Mga Batayang Estadistika

| Nilai Portofolio | $ 55,438,215 |

| Posisi Saat Ini | 52 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

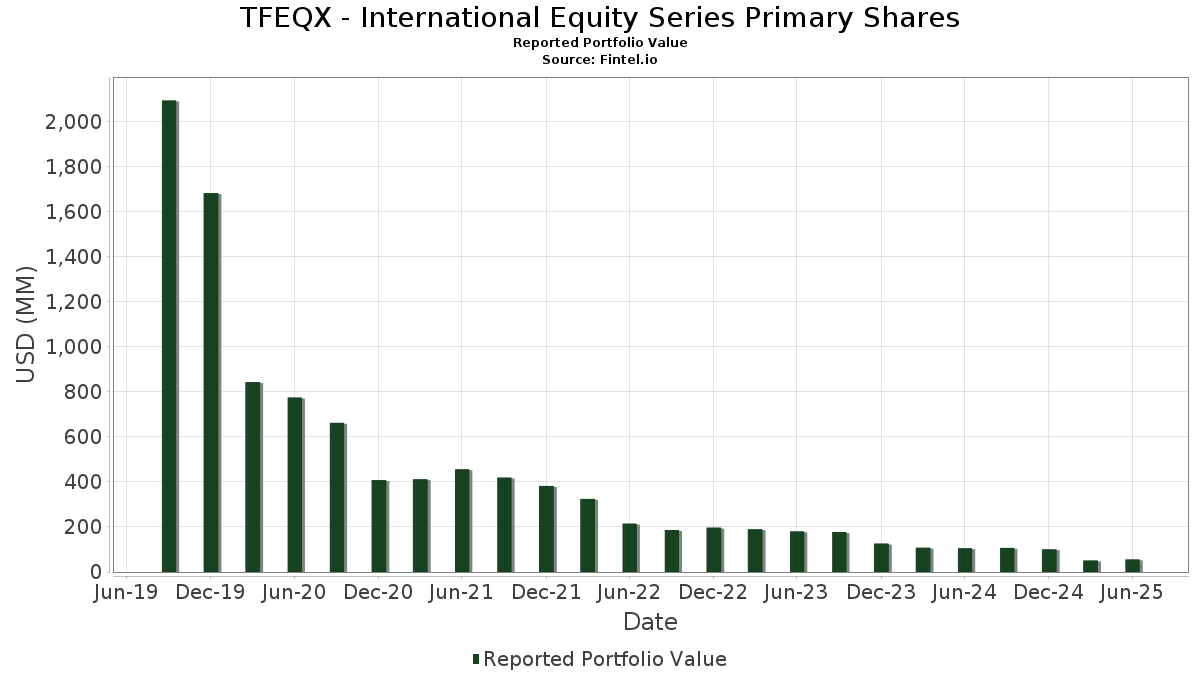

TFEQX - International Equity Series Primary Shares telah mengungkapkan total kepemilikan 52 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 55,438,215 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama TFEQX - International Equity Series Primary Shares adalah Institutional Fiduciary Trust - Institutional Fiduciary Trust Money Market Portfolio (US:INFXX) , Deutsche Telekom AG (DE:DTE) , Taiwan Semiconductor Manufacturing Company Limited (TW:2330) , Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) (US:MFG) , and Standard Chartered PLC - Depositary Receipt (Common Stock) (US:SCBFY) . Posisi baru TFEQX - International Equity Series Primary Shares meliputi: Vinci SA (FR:DG) , Novo Nordisk A/S - Depositary Receipt (Common Stock) (US:NVO) , SSE plc - Depositary Receipt (Common Stock) (US:SSEZY) , Akzo Nobel N.V. (NL:AKZA) , and ASM International NV (NL:ASM) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 1.03 | 1.7410 | 1.7410 | |

| 0.01 | 0.92 | 1.5543 | 1.5543 | |

| 0.04 | 0.91 | 1.5440 | 1.5440 | |

| 0.01 | 0.90 | 1.5140 | 1.5140 | |

| 0.00 | 0.87 | 1.4631 | 1.4631 | |

| 0.00 | 0.85 | 1.4289 | 1.4289 | |

| 2.20 | 2.20 | 3.7220 | 1.2759 | |

| 0.00 | 0.78 | 1.3143 | 0.8221 | |

| 0.07 | 1.38 | 2.3296 | 0.6369 | |

| 0.62 | 0.75 | 1.2727 | 0.2540 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 2.20 | 3.7203 | -1.3257 | |

| 0.01 | 1.41 | 2.3748 | -0.8015 | |

| 0.01 | 1.03 | 1.7357 | -0.7528 | |

| 0.26 | 1.31 | 2.2062 | -0.7001 | |

| 0.08 | 1.19 | 2.0123 | -0.5739 | |

| 0.08 | 1.19 | 2.0042 | -0.5662 | |

| 0.10 | 0.88 | 1.4906 | -0.5656 | |

| 0.04 | 1.39 | 2.3430 | -0.4228 | |

| 0.01 | 1.33 | 2.2532 | -0.3900 | |

| 0.01 | 0.73 | 1.2261 | -0.2855 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| INFXX / Institutional Fiduciary Trust - Institutional Fiduciary Trust Money Market Portfolio | 2.20 | 73.59 | 2.20 | 73.60 | 3.7220 | 1.2759 | |||

| DTE / Deutsche Telekom AG | 0.06 | -15.16 | 2.20 | -15.89 | 3.7203 | -1.3257 | |||

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 0.05 | -4.06 | 1.73 | 24.57 | 2.9222 | 0.2463 | |||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 0.06 | 7.53 | 1.70 | 8.74 | 2.8796 | -0.1406 | |||

| SCBFY / Standard Chartered PLC - Depositary Receipt (Common Stock) | 0.10 | 1.12 | 1.65 | 12.76 | 2.7936 | -0.0327 | |||

| 6503 / Mitsubishi Electric Corporation | 0.08 | 3.10 | 1.64 | 20.26 | 2.7784 | 0.1425 | |||

| RY / Royal Bank of Canada | 0.01 | -1.74 | 1.49 | 14.98 | 2.5161 | 0.0194 | |||

| SAN / Santander UK plc - Preferred Stock | 0.01 | -2.45 | 1.41 | -14.69 | 2.3748 | -0.8015 | |||

| SHEL / Shell plc | 0.04 | 0.83 | 1.39 | -3.41 | 2.3430 | -0.4228 | |||

| EAR / Ebara Corporation | 0.07 | 24.61 | 1.38 | 56.95 | 2.3296 | 0.6369 | |||

| INGA / ING Groep N.V. - Depositary Receipt (Common Stock) | 0.06 | -2.46 | 1.35 | 9.11 | 2.2868 | -0.1040 | |||

| CRH / CRH plc | 0.01 | -2.45 | 1.35 | 2.75 | 2.2766 | -0.2512 | |||

| AZN / Astrazeneca plc | 0.01 | 2.61 | 1.33 | -2.77 | 2.2532 | -0.3900 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.26 | -2.46 | 1.31 | -13.40 | 2.2062 | -0.7001 | |||

| 1211 N / BYD Company Limited | 0.08 | 188.68 | 1.19 | -11.19 | 2.0123 | -0.5739 | |||

| 2RR / Alibaba Group Holding Limited | 0.08 | 3.97 | 1.19 | -11.03 | 2.0042 | -0.5662 | |||

| DB1 / Deutsche Börse AG | 0.00 | -2.42 | 1.17 | 8.03 | 1.9787 | -0.1107 | |||

| LLOY / Lloyds Banking Group plc | 1.07 | -2.46 | 1.13 | 9.33 | 1.9012 | -0.0823 | |||

| GOB / Compagnie de Saint-Gobain S.A. | 0.01 | -2.45 | 1.11 | 15.10 | 1.8807 | 0.0157 | |||

| VIE / Veolia Environnement SA | 0.03 | 7.53 | 1.07 | 11.59 | 1.8077 | -0.0397 | |||

| BA. / BAE Systems plc | 0.04 | -2.46 | 1.07 | 25.41 | 1.8010 | 0.1621 | |||

| IFNNY / Infineon Technologies AG - Depositary Receipt (Common Stock) | 0.02 | 1.00 | 1.05 | 29.26 | 1.7702 | 0.2082 | |||

| SAP / SAP SE | 0.00 | -2.43 | 1.04 | 11.30 | 1.7647 | -0.0433 | |||

| DG / Vinci SA | 0.01 | 1.03 | 1.7410 | 1.7410 | |||||

| SREN / Swiss Re AG | 0.01 | -21.72 | 1.03 | -20.45 | 1.7357 | -0.7528 | |||

| MFC / Manulife Financial Corporation | 0.03 | -2.16 | 1.01 | 0.40 | 1.7124 | -0.2334 | |||

| S7MB / Securitas AB (publ) | 0.06 | -2.46 | 0.97 | 3.20 | 1.6350 | -0.1724 | |||

| 37C / CNH Industrial N.V. | 0.07 | -2.46 | 0.96 | 3.00 | 1.6255 | -0.1760 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.01 | 0.92 | 1.5543 | 1.5543 | |||||

| SSEZY / SSE plc - Depositary Receipt (Common Stock) | 0.04 | 0.91 | 1.5440 | 1.5440 | |||||

| Smurfit WestRock plc / EC (IE00028FXN24) | 0.02 | 2.63 | 0.90 | -1.10 | 1.5175 | -0.2330 | |||

| AKZA / Akzo Nobel N.V. | 0.01 | 0.90 | 1.5140 | 1.5140 | |||||

| UNA / Unilever PLC | 0.01 | -2.45 | 0.89 | -0.22 | 1.5090 | -0.2164 | |||

| 1299 / AIA Group Limited | 0.10 | -84.92 | 0.88 | -86.92 | 1.4906 | -0.5656 | |||

| DTG / Daimler Truck Holding AG | 0.02 | 5.59 | 0.88 | 23.66 | 1.4841 | 0.1151 | |||

| ASM / ASM International NV | 0.00 | 0.87 | 1.4631 | 1.4631 | |||||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.00 | 0.85 | 1.4289 | 1.4289 | |||||

| FG1 / Antofagasta plc | 0.03 | -2.46 | 0.84 | 11.39 | 1.4222 | -0.0344 | |||

| 005930 / Samsung Electronics Co., Ltd. | 0.02 | -2.46 | 0.82 | 8.72 | 1.3917 | -0.0675 | |||

| FME / Fresenius Medical Care AG | 0.01 | 18.70 | 0.79 | 37.09 | 1.3366 | 0.2240 | |||

| ADEN / Adecco Group AG | 0.03 | 0.86 | 0.78 | -0.13 | 1.3143 | -0.1859 | |||

| TKY / Tokyo Electron Limited | 0.00 | 118.15 | 0.78 | 204.71 | 1.3143 | 0.8221 | |||

| RELIANCE / Reliance Industries Limited | 0.04 | 4.84 | 0.76 | 23.57 | 1.2756 | 0.0966 | |||

| JD. / JD Sports Fashion Plc | 0.62 | 3.35 | 0.75 | 42.61 | 1.2727 | 0.2540 | |||

| GALP / Galp Energia, SGPS, S.A. | 0.04 | -2.46 | 0.74 | 1.94 | 1.2446 | -0.1486 | |||

| BDEV / Barratt Developments plc | 0.12 | -2.46 | 0.73 | 11.11 | 1.2337 | -0.0339 | |||

| FP / TotalEnergies SE | 0.01 | -2.46 | 0.73 | -7.53 | 1.2261 | -0.2855 | |||

| DIP / KDDI Corporation | 0.04 | 4.91 | 0.70 | 13.91 | 1.1773 | -0.0004 | |||

| NOH1 / Norsk Hydro ASA | 0.12 | -2.46 | 0.67 | -3.33 | 1.1293 | -0.2041 | |||

| IJF / ICON Public Limited Company | 0.00 | 66.10 | 0.66 | 38.03 | 1.1115 | 0.1931 | |||

| D2G / Ørsted A/S | 0.01 | -2.45 | 0.51 | -3.93 | 0.8683 | -0.1611 | |||

| MSCI EAFE Index / DE (N/A) | 0.04 | 0.0651 | 0.0651 | ||||||

| Hemisphere Properties India Ltd., Escrow Account / EC (N/A) | 2.09 | 0.00 | 0.0000 | 0.0000 |