Mga Batayang Estadistika

| Nilai Portofolio | $ 152,778,960 |

| Posisi Saat Ini | 191 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

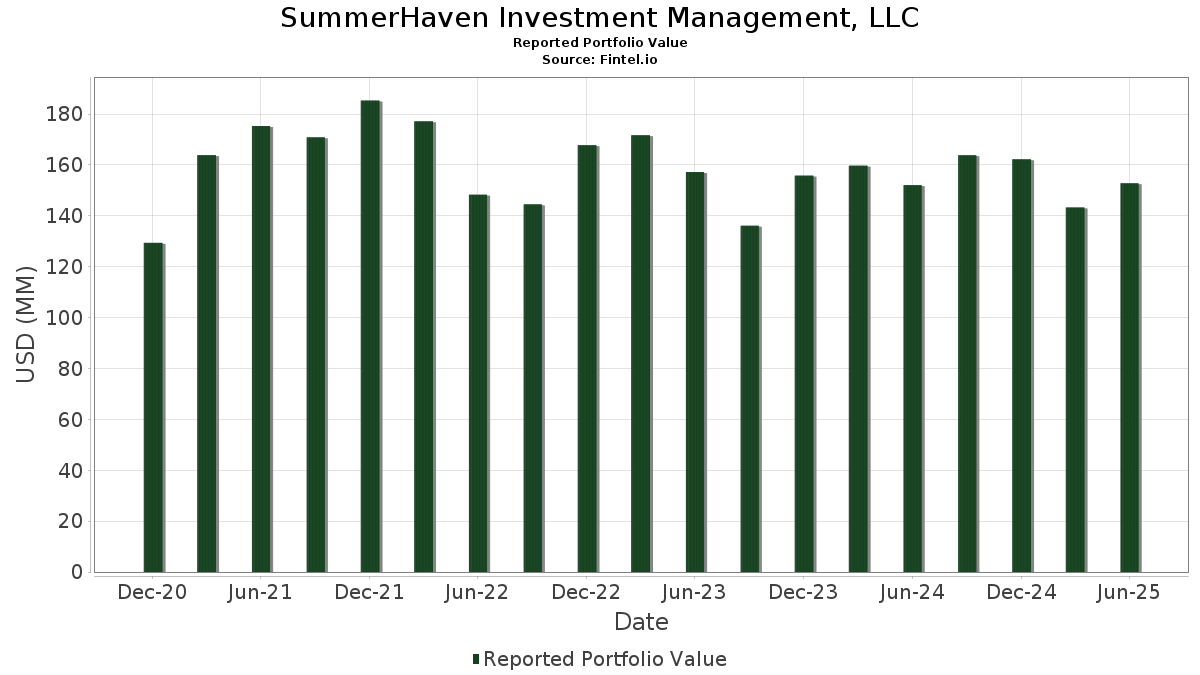

SummerHaven Investment Management, LLC telah mengungkapkan total kepemilikan 191 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 152,778,960 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama SummerHaven Investment Management, LLC adalah Hallador Energy Company (US:HNRG) , Coastal Financial Corporation (US:CCB) , Build-A-Bear Workshop, Inc. (US:BBW) , Pediatrix Medical Group, Inc. (US:MD) , and First Busey Corporation (US:BUSE) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.08 | 1.51 | 0.9883 | 0.5087 | |

| 0.01 | 1.32 | 0.8625 | 0.4587 | |

| 0.03 | 1.51 | 0.9899 | 0.2994 | |

| 0.02 | 1.21 | 0.7947 | 0.2645 | |

| 0.03 | 0.90 | 0.5913 | 0.2627 | |

| 0.03 | 1.66 | 1.0892 | 0.2626 | |

| 0.08 | 1.13 | 0.7409 | 0.2214 | |

| 0.01 | 1.08 | 0.7100 | 0.2107 | |

| 0.05 | 1.37 | 0.8994 | 0.2062 | |

| 0.11 | 1.71 | 1.1166 | 0.2016 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.33 | 0.2175 | -0.2262 | |

| 0.12 | 0.18 | 0.1163 | -0.2090 | |

| 0.14 | 0.56 | 0.3633 | -0.2018 | |

| 0.10 | 0.43 | 0.2845 | -0.1985 | |

| 0.07 | 0.68 | 0.4463 | -0.1647 | |

| 0.07 | 0.64 | 0.4206 | -0.1583 | |

| 0.01 | 0.48 | 0.3174 | -0.1536 | |

| 0.04 | 0.63 | 0.4100 | -0.1253 | |

| 0.06 | 0.91 | 0.5943 | -0.1248 | |

| 0.03 | 0.68 | 0.4459 | -0.1240 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-17 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| HNRG / Hallador Energy Company | 0.11 | 0.95 | 1.71 | 30.15 | 1.1166 | 0.2016 | |||

| CCB / Coastal Financial Corporation | 0.02 | 0.96 | 1.68 | 8.20 | 1.0971 | 0.0156 | |||

| BBW / Build-A-Bear Workshop, Inc. | 0.03 | 1.30 | 1.66 | 40.54 | 1.0892 | 0.2626 | |||

| MD / Pediatrix Medical Group, Inc. | 0.11 | 1.03 | 1.63 | 0.06 | 1.0659 | -0.0702 | |||

| BUSE / First Busey Corporation | 0.07 | 1.02 | 1.58 | 7.05 | 1.0336 | 0.0037 | |||

| DXPE / DXP Enterprises, Inc. | 0.02 | 1.03 | 1.54 | 7.68 | 1.0093 | 0.0095 | |||

| REVG / REV Group, Inc. | 0.03 | 1.52 | 1.51 | 52.88 | 0.9899 | 0.2994 | |||

| CMP / Compass Minerals International, Inc. | 0.08 | 1.63 | 1.51 | 119.97 | 0.9883 | 0.5087 | |||

| SNEX / StoneX Group Inc. | 0.02 | 1.15 | 1.42 | 20.70 | 0.9320 | 0.1085 | |||

| APEI / American Public Education, Inc. | 0.05 | 1.39 | 1.37 | 38.37 | 0.8994 | 0.2062 | |||

| CAR / Avis Budget Group, Inc. | 0.01 | 2.26 | 1.32 | 127.85 | 0.8625 | 0.4587 | |||

| MCB / Metropolitan Bank Holding Corp. | 0.02 | 1.38 | 1.28 | 26.81 | 0.8360 | 0.1326 | |||

| LAUR / Laureate Education, Inc. | 0.05 | 1.41 | 1.25 | 15.97 | 0.8179 | 0.0656 | |||

| AAMI / Acadian Asset Management Inc. | 0.04 | 1.56 | 1.25 | 38.40 | 0.8166 | 0.1874 | |||

| EVRI / Everi Holdings Inc. | 0.09 | 1.18 | 1.23 | 5.39 | 0.8070 | -0.0095 | |||

| PRDO / Perdoceo Education Corporation | 0.04 | 1.56 | 1.22 | 31.78 | 0.7958 | 0.1521 | |||

| CBRL / Cracker Barrel Old Country Store, Inc. | 0.02 | 1.59 | 1.21 | 59.95 | 0.7947 | 0.2645 | |||

| GPI / Group 1 Automotive, Inc. | 0.00 | 1.32 | 1.20 | 15.80 | 0.7872 | 0.0626 | |||

| HAFC / Hanmi Financial Corporation | 0.05 | 1.36 | 1.18 | 10.38 | 0.7730 | 0.0263 | |||

| FDP / Fresh Del Monte Produce Inc. | 0.04 | 1.15 | 1.18 | 6.31 | 0.7728 | -0.0020 | |||

| DAN / Dana Incorporated | 0.07 | 1.82 | 1.17 | 31.03 | 0.7685 | 0.1429 | |||

| HSII / Heidrick & Struggles International, Inc. | 0.03 | 1.48 | 1.17 | 8.33 | 0.7664 | 0.0125 | |||

| SANM / Sanmina Corporation | 0.01 | 1.61 | 1.16 | 30.53 | 0.7619 | 0.1392 | |||

| SPTN / SpartanNash Company | 0.04 | 1.61 | 1.15 | 32.87 | 0.7542 | 0.1488 | |||

| TWI / Titan International, Inc. | 0.11 | 1.95 | 1.14 | 24.78 | 0.7452 | 0.1084 | |||

| HCSG / Healthcare Services Group, Inc. | 0.08 | 2.00 | 1.13 | 52.15 | 0.7409 | 0.2214 | |||

| OI / O-I Glass, Inc. | 0.08 | 1.71 | 1.13 | 30.74 | 0.7382 | 0.1359 | |||

| TBBK / The Bancorp, Inc. | 0.02 | 1.65 | 1.11 | 9.65 | 0.7295 | 0.0197 | |||

| BANF / BancFirst Corporation | 0.01 | 1.38 | 1.11 | 14.01 | 0.7251 | 0.0472 | |||

| LC / LendingClub Corporation | 0.09 | 1.65 | 1.11 | 18.52 | 0.7249 | 0.0725 | |||

| GMS / GMS Inc. | 0.01 | 2.04 | 1.08 | 51.61 | 0.7100 | 0.2107 | |||

| PLPC / Preformed Line Products Company | 0.01 | 1.57 | 1.07 | 15.98 | 0.6984 | 0.0556 | |||

| CASH / Pathward Financial, Inc. | 0.01 | 1.48 | 1.07 | 10.02 | 0.6975 | 0.0217 | |||

| CCSI / Consensus Cloud Solutions, Inc. | 0.05 | 1.69 | 1.06 | 1.54 | 0.6917 | -0.0343 | |||

| R / Ryder System, Inc. | 0.01 | 1.58 | 1.06 | 12.35 | 0.6907 | 0.0348 | |||

| AX / Axos Financial, Inc. | 0.01 | 1.75 | 1.04 | 19.93 | 0.6779 | 0.0750 | |||

| CNX / CNX Resources Corporation | 0.03 | 1.53 | 1.04 | 8.60 | 0.6778 | 0.0123 | |||

| GPOR / Gulfport Energy Corporation | 0.01 | 1.64 | 1.04 | 11.05 | 0.6775 | 0.0268 | |||

| TITN / Titan Machinery Inc. | 0.05 | 1.70 | 1.03 | 18.21 | 0.6759 | 0.0663 | |||

| ALK / Alaska Air Group, Inc. | 0.02 | 1.54 | 1.03 | 2.09 | 0.6727 | -0.0301 | |||

| CPF / Central Pacific Financial Corp. | 0.04 | 1.52 | 1.02 | 5.24 | 0.6707 | -0.0090 | |||

| PGC / Peapack-Gladstone Financial Corporation | 0.04 | 1.50 | 1.02 | 0.99 | 0.6700 | -0.0377 | |||

| BBSI / Barrett Business Services, Inc. | 0.02 | 1.49 | 1.01 | 2.86 | 0.6599 | -0.0245 | |||

| AN / AutoNation, Inc. | 0.01 | 1.73 | 0.99 | 24.75 | 0.6505 | 0.0947 | |||

| BKE / The Buckle, Inc. | 0.02 | 1.91 | 0.99 | 20.54 | 0.6458 | 0.0747 | |||

| VBTX / Veritex Holdings, Inc. | 0.04 | 1.74 | 0.98 | 6.27 | 0.6440 | -0.0018 | |||

| CTBI / Community Trust Bancorp, Inc. | 0.02 | 1.60 | 0.98 | 6.74 | 0.6433 | 0.0008 | |||

| TOWN / TowneBank | 0.03 | 1.57 | 0.98 | 1.56 | 0.6408 | -0.0322 | |||

| UMBF / UMB Financial Corporation | 0.01 | 1.67 | 0.98 | 5.74 | 0.6400 | -0.0054 | |||

| UVV / Universal Corporation | 0.02 | 1.62 | 0.98 | 5.62 | 0.6399 | -0.0064 | |||

| WSBC / WesBanco, Inc. | 0.03 | 1.63 | 0.98 | 3.83 | 0.6395 | -0.0173 | |||

| CATY / Cathay General Bancorp | 0.02 | 1.73 | 0.96 | 7.62 | 0.6290 | 0.0058 | |||

| IBCP / Independent Bank Corporation | 0.03 | 1.59 | 0.96 | 6.94 | 0.6252 | 0.0017 | |||

| ALGT / Allegiant Travel Company | 0.02 | 2.00 | 0.95 | 8.58 | 0.6213 | 0.0107 | |||

| MTW / The Manitowoc Company, Inc. | 0.08 | 2.44 | 0.94 | 43.31 | 0.6177 | 0.1582 | |||

| FHB / First Hawaiian, Inc. | 0.04 | 1.69 | 0.93 | 3.93 | 0.6063 | -0.0163 | |||

| RYI / Ryerson Holding Corporation | 0.04 | 1.49 | 0.92 | -4.66 | 0.6031 | -0.0714 | |||

| REZI / Resideo Technologies, Inc. | 0.04 | 2.16 | 0.92 | 27.29 | 0.6020 | 0.0978 | |||

| SMP / Standard Motor Products, Inc. | 0.03 | 2.01 | 0.92 | 25.69 | 0.5995 | 0.0909 | |||

| PFBC / Preferred Bank | 0.01 | 1.63 | 0.92 | 5.05 | 0.5994 | -0.0086 | |||

| TRST / TrustCo Bank Corp NY | 0.03 | 1.81 | 0.91 | 11.60 | 0.5986 | 0.0268 | |||

| SMLR / Semler Scientific, Inc. | 0.02 | 2.01 | 0.91 | 9.21 | 0.5977 | 0.0138 | |||

| AMAL / Amalgamated Financial Corp. | 0.03 | 1.83 | 0.91 | 10.42 | 0.5968 | 0.0209 | |||

| HTBK / Heritage Commerce Corp | 0.09 | 1.76 | 0.91 | 6.18 | 0.5966 | -0.0028 | |||

| WMK / Weis Markets, Inc. | 0.01 | 1.35 | 0.91 | -4.61 | 0.5959 | -0.0706 | |||

| DNOW / DNOW Inc. | 0.06 | 1.51 | 0.91 | -11.84 | 0.5943 | -0.1248 | |||

| NBBK / NB Bancorp, Inc. | 0.05 | 1.70 | 0.91 | 0.44 | 0.5942 | -0.0362 | |||

| PARR / Par Pacific Holdings, Inc. | 0.03 | 3.14 | 0.90 | 92.13 | 0.5913 | 0.2627 | |||

| FBP / First BanCorp. | 0.04 | 1.80 | 0.90 | 10.55 | 0.5903 | 0.0212 | |||

| WKC / World Kinect Corporation | 0.03 | 1.92 | 0.90 | 1.93 | 0.5872 | -0.0274 | |||

| OFG / OFG Bancorp | 0.02 | 1.91 | 0.89 | 9.02 | 0.5854 | 0.0126 | |||

| DOLE / Dole plc | 0.06 | 1.58 | 0.89 | -1.66 | 0.5818 | -0.0491 | |||

| TMHC / Taylor Morrison Home Corporation | 0.01 | 1.75 | 0.89 | 4.10 | 0.5816 | -0.0143 | |||

| REX / REX American Resources Corporation | 0.02 | 1.93 | 0.88 | 32.19 | 0.5782 | 0.1116 | |||

| BHLB / Berkshire Hills Bancorp, Inc. | 0.03 | 1.73 | 0.87 | -2.35 | 0.5717 | -0.0528 | |||

| CVI / CVR Energy, Inc. | 0.03 | 2.39 | 0.87 | 41.63 | 0.5706 | 0.1412 | |||

| DAKT / Daktronics, Inc. | 0.06 | 2.03 | 0.87 | 26.68 | 0.5691 | 0.0899 | |||

| AGCO / AGCO Corporation | 0.01 | 2.10 | 0.87 | 13.78 | 0.5681 | 0.0356 | |||

| PHIN / PHINIA Inc. | 0.02 | 1.80 | 0.86 | 6.72 | 0.5613 | 0.0005 | |||

| ARW / Arrow Electronics, Inc. | 0.01 | 2.05 | 0.86 | 25.37 | 0.5598 | 0.0832 | |||

| AVT / Avnet, Inc. | 0.02 | 1.93 | 0.82 | 12.60 | 0.5381 | 0.0281 | |||

| MCFT / MasterCraft Boat Holdings, Inc. | 0.04 | 1.97 | 0.82 | 9.92 | 0.5373 | 0.0165 | |||

| ETD / Ethan Allen Interiors Inc. | 0.03 | 1.82 | 0.82 | 2.38 | 0.5366 | -0.0224 | |||

| MEI / Methode Electronics, Inc. | 0.09 | 2.90 | 0.82 | 53.28 | 0.5353 | 0.1631 | |||

| TK / Teekay Corporation Ltd. | 0.10 | 2.23 | 0.81 | 28.39 | 0.5271 | 0.0892 | |||

| GDEN / Golden Entertainment, Inc. | 0.03 | 2.04 | 0.80 | 13.78 | 0.5249 | 0.0330 | |||

| KMT / Kennametal Inc. | 0.03 | 2.18 | 0.80 | 10.18 | 0.5244 | 0.0167 | |||

| MATW / Matthews International Corporation | 0.03 | 2.19 | 0.80 | 9.92 | 0.5224 | 0.0153 | |||

| NVRI / Enviri Corporation | 0.09 | 2.65 | 0.80 | 33.95 | 0.5223 | 0.1066 | |||

| VSCO / Victoria's Secret & Co. | 0.04 | 2.00 | 0.80 | 1.66 | 0.5218 | -0.0255 | |||

| HOPE / Hope Bancorp, Inc. | 0.07 | 1.99 | 0.80 | 4.59 | 0.5217 | -0.0106 | |||

| VSAT / Viasat, Inc. | 0.05 | 3.15 | 0.79 | 44.63 | 0.5199 | 0.1363 | |||

| SCSC / ScanSource, Inc. | 0.02 | 2.41 | 0.79 | 25.88 | 0.5159 | 0.0789 | |||

| HDSN / Hudson Technologies, Inc. | 0.10 | 2.79 | 0.79 | 35.46 | 0.5151 | 0.1091 | |||

| GRNT / Granite Ridge Resources, Inc. | 0.12 | 2.46 | 0.78 | 7.41 | 0.5128 | 0.0033 | |||

| FFWM / First Foundation Inc. | 0.15 | 1.88 | 0.78 | 0.00 | 0.5079 | -0.0331 | |||

| GT / The Goodyear Tire & Rubber Company | 0.07 | 1.90 | 0.77 | 14.33 | 0.5071 | 0.0342 | |||

| AHCO / AdaptHealth Corp. | 0.08 | 2.36 | 0.77 | -10.87 | 0.5047 | -0.0997 | |||

| CCRN / Cross Country Healthcare, Inc. | 0.06 | 1.70 | 0.76 | -10.96 | 0.5007 | -0.0984 | |||

| SIG / Signet Jewelers Limited | 0.01 | 2.87 | 0.75 | 41.01 | 0.4935 | 0.1201 | |||

| DK / Delek US Holdings, Inc. | 0.04 | 3.18 | 0.75 | 45.09 | 0.4932 | 0.1305 | |||

| REPX / Riley Exploration Permian, Inc. | 0.03 | 1.97 | 0.75 | -8.31 | 0.4913 | -0.0801 | |||

| CMC / Commercial Metals Company | 0.02 | 2.22 | 0.75 | 8.75 | 0.4884 | 0.0091 | |||

| KOP / Koppers Holdings Inc. | 0.02 | 2.52 | 0.74 | 17.68 | 0.4843 | 0.0455 | |||

| MHO / M/I Homes, Inc. | 0.01 | 2.06 | 0.74 | 0.27 | 0.4826 | -0.0309 | |||

| COLL / Collegium Pharmaceutical, Inc. | 0.02 | 2.11 | 0.74 | 1.24 | 0.4813 | -0.0261 | |||

| SNCY / Sun Country Airlines Holdings, Inc. | 0.06 | 2.77 | 0.73 | -2.00 | 0.4806 | -0.0423 | |||

| KE / Kimball Electronics, Inc. | 0.04 | 2.84 | 0.73 | 20.30 | 0.4775 | 0.0539 | |||

| CRC / California Resources Corporation | 0.02 | 2.63 | 0.72 | 6.53 | 0.4705 | -0.0002 | |||

| HLF / Herbalife Ltd. | 0.08 | 2.66 | 0.71 | 2.60 | 0.4657 | -0.0187 | |||

| SBH / Sally Beauty Holdings, Inc. | 0.07 | 2.40 | 0.69 | 5.03 | 0.4511 | -0.0070 | |||

| ASO / Academy Sports and Outdoors, Inc. | 0.02 | 2.53 | 0.68 | 0.74 | 0.4473 | -0.0263 | |||

| TCMD / Tactile Systems Technology, Inc. | 0.07 | 1.55 | 0.68 | -22.17 | 0.4463 | -0.1647 | |||

| GIII / G-III Apparel Group, Ltd. | 0.03 | 1.88 | 0.68 | -16.54 | 0.4459 | -0.1240 | |||

| ADNT / Adient plc | 0.03 | 3.63 | 0.67 | 56.67 | 0.4383 | 0.1402 | |||

| LEG / Leggett & Platt, Incorporated | 0.07 | 2.78 | 0.66 | 15.96 | 0.4330 | 0.0346 | |||

| LEA / Lear Corporation | 0.01 | 2.59 | 0.66 | 10.54 | 0.4328 | 0.0149 | |||

| EBF / Ennis, Inc. | 0.04 | 2.25 | 0.66 | -7.69 | 0.4325 | -0.0671 | |||

| NUS / Nu Skin Enterprises, Inc. | 0.08 | 3.11 | 0.66 | 13.47 | 0.4306 | 0.0259 | |||

| HZO / MarineMax, Inc. | 0.03 | 2.98 | 0.66 | 20.37 | 0.4299 | 0.0491 | |||

| DXC / DXC Technology Company | 0.04 | 2.36 | 0.65 | -8.16 | 0.4276 | -0.0692 | |||

| TH / Target Hospitality Corp. | 0.09 | 2.44 | 0.65 | 10.90 | 0.4265 | 0.0162 | |||

| TTEC / TTEC Holdings, Inc. | 0.14 | 2.86 | 0.65 | 50.46 | 0.4259 | 0.1239 | |||

| RES / RPC, Inc. | 0.14 | 2.08 | 0.65 | -12.16 | 0.4255 | -0.0914 | |||

| BXC / BlueLinx Holdings Inc. | 0.01 | 2.29 | 0.65 | 1.41 | 0.4232 | -0.0216 | |||

| MLR / Miller Industries, Inc. | 0.01 | 2.46 | 0.65 | 7.49 | 0.4231 | 0.0034 | |||

| EMBC / Embecta Corp. | 0.07 | 1.95 | 0.64 | -22.56 | 0.4206 | -0.1583 | |||

| SIGA / SIGA Technologies, Inc. | 0.10 | 2.41 | 0.64 | 21.82 | 0.4205 | 0.0525 | |||

| AMTB / Amerant Bancorp Inc. | 0.04 | 2.20 | 0.64 | -9.76 | 0.4180 | -0.0758 | |||

| ZEUS / Olympic Steel, Inc. | 0.02 | 2.43 | 0.64 | 6.00 | 0.4165 | -0.0029 | |||

| WOW / WideOpenWest, Inc. | 0.16 | 2.20 | 0.63 | -16.16 | 0.4146 | -0.1128 | |||

| LOVE / The Lovesac Company | 0.03 | 2.04 | 0.63 | 2.11 | 0.4127 | -0.0182 | |||

| WERN / Werner Enterprises, Inc. | 0.02 | 2.19 | 0.63 | -4.55 | 0.4120 | -0.0485 | |||

| IMMR / Immersion Corporation | 0.08 | 2.56 | 0.63 | 6.62 | 0.4111 | -0.0001 | |||

| ATNI / ATN International, Inc. | 0.04 | 2.09 | 0.63 | -18.28 | 0.4100 | -0.1253 | |||

| ANDE / The Andersons, Inc. | 0.02 | 2.24 | 0.62 | -12.50 | 0.4081 | -0.0892 | |||

| GCO / Genesco Inc. | 0.03 | 2.36 | 0.62 | -5.08 | 0.4033 | -0.0497 | |||

| MBC / MasterBrand, Inc. | 0.06 | 2.29 | 0.61 | -14.45 | 0.3999 | -0.0982 | |||

| MED / Medifast, Inc. | 0.04 | 2.74 | 0.61 | 7.05 | 0.3975 | 0.0016 | |||

| SNBR / Sleep Number Corporation | 0.09 | 3.01 | 0.60 | 9.69 | 0.3930 | 0.0111 | |||

| BCC / Boise Cascade Company | 0.01 | 2.27 | 0.60 | -9.44 | 0.3898 | -0.0695 | |||

| PUMP / ProPetro Holding Corp. | 0.10 | 2.89 | 0.59 | -16.36 | 0.3883 | -0.1072 | |||

| PLAB / Photronics, Inc. | 0.03 | 2.56 | 0.59 | -7.10 | 0.3860 | -0.0565 | |||

| HTLD / Heartland Express, Inc. | 0.07 | 2.52 | 0.59 | -3.92 | 0.3853 | -0.0424 | |||

| DLX / Deluxe Corporation | 0.04 | 2.72 | 0.59 | 3.36 | 0.3831 | -0.0121 | |||

| ARCB / ArcBest Corporation | 0.01 | 3.17 | 0.58 | 12.52 | 0.3826 | 0.0201 | |||

| CSTM / Constellium SE | 0.04 | 3.94 | 0.58 | 36.94 | 0.3812 | 0.0845 | |||

| THRY / Thryv Holdings, Inc. | 0.05 | 2.52 | 0.58 | -2.68 | 0.3804 | -0.0364 | |||

| NX / Quanex Building Products Corporation | 0.03 | 3.03 | 0.57 | 4.75 | 0.3751 | -0.0068 | |||

| OMI / Owens & Minor, Inc. | 0.06 | 3.58 | 0.56 | 4.48 | 0.3666 | -0.0080 | |||

| MNRO / Monro, Inc. | 0.04 | 2.71 | 0.56 | 5.88 | 0.3653 | -0.0028 | |||

| RYAM / Rayonier Advanced Materials Inc. | 0.14 | 2.40 | 0.56 | -31.40 | 0.3633 | -0.2018 | |||

| CNR / Core Natural Resources, Inc. | 0.01 | 2.45 | 0.55 | -7.37 | 0.3623 | -0.0546 | |||

| APOG / Apogee Enterprises, Inc. | 0.01 | 2.36 | 0.55 | -10.33 | 0.3586 | -0.0677 | |||

| AMWD / American Woodmark Corporation | 0.01 | 2.57 | 0.55 | -7.00 | 0.3569 | -0.0521 | |||

| WU / The Western Union Company | 0.06 | 2.27 | 0.54 | -18.67 | 0.3541 | -0.1099 | |||

| HCC / Warrior Met Coal, Inc. | 0.01 | 2.55 | 0.53 | -1.48 | 0.3491 | -0.0289 | |||

| INSW / International Seaways, Inc. | 0.01 | 3.10 | 0.52 | 13.38 | 0.3387 | 0.0198 | |||

| GSM / Ferroglobe PLC | 0.14 | 2.87 | 0.52 | 1.78 | 0.3379 | -0.0162 | |||

| PLTK / Playtika Holding Corp. | 0.11 | 2.73 | 0.50 | -5.99 | 0.3286 | -0.0443 | |||

| AXL / American Axle & Manufacturing Holdings, Inc. | 0.12 | 3.62 | 0.49 | 3.85 | 0.3176 | -0.0085 | |||

| MAN / ManpowerGroup Inc. | 0.01 | 2.97 | 0.48 | -28.19 | 0.3174 | -0.1536 | |||

| BOOM / DMC Global Inc. | 0.06 | 3.86 | 0.48 | -0.62 | 0.3144 | -0.0229 | |||

| CLW / Clearwater Paper Corporation | 0.02 | 3.32 | 0.48 | 11.11 | 0.3142 | 0.0122 | |||

| VIRC / Virco Mfg. Corporation | 0.06 | 2.50 | 0.48 | -13.54 | 0.3139 | -0.0733 | |||

| LPG / Dorian LPG Ltd. | 0.02 | 3.56 | 0.48 | 13.03 | 0.3128 | 0.0176 | |||

| FORR / Forrester Research, Inc. | 0.05 | 3.16 | 0.47 | 10.54 | 0.3093 | 0.0109 | |||

| BTU / Peabody Energy Corporation | 0.03 | 3.33 | 0.47 | 2.41 | 0.3060 | -0.0129 | |||

| EGY / VAALCO Energy, Inc. | 0.13 | 3.29 | 0.47 | -0.85 | 0.3055 | -0.0230 | |||

| ATKR / Atkore Inc. | 0.01 | 4.04 | 0.44 | 22.38 | 0.2901 | 0.0373 | |||

| RGP / Resources Connection, Inc. | 0.08 | 3.26 | 0.44 | -15.28 | 0.2871 | -0.0740 | |||

| BGS / B&G Foods, Inc. | 0.10 | 2.02 | 0.43 | -37.28 | 0.2845 | -0.1985 | |||

| SSTK / Shutterstock, Inc. | 0.02 | 4.03 | 0.42 | 5.78 | 0.2760 | -0.0020 | |||

| WNC / Wabash National Corporation | 0.04 | 3.72 | 0.41 | -0.24 | 0.2711 | -0.0187 | |||

| ODP / The ODP Corporation | 0.02 | 5.10 | 0.41 | 33.11 | 0.2662 | 0.0527 | |||

| XRX / Xerox Holdings Corporation | 0.08 | 4.71 | 0.40 | 14.37 | 0.2605 | 0.0173 | |||

| CRI / Carter's, Inc. | 0.01 | 3.05 | 0.39 | -24.08 | 0.2563 | -0.1038 | |||

| ASC / Ardmore Shipping Corporation | 0.04 | 3.87 | 0.39 | 1.83 | 0.2559 | -0.0120 | |||

| AMPY / Amplify Energy Corp. | 0.12 | 5.04 | 0.39 | -10.26 | 0.2526 | -0.0471 | |||

| AVD / American Vanguard Corporation | 0.10 | 3.84 | 0.39 | -7.45 | 0.2524 | -0.0385 | |||

| AMN / AMN Healthcare Services, Inc. | 0.02 | 4.77 | 0.35 | -11.31 | 0.2311 | -0.0473 | |||

| BRY / Berry Corporation | 0.13 | 4.80 | 0.35 | -9.54 | 0.2303 | -0.0413 | |||

| JILL / J.Jill, Inc. | 0.02 | 4.06 | 0.35 | -22.15 | 0.2284 | -0.0838 | |||

| CABO / Cable One, Inc. | 0.00 | 2.30 | 0.33 | -47.72 | 0.2175 | -0.2262 | |||

| KSS / Kohl's Corporation | 0.04 | 5.63 | 0.31 | 9.44 | 0.2053 | 0.0054 | |||

| CAL / Caleres, Inc. | 0.03 | 3.68 | 0.31 | -26.48 | 0.2038 | -0.0917 | |||

| VRA / Vera Bradley, Inc. | 0.14 | 5.73 | 0.31 | 4.10 | 0.1997 | -0.0054 | |||

| AMR / Alpha Metallurgical Resources, Inc. | 0.00 | 4.43 | 0.30 | -6.21 | 0.1979 | -0.0271 | |||

| JELD / JELD-WEN Holding, Inc. | 0.06 | 4.46 | 0.24 | -31.46 | 0.1601 | -0.0888 | |||

| HAIN / The Hain Celestial Group, Inc. | 0.12 | 4.08 | 0.18 | -62.02 | 0.1163 | -0.2090 | |||

| MODV / ModivCare Inc. | 0.05 | 38.56 | 0.16 | 229.79 | 0.1015 | 0.0686 | |||

| X / United States Steel Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PDCO / Patterson Companies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| JWN / Nordstrom, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ATSG / Air Transport Services Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |