Mga Batayang Estadistika

| Nilai Portofolio | $ 306,837,353 |

| Posisi Saat Ini | 183 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

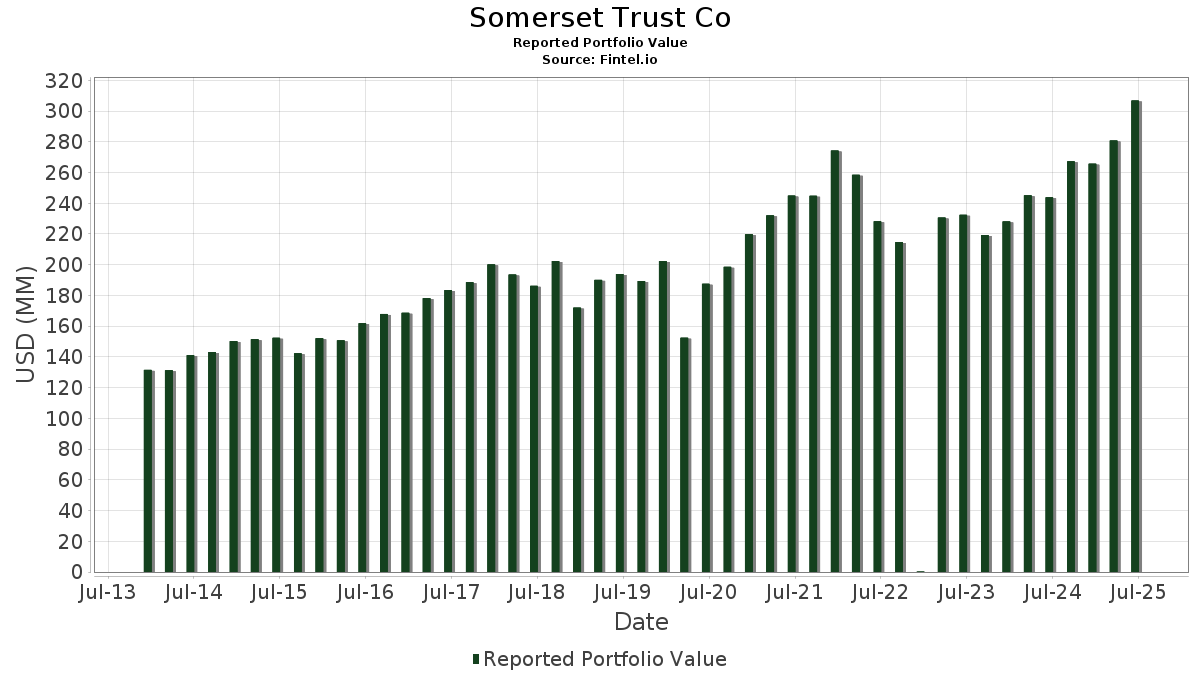

Somerset Trust Co telah mengungkapkan total kepemilikan 183 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 306,837,353 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Somerset Trust Co adalah Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , JPMorgan Chase & Co. (US:JPM) , Cisco Systems, Inc. (US:CSCO) , and Walmart Inc. (US:WMT) . Posisi baru Somerset Trust Co meliputi: Broadcom Inc. (US:AVGO) , Meta Platforms, Inc. (US:META) , Constellation Energy Corporation (US:CEG) , Reddit, Inc. (US:RDDT) , and Alibaba Group Holding Limited - Depositary Receipt (Common Stock) (US:BABA) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 4.73 | 1.5422 | 1.5422 | |

| 0.01 | 4.69 | 1.5299 | 1.5299 | |

| 0.01 | 3.14 | 1.0246 | 1.0246 | |

| 0.01 | 0.75 | 0.2454 | 0.2454 | |

| 0.01 | 0.58 | 0.1885 | 0.1885 | |

| 0.02 | 0.56 | 0.1823 | 0.1823 | |

| 0.03 | 10.04 | 3.2707 | 0.1803 | |

| 0.00 | 1.49 | 0.4840 | 0.1441 | |

| 0.01 | 0.36 | 0.1189 | 0.1189 | |

| 0.01 | 0.36 | 0.1172 | 0.1172 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 5.70 | 1.3179 | -0.9479 | |

| 0.04 | 5.89 | 1.3607 | -0.9091 | |

| 0.05 | 5.74 | 1.3268 | -0.8703 | |

| 0.09 | 6.24 | 1.4411 | -0.8236 | |

| 0.02 | 5.35 | 1.2370 | -0.8110 | |

| 0.03 | 4.78 | 1.1053 | -0.7213 | |

| 0.04 | 5.93 | 1.3708 | -0.7114 | |

| 0.01 | 5.30 | 1.2245 | -0.6763 | |

| 0.05 | 11.24 | 3.6631 | -0.6749 | |

| 0.02 | 2.83 | 0.6539 | -0.6677 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-07 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.03 | -0.17 | 16.88 | 32.27 | 3.9007 | -0.6433 | |||

| AAPL / Apple Inc. | 0.05 | -0.11 | 11.24 | -7.73 | 3.6631 | -0.6749 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | -2.15 | 10.04 | 15.64 | 3.2707 | 0.1803 | |||

| CSCO / Cisco Systems, Inc. | 0.11 | -0.42 | 7.59 | 11.96 | 1.7549 | -0.6604 | |||

| WMT / Walmart Inc. | 0.08 | -2.19 | 7.48 | 8.94 | 2.4393 | -0.0073 | |||

| LOW / Lowe's Companies, Inc. | 0.03 | -0.08 | 6.75 | -4.95 | 2.1985 | -0.3288 | |||

| ADI / Analog Devices, Inc. | 0.03 | -0.29 | 6.46 | 17.67 | 1.4928 | -0.4620 | |||

| FDN / First Trust Exchange-Traded Fund - First Trust Dow Jones Internet Index Fund | 0.02 | -2.27 | 6.35 | 18.48 | 1.4668 | -0.4409 | |||

| NEE / NextEra Energy, Inc. | 0.09 | 0.13 | 6.24 | -1.95 | 1.4411 | -0.8236 | |||

| ADP / Automatic Data Processing, Inc. | 0.02 | -1.93 | 5.94 | -1.00 | 1.9372 | -0.2012 | |||

| ABT / Abbott Laboratories | 0.04 | -1.06 | 5.93 | 1.45 | 1.3708 | -0.7114 | |||

| JNJ / Johnson & Johnson | 0.04 | 0.29 | 5.89 | -7.61 | 1.3607 | -0.9091 | |||

| AFL / Aflac Incorporated | 0.05 | -1.89 | 5.74 | -6.94 | 1.3268 | -0.8703 | |||

| COST / Costco Wholesale Corporation | 0.01 | -2.54 | 5.71 | 2.00 | 1.8606 | -0.1323 | |||

| AMGN / Amgen Inc. | 0.02 | 0.01 | 5.70 | -10.37 | 1.3179 | -0.9479 | |||

| RTX / RTX Corporation | 0.04 | 0.44 | 5.68 | 10.72 | 1.3132 | -0.5145 | |||

| MCD / McDonald's Corporation | 0.02 | -0.49 | 5.35 | -6.94 | 1.2370 | -0.8110 | |||

| LIN / Linde plc | 0.01 | -1.48 | 5.30 | -0.73 | 1.2245 | -0.6763 | |||

| ITW / Illinois Tool Works Inc. | 0.02 | 0.33 | 4.98 | 0.02 | 1.1501 | -0.6218 | |||

| LHX / L3Harris Technologies, Inc. | 0.02 | 0.26 | 4.90 | 20.15 | 1.1326 | -0.3199 | |||

| BLK / BlackRock, Inc. | 0.00 | 0.28 | 4.88 | 11.19 | 1.1275 | -0.4354 | |||

| PAYX / Paychex, Inc. | 0.03 | -1.10 | 4.78 | -6.77 | 1.1053 | -0.7213 | |||

| AVGO / Broadcom Inc. | 0.02 | 4.73 | 1.5422 | 1.5422 | |||||

| META / Meta Platforms, Inc. | 0.01 | 4.69 | 1.5299 | 1.5299 | |||||

| NSC / Norfolk Southern Corporation | 0.02 | -0.23 | 4.44 | 7.82 | 1.4479 | -0.0194 | |||

| GD / General Dynamics Corporation | 0.01 | -0.60 | 4.31 | 6.33 | 1.4062 | -0.0385 | |||

| MDT / Medtronic plc | 0.05 | 0.14 | 4.26 | -2.85 | 0.9836 | -0.5767 | |||

| CB / Chubb Limited | 0.01 | -1.68 | 4.17 | -5.68 | 0.9629 | -0.6102 | |||

| ACN / Accenture plc | 0.01 | 0.46 | 4.02 | -3.78 | 0.9285 | -0.5585 | |||

| FDS / FactSet Research Systems Inc. | 0.01 | -0.37 | 3.89 | -1.99 | 0.8996 | -0.5146 | |||

| WEC / WEC Energy Group, Inc. | 0.04 | -0.18 | 3.73 | -4.55 | 1.2166 | -0.1763 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | 0.71 | 3.62 | -3.67 | 1.1805 | -0.1587 | |||

| EMR / Emerson Electric Co. | 0.03 | 0.57 | 3.59 | 22.31 | 0.8300 | -0.2158 | |||

| PG / The Procter & Gamble Company | 0.02 | 0.96 | 3.42 | -5.63 | 1.1139 | -0.1757 | |||

| CEG / Constellation Energy Corporation | 0.01 | 3.14 | 1.0246 | 1.0246 | |||||

| HD / The Home Depot, Inc. | 0.01 | -0.27 | 3.02 | -0.23 | 0.9830 | -0.0935 | |||

| BDX / Becton, Dickinson and Company | 0.02 | 1.39 | 2.83 | -23.77 | 0.6539 | -0.6677 | |||

| PEP / PepsiCo, Inc. | 0.02 | 1.23 | 2.82 | -10.85 | 0.6513 | -0.4745 | |||

| ES / Eversource Energy | 0.04 | 0.31 | 2.54 | 2.75 | 0.8283 | -0.0525 | |||

| PSX / Phillips 66 | 0.02 | -0.32 | 2.44 | -3.71 | 0.5648 | -0.3389 | |||

| CL / Colgate-Palmolive Company | 0.03 | 1.26 | 2.42 | -1.79 | 0.5583 | -0.3175 | |||

| COF / Capital One Financial Corporation | 0.01 | 3.59 | 2.34 | 22.94 | 0.5413 | -0.1373 | |||

| MS / Morgan Stanley | 0.02 | 1.05 | 2.30 | 22.01 | 0.5306 | -0.1396 | |||

| CMCSA / Comcast Corporation | 0.06 | -5.14 | 2.24 | -8.24 | 0.5176 | -0.3517 | |||

| CVX / Chevron Corporation | 0.02 | -0.36 | 2.16 | -14.71 | 0.4985 | -0.4022 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | -7.99 | 2.00 | -45.20 | 0.6532 | -0.6492 | |||

| ROST / Ross Stores, Inc. | 0.01 | -1.83 | 1.91 | -2.00 | 0.4413 | -0.2525 | |||

| CLX / The Clorox Company | 0.02 | 1.54 | 1.87 | -17.20 | 0.6104 | -0.1951 | |||

| TGT / Target Corporation | 0.02 | 0.44 | 1.84 | -5.06 | 0.4247 | -0.2646 | |||

| JEPI / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Equity Premium Income ETF | 0.03 | 1.04 | 1.83 | 0.55 | 0.4240 | -0.2259 | |||

| T / AT&T Inc. | 0.06 | -2.94 | 1.70 | -0.64 | 0.3924 | -0.2164 | |||

| NKE / NIKE, Inc. | 0.02 | -0.62 | 1.67 | 11.21 | 0.3854 | -0.1486 | |||

| DGX / Quest Diagnostics Incorporated | 0.01 | -1.37 | 1.66 | 4.74 | 0.3832 | -0.1807 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.01 | 1.04 | 1.50 | 37.80 | 0.4898 | 0.1016 | |||

| GOOGL / Alphabet Inc. | 0.01 | 6.18 | 1.49 | 21.02 | 0.3447 | -0.0943 | |||

| TSLA / Tesla, Inc. | 0.00 | 26.93 | 1.49 | 55.66 | 0.4840 | 0.1441 | |||

| DY / Dycom Industries, Inc. | 0.01 | 1.85 | 1.48 | 63.36 | 0.3422 | 0.0195 | |||

| PFF / iShares Trust - iShares Preferred and Income Securities ETF | 0.05 | -4.98 | 1.48 | -5.14 | 0.3415 | -0.2132 | |||

| MET / MetLife, Inc. | 0.02 | -2.11 | 1.39 | -1.98 | 0.3212 | -0.1836 | |||

| USB / U.S. Bancorp | 0.03 | 0.57 | 1.37 | 7.80 | 0.3165 | -0.1359 | |||

| AMT / American Tower Corporation | 0.01 | 0.69 | 1.32 | 2.25 | 0.3049 | -0.1545 | |||

| ITOT / iShares Trust - iShares Core S&P Total U.S. Stock Market ETF | 0.01 | 0.00 | 1.27 | 10.66 | 0.2929 | -0.1149 | |||

| C / Citigroup Inc. | 0.01 | -3.02 | 1.26 | 16.24 | 0.2914 | -0.0947 | |||

| NVDA / NVIDIA Corporation | 0.01 | 5.07 | 1.23 | 53.17 | 0.4019 | 0.1152 | |||

| MU / Micron Technology, Inc. | 0.01 | 3.75 | 1.09 | 47.11 | 0.2527 | -0.0119 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | -1.32 | 0.85 | -2.40 | 0.2782 | -0.0331 | |||

| MRK / Merck & Co., Inc. | 0.01 | 1.27 | 0.84 | -10.67 | 0.1935 | -0.1404 | |||

| FANG / Diamondback Energy, Inc. | 0.01 | 2.14 | 0.83 | -12.21 | 0.1927 | -0.1456 | |||

| VZ / Verizon Communications Inc. | 0.02 | 1.19 | 0.81 | -3.46 | 0.1873 | -0.1117 | |||

| PNR / Pentair plc | 0.01 | -2.40 | 0.77 | 14.52 | 0.2520 | 0.0116 | |||

| RDDT / Reddit, Inc. | 0.01 | 0.75 | 0.2454 | 0.2454 | |||||

| ABBV / AbbVie Inc. | 0.00 | 2.28 | 0.72 | -9.36 | 0.2339 | -0.0482 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.00 | 0.71 | 10.54 | 0.1649 | -0.0650 | |||

| CI / The Cigna Group | 0.00 | -1.99 | 0.70 | -1.55 | 0.1620 | -0.0915 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.01 | -3.47 | 0.70 | 2.49 | 0.1617 | -0.0812 | |||

| PKG / Packaging Corporation of America | 0.00 | -1.48 | 0.66 | -6.36 | 0.2161 | -0.0358 | |||

| MA / Mastercard Incorporated | 0.00 | 1.30 | 0.66 | 3.97 | 0.1514 | -0.0732 | |||

| HEWJ / iShares Trust - iShares Currency Hedged MSCI Japan ETF | 0.01 | -3.84 | 0.65 | 2.85 | 0.1502 | -0.0752 | |||

| AJG / Arthur J. Gallagher & Co. | 0.00 | -0.73 | 0.65 | -7.95 | 0.1499 | -0.1010 | |||

| ADBE / Adobe Inc. | 0.00 | 7.27 | 0.63 | 8.10 | 0.2046 | -0.0020 | |||

| PSCT / Invesco Exchange-Traded Fund Trust II - Invesco S&P SmallCap Information Technology ETF | 0.01 | 0.00 | 0.62 | 15.43 | 0.1437 | -0.0482 | |||

| VMC / Vulcan Materials Company | 0.00 | 4.84 | 0.62 | 17.14 | 0.1423 | -0.0448 | |||

| HSY / The Hershey Company | 0.00 | -2.20 | 0.60 | -5.19 | 0.1967 | -0.0298 | |||

| LDOS / Leidos Holdings, Inc. | 0.00 | 6.66 | 0.60 | 24.69 | 0.1389 | -0.0327 | |||

| IRM / Iron Mountain Incorporated | 0.01 | 4.00 | 0.59 | 23.89 | 0.1356 | -0.0329 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.01 | 0.58 | 0.1885 | 0.1885 | |||||

| HUBB / Hubbell Incorporated | 0.00 | 0.00 | 0.58 | 23.55 | 0.1335 | -0.0332 | |||

| ACM / AECOM | 0.01 | 8.36 | 0.57 | 32.03 | 0.1869 | 0.0321 | |||

| CHWY / Chewy, Inc. | 0.01 | -4.76 | 0.57 | 24.89 | 0.1865 | 0.0233 | |||

| SBUX / Starbucks Corporation | 0.01 | 3.91 | 0.57 | -2.89 | 0.1322 | -0.0777 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.02 | 0.56 | 0.1823 | 0.1823 | |||||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.01 | -3.20 | 0.55 | 1.10 | 0.1278 | -0.0668 | |||

| SPYG / SPDR Series Trust - SPDR Portfolio S&P 500 Growth ETF | 0.01 | -10.20 | 0.55 | 6.38 | 0.1273 | -0.0569 | |||

| RBC / RBC Bearings Incorporated | 0.00 | 6.42 | 0.55 | 27.15 | 0.1268 | -0.0267 | |||

| GWRE / Guidewire Software, Inc. | 0.00 | -1.02 | 0.55 | 24.32 | 0.1784 | 0.0217 | |||

| NTR / Nutrien Ltd. | 0.01 | -4.92 | 0.54 | 11.48 | 0.1258 | -0.0481 | |||

| DAL / Delta Air Lines, Inc. | 0.01 | -4.81 | 0.54 | 7.34 | 0.1764 | -0.0031 | |||

| AIG / American International Group, Inc. | 0.01 | -3.31 | 0.54 | -4.76 | 0.1249 | -0.0773 | |||

| AMP / Ameriprise Financial, Inc. | 0.00 | 5.50 | 0.53 | 16.41 | 0.1231 | -0.0400 | |||

| PFE / Pfizer Inc. | 0.02 | -9.24 | 0.52 | -13.30 | 0.1682 | -0.0435 | |||

| SONY / Sony Group Corporation - Depositary Receipt (Common Stock) | 0.02 | 8.31 | 0.50 | 11.14 | 0.1154 | -0.0448 | |||

| CBOE / Cboe Global Markets, Inc. | 0.00 | -1.29 | 0.50 | 1.63 | 0.1152 | -0.0593 | |||

| LLY / Eli Lilly and Company | 0.00 | -3.77 | 0.50 | -9.12 | 0.1151 | -0.0802 | |||

| XAR / SPDR Series Trust - SPDR S&P Aerospace & Defense ETF | 0.00 | 73.86 | 0.50 | 128.44 | 0.1151 | 0.0374 | |||

| SIGI / Selective Insurance Group, Inc. | 0.01 | 0.00 | 0.49 | -5.41 | 0.1134 | -0.0712 | |||

| FIVE / Five Below, Inc. | 0.00 | 5.14 | 0.49 | 84.15 | 0.1592 | 0.0647 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 9.42 | 0.47 | 26.15 | 0.1083 | -0.0240 | |||

| LRCX / Lam Research Corporation | 0.00 | 5.63 | 0.47 | 41.52 | 0.1525 | 0.0347 | |||

| AMAT / Applied Materials, Inc. | 0.00 | 7.91 | 0.47 | 36.15 | 0.1080 | -0.0143 | |||

| RSPG / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight Energy ETF | 0.01 | -1.91 | 0.44 | -10.77 | 0.1016 | -0.0739 | |||

| DIS / The Walt Disney Company | 0.00 | 2.13 | 0.43 | 28.40 | 0.1004 | -0.0202 | |||

| BRO / Brown & Brown, Inc. | 0.00 | -1.47 | 0.43 | -12.24 | 0.1403 | -0.0343 | |||

| EQT / EQT Corporation | 0.01 | 5.23 | 0.43 | 14.71 | 0.0993 | -0.0339 | |||

| GLD / SPDR Gold Trust | 0.00 | -18.96 | 0.43 | -14.26 | 0.1393 | -0.0382 | |||

| SHOP / Shopify Inc. | 0.00 | 4.57 | 0.42 | 26.59 | 0.0969 | -0.0213 | |||

| THC / Tenet Healthcare Corporation | 0.00 | 5.59 | 0.42 | 37.95 | 0.0968 | -0.0112 | |||

| SPYV / SPDR Series Trust - SPDR Portfolio S&P 500 Value ETF | 0.01 | -11.27 | 0.40 | -9.01 | 0.0935 | -0.0649 | |||

| TYL / Tyler Technologies, Inc. | 0.00 | -1.49 | 0.39 | 0.51 | 0.1275 | -0.0112 | |||

| KEYS / Keysight Technologies, Inc. | 0.00 | -1.65 | 0.39 | 7.44 | 0.1274 | -0.0020 | |||

| MO / Altria Group, Inc. | 0.01 | 3.37 | 0.39 | 1.04 | 0.1261 | -0.0104 | |||

| DHI / D.R. Horton, Inc. | 0.00 | 4.77 | 0.39 | 6.35 | 0.0890 | -0.0401 | |||

| WCN / Waste Connections, Inc. | 0.00 | -1.63 | 0.38 | -5.90 | 0.0886 | -0.0565 | |||

| TKO / TKO Group Holdings, Inc. | 0.00 | 13.74 | 0.38 | 35.46 | 0.0884 | -0.0122 | |||

| CSGS / CSG Systems International, Inc. | 0.01 | 11.67 | 0.37 | 20.52 | 0.0856 | -0.0238 | |||

| INFY / Infosys Limited - Depositary Receipt (Common Stock) | 0.02 | 2.64 | 0.37 | 4.27 | 0.1195 | -0.0058 | |||

| BLBD / Blue Bird Corporation | 0.01 | 0.36 | 0.1189 | 0.1189 | |||||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 5.05 | 0.36 | -4.22 | 0.0841 | -0.0511 | |||

| SYM / Symbotic Inc. | 0.01 | 0.36 | 0.1172 | 0.1172 | |||||

| TRV / The Travelers Companies, Inc. | 0.00 | 2.02 | 0.35 | 3.24 | 0.1143 | -0.0067 | |||

| BAH / Booz Allen Hamilton Holding Corporation | 0.00 | -1.32 | 0.35 | -1.69 | 0.0807 | -0.0459 | |||

| FDX / FedEx Corporation | 0.00 | 2.07 | 0.35 | -4.67 | 0.1132 | -0.0168 | |||

| CHE / Chemed Corporation | 0.00 | 0.85 | 0.34 | -20.19 | 0.0797 | -0.0742 | |||

| CRUS / Cirrus Logic, Inc. | 0.00 | 3.46 | 0.34 | 8.20 | 0.0793 | -0.0336 | |||

| ETB / Eaton Vance Tax-Managed Buy-Write Income Fund | 0.02 | 0.34 | 0.0782 | 0.0782 | |||||

| NEM / Newmont Corporation | 0.01 | 18.71 | 0.34 | 43.40 | 0.0780 | -0.0059 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 3.25 | 0.34 | -15.83 | 0.1093 | -0.0327 | |||

| RLI / RLI Corp. | 0.00 | -1.50 | 0.33 | -11.47 | 0.0769 | -0.0569 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.00 | 0.00 | 0.33 | -2.96 | 0.0760 | -0.0447 | |||

| GNRC / Generac Holdings Inc. | 0.00 | 0.71 | 0.33 | 13.99 | 0.0755 | -0.0267 | |||

| HON / Honeywell International Inc. | 0.00 | 12.84 | 0.33 | 24.05 | 0.0752 | -0.0182 | |||

| CRM / Salesforce, Inc. | 0.00 | 16.22 | 0.32 | 18.38 | 0.1050 | 0.0079 | |||

| PSCH / Invesco Exchange-Traded Fund Trust II - Invesco S&P SmallCap Health Care ETF | 0.01 | 0.00 | 0.31 | -7.42 | 0.0722 | -0.0480 | |||

| CHD / Church & Dwight Co., Inc. | 0.00 | -1.02 | 0.31 | -13.56 | 0.0708 | -0.0555 | |||

| WRB / W. R. Berkley Corporation | 0.00 | -2.06 | 0.30 | 1.35 | 0.0694 | -0.0364 | |||

| ROL / Rollins, Inc. | 0.01 | -1.45 | 0.29 | 2.83 | 0.0951 | -0.0059 | |||

| GGG / Graco Inc. | 0.00 | -1.90 | 0.29 | 1.05 | 0.0941 | -0.0077 | |||

| UPS / United Parcel Service, Inc. | 0.00 | -7.86 | 0.29 | -15.59 | 0.0937 | -0.0274 | |||

| CVS / CVS Health Corporation | 0.00 | 0.68 | 0.29 | 2.51 | 0.0663 | -0.0334 | |||

| TEL / TE Connectivity plc | 0.00 | 5.50 | 0.28 | 26.01 | 0.0651 | -0.0146 | |||

| UNP / Union Pacific Corporation | 0.00 | 14.68 | 0.28 | 11.55 | 0.0914 | 0.0020 | |||

| V / Visa Inc. | 0.00 | 17.39 | 0.28 | 19.31 | 0.0642 | -0.0190 | |||

| FCF / First Commonwealth Financial Corporation | 0.02 | -2.28 | 0.28 | 1.84 | 0.0642 | -0.0328 | |||

| DECK / Deckers Outdoor Corporation | 0.00 | 2.01 | 0.28 | -6.12 | 0.0640 | -0.0409 | |||

| MGM / MGM Resorts International | 0.01 | -2.20 | 0.28 | 13.58 | 0.0638 | -0.0229 | |||

| EG / Everest Group, Ltd. | 0.00 | 2.68 | 0.27 | -4.21 | 0.0633 | -0.0383 | |||

| MLPX / Global X Funds - Global X MLP & Energy Infrastructure ETF | 0.00 | 7.49 | 0.27 | 5.49 | 0.0624 | -0.0287 | |||

| EGP / EastGroup Properties, Inc. | 0.00 | 0.00 | 0.26 | -5.04 | 0.0611 | -0.0381 | |||

| MPLX / MPLX LP - Limited Partnership | 0.01 | 0.26 | 0.0860 | 0.0860 | |||||

| O / Realty Income Corporation | 0.00 | 2.35 | 0.26 | 1.55 | 0.0857 | -0.0064 | |||

| CNC / Centene Corporation | 0.00 | 0.00 | 0.26 | -10.76 | 0.0596 | -0.0431 | |||

| ICLR / ICON Public Limited Company | 0.00 | -4.16 | 0.26 | -20.43 | 0.0840 | -0.0312 | |||

| VSH / Vishay Intertechnology, Inc. | 0.02 | 2.94 | 0.26 | 2.80 | 0.0840 | -0.0053 | |||

| STAG / STAG Industrial, Inc. | 0.01 | -2.20 | 0.26 | -1.92 | 0.0593 | -0.0337 | |||

| APPF / AppFolio, Inc. | 0.00 | 6.66 | 0.25 | 11.89 | 0.0588 | -0.0223 | |||

| VHT / Vanguard World Fund - Vanguard Health Care ETF | 0.00 | 3.55 | 0.25 | -2.77 | 0.0569 | -0.0334 | |||

| IBM / International Business Machines Corporation | 0.00 | -2.34 | 0.25 | 16.04 | 0.0569 | -0.0188 | |||

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.00 | 0.00 | 0.23 | 10.58 | 0.0532 | -0.0211 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 0.23 | 0.0532 | 0.0532 | |||||

| RPM / RPM International Inc. | 0.00 | -2.26 | 0.23 | -7.35 | 0.0526 | -0.0347 | |||

| MCHP / Microchip Technology Incorporated | 0.00 | 0.22 | 0.0727 | 0.0727 | |||||

| D / Dominion Energy, Inc. | 0.00 | 3.25 | 0.22 | 3.77 | 0.0510 | -0.0245 | |||

| POST / Post Holdings, Inc. | 0.00 | -0.69 | 0.22 | -7.23 | 0.0506 | -0.0332 | |||

| AXP / American Express Company | 0.00 | 0.22 | 0.0502 | 0.0502 | |||||

| THG / The Hanover Insurance Group, Inc. | 0.00 | 7.11 | 0.21 | 4.39 | 0.0497 | -0.0235 | |||

| CTO / CTO Realty Growth, Inc. | 0.01 | 14.34 | 0.21 | 2.42 | 0.0693 | -0.0048 | |||

| LH / Labcorp Holdings Inc. | 0.00 | 0.21 | 0.0686 | 0.0686 | |||||

| BJRI / BJ's Restaurants, Inc. | 0.00 | 0.21 | 0.0482 | 0.0482 | |||||

| CSX / CSX Corporation | 0.01 | 0.21 | 0.0677 | 0.0677 | |||||

| CTAS / Cintas Corporation | 0.00 | 0.21 | 0.0676 | 0.0676 | |||||

| XOM / Exxon Mobil Corporation | 0.00 | 0.00 | 0.20 | -9.37 | 0.0470 | -0.0329 | |||

| MDYG / SPDR Series Trust - SPDR S&P 400 Mid Cap Growth ETF | 0.00 | 0.20 | 0.0464 | 0.0464 | |||||

| FNB / F.N.B. Corporation | 0.01 | 0.00 | 0.19 | 8.14 | 0.0431 | -0.0182 | |||

| PTEN / Patterson-UTI Energy, Inc. | 0.03 | 8.03 | 0.18 | -21.98 | 0.0420 | -0.0410 | |||

| SJM / The J. M. Smucker Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NEOG / Neogen Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MDYV / SPDR Series Trust - SPDR S&P 400 Mid Cap Value ETF | 0.00 | -100.00 | 0.00 | 0.0000 |