Mga Batayang Estadistika

| Nilai Portofolio | $ 15,972,287,035 |

| Posisi Saat Ini | 40 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

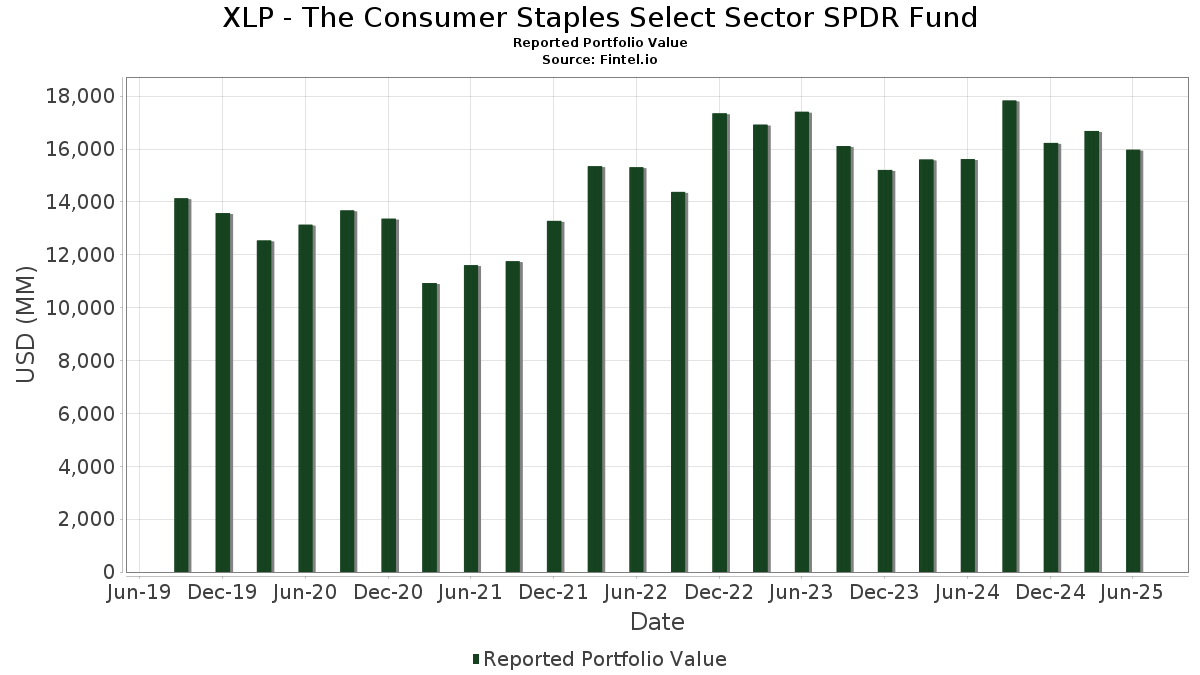

XLP - The Consumer Staples Select Sector SPDR Fund telah mengungkapkan total kepemilikan 40 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 15,972,287,035 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama XLP - The Consumer Staples Select Sector SPDR Fund adalah Costco Wholesale Corporation (US:COST) , Walmart Inc. (US:WMT) , The Procter & Gamble Company (US:PG) , Philip Morris International Inc. (US:PM) , and The Coca-Cola Company (US:KO) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 15.63 | 1,527.84 | 9.5795 | 0.7692 | |

| 5.63 | 1,025.26 | 6.4284 | 0.7188 | |

| 2.19 | 250.94 | 1.5734 | 0.4012 | |

| 13.55 | 447.89 | 2.8083 | 0.3317 | |

| 1.97 | 195.15 | 1.2236 | 0.3038 | |

| 7.00 | 438.74 | 2.7509 | 0.2671 | |

| 1.60 | 1,588.43 | 9.9594 | 0.2471 | |

| 2.34 | 188.77 | 1.1836 | 0.2467 | |

| 44.63 | 44.63 | 0.2798 | 0.2380 | |

| 4.79 | 252.94 | 1.5860 | 0.1933 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 8.48 | 1,350.90 | 8.4701 | -0.7746 | |

| 19.15 | 400.83 | 2.5132 | -0.2737 | |

| 5.46 | 283.00 | 1.7744 | -0.2234 | |

| 8.62 | 222.52 | 1.3952 | -0.2139 | |

| 14.01 | 991.14 | 6.2144 | -0.2006 | |

| 5.51 | 727.48 | 4.5613 | -0.1961 | |

| 3.31 | 426.71 | 2.6755 | -0.1839 | |

| 1.23 | 147.62 | 0.9255 | -0.1740 | |

| 1.53 | 248.39 | 1.5574 | -0.1713 | |

| 2.46 | 236.11 | 1.4804 | -0.1610 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| COST / Costco Wholesale Corporation | 1.60 | -6.70 | 1,588.43 | -2.34 | 9.9594 | 0.2471 | |||

| WMT / Walmart Inc. | 15.63 | -7.03 | 1,527.84 | 3.55 | 9.5795 | 0.7692 | |||

| PG / The Procter & Gamble Company | 8.48 | -6.67 | 1,350.90 | -12.74 | 8.4701 | -0.7746 | |||

| PM / Philip Morris International Inc. | 5.63 | -6.55 | 1,025.26 | 7.22 | 6.4284 | 0.7188 | |||

| KO / The Coca-Cola Company | 14.01 | -6.61 | 991.14 | -7.74 | 6.2144 | -0.2006 | |||

| PEP / PepsiCo, Inc. | 5.51 | 3.69 | 727.48 | -8.69 | 4.5613 | -0.1961 | |||

| MDLZ / Mondelez International, Inc. | 10.69 | -4.90 | 720.93 | -5.47 | 4.5202 | -0.0338 | |||

| CL / Colgate-Palmolive Company | 7.77 | -3.39 | 706.29 | -6.27 | 4.4284 | -0.0712 | |||

| MO / Altria Group, Inc. | 11.95 | -5.45 | 700.40 | -7.64 | 4.3915 | -0.1366 | |||

| KDP / Keurig Dr Pepper Inc. | 13.55 | 11.78 | 447.89 | 7.99 | 2.8083 | 0.3317 | |||

| TGT / Target Corporation | 4.53 | -2.56 | 447.11 | -7.89 | 2.8034 | -0.0952 | |||

| MNST / Monster Beverage Corporation | 7.00 | -1.46 | 438.74 | 5.48 | 2.7509 | 0.2671 | |||

| KR / The Kroger Co. | 6.11 | -9.58 | 438.31 | -4.18 | 2.7482 | 0.0167 | |||

| KMB / Kimberly-Clark Corporation | 3.31 | -1.70 | 426.71 | -10.89 | 2.6755 | -0.1839 | |||

| KVUE / Kenvue Inc. | 19.15 | -1.60 | 400.83 | -14.12 | 2.5132 | -0.2737 | |||

| SYY / Sysco Corporation | 4.84 | -2.64 | 366.23 | -1.73 | 2.2962 | 0.0709 | |||

| GIS / General Mills, Inc. | 5.46 | -2.38 | 283.00 | -15.41 | 1.7744 | -0.2234 | |||

| ADM / Archer-Daniels-Midland Company | 4.79 | -1.35 | 252.94 | 8.46 | 1.5860 | 0.1933 | |||

| DG / Dollar General Corporation | 2.19 | -1.73 | 250.94 | 27.83 | 1.5734 | 0.4012 | |||

| STZ / Constellation Brands, Inc. | 1.53 | -3.21 | 248.39 | -14.20 | 1.5574 | -0.1713 | |||

| HSY / The Hershey Company | 1.48 | -1.58 | 244.97 | -4.50 | 1.5359 | 0.0043 | |||

| CHD / Church & Dwight Co., Inc. | 2.46 | -1.61 | 236.11 | -14.11 | 1.4804 | -0.1610 | |||

| KHC / The Kraft Heinz Company | 8.62 | -2.68 | 222.52 | -17.42 | 1.3952 | -0.2139 | |||

| K / Kellanova | 2.68 | -1.74 | 213.29 | -5.26 | 1.3373 | -0.0070 | |||

| DLTR / Dollar Tree, Inc. | 1.97 | -3.98 | 195.15 | 26.69 | 1.2236 | 0.3038 | |||

| MKC / McCormick & Company, Incorporated | 2.52 | -1.68 | 191.10 | -9.43 | 1.1982 | -0.0617 | |||

| EL / The Estée Lauder Companies Inc. | 2.34 | -1.72 | 188.77 | 20.32 | 1.1836 | 0.2467 | |||

| TSN / Tyson Foods, Inc. | 2.86 | -1.73 | 159.71 | -13.85 | 1.0014 | -0.1055 | |||

| CLX / The Clorox Company | 1.23 | -1.69 | 147.62 | -19.84 | 0.9255 | -0.1740 | |||

| CH1300646267 / Bunge Global SA | 1.34 | -1.06 | 107.63 | 3.94 | 0.6748 | 0.0565 | |||

| SJM / The J. M. Smucker Company | 1.06 | -1.74 | 104.24 | -18.51 | 0.6536 | -0.1102 | |||

| CAG / Conagra Brands, Inc. | 4.76 | -1.73 | 97.47 | -24.58 | 0.6111 | -0.1605 | |||

| HRL / Hormel Foods Corporation | 2.91 | -1.58 | 87.94 | -3.77 | 0.5514 | 0.0057 | |||

| WBA / Walgreens Boots Alliance, Inc. | 7.16 | -1.67 | 82.19 | 1.06 | 0.5153 | 0.0297 | |||

| TAP / Molson Coors Beverage Company | 1.71 | -2.22 | 82.19 | -22.75 | 0.5153 | -0.1199 | |||

| LW / Lamb Weston Holdings, Inc. | 1.41 | -2.79 | 72.99 | -5.43 | 0.4576 | -0.0032 | |||

| CPB / The Campbell's Company | 1.96 | -1.72 | 60.17 | -24.54 | 0.3773 | -0.0989 | |||

| BFB / Brown-Forman Corp. - Class B | 1.82 | -1.74 | 48.89 | -22.09 | 0.3065 | -0.0682 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 44.63 | 536.93 | 44.63 | 537.01 | 0.2798 | 0.2380 | |||

| XAP CONS STAPLES SEP25 / DE (000000000) | 0.34 | 0.0021 | 0.0021 |