Mga Batayang Estadistika

| Nilai Portofolio | $ 186,870,693 |

| Posisi Saat Ini | 47 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

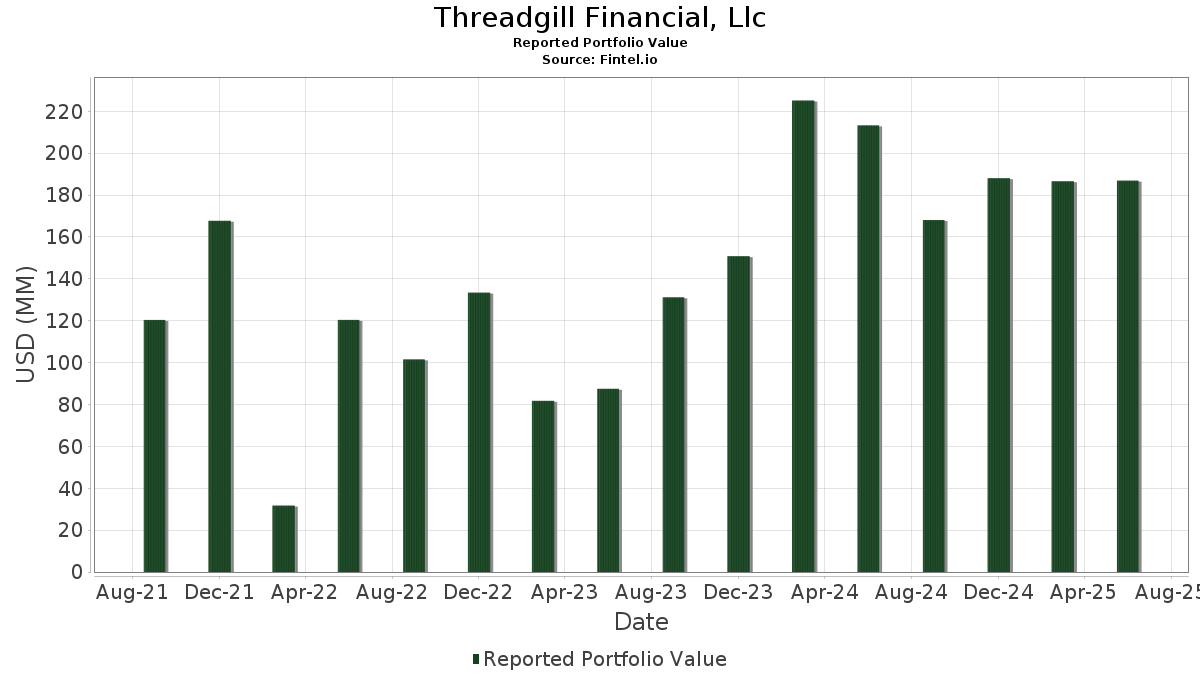

Threadgill Financial, Llc telah mengungkapkan total kepemilikan 47 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 186,870,693 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Threadgill Financial, Llc adalah AutoZone, Inc. (US:AZO) , Visa Inc. (US:V) , Mastercard Incorporated (US:MA) , Amazon.com, Inc. (US:AMZN) , and Moody's Corporation (US:MCO) . Posisi baru Threadgill Financial, Llc meliputi: TransDigm Group Incorporated (US:TDG) , Chipotle Mexican Grill, Inc. (US:CMG) , Equifax Inc. (US:EFX) , Intercontinental Exchange, Inc. (US:ICE) , and Builders FirstSource, Inc. (US:BLDR) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 5.54 | 2.9651 | 2.8517 | |

| 0.00 | 5.26 | 2.8139 | 2.8139 | |

| 0.02 | 9.75 | 5.2181 | 2.6727 | |

| 0.08 | 4.74 | 2.5356 | 2.5356 | |

| 0.02 | 4.68 | 2.5046 | 2.5046 | |

| 0.02 | 9.48 | 5.0752 | 2.4529 | |

| 0.02 | 4.49 | 2.4004 | 2.4004 | |

| 0.01 | 8.54 | 4.5697 | 2.3113 | |

| 0.03 | 3.62 | 1.9374 | 1.9374 | |

| 0.16 | 7.80 | 4.1743 | 1.5102 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.49 | 0.2649 | -19.2309 | |

| 0.00 | 0.00 | -1.6502 | ||

| 0.01 | 3.77 | 2.0149 | -1.6290 | |

| 0.01 | 21.69 | 11.6073 | -0.3576 | |

| 0.02 | 2.51 | 1.3424 | -0.2477 | |

| 0.04 | 3.89 | 2.0821 | -0.2224 | |

| 0.07 | 5.86 | 3.1354 | -0.1924 | |

| 0.03 | 3.25 | 1.7387 | -0.1179 | |

| 0.01 | 5.33 | 2.8547 | -0.1100 | |

| 0.01 | 2.35 | 1.2562 | -0.1046 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-10 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AZO / AutoZone, Inc. | 0.01 | -0.20 | 21.69 | -2.84 | 11.6073 | -0.3576 | |||

| V / Visa Inc. | 0.06 | 0.32 | 19.64 | 1.64 | 10.5090 | 0.1527 | |||

| MA / Mastercard Incorporated | 0.03 | 0.40 | 18.80 | 2.93 | 10.0618 | 0.2715 | |||

| AMZN / Amazon.com, Inc. | 0.05 | 2.93 | 10.77 | 18.86 | 5.7610 | 0.9064 | |||

| MCO / Moody's Corporation | 0.02 | 90.63 | 9.75 | 105.33 | 5.2181 | 2.6727 | |||

| SPGI / S&P Global Inc. | 0.02 | 86.79 | 9.48 | 93.85 | 5.0752 | 2.4529 | |||

| MSCI / MSCI Inc. | 0.01 | 98.71 | 8.54 | 102.68 | 4.5697 | 2.3113 | |||

| CPRT / Copart, Inc. | 0.16 | 80.98 | 7.80 | 56.94 | 4.1743 | 1.5102 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.07 | 1,399.93 | 5.86 | -5.62 | 3.1354 | -0.1924 | |||

| HEI / HEICO Corporation | 0.02 | 2,032.95 | 5.54 | 2,525.59 | 2.9651 | 2.8517 | |||

| ROP / Roper Technologies, Inc. | 0.01 | 0.31 | 5.33 | -3.56 | 2.8547 | -0.1100 | |||

| TDG / TransDigm Group Incorporated | 0.00 | 5.26 | 2.8139 | 2.8139 | |||||

| SHW / The Sherwin-Williams Company | 0.01 | 0.13 | 4.91 | -1.54 | 2.6301 | -0.0452 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.08 | 4.74 | 2.5356 | 2.5356 | |||||

| EFX / Equifax Inc. | 0.02 | 4.68 | 2.5046 | 2.5046 | |||||

| ICE / Intercontinental Exchange, Inc. | 0.02 | 4.49 | 2.4004 | 2.4004 | |||||

| LOW / Lowe's Companies, Inc. | 0.02 | 29.03 | 4.12 | 22.76 | 2.2023 | 0.4052 | |||

| BRO / Brown & Brown, Inc. | 0.04 | 1.41 | 3.89 | -9.51 | 2.0821 | -0.2224 | |||

| LIN / Linde plc | 0.01 | -45.04 | 3.77 | -44.62 | 2.0149 | -1.6290 | |||

| BLDR / Builders FirstSource, Inc. | 0.03 | 3.62 | 1.9374 | 1.9374 | |||||

| OTIS / Otis Worldwide Corporation | 0.03 | -0.28 | 3.25 | -6.18 | 1.7387 | -0.1179 | |||

| TSCO / Tractor Supply Company | 0.06 | 48.87 | 3.08 | 42.54 | 1.6465 | 0.4896 | |||

| CVX / Chevron Corporation | 0.02 | -1.21 | 2.51 | -15.44 | 1.3424 | -0.2477 | |||

| AAPL / Apple Inc. | 0.01 | 0.10 | 2.35 | -7.53 | 1.2562 | -0.1046 | |||

| VLO / Valero Energy Corporation | 0.01 | 0.00 | 1.42 | 1.79 | 0.7614 | 0.0121 | |||

| SPLG / SPDR Series Trust - SPDR Portfolio S&P 500 ETF | 0.02 | -2.87 | 1.32 | 7.39 | 0.7083 | 0.0476 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.05 | 1.19 | 17.78 | 0.6347 | 0.0946 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -0.03 | 1.15 | -9.39 | 0.6145 | -0.0647 | |||

| LECO / Lincoln Electric Holdings, Inc. | 0.00 | 0.00 | 0.87 | 9.66 | 0.4678 | 0.0403 | |||

| MSFT / Microsoft Corporation | 0.00 | 1.23 | 0.78 | 34.14 | 0.4165 | 0.1055 | |||

| CNP / CenterPoint Energy, Inc. | 0.02 | -9.35 | 0.71 | -8.13 | 0.3813 | -0.0341 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 21.88 | 0.71 | 11.09 | 0.3808 | 0.0377 | |||

| LNG / Cheniere Energy, Inc. | 0.00 | 0.00 | 0.59 | 5.19 | 0.3151 | 0.0152 | |||

| DFAC / Dimensional ETF Trust - Dimensional U.S. Core Equity 2 ETF | 0.02 | 0.00 | 0.56 | 8.49 | 0.3012 | 0.0235 | |||

| VT / Vanguard International Equity Index Funds - Vanguard Total World Stock ETF | 0.00 | -98.77 | 0.49 | -98.64 | 0.2649 | -19.2309 | |||

| DFAX / Dimensional ETF Trust - Dimensional World ex U.S. Core Equity 2 ETF | 0.01 | 0.00 | 0.34 | 12.05 | 0.1842 | 0.0196 | |||

| PSN / Parsons Corporation | 0.00 | 0.00 | 0.34 | 21.58 | 0.1809 | 0.0314 | |||

| FICO / Fair Isaac Corporation | 0.00 | 0.00 | 0.31 | -0.65 | 0.1643 | -0.0017 | |||

| WMT / Walmart Inc. | 0.00 | -19.32 | 0.29 | -10.15 | 0.1564 | -0.0179 | |||

| KO / The Coca-Cola Company | 0.00 | 0.00 | 0.28 | -1.05 | 0.1522 | -0.0021 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.27 | 0.1432 | 0.1432 | |||||

| OXY / Occidental Petroleum Corporation | 0.01 | 11.77 | 0.26 | -5.07 | 0.1407 | -0.0074 | |||

| SCHG / Schwab Strategic Trust - Schwab U.S. Large-Cap Growth ETF | 0.01 | -2.48 | 0.23 | 13.66 | 0.1252 | 0.0149 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 0.23 | -5.67 | 0.1251 | -0.0077 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.22 | 0.1197 | 0.1197 | |||||

| NVDA / NVIDIA Corporation | 0.00 | 0.22 | 0.1156 | 0.1156 | |||||

| WM / Waste Management, Inc. | 0.00 | -0.56 | 0.20 | -1.45 | 0.1092 | -0.0021 | |||

| HD / The Home Depot, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -1.6502 | ||||

| DPZ / Domino's Pizza, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TXRH / Texas Roadhouse, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNP / Union Pacific Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |