Mga Batayang Estadistika

| Nilai Portofolio | $ 9,293,952 |

| Posisi Saat Ini | 42 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

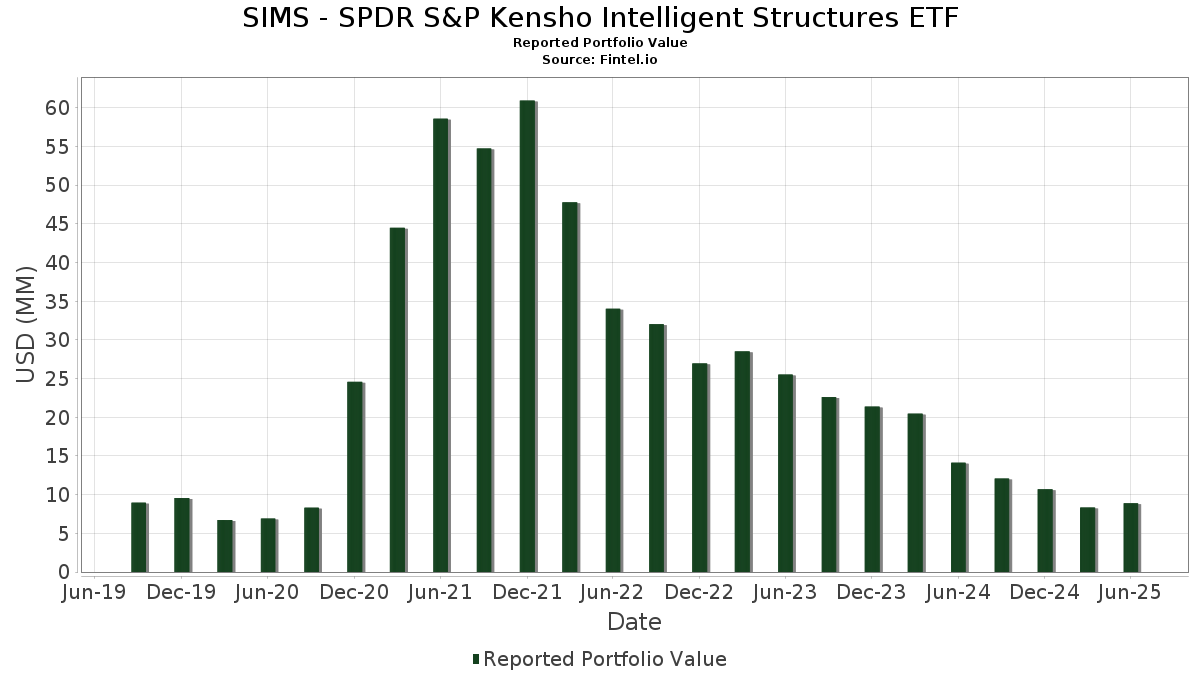

SIMS - SPDR S&P Kensho Intelligent Structures ETF telah mengungkapkan total kepemilikan 42 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 9,293,952 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama SIMS - SPDR S&P Kensho Intelligent Structures ETF adalah State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls (US:GVMXX) , Generac Holdings Inc. (US:GNRC) , Silicon Laboratories Inc. (US:SLAB) , Itron, Inc. (US:ITRI) , and Bloom Energy Corporation (US:BE) . Posisi baru SIMS - SPDR S&P Kensho Intelligent Structures ETF meliputi: Fluence Energy, Inc. (US:FLNC) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.40 | 0.40 | 4.7613 | 4.7381 | |

| 0.03 | 0.22 | 2.6004 | 2.6004 | |

| 0.06 | 0.23 | 2.6866 | 1.2221 | |

| 0.01 | 0.28 | 3.2829 | 0.9211 | |

| 0.00 | 0.30 | 3.4756 | 0.8512 | |

| 0.06 | 0.07 | 0.7828 | 0.7828 | |

| 0.03 | 0.25 | 2.9331 | 0.7554 | |

| 0.01 | 0.27 | 3.1796 | 0.7156 | |

| 0.00 | 0.16 | 1.9379 | 0.6390 | |

| 0.00 | 0.17 | 1.9715 | 0.6220 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.16 | 1.9330 | -1.1284 | |

| 0.03 | 0.28 | 3.2462 | -0.6685 | |

| 0.00 | 0.16 | 1.8977 | -0.5642 | |

| 0.01 | 0.16 | 1.8598 | -0.5553 | |

| 0.01 | 0.27 | 3.1426 | -0.5112 | |

| 0.00 | 0.16 | 1.9072 | -0.4136 | |

| 0.00 | 0.16 | 1.8755 | -0.3574 | |

| 0.00 | 0.16 | 1.8451 | -0.3554 | |

| 0.01 | 0.16 | 1.8488 | -0.2951 | |

| 0.00 | 0.27 | 3.2080 | -0.2365 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 0.40 | 20,762.42 | 0.40 | 40,300.00 | 4.7613 | 4.7381 | |||

| GNRC / Generac Holdings Inc. | 0.00 | 19.11 | 0.30 | 34.70 | 3.4756 | 0.8512 | |||

| SLAB / Silicon Laboratories Inc. | 0.00 | -14.76 | 0.29 | 11.58 | 3.4030 | 0.3013 | |||

| ITRI / Itron, Inc. | 0.00 | -16.06 | 0.29 | 5.51 | 3.3820 | 0.1207 | |||

| BE / Bloom Energy Corporation | 0.01 | -5.70 | 0.28 | 14.98 | 3.3447 | 0.3801 | |||

| REZI / Resideo Technologies, Inc. | 0.01 | 13.42 | 0.28 | 41.62 | 3.2829 | 0.9211 | |||

| PNR / Pentair plc | 0.00 | -0.92 | 0.28 | 16.39 | 3.2596 | 0.4086 | |||

| ADT / ADT Inc. | 0.03 | -18.95 | 0.28 | -15.90 | 3.2462 | -0.6685 | |||

| VLTO / Veralto Corporation | 0.00 | -3.40 | 0.28 | 0.00 | 3.2386 | -0.0528 | |||

| TYIA / Johnson Controls International plc | 0.00 | -26.69 | 0.27 | -3.18 | 3.2244 | -0.1685 | |||

| XYL / Xylem Inc. | 0.00 | -12.53 | 0.27 | -5.23 | 3.2080 | -0.2365 | |||

| TTEK / Tetra Tech, Inc. | 0.01 | 6.75 | 0.27 | 31.71 | 3.1796 | 0.7156 | |||

| BMI / Badger Meter, Inc. | 0.00 | -12.78 | 0.27 | 12.18 | 3.1468 | 0.2970 | |||

| MWA / Mueller Water Products, Inc. | 0.01 | -7.51 | 0.27 | -12.46 | 3.1426 | -0.5112 | |||

| ALRM / Alarm.com Holdings, Inc. | 0.00 | 4.65 | 0.26 | 6.61 | 3.0387 | 0.1338 | |||

| WTTR / Select Water Solutions, Inc. | 0.03 | 66.47 | 0.25 | 36.81 | 2.9331 | 0.7554 | |||

| EVGO / EVgo, Inc. | 0.06 | 35.96 | 0.23 | 86.89 | 2.6866 | 1.2221 | |||

| SHLS / Shoals Technologies Group, Inc. | 0.05 | -19.17 | 0.22 | 3.24 | 2.6304 | 0.0452 | |||

| FLNC / Fluence Energy, Inc. | 0.03 | 0.22 | 2.6004 | 2.6004 | |||||

| ARLO / Arlo Technologies, Inc. | 0.01 | -30.69 | 0.22 | 19.23 | 2.5553 | 0.3734 | |||

| GTLS / Chart Industries, Inc. | 0.00 | 21.40 | 0.18 | 38.64 | 2.1539 | 0.5718 | |||

| ROKU / Roku, Inc. | 0.00 | -8.01 | 0.18 | 14.94 | 2.0907 | 0.2383 | |||

| AYI / Acuity Inc. | 0.00 | 5.89 | 0.18 | 19.73 | 2.0813 | 0.3168 | |||

| NRG / NRG Energy, Inc. | 0.00 | -42.47 | 0.18 | -3.31 | 2.0629 | -0.1048 | |||

| CNM / Core & Main, Inc. | 0.00 | -16.60 | 0.17 | 4.27 | 2.0121 | 0.0480 | |||

| HON / Honeywell International Inc. | 0.00 | -8.96 | 0.17 | 0.00 | 1.9753 | -0.0312 | |||

| PSN / Parsons Corporation | 0.00 | 22.57 | 0.17 | 49.11 | 1.9715 | 0.6220 | |||

| TE Connectivity PLC / EC (IE000IVNQZ81) | 0.00 | -18.84 | 0.17 | -2.94 | 1.9486 | -0.0973 | |||

| ON / ON Semiconductor Corporation | 0.00 | 17.80 | 0.16 | 51.85 | 1.9379 | 0.6390 | |||

| CARR / Carrier Global Corporation | 0.00 | -44.38 | 0.16 | -35.69 | 1.9330 | -1.1284 | |||

| NVEE / NV5 Global, Inc. | 0.01 | -19.49 | 0.16 | -3.55 | 1.9254 | -0.1044 | |||

| AME / AMETEK, Inc. | 0.00 | -6.25 | 0.16 | -1.82 | 1.9160 | -0.0612 | |||

| GNTX / Gentex Corporation | 0.01 | 25.92 | 0.16 | 19.12 | 1.9092 | 0.2753 | |||

| ROP / Roper Technologies, Inc. | 0.00 | -13.07 | 0.16 | -16.06 | 1.9072 | -0.4136 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.00 | -18.41 | 0.16 | -21.46 | 1.8977 | -0.5642 | |||

| BCE / BCE Inc. | 0.01 | 3.90 | 0.16 | 0.00 | 1.8906 | -0.0259 | |||

| BIDU / Baidu, Inc. - Depositary Receipt (Common Stock) | 0.00 | -8.33 | 0.16 | -14.52 | 1.8755 | -0.3574 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.01 | -11.58 | 0.16 | -21.39 | 1.8598 | -0.5553 | |||

| ERII / Energy Recovery, Inc. | 0.01 | 9.04 | 0.16 | -12.29 | 1.8488 | -0.2951 | |||

| SU / Suncor Energy Inc. | 0.00 | -11.83 | 0.16 | -14.75 | 1.8451 | -0.3554 | |||

| CWCO / Consolidated Water Co. Ltd. | 0.00 | 19.77 | 0.09 | 46.55 | 1.0100 | 0.3103 | |||

| REKR / Rekor Systems, Inc. | 0.06 | 0.07 | 0.7828 | 0.7828 |