Mga Batayang Estadistika

| Nilai Portofolio | $ 485,955,057 |

| Posisi Saat Ini | 47 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

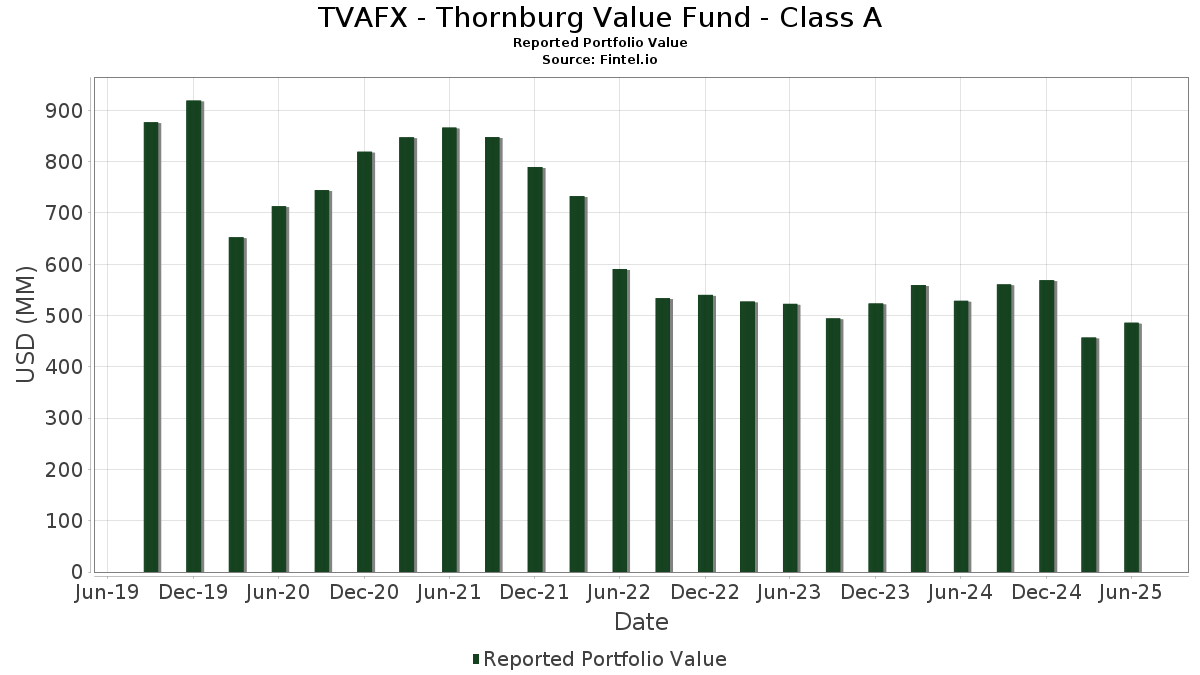

TVAFX - Thornburg Value Fund - Class A telah mengungkapkan total kepemilikan 47 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 485,955,057 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama TVAFX - Thornburg Value Fund - Class A adalah Casella Waste Systems, Inc. (US:CWST) , LPL Financial Holdings Inc. (US:LPLA) , Clean Harbors, Inc. (US:CLH) , Pinnacle Financial Partners, Inc. (US:PNFP) , and MYR Group Inc. (US:MYRG) . Posisi baru TVAFX - Thornburg Value Fund - Class A meliputi: The Simply Good Foods Company (US:SMPL) , Adtalem Global Education Inc. (US:ATGE) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.26 | 8.24 | 1.6971 | 1.6971 | |

| 0.06 | 8.00 | 1.6471 | 1.6471 | |

| 0.80 | 8.01 | 1.6498 | 1.4149 | |

| 0.11 | 13.95 | 2.8746 | 1.0460 | |

| 0.08 | 14.04 | 2.8920 | 0.8527 | |

| 0.12 | 13.22 | 2.7231 | 0.8384 | |

| 0.04 | 12.29 | 2.5316 | 0.6820 | |

| 0.32 | 12.44 | 2.5636 | 0.5913 | |

| 0.10 | 10.63 | 2.1908 | 0.4925 | |

| 0.07 | 10.63 | 2.1902 | 0.4543 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.11 | 7.96 | 1.6397 | -0.6071 | |

| 0.12 | 5.54 | 1.1417 | -0.5557 | |

| 0.12 | 12.63 | 2.6013 | -0.5130 | |

| 0.12 | 9.38 | 1.9314 | -0.5040 | |

| 0.44 | 5.92 | 1.2202 | -0.4424 | |

| 0.05 | 10.34 | 2.1297 | -0.4294 | |

| 0.24 | 13.75 | 2.8334 | -0.4222 | |

| 0.08 | 4.14 | 0.8537 | -0.3884 | |

| 0.17 | 10.78 | 2.2203 | -0.3817 | |

| 0.16 | 18.70 | 3.8533 | -0.3601 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-21 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| CWST / Casella Waste Systems, Inc. | 0.16 | -8.13 | 18.70 | -4.95 | 3.8533 | -0.3601 | |||

| LPLA / LPL Financial Holdings Inc. | 0.04 | -9.03 | 14.94 | 4.27 | 3.0773 | 0.0096 | |||

| CLH / Clean Harbors, Inc. | 0.06 | -8.13 | 14.30 | 7.75 | 2.9457 | 0.1043 | |||

| PNFP / Pinnacle Financial Partners, Inc. | 0.13 | -8.13 | 14.11 | -4.34 | 2.9075 | -0.2519 | |||

| MYRG / MYR Group Inc. | 0.08 | -8.13 | 14.04 | 47.40 | 2.8920 | 0.8527 | |||

| VRT / Vertiv Holdings Co | 0.11 | -8.13 | 13.95 | 63.40 | 2.8746 | 1.0460 | |||

| TXNM / TXNM Energy, Inc. | 0.24 | -14.10 | 13.75 | -9.54 | 2.8334 | -0.4222 | |||

| FTI / TechnipFMC plc | 0.39 | -7.56 | 13.56 | 0.46 | 2.7937 | -0.0969 | |||

| SXT / Sensient Technologies Corporation | 0.14 | -8.13 | 13.53 | 21.60 | 2.7867 | 0.4047 | |||

| AGYS / Agilysys, Inc. | 0.12 | -4.97 | 13.22 | 50.18 | 2.7231 | 0.8384 | |||

| NTNX / Nutanix, Inc. | 0.17 | -8.13 | 13.03 | 0.59 | 2.6842 | -0.0893 | |||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.12 | -8.13 | 12.63 | -13.18 | 2.6013 | -0.5130 | |||

| MRX / Marex Group plc | 0.32 | 20.90 | 12.44 | 35.10 | 2.5636 | 0.5913 | |||

| TLN / Talen Energy Corporation | 0.04 | -2.30 | 12.29 | 42.27 | 2.5316 | 0.6820 | |||

| AIT / Applied Industrial Technologies, Inc. | 0.05 | -8.13 | 12.18 | -5.23 | 2.5086 | -0.2428 | |||

| COHR / Coherent Corp. | 0.14 | -8.13 | 12.16 | 26.20 | 2.5058 | 0.4420 | |||

| ITT / ITT Inc. | 0.08 | -8.13 | 11.80 | 11.55 | 2.4316 | 0.1659 | |||

| TRU / TransUnion | 0.13 | -8.13 | 11.50 | -2.58 | 2.3691 | -0.1587 | |||

| WAL / Western Alliance Bancorporation | 0.15 | -8.13 | 11.44 | -6.75 | 2.3562 | -0.2703 | |||

| THC / Tenet Healthcare Corporation | 0.06 | -5.55 | 11.15 | 23.59 | 2.2962 | 0.3650 | |||

| SN / SharkNinja, Inc. | 0.11 | -8.13 | 11.08 | 9.03 | 2.2836 | 0.1066 | |||

| KMPR / Kemper Corporation | 0.17 | -8.13 | 10.78 | -11.31 | 2.2203 | -0.3817 | |||

| DTM / DT Midstream, Inc. | 0.10 | 17.70 | 10.63 | 34.09 | 2.1908 | 0.4925 | |||

| MTSI / MACOM Technology Solutions Holdings, Inc. | 0.07 | -8.13 | 10.63 | 31.14 | 2.1902 | 0.4543 | |||

| XPO / XPO, Inc. | 0.08 | -8.13 | 10.60 | 7.85 | 2.1830 | 0.0791 | |||

| GPI / Group 1 Automotive, Inc. | 0.02 | -14.08 | 10.40 | -1.76 | 2.1426 | -0.1244 | |||

| AIZ / Assurant, Inc. | 0.05 | -8.13 | 10.34 | -13.50 | 2.1297 | -0.4294 | |||

| STKL / SunOpta Inc. | 1.77 | -4.97 | 10.29 | 13.41 | 2.1194 | 0.1769 | |||

| AL / Air Lease Corporation | 0.17 | 4.94 | 10.23 | 27.05 | 2.1075 | 0.3834 | |||

| WH / Wyndham Hotels & Resorts, Inc. | 0.12 | -8.13 | 9.38 | -17.57 | 1.9314 | -0.5040 | |||

| CCCS / CCC Intelligent Solutions Holdings Inc. | 0.93 | -8.13 | 8.77 | -4.26 | 1.8057 | -0.1548 | |||

| ACA / Arcosa, Inc. | 0.10 | -8.13 | 8.39 | 3.29 | 1.7287 | -0.0108 | |||

| PJT / PJT Partners Inc. | 0.05 | 7.80 | 8.38 | 29.02 | 1.7265 | 0.3355 | |||

| SMPL / The Simply Good Foods Company | 0.26 | 8.24 | 1.6971 | 1.6971 | |||||

| PSTG / Pure Storage, Inc. | 0.14 | -8.13 | 8.11 | 19.50 | 1.6703 | 0.2173 | |||

| US8852167399 / Thornburg Capital Management Fund | 0.80 | 629.84 | 8.01 | 629.99 | 1.6498 | 1.4149 | |||

| ATGE / Adtalem Global Education Inc. | 0.06 | 8.00 | 1.6471 | 1.6471 | |||||

| WD / Walker & Dunlop, Inc. | 0.11 | -8.13 | 7.96 | -24.14 | 1.6397 | -0.6071 | |||

| KRG / Kite Realty Group Trust | 0.35 | -8.13 | 7.89 | -6.98 | 1.6247 | -0.1908 | |||

| BLDR / Builders FirstSource, Inc. | 0.06 | -8.13 | 7.38 | -14.20 | 1.5203 | -0.3214 | |||

| AVTR / Avantor, Inc. | 0.44 | -8.13 | 5.92 | -23.72 | 1.2202 | -0.4424 | |||

| DECK / Deckers Outdoor Corporation | 0.05 | -8.13 | 5.60 | -15.31 | 1.1532 | -0.2621 | |||

| MTDR / Matador Resources Company | 0.12 | -25.15 | 5.54 | -30.09 | 1.1417 | -0.5557 | |||

| RPAY / Repay Holdings Corporation | 1.08 | -8.13 | 5.18 | -20.50 | 1.0682 | -0.3284 | |||

| ENTG / Entegris, Inc. | 0.06 | -8.13 | 5.05 | -15.30 | 1.0412 | -0.2366 | |||

| SDHC / Smith Douglas Homes Corp. | 0.22 | -8.13 | 4.33 | -8.60 | 0.8931 | -0.1226 | |||

| BMRN / BioMarin Pharmaceutical Inc. | 0.08 | -8.13 | 4.14 | -28.57 | 0.8537 | -0.3884 |