Mga Batayang Estadistika

| Nilai Portofolio | $ 82,081,681 |

| Posisi Saat Ini | 208 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

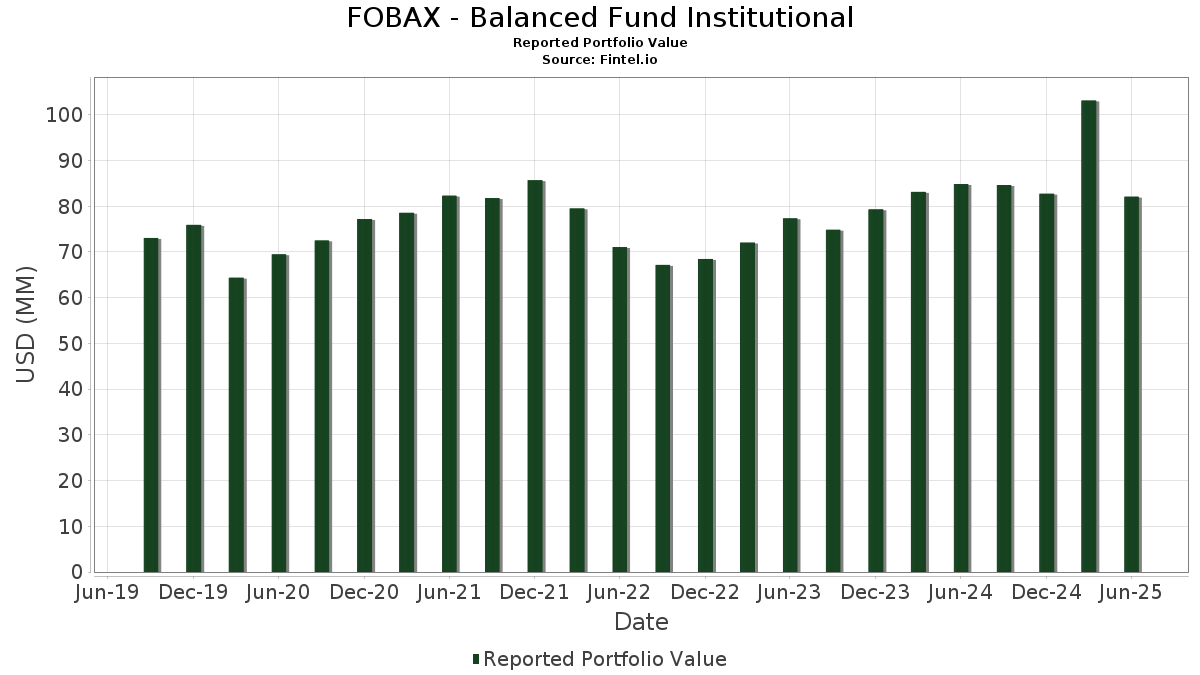

FOBAX - Balanced Fund Institutional telah mengungkapkan total kepemilikan 208 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 82,081,681 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama FOBAX - Balanced Fund Institutional adalah NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , United States Treasury Note/Bond (US:US91282CDY49) , Apple Inc. (US:AAPL) , and United States Treasury Note/Bond (US:US912828Z948) . Posisi baru FOBAX - Balanced Fund Institutional meliputi: United States Treasury Note/Bond (US:US91282CDY49) , United States Treasury Note/Bond (US:US912828Z948) , US TNOTE 3.875% DUE 08/15/2033 (US:US91282CHT18) , United States Treasury Note/Bond (US:US912828V988) , and AbbVie Inc. (US:ABBV) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 4.00 | 4.8685 | 1.2669 | |

| 0.01 | 3.75 | 4.5651 | 0.7772 | |

| 0.00 | 0.57 | 0.6896 | 0.6896 | |

| 0.87 | 1.0570 | 0.5398 | ||

| 0.00 | 0.38 | 0.4673 | 0.4673 | |

| 0.00 | 1.78 | 2.1666 | 0.3797 | |

| 0.31 | 0.3785 | 0.3785 | ||

| 0.00 | 0.29 | 0.3490 | 0.3490 | |

| 0.20 | 0.2467 | 0.2467 | ||

| 0.01 | 0.49 | 0.5931 | 0.2406 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 3.06 | 3.7310 | -0.6132 | |

| 0.00 | 0.13 | 0.1605 | -0.5016 | |

| 2.63 | 2.63 | 3.2013 | -0.4543 | |

| 1.25 | 1.5270 | -0.3071 | ||

| 2.95 | 3.5877 | -0.2458 | ||

| 0.01 | 0.56 | 0.6848 | -0.1492 | |

| 0.00 | 0.88 | 1.0729 | -0.1469 | |

| 0.01 | 0.68 | 0.8292 | -0.1422 | |

| 0.00 | 0.50 | 0.6048 | -0.1347 | |

| 0.00 | 0.49 | 0.6019 | -0.1240 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-20 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.03 | -3.07 | 4.00 | 41.34 | 4.8685 | 1.2669 | |||

| MSFT / Microsoft Corporation | 0.01 | -4.92 | 3.75 | 25.99 | 4.5651 | 0.7772 | |||

| US91282CDY49 / United States Treasury Note/Bond | 3.10 | 1.31 | 3.7715 | -0.1203 | |||||

| AAPL / Apple Inc. | 0.01 | -2.80 | 3.06 | -10.20 | 3.7310 | -0.6132 | |||

| US912828Z948 / United States Treasury Note/Bond | 2.95 | -2.16 | 3.5877 | -0.2458 | |||||

| US09248U7182 / BlackRock Liquidity Funds: T-Fund, Institutional Shares | 2.63 | -8.46 | 2.63 | -8.46 | 3.2013 | -0.4543 | |||

| AMZN / Amazon.com, Inc. | 0.01 | -1.59 | 2.04 | 13.43 | 2.4798 | 0.1954 | |||

| GOOG / Alphabet Inc. | 0.01 | -8.08 | 1.92 | 4.36 | 2.3345 | -0.0038 | |||

| META / Meta Platforms, Inc. | 0.00 | -1.03 | 1.78 | 26.73 | 2.1666 | 0.3797 | |||

| US91282CHT18 / US TNOTE 3.875% DUE 08/15/2033 | 1.72 | 5.01 | 2.0930 | 0.0091 | |||||

| U.S. Treasury Note/Bond / DBT (US91282CKD29) | 1.52 | 0.60 | 1.8530 | -0.0728 | |||||

| US912828V988 / United States Treasury Note/Bond | 1.25 | -12.99 | 1.5270 | -0.3071 | |||||

| JPM / JPMorgan Chase & Co. | 0.00 | -1.24 | 1.15 | 16.72 | 1.4036 | 0.1465 | |||

| MA / Mastercard Incorporated | 0.00 | -2.78 | 0.89 | -0.23 | 1.0780 | -0.0526 | |||

| LLY / Eli Lilly and Company | 0.00 | -2.59 | 0.88 | -8.14 | 1.0729 | -0.1469 | |||

| U.S. Treasury Note/Bond / DBT (US91282CLW90) | 0.87 | 113.55 | 1.0570 | 0.5398 | |||||

| RTX / RTX Corporation | 0.00 | -2.06 | 0.69 | 7.93 | 0.8460 | 0.0269 | |||

| APH / Amphenol Corporation | 0.01 | -26.47 | 0.69 | 10.66 | 0.8353 | 0.0466 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -1.56 | 0.68 | -10.76 | 0.8292 | -0.1422 | |||

| KO / The Coca-Cola Company | 0.01 | 0.00 | 0.68 | -1.16 | 0.8273 | -0.0482 | |||

| WMT / Walmart Inc. | 0.01 | -2.86 | 0.67 | 8.31 | 0.8105 | 0.0274 | |||

| COST / Costco Wholesale Corporation | 0.00 | -2.92 | 0.66 | 1.70 | 0.8018 | -0.0231 | |||

| WFC / Wells Fargo & Company | 0.01 | -1.22 | 0.65 | 10.17 | 0.7924 | 0.0410 | |||

| ABT / Abbott Laboratories | 0.00 | -3.16 | 0.62 | -0.64 | 0.7604 | -0.0402 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | -2.49 | 0.62 | 1.14 | 0.7594 | -0.0258 | |||

| MS / Morgan Stanley | 0.00 | -2.74 | 0.60 | 17.42 | 0.7317 | 0.0803 | |||

| MTZ / MasTec, Inc. | 0.00 | -2.77 | 0.60 | 42.04 | 0.7286 | 0.1922 | |||

| LIN / Linde plc | 0.00 | -3.08 | 0.59 | -2.31 | 0.7200 | -0.0507 | |||

| WM / Waste Management, Inc. | 0.00 | -1.91 | 0.59 | -3.14 | 0.7149 | -0.0559 | |||

| CTAS / Cintas Corporation | 0.00 | -1.14 | 0.58 | 7.20 | 0.7085 | 0.0176 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.57 | 0.6896 | 0.6896 | |||||

| HD / The Home Depot, Inc. | 0.00 | -3.15 | 0.56 | -3.10 | 0.6855 | -0.0541 | |||

| CHD / Church & Dwight Co., Inc. | 0.01 | -1.68 | 0.56 | -14.20 | 0.6848 | -0.1492 | |||

| CB / Chubb Limited | 0.00 | 0.00 | 0.54 | -4.08 | 0.6599 | -0.0591 | |||

| CME / CME Group Inc. | 0.00 | -2.10 | 0.51 | 1.78 | 0.6261 | -0.0174 | |||

| AME / AMETEK, Inc. | 0.00 | -3.42 | 0.51 | 1.59 | 0.6227 | -0.0184 | |||

| NEE / NextEra Energy, Inc. | 0.01 | 28.47 | 0.50 | 25.88 | 0.6105 | 0.1032 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -1.15 | 0.50 | 24.25 | 0.6064 | 0.0961 | |||

| FI / Fiserv, Inc. | 0.00 | 9.51 | 0.50 | -14.48 | 0.6048 | -0.1347 | |||

| AMGN / Amgen Inc. | 0.00 | -3.28 | 0.49 | -13.33 | 0.6019 | -0.1240 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.00 | -3.10 | 0.49 | 48.04 | 0.5969 | 0.1745 | |||

| SO / The Southern Company | 0.01 | -1.85 | 0.49 | -1.81 | 0.5945 | -0.0395 | |||

| ADBE / Adobe Inc. | 0.00 | 0.00 | 0.49 | 0.83 | 0.5937 | -0.0216 | |||

| MCHP / Microchip Technology Incorporated | 0.01 | 20.98 | 0.49 | 76.09 | 0.5931 | 0.2406 | |||

| AMT / American Tower Corporation | 0.00 | -3.11 | 0.48 | -1.64 | 0.5869 | -0.0365 | |||

| TSLA / Tesla, Inc. | 0.00 | 0.00 | 0.47 | 22.66 | 0.5746 | 0.0845 | |||

| MCO / Moody's Corporation | 0.00 | -2.73 | 0.45 | 4.69 | 0.5437 | 0.0012 | |||

| BRO / Brown & Brown, Inc. | 0.00 | -3.59 | 0.45 | -14.07 | 0.5435 | -0.1178 | |||

| ATO / Atmos Energy Corporation | 0.00 | 0.00 | 0.44 | -0.45 | 0.5406 | -0.0262 | |||

| FR / First Industrial Realty Trust, Inc. | 0.01 | -3.22 | 0.43 | -13.75 | 0.5282 | -0.1115 | |||

| MANH / Manhattan Associates, Inc. | 0.00 | 22.35 | 0.43 | 39.81 | 0.5267 | 0.1324 | |||

| EW / Edwards Lifesciences Corporation | 0.01 | 31.52 | 0.42 | 42.28 | 0.5168 | 0.1361 | |||

| IR / Ingersoll Rand Inc. | 0.01 | 0.00 | 0.42 | 3.94 | 0.5142 | -0.0030 | |||

| GLW / Corning Incorporated | 0.01 | -1.23 | 0.42 | 13.51 | 0.5124 | 0.0403 | |||

| ZTS / Zoetis Inc. | 0.00 | -1.90 | 0.40 | -7.16 | 0.4901 | -0.0613 | |||

| FICO / Fair Isaac Corporation | 0.00 | -3.98 | 0.40 | -4.81 | 0.4831 | -0.0475 | |||

| ANET / Arista Networks Inc | 0.00 | 0.38 | 0.4673 | 0.4673 | |||||

| FAF / First American Financial Corporation | 0.01 | -2.51 | 0.38 | -8.85 | 0.4647 | -0.0680 | |||

| SUI / Sun Communities, Inc. | 0.00 | -2.90 | 0.38 | -4.51 | 0.4645 | -0.0441 | |||

| EQH / Equitable Holdings, Inc. | 0.01 | -1.46 | 0.38 | 6.16 | 0.4623 | 0.0069 | |||

| PAYC / Paycom Software, Inc. | 0.00 | 47.09 | 0.38 | 55.97 | 0.4622 | 0.1521 | |||

| VZ / Verizon Communications Inc. | 0.01 | 36.22 | 0.37 | 29.86 | 0.4559 | 0.0891 | |||

| PCT / PureCycle Technologies, Inc. | 0.03 | -27.25 | 0.37 | 44.27 | 0.4456 | 0.1222 | |||

| TXRH / Texas Roadhouse, Inc. | 0.00 | -2.53 | 0.36 | 9.42 | 0.4394 | 0.0204 | |||

| EOG / EOG Resources, Inc. | 0.00 | -3.61 | 0.35 | -10.23 | 0.4283 | -0.0697 | |||

| TMUS / T-Mobile US, Inc. | 0.00 | 0.00 | 0.35 | -10.71 | 0.4266 | -0.0726 | |||

| TKR / The Timken Company | 0.00 | 0.00 | 0.35 | 0.87 | 0.4237 | -0.0151 | |||

| UFPT / UFP Technologies, Inc. | 0.00 | 0.00 | 0.33 | 21.01 | 0.4074 | 0.0556 | |||

| UTHR / United Therapeutics Corporation | 0.00 | 0.00 | 0.32 | -6.65 | 0.3937 | -0.0478 | |||

| ENTG / Entegris, Inc. | 0.00 | -2.44 | 0.32 | -10.06 | 0.3931 | -0.0638 | |||

| NSSC / Napco Security Technologies, Inc. | 0.01 | 0.00 | 0.32 | 29.15 | 0.3887 | 0.0736 | |||

| US46647PBE51 / JPMorgan Chase & Co | 0.32 | 1.93 | 0.3861 | -0.0111 | |||||

| US983919AK78 / XILINX INC REGD 2.37500000 | 0.32 | 1.94 | 0.3852 | -0.0105 | |||||

| US95000U2J10 / WELLS FARGO and CO NEW 2.572/VAR 02/11/2031 | 0.32 | 1.94 | 0.3850 | -0.0109 | |||||

| US45866FAK03 / Intercontinental Exchange Inc | 0.31 | 1.30 | 0.3812 | -0.0114 | |||||

| VZ / Verizon Communications Inc. - Depositary Receipt (Common Stock) | 0.31 | 0.3785 | 0.3785 | ||||||

| US06051GJT76 / Bank of America Corp | 0.31 | 1.98 | 0.3771 | -0.0095 | |||||

| US254687FX90 / DISNEY (WALT) CO 2.65% 01/13/2031 | 0.31 | 1.99 | 0.3762 | -0.0092 | |||||

| E1XC34 / Exelon Corporation - Depositary Receipt (Common Stock) | 0.31 | 1.32 | 0.3743 | -0.0119 | |||||

| ORLY / O'Reilly Automotive, Inc. | 0.00 | 1,367.53 | 0.31 | -7.58 | 0.3721 | -0.0492 | |||

| Mars, Inc. / DBT (US571676AY11) | 0.30 | 0.66 | 0.3702 | -0.0139 | |||||

| US00206RGQ92 / AT&T Inc | 0.30 | 1.34 | 0.3679 | -0.0120 | |||||

| US278642AU75 / eBay Inc | 0.30 | 0.67 | 0.3676 | -0.0135 | |||||

| Avant Loans Funding Trust / ABS-MBS (US05352BAA61) | 0.30 | -0.33 | 0.3665 | -0.0173 | |||||

| LNTH / Lantheus Holdings, Inc. | 0.00 | -1.34 | 0.30 | -17.36 | 0.3659 | -0.0964 | |||

| US58013MFM10 / McDonald's Corp | 0.30 | 1.70 | 0.3647 | -0.0096 | |||||

| US172967NU15 / CITIGROUP INC REGD V/R 4.91000000 | 0.30 | 24.58 | 0.3646 | 0.0587 | |||||

| US747525BK80 / QUALCOMM Inc | 0.30 | 1.71 | 0.3635 | -0.0108 | |||||

| US38141GZM94 / Goldman Sachs Group Inc/The | 0.30 | 2.41 | 0.3618 | -0.0086 | |||||

| US256677AG02 / Dollar General Corp | 0.29 | 1.38 | 0.3584 | -0.0109 | |||||

| FANG / Diamondback Energy, Inc. | 0.00 | -2.29 | 0.29 | -16.09 | 0.3565 | -0.0873 | |||

| SYF / Synchrony Financial | 0.00 | -2.25 | 0.29 | 23.40 | 0.3536 | 0.0537 | |||

| US16144KAD00 / Chase Auto Owner Trust | 0.29 | 0.00 | 0.3512 | -0.0157 | |||||

| US12505BAE02 / CBRE Services Inc | 0.29 | 1.77 | 0.3509 | -0.0104 | |||||

| US912810PV44 / United States Treasury Inflation Indexed Bonds | 0.29 | 0.35 | 0.3494 | -0.0136 | |||||

| BCPC / Balchem Corporation | 0.00 | 0.29 | 0.3490 | 0.3490 | |||||

| US61747YEU55 / Morgan Stanley | 0.29 | 1.79 | 0.3475 | -0.0100 | |||||

| CSX / CSX Corporation | 0.01 | 0.00 | 0.28 | 10.55 | 0.3458 | 0.0198 | |||

| Space Coast Credit Union Auto Receivables Trust / ABS-MBS (US78436RAE09) | 0.28 | -0.35 | 0.3430 | -0.0166 | |||||

| LW / Lamb Weston Holdings, Inc. | 0.01 | -1.81 | 0.28 | -4.42 | 0.3423 | -0.0323 | |||

| SN / SharkNinja, Inc. | 0.00 | -2.59 | 0.28 | 15.77 | 0.3406 | 0.0326 | |||

| POOL / Pool Corporation | 0.00 | -4.02 | 0.28 | -12.03 | 0.3390 | -0.0643 | |||

| US00846UAM36 / AGILENT TECHNOLOGIES INC SR UNSECURED 06/30 2.1 | 0.28 | 1.47 | 0.3383 | -0.0094 | |||||

| Wells Fargo Commercial Mortgage Trust / ABS-MBS (US95003PAA93) | 0.28 | 0.00 | 0.3370 | -0.0146 | |||||

| Enact Holdings, Inc. / DBT (US29249EAA73) | 0.26 | 1.17 | 0.3160 | -0.0106 | |||||

| US446413AL01 / Huntington Ingalls Industries Inc | 0.25 | 0.79 | 0.3096 | -0.0114 | |||||

| US292480AL49 / Enable Midstream Partners, L.P. | 0.25 | 0.81 | 0.3026 | -0.0115 | |||||

| US94106LBP31 / Waste Management Inc | 0.24 | 1.67 | 0.2968 | -0.0081 | |||||

| US12530MAA36 / CF Hippolyta LLC, Series 2020-1, Class A1 | 0.23 | 0.43 | 0.2818 | -0.0120 | |||||

| US134429BJ73 / Campbell Soup Co | 0.23 | 1.35 | 0.2760 | -0.0083 | |||||

| US92943AAA25 / WSTN_23-MAUI | 0.22 | 0.00 | 0.2717 | -0.0131 | |||||

| US35564CDD65 / Seasoned Loans Structured Transaction Trust | 0.22 | 1.84 | 0.2698 | -0.0077 | |||||

| US05600LAC00 / BMW Finance NV | 0.22 | 1.42 | 0.2622 | -0.0084 | |||||

| US68389XCD57 / Oracle Corp | 0.21 | 0.95 | 0.2601 | -0.0090 | |||||

| US17331KAD19 / Citizens Auto Receivables Trust | 0.21 | -22.26 | 0.2596 | -0.0899 | |||||

| US7591EPAT77 / Regions Financial Corp | 0.21 | 1.47 | 0.2531 | -0.0075 | |||||

| US91159HJL50 / US Bancorp | 0.21 | 1.47 | 0.2526 | -0.0073 | |||||

| FCCU Auto Receivables Trust / ABS-MBS (US31424YAD04) | 0.20 | 0.2467 | 0.2467 | ||||||

| SoFi Consumer Loan Program Trust / ABS-MBS (US83406YAB74) | 0.20 | 0.00 | 0.2460 | -0.0106 | |||||

| GreatAmerica Leasing Receivables Funding, LLC / ABS-MBS (US39154TCJ51) | 0.20 | 0.00 | 0.2455 | -0.0109 | |||||

| Purchasing Power Funding, LLC / ABS-MBS (US745935AA40) | 0.20 | -0.50 | 0.2444 | -0.0123 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.20 | 1.01 | 0.2441 | -0.0080 | |||||

| US44421GAA13 / Hudson Yards 2019-30HY Mortgage Trust | 0.19 | 1.63 | 0.2286 | -0.0068 | |||||

| US30322DAA72 / FRTKL, Series 2021-SFR1, Class A | 0.18 | 1.10 | 0.2230 | -0.0079 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0.18 | 0.2183 | 0.2183 | ||||||

| US92212KAB26 / Vantage Data Centers LLC | 0.18 | 0.56 | 0.2175 | -0.0079 | |||||

| BofA Auto Trust / ABS-MBS (US09709AAD46) | 0.18 | 0.00 | 0.2173 | -0.0102 | |||||

| PSX / Phillips 66 | 0.00 | -3.28 | 0.18 | -6.91 | 0.2143 | -0.0254 | |||

| US907818EY04 / Union Pacific Corp | 0.17 | 1.16 | 0.2120 | -0.0082 | |||||

| US36265AAA97 / Goldman Sachs Mortgage Securities Trust | 0.17 | 0.00 | 0.2116 | -0.0091 | |||||

| GreenState Auto Receivables Trust / ABS-CBDO (US39573AAC62) | 0.17 | -0.58 | 0.2083 | -0.0101 | |||||

| US36258RBB87 / Goldman Sachs Mortgage Securities Trust | 0.16 | -0.61 | 0.1998 | -0.0104 | |||||

| US05609VAG05 / BX Commercial Mortgage Trust 2021-VOLT | 0.15 | -2.53 | 0.1880 | -0.0136 | |||||

| NNN / NNN REIT, Inc. | 0.15 | 0.1878 | 0.1878 | ||||||

| Wells Fargo Commercial Mortgage Trust / ABS-MBS (US95004JAC80) | 0.15 | 0.66 | 0.1865 | -0.0071 | |||||

| IP 2025-IP Mortgage Trust / ABS-MBS (US449843AA99) | 0.15 | 0.1853 | 0.1853 | ||||||

| US038222AN54 / APPLIED MATERIALS INC | 0.15 | 2.03 | 0.1840 | -0.0051 | |||||

| Post Road Equipment Finance, LLC / ABS-MBS (US73747LAB45) | 0.15 | 0.00 | 0.1837 | -0.0078 | |||||

| US01627AAA60 / Aligned Data Centers Issuer LLC, Series 2021-1A, Class A2 | 0.15 | 0.68 | 0.1825 | -0.0066 | |||||

| Federal National Mortgage Association / ABS-MBS (US31392DSE30) | 0.15 | -6.41 | 0.1790 | -0.0197 | |||||

| US49326EEK55 / KeyCorp | 0.14 | 0.70 | 0.1762 | -0.0059 | |||||

| Huntington Bank Auto Credit-Linked Notes / ABS-MBS (US446438SX24) | 0.14 | -9.43 | 0.1754 | -0.0279 | |||||

| US482606AA89 / KNDR Trust 21-KIND Class A | 0.14 | 0.71 | 0.1732 | -0.0074 | |||||

| PEAC Solutions Receivables, LLC / ABS-MBS (US69392HAC79) | 0.14 | 1.43 | 0.1730 | -0.0063 | |||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -68.90 | 0.13 | -74.76 | 0.1605 | -0.5016 | |||

| US90278PAY60 / UBS Commercial Mortgage Trust | 0.13 | -5.84 | 0.1579 | -0.0166 | |||||

| US89616QAA94 / Tricon Residential 2022-SFR1 Trust | 0.13 | 0.79 | 0.1556 | -0.0059 | |||||

| Foundation Finance Trust / ABS-MBS (US35040VAA70) | 0.13 | -11.89 | 0.1537 | -0.0289 | |||||

| US10638CAA09 / BREAN ASSET BACKED SECURITIES BABS 2021 RM1 A 144A | 0.12 | 0.81 | 0.1515 | -0.0056 | |||||

| US67116WAC38 / Onslow Bay Financial LLC | 0.12 | -1.60 | 0.1499 | -0.0103 | |||||

| Woodward Capital Management / ABS-CBDO (US749427AA88) | 0.12 | -4.10 | 0.1427 | -0.0136 | |||||

| US74333HAA32 / Progress Residential Trust | 0.12 | 0.87 | 0.1417 | -0.0053 | |||||

| Ellington Financial Mortgage Trust / ABS-MBS (US26846VAA26) | 0.12 | -4.17 | 0.1410 | -0.0119 | |||||

| Wingspire Equipment Finance, LLC / ABS-CBDO (US97415AAB89) | 0.12 | 0.00 | 0.1401 | -0.0063 | |||||

| US16159LAC28 / Chase Mortgage Finance Corp. | 0.11 | -2.59 | 0.1383 | -0.0102 | |||||

| US83405NAA46 / SoFi Professional Loan Program 2021-B Trust | 0.11 | -6.67 | 0.1375 | -0.0154 | |||||

| US75625QAE98 / Reckitt Benckiser Treasury Services PLC | 0.11 | 0.90 | 0.1369 | -0.0050 | |||||

| US072863AH63 / Baylor Scott & White Holdings | 0.11 | 1.87 | 0.1333 | -0.0035 | |||||

| US12530MAE57 / CF Hippolyta LLC | 0.11 | 0.00 | 0.1325 | -0.0051 | |||||

| HUM / Humana Inc. | 0.00 | -5.38 | 0.11 | -13.01 | 0.1310 | -0.0256 | |||

| M&T Equipment Notes / ABS-CBDO (US55376YAD76) | 0.11 | 0.95 | 0.1300 | -0.0043 | |||||

| US89613JAA88 / Tricon American Homes 2020-SFR2 Trust | 0.10 | 0.00 | 0.1265 | -0.0054 | |||||

| GreenSky Home Improvement Trust / ABS-CBDO (US39571MAC29) | 0.10 | 0.99 | 0.1247 | -0.0044 | |||||

| Kubota Credit Owner Trust / ABS-MBS (US50117DAD84) | 0.10 | 0.00 | 0.1246 | -0.0054 | |||||

| US26441CBZ77 / Duke Energy Corp. | 0.09 | 0.1087 | 0.1087 | ||||||

| NMEF Funding, LLC / ABS-CBDO (US62919UAB98) | 0.09 | -14.56 | 0.1077 | -0.0236 | |||||

| US87277JAA97 / TRTX 2022-FL5 Issuer Ltd | 0.09 | -7.37 | 0.1076 | -0.0144 | |||||

| American Heritage Auto Receivables Trust / ABS-MBS (US026944AD09) | 0.09 | 0.00 | 0.1045 | -0.0049 | |||||

| US50168BAC28 / LADAR 23-3 A3 144A 6.12% 09-15-27/25 | 0.08 | -44.00 | 0.1035 | -0.0876 | |||||

| US89179YAR45 / TOWD POINT MORTGAGE TRUST 2021-1 VAR 11/25/2061 144A | 0.08 | -5.62 | 0.1028 | -0.0108 | |||||

| CCG Receivables Trust / ABS-CBDO (US12515PAB31) | 0.08 | -10.11 | 0.0980 | -0.0156 | |||||

| First Help Financial LLC / ABS-MBS (US30339EAB48) | 0.08 | -12.22 | 0.0972 | -0.0176 | |||||

| US03464PAA57 / Angel Oak Mortgage Trust, Series 2022-2, Class A1 | 0.08 | -3.66 | 0.0966 | -0.0079 | |||||

| Octane Receivables Trust / ABS-MBS (US67578YAB20) | 0.08 | -17.89 | 0.0953 | -0.0267 | |||||

| US31739MAA27 / Finance of America Structured Securities Trust | 0.08 | -3.75 | 0.0945 | -0.0077 | |||||

| US12512JAT16 / CD Commercial Mortgage Trust | 0.08 | -7.23 | 0.0940 | -0.0121 | |||||

| Auxilior Term Funding, LLC / ABS-MBS (US05335FAB76) | 0.08 | -27.88 | 0.0923 | -0.0410 | |||||

| US12651RAA59 / CSMC 2017-FHA1 Trust | 0.07 | -2.63 | 0.0913 | -0.0056 | |||||

| US92259TAA97 / Velocity Commercial Capital Loan Trust, Series 2021-1, Class A | 0.07 | -4.17 | 0.0841 | -0.0081 | |||||

| US85236KAE29 / Stack Infrastructure Issuer LLC | 0.07 | 1.49 | 0.0833 | -0.0032 | |||||

| US12511QAB59 / CCG 23-2 A2 144A 6.28% 04-14-32/03-15-27 | 0.07 | -19.28 | 0.0817 | -0.0248 | |||||

| US3136B4TV00 / Federal National Mortgage Association REMIC | 0.06 | 1.59 | 0.0782 | -0.0032 | |||||

| US03236XAB38 / Amur Equipment Finance Receivables XI LLC, Series 2022-2A, Class A2 | 0.06 | -27.06 | 0.0758 | -0.0331 | |||||

| US66286VAB36 / North Texas Higher Education Authority, Inc. | 0.06 | -3.17 | 0.0745 | -0.0069 | |||||

| US38380LSA25 / Government National Mortgage Association | 0.06 | -1.69 | 0.0710 | -0.0047 | |||||

| US78485GAA22 / SREIT 2021-FLWR A | 0.06 | 1.79 | 0.0695 | -0.0028 | |||||

| US05610HAA14 / BX Commercial Mortgage Trust 2022-LP2 | 0.06 | -14.06 | 0.0677 | -0.0142 | |||||

| GreenSky Home Improvement Trust / ABS-CBDO (US39571MAD02) | 0.05 | -22.06 | 0.0652 | -0.0217 | |||||

| US78445AAD81 / SLM Student Loan Trust | 0.05 | -3.64 | 0.0647 | -0.0059 | |||||

| US86935CAA09 / Sutherland Commercial Mortgage Trust | 0.05 | -5.56 | 0.0629 | -0.0060 | |||||

| US05492JAT97 / Barclays Commercial Mortgage Trust | 0.05 | -2.00 | 0.0608 | -0.0032 | |||||

| US855244AV14 / Starbucks Corp | 0.05 | 2.13 | 0.0586 | -0.0022 | |||||

| US872882AG07 / TSMC Global Ltd | 0.05 | 2.17 | 0.0577 | -0.0015 | |||||

| US505321AQ26 / La Vista Economic Development Fund | 0.05 | 2.22 | 0.0562 | -0.0018 | |||||

| US12512XAB91 / CCG Receivables Trust 2023-1 | 0.03 | -24.39 | 0.0379 | -0.0151 | |||||

| US26857LAA08 / ELFI Graduate Loan Program 2020-A, LLC | 0.03 | -3.23 | 0.0366 | -0.0037 | |||||

| US3137BWNS93 / Federal Home Loan Mortgage Corp. | 0.03 | -6.45 | 0.0363 | -0.0039 | |||||

| US17327RAA86 / Citigroup Mortgage Loan Trust 2019-RP1 | 0.03 | -3.70 | 0.0325 | -0.0028 | |||||

| US00178UAA79 / AMSR Trust | 0.02 | -9.09 | 0.0253 | -0.0030 | |||||

| US20267XAA19 / Commonbond Student Loan Trust | 0.02 | -5.00 | 0.0234 | -0.0027 | |||||

| US12511JAB17 / CCG Receivables Trust | 0.02 | -50.00 | 0.0230 | -0.0233 | |||||

| US64829EAA29 / New Residential Mortgage Loan Trust REMIC | 0.02 | -5.56 | 0.0214 | -0.0017 | |||||

| US17322GAA76 / Citigroup Mortgage Loan Trust 2014-A | 0.01 | 0.00 | 0.0110 | -0.0012 | |||||

| US62890MAB00 / NMEF Funding 2022-B LLC | 0.01 | -33.33 | 0.0098 | -0.0067 | |||||

| US3137BDX766 / Federal Home Loan Mortgage Corp. REMIC | 0.00 | -25.00 | 0.0048 | -0.0014 | |||||

| US3137G1AR80 / Freddie Mac Whole Loan Securities Trust 2015-SC02 | 0.00 | -50.00 | 0.0047 | -0.0032 | |||||

| US3138EHPF34 / Federal National Mortgage Association | 0.00 | -25.00 | 0.0043 | -0.0016 | |||||

| US63939CAD92 / NAVIENT PRIVATE EDUCATION LOAN TRUST 2014-A NAVSL 2014-AA A3 | 0.00 | -83.33 | 0.0026 | -0.0130 |