Mga Batayang Estadistika

| Nilai Portofolio | $ 15,454,573,190 |

| Posisi Saat Ini | 44 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

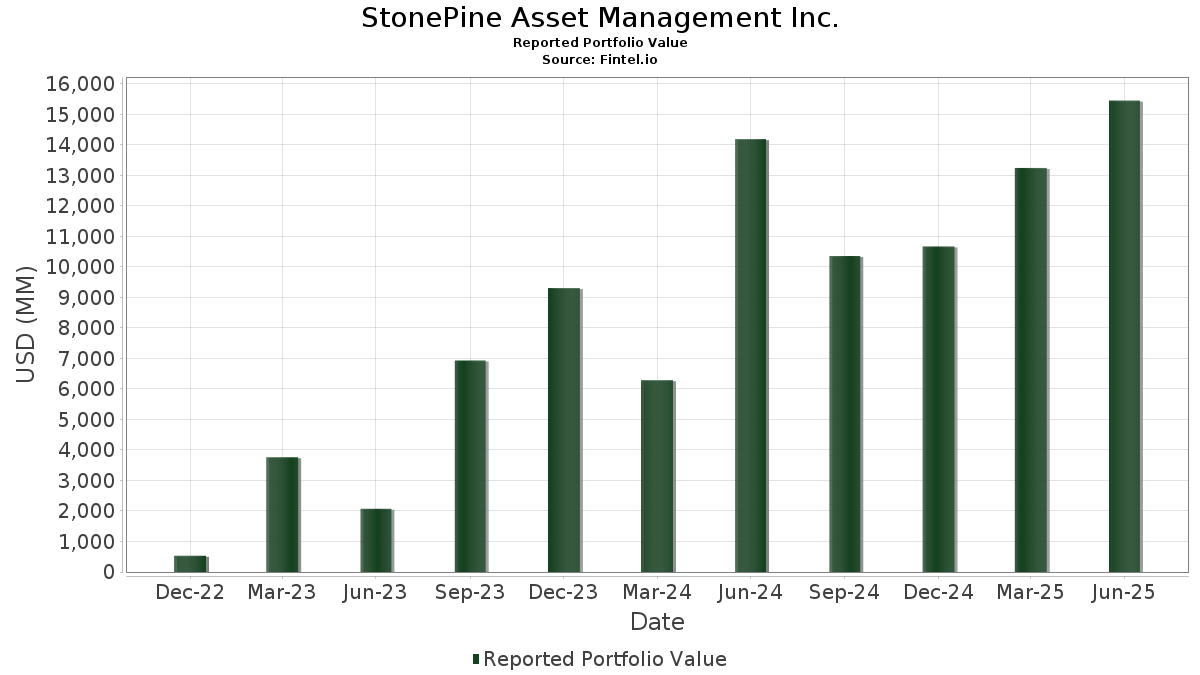

StonePine Asset Management Inc. telah mengungkapkan total kepemilikan 44 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 15,454,573,190 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama StonePine Asset Management Inc. adalah Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) , Microsoft Corporation (US:MSFT) , Alphabet Inc. (US:GOOGL) , Moody's Corporation (US:MCO) , and AutoZone, Inc. (US:AZO) . Posisi baru StonePine Asset Management Inc. meliputi: Hayward Holdings, Inc. (US:HAYW) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 3.59 | 785.06 | 5.0798 | 2.1023 | |

| 7.03 | 1,591.26 | 10.2964 | 1.7928 | |

| 3.11 | 1,547.92 | 10.0159 | 1.7137 | |

| 0.33 | 392.77 | 2.5414 | 0.4409 | |

| 0.84 | 224.93 | 1.4554 | 0.4143 | |

| 0.94 | 224.78 | 1.4545 | 0.2958 | |

| 6.41 | 314.41 | 2.0344 | 0.2839 | |

| 5.30 | 387.94 | 2.5102 | 0.2613 | |

| 6.81 | 1,199.62 | 7.7622 | 0.1344 | |

| 2.31 | 1,159.18 | 7.5006 | 0.1334 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.83 | 258.73 | 1.6742 | -2.7664 | |

| 0.28 | 1,045.71 | 6.7663 | -1.0412 | |

| 2.52 | 333.26 | 2.1564 | -0.5908 | |

| 2.18 | 332.84 | 2.1537 | -0.4313 | |

| 4.69 | 579.21 | 3.7478 | -0.4115 | |

| 1.61 | 903.15 | 5.8439 | -0.3088 | |

| 0.62 | 326.10 | 2.1100 | -0.2801 | |

| 1.68 | 577.22 | 3.7350 | -0.2207 | |

| 4.64 | 459.36 | 2.9723 | -0.2183 | |

| 2.54 | 700.23 | 4.5309 | -0.2061 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-16 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 7.03 | 3.54 | 1,591.26 | 41.27 | 10.2964 | 1.7928 | |||

| MSFT / Microsoft Corporation | 3.11 | 6.23 | 1,547.92 | 40.76 | 10.0159 | 1.7137 | |||

| GOOGL / Alphabet Inc. | 6.81 | 4.19 | 1,199.62 | 18.73 | 7.7622 | 0.1344 | |||

| MCO / Moody's Corporation | 2.31 | 10.29 | 1,159.18 | 18.79 | 7.5006 | 0.1334 | |||

| AZO / AutoZone, Inc. | 0.28 | 3.85 | 1,045.71 | 1.12 | 6.7663 | -1.0412 | |||

| MA / Mastercard Incorporated | 1.61 | 8.09 | 903.15 | 10.82 | 5.8439 | -0.3088 | |||

| ORCL / Oracle Corporation | 3.59 | 27.29 | 785.06 | 99.06 | 5.0798 | 2.1023 | |||

| CME / CME Group Inc. | 2.54 | 7.42 | 700.23 | 11.60 | 4.5309 | -0.2061 | |||

| TJX / The TJX Companies, Inc. | 4.69 | 3.69 | 579.21 | 5.13 | 3.7478 | -0.4115 | |||

| SHW / The Sherwin-Williams Company | 1.68 | 12.04 | 577.22 | 10.17 | 3.7350 | -0.2207 | |||

| MSCI / MSCI Inc. | 0.89 | 11.87 | 513.37 | 14.10 | 3.3218 | -0.0751 | |||

| OTIS / Otis Worldwide Corporation | 4.64 | 13.28 | 459.36 | 8.69 | 2.9723 | -0.2183 | |||

| MTD / Mettler-Toledo International Inc. | 0.33 | 41.91 | 392.77 | 41.16 | 2.5414 | 0.4409 | |||

| CARR / Carrier Global Corporation | 5.30 | 12.81 | 387.94 | 30.23 | 2.5102 | 0.2613 | |||

| GGG / Graco Inc. | 3.91 | 9.12 | 336.26 | 12.33 | 2.1758 | -0.0841 | |||

| PEP / PepsiCo, Inc. | 2.52 | 4.00 | 333.26 | -8.41 | 2.1564 | -0.5908 | |||

| JNJ / Johnson & Johnson | 2.18 | 5.54 | 332.84 | -2.79 | 2.1537 | -0.4313 | |||

| SPGI / S&P Global Inc. | 0.62 | -0.75 | 326.10 | 3.00 | 2.1100 | -0.2801 | |||

| CPRT / Copart, Inc. | 6.41 | 56.38 | 314.41 | 35.60 | 2.0344 | 0.2839 | |||

| HDB / HDFC Bank Limited - Depositary Receipt (Common Stock) | 4.07 | 2.66 | 312.39 | 18.46 | 2.0213 | 0.0305 | |||

| UNH / UnitedHealth Group Incorporated | 0.83 | -26.15 | 258.73 | -56.01 | 1.6742 | -2.7664 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.84 | 39.35 | 224.93 | 63.11 | 1.4554 | 0.4143 | |||

| ADI / Analog Devices, Inc. | 0.94 | 24.10 | 224.78 | 46.47 | 1.4545 | 0.2958 | |||

| LOW / Lowe's Companies, Inc. | 0.99 | 7.45 | 219.58 | 2.22 | 1.4208 | -0.2010 | |||

| FDS / FactSet Research Systems Inc. | 0.38 | 8.83 | 170.17 | 7.07 | 1.1011 | -0.0988 | |||

| ADBE / Adobe Inc. | 0.33 | 13.25 | 126.59 | 14.24 | 0.8191 | -0.0175 | |||

| NKE / NIKE, Inc. | 1.68 | 17.14 | 119.69 | 31.09 | 0.7745 | 0.0852 | |||

| CL / Colgate-Palmolive Company | 1.26 | 8.09 | 114.48 | 4.87 | 0.7407 | -0.0834 | |||

| WH / Wyndham Hotels & Resorts, Inc. | 0.41 | 102.96 | 35.30 | 92.39 | 0.2284 | 0.0899 | |||

| FSS / Federal Signal Corporation | 0.20 | 13.32 | 21.09 | 63.97 | 0.1365 | 0.0394 | |||

| IPAR / Interparfums, Inc. | 0.11 | -1.42 | 14.25 | 13.67 | 0.0922 | -0.0024 | |||

| HLI / Houlihan Lokey, Inc. | 0.07 | 7.35 | 13.41 | 19.61 | 0.0867 | 0.0021 | |||

| TREX / Trex Company, Inc. | 0.24 | 20.02 | 13.04 | 12.34 | 0.0844 | -0.0033 | |||

| MEDP / Medpace Holdings, Inc. | 0.04 | 0.00 | 11.39 | 3.01 | 0.0737 | -0.0098 | |||

| JKHY / Jack Henry & Associates, Inc. | 0.06 | 37.44 | 10.85 | 35.63 | 0.0702 | 0.0098 | |||

| JBTM / JBT Marel Corporation | 0.09 | -4.80 | 10.49 | -6.31 | 0.0679 | -0.0167 | |||

| DCI / Donaldson Company, Inc. | 0.15 | -14.02 | 10.46 | -11.08 | 0.0677 | -0.0211 | |||

| WDFC / WD-40 Company | 0.04 | 7.15 | 9.95 | 0.17 | 0.0644 | -0.0106 | |||

| BRKR / Bruker Corporation | 0.24 | 0.00 | 9.79 | -1.29 | 0.0633 | -0.0115 | |||

| EXPO / Exponent, Inc. | 0.12 | 6.60 | 9.17 | -1.75 | 0.0593 | -0.0111 | |||

| SSD / Simpson Manufacturing Co., Inc. | 0.06 | -3.81 | 9.01 | -4.90 | 0.0583 | -0.0132 | |||

| FND / Floor & Decor Holdings, Inc. | 0.11 | 0.00 | 8.53 | -5.60 | 0.0552 | -0.0130 | |||

| HAYW / Hayward Holdings, Inc. | 0.52 | 7.19 | 0.0465 | 0.0465 | |||||

| POWI / Power Integrations, Inc. | 0.08 | 0.00 | 4.42 | 10.69 | 0.0286 | -0.0015 | |||

| MIDD / The Middleby Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BDX / Becton, Dickinson and Company | 0.00 | -100.00 | 0.00 | 0.0000 |