Mga Batayang Estadistika

| Nilai Portofolio | $ 1,303,443,345 |

| Posisi Saat Ini | 153 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

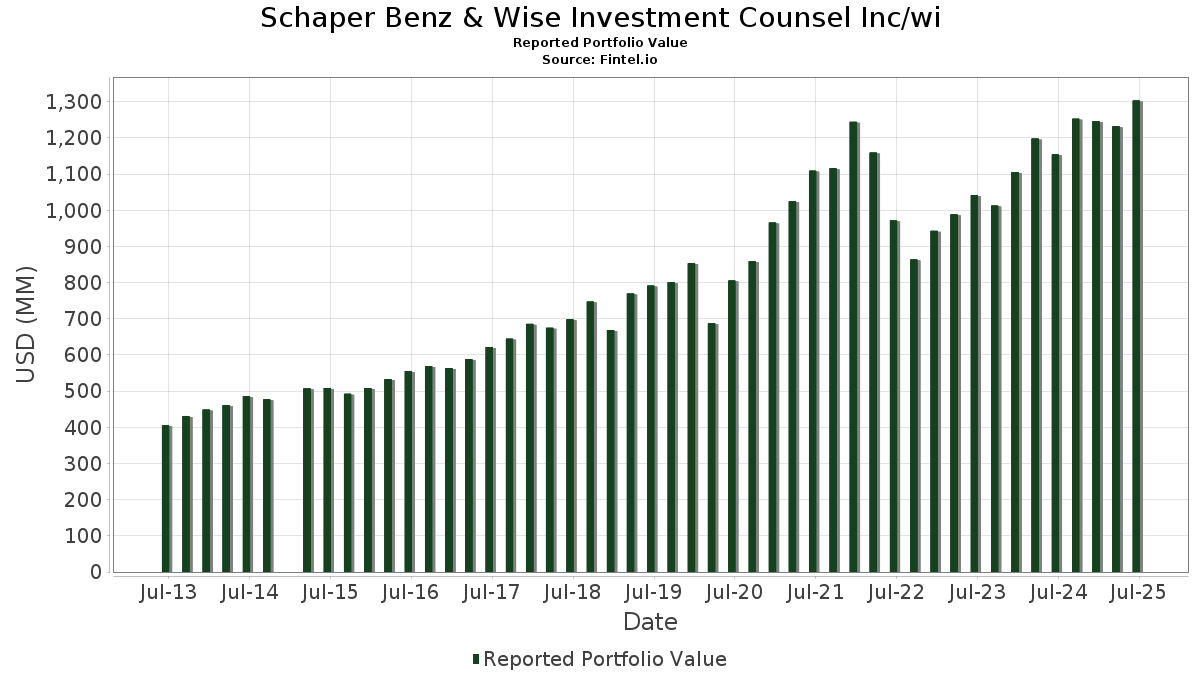

Schaper Benz & Wise Investment Counsel Inc/wi telah mengungkapkan total kepemilikan 153 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,303,443,345 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Schaper Benz & Wise Investment Counsel Inc/wi adalah Apple Inc. (US:AAPL) , Stryker Corporation (US:SYK) , American Express Company (US:AXP) , Waters Corporation (US:WAT) , and Cisco Systems, Inc. (US:CSCO) . Posisi baru Schaper Benz & Wise Investment Counsel Inc/wi meliputi: Vanguard Index Funds - Vanguard Growth ETF (US:VUG) , Vanguard Developed Markets Index Fund (US:VDMIX) , abrdn Precious Metals Basket ETF - abrdn Physical Precious Metals Basket Shares ETF (US:GLTR) , Schwab Strategic Trust - Schwab U.S. Large-Cap Growth ETF (US:SCHG) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.15 | 32.55 | 2.4972 | 0.6279 | |

| 0.13 | 17.73 | 1.3599 | 0.4673 | |

| 0.02 | 15.49 | 1.1882 | 0.3785 | |

| 0.05 | 26.91 | 2.0645 | 0.3662 | |

| 0.04 | 21.80 | 1.6725 | 0.3308 | |

| 0.02 | 14.64 | 1.1232 | 0.3016 | |

| 0.22 | 20.36 | 1.5617 | 0.2657 | |

| 0.13 | 18.75 | 1.4382 | 0.2643 | |

| 0.03 | 23.73 | 1.8202 | 0.2617 | |

| 0.08 | 12.15 | 0.9322 | 0.2342 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.21 | 42.69 | 3.2751 | -0.5775 | |

| 0.07 | 32.23 | 2.4730 | -0.4234 | |

| 0.18 | 26.74 | 2.0518 | -0.3777 | |

| 0.10 | 36.49 | 2.7992 | -0.3358 | |

| 0.22 | 22.81 | 1.7501 | -0.3179 | |

| 0.11 | 15.80 | 1.2119 | -0.2632 | |

| 0.06 | 22.83 | 1.7515 | -0.2296 | |

| 0.11 | 14.25 | 1.0934 | -0.2196 | |

| 0.06 | 21.67 | 1.6626 | -0.1859 | |

| 0.34 | 12.18 | 0.9345 | -0.1753 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-30 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.21 | -2.65 | 42.69 | -10.08 | 3.2751 | -0.5775 | |||

| SYK / Stryker Corporation | 0.11 | -1.08 | 42.60 | 5.14 | 3.2679 | -0.0198 | |||

| AXP / American Express Company | 0.12 | -3.34 | 39.20 | 14.59 | 3.0072 | 0.2315 | |||

| WAT / Waters Corporation | 0.10 | -0.27 | 36.49 | -5.55 | 2.7992 | -0.3358 | |||

| CSCO / Cisco Systems, Inc. | 0.53 | -1.96 | 36.49 | 10.22 | 2.7992 | 0.1129 | |||

| GOOG / Alphabet Inc. | 0.19 | -3.48 | 34.55 | 9.60 | 2.6508 | 0.0924 | |||

| ORCL / Oracle Corporation | 0.15 | -9.64 | 32.55 | 41.30 | 2.4972 | 0.6279 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.07 | -0.98 | 32.23 | -9.69 | 2.4730 | -0.4234 | |||

| WFC / Wells Fargo & Company | 0.36 | -0.26 | 28.76 | 11.32 | 2.2065 | 0.1099 | |||

| ADBE / Adobe Inc. | 0.07 | 0.90 | 27.86 | 1.78 | 2.1374 | -0.0840 | |||

| LIN / Linde plc | 0.06 | -2.29 | 27.45 | -1.55 | 2.1059 | -0.1566 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.05 | 0.68 | 26.91 | 28.59 | 2.0645 | 0.3662 | |||

| PAYX / Paychex, Inc. | 0.18 | -5.25 | 26.74 | -10.67 | 2.0518 | -0.3777 | |||

| ADP / Automatic Data Processing, Inc. | 0.08 | -2.86 | 24.76 | -1.95 | 1.8995 | -0.1496 | |||

| GOOGL / Alphabet Inc. | 0.14 | -2.43 | 24.30 | 11.20 | 1.8644 | 0.0909 | |||

| UNP / Union Pacific Corporation | 0.10 | 0.24 | 24.00 | -2.38 | 1.8410 | -0.1538 | |||

| INTU / Intuit Inc. | 0.03 | -3.70 | 23.73 | 23.54 | 1.8202 | 0.2617 | |||

| V / Visa Inc. | 0.06 | -7.69 | 22.83 | -6.48 | 1.7515 | -0.2296 | |||

| AFL / Aflac Incorporated | 0.22 | -5.62 | 22.81 | -10.49 | 1.7501 | -0.3179 | |||

| MSFT / Microsoft Corporation | 0.04 | -0.49 | 21.80 | 31.86 | 1.6725 | 0.3308 | |||

| HD / The Home Depot, Inc. | 0.06 | -4.90 | 21.67 | -4.86 | 1.6626 | -0.1859 | |||

| ABT / Abbott Laboratories | 0.15 | -6.14 | 20.63 | -3.77 | 1.5831 | -0.1570 | |||

| UBER / Uber Technologies, Inc. | 0.22 | -0.46 | 20.36 | 27.46 | 1.5617 | 0.2657 | |||

| SYY / Sysco Corporation | 0.26 | -0.93 | 19.78 | 0.00 | 1.5177 | -0.0877 | |||

| AME / AMETEK, Inc. | 0.11 | 4.46 | 19.57 | 9.81 | 1.5011 | 0.0552 | |||

| ADI / Analog Devices, Inc. | 0.08 | 0.04 | 19.22 | 18.07 | 1.4748 | 0.1536 | |||

| ISRG / Intuitive Surgical, Inc. | 0.03 | -0.03 | 18.93 | 9.68 | 1.4521 | 0.0518 | |||

| AMD / Advanced Micro Devices, Inc. | 0.13 | -6.17 | 18.75 | 29.60 | 1.4382 | 0.2643 | |||

| PLTR / Palantir Technologies Inc. | 0.13 | -0.23 | 17.73 | 61.16 | 1.3599 | 0.4673 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.20 | 0.36 | 16.69 | -0.52 | 1.2802 | -0.0810 | |||

| CVX / Chevron Corporation | 0.11 | 1.53 | 15.80 | -13.10 | 1.2119 | -0.2632 | |||

| AXON / Axon Enterprise, Inc. | 0.02 | -1.40 | 15.49 | 55.23 | 1.1882 | 0.3785 | |||

| SBUX / Starbucks Corporation | 0.16 | -0.89 | 14.85 | -7.42 | 1.1392 | -0.1624 | |||

| JNJ / Johnson & Johnson | 0.10 | -0.26 | 14.71 | -8.13 | 1.1287 | -0.1708 | |||

| SPOT / Spotify Technology S.A. | 0.02 | 3.64 | 14.64 | 44.59 | 1.1232 | 0.3016 | |||

| DIS / The Walt Disney Company | 0.12 | -4.14 | 14.61 | 20.44 | 1.1211 | 0.1365 | |||

| KMB / Kimberly-Clark Corporation | 0.11 | -2.83 | 14.25 | -11.92 | 1.0934 | -0.2196 | |||

| PYPL / PayPal Holdings, Inc. | 0.19 | 11.22 | 13.95 | 26.68 | 1.0700 | 0.1766 | |||

| AMZN / Amazon.com, Inc. | 0.06 | 0.87 | 13.51 | 16.32 | 1.0365 | 0.0939 | |||

| USB / U.S. Bancorp | 0.29 | 0.19 | 13.31 | 7.38 | 1.0214 | 0.0153 | |||

| ECL / Ecolab Inc. | 0.05 | 0.18 | 12.98 | 6.47 | 0.9956 | 0.0065 | |||

| TROW / T. Rowe Price Group, Inc. | 0.13 | -7.16 | 12.74 | -2.49 | 0.9777 | -0.0828 | |||

| CMCSA / Comcast Corporation | 0.34 | -7.91 | 12.18 | -10.93 | 0.9345 | -0.1753 | |||

| NVDA / NVIDIA Corporation | 0.08 | -3.09 | 12.15 | 41.28 | 0.9322 | 0.2342 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.02 | 11.24 | 11.74 | -7.92 | 0.9005 | -0.1339 | |||

| TFC / Truist Financial Corporation | 0.26 | -1.88 | 11.25 | 2.52 | 0.8631 | -0.0275 | |||

| NKE / NIKE, Inc. | 0.16 | 15.46 | 11.07 | 29.22 | 0.8489 | 0.1540 | |||

| ENB / Enbridge Inc. | 0.24 | -0.18 | 10.65 | 2.10 | 0.8173 | -0.0294 | |||

| ANSS / ANSYS, Inc. | 0.03 | -2.35 | 10.44 | 8.34 | 0.8007 | 0.0190 | |||

| IBM / International Business Machines Corporation | 0.03 | -26.01 | 10.00 | -12.29 | 0.7675 | -0.1580 | |||

| ALGN / Align Technology, Inc. | 0.05 | -2.77 | 9.70 | 15.88 | 0.7442 | 0.0649 | |||

| EVRG / Evergy, Inc. | 0.14 | 0.84 | 9.53 | 0.81 | 0.7310 | -0.0360 | |||

| SLM / SLM Corporation | 0.29 | -5.45 | 9.41 | 5.55 | 0.7217 | -0.0015 | |||

| META / Meta Platforms, Inc. | 0.01 | -0.34 | 9.08 | 27.63 | 0.6967 | 0.1193 | |||

| GE / General Electric Company | 0.04 | -0.31 | 9.08 | 28.21 | 0.6963 | 0.1218 | |||

| MDT / Medtronic plc | 0.10 | -0.90 | 8.98 | -3.86 | 0.6892 | -0.0691 | |||

| SLB / Schlumberger Limited | 0.26 | 10.40 | 8.94 | -10.72 | 0.6861 | -0.1268 | |||

| INTC / Intel Corporation | 0.38 | -1.36 | 8.53 | -2.70 | 0.6547 | -0.0571 | |||

| AMCR / Amcor plc | 0.89 | 0.94 | 8.15 | -4.36 | 0.6254 | -0.0663 | |||

| MRK / Merck & Co., Inc. | 0.10 | 0.09 | 7.86 | -11.73 | 0.6032 | -0.1196 | |||

| CP / Canadian Pacific Kansas City Limited | 0.09 | -8.14 | 7.31 | 3.72 | 0.5608 | -0.0112 | |||

| GPN / Global Payments Inc. | 0.09 | 3.43 | 7.20 | -15.46 | 0.5526 | -0.1387 | |||

| ROK / Rockwell Automation, Inc. | 0.02 | 10.63 | 7.08 | 42.24 | 0.5431 | 0.1392 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.06 | 10.97 | 6.19 | 6.79 | 0.4752 | 0.0045 | |||

| SO / The Southern Company | 0.06 | -0.80 | 5.80 | -0.92 | 0.4452 | -0.0301 | |||

| IPGP / IPG Photonics Corporation | 0.08 | 7.46 | 5.79 | 16.85 | 0.4443 | 0.0421 | |||

| PAYC / Paycom Software, Inc. | 0.02 | -3.44 | 5.73 | 2.27 | 0.4396 | -0.0150 | |||

| DUK / Duke Energy Corporation | 0.05 | -0.61 | 5.71 | -3.84 | 0.4378 | -0.0438 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.03 | 1.61 | 5.66 | -8.97 | 0.4343 | -0.0703 | |||

| BEN / Franklin Resources, Inc. | 0.22 | 1.67 | 5.18 | 25.95 | 0.3973 | 0.0637 | |||

| PFE / Pfizer Inc. | 0.21 | 2.55 | 4.99 | -1.89 | 0.3829 | -0.0300 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | -6.79 | 4.24 | 2.96 | 0.3252 | -0.0089 | |||

| VRSN / VeriSign, Inc. | 0.01 | -0.55 | 4.19 | 13.14 | 0.3212 | 0.0209 | |||

| KIM / Kimco Realty Corporation | 0.19 | -1.33 | 3.96 | -2.37 | 0.3040 | -0.0253 | |||

| OVV / Ovintiv Inc. | 0.10 | -1.65 | 3.95 | -12.57 | 0.3030 | -0.0636 | |||

| KO / The Coca-Cola Company | 0.06 | -4.23 | 3.94 | -5.40 | 0.3022 | -0.0357 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.02 | -4.81 | 3.61 | -11.03 | 0.2773 | -0.0523 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -0.33 | 3.49 | 25.22 | 0.2674 | 0.0416 | |||

| COST / Costco Wholesale Corporation | 0.00 | 3.12 | 3.46 | 7.95 | 0.2658 | 0.0053 | |||

| VERSX / Vanguard Emerging Markets Stock Index Fund | 0.06 | 177.82 | 2.92 | 203.54 | 0.2238 | 0.1459 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | -20.00 | 2.92 | -26.98 | 0.2237 | -0.1003 | |||

| ASB / Associated Banc-Corp | 0.11 | 2.25 | 2.77 | 10.70 | 0.2127 | 0.0094 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.01 | 0.00 | 2.71 | 3.23 | 0.2083 | -0.0051 | |||

| XOM / Exxon Mobil Corporation | 0.02 | 0.38 | 2.69 | -9.02 | 0.2068 | -0.0336 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.01 | 5.67 | 2.38 | 16.84 | 0.1826 | 0.0173 | |||

| ETSY / Etsy, Inc. | 0.05 | 0.35 | 2.27 | 6.67 | 0.1742 | 0.0015 | |||

| VEEV / Veeva Systems Inc. | 0.01 | 19.29 | 2.19 | 48.34 | 0.1683 | 0.0483 | |||

| GEV / GE Vernova Inc. | 0.00 | -12.29 | 1.97 | 52.04 | 0.1513 | 0.0460 | |||

| FICO / Fair Isaac Corporation | 0.00 | 0.28 | 1.95 | -0.61 | 0.1500 | -0.0096 | |||

| PEP / PepsiCo, Inc. | 0.01 | 0.34 | 1.69 | -11.66 | 0.1297 | -0.0256 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.14 | -0.96 | 1.65 | 1.79 | 0.1268 | -0.0050 | |||

| HQY / HealthEquity, Inc. | 0.02 | 0.33 | 1.64 | 18.97 | 0.1261 | 0.0140 | |||

| CWB / SPDR Series Trust - SPDR Bloomberg Convertible Securities ETF | 0.02 | -2.34 | 1.55 | 5.37 | 0.1189 | -0.0005 | |||

| LAMR / Lamar Advertising Company | 0.01 | 40.05 | 1.52 | 49.31 | 0.1169 | 0.0341 | |||

| GLD / SPDR Gold Trust | 0.00 | 0.00 | 1.51 | 5.81 | 0.1159 | 0.0000 | |||

| MTCH / Match Group, Inc. | 0.05 | -0.07 | 1.39 | -1.07 | 0.1067 | -0.0074 | |||

| O / Realty Income Corporation | 0.02 | 2.46 | 1.38 | 1.77 | 0.1060 | -0.0042 | |||

| QEPC / Q.E.P. Co., Inc. | 0.11 | -0.88 | 1.32 | -25.00 | 0.1013 | -0.0415 | |||

| PLXS / Plexus Corp. | 0.01 | -19.78 | 1.32 | -15.31 | 0.1011 | -0.0251 | |||

| ABBV / AbbVie Inc. | 0.01 | 11.99 | 1.15 | -0.78 | 0.0883 | -0.0058 | |||

| FAST / Fastenal Company | 0.03 | 100.00 | 1.10 | 8.30 | 0.0841 | 0.0020 | |||

| TCAF / T. Rowe Price Exchange-Traded Funds, Inc. - T. Rowe Price Capital Appreciation Equity ETF | 0.03 | 11.51 | 1.04 | 21.96 | 0.0801 | 0.0106 | |||

| ESGV / Vanguard World Fund - Vanguard ESG U.S. Stock ETF | 0.01 | 7.58 | 1.04 | 20.46 | 0.0800 | 0.0097 | |||

| ANET / Arista Networks Inc | 0.01 | 0.00 | 0.99 | 32.17 | 0.0757 | 0.0151 | |||

| NIC / Nicolet Bankshares, Inc. | 0.01 | 0.00 | 0.79 | 13.24 | 0.0604 | 0.0040 | |||

| NFLX / Netflix, Inc. | 0.00 | 120.46 | 0.76 | 217.01 | 0.0587 | 0.0391 | |||

| TSLA / Tesla, Inc. | 0.00 | 6.57 | 0.70 | 30.64 | 0.0534 | 0.0102 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | 1.22 | 0.66 | 21.47 | 0.0508 | 0.0065 | |||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.65 | -6.45 | 0.0501 | -0.0066 | |||

| TDVG / T. Rowe Price Exchange-Traded Funds, Inc. - T. Rowe Price Dividend Growth ETF | 0.01 | 8.83 | 0.62 | 14.21 | 0.0475 | 0.0035 | |||

| MA / Mastercard Incorporated | 0.00 | -7.02 | 0.62 | -4.64 | 0.0474 | -0.0052 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -11.17 | 0.57 | 5.00 | 0.0435 | -0.0003 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.53 | 0.56 | 15.32 | 0.0428 | 0.0035 | |||

| IJJ / iShares Trust - iShares S&P Mid-Cap 400 Value ETF | 0.00 | 0.00 | 0.56 | 3.15 | 0.0427 | -0.0011 | |||

| WMT / Walmart Inc. | 0.01 | 12.25 | 0.54 | 24.88 | 0.0412 | 0.0063 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 1.44 | 0.52 | 12.28 | 0.0400 | 0.0023 | |||

| TSCO / Tractor Supply Company | 0.01 | 0.00 | 0.51 | -4.11 | 0.0394 | -0.0041 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.01 | 56.99 | 0.51 | 76.57 | 0.0387 | 0.0155 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 1.21 | 0.48 | -3.61 | 0.0369 | -0.0036 | |||

| SLV / iShares Silver Trust | 0.01 | 6.74 | 0.48 | 12.94 | 0.0369 | 0.0024 | |||

| AMGN / Amgen Inc. | 0.00 | -10.50 | 0.47 | -19.86 | 0.0360 | -0.0115 | |||

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.01 | -1.76 | 0.45 | 8.47 | 0.0344 | 0.0008 | |||

| WTFC / Wintrust Financial Corporation | 0.00 | -32.13 | 0.43 | -25.22 | 0.0333 | -0.0138 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.00 | 0.42 | 0.0325 | 0.0325 | |||||

| VDMIX / Vanguard Developed Markets Index Fund | 0.01 | 0.42 | 0.0321 | 0.0321 | |||||

| WEC / WEC Energy Group, Inc. | 0.00 | 1.25 | 0.41 | -3.27 | 0.0318 | -0.0029 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.00 | 0.00 | 0.41 | 4.58 | 0.0315 | -0.0004 | |||

| FNDX / Schwab Strategic Trust - Schwab Fundamental U.S. Large Company ETF | 0.02 | 1.73 | 0.38 | 5.63 | 0.0288 | -0.0000 | |||

| RTX / RTX Corporation | 0.00 | 3.75 | 0.36 | 14.52 | 0.0273 | 0.0020 | |||

| CL / Colgate-Palmolive Company | 0.00 | 0.00 | 0.33 | -2.97 | 0.0251 | -0.0023 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 0.32 | 17.82 | 0.0249 | 0.0025 | |||

| MO / Altria Group, Inc. | 0.01 | -0.24 | 0.32 | -2.47 | 0.0243 | -0.0021 | |||

| SHOP / Shopify Inc. | 0.00 | 1.56 | 0.31 | 22.80 | 0.0236 | 0.0033 | |||

| SEE / Sealed Air Corporation | 0.01 | 0.00 | 0.30 | 7.45 | 0.0233 | 0.0003 | |||

| HUBB / Hubbell Incorporated | 0.00 | 0.00 | 0.28 | 23.68 | 0.0217 | 0.0031 | |||

| CEF / Sprott Physical Gold and Silver Trust | 0.01 | 0.00 | 0.28 | 6.06 | 0.0215 | 0.0000 | |||

| AMP / Ameriprise Financial, Inc. | 0.00 | -0.19 | 0.28 | 9.80 | 0.0215 | 0.0008 | |||

| COP / ConocoPhillips | 0.00 | 3.28 | 0.28 | -11.71 | 0.0214 | -0.0043 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | -26.52 | 0.27 | -13.59 | 0.0205 | -0.0046 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | 0.00 | 0.27 | 1.14 | 0.0205 | -0.0009 | |||

| SIVR / abrdn Silver ETF Trust - abrdn Physical Silver Shares ETF | 0.01 | 0.00 | 0.27 | 5.98 | 0.0205 | 0.0000 | |||

| GLTR / abrdn Precious Metals Basket ETF - abrdn Physical Precious Metals Basket Shares ETF | 0.00 | 0.27 | 0.0205 | 0.0205 | |||||

| VZ / Verizon Communications Inc. | 0.01 | -0.44 | 0.25 | -5.28 | 0.0193 | -0.0022 | |||

| MMM / 3M Company | 0.00 | 0.00 | 0.25 | 3.73 | 0.0192 | -0.0004 | |||

| MOAT / VanEck ETF Trust - VanEck Morningstar Wide Moat ETF | 0.00 | -73.35 | 0.23 | -71.62 | 0.0176 | -0.0479 | |||

| GNTX / Gentex Corporation | 0.01 | 0.00 | 0.22 | -5.70 | 0.0165 | -0.0020 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.00 | 0.00 | 0.21 | -8.23 | 0.0163 | -0.0025 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.21 | -4.15 | 0.0160 | -0.0016 | |||

| INDA / iShares Trust - iShares MSCI India ETF | 0.00 | 0.20 | 0.0156 | 0.0156 | |||||

| SCHG / Schwab Strategic Trust - Schwab U.S. Large-Cap Growth ETF | 0.01 | 0.20 | 0.0155 | 0.0155 | |||||

| EMR / Emerson Electric Co. | 0.00 | 0.20 | 0.0155 | 0.0155 | |||||

| INDV / Indivior PLC | 0.01 | 0.00 | 0.15 | 54.74 | 0.0113 | 0.0036 | |||

| BGS / B&G Foods, Inc. | 0.01 | 0.00 | 0.06 | -38.61 | 0.0048 | -0.0035 | |||

| UHS / Universal Health Services, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 |