Mga Batayang Estadistika

| Nilai Portofolio | $ 280,745,994 |

| Posisi Saat Ini | 35 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

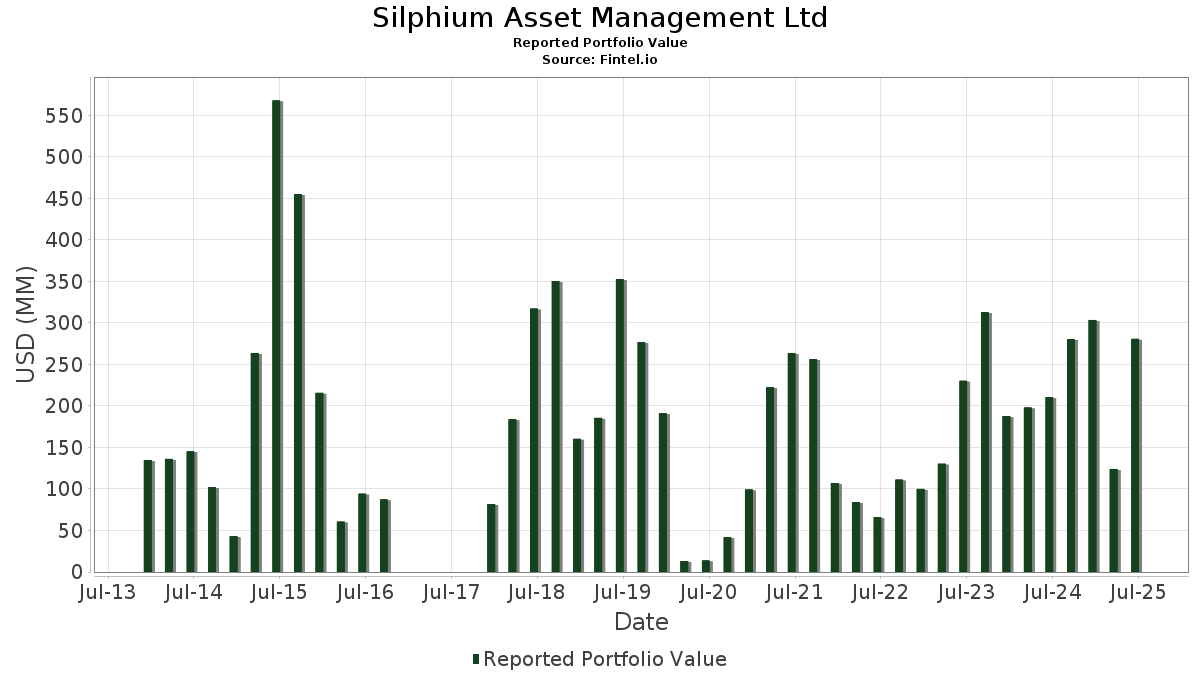

Silphium Asset Management Ltd telah mengungkapkan total kepemilikan 35 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 280,745,994 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Silphium Asset Management Ltd adalah Vanguard Index Funds - Vanguard S&P 500 ETF (US:VOO) , Vanguard STAR Funds - Vanguard Total International Stock ETF (US:VXUS) , iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF (US:LQD) , iShares Trust - iShares Core International Aggregate Bond ETF (US:IAGG) , and iShares Trust - iShares U.S. Treasury Bond ETF (US:GOVT) . Posisi baru Silphium Asset Management Ltd meliputi: Vanguard Index Funds - Vanguard S&P 500 ETF (US:VOO) , Vanguard STAR Funds - Vanguard Total International Stock ETF (US:VXUS) , iShares Trust - iShares Core International Aggregate Bond ETF (US:IAGG) , iShares Trust - iShares U.S. Treasury Bond ETF (US:GOVT) , and CACI International Inc (US:CACI) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.10 | 56.54 | 20.1378 | 20.1378 | |

| 0.41 | 28.29 | 10.0776 | 10.0776 | |

| 0.19 | 21.29 | 7.5820 | 7.5820 | |

| 0.37 | 19.05 | 6.7860 | 6.7860 | |

| 0.49 | 11.29 | 4.0206 | 4.0206 | |

| 0.04 | 7.59 | 2.7047 | 2.7047 | |

| 0.01 | 3.57 | 1.2701 | 1.2701 | |

| 0.04 | 3.02 | 1.0761 | 1.0761 | |

| 0.06 | 9.04 | 3.2206 | 0.2475 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.08 | 7.98 | 2.8413 | -4.1356 | |

| 0.01 | 6.03 | 2.1470 | -3.6720 | |

| 0.04 | 4.46 | 1.5885 | -3.3066 | |

| 0.03 | 5.16 | 1.8381 | -3.2256 | |

| 0.02 | 4.92 | 1.7530 | -3.2134 | |

| 0.03 | 5.75 | 2.0470 | -2.3552 | |

| 0.01 | 4.83 | 1.7208 | -2.3081 | |

| 0.02 | 4.92 | 1.7536 | -2.2510 | |

| 0.02 | 6.09 | 2.1675 | -2.0684 | |

| 0.16 | 5.90 | 2.1015 | -1.8702 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-13 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.10 | 56.54 | 20.1378 | 20.1378 | |||||

| VXUS / Vanguard STAR Funds - Vanguard Total International Stock ETF | 0.41 | 28.29 | 10.0776 | 10.0776 | |||||

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | 0.19 | 21.29 | 7.5820 | 7.5820 | |||||

| IAGG / iShares Trust - iShares Core International Aggregate Bond ETF | 0.37 | 19.05 | 6.7860 | 6.7860 | |||||

| GOVT / iShares Trust - iShares U.S. Treasury Bond ETF | 0.49 | 11.29 | 4.0206 | 4.0206 | |||||

| NVDA / NVIDIA Corporation | 0.06 | 68.14 | 9.04 | 145.15 | 3.2206 | 0.2475 | |||

| MSFT / Microsoft Corporation | 0.02 | 6.25 | 8.38 | 40.78 | 2.9833 | -1.8115 | |||

| WMT / Walmart Inc. | 0.08 | -17.27 | 7.98 | -7.86 | 2.8413 | -4.1356 | |||

| URTH / iShares, Inc. - iShares MSCI World ETF | 0.04 | 7.59 | 2.7047 | 2.7047 | |||||

| META / Meta Platforms, Inc. | 0.01 | 6.86 | 7.08 | 36.85 | 2.5212 | -1.6474 | |||

| INTU / Intuit Inc. | 0.01 | 5.36 | 6.65 | 35.16 | 2.3673 | -1.5960 | |||

| ETN / Eaton Corporation plc | 0.02 | -11.84 | 6.09 | 15.79 | 2.1675 | -2.0684 | |||

| COST / Costco Wholesale Corporation | 0.01 | -20.24 | 6.03 | -16.52 | 2.1470 | -3.6720 | |||

| FXI / iShares Trust - iShares China Large-Cap ETF | 0.16 | 16.73 | 5.90 | 19.70 | 2.1015 | -1.8702 | |||

| AMZN / Amazon.com, Inc. | 0.03 | -8.76 | 5.75 | 5.20 | 2.0470 | -2.3552 | |||

| FI / Fiserv, Inc. | 0.03 | 5.20 | 5.16 | -17.86 | 1.8381 | -3.2256 | |||

| WM / Waste Management, Inc. | 0.02 | 0.25 | 4.92 | -0.91 | 1.7536 | -2.2510 | |||

| CME / CME Group Inc. | 0.02 | -23.13 | 4.92 | -20.14 | 1.7530 | -3.2134 | |||

| AVGO / Broadcom Inc. | 0.02 | 2.34 | 4.85 | 68.47 | 1.7285 | -0.5927 | |||

| TXN / Texas Instruments Incorporated | 0.02 | 25.06 | 4.85 | 44.49 | 1.7284 | -0.9782 | |||

| MA / Mastercard Incorporated | 0.01 | -5.73 | 4.83 | -3.36 | 1.7208 | -2.3081 | |||

| BRO / Brown & Brown, Inc. | 0.04 | -17.61 | 4.46 | -26.58 | 1.5885 | -3.3066 | |||

| GOOGL / Alphabet Inc. | 0.02 | 11.16 | 4.30 | 26.69 | 1.5316 | -1.2041 | |||

| CP / Canadian Pacific Kansas City Limited | 0.05 | 43.19 | 3.93 | 61.71 | 1.3992 | -0.5591 | |||

| LLY / Eli Lilly and Company | 0.00 | 8.40 | 3.72 | 2.31 | 1.3264 | -1.6071 | |||

| RACE / Ferrari N.V. | 0.01 | -7.42 | 3.69 | 6.19 | 1.3145 | -1.4867 | |||

| CACI / CACI International Inc | 0.01 | 3.57 | 1.2701 | 1.2701 | |||||

| CRM / Salesforce, Inc. | 0.01 | -9.00 | 3.27 | -7.54 | 1.1662 | -1.6876 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.04 | 3.02 | 1.0761 | 1.0761 | |||||

| MCK / McKesson Corporation | 0.00 | -16.09 | 2.82 | -8.63 | 1.0031 | -1.4811 | |||

| HD / The Home Depot, Inc. | 0.01 | -10.58 | 2.80 | -10.54 | 0.9983 | -1.5266 | |||

| HQY / HealthEquity, Inc. | 0.02 | -11.27 | 2.56 | 5.19 | 0.9105 | -1.0481 | |||

| TJX / The TJX Companies, Inc. | 0.02 | 11.75 | 2.49 | 13.29 | 0.8868 | -0.8842 | |||

| FICO / Fair Isaac Corporation | 0.00 | -24.95 | 2.11 | -25.62 | 0.7501 | -1.5314 | |||

| BIDU / Baidu, Inc. - Depositary Receipt (Common Stock) | 0.02 | 44.24 | 1.55 | 34.43 | 0.5508 | -0.3764 | |||

| VLTO / Veralto Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 |