Mga Batayang Estadistika

| Nilai Portofolio | $ 194,753,441 |

| Posisi Saat Ini | 67 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

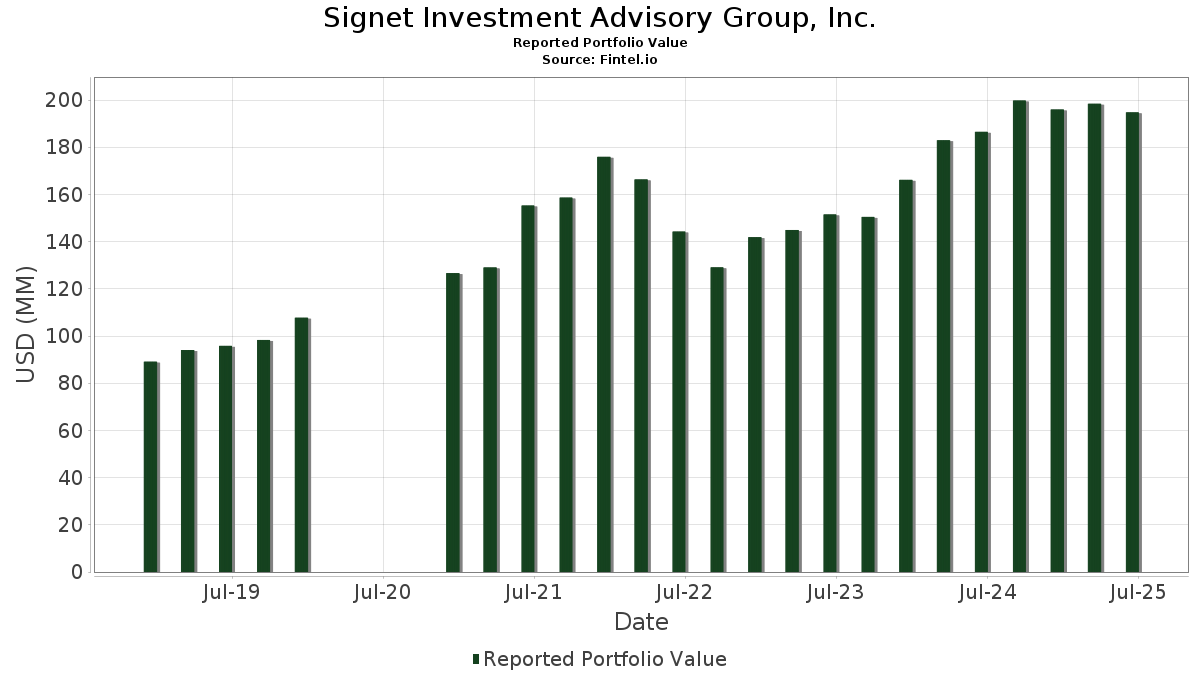

Signet Investment Advisory Group, Inc. telah mengungkapkan total kepemilikan 67 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 194,753,441 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Signet Investment Advisory Group, Inc. adalah Schwab Strategic Trust - Schwab International Equity ETF (US:SCHF) , iShares Gold Trust (US:IAU) , Microsoft Corporation (US:MSFT) , Schwab Strategic Trust - Schwab U.S. TIPS ETF (US:SCHP) , and JPMorgan Chase & Co. (US:JPM) . Posisi baru Signet Investment Advisory Group, Inc. meliputi: GE Vernova Inc. (US:GEV) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 8.77 | 4.5033 | 1.1649 | |

| 0.02 | 4.54 | 2.3303 | 0.8552 | |

| 0.52 | 11.47 | 5.8871 | 0.7385 | |

| 0.02 | 6.76 | 3.4725 | 0.5758 | |

| 0.02 | 3.74 | 1.9184 | 0.3726 | |

| 0.08 | 5.60 | 2.8736 | 0.3602 | |

| 0.15 | 4.79 | 2.4586 | 0.3486 | |

| 0.02 | 3.48 | 1.7848 | 0.3314 | |

| 0.02 | 5.80 | 2.9768 | 0.2979 | |

| 0.01 | 2.05 | 1.0551 | 0.2754 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.18 | 11.01 | 5.6517 | -1.4360 | |

| 0.01 | 2.32 | 1.1931 | -0.7296 | |

| 0.01 | 6.30 | 3.2323 | -0.2727 | |

| 0.03 | 6.48 | 3.3258 | -0.2463 | |

| 0.02 | 2.16 | 1.1085 | -0.1622 | |

| 0.02 | 2.09 | 1.0710 | -0.1406 | |

| 0.03 | 4.42 | 2.2684 | -0.1349 | |

| 0.07 | 6.61 | 3.3945 | -0.1272 | |

| 0.02 | 2.89 | 1.4819 | -0.1161 | |

| 0.01 | 1.71 | 0.8777 | -0.0931 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-01 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SCHF / Schwab Strategic Trust - Schwab International Equity ETF | 0.52 | 0.46 | 11.47 | 12.25 | 5.8871 | 0.7385 | |||

| IAU / iShares Gold Trust | 0.18 | -25.99 | 11.01 | -21.73 | 5.6517 | -1.4360 | |||

| MSFT / Microsoft Corporation | 0.02 | -0.07 | 8.77 | 32.42 | 4.5033 | 1.1649 | |||

| SCHP / Schwab Strategic Trust - Schwab U.S. TIPS ETF | 0.33 | 0.30 | 8.76 | -0.48 | 4.4955 | 0.0613 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | -0.43 | 6.76 | 17.68 | 3.4725 | 0.5758 | |||

| WMT / Walmart Inc. | 0.07 | -15.05 | 6.61 | -5.40 | 3.3945 | -0.1272 | |||

| AAPL / Apple Inc. | 0.03 | -1.05 | 6.48 | -8.59 | 3.3258 | -0.2463 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -0.75 | 6.30 | -9.46 | 3.2323 | -0.2727 | |||

| V / Visa Inc. | 0.02 | -0.57 | 5.86 | 0.72 | 3.0108 | 0.0767 | |||

| HON / Honeywell International Inc. | 0.02 | -0.82 | 5.80 | 9.09 | 2.9768 | 0.2979 | |||

| CSCO / Cisco Systems, Inc. | 0.08 | -0.18 | 5.60 | 12.23 | 2.8736 | 0.3602 | |||

| ACN / Accenture plc | 0.02 | 1.77 | 5.17 | -2.51 | 2.6538 | -0.0185 | |||

| CSX / CSX Corporation | 0.15 | 3.20 | 4.79 | 14.38 | 2.4586 | 0.3486 | |||

| WM / Waste Management, Inc. | 0.02 | -0.70 | 4.57 | -1.87 | 2.3466 | -0.0004 | |||

| NEE / NextEra Energy, Inc. | 0.07 | 1.75 | 4.56 | -0.35 | 2.3397 | 0.0348 | |||

| ORCL / Oracle Corporation | 0.02 | -0.84 | 4.54 | 55.09 | 2.3303 | 0.8552 | |||

| JNJ / Johnson & Johnson | 0.03 | 0.59 | 4.42 | -7.36 | 2.2684 | -0.1349 | |||

| USB / U.S. Bancorp | 0.09 | 3.68 | 4.21 | 11.11 | 2.1621 | 0.2521 | |||

| PG / The Procter & Gamble Company | 0.02 | 0.58 | 3.86 | -5.96 | 1.9838 | -0.0871 | |||

| ADBE / Adobe Inc. | 0.01 | 3.99 | 3.79 | 4.89 | 1.9486 | 0.1250 | |||

| DLR / Digital Realty Trust, Inc. | 0.02 | 0.14 | 3.74 | 21.85 | 1.9184 | 0.3726 | |||

| GOOG / Alphabet Inc. | 0.02 | 6.17 | 3.48 | 20.53 | 1.7848 | 0.3314 | |||

| PFE / Pfizer Inc. | 0.14 | 2.42 | 3.28 | -2.03 | 1.6842 | -0.0033 | |||

| HD / The Home Depot, Inc. | 0.01 | -0.30 | 3.24 | -0.25 | 1.6642 | 0.0263 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.22 | 3.16 | -5.42 | 1.6219 | -0.0612 | |||

| KO / The Coca-Cola Company | 0.04 | -0.62 | 3.05 | -1.84 | 1.5640 | 0.0001 | |||

| MCD / McDonald's Corporation | 0.01 | 0.54 | 2.99 | -5.95 | 1.5355 | -0.0673 | |||

| AMZN / Amazon.com, Inc. | 0.01 | -9.43 | 2.91 | 4.41 | 1.4946 | 0.0897 | |||

| PEP / PepsiCo, Inc. | 0.02 | 3.37 | 2.89 | -8.96 | 1.4819 | -0.1161 | |||

| NOC / Northrop Grumman Corporation | 0.01 | -1.47 | 2.68 | -3.81 | 1.3755 | -0.0279 | |||

| AXP / American Express Company | 0.01 | -0.24 | 2.63 | 18.28 | 1.3529 | 0.2300 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 2.27 | 2.32 | -39.09 | 1.1931 | -0.7296 | |||

| CVS / CVS Health Corporation | 0.03 | -1.15 | 2.18 | 0.65 | 1.1213 | 0.0277 | |||

| MDT / Medtronic plc | 0.02 | 1.79 | 2.16 | -1.28 | 1.1099 | 0.0065 | |||

| CVX / Chevron Corporation | 0.02 | 0.05 | 2.16 | -14.37 | 1.1085 | -0.1622 | |||

| COP / ConocoPhillips | 0.02 | 1.54 | 2.09 | -13.23 | 1.0710 | -0.1406 | |||

| ETN / Eaton Corporation plc | 0.01 | 1.14 | 2.05 | 32.86 | 1.0551 | 0.2754 | |||

| SCHG / Schwab Strategic Trust - Schwab U.S. Large-Cap Growth ETF | 0.07 | -1.81 | 1.99 | 14.53 | 1.0202 | 0.1458 | |||

| AMGN / Amgen Inc. | 0.01 | -0.97 | 1.71 | -11.27 | 0.8777 | -0.0931 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | 3.07 | 1.61 | -1.47 | 0.8261 | 0.0035 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 18.40 | 1.50 | 22.78 | 0.7726 | 0.1548 | |||

| CMCSA / Comcast Corporation | 0.04 | 0.30 | 1.49 | -2.99 | 0.7667 | -0.0091 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.02 | 0.12 | 1.49 | -0.53 | 0.7655 | 0.0104 | |||

| COST / Costco Wholesale Corporation | 0.00 | -0.55 | 1.44 | 4.12 | 0.7401 | 0.0422 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.05 | -0.99 | 1.40 | -6.15 | 0.7205 | -0.0332 | |||

| MRK / Merck & Co., Inc. | 0.02 | 0.91 | 1.37 | -10.96 | 0.7009 | -0.0722 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -4.84 | 0.96 | 5.15 | 0.4927 | 0.0325 | |||

| MUNI / PIMCO ETF Trust - PIMCO Intermediate Municipal Bond Active Exchange-Traded Fund | 0.02 | 12.29 | 0.94 | 11.93 | 0.4819 | 0.0591 | |||

| SCHZ / Schwab Strategic Trust - Schwab U.S. Aggregate Bond ETF | 0.04 | 7.00 | 0.93 | 7.41 | 0.4768 | 0.0409 | |||

| DE / Deere & Company | 0.00 | -0.71 | 0.93 | 7.54 | 0.4762 | 0.0417 | |||

| GIS / General Mills, Inc. | 0.02 | -2.88 | 0.89 | -15.80 | 0.4571 | -0.0761 | |||

| SPGI / S&P Global Inc. | 0.00 | 0.00 | 0.63 | 3.78 | 0.3249 | 0.0176 | |||

| GD / General Dynamics Corporation | 0.00 | 0.28 | 0.62 | 7.24 | 0.3199 | 0.0272 | |||

| NVDA / NVIDIA Corporation | 0.00 | 20.83 | 0.57 | 76.00 | 0.2941 | 0.1302 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 0.00 | 0.47 | 10.56 | 0.2421 | 0.0271 | |||

| SCHO / Schwab Strategic Trust - Schwab Short-Term U.S. Treasury ETF | 0.02 | 1.80 | 0.45 | 2.05 | 0.2306 | 0.0086 | |||

| DIS / The Walt Disney Company | 0.00 | -0.28 | 0.44 | 25.43 | 0.2258 | 0.0489 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | 0.00 | 0.31 | 10.51 | 0.1570 | 0.0176 | |||

| FSS / Federal Signal Corporation | 0.00 | 0.00 | 0.29 | 44.55 | 0.1503 | 0.0483 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.00 | 0.00 | 0.29 | 4.38 | 0.1473 | 0.0090 | |||

| GE / General Electric Company | 0.00 | 0.00 | 0.29 | 28.38 | 0.1467 | 0.0347 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | -1.22 | 0.28 | -25.07 | 0.1461 | -0.0452 | |||

| BAC / Bank of America Corporation | 0.01 | -1.36 | 0.26 | 11.79 | 0.1318 | 0.0161 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | -3.25 | 0.23 | -2.14 | 0.1178 | -0.0006 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.22 | 0.1136 | 0.1136 | |||||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0.00 | 0.00 | 0.22 | 0.00 | 0.1134 | 0.0024 | |||

| VZ / Verizon Communications Inc. | 0.01 | -23.76 | 0.22 | -27.27 | 0.1111 | -0.0388 | |||

| SBUX / Starbucks Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IBM / International Business Machines Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RTX / RTX Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |