44988LAL18) | 0.18 | 0.1016 | 0.1016 | ||||||

| US85205TAN00 / Spirit AeroSystems Inc | 0.18 | -0.55 | 0.1015 | -0.0011 | |||||

| BANK LOAN NOTE / DBT (US31732FAV85) | 0.18 | 0.1009 | 0.1009 | ||||||

| US25461LAA08 / DIRECTV Holdings LLC/DIRECTV Financing Co., Inc. | 0.18 | -67.87 | 0.1003 | -0.2109 | |||||

| US126307AS68 / CSC Holdings LLC | 0.17 | -1.14 | 0.0981 | -0.0007 | |||||

| US65336YAN31 / Nexstar Broadcasting Inc | 0.17 | -35.56 | 0.0977 | -0.1342 | |||||

| BANK LOAN NOTE / DBT (US80875CAE75) | 0.17 | 0.0966 | 0.0966 | ||||||

| US513075BW03 / Lamar Media Corp | 0.17 | 0.0966 | 0.0966 | ||||||

| BLCO / Bausch + Lomb Corporation | 0.17 | -0.58 | 0.0962 | -0.0008 | |||||

| ACA / Arcosa, Inc. | 0.17 | -0.59 | 0.0943 | -0.0006 | |||||

| US880779BA01 / Terex Corp | 0.17 | -0.60 | 0.0939 | -0.0006 | |||||

| CORP. PIK BOND / DBT (US169918AA77) | 0.17 | 2.47 | 0.0931 | 0.0017 | |||||

| US62886HBG56 / NCL Corp Ltd | 0.17 | -2.94 | 0.0926 | -0.0028 | |||||

| US87724RAB87 / Taylor Morrison Communities, Inc. | 0.17 | 0.00 | 0.0926 | -0.0004 | |||||

| P2OD34 / Insulet Corporation - Depositary Receipt (Common Stock) | 0.16 | 0.0887 | 0.0887 | ||||||

| US15135BAW19 / Centene Corp | 0.15 | 2.11 | 0.0813 | 0.0011 | |||||

| US16115QAG55 / Chart Industries Inc | 0.14 | -1.38 | 0.0807 | -0.0010 | |||||

| CORP. NOTE / DBT (US37441QAA94) | 0.14 | 0.00 | 0.0806 | 0.0003 | |||||

| CORP. NOTE / DBT (US98372MAE57) | 0.14 | -2.05 | 0.0802 | -0.0021 | |||||

| CORP. NOTE / DBT (US00687YAD76) | 0.14 | -6.58 | 0.0797 | -0.0056 | |||||

| US17888HAA14 / Civitas Resources Inc | 0.14 | -6.16 | 0.0772 | -0.0050 | |||||

| US69007TAB08 / Outfront Media Capital LLC / Outfront Media Capital Corp | 0.14 | -50.18 | 0.0770 | -0.0776 | |||||

| US02376CBM64 / BANK LOAN NOTE | 0.13 | -2.90 | 0.0757 | -0.0023 | |||||

| US04020JAA43 / Aretec Escrow Issuer 2 Inc | 0.13 | -2.19 | 0.0755 | -0.0016 | |||||

| US25213YAU91 / DexKo Global, Inc., First Lien Term Loan | 0.13 | -3.62 | 0.0747 | -0.0030 | |||||

| Credit Default Swap Basket Index / DCR (N/A) | 0.13 | 0.0745 | 0.0745 | ||||||

| CORP. NOTE / DBT (US68245XAR08) | 0.13 | 0.76 | 0.0741 | 0.0001 | |||||

| CORP. NOTE / DBT (US01883LAH69) | 0.13 | -0.76 | 0.0737 | -0.0009 | |||||

| RIG / Transocean Ltd. | 0.13 | -11.35 | 0.0702 | -0.0094 | |||||

| US143658BR27 / Carnival Corp | 0.12 | -0.83 | 0.0669 | -0.0005 | |||||

| CORPORATE BONDS / DBT (US922966AB20) | 0.12 | 0.0662 | 0.0662 | ||||||

| CORP. NOTE / DBT (US922966AA47) | 0.12 | 0.0662 | 0.0662 | ||||||

| US89383JAA60 / Transocean Poseidon Ltd | 0.11 | -13.64 | 0.0643 | -0.0100 | |||||

| US740212AL91 / Precision Drilling Corp | 0.11 | -0.93 | 0.0604 | -0.0004 | |||||

| BANK LOAN NOTE / DBT (XAN8232NAM91) | 0.10 | -0.96 | 0.0578 | -0.0010 | |||||

| US893790AA34 / Transocean Aquila Ltd | 0.10 | -13.79 | 0.0564 | -0.0091 | |||||

| CHEF / The Chefs' Warehouse, Inc. | 0.09 | 0.0525 | 0.0525 | ||||||

| US76774LAB36 / Ritchie Bros Holdings Inc | 0.09 | -1.15 | 0.0486 | -0.0003 | |||||

| US143658BW12 / CORP. NOTE | 0.08 | 0.00 | 0.0468 | -0.0003 | |||||

| CROX / Crocs, Inc. | 0.08 | 0.00 | 0.0462 | -0.0002 | |||||

| US505742AG11 / Ladder Capital Finance Holdings LLLP / Ladder Capital Finance Corp | 0.08 | -1.25 | 0.0447 | -0.0002 | |||||

| MTDR / Matador Resources Company | 0.08 | -56.40 | 0.0424 | -0.0545 | |||||

| US1248EPCK74 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.07 | 1.41 | 0.0406 | 0.0007 | |||||

| CORP. NOTE / DBT (US95081QAQ73) | 0.07 | 0.00 | 0.0398 | -0.0002 | |||||

| US389286AA34 / Gray Escrow II Inc | 0.07 | -65.43 | 0.0368 | -0.0687 | |||||

| US65249BAB53 / News Corp | 0.06 | 0.00 | 0.0348 | -0.0000 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.06 | -1.64 | 0.0342 | -0.0001 | |||||

| US92555WAD74 / ViaSat, Inc. Term Loan | 0.06 | 3.77 | 0.0312 | 0.0011 | |||||

| CORP. NOTE / DBT (US12769GAC42) | 0.06 | 0.00 | 0.0310 | -0.0002 | |||||

| US18060TAC99 / Clarios Global LP / Clarios US Finance Co | 0.05 | 0.00 | 0.0285 | -0.0001 | |||||

| CORP. NOTE / DBT (US367398AA27) | 0.05 | -2.17 | 0.0256 | -0.0002 | |||||

| CORP. NOTE / DBT (US47077WAE84) | 0.04 | 0.0197 | 0.0197 |