Mga Batayang Estadistika

| Nilai Portofolio | $ 10,041,022 |

| Posisi Saat Ini | 30 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

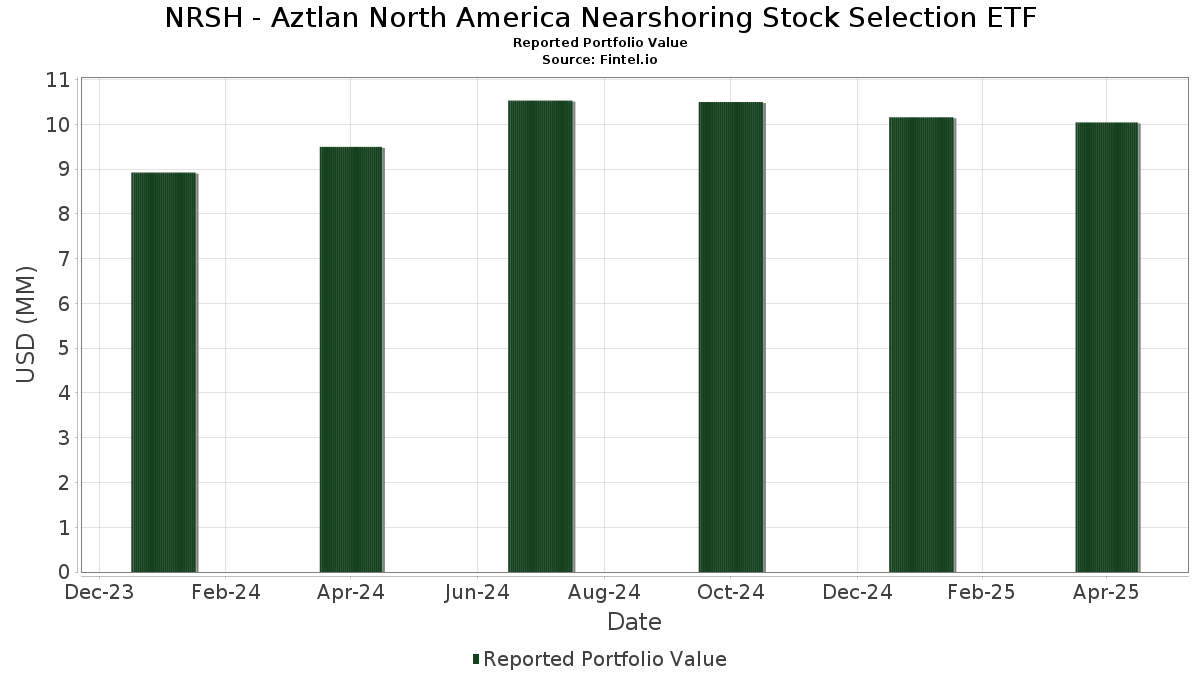

NRSH - Aztlan North America Nearshoring Stock Selection ETF telah mengungkapkan total kepemilikan 30 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 10,041,022 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama NRSH - Aztlan North America Nearshoring Stock Selection ETF adalah Kirby Corporation (US:KEX) , Corporación Inmobiliaria Vesta, S.A.B. de C.V. (MX:VESTA) , Matson, Inc. (US:MATX) , PrologisProperty Mexico SA de CV (MX:FIBRAPL14) , and Cargojet Inc. (US:CGJTF) . Posisi baru NRSH - Aztlan North America Nearshoring Stock Selection ETF meliputi: Cargojet Inc. (US:CGJTF) , SBA Communications Corporation (US:SBAC) , Grupo Traxion Sab De CV - Class A (MX:TRAXIONA) , Plymouth Industrial REIT, Inc. (US:PLYM) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 0.55 | 5.4525 | 5.4525 | |

| 0.00 | 0.51 | 5.0793 | 5.0793 | |

| 0.01 | 0.52 | 5.1916 | 4.2693 | |

| 0.01 | 0.42 | 4.1894 | 4.1894 | |

| 0.00 | 0.54 | 5.3722 | 2.2395 | |

| 0.01 | 0.59 | 5.8288 | 1.9065 | |

| 0.00 | 0.48 | 4.7398 | 1.7606 | |

| 0.01 | 0.66 | 6.5324 | 1.1643 | |

| 0.13 | 0.11 | 1.0759 | 1.0759 | |

| 0.01 | 0.10 | 0.9512 | 0.9512 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -5.4628 | ||

| 0.00 | 0.00 | -5.4345 | ||

| 0.00 | 0.00 | -4.9187 | ||

| 0.00 | 0.00 | -4.4837 | ||

| 0.00 | 0.00 | -4.1856 | ||

| 0.07 | 0.11 | 1.1026 | -4.0191 | |

| 0.00 | 0.00 | -3.8671 | ||

| 0.00 | 0.00 | -3.0990 | ||

| 0.01 | 0.33 | 3.2503 | -1.7202 | |

| 0.01 | 0.33 | 3.2644 | -1.5457 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-26 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| KEX / Kirby Corporation | 0.01 | 36.15 | 0.66 | 20.18 | 6.5324 | 1.1643 | |||

| VESTA / Corporación Inmobiliaria Vesta, S.A.B. de C.V. | 0.23 | 6.98 | 0.63 | 11.86 | 6.3012 | 0.7348 | |||

| MATX / Matson, Inc. | 0.01 | 90.89 | 0.59 | 46.98 | 5.8288 | 1.9065 | |||

| FIBRAPL14 / PrologisProperty Mexico SA de CV | 0.16 | -9.52 | 0.58 | 2.84 | 5.7826 | 0.2287 | |||

| CGJTF / Cargojet Inc. | 0.01 | 0.55 | 5.4525 | 5.4525 | |||||

| EXPD / Expeditors International of Washington, Inc. | 0.00 | 75.06 | 0.54 | 69.50 | 5.3722 | 2.2395 | |||

| GRP.U / Granite Real Estate Investment Trust | 0.01 | 540.99 | 0.52 | 442.71 | 5.1916 | 4.2693 | |||

| SBAC / SBA Communications Corporation | 0.00 | 0.51 | 5.0793 | 5.0793 | |||||

| UNP / Union Pacific Corporation | 0.00 | 40.27 | 0.49 | 22.14 | 4.8936 | 0.9338 | |||

| AMT / American Tower Corporation | 0.00 | 28.96 | 0.48 | 57.28 | 4.7398 | 1.7606 | |||

| TFII / TFI International Inc. | 0.01 | 51.53 | 0.47 | -7.98 | 4.7149 | -0.1880 | |||

| CSX / CSX Corporation | 0.02 | -9.67 | 0.44 | -24.57 | 4.3733 | -1.1762 | |||

| IIPR / Innovative Industrial Properties, Inc. | 0.01 | 0.42 | 4.1894 | 4.1894 | |||||

| CNI / Canadian National Railway Company | 0.00 | -2.24 | 0.42 | -12.39 | 4.1554 | -0.3813 | |||

| IRM / Iron Mountain Incorporated | 0.00 | -17.80 | 0.37 | -27.43 | 3.7202 | -1.3441 | |||

| CP / Canadian Pacific Kansas City Limited | 0.00 | -0.76 | 0.36 | -9.82 | 3.5740 | -0.3338 | |||

| GXO / GXO Logistics, Inc. | 0.01 | -3.95 | 0.36 | -23.34 | 3.5662 | -1.0336 | |||

| HUBG / Hub Group, Inc. | 0.01 | -10.85 | 0.33 | -35.12 | 3.2644 | -1.5457 | |||

| ARCB / ArcBest Corporation | 0.01 | 11.34 | 0.33 | -37.43 | 3.2503 | -1.7202 | |||

| PINFRA / Promotora y Operadora de Infraestructura, S. A. B. de C. V. | 0.01 | -9.85 | 0.12 | 8.11 | 1.1977 | 0.1038 | |||

| WTE / Westshore Terminals Investment Corporation | 0.01 | 87.68 | 0.12 | 114.55 | 1.1838 | 0.6383 | |||

| Fibra MTY SAPI de CV / EC (MXCFFM010000) | 0.19 | 87.36 | 0.12 | 125.49 | 1.1460 | 0.6410 | |||

| MTL / Mullen Group Ltd. | 0.01 | 19.58 | 0.11 | 4.59 | 1.1452 | 0.1025 | |||

| FIBRAMQ12 / Deutsche Bank, S.A., Institucion De Banca Multiple | 0.07 | -79.45 | 0.11 | -78.85 | 1.1026 | -4.0191 | |||

| TRAXIONA / Grupo Traxion Sab De CV - Class A | 0.13 | 0.11 | 1.0759 | 1.0759 | |||||

| DIR.UN / Dream Industrial Real Estate Investment Trust | 0.01 | 5.96 | 0.10 | 0.00 | 1.0446 | 0.0211 | |||

| PLYM / Plymouth Industrial REIT, Inc. | 0.01 | 0.10 | 0.9512 | 0.9512 | |||||

| GMXT / GMéxico Transportes, S.A.B. de C.V. | 0.03 | -45.71 | 0.06 | -37.36 | 0.5747 | -0.2998 | |||

| ULH / Universal Logistics Holdings, Inc. | 0.00 | 85.17 | 0.05 | -8.16 | 0.4515 | -0.0384 | |||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 0.02 | 14.55 | 0.02 | 14.29 | 0.1633 | 0.0225 | |||

| XPO / XPO, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.8671 | ||||

| FR / First Industrial Realty Trust, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -4.1856 | ||||

| STAG / STAG Industrial, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -4.4837 | ||||

| UNIT / Unity Group LLC | 0.00 | -100.00 | 0.00 | -100.00 | -0.9694 | ||||

| EGP / EastGroup Properties, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -5.4345 | ||||

| LXP / LXP Industrial Trust | 0.00 | -100.00 | 0.00 | -100.00 | -4.9187 | ||||

| PLD / Prologis, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.0990 | ||||

| TRNO / Terreno Realty Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -5.4628 |