Mga Batayang Estadistika

| Nilai Portofolio | $ 1,865,723,953 |

| Posisi Saat Ini | 1,632 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

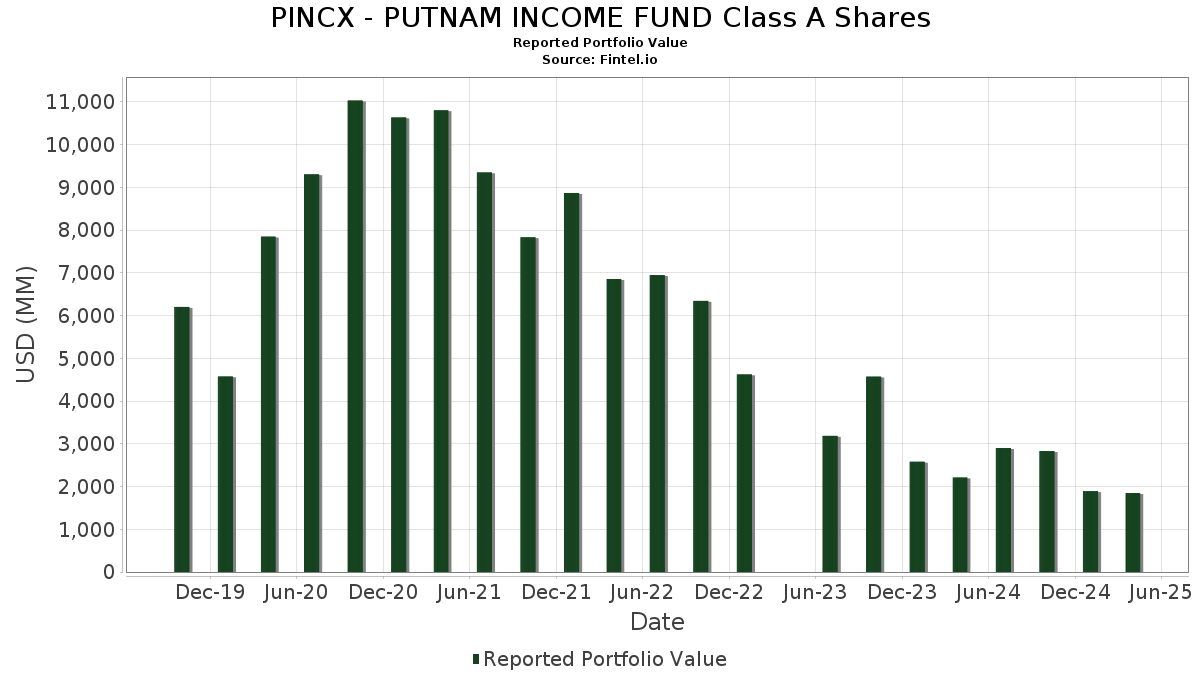

PINCX - PUTNAM INCOME FUND Class A Shares telah mengungkapkan total kepemilikan 1,632 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,865,723,953 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PINCX - PUTNAM INCOME FUND Class A Shares adalah SHORT TERM INV FUND (US:US74676P6640) , Uniform Mortgage-Backed Security, TBA (US:US01F0606594) , Uniform Mortgage-Backed Security, TBA (US:US01F0206536) , Ginnie Mae (US:US21H0426534) , and Ginnie Mae (US:US21H0526523) . Posisi baru PINCX - PUTNAM INCOME FUND Class A Shares meliputi: Uniform Mortgage-Backed Security, TBA (US:US01F0606594) , Uniform Mortgage-Backed Security, TBA (US:US01F0206536) , Ginnie Mae (US:US21H0426534) , Ginnie Mae (US:US21H0526523) , and FNMA 30YR TBA 2.5% 4/25/50 TO BE ANNOUNCED 2.50000000 (US:US01F0226591) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 30.99 | 2.9691 | 2.7183 | ||

| 17.90 | 1.7149 | 1.7149 | ||

| 76.96 | 76.96 | 7.3732 | 1.5994 | |

| 13.46 | 1.2895 | 1.2895 | ||

| 13.46 | 1.2895 | 1.2895 | ||

| 13.46 | 1.2895 | 1.2895 | ||

| 13.46 | 1.2895 | 1.2895 | ||

| 10.61 | 1.0163 | 1.0163 | ||

| 18.96 | 1.8165 | 0.9061 | ||

| 10.25 | 0.9822 | 0.7537 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| -15.66 | -1.5007 | -4.2480 | ||

| 9.31 | 0.8919 | -2.8156 | ||

| 28.27 | 2.7083 | -2.6211 | ||

| 34.47 | 3.3019 | -2.3354 | ||

| 4.78 | 0.4582 | -2.0557 | ||

| -11.13 | -1.0661 | -1.2371 | ||

| 1.03 | 0.0987 | -1.1900 | ||

| 7.81 | 0.7484 | -1.0823 | ||

| 63.92 | 6.1233 | -0.6356 | ||

| 3.47 | 0.3326 | -0.1969 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-24 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US74676P6640 / SHORT TERM INV FUND | 76.96 | 24.28 | 76.96 | 24.28 | 7.3732 | 1.5994 | |||

| US01F0606594 / Uniform Mortgage-Backed Security, TBA | 63.92 | -19.40 | 6.1233 | -0.6356 | |||||

| US01F0206536 / Uniform Mortgage-Backed Security, TBA | 54.75 | -11.60 | 5.2447 | -0.0335 | |||||

| US21H0426534 / Ginnie Mae | 34.47 | -47.89 | 3.3019 | -2.3354 | |||||

| US21H0526523 / Ginnie Mae | 30.99 | 953.47 | 2.9691 | 2.7183 | |||||

| US01F0226591 / FNMA 30YR TBA 2.5% 4/25/50 TO BE ANNOUNCED 2.50000000 | 28.27 | -54.79 | 2.7083 | -2.6211 | |||||

| US01F0526560 / FNMA TBA 30 YR 5.5 SINGLE FAMILY MORTGAGE | 18.96 | 77.50 | 1.8165 | 0.9061 | |||||

| US21H0226553 / Ginnie Mae | 17.90 | 1.7149 | 1.7149 | ||||||

| FLUD / Franklin Templeton ETF Trust - Franklin Ultra Short Bond ETF | 0.69 | 0.00 | 17.29 | 0.05 | 1.6563 | 0.0451 | |||

| U.S. Treasury Bills / STIV (US912797MS31) | 13.46 | 1.2895 | 1.2895 | ||||||

| U.S. Treasury Bills / STIV (US912797MS31) | 13.46 | 1.2895 | 1.2895 | ||||||

| U.S. Treasury Bills / STIV (US912797MS31) | 13.46 | 1.2895 | 1.2895 | ||||||

| U.S. Treasury Bills / STIV (US912797MS31) | 13.46 | 1.2895 | 1.2895 | ||||||

| US21H0306587 / G2SF 3 5/16 | 12.40 | -2.84 | 1.1876 | 0.1001 | |||||

| US21H0206597 / GNMA II 30 YR TBA 2% MAY 21 TO BE ANNOUNCED 2.00000000 | 10.61 | 1.0163 | 1.0163 | ||||||

| US01F0406516 / Uniform Mortgage-Backed Security, TBA | 10.25 | 282.39 | 0.9822 | 0.7537 | |||||

| US21H0406577 / Ginnie Mae | 9.31 | -78.60 | 0.8919 | -2.8156 | |||||

| US01F0306526 / FNMA TBA 30YR 3.0% MAY 20 TO BE ANNOUNCED 3.00000000 | 7.81 | -63.63 | 0.7484 | -1.0823 | |||||

| US01F0124523 / FNCI 1.5 UMBS TBA 05-01-36 | 7.06 | 4.87 | 0.6767 | 0.1026 | |||||

| US35564KTJ87 / Freddie Mac STACR REMIC Trust 2022-HQA1 | 6.71 | -1.73 | 0.6427 | 0.0063 | |||||

| FNCI / UMBS 15YR TBA(REG B) 2.0 UMBS TBA 05-01-35 | 6.36 | 5.30 | 0.6094 | 0.0945 | |||||

| US21H0326544 / Ginnie Mae | 6.36 | 3.11 | 0.6093 | 0.0836 | |||||

| US254683CW31 / Discover Card Execution Note Trust | 5.94 | 0.20 | 0.5695 | 0.0164 | |||||

| US14041NGA37 / Capital One Multi-Asset Execution Trust | 5.94 | 0.25 | 0.5692 | 0.0166 | |||||

| Ford Credit Auto Owner Trust, Series 2024-A, Class A3 / ABS-O (US34535EAD40) | 5.90 | 0.31 | 0.5652 | 0.0168 | |||||

| Ford Credit Auto Owner Trust, Series 2024-A, Class A3 / ABS-O (US34535EAD40) | 5.90 | 0.31 | 0.5652 | 0.0168 | |||||

| Ford Credit Auto Owner Trust, Series 2024-A, Class A3 / ABS-O (US34535EAD40) | 5.90 | 0.31 | 0.5652 | 0.0168 | |||||

| US6174467Y92 / Morgan Stanley | 5.78 | 0.49 | 0.5541 | 0.0175 | |||||

| US05522RDH84 / BA Credit Card Trust | 5.78 | 0.68 | 0.5535 | 0.0185 | |||||

| US05522RDH84 / BA Credit Card Trust | 5.78 | 0.68 | 0.5535 | 0.0185 | |||||

| US31418D6K36 / Fannie Mae Pool | 5.64 | -1.14 | 0.5400 | 0.0085 | |||||

| US04010LAZ67 / Ares Capital Corp. | 5.57 | 0.25 | 0.5335 | 0.0157 | |||||

| US02582JJV35 / American Express Credit Account Master Trust | 5.54 | 0.14 | 0.5308 | 0.0150 | |||||

| US380881FP22 / Golden Credit Card Trust | 5.49 | 0.04 | 0.5255 | 0.0142 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 5.31 | -0.67 | 0.5090 | 0.0103 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 5.31 | -0.67 | 0.5090 | 0.0103 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 5.31 | -0.67 | 0.5090 | 0.0103 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 5.31 | -0.67 | 0.5090 | 0.0103 | |||||

| US10568YAF51 / BRAVO Residential Funding Trust, Series 2020-RPL1, Class M1 | 5.14 | 1.16 | 0.4925 | 0.0187 | |||||

| US46647PDA12 / JPMorgan Chase & Co. | 5.13 | 0.93 | 0.4911 | 0.0176 | |||||

| US225401AQ16 / Credit Suisse Group AG | 4.90 | 0.66 | 0.4695 | 0.0156 | |||||

| US01F0426571 / Uniform Mortgage-Backed Security, TBA | 4.78 | -83.79 | 0.4582 | -2.0557 | |||||

| US3140FXG558 / Fannie Mae Pool | 4.61 | -1.01 | 0.4418 | 0.0075 | |||||

| US05971KAA79 / Banco Santander SA | 4.61 | 0.07 | 0.4412 | 0.0122 | |||||

| US3132E0JF09 / FR SD3862 | 4.51 | -0.66 | 0.4317 | 0.0088 | |||||

| US693964AA61 / CORP CMO | 4.46 | -11.36 | 0.4270 | -0.0418 | |||||

| US3140XMA557 / FN30 | 4.34 | -1.21 | 0.4160 | 0.0062 | |||||

| Chase Auto Owner Trust, Series 2024-1A, Class A3 / ABS-O (US16144BAC28) | 4.25 | 0.09 | 0.4076 | 0.0113 | |||||

| Chase Auto Owner Trust, Series 2024-1A, Class A3 / ABS-O (US16144BAC28) | 4.25 | 0.09 | 0.4076 | 0.0113 | |||||

| Chase Auto Owner Trust, Series 2024-1A, Class A3 / ABS-O (US16144BAC28) | 4.25 | 0.09 | 0.4076 | 0.0113 | |||||

| SOP / DIR (N/A) | 4.21 | 0.4034 | 0.4034 | ||||||

| US06054ABC27 / BANC OF AMERICA COMMERCIAL MORTGAGE TRUST FRN 09/15/2048 2015-UBS7 B | 4.10 | 0.66 | 0.3926 | 0.0130 | |||||

| OIS / DIR (N/A) | 4.06 | 0.3887 | 0.3887 | ||||||

| OIS / DIR (N/A) | 4.06 | 0.3887 | 0.3887 | ||||||

| OIS / DIR (N/A) | 4.06 | 0.3887 | 0.3887 | ||||||

| Station Place Securitization Trust, Series 2024-10, Class A / ABS-MBS (US85779PAA21) | 4.01 | -0.20 | 0.3845 | 0.0095 | |||||

| Station Place Securitization Trust, Series 2024-10, Class A / ABS-MBS (US85779PAA21) | 4.01 | -0.20 | 0.3845 | 0.0095 | |||||

| Station Place Securitization Trust, Series 2024-10, Class A / ABS-MBS (US85779PAA21) | 4.01 | -0.20 | 0.3845 | 0.0095 | |||||

| US3136BFHG14 / FNMA CMO IO | 3.97 | -0.55 | 0.3807 | 0.0081 | |||||

| US21H0506566 / Ginnie Mae | 3.92 | 0.3760 | 0.3760 | ||||||

| US75575WAC01 / Ready Capital Mortgage Financing 2021-FL7 LLC | 3.89 | -0.43 | 0.3731 | 0.0084 | |||||

| US3140XFZU87 / FN FS0754 | 3.86 | -0.92 | 0.3695 | 0.0066 | |||||

| Station Place Securitization Trust, Series 2024-2, Class A / ABS-MBS (US85770KAA25) | 3.84 | 0.00 | 0.3682 | 0.0099 | |||||

| Station Place Securitization Trust, Series 2024-2, Class A / ABS-MBS (US85770KAA25) | 3.84 | 0.00 | 0.3682 | 0.0099 | |||||

| US38382J3Q72 / GNMA CMO IO | 3.83 | -1.59 | 0.3672 | 0.0041 | |||||

| US35564KNS41 / Freddie Mac STACR REMIC Trust 2021-HQA4 | 3.76 | -0.79 | 0.3600 | 0.0069 | |||||

| US35563PLU11 / Seasoned Credit Risk Transfer Trust Series 2019-3 | 3.75 | -4.36 | 0.3594 | -0.0062 | |||||

| Ford Credit Auto Owner Trust, Series 2024-B, Class A3 / ABS-O (US34531QAD16) | 3.72 | 0.30 | 0.3565 | 0.0106 | |||||

| US3140QL5S11 / FN15 | 3.70 | -1.88 | 0.3547 | 0.0029 | |||||

| Station Place Securitization Trust, Series 2024-5, Class A / ABS-MBS (US85778YAA47) | 3.62 | -0.11 | 0.3466 | 0.0089 | |||||

| Station Place Securitization Trust, Series 2024-5, Class A / ABS-MBS (US85778YAA47) | 3.62 | -0.11 | 0.3466 | 0.0089 | |||||

| US06051GGC78 / Bank of America Corp | 3.49 | 0.98 | 0.3346 | 0.0121 | |||||

| US172967KA87 / Citigroup Inc | 3.47 | -38.86 | 0.3326 | -0.1969 | |||||

| US61690AAJ34 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C27 | 3.41 | -0.76 | 0.3269 | 0.0063 | |||||

| US43815QAC15 / HAROT 23-3 A3 5.41% 02-18-28/11-18-26 | 3.30 | -0.18 | 0.3159 | 0.0079 | |||||

| US38384ARL97 / GNMA CMO IO | 3.22 | 4.38 | 0.3085 | 0.0208 | |||||

| US3140XJJM67 / FN FS2967 | 3.18 | -0.50 | 0.3050 | 0.0067 | |||||

| US62548QAD34 / Multifamily Connecticut Avenue Securities Trust 2020-01 | 3.18 | -0.75 | 0.3044 | 0.0059 | |||||

| U.S. Treasury 5 Year Notes / DIR (N/A) | 3.09 | 0.2959 | 0.2959 | ||||||

| U.S. Treasury 5 Year Notes / DIR (N/A) | 3.09 | 0.2959 | 0.2959 | ||||||

| U.S. Treasury 5 Year Notes / DIR (N/A) | 3.09 | 0.2959 | 0.2959 | ||||||

| US10569CAJ45 / BRAVO_21-HE2 | 2.99 | -0.33 | 0.2867 | 0.0067 | |||||

| US08576PAF80 / Berry Global Inc | 2.98 | 0.95 | 0.2858 | 0.0102 | |||||

| US95002EBF34 / Wells Fargo Commercial Mortgage Trust, Series 2020-C55, Class XA | 2.98 | -3.13 | 0.2851 | -0.0013 | |||||

| US69688FAJ93 / Palmer Square CLO 2021-3 Ltd | 2.93 | -0.17 | 0.2807 | 0.0070 | |||||

| GNMA, Series 2021-91, Class AI / ABS-MBS (US38382TNG57) | 2.92 | -3.34 | 0.2802 | -0.0019 | |||||

| GNMA, Series 2021-91, Class AI / ABS-MBS (US38382TNG57) | 2.92 | -3.34 | 0.2802 | -0.0019 | |||||

| US23305YAM12 / COMMERCIAL MORTGAGE BACKED SECURITIES | 2.88 | -0.17 | 0.2755 | 0.0068 | |||||

| US16411QAG64 / Cheniere Energy Partners LP | 2.85 | 0.74 | 0.2727 | 0.0093 | |||||

| US64110LAU08 / Netflix Inc | 2.84 | 7.32 | 0.2724 | 0.0253 | |||||

| US674599DZ54 / Occidental Petroleum Corp | 2.84 | -0.77 | 0.2722 | 0.0052 | |||||

| US38384DZX82 / GNMA CMO IO | 2.84 | -2.84 | 0.2720 | -0.0004 | |||||

| US3140FXFM99 / Fannie Mae Pool | 2.80 | 0.04 | 0.2679 | 0.0073 | |||||

| US11134LAH24 / Broadcom Corp / Broadcom Cayman Finance Ltd | 2.80 | 0.79 | 0.2678 | 0.0092 | |||||

| US693475BE43 / PNC Financial Services Group Inc/The | 2.79 | 0.22 | 0.2677 | 0.0078 | |||||

| US62956BAA70 / NYMT Loan Trust 2022-SP1 | 2.79 | -1.59 | 0.2672 | 0.0030 | |||||

| US01F0224513 / Fannie Mae or Freddie Mac | 2.79 | 57.34 | 0.2671 | 0.1161 | |||||

| Hyundai Auto Receivables Trust, Series 2024-A, Class A3 / ABS-O (US448973AD90) | 2.78 | 0.25 | 0.2663 | 0.0078 | |||||

| Hyundai Auto Receivables Trust, Series 2024-A, Class A3 / ABS-O (US448973AD90) | 2.78 | 0.25 | 0.2663 | 0.0078 | |||||

| Hyundai Auto Receivables Trust, Series 2024-A, Class A3 / ABS-O (US448973AD90) | 2.78 | 0.25 | 0.2663 | 0.0078 | |||||

| US04285AAD72 / Arroyo Mortgage Trust, Series 2019-3, Class M1 | 2.76 | 3.61 | 0.2641 | 0.0160 | |||||

| US95000U3E14 / Wells Fargo & Co. | 2.72 | 0.96 | 0.2610 | 0.0095 | |||||

| D1HI34 / D.R. Horton, Inc. - Depositary Receipt (Common Stock) | 2.71 | 0.26 | 0.2593 | 0.0076 | |||||

| D1HI34 / D.R. Horton, Inc. - Depositary Receipt (Common Stock) | 2.71 | 0.26 | 0.2593 | 0.0076 | |||||

| D1HI34 / D.R. Horton, Inc. - Depositary Receipt (Common Stock) | 2.71 | 0.26 | 0.2593 | 0.0076 | |||||

| D1HI34 / D.R. Horton, Inc. - Depositary Receipt (Common Stock) | 2.71 | 0.26 | 0.2593 | 0.0076 | |||||

| US62547NAB55 / COMMERCIAL MORTGAGE BACKED SECURITIES | 2.67 | -3.05 | 0.2561 | -0.0010 | |||||

| US3618FMUL30 / GII30 | 2.65 | 0.00 | 0.2534 | 0.0068 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 2.64 | 2.21 | 0.2529 | 0.0121 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 2.64 | 2.21 | 0.2529 | 0.0121 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 2.64 | 2.21 | 0.2529 | 0.0121 | |||||

| US95000U2A01 / Wells Fargo & Co | 2.61 | 1.08 | 0.2503 | 0.0093 | |||||

| US92328MAE30 / Venture Global Calcasieu Pass LLC | 2.60 | -1.74 | 0.2494 | 0.0024 | |||||

| US3618FDLL32 / GII30 | 2.60 | -12.57 | 0.2487 | -0.0281 | |||||

| US12555QAN60 / CIFC Funding 2020-I Ltd | 2.52 | 0.2418 | 0.2418 | ||||||

| US3133KR5T72 / FR RA9858 | 2.51 | -3.01 | 0.2405 | -0.0008 | |||||

| US449259AJ97 / ICG US CLO 2017-1 Ltd | 2.51 | 0.04 | 0.2400 | 0.0065 | |||||

| US30296DAG60 / FREMF Mortgage Trust, Series 2018-KF43, Class B | 2.49 | 0.00 | 0.2383 | 0.0063 | |||||

| US55354GAK67 / MSCI Inc | 2.49 | 0.89 | 0.2382 | 0.0084 | |||||

| US24381YAC84 / CORP CMO | 2.47 | -2.72 | 0.2365 | -0.0002 | |||||

| US3618FDL589 / GII30 | 2.47 | 0.24 | 0.2364 | 0.0070 | |||||

| US90353DBA28 / COMMERCIAL MORT BACKED SEC IO | 2.46 | -6.44 | 0.2353 | -0.0095 | |||||

| US83614XAQ43 / Sound Point CLO XXVI Ltd | 2.46 | -0.32 | 0.2353 | 0.0056 | |||||

| US29444UBE55 / Equinix, Inc. | 2.41 | 1.99 | 0.2311 | 0.0106 | |||||

| US817826AD20 / 7-Eleven Inc | 2.41 | 0.2308 | 0.2308 | ||||||

| US12597BAW90 / CSAIL 2019-C17 Commercial Mortgage Trust | 2.40 | -7.18 | 0.2303 | -0.0111 | |||||

| US125581GX07 / CIT GROUP INC SUBORDINATED 03/28 6.125 | 2.35 | 0.43 | 0.2254 | 0.0070 | |||||

| US3140J5JS92 / FN30 | 2.31 | -0.09 | 0.2209 | 0.0058 | |||||

| US718172DA46 / Philip Morris International Inc | 2.29 | 1.69 | 0.2194 | 0.0094 | |||||

| US05492JAE29 / BARCLAYS COMMERCIAL MORTGAGE CSTR 11/15/2052 144A | 2.26 | -2.51 | 0.2160 | 0.0004 | |||||

| US28368EAE68 / El Paso 7.75% Senior Notes 1/15/32 | 2.24 | -0.13 | 0.2148 | 0.0055 | |||||

| US19688EAE86 / CORP CMO | 2.18 | 3.76 | 0.2088 | 0.0129 | |||||

| GM Financial Consumer Automobile Receivables Trust, Series 2024-2, Class A3 / ABS-O (US379931AD07) | 2.17 | 0.23 | 0.2079 | 0.0060 | |||||

| GM Financial Consumer Automobile Receivables Trust, Series 2024-2, Class A3 / ABS-O (US379931AD07) | 2.17 | 0.23 | 0.2079 | 0.0060 | |||||

| GM Financial Consumer Automobile Receivables Trust, Series 2024-2, Class A3 / ABS-O (US379931AD07) | 2.17 | 0.23 | 0.2079 | 0.0060 | |||||

| US3140QKVB11 / Fannie Mae Pool | 2.16 | -0.87 | 0.2074 | 0.0038 | |||||

| US68389XCD57 / Oracle Corp | 2.15 | 1.94 | 0.2063 | 0.0093 | |||||

| US3136AXV853 / FNMA CMO IO | 2.15 | -3.24 | 0.2058 | -0.0012 | |||||

| US15089QAM69 / Celanese US Holdings LLC | 2.14 | -37.02 | 0.2047 | -0.1117 | |||||

| US14043QAC69 / COPAR 2022-1 A3 | 2.13 | -26.90 | 0.2041 | -0.0676 | |||||

| US38382HM982 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2020-123 CL NI 2.50000000 | 2.13 | 2.16 | 0.2040 | 0.0097 | |||||

| US92922F4W51 / CORP CMO | 2.12 | 0.05 | 0.2033 | 0.0056 | |||||

| GNMA, Series 2023-19, Class S / ABS-MBS (US38383V3H92) | 2.08 | 15.20 | 0.1997 | 0.0310 | |||||

| GNMA, Series 2023-19, Class S / ABS-MBS (US38383V3H92) | 2.08 | 15.20 | 0.1997 | 0.0310 | |||||

| GNMA, Series 2023-19, Class S / ABS-MBS (US38383V3H92) | 2.08 | 15.20 | 0.1997 | 0.0310 | |||||

| US06539LBC37 / BANK 2018-BNK13 | 2.08 | -10.25 | 0.1996 | -0.0169 | |||||

| US69047QAB86 / Ovintiv Inc | 2.07 | 0.19 | 0.1987 | 0.0057 | |||||

| US48129RBC88 / JPMDB_19-COR6 | 2.05 | -4.43 | 0.1962 | -0.0036 | |||||

| GreenState Auto Receivables Trust, Series 2024-1A, Class A3 / ABS-O (US39573AAC62) | 2.01 | -0.05 | 0.1929 | 0.0051 | |||||

| GreenState Auto Receivables Trust, Series 2024-1A, Class A3 / ABS-O (US39573AAC62) | 2.01 | -0.05 | 0.1929 | 0.0051 | |||||

| GreenState Auto Receivables Trust, Series 2024-1A, Class A3 / ABS-O (US39573AAC62) | 2.01 | -0.05 | 0.1929 | 0.0051 | |||||

| GreenState Auto Receivables Trust, Series 2024-1A, Class A3 / ABS-O (US39573AAC62) | 2.01 | -0.05 | 0.1929 | 0.0051 | |||||

| US3133Q3H798 / GOVT CMO | 2.01 | -4.52 | 0.1924 | -0.0037 | |||||

| US773663AC30 / ROCKP 2021-1A B | 2.00 | -0.20 | 0.1920 | 0.0048 | |||||

| Magnetite XL Ltd., Series 2024-40A, Class A1 / ABS-CBDO (US55955RAA77) | 2.00 | -0.60 | 0.1919 | 0.0041 | |||||

| Magnetite XL Ltd., Series 2024-40A, Class A1 / ABS-CBDO (US55955RAA77) | 2.00 | -0.60 | 0.1919 | 0.0041 | |||||

| Magnetite XL Ltd., Series 2024-40A, Class A1 / ABS-CBDO (US55955RAA77) | 2.00 | -0.60 | 0.1919 | 0.0041 | |||||

| US12062RAC43 / CORP CMO | 1.98 | 3.23 | 0.1898 | 0.0109 | |||||

| US06051GKL22 / BAC 3.846 03/08/37 | 1.98 | 0.30 | 0.1897 | 0.0057 | |||||

| US045054AF03 / Ashtead Capital Inc | 1.98 | 0.87 | 0.1896 | 0.0066 | |||||

| US38378DRC10 / GNMA CMO IO | 1.97 | -2.52 | 0.1888 | 0.0003 | |||||

| SOP / DIR (N/A) | 1.96 | 0.1882 | 0.1882 | ||||||

| US87264ABD63 / CORP. NOTE | 1.96 | 1.03 | 0.1873 | 0.0068 | |||||

| US87250FAN06 / TICP CLO XII Ltd | 1.95 | -0.20 | 0.1872 | 0.0047 | |||||

| CNO.PRA / CNO Financial Group, Inc. - Corporate Bond/Note | 1.94 | -0.21 | 0.1855 | 0.0046 | |||||

| CNO.PRA / CNO Financial Group, Inc. - Corporate Bond/Note | 1.94 | -0.21 | 0.1855 | 0.0046 | |||||

| US3137FJK993 / FHLMC CMO IO | 1.93 | 18.40 | 0.1850 | 0.0329 | |||||

| US26078JAF75 / DuPont de Nemours Inc | 1.92 | 65.72 | 0.1844 | 0.0761 | |||||

| US71713UAW27 / Pharmacia LLC | 1.92 | 1.11 | 0.1836 | 0.0068 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL4, Class A1 / ABS-MBS (US79584CAA99) | 1.90 | 0.1822 | 0.1822 | ||||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL4, Class A1 / ABS-MBS (US79584CAA99) | 1.90 | 0.1822 | 0.1822 | ||||||

| Signal Peak CLO 5 Ltd., Series 2018-5A, Class A1R / ABS-CBDO (US82666VAA26) | 1.90 | -0.68 | 0.1822 | 0.0037 | |||||

| Signal Peak CLO 5 Ltd., Series 2018-5A, Class A1R / ABS-CBDO (US82666VAA26) | 1.90 | -0.68 | 0.1822 | 0.0037 | |||||

| Signal Peak CLO 5 Ltd., Series 2018-5A, Class A1R / ABS-CBDO (US82666VAA26) | 1.90 | -0.68 | 0.1822 | 0.0037 | |||||

| Rogers Communications, Inc. / DBT (US775109DE81) | 1.90 | 1.39 | 0.1819 | 0.0073 | |||||

| US694308KL02 / Pacific Gas and Electric Co | 1.90 | 1.94 | 0.1817 | 0.0082 | |||||

| US14919GAA31 / Cathedral Lake Ltd., Series 2021-8A, Class A1 | 1.89 | 0.1806 | 0.1806 | ||||||

| US35563PMX41 / Seasoned Credit Risk Transfer Trust Series 2019-4 | 1.88 | 0.16 | 0.1804 | 0.0051 | |||||

| US46647PBP09 / JPMORGAN CHASE and CO 2.956/VAR 05/13/2031 | 1.88 | 1.68 | 0.1802 | 0.0076 | |||||

| AIMCO CLO 17 Ltd., Series 2022-17A, Class A1R / ABS-CBDO (US00889JAK07) | 1.85 | -0.16 | 0.1776 | 0.0045 | |||||

| AIMCO CLO 17 Ltd., Series 2022-17A, Class A1R / ABS-CBDO (US00889JAK07) | 1.85 | -0.16 | 0.1776 | 0.0045 | |||||

| US3132AATC89 / FR30 | 1.84 | -1.76 | 0.1767 | 0.0017 | |||||

| Voya CLO Ltd., Series 2024-4A, Class A1 / ABS-CBDO (US92920KAA79) | 1.84 | -1.34 | 0.1761 | 0.0024 | |||||

| Voya CLO Ltd., Series 2024-4A, Class A1 / ABS-CBDO (US92920KAA79) | 1.84 | -1.34 | 0.1761 | 0.0024 | |||||

| Voya CLO Ltd., Series 2024-4A, Class A1 / ABS-CBDO (US92920KAA79) | 1.84 | -1.34 | 0.1761 | 0.0024 | |||||

| Voya CLO Ltd., Series 2024-4A, Class A1 / ABS-CBDO (US92920KAA79) | 1.84 | -1.34 | 0.1761 | 0.0024 | |||||

| US3140FXDF66 / FN40 | 1.83 | 0.27 | 0.1752 | 0.0051 | |||||

| US74970FAA57 / RMF Proprietary Issuance Trust 2022-3 | 1.82 | 1.28 | 0.1747 | 0.0068 | |||||

| US852060AD48 / Sprint Capital Corp 6.875% Notes 11/15/2028 | 1.82 | 0.78 | 0.1744 | 0.0060 | |||||

| US3618FDLM15 / GII30 | 1.81 | 0.00 | 0.1729 | 0.0046 | |||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 1.80 | 2.04 | 0.1729 | 0.0080 | |||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 1.80 | 2.04 | 0.1729 | 0.0080 | |||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 1.80 | 2.04 | 0.1729 | 0.0080 | |||||

| MTZ / MasTec, Inc. | 1.80 | 0.33 | 0.1723 | 0.0052 | |||||

| MTZ / MasTec, Inc. | 1.80 | 0.33 | 0.1723 | 0.0052 | |||||

| MTZ / MasTec, Inc. | 1.80 | 0.33 | 0.1723 | 0.0052 | |||||

| US95001XBF24 / Wells Fargo Commercial Mortgage Trust 2019-C50 | 1.80 | -5.13 | 0.1720 | -0.0045 | |||||

| IMB / Imperial Brands PLC | 1.78 | 1.60 | 0.1707 | 0.0072 | |||||

| IMB / Imperial Brands PLC | 1.78 | 1.60 | 0.1707 | 0.0072 | |||||

| IMB / Imperial Brands PLC | 1.78 | 1.60 | 0.1707 | 0.0072 | |||||

| US88731EAJ91 / Time Warner Entmt Co Lp Srsubdb 8.375% 07/15/33 | 1.77 | 0.62 | 0.1698 | 0.0055 | |||||

| Bank of America Corp. / DBT (US06051GMB22) | 1.76 | 0.40 | 0.1687 | 0.0052 | |||||

| Bank of America Corp. / DBT (US06051GMB22) | 1.76 | 0.40 | 0.1687 | 0.0052 | |||||

| Bank of America Corp. / DBT (US06051GMB22) | 1.76 | 0.40 | 0.1687 | 0.0052 | |||||

| Bank of America Corp. / DBT (US06051GMB22) | 1.76 | 0.40 | 0.1687 | 0.0052 | |||||

| US30303M8R66 / META PLATFORMS INC | 1.76 | -0.40 | 0.1686 | 0.0039 | |||||

| US95001ABE55 / Wells Fargo Commercial Mortgage Trust, Series 2017-C41, Class XA | 1.76 | -9.86 | 0.1682 | -0.0134 | |||||

| Birch Grove CLO 2 Ltd., Series 2021-2A, Class A1R / ABS-CBDO (US09077LAL62) | 1.75 | -0.51 | 0.1681 | 0.0037 | |||||

| Birch Grove CLO 2 Ltd., Series 2021-2A, Class A1R / ABS-CBDO (US09077LAL62) | 1.75 | -0.51 | 0.1681 | 0.0037 | |||||

| US444859BU54 / Humana Inc | 1.75 | 0.69 | 0.1678 | 0.0057 | |||||

| US29273VAJ98 / PERPETUAL BONDS | 1.75 | -2.34 | 0.1678 | 0.0006 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 1.75 | 0.1673 | 0.1673 | ||||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 1.75 | 0.1673 | 0.1673 | ||||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 1.75 | 0.1673 | 0.1673 | ||||||

| US49177JAK88 / Kenvue Inc | 1.74 | 2.65 | 0.1669 | 0.0087 | |||||

| AS Mileage Plan IP Ltd. / DBT (US00218QAA85) | 1.74 | -1.14 | 0.1664 | 0.0026 | |||||

| AS Mileage Plan IP Ltd. / DBT (US00218QAA85) | 1.74 | -1.14 | 0.1664 | 0.0026 | |||||

| AS Mileage Plan IP Ltd. / DBT (US00218QAA85) | 1.74 | -1.14 | 0.1664 | 0.0026 | |||||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 1.73 | 1.71 | 0.1654 | 0.0072 | |||||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 1.73 | 1.71 | 0.1654 | 0.0072 | |||||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 1.73 | 1.71 | 0.1654 | 0.0072 | |||||

| Verus Securitization Trust, Series 2024-1, Class A1 / ABS-MBS (US92540EAA10) | 1.71 | -10.62 | 0.1637 | -0.0146 | |||||

| Verus Securitization Trust, Series 2024-1, Class A1 / ABS-MBS (US92540EAA10) | 1.71 | -10.62 | 0.1637 | -0.0146 | |||||

| Elmwood CLO III Ltd., Series 2019-3A, Class A1RR / ABS-CBDO (US29002HAW97) | 1.70 | -0.64 | 0.1629 | 0.0034 | |||||

| Elmwood CLO III Ltd., Series 2019-3A, Class A1RR / ABS-CBDO (US29002HAW97) | 1.70 | -0.64 | 0.1629 | 0.0034 | |||||

| Elmwood CLO III Ltd., Series 2019-3A, Class A1RR / ABS-CBDO (US29002HAW97) | 1.70 | -0.64 | 0.1629 | 0.0034 | |||||

| US06540JBM36 / BANK 2020-BNK26 | 1.68 | -7.03 | 0.1609 | -0.0076 | |||||

| US03027XAX84 / AMERICAN TOWER CORP SR UNSECURED 01/27 2.75 | 1.68 | 0.96 | 0.1605 | 0.0058 | |||||

| US12655TBN81 / Commercial Mortgage Trust, Series 2019-GC44, Class XA | 1.67 | -4.35 | 0.1601 | -0.0028 | |||||

| US25278XAV10 / Diamondback Energy Inc | 1.67 | 0.18 | 0.1600 | 0.0046 | |||||

| US456837BF96 / ING Groep NV | 1.66 | 0.18 | 0.1589 | 0.0045 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 1.65 | 1.72 | 0.1584 | 0.0069 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 1.65 | 1.72 | 0.1584 | 0.0069 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 1.65 | 1.72 | 0.1584 | 0.0069 | |||||

| US81880XAQ51 / Shackleton 2019-XIV Clo Ltd | 1.65 | -0.18 | 0.1584 | 0.0040 | |||||

| US12481KAS78 / CBAM 2017-2 Ltd | 1.65 | 0.00 | 0.1584 | 0.0042 | |||||

| US42088AAA25 / Hayfin US XIV Ltd | 1.65 | 0.00 | 0.1583 | 0.0042 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.65 | -2.32 | 0.1576 | 0.0005 | |||||

| CIFC Funding Ltd., Series 2021-4A, Class AR / ABS-CBDO (US12547DAL01) | 1.64 | -0.73 | 0.1574 | 0.0031 | |||||

| US448979AD60 / Hyundai Auto Receivables Trust 2023-A | 1.64 | -24.41 | 0.1567 | -0.0450 | |||||

| US126650CY46 / CVS Health Corp | 1.63 | 2.72 | 0.1558 | 0.0081 | |||||

| US361841AH26 / GLP Capital LP / GLP Financing II Inc | 1.62 | -0.43 | 0.1554 | 0.0035 | |||||

| CarMax Auto Owner Trust, Series 2024-2, Class A3 / ABS-O (US14319EAE68) | 1.62 | 0.00 | 0.1551 | 0.0042 | |||||

| CarMax Auto Owner Trust, Series 2024-2, Class A3 / ABS-O (US14319EAE68) | 1.62 | 0.00 | 0.1551 | 0.0042 | |||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 1.61 | -1.11 | 0.1539 | 0.0025 | |||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 1.61 | -1.11 | 0.1539 | 0.0025 | |||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 1.61 | -1.11 | 0.1539 | 0.0025 | |||||

| X1EL34 / Xcel Energy Inc. - Depositary Receipt (Common Stock) | 1.61 | 0.1539 | 0.1539 | ||||||

| X1EL34 / Xcel Energy Inc. - Depositary Receipt (Common Stock) | 1.61 | 0.1539 | 0.1539 | ||||||

| X1EL34 / Xcel Energy Inc. - Depositary Receipt (Common Stock) | 1.61 | 0.1539 | 0.1539 | ||||||

| US36179TSH94 / Ginnie Mae II Pool | 1.61 | -1.71 | 0.1539 | 0.0015 | |||||

| Diameter Capital CLO 7 Ltd., Series 2024-7A, Class A1A / ABS-CBDO (US25255WAA62) | 1.60 | -0.56 | 0.1536 | 0.0033 | |||||

| Diameter Capital CLO 7 Ltd., Series 2024-7A, Class A1A / ABS-CBDO (US25255WAA62) | 1.60 | -0.56 | 0.1536 | 0.0033 | |||||

| Diameter Capital CLO 7 Ltd., Series 2024-7A, Class A1A / ABS-CBDO (US25255WAA62) | 1.60 | -0.56 | 0.1536 | 0.0033 | |||||

| Diameter Capital CLO 7 Ltd., Series 2024-7A, Class A1A / ABS-CBDO (US25255WAA62) | 1.60 | -0.56 | 0.1536 | 0.0033 | |||||

| US3132E0K272 / Freddie Mac Pool | 1.60 | -2.26 | 0.1532 | 0.0007 | |||||

| US38381XAY22 / GNMA CMO IO | 1.60 | -2.14 | 0.1530 | 0.0009 | |||||

| US36179XS723 / Ginnie Mae II Pool | 1.60 | -0.13 | 0.1530 | 0.0039 | |||||

| US3131XWED18 / FR30 | 1.60 | 1.21 | 0.1528 | 0.0058 | |||||

| US20754BAB71 / Connecticut Avenue Securities Trust 2022-R02 | 1.58 | -0.82 | 0.1515 | 0.0028 | |||||

| US92564RAK14 / VICI PROPERTIES LP/VICI NOTE CO | 1.58 | 0.38 | 0.1514 | 0.0046 | |||||

| US31418EDJ64 / Fannie Mae Pool | 1.57 | -1.63 | 0.1503 | 0.0016 | |||||

| Aviation Capital Group LLC / DBT (US05369AAQ40) | 1.57 | 0.64 | 0.1502 | 0.0050 | |||||

| Aviation Capital Group LLC / DBT (US05369AAQ40) | 1.57 | 0.64 | 0.1502 | 0.0050 | |||||

| Aviation Capital Group LLC / DBT (US05369AAQ40) | 1.57 | 0.64 | 0.1502 | 0.0050 | |||||

| Huntsman International LLC / DBT (US44701QBG64) | 1.55 | -4.73 | 0.1488 | -0.0032 | |||||

| Huntsman International LLC / DBT (US44701QBG64) | 1.55 | -4.73 | 0.1488 | -0.0032 | |||||

| Rogers Communications, Inc., Series NC5 / DBT (US775109DG30) | 1.55 | 0.1482 | 0.1482 | ||||||

| Rogers Communications, Inc., Series NC5 / DBT (US775109DG30) | 1.55 | 0.1482 | 0.1482 | ||||||

| Rogers Communications, Inc., Series NC5 / DBT (US775109DG30) | 1.55 | 0.1482 | 0.1482 | ||||||

| US709599BN39 / Penske Truck Leasing Co Lp / PTL Finance Corp | 1.54 | 0.72 | 0.1476 | 0.0050 | |||||

| US00914AAT97 / AIR LEASE CORPORATION | 1.54 | 0.39 | 0.1475 | 0.0045 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 1.53 | 0.1469 | 0.1469 | ||||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 1.53 | 0.1469 | 0.1469 | ||||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 1.53 | 0.1469 | 0.1469 | ||||||

| US097023AU94 / Boeing Company 6.125% Notes 02/15/33 | 1.53 | 0.33 | 0.1464 | 0.0043 | |||||

| US3140QNJP83 / Fannie Mae Pool | 1.53 | -1.23 | 0.1462 | 0.0022 | |||||

| US00206RHJ41 / AT&T Inc | 1.52 | 1.74 | 0.1459 | 0.0063 | |||||

| US3140XM2T25 / FN15 | 1.52 | -0.78 | 0.1459 | 0.0029 | |||||

| Harley-Davidson Motorcycle Trust, Series 2024-A, Class A3 / ABS-O (US412922AC08) | 1.52 | 0.07 | 0.1457 | 0.0041 | |||||

| Harley-Davidson Motorcycle Trust, Series 2024-A, Class A3 / ABS-O (US412922AC08) | 1.52 | 0.07 | 0.1457 | 0.0041 | |||||

| Harley-Davidson Motorcycle Trust, Series 2024-A, Class A3 / ABS-O (US412922AC08) | 1.52 | 0.07 | 0.1457 | 0.0041 | |||||

| US97719TAA25 / WISE CLO 2023-2 LTD SER 2023-2A CL A V/R REGD 144A P/P 0.00000000 | 1.51 | -0.20 | 0.1443 | 0.0036 | |||||

| US28852LAG86 / ELLINGTON CLO III LTD SER 2018-3A CL B V/R REGD 144A P/P 2.13425000 | 1.51 | -0.07 | 0.1442 | 0.0038 | |||||

| GoldenTree Loan Management US CLO 9 Ltd., Series 2021-9A, Class AR / ABS-CBDO (US38138JAN37) | 1.50 | -0.59 | 0.1442 | 0.0031 | |||||

| GoldenTree Loan Management US CLO 9 Ltd., Series 2021-9A, Class AR / ABS-CBDO (US38138JAN37) | 1.50 | -0.59 | 0.1442 | 0.0031 | |||||

| Birch Grove CLO 8 Ltd., Series 2024-8A, Class A1 / ABS-CBDO (US09077TAA34) | 1.50 | -0.59 | 0.1441 | 0.0030 | |||||

| Birch Grove CLO 8 Ltd., Series 2024-8A, Class A1 / ABS-CBDO (US09077TAA34) | 1.50 | -0.59 | 0.1441 | 0.0030 | |||||

| Birch Grove CLO 8 Ltd., Series 2024-8A, Class A1 / ABS-CBDO (US09077TAA34) | 1.50 | -0.59 | 0.1441 | 0.0030 | |||||

| US92535UAB08 / Vertiv Group Corp | 1.50 | 0.1440 | 0.1440 | ||||||

| US87190MAC29 / TCW GEM Ltd | 1.50 | 0.07 | 0.1440 | 0.0039 | |||||

| DT Midstream, Inc. / DBT (US23345MAD92) | 1.50 | -0.73 | 0.1439 | 0.0028 | |||||

| DT Midstream, Inc. / DBT (US23345MAD92) | 1.50 | -0.73 | 0.1439 | 0.0028 | |||||

| DT Midstream, Inc. / DBT (US23345MAD92) | 1.50 | -0.73 | 0.1439 | 0.0028 | |||||

| Apex Credit CLO Ltd., Series 2024-2A, Class A / ABS-CBDO (US03753EAA01) | 1.50 | -1.19 | 0.1435 | 0.0022 | |||||

| Apex Credit CLO Ltd., Series 2024-2A, Class A / ABS-CBDO (US03753EAA01) | 1.50 | -1.19 | 0.1435 | 0.0022 | |||||

| Apex Credit CLO Ltd., Series 2024-2A, Class A / ABS-CBDO (US03753EAA01) | 1.50 | -1.19 | 0.1435 | 0.0022 | |||||

| CIFC Funding Ltd., Series 2014-2RA, Class AR / ABS-CBDO (US12548RAH75) | 1.50 | -0.33 | 0.1434 | 0.0034 | |||||

| CIFC Funding Ltd., Series 2014-2RA, Class AR / ABS-CBDO (US12548RAH75) | 1.50 | -0.33 | 0.1434 | 0.0034 | |||||

| Elmwood CLO 33 Ltd., Series 2024-9RA, Class AR / ABS-CBDO (US29001EAA55) | 1.49 | -1.26 | 0.1432 | 0.0021 | |||||

| Elmwood CLO 33 Ltd., Series 2024-9RA, Class AR / ABS-CBDO (US29001EAA55) | 1.49 | -1.26 | 0.1432 | 0.0021 | |||||

| Elmwood CLO 33 Ltd., Series 2024-9RA, Class AR / ABS-CBDO (US29001EAA55) | 1.49 | -1.26 | 0.1432 | 0.0021 | |||||

| US17291EAZ43 / CGCMT 16-P6 B FRN 12-10-49/12-11-26 | 1.49 | 1.64 | 0.1424 | 0.0060 | |||||

| US03027XBM11 / CORPORATE BONDS | 1.47 | 2.37 | 0.1408 | 0.0070 | |||||

| Athene Global Funding / DBT (US04685A3Z27) | 1.46 | 1.32 | 0.1402 | 0.0056 | |||||

| Athene Global Funding / DBT (US04685A3Z27) | 1.46 | 1.32 | 0.1402 | 0.0056 | |||||

| Athene Global Funding / DBT (US04685A3Z27) | 1.46 | 1.32 | 0.1402 | 0.0056 | |||||

| US68233JCM45 / Oncor Electric Delivery Co LLC | 1.45 | -0.55 | 0.1393 | 0.0030 | |||||

| SOP / DIR (N/A) | 1.45 | 0.1385 | 0.1385 | ||||||

| SOP / DIR (N/A) | 1.45 | 0.1385 | 0.1385 | ||||||

| SOP / DIR (N/A) | 1.45 | 0.1385 | 0.1385 | ||||||

| SOP / DIR (N/A) | 1.45 | 0.1385 | 0.1385 | ||||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 1.45 | 210.75 | 0.1384 | 0.0950 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 1.45 | 210.75 | 0.1384 | 0.0950 | |||||

| 30064K105 / Exacttarget, Inc. | 1.44 | 0.84 | 0.1383 | 0.0048 | |||||

| 30064K105 / Exacttarget, Inc. | 1.44 | 0.84 | 0.1383 | 0.0048 | |||||

| 30064K105 / Exacttarget, Inc. | 1.44 | 0.84 | 0.1383 | 0.0048 | |||||

| US462613AP51 / CORP. NOTE | 1.43 | 0.56 | 0.1371 | 0.0044 | |||||

| IVW / Meta Platforms, Inc. - Depositary Receipt (Common Stock) | 1.43 | -50.40 | 0.1367 | -0.1316 | |||||

| IVW / Meta Platforms, Inc. - Depositary Receipt (Common Stock) | 1.43 | -50.40 | 0.1367 | -0.1316 | |||||

| IVW / Meta Platforms, Inc. - Depositary Receipt (Common Stock) | 1.43 | -50.40 | 0.1367 | -0.1316 | |||||

| US29278GBA58 / ENEL FINANCE INTERNATIONAL NV | 1.42 | 1.57 | 0.1361 | 0.0057 | |||||

| US78448TAB89 / SMBC Aviation Capital Finance DAC | 1.42 | 0.92 | 0.1361 | 0.0049 | |||||

| US78448TAB89 / SMBC Aviation Capital Finance DAC | 1.42 | 0.92 | 0.1361 | 0.0049 | |||||

| US78448TAB89 / SMBC Aviation Capital Finance DAC | 1.42 | 0.92 | 0.1361 | 0.0049 | |||||

| US78448TAB89 / SMBC Aviation Capital Finance DAC | 1.42 | 0.92 | 0.1361 | 0.0049 | |||||

| US55903VBC63 / Warnermedia Holdings Inc | 1.41 | -3.02 | 0.1352 | -0.0005 | |||||

| US01626PAH91 / Alimentation Couche-Tard Inc | 1.41 | 0.79 | 0.1348 | 0.0047 | |||||

| Elmwood CLO I Ltd., Series 2019-1A, Class A1RR / ABS-CBDO (US290015AW69) | 1.40 | -0.57 | 0.1344 | 0.0028 | |||||

| Elmwood CLO I Ltd., Series 2019-1A, Class A1RR / ABS-CBDO (US290015AW69) | 1.40 | -0.57 | 0.1344 | 0.0028 | |||||

| Elmwood CLO I Ltd., Series 2019-1A, Class A1RR / ABS-CBDO (US290015AW69) | 1.40 | -0.57 | 0.1344 | 0.0028 | |||||

| US3138ET7G57 / Fannie Mae Pool | 1.40 | -1.34 | 0.1342 | 0.0018 | |||||

| US031162DQ06 / Amgen Inc | 1.40 | 1.60 | 0.1341 | 0.0056 | |||||

| US00774MAX39 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 1.40 | 0.72 | 0.1339 | 0.0045 | |||||

| US097023DG73 / Boeing Co/The | 1.40 | 0.58 | 0.1337 | 0.0043 | |||||

| BBCMS Mortgage Trust, Series 2024-5C29, Class XA / ABS-MBS (US05555PAD42) | 1.39 | -4.33 | 0.1335 | -0.0022 | |||||

| BBCMS Mortgage Trust, Series 2024-5C29, Class XA / ABS-MBS (US05555PAD42) | 1.39 | -4.33 | 0.1335 | -0.0022 | |||||

| BBCMS Mortgage Trust, Series 2024-5C29, Class XA / ABS-MBS (US05555PAD42) | 1.39 | -4.33 | 0.1335 | -0.0022 | |||||

| US30293XAJ90 / FREMF Mortgage Trust, Series 2015-K51, Class B | 1.39 | 0.29 | 0.1334 | 0.0039 | |||||

| Chobani LLC, First Lien, 2025 New CME Term Loan / LON (US17026YAK55) | 1.39 | 0.1333 | 0.1333 | ||||||

| Chobani LLC, First Lien, 2025 New CME Term Loan / LON (US17026YAK55) | 1.39 | 0.1333 | 0.1333 | ||||||

| US3617MH3D63 / GII30 | 1.39 | 1.09 | 0.1333 | 0.0049 | |||||

| SOP / DIR (N/A) | 1.39 | 0.1329 | 0.1329 | ||||||

| Jane Street Group / JSG Finance, Inc. / DBT (US47077WAE84) | 1.38 | 0.1320 | 0.1320 | ||||||

| Jane Street Group / JSG Finance, Inc. / DBT (US47077WAE84) | 1.38 | 0.1320 | 0.1320 | ||||||

| Jane Street Group / JSG Finance, Inc. / DBT (US47077WAE84) | 1.38 | 0.1320 | 0.1320 | ||||||

| US126281BF05 / CSAIL 2015-C1 Commercial Mortgage Trust | 1.38 | 0.44 | 0.1318 | 0.0041 | |||||

| Cross Mortgage Trust, Series 2024-H4, Class A1 / ABS-MBS (US22758HAA86) | 1.37 | -4.67 | 0.1310 | -0.0027 | |||||

| Cross Mortgage Trust, Series 2024-H4, Class A1 / ABS-MBS (US22758HAA86) | 1.37 | -4.67 | 0.1310 | -0.0027 | |||||

| Cross Mortgage Trust, Series 2024-H4, Class A1 / ABS-MBS (US22758HAA86) | 1.37 | -4.67 | 0.1310 | -0.0027 | |||||

| ISNPY / Intesa Sanpaolo S.p.A. - Depositary Receipt (Common Stock) | 1.36 | 0.82 | 0.1303 | 0.0045 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 1.36 | 0.97 | 0.1300 | 0.0047 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 1.36 | 0.97 | 0.1300 | 0.0047 | |||||

| US89532WAA71 / TRESTLES CLO Ltd., Series 2021-4A, Class A | 1.35 | -0.07 | 0.1296 | 0.0034 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 1.35 | -3.91 | 0.1295 | -0.0016 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 1.35 | -3.91 | 0.1295 | -0.0016 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 1.35 | -3.91 | 0.1295 | -0.0016 | |||||

| US925650AB99 / VICI Properties LP | 1.34 | 0.75 | 0.1284 | 0.0044 | |||||

| US92838CAB46 / CORP CMO | 1.33 | -4.31 | 0.1278 | -0.0021 | |||||

| US61690WAY21 / CORP CMO | 1.33 | -19.16 | 0.1270 | -0.0259 | |||||

| US378272AY43 / Glencore Funding LLC 2.50%, Due 09/01/2030 | 1.32 | 1.61 | 0.1268 | 0.0054 | |||||

| South Bow USA Infrastructure Holdings LLC / DBT (US83007CAC64) | 1.31 | 0.77 | 0.1260 | 0.0044 | |||||

| South Bow USA Infrastructure Holdings LLC / DBT (US83007CAC64) | 1.31 | 0.77 | 0.1260 | 0.0044 | |||||

| US30225VAR87 / Extra Space Storage LP | 1.31 | 1.00 | 0.1256 | 0.0045 | |||||

| US36264FAK75 / CORP. NOTE | 1.31 | 1.16 | 0.1256 | 0.0048 | |||||

| US816851BA63 / Sempra Energy | 1.30 | 0.78 | 0.1244 | 0.0043 | |||||

| US3622ACN556 / GII30P | 1.30 | -2.26 | 0.1243 | 0.0006 | |||||

| US61747YFA82 / Morgan Stanley | 1.30 | 1.01 | 0.1242 | 0.0045 | |||||

| US44701QBE17 / Huntsman International LLC | 1.29 | -1.45 | 0.1239 | 0.0016 | |||||

| US210385AB64 / CONSTELLATION ENERGY GENERATION | 1.29 | 1.34 | 0.1233 | 0.0049 | |||||

| JBS USA Holding Lux SARL / JBS USA Food Co. / JBS Lux Co. SARL / DBT (US47214BAC28) | 1.28 | 1.83 | 0.1230 | 0.0055 | |||||

| JBS USA Holding Lux SARL / JBS USA Food Co. / JBS Lux Co. SARL / DBT (US47214BAC28) | 1.28 | 1.83 | 0.1230 | 0.0055 | |||||

| US92840VAQ59 / Vistra Operations Co. LLC | 1.28 | 13.73 | 0.1223 | 0.0176 | |||||

| US61691RAF38 / Morgan Stanley Capital I Trust 2018-H4 | 1.27 | -7.14 | 0.1221 | -0.0058 | |||||

| E1XC34 / Exelon Corporation - Depositary Receipt (Common Stock) | 1.27 | 1.52 | 0.1217 | 0.0050 | |||||

| E1XC34 / Exelon Corporation - Depositary Receipt (Common Stock) | 1.27 | 1.52 | 0.1217 | 0.0050 | |||||

| E1XC34 / Exelon Corporation - Depositary Receipt (Common Stock) | 1.27 | 1.52 | 0.1217 | 0.0050 | |||||

| US67117XAA46 / CORP CMO | 1.27 | -7.73 | 0.1213 | -0.0066 | |||||

| US25470DAL38 / Discovery Communications LLC | 1.26 | 0.08 | 0.1202 | 0.0033 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBJ36) | 1.25 | 0.89 | 0.1201 | 0.0043 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBJ36) | 1.25 | 0.89 | 0.1201 | 0.0043 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBJ36) | 1.25 | 0.89 | 0.1201 | 0.0043 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBJ36) | 1.25 | 0.89 | 0.1201 | 0.0043 | |||||

| Elmwood CLO 27 Ltd., Series 2024-3A, Class A / ABS-CBDO (US29003FAA03) | 1.25 | -0.71 | 0.1199 | 0.0025 | |||||

| Elmwood CLO 27 Ltd., Series 2024-3A, Class A / ABS-CBDO (US29003FAA03) | 1.25 | -0.71 | 0.1199 | 0.0025 | |||||

| Elmwood CLO 27 Ltd., Series 2024-3A, Class A / ABS-CBDO (US29003FAA03) | 1.25 | -0.71 | 0.1199 | 0.0025 | |||||

| US44891ACR68 / Hyundai Capital America | 1.25 | -0.24 | 0.1196 | 0.0030 | |||||

| US87264ABV61 / T-Mobile USA Inc | 1.25 | 1.71 | 0.1194 | 0.0051 | |||||

| US46590XAN66 / CORP. NOTE | 1.25 | 2.05 | 0.1193 | 0.0055 | |||||

| US172967MV07 / Citigroup Inc | 1.24 | -0.64 | 0.1191 | 0.0024 | |||||

| W1AB34 / Westinghouse Air Brake Technologies Corporation - Depositary Receipt (Common Stock) | 1.24 | 1.64 | 0.1191 | 0.0050 | |||||

| W1AB34 / Westinghouse Air Brake Technologies Corporation - Depositary Receipt (Common Stock) | 1.24 | 1.64 | 0.1191 | 0.0050 | |||||

| W1AB34 / Westinghouse Air Brake Technologies Corporation - Depositary Receipt (Common Stock) | 1.24 | 1.64 | 0.1191 | 0.0050 | |||||

| Elevation CLO Ltd., Series 2018-10A, Class AR / ABS-CBDO (US28623CAL54) | 1.24 | 0.1189 | 0.1189 | ||||||

| Elevation CLO Ltd., Series 2018-10A, Class AR / ABS-CBDO (US28623CAL54) | 1.24 | 0.1189 | 0.1189 | ||||||

| Elevation CLO Ltd., Series 2018-10A, Class AR / ABS-CBDO (US28623CAL54) | 1.24 | 0.1189 | 0.1189 | ||||||

| Elevation CLO Ltd., Series 2018-10A, Class AR / ABS-CBDO (US28623CAL54) | 1.24 | 0.1189 | 0.1189 | ||||||

| US53944YAQ61 / VAR.RT. CORP. BONDS | 1.23 | -1.12 | 0.1183 | 0.0019 | |||||

| FLEX / Flex Ltd. | 1.23 | -0.40 | 0.1182 | 0.0028 | |||||

| FLEX / Flex Ltd. | 1.23 | -0.40 | 0.1182 | 0.0028 | |||||

| FLEX / Flex Ltd. | 1.23 | -0.40 | 0.1182 | 0.0028 | |||||

| J1EF34 / Jefferies Financial Group Inc. - Depositary Receipt (Common Stock) | 1.23 | 0.1181 | 0.1181 | ||||||

| J1EF34 / Jefferies Financial Group Inc. - Depositary Receipt (Common Stock) | 1.23 | 0.1181 | 0.1181 | ||||||

| J1EF34 / Jefferies Financial Group Inc. - Depositary Receipt (Common Stock) | 1.23 | 0.1181 | 0.1181 | ||||||

| US36166RAC88 / CORP CMO | 1.23 | -4.86 | 0.1181 | -0.0027 | |||||

| US92939FAY51 / WFRBS Commercial Mortgage Trust 2014-C21 | 1.23 | 0.41 | 0.1177 | 0.0036 | |||||

| US3618FDLN97 / GII30 | 1.23 | 0.08 | 0.1176 | 0.0032 | |||||

| US90276WAT45 / UBSCM 2017-C7 XA CSTR 12/50 | 1.22 | -8.72 | 0.1173 | -0.0077 | |||||

| Chobani LLC / Chobani Finance Corp., Inc. / DBT (US17027NAC65) | 1.22 | 0.1165 | 0.1165 | ||||||

| Chobani LLC / Chobani Finance Corp., Inc. / DBT (US17027NAC65) | 1.22 | 0.1165 | 0.1165 | ||||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 1.22 | -1.06 | 0.1164 | 0.0019 | |||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 1.22 | -1.06 | 0.1164 | 0.0019 | |||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 1.22 | -1.06 | 0.1164 | 0.0019 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1.21 | 0.00 | 0.1159 | 0.0031 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1.21 | 0.00 | 0.1159 | 0.0031 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 1.21 | 0.1156 | 0.1156 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 1.21 | 0.1156 | 0.1156 | ||||||

| US97316UAA60 / ASSET BACKED SECURITY | 1.20 | -0.33 | 0.1149 | 0.0028 | |||||

| US06051GHZ54 / Bank of America Corp | 1.20 | 2.22 | 0.1149 | 0.0055 | |||||

| US14040HDC60 / Capital One Financial Corp | 1.19 | 0.68 | 0.1140 | 0.0038 | |||||

| US3618FAHE06 / GII30 | 1.19 | 0.00 | 0.1140 | 0.0031 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 1.19 | 0.1138 | 0.1138 | ||||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 1.19 | 0.1138 | 0.1138 | ||||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 1.19 | 0.1138 | 0.1138 | ||||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 1.19 | 0.1138 | 0.1138 | ||||||

| US38379HVB85 / GNMA CMO IO | 1.17 | -3.93 | 0.1124 | -0.0015 | |||||

| US688239AF99 / Oshkosh Corp | 1.17 | 0.77 | 0.1123 | 0.0038 | |||||

| US21871XAF69 / CORP. NOTE | 1.17 | 1.65 | 0.1123 | 0.0048 | |||||

| US034931AA35 / CORP CMO | 1.17 | -2.01 | 0.1123 | 0.0007 | |||||

| B1BT34 / Truist Financial Corporation - Depositary Receipt (Common Stock) | 1.17 | 1.04 | 0.1119 | 0.0041 | |||||

| B1BT34 / Truist Financial Corporation - Depositary Receipt (Common Stock) | 1.17 | 1.04 | 0.1119 | 0.0041 | |||||

| US15135BAZ40 / SENIOR UNSECURED GLOBAL NOTES | 1.17 | 2.10 | 0.1118 | 0.0052 | |||||

| RPRX / Royalty Pharma plc | 1.16 | 1.67 | 0.1112 | 0.0047 | |||||

| RPRX / Royalty Pharma plc | 1.16 | 1.67 | 0.1112 | 0.0047 | |||||

| RPRX / Royalty Pharma plc | 1.16 | 1.67 | 0.1112 | 0.0047 | |||||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 1.15 | 0.87 | 0.1106 | 0.0039 | |||||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 1.15 | 0.87 | 0.1106 | 0.0039 | |||||

| RR 29 Ltd., Series 2024-29RA, Class A1R / ABS-CBDO (US74989VAA98) | 1.15 | -0.09 | 0.1105 | 0.0029 | |||||

| RR 29 Ltd., Series 2024-29RA, Class A1R / ABS-CBDO (US74989VAA98) | 1.15 | -0.09 | 0.1105 | 0.0029 | |||||

| RR 29 Ltd., Series 2024-29RA, Class A1R / ABS-CBDO (US74989VAA98) | 1.15 | -0.09 | 0.1105 | 0.0029 | |||||

| KKR CLO 43 Ltd., Series 2022-43A, Class A1R / ABS-CBDO (US48255UAJ34) | 1.15 | 0.1104 | 0.1104 | ||||||

| KKR CLO 43 Ltd., Series 2022-43A, Class A1R / ABS-CBDO (US48255UAJ34) | 1.15 | 0.1104 | 0.1104 | ||||||

| KKR CLO 43 Ltd., Series 2022-43A, Class A1R / ABS-CBDO (US48255UAJ34) | 1.15 | 0.1104 | 0.1104 | ||||||

| KKR CLO 43 Ltd., Series 2022-43A, Class A1R / ABS-CBDO (US48255UAJ34) | 1.15 | 0.1104 | 0.1104 | ||||||

| US38384EUV54 / GNMA CMO IO | 1.14 | -3.56 | 0.1090 | -0.0010 | |||||

| US694308KG17 / Pacific Gas and Electric Co | 1.13 | 1.07 | 0.1085 | 0.0040 | |||||

| FR00140063V5 / ELECTRICITE DE FRANCE RT SCRIP 12/31/49 | 1.13 | 2.44 | 0.1085 | 0.0054 | |||||

| U.S. Treasury 10 Year Ultra Notes / DIR (N/A) | 1.13 | 0.1082 | 0.1082 | ||||||

| U.S. Treasury 10 Year Ultra Notes / DIR (N/A) | 1.13 | 0.1082 | 0.1082 | ||||||

| F&G Annuities & Life, Inc. / DBT (US30190AAF12) | 1.13 | -0.27 | 0.1078 | 0.0027 | |||||

| F&G Annuities & Life, Inc. / DBT (US30190AAF12) | 1.13 | -0.27 | 0.1078 | 0.0027 | |||||

| F&G Annuities & Life, Inc. / DBT (US30190AAF12) | 1.13 | -0.27 | 0.1078 | 0.0027 | |||||

| F&G Annuities & Life, Inc. / DBT (US30190AAF12) | 1.13 | -0.27 | 0.1078 | 0.0027 | |||||

| US443201AB48 / Howmet Aerospace Inc | 1.13 | 1.90 | 0.1078 | 0.0049 | |||||

| US48252AAA97 / KKR Group Finance Co VI LLC | 1.12 | 1.36 | 0.1076 | 0.0043 | |||||

| D1HI34 / D.R. Horton, Inc. - Depositary Receipt (Common Stock) | 1.12 | 0.1070 | 0.1070 | ||||||

| D1HI34 / D.R. Horton, Inc. - Depositary Receipt (Common Stock) | 1.12 | 0.1070 | 0.1070 | ||||||

| D1HI34 / D.R. Horton, Inc. - Depositary Receipt (Common Stock) | 1.12 | 0.1070 | 0.1070 | ||||||

| US3140EVUP09 / Fannie Mae Pool | 1.12 | 0.63 | 0.1069 | 0.0035 | |||||

| US30040WAT53 / Eversource Energy | 1.10 | 1.01 | 0.1058 | 0.0038 | |||||

| US38379LL461 / GNMA CMO IO | 1.10 | 4.18 | 0.1051 | 0.0069 | |||||

| US378272BP27 / Glencore Funding LLC | 1.09 | 1.11 | 0.1049 | 0.0040 | |||||

| US257375AJ44 / Dominion Energy Gas Holdings LLC | 1.09 | 1.49 | 0.1044 | 0.0043 | |||||

| US257375AJ44 / Dominion Energy Gas Holdings LLC | 1.09 | 1.49 | 0.1044 | 0.0043 | |||||

| Oaktree CLO Ltd., Series 2021-1A, Class A1R / ABS-CBDO (US67402JAN19) | 1.08 | -1.46 | 0.1038 | 0.0013 | |||||

| Oaktree CLO Ltd., Series 2021-1A, Class A1R / ABS-CBDO (US67402JAN19) | 1.08 | -1.46 | 0.1038 | 0.0013 | |||||

| Oaktree CLO Ltd., Series 2021-1A, Class A1R / ABS-CBDO (US67402JAN19) | 1.08 | -1.46 | 0.1038 | 0.0013 | |||||

| US37045XEN21 / General Motors Financial Co Inc | 1.08 | 0.28 | 0.1033 | 0.0030 | |||||

| US87612BBG68 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 1.08 | 0.28 | 0.1031 | 0.0031 | |||||

| US3620C0ZX96 / GN30 | 1.07 | -0.83 | 0.1030 | 0.0019 | |||||

| US85205TAR14 / Spirit AeroSystems Inc | 1.07 | 0.1028 | 0.1028 | ||||||

| JBS USA LUX SARL / JBS USA Food Co. / JBS USA Foods Group / DBT (US472140AA00) | 1.07 | 1.61 | 0.1026 | 0.0043 | |||||

| JBS USA LUX SARL / JBS USA Food Co. / JBS USA Foods Group / DBT (US472140AA00) | 1.07 | 1.61 | 0.1026 | 0.0043 | |||||

| US92676XAG25 / Viking Cruises Ltd | 1.07 | 0.1025 | 0.1025 | ||||||

| US36291FRM22 / GII30 | 1.07 | 0.75 | 0.1023 | 0.0034 | |||||

| TransDigm, Inc., First Lien, CME Term Loan, L / LON (US89364MCD48) | 1.06 | 0.1020 | 0.1020 | ||||||

| TransDigm, Inc., First Lien, CME Term Loan, L / LON (US89364MCD48) | 1.06 | 0.1020 | 0.1020 | ||||||

| US55316HAB15 / GENESEE+WYOMING INC TERM LOAN | 1.06 | 0.1018 | 0.1018 | ||||||

| US55316HAB15 / GENESEE+WYOMING INC TERM LOAN | 1.06 | 0.1018 | 0.1018 | ||||||

| US55316HAB15 / GENESEE+WYOMING INC TERM LOAN | 1.06 | 0.1018 | 0.1018 | ||||||

| US55316HAB15 / GENESEE+WYOMING INC TERM LOAN | 1.06 | 0.1018 | 0.1018 | ||||||

| US124857AZ68 / ViacomCBS Inc | 1.06 | 1.63 | 0.1018 | 0.0043 | |||||

| US71677HAL96 / PetSmart, Inc., Term Loan B | 1.06 | -1.76 | 0.1018 | 0.0009 | |||||

| Caesars Entertainment, Inc., First Lien, CME Term Loan, B1 / LON (US12768EAH99) | 1.06 | 0.1015 | 0.1015 | ||||||

| Caesars Entertainment, Inc., First Lien, CME Term Loan, B1 / LON (US12768EAH99) | 1.06 | 0.1015 | 0.1015 | ||||||

| Caesars Entertainment, Inc., First Lien, CME Term Loan, B1 / LON (US12768EAH99) | 1.06 | 0.1015 | 0.1015 | ||||||

| USI, Inc., First Lien, 2024-D CME Term Loan / LON (US90351NAR61) | 1.06 | 0.1015 | 0.1015 | ||||||

| USI, Inc., First Lien, 2024-D CME Term Loan / LON (US90351NAR61) | 1.06 | 0.1015 | 0.1015 | ||||||

| USI, Inc., First Lien, 2024-D CME Term Loan / LON (US90351NAR61) | 1.06 | 0.1015 | 0.1015 | ||||||

| US268317AP93 / ELECTRICITE DE FRANCE 144A LIFE SR UNSEC 4.75% 10-13-35 | 1.06 | 3.02 | 0.1014 | 0.0056 | |||||

| US3140EVTB32 / FN30 | 1.06 | 0.48 | 0.1013 | 0.0032 | |||||

| Bayview Opportunity Master Fund VII Trust, Series 2023-1A, Class A / ABS-O (US072927AA49) | 1.05 | -5.39 | 0.1010 | -0.0029 | |||||

| Bayview Opportunity Master Fund VII Trust, Series 2023-1A, Class A / ABS-O (US072927AA49) | 1.05 | -5.39 | 0.1010 | -0.0029 | |||||

| Bayview Opportunity Master Fund VII Trust, Series 2023-1A, Class A / ABS-O (US072927AA49) | 1.05 | -5.39 | 0.1010 | -0.0029 | |||||

| US35564KB324 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1.05 | -1.03 | 0.1009 | 0.0017 | |||||

| US87264ACY91 / T-Mobile USA Inc | 1.05 | 1.45 | 0.1004 | 0.0041 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 1.05 | -1.13 | 0.1003 | 0.0015 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 1.05 | -1.13 | 0.1003 | 0.0015 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 1.05 | -1.13 | 0.1003 | 0.0015 | |||||

| US00912XBF06 / Air Lease Corp. | 1.04 | 1.06 | 0.1001 | 0.0038 | |||||

| WCN / Waste Connections, Inc. | 1.04 | 2.56 | 0.0997 | 0.0050 | |||||

| WCN / Waste Connections, Inc. | 1.04 | 2.56 | 0.0997 | 0.0050 | |||||

| Glatfelter Corp., First Lien, CME Term Loan / LON (US89458XAB38) | 1.04 | 0.0996 | 0.0996 | ||||||

| Glatfelter Corp., First Lien, CME Term Loan / LON (US89458XAB38) | 1.04 | 0.0996 | 0.0996 | ||||||

| Glatfelter Corp., First Lien, CME Term Loan / LON (US89458XAB38) | 1.04 | 0.0996 | 0.0996 | ||||||

| Glatfelter Corp., First Lien, CME Term Loan / LON (US89458XAB38) | 1.04 | 0.0996 | 0.0996 | ||||||

| US3140XGML09 / FANNIE MAE POOL FN FS1262 | 1.04 | -0.86 | 0.0995 | 0.0018 | |||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 1.04 | 1.86 | 0.0995 | 0.0044 | |||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 1.04 | 1.86 | 0.0995 | 0.0044 | |||||

| US36179TXX89 / Ginnie Mae II Pool | 1.04 | -0.38 | 0.0993 | 0.0023 | |||||

| U.S. Treasury 10 Year Notes / DIR (N/A) | 1.03 | 0.0989 | 0.0989 | ||||||

| U.S. Treasury 10 Year Notes / DIR (N/A) | 1.03 | 0.0989 | 0.0989 | ||||||

| U.S. Treasury 10 Year Notes / DIR (N/A) | 1.03 | 0.0989 | 0.0989 | ||||||

| U.S. Treasury 10 Year Notes / DIR (N/A) | 1.03 | 0.0989 | 0.0989 | ||||||

| US01F0626550 / Uniform Mortgage-Backed Security, TBA | 1.03 | -93.19 | 0.0987 | -1.1900 | |||||

| US3617GQXB43 / GII30 | 1.03 | 0.39 | 0.0986 | 0.0030 | |||||

| US3618FMUP44 / GII30 | 1.03 | 0.00 | 0.0983 | 0.0027 | |||||

| US36179T7J86 / Ginnie Mae II Pool | 1.02 | -1.35 | 0.0978 | 0.0013 | |||||

| US03027XBA72 / CORPORATE BONDS | 1.01 | 2.42 | 0.0972 | 0.0049 | |||||

| US92922F7S13 / CORP CMO | 1.01 | -3.25 | 0.0970 | -0.0006 | |||||

| US95002XBG97 / Wells Fargo Commercial Mortgage Trust, Series 2020-C57, Class C | 1.01 | 0.10 | 0.0964 | 0.0027 | |||||

| US064159VL70 / Bank of Nova Scotia/The | 1.01 | 0.90 | 0.0964 | 0.0033 | |||||

| US47048JAX19 / Jamestown CLO IX Ltd | 1.00 | 0.10 | 0.0961 | 0.0027 | |||||

| US68389XBZ78 / Oracle Corp | 1.00 | -1.19 | 0.0958 | 0.0015 | |||||

| Sound Point CLO XXXII Ltd., Series 2021-4A, Class A / ABS-CBDO (US83616AAC36) | 1.00 | -0.10 | 0.0958 | 0.0024 | |||||

| Sound Point CLO XXXII Ltd., Series 2021-4A, Class A / ABS-CBDO (US83616AAC36) | 1.00 | -0.10 | 0.0958 | 0.0024 | |||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 1.00 | 0.0958 | 0.0958 | ||||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 1.00 | 0.0958 | 0.0958 | ||||||

| Neuberger Berman CLO XVII Ltd., Series 2014-17A, Class AR3 / ABS-CBDO (US64129UCC71) | 1.00 | -0.99 | 0.0955 | 0.0016 | |||||

| Neuberger Berman CLO XVII Ltd., Series 2014-17A, Class AR3 / ABS-CBDO (US64129UCC71) | 1.00 | -0.99 | 0.0955 | 0.0016 | |||||

| US19688RAA77 / COLT 2023-3 Mortgage Loan Trust | 1.00 | -6.92 | 0.0954 | -0.0044 | |||||

| RPRX / Royalty Pharma plc | 0.99 | 1.12 | 0.0951 | 0.0036 | |||||

| RPRX / Royalty Pharma plc | 0.99 | 1.12 | 0.0951 | 0.0036 | |||||

| RPRX / Royalty Pharma plc | 0.99 | 1.12 | 0.0951 | 0.0036 | |||||

| RPRX / Royalty Pharma plc | 0.99 | 1.12 | 0.0951 | 0.0036 | |||||

| US052528AM81 / Australia & New Zealand Banking Group Ltd | 0.99 | 1.74 | 0.0951 | 0.0041 | |||||

| US04685A3D15 / ATHENE GLOBAL FUNDING | 0.99 | 1.23 | 0.0950 | 0.0036 | |||||

| US682680BL63 / CORPORATE BONDS | 0.99 | -0.10 | 0.0948 | 0.0024 | |||||

| Wayfair LLC / DBT (US94419NAB38) | 0.99 | 0.0947 | 0.0947 | ||||||

| Wayfair LLC / DBT (US94419NAB38) | 0.99 | 0.0947 | 0.0947 | ||||||

| Wayfair LLC / DBT (US94419NAB38) | 0.99 | 0.0947 | 0.0947 | ||||||

| Glencore Funding LLC / DBT (US378272BU12) | 0.98 | -0.10 | 0.0943 | 0.0024 | |||||

| Glencore Funding LLC / DBT (US378272BU12) | 0.98 | -0.10 | 0.0943 | 0.0024 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.98 | 0.0943 | 0.0943 | ||||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.98 | 0.0943 | 0.0943 | ||||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.98 | 0.0943 | 0.0943 | ||||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 0.98 | 0.51 | 0.0943 | 0.0030 | |||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 0.98 | 0.51 | 0.0943 | 0.0030 | |||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 0.98 | 0.51 | 0.0943 | 0.0030 | |||||

| US366651AE76 / Gartner Inc | 0.98 | 0.41 | 0.0938 | 0.0029 | |||||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 0.98 | 0.0938 | 0.0938 | ||||||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 0.98 | 0.0938 | 0.0938 | ||||||

| Prologis LP / DBT (US74340XCJ81) | 0.98 | 1.14 | 0.0937 | 0.0036 | |||||

| Prologis LP / DBT (US74340XCJ81) | 0.98 | 1.14 | 0.0937 | 0.0036 | |||||

| US31556PAB31 / Fertitta Entertainment LLC, Term Loan B | 0.97 | 0.0933 | 0.0933 | ||||||

| US1248EPCQ45 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.97 | 298.77 | 0.0933 | 0.0743 | |||||

| US36260AAG13 / GS MORTGAGE BACKED SECURITIES GSMBS 2020 RPL1 M2 144A | 0.97 | 0.73 | 0.0930 | 0.0032 | |||||

| DVAI34 / DaVita Inc. - Depositary Receipt (Common Stock) | 0.97 | 0.0929 | 0.0929 | ||||||

| DVAI34 / DaVita Inc. - Depositary Receipt (Common Stock) | 0.97 | 0.0929 | 0.0929 | ||||||

| DVAI34 / DaVita Inc. - Depositary Receipt (Common Stock) | 0.97 | 0.0929 | 0.0929 | ||||||

| US3617HTC871 / GIIARM | 0.97 | -4.26 | 0.0927 | -0.0014 | |||||

| US92937EAG98 / WFRBS 13-C11 B FRN 03-15-45 | 0.97 | -6.39 | 0.0927 | -0.0037 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.96 | -1.53 | 0.0924 | 0.0011 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.96 | -1.53 | 0.0924 | 0.0011 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.96 | -1.53 | 0.0924 | 0.0011 | |||||

| US38378HVU75 / GNMA CMO IO | 0.96 | -3.41 | 0.0924 | -0.0006 | |||||

| US01F0324503 / Fannie Mae or Freddie Mac | 0.96 | 3.77 | 0.0923 | 0.0131 | |||||

| US14688GAC87 / CRVNA 23-P3 A3 144A 5.82% 08-10-28/11-10-26 | 0.96 | -5.04 | 0.0920 | -0.0023 | |||||

| US3618FMUQ27 / GII30 | 0.96 | -20.17 | 0.0918 | -0.0201 | |||||

| US19828TAA43 / CORP. NOTE | 0.96 | 1.38 | 0.0917 | 0.0037 | |||||

| Aviation Capital Group LLC / DBT (US05369AAS06) | 0.95 | 0.0911 | 0.0911 | ||||||

| Aviation Capital Group LLC / DBT (US05369AAS06) | 0.95 | 0.0911 | 0.0911 | ||||||

| US01F0304547 / Fannie Mae or Freddie Mac | 0.95 | 4.52 | 0.0910 | 0.0136 | |||||

| US3132AA4K71 / FR30 | 0.95 | 0.21 | 0.0910 | 0.0026 | |||||

| US61767YBA73 / Morgan Stanley Capital I Trust 2018-H3 | 0.95 | -8.49 | 0.0909 | -0.0057 | |||||

| Hunter Douglas, Inc., First Lien, CME Term Loan, B1 / LON (XAN8137FAE06) | 0.95 | 0.0909 | 0.0909 | ||||||

| US124857AX11 / ViacomCBS Inc | 0.95 | 2.16 | 0.0907 | 0.0043 | |||||

| Caesars Entertainment, Inc. / DBT (US12769GAD25) | 0.94 | 0.0904 | 0.0904 | ||||||

| Caesars Entertainment, Inc. / DBT (US12769GAD25) | 0.94 | 0.0904 | 0.0904 | ||||||

| Caesars Entertainment, Inc. / DBT (US12769GAD25) | 0.94 | 0.0904 | 0.0904 | ||||||

| US682680BG78 / ONEOK INC | 0.94 | 0.32 | 0.0902 | 0.0027 | |||||

| Corebridge Global Funding / DBT (US00138CBA53) | 0.93 | 0.97 | 0.0894 | 0.0033 | |||||

| Corebridge Global Funding / DBT (US00138CBA53) | 0.93 | 0.97 | 0.0894 | 0.0033 | |||||

| CNQ / Canadian Natural Resources Limited | 0.93 | 0.87 | 0.0893 | 0.0032 | |||||

| CNQ / Canadian Natural Resources Limited | 0.93 | 0.87 | 0.0893 | 0.0032 | |||||

| CNQ / Canadian Natural Resources Limited | 0.93 | 0.87 | 0.0893 | 0.0032 | |||||

| US22822VAH42 / Crown Castle International Corp | 0.93 | 0.76 | 0.0893 | 0.0031 | |||||

| US92564RAL96 / VICI Properties LP / VICI Note Co., Inc. | 0.93 | 1.31 | 0.0893 | 0.0035 | |||||

| US136385AC52 / Canadian Natural Resources 7.2% Notes 1/15/32 | 0.93 | -0.43 | 0.0892 | 0.0020 | |||||

| Hyundai Capital America / DBT (US44891ACY10) | 0.93 | 0.11 | 0.0887 | 0.0025 | |||||

| Hyundai Capital America / DBT (US44891ACY10) | 0.93 | 0.11 | 0.0887 | 0.0025 | |||||

| Hyundai Capital America / DBT (US44891ACY10) | 0.93 | 0.11 | 0.0887 | 0.0025 | |||||

| US89231FAD24 / Toyota Auto Receivables 2023-C Owner Trust | 0.93 | -0.11 | 0.0887 | 0.0022 | |||||

| US780082AD52 / Royal Bank of Canada Bond | 0.92 | 0.11 | 0.0883 | 0.0024 | |||||

| Protective Life Global Funding / DBT (US74368CBV54) | 0.92 | 1.77 | 0.0880 | 0.0039 | |||||

| Protective Life Global Funding / DBT (US74368CBV54) | 0.92 | 1.77 | 0.0880 | 0.0039 | |||||

| US89117F8Z56 / Toronto-Dominion Bank/The | 0.92 | -1.08 | 0.0878 | 0.0014 | |||||

| HCA, Inc. / DBT (US404119CV94) | 0.92 | -1.51 | 0.0877 | 0.0011 | |||||

| HCA, Inc. / DBT (US404119CV94) | 0.92 | -1.51 | 0.0877 | 0.0011 | |||||

| HCA, Inc. / DBT (US404119CV94) | 0.92 | -1.51 | 0.0877 | 0.0011 | |||||

| US87612BBS07 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 0.91 | -54.17 | 0.0874 | -0.0982 | |||||

| US3136APCA89 / FNMA CMO IO | 0.91 | -6.76 | 0.0874 | -0.0038 | |||||

| US50212YAH71 / LPL Holdings, Inc. | 0.91 | 0.78 | 0.0871 | 0.0030 | |||||

| B1BT34 / Truist Financial Corporation - Depositary Receipt (Common Stock) | 0.91 | 0.67 | 0.0871 | 0.0029 | |||||

| B1BT34 / Truist Financial Corporation - Depositary Receipt (Common Stock) | 0.91 | 0.67 | 0.0871 | 0.0029 | |||||

| B1BT34 / Truist Financial Corporation - Depositary Receipt (Common Stock) | 0.91 | 0.67 | 0.0871 | 0.0029 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0.90 | 0.00 | 0.0865 | 0.0023 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0.90 | 0.00 | 0.0865 | 0.0023 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0.90 | 0.00 | 0.0865 | 0.0023 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0.90 | 0.00 | 0.0865 | 0.0023 | |||||

| Bain Capital Credit CLO Ltd., Series 2022-2A, Class A1 / ABS-CBDO (US05682GAA67) | 0.90 | 0.0861 | 0.0861 | ||||||

| US13063A5E03 / State of California | 0.90 | 2.05 | 0.0858 | 0.0040 | |||||

| US92840VAE20 / Vistra Operations Co LLC | 0.90 | 2.05 | 0.0858 | 0.0040 | |||||

| US91087BAM28 / Mexico Government International Bond | 0.89 | 3.59 | 0.0857 | 0.0052 | |||||

| Icon Investments Six DAC / DBT (US45115AAA25) | 0.89 | 0.22 | 0.0854 | 0.0025 | |||||

| Icon Investments Six DAC / DBT (US45115AAA25) | 0.89 | 0.22 | 0.0854 | 0.0025 | |||||

| Icon Investments Six DAC / DBT (US45115AAA25) | 0.89 | 0.22 | 0.0854 | 0.0025 | |||||

| US251526CE71 / DEUTSCHE BANK AG NEW YORK BNCH 2.129%/VAR 11/24/2026 | 0.89 | 0.57 | 0.0852 | 0.0028 | |||||

| US92840VAG77 / Vistra Operations Co LLC | 0.89 | 0.91 | 0.0851 | 0.0030 | |||||

| US98389BBA70 / XCEL ENERGY INC | 0.88 | 1.38 | 0.0847 | 0.0034 | |||||

| Cisco Systems, Inc. / DBT (US17275RBT86) | 0.88 | 1.50 | 0.0846 | 0.0035 | |||||

| Cisco Systems, Inc. / DBT (US17275RBT86) | 0.88 | 1.50 | 0.0846 | 0.0035 | |||||

| Cisco Systems, Inc. / DBT (US17275RBT86) | 0.88 | 1.50 | 0.0846 | 0.0035 | |||||

| Cisco Systems, Inc. / DBT (US17275RBT86) | 0.88 | 1.50 | 0.0846 | 0.0035 | |||||

| IMB / Imperial Brands PLC | 0.88 | 0.46 | 0.0838 | 0.0026 | |||||

| IMB / Imperial Brands PLC | 0.88 | 0.46 | 0.0838 | 0.0026 | |||||

| IMB / Imperial Brands PLC | 0.88 | 0.46 | 0.0838 | 0.0026 | |||||

| N1IS34 / NiSource Inc. - Depositary Receipt (Common Stock) | 0.87 | 1.27 | 0.0838 | 0.0033 | |||||

| N1IS34 / NiSource Inc. - Depositary Receipt (Common Stock) | 0.87 | 1.27 | 0.0838 | 0.0033 | |||||

| N1IS34 / NiSource Inc. - Depositary Receipt (Common Stock) | 0.87 | 1.27 | 0.0838 | 0.0033 | |||||

| US14040HBJ32 / Capital One Financial Corp. | 0.87 | 0.34 | 0.0837 | 0.0025 | |||||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 0.87 | 1.04 | 0.0836 | 0.0032 | |||||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 0.87 | 1.04 | 0.0836 | 0.0032 | |||||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 0.87 | 1.04 | 0.0836 | 0.0032 | |||||

| US3138Y7E999 / FN30 | 0.87 | 1.28 | 0.0834 | 0.0033 | |||||

| Athene Global Funding / DBT (US04685A4D06) | 0.87 | 1.16 | 0.0834 | 0.0031 | |||||

| Athene Global Funding / DBT (US04685A4D06) | 0.87 | 1.16 | 0.0834 | 0.0031 | |||||

| Angel Oak Mortgage Trust, Series 2024-9, Class A1 / ABS-MBS (US03466JAA79) | 0.87 | -4.31 | 0.0830 | -0.0014 | |||||

| Angel Oak Mortgage Trust, Series 2024-9, Class A1 / ABS-MBS (US03466JAA79) | 0.87 | -4.31 | 0.0830 | -0.0014 | |||||

| US12624BAL09 / COMM 2012-CR1 D CSTR 5/45 | 0.86 | 1.17 | 0.0828 | 0.0032 | |||||

| US816851BR98 / Sempra Energy | 0.86 | 1.18 | 0.0820 | 0.0031 | |||||

| US629377CN02 / NRG ENERGY INC | 0.85 | 0.59 | 0.0816 | 0.0027 | |||||

| US50168BAC28 / LADAR 23-3 A3 144A 6.12% 09-15-27/25 | 0.85 | -34.44 | 0.0815 | -0.0396 | |||||

| US3140JMSD52 / FN30 | 0.85 | 0.95 | 0.0815 | 0.0029 | |||||

| US014916AA85 / CORP. NOTE | 0.85 | 0.24 | 0.0812 | 0.0024 | |||||

| US01626PAM86 / Alimentation Couche-Tard Inc | 0.85 | 2.42 | 0.0812 | 0.0040 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0.84 | -4.43 | 0.0808 | -0.0014 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0.84 | -4.43 | 0.0808 | -0.0014 | |||||

| US09261HAK32 / Blackstone Private Credit Fund | 0.84 | 0.60 | 0.0807 | 0.0026 | |||||

| BC.PRA / Brunswick Corporation - Corporate Bond/Note | 0.84 | -0.59 | 0.0806 | 0.0017 | |||||

| BC.PRA / Brunswick Corporation - Corporate Bond/Note | 0.84 | -0.59 | 0.0806 | 0.0017 | |||||

| BC.PRA / Brunswick Corporation - Corporate Bond/Note | 0.84 | -0.59 | 0.0806 | 0.0017 | |||||

| US92328XBD03 / Venture XV CLO Ltd | 0.84 | -16.50 | 0.0806 | -0.0133 | |||||

| CABK / CaixaBank, S.A. | 0.84 | 1.46 | 0.0801 | 0.0033 | |||||

| CABK / CaixaBank, S.A. | 0.84 | 1.46 | 0.0801 | 0.0033 | |||||

| US30711XY248 / Fannie Mae Connecticut Avenue Securities, Series 2018-C05, Class 1M2 | 0.83 | -5.98 | 0.0800 | -0.0028 | |||||

| US3133KPPA02 / FR30 | 0.83 | -0.36 | 0.0796 | 0.0018 | |||||

| US677632MV00 / OHIO ST UNIV | 0.83 | 4.01 | 0.0796 | 0.0051 | |||||

| US3618FFCD64 / GII30 | 0.83 | 0.00 | 0.0795 | 0.0021 | |||||

| US00973RAD52 / Aker BP ASA | 0.83 | -3.38 | 0.0795 | -0.0005 | |||||

| US00973RAD52 / Aker BP ASA | 0.83 | -3.38 | 0.0795 | -0.0005 | |||||

| US00973RAD52 / Aker BP ASA | 0.83 | -3.38 | 0.0795 | -0.0005 | |||||

| US92564RAD70 / VICI PROPERTIES / NOTE 3.75% 02/15/2027 144A | 0.83 | 1.10 | 0.0794 | 0.0029 | |||||

| US88947EAU47 / Toll Brothers Finance Corp | 0.83 | 1.60 | 0.0793 | 0.0033 | |||||

| US373334KT78 / Georgia Power Co. | 0.83 | 1.97 | 0.0793 | 0.0036 | |||||

| US07335YAA47 / BDS 2021-FL10 LTD / BDS 2021-FL10 LLC 1ML+135 12/18/2036 144A | 0.83 | -4.50 | 0.0793 | -0.0015 | |||||

| US36179XS806 / GINNIE MAE II POOL P#MA8643 3.00000000 | 0.83 | -1.32 | 0.0791 | 0.0011 | |||||

| US3622AANA84 / Ginnie Mae II Pool | 0.82 | -0.97 | 0.0786 | 0.0013 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.82 | -0.36 | 0.0786 | 0.0017 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.82 | -0.36 | 0.0786 | 0.0017 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.82 | -0.36 | 0.0786 | 0.0017 | |||||

| US3618FAHL49 / GII30 | 0.82 | -5.54 | 0.0786 | -0.0024 | |||||

| TPRY34 / Tapestry, Inc. - Depositary Receipt (Common Stock) | 0.82 | -1.21 | 0.0785 | 0.0012 | |||||

| TPRY34 / Tapestry, Inc. - Depositary Receipt (Common Stock) | 0.82 | -1.21 | 0.0785 | 0.0012 | |||||

| I1LM34 / Illumina, Inc. - Depositary Receipt (Common Stock) | 0.82 | 0.37 | 0.0785 | 0.0023 | |||||

| I1LM34 / Illumina, Inc. - Depositary Receipt (Common Stock) | 0.82 | 0.37 | 0.0785 | 0.0023 | |||||

| US35564KE393 / Freddie Mac STACR REMIC Trust 2022-HQA3 | 0.82 | -5.88 | 0.0783 | -0.0027 | |||||

| US210385AE04 / Constellation Energy Generation LLC | 0.81 | -1.33 | 0.0779 | 0.0011 | |||||

| US3133KK5P06 / Freddie Mac Pool | 0.81 | -0.12 | 0.0777 | 0.0020 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.81 | 0.75 | 0.0773 | 0.0027 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.81 | 0.75 | 0.0773 | 0.0027 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.81 | 0.75 | 0.0773 | 0.0027 | |||||

| Allegro CLO XII Ltd., Series 2020-1A, Class A1R / ABS-CBDO (US01750TAN63) | 0.80 | -0.25 | 0.0767 | 0.0018 | |||||

| Allegro CLO XII Ltd., Series 2020-1A, Class A1R / ABS-CBDO (US01750TAN63) | 0.80 | -0.25 | 0.0767 | 0.0018 | |||||

| US842587DS35 / Southern Co. (The) | 0.79 | 1.67 | 0.0759 | 0.0033 | |||||

| US716973AG71 / Pfizer Investment Enterprises Pte Ltd | 0.79 | -1.12 | 0.0758 | 0.0012 | |||||

| R1SG34 / Republic Services, Inc. - Depositary Receipt (Common Stock) | 0.79 | 1.67 | 0.0757 | 0.0032 | |||||

| R1SG34 / Republic Services, Inc. - Depositary Receipt (Common Stock) | 0.79 | 1.67 | 0.0757 | 0.0032 | |||||

| R1SG34 / Republic Services, Inc. - Depositary Receipt (Common Stock) | 0.79 | 1.67 | 0.0757 | 0.0032 | |||||

| US303901BB79 / Fairfax Financial Holdings Ltd | 0.79 | 1.28 | 0.0757 | 0.0029 | |||||

| LPL Holdings, Inc. / DBT (US50212YAL83) | 0.79 | 0.0754 | 0.0754 | ||||||

| LPL Holdings, Inc. / DBT (US50212YAL83) | 0.79 | 0.0754 | 0.0754 | ||||||

| LPL Holdings, Inc. / DBT (US50212YAL83) | 0.79 | 0.0754 | 0.0754 | ||||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.79 | -2.12 | 0.0752 | 0.0004 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.79 | -2.12 | 0.0752 | 0.0004 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.79 | -2.12 | 0.0752 | 0.0004 | |||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 0.78 | 2.09 | 0.0750 | 0.0035 | |||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 0.78 | 2.09 | 0.0750 | 0.0035 | |||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 0.78 | 2.09 | 0.0750 | 0.0035 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0.78 | 0.39 | 0.0746 | 0.0023 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0.78 | 0.39 | 0.0746 | 0.0023 | |||||

| Vistra Operations Co. LLC / DBT (US92840VAS16) | 0.78 | 0.00 | 0.0745 | 0.0020 | |||||

| Vistra Operations Co. LLC / DBT (US92840VAS16) | 0.78 | 0.00 | 0.0745 | 0.0020 | |||||

| Vistra Operations Co. LLC / DBT (US92840VAS16) | 0.78 | 0.00 | 0.0745 | 0.0020 | |||||

| Vistra Operations Co. LLC / DBT (US92840VAS16) | 0.78 | 0.00 | 0.0745 | 0.0020 | |||||

| US78409VAP94 / S&P Global Inc | 0.78 | 2.64 | 0.0745 | 0.0039 | |||||

| US3140QPSZ13 / FN30 | 0.78 | -0.64 | 0.0743 | 0.0015 | |||||

| US117043AV12 / Brunswick Corp. | 0.77 | -5.28 | 0.0740 | -0.0020 | |||||

| US345397A860 / Ford Motor Credit Co LLC | 0.77 | -1.03 | 0.0740 | 0.0012 | |||||

| US3617LNR973 / GII30 | 0.77 | 0.92 | 0.0737 | 0.0026 | |||||

| US023608AQ57 / Ameren Corp | 0.77 | 1.45 | 0.0736 | 0.0030 | |||||

| US88947EAT73 / Toll Brothers Finance Corp | 0.77 | 0.92 | 0.0734 | 0.0026 | |||||

| R / Ryder System, Inc. | 0.77 | 0.92 | 0.0733 | 0.0026 | |||||

| R / Ryder System, Inc. | 0.77 | 0.92 | 0.0733 | 0.0026 | |||||

| US917288BA96 / Uruguay Government International Bond | 0.76 | 1.06 | 0.0732 | 0.0028 | |||||

| Rogers Communications, Inc. / DBT (US775109DH13) | 0.76 | 0.0731 | 0.0731 | ||||||

| Rogers Communications, Inc. / DBT (US775109DH13) | 0.76 | 0.0731 | 0.0731 | ||||||

| Rogers Communications, Inc. / DBT (US775109DH13) | 0.76 | 0.0731 | 0.0731 | ||||||

| Rogers Communications, Inc. / DBT (US775109DH13) | 0.76 | 0.0731 | 0.0731 | ||||||

| US143658BQ44 / Carnival Corp | 0.76 | -44.97 | 0.0730 | -0.0561 | |||||

| US22822VAK70 / Crown Castle International Corp | 0.76 | 0.93 | 0.0727 | 0.0025 | |||||

| US68389XCE31 / Oracle Corp | 0.76 | 2.16 | 0.0726 | 0.0034 | |||||

| US3140XK5T34 / FN30 | 0.76 | 0.66 | 0.0726 | 0.0024 | |||||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 0.75 | 1.34 | 0.0723 | 0.0029 | |||||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 0.75 | 1.34 | 0.0723 | 0.0029 | |||||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 0.75 | 1.34 | 0.0723 | 0.0029 | |||||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 0.75 | 1.34 | 0.0723 | 0.0029 | |||||

| US378272BN78 / Glencore Funding LLC | 0.75 | 0.80 | 0.0722 | 0.0025 | |||||

| US517834AE74 / Las Vegas Sands Corp | 0.75 | 0.0721 | 0.0721 | ||||||

| AGL Core CLO 31 Ltd., Series 2024-31A, Class A / ABS-CBDO (US00852MAA80) | 0.75 | -0.13 | 0.0720 | 0.0018 | |||||

| AGL Core CLO 31 Ltd., Series 2024-31A, Class A / ABS-CBDO (US00852MAA80) | 0.75 | -0.13 | 0.0720 | 0.0018 | |||||

| AGL Core CLO 31 Ltd., Series 2024-31A, Class A / ABS-CBDO (US00852MAA80) | 0.75 | -0.13 | 0.0720 | 0.0018 | |||||

| US66285WFB72 / North Texas Tollway Authority, System Revenue Bonds, Taxble Build America Bond Series 2009B | 0.75 | 0.54 | 0.0719 | 0.0023 | |||||

| US12509VAG77 / CBAM 2020-12 Ltd | 0.75 | -0.13 | 0.0718 | 0.0018 | |||||

| US3132D55F58 / Freddie Mac Pool | 0.75 | -1.45 | 0.0718 | 0.0009 | |||||

| US89640LAA08 / TRINITAS CLO XVIII LTD SER 2021-18A CL A1 V/R REGD 144A P/P 3.87986000 | 0.75 | -0.27 | 0.0718 | 0.0017 | |||||

| US87168NAC83 / SYMPHONY CLO LTD | 0.75 | 0.0718 | 0.0718 | ||||||

| US38380LU684 / GNMA CMO IO | 0.75 | -4.71 | 0.0717 | -0.0015 | |||||

| Wise CLO Ltd., Series 2024-2A, Class A / ABS-CBDO (US97718GAA13) | 0.75 | -0.53 | 0.0717 | 0.0015 | |||||

| Wise CLO Ltd., Series 2024-2A, Class A / ABS-CBDO (US97718GAA13) | 0.75 | -0.53 | 0.0717 | 0.0015 | |||||

| Macquarie Airfinance Holdings Ltd. / DBT (US55609NAE85) | 0.74 | -0.27 | 0.0713 | 0.0018 | |||||

| Macquarie Airfinance Holdings Ltd. / DBT (US55609NAE85) | 0.74 | -0.27 | 0.0713 | 0.0018 | |||||

| Macquarie Airfinance Holdings Ltd. / DBT (US55609NAE85) | 0.74 | -0.27 | 0.0713 | 0.0018 | |||||

| Macquarie Airfinance Holdings Ltd. / DBT (US55609NAE85) | 0.74 | -0.27 | 0.0713 | 0.0018 | |||||

| US606822AD62 / Mitsubishi UFJ Financial Group, Inc. COM | 0.74 | 0.54 | 0.0713 | 0.0022 | |||||

| US26442EAF79 / Duke Energy Ohio Bond | 0.74 | 2.20 | 0.0712 | 0.0034 | |||||

| J1EF34 / Jefferies Financial Group Inc. - Depositary Receipt (Common Stock) | 0.74 | -1.59 | 0.0712 | 0.0008 | |||||

| J1EF34 / Jefferies Financial Group Inc. - Depositary Receipt (Common Stock) | 0.74 | -1.59 | 0.0712 | 0.0008 | |||||

| J1EF34 / Jefferies Financial Group Inc. - Depositary Receipt (Common Stock) | 0.74 | -1.59 | 0.0712 | 0.0008 | |||||

| J1EF34 / Jefferies Financial Group Inc. - Depositary Receipt (Common Stock) | 0.74 | -1.59 | 0.0712 | 0.0008 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.74 | 0.41 | 0.0712 | 0.0022 | |||||

| US3140KLLG54 / Fannie Mae Pool | 0.74 | 0.00 | 0.0707 | 0.0020 | |||||

| HCA, Inc. / DBT (US404119CU12) | 0.74 | 1.52 | 0.0704 | 0.0028 | |||||

| HCA, Inc. / DBT (US404119CU12) | 0.74 | 1.52 | 0.0704 | 0.0028 | |||||

| HCA, Inc. / DBT (US404119CU12) | 0.74 | 1.52 | 0.0704 | 0.0028 | |||||

| US00914AAE29 / Air Lease Corp. | 0.73 | 1.38 | 0.0703 | 0.0028 | |||||

| US097023CR48 / Boeing Co. | 0.73 | -0.82 | 0.0700 | 0.0013 | |||||

| US38013JAD54 / GM Financial Consumer Automobile Receivables Trust, Series 2023-1, Class A3 | 0.73 | -18.82 | 0.0699 | -0.0138 | |||||

| US3137HANZ52 / FHLMC CMO IO | 0.73 | 4.32 | 0.0695 | 0.0047 | |||||

| US253393AG77 / Dick's Sporting Goods, Inc. | 0.72 | -5.86 | 0.0693 | -0.0023 | |||||

| US15089QAX25 / CORP. NOTE | 0.72 | -3.74 | 0.0690 | -0.0008 | |||||

| US00130HCG83 / CORP. NOTE | 0.72 | 2.27 | 0.0690 | 0.0033 | |||||

| US30161NAC56 / Exelon Corp. 5 5/8% Bonds Due 6/15/2035 | 0.72 | 0.0686 | 0.0686 | ||||||

| US3140MWH661 / FN30 | 0.71 | -6.05 | 0.0685 | -0.0025 | |||||

| US46640LAN29 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0.71 | 0.42 | 0.0680 | 0.0021 | |||||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0.71 | -0.28 | 0.0680 | 0.0017 | |||||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0.71 | -0.28 | 0.0680 | 0.0017 | |||||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0.71 | -0.28 | 0.0680 | 0.0017 | |||||

| US117043AT65 / Brunswick Corp/DE | 0.71 | -0.98 | 0.0678 | 0.0012 | |||||

| US3618FFCK08 / GII30 | 0.71 | 0.43 | 0.0676 | 0.0022 | |||||

| D1TE34 / DTE Energy Company - Depositary Receipt (Common Stock) | 0.71 | 0.0676 | 0.0676 | ||||||

| D1TE34 / DTE Energy Company - Depositary Receipt (Common Stock) | 0.71 | 0.0676 | 0.0676 | ||||||

| D1TE34 / DTE Energy Company - Depositary Receipt (Common Stock) | 0.71 | 0.0676 | 0.0676 | ||||||

| Wells Fargo Commercial Mortgage Trust, Series 2015-C31, Class AS / ABS-MBS (US94989WAU18) | 0.70 | 0.14 | 0.0675 | 0.0019 | |||||

| Wells Fargo Commercial Mortgage Trust, Series 2015-C31, Class AS / ABS-MBS (US94989WAU18) | 0.70 | 0.14 | 0.0675 | 0.0019 | |||||

| US3138WJTE86 / FN30 | 0.70 | -0.42 | 0.0675 | 0.0015 | |||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 0.70 | 2.03 | 0.0674 | 0.0031 | |||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 0.70 | 2.03 | 0.0674 | 0.0031 | |||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 0.70 | 2.03 | 0.0674 | 0.0031 | |||||

| US3140MN3M63 / UMBS, 30 Year | 0.70 | 0.14 | 0.0674 | 0.0019 | |||||