Mga Batayang Estadistika

| Nilai Portofolio | $ 102,107,831 |

| Posisi Saat Ini | 67 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

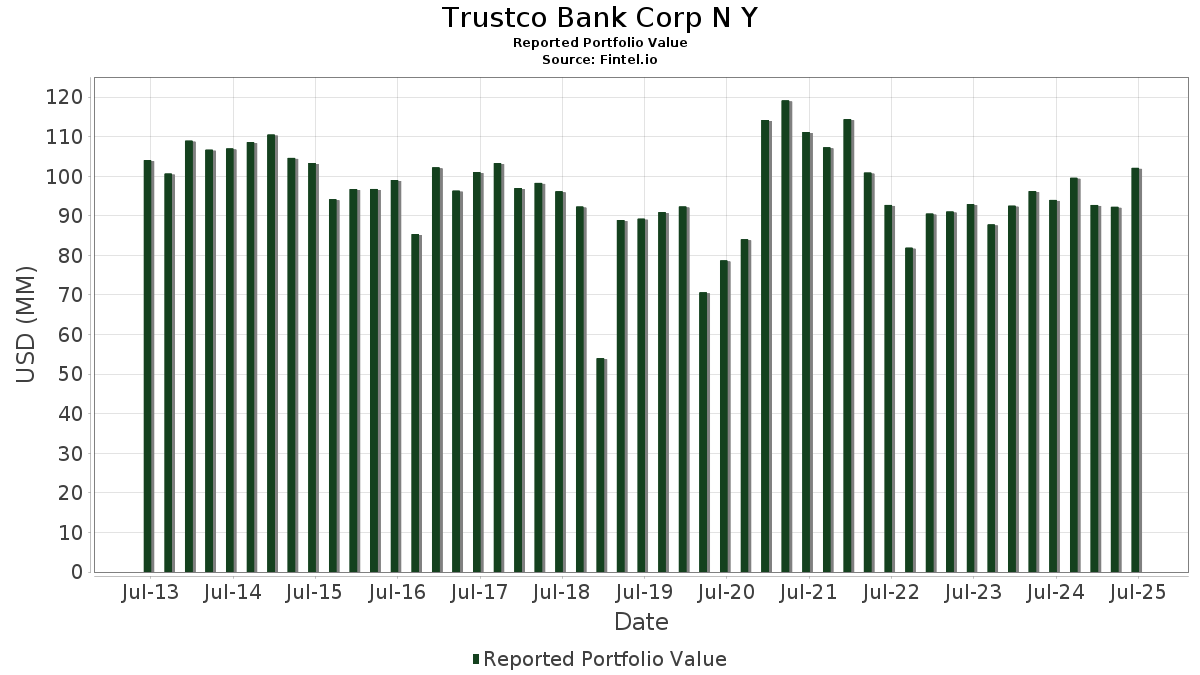

Trustco Bank Corp N Y telah mengungkapkan total kepemilikan 67 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 102,107,831 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Trustco Bank Corp N Y adalah General Electric Company (US:GE) , JPMorgan Chase & Co. (US:JPM) , Microsoft Corporation (US:MSFT) , Applied Materials, Inc. (US:AMAT) , and Apple Inc. (US:AAPL) . Posisi baru Trustco Bank Corp N Y meliputi: The Travelers Companies, Inc. (US:TRV) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 7.39 | 7.2336 | 4.0555 | |

| 0.03 | 5.19 | 5.0847 | 2.6296 | |

| 0.04 | 3.90 | 3.8237 | 1.6497 | |

| 0.01 | 2.89 | 2.8300 | 1.4256 | |

| 0.02 | 3.50 | 3.4269 | 1.0759 | |

| 0.02 | 2.68 | 2.6212 | 1.0577 | |

| 0.01 | 1.73 | 1.6951 | 0.8712 | |

| 0.01 | 3.81 | 2.0459 | 0.8344 | |

| 0.01 | 1.79 | 1.7517 | 0.7650 | |

| 0.03 | 7.27 | 3.9046 | 0.5942 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 5.07 | 2.7237 | -0.5509 | |

| 0.02 | 2.99 | 1.6075 | -0.3499 | |

| 0.02 | 2.62 | 1.4063 | -0.2637 | |

| 0.01 | 1.73 | 0.9297 | -0.2625 | |

| 0.04 | 2.95 | 1.5829 | -0.2229 | |

| 0.01 | 1.80 | 0.9659 | -0.1806 | |

| 0.03 | 0.60 | 0.3231 | -0.1302 | |

| 0.00 | 1.33 | 0.7130 | -0.1257 | |

| 0.02 | 0.79 | 0.4219 | -0.1187 | |

| 0.01 | 1.30 | 0.6959 | -0.1163 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-08 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GE / General Electric Company | 0.03 | 7.70 | 7.39 | 38.52 | 7.2336 | 4.0555 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | 10.80 | 7.27 | 30.97 | 3.9046 | 0.5942 | |||

| MSFT / Microsoft Corporation | 0.01 | 0.80 | 6.27 | 33.55 | 3.3660 | 0.5681 | |||

| AMAT / Applied Materials, Inc. | 0.03 | -0.10 | 5.19 | 26.03 | 5.0847 | 2.6296 | |||

| AAPL / Apple Inc. | 0.02 | -0.02 | 5.07 | -7.64 | 2.7237 | -0.5509 | |||

| XOM / Exxon Mobil Corporation | 0.04 | 18.07 | 3.90 | 7.02 | 3.8237 | 1.6497 | |||

| TRST / TrustCo Bank Corp NY | 0.12 | 5.42 | 3.90 | 15.61 | 2.0914 | 0.0827 | |||

| GEV / GE Vernova Inc. | 0.01 | 8.17 | 3.81 | 87.55 | 2.0459 | 0.8344 | |||

| ABBV / AbbVie Inc. | 0.02 | 0.12 | 3.50 | -11.31 | 3.4269 | 1.0759 | |||

| JNJ / Johnson & Johnson | 0.02 | -1.01 | 2.99 | -8.83 | 1.6075 | -0.3499 | |||

| KO / The Coca-Cola Company | 0.04 | -1.49 | 2.95 | -2.71 | 1.5829 | -0.2229 | |||

| AXP / American Express Company | 0.01 | 3.43 | 2.89 | 22.62 | 2.8300 | 1.4256 | |||

| ABT / Abbott Laboratories | 0.02 | -0.51 | 2.68 | 2.02 | 2.6212 | 1.0577 | |||

| PG / The Procter & Gamble Company | 0.02 | 0.01 | 2.62 | -6.53 | 1.4063 | -0.2637 | |||

| WMT / Walmart Inc. | 0.02 | 0.00 | 2.18 | 11.40 | 1.1697 | 0.0037 | |||

| CVX / Chevron Corporation | 0.01 | -1.37 | 2.07 | -15.56 | 2.0248 | 0.5654 | |||

| ORCL / Oracle Corporation | 0.01 | 3.30 | 2.05 | 61.57 | 1.1018 | 0.3446 | |||

| MCD / McDonald's Corporation | 0.01 | 0.00 | 1.80 | -6.45 | 0.9659 | -0.1806 | |||

| RTX / RTX Corporation | 0.01 | -2.00 | 1.79 | 8.04 | 1.7517 | 0.7650 | |||

| PEP / PepsiCo, Inc. | 0.01 | -1.69 | 1.73 | -13.45 | 0.9297 | -0.2625 | |||

| DIS / The Walt Disney Company | 0.01 | -0.36 | 1.73 | 25.18 | 1.6951 | 0.8712 | |||

| IBM / International Business Machines Corporation | 0.00 | -0.50 | 1.47 | 17.95 | 0.7866 | 0.0462 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 1.33 | -5.61 | 0.7130 | -0.1257 | |||

| TXN / Texas Instruments Incorporated | 0.01 | -3.66 | 1.32 | 11.37 | 0.7097 | 0.0018 | |||

| CSCO / Cisco Systems, Inc. | 0.02 | -0.66 | 1.30 | 11.69 | 1.2723 | 0.5791 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 0.00 | 1.30 | -4.85 | 0.6959 | -0.1163 | |||

| EMR / Emerson Electric Co. | 0.01 | 0.00 | 1.05 | 21.58 | 1.0267 | 0.5130 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.38 | 0.97 | 0.41 | 0.9519 | 0.3751 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 6.03 | 0.97 | 24.71 | 0.5206 | 0.0572 | |||

| CL / Colgate-Palmolive Company | 0.01 | -2.26 | 0.95 | -5.19 | 0.9312 | 0.3336 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.94 | 0.86 | 0.9215 | 0.3660 | |||

| SO / The Southern Company | 0.01 | -2.96 | 0.90 | -3.12 | 0.4841 | -0.0705 | |||

| GIS / General Mills, Inc. | 0.02 | 0.00 | 0.79 | -13.34 | 0.4219 | -0.1187 | |||

| NKE / NIKE, Inc. | 0.01 | 1.91 | 0.76 | 13.98 | 0.4074 | 0.0108 | |||

| MRK / Merck & Co., Inc. | 0.01 | 0.00 | 0.73 | -11.84 | 0.7156 | 0.2219 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.68 | 14.75 | 0.3636 | 0.0118 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.65 | -8.74 | 0.3473 | -0.0754 | |||

| MAS / Masco Corporation | 0.01 | 2.10 | 0.63 | -5.59 | 0.6130 | 0.2182 | |||

| GOOGL / Alphabet Inc. | 0.00 | 6.03 | 0.62 | 20.27 | 0.3348 | 0.0261 | |||

| INTC / Intel Corporation | 0.03 | -19.78 | 0.60 | -20.92 | 0.3231 | -0.1302 | |||

| JCI / Johnson Controls International plc | 0.01 | 0.00 | 0.56 | 31.83 | 0.5443 | 0.2931 | |||

| MMM / 3M Company | 0.00 | -4.79 | 0.55 | -1.26 | 0.5390 | 0.2067 | |||

| TGT / Target Corporation | 0.01 | -2.65 | 0.54 | -7.97 | 0.5324 | 0.1804 | |||

| NSC / Norfolk Southern Corporation | 0.00 | 4.96 | 0.54 | 13.42 | 0.5305 | 0.2459 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.01 | 4.82 | 0.54 | -3.94 | 0.2887 | -0.0445 | |||

| VZ / Verizon Communications Inc. | 0.01 | -5.49 | 0.54 | -9.76 | 0.5251 | 0.1707 | |||

| MDT / Medtronic plc | 0.01 | 0.00 | 0.52 | -2.99 | 0.5094 | 0.1899 | |||

| CAT / Caterpillar Inc. | 0.00 | 17.89 | 0.51 | 38.86 | 0.5011 | 0.2814 | |||

| STT / State Street Corporation | 0.00 | -1.37 | 0.50 | 17.21 | 0.4936 | 0.2372 | |||

| ECL / Ecolab Inc. | 0.00 | 2.84 | 0.49 | 9.19 | 0.2618 | -0.0041 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.48 | 28.04 | 0.2603 | 0.0346 | |||

| T / AT&T Inc. | 0.02 | -6.69 | 0.44 | -4.52 | 0.2384 | -0.0388 | |||

| PFE / Pfizer Inc. | 0.02 | -3.24 | 0.38 | -7.56 | 0.2039 | -0.0407 | |||

| ALL / The Allstate Corporation | 0.00 | 0.00 | 0.34 | -2.59 | 0.3312 | 0.1239 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 0.33 | 3.81 | 0.3207 | 0.1325 | |||

| CVS / CVS Health Corporation | 0.00 | -5.28 | 0.31 | -3.44 | 0.1661 | -0.0251 | |||

| CME / CME Group Inc. | 0.00 | -7.33 | 0.29 | -3.67 | 0.2834 | 0.1043 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.28 | 2.61 | 0.1478 | -0.0123 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | 0.00 | 0.27 | -24.23 | 0.2639 | 0.0523 | |||

| MO / Altria Group, Inc. | 0.00 | 0.00 | 0.27 | -2.21 | 0.1423 | -0.0194 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | 0.26 | 0.2586 | 0.2586 | |||||

| FDIS / Fidelity Covington Trust - Fidelity MSCI Consumer Discretionary Index ETF | 0.00 | 0.00 | 0.26 | 11.44 | 0.1414 | 0.0004 | |||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0.00 | 0.00 | 0.24 | 8.44 | 0.1311 | -0.0034 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.24 | 0.2357 | 0.2357 | |||||

| J / Jacobs Solutions Inc. | 0.00 | 2.87 | 0.24 | 11.90 | 0.1267 | 0.0009 | |||

| C / Citigroup Inc. | 0.00 | 0.23 | 0.1219 | 0.1219 | |||||

| UPS / United Parcel Service, Inc. | 0.00 | -15.59 | 0.23 | -22.41 | 0.2205 | 0.0473 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DD / DuPont de Nemours, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |