Mga Batayang Estadistika

| Nilai Portofolio | $ 571,934,478 |

| Posisi Saat Ini | 122 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

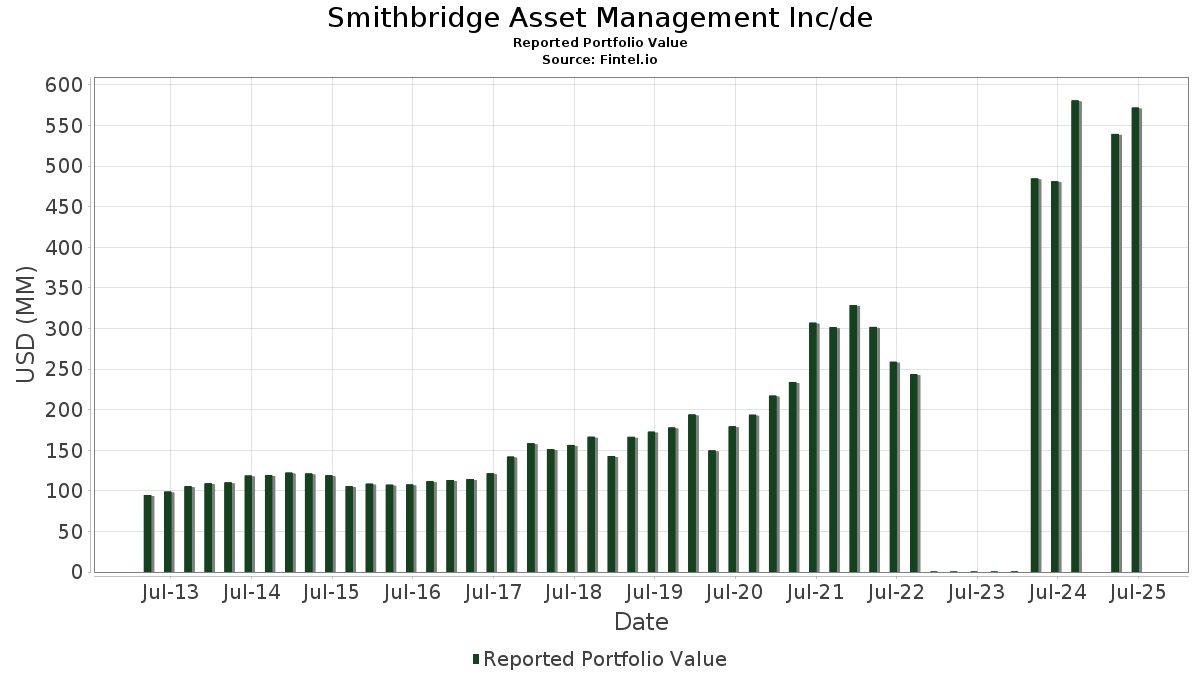

Smithbridge Asset Management Inc/de telah mengungkapkan total kepemilikan 122 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 571,934,478 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Smithbridge Asset Management Inc/de adalah Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Amazon.com, Inc. (US:AMZN) , and SPDR S&P 500 ETF (US:SPY) . Posisi baru Smithbridge Asset Management Inc/de meliputi: Royal Caribbean Cruises Ltd. (US:RCL) , Take-Two Interactive Software, Inc. (US:TTWO) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 7.83 | 1.3697 | 1.3697 | |

| 0.03 | 6.89 | 1.2045 | 1.2045 | |

| 0.12 | 15.98 | 2.7937 | 1.0195 | |

| 0.14 | 21.64 | 3.7833 | 0.9955 | |

| 0.06 | 30.12 | 5.2670 | 0.9433 | |

| 0.13 | 8.25 | 1.4431 | 0.7001 | |

| 0.06 | 6.03 | 1.0542 | 0.4970 | |

| 0.01 | 12.76 | 2.2314 | 0.4887 | |

| 0.46 | 13.33 | 2.3312 | 0.3478 | |

| 0.05 | 9.12 | 1.5950 | 0.2449 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.16 | 32.34 | 5.6549 | -1.0344 | |

| 0.02 | 6.70 | 1.1707 | -0.9712 | |

| 0.03 | 9.06 | 1.5840 | -0.9316 | |

| 0.05 | 1.30 | 0.2266 | -0.8764 | |

| 0.05 | 8.55 | 1.4953 | -0.5153 | |

| 0.01 | 0.40 | 0.0704 | -0.4309 | |

| 0.01 | 0.34 | 0.0587 | -0.3329 | |

| 0.04 | 7.64 | 1.3365 | -0.3268 | |

| 0.01 | 9.97 | 1.7428 | -0.3160 | |

| 0.04 | 1.03 | 0.1798 | -0.2769 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-29 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.16 | -3.00 | 32.34 | -10.40 | 5.6549 | -1.0344 | |||

| MSFT / Microsoft Corporation | 0.06 | -2.56 | 30.12 | 29.11 | 5.2670 | 0.9433 | |||

| NVDA / NVIDIA Corporation | 0.14 | -1.33 | 21.64 | 43.83 | 3.7833 | 0.9955 | |||

| AMZN / Amazon.com, Inc. | 0.08 | -3.22 | 17.02 | 11.61 | 2.9759 | 0.1497 | |||

| SPY / SPDR S&P 500 ETF | 0.03 | 2.00 | 16.98 | 12.66 | 2.9685 | 0.1759 | |||

| VRT / Vertiv Holdings Co | 0.12 | -6.16 | 15.98 | 66.89 | 2.7937 | 1.0195 | |||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.04 | 0.92 | 15.88 | 5.91 | 2.7774 | -0.0019 | |||

| APO / Apollo Global Management, Inc. | 0.10 | -2.78 | 14.00 | 0.72 | 2.4473 | -0.1279 | |||

| JPM / JPMorgan Chase & Co. | 0.05 | -0.82 | 13.38 | 17.22 | 2.3402 | 0.2242 | |||

| SCHG / Schwab Strategic Trust - Schwab U.S. Large-Cap Growth ETF | 0.46 | 6.79 | 13.33 | 24.57 | 2.3312 | 0.3478 | |||

| NFLX / Netflix, Inc. | 0.01 | -5.49 | 12.76 | 35.71 | 2.2314 | 0.4887 | |||

| GOOG / Alphabet Inc. | 0.06 | -1.86 | 11.17 | 11.44 | 1.9522 | 0.0954 | |||

| URI / United Rentals, Inc. | 0.01 | -5.25 | 10.89 | 13.90 | 1.9040 | 0.1323 | |||

| QCOM / QUALCOMM Incorporated | 0.07 | -2.01 | 10.57 | 1.60 | 1.8479 | -0.0799 | |||

| AJG / Arthur J. Gallagher & Co. | 0.03 | -0.48 | 10.41 | -7.72 | 1.8202 | -0.2705 | |||

| LLY / Eli Lilly and Company | 0.01 | -4.94 | 9.97 | -10.29 | 1.7428 | -0.3160 | |||

| RTX / RTX Corporation | 0.07 | 0.19 | 9.64 | 10.44 | 1.6854 | 0.0680 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.36 | 20.10 | 9.60 | 13.83 | 1.6777 | 0.1156 | |||

| SPYV / SPDR Series Trust - SPDR Portfolio S&P 500 Value ETF | 0.17 | 17.97 | 9.13 | 20.90 | 1.5965 | 0.1969 | |||

| AMAT / Applied Materials, Inc. | 0.05 | -0.74 | 9.12 | 25.22 | 1.5950 | 0.2449 | |||

| APP / AppLovin Corporation | 0.03 | -49.49 | 9.06 | -33.27 | 1.5840 | -0.9316 | |||

| TJX / The TJX Companies, Inc. | 0.07 | 0.03 | 8.79 | 1.42 | 1.5362 | -0.0692 | |||

| FI / Fiserv, Inc. | 0.05 | 0.96 | 8.55 | -21.18 | 1.4953 | -0.5153 | |||

| JIRE / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan International Research Enhanced Equity ETF | 0.12 | 3.44 | 8.41 | 14.88 | 1.4711 | 0.1140 | |||

| PANW / Palo Alto Networks, Inc. | 0.04 | -5.21 | 8.28 | 13.68 | 1.4475 | 0.0980 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.13 | 93.68 | 8.25 | 105.86 | 1.4431 | 0.7001 | |||

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.10 | 7.04 | 8.17 | 18.12 | 1.4282 | 0.1467 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.03 | 7.83 | 1.3697 | 1.3697 | |||||

| ACN / Accenture plc | 0.03 | 1.28 | 7.74 | -2.98 | 1.3537 | -0.1252 | |||

| ABBV / AbbVie Inc. | 0.04 | -3.87 | 7.64 | -14.84 | 1.3365 | -0.3268 | |||

| GOOGL / Alphabet Inc. | 0.04 | -4.75 | 7.32 | 8.55 | 1.2803 | 0.0302 | |||

| SYK / Stryker Corporation | 0.02 | 0.79 | 7.09 | 7.12 | 1.2389 | 0.0131 | |||

| TTWO / Take-Two Interactive Software, Inc. | 0.03 | 6.89 | 1.2045 | 1.2045 | |||||

| HON / Honeywell International Inc. | 0.03 | 0.81 | 6.78 | 10.87 | 1.1858 | 0.0522 | |||

| UNH / UnitedHealth Group Incorporated | 0.02 | -2.75 | 6.70 | -42.07 | 1.1707 | -0.9712 | |||

| JNJ / Johnson & Johnson | 0.04 | 1.66 | 6.41 | -6.37 | 1.1208 | -0.1478 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.09 | 3.50 | 6.32 | 2.88 | 1.1058 | -0.0334 | |||

| SHW / The Sherwin-Williams Company | 0.02 | -4.99 | 6.22 | -6.58 | 1.0876 | -0.1462 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | 0.21 | 6.18 | 29.83 | 1.0813 | 0.1985 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.06 | 91.85 | 6.03 | 100.57 | 1.0542 | 0.4970 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.05 | 1.11 | 5.87 | 9.76 | 1.0267 | 0.0353 | |||

| LMT / Lockheed Martin Corporation | 0.01 | 1.38 | 5.67 | 5.11 | 0.9920 | -0.0083 | |||

| ABT / Abbott Laboratories | 0.04 | 1.40 | 5.56 | 3.96 | 0.9721 | -0.0189 | |||

| MDT / Medtronic plc | 0.06 | 3.55 | 5.44 | 0.44 | 0.9513 | -0.0524 | |||

| ECL / Ecolab Inc. | 0.02 | 0.94 | 5.39 | 7.29 | 0.9419 | 0.0113 | |||

| CRM / Salesforce, Inc. | 0.02 | -3.38 | 5.31 | -1.81 | 0.9282 | -0.0738 | |||

| MA / Mastercard Incorporated | 0.01 | -5.07 | 5.03 | -2.67 | 0.8792 | -0.0783 | |||

| PG / The Procter & Gamble Company | 0.03 | 2.15 | 4.96 | -4.48 | 0.8678 | -0.0953 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.06 | 1.11 | 3.93 | 3.86 | 0.6863 | -0.0141 | |||

| ROK / Rockwell Automation, Inc. | 0.01 | -1.13 | 3.88 | 27.11 | 0.6781 | 0.1127 | |||

| EOG / EOG Resources, Inc. | 0.03 | -5.01 | 3.66 | -11.42 | 0.6392 | -0.1255 | |||

| TROW / T. Rowe Price Group, Inc. | 0.04 | 1.41 | 3.63 | 6.52 | 0.6339 | 0.0032 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | -4.87 | 3.55 | -22.49 | 0.6213 | -0.2282 | |||

| LH / Labcorp Holdings Inc. | 0.01 | 3.30 | 3.49 | 16.53 | 0.6100 | 0.0551 | |||

| PEP / PepsiCo, Inc. | 0.03 | 0.83 | 3.46 | -11.20 | 0.6043 | -0.1170 | |||

| CNI / Canadian National Railway Company | 0.03 | -1.02 | 3.19 | 5.64 | 0.5572 | -0.0017 | |||

| AKAM / Akamai Technologies, Inc. | 0.03 | -4.97 | 2.62 | -5.82 | 0.4584 | -0.0576 | |||

| SEIC / SEI Investments Company | 0.03 | 0.00 | 2.35 | 15.79 | 0.4117 | 0.0347 | |||

| DLTR / Dollar Tree, Inc. | 0.02 | -5.07 | 2.22 | 25.30 | 0.3880 | 0.0597 | |||

| OC / Owens Corning | 0.02 | -4.87 | 2.17 | -8.40 | 0.3796 | -0.0596 | |||

| EMXC / iShares, Inc. - iShares MSCI Emerging Markets ex China ETF | 0.03 | 3.17 | 2.15 | 18.24 | 0.3753 | 0.0389 | |||

| IEMG / iShares, Inc. - iShares Core MSCI Emerging Markets ETF | 0.03 | 3.65 | 2.09 | 15.25 | 0.3661 | 0.0295 | |||

| IDCC / InterDigital, Inc. | 0.01 | 0.00 | 1.79 | 8.40 | 0.3136 | 0.0071 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.05 | -20.68 | 1.64 | -27.96 | 0.2875 | -0.1354 | |||

| KMI / Kinder Morgan, Inc. | 0.06 | 0.00 | 1.63 | 3.10 | 0.2850 | -0.0081 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -15.67 | 1.54 | -6.84 | 0.2692 | -0.0370 | |||

| VLO / Valero Energy Corporation | 0.01 | -5.22 | 1.52 | -3.55 | 0.2665 | -0.0263 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -7.14 | 1.51 | 16.76 | 0.2632 | 0.0241 | |||

| CMI / Cummins Inc. | 0.00 | -6.43 | 1.32 | -2.22 | 0.2316 | -0.0195 | |||

| SCHM / Schwab Strategic Trust - Schwab U.S. Mid-Cap ETF | 0.05 | -79.66 | 1.30 | -78.23 | 0.2266 | -0.8764 | |||

| COR / Cencora, Inc. | 0.00 | -7.35 | 1.21 | -0.08 | 0.2122 | -0.0129 | |||

| EW / Edwards Lifesciences Corporation | 0.02 | 6.93 | 1.19 | 15.38 | 0.2086 | 0.0170 | |||

| GD / General Dynamics Corporation | 0.00 | 0.00 | 1.18 | 7.07 | 0.2065 | 0.0020 | |||

| AFL / Aflac Incorporated | 0.01 | 0.00 | 1.07 | -5.14 | 0.1872 | -0.0220 | |||

| SLB / Schlumberger Limited | 0.03 | 6.84 | 1.04 | -13.63 | 0.1817 | -0.0412 | |||

| SCHA / Schwab Strategic Trust - Schwab U.S. Small-Cap ETF | 0.04 | -61.36 | 1.03 | -58.28 | 0.1798 | -0.2769 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.02 | -7.18 | 1.02 | 4.18 | 0.1789 | -0.0032 | |||

| IWN / iShares Trust - iShares Russell 2000 Value ETF | 0.01 | 0.00 | 0.99 | 4.41 | 0.1739 | -0.0025 | |||

| ELV / Elevance Health, Inc. | 0.00 | -7.08 | 0.95 | -16.90 | 0.1660 | -0.0457 | |||

| EQIX / Equinix, Inc. | 0.00 | -7.56 | 0.92 | -9.77 | 0.1616 | -0.0283 | |||

| DHI / D.R. Horton, Inc. | 0.01 | -7.40 | 0.90 | -6.09 | 0.1565 | -0.0201 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | -6.94 | 0.88 | -1.34 | 0.1547 | -0.0114 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.00 | -1.15 | 0.88 | 4.28 | 0.1534 | -0.0025 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | -0.32 | 0.84 | 10.25 | 0.1467 | 0.0056 | |||

| NOC / Northrop Grumman Corporation | 0.00 | -3.91 | 0.84 | -6.17 | 0.1463 | -0.0189 | |||

| CVX / Chevron Corporation | 0.01 | 0.00 | 0.82 | -14.45 | 0.1440 | -0.0343 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | -6.92 | 0.82 | -11.48 | 0.1429 | -0.0282 | |||

| PSA / Public Storage | 0.00 | -7.89 | 0.73 | -9.73 | 0.1283 | -0.0223 | |||

| SCHB / Schwab Strategic Trust - Schwab U.S. Broad Market ETF | 0.03 | -22.55 | 0.72 | -14.29 | 0.1260 | -0.0298 | |||

| KR / The Kroger Co. | 0.01 | -8.88 | 0.70 | -3.44 | 0.1227 | -0.0120 | |||

| DVN / Devon Energy Corporation | 0.02 | -6.57 | 0.69 | -20.55 | 0.1203 | -0.0402 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 0.68 | 31.40 | 0.1186 | 0.0229 | |||

| AVY / Avery Dennison Corporation | 0.00 | -51.40 | 0.65 | -52.11 | 0.1134 | -0.1374 | |||

| NTAP / NetApp, Inc. | 0.01 | -7.29 | 0.65 | 12.52 | 0.1132 | 0.0065 | |||

| IWO / iShares Trust - iShares Russell 2000 Growth ETF | 0.00 | 0.00 | 0.65 | 11.98 | 0.1128 | 0.0059 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | 0.00 | 0.64 | -0.31 | 0.1120 | -0.0071 | |||

| MET / MetLife, Inc. | 0.01 | -6.62 | 0.63 | -6.37 | 0.1105 | -0.0147 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.01 | 1,400.00 | 0.61 | -5.59 | 0.1064 | -0.0131 | |||

| V / Visa Inc. | 0.00 | 0.13 | 0.54 | 1.52 | 0.0937 | -0.0042 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 1.32 | 0.52 | -7.62 | 0.0912 | -0.0134 | |||

| BAC / Bank of America Corporation | 0.01 | 0.00 | 0.52 | 13.51 | 0.0911 | 0.0060 | |||

| LFST / LifeStance Health Group, Inc. | 0.08 | 0.00 | 0.44 | -22.38 | 0.0764 | -0.0279 | |||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 0.01 | -46.06 | 0.41 | -49.26 | 0.0715 | -0.0779 | |||

| NKE / NIKE, Inc. | 0.01 | -86.69 | 0.40 | -85.14 | 0.0704 | -0.4309 | |||

| VBK / Vanguard Index Funds - Vanguard Small-Cap Growth ETF | 0.00 | -74.13 | 0.38 | -71.60 | 0.0662 | -0.1805 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.02 | 4.37 | 0.35 | 1.72 | 0.0620 | -0.0026 | |||

| EES / WisdomTree Trust - WisdomTree U.S. SmallCap Fund | 0.01 | -84.77 | 0.34 | -84.15 | 0.0587 | -0.3329 | |||

| WSM / Williams-Sonoma, Inc. | 0.00 | 0.05 | 0.33 | 3.17 | 0.0569 | -0.0015 | |||

| ITOT / iShares Trust - iShares Core S&P Total U.S. Stock Market ETF | 0.00 | 0.00 | 0.32 | 10.96 | 0.0567 | 0.0024 | |||

| EMR / Emerson Electric Co. | 0.00 | 0.00 | 0.32 | 21.29 | 0.0559 | 0.0072 | |||

| IYW / iShares Trust - iShares U.S. Technology ETF | 0.00 | -14.75 | 0.31 | 5.05 | 0.0546 | -0.0004 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 0.31 | 4.73 | 0.0543 | -0.0007 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.25 | 0.00 | 0.0446 | -0.0026 | |||

| PAYX / Paychex, Inc. | 0.00 | 0.00 | 0.25 | -5.73 | 0.0432 | -0.0054 | |||

| XCEM / Columbia ETF Trust II - Columbia EM Core ex-China ETF | 0.01 | -5.36 | 0.23 | 9.39 | 0.0409 | 0.0013 | |||

| ALL / The Allstate Corporation | 0.00 | 0.00 | 0.23 | -2.60 | 0.0394 | -0.0036 | |||

| AMGN / Amgen Inc. | 0.00 | 0.00 | 0.22 | -10.44 | 0.0391 | -0.0071 | |||

| DE / Deere & Company | 0.00 | 0.00 | 0.22 | 8.50 | 0.0380 | 0.0008 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.00 | -14.24 | 0.21 | -10.04 | 0.0361 | -0.0063 | |||

| FDM / First Trust Exchange-Traded Fund - First Trust Dow Jones Select MicroCap Index Fund | 0.00 | -86.28 | 0.21 | -84.21 | 0.0359 | -0.2048 | |||

| VBR / Vanguard Index Funds - Vanguard Small-Cap Value ETF | 0.00 | 0.20 | 0.0351 | 0.0351 | |||||

| OMEX / Odyssey Marine Exploration, Inc. | 0.01 | -15.44 | 0.02 | 150.00 | 0.0027 | 0.0015 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MRK / Merck & Co., Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XLB / The Select Sector SPDR Trust - The Materials Select Sector SPDR Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HDV / iShares Trust - iShares Core High Dividend ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XLP / The Select Sector SPDR Trust - The Consumer Staples Select Sector SPDR Fund | 0.00 | -100.00 | 0.00 | 0.0000 |