Mga Batayang Estadistika

| Nilai Portofolio | $ 263,062,001 |

| Posisi Saat Ini | 76 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

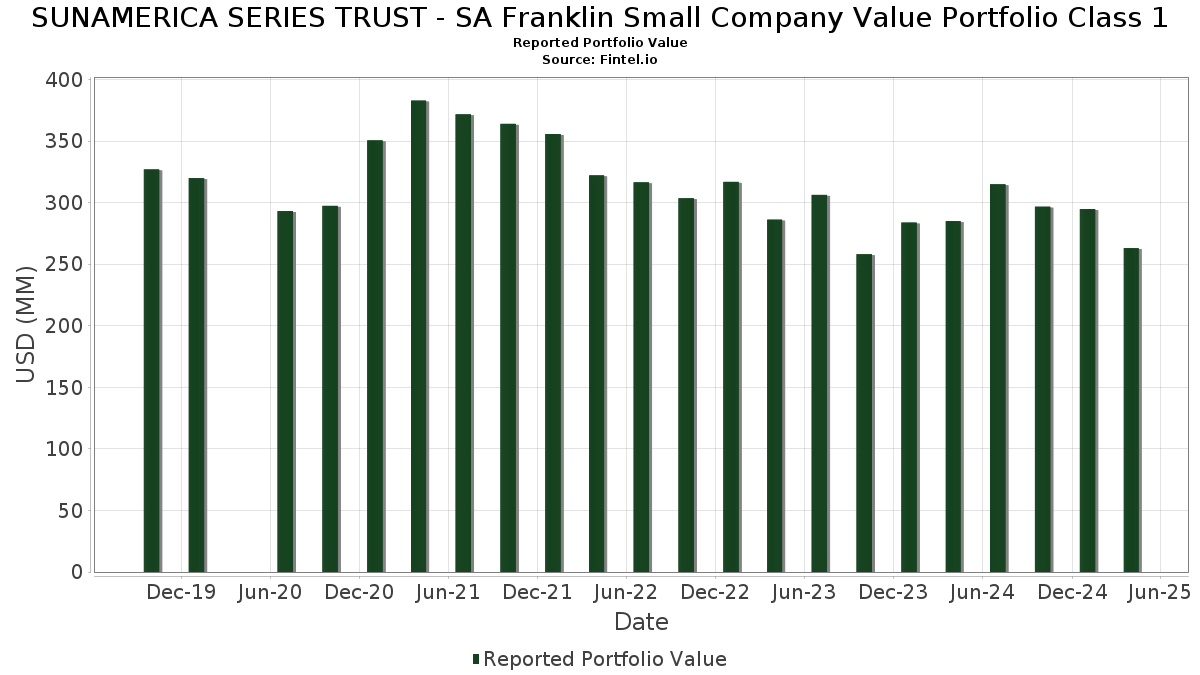

SUNAMERICA SERIES TRUST - SA Franklin Small Company Value Portfolio Class 1 telah mengungkapkan total kepemilikan 76 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 263,062,001 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama SUNAMERICA SERIES TRUST - SA Franklin Small Company Value Portfolio Class 1 adalah The Hanover Insurance Group, Inc. (US:THG) , ACI Worldwide, Inc. (US:ACIW) , Sanmina Corporation (US:SANM) , CNO Financial Group, Inc. (US:CNO) , and Horace Mann Educators Corporation (US:HMN) . Posisi baru SUNAMERICA SERIES TRUST - SA Franklin Small Company Value Portfolio Class 1 meliputi: The Gap, Inc. (US:GPS) , Select Water Solutions, Inc. (US:WTTR) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 6.00 | 2.2820 | 2.2820 | ||

| 0.13 | 2.92 | 1.1109 | 1.1109 | |

| 0.15 | 6.56 | 2.4963 | 1.1041 | |

| 0.18 | 7.34 | 2.7934 | 1.0398 | |

| 0.02 | 3.33 | 1.2680 | 1.0153 | |

| 0.20 | 6.68 | 2.5403 | 0.9519 | |

| 1.38 | 7.21 | 2.7439 | 0.7303 | |

| 0.15 | 4.15 | 1.5777 | 0.7225 | |

| 0.21 | 1.81 | 0.6890 | 0.6890 | |

| 0.09 | 2.67 | 1.0164 | 0.6126 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.32 | 1.88 | 0.7154 | -1.1384 | |

| 0.02 | 2.21 | 0.8407 | -1.0814 | |

| 0.13 | 4.24 | 1.6126 | -1.0346 | |

| 0.16 | 2.46 | 0.9370 | -0.9657 | |

| 0.36 | 5.78 | 2.1974 | -0.8395 | |

| 0.05 | 0.71 | 0.2690 | -0.6052 | |

| 0.05 | 7.28 | 2.7701 | -0.5826 | |

| 0.09 | 3.52 | 1.3378 | -0.5267 | |

| 0.03 | 1.29 | 0.4890 | -0.4638 | |

| 0.24 | 6.13 | 2.3331 | -0.3356 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-27 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| THG / The Hanover Insurance Group, Inc. | 0.05 | -10.92 | 7.99 | -3.35 | 3.0406 | 0.2320 | |||

| ACIW / ACI Worldwide, Inc. | 0.15 | -10.84 | 7.93 | -11.15 | 3.0178 | -0.0145 | |||

| SANM / Sanmina Corporation | 0.10 | 10.38 | 7.72 | 1.23 | 2.9375 | 0.3471 | |||

| CNO / CNO Financial Group, Inc. | 0.20 | 5.39 | 7.40 | 0.12 | 2.8150 | 0.3049 | |||

| HMN / Horace Mann Educators Corporation | 0.18 | 32.24 | 7.34 | 42.20 | 2.7934 | 1.0398 | |||

| GTLS / Chart Industries, Inc. | 0.05 | 15.62 | 7.28 | -26.24 | 2.7701 | -0.5826 | |||

| QY6 / QinetiQ Group plc | 1.38 | 7.21 | 7.21 | 21.66 | 2.7439 | 0.7303 | |||

| COLB / Columbia Banking System, Inc. | 0.32 | 5.89 | 7.13 | -14.92 | 2.7106 | -0.1331 | |||

| SSB / SouthState Corporation | 0.08 | 5.97 | 7.02 | -12.92 | 2.6695 | -0.0669 | |||

| VMI / Valmont Industries, Inc. | 0.02 | -0.65 | 6.99 | -12.19 | 2.6597 | -0.0444 | |||

| FIBK / First Interstate BancSystem, Inc. | 0.27 | 5.62 | 6.98 | -16.03 | 2.6552 | -0.1676 | |||

| AVNT / Avient Corporation | 0.20 | 83.87 | 6.68 | 42.78 | 2.5403 | 0.9519 | |||

| CMC / Commercial Metals Company | 0.15 | 74.27 | 6.56 | 60.09 | 2.4963 | 1.1041 | |||

| WSFS / WSFS Financial Corporation | 0.13 | 6.46 | 6.48 | -2.00 | 2.4647 | 0.2195 | |||

| UFPI / UFP Industries, Inc. | 0.06 | 20.58 | 6.19 | 3.05 | 2.3534 | 0.3149 | |||

| WSC / WillScot Holdings Corporation | 0.24 | 15.14 | 6.13 | -21.96 | 2.3331 | -0.3356 | |||

| US3130AK6H44 / Federal Home Loan Banks | 6.00 | 2.2820 | 2.2820 | ||||||

| VCTR / Victory Capital Holdings, Inc. | 0.10 | 19.35 | 5.99 | 3.31 | 2.2768 | 0.3095 | |||

| MAT / Mattel, Inc. | 0.36 | -24.23 | 5.78 | -35.41 | 2.1974 | -0.8395 | |||

| MGRC / McGrath RentCorp | 0.05 | -10.36 | 5.43 | -22.05 | 2.0640 | -0.2998 | |||

| NVST / Envista Holdings Corporation | 0.33 | 8.06 | 5.38 | -15.32 | 2.0459 | -0.1109 | |||

| MWA / Mueller Water Products, Inc. | 0.20 | -24.01 | 5.19 | -13.31 | 1.9730 | -0.0585 | |||

| ELM / Elcora Advanced Materials Corp. | 2.89 | 0.00 | 4.81 | -14.55 | 1.8314 | -0.0820 | |||

| FBNC / First Bancorp | 0.11 | 13.92 | 4.38 | 4.46 | 1.6658 | 0.2420 | |||

| GTES / Gates Industrial Corporation plc | 0.23 | 10.69 | 4.32 | 1.22 | 1.6443 | 0.1941 | |||

| HGV / Hilton Grand Vacations Inc. | 0.13 | -33.38 | 4.24 | -45.62 | 1.6126 | -1.0346 | |||

| AUB / Atlantic Union Bankshares Corporation | 0.15 | 124.55 | 4.15 | 64.69 | 1.5777 | 0.7225 | |||

| CABO / Cable One, Inc. | 0.01 | 11.05 | 3.95 | -2.37 | 1.5024 | 0.1287 | |||

| 27M / Melrose Industries PLC | 0.63 | 0.00 | 3.65 | -23.66 | 1.3899 | -0.2351 | |||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.09 | -6.64 | 3.52 | -35.96 | 1.3378 | -0.5267 | |||

| BHE / Benchmark Electronics, Inc. | 0.10 | 13.93 | 3.39 | -13.12 | 1.2897 | -0.0356 | |||

| MIDD / The Middleby Corporation | 0.02 | 474.93 | 3.33 | 347.98 | 1.2680 | 1.0153 | |||

| ADS / Bread Financial Holdings Inc | 0.07 | 68.56 | 3.24 | 26.29 | 1.2320 | 0.3611 | |||

| GABC / German American Bancorp, Inc. | 0.08 | 0.00 | 3.19 | -8.26 | 1.2131 | 0.0325 | |||

| TCBK / TriCo Bancshares | 0.08 | 8.57 | 3.11 | -4.52 | 1.1815 | 0.0768 | |||

| FCF / First Commonwealth Financial Corporation | 0.19 | 28.93 | 2.95 | 18.42 | 1.1229 | 0.2764 | |||

| RYI / Ryerson Holding Corporation | 0.13 | 19.08 | 2.93 | 24.52 | 1.1146 | 0.3154 | |||

| GPS / The Gap, Inc. | 0.13 | 2.92 | 1.1109 | 1.1109 | |||||

| BKH / Black Hills Corporation | 0.05 | 82.72 | 2.82 | 89.52 | 1.0730 | 0.5674 | |||

| IDA / IDACORP, Inc. | 0.02 | 75.32 | 2.75 | 88.34 | 1.0447 | 0.5495 | |||

| BBWI / Bath & Body Works, Inc. | 0.09 | 177.01 | 2.67 | 124.73 | 1.0164 | 0.6126 | |||

| TMHC / Taylor Morrison Home Corporation | 0.05 | 33.74 | 2.64 | 18.98 | 1.0040 | 0.2507 | |||

| BYD / Boyd Gaming Corporation | 0.04 | -8.99 | 2.64 | -17.92 | 1.0037 | -0.0878 | |||

| SBCF / Seacoast Banking Corporation of Florida | 0.11 | 11.21 | 2.56 | -7.32 | 0.9735 | 0.0358 | |||

| KRG / Kite Realty Group Trust | 0.11 | 0.16 | 2.46 | -6.31 | 0.9373 | 0.0440 | |||

| KN / Knowles Corporation | 0.16 | -47.13 | 2.46 | -56.04 | 0.9370 | -0.9657 | |||

| CAC / Camden National Corporation | 0.06 | 0.00 | 2.34 | -15.07 | 0.8899 | -0.0456 | |||

| PEBO / Peoples Bancorp Inc. | 0.08 | 0.00 | 2.22 | -11.14 | 0.8439 | -0.0040 | |||

| US7587501039 / Regal-Beloit Corp. | 0.02 | -41.44 | 2.21 | -60.95 | 0.8407 | -1.0814 | |||

| LBRT / Liberty Energy Inc. | 0.19 | 10.30 | 2.15 | -30.73 | 0.8191 | -0.2364 | |||

| BCKIF / Babcock International Group PLC | 0.19 | -12.66 | 2.09 | 40.32 | 0.7946 | 0.2892 | |||

| MHO / M/I Homes, Inc. | 0.02 | 53.59 | 1.91 | 30.26 | 0.7257 | 0.2283 | |||

| VRN / Veren Inc. | 0.32 | -70.69 | 1.88 | -65.56 | 0.7154 | -1.1384 | |||

| WTTR / Select Water Solutions, Inc. | 0.21 | 1.81 | 0.6890 | 0.6890 | |||||

| ALEX / Alexander & Baldwin, Inc. | 0.10 | -19.63 | 1.76 | -22.68 | 0.6710 | -0.1034 | |||

| MTH / Meritage Homes Corporation | 0.02 | 0.00 | 1.61 | -12.51 | 0.6120 | -0.0124 | |||

| 0YT / Hunting PLC | 0.46 | 0.00 | 1.59 | -20.45 | 0.6040 | -0.0736 | |||

| TTMI / TTM Technologies, Inc. | 0.07 | 0.00 | 1.46 | -18.60 | 0.5564 | -0.0537 | |||

| HNI / HNI Corporation | 0.03 | -46.01 | 1.29 | -54.19 | 0.4890 | -0.4638 | |||

| LPX / Louisiana-Pacific Corporation | 0.01 | 25.61 | 1.27 | -7.32 | 0.4820 | 0.0177 | |||

| 1JD / Senior plc | 0.68 | 0.00 | 1.25 | -9.28 | 0.4766 | 0.0079 | |||

| DOCMF / Dr. Martens plc | 1.68 | 0.00 | 1.23 | -18.10 | 0.4685 | -0.0419 | |||

| STAG / STAG Industrial, Inc. | 0.04 | 0.00 | 1.21 | -3.42 | 0.4618 | 0.0352 | |||

| CROX / Crocs, Inc. | 0.01 | 1.15 | 0.4377 | 0.4377 | |||||

| PIPR / Piper Sandler Companies | 0.00 | -34.01 | 0.93 | -41.82 | 0.3533 | -0.1542 | |||

| AMWD / American Woodmark Corporation | 0.02 | 0.00 | 0.93 | -24.22 | 0.3524 | -0.0628 | |||

| ASH / Ashland Inc. | 0.01 | 229.30 | 0.74 | 182.13 | 0.2823 | 0.1929 | |||

| CCS / Century Communities, Inc. | 0.01 | 28.92 | 0.71 | -7.89 | 0.2709 | 0.0082 | |||

| RXO / RXO, Inc. | 0.05 | -50.00 | 0.71 | -72.53 | 0.2690 | -0.6052 | |||

| WASH / Washington Trust Bancorp, Inc. | 0.02 | 150.95 | 0.66 | 111.61 | 0.2498 | 0.1443 | |||

| LZB / La-Z-Boy Incorporated | 0.02 | 65.42 | 0.64 | 38.66 | 0.2443 | 0.0867 | |||

| FTI / TechnipFMC plc | 0.02 | -58.72 | 0.43 | -61.34 | 0.1624 | -0.2121 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 0.37 | -47.06 | 0.37 | -47.19 | 0.1396 | -0.0958 | |||

| BC / Brunswick Corporation | 0.01 | 0.00 | 0.35 | -31.62 | 0.1316 | -0.0405 | |||

| DOOO / BRP Inc. | 0.01 | 0.00 | 0.27 | -29.29 | 0.1022 | -0.0266 | |||

| TWFG / TWFG, Inc. | 0.00 | 0.00 | 0.02 | 15.38 | 0.0057 | 0.0011 |