Mga Batayang Estadistika

| Nilai Portofolio | $ 27,337,822 |

| Posisi Saat Ini | 65 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

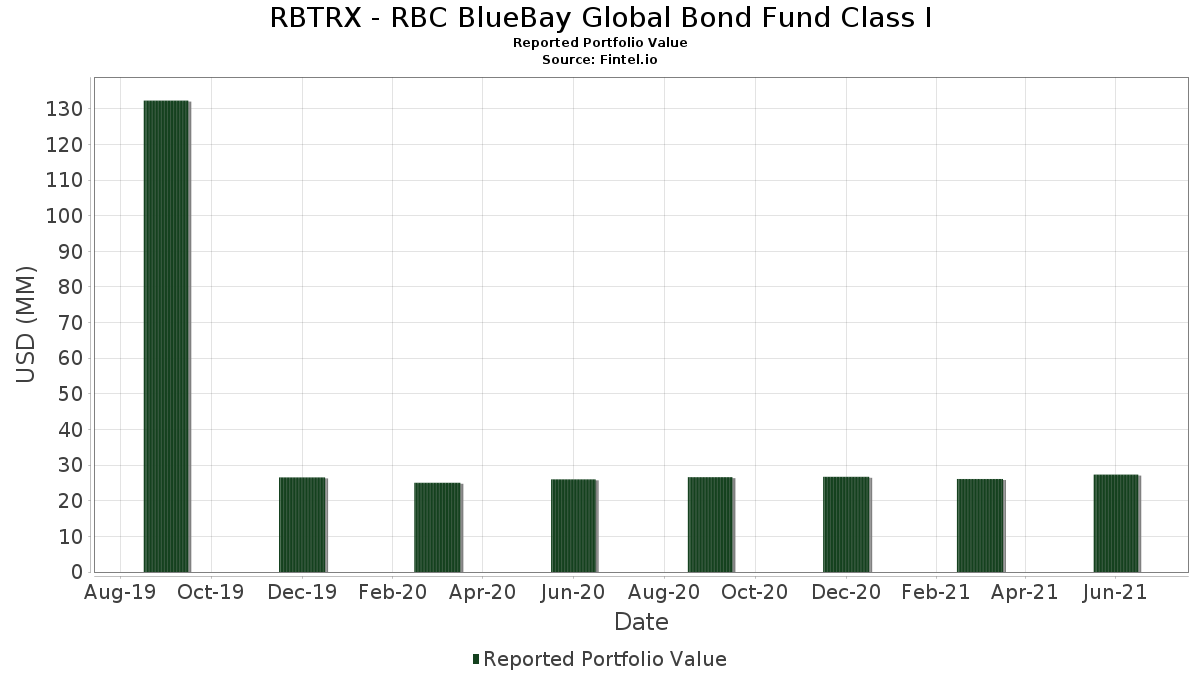

RBTRX - RBC BlueBay Global Bond Fund Class I telah mengungkapkan total kepemilikan 65 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 27,337,822 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama RBTRX - RBC BlueBay Global Bond Fund Class I adalah United States Treasury Note/Bond (US:US9128284R87) , US GOVERNMENT MONEY MARKET FUND (US:HMUXX) , United States Treasury Note/Bond 1.5% 09/30/2021 (US:US912828YJ31) , Charter Communications Operating LLC / Charter Communications Operating Capital (US:US161175BL78) , and United States Treasury Note/Bond (US:US912828YF19) . Posisi baru RBTRX - RBC BlueBay Global Bond Fund Class I meliputi: United States Treasury Note/Bond (US:US9128284R87) , United States Treasury Note/Bond 1.5% 09/30/2021 (US:US912828YJ31) , Charter Communications Operating LLC / Charter Communications Operating Capital (US:US161175BL78) , United States Treasury Note/Bond (US:US912828YF19) , and Japan Government Ten Year Bond (JP:JP1103381F34) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 3.38 | 11.7823 | 7.9590 | ||

| 0.86 | 2.9907 | 2.9907 | ||

| 0.27 | 0.9462 | 0.9462 | ||

| 0.06 | 0.2019 | 0.2019 | ||

| 1.23 | 4.2768 | 0.1950 | ||

| 0.32 | 1.1073 | 0.0780 | ||

| 0.31 | 1.0945 | 0.0443 | ||

| 0.76 | 2.6431 | 0.0376 | ||

| 0.37 | 1.2963 | 0.0311 | ||

| 0.13 | 0.4386 | 0.0234 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| -0.01 | -0.0424 | -1.6840 | ||

| -0.01 | -0.0203 | -1.6619 | ||

| -0.00 | -0.0078 | -1.6495 | ||

| 0.00 | 0.0008 | -1.6409 | ||

| 0.00 | 0.0025 | -1.6392 | ||

| 0.00 | 0.0036 | -1.6381 | ||

| 0.01 | 0.0236 | -1.6181 | ||

| 2.17 | 2.17 | 7.5783 | -1.4934 | |

| 0.11 | 0.3871 | -1.2546 | ||

| 0.37 | 1.2824 | -1.2205 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2021-08-24 untuk periode pelaporan 2021-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US9128284R87 / United States Treasury Note/Bond | 3.38 | 211.14 | 11.7823 | 7.9590 | |||||

| HMUXX / US GOVERNMENT MONEY MARKET FUND | 2.17 | -15.67 | 2.17 | -15.68 | 7.5783 | -1.4934 | |||

| US912828YJ31 / United States Treasury Note/Bond 1.5% 09/30/2021 | 2.01 | -0.35 | 6.9968 | -0.0925 | |||||

| US161175BL78 / Charter Communications Operating LLC / Charter Communications Operating Capital | 1.23 | 5.78 | 4.2768 | 0.1950 | |||||

| US912828YF19 / United States Treasury Note/Bond | 1.02 | -0.29 | 3.5436 | -0.0456 | |||||

| JP1103381F34 / Japan Government Ten Year Bond | 0.99 | -0.40 | 3.4382 | -0.0486 | |||||

| JP1103521JA8 / Japan Government Ten Year Bond | 0.92 | 0.00 | 3.2126 | -0.0296 | |||||

| XS2256949749 / Abertis Infraestructuras Finance BV | 0.86 | 2.9907 | 2.9907 | ||||||

| US912828ZX16 / United States Treasury Note/Bond | 0.83 | 0.00 | 2.9095 | -0.0275 | |||||

| XS1548475968 / Intesa Sanpaolo SpA | 0.83 | 0.98 | 2.8798 | -0.0001 | |||||

| FR0011697028 / Electricite de France SA | 0.80 | -0.13 | 2.7837 | -0.0301 | |||||

| AU3TB0000101 / Australia Government Bond | 0.78 | -2.37 | 2.7269 | -0.0929 | |||||

| US912828Z948 / United States Treasury Note/Bond | 0.76 | 2.43 | 2.6431 | 0.0376 | |||||

| GB00B24FF097 / United Kingdom Gilt | 0.76 | 0.67 | 2.6358 | -0.0087 | |||||

| JP1201561G37 / Japan Government Twenty Year Bond | 0.59 | 0.51 | 2.0574 | -0.0097 | |||||

| DE0001104792 / Bundesschatzanweisungen | 0.57 | 0.88 | 1.9901 | 0.0007 | |||||

| US36179UZS40 / Ginnie Mae II Pool | 0.55 | -17.76 | 1.9211 | -0.4398 | |||||

| BB67 / Germany - Corporate Bond/Note | 0.54 | 0.56 | 1.8675 | -0.0072 | |||||

| US3133KGQE16 / Freddie Mac Pool | 0.53 | -18.89 | 1.8407 | -0.4511 | |||||

| XS1880365975 / Bankia SA | 0.52 | -32.24 | 1.8038 | -0.8841 | |||||

| IT0005365165 / Italy Buoni Poliennali Del Tesoro | 0.50 | -0.20 | 1.7390 | -0.0181 | |||||

| JP1201471DC6 / Japan Government Twenty Year Bond | 0.49 | 0.00 | 1.7229 | -0.0168 | |||||

| JP1300571HC4 / Japan Government Thirty Year Bond | 0.49 | -0.20 | 1.7208 | -0.0190 | |||||

| XS1218289103 / Mexico Government International Bond | 0.46 | 1.78 | 1.5968 | 0.0099 | |||||

| US11135FAZ45 / Broadcom Inc | 0.45 | 0.90 | 1.5642 | 0.0012 | |||||

| IT0005433195 / Italy Buoni Poliennali Del Tesoro | 0.42 | -1.17 | 1.4756 | -0.0309 | |||||

| GB00BFWFPP71 / United Kingdom Gilt | 0.37 | 3.34 | 1.2963 | 0.0311 | |||||

| XS2023698553 / Banque Centrale de Tunisie International Bond | 0.37 | -48.38 | 1.2824 | -1.2205 | |||||

| CA135087XG49 / Canadian Government Bond | 0.35 | 2.33 | 1.2279 | 0.0156 | |||||

| BE0000352618 / Kingdom of Belgium Government Bond | 0.35 | 0.28 | 1.2274 | -0.0097 | |||||

| JP1103271D13 / Japan Government Ten Year Bond | 0.33 | -0.60 | 1.1559 | -0.0179 | |||||

| US912810SN90 / UNITED STATES TREASURY BOND 1.25% 05/15/2050 | 0.32 | 8.56 | 1.1073 | 0.0780 | |||||

| US912810RC45 / United States Treas Bds Bond | 0.31 | 5.03 | 1.0945 | 0.0443 | |||||

| ES0840609020 / CaixaBank SA | 0.27 | 0.9462 | 0.9462 | ||||||

| ES0840609004 / CaixaBank SA | 0.27 | 3.09 | 0.9320 | 0.0186 | |||||

| DE0001135325 / Bundesrepublik Deutschland Bundesanleihe | 0.22 | 0.00 | 0.7502 | -0.0066 | |||||

| CA135087XW98 / Canadian Government Bond | 0.17 | 2.96 | 0.6094 | 0.0124 | |||||

| NZGOVDT425C5 / New Zealand Government Bond | 0.15 | -0.67 | 0.5203 | -0.0109 | |||||

| US912810SE91 / United States Treas Bds Bond | 0.13 | 6.84 | 0.4386 | 0.0234 | |||||

| USD/EUR FORWARD / DFE (000000000) | 0.11 | -96.04 | 0.3871 | -1.2546 | |||||

| USD/JPY FORWARD / DFE (000000000) | 0.07 | -77.93 | 0.2328 | -0.1594 | |||||

| IT0005441883 / Italy Buoni Poliennali Del Tesoro | 0.06 | 0.2019 | 0.2019 | ||||||

| USP7807HAV70 / Petroleos de Venezuela SA | 0.03 | -20.93 | 0.1210 | -0.0307 | |||||

| AUD/USD FORWARD / DFE (000000000) | 0.03 | -90.97 | 0.0950 | -0.2973 | |||||

| VENZ / Venezuela Government International Bond | 0.01 | 0.00 | 0.0422 | -0.0004 | |||||

| IRS CNY / DIR (000000000) | 0.01 | -96.99 | 0.0320 | -0.3603 | |||||

| CAD/USD FORWARD / DFE (000000000) | 0.01 | -99.79 | 0.0236 | -1.6181 | |||||

| GBP/USD FORWARD / DFE (000000000) | 0.01 | -97.99 | 0.0234 | -0.3688 | |||||

| USD/NZD FORWARD / DFE (000000000) | 0.00 | -98.66 | 0.0165 | -0.3758 | |||||

| Euro-BTP Italian Bond / DIR (000000000) | 0.00 | -99.33 | 0.0082 | -0.3841 | |||||

| USD/EUR FORWARD / DFE (000000000) | 0.00 | -99.67 | 0.0036 | -0.3887 | |||||

| USD/EUR FORWARD / DFE (000000000) | 0.00 | -99.96 | 0.0036 | -1.6381 | |||||

| ZAR/USD FORWARD / DFE (000000000) | 0.00 | -100.00 | 0.0025 | -1.6392 | |||||

| Eurex 5 Year Euro BOBL / DIR (000000000) | 0.00 | -100.00 | 0.0009 | -0.3914 | |||||

| USD/ZAR FORWARD / DFE (000000000) | 0.00 | -100.00 | 0.0008 | -1.6409 | |||||

| CAD/USD FORWARD / DFE (000000000) | -0.00 | -100.00 | -0.0012 | -0.3935 | |||||

| CBOT 5 Year US Treasury Note / DIR (000000000) | -0.00 | -100.33 | -0.0039 | -0.3962 | |||||

| Eurex 10 Year Euro BUND / DIR (000000000) | -0.00 | -100.33 | -0.0040 | -0.3963 | |||||

| USD/ZAR FORWARD / DFE (000000000) | -0.00 | -100.07 | -0.0078 | -1.6495 | |||||

| IRS USD / DIR (000000000) | -0.00 | -101.00 | -0.0125 | -0.4048 | |||||

| ZAR/USD FORWARD / DFE (000000000) | -0.01 | -101.67 | -0.0203 | -0.4125 | |||||

| ZAR/USD FORWARD / DFE (000000000) | -0.01 | -100.18 | -0.0203 | -1.6619 | |||||

| CBOT 10 Year US Treasury Note / DIR (000000000) | -0.01 | -102.01 | -0.0223 | -0.4145 | |||||

| ZAR/USD FORWARD / DFE (000000000) | -0.01 | -100.43 | -0.0424 | -1.6840 | |||||

| USD/ZAR FORWARD / DFE (000000000) | -0.01 | -104.35 | -0.0458 | -0.4381 |