Mga Batayang Estadistika

| Nilai Portofolio | $ 868,062,258 |

| Posisi Saat Ini | 141 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

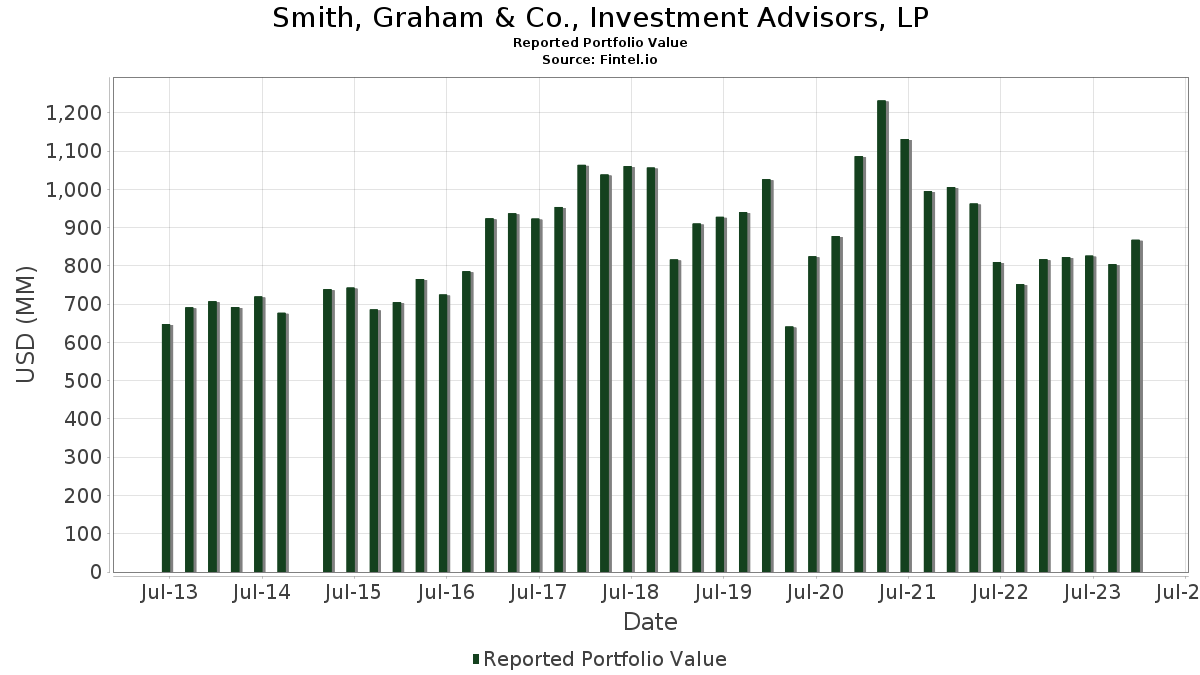

Smith, Graham & Co., Investment Advisors, LP telah mengungkapkan total kepemilikan 141 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 868,062,258 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Smith, Graham & Co., Investment Advisors, LP adalah Koppers Holdings Inc. (US:KOP) , Hibbett, Inc. (US:HIBB) , Dycom Industries, Inc. (US:DY) , Griffon Corporation (US:GFF) , and Group 1 Automotive, Inc. (US:GPI) . Posisi baru Smith, Graham & Co., Investment Advisors, LP meliputi: Permian Resources Corporation (US:PR) , Preferred Bank (US:PFBC) , Clearfield, Inc. (US:CLFD) , OGE Energy Corp. (US:OGE) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.74 | 10.01 | 1.1529 | 1.1529 | |

| 0.09 | 6.52 | 0.7513 | 0.7513 | |

| 0.18 | 5.15 | 0.5931 | 0.5931 | |

| 0.21 | 15.08 | 1.7371 | 0.4346 | |

| 0.24 | 14.39 | 1.6581 | 0.4241 | |

| 0.44 | 7.29 | 0.8393 | 0.4184 | |

| 0.09 | 3.23 | 0.3717 | 0.3717 | |

| 0.38 | 7.20 | 0.8299 | 0.3379 | |

| 0.29 | 15.10 | 1.7390 | 0.2812 | |

| 0.13 | 14.77 | 1.7019 | 0.2729 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.2881 | ||

| 0.00 | 0.00 | -0.9489 | ||

| 0.00 | 0.00 | -0.7241 | ||

| 0.00 | 0.00 | -0.7226 | ||

| 0.00 | 0.00 | -0.5354 | ||

| 0.35 | 3.69 | 0.4254 | -0.4336 | |

| 0.02 | 12.14 | 1.3981 | -0.3308 | |

| 0.12 | 5.56 | 0.6409 | -0.3244 | |

| 0.10 | 7.77 | 0.8952 | -0.3196 | |

| 0.06 | 7.38 | 0.8501 | -0.2943 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2024-01-29 untuk periode pelaporan 2023-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| KOP / Koppers Holdings Inc. | 0.29 | -0.60 | 15.10 | 28.73 | 1.7390 | 0.2812 | |||

| HIBB / Hibbett, Inc. | 0.21 | -5.06 | 15.08 | 43.92 | 1.7371 | 0.4346 | |||

| DY / Dycom Industries, Inc. | 0.13 | -0.62 | 14.77 | 28.52 | 1.7019 | 0.2729 | |||

| GFF / Griffon Corporation | 0.24 | -5.63 | 14.39 | 45.00 | 1.6581 | 0.4241 | |||

| GPI / Group 1 Automotive, Inc. | 0.04 | -13.01 | 13.63 | -1.35 | 1.5700 | -0.1474 | |||

| LAD / Lithia Motors, Inc. | 0.04 | -0.60 | 13.58 | 10.83 | 1.5645 | 0.0411 | |||

| SIGI / Selective Insurance Group, Inc. | 0.12 | -0.60 | 12.33 | -4.15 | 1.4206 | -0.1788 | |||

| MDC / M.D.C. Holdings, Inc. | 0.22 | -0.60 | 12.22 | 33.21 | 1.4072 | 0.2672 | |||

| DECK / Deckers Outdoor Corporation | 0.02 | -32.88 | 12.14 | -12.73 | 1.3981 | -0.3308 | |||

| SCSC / ScanSource, Inc. | 0.30 | -0.60 | 12.06 | 29.91 | 1.3891 | 0.2351 | |||

| WBS / Webster Financial Corporation | 0.22 | -0.60 | 11.23 | 25.17 | 1.2938 | 0.1784 | |||

| UCTT / Ultra Clean Holdings, Inc. | 0.32 | -0.59 | 10.94 | 14.38 | 1.2601 | 0.0712 | |||

| PRIM / Primoris Services Corporation | 0.30 | -0.60 | 10.08 | 0.86 | 1.1612 | -0.0813 | |||

| PR / Permian Resources Corporation | 0.74 | 10.01 | 1.1529 | 1.1529 | |||||

| GB.WS / Global Blue Group Holding AG - Equity Warrant | 0.10 | -0.61 | 9.86 | 25.56 | 1.1364 | 0.1597 | |||

| TTEK / Tetra Tech, Inc. | 0.06 | -0.60 | 9.82 | 9.13 | 1.1318 | 0.0127 | |||

| GBX / The Greenbrier Companies, Inc. | 0.22 | 1.73 | 9.69 | 12.35 | 1.1164 | 0.0441 | |||

| ECPG / Encore Capital Group, Inc. | 0.19 | -0.60 | 9.66 | 5.63 | 1.1131 | -0.0241 | |||

| TTMI / TTM Technologies, Inc. | 0.61 | -0.59 | 9.66 | 22.02 | 1.1125 | 0.1286 | |||

| SEM / Select Medical Holdings Corporation | 0.41 | -0.60 | 9.63 | -7.56 | 1.1098 | -0.1858 | |||

| OMI / Owens & Minor, Inc. | 0.49 | -0.59 | 9.47 | 18.54 | 1.0910 | 0.0978 | |||

| LZB / La-Z-Boy Incorporated | 0.24 | -0.59 | 8.89 | 18.85 | 1.0244 | 0.0943 | |||

| PWR / Quanta Services, Inc. | 0.04 | -11.62 | 8.85 | 1.96 | 1.0196 | -0.0596 | |||

| CRUS / Cirrus Logic, Inc. | 0.10 | -0.61 | 8.48 | 11.79 | 0.9766 | 0.0339 | |||

| AEIS / Advanced Energy Industries, Inc. | 0.08 | -0.58 | 8.45 | 5.01 | 0.9733 | -0.0269 | |||

| BLDR / Builders FirstSource, Inc. | 0.05 | -13.47 | 8.44 | 16.03 | 0.9723 | 0.0680 | |||

| AXL / American Axle & Manufacturing Holdings, Inc. | 0.95 | -0.60 | 8.37 | 20.63 | 0.9645 | 0.1016 | |||

| TITN / Titan Machinery Inc. | 0.29 | 20.33 | 8.28 | 30.74 | 0.9539 | 0.1665 | |||

| 872307903 / TCF Financial Corporation | 0.21 | 19.47 | 8.26 | 21.91 | 0.9512 | 0.1092 | |||

| VTLE / Vital Energy, Inc. | 0.18 | 62.38 | 8.22 | 33.28 | 0.9466 | 0.1802 | |||

| PBH / Prestige Consumer Healthcare Inc. | 0.13 | -0.61 | 8.01 | 6.39 | 0.9231 | -0.0132 | |||

| HOUS / Anywhere Real Estate Inc. | 0.97 | -0.59 | 7.88 | 25.39 | 0.9081 | 0.1265 | |||

| GATX / GATX Corporation | 0.06 | -0.60 | 7.79 | 9.80 | 0.8971 | 0.0154 | |||

| DRH / DiamondRock Hospitality Company | 0.83 | -0.60 | 7.79 | 16.23 | 0.8970 | 0.0642 | |||

| BDC / Belden Inc. | 0.10 | -0.61 | 7.77 | -20.48 | 0.8952 | -0.3196 | |||

| ENS / EnerSys | 0.07 | -0.61 | 7.52 | 6.00 | 0.8665 | -0.0157 | |||

| CARG / CarGurus, Inc. | 0.31 | 8.71 | 7.52 | 49.92 | 0.8660 | 0.2426 | |||

| PDCO / Patterson Companies, Inc. | 0.26 | -0.60 | 7.41 | -4.59 | 0.8535 | -0.1118 | |||

| JBL / Jabil Inc. | 0.06 | -20.16 | 7.38 | -19.84 | 0.8501 | -0.2943 | |||

| TGI / Triumph Group, Inc. | 0.44 | -0.60 | 7.29 | 115.18 | 0.8393 | 0.4184 | |||

| AMCX / AMC Networks Inc. | 0.38 | 14.13 | 7.20 | 82.03 | 0.8299 | 0.3379 | |||

| WAFD / WaFd, Inc | 0.22 | -0.58 | 7.15 | 27.92 | 0.8235 | 0.1287 | |||

| HOPE / Hope Bancorp, Inc. | 0.58 | -0.60 | 7.05 | 35.68 | 0.8117 | 0.1661 | |||

| BAND / Bandwidth Inc. | 0.49 | -0.59 | 7.02 | 27.65 | 0.8085 | 0.1249 | |||

| NMIH / NMI Holdings, Inc. | 0.23 | -0.58 | 6.89 | 8.94 | 0.7934 | 0.0074 | |||

| X / United States Steel Corporation | 0.14 | -9.28 | 6.83 | 35.87 | 0.7863 | 0.1619 | |||

| BV / BrightView Holdings, Inc. | 0.80 | 10.31 | 6.77 | 19.86 | 0.7801 | 0.0777 | |||

| CRK / Comstock Resources, Inc. | 0.76 | -0.59 | 6.70 | -20.24 | 0.7717 | -0.2724 | |||

| BGS / B&G Foods, Inc. | 0.63 | 4.28 | 6.62 | 10.72 | 0.7628 | 0.0193 | |||

| WEX / WEX Inc. | 0.03 | -0.61 | 6.61 | 2.80 | 0.7615 | -0.0378 | |||

| M / Macy's, Inc. | 0.33 | -9.28 | 6.60 | 57.20 | 0.7609 | 0.2386 | |||

| ANTX / AN2 Therapeutics, Inc. | 0.01 | -9.24 | 6.60 | -1.71 | 0.7605 | -0.0745 | |||

| SYNA / Synaptics Incorporated | 0.06 | -0.60 | 6.57 | 26.78 | 0.7571 | 0.1127 | |||

| PFBC / Preferred Bank | 0.09 | 6.52 | 0.7513 | 0.7513 | |||||

| BANC / Banc of California, Inc. | 0.48 | 11.75 | 6.47 | 21.23 | 0.7454 | 0.0819 | |||

| SPTN / SpartanNash Company | 0.28 | 20.07 | 6.46 | 25.26 | 0.7445 | 0.1031 | |||

| MTZ / MasTec, Inc. | 0.09 | 21.32 | 6.45 | 27.66 | 0.7428 | 0.1148 | |||

| ACRE / Ares Commercial Real Estate Corporation | 0.61 | -0.59 | 6.29 | 8.19 | 0.7242 | 0.0018 | |||

| TMHC / Taylor Morrison Home Corporation | 0.11 | -9.28 | 5.98 | 13.60 | 0.6891 | 0.0344 | |||

| TXT / Textron Inc. | 0.07 | -9.29 | 5.96 | -6.64 | 0.6866 | -0.1071 | |||

| LGND / Ligand Pharmaceuticals Incorporated | 0.08 | 34.39 | 5.94 | 60.22 | 0.6839 | 0.2232 | |||

| GDOT / Green Dot Corporation | 0.60 | 54.13 | 5.91 | 9.54 | 0.6813 | 0.0101 | |||

| CI / The Cigna Group | 0.02 | -9.29 | 5.85 | -5.05 | 0.6737 | -0.0919 | |||

| CCRN / Cross Country Healthcare, Inc. | 0.25 | 1.51 | 5.76 | -7.29 | 0.6638 | -0.1089 | |||

| AN / AutoNation, Inc. | 0.04 | -9.30 | 5.72 | -10.03 | 0.6585 | -0.1313 | |||

| RS / Reliance, Inc. | 0.02 | -9.30 | 5.69 | -3.26 | 0.6555 | -0.0757 | |||

| OI / O-I Glass, Inc. | 0.34 | 5.14 | 5.59 | 2.95 | 0.6435 | -0.0311 | |||

| SFM / Sprouts Farmers Market, Inc. | 0.12 | -36.26 | 5.56 | -28.35 | 0.6409 | -0.3244 | |||

| WSM / Williams-Sonoma, Inc. | 0.03 | -9.28 | 5.56 | 17.79 | 0.6407 | 0.0537 | |||

| ZM / Zoom Communications Inc. | 0.08 | 29.50 | 5.48 | 33.15 | 0.6313 | 0.1196 | |||

| FANG / Diamondback Energy, Inc. | 0.03 | -9.25 | 5.32 | -9.13 | 0.6134 | -0.1151 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.04 | -9.26 | 5.30 | 22.83 | 0.6100 | 0.0740 | |||

| VBTX / Veritex Holdings, Inc. | 0.23 | -0.59 | 5.29 | 28.86 | 0.6092 | 0.0991 | |||

| ACM / AECOM | 0.06 | -9.30 | 5.27 | 0.96 | 0.6068 | -0.0418 | |||

| PAHC / Phibro Animal Health Corporation | 0.45 | -0.59 | 5.19 | -9.86 | 0.5975 | -0.1178 | |||

| STLD / Steel Dynamics, Inc. | 0.04 | -9.28 | 5.18 | -0.08 | 0.5967 | -0.0477 | |||

| CLFD / Clearfield, Inc. | 0.18 | 5.15 | 0.5931 | 0.5931 | |||||

| LITE / Lumentum Holdings Inc. | 0.10 | -9.26 | 5.11 | 5.27 | 0.5891 | -0.0148 | |||

| PMT / PennyMac Mortgage Investment Trust | 0.33 | -0.60 | 4.98 | 19.85 | 0.5740 | 0.0571 | |||

| MD / Pediatrix Medical Group, Inc. | 0.53 | 51.47 | 4.97 | 10.81 | 0.5728 | 0.0151 | |||

| PRA / ProAssurance Corporation | 0.36 | 6.61 | 4.92 | -22.19 | 0.5670 | -0.2192 | |||

| ELAN / Elanco Animal Health Incorporated | 0.32 | 16.02 | 4.81 | 53.81 | 0.5536 | 0.1651 | |||

| AL / Air Lease Corporation | 0.11 | 9.02 | 4.80 | 16.01 | 0.5534 | 0.0387 | |||

| CBRE / CBRE Group, Inc. | 0.05 | -9.29 | 4.79 | 14.32 | 0.5520 | 0.0310 | |||

| RJF / Raymond James Financial, Inc. | 0.04 | -9.28 | 4.71 | 0.70 | 0.5431 | -0.0388 | |||

| TPR / Tapestry, Inc. | 0.13 | -9.28 | 4.69 | 16.13 | 0.5399 | 0.0383 | |||

| SAIC / Science Applications International Corporation | 0.04 | -9.28 | 4.66 | 6.85 | 0.5371 | -0.0053 | |||

| AMSF / AMERISAFE, Inc. | 0.10 | -0.61 | 4.63 | -7.14 | 0.5331 | -0.0864 | |||

| HUM / Humana Inc. | 0.01 | -9.24 | 4.58 | -14.61 | 0.5272 | -0.1390 | |||

| PLXS / Plexus Corp. | 0.04 | -9.26 | 4.56 | 5.54 | 0.5249 | -0.0119 | |||

| ARW / Arrow Electronics, Inc. | 0.04 | -9.28 | 4.55 | -11.45 | 0.5246 | -0.1147 | |||

| SLGN / Silgan Holdings Inc. | 0.10 | -0.45 | 4.53 | 4.50 | 0.5213 | -0.0171 | |||

| WDC / Western Digital Corporation | 0.09 | -16.83 | 4.50 | -4.54 | 0.5187 | -0.0677 | |||

| WLK / Westlake Corporation | 0.03 | -9.25 | 4.49 | 1.88 | 0.5174 | -0.0306 | |||

| VSH / Vishay Intertechnology, Inc. | 0.19 | -9.28 | 4.44 | -12.05 | 0.5113 | -0.1160 | |||

| RDN / Radian Group Inc. | 0.15 | -9.28 | 4.38 | 3.16 | 0.5044 | -0.0233 | |||

| PLCE / The Children's Place, Inc. | 0.19 | -0.60 | 4.37 | -14.61 | 0.5036 | -0.1328 | |||

| JLL / Jones Lang LaSalle Incorporated | 0.02 | -9.33 | 4.37 | 21.28 | 0.5036 | 0.0556 | |||

| SWKS / Skyworks Solutions, Inc. | 0.04 | -9.29 | 4.32 | 3.45 | 0.4981 | -0.0216 | |||

| HPE / Hewlett Packard Enterprise Company | 0.25 | -9.28 | 4.31 | -11.33 | 0.4970 | -0.1078 | |||

| COLB / Columbia Banking System, Inc. | 0.16 | -0.60 | 4.28 | 30.67 | 0.4928 | 0.0857 | |||

| GCO / Genesco Inc. | 0.12 | -0.60 | 4.21 | 13.58 | 0.4848 | 0.0241 | |||

| CDP / COPT Defense Properties | 0.16 | -9.29 | 3.99 | -2.44 | 0.4598 | -0.0488 | |||

| CNP / CenterPoint Energy, Inc. | 0.14 | -9.28 | 3.95 | -3.45 | 0.4548 | -0.0536 | |||

| DINO / HF Sinclair Corporation | 0.07 | -9.28 | 3.93 | -11.47 | 0.4527 | -0.0990 | |||

| UBSI / United Bankshares, Inc. | 0.10 | -0.59 | 3.90 | 35.31 | 0.4495 | 0.0910 | |||

| SF / Stifel Financial Corp. | 0.06 | -9.26 | 3.83 | 2.11 | 0.4409 | -0.0250 | |||

| INGR / Ingredion Incorporated | 0.04 | 14.29 | 3.81 | 26.08 | 0.4389 | 0.0632 | |||

| REZI / Resideo Technologies, Inc. | 0.20 | -9.28 | 3.79 | 8.04 | 0.4367 | 0.0006 | |||

| VLO / Valero Energy Corporation | 0.03 | -9.25 | 3.77 | -16.76 | 0.4349 | -0.1288 | |||

| RL / Ralph Lauren Corporation | 0.03 | -9.26 | 3.73 | 12.72 | 0.4299 | 0.0183 | |||

| SLG / SL Green Realty Corp. | 0.08 | -9.28 | 3.72 | 9.87 | 0.4283 | 0.0076 | |||

| JNPR / Juniper Networks, Inc. | 0.13 | -9.28 | 3.71 | -3.79 | 0.4274 | -0.0519 | |||

| MDRX / Veradigm Inc. | 0.35 | -33.06 | 3.69 | -46.56 | 0.4254 | -0.4336 | |||

| FULT / Fulton Financial Corporation | 0.22 | -9.28 | 3.69 | 23.31 | 0.4248 | 0.0530 | |||

| PTEN / Patterson-UTI Energy, Inc. | 0.34 | -9.30 | 3.68 | -29.22 | 0.4242 | -0.2226 | |||

| DFS / Discover Financial Services | 0.03 | -9.25 | 3.65 | 17.77 | 0.4199 | 0.0351 | |||

| GNTX / Gentex Corporation | 0.11 | -9.28 | 3.64 | -8.94 | 0.4191 | -0.0776 | |||

| FL / Foot Locker, Inc. | 0.12 | -9.27 | 3.63 | 62.91 | 0.4186 | 0.1413 | |||

| RF / Regions Financial Corporation | 0.18 | -9.28 | 3.56 | 2.24 | 0.4105 | -0.0229 | |||

| KLIC / Kulicke and Soffa Industries, Inc. | 0.07 | -9.27 | 3.56 | 2.09 | 0.4104 | -0.0234 | |||

| HST / Host Hotels & Resorts, Inc. | 0.18 | -9.27 | 3.53 | 9.94 | 0.4066 | 0.0074 | |||

| COF / Capital One Financial Corporation | 0.03 | -9.26 | 3.49 | 22.61 | 0.4023 | 0.0482 | |||

| CE / Celanese Corporation | 0.02 | -9.29 | 3.40 | 12.30 | 0.3914 | 0.0152 | |||

| FITB / Fifth Third Bancorp | 0.10 | -9.28 | 3.38 | 23.57 | 0.3896 | 0.0492 | |||

| EWBC / East West Bancorp, Inc. | 0.05 | -9.28 | 3.37 | 23.82 | 0.3881 | 0.0499 | |||

| FAF / First American Financial Corporation | 0.05 | -9.29 | 3.35 | 3.49 | 0.3863 | -0.0166 | |||

| OGE / OGE Energy Corp. | 0.09 | 3.23 | 0.3717 | 0.3717 | |||||

| CATY / Cathay General Bancorp | 0.07 | -9.29 | 3.18 | 16.30 | 0.3658 | 0.0264 | |||

| LEA / Lear Corporation | 0.02 | -9.32 | 3.13 | -4.58 | 0.3604 | -0.0472 | |||

| LUV / Southwest Airlines Co. | 0.10 | -9.28 | 3.02 | -3.21 | 0.3479 | -0.0400 | |||

| LH / Labcorp Holdings Inc. | 0.01 | -9.30 | 2.91 | 2.54 | 0.3350 | -0.0176 | |||

| DBI / Designer Brands Inc. | 0.31 | -9.28 | 2.74 | -36.60 | 0.3154 | -0.2213 | |||

| MTB / M&T Bank Corporation | 0.02 | -9.27 | 2.70 | -1.64 | 0.3115 | -0.0303 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.04 | -9.29 | 2.65 | -2.54 | 0.3050 | -0.0327 | |||

| TCBI / Texas Capital Bancshares, Inc. | 0.04 | -9.28 | 2.62 | -0.46 | 0.3018 | -0.0254 | |||

| HBAN / Huntington Bancshares Incorporated | 0.19 | -9.28 | 2.48 | 10.97 | 0.2856 | 0.0078 | |||

| KEY / KeyCorp | 0.17 | -9.28 | 2.47 | 21.41 | 0.2842 | 0.0316 | |||

| GLW / Corning Incorporated | 0.07 | -9.29 | 2.21 | -9.35 | 0.2547 | -0.0485 | |||

| JBLU / JetBlue Airways Corporation | 0.36 | -9.28 | 1.99 | 9.46 | 0.2294 | 0.0032 | |||

| AEE / Ameren Corporation | 0.02 | -9.28 | 1.58 | -12.30 | 0.1816 | -0.0419 | |||

| NXGN / NextGen Healthcare Inc | 0.00 | -100.00 | 0.00 | -100.00 | -0.7241 | ||||

| COMM / CommScope Holding Company, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1481 | ||||

| ESTE / Earthstone Energy Inc - Class A | 0.00 | -100.00 | 0.00 | -100.00 | -1.2881 | ||||

| EGRX / Eagle Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5354 | ||||

| WOR / Worthington Enterprises, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9489 | ||||

| CHS / Chico's FAS, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7226 |