Mga Batayang Estadistika

| Nilai Portofolio | $ 507,217,151 |

| Posisi Saat Ini | 100 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

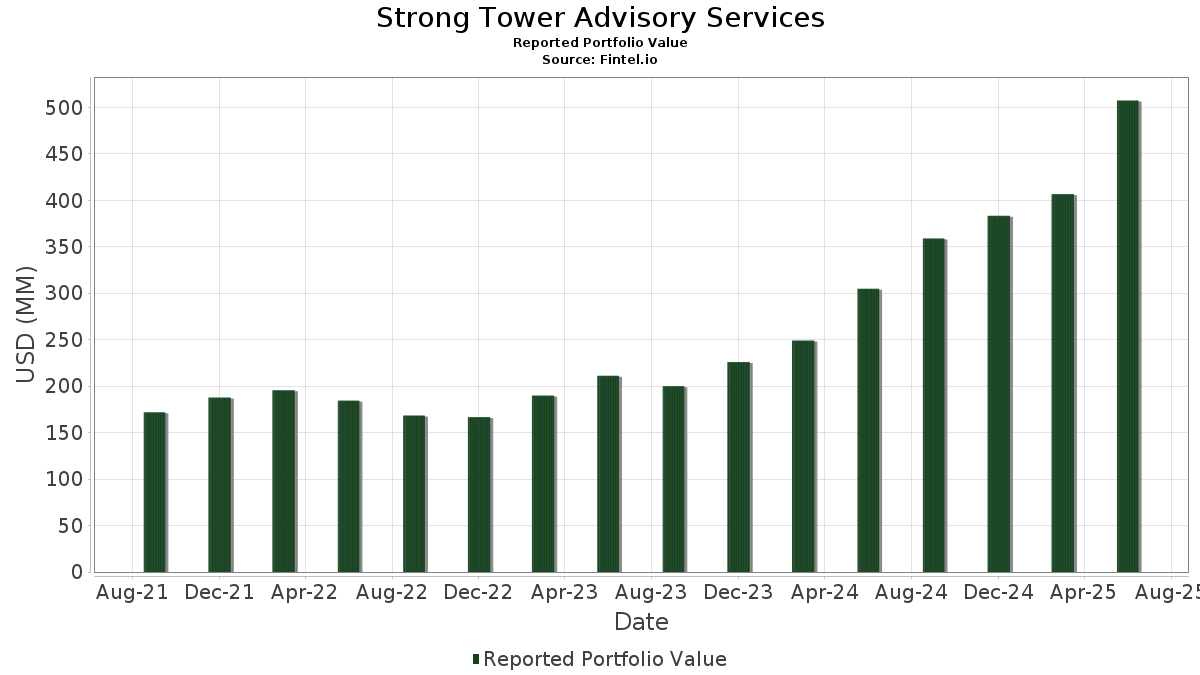

Strong Tower Advisory Services telah mengungkapkan total kepemilikan 100 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 507,217,151 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Strong Tower Advisory Services adalah Strategy Inc (US:MSTR) , iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF (US:HYG) , FS KKR Capital Corp. (US:FSK) , NVIDIA Corporation (US:NVDA) , and iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF (US:LQD) . Posisi baru Strong Tower Advisory Services meliputi: Vanguard Bond Index Funds - Vanguard Long-Term Bond ETF (US:BLV) , Janus Detroit Street Trust - Janus Henderson B-BBB CLO ETF (US:JBBB) , The Travelers Companies, Inc. (US:TRV) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.13 | 54.20 | 10.6852 | 1.7515 | |

| 0.21 | 10.35 | 2.0401 | 1.6581 | |

| 0.11 | 7.74 | 1.5255 | 1.5255 | |

| 0.14 | 22.18 | 4.3726 | 0.8951 | |

| 0.04 | 17.86 | 3.5206 | 0.4227 | |

| 0.03 | 10.11 | 1.9934 | 0.3907 | |

| 0.04 | 8.50 | 1.6759 | 0.3433 | |

| 0.02 | 5.27 | 1.0388 | 0.3263 | |

| 0.29 | 17.64 | 3.4769 | 0.3206 | |

| 0.02 | 5.12 | 1.0093 | 0.3157 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 6.79 | 1.3395 | -1.3947 | |

| 1.41 | 15.06 | 2.9688 | -0.7908 | |

| 1.10 | 22.91 | 4.5158 | -0.5894 | |

| 0.30 | 24.13 | 4.7583 | -0.5733 | |

| 0.20 | 21.50 | 4.2398 | -0.3893 | |

| 0.01 | 7.19 | 1.4177 | -0.3136 | |

| 0.01 | 8.28 | 1.6323 | -0.1877 | |

| 0.08 | 6.83 | 1.3461 | -0.1804 | |

| 0.07 | 7.06 | 1.3915 | -0.1600 | |

| 0.06 | 6.48 | 1.2770 | -0.1559 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-24 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSTR / Strategy Inc | 0.13 | -1.02 | 54.20 | 49.22 | 10.6852 | 1.7515 | |||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | 0.30 | 5.06 | 24.13 | 11.34 | 4.7583 | -0.5733 | |||

| FSK / FS KKR Capital Corp. | 1.10 | -1.93 | 22.91 | 10.36 | 4.5158 | -0.5894 | |||

| NVDA / NVIDIA Corporation | 0.14 | -3.05 | 22.18 | 56.88 | 4.3726 | 0.8951 | |||

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | 0.20 | 11.19 | 21.50 | 14.27 | 4.2398 | -0.3893 | |||

| MSFT / Microsoft Corporation | 0.04 | 2.00 | 17.86 | 41.79 | 3.5206 | 0.4227 | |||

| IBIT / iShares Bitcoin Trust ETF | 0.29 | -0.60 | 17.64 | 37.43 | 3.4769 | 0.3206 | |||

| FBRT / Franklin BSP Realty Trust, Inc. | 1.41 | 4.69 | 15.06 | -1.48 | 2.9688 | -0.7908 | |||

| AMZN / Amazon.com, Inc. | 0.06 | 0.10 | 12.57 | 25.30 | 2.4776 | 0.0107 | |||

| TSLA / Tesla, Inc. | 0.03 | 1.47 | 10.82 | 38.16 | 2.1332 | 0.2069 | |||

| TBIL / The RBB Fund, Inc. - F/m US Treasury 3 Month Bill ETF | 0.21 | 564.70 | 10.35 | 566.69 | 2.0401 | 1.6581 | |||

| PWR / Quanta Services, Inc. | 0.03 | 0.64 | 10.11 | 55.18 | 1.9934 | 0.3907 | |||

| GOOGL / Alphabet Inc. | 0.05 | 0.61 | 8.89 | 20.82 | 1.7532 | -0.0571 | |||

| FCX / Freeport-McMoRan Inc. | 0.20 | 0.46 | 8.83 | 43.42 | 1.7401 | 0.2262 | |||

| COF / Capital One Financial Corporation | 0.04 | 2.45 | 8.78 | 40.93 | 1.7317 | 0.1987 | |||

| BA / The Boeing Company | 0.04 | 3.98 | 8.50 | 56.91 | 1.6759 | 0.3433 | |||

| AAPL / Apple Inc. | 0.04 | 1.80 | 8.41 | 15.09 | 1.6584 | -0.1393 | |||

| LLY / Eli Lilly and Company | 0.01 | 3.88 | 8.28 | 11.89 | 1.6323 | -0.1877 | |||

| V / Visa Inc. | 0.02 | 2.88 | 7.87 | 16.96 | 1.5513 | -0.1035 | |||

| MMM / 3M Company | 0.05 | 1.56 | 7.80 | 20.29 | 1.5380 | -0.0573 | |||

| BLV / Vanguard Bond Index Funds - Vanguard Long-Term Bond ETF | 0.11 | 7.74 | 1.5255 | 1.5255 | |||||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | 3.13 | 7.19 | 2.16 | 1.4177 | -0.3136 | |||

| XOM / Exxon Mobil Corporation | 0.07 | 6.85 | 7.06 | 11.89 | 1.3915 | -0.1600 | |||

| LPX / Louisiana-Pacific Corporation | 0.08 | 6.45 | 6.83 | 10.01 | 1.3461 | -0.1804 | |||

| UNH / UnitedHealth Group Incorporated | 0.02 | 2.79 | 6.79 | -38.88 | 1.3395 | -1.3947 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.06 | 3.90 | 6.48 | 11.18 | 1.2770 | -0.1559 | |||

| SOLV / Solventum Corporation | 0.08 | 6.53 | 6.24 | 23.68 | 1.2308 | -0.0107 | |||

| CEG / Constellation Energy Corporation | 0.02 | 1.33 | 5.27 | 81.94 | 1.0388 | 0.3263 | |||

| AVGO / Broadcom Inc. | 0.02 | 1.52 | 5.12 | 81.59 | 1.0093 | 0.3157 | |||

| PH / Parker-Hannifin Corporation | 0.01 | 1.15 | 4.11 | 32.89 | 0.8101 | 0.0496 | |||

| RTX / RTX Corporation | 0.02 | 1.94 | 3.59 | 26.89 | 0.7081 | 0.0118 | |||

| BLK / BlackRock, Inc. | 0.00 | 3.27 | 3.55 | 32.56 | 0.6992 | 0.0411 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 4.32 | 3.53 | 41.05 | 0.6964 | 0.0804 | |||

| GRMN / Garmin Ltd. | 0.02 | 0.85 | 3.53 | 16.41 | 0.6952 | -0.0500 | |||

| LHX / L3Harris Technologies, Inc. | 0.01 | 2.20 | 3.50 | 28.04 | 0.6905 | 0.0177 | |||

| ETN / Eaton Corporation plc | 0.01 | 8.72 | 3.49 | 53.73 | 0.6872 | 0.1296 | |||

| MA / Mastercard Incorporated | 0.01 | 2.54 | 3.47 | 18.65 | 0.6849 | -0.0351 | |||

| ECL / Ecolab Inc. | 0.01 | 2.53 | 3.46 | 19.93 | 0.6823 | -0.0274 | |||

| SPLG / SPDR Series Trust - SPDR Portfolio S&P 500 ETF | 0.05 | 42.98 | 3.34 | 75.21 | 0.6578 | 0.1893 | |||

| CTVA / Corteva, Inc. | 0.04 | 4.56 | 3.14 | 40.29 | 0.6193 | 0.0684 | |||

| STE / STERIS plc | 0.01 | 2.05 | 3.13 | 15.25 | 0.6167 | -0.0510 | |||

| SHW / The Sherwin-Williams Company | 0.01 | 3.82 | 3.12 | 10.45 | 0.6148 | -0.0798 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 4.90 | 3.11 | 7.28 | 0.6129 | -0.0998 | |||

| BHP / BHP Group Limited - Depositary Receipt (Common Stock) | 0.06 | 1.50 | 3.10 | 15.35 | 0.6105 | -0.0499 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.04 | 4.39 | 3.07 | 13.18 | 0.6044 | -0.0617 | |||

| CNI / Canadian National Railway Company | 0.03 | 2.99 | 3.06 | 13.09 | 0.6030 | -0.0622 | |||

| PM / Philip Morris International Inc. | 0.02 | 4.71 | 3.05 | 26.08 | 0.6007 | 0.0064 | |||

| ITW / Illinois Tool Works Inc. | 0.01 | 2.55 | 3.04 | 14.37 | 0.5994 | -0.0546 | |||

| COST / Costco Wholesale Corporation | 0.00 | 3.95 | 3.03 | 13.34 | 0.5964 | -0.0603 | |||

| WMT / Walmart Inc. | 0.03 | 4.19 | 3.01 | 21.53 | 0.5933 | -0.0158 | |||

| NEM / Newmont Corporation | 0.05 | 4.08 | 3.01 | 35.16 | 0.5927 | 0.0456 | |||

| CMI / Cummins Inc. | 0.01 | 5.03 | 2.96 | 24.79 | 0.5827 | 0.0001 | |||

| FDS / FactSet Research Systems Inc. | 0.01 | 3.15 | 2.95 | 13.79 | 0.5824 | -0.0563 | |||

| ROP / Roper Technologies, Inc. | 0.01 | 2.98 | 2.88 | 9.62 | 0.5686 | -0.0786 | |||

| CVX / Chevron Corporation | 0.02 | 5.36 | 2.82 | 7.67 | 0.5560 | -0.0884 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.15 | 10.06 | 2.80 | 25.73 | 0.5511 | 0.0043 | |||

| KMI / Kinder Morgan, Inc. | 0.09 | 4.87 | 2.77 | 21.53 | 0.5455 | -0.0145 | |||

| XEL / Xcel Energy Inc. | 0.04 | 9.63 | 2.68 | 11.34 | 0.5284 | -0.0637 | |||

| ABBV / AbbVie Inc. | 0.01 | 14.59 | 2.63 | 14.00 | 0.5187 | -0.0489 | |||

| MCD / McDonald's Corporation | 0.01 | 5.23 | 2.50 | 2.55 | 0.4923 | -0.1068 | |||

| PG / The Procter & Gamble Company | 0.02 | 10.61 | 2.48 | 10.01 | 0.4898 | -0.0658 | |||

| PAYX / Paychex, Inc. | 0.02 | 5.25 | 2.42 | 8.98 | 0.4763 | -0.0690 | |||

| MRK / Merck & Co., Inc. | 0.03 | 5.67 | 2.34 | 3.04 | 0.4618 | -0.0973 | |||

| VZ / Verizon Communications Inc. | 0.05 | 5.60 | 2.34 | 7.29 | 0.4617 | -0.0751 | |||

| PLTR / Palantir Technologies Inc. | 0.02 | -9.61 | 2.34 | 58.31 | 0.4605 | 0.0976 | |||

| MLPA / Global X Funds - Global X MLP ETF | 0.05 | 6.12 | 2.32 | 10.61 | 0.4583 | -0.0586 | |||

| AWK / American Water Works Company, Inc. | 0.02 | 5.64 | 2.32 | 3.24 | 0.4581 | -0.0955 | |||

| KMB / Kimberly-Clark Corporation | 0.02 | 8.96 | 2.29 | 4.37 | 0.4525 | -0.0882 | |||

| WY / Weyerhaeuser Company | 0.09 | 6.07 | 2.20 | 6.97 | 0.4328 | -0.0721 | |||

| CION / CION Investment Corporation | 0.20 | 3.92 | 1.90 | 12.68 | 0.3750 | -0.0404 | |||

| QQQM / Invesco Exchange-Traded Fund Trust II - Invesco NASDAQ 100 ETF | 0.01 | 49.62 | 1.53 | 94.66 | 0.3021 | 0.1085 | |||

| ENVX / Enovix Corporation | 0.15 | 1.38 | 1.51 | 74.45 | 0.2977 | 0.0848 | |||

| IONQ / IonQ, Inc. | 0.03 | -1.32 | 1.25 | 86.38 | 0.2456 | 0.0812 | |||

| POWL / Powell Industries, Inc. | 0.01 | 0.39 | 1.19 | 25.21 | 0.2351 | 0.0007 | |||

| INOD / Innodata Inc. | 0.02 | -5.67 | 1.12 | 51.76 | 0.2216 | 0.0395 | |||

| APH / Amphenol Corporation | 0.01 | -2.15 | 1.03 | 58.86 | 0.2033 | 0.0435 | |||

| HIMS / Hims & Hers Health, Inc. | 0.02 | -1.86 | 1.01 | 76.22 | 0.1987 | 0.0580 | |||

| MTW / The Manitowoc Company, Inc. | 0.08 | -0.29 | 0.99 | 61.54 | 0.1946 | 0.0443 | |||

| HBM / Hudbay Minerals Inc. | 0.09 | 0.51 | 0.98 | 68.57 | 0.1924 | 0.0499 | |||

| ROK / Rockwell Automation, Inc. | 0.00 | 0.60 | 0.95 | 46.90 | 0.1871 | 0.0281 | |||

| TDG / TransDigm Group Incorporated | 0.00 | 0.34 | 0.89 | 22.24 | 0.1745 | -0.0038 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.01 | 0.00 | 0.88 | 20.49 | 0.1741 | -0.0062 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.00 | -0.02 | 0.88 | 29.63 | 0.1727 | 0.0065 | |||

| SMMD / iShares Trust - iShares Russell 2500 ETF | 0.01 | -1.87 | 0.73 | 18.76 | 0.1436 | -0.0073 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.01 | 1,406.13 | 0.66 | 1.69 | 0.1309 | -0.0296 | |||

| JBBB / Janus Detroit Street Trust - Janus Henderson B-BBB CLO ETF | 0.01 | 0.65 | 0.1281 | 0.1281 | |||||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 0.02 | 2.88 | 0.62 | 7.44 | 0.1224 | -0.0198 | |||

| EQIX / Equinix, Inc. | 0.00 | 0.13 | 0.60 | 6.54 | 0.1189 | -0.0203 | |||

| POOL / Pool Corporation | 0.00 | 1.38 | 0.60 | -2.60 | 0.1183 | -0.0330 | |||

| GOOG / Alphabet Inc. | 0.00 | 0.00 | 0.45 | 18.83 | 0.0884 | -0.0044 | |||

| BSX / Boston Scientific Corporation | 0.00 | 0.00 | 0.45 | 17.32 | 0.0883 | -0.0056 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.15 | 0.40 | 22.70 | 0.0790 | -0.0013 | |||

| ETHA / iShares Ethereum Trust - iShares Ethereum Trust ETF | 0.02 | 0.00 | 0.38 | 63.76 | 0.0741 | 0.0177 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.35 | 42.80 | 0.0685 | 0.0087 | |||

| TJX / The TJX Companies, Inc. | 0.00 | 0.00 | 0.34 | 3.64 | 0.0675 | -0.0137 | |||

| PLD / Prologis, Inc. | 0.00 | 0.00 | 0.27 | 11.20 | 0.0528 | -0.0064 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | 0.27 | 0.0524 | 0.0524 | |||||

| BMI / Badger Meter, Inc. | 0.00 | 0.25 | 0.0492 | 0.0492 | |||||

| LULU / lululemon athletica inc. | 0.00 | 0.00 | 0.24 | -10.53 | 0.0471 | -0.0184 | |||

| PLUG / Plug Power Inc. | 0.01 | 0.00 | 0.01 | 16.67 | 0.0029 | -0.0001 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | -100.00 | 0.00 | 0.0000 |