Mga Batayang Estadistika

| Nilai Portofolio | $ 94,619,059 |

| Posisi Saat Ini | 185 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

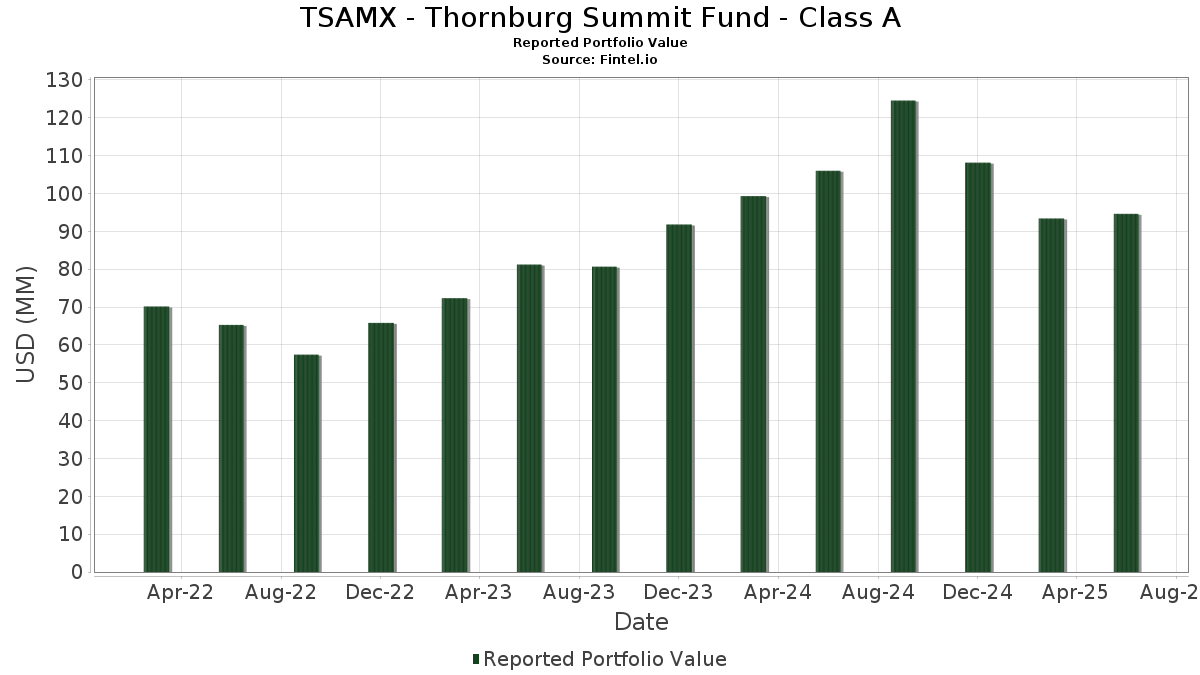

TSAMX - Thornburg Summit Fund - Class A telah mengungkapkan total kepemilikan 185 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 94,619,059 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama TSAMX - Thornburg Summit Fund - Class A adalah Amazon.com, Inc. (US:AMZN) , Zegona Communications plc (US:ZEGLF) , Meta Platforms, Inc. (US:META) , Thornburg Capital Management Fund (US:US8852167399) , and NVIDIA Corporation (US:NVDA) . Posisi baru TSAMX - Thornburg Summit Fund - Class A meliputi: United States Treasury Inflation Indexed Bonds (US:US91282CBF77) , US TREASURY NOTE 4.5% 11-15-33 (US:US91282CJJ18) , United States Treasury Strip Coupon (US:US912834MZ86) , U.S. Treasury Bonds (US:US912810TA60) , and FN MA4512 (US:US31418EAN04) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.99 | 1.0396 | 1.0396 | ||

| 0.15 | 1.53 | 1.6029 | 0.5510 | |

| 0.08 | 0.88 | 0.9266 | 0.5168 | |

| 0.01 | 2.00 | 2.1002 | 0.4403 | |

| 0.05 | 1.99 | 2.0882 | 0.4350 | |

| 0.02 | 1.61 | 1.6873 | 0.3671 | |

| 0.00 | 2.33 | 2.4426 | 0.3389 | |

| 0.01 | 1.64 | 1.7191 | 0.3387 | |

| 0.28 | 0.2888 | 0.2888 | ||

| 0.25 | 0.2637 | 0.2637 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.72 | 1.8040 | -0.5435 | ||

| 0.01 | 0.15 | 0.1564 | -0.4903 | |

| 0.03 | 1.15 | 1.2105 | -0.3165 | |

| 0.35 | 0.3701 | -0.2200 | ||

| 0.00 | 0.20 | 0.2084 | -0.2054 | |

| 0.10 | 0.51 | 0.5349 | -0.2044 | |

| 0.11 | 0.1202 | -0.1485 | ||

| 0.05 | 1.58 | 1.6621 | -0.1456 | |

| 0.00 | 1.13 | 1.1834 | -0.1274 | |

| 0.00 | 1.48 | 1.5535 | -0.1139 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-21 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AMZN / Amazon.com, Inc. | 0.01 | -2.19 | 2.45 | 12.78 | 2.5683 | 0.2454 | |||

| ZEGLF / Zegona Communications plc | 0.25 | 0.00 | 2.38 | 12.51 | 2.4948 | 0.2325 | |||

| META / Meta Platforms, Inc. | 0.00 | -7.51 | 2.33 | 18.44 | 2.4426 | 0.3389 | |||

| US8852167399 / Thornburg Capital Management Fund | 0.20 | 1.31 | 2.03 | 1.29 | 2.1367 | -0.0147 | |||

| NVDA / NVIDIA Corporation | 0.01 | -11.46 | 2.00 | 29.05 | 2.1002 | 0.4403 | |||

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 0.05 | 0.00 | 1.99 | 28.84 | 2.0882 | 0.4350 | |||

| ORA / Orange S.A. | 0.12 | 0.00 | 1.82 | 17.48 | 1.9128 | 0.2514 | |||

| SSNLF / Samsung Electronics Co., Ltd. | 0.04 | 0.00 | 1.80 | 11.83 | 1.8863 | 0.1647 | |||

| US91282CBF77 / United States Treasury Inflation Indexed Bonds | 1.72 | -21.63 | 1.8040 | -0.5435 | |||||

| AVGO / Broadcom Inc. | 0.01 | -22.84 | 1.64 | 27.02 | 1.7191 | 0.3387 | |||

| C / Citigroup Inc. | 0.02 | 8.73 | 1.61 | 30.36 | 1.6873 | 0.3671 | |||

| GOOGL / Alphabet Inc. | 0.01 | -3.14 | 1.61 | 10.39 | 1.6862 | 0.1281 | |||

| T / AT&T Inc. | 0.05 | -8.35 | 1.58 | -6.22 | 1.6621 | -0.1456 | |||

| ROG / Roche Holding AG | 0.00 | 0.00 | 1.54 | -1.03 | 1.6196 | -0.0500 | |||

| RNDOF / Round One Corporation | 0.15 | 0.00 | 1.53 | 55.56 | 1.6029 | 0.5510 | |||

| OTEX / Open Text Corporation | 0.05 | 0.00 | 1.50 | 15.78 | 1.5724 | 0.1870 | |||

| V / Visa Inc. | 0.00 | -6.19 | 1.48 | -4.95 | 1.5535 | -0.1139 | |||

| MSFT / Microsoft Corporation | 0.00 | -15.90 | 1.45 | 11.40 | 1.5197 | 0.1286 | |||

| SHELL / Shell plc | 0.04 | 0.00 | 1.39 | -3.47 | 1.4623 | -0.0828 | |||

| BNP / BNP Paribas SA | 0.02 | 0.00 | 1.37 | 7.57 | 1.4346 | 0.0742 | |||

| CP / Canadian Pacific Kansas City Limited | 0.02 | -3.67 | 1.35 | 8.72 | 1.4142 | 0.0878 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 1.24 | 2.56 | 1.3049 | 0.0066 | |||

| MELI / MercadoLibre, Inc. | 0.00 | -12.40 | 1.16 | 17.36 | 1.2215 | 0.1598 | |||

| SLB / Schlumberger Limited | 0.03 | 0.00 | 1.15 | -19.16 | 1.2105 | -0.3165 | |||

| CME / CME Group Inc. | 0.00 | -11.36 | 1.13 | -7.93 | 1.1834 | -0.1274 | |||

| US91282CJJ18 / US TREASURY NOTE 4.5% 11-15-33 | 1.08 | 0.28 | 1.1383 | -0.0191 | |||||

| MDT / Medtronic plc | 0.01 | 0.00 | 1.03 | -3.02 | 1.0807 | -0.0557 | |||

| US912834MZ86 / United States Treasury Strip Coupon | 1.01 | -2.78 | 1.0659 | -0.0523 | |||||

| NOW / ServiceNow, Inc. | 0.00 | -4.73 | 0.99 | 23.02 | 1.0441 | 0.1784 | |||

| SCHW / The Charles Schwab Corporation | 0.01 | -5.03 | 0.99 | 10.70 | 1.0435 | 0.0819 | |||

| U.S. Treasury Bonds / DBT (US912810UJ50) | 0.99 | 1.0396 | 1.0396 | ||||||

| AZN / Astrazeneca plc | 0.01 | 0.00 | 0.98 | -5.42 | 1.0281 | -0.0805 | |||

| ICLR / ICON Public Limited Company | 0.01 | 19.91 | 0.96 | -0.31 | 1.0038 | -0.0235 | |||

| TS / Tenaris S.A. - Depositary Receipt (Common Stock) | 0.03 | 18.84 | 0.94 | 13.73 | 0.9832 | 0.1007 | |||

| LIN / Linde plc | 0.00 | -5.06 | 0.93 | -4.34 | 0.9717 | -0.0644 | |||

| 27 / Galaxy Entertainment Group Limited | 0.20 | 0.00 | 0.91 | 13.61 | 0.9559 | 0.0976 | |||

| ZTS / Zoetis Inc. | 0.01 | 0.00 | 0.91 | -5.22 | 0.9526 | -0.0733 | |||

| LBRT / Liberty Energy Inc. | 0.08 | 268.79 | 0.88 | 102.76 | 0.9266 | 0.5168 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 0.84 | -2.10 | 0.8823 | -0.0375 | |||||

| AMD / Advanced Micro Devices, Inc. | 0.01 | -7.57 | 0.83 | 27.51 | 0.8675 | 0.1743 | |||

| US912810TA60 / U.S. Treasury Bonds | 0.82 | -2.04 | 0.8573 | -0.0355 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.81 | -2.28 | 0.8551 | -0.0378 | |||||

| JPM / JPMorgan Chase & Co. | 0.00 | -20.68 | 0.80 | -6.24 | 0.8361 | -0.0737 | |||

| U.S. Treasury Notes / DBT (US91282CJZ59) | 0.79 | 0.25 | 0.8317 | -0.0139 | |||||

| GLEN N / Glencore plc | 0.19 | 0.00 | 0.76 | 6.33 | 0.7946 | 0.0325 | |||

| FP / TotalEnergies SE | 0.01 | 0.00 | 0.74 | -4.74 | 0.7804 | -0.0553 | |||

| SHOP / Shopify Inc. | 0.01 | -20.82 | 0.73 | -4.33 | 0.7674 | -0.0501 | |||

| PFE / Pfizer Inc. | 0.03 | 0.00 | 0.72 | -4.38 | 0.7572 | -0.0502 | |||

| U.S. Treasury Notes / DBT (US91282CLW90) | 0.69 | 0.00 | 0.7272 | -0.0143 | |||||

| KEE / Keyence Corporation | 0.00 | 0.00 | 0.69 | 2.22 | 0.7252 | 0.0010 | |||

| BMRPF / B&M European Value Retail S.A. | 0.18 | 16.61 | 0.66 | 28.71 | 0.6924 | 0.1432 | |||

| LHX / L3Harris Technologies, Inc. | 0.00 | 0.00 | 0.64 | 20.00 | 0.6744 | 0.1004 | |||

| AAPL / Apple Inc. | 0.00 | 0.00 | 0.64 | -7.69 | 0.6687 | -0.0698 | |||

| BLDR / Builders FirstSource, Inc. | 0.01 | 7.58 | 0.63 | 0.48 | 0.6624 | -0.0100 | |||

| ASML / ASML Holding N.V. | 0.00 | 0.00 | 0.60 | 20.61 | 0.6271 | 0.0967 | |||

| US31418EAN04 / FN MA4512 | 0.58 | -2.21 | 0.6056 | -0.0257 | |||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.57 | 1.61 | 0.5980 | -0.0030 | |||

| IOC / ITOCHU Corporation | 0.01 | 0.00 | 0.52 | 12.93 | 0.5511 | 0.0537 | |||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CJY84) | 0.52 | 0.39 | 0.5422 | -0.0091 | |||||

| U.S. Treasury Notes / DBT (US91282CKQ32) | 0.51 | 0.20 | 0.5388 | -0.0096 | |||||

| VBL / Varun Beverages Limited | 0.10 | -12.80 | 0.51 | -26.23 | 0.5349 | -0.2044 | |||

| US3140MHSH35 / Fannie Mae Pool | 0.49 | -1.82 | 0.5108 | -0.0204 | |||||

| US3132DWEP41 / FED HM LN PC POOL SD8242 FR 09/52 FIXED 3 | 0.48 | -2.04 | 0.5047 | -0.0203 | |||||

| US1248EPCK74 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.47 | 5.43 | 0.4900 | 0.0155 | |||||

| US31418EE308 / Fannie Mae Pool | 0.43 | -2.30 | 0.4473 | -0.0193 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.42 | -2.10 | 0.4407 | -0.0181 | |||||

| MRK / Merck & Co., Inc. | 0.01 | 0.00 | 0.42 | -11.84 | 0.4384 | -0.0687 | |||

| US3140QLRJ75 / Fannie Mae Pool | 0.42 | -2.34 | 0.4382 | -0.0198 | |||||

| US31418EBS81 / FNMA UMBS, 30 Year | 0.42 | -2.35 | 0.4365 | -0.0192 | |||||

| US3140QMRX43 / FANNIE MAE POOL UMBS P#CB2301 3.00000000 | 0.38 | -1.81 | 0.3988 | -0.0155 | |||||

| XS2696112601 / GTCR W-2 Merger Sub LLC / GTCR W Dutch Finance Sub BV | 0.37 | 7.60 | 0.3865 | 0.0197 | |||||

| XS1953916290 / Republic of Uzbekistan Bond | 0.37 | 2.53 | 0.3839 | 0.0015 | |||||

| US91282CFV81 / United States Treasury Note/Bond | 0.35 | -36.00 | 0.3701 | -0.2200 | |||||

| INE303R01014 / KALYAN JEWELLERS INDIA LTD | 0.05 | 0.00 | 0.34 | 19.64 | 0.3523 | 0.0520 | |||

| US29249FAA49 / Empresa Generadora de Electricidad Haina SA | 0.33 | 0.30 | 0.3504 | -0.0059 | |||||

| XS2361047454 / PROSUS NV SR UNSECURED 144A 07/29 1.288 | 0.31 | 11.87 | 0.3268 | 0.0284 | |||||

| US912810TE82 / United States Treasury Inflation Indexed Bonds | 0.31 | -4.66 | 0.3232 | -0.0228 | |||||

| AU0000217101 / AUSTRALIA GOVT AUD REG S 3.0% 11-21-33 | 0.31 | 7.77 | 0.3207 | 0.0174 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.30 | -0.98 | 0.3177 | -0.0094 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 2024-RPL1 / ABS-MBS (US61776YAA73) | 0.30 | -2.27 | 0.3177 | -0.0138 | |||||

| US78472JAE38 / SPS Servicer Advance Receivables Trust, Series 2020-T2, Class A | 0.30 | 0.68 | 0.3110 | -0.0044 | |||||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.29 | 0.00 | 0.3084 | -0.0061 | |||

| US33845F1066 / Flagship Credit Auto Trust 2019-4 | 0.29 | 1.03 | 0.3084 | -0.0024 | |||||

| US03027WAK80 / ASSET BACKED 144A 03/48 3.652 | 0.29 | 1.03 | 0.3078 | -0.0031 | |||||

| US64831QAA13 / NEW RESIDENTIAL MTGE. VAR | 0.28 | -3.75 | 0.2962 | -0.0184 | |||||

| US05607TAA07 / BXP Trust 2021-601L | 0.28 | 1.47 | 0.2911 | -0.0023 | |||||

| US708696CA52 / Pennsylvania Electric Co | 0.28 | -0.36 | 0.2895 | -0.0068 | |||||

| US912810TC27 / United States Treasury Note/Bond | 0.28 | 0.2888 | 0.2888 | ||||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0.27 | 0.00 | 0.2887 | -0.0058 | |||||

| US45783NAA54 / INSTAR LEASING III LLC SER 2021-1A CL A REGD 144A P/P 2.30000000 | 0.27 | 0.00 | 0.2866 | -0.0054 | |||||

| US08576PAH47 / Berry Global Inc | 0.27 | 0.37 | 0.2833 | -0.0039 | |||||

| SAP / SAP SE | 0.00 | -33.91 | 0.27 | -25.21 | 0.2814 | -0.1013 | |||

| US00775CAC01 / Aegea Finance Sarl | 0.26 | 0.76 | 0.2774 | -0.0036 | |||||

| US12116LAE92 / Burford Capital Global Finance LLC | 0.26 | 0.00 | 0.2766 | -0.0063 | |||||

| US092113AW94 / Black Hills Corp | 0.26 | 0.38 | 0.2761 | -0.0042 | |||||

| US75907DAA54 / REGIONAL MANAGEMENT ISSUANCE TRUST 2022-1 SER 2022-1 CL A REGD 144A P/P 3.07000000 | 0.26 | 31.16 | 0.2750 | 0.0617 | |||||

| ClickLease Equipment Receivables 2024-1 Trust / ABS-O (US18682FAB94) | 0.26 | -13.91 | 0.2735 | -0.0501 | |||||

| TCELL / Turkcell Iletisim Hizmetleri A.S. | 0.25 | 0.79 | 0.2672 | -0.0030 | |||||

| Antares Holdings LP / DBT (US03666HAG65) | 0.25 | 0.80 | 0.2662 | -0.0032 | |||||

| DailyPay Securitization Trust 2025-1 / ABS-O (US233824AD30) | 0.25 | 0.2637 | 0.2637 | ||||||

| US89616KAD63 / Tricolor Auto Securitization Trust 2023-1 | 0.25 | 0.2637 | 0.2637 | ||||||

| SBNA Auto Receivables Trust 2025-SF1 / ABS-O (US78437XAB29) | 0.25 | 0.2626 | 0.2626 | ||||||

| US29444UBF21 / Equinix Inc | 0.25 | 0.81 | 0.2621 | -0.0029 | |||||

| NMEF Funding 2022-A LLC / ABS-O (US62920KAD46) | 0.25 | 0.81 | 0.2606 | -0.0038 | |||||

| US71654QDD16 / Petroleos Mexicanos | 0.25 | 4.66 | 0.2602 | 0.0070 | |||||

| Tesla Sustainable Energy Trust 2024-1 / ABS-O (US88164AAB08) | 0.24 | -3.19 | 0.2561 | -0.0133 | |||||

| US431116AD45 / Highmark Inc | 0.24 | 0.83 | 0.2545 | -0.0031 | |||||

| US427096AH50 / Hercules Capital Inc | 0.24 | 0.83 | 0.2544 | -0.0030 | |||||

| NRM FHT1 Excess Owner LLC / ABS-MBS (US64832EAA73) | 0.24 | -4.84 | 0.2480 | -0.0178 | |||||

| SKY Trust 2025-LINE / ABS-MBS (US830941AA83) | 0.23 | -0.43 | 0.2453 | -0.0058 | |||||

| US23312BAA89 / DC Office Trust 2019-MTC | 0.23 | 1.33 | 0.2399 | -0.0015 | |||||

| US68236JAA97 / One Bryant Park Trust 2019-OBP | 0.23 | 1.79 | 0.2387 | -0.0004 | |||||

| US91282CGK18 / U.S. Treasury Inflation Linked Notes | 0.23 | 0.89 | 0.2377 | -0.0030 | |||||

| US29273VAN01 / Energy Transfer LP | 0.23 | 0.44 | 0.2375 | -0.0037 | |||||

| US44421MAA80 / Hudson Yards 2019-55HY Mortgage Trust | 0.23 | 1.35 | 0.2369 | -0.0012 | |||||

| US50203YAD76 / LL ABS Trust 2022-1 | 0.23 | -0.44 | 0.2367 | -0.0063 | |||||

| Dominican Republic International Bond / DBT (US25714PFA12) | 0.23 | 5.63 | 0.2365 | 0.0082 | |||||

| US552758AA28 / MFRA Trust | 0.23 | -2.60 | 0.2364 | -0.0120 | |||||

| US12654YAA73 / Century Plaza Towers 2019-CPT | 0.22 | 0.91 | 0.2339 | -0.0023 | |||||

| US28166LAA26 / EDvestinU Private Education Loan Issue No 3 LLC | 0.22 | -5.53 | 0.2336 | -0.0189 | |||||

| US83405NAA46 / SoFi Professional Loan Program 2021-B Trust | 0.22 | -5.98 | 0.2320 | -0.0188 | |||||

| US78449RAA32 / SLG Office Trust 2021-OVA | 0.22 | 2.34 | 0.2301 | -0.0002 | |||||

| Towd Point Mortgage Trust 2025-R1 / ABS-MBS (US89183DAA19) | 0.22 | 1.90 | 0.2259 | -0.0001 | |||||

| US3132DN2A07 / Freddie Mac Pool | 0.21 | -2.31 | 0.2221 | -0.0099 | |||||

| US12659WAG33 / CPS Auto Receivables Trust | 0.21 | -14.63 | 0.2211 | -0.0431 | |||||

| WE Soda Investments Holding PLC / DBT (US92943TAC71) | 0.21 | 1.95 | 0.2197 | -0.0004 | |||||

| / Emera Inc. | 0.20 | 0.2116 | 0.2116 | ||||||

| US3133SKBP57 / Freddie Mac Pool | 0.20 | -0.99 | 0.2112 | -0.0072 | |||||

| Crossroads Asset Trust 2025-A / ABS-O (US22767VAB45) | 0.20 | 0.2107 | 0.2107 | ||||||

| PGSUS / Pegasus Hava Tasimaciligi Anonim Sirketi | 0.20 | 1.01 | 0.2106 | -0.0016 | |||||

| Imagefirst Holdings LLC 2025 Term Loan B / LON (US45249TAR32) | 0.20 | 0.2098 | 0.2098 | ||||||

| DataBank Issuer / ABS-O (US23802WAN11) | 0.20 | 1.02 | 0.2090 | -0.0029 | |||||

| US36179WFH60 / Ginnie Mae II Pool | 0.20 | 0.2090 | 0.2090 | ||||||

| US842587DF14 / Southern Co/The | 0.20 | 0.51 | 0.2089 | -0.0025 | |||||

| US184496AN71 / Clean Harbors Inc | 0.20 | 0.2088 | 0.2088 | ||||||

| VRT / Vertiv Holdings Co | 0.00 | -71.12 | 0.20 | -48.70 | 0.2084 | -0.2054 | |||

| US80287FAD42 / SDART 22-7 B 5.95% 01-17-28/01-15-26 | 0.19 | -31.88 | 0.1983 | -0.0974 | |||||

| GB00BFX0ZL78 / United Kingdom Gilt | 0.18 | 8.43 | 0.1891 | 0.0107 | |||||

| US691205AC21 / Owl Rock Technology Finance Corp | 0.18 | 0.56 | 0.1870 | -0.0037 | |||||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.00 | 0.00 | 0.17 | -15.20 | 0.1821 | -0.0375 | |||

| US78432WAA18 / SFO Commercial Mortgage Trust 2021-555 | 0.17 | 0.58 | 0.1816 | -0.0025 | |||||

| US35634EAD13 / Freedom Financial Series 2022-3FP, Class D | 0.17 | -24.23 | 0.1815 | -0.0623 | |||||

| BRSTNCNTF1Q6 / Brazil Notas do Tesouro Nacional Serie F | 0.17 | 7.01 | 0.1774 | 0.0089 | |||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CKL45) | 0.17 | 0.1733 | 0.1733 | ||||||

| US08860DAB91 / BHG Securitization Trust 2022-C | 0.16 | -22.39 | 0.1642 | -0.0521 | |||||

| SRPT / Sarepta Therapeutics, Inc. | 0.01 | -7.93 | 0.15 | -75.46 | 0.1564 | -0.4903 | |||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 0.14 | 0.00 | 0.1500 | -0.0025 | |||||

| US452761AA75 / Imperial Fund Mortgage Trust | 0.14 | -3.50 | 0.1450 | -0.0084 | |||||

| US36167AAA88 / GCAT_21-CM2 | 0.13 | -12.67 | 0.1376 | -0.0232 | |||||

| US886312CD73 / TIAA Bank Mortgage Loan Trust 2018-2 | 0.13 | -0.76 | 0.1366 | -0.0039 | |||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0.12 | 0.00 | 0.1288 | -0.0024 | |||||

| US279158AS81 / Ecopetrol SA | 0.12 | 0.00 | 0.1267 | -0.0027 | |||||

| BMRN / BioMarin Pharmaceutical Inc. | 0.00 | -25.42 | 0.12 | -42.03 | 0.1264 | -0.0959 | |||

| XS2251742610 / Avantor Funding Inc | 0.12 | 9.35 | 0.1235 | 0.0082 | |||||

| US02530CAC29 / ACAR_23-4 | 0.11 | -54.40 | 0.1202 | -0.1485 | |||||

| US71654QDE98 / Petroleos Mexicanos | 0.11 | 5.88 | 0.1138 | 0.0045 | |||||

| US61946RAE99 / Mosaic Solar Loans LLC | 0.10 | 15.91 | 0.1079 | 0.0135 | |||||

| AMCR ABS TRUST 2024-A / ABS-O (US00178EAA38) | 0.10 | -30.14 | 0.1078 | -0.0490 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.10 | 0.1060 | 0.1060 | ||||||

| US064058AF75 / Bank Of New York 4.625 3/20 Bond | 0.10 | 1.02 | 0.1044 | -0.0009 | |||||

| US78403DAT72 / SBA Tower Trust | 0.10 | 0.1008 | 0.1008 | ||||||

| Dominican Republic Central Bank Notes / DBT (XS2543286004) | 0.10 | 5.56 | 0.0999 | 0.0033 | |||||

| US038370AB82 / Aqua Finance Trust, Series 2019-A, Class B | 0.09 | -8.00 | 0.0976 | -0.0103 | |||||

| US38149XAE94 / Goldman Home Improvement Trust 2021-GRN2 Issuer Trust | 0.08 | 0.00 | 0.0881 | -0.0017 | |||||

| PAL634445XA3 / Panama Bonos del Tesoro | 0.08 | 1.23 | 0.0862 | -0.0010 | |||||

| US76042UAA16 / Republic Finance Issuance Trust | 0.08 | -46.85 | 0.0808 | -0.0730 | |||||

| US26827EAC93 / ECAF I Ltd | 0.07 | -13.10 | 0.0773 | -0.0129 | |||||

| US28141PAA30 / Education Funding Trust | 0.07 | 0.0773 | 0.0773 | ||||||

| Tricolor Auto Securitization Trust 2024-2 / ABS-O (US89616PAA12) | 0.07 | -41.60 | 0.0770 | -0.0569 | |||||

| RGEN / Repligen Corporation | 0.00 | -52.97 | 0.07 | -54.43 | 0.0766 | -0.0933 | |||

| US541056AA53 / Logan Merger Sub Inc | 0.06 | -4.55 | 0.0669 | -0.0041 | |||||

| US03464WAD48 / Angel Oak Mortgage Trust LLC 2020-5 | 0.05 | 0.0565 | 0.0565 | ||||||

| US3137G1BS54 / Freddie Mac Whole Loan Securities Trust 2017-SC02 | 0.05 | -1.92 | 0.0543 | -0.0023 | |||||

| Momnt Technologies Trust 2023-1 / ABS-O (US608934AA33) | 0.05 | -27.42 | 0.0473 | -0.0200 | |||||

| US68378NAA81 / Oportun Issuance Trust, Series 2022-A, Class A | 0.04 | -50.00 | 0.0441 | -0.0462 | |||||

| US541056AA53 / Logan Merger Sub Inc | 0.04 | -25.53 | 0.0370 | -0.0137 | |||||

| US35563PJF71 / Seasoned Credit Risk Transfer Trust Series 2019-1 | 0.03 | -2.86 | 0.0361 | -0.0019 | |||||

| US88339FAA12 / Theorem Funding Trust 2022-2 | 0.03 | -68.27 | 0.0352 | -0.0768 | |||||

| US57108T1079 / Marlette Funding Trust 2021-2, Series 2021-2A, Class R | 0.02 | 0.00 | 0.0212 | -0.0011 | |||||

| US57108Q1031 / Marlette Funding Trust 2021-3 | 0.02 | -5.00 | 0.0209 | -0.0014 | |||||

| US57110N1063 / Marlette Funding Trust 2021-1 | 0.02 | 0.00 | 0.0180 | -0.0006 | |||||

| US78403DAZ33 / SBA TOWER TRUST | 0.01 | 0.00 | 0.0140 | -0.0002 | |||||

| US12636FBG72 / COMM 2015-LC23 Mortgage Trust | 0.01 | -83.82 | 0.0123 | -0.0609 | |||||

| US52607NAA54 / LendingPoint Pass-Through Trust Series 2022-ST1 | 0.01 | -47.37 | 0.0112 | -0.0097 | |||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | -0.04 | -0.0411 | -0.0411 |