Mga Batayang Estadistika

| Nilai Portofolio | $ 541,142,062 |

| Posisi Saat Ini | 149 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

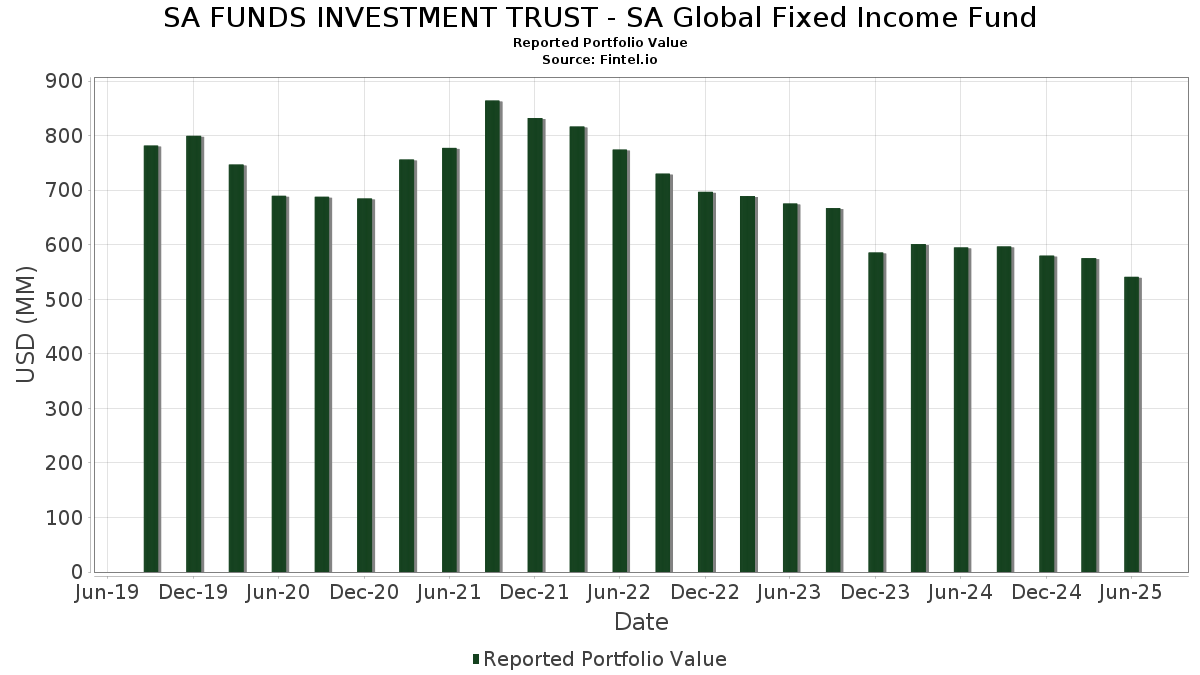

SA FUNDS INVESTMENT TRUST - SA Global Fixed Income Fund telah mengungkapkan total kepemilikan 149 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 541,142,062 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama SA FUNDS INVESTMENT TRUST - SA Global Fixed Income Fund adalah United States Treasury Inflation Indexed Bonds (US:US9128282L36) , UNITED STATES TREASURY INFLATION INDEXED BONDS 0.12500000 (US:US91282CDC29) , United States Treasury Inflation Indexed Bonds (US:US912828ZZ63) , NEW ZEALAND GVT (NZ:NZGOVDT532C8) , and United States Treasury Inflation Indexed Bonds (US:US9128287D64) . Posisi baru SA FUNDS INVESTMENT TRUST - SA Global Fixed Income Fund meliputi: United States Treasury Inflation Indexed Bonds (US:US9128282L36) , UNITED STATES TREASURY INFLATION INDEXED BONDS 0.12500000 (US:US91282CDC29) , United States Treasury Inflation Indexed Bonds (US:US912828ZZ63) , NEW ZEALAND GVT (NZ:NZGOVDT532C8) , and United States Treasury Inflation Indexed Bonds (US:US9128287D64) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 25.23 | 4.6448 | 4.6448 | ||

| 24.95 | 4.5936 | 4.5936 | ||

| 16.46 | 3.0304 | 3.0304 | ||

| 15.66 | 2.8831 | 2.8831 | ||

| 12.56 | 2.3133 | 2.3133 | ||

| 11.77 | 2.1670 | 2.1670 | ||

| 7.65 | 1.4080 | 1.4080 | ||

| 6.65 | 6.65 | 1.2244 | 1.2244 | |

| 10.61 | 1.9542 | 1.1217 | ||

| 6.09 | 1.1216 | 1.1216 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 5.06 | 0.9311 | -1.6602 | ||

| 8.30 | 1.5283 | -0.8848 | ||

| -3.97 | -0.7304 | -0.7304 | ||

| -1.06 | -0.1951 | -0.1951 | ||

| -0.83 | -0.1530 | -0.1530 | ||

| -0.77 | -0.1423 | -0.1423 | ||

| -0.58 | -0.1069 | -0.1069 | ||

| -0.58 | -0.1069 | -0.1069 | ||

| 9.78 | 1.8014 | -0.0946 | ||

| -0.48 | -0.0885 | -0.0885 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-29 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US9128282L36 / United States Treasury Inflation Indexed Bonds | 25.23 | 4.6448 | 4.6448 | ||||||

| US91282CDC29 / UNITED STATES TREASURY INFLATION INDEXED BONDS 0.12500000 | 24.95 | 4.5936 | 4.5936 | ||||||

| Agence France Locale / DBT (FR001400N9U7) | 16.92 | 10.48 | 3.1160 | 0.4655 | |||||

| US912828ZZ63 / United States Treasury Inflation Indexed Bonds | 16.46 | 3.0304 | 3.0304 | ||||||

| NZGOVDT532C8 / NEW ZEALAND GVT | 15.89 | -1.27 | 2.9254 | 0.1412 | |||||

| US9128287D64 / United States Treasury Inflation Indexed Bonds | 15.66 | 2.8831 | 2.8831 | ||||||

| XS2408621238 / Kommunalbanken AS | 15.40 | -0.21 | 2.8351 | 0.1655 | |||||

| Province of British Columbia Canada / DBT (CA110709AK82) | 13.86 | 4.54 | 2.5527 | 0.2581 | |||||

| US91282CBF77 / United States Treasury Inflation Indexed Bonds | 12.56 | 2.3133 | 2.3133 | ||||||

| US912828Z377 / United States Treasury Inflation Indexed Bonds | 11.77 | 2.1670 | 2.1670 | ||||||

| Novo Nordisk Finance Netherlands BV / DBT (XS2820460751) | 11.18 | 10.37 | 2.0593 | 0.3061 | |||||

| XS2456839369 / BERKSHIRE HATHAWAY FIN CORP 2% 03/18/2034 | 10.61 | 120.60 | 1.9542 | 1.1217 | |||||

| CA68333ZAY30 / ONTARIO PROVINCE CDA 3.65% 06/02/2033 | 10.34 | 4.66 | 1.9038 | 0.1943 | |||||

| European Bank for Reconstruction & Development / DBT (US29875BAK26) | 10.01 | -0.01 | 1.8429 | 0.1110 | |||||

| CA013051ER40 / ALBERTA PROVINCE | 9.78 | -10.71 | 1.8014 | -0.0946 | |||||

| Ministeries Van de Vlaamse Gemeenschap / DBT (BE0390121847) | 8.56 | 10.14 | 1.5756 | 0.2314 | |||||

| International Bank for Reconstruction & Development / DBT (US459058LH49) | 8.50 | 0.00 | 1.5653 | 0.0944 | |||||

| Province of Manitoba Canada / DBT (CA563469VE28) | 8.37 | 4.47 | 1.5416 | 0.1550 | |||||

| Nordic Investment Bank / DBT (US65562YAL20) | 8.33 | 0.02 | 1.5330 | 0.0928 | |||||

| FR0013299591 / BPIFRANCE | 8.30 | -40.49 | 1.5283 | -0.8848 | |||||

| Province of Saskatchewan Canada / DBT (XS2816664879) | 7.84 | 9.73 | 1.4431 | 0.2072 | |||||

| Q / Quetzal Copper Corp. | 7.73 | 4.37 | 1.4233 | 0.1418 | |||||

| CPPIB Capital Inc / DBT (CA12593CAY71) | 7.66 | 4.30 | 1.4112 | 0.1398 | |||||

| Kuntarahoitus Oyj / DBT (XS2982106903) | 7.65 | 1.4080 | 1.4080 | ||||||

| XS2196322403 / EXXON MOBIL CORP 0.835000% 06/26/2032 | 6.96 | 97.03 | 1.2821 | 0.6707 | |||||

| CA563469VB88 / MANITOBA (PROV) | 6.69 | 4.66 | 1.2326 | 0.1260 | |||||

| SS INST US GOV MM ADMIN SALXX / STIV (000000000) | 6.65 | 6.65 | 1.2244 | 1.2244 | |||||

| SAN / Sanofi | 6.09 | 1.1216 | 1.1216 | ||||||

| NAB / National Australia Bank Limited | 5.99 | 1.1031 | 1.1031 | ||||||

| PSP Capital Inc / DBT (XS2850686655) | 5.91 | 9.56 | 1.0888 | 0.1550 | |||||

| European Union / DBT (EU000A3K4ES4) | 5.90 | 1.0866 | 1.0866 | ||||||

| BNG Bank NV / DBT (XS2887172067) | 5.80 | 1.0673 | 1.0673 | ||||||

| Agence Francaise de Developpement EPIC / DBT (FR001400N7K2) | 5.79 | 10.65 | 1.0653 | 0.1605 | |||||

| US4581X0EG91 / Inter-American Development Bank | 5.49 | -0.05 | 1.0101 | 0.0603 | |||||

| PG / The Procter & Gamble Company - Depositary Receipt (Common Stock) | 5.35 | 10.65 | 0.9851 | 0.1485 | |||||

| US61690U7X23 / Morgan Stanley Bank NA | 5.29 | -0.26 | 0.9732 | 0.0564 | |||||

| D05 / DBS Group Holdings Ltd | 5.10 | 0.9392 | 0.9392 | ||||||

| US09247XAT81 / BlackRock Inc | 5.06 | -66.23 | 0.9311 | -1.6602 | |||||

| XS2520339800 / ASIAN INFRASTRUCTURE INV SR UNSECURED REGS 08/27 VAR | 5.03 | -0.08 | 0.9266 | 0.0553 | |||||

| X5S8VL105 / Nordea Bank Abp | 5.03 | 0.12 | 0.9254 | 0.0569 | |||||

| Province of Ontario Canada / DBT (CA68333ZBC01) | 5.00 | -9.35 | 0.9213 | -0.0337 | |||||

| FR001400HOV1 / Caisse des Depots et Consignations | 4.80 | 0.02 | 0.8832 | 0.0535 | |||||

| XS2019976070 / Enexis Holding NV | 4.15 | 0.7635 | 0.7635 | ||||||

| AU3FN0074506 / COMMONWEALTH BANK AUST SR UNSECURED 01/26 VAR | 4.09 | 5.22 | 0.7537 | 0.0806 | |||||

| Inter-American Development Bank / DBT (US4581X0EQ73) | 4.00 | 0.00 | 0.7373 | 0.0444 | |||||

| AU3FN0070355 / WESTPAC BANKING CORP SR UNSECURED REGS 08/25 VAR | 3.95 | 5.22 | 0.7276 | 0.0778 | |||||

| EIB / EUROPEAN INVESTMENT BANK SR UNSECURED 03/21 9 | 3.87 | -0.15 | 0.7128 | 0.0420 | |||||

| CA74814ZFS70 / Province of Quebec Canada | 3.67 | 4.68 | 0.6755 | 0.0691 | |||||

| US459058JF11 / International Bank for Reconstruction & Development | 3.66 | -0.05 | 0.6744 | 0.0403 | |||||

| FR001400HIK6 / SOCIETE NATIONALE SNCF /EUR/ REGD REG S 3.37500000 | 3.59 | 10.58 | 0.6601 | 0.0992 | |||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 3.56 | -0.34 | 0.6548 | 0.0374 | |||||

| US2027A0KG30 / Commonwealth Bank of Australia | 3.55 | -0.03 | 0.6533 | 0.0391 | |||||

| FR0013257623 / LVMH Moet Hennessy Louis Vuitton SE | 3.53 | 0.6506 | 0.6506 | ||||||

| XS2479941572 / Visa Inc | 3.46 | 0.6368 | 0.6368 | ||||||

| D05 / DBS Group Holdings Ltd | 3.41 | 0.6273 | 0.6273 | ||||||

| AU3CB0295681 / Asian Development Bank | 3.37 | 7.08 | 0.6207 | 0.0761 | |||||

| AU3SG0002504 / Treasury Corp of Victoria | 3.31 | 8.38 | 0.6097 | 0.0811 | |||||

| XS2152924952 / Oesterreichische Kontrollbank AG | 3.24 | 10.35 | 0.5969 | 0.0886 | |||||

| US29874QEN07 / European Bank for Reconstruction & Development | 3.13 | 0.03 | 0.5754 | 0.0348 | |||||

| XS1735583335 / SCHENC 5.375 06/15/23 144A | 3.04 | -0.20 | 0.5591 | 0.0326 | |||||

| US45828RAA32 / Inter-American Development Bank | 3.02 | 0.00 | 0.5567 | 0.0335 | |||||

| New Zealand Local Government Funding Agency Bond / DBT (AU3CB0307486) | 3.01 | 7.04 | 0.5543 | 0.0677 | |||||

| Province of Alberta Canada / DBT (XS2802866728) | 2.94 | 9.72 | 0.5405 | 0.0776 | |||||

| US04517PBG63 / Asian Development Bank | 2.92 | -0.14 | 0.5383 | 0.0319 | |||||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 2.75 | 0.5072 | 0.5072 | ||||||

| XS2634616572 / ENEXIS HOLDING | 2.42 | 9.77 | 0.4448 | 0.0641 | |||||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 2.35 | 0.86 | 2.35 | 0.86 | 0.4330 | 0.0296 | |||

| OMERS Finance Trust / DBT (XS2989340869) | 2.35 | 9.78 | 0.4321 | 0.0622 | |||||

| AU3FN0057154 / UNITED OVERSEAS BANK/SYD SR UNSECURED 10/25 VAR | 2.31 | 5.30 | 0.4245 | 0.0456 | |||||

| AU0000079402 / Queensland Treasury Corp | 2.30 | 8.29 | 0.4232 | 0.0559 | |||||

| XS2190255211 / Enexis Holding NV | 2.25 | 0.4141 | 0.4141 | ||||||

| NAB / National Australia Bank Limited | 2.20 | 0.4058 | 0.4058 | ||||||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 2.17 | 0.3991 | 0.3991 | ||||||

| AU3SG0002553 / NEW S WALES TREA | 2.08 | 8.44 | 0.3832 | 0.0512 | |||||

| NAB / National Australia Bank Limited | 2.01 | 0.3706 | 0.3706 | ||||||

| Chevron USA Inc / DBT (US166756BC91) | 2.01 | 0.3700 | 0.3700 | ||||||

| XS2435663393 / KUNTARAHOITUS | 2.01 | 0.3695 | 0.3695 | ||||||

| ANZ / ANZ Group Holdings Limited | 2.00 | 0.3687 | 0.3687 | ||||||

| EIB / EUROPEAN INVESTMENT BANK SR UNSECURED 03/21 9 | 2.00 | 0.00 | 0.3687 | 0.0222 | |||||

| Federal Farm Credit Banks Funding Corp / DBT (US3133ERKS94) | 2.00 | 0.00 | 0.3685 | 0.0222 | |||||

| Asian Development Bank / DBT (US04517PBZ45) | 2.00 | 0.3679 | 0.3679 | ||||||

| US4581X0DU94 / Inter-American Development Bank | 2.00 | 0.00 | 0.3678 | 0.0222 | |||||

| FR0013409612 / Societe Du Grand Paris EPIC | 1.98 | 11.46 | 0.3637 | 0.0570 | |||||

| ANZ / ANZ Group Holdings Limited | 1.91 | 0.3517 | 0.3517 | ||||||

| US87031CAF05 / Svensk Exportkredit AB | 1.85 | -0.11 | 0.3406 | 0.0202 | |||||

| AU3FN0073904 / NATIONAL AUSTRALIA BANK SR UNSECURED 11/25 VAR | 1.65 | 5.23 | 0.3037 | 0.0324 | |||||

| AU3FN0073011 / AUST + NZ BANKING GROUP SR UNSECURED REGS 11/25 VAR | 1.65 | 5.17 | 0.3036 | 0.0324 | |||||

| DE000A351ZT4 / Deutsche Boerse AG. | 1.60 | 10.42 | 0.2948 | 0.0440 | |||||

| National Securities Clearing Corp / DBT (US637639AP09) | 1.50 | 0.2768 | 0.2768 | ||||||

| US459058KG74 / International Bank for Reconstruction & Development | 1.50 | 0.00 | 0.2761 | 0.0167 | |||||

| Province of Ontario Canada / DBT (AU3CB0309268) | 1.37 | 6.96 | 0.2519 | 0.0306 | |||||

| AU3FN0070561 / COMMONWEALTH BANK AUST SR UNSECURED 08/25 VAR | 1.32 | 5.19 | 0.2426 | 0.0260 | |||||

| Province of Manitoba Canada / DBT (AU3CB0312734) | 1.32 | 7.00 | 0.2422 | 0.0295 | |||||

| International Bank for Reconstruction & Development / DBT (AU3CB0298545) | 1.29 | 7.21 | 0.2381 | 0.0294 | |||||

| Gestion Securite de Stocks Securite SA / DBT (FR001400XJE4) | 1.18 | 0.2170 | 0.2170 | ||||||

| FR001400H8C5 / Regie Autonome des Transports Parisiens | 1.18 | 10.51 | 0.2169 | 0.0325 | |||||

| US21688AAZ57 / Cooperatieve Rabobank UA/NY | 1.12 | 0.00 | 0.2057 | 0.0125 | |||||

| US771196CD29 / ROCHE HLDGS INC FRN SOFR+74 11/13/2026 144A | 1.06 | 0.00 | 0.1947 | 0.0117 | |||||

| US65562QBR56 / Nordic Investment Bank | 1.06 | -0.19 | 0.1947 | 0.0115 | |||||

| US459058KN26 / International Bank for Reconstruction & Development | 1.00 | -0.10 | 0.1845 | 0.0111 | |||||

| AU3FN0073367 / WESTPAC BANKING | 1.00 | 5.37 | 0.1845 | 0.0199 | |||||

| US4581X0ED60 / INTER AMERICAN DEVEL BK | 1.00 | 0.00 | 0.1842 | 0.0111 | |||||

| AU3FN0074514 / COMMONWEALTH BANK AUST SR UNSECURED REGS 01/28 VAR | 1.00 | 5.37 | 0.1842 | 0.0199 | |||||

| AU3FN0077822 / National Australia Bank Ltd. | 0.99 | 5.43 | 0.1825 | 0.0197 | |||||

| AU3FN0076980 / AUST + NZ BANKING GROUP SR UNSECURED 03/26 VAR | 0.99 | 5.21 | 0.1824 | 0.0196 | |||||

| AU3FN0073359 / WESTPAC BANKING CORP SR UNSECURED 11/25 VAR | 0.92 | 5.13 | 0.1701 | 0.0182 | |||||

| Federal Farm Credit Banks Funding Corp / DBT (US3133ERNW79) | 0.78 | 0.00 | 0.1437 | 0.0086 | |||||

| ANZ / ANZ Group Holdings Limited | 0.72 | 0.1317 | 0.1317 | ||||||

| AU3FN0065702 / WESTPAC BANKING CORP SR UNSECURED 01/27 VAR | 0.66 | 5.43 | 0.1216 | 0.0132 | |||||

| AU3FN0065579 / COM BK AUSTRALIA | 0.66 | 5.43 | 0.1216 | 0.0132 | |||||

| AU3FN0075412 / Westpac Banking Corp. | 0.66 | 5.27 | 0.1215 | 0.0130 | |||||

| Cooperatieve Rabobank UA/NY / DBT (US21688ABE10) | 0.50 | -0.20 | 0.0924 | 0.0055 | |||||

| AU3FN0078150 / Cooperatieve Rabobank UA | 0.46 | 5.24 | 0.0852 | 0.0092 | |||||

| US94988J6G76 / Wells Fargo Bank NA | 0.39 | 0.00 | 0.0715 | 0.0042 | |||||

| AU3FN0073003 / Australia & New Zealand Banking Group Ltd. | 0.33 | 5.38 | 0.0614 | 0.0066 | |||||

| AU3FN0073896 / NATIONAL AUSTRALIA BANK SR UNSECURED 11/27 VAR | 0.33 | 5.38 | 0.0614 | 0.0066 | |||||

| AU3FN0075420 / WESTPAC BANKING CORP SR UNSECURED 02/28 VAR | 0.33 | 5.73 | 0.0611 | 0.0066 | |||||

| AU3FN0068771 / AUST + NZ BANKING GROUP SR UNSECURED 05/27 VAR | 0.33 | 5.41 | 0.0611 | 0.0066 | |||||

| AU3FN0080404 / Commonwealth Bank of Australia | 0.33 | 5.43 | 0.0609 | 0.0066 | |||||

| XS2231336061 / International Finance Corp | 0.31 | 8.01 | 0.0571 | 0.0073 | |||||

| US22411VAS79 / CPPIB CAPITAL 144A SR UNSEC FRN (SOFR+125) 03-11-26 | 0.25 | -0.40 | 0.0463 | 0.0027 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.25 | 0.0457 | 0.0457 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.25 | 0.0457 | 0.0457 | ||||||

| US2027A0KR94 / Commonwealth Bank of Australia | 0.23 | 0.00 | 0.0429 | 0.0025 | |||||

| PURCHASED SEK / SOLD USD / DFE (000000000) | 0.22 | 0.0410 | 0.0410 | ||||||

| US04517PBK75 / Asian Development Bank | 0.20 | 0.00 | 0.0373 | 0.0022 | |||||

| Nestle Finance International Ltd / DBT (XS2976328760) | 0.12 | 0.0221 | 0.0221 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0.06 | 0.0107 | 0.0107 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0.05 | 0.0099 | 0.0099 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0.05 | 0.0099 | 0.0099 | ||||||

| PURCHASED NZD / SOLD USD / DFE (000000000) | 0.04 | 0.0065 | 0.0065 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.08 | -0.0138 | -0.0138 | ||||||

| PURCHASED NOK / SOLD USD / DFE (000000000) | -0.09 | -0.0171 | -0.0171 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | -0.09 | -0.0175 | -0.0175 | ||||||

| PURCHASED USD / SOLD NOK / DFE (000000000) | -0.13 | -0.0248 | -0.0248 | ||||||

| PURCHASED USD / SOLD NZD / DFE (000000000) | -0.13 | -0.0248 | -0.0248 | ||||||

| PURCHASED USD / SOLD NZD / DFE (000000000) | -0.13 | -0.0248 | -0.0248 | ||||||

| PURCHASED USD / SOLD SEK / DFE (000000000) | -0.14 | -0.0263 | -0.0263 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.15 | -0.0275 | -0.0275 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.23 | -0.0415 | -0.0415 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.24 | -0.0442 | -0.0442 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | -0.30 | -0.0555 | -0.0555 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.48 | -0.0885 | -0.0885 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.58 | -0.1069 | -0.1069 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.58 | -0.1069 | -0.1069 | ||||||

| PURCHASED USD / SOLD AUD / DFE (000000000) | -0.77 | -0.1423 | -0.1423 | ||||||

| PURCHASED USD / SOLD AUD / DFE (000000000) | -0.83 | -0.1530 | -0.1530 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -1.06 | -0.1951 | -0.1951 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -3.97 | -0.7304 | -0.7304 |