Mga Batayang Estadistika

| Nilai Portofolio | $ 488,348,015 |

| Posisi Saat Ini | 148 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

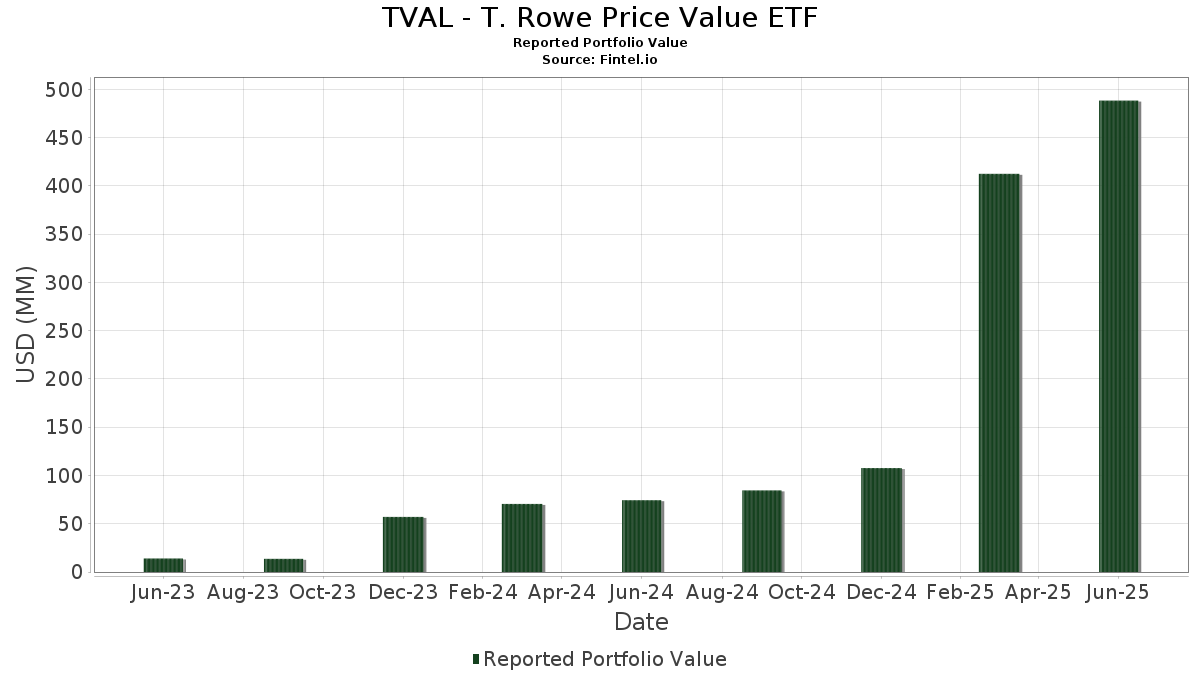

TVAL - T. Rowe Price Value ETF telah mengungkapkan total kepemilikan 148 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 488,348,015 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama TVAL - T. Rowe Price Value ETF adalah Wells Fargo & Company (US:WFC) , Exxon Mobil Corporation (US:XOM) , Alphabet Inc. (US:GOOG) , The Hartford Insurance Group, Inc. (US:HIG) , and Bank of America Corporation (US:BAC) . Posisi baru TVAL - T. Rowe Price Value ETF meliputi: Amazon.com, Inc. (US:AMZN) , Netflix, Inc. (US:NFLX) , Parker-Hannifin Corporation (US:PH) , Corebridge Financial, Inc. (US:US21871X1090) , and Gilead Sciences, Inc. (US:GILD) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 10.40 | 2.1287 | 1.4754 | |

| 0.03 | 6.96 | 1.4245 | 1.4245 | |

| 0.00 | 3.27 | 0.6699 | 0.6699 | |

| 0.02 | 4.37 | 0.8931 | 0.5942 | |

| 0.00 | 2.46 | 0.5027 | 0.5027 | |

| 0.07 | 2.31 | 0.4729 | 0.4729 | |

| 0.11 | 3.45 | 0.7066 | 0.4697 | |

| 0.01 | 5.52 | 1.1292 | 0.4681 | |

| 0.02 | 2.94 | 0.6019 | 0.3258 | |

| 0.02 | 4.54 | 0.9280 | 0.2815 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 2.98 | 0.6097 | -1.1350 | |

| 0.02 | 3.76 | 0.7686 | -0.9405 | |

| 0.02 | 1.59 | 0.3243 | -0.5627 | |

| 0.01 | 2.19 | 0.4489 | -0.5557 | |

| 0.08 | 7.60 | 1.5545 | -0.4091 | |

| 0.03 | 2.07 | 0.4231 | -0.3719 | |

| 0.10 | 10.74 | 2.1979 | -0.3116 | |

| 0.04 | 7.95 | 1.6266 | -0.2908 | |

| 0.35 | 7.32 | 1.4977 | -0.2781 | |

| 0.02 | 3.57 | 0.7297 | -0.2737 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| WFC / Wells Fargo & Company | 0.13 | 0.54 | 10.79 | 12.21 | 2.2081 | -0.1271 | |||

| XOM / Exxon Mobil Corporation | 0.10 | 14.66 | 10.74 | 3.93 | 2.1979 | -0.3116 | |||

| GOOG / Alphabet Inc. | 0.06 | 240.55 | 10.40 | 286.77 | 2.1287 | 1.4754 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.08 | 14.66 | 10.35 | 17.57 | 2.1185 | -0.0197 | |||

| BAC / Bank of America Corporation | 0.22 | 6.84 | 10.30 | 21.16 | 2.1068 | 0.0432 | |||

| CB / Chubb Limited | 0.03 | 14.67 | 9.35 | 10.02 | 1.9122 | -0.1504 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | 14.63 | 8.31 | 35.47 | 1.7012 | 0.2111 | |||

| SCHW / The Charles Schwab Corporation | 0.09 | 9.61 | 8.18 | 27.77 | 1.6731 | 0.1191 | |||

| PM / Philip Morris International Inc. | 0.04 | -12.26 | 7.95 | 0.67 | 1.6266 | -0.2908 | |||

| WMT / Walmart Inc. | 0.08 | -15.65 | 7.60 | -6.06 | 1.5545 | -0.4091 | |||

| ELV / Elevance Health, Inc. | 0.02 | 25.02 | 7.44 | 11.81 | 1.5229 | -0.0935 | |||

| GE / General Electric Company | 0.03 | -15.06 | 7.39 | 9.24 | 1.5116 | -0.1305 | |||

| KVUE / Kenvue Inc. | 0.35 | 14.66 | 7.32 | 0.08 | 1.4977 | -0.2781 | |||

| LHX / L3Harris Technologies, Inc. | 0.03 | -0.03 | 6.99 | 19.80 | 1.4297 | 0.0136 | |||

| AMZN / Amazon.com, Inc. | 0.03 | 6.96 | 1.4245 | 1.4245 | |||||

| SO / The Southern Company | 0.07 | 14.69 | 6.79 | 14.54 | 1.3893 | -0.0501 | |||

| COP / ConocoPhillips | 0.07 | 27.63 | 6.44 | 9.06 | 1.3170 | -0.1160 | |||

| C / Citigroup Inc. | 0.07 | 14.68 | 6.27 | 37.53 | 1.2828 | 0.1758 | |||

| MCK / McKesson Corporation | 0.01 | 14.58 | 5.67 | 24.75 | 1.1593 | 0.0566 | |||

| META / Meta Platforms, Inc. | 0.01 | 58.26 | 5.52 | 102.68 | 1.1292 | 0.4681 | |||

| AVB / AvalonBay Communities, Inc. | 0.03 | 14.71 | 5.42 | 8.76 | 1.1080 | -0.1008 | |||

| AEE / Ameren Corporation | 0.06 | 14.67 | 5.29 | 9.69 | 1.0813 | -0.0885 | |||

| EQH / Equitable Holdings, Inc. | 0.09 | -2.37 | 4.92 | 5.15 | 1.0061 | -0.1294 | |||

| NSC / Norfolk Southern Corporation | 0.02 | -4.88 | 4.90 | 2.81 | 1.0025 | -0.1547 | |||

| PG / The Procter & Gamble Company | 0.03 | 65.61 | 4.70 | 54.81 | 0.9611 | 0.2244 | |||

| HD / The Home Depot, Inc. | 0.01 | 14.62 | 4.70 | 14.68 | 0.9607 | -0.0335 | |||

| MET / MetLife, Inc. | 0.06 | 14.66 | 4.55 | 14.86 | 0.9302 | -0.0309 | |||

| VST / Vistra Corp. | 0.02 | 3.21 | 4.54 | 70.33 | 0.9280 | 0.2815 | |||

| LLY / Eli Lilly and Company | 0.01 | 5.87 | 4.51 | -0.07 | 0.9234 | -0.1732 | |||

| CRM / Salesforce, Inc. | 0.02 | 248.93 | 4.37 | 254.59 | 0.8931 | 0.5942 | |||

| QCOM / QUALCOMM Incorporated | 0.03 | 38.38 | 4.31 | 43.48 | 0.8819 | 0.1525 | |||

| EOG / EOG Resources, Inc. | 0.03 | 14.71 | 4.17 | 6.98 | 0.8529 | -0.0931 | |||

| HWM / Howmet Aerospace Inc. | 0.02 | 25.20 | 4.03 | 79.70 | 0.8239 | 0.2796 | |||

| ACN / Accenture plc | 0.01 | -2.82 | 3.97 | -6.92 | 0.8119 | -0.2231 | |||

| CMI / Cummins Inc. | 0.01 | 14.72 | 3.88 | 19.85 | 0.7932 | 0.0080 | |||

| RSG / Republic Services, Inc. | 0.02 | 14.76 | 3.79 | 16.84 | 0.7754 | -0.0119 | |||

| BA / The Boeing Company | 0.02 | 14.74 | 3.77 | 40.95 | 0.7713 | 0.1220 | |||

| TXN / Texas Instruments Incorporated | 0.02 | 25.40 | 3.76 | 44.89 | 0.7693 | 0.1392 | |||

| FI / Fiserv, Inc. | 0.02 | -31.65 | 3.76 | -46.65 | 0.7686 | -0.9405 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.04 | 14.69 | 3.75 | -7.57 | 0.7672 | -0.2178 | |||

| ROK / Rockwell Automation, Inc. | 0.01 | 6.81 | 3.75 | 37.33 | 0.7664 | 0.1041 | |||

| MS / Morgan Stanley | 0.03 | 14.70 | 3.74 | 38.51 | 0.7661 | 0.1097 | |||

| LIN / Linde plc | 0.01 | 22.29 | 3.71 | 23.22 | 0.7600 | 0.0281 | |||

| CVS / CVS Health Corporation | 0.05 | 33.40 | 3.66 | 35.82 | 0.7479 | 0.0945 | |||

| CL / Colgate-Palmolive Company | 0.04 | 14.69 | 3.63 | 11.29 | 0.7423 | -0.0494 | |||

| BDX / Becton, Dickinson and Company | 0.02 | 14.75 | 3.57 | -13.72 | 0.7297 | -0.2737 | |||

| DIS / The Walt Disney Company | 0.03 | 24.58 | 3.51 | 56.52 | 0.7175 | 0.1736 | |||

| IP / International Paper Company | 0.07 | 14.68 | 3.50 | 0.66 | 0.7170 | -0.1282 | |||

| KMB / Kimberly-Clark Corporation | 0.03 | 14.71 | 3.47 | 3.99 | 0.7101 | -0.1003 | |||

| CSX / CSX Corporation | 0.11 | 219.31 | 3.45 | 254.15 | 0.7066 | 0.4697 | |||

| MCD / McDonald's Corporation | 0.01 | 22.01 | 3.40 | 14.13 | 0.6958 | -0.0277 | |||

| MSFT / Microsoft Corporation | 0.01 | 7.82 | 3.35 | 42.89 | 0.6845 | 0.1160 | |||

| CI / The Cigna Group | 0.01 | 14.50 | 3.31 | 15.07 | 0.6781 | -0.0213 | |||

| NFLX / Netflix, Inc. | 0.00 | 3.27 | 0.6699 | 0.6699 | |||||

| MMC / Marsh & McLennan Companies, Inc. | 0.01 | 14.75 | 3.23 | 2.80 | 0.6611 | -0.1019 | |||

| PGR / The Progressive Corporation | 0.01 | 46.85 | 3.23 | 38.47 | 0.6599 | 0.0944 | |||

| APH / Amphenol Corporation | 0.03 | 14.70 | 3.18 | 72.73 | 0.6506 | 0.2035 | |||

| T / AT&T Inc. | 0.11 | 34.44 | 3.12 | 37.58 | 0.6382 | 0.0878 | |||

| DE / Deere & Company | 0.01 | 24.41 | 3.11 | 34.79 | 0.6357 | 0.0760 | |||

| COF / Capital One Financial Corporation | 0.01 | 51.21 | 3.07 | 79.47 | 0.6280 | 0.2127 | |||

| MU / Micron Technology, Inc. | 0.02 | 14.71 | 3.06 | 62.73 | 0.6263 | 0.1696 | |||

| SRE / Sempra | 0.04 | 14.69 | 3.05 | 21.78 | 0.6235 | 0.0159 | |||

| KO / The Coca-Cola Company | 0.04 | 0.46 | 3.04 | -0.75 | 0.6226 | -0.1219 | |||

| AZO / AutoZone, Inc. | 0.00 | 23.01 | 3.04 | 19.76 | 0.6213 | 0.0057 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | -30.38 | 2.98 | -58.54 | 0.6097 | -1.1350 | |||

| AMD / Advanced Micro Devices, Inc. | 0.02 | 87.31 | 2.94 | 158.75 | 0.6019 | 0.3258 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 33.27 | 2.88 | 19.05 | 0.5895 | 0.0019 | |||

| WY / Weyerhaeuser Company | 0.11 | -1.35 | 2.84 | -13.43 | 0.5803 | -0.2152 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.01 | 14.76 | 2.81 | 56.55 | 0.5751 | 0.1392 | |||

| ARES / Ares Management Corporation | 0.02 | 14.75 | 2.81 | 35.54 | 0.5744 | 0.0716 | |||

| CVX / Chevron Corporation | 0.02 | 14.73 | 2.80 | -1.79 | 0.5722 | -0.1192 | |||

| AGCO / AGCO Corporation | 0.03 | 14.71 | 2.78 | 27.87 | 0.5680 | 0.0407 | |||

| CF / CF Industries Holdings, Inc. | 0.03 | 14.70 | 2.75 | 35.02 | 0.5626 | 0.0682 | |||

| USB / U.S. Bancorp | 0.06 | 14.67 | 2.71 | 22.90 | 0.5535 | 0.0191 | |||

| EQT / EQT Corporation | 0.05 | -14.54 | 2.66 | -6.69 | 0.5448 | -0.1483 | |||

| WMB / The Williams Companies, Inc. | 0.04 | 14.67 | 2.65 | 20.54 | 0.5429 | 0.0084 | |||

| FITB / Fifth Third Bancorp | 0.06 | -17.18 | 2.63 | -13.10 | 0.5377 | -0.1965 | |||

| KEYS / Keysight Technologies, Inc. | 0.02 | 14.80 | 2.61 | 25.61 | 0.5338 | 0.0295 | |||

| SIEGY / Siemens Aktiengesellschaft - Depositary Receipt (Common Stock) | 0.02 | 14.76 | 2.57 | 28.20 | 0.5265 | 0.0391 | |||

| BLK / BlackRock, Inc. | 0.00 | 14.25 | 2.56 | 26.71 | 0.5231 | 0.0330 | |||

| BSX / Boston Scientific Corporation | 0.02 | 82.59 | 2.52 | 94.45 | 0.5160 | 0.2010 | |||

| HUBB / Hubbell Incorporated | 0.01 | 14.46 | 2.52 | 41.25 | 0.5151 | 0.0824 | |||

| BAX / Baxter International Inc. | 0.08 | 14.70 | 2.51 | 1.46 | 0.5130 | -0.0870 | |||

| DHR / Danaher Corporation | 0.01 | 26.12 | 2.51 | 21.53 | 0.5128 | 0.0121 | |||

| HBAN / Huntington Bancshares Incorporated | 0.15 | 14.68 | 2.50 | 28.08 | 0.5123 | 0.0376 | |||

| PH / Parker-Hannifin Corporation | 0.00 | 2.46 | 0.5027 | 0.5027 | |||||

| AMAT / Applied Materials, Inc. | 0.01 | 62.95 | 2.45 | 105.62 | 0.5016 | 0.2120 | |||

| FERG / Ferguson Enterprises Inc. | 0.01 | 14.81 | 2.44 | 56.02 | 0.4987 | 0.1194 | |||

| NEE / NextEra Energy, Inc. | 0.03 | 14.70 | 2.40 | 12.37 | 0.4908 | -0.0277 | |||

| ADI / Analog Devices, Inc. | 0.01 | 14.77 | 2.39 | 35.51 | 0.4888 | 0.0606 | |||

| CME / CME Group Inc. | 0.01 | 53.34 | 2.38 | 59.36 | 0.4863 | 0.1241 | |||

| FTV / Fortive Corporation | 0.04 | 14.69 | 2.34 | -18.30 | 0.4796 | -0.2170 | |||

| SLB / Schlumberger Limited | 0.07 | 14.66 | 2.33 | -7.27 | 0.4773 | -0.1336 | |||

| US21871X1090 / Corebridge Financial, Inc. | 0.07 | 2.31 | 0.4729 | 0.4729 | |||||

| TEL / TE Connectivity plc | 0.01 | 14.83 | 2.24 | 37.03 | 0.4574 | 0.0614 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | -34.92 | 2.19 | -46.98 | 0.4489 | -0.5557 | |||

| MAR / Marriott International, Inc. | 0.01 | 14.84 | 2.17 | 31.71 | 0.4437 | 0.0440 | |||

| HCA / HCA Healthcare, Inc. | 0.01 | 14.43 | 2.14 | 26.92 | 0.4370 | 0.0282 | |||

| YUM / Yum! Brands, Inc. | 0.01 | 27.52 | 2.13 | 20.03 | 0.4366 | 0.0052 | |||

| CMCSA / Comcast Corporation | 0.06 | 14.71 | 2.13 | 10.99 | 0.4360 | -0.0303 | |||

| SWK / Stanley Black & Decker, Inc. | 0.03 | -28.33 | 2.07 | -36.84 | 0.4231 | -0.3719 | |||

| CPAY / Corpay, Inc. | 0.01 | 14.74 | 1.96 | 9.19 | 0.4011 | -0.0348 | |||

| JNJ / Johnson & Johnson | 0.01 | 14.76 | 1.90 | 5.69 | 0.3879 | -0.0476 | |||

| TDG / TransDigm Group Incorporated | 0.00 | 14.06 | 1.87 | 25.35 | 0.3836 | 0.0206 | |||

| TJX / The TJX Companies, Inc. | 0.02 | 14.74 | 1.86 | 16.36 | 0.3812 | -0.0077 | |||

| AME / AMETEK, Inc. | 0.01 | 32.92 | 1.86 | 39.71 | 0.3809 | 0.0574 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0.03 | 14.72 | 1.84 | 8.90 | 0.3757 | -0.0338 | |||

| KDP / Keurig Dr Pepper Inc. | 0.05 | -6.89 | 1.82 | -10.05 | 0.3718 | -0.1187 | |||

| PSA / Public Storage | 0.01 | 14.75 | 1.73 | 12.52 | 0.3549 | -0.0194 | |||

| SPGI / S&P Global Inc. | 0.00 | 14.54 | 1.72 | 18.87 | 0.3519 | 0.0006 | |||

| CAT / Caterpillar Inc. | 0.00 | 14.83 | 1.71 | 35.18 | 0.3499 | 0.0427 | |||

| ABBV / AbbVie Inc. | 0.01 | 14.80 | 1.70 | 1.68 | 0.3469 | -0.0578 | |||

| TT / Trane Technologies plc | 0.00 | 14.56 | 1.69 | 48.68 | 0.3451 | 0.0697 | |||

| REXR / Rexford Industrial Realty, Inc. | 0.05 | 14.70 | 1.67 | 4.18 | 0.3420 | -0.0474 | |||

| MRK / Merck & Co., Inc. | 0.02 | 163.41 | 1.66 | 132.44 | 0.3387 | 0.1657 | |||

| CBOE / Cboe Global Markets, Inc. | 0.01 | 14.80 | 1.65 | 18.29 | 0.3375 | -0.0010 | |||

| XEL / Xcel Energy Inc. | 0.02 | 32.43 | 1.63 | 27.45 | 0.3325 | 0.0228 | |||

| STLD / Steel Dynamics, Inc. | 0.01 | 14.75 | 1.59 | 17.44 | 0.3253 | -0.0034 | |||

| AIG / American International Group, Inc. | 0.02 | -55.93 | 1.59 | -56.61 | 0.3243 | -0.5627 | |||

| GEV / GE Vernova Inc. | 0.00 | 14.50 | 1.56 | 98.47 | 0.3188 | 0.1282 | |||

| LAMR / Lamar Advertising Company | 0.01 | -0.47 | 1.56 | 6.14 | 0.3183 | -0.0375 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.02 | 14.75 | 1.53 | 9.14 | 0.3129 | -0.0274 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | 14.56 | 1.51 | 10.07 | 0.3086 | -0.0242 | |||

| AXP / American Express Company | 0.00 | 14.78 | 1.51 | 36.04 | 0.3082 | 0.0394 | |||

| APO / Apollo Global Management, Inc. | 0.01 | -34.35 | 1.49 | -32.01 | 0.3044 | -0.2267 | |||

| MOH / Molina Healthcare, Inc. | 0.00 | 0.14 | 1.45 | -9.44 | 0.2963 | -0.0919 | |||

| VTRS / Viatris Inc. | 0.16 | 14.70 | 1.42 | 17.61 | 0.2898 | -0.0026 | |||

| PLD / Prologis, Inc. | 0.01 | 14.78 | 1.40 | 7.97 | 0.2857 | -0.0284 | |||

| RPM / RPM International Inc. | 0.01 | -32.49 | 1.37 | -35.90 | 0.2809 | -0.2391 | |||

| D / Dominion Energy, Inc. | 0.02 | 14.75 | 1.37 | 15.61 | 0.2805 | -0.0073 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.03 | -21.37 | 1.35 | -31.54 | 0.2768 | -0.2027 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 1.33 | 34.94 | 1.33 | 34.88 | 0.2731 | 0.0329 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | 14.51 | 1.32 | 5.08 | 0.2711 | -0.0348 | |||

| A / Agilent Technologies, Inc. | 0.01 | 14.73 | 1.29 | 15.77 | 0.2644 | -0.0067 | |||

| FANG / Diamondback Energy, Inc. | 0.01 | 14.83 | 1.25 | -1.34 | 0.2565 | -0.0519 | |||

| LEN / Lennar Corporation | 0.01 | 14.73 | 1.21 | 10.59 | 0.2479 | -0.0182 | |||

| MDLZ / Mondelez International, Inc. | 0.02 | 14.74 | 1.17 | 14.11 | 0.2400 | -0.0097 | |||

| DGX / Quest Diagnostics Incorporated | 0.01 | 14.83 | 1.16 | 21.93 | 0.2379 | 0.0063 | |||

| VMC / Vulcan Materials Company | 0.00 | 14.78 | 1.15 | 28.36 | 0.2362 | 0.0178 | |||

| EFX / Equifax Inc. | 0.00 | 14.92 | 1.11 | 22.42 | 0.2280 | 0.0069 | |||

| DTE / DTE Energy Company | 0.01 | 42.39 | 1.11 | 36.44 | 0.2276 | 0.0296 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.00 | 15.37 | 1.04 | 34.94 | 0.2127 | 0.0258 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | 0.92 | 0.1876 | 0.1876 | |||||

| LVS / Las Vegas Sands Corp. | 0.02 | 14.72 | 0.88 | 29.16 | 0.1795 | 0.0146 | |||

| ROP / Roper Technologies, Inc. | 0.00 | 14.42 | 0.85 | 9.91 | 0.1749 | -0.0138 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -20.32 | 0.76 | -34.06 | 0.1559 | -0.1245 | |||

| ECL / Ecolab Inc. | 0.00 | 0.73 | 0.1498 | 0.1498 | |||||

| RAL / Ralliant Corporation | 0.01 | 0.73 | 0.1487 | 0.1487 |