Mga Batayang Estadistika

| Nilai Portofolio | $ 792,458,768 |

| Posisi Saat Ini | 237 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

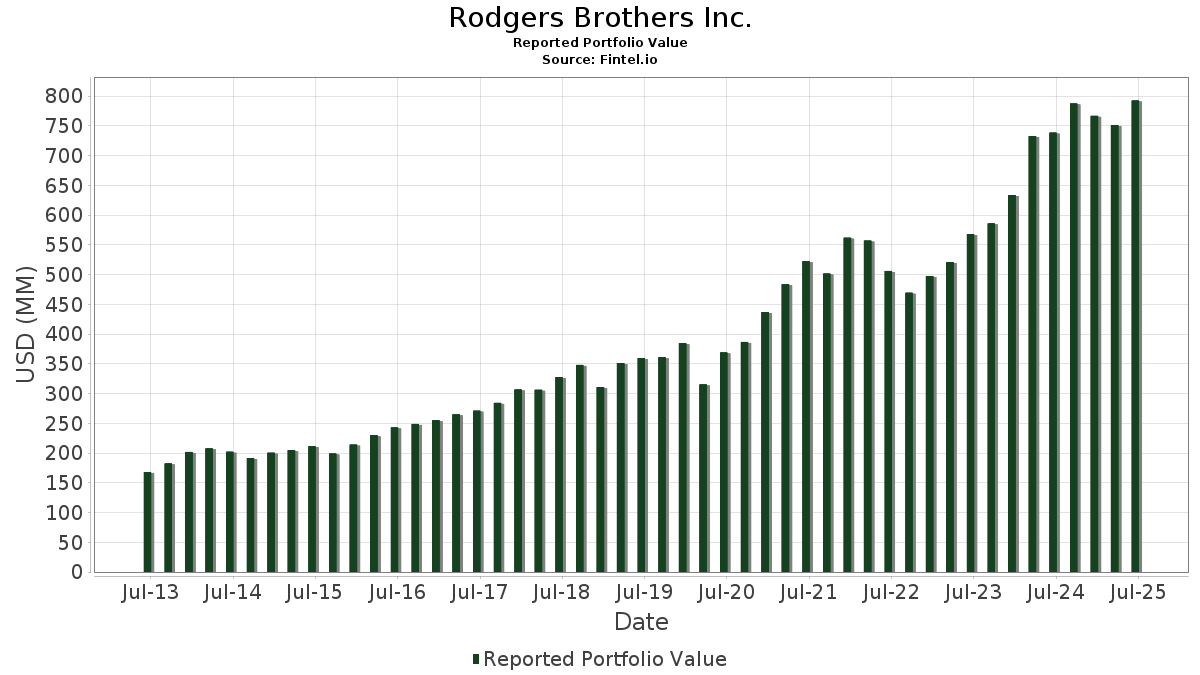

Rodgers Brothers Inc. telah mengungkapkan total kepemilikan 237 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 792,458,768 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Rodgers Brothers Inc. adalah Eli Lilly and Company (US:LLY) , Coherent Corp. (US:COHR) , AbbVie Inc. (US:ABBV) , Williams-Sonoma, Inc. (US:WSM) , and Badger Meter, Inc. (US:BMI) . Posisi baru Rodgers Brothers Inc. meliputi: California Water Service Group (US:CWT) , SJW Group (US:SJW) , Flowers Foods, Inc. (US:FLO) , Equinor ASA - Depositary Receipt (Common Stock) (US:EQNR) , and Winnebago Industries, Inc. (US:WGO) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.44 | 39.63 | 5.0010 | 1.1808 | |

| 0.39 | 7.62 | 0.9612 | 0.5582 | |

| 0.04 | 20.57 | 2.5955 | 0.4889 | |

| 0.09 | 21.28 | 2.6849 | 0.4632 | |

| 0.06 | 7.24 | 0.9137 | 0.4516 | |

| 0.05 | 15.94 | 2.0119 | 0.4148 | |

| 0.03 | 2.92 | 0.3679 | 0.3679 | |

| 0.03 | 2.87 | 0.3625 | 0.3625 | |

| 0.12 | 2.83 | 0.3570 | 0.3570 | |

| 0.06 | 2.78 | 0.3505 | 0.3505 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 46.32 | 5.8450 | -0.7427 | |

| 0.13 | 24.40 | 3.0791 | -0.6065 | |

| 0.06 | 4.25 | 0.5357 | -0.5972 | |

| 0.01 | 2.63 | 0.3318 | -0.3755 | |

| 0.55 | 8.71 | 1.0989 | -0.3560 | |

| 0.01 | 1.12 | 0.1416 | -0.3237 | |

| 0.07 | 3.18 | 0.4007 | -0.3229 | |

| 0.12 | 19.30 | 2.4361 | -0.3126 | |

| 0.07 | 9.49 | 1.1978 | -0.2836 | |

| 0.18 | 9.16 | 1.1557 | -0.2480 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| LLY / Eli Lilly and Company | 0.06 | -0.82 | 46.32 | -6.39 | 5.8450 | -0.7427 | |||

| COHR / Coherent Corp. | 0.44 | 0.54 | 39.63 | 38.12 | 5.0010 | 1.1808 | |||

| ABBV / AbbVie Inc. | 0.13 | -0.51 | 24.40 | -11.86 | 3.0791 | -0.6065 | |||

| WSM / Williams-Sonoma, Inc. | 0.14 | -0.17 | 23.57 | 3.16 | 2.9741 | -0.0676 | |||

| BMI / Badger Meter, Inc. | 0.09 | -0.97 | 21.28 | 27.51 | 2.6849 | 0.4632 | |||

| MSFT / Microsoft Corporation | 0.04 | -1.90 | 20.57 | 29.99 | 2.5955 | 0.4889 | |||

| ABT / Abbott Laboratories | 0.14 | -0.35 | 19.53 | 2.18 | 2.4645 | -0.0803 | |||

| PG / The Procter & Gamble Company | 0.12 | 0.02 | 19.30 | -6.49 | 2.4361 | -0.3126 | |||

| EMR / Emerson Electric Co. | 0.14 | 0.16 | 19.15 | 21.80 | 2.4165 | 0.3232 | |||

| ROK / Rockwell Automation, Inc. | 0.05 | 3.39 | 15.94 | 32.91 | 2.0119 | 0.4148 | |||

| AXP / American Express Company | 0.03 | 0.00 | 10.90 | 18.55 | 1.3757 | 0.1514 | |||

| MRK / Merck & Co., Inc. | 0.14 | 2.24 | 10.74 | -9.83 | 1.3547 | -0.2304 | |||

| JNJ / Johnson & Johnson | 0.07 | -0.38 | 9.98 | -8.25 | 1.2592 | -0.1888 | |||

| CVX / Chevron Corporation | 0.07 | -0.33 | 9.49 | -14.69 | 1.1978 | -0.2836 | |||

| HUBB / Hubbell Incorporated | 0.02 | 3.22 | 9.35 | 27.41 | 1.1799 | 0.2028 | |||

| KMB / Kimberly-Clark Corporation | 0.07 | -0.92 | 9.28 | -10.19 | 1.1715 | -0.2047 | |||

| GIS / General Mills, Inc. | 0.18 | 0.24 | 9.16 | -13.14 | 1.1557 | -0.2480 | |||

| UNP / Union Pacific Corporation | 0.04 | -0.51 | 9.01 | -3.10 | 1.1369 | -0.1010 | |||

| KLG / WK Kellogg Co | 0.55 | -0.36 | 8.71 | -20.32 | 1.0989 | -0.3560 | |||

| TGT / Target Corporation | 0.09 | 3.89 | 8.69 | -1.80 | 1.0967 | -0.0816 | |||

| IBM / International Business Machines Corporation | 0.03 | -5.47 | 8.52 | 12.05 | 1.0757 | 0.0629 | |||

| AAPL / Apple Inc. | 0.04 | 0.00 | 8.31 | -7.63 | 1.0484 | -0.1492 | |||

| CL / Colgate-Palmolive Company | 0.09 | -0.33 | 7.95 | -3.31 | 1.0028 | -0.0914 | |||

| PSX / Phillips 66 | 0.07 | -0.90 | 7.86 | -4.26 | 0.9923 | -0.1012 | |||

| HSY / The Hershey Company | 0.05 | 26.66 | 7.71 | 22.91 | 0.9729 | 0.1377 | |||

| MLKN / MillerKnoll, Inc. | 0.39 | 148.03 | 7.62 | 151.69 | 0.9612 | 0.5582 | |||

| LW / Lamb Weston Holdings, Inc. | 0.15 | 0.47 | 7.55 | -2.26 | 0.9531 | -0.0758 | |||

| NFG / National Fuel Gas Company | 0.09 | -4.14 | 7.39 | 2.54 | 0.9322 | -0.0270 | |||

| PPG / PPG Industries, Inc. | 0.06 | -7.26 | 7.26 | -3.53 | 0.9163 | -0.0858 | |||

| DIS / The Walt Disney Company | 0.06 | 66.05 | 7.24 | 108.65 | 0.9137 | 0.4516 | |||

| APD / Air Products and Chemicals, Inc. | 0.03 | 59.40 | 7.06 | 52.45 | 0.8906 | 0.2743 | |||

| CBRL / Cracker Barrel Old Country Store, Inc. | 0.11 | 6.43 | 6.69 | 67.47 | 0.8445 | 0.3124 | |||

| HOLX / Hologic, Inc. | 0.10 | -1.77 | 6.69 | 3.63 | 0.8436 | -0.0153 | |||

| EW / Edwards Lifesciences Corporation | 0.08 | -0.31 | 6.30 | 7.56 | 0.7954 | 0.0153 | |||

| MSA / MSA Safety Incorporated | 0.04 | 1.01 | 6.06 | 15.35 | 0.7653 | 0.0654 | |||

| PEP / PepsiCo, Inc. | 0.04 | 6.82 | 5.90 | -5.93 | 0.7447 | -0.0905 | |||

| ORI / Old Republic International Corporation | 0.15 | 108.18 | 5.70 | 104.04 | 0.7195 | 0.3474 | |||

| MKC / McCormick & Company, Incorporated | 0.08 | -2.02 | 5.69 | -9.75 | 0.7185 | -0.1214 | |||

| GLW / Corning Incorporated | 0.11 | -0.46 | 5.66 | 14.36 | 0.7147 | 0.0552 | |||

| OKE / ONEOK, Inc. | 0.07 | 0.00 | 5.59 | -17.74 | 0.7059 | -0.1994 | |||

| HRB / H&R Block, Inc. | 0.10 | -9.10 | 5.48 | -9.13 | 0.6920 | -0.1115 | |||

| FFIV / F5, Inc. | 0.02 | 0.00 | 5.48 | 10.53 | 0.6916 | 0.0315 | |||

| LRCX / Lam Research Corporation | 0.05 | 0.15 | 5.01 | 34.10 | 0.6323 | 0.1348 | |||

| MET / MetLife, Inc. | 0.06 | 0.84 | 5.01 | 1.01 | 0.6317 | -0.0282 | |||

| CW / Curtiss-Wright Corporation | 0.01 | -2.95 | 4.99 | 49.43 | 0.6291 | 0.1850 | |||

| TXN / Texas Instruments Incorporated | 0.02 | 0.00 | 4.90 | 15.54 | 0.6184 | 0.0537 | |||

| FDX / FedEx Corporation | 0.02 | -0.12 | 4.81 | -6.86 | 0.6069 | -0.0806 | |||

| GPC / Genuine Parts Company | 0.04 | -0.64 | 4.70 | 1.19 | 0.5925 | -0.0254 | |||

| LNN / Lindsay Corporation | 0.03 | -13.58 | 4.47 | -1.48 | 0.5639 | -0.0400 | |||

| QCOM / QUALCOMM Incorporated | 0.03 | 0.00 | 4.45 | 3.68 | 0.5620 | -0.0099 | |||

| EL / The Estée Lauder Companies Inc. | 0.05 | -12.75 | 4.39 | 6.81 | 0.5542 | 0.0068 | |||

| XOM / Exxon Mobil Corporation | 0.04 | 0.00 | 4.28 | -9.35 | 0.5395 | -0.0885 | |||

| PAYX / Paychex, Inc. | 0.03 | -0.59 | 4.26 | -6.28 | 0.5371 | -0.0675 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.02 | -0.01 | 4.25 | 15.44 | 0.5368 | 0.0461 | |||

| KO / The Coca-Cola Company | 0.06 | -49.49 | 4.25 | -50.11 | 0.5357 | -0.5972 | |||

| HON / Honeywell International Inc. | 0.02 | -0.29 | 4.22 | 9.67 | 0.5324 | 0.0202 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 0.00 | 4.02 | 15.34 | 0.5068 | 0.0431 | |||

| RVTY / Revvity, Inc. | 0.04 | 3.71 | 3.98 | -5.19 | 0.5028 | -0.0567 | |||

| CLX / The Clorox Company | 0.03 | -0.83 | 3.91 | -19.14 | 0.4931 | -0.1503 | |||

| NEE / NextEra Energy, Inc. | 0.06 | -0.47 | 3.86 | -2.53 | 0.4871 | -0.0402 | |||

| LOCO / El Pollo Loco Holdings, Inc. | 0.34 | 34.71 | 3.70 | 44.01 | 0.4671 | 0.1249 | |||

| ALCO / Alico, Inc. | 0.11 | 37.68 | 3.70 | 50.80 | 0.4664 | 0.1400 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | 326.81 | 3.67 | 247.82 | 0.4627 | 0.3224 | |||

| BMY / Bristol-Myers Squibb Company | 0.08 | 0.02 | 3.66 | -24.10 | 0.4618 | -0.1801 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.05 | 116.62 | 3.66 | 120.91 | 0.4615 | 0.2411 | |||

| TRI / Thomson Reuters Corporation | 0.02 | 0.00 | 3.45 | 16.41 | 0.4352 | 0.0408 | |||

| GOOG / Alphabet Inc. | 0.02 | 0.00 | 3.44 | 13.56 | 0.4346 | 0.0308 | |||

| UPS / United Parcel Service, Inc. | 0.03 | 36.25 | 3.44 | 25.04 | 0.4336 | 0.0677 | |||

| CMI / Cummins Inc. | 0.01 | -0.05 | 3.43 | 4.41 | 0.4332 | -0.0045 | |||

| AKAM / Akamai Technologies, Inc. | 0.04 | 4.16 | 3.29 | 3.20 | 0.4156 | -0.0093 | |||

| DRI / Darden Restaurants, Inc. | 0.01 | -1.64 | 3.27 | 3.19 | 0.4124 | -0.0092 | |||

| ADBE / Adobe Inc. | 0.01 | 23.92 | 3.21 | 25.03 | 0.4047 | 0.0631 | |||

| VZ / Verizon Communications Inc. | 0.07 | -38.76 | 3.18 | -41.58 | 0.4007 | -0.3229 | |||

| NUE / Nucor Corporation | 0.02 | 0.00 | 3.17 | 7.65 | 0.3997 | 0.0079 | |||

| SYY / Sysco Corporation | 0.04 | 3.07 | 3.05 | 4.02 | 0.3853 | -0.0055 | |||

| AMCR / Amcor plc | 0.32 | 0.33 | 2.96 | -4.94 | 0.3739 | -0.0411 | |||

| KVUE / Kenvue Inc. | 0.14 | 1.61 | 2.93 | -11.31 | 0.3701 | -0.0702 | |||

| PRU / Prudential Financial, Inc. | 0.03 | 2.92 | 0.3679 | 0.3679 | |||||

| ED / Consolidated Edison, Inc. | 0.03 | 2.87 | 0.3625 | 0.3625 | |||||

| HPQ / HP Inc. | 0.12 | 2.83 | 0.3570 | 0.3570 | |||||

| CWT / California Water Service Group | 0.06 | 2.78 | 0.3505 | 0.3505 | |||||

| ITW / Illinois Tool Works Inc. | 0.01 | 275.54 | 2.77 | 274.46 | 0.3498 | 0.2512 | |||

| DUK / Duke Energy Corporation | 0.02 | 0.00 | 2.77 | -3.25 | 0.3491 | -0.0316 | |||

| HRL / Hormel Foods Corporation | 0.09 | -16.08 | 2.74 | -17.94 | 0.3457 | -0.0988 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.03 | -13.54 | 2.71 | -30.31 | 0.3417 | -0.1757 | |||

| O / Realty Income Corporation | 0.05 | 644.00 | 2.68 | 639.78 | 0.3380 | 0.2898 | |||

| GD / General Dynamics Corporation | 0.01 | -53.74 | 2.63 | -50.51 | 0.3318 | -0.3755 | |||

| SJW / SJW Group | 0.05 | 2.62 | 0.3312 | 0.3312 | |||||

| PNC / The PNC Financial Services Group, Inc. | 0.01 | 0.04 | 2.52 | 6.10 | 0.3182 | 0.0018 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 0.00 | 2.52 | 18.17 | 0.3177 | 0.0341 | |||

| GRC / The Gorman-Rupp Company | 0.07 | 0.00 | 2.48 | 4.60 | 0.3128 | -0.0027 | |||

| SJM / The J. M. Smucker Company | 0.02 | -0.15 | 2.30 | -17.18 | 0.2902 | -0.0796 | |||

| FLO / Flowers Foods, Inc. | 0.14 | 2.29 | 0.2893 | 0.2893 | |||||

| SPGI / S&P Global Inc. | 0.00 | 0.00 | 2.28 | 3.79 | 0.2871 | -0.0048 | |||

| EBAY / eBay Inc. | 0.03 | -0.50 | 2.23 | 9.38 | 0.2813 | 0.0100 | |||

| KLIC / Kulicke and Soffa Industries, Inc. | 0.06 | -5.30 | 2.15 | -0.65 | 0.2714 | -0.0168 | |||

| MCO / Moody's Corporation | 0.00 | 0.05 | 2.08 | 7.81 | 0.2630 | 0.0056 | |||

| BK / The Bank of New York Mellon Corporation | 0.02 | -3.72 | 2.08 | 4.58 | 0.2621 | -0.0023 | |||

| RHI / Robert Half Inc. | 0.05 | 0.00 | 2.06 | -24.74 | 0.2595 | -0.1043 | |||

| CAT / Caterpillar Inc. | 0.01 | 40.81 | 2.01 | 65.76 | 0.2536 | 0.0922 | |||

| NTCT / NetScout Systems, Inc. | 0.08 | -35.67 | 1.98 | -24.03 | 0.2501 | -0.0973 | |||

| TJX / The TJX Companies, Inc. | 0.01 | 0.00 | 1.82 | 1.39 | 0.2296 | -0.0093 | |||

| WEC / WEC Energy Group, Inc. | 0.02 | -24.11 | 1.81 | -27.43 | 0.2284 | -0.1037 | |||

| JOUT / Johnson Outdoors Inc. | 0.06 | -4.51 | 1.76 | 16.36 | 0.2218 | 0.0207 | |||

| POWL / Powell Industries, Inc. | 0.01 | 0.00 | 1.76 | 23.56 | 0.2217 | 0.0324 | |||

| STX / Seagate Technology Holdings plc | 0.01 | -54.60 | 1.73 | -22.88 | 0.2178 | -0.0801 | |||

| D / Dominion Energy, Inc. | 0.03 | 1.68 | 0.2116 | 0.2116 | |||||

| AME / AMETEK, Inc. | 0.01 | 0.00 | 1.67 | 5.09 | 0.2112 | -0.0008 | |||

| NEM / Newmont Corporation | 0.03 | -17.80 | 1.66 | -0.84 | 0.2097 | -0.0133 | |||

| CSCO / Cisco Systems, Inc. | 0.02 | -2.89 | 1.63 | 9.18 | 0.2057 | 0.0069 | |||

| TFX / Teleflex Incorporated | 0.01 | 0.00 | 1.61 | -14.35 | 0.2034 | -0.0471 | |||

| HP / Helmerich & Payne, Inc. | 0.10 | 1.01 | 1.58 | -41.38 | 0.2000 | -0.1599 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.01 | 322.41 | 1.58 | 314.70 | 0.1995 | 0.1487 | |||

| HAS / Hasbro, Inc. | 0.02 | -9.03 | 1.52 | 9.25 | 0.1924 | 0.0065 | |||

| TPR / Tapestry, Inc. | 0.02 | -3.89 | 1.52 | 19.86 | 0.1912 | 0.0229 | |||

| ERIE / Erie Indemnity Company | 0.00 | 0.00 | 1.51 | -17.21 | 0.1906 | -0.0524 | |||

| DE / Deere & Company | 0.00 | 0.00 | 1.47 | 8.30 | 0.1861 | 0.0049 | |||

| GE / General Electric Company | 0.01 | -0.42 | 1.46 | 28.08 | 0.1837 | 0.0323 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 1.44 | 20.97 | 0.1820 | 0.0232 | |||

| FBIN / Fortune Brands Innovations, Inc. | 0.03 | -8.52 | 1.44 | -22.67 | 0.1813 | -0.0660 | |||

| SNPS / Synopsys, Inc. | 0.00 | 0.00 | 1.41 | 19.51 | 0.1779 | 0.0209 | |||

| ADM / Archer-Daniels-Midland Company | 0.03 | -27.35 | 1.40 | -20.17 | 0.1769 | -0.0568 | |||

| PSA / Public Storage | 0.00 | 0.00 | 1.35 | -1.96 | 0.1703 | -0.0130 | |||

| MDLZ / Mondelez International, Inc. | 0.02 | -2.33 | 1.27 | -2.99 | 0.1599 | -0.0139 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.02 | -12.51 | 1.25 | -10.11 | 0.1581 | -0.0275 | |||

| WWD / Woodward, Inc. | 0.01 | 0.00 | 1.25 | 34.33 | 0.1580 | 0.0339 | |||

| INTC / Intel Corporation | 0.06 | -5.34 | 1.24 | -6.61 | 0.1569 | -0.0204 | |||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.01 | 0.00 | 1.24 | -6.28 | 0.1563 | -0.0197 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 1.22 | -8.85 | 0.1534 | -0.0240 | |||

| NVDA / NVIDIA Corporation | 0.01 | 0.00 | 1.21 | 45.77 | 0.1523 | 0.0421 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.02 | -1.17 | 1.19 | -5.02 | 0.1504 | -0.0167 | |||

| BAX / Baxter International Inc. | 0.04 | -0.26 | 1.12 | -11.79 | 0.1416 | -0.0277 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.01 | -66.64 | 1.12 | -67.92 | 0.1416 | -0.3237 | |||

| MPC / Marathon Petroleum Corporation | 0.01 | 0.09 | 1.09 | 14.20 | 0.1371 | 0.0103 | |||

| EQH / Equitable Holdings, Inc. | 0.02 | 2.70 | 1.07 | 10.59 | 0.1345 | 0.0062 | |||

| DLN / WisdomTree Trust - WisdomTree U.S. LargeCap Dividend Fund | 0.01 | 0.00 | 1.05 | 3.47 | 0.1320 | -0.0026 | |||

| VLO / Valero Energy Corporation | 0.01 | 0.04 | 0.99 | 1.75 | 0.1248 | -0.0045 | |||

| WTRG / Essential Utilities, Inc. | 0.03 | -62.47 | 0.97 | -64.75 | 0.1226 | -0.2443 | |||

| CPRT / Copart, Inc. | 0.02 | 0.00 | 0.94 | -13.26 | 0.1189 | -0.0258 | |||

| SBUX / Starbucks Corporation | 0.01 | -9.50 | 0.91 | -15.52 | 0.1148 | -0.0285 | |||

| NSC / Norfolk Southern Corporation | 0.00 | -0.09 | 0.90 | 8.06 | 0.1133 | 0.0026 | |||

| PPL / PPL Corporation | 0.03 | -6.92 | 0.87 | -12.63 | 0.1101 | -0.0229 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 0.86 | 3.72 | 0.1091 | -0.0019 | |||

| PFE / Pfizer Inc. | 0.04 | -7.70 | 0.86 | -11.75 | 0.1081 | -0.0211 | |||

| STE / STERIS plc | 0.00 | 0.00 | 0.84 | 6.03 | 0.1065 | 0.0005 | |||

| CPB / The Campbell's Company | 0.03 | 0.02 | 0.84 | -23.15 | 0.1064 | -0.0398 | |||

| DOCU / DocuSign, Inc. | 0.01 | 37.12 | 0.84 | 31.19 | 0.1057 | 0.0207 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.83 | 0.98 | 0.1045 | -0.0047 | |||

| TRMB / Trimble Inc. | 0.01 | 0.00 | 0.80 | 15.67 | 0.1007 | 0.0089 | |||

| RY / Royal Bank of Canada | 0.01 | 0.00 | 0.80 | 16.74 | 0.1004 | 0.0096 | |||

| GOOGL / Alphabet Inc. | 0.00 | -1.10 | 0.79 | 12.73 | 0.0995 | 0.0064 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.47 | 0.79 | 0.51 | 0.0991 | -0.0049 | |||

| ONC / BeOne Medicines AG - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.77 | -10.98 | 0.0972 | -0.0181 | |||

| SO / The Southern Company | 0.01 | 0.00 | 0.77 | -0.13 | 0.0967 | -0.0055 | |||

| NOC / Northrop Grumman Corporation | 0.00 | -3.19 | 0.76 | -5.49 | 0.0956 | -0.0111 | |||

| MHK / Mohawk Industries, Inc. | 0.01 | 16.09 | 0.76 | 6.63 | 0.0955 | 0.0010 | |||

| CSX / CSX Corporation | 0.02 | 0.00 | 0.75 | 10.88 | 0.0952 | 0.0046 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.75 | 28.11 | 0.0950 | 0.0167 | |||

| CNA / CNA Financial Corporation | 0.02 | 18.52 | 0.74 | 8.61 | 0.0939 | 0.0027 | |||

| RTX / RTX Corporation | 0.01 | 0.65 | 0.74 | 10.93 | 0.0935 | 0.0046 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.73 | -8.77 | 0.0920 | -0.0143 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.00 | 0.72 | 73.43 | 0.0907 | 0.0355 | |||

| UG / United-Guardian, Inc. | 0.09 | -4.12 | 0.72 | -14.63 | 0.0906 | -0.0215 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 0.70 | 31.26 | 0.0880 | 0.0173 | |||

| FHI / Federated Hermes, Inc. | 0.02 | 0.00 | 0.69 | 8.83 | 0.0871 | 0.0026 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.00 | -3.08 | 0.69 | -13.24 | 0.0869 | -0.0187 | |||

| EQNR / Equinor ASA - Depositary Receipt (Common Stock) | 0.03 | 0.69 | 0.0866 | 0.0866 | |||||

| AZTA / Azenta, Inc. | 0.02 | -6.66 | 0.67 | -17.12 | 0.0844 | -0.0230 | |||

| TDY / Teledyne Technologies Incorporated | 0.00 | 0.00 | 0.65 | 3.01 | 0.0822 | -0.0021 | |||

| V / Visa Inc. | 0.00 | 0.00 | 0.65 | 1.41 | 0.0817 | -0.0034 | |||

| COP / ConocoPhillips | 0.01 | 0.03 | 0.64 | -14.50 | 0.0804 | -0.0188 | |||

| SXI / Standex International Corporation | 0.00 | 0.00 | 0.63 | -3.10 | 0.0790 | -0.0070 | |||

| NWN / Northwest Natural Holding Company | 0.02 | 0.00 | 0.62 | -7.04 | 0.0784 | -0.0106 | |||

| FMNB / Farmers National Banc Corp. | 0.04 | 47.89 | 0.61 | 56.15 | 0.0770 | 0.0250 | |||

| CF / CF Industries Holdings, Inc. | 0.01 | 0.00 | 0.61 | 17.83 | 0.0767 | 0.0080 | |||

| SAIC / Science Applications International Corporation | 0.01 | -4.44 | 0.61 | -4.11 | 0.0765 | -0.0077 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.00 | 0.60 | -4.93 | 0.0755 | -0.0082 | |||

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.01 | 0.00 | 0.60 | 0.17 | 0.0753 | -0.0040 | |||

| CARR / Carrier Global Corporation | 0.01 | 3.83 | 0.59 | 19.80 | 0.0749 | 0.0090 | |||

| MO / Altria Group, Inc. | 0.01 | 0.00 | 0.59 | -2.31 | 0.0746 | -0.0060 | |||

| MAR / Marriott International, Inc. | 0.00 | 0.00 | 0.58 | 14.74 | 0.0727 | 0.0058 | |||

| YUM / Yum! Brands, Inc. | 0.00 | 0.00 | 0.55 | -5.80 | 0.0697 | -0.0084 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.00 | 0.81 | 0.55 | 19.21 | 0.0690 | 0.0079 | |||

| AMGN / Amgen Inc. | 0.00 | -15.00 | 0.54 | -23.80 | 0.0679 | -0.0261 | |||

| ORCL / Oracle Corporation | 0.00 | 0.00 | 0.52 | 56.36 | 0.0652 | 0.0212 | |||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.50 | -6.34 | 0.0634 | -0.0081 | |||

| AMAT / Applied Materials, Inc. | 0.00 | 39.06 | 0.49 | 75.54 | 0.0617 | 0.0246 | |||

| SYK / Stryker Corporation | 0.00 | 0.00 | 0.48 | 6.18 | 0.0608 | 0.0005 | |||

| ACN / Accenture plc | 0.00 | 0.00 | 0.47 | -4.28 | 0.0594 | -0.0060 | |||

| TR / Tootsie Roll Industries, Inc. | 0.01 | -13.99 | 0.45 | -8.62 | 0.0563 | -0.0087 | |||

| SNA / Snap-on Incorporated | 0.00 | -1.77 | 0.43 | -9.24 | 0.0546 | -0.0089 | |||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | 0.00 | 0.42 | 6.02 | 0.0535 | 0.0003 | |||

| BFST / Business First Bancshares, Inc. | 0.02 | 0.00 | 0.41 | 1.25 | 0.0513 | -0.0022 | |||

| IP / International Paper Company | 0.01 | -3.35 | 0.41 | -15.27 | 0.0512 | -0.0125 | |||

| PYPL / PayPal Holdings, Inc. | 0.01 | -2.71 | 0.40 | 10.83 | 0.0504 | 0.0024 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | -3.39 | 0.40 | -4.36 | 0.0498 | -0.0052 | |||

| CKX / CKX Lands, Inc. | 0.04 | -6.37 | 0.39 | -15.48 | 0.0496 | -0.0124 | |||

| T / AT&T Inc. | 0.01 | -30.36 | 0.39 | -28.70 | 0.0486 | -0.0234 | |||

| DHR / Danaher Corporation | 0.00 | 0.00 | 0.38 | -3.58 | 0.0476 | -0.0045 | |||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0.01 | -28.57 | 0.37 | -28.40 | 0.0465 | -0.0220 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.00 | 0.36 | 17.59 | 0.0456 | 0.0047 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.00 | 0.36 | 64.84 | 0.0456 | 0.0164 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 0.00 | 0.36 | 9.85 | 0.0451 | 0.0017 | |||

| PLTR / Palantir Technologies Inc. | 0.00 | 0.00 | 0.34 | 61.79 | 0.0433 | 0.0150 | |||

| AFL / Aflac Incorporated | 0.00 | 0.00 | 0.34 | -5.37 | 0.0424 | -0.0048 | |||

| DVY / iShares Trust - iShares Select Dividend ETF | 0.00 | 0.00 | 0.32 | -1.23 | 0.0406 | -0.0027 | |||

| WMT / Walmart Inc. | 0.00 | -0.47 | 0.31 | 11.03 | 0.0394 | 0.0019 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.00 | 0.00 | 0.30 | -5.02 | 0.0383 | -0.0042 | |||

| WDFC / WD-40 Company | 0.00 | 0.00 | 0.30 | -6.62 | 0.0374 | -0.0048 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.30 | 2.43 | 0.0373 | -0.0011 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 0.29 | 5.00 | 0.0371 | -0.0003 | |||

| WGO / Winnebago Industries, Inc. | 0.01 | 0.29 | 0.0366 | 0.0366 | |||||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.27 | 14.71 | 0.0345 | 0.0028 | |||

| NKE / NIKE, Inc. | 0.00 | 0.43 | 0.27 | 12.66 | 0.0337 | 0.0021 | |||

| PH / Parker-Hannifin Corporation | 0.00 | 0.00 | 0.26 | 14.85 | 0.0332 | 0.0027 | |||

| MMM / 3M Company | 0.00 | 0.23 | 0.26 | 4.00 | 0.0328 | -0.0005 | |||

| TMHC / Taylor Morrison Home Corporation | 0.00 | 0.00 | 0.25 | 2.06 | 0.0314 | -0.0010 | |||

| TIP / iShares Trust - iShares TIPS Bond ETF | 0.00 | 0.00 | 0.25 | -1.20 | 0.0311 | -0.0020 | |||

| COF / Capital One Financial Corporation | 0.00 | 0.24 | 0.0309 | 0.0309 | |||||

| SDY / SPDR Series Trust - SPDR S&P Dividend ETF | 0.00 | 0.00 | 0.24 | 0.00 | 0.0308 | -0.0017 | |||

| CB / Chubb Limited | 0.00 | 0.00 | 0.24 | -4.03 | 0.0301 | -0.0030 | |||

| SLB / Schlumberger Limited | 0.01 | 0.00 | 0.23 | -19.30 | 0.0291 | -0.0089 | |||

| WM / Waste Management, Inc. | 0.00 | 0.00 | 0.23 | -1.29 | 0.0291 | -0.0020 | |||

| GLD / SPDR Gold Trust | 0.00 | 0.00 | 0.22 | 5.66 | 0.0284 | 0.0001 | |||

| TSCO / Tractor Supply Company | 0.00 | 0.00 | 0.22 | -4.27 | 0.0283 | -0.0029 | |||

| AVT / Avnet, Inc. | 0.00 | 0.00 | 0.22 | 10.45 | 0.0281 | 0.0012 | |||

| EQT / EQT Corporation | 0.00 | 0.00 | 0.22 | 8.96 | 0.0278 | 0.0009 | |||

| WFC / Wells Fargo & Company | 0.00 | -4.42 | 0.22 | 6.93 | 0.0273 | 0.0003 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.00 | 1.33 | 0.22 | 3.86 | 0.0272 | -0.0005 | |||

| CMCSA / Comcast Corporation | 0.01 | 0.00 | 0.21 | -3.65 | 0.0267 | -0.0024 | |||

| VGK / Vanguard International Equity Index Funds - Vanguard FTSE Europe ETF | 0.00 | 0.21 | 0.0267 | 0.0267 | |||||

| NXPI / NXP Semiconductors N.V. | 0.00 | 0.21 | 0.0262 | 0.0262 | |||||

| DOV / Dover Corporation | 0.00 | 0.21 | 0.0259 | 0.0259 | |||||

| CI / The Cigna Group | 0.00 | 0.00 | 0.20 | 0.00 | 0.0254 | -0.0013 | |||

| OKTA / Okta, Inc. | 0.00 | 0.00 | 0.20 | -5.21 | 0.0254 | -0.0028 | |||

| VPV / Invesco Pennsylvania Value Municipal Income Trust | 0.02 | 0.51 | 0.15 | -0.66 | 0.0192 | -0.0012 | |||

| NEOG / Neogen Corporation | 0.02 | -31.11 | 0.08 | -62.19 | 0.0097 | -0.0172 | |||

| AGCO / AGCO Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WSO / Watsco, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AEP / American Electric Power Company, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MOS / The Mosaic Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EVRG / Evergy, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GDXD / MicroSectors Gold Miners -3X Inverse Leveraged ETNs due June 29, 2040 | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| K / Kellanova | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ES / Eversource Energy | 0.00 | -100.00 | 0.00 | 0.0000 |