Mga Batayang Estadistika

| Nilai Portofolio | $ 267,099,575 |

| Posisi Saat Ini | 33 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

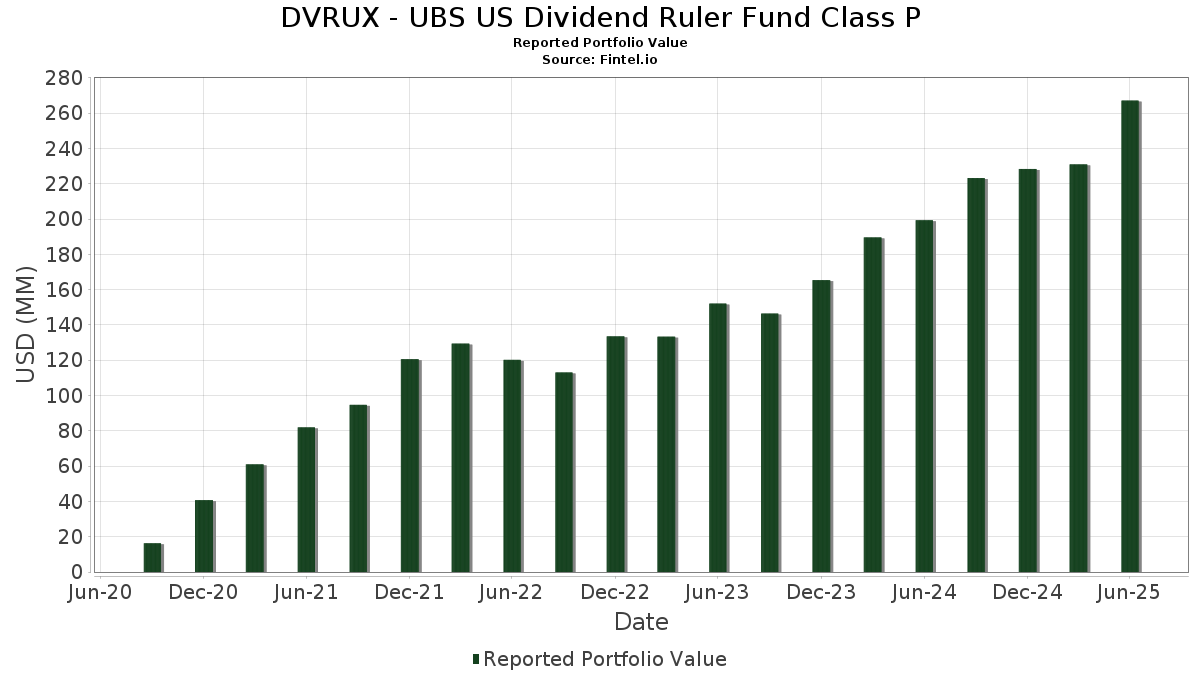

DVRUX - UBS US Dividend Ruler Fund Class P telah mengungkapkan total kepemilikan 33 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 267,099,575 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama DVRUX - UBS US Dividend Ruler Fund Class P adalah Microsoft Corporation (US:MSFT) , Broadcom Inc. (US:AVGO) , Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) , JPMorgan Chase & Co. (US:JPM) , and Oracle Corporation (US:ORCL) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 27.75 | 10.3939 | 1.6704 | |

| 0.07 | 18.16 | 6.8031 | 1.6440 | |

| 0.05 | 6.67 | 2.4996 | 1.3495 | |

| 0.06 | 12.82 | 4.8015 | 1.3271 | |

| 0.02 | 8.35 | 3.1259 | 0.9067 | |

| 0.07 | 9.27 | 3.4737 | 0.7805 | |

| 0.06 | 12.15 | 4.5520 | 0.7658 | |

| 0.02 | 8.57 | 3.2091 | 0.7476 | |

| 0.03 | 7.48 | 2.8016 | 0.7158 | |

| 0.06 | 6.57 | 2.4608 | 0.6282 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 6.49 | 2.4312 | -1.0918 | |

| 0.02 | 5.05 | 1.8930 | -0.9494 | |

| 0.02 | 6.57 | 2.4602 | -0.9391 | |

| 0.01 | 3.20 | 1.1990 | -0.7943 | |

| 0.02 | 5.69 | 2.1306 | -0.7227 | |

| 0.04 | 6.58 | 2.4653 | -0.6437 | |

| 0.00 | 2.33 | 0.8737 | -0.6276 | |

| 0.04 | 6.37 | 2.3876 | -0.4458 | |

| 3.30 | 3.30 | 1.2343 | -0.4443 | |

| 0.01 | 2.07 | 0.7768 | -0.3229 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.06 | 4.03 | 27.75 | 37.85 | 10.3939 | 1.6704 | |||

| AVGO / Broadcom Inc. | 0.07 | -7.33 | 18.16 | 52.57 | 6.8031 | 1.6440 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.06 | 17.18 | 12.82 | 59.90 | 4.8015 | 1.3271 | |||

| JPM / JPMorgan Chase & Co. | 0.04 | 3.68 | 12.52 | 22.54 | 4.6902 | 0.2618 | |||

| ORCL / Oracle Corporation | 0.06 | -11.05 | 12.15 | 39.10 | 4.5520 | 0.7658 | |||

| BLK / BlackRock, Inc. | 0.01 | 22.55 | 9.47 | 35.86 | 3.5461 | 0.5261 | |||

| MS / Morgan Stanley | 0.07 | 23.60 | 9.27 | 49.24 | 3.4737 | 0.7805 | |||

| HD / The Home Depot, Inc. | 0.02 | 50.77 | 8.57 | 50.83 | 3.2091 | 0.7476 | |||

| TJX / The TJX Companies, Inc. | 0.07 | 5.78 | 8.39 | 7.25 | 3.1416 | -0.2474 | |||

| ETN / Eaton Corporation plc | 0.02 | 24.09 | 8.35 | 62.96 | 3.1259 | 0.9067 | |||

| AXP / American Express Company | 0.03 | 4.26 | 8.20 | 23.61 | 3.0732 | 0.1969 | |||

| ABT / Abbott Laboratories | 0.06 | 4.02 | 7.86 | 6.65 | 2.9428 | -0.2493 | |||

| UNP / Union Pacific Corporation | 0.03 | 59.56 | 7.48 | 55.39 | 2.8016 | 0.7158 | |||

| NEE / NextEra Energy, Inc. | 0.11 | 23.40 | 7.42 | 20.84 | 2.7777 | 0.1184 | |||

| LIN / Linde plc | 0.02 | 26.05 | 7.37 | 27.01 | 2.7604 | 0.2458 | |||

| CB / Chubb Limited | 0.03 | 25.51 | 7.36 | 20.42 | 2.7573 | 0.1081 | |||

| KO / The Coca-Cola Company | 0.10 | 5.56 | 7.05 | 4.28 | 2.6387 | -0.2889 | |||

| ADI / Analog Devices, Inc. | 0.03 | 3.50 | 6.99 | 22.16 | 2.6179 | 0.1384 | |||

| PLD / Prologis, Inc. | 0.06 | 27.25 | 6.71 | 19.67 | 2.5115 | 0.0832 | |||

| RTX / RTX Corporation | 0.05 | 95.53 | 6.67 | 296.73 | 2.4996 | 1.3495 | |||

| ABBV / AbbVie Inc. | 0.04 | 3.55 | 6.58 | -8.27 | 2.4653 | -0.6437 | |||

| XOM / Exxon Mobil Corporation | 0.06 | 71.39 | 6.57 | 55.33 | 2.4608 | 0.6282 | |||

| MCD / McDonald's Corporation | 0.02 | -10.48 | 6.57 | -16.27 | 2.4602 | -0.9391 | |||

| JNJ / Johnson & Johnson | 0.04 | -13.32 | 6.49 | -20.16 | 2.4312 | -1.0918 | |||

| PG / The Procter & Gamble Company | 0.04 | 4.29 | 6.37 | -2.51 | 2.3876 | -0.4458 | |||

| TXN / Texas Instruments Incorporated | 0.03 | 3.46 | 6.32 | 19.52 | 2.3668 | 0.0760 | |||

| TT / Trane Technologies plc | 0.01 | 3.39 | 6.00 | 34.22 | 2.2465 | 0.3101 | |||

| ADP / Automatic Data Processing, Inc. | 0.02 | -14.41 | 5.69 | -13.61 | 2.1306 | -0.7227 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.02 | -14.00 | 5.05 | -22.96 | 1.8930 | -0.9494 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 3.30 | -14.93 | 3.30 | -14.92 | 1.2343 | -0.4443 | |||

| ACN / Accenture plc | 0.01 | -27.35 | 3.20 | -30.40 | 1.1990 | -0.7943 | |||

| KLAC / KLA Corporation | 0.00 | -48.90 | 2.33 | -32.68 | 0.8737 | -0.6276 | |||

| RSG / Republic Services, Inc. | 0.01 | -19.75 | 2.07 | -18.29 | 0.7768 | -0.3229 |