Mga Batayang Estadistika

| Nilai Portofolio | $ 979,389,464 |

| Posisi Saat Ini | 72 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

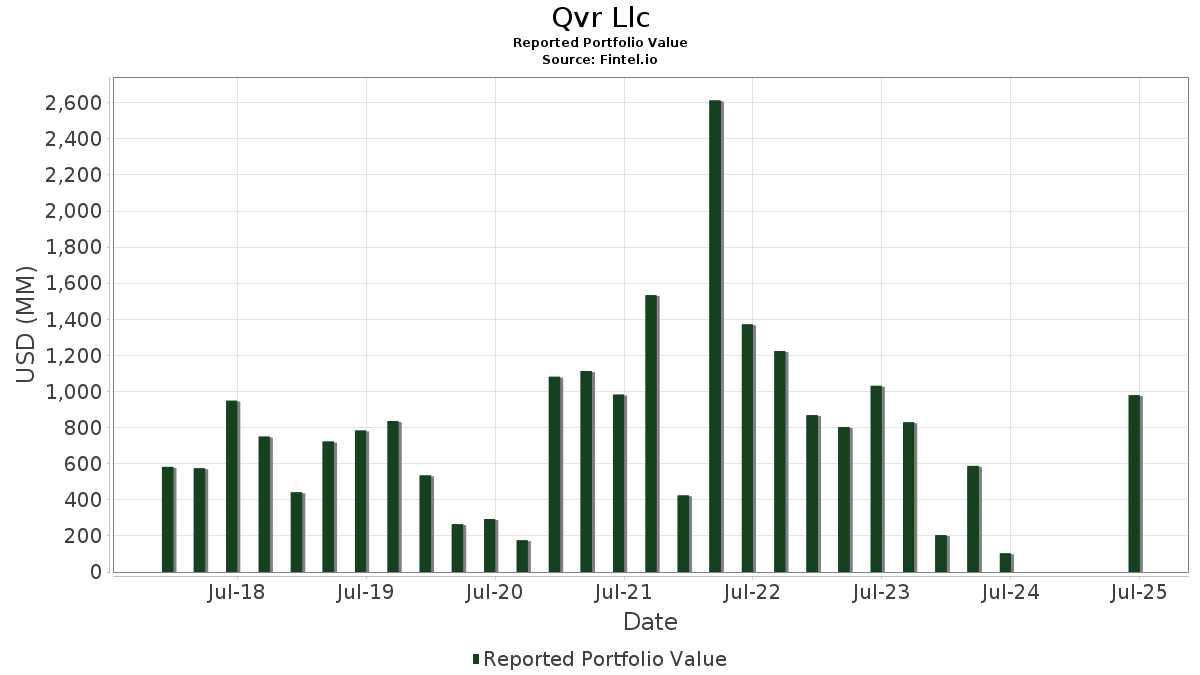

Qvr Llc telah mengungkapkan total kepemilikan 72 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 979,389,464 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Qvr Llc adalah NVIDIA Corporation (US:NVDA) , Palantir Technologies Inc. (US:PLTR) , Tesla, Inc. (US:TSLA) , Blackstone Inc. (US:BX) , and Blackstone Inc. (US:BX) . Posisi baru Qvr Llc meliputi: Palantir Technologies Inc. (US:PLTR) , Blackstone Inc. (US:BX) , Blackstone Inc. (US:BX) , Apollo Global Management, Inc. (US:APO) , and KKR & Co. Inc. (US:KKR) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.81 | 127.88 | 13.0568 | 13.0568 | |

| 0.54 | 73.01 | 7.4549 | 7.4549 | |

| 0.20 | 64.71 | 6.6069 | 6.6069 | |

| 0.41 | 60.95 | 6.2237 | 6.2237 | |

| 0.40 | 60.28 | 6.1549 | 6.1549 | |

| 0.41 | 58.75 | 5.9985 | 5.9985 | |

| 0.33 | 57.94 | 5.9155 | 5.9155 | |

| 0.42 | 55.86 | 5.7035 | 5.7035 | |

| 0.35 | 49.16 | 5.0192 | 5.0192 | |

| 0.33 | 44.19 | 4.5123 | 4.5123 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-12 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | Put | 0.81 | 127.88 | 13.0568 | 13.0568 | ||||

| PLTR / Palantir Technologies Inc. | Put | 0.54 | 73.01 | 7.4549 | 7.4549 | ||||

| TSLA / Tesla, Inc. | Put | 0.20 | 64.71 | 6.6069 | 6.6069 | ||||

| BX / Blackstone Inc. | Call | 0.41 | 60.95 | 6.2237 | 6.2237 | ||||

| BX / Blackstone Inc. | Put | 0.40 | 60.28 | 6.1549 | 6.1549 | ||||

| APO / Apollo Global Management, Inc. | Call | 0.41 | 58.75 | 5.9985 | 5.9985 | ||||

| GOOG / Alphabet Inc. | Put | 0.33 | 57.94 | 5.9155 | 5.9155 | ||||

| KKR / KKR & Co. Inc. | Put | 0.42 | 55.86 | 5.7035 | 5.7035 | ||||

| APO / Apollo Global Management, Inc. | Put | 0.35 | 49.16 | 5.0192 | 5.0192 | ||||

| KKR / KKR & Co. Inc. | Call | 0.33 | 44.19 | 4.5123 | 4.5123 | ||||

| AMZN / Amazon.com, Inc. | Put | 0.20 | 44.03 | 4.4958 | 4.4958 | ||||

| SPY / SPDR S&P 500 ETF | 0.06 | 37.01 | 3.7792 | 3.7792 | |||||

| META / Meta Platforms, Inc. | Put | 0.04 | 31.52 | 3.2180 | 3.2180 | ||||

| AMD / Advanced Micro Devices, Inc. | Put | 0.19 | 26.90 | 2.7470 | 2.7470 | ||||

| COST / Costco Wholesale Corporation | 0.02 | 22.66 | 2.3133 | 2.3133 | |||||

| GOOGL / Alphabet Inc. | Put | 0.13 | 22.47 | 2.2942 | 2.2942 | ||||

| SPY / SPDR S&P 500 ETF | Put | 0.04 | 21.87 | 2.2332 | 2.2332 | ||||

| QQQ / Invesco QQQ Trust, Series 1 | Call | 0.04 | 21.46 | 2.1910 | 2.1910 | ||||

| OWL / Blue Owl Capital Inc. | Put | 1.09 | 20.92 | 2.1358 | 2.1358 | ||||

| OWL / Blue Owl Capital Inc. | Call | 0.97 | 18.66 | 1.9057 | 1.9057 | ||||

| TGT / Target Corporation | 0.11 | 11.01 | 1.1246 | 1.1246 | |||||

| QQQ / Invesco QQQ Trust, Series 1 | 0.01 | 3.92 | 0.3999 | 0.3999 | |||||

| KWEB / KraneShares Trust - KraneShares CSI China Internet ETF | Put | 0.11 | 3.84 | 0.3926 | 0.3926 | ||||

| NVDA / NVIDIA Corporation | 0.02 | 3.14 | 0.3211 | 0.3211 | |||||

| PLTR / Palantir Technologies Inc. | 0.02 | 2.79 | 0.2853 | 0.2853 | |||||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | Put | 0.03 | 2.56 | 0.2619 | 0.2619 | ||||

| SPY / SPDR S&P 500 ETF | Call | 0.00 | 2.53 | 0.2586 | 0.2586 | ||||

| GOOG / Alphabet Inc. | 0.01 | 2.38 | 0.2431 | 0.2431 | |||||

| QQQ / Invesco QQQ Trust, Series 1 | Put | 0.00 | 2.37 | 0.2422 | 0.2422 | ||||

| AAPL / Apple Inc. | 0.01 | 1.95 | 0.1995 | 0.1995 | |||||

| MSFT / Microsoft Corporation | Put | 0.00 | 1.89 | 0.1930 | 0.1930 | ||||

| KO / The Coca-Cola Company | 0.03 | 1.88 | 0.1921 | 0.1921 | |||||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | Call | 0.02 | 1.86 | 0.1901 | 0.1901 | ||||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | Put | 0.02 | 1.86 | 0.1901 | 0.1901 | ||||

| TSLA / Tesla, Inc. | 0.00 | 1.22 | 0.1248 | 0.1248 | |||||

| MSFT / Microsoft Corporation | 0.00 | 1.19 | 0.1216 | 0.1216 | |||||

| SVXY / ProShares Trust II - ProShares Short VIX Short-Term Futures ETF | 0.03 | 1.16 | 0.1188 | 0.1188 | |||||

| AMZN / Amazon.com, Inc. | 0.01 | 1.15 | 0.1170 | 0.1170 | |||||

| NFLX / Netflix, Inc. | 0.00 | 1.05 | 0.1069 | 0.1069 | |||||

| META / Meta Platforms, Inc. | 0.00 | 0.76 | 0.0776 | 0.0776 | |||||

| GOOGL / Alphabet Inc. | 0.00 | 0.74 | 0.0756 | 0.0756 | |||||

| META / Meta Platforms, Inc. | Call | 0.00 | 0.74 | 0.0754 | 0.0754 | ||||

| IBIT / iShares Bitcoin Trust ETF | 0.01 | 0.54 | 0.0552 | 0.0552 | |||||

| MSFT / Microsoft Corporation | Call | 0.00 | 0.50 | 0.0508 | 0.0508 | ||||

| WMT / Walmart Inc. | 0.01 | 0.49 | 0.0502 | 0.0502 | |||||

| AVGO / Broadcom Inc. | 0.00 | 0.48 | 0.0486 | 0.0486 | |||||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.44 | 0.0450 | 0.0450 | |||||

| ORCL / Oracle Corporation | 0.00 | 0.38 | 0.0388 | 0.0388 | |||||

| V / Visa Inc. | 0.00 | 0.32 | 0.0322 | 0.0322 | |||||

| MA / Mastercard Incorporated | 0.00 | 0.31 | 0.0321 | 0.0321 | |||||

| GLD / SPDR Gold Trust | Call | 0.00 | 0.30 | 0.0311 | 0.0311 | ||||

| DIS / The Walt Disney Company | 0.00 | 0.30 | 0.0303 | 0.0303 | |||||

| GE / General Electric Company | 0.00 | 0.29 | 0.0295 | 0.0295 | |||||

| CAT / Caterpillar Inc. | 0.00 | 0.28 | 0.0291 | 0.0291 | |||||

| AVGO / Broadcom Inc. | Put | 0.00 | 0.28 | 0.0281 | 0.0281 | ||||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.00 | 0.24 | 0.0250 | 0.0250 | |||||

| KO / The Coca-Cola Company | Put | 0.00 | 0.23 | 0.0238 | 0.0238 | ||||

| AXP / American Express Company | 0.00 | 0.23 | 0.0235 | 0.0235 | |||||

| T / AT&T Inc. | 0.01 | 0.21 | 0.0212 | 0.0212 | |||||

| ORCL / Oracle Corporation | Put | 0.00 | 0.20 | 0.0201 | 0.0201 | ||||

| MCD / McDonald's Corporation | 0.00 | 0.19 | 0.0194 | 0.0194 | |||||

| WMT / Walmart Inc. | Put | 0.00 | 0.16 | 0.0160 | 0.0160 | ||||

| VZ / Verizon Communications Inc. | 0.00 | 0.15 | 0.0156 | 0.0156 | |||||

| BX / Blackstone Inc. | 0.00 | 0.11 | 0.0117 | 0.0117 | |||||

| VZ / Verizon Communications Inc. | Put | 0.00 | 0.11 | 0.0115 | 0.0115 | ||||

| PEP / PepsiCo, Inc. | Put | 0.00 | 0.11 | 0.0108 | 0.0108 | ||||

| PEP / PepsiCo, Inc. | 0.00 | 0.10 | 0.0107 | 0.0107 | |||||

| AMD / Advanced Micro Devices, Inc. | 0.00 | 0.09 | 0.0091 | 0.0091 | |||||

| GLD / SPDR Gold Trust | 0.00 | 0.05 | 0.0050 | 0.0050 | |||||

| MCD / McDonald's Corporation | Put | 0.00 | 0.03 | 0.0030 | 0.0030 | ||||

| DIS / The Walt Disney Company | Put | 0.00 | 0.01 | 0.0013 | 0.0013 | ||||

| KKR / KKR & Co. Inc. | 0.00 | 0.00 | 0.0002 | 0.0002 |