Mga Batayang Estadistika

| Nilai Portofolio | $ 236,504,000 |

| Posisi Saat Ini | 75 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

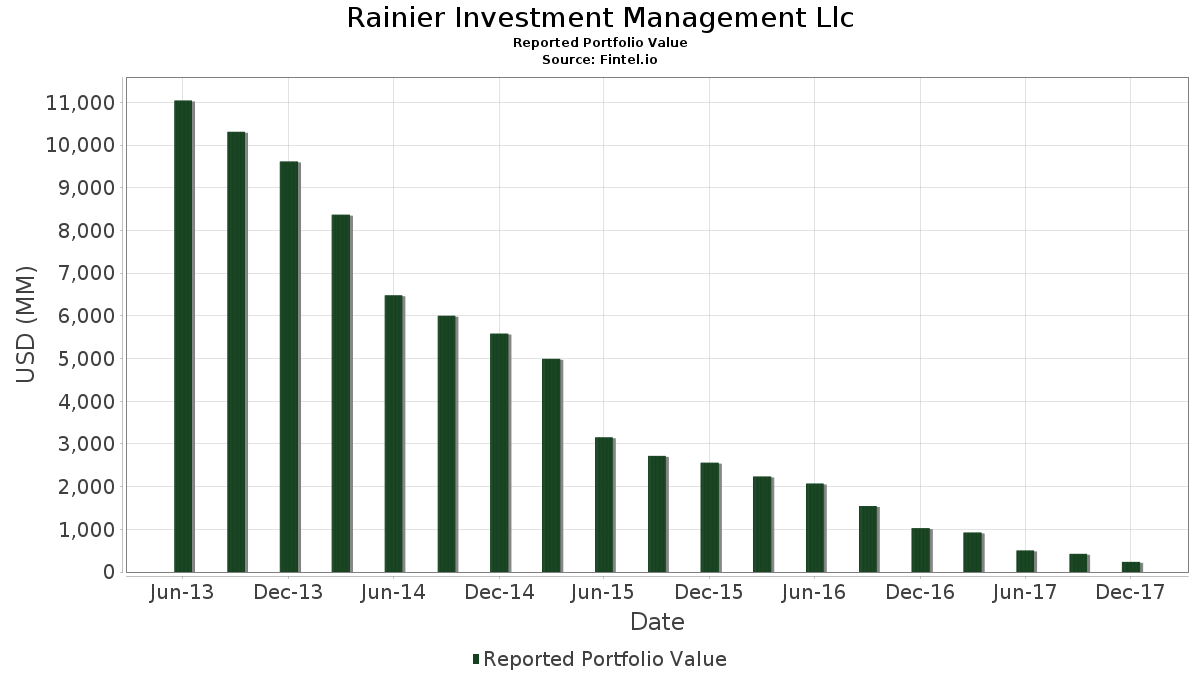

Rainier Investment Management Llc telah mengungkapkan total kepemilikan 75 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 236,504,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Rainier Investment Management Llc adalah Teleflex Incorporated (US:TFX) , Evercore Inc. (US:EVR) , A. O. Smith Corporation (US:AOS) , Mercury Systems, Inc. (US:MRCY) , and Oshkosh Corporation (US:OSK) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.10 | 5.31 | 2.2448 | 2.2448 | |

| 0.06 | 5.21 | 2.2025 | 2.2025 | |

| 0.09 | 5.20 | 2.1974 | 2.1974 | |

| 0.10 | 5.04 | 2.1289 | 2.1289 | |

| 0.10 | 4.45 | 1.8795 | 1.8795 | |

| 0.07 | 4.36 | 1.8427 | 1.8427 | |

| 0.09 | 4.36 | 1.8423 | 1.8423 | |

| 0.06 | 4.08 | 1.7239 | 1.7239 | |

| 0.18 | 3.85 | 1.6258 | 1.6258 | |

| 0.07 | 3.62 | 1.5311 | 1.5311 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -0.9057 | ||

| 0.00 | 0.00 | -0.8284 | ||

| 0.00 | 0.00 | -0.7966 | ||

| 0.00 | 0.00 | -0.7926 | ||

| 0.00 | 0.00 | -0.6553 | ||

| 0.00 | 0.00 | -0.6385 | ||

| 0.00 | 0.00 | -0.6341 | ||

| 0.00 | 0.00 | -0.6100 | ||

| 0.00 | 0.00 | -0.6068 | ||

| 0.00 | 0.00 | -0.5717 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2018-02-02 untuk periode pelaporan 2017-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TFX / Teleflex Incorporated | 0.02 | -23.22 | 6.00 | -21.05 | 2.5357 | 0.7465 | |||

| EVR / Evercore Inc. | 0.07 | -3.17 | 5.94 | 8.60 | 2.5099 | 1.2224 | |||

| AOS / A. O. Smith Corporation | 0.09 | -28.79 | 5.70 | -26.56 | 2.4093 | 0.5817 | |||

| MRCY / Mercury Systems, Inc. | 0.10 | -3.17 | 5.31 | -4.15 | 2.2448 | 2.2448 | |||

| OSK / Oshkosh Corporation | 0.06 | -34.35 | 5.21 | -27.71 | 2.2025 | 2.2025 | |||

| WAL / Western Alliance Bancorporation | 0.09 | -27.99 | 5.20 | -23.18 | 2.1974 | 2.1974 | |||

| RNG / RingCentral, Inc. | 0.10 | -26.66 | 5.04 | -14.98 | 2.1289 | 2.1289 | |||

| TSS / Total System Services, Inc. | 0.06 | -41.36 | 4.50 | -29.19 | 1.9044 | 0.4061 | |||

| EQIX / Equinix, Inc. | 0.01 | -27.20 | 4.46 | -26.07 | 1.8875 | 0.4653 | |||

| FIX / Comfort Systems USA, Inc. | 0.10 | -3.17 | 4.45 | 18.41 | 1.8795 | 1.8795 | |||

| MHK / Mohawk Industries, Inc. | 0.02 | -41.01 | 4.40 | -34.23 | 1.8596 | 0.2845 | |||

| PF / Pinnacle Foods, Inc. | 0.07 | -26.61 | 4.36 | -23.66 | 1.8427 | 1.8427 | |||

| TTEK / Tetra Tech, Inc. | 0.09 | -20.58 | 4.36 | -17.84 | 1.8423 | 1.8423 | |||

| RJF / Raymond James Financial, Inc. | 0.05 | -43.83 | 4.10 | -40.53 | 1.7344 | 0.1097 | |||

| ASGN / ASGN Incorporated | 0.06 | -3.16 | 4.08 | 15.92 | 1.7239 | 1.7239 | |||

| PWR / Quanta Services, Inc. | 0.10 | -40.64 | 4.01 | -37.87 | 1.6960 | 0.1753 | |||

| PGR / The Progressive Corporation | 0.07 | -37.69 | 4.00 | -27.51 | 1.6921 | 0.3917 | |||

| THO / THOR Industries, Inc. | 0.03 | -24.94 | 3.94 | -10.16 | 1.6647 | 0.6325 | |||

| MRVL / Marvell Technology, Inc. | 0.18 | -28.03 | 3.85 | -13.69 | 1.6258 | 1.6258 | |||

| US2692464017 / E*TRADE Financial, Inc. | 0.08 | -25.77 | 3.83 | -15.63 | 1.6182 | 0.5497 | |||

| AWK / American Water Works Company, Inc. | 0.04 | -36.44 | 3.72 | -28.12 | 1.5733 | 0.3539 | |||

| OZRK / Bank of the Ozarks, Inc. | 0.07 | -24.91 | 3.62 | -24.28 | 1.5311 | 1.5311 | |||

| FTNT / Fortinet, Inc. | 0.08 | -29.05 | 3.52 | -13.49 | 1.4888 | 0.5301 | |||

| NCLH / Norwegian Cruise Line Holdings Ltd. | 0.07 | -25.89 | 3.51 | -26.99 | 1.4845 | 0.3518 | |||

| MIDD / The Middleby Corporation | 0.03 | -27.58 | 3.42 | -23.73 | 1.4444 | 1.4444 | |||

| MTDR / Matador Resources Company | 0.11 | -3.16 | 3.39 | 11.05 | 1.4325 | 0.7139 | |||

| AXTA / Axalta Coating Systems Ltd. | 0.10 | -39.45 | 3.36 | -32.23 | 1.4198 | 1.4198 | |||

| EXP / Eagle Materials Inc. | 0.03 | -33.31 | 3.35 | -29.19 | 1.4165 | 0.3021 | |||

| EWBC / East West Bancorp, Inc. | 0.05 | -22.58 | 3.34 | -21.24 | 1.4127 | 0.4135 | |||

| FRC / First Republic Bank | 0.04 | -25.78 | 3.33 | -38.43 | 1.4101 | 0.1342 | |||

| FANG / Diamondback Energy, Inc. | 0.03 | -22.84 | 3.30 | -0.57 | 1.3936 | 0.6128 | |||

| CSGP / CoStar Group, Inc. | 0.01 | -31.56 | 3.28 | -24.24 | 1.3886 | 0.3675 | |||

| VMC / Vulcan Materials Company | 0.03 | -45.55 | 3.26 | -41.56 | 1.3801 | 0.0646 | |||

| MNR / Mach Natural Resources LP | 0.18 | -3.16 | 3.21 | 6.47 | 1.3577 | 1.3577 | |||

| NTUS / Natus Medical Inc | 0.08 | 25.74 | 3.18 | 28.05 | 1.3433 | 1.3433 | |||

| LRCX / Lam Research Corporation | 0.02 | -22.05 | 3.12 | -22.46 | 1.3209 | 0.3719 | |||

| LII / Lennox International Inc. | 0.01 | -24.42 | 3.12 | -12.06 | 1.3192 | 1.3192 | |||

| PNFP / Pinnacle Financial Partners, Inc. | 0.05 | -3.16 | 2.99 | -4.11 | 1.2630 | 0.5293 | |||

| JBLU / JetBlue Airways Corporation | 0.13 | -24.54 | 2.97 | -9.04 | 1.2554 | 1.2554 | |||

| NFX / Newfield Exploration Company | 0.09 | -35.19 | 2.96 | -31.12 | 1.2503 | 0.2391 | |||

| NSA / National Storage Affiliates Trust | 0.11 | -3.15 | 2.96 | 8.92 | 1.2499 | 1.2499 | |||

| LYV / Live Nation Entertainment, Inc. | 0.07 | -27.80 | 2.89 | -29.41 | 1.2211 | 0.2575 | |||

| SWKS / Skyworks Solutions, Inc. | 0.03 | -22.34 | 2.86 | -27.65 | 1.2084 | 0.2781 | |||

| BURL / Burlington Stores, Inc. | 0.02 | -23.98 | 2.84 | -2.03 | 1.2021 | 0.5186 | |||

| PAYC / Paycom Software, Inc. | 0.04 | -21.06 | 2.82 | -15.42 | 1.1941 | 1.1941 | |||

| NUVA / Nuvasive Inc | 0.05 | -39.70 | 2.81 | -36.38 | 1.1903 | 1.1903 | |||

| FLT / Corpay, Inc. | 0.01 | -48.38 | 2.76 | -35.80 | 1.1653 | 0.1541 | |||

| COUP / Coupa Software Inc | 0.08 | -3.15 | 2.64 | -2.94 | 1.1154 | 1.1154 | |||

| HUBS / HubSpot, Inc. | 0.03 | -27.98 | 2.62 | -24.26 | 1.1074 | 1.1074 | |||

| HPP / Hudson Pacific Properties, Inc. | 0.08 | -28.03 | 2.60 | -26.48 | 1.0989 | 0.2663 | |||

| MDU / MDU Resources Group, Inc. | 0.10 | -20.86 | 2.57 | -18.02 | 1.0850 | 1.0850 | |||

| ROIC / Retail Opportunity Investments Corp. | 0.13 | -3.15 | 2.55 | 1.63 | 1.0799 | 1.0799 | |||

| DOC / Healthpeak Properties, Inc. | 0.14 | -3.15 | 2.54 | -1.71 | 1.0723 | 1.0723 | |||

| ON / ON Semiconductor Corporation | 0.12 | -23.12 | 2.51 | -12.83 | 1.0630 | 0.3837 | |||

| SBNY / Signature Bank | 0.02 | -23.41 | 2.44 | -17.91 | 1.0313 | 0.3315 | |||

| EEFT / Euronet Worldwide, Inc. | 0.03 | -29.04 | 2.43 | -36.92 | 1.0275 | 0.1202 | |||

| PANW / Palo Alto Networks, Inc. | 0.02 | -19.94 | 2.42 | -19.49 | 1.0232 | 0.3152 | |||

| OSIS / OSI Systems, Inc. | 0.04 | -3.15 | 2.29 | -31.76 | 0.9695 | 0.9695 | |||

| PODD / Insulet Corporation | 0.03 | -63.42 | 2.25 | -54.18 | 0.9514 | -0.2051 | |||

| US69354M1080 / PRA Health Sciences Inc | 0.02 | -23.21 | 2.16 | -8.16 | 0.9133 | 0.9133 | |||

| TYL / Tyler Technologies, Inc. | 0.01 | -23.88 | 2.13 | -22.67 | 0.8998 | 0.2516 | |||

| BC / Brunswick Corporation | 0.04 | -23.86 | 2.07 | -24.87 | 0.8761 | 0.2265 | |||

| ULTA / Ulta Beauty, Inc. | 0.01 | -23.75 | 2.01 | -24.54 | 0.8503 | 0.2226 | |||

| PRGO / Perrigo Company plc | 0.02 | -52.44 | 2.00 | -51.03 | 0.8469 | -0.1164 | |||

| PFPT / Proofpoint Inc | 0.02 | -3.13 | 1.95 | -1.37 | 0.8241 | 0.8241 | |||

| LITE / Lumentum Holdings Inc. | 0.04 | -3.12 | 1.94 | -12.84 | 0.8207 | 0.8207 | |||

| AMED / Amedisys, Inc. | 0.04 | -3.11 | 1.90 | -8.77 | 0.8046 | 0.8046 | |||

| IT / Gartner, Inc. | 0.02 | -25.38 | 1.89 | -26.14 | 0.7991 | 0.1964 | |||

| OLLI / Ollie's Bargain Outlet Holdings, Inc. | 0.04 | -3.10 | 1.88 | 11.18 | 0.7945 | 0.7945 | |||

| APOG / Apogee Enterprises, Inc. | 0.04 | -3.13 | 1.80 | -8.17 | 0.7607 | 0.2992 | |||

| KTWO / K2M Group Holdings, Inc. | 0.09 | -3.10 | 1.67 | -17.76 | 0.7049 | 0.7049 | |||

| PRTK / Paratek Pharmaceuticals Inc. | 0.08 | -3.08 | 1.37 | -30.89 | 0.5788 | 0.5788 | |||

| IONS / Ionis Pharmaceuticals, Inc. | 0.02 | -63.67 | 1.16 | -63.96 | 0.4901 | -0.2674 | |||

| CDNS / Cadence Design Systems, Inc. | 0.03 | -62.45 | 1.16 | -60.20 | 0.4884 | -0.1952 | |||

| GVA / Granite Construction Incorporated | 0.02 | -54.28 | 0.96 | -49.97 | 0.4068 | 0.4068 | |||

| CRM / Salesforce, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2447 | ||||

| ORLY / O'Reilly Automotive, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3100 | ||||

| EXPE / Expedia Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0862 | ||||

| AMT / American Tower Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.4918 | ||||

| CME / CME Group Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2657 | ||||

| BRX / Brixmor Property Group Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| PZZA / Papa John's International, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| XRAY / DENTSPLY SIRONA Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| ADBE / Adobe Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| PLD / Prologis, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2657 | ||||

| US0153511094 / Alexion Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3175 | ||||

| SBUX / Starbucks Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.3354 | ||||

| NWL / Newell Brands Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| WCN / Waste Connections, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| HOLX / Hologic, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| EIX / Edison International | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| US20605P1012 / Concho Resources, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3736 | ||||

| KEY / KeyCorp | 0.00 | -100.00 | 0.00 | -100.00 | -0.2902 | ||||

| CELG / Celgene Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3455 | ||||

| DOOR / Masonite International Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| SMIN / iShares Trust - iShares MSCI India Small-Cap ETF | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| ESLT / Elbit Systems Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| DVN / Devon Energy Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.2120 | ||||

| V / Visa Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5717 | ||||

| GS / The Goldman Sachs Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5465 | ||||

| C.WSA / Citigroup, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5622 | ||||

| SHW / The Sherwin-Williams Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.6553 | ||||

| RTN / Raytheon Co. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4664 | ||||

| UNP / Union Pacific Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.4193 | ||||

| STZ / Constellation Brands, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5448 | ||||

| CHD / Church & Dwight Co., Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2044 | ||||

| AME / AMETEK, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2730 | ||||

| ULTI / Ultimate Software Group, Inc. (The) | 0.00 | -100.00 | 0.00 | -100.00 | -0.1625 | ||||

| AMZN / Amazon.com, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6068 | ||||

| COST / Costco Wholesale Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.3001 | ||||

| SHPG / Shire Plc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3976 | ||||

| DAL / Delta Air Lines, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2320 | ||||

| EOG / EOG Resources, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2087 | ||||

| SLB / Schlumberger Limited | 0.00 | -100.00 | 0.00 | -100.00 | -0.2942 | ||||

| ICE / Intercontinental Exchange, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5505 | ||||

| JPM / JPMorgan Chase & Co. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7966 | ||||

| INTC / Intel Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.4169 | ||||

| CLR / Continental Resources Inc (OKLA) | 0.00 | -100.00 | 0.00 | -100.00 | -0.2438 | ||||

| BSX / Boston Scientific Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.2384 | ||||

| COO / The Cooper Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3608 | ||||

| HD / The Home Depot, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4935 | ||||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3896 | ||||

| SRCL / Stericycle, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1849 | ||||

| US0325111070 / Anadarko Petroleum Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1566 | ||||

| XEC / Cimarex Energy Co. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1552 | ||||

| AAPL / Apple Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8284 | ||||

| CTAS / Cintas Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.6385 | ||||

| FTV / Fortive Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.6341 | ||||

| GOOGL / Alphabet Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7926 | ||||

| CMCSA / Comcast Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.2372 | ||||

| MA / Mastercard Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.3809 | ||||

| IR / Ingersoll Rand Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1811 | ||||

| MSFT / Microsoft Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.9057 | ||||

| META / Meta Platforms, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5695 | ||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| NOC / Northrop Grumman Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| MNST / Monster Beverage Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.2249 | ||||

| SPB / Spectrum Brands Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| SIG / Signet Jewelers Limited | 0.00 | -100.00 | 0.00 | -100.00 | -0.6100 |