Mga Batayang Estadistika

| Nilai Portofolio | $ 823,663,000 |

| Posisi Saat Ini | 215 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

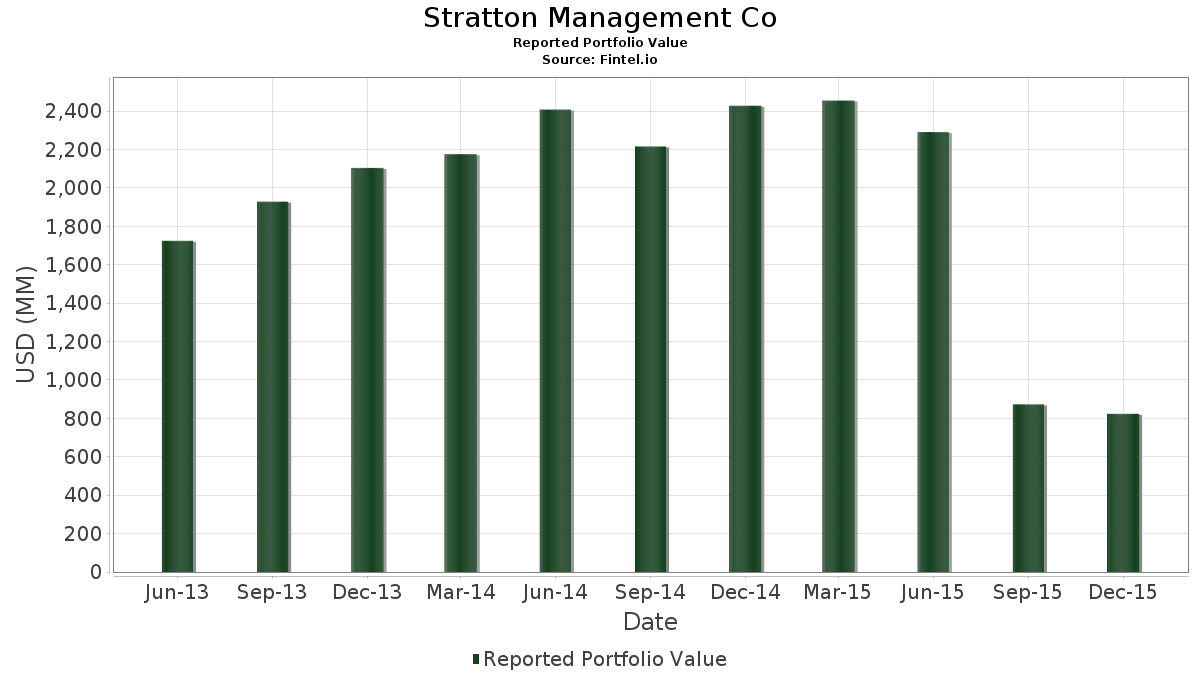

Stratton Management Co telah mengungkapkan total kepemilikan 215 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 823,663,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Stratton Management Co adalah United Parcel Service, Inc. (US:UPS) , AbbVie Inc. (US:ABBV) , General Electric Company (US:GE) , Microsoft Corporation (US:MSFT) , and Johnson & Johnson (US:JNJ) . Posisi baru Stratton Management Co meliputi: Johnson Controls International plc (US:JCI) , AutoNation, Inc. (US:AN) , Triumph Group, Inc. (US:TGI) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.17 | 8.59 | 1.0429 | 1.0429 | |

| 0.29 | 16.07 | 1.9507 | 0.4065 | |

| 0.09 | 6.66 | 0.8083 | 0.3484 | |

| 0.05 | 2.73 | 0.3321 | 0.3321 | |

| 0.26 | 7.09 | 0.8612 | 0.2849 | |

| 0.54 | 16.95 | 2.0582 | 0.2724 | |

| 0.12 | 6.90 | 0.8374 | 0.2550 | |

| 0.03 | 1.92 | 0.2329 | 0.2329 | |

| 0.03 | 4.78 | 0.5802 | 0.2241 | |

| 0.18 | 5.45 | 0.6613 | 0.2208 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.22 | 20.93 | 2.5405 | -0.7836 | |

| 0.04 | 1.99 | 0.2418 | -0.5633 | |

| 0.00 | 0.00 | -0.4218 | ||

| 0.02 | 0.74 | 0.0904 | -0.3989 | |

| 0.02 | 0.57 | 0.0690 | -0.3856 | |

| 0.17 | 8.70 | 1.0560 | -0.2751 | |

| 0.09 | 7.66 | 0.9302 | -0.1564 | |

| 0.04 | 4.98 | 0.6050 | -0.1557 | |

| 0.10 | 4.79 | 0.5809 | -0.1407 | |

| 0.07 | 5.19 | 0.6304 | -0.1360 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2016-02-11 untuk periode pelaporan 2015-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| UPS / United Parcel Service, Inc. | 0.22 | -26.05 | 20.93 | -27.89 | 2.5405 | -0.7836 | |||

| ABBV / AbbVie Inc. | 0.29 | -10.18 | 17.04 | -2.21 | 2.0692 | 0.0727 | |||

| GE / General Electric Company | 0.54 | -11.96 | 16.95 | 8.74 | 2.0582 | 0.2724 | |||

| MSFT / Microsoft Corporation | 0.29 | -4.91 | 16.07 | 19.19 | 1.9507 | 0.4065 | |||

| JNJ / Johnson & Johnson | 0.15 | -8.71 | 15.27 | 0.45 | 1.8537 | 0.1126 | |||

| KMB / Kimberly-Clark Corporation | 0.11 | -14.60 | 14.53 | -0.30 | 1.7635 | 0.0947 | |||

| RTX / RTX Corporation | 0.14 | -1.94 | 13.55 | 5.87 | 1.6446 | 0.1789 | |||

| APD / Air Products and Chemicals, Inc. | 0.10 | -8.56 | 13.49 | -6.74 | 1.6383 | -0.0191 | |||

| CVS / CVS Health Corporation | 0.13 | -6.92 | 12.54 | -5.67 | 1.5223 | -0.0004 | |||

| ACN / Accenture plc | 0.12 | -7.21 | 12.37 | -1.32 | 1.5018 | 0.0659 | |||

| BMY / Bristol-Myers Squibb Company | 0.18 | -8.97 | 12.35 | 5.78 | 1.4988 | 0.1620 | |||

| WM / Waste Management, Inc. | 0.22 | -6.36 | 11.78 | 0.33 | 1.4300 | 0.0853 | |||

| HON / Honeywell International Inc. | 0.11 | -9.19 | 11.59 | -0.67 | 1.4075 | 0.0706 | |||

| CHD / Church & Dwight Co., Inc. | 0.13 | -3.58 | 11.15 | -2.45 | 1.3532 | 0.0444 | |||

| XOM / Exxon Mobil Corporation | 0.14 | -15.25 | 11.04 | -11.15 | 1.3410 | -0.0830 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.18 | -0.54 | 10.74 | 6.50 | 1.3045 | 0.1488 | |||

| JPM / JPMorgan Chase & Co. | 0.16 | -10.99 | 10.70 | -3.61 | 1.2994 | 0.0275 | |||

| MMM / 3M Company | 0.07 | -15.12 | 10.67 | -9.81 | 1.2954 | -0.0597 | |||

| MCD / McDonald's Corporation | 0.08 | -21.60 | 9.61 | -5.99 | 1.1663 | -0.0042 | |||

| LLY / Eli Lilly and Company | 0.11 | -4.24 | 9.51 | -3.59 | 1.1545 | 0.0247 | |||

| AMGN / Amgen Inc. | 0.06 | -13.73 | 9.01 | 1.25 | 1.0943 | 0.0745 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.09 | -7.80 | 8.93 | -1.48 | 1.0845 | 0.0459 | |||

| VZ / Verizon Communications Inc. | 0.19 | -10.68 | 8.92 | -5.13 | 1.0828 | 0.0060 | |||

| PPG / PPG Industries, Inc. | 0.09 | -4.36 | 8.78 | 7.78 | 1.0661 | 0.1329 | |||

| PEP / PepsiCo, Inc. | 0.09 | -9.82 | 8.73 | -4.46 | 1.0595 | 0.0132 | |||

| ETN / Eaton Corporation plc | 0.17 | -26.21 | 8.70 | -25.15 | 1.0560 | -0.2751 | |||

| ABT / Abbott Laboratories | 0.19 | -9.55 | 8.65 | 1.00 | 1.0502 | 0.0692 | |||

| DOW / Dow Inc. | 0.17 | -29.27 | 8.59 | -14.13 | 1.0429 | 1.0429 | |||

| VFC / V.F. Corporation | 0.14 | 1.41 | 8.50 | -7.46 | 1.0322 | -0.0202 | |||

| AWK / American Water Works Company, Inc. | 0.14 | -2.70 | 8.41 | 5.55 | 1.0207 | 0.1083 | |||

| TRV / The Travelers Companies, Inc. | 0.07 | -12.78 | 8.33 | -1.12 | 1.0118 | 0.0464 | |||

| RPM / RPM International Inc. | 0.18 | -5.66 | 8.08 | -0.77 | 0.9807 | 0.0482 | |||

| PSX / Phillips 66 | 0.09 | -24.12 | 7.66 | -19.23 | 0.9302 | -0.1564 | |||

| CSCO / Cisco Systems, Inc. | 0.26 | 36.29 | 7.09 | 40.99 | 0.8612 | 0.2849 | |||

| AMP / Ameriprise Financial, Inc. | 0.07 | -6.96 | 7.06 | -9.26 | 0.8573 | -0.0342 | |||

| PNY / Piedmont Natural Gas Co., Inc. | 0.12 | -4.67 | 6.90 | 35.66 | 0.8374 | 0.2550 | |||

| SPG / Simon Property Group, Inc. | 0.03 | -7.53 | 6.74 | -2.13 | 0.8187 | 0.0294 | |||

| TGT / Target Corporation | 0.09 | 79.64 | 6.66 | 65.83 | 0.8083 | 0.3484 | |||

| MET / MetLife, Inc. | 0.13 | -13.74 | 6.42 | -11.80 | 0.7798 | -0.0543 | |||

| WDFC / WD-40 Company | 0.06 | -7.25 | 6.06 | 2.73 | 0.7360 | 0.0600 | |||

| EMR / Emerson Electric Co. | 0.13 | -4.92 | 6.06 | 2.96 | 0.7354 | 0.0615 | |||

| BDX / Becton, Dickinson and Company | 0.04 | -1.64 | 6.01 | 14.25 | 0.7302 | 0.1272 | |||

| MRK / Merck & Co., Inc. | 0.11 | 4.67 | 6.01 | 11.94 | 0.7297 | 0.1146 | |||

| ESRX / Express Scripts Holding Co. | 0.07 | -12.04 | 5.88 | -5.04 | 0.7142 | 0.0046 | |||

| WHR / Whirlpool Corporation | 0.04 | -18.70 | 5.86 | -18.92 | 0.7115 | -0.1164 | |||

| SWK / Stanley Black & Decker, Inc. | 0.05 | -11.82 | 5.62 | -2.95 | 0.6827 | 0.0190 | |||

| NSC / Norfolk Southern Corporation | 0.07 | -3.98 | 5.62 | 6.32 | 0.6817 | 0.0768 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.04 | -6.02 | 5.59 | 9.03 | 0.6789 | 0.0914 | |||

| WPC / W. P. Carey Inc. | 0.09 | -2.51 | 5.51 | -0.51 | 0.6686 | 0.0346 | |||

| WY / Weyerhaeuser Company | 0.18 | 29.17 | 5.45 | 41.63 | 0.6613 | 0.2208 | |||

| FDX / FedEx Corporation | 0.04 | 3.63 | 5.43 | 7.23 | 0.6590 | 0.0792 | |||

| SWKS / Skyworks Solutions, Inc. | 0.07 | -14.93 | 5.19 | -22.39 | 0.6304 | -0.1360 | |||

| NEE / NextEra Energy, Inc. | 0.05 | -10.76 | 5.09 | -4.94 | 0.6186 | 0.0046 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.05 | -5.10 | 5.09 | -3.97 | 0.6175 | 0.0108 | |||

| CVX / Chevron Corporation | 0.06 | -27.54 | 5.08 | -17.36 | 0.6166 | -0.0874 | |||

| IBM / International Business Machines Corporation | 0.04 | -20.96 | 4.98 | -24.97 | 0.6050 | -0.1557 | |||

| ORCL / Oracle Corporation | 0.14 | -10.79 | 4.98 | -9.77 | 0.6044 | -0.0276 | |||

| PG / The Procter & Gamble Company | 0.06 | -12.19 | 4.96 | -3.07 | 0.6016 | 0.0160 | |||

| NXPI / NXP Semiconductors N.V. | 0.06 | -14.61 | 4.83 | -17.38 | 0.5864 | -0.0833 | |||

| DLR / Digital Realty Trust, Inc. | 0.06 | -4.79 | 4.81 | 10.24 | 0.5845 | 0.0842 | |||

| COP / ConocoPhillips | 0.10 | -21.99 | 4.79 | -24.05 | 0.5809 | -0.1407 | |||

| ARG / Airgas, Inc. | 0.03 | -0.72 | 4.78 | 53.72 | 0.5802 | 0.2241 | |||

| CCL / Carnival Corporation & plc | 0.09 | -12.36 | 4.73 | -3.94 | 0.5738 | 0.0102 | |||

| INTC / Intel Corporation | 0.14 | -6.90 | 4.70 | 6.40 | 0.5711 | 0.0647 | |||

| AAPL / Apple Inc. | 0.04 | -12.98 | 4.63 | -16.95 | 0.5626 | -0.0766 | |||

| LYB / LyondellBasell Industries N.V. | 0.05 | -12.98 | 4.62 | -9.27 | 0.5608 | -0.0224 | |||

| PRU / Prudential Financial, Inc. | 0.06 | -4.75 | 4.57 | 1.74 | 0.5546 | 0.0403 | |||

| MGA / Magna International Inc. | 0.11 | -1.30 | 4.55 | -16.61 | 0.5527 | -0.0727 | |||

| AAL / American Airlines Group Inc. | 0.10 | -13.78 | 4.41 | -5.95 | 0.5355 | -0.0017 | |||

| 018490100 / Allergan plc | 0.01 | -17.51 | 4.34 | -5.15 | 0.5275 | 0.0028 | |||

| OXY / Occidental Petroleum Corporation | 0.06 | -11.96 | 4.34 | -10.02 | 0.5275 | -0.0256 | |||

| KIM / Kimco Realty Corporation | 0.16 | -9.52 | 4.32 | -1.99 | 0.5250 | 0.0196 | |||

| PFE / Pfizer Inc. | 0.13 | -18.64 | 4.31 | -16.39 | 0.5228 | -0.0671 | |||

| AMG / Affiliated Managers Group, Inc. | 0.03 | 12.31 | 4.26 | 4.92 | 0.5177 | 0.0522 | |||

| CDW / CDW Corporation | 0.10 | -13.24 | 4.21 | -10.74 | 0.5115 | -0.0292 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.04 | 5.27 | 4.19 | 14.97 | 0.5091 | 0.0913 | |||

| RTN / Raytheon Co. | 0.03 | -19.51 | 4.16 | -8.27 | 0.5049 | -0.0144 | |||

| T / AT&T Inc. | 0.12 | -19.94 | 4.15 | -15.44 | 0.5038 | -0.0584 | |||

| MO / Altria Group, Inc. | 0.07 | -11.21 | 4.10 | -4.98 | 0.4981 | 0.0035 | |||

| TD / The Toronto-Dominion Bank | 0.10 | -9.28 | 4.06 | -9.85 | 0.4932 | -0.0230 | |||

| URI / United Rentals, Inc. | 0.06 | -18.95 | 4.06 | -2.10 | 0.4930 | 0.0179 | |||

| UGI / UGI Corporation | 0.12 | -9.34 | 3.90 | -12.10 | 0.4737 | -0.0347 | |||

| COF / Capital One Financial Corporation | 0.05 | -12.27 | 3.88 | -12.69 | 0.4713 | -0.0380 | |||

| PNR / Pentair plc | 0.08 | -4.31 | 3.81 | -7.14 | 0.4623 | -0.0074 | |||

| DE / Deere & Company | 0.05 | -14.71 | 3.79 | -12.10 | 0.4603 | -0.0338 | |||

| MHK / Mohawk Industries, Inc. | 0.02 | -14.74 | 3.77 | -11.17 | 0.4577 | -0.0284 | |||

| DHI / D.R. Horton, Inc. | 0.12 | -14.62 | 3.71 | -6.85 | 0.4505 | -0.0058 | |||

| CPB / The Campbell's Company | 0.07 | 0.00 | 3.69 | 3.68 | 0.4485 | 0.0403 | |||

| JCI / Johnson Controls International plc | 0.09 | 3.60 | 0.4374 | 0.0115 | |||||

| TYG / Tortoise Energy Infrastructure Corporation | 0.13 | 17.97 | 3.56 | 21.08 | 0.4323 | 0.0954 | |||

| TEL / TE Connectivity plc | 0.06 | -16.79 | 3.56 | -10.23 | 0.4316 | -0.0220 | |||

| CSX / CSX Corporation | 0.14 | -10.10 | 3.55 | -13.27 | 0.4309 | -0.0379 | |||

| LHX / L3Harris Technologies, Inc. | 0.04 | -3.84 | 3.48 | 14.20 | 0.4227 | 0.0735 | |||

| GILD / Gilead Sciences, Inc. | 0.03 | -15.01 | 3.48 | -12.42 | 0.4221 | -0.0326 | |||

| SLB / Schlumberger Limited | 0.05 | -10.64 | 3.48 | -9.62 | 0.4219 | -0.0185 | |||

| US40416M1053 / Hd Supply Inc. | 0.12 | -15.07 | 3.47 | -10.87 | 0.4209 | -0.0247 | |||

| JCI / Johnson Controls International plc | 0.11 | -5.34 | 3.45 | -9.78 | 0.4187 | -0.0192 | |||

| CAT / Caterpillar Inc. | 0.05 | -11.58 | 3.41 | -8.05 | 0.4144 | -0.0108 | |||

| US00C4U1L353 / Mylan N.V. | 0.06 | -28.65 | 3.41 | -4.19 | 0.4139 | 0.0063 | |||

| GPC / Genuine Parts Company | 0.04 | -1.25 | 3.40 | 2.32 | 0.4125 | 0.0321 | |||

| USB / U.S. Bancorp | 0.08 | -10.66 | 3.32 | -7.05 | 0.4036 | -0.0061 | |||

| MCK / McKesson Corporation | 0.02 | -15.62 | 3.31 | -10.07 | 0.4021 | -0.0198 | |||

| MS / Morgan Stanley | 0.10 | -17.38 | 3.31 | -16.57 | 0.4015 | -0.0526 | |||

| CCI / Crown Castle Inc. | 0.04 | 11.48 | 3.27 | 22.16 | 0.3975 | 0.0905 | |||

| KEY / KeyCorp | 0.24 | -11.68 | 3.23 | -10.46 | 0.3919 | -0.0210 | |||

| HBAN / Huntington Bancshares Incorporated | 0.29 | -10.57 | 3.22 | -6.67 | 0.3905 | -0.0043 | |||

| D / Dominion Energy, Inc. | 0.05 | -5.21 | 3.08 | -8.88 | 0.3738 | -0.0132 | |||

| DOW / Dow Inc. | 0.05 | -32.26 | 3.08 | -6.42 | 0.3735 | -0.0031 | |||

| F / Ford Motor Company | 0.20 | -20.92 | 2.89 | -17.89 | 0.3504 | -0.0523 | |||

| CF / CF Industries Holdings, Inc. | 0.07 | -12.83 | 2.85 | -20.78 | 0.3458 | -0.0660 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.09 | -14.58 | 2.81 | -16.12 | 0.3412 | -0.0426 | |||

| PM / Philip Morris International Inc. | 0.03 | -7.37 | 2.76 | 2.64 | 0.3353 | 0.0271 | |||

| AN / AutoNation, Inc. | 0.05 | 2.73 | 0.3321 | 0.3321 | |||||

| MKC / McCormick & Company, Incorporated | 0.03 | -3.08 | 2.69 | 0.90 | 0.3272 | 0.0212 | |||

| HD / The Home Depot, Inc. | 0.02 | -1.40 | 2.69 | 12.90 | 0.3272 | 0.0538 | |||

| KYN / Kayne Anderson Energy Infrastructure Fund, Inc. | 0.16 | -5.81 | 2.68 | -29.76 | 0.3259 | -0.1118 | |||

| DUK / Duke Energy Corporation | 0.04 | -13.26 | 2.67 | -13.93 | 0.3248 | -0.0313 | |||

| UNP / Union Pacific Corporation | 0.03 | -10.12 | 2.59 | -20.50 | 0.3140 | -0.0587 | |||

| DIS / The Walt Disney Company | 0.02 | -3.85 | 2.57 | -1.15 | 0.3120 | 0.0142 | |||

| FISV / Fiserv, Inc. | 0.03 | -1.51 | 2.54 | 3.98 | 0.3078 | 0.0285 | |||

| NJR / New Jersey Resources Corporation | 0.08 | 0.00 | 2.52 | 9.75 | 0.3061 | 0.0430 | |||

| PH / Parker-Hannifin Corporation | 0.03 | -4.96 | 2.46 | -5.28 | 0.2984 | 0.0012 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.07 | -4.30 | 2.29 | -5.38 | 0.2777 | 0.0008 | |||

| ITW / Illinois Tool Works Inc. | 0.02 | 0.00 | 2.19 | 12.56 | 0.2655 | 0.0430 | |||

| QCOM / QUALCOMM Incorporated | 0.04 | -69.54 | 1.99 | -71.66 | 0.2418 | -0.5633 | |||

| WELL / Welltower Inc. | 0.03 | -16.32 | 1.92 | -15.95 | 0.2329 | 0.2329 | |||

| ACC / American Campus Communities Inc. | 0.04 | -13.34 | 1.79 | -1.16 | 0.2168 | 0.0098 | |||

| LPT / Liberty Property Trust | 0.06 | -13.45 | 1.76 | -14.74 | 0.2136 | -0.0228 | |||

| WFC / Wells Fargo & Company | 0.03 | -16.81 | 1.75 | -11.93 | 0.2123 | -0.0152 | |||

| GL / Globe Life Inc. | 0.03 | -9.91 | 1.71 | -8.73 | 0.2070 | -0.0070 | |||

| EPP / iShares, Inc. - iShares MSCI Pacific ex Japan ETF | 0.04 | -26.79 | 1.57 | -23.33 | 0.1911 | -0.0441 | |||

| AFL / Aflac Incorporated | 0.03 | -12.35 | 1.57 | -9.71 | 0.1909 | -0.0086 | |||

| SJM / The J. M. Smucker Company | 0.01 | 0.00 | 1.50 | 8.09 | 0.1817 | 0.0231 | |||

| MDLZ / Mondelez International, Inc. | 0.03 | -2.09 | 1.45 | 4.84 | 0.1762 | 0.0176 | |||

| / Total S.A. | 0.03 | -18.84 | 1.42 | -18.40 | 0.1723 | -0.0269 | |||

| ALL / The Allstate Corporation | 0.02 | -6.37 | 1.37 | -0.15 | 0.1663 | 0.0092 | |||

| BKH / Black Hills Corporation | 0.03 | -0.70 | 1.32 | 11.55 | 0.1606 | 0.0248 | |||

| KO / The Coca-Cola Company | 0.03 | -44.29 | 1.32 | -40.34 | 0.1598 | -0.0929 | |||

| LLL / JX Luxventure Limited | 0.01 | -11.35 | 1.31 | 1.32 | 0.1587 | 0.0109 | |||

| HRL / Hormel Foods Corporation | 0.02 | 0.00 | 1.30 | 24.95 | 0.1575 | 0.0386 | |||

| AXP / American Express Company | 0.02 | -7.35 | 1.26 | -13.09 | 0.1531 | -0.0131 | |||

| WGL / WGL Holdings, Inc. | 0.02 | 0.00 | 1.25 | 9.19 | 0.1514 | 0.0206 | |||

| BXLT / Baxalta Incorporated | 0.03 | -12.77 | 1.23 | 8.02 | 0.1488 | 0.0188 | |||

| BAX / Baxter International Inc. | 0.03 | -16.01 | 1.16 | -2.44 | 0.1410 | 0.0046 | |||

| PPL / PPL Corporation | 0.03 | -16.45 | 1.13 | -13.31 | 0.1368 | -0.0121 | |||

| PAYX / Paychex, Inc. | 0.02 | 0.00 | 1.07 | 11.11 | 0.1299 | 0.0196 | |||

| PEAK / Healthpeak Properties, Inc. | 0.03 | -17.42 | 1.03 | -15.24 | 0.1249 | -0.0141 | |||

| BA / The Boeing Company | 0.01 | 6.02 | 1.02 | 16.99 | 0.1237 | 0.0239 | |||

| VTR / Ventas, Inc. | 0.02 | 53.48 | 1.00 | 54.42 | 0.1209 | 0.0470 | |||

| SYY / Sysco Corporation | 0.02 | -6.18 | 0.90 | -1.31 | 0.1098 | 0.0048 | |||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.00 | 0.00 | 0.88 | 11.53 | 0.1068 | 0.0165 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 32.79 | 0.88 | 39.08 | 0.1067 | 0.0343 | |||

| KHC / The Kraft Heinz Company | 0.01 | -4.76 | 0.88 | -1.79 | 0.1065 | 0.0042 | |||

| PFF / iShares Trust - iShares Preferred and Income Securities ETF | 0.02 | 0.00 | 0.85 | 0.71 | 0.1038 | 0.0066 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.01 | -2.00 | 0.84 | -8.25 | 0.1026 | -0.0029 | |||

| THO / THOR Industries, Inc. | 0.01 | -3.25 | 0.84 | 4.89 | 0.1016 | 0.0102 | |||

| CL / Colgate-Palmolive Company | 0.01 | 0.00 | 0.84 | 5.03 | 0.1015 | 0.0103 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.02 | -1.17 | 0.81 | -6.18 | 0.0977 | -0.0005 | |||

| RGCO / RGC Resources, Inc. | 0.04 | -6.93 | 0.80 | -1.72 | 0.0974 | 0.0039 | |||

| MPC / Marathon Petroleum Corporation | 0.02 | -18.40 | 0.78 | -8.64 | 0.0949 | -0.0031 | |||

| M / Macy's, Inc. | 0.02 | -74.41 | 0.74 | -82.56 | 0.0904 | -0.3989 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.02 | -31.18 | 0.70 | -27.75 | 0.0854 | -0.0261 | |||

| MDP / Meredith Holdings Corp | 0.02 | -11.72 | 0.70 | -10.24 | 0.0851 | -0.0044 | |||

| APU / AmeriGas Partners, L.P. | 0.02 | -1.99 | 0.68 | -19.16 | 0.0820 | -0.0137 | |||

| 74005P104 / Praxair, Inc. | 0.01 | 0.00 | 0.67 | 0.45 | 0.0818 | 0.0050 | |||

| DGX / Quest Diagnostics Incorporated | 0.01 | 0.00 | 0.64 | 15.73 | 0.0777 | 0.0144 | |||

| DRI / Darden Restaurants, Inc. | 0.01 | -18.85 | 0.63 | -24.64 | 0.0765 | -0.0193 | |||

| OMC / Omnicom Group Inc. | 0.01 | -1.22 | 0.61 | 13.52 | 0.0744 | 0.0126 | |||

| GIS / General Mills, Inc. | 0.01 | -19.29 | 0.60 | -17.06 | 0.0732 | -0.0101 | |||

| UDR / UDR, Inc. | 0.02 | -3.74 | 0.58 | 4.88 | 0.0704 | 0.0071 | |||

| CAG / Conagra Brands, Inc. | 0.01 | -18.38 | 0.57 | -15.03 | 0.0693 | -0.0077 | |||

| HAL / Halliburton Company | 0.02 | -85.14 | 0.57 | -85.69 | 0.0690 | -0.3856 | |||

| IR / Ingersoll Rand Inc. | 0.01 | 0.00 | 0.54 | 8.89 | 0.0654 | 0.0087 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.01 | 0.00 | 0.54 | 6.75 | 0.0653 | 0.0076 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.53 | 0.0645 | 0.0645 | |||||

| US1182301010 / Buckeye Partners, L.P. | 0.01 | -41.76 | 0.52 | -35.23 | 0.0636 | -0.0291 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.01 | -36.28 | 0.52 | -34.79 | 0.0635 | -0.0284 | |||

| RDS.A / Shell Plc - ADR (Representing Ordinary Shares - Class A) | 0.01 | -24.05 | 0.50 | -26.59 | 0.0603 | -0.0172 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | -10.70 | 0.48 | -1.45 | 0.0578 | 0.0025 | |||

| CELG / Celgene Corp. | 0.00 | -30.70 | 0.47 | -23.34 | 0.0574 | -0.0133 | |||

| AGU / Agrium Inc. | 0.01 | -8.77 | 0.47 | -8.82 | 0.0565 | -0.0020 | |||

| SO / The Southern Company | 0.01 | -3.43 | 0.46 | 1.10 | 0.0560 | 0.0037 | |||

| LH / Labcorp Holdings Inc. | 0.00 | 0.00 | 0.45 | 13.85 | 0.0549 | 0.0094 | |||

| DGICA / Donegal Group Inc. | 0.03 | -9.00 | 0.41 | -8.85 | 0.0500 | -0.0018 | |||

| APA / APA Corporation | 0.01 | -17.39 | 0.41 | -6.15 | 0.0500 | -0.0003 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.01 | -14.98 | 0.41 | -22.05 | 0.0498 | -0.0105 | |||

| GOOG / Alphabet Inc. | 0.00 | -23.90 | 0.39 | -25.80 | 0.0478 | 0.0478 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 0.39 | 11.78 | 0.0472 | 0.0074 | |||

| BHB / Bar Harbor Bankshares | 0.01 | 0.00 | 0.36 | 7.44 | 0.0438 | 0.0053 | |||

| HRB / H&R Block, Inc. | 0.01 | -38.88 | 0.36 | -43.86 | 0.0438 | -0.0298 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.34 | 5.61 | 0.0412 | 0.0044 | |||

| NNN / NNN REIT, Inc. | 0.01 | 0.00 | 0.34 | 10.16 | 0.0408 | 0.0059 | |||

| AON / Aon plc | 0.00 | 0.00 | 0.32 | 3.85 | 0.0393 | 0.0036 | |||

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.01 | 0.00 | 0.32 | 2.90 | 0.0387 | 0.0032 | |||

| BAC / Bank of America Corporation | 0.02 | -22.83 | 0.32 | -16.75 | 0.0386 | -0.0051 | |||

| IHRMF / iShares Public Limited Company - iShares MSCI Japan UCITS ETF USD (Dist) | 0.03 | 0.00 | 0.32 | 6.04 | 0.0384 | 0.0042 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.00 | -41.94 | 0.31 | -34.11 | 0.0378 | -0.0163 | |||

| HPT / Hospitality Properties Trust | 0.01 | -18.62 | 0.31 | -16.71 | 0.0375 | -0.0050 | |||

| DNP / DNP Select Income Fund Inc. | 0.00 | 0.30 | 17.05 | 0.0367 | 0.0071 | ||||

| AEP / American Electric Power Company, Inc. | 0.01 | -10.71 | 0.29 | -8.49 | 0.0353 | -0.0011 | |||

| HSY / The Hershey Company | 0.00 | 0.00 | 0.28 | -2.77 | 0.0341 | 0.0010 | |||

| 153501101 / Central Fund of Canada Ltd. | 0.03 | 0.00 | 0.28 | -5.50 | 0.0334 | 0.0001 | |||

| SXL / Sunoco Logistics Partners L.P. | 0.01 | -14.25 | 0.27 | -29.72 | 0.0330 | -0.0113 | |||

| FCX / Freeport-McMoRan Inc. | 0.04 | -18.35 | 0.26 | -43.01 | 0.0317 | -0.0208 | |||

| US0325111070 / Anadarko Petroleum Corp. | 0.01 | -7.89 | 0.26 | -25.87 | 0.0310 | -0.0084 | |||

| CI / The Cigna Group | 0.00 | 0.00 | 0.23 | 8.33 | 0.0284 | 0.0037 | |||

| WASH / Washington Trust Bancorp, Inc. | 0.01 | 0.00 | 0.23 | 2.70 | 0.0277 | 0.0023 | |||

| CECE / Ceco Environmental Corp. | 0.03 | 0.00 | 0.23 | -6.25 | 0.0273 | -0.0002 | |||

| TGI / Triumph Group, Inc. | 0.01 | 0.22 | 0.0266 | 0.0266 | |||||

| VFINX / Vanguard Index Funds - Vanguard Index Trust 500 Index Fund | 0.00 | 0.00 | 0.22 | 6.40 | 0.0262 | 0.0262 | |||

| GLW / Corning Incorporated | 0.01 | -9.98 | 0.21 | -3.59 | 0.0261 | 0.0006 | |||

| ESS / Essex Property Trust, Inc. | 0.00 | -16.67 | 0.21 | -11.06 | 0.0254 | -0.0015 | |||

| SPGI / S&P Global Inc. | 0.00 | -9.87 | 0.21 | 2.48 | 0.0251 | 0.0020 | |||

| VLO / Valero Energy Corporation | 0.00 | 0.00 | 0.20 | 0.0249 | 0.0249 | ||||

| TFX / Teleflex Incorporated | 0.00 | 0.00 | 0.20 | 0.0248 | 0.0248 | ||||

| DOV / Dover Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0393 | ||||

| DVN / Devon Energy Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0235 | ||||

| NOV / NOV Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0290 | ||||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.0645 | ||||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.0238 | ||||

| K / Kellanova | 0.00 | -100.00 | 0.00 | -100.00 | -0.0244 | ||||

| WMT / Walmart Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0267 | ||||

| MRO / Marathon Oil Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0271 | ||||

| AVGO / Broadcom Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4218 | ||||

| WTRG / Essential Utilities, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0244 | ||||

| CPT / Camden Property Trust | 0.00 | -100.00 | 0.00 | -100.00 | -0.0262 | ||||

| KMI / Kinder Morgan, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0688 | ||||

| 847560109 / Spectra Energy Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0245 | ||||

| VTIAX / Vanguard Star Funds - Vanguard Total International Stock Index Fund Admiral | 0.00 | -100.00 | 0.00 | -100.00 | -0.0396 | ||||

| KSS / Kohl's Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0334 |