Mga Batayang Estadistika

| Nilai Portofolio | $ 656,687,153 |

| Posisi Saat Ini | 190 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

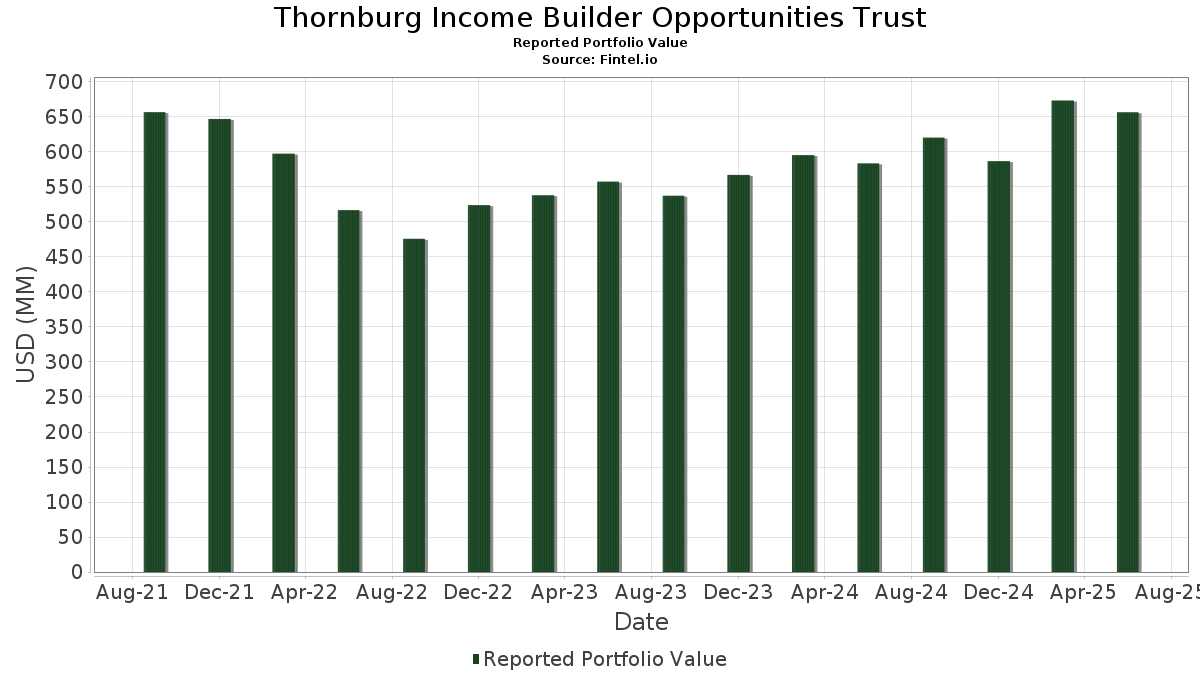

Thornburg Income Builder Opportunities Trust telah mengungkapkan total kepemilikan 190 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 656,687,153 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Thornburg Income Builder Opportunities Trust adalah Orange S.A. (FR:ORA) , Enel SpA (IT:ENEL) , AT&T Inc. (US:T) , NN Group N.V. (NL:NN) , and Snam S.p.A. (IT:SRG) . Posisi baru Thornburg Income Builder Opportunities Trust meliputi: Leverage Shares Plc - Corporate Bond/Note (GB:BAS) , United States Treasury Strip Coupon (US:US912834KP23) , Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk (ID:TLKM) , United States Treasury Strip Coupon (US:US912834FB91) , and Freddie Mac Pool (US:US3132DWJS35) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.16 | 7.76 | 1.1711 | 1.1711 | |

| 3.63 | 0.5475 | 0.5475 | ||

| 20.62 | 3.53 | 0.5325 | 0.5325 | |

| 3.44 | 0.5190 | 0.5190 | ||

| 0.06 | 13.18 | 1.9876 | 0.4409 | |

| 1.99 | 30.22 | 4.5578 | 0.4371 | |

| 0.11 | 2.66 | 0.4011 | 0.4011 | |

| 2.38 | 0.3590 | 0.3590 | ||

| 0.00 | 11.24 | 1.6951 | 0.3517 | |

| 2.62 | 24.87 | 3.7513 | 0.3464 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.94 | 9.36 | 1.4117 | -2.1811 | |

| 0.05 | 1.65 | 0.2484 | -0.4167 | |

| 0.55 | 10.06 | 1.5172 | -0.2551 | |

| 0.10 | 7.79 | 1.1750 | -0.2396 | |

| 0.08 | 4.80 | 0.7235 | -0.2112 | |

| 0.18 | 11.27 | 1.6998 | -0.1950 | |

| 0.05 | 15.97 | 2.4084 | -0.1759 | |

| 0.43 | 10.50 | 1.5833 | -0.1741 | |

| 0.03 | 4.66 | 0.7034 | -0.1396 | |

| 0.28 | 2.52 | 0.3808 | -0.1389 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-21 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| ORA / Orange S.A. | 1.99 | 0.00 | 30.22 | 17.44 | 4.5578 | 0.4371 | |||

| ENEL / Enel SpA | 2.62 | 0.00 | 24.87 | 16.97 | 3.7513 | 0.3464 | |||

| T / AT&T Inc. | 0.84 | 0.00 | 24.35 | 2.33 | 3.6730 | -0.1379 | |||

| NN / NN Group N.V. | 0.26 | 0.00 | 17.61 | 19.44 | 2.6560 | 0.2948 | |||

| SRG / Snam S.p.A. | 2.69 | 0.00 | 16.30 | 16.69 | 2.4592 | 0.2216 | |||

| ELE / Endesa, S.A. | 0.51 | 0.00 | 16.29 | 19.51 | 2.4563 | 0.2740 | |||

| ROG / Roche Holding AG | 0.05 | 0.00 | 15.97 | -1.05 | 2.4084 | -0.1759 | |||

| CME / CME Group Inc. | 0.05 | 0.00 | 13.51 | 3.89 | 2.0370 | -0.0448 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.06 | 0.00 | 13.18 | 36.44 | 1.9876 | 0.4409 | |||

| CSCO / Cisco Systems, Inc. | 0.17 | 0.00 | 12.08 | 12.44 | 1.8219 | 0.1013 | |||

| NOVN / Novartis AG | 0.10 | 0.00 | 11.95 | 9.13 | 1.8018 | 0.0487 | |||

| 005930 / Samsung Electronics Co., Ltd. | 0.26 | 0.00 | 11.63 | 11.77 | 1.7545 | 0.0877 | |||

| ENB / Enbridge Inc. | 0.25 | 0.00 | 11.38 | 2.45 | 1.7158 | -0.0623 | |||

| FP / TotalEnergies SE | 0.18 | 0.00 | 11.27 | -4.75 | 1.6998 | -0.1950 | |||

| MELI / MercadoLibre, Inc. | 0.00 | 0.00 | 11.24 | 33.98 | 1.6951 | 0.3517 | |||

| META / Meta Platforms, Inc. | 0.02 | 0.00 | 11.22 | 28.06 | 1.6922 | 0.2892 | |||

| DPW / Deutsche Post AG | 0.24 | 0.00 | 11.17 | 7.58 | 1.6847 | 0.0220 | |||

| PFE / Pfizer Inc. | 0.43 | 0.00 | 10.50 | -4.34 | 1.5833 | -0.1741 | |||

| EOAN / E.ON SE | 0.55 | -25.46 | 10.06 | -9.11 | 1.5172 | -0.2551 | |||

| US8852167399 / Thornburg Capital Management Fund | 0.94 | -58.28 | 9.36 | -58.28 | 1.4117 | -2.1811 | |||

| BHP / BHP Group Limited | 0.37 | 0.00 | 8.96 | -0.31 | 1.3516 | -0.0880 | |||

| MBG / Mercedes-Benz Group AG | 0.13 | 0.00 | 7.82 | -0.91 | 1.1792 | -0.0844 | |||

| MRK / Merck & Co., Inc. | 0.10 | 0.00 | 7.79 | -11.81 | 1.1750 | -0.2396 | |||

| BAS / Leverage Shares Plc - Corporate Bond/Note | 0.16 | 7.76 | 1.1711 | 1.1711 | |||||

| EQNR / Equinor ASA - Depositary Receipt (Common Stock) | 0.26 | 0.00 | 6.50 | -4.16 | 0.9809 | -0.1058 | |||

| TRP / TC Energy Corporation | 0.13 | 0.00 | 6.46 | 3.38 | 0.9747 | -0.0264 | |||

| SHEL / Shell plc | 0.17 | 0.00 | 6.12 | -3.47 | 0.9229 | -0.0922 | |||

| SE / Sea Limited - Depositary Receipt (Common Stock) | 0.04 | 0.00 | 5.90 | 22.55 | 0.8902 | 0.1190 | |||

| NNND / Tencent Holdings Limited | 0.09 | 0.00 | 5.87 | 0.29 | 0.8853 | -0.0520 | |||

| ENI / Eni S.p.A. | 0.36 | 0.00 | 5.87 | 4.80 | 0.8852 | -0.0116 | |||

| LGI / Legal & General Group Plc | 1.64 | 0.00 | 5.74 | 10.80 | 0.8664 | 0.0363 | |||

| MSFT / Microsoft Corporation | 0.01 | 0.00 | 5.32 | 32.52 | 0.8028 | 0.1595 | |||

| NOW / ServiceNow, Inc. | 0.01 | 0.00 | 5.14 | 29.15 | 0.7753 | 0.1378 | |||

| MDT / Medtronic plc | 0.06 | 0.00 | 4.85 | -3.00 | 0.7310 | -0.0691 | |||

| LYB / LyondellBasell Industries N.V. | 0.08 | 0.00 | 4.80 | -17.82 | 0.7235 | -0.2112 | |||

| MNDI / Mondi plc | 0.29 | 0.00 | 4.75 | 9.45 | 0.7164 | 0.0215 | |||

| ABBV / AbbVie Inc. | 0.03 | 0.00 | 4.66 | -11.40 | 0.7034 | -0.1396 | |||

| AKZA / Akzo Nobel N.V. | 0.06 | 0.00 | 4.50 | 13.60 | 0.6793 | 0.0445 | |||

| 6861 / Keyence Corporation | 0.01 | 0.00 | 4.42 | 2.15 | 0.6664 | -0.0263 | |||

| RF / Regions Financial Corporation | 0.18 | 0.00 | 4.33 | 8.25 | 0.6531 | 0.0124 | |||

| C / Citigroup Inc. | 0.05 | 0.00 | 4.31 | 19.91 | 0.6498 | 0.0744 | |||

| NESN / Nestlé S.A. | 0.04 | 0.00 | 4.01 | -1.67 | 0.6053 | -0.0484 | |||

| FCFS / FirstCash Holdings, Inc. | 3.88 | 2.29 | 0.5855 | -0.0222 | |||||

| PBR / Petróleo Brasileiro S.A. - Petrobras - Depositary Receipt (Common Stock) | 0.30 | 0.00 | 3.79 | -12.77 | 0.5709 | -0.1239 | |||

| OTEX / Open Text Corporation | 0.13 | 0.00 | 3.74 | 15.77 | 0.5646 | 0.0468 | |||

| VOD / Vodafone Group Public Limited Company | 3.45 | 0.00 | 3.68 | 13.64 | 0.5556 | 0.0364 | |||

| US36242H8723 / Gabelli Dividend & Income Trust/The | 0.00 | 0.00 | 3.65 | 0.66 | 0.5502 | -0.0302 | |||

| US912834KP23 / United States Treasury Strip Coupon | 3.63 | 0.5475 | 0.5475 | ||||||

| TLKM / Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk | 20.62 | 3.53 | 0.5325 | 0.5325 | |||||

| SONY / Sony Group Corporation - Depositary Receipt (Common Stock) | 0.13 | 0.00 | 3.47 | 2.51 | 0.5227 | -0.0186 | |||

| U.S. Treasury Inflation-Indexed Bonds / DBT (US912810UH94) | 3.44 | 0.5190 | 0.5190 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 3.43 | -2.61 | 0.5175 | -0.0467 | |||||

| US912834FB91 / United States Treasury Strip Coupon | 3.34 | -1.27 | 0.5033 | -0.0379 | |||||

| CPX / Capital Power Corporation | 0.08 | 0.00 | 3.32 | 21.05 | 0.5015 | 0.0617 | |||

| US3132DWJS35 / Freddie Mac Pool | 3.25 | -3.85 | 0.4898 | -0.0510 | |||||

| THC / Tenet Healthcare Corporation | 3.10 | 1.97 | 0.4682 | -0.0193 | |||||

| US91153LAA52 / United Shore Financial Services LLC | 3.00 | 0.23 | 0.4522 | -0.0269 | |||||

| US737446AP91 / Post Holdings Inc | 2.99 | 2.36 | 0.4507 | -0.0169 | |||||

| US185899AM31 / Cleveland-Cliffs Inc | 2.98 | 0.30 | 0.4496 | -0.0262 | |||||

| XS1505143393 / Comision Federal de Electricidad | 2.97 | 0.82 | 0.4477 | -0.0238 | |||||

| US808625AA58 / Science Applications International Corp | 2.95 | 2.96 | 0.4454 | -0.0140 | |||||

| Dominican Republic International Bond / DBT (US25714PFA12) | 2.94 | 5.63 | 0.4442 | -0.0022 | |||||

| US691205AE86 / Owl Rock Technology Finance Corp | 2.94 | 0.41 | 0.4436 | -0.0256 | |||||

| US43789XAG97 / HOF_20-2 | 2.90 | 1.26 | 0.4368 | -0.0212 | |||||

| US46285MAA80 / Iron Mountain Information Management Services Inc | 2.88 | 3.94 | 0.4341 | -0.0093 | |||||

| BME / B&M European Value Retail S.A. | 0.77 | 0.00 | 2.86 | 10.30 | 0.4311 | 0.0161 | |||

| 2RR / Alibaba Group Holding Limited | 0.20 | 0.00 | 2.83 | -15.47 | 0.4262 | -0.1091 | |||

| STLAP / Stellantis N.V. | 0.28 | 0.00 | 2.79 | -10.52 | 0.4209 | -0.0786 | |||

| XPG / Vend Marketplaces ASA | 0.08 | 0.00 | 2.76 | 30.68 | 0.4164 | 0.0781 | |||

| US067316AG42 / Bacardi Ltd | 2.76 | 0.11 | 0.4156 | -0.0252 | |||||

| US31288QTU49 / Freddie Mac Non Gold Pool | 2.72 | -2.47 | 0.4109 | -0.0364 | |||||

| CSQ / Calamos Strategic Total Return Fund | 0.11 | 2.66 | 0.4011 | 0.4011 | |||||

| OCI / OCI N.V. | 0.28 | 0.00 | 2.52 | -22.22 | 0.3808 | -0.1389 | |||

| US82967NBC11 / Sirius XM Radio Inc | 2.48 | 2.73 | 0.3742 | -0.0125 | |||||

| Homeward Opportunities Fund Trust 2024-RTL1 / ABS-MBS (US43789FAA12) | 2.47 | -0.16 | 0.3721 | -0.0236 | |||||

| KKR Reign I LLC / SN (US49836MAA62) | 2.38 | 0.3590 | 0.3590 | ||||||

| US31200BAA61 / Fat Brands Fazoli's Native I LLC | 2.24 | -3.66 | 0.3371 | -0.0344 | |||||

| US38381CAB81 / Finance Department Government of Sharjah | 2.23 | -1.81 | 0.3361 | -0.0273 | |||||

| US3140QMN836 / Fannie Mae Pool | 2.21 | -2.73 | 0.3334 | -0.0305 | |||||

| US71654QCC42 / Petroleos Mexicanos Bond | 2.17 | 5.60 | 0.3273 | -0.0018 | |||||

| GEO Group Inc/The / DBT (US36162JAG13) | 2.12 | 0.71 | 0.3193 | -0.0174 | |||||

| US61767YAA82 / Morgan Stanley Capital I Trust 2018-H3 | 2.08 | 1.27 | 0.3133 | -0.0152 | |||||

| KeHE Distributors LLC / KeHE Finance Corp / NextWave Distribution Inc / DBT (US487526AC91) | 2.07 | 0.63 | 0.3125 | -0.0172 | |||||

| US07586PAA93 / Becle SAB de CV | 2.07 | 2.28 | 0.3117 | -0.0119 | |||||

| US91679AAC09 / Upstart Securitization Trust 2023-1 | 2.06 | 0.3103 | 0.3103 | ||||||

| US03512TAB70 / Anglogold Ashanti Holdings Plc. 6.5% Notes Due 4/15/2040 | 2.04 | 0.44 | 0.3076 | -0.0176 | |||||

| BX Trust 2025-LIFE / ABS-MBS (US05616HAA59) | 2.04 | 0.3072 | 0.3072 | ||||||

| Continental Finance Credit Card ABS Master Trust / ABS-O (US66981PAT57) | 2.02 | 0.20 | 0.3050 | -0.0182 | |||||

| SHOP / Shopify Inc. | 0.02 | 0.00 | 2.02 | 20.91 | 0.3045 | 0.0371 | |||

| US12659FAD78 / CSMC_21-NQM8 | 2.02 | -6.19 | 0.3043 | -0.0401 | |||||

| US23166MAA18 / DTZ US BORROWER LLC 6.75% 05/15/2028 144A | 2.02 | 0.55 | 0.3042 | -0.0169 | |||||

| US912834MT27 / United States Treasury Strip Coupon | 2.02 | -2.75 | 0.3040 | -0.0279 | |||||

| INDUSTRIALIZADORA INTEGRAL DEL / DBT (US45646HAA59) | 2.01 | 1.77 | 0.3036 | -0.0131 | |||||

| US86765LAN73 / Sunoco LP / Sunoco Finance Corp | 2.00 | 0.45 | 0.3022 | -0.0172 | |||||

| RFT 2025-RR1 Trust / ABS-MBS (US749433AA64) | 2.00 | 0.3017 | 0.3017 | ||||||

| US87256YAC75 / TKC Holdings Inc | 2.00 | 0.30 | 0.3013 | -0.0177 | |||||

| US74365PAD06 / Prosus NV | 1.99 | -0.85 | 0.3009 | -0.0213 | |||||

| CXW / CoreCivic, Inc. | 1.98 | 0.25 | 0.2988 | -0.0177 | |||||

| US03666HAC51 / Antares Holdings LP | 1.97 | 0.31 | 0.2968 | -0.0172 | |||||

| APA Corp / DBT (US03743QAC24) | 1.97 | 0.2968 | 0.2968 | ||||||

| PRPM 2025-1 LLC / ABS-MBS (US69382GAA58) | 1.96 | 0.2961 | 0.2961 | ||||||

| US064058AL44 / Bank of New York Mellon Corp/The | 1.95 | 1.93 | 0.2947 | -0.0122 | |||||

| US15239XAA63 / Central American Bottling Corp / CBC Bottling Holdco SL / Beliv Holdco SL | 1.95 | 1.62 | 0.2936 | -0.0131 | |||||

| SKY Trust 2025-LINE / ABS-MBS (US830941AA83) | 1.94 | -0.36 | 0.2924 | -0.0192 | |||||

| US00109YAA38 / AES Andres BV | 1.92 | -0.31 | 0.2894 | -0.0188 | |||||

| Glebe Funding Trust 2024-1/The / ABS-MBS (US37735RAA23) | 1.90 | -1.76 | 0.2871 | -0.0233 | |||||

| NRM FHT1 Excess Owner LLC / ABS-MBS (US64832EAA73) | 1.89 | -4.84 | 0.2850 | -0.0329 | |||||

| 1N8 / Adyen N.V. | 0.00 | 0.00 | 1.88 | 19.73 | 0.2838 | 0.0322 | |||

| Harvest SBA Loan Trust 2024-1 / ABS-O (US41756NAA72) | 1.87 | -2.55 | 0.2825 | -0.0253 | |||||

| US1248EPCN14 / CORPORATE BONDS | 1.86 | 7.08 | 0.2807 | 0.0023 | |||||

| GLEN / Glencore plc | 0.47 | 0.00 | 1.85 | 6.39 | 0.2789 | 0.0005 | |||

| MATW / Matthews International Corporation | 1.82 | 0.11 | 0.2747 | -0.0165 | |||||

| US12659XAA46 / Credit Suisse Mortgage Capital Certificates | 1.81 | 0.95 | 0.2724 | -0.0141 | |||||

| US06744JAA43 / Barclays Mortgage Trust 2021-NPL1 | 1.80 | -8.87 | 0.2714 | -0.0447 | |||||

| BMY / Bristol-Myers Squibb Company | 0.04 | 0.00 | 1.78 | -24.12 | 0.2681 | -0.1070 | |||

| Towd Point Mortgage Trust 2025-R1 / ABS-MBS (US89183DAA19) | 1.72 | 1.90 | 0.2596 | -0.0108 | |||||

| US81748CAA80 / Sequoia Mortgage Trust 2021-9 | 1.70 | -2.58 | 0.2561 | -0.0230 | |||||

| US06745CAA80 / BARC_22-RPL1 | 1.68 | -3.06 | 0.2530 | -0.0242 | |||||

| G / Assicurazioni Generali S.p.A. | 0.05 | -60.85 | 1.65 | -60.34 | 0.2484 | -0.4167 | |||

| US63543LAD73 / National Collegiate Student Loan Trust 2007-2 | 1.64 | -9.95 | 0.2471 | -0.0443 | |||||

| Mosaic Solar Loan Trust 2018-2-GS / ABS-O (US61946LAD47) | 1.56 | -3.99 | 0.2360 | -0.0249 | |||||

| Kinetic Advantage Master Owner Trust / ABS-O (US49462DAD12) | 1.50 | -0.13 | 0.2270 | -0.0142 | |||||

| US013092AB74 / Albertsons Cos LLC / Safeway Inc / New Albertsons LP / Albertson's LLC | 1.50 | -0.13 | 0.2260 | -0.0143 | |||||

| AEF000901015 / FERTIGLOBE PLC COMMON STOCK | 2.29 | 0.00 | 1.49 | 12.49 | 0.2242 | 0.0125 | |||

| US912834VV71 / STRIPS | 1.45 | 0.2183 | 0.2183 | ||||||

| Redwood Funding Trust 2024-1 / ABS-MBS (US75806FAA21) | 1.41 | -0.77 | 0.2126 | -0.0148 | |||||

| MFA 2024-NPL1 Trust / ABS-MBS (US58004YAA73) | 1.39 | -4.48 | 0.2092 | -0.0234 | |||||

| US06744YAC75 / Barclays Mortgage Loan Trust 2022-INV1 | 1.38 | -3.08 | 0.2088 | -0.0200 | |||||

| US46656RAN08 / J.P. Morgan Mortgage Trust 2023-3 | 1.35 | -7.96 | 0.2041 | -0.0313 | |||||

| US86074QAQ55 / Stillwater Mining Co | 1.34 | 6.44 | 0.2021 | 0.0005 | |||||

| US912834DV73 / United States Treasury Strip Coupon | 1.29 | -33.81 | 0.1949 | -0.1178 | |||||

| US12663DAE40 / CSMC 2022-NQM5 Trust | 1.28 | -1.31 | 0.1932 | -0.0146 | |||||

| US1248EPCJ02 / CCO Holdings LLC / CCO Holdings Capital Corp | 1.26 | 7.04 | 0.1905 | 0.0015 | |||||

| CCZ / Comcast Holdings Corporation - Corporate Bond/Note | 1.25 | 29.06 | 0.1883 | 0.0403 | |||||

| CD&R Smokey Buyer Inc / Radio Systems Corp / DBT (US12515KAA60) | 1.23 | -10.15 | 0.1855 | -0.0338 | |||||

| US816943BF01 / Sequoia Mortgage Trust 2023-3 | 1.17 | -1.43 | 0.1764 | -0.0136 | |||||

| US43789KAA07 / Homeward Opportunities Fund Trust 2022-1 | 1.14 | -2.22 | 0.1724 | -0.0148 | |||||

| US31418EW482 / Fannie Mae Pool | 1.10 | -4.51 | 0.1662 | -0.0187 | |||||

| Cogent Ipv4 LLC / ABS-O (US19240JAA60) | 1.06 | -36.51 | 0.1598 | -0.1073 | |||||

| US64829WAL81 / New Residential Mortgage Loan Trust 2021-INV1 | 1.06 | -2.94 | 0.1596 | -0.0150 | |||||

| US78432WAA18 / SFO Commercial Mortgage Trust 2021-555 | 1.04 | 0.58 | 0.1563 | -0.0087 | |||||

| XS1953916290 / Republic of Uzbekistan Bond | 1.03 | 2.59 | 0.1554 | -0.0055 | |||||

| US30767EAD13 / FARM CREDIT BK OF TEXAS JR SUBORDINA 144A 12/99 VAR | 1.00 | 0.50 | 0.1503 | -0.0085 | |||||

| US85573RAF55 / STARWOOD MORTGAGE RESIDENTIAL STAR 2021 6 M1 144A | 0.96 | 0.42 | 0.1452 | -0.0083 | |||||

| US097093AB43 / BOF VII AL Funding Trust I | 0.76 | -14.09 | 0.1150 | -0.0270 | |||||

| US58549XBZ50 / Mello Mortgage Capital Acceptance 2021-INV2 | 0.76 | -1.82 | 0.1140 | -0.0093 | |||||

| US95003KAX00 / Wells Fargo Mortgage Backed Securities 2021-INV1 Trust | 0.74 | 0.14 | 0.1114 | -0.0067 | |||||

| SOBO / South Bow Corporation | 0.03 | 0.00 | 0.69 | 1.63 | 0.1037 | -0.0046 | |||

| Affirm Asset Securitization Trust 2023-X1 / ABS-O (US00834KAD90) | 0.66 | 0.0989 | 0.0989 | ||||||

| US55284TAC18 / MFA 2022-INV1 TRUST MFRA 2022-INV1 A3 | 0.64 | -2.43 | 0.0969 | -0.0086 | |||||

| US14688DAM39 / Carvana Auto Receivables Trust 2022-P1 | 0.64 | -2.00 | 0.0961 | -0.0079 | |||||

| US91683LAB27 / Upstart Pass-Through Trust Series 2021-ST8 | 0.59 | -22.66 | 0.0896 | -0.0334 | |||||

| US038413AD22 / Aqua Finance Trust 2020-A | 0.59 | -5.61 | 0.0890 | -0.0110 | |||||

| US36167AAA88 / GCAT_21-CM2 | 0.55 | -12.82 | 0.0832 | -0.0180 | |||||

| US46654KCG04 / JP Morgan Mortgage Trust 2021-11 | 0.53 | 0.75 | 0.0807 | -0.0043 | |||||

| US38149XAE94 / Goldman Home Improvement Trust 2021-GRN2 Issuer Trust | 0.52 | 0.00 | 0.0791 | -0.0049 | |||||

| US91683KAB44 / Upstart Pass-Through Trust, Series 2021-ST7, Class CERT | 0.45 | -23.83 | 0.0686 | -0.0269 | |||||

| US00081TAK43 / ACCO Brands Corp | 0.44 | -2.21 | 0.0667 | -0.0057 | |||||

| US50214JAD72 / LP LMS 2021-2 Asset Securitization Trust | 0.44 | 5.77 | 0.0664 | -0.0003 | |||||

| US46654KCH86 / JP Morgan Mortgage Trust 2021-11 | 0.41 | -3.55 | 0.0614 | -0.0062 | |||||

| US95003KBL52 / Wells Fargo Mortgage Backed Securities 2021-INV1 Trust | 0.39 | 0.51 | 0.0596 | -0.0033 | |||||

| US58549XBQ51 / Mello Mortgage Capital Acceptance 2021-INV2 | 0.39 | -9.24 | 0.0594 | -0.0100 | |||||

| US64829WBB90 / New Residential Mortgage Loan Trust 2021-INV1 | 0.37 | -0.54 | 0.0561 | -0.0037 | |||||

| US52607KAA16 / Lendbuzz Securitization Trust 2022-1 | 0.37 | -20.82 | 0.0557 | -0.0190 | |||||

| US3140JP5N12 / Fannie Mae Pool | 0.36 | -1.09 | 0.0549 | -0.0039 | |||||

| US95003KBM36 / Wells Fargo Mortgage Backed Securities 2021-INV1 Trust | 0.30 | 0.00 | 0.0459 | -0.0028 | |||||

| US31342WA433 / Freddie Mac Non Gold Pool | 0.29 | -0.35 | 0.0430 | -0.0029 | |||||

| US64829WBA18 / New Residential Mortgage Loan Trust 2021-INV1 | 0.28 | 0.71 | 0.0426 | -0.0023 | |||||

| US14687JAB52 / Carvana Auto Receivables Trust 2021-P3 | 0.28 | -11.11 | 0.0423 | -0.0083 | |||||

| US61946TAE55 / Mosaic Solar Loan Trust 2021-3 | 0.28 | -5.42 | 0.0422 | -0.0051 | |||||

| US3140JP5P69 / Fannie Mae Pool | 0.27 | -1.08 | 0.0414 | -0.0030 | |||||

| US58549XBT90 / Mello Mortgage Capital Acceptance 2021-INV2 | 0.26 | -1.13 | 0.0396 | -0.0030 | |||||

| US57108Q1031 / Marlette Funding Trust 2021-3 | 0.24 | -4.38 | 0.0363 | -0.0040 | |||||

| US58549XBY85 / Mello Mortgage Capital Acceptance 2021-INV2 | 0.23 | 0.44 | 0.0346 | -0.0020 | |||||

| US3140H54H12 / Fannie Mae Pool | 0.23 | -0.44 | 0.0341 | -0.0022 | |||||

| US90944DAL55 / United Auto Credit Securitization Trust 2022-1 | 0.21 | 22.99 | 0.0324 | 0.0045 | |||||

| US585491BZ53 / Mello Mortgage Capital Acceptance 2021-INV3 | 0.21 | -1.39 | 0.0321 | -0.0025 | |||||

| US17330BDP22 / Citigroup Mortgage Loan Trust 2021-J3 | 0.18 | -1.62 | 0.0276 | -0.0022 | |||||

| US585491BQ54 / Mello Mortgage Capital Acceptance 2021-INV3 | 0.17 | -5.08 | 0.0254 | -0.0029 | |||||

| US14688DAK72 / Carvana Auto Receivables Trust 2022-P1 | 0.16 | -10.99 | 0.0246 | -0.0047 | |||||

| US95003KBN19 / Wells Fargo Mortgage Backed Securities 2021-INV1 Trust | 0.13 | -2.21 | 0.0201 | -0.0018 | |||||

| US3140K7V268 / Fannie Mae Pool | 0.10 | -1.00 | 0.0150 | -0.0010 | |||||

| CLF / Cleveland-Cliffs Inc. | 0.10 | 0.00 | 0.0150 | -0.0009 | |||||

| US91679XAA46 / Upstart Pass-Through Trust Series | 0.08 | -27.10 | 0.0118 | -0.0054 | |||||

| US17330BDR87 / Citigroup Mortgage Loan Trust 2021-J3 | 0.07 | 0.00 | 0.0107 | -0.0008 | |||||

| US585491BY88 / Mello Mortgage Capital Acceptance 2021-INV3 | 0.07 | 1.47 | 0.0104 | -0.0006 | |||||

| US585491BT93 / Mello Mortgage Capital Acceptance 2021-INV3 | 0.05 | -1.89 | 0.0080 | -0.0007 | |||||

| TRISTATE INSURED CASH SWEEP / STIV (000000000) | 0.00 | 0.00 | 0.0001 | 0.0001 | |||||

| GMKN / Public Joint Stock Company Mining and Metallurgical Company Norilsk Nickel | 3.07 | 0.00 | 0.00 | 0.0000 | -0.0000 | ||||

| SVST / Public Joint Stock Company Severstal - Depositary Receipt (Common Stock) | 0.24 | 0.00 | 0.00 | 0.0000 | -0.0000 | ||||

| ES12363283 THORNBURGOPT / DE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.03 | -0.0050 | -0.0050 |