Mga Batayang Estadistika

| Nilai Portofolio | $ 92,245,753 |

| Posisi Saat Ini | 54 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

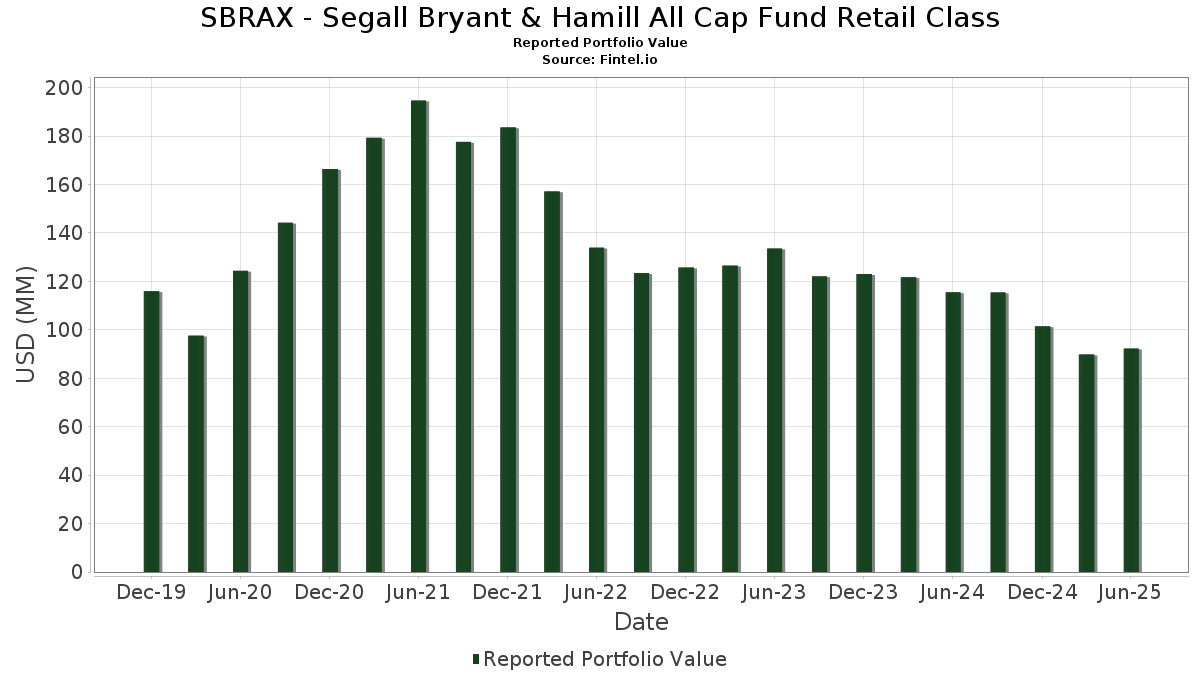

SBRAX - Segall Bryant & Hamill All Cap Fund Retail Class telah mengungkapkan total kepemilikan 54 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 92,245,753 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama SBRAX - Segall Bryant & Hamill All Cap Fund Retail Class adalah Microsoft Corporation (US:MSFT) , JPMorgan Chase & Co. (US:JPM) , Alphabet Inc. (US:GOOG) , Visa Inc. (US:V) , and Amazon.com, Inc. (US:AMZN) . Posisi baru SBRAX - Segall Bryant & Hamill All Cap Fund Retail Class meliputi: CACI International Inc (US:CACI) , 3M Company (US:MMM) , Arista Networks Inc (US:ANET) , BellRing Brands, Inc. (US:BRBR) , and Deckers Outdoor Corporation (US:DECK) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 2.89 | 3.0788 | 1.9581 | |

| 0.00 | 1.37 | 1.4590 | 1.4590 | |

| 0.01 | 1.23 | 1.3096 | 1.3096 | |

| 0.01 | 1.17 | 1.2471 | 1.2471 | |

| 0.02 | 1.07 | 1.1374 | 1.1374 | |

| 0.01 | 1.05 | 1.1211 | 1.1211 | |

| 0.00 | 0.95 | 1.0121 | 1.0121 | |

| 0.01 | 2.35 | 2.5019 | 0.9293 | |

| 0.03 | 2.16 | 2.3041 | 0.8919 | |

| 0.03 | 2.17 | 2.3095 | 0.8074 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 1.64 | 1.7478 | -0.6360 | |

| 0.01 | 1.67 | 1.7734 | -0.5522 | |

| 0.00 | 1.30 | 1.3802 | -0.5334 | |

| 0.00 | 1.57 | 1.6762 | -0.5185 | |

| 0.01 | 1.49 | 1.5858 | -0.4133 | |

| 0.01 | 1.76 | 1.8726 | -0.4036 | |

| 0.01 | 2.03 | 2.1663 | -0.3845 | |

| 0.01 | 0.90 | 0.9544 | -0.3680 | |

| 0.00 | 1.02 | 1.0855 | -0.3628 | |

| 0.01 | 1.26 | 1.3399 | -0.3294 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.01 | -12.07 | 4.46 | 16.52 | 4.7477 | 0.5561 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | -5.42 | 3.24 | 11.80 | 3.4503 | 0.2752 | |||

| GOOG / Alphabet Inc. | 0.02 | -12.58 | 3.10 | -0.74 | 3.3058 | -0.1202 | |||

| V / Visa Inc. | 0.01 | -5.43 | 3.01 | -4.21 | 3.2010 | -0.2358 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 3.99 | 2.96 | 19.94 | 3.1514 | 0.4480 | |||

| META / Meta Platforms, Inc. | 0.00 | 120.68 | 2.89 | 182.60 | 3.0788 | 1.9581 | |||

| NOW / ServiceNow, Inc. | 0.00 | -13.92 | 2.40 | 11.18 | 2.5531 | 0.1905 | |||

| GL / Globe Life Inc. | 0.02 | 1.70 | 2.38 | -4.03 | 2.5350 | -0.1824 | |||

| PWR / Quanta Services, Inc. | 0.01 | 10.02 | 2.35 | 63.69 | 2.5019 | 0.9293 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.01 | 2.39 | 2.34 | 3.18 | 2.4898 | 0.0068 | |||

| PANW / Palo Alto Networks, Inc. | 0.01 | -14.65 | 2.30 | 2.36 | 2.4499 | -0.0123 | |||

| MRVL / Marvell Technology, Inc. | 0.03 | 25.81 | 2.17 | 58.13 | 2.3095 | 0.8074 | |||

| ATI / ATI Inc. | 0.03 | 1.14 | 2.16 | 67.80 | 2.3041 | 0.8919 | |||

| INTU / Intuit Inc. | 0.00 | 11.12 | 2.04 | 42.59 | 2.1715 | 0.6044 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.01 | 1.42 | 2.04 | 14.89 | 2.1700 | 0.2272 | |||

| AAPL / Apple Inc. | 0.01 | -5.42 | 2.03 | -12.63 | 2.1663 | -0.3845 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | -0.57 | 1.91 | -4.49 | 2.0373 | -0.1574 | |||

| MPWR / Monolithic Power Systems, Inc. | 0.00 | -4.68 | 1.89 | 20.17 | 2.0126 | 0.2902 | |||

| FICO / Fair Isaac Corporation | 0.00 | 2.82 | 1.87 | 1.91 | 1.9875 | -0.0185 | |||

| CDNS / Cadence Design Systems, Inc. | 0.01 | -16.77 | 1.82 | 0.89 | 1.9328 | -0.0389 | |||

| ARES / Ares Management Corporation | 0.01 | -28.36 | 1.76 | -15.36 | 1.8726 | -0.4036 | |||

| RSG / Republic Services, Inc. | 0.01 | -5.42 | 1.70 | -3.69 | 1.8055 | -0.1228 | |||

| STE / STERIS plc | 0.01 | 5.42 | 1.69 | 11.69 | 1.8017 | 0.1429 | |||

| TJX / The TJX Companies, Inc. | 0.01 | -22.63 | 1.67 | -21.54 | 1.7734 | -0.5522 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.02 | 1,098.82 | 1.64 | -24.59 | 1.7478 | -0.6360 | |||

| MCK / McKesson Corporation | 0.00 | -27.85 | 1.57 | -21.42 | 1.6762 | -0.5185 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | 11.72 | 1.53 | 42.74 | 1.6329 | 0.4557 | |||

| SU / Suncor Energy Inc. | 0.04 | -5.42 | 1.53 | -8.48 | 1.6316 | -0.2031 | |||

| CVX / Chevron Corporation | 0.01 | -4.67 | 1.49 | -18.37 | 1.5858 | -0.4133 | |||

| RTX / RTX Corporation | 0.01 | -22.45 | 1.43 | -14.56 | 1.5257 | -0.3102 | |||

| BSX / Boston Scientific Corporation | 0.01 | 14.63 | 1.43 | 22.08 | 1.5251 | 0.2397 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.02 | -4.49 | 1.40 | 6.80 | 1.4883 | 0.0549 | |||

| CACI / CACI International Inc | 0.00 | 1.37 | 1.4590 | 1.4590 | |||||

| CBRE / CBRE Group, Inc. | 0.01 | -5.42 | 1.35 | 1.35 | 1.4390 | -0.0218 | |||

| ZTS / Zoetis Inc. | 0.01 | 10.71 | 1.30 | 4.91 | 1.3889 | 0.0264 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -18.66 | 1.30 | -25.77 | 1.3802 | -0.5334 | |||

| TTEK / Tetra Tech, Inc. | 0.04 | 13.93 | 1.28 | 40.07 | 1.3673 | 0.3631 | |||

| CHD / Church & Dwight Co., Inc. | 0.01 | -5.42 | 1.26 | -17.40 | 1.3399 | -0.3294 | |||

| MDLZ / Mondelez International, Inc. | 0.02 | -5.42 | 1.25 | -6.02 | 1.3296 | -0.1252 | |||

| MMM / 3M Company | 0.01 | 1.23 | 1.3096 | 1.3096 | |||||

| AVY / Avery Dennison Corporation | 0.01 | -5.41 | 1.21 | -6.76 | 1.2931 | -0.1332 | |||

| ANET / Arista Networks Inc | 0.01 | 1.17 | 1.2471 | 1.2471 | |||||

| NDAQ / Nasdaq, Inc. | 0.01 | -5.42 | 1.13 | 11.43 | 1.2053 | 0.0932 | |||

| DOV / Dover Corporation | 0.01 | -5.42 | 1.13 | -1.40 | 1.1986 | -0.0513 | |||

| IHG / InterContinental Hotels Group PLC - Depositary Receipt (Common Stock) | 0.01 | -5.42 | 1.12 | -0.53 | 1.1969 | -0.0399 | |||

| TECH / Bio-Techne Corporation | 0.02 | 18.31 | 1.10 | 3.86 | 1.1739 | 0.0108 | |||

| BRBR / BellRing Brands, Inc. | 0.02 | 1.07 | 1.1374 | 1.1374 | |||||

| DECK / Deckers Outdoor Corporation | 0.01 | 1.05 | 1.1211 | 1.1211 | |||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -5.38 | 1.02 | -22.92 | 1.0855 | -0.3628 | |||

| HD / The Home Depot, Inc. | 0.00 | -5.40 | 0.99 | -5.36 | 1.0538 | -0.0916 | |||

| ADI / Analog Devices, Inc. | 0.00 | 0.95 | 1.0121 | 1.0121 | |||||

| SBUX / Starbucks Corporation | 0.01 | -20.52 | 0.90 | -25.77 | 0.9544 | -0.3680 | |||

| COO / The Cooper Companies, Inc. | 0.01 | -2.52 | 0.85 | -17.73 | 0.9043 | -0.2268 | |||

| AMTM / Amentum Holdings, Inc. | 0.00 | -95.16 | 0.01 | -96.60 | 0.0134 | -0.2903 |