Mga Batayang Estadistika

| Nilai Portofolio | $ 240,399,351 |

| Posisi Saat Ini | 121 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

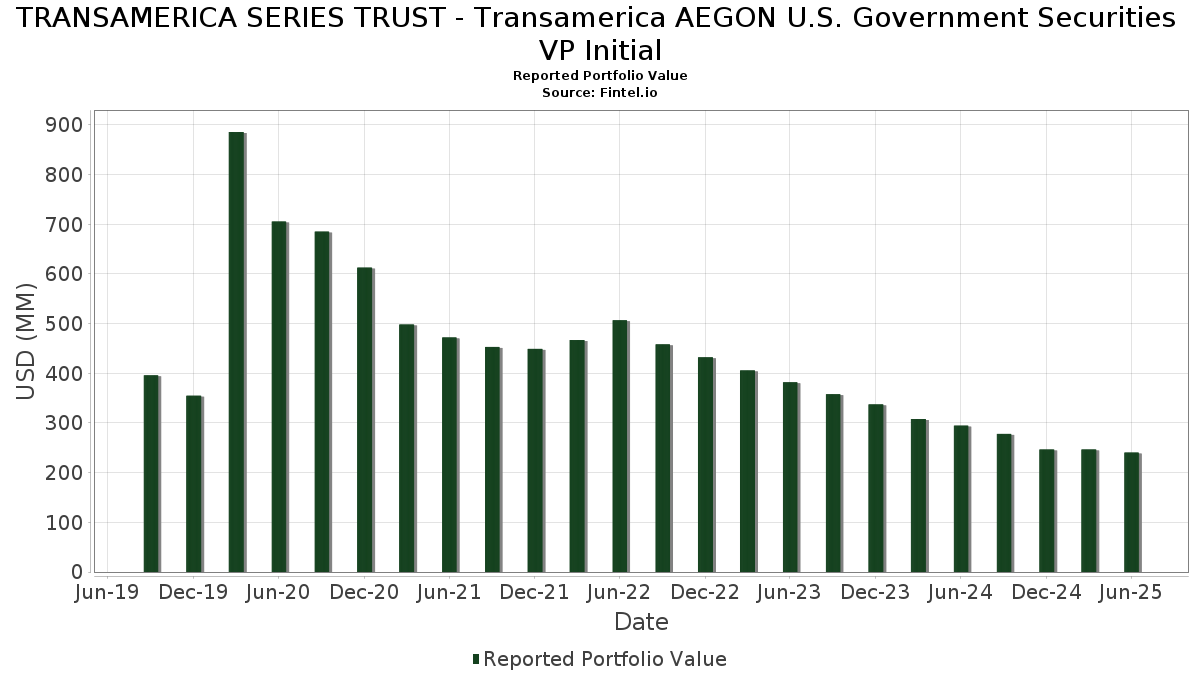

TRANSAMERICA SERIES TRUST - Transamerica AEGON U.S. Government Securities VP Initial telah mengungkapkan total kepemilikan 121 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 240,399,351 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama TRANSAMERICA SERIES TRUST - Transamerica AEGON U.S. Government Securities VP Initial adalah State Street Navigator Securities Lending Government Money Market Portfolio (US:US8575093013) , Federal Farm Credit Banks Funding Corp. (US:US3133EKS640) , Uniform Mortgage-Backed Security, TBA (US:US01F0324768) , Federal National Mortgage Association (US:US3135G05Q27) , and Tennessee Valley Authority 4.875% Glb Pwr Bonds 1/15/48 (US:US880591EB45) . Posisi baru TRANSAMERICA SERIES TRUST - Transamerica AEGON U.S. Government Securities VP Initial meliputi: Federal Farm Credit Banks Funding Corp. (US:US3133EKS640) , Uniform Mortgage-Backed Security, TBA (US:US01F0324768) , Federal National Mortgage Association (US:US3135G05Q27) , Tennessee Valley Authority 4.875% Glb Pwr Bonds 1/15/48 (US:US880591EB45) , and Federal Home Loan Banks (US:US3130ATVX24) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 12.00 | 5.5265 | 5.5265 | ||

| 7.91 | 3.6437 | 3.6437 | ||

| 7.34 | 3.3781 | 3.3781 | ||

| 4.88 | 2.2480 | 2.2480 | ||

| 4.09 | 1.8828 | 1.8828 | ||

| 4.07 | 1.8722 | 1.5430 | ||

| 2.55 | 1.1746 | 1.1746 | ||

| 2.49 | 1.1481 | 1.1481 | ||

| 1.62 | 0.7471 | 0.7471 | ||

| 2.88 | 1.3252 | 0.6323 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.09 | 0.5040 | -3.1697 | ||

| 0.68 | 0.3120 | -1.8252 | ||

| 1.56 | 0.7190 | -0.8180 | ||

| 0.35 | 0.1613 | -0.6158 | ||

| 1.93 | 0.8896 | -0.4288 | ||

| 6.11 | 2.8151 | -0.3905 | ||

| 0.40 | 0.1831 | -0.3761 | ||

| 0.47 | 0.2157 | -0.3346 | ||

| 0.60 | 0.2774 | -0.3322 | ||

| 1.45 | 0.6686 | -0.3137 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-27 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 12.34 | 8.08 | 12.34 | 8.08 | 5.6819 | 0.5945 | |||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 12.00 | 5.5265 | 5.5265 | ||||||

| US3133EKS640 / Federal Farm Credit Banks Funding Corp. | 9.25 | 0.89 | 4.2618 | 0.1745 | |||||

| U.S. Treasury Notes / DBT (US91282CMS79) | 7.91 | 3.6437 | 3.6437 | ||||||

| US01F0324768 / Uniform Mortgage-Backed Security, TBA | 7.34 | 3.3781 | 3.3781 | ||||||

| US3135G05Q27 / Federal National Mortgage Association | 7.17 | 1.86 | 3.3025 | 0.1654 | |||||

| U.S. Treasury Notes / DBT (US91282CKH33) | 6.11 | -15.02 | 2.8151 | -0.3905 | |||||

| TVC / Tennessee Valley Authority - Preferred Stock | 5.85 | -1.43 | 2.6953 | 0.0494 | |||||

| US880591EB45 / Tennessee Valley Authority 4.875% Glb Pwr Bonds 1/15/48 | 5.66 | -3.59 | 2.6073 | -0.0100 | |||||

| US3130ATVX24 / Federal Home Loan Banks | 5.19 | 0.91 | 2.3881 | 0.0983 | |||||

| Federal Farm Credit Banks Funding Corp. / DBT (US3133ER4Q12) | 5.05 | 0.22 | 2.3267 | 0.0800 | |||||

| US91282CDK45 / United States Treasury Note/Bond | 5.04 | 0.78 | 2.3198 | 0.0921 | |||||

| U.S. Treasury Notes / DBT (US91282CLP40) | 5.00 | 0.18 | 2.3004 | 0.0783 | |||||

| TVC / Tennessee Valley Authority - Preferred Stock | 4.97 | 0.57 | 2.2877 | 0.0864 | |||||

| U.S. Treasury Notes / DBT (US91282CLX73) | 4.91 | 0.43 | 2.2622 | 0.0821 | |||||

| US01F0404792 / UMBS TBA | 4.88 | 2.2480 | 2.2480 | ||||||

| U.S. Treasury Notes / DBT (US91282CMN82) | 4.26 | 0.42 | 1.9599 | 0.0715 | |||||

| US91282CGC91 / United States Treasury Note/Bond | 4.14 | 0.51 | 1.9059 | 0.0710 | |||||

| US76116FAC14 / Resol Fnd Ser B 2030 Bonds Prin Comp 04/15/30 | 4.12 | 1.78 | 1.8987 | 0.0934 | |||||

| TVC / Tennessee Valley Authority - Preferred Stock | 4.09 | 1.8828 | 1.8828 | ||||||

| US91282CET45 / U.S. Treasury Notes | 4.07 | 450.81 | 1.8722 | 1.5430 | |||||

| US3137FBU791 / Freddie Mac Multifamily Structured Pass Through Certificates | 3.92 | 0.18 | 1.8054 | 0.0613 | |||||

| US3135GACR09 / FNMA | 3.75 | -1.75 | 1.7284 | 0.0256 | |||||

| US91282CFU09 / United States Treasury Note/Bond - When Issued | 3.51 | 0.40 | 1.6173 | 0.0586 | |||||

| U.S. Treasury Inflation-Protected Indexed Notes / DBT (US91282CJY84) | 2.88 | 85.14 | 1.3252 | 0.6323 | |||||

| US91282CGH88 / United States Treasury Note/Bond | 2.79 | 0.61 | 1.2852 | 0.0491 | |||||

| US91282CFH97 / United States Treasury Note/Bond | 2.59 | 0.58 | 1.1913 | 0.0455 | |||||

| U.S. Treasury Notes / DBT (US91282CMU26) | 2.55 | 1.1746 | 1.1746 | ||||||

| US91282CJA09 / United States Treasury Note/Bond | 2.52 | 0.48 | 1.1591 | 0.0432 | |||||

| US912810TF57 / TREASURY BOND | 2.50 | 49.55 | 1.1512 | 0.4064 | |||||

| U.S. Treasury Notes / DBT (US91282CKP58) | 2.50 | 0.60 | 1.1498 | 0.0439 | |||||

| International Bank for Reconstruction & Development / DBT (US459058LU59) | 2.49 | 1.1481 | 1.1481 | ||||||

| U.S. Treasury Notes / DBT (US91282CKU44) | 2.48 | 0.85 | 1.1417 | 0.0460 | |||||

| U.S. Treasury Notes / DBT (US91282CMB45) | 2.41 | 0.50 | 1.1118 | 0.0411 | |||||

| U.S. Treasury Notes / DBT (US91282CLG41) | 2.34 | 0.47 | 1.0791 | 0.0394 | |||||

| U.S. Treasury Notes / DBT (US91282CLQ23) | 2.02 | 0.50 | 0.9317 | 0.0342 | |||||

| US556227AA48 / Eleven Madison Trust 2015-11MD Mortgage Trust | 1.97 | 0.05 | 0.9092 | 0.0297 | |||||

| US91282CDY49 / United States Treasury Note/Bond | 1.96 | 1.35 | 0.9026 | 0.0409 | |||||

| US91282CEV90 / United States Treasury Note/Bond | 1.96 | 0.98 | 0.9015 | 0.0374 | |||||

| US91282CEW73 / United States Treasury Note/Bond | 1.93 | -34.72 | 0.8896 | -0.4288 | |||||

| US78442GRX69 / SLM Student Loan Trust 2006-2 | 1.83 | -3.69 | 0.8426 | -0.0039 | |||||

| US912810SH23 / United States Treas Bds Bond | 1.81 | 135.98 | 0.8337 | 0.4919 | |||||

| U.S. Treasury Notes / DBT (US91282CLL36) | 1.81 | 0.56 | 0.8328 | 0.0314 | |||||

| US91282CDW82 / UNITED STATES TREASURY NOTE/BOND | 1.71 | 1.24 | 0.7869 | 0.0349 | |||||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 1.62 | 0.7471 | 0.7471 | ||||||

| US912810SR05 / United States Treasury Note/Bond - When Issued | 1.59 | 124.05 | 0.7337 | 0.4168 | |||||

| U.S. Treasury Notes / DBT (US91282CMR96) | 1.56 | -54.73 | 0.7190 | -0.8180 | |||||

| US91282CEE75 / United States Treasury Note/Bond | 1.50 | 1.15 | 0.6905 | 0.0298 | |||||

| U.S. Treasury Bonds / DBT (US912810TZ12) | 1.45 | -34.17 | 0.6686 | -0.3137 | |||||

| US912810TU25 / United States Treasury Note/Bond | 1.33 | -25.01 | 0.6131 | -0.1780 | |||||

| U.S. Treasury Notes / DBT (US91282CNC19) | 1.27 | 0.5844 | 0.5844 | ||||||

| US91282CGW55 / United States Treasury Inflation Indexed Bonds | 1.26 | 0.5791 | 0.5791 | ||||||

| U.S. Treasury Notes / DBT (US91282CLC37) | 1.24 | -17.93 | 0.5694 | -0.1018 | |||||

| U.S. Treasury Notes / DBT (US91282CMT52) | 1.21 | 0.5552 | 0.5552 | ||||||

| US912810SU34 / United States Treasury Note/Bond | 1.20 | -28.78 | 0.5517 | -0.1983 | |||||

| US34532JAA25 / Ford Credit Auto Owner Trust 2020-REV2 | 1.19 | 0.85 | 0.5471 | 0.0224 | |||||

| US912810SK51 / United States Treasury Note/Bond | 1.17 | 25.19 | 0.5406 | 0.1229 | |||||

| US89237MAA71 / Toyota Auto Loan Extended Note Trust 2021-1 | 1.17 | 0.5405 | 0.5405 | ||||||

| U.S. Treasury Notes / DBT (US91282CKF76) | 1.15 | 0.97 | 0.5279 | 0.0217 | |||||

| U.S. Treasury Notes / DBT (US91282CMM00) | 1.14 | 1,837.29 | 0.5265 | 0.4998 | |||||

| US91282CBB63 / United States Treasury Note/Bond | 1.14 | 1.34 | 0.5235 | 0.0236 | |||||

| US17305EGW93 / CITIBANK CREDIT CARD ISSUANCE TRUST SER 2023-A1 CL A1 REGD 5.23000000 | 1.10 | -0.09 | 0.5081 | 0.0157 | |||||

| U.S. Treasury Notes / DBT (US91282CJV46) | 1.09 | -86.73 | 0.5040 | -3.1697 | |||||

| US912810SL35 / United States Treasury Note/Bond | 1.07 | -19.41 | 0.4915 | -0.0988 | |||||

| US91282CHK09 / United States Treasury Note/Bond | 1.07 | 0.66 | 0.4905 | 0.0187 | |||||

| US91282CGQ87 / United States Treasury Note/Bond | 1.04 | 1.57 | 0.4776 | 0.0230 | |||||

| U.S. Treasury Notes / DBT (US91282CMZ13) | 1.04 | 0.4769 | 0.4769 | ||||||

| U.S. Treasury Notes / DBT (US91282CLD10) | 1.02 | 0.89 | 0.4719 | 0.0194 | |||||

| US161571HT41 / Chase Issuance Trust, Series 2023-A1, Class A | 1.01 | 0.00 | 0.4659 | 0.0152 | |||||

| US91282CEC10 / United States Treasury Note/Bond | 1.01 | 0.70 | 0.4656 | 0.0183 | |||||

| Georgia-Pacific LLC / DBT (US37331NAR26) | 1.01 | 0.4628 | 0.4628 | ||||||

| US912810RX81 / United States Treas Bds Bond | 0.79 | -2.10 | 0.3645 | 0.0042 | |||||

| U.S. Treasury Notes / DBT (US91282CMC28) | 0.78 | 0.77 | 0.3599 | 0.0143 | |||||

| US91282CEP23 / WI TREASURY N/B REGD 2.87500000 | 0.77 | 1.05 | 0.3545 | 0.0150 | |||||

| US912810SE91 / United States Treas Bds Bond | 0.76 | -2.07 | 0.3490 | 0.0041 | |||||

| US912810TJ79 / United States Treasury Note/Bond | 0.74 | -2.49 | 0.3424 | 0.0024 | |||||

| US91282CEF41 / United States Treasury Note/Bond | 0.73 | 0.55 | 0.3385 | 0.0128 | |||||

| US912810TG31 / U.S. Treasury Bonds | 0.72 | -45.71 | 0.3296 | -0.2574 | |||||

| U.S. Treasury Bonds / DBT (US912810UC08) | 0.68 | -17.59 | 0.3152 | -0.0548 | |||||

| Hyundai Capital America / DBT (US44891ADV61) | 0.68 | 0.3131 | 0.3131 | ||||||

| US3137BLMZ80 / Freddie Mac Multifamily Structured Pass Through Certificates | 0.68 | -85.88 | 0.3120 | -1.8252 | |||||

| US912810RK60 / United States Treas Bds Bond | 0.66 | -1.94 | 0.3028 | 0.0040 | |||||

| US06051GHZ54 / Bank of America Corp | 0.65 | 1.88 | 0.2999 | 0.0149 | |||||

| US912810TK43 / U.S. Treasury Bonds | 0.64 | -1.69 | 0.2949 | 0.0045 | |||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 0.63 | 1.29 | 0.2888 | 0.0129 | |||||

| U.S. Treasury Bonds / DBT (US912810UJ50) | 0.61 | 34.73 | 0.2826 | 0.0797 | |||||

| Health Care Service Corp. A Mutual Legal Reserve Co. / DBT (US42218SAL25) | 0.61 | 0.33 | 0.2812 | 0.0101 | |||||

| US912810SA79 / United States Treas Bds Bond | 0.61 | -2.10 | 0.2799 | 0.0033 | |||||

| US125509BN86 / Cigna Corp 4.375% Senior Notes 12/15/20 | 0.60 | -55.99 | 0.2774 | -0.3322 | |||||

| US912810TP30 / US TREASURY I/L 1.5% 02-15-53 | 0.60 | 0.2754 | 0.2754 | ||||||

| U.S. Treasury Notes / DBT (US91282CLM19) | 0.56 | 1.08 | 0.2599 | 0.0109 | |||||

| US912810RS96 / United States Treas Bds Bond | 0.52 | -21.35 | 0.2412 | -0.0553 | |||||

| US141781BZ62 / Cargill Inc | 0.52 | 1.36 | 0.2402 | 0.0111 | |||||

| US912810RC45 / United States Treas Bds Bond | 0.51 | -26.28 | 0.2330 | -0.0726 | |||||

| Takeda U.S. Financing, Inc. / DBT (US87406BAA08) | 0.50 | 0.2303 | 0.2303 | ||||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 0.49 | 0.2255 | 0.2255 | ||||||

| Foundry JV Holdco LLC / DBT (US350930AC75) | 0.47 | 1.28 | 0.2181 | 0.0099 | |||||

| US912810TV08 / US TREASURY N/B 4.75% 11-15-53 | 0.47 | -62.07 | 0.2157 | -0.3346 | |||||

| U.S. Treasury Bonds / DBT (US912810UL07) | 0.46 | 0.2105 | 0.2105 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.42 | 1.20 | 0.1951 | 0.0087 | |||||

| U.S. Treasury Bonds / DBT (US912810UB25) | 0.40 | -1.71 | 0.1856 | 0.0026 | |||||

| US912810TD00 / United States Treasury Note/Bond | 0.40 | -68.34 | 0.1831 | -0.3761 | |||||

| U.S. Treasury Bonds / DBT (US912810UA42) | 0.36 | -63.22 | 0.1673 | -0.2727 | |||||

| U.S. Treasury Notes / DBT (US91282CMH15) | 0.35 | -41.96 | 0.1615 | -0.1076 | |||||

| US912810TT51 / United States Treasury Note/Bond | 0.35 | -79.92 | 0.1613 | -0.6158 | |||||

| U.S. Treasury Notes / DBT (US91282CJZ59) | 0.32 | -62.44 | 0.1491 | -0.2346 | |||||

| U.S. Treasury Bonds / DBT (US912810UE63) | 0.31 | -2.86 | 0.1413 | 0.0006 | |||||

| US912810RP57 / United States Treas Bds Bond | 0.29 | -2.05 | 0.1323 | 0.0017 | |||||

| U.S. Treasury Notes / DBT (US91282CLK52) | 0.28 | 0.72 | 0.1292 | 0.0053 | |||||

| U.S. Treasury Bonds / DBT (US912810UG12) | 0.27 | 0.1237 | 0.1237 | ||||||

| US91282CFV81 / United States Treasury Note/Bond | 0.25 | 0.81 | 0.1150 | 0.0045 | |||||

| US36176F3A43 / Ginnie Mae II Pool | 0.21 | 0.49 | 0.0951 | 0.0037 | |||||

| Future / DIR (000000000) | 0.19 | 0.0893 | 0.0893 | ||||||

| Future / DIR (000000000) | 0.17 | 0.0760 | 0.0760 | ||||||

| US924279AC68 / Vermont Student Assistance Corp | 0.14 | -12.18 | 0.0632 | -0.0065 | |||||

| US12624QAR48 / Commercial Mortgage Trust, Series 2012-CR4, Class A3 | 0.08 | 0.00 | 0.0371 | 0.0014 | |||||

| Future / DIR (000000000) | 0.04 | 0.0199 | 0.0199 | ||||||

| Future / DIR (000000000) | 0.01 | 0.0053 | 0.0053 | ||||||

| US36176FZN13 / Ginnie Mae II Pool | 0.01 | 0.00 | 0.0034 | -0.0000 | |||||

| US36230RNF90 / Ginnie Mae II Pool | 0.01 | -16.67 | 0.0028 | -0.0000 | |||||

| Future / DIR (000000000) | -0.12 | -0.0558 | -0.0558 |