Mga Batayang Estadistika

| Nilai Portofolio | $ 103,932,239 |

| Posisi Saat Ini | 148 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

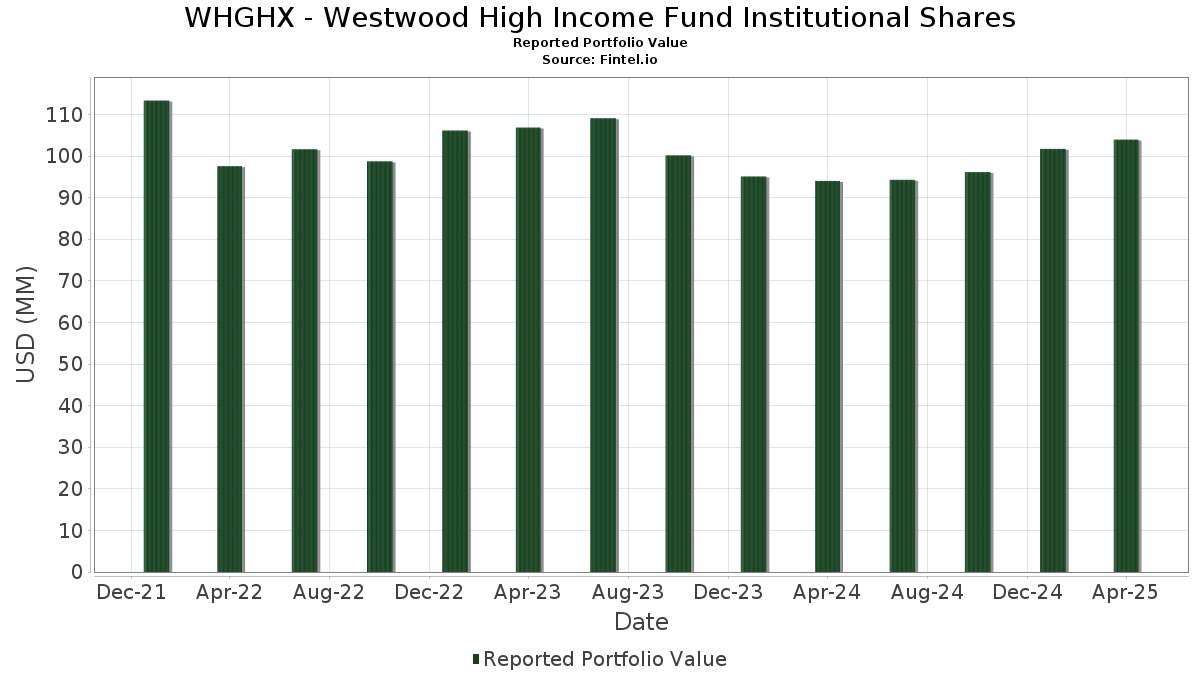

WHGHX - Westwood High Income Fund Institutional Shares telah mengungkapkan total kepemilikan 148 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 103,932,239 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama WHGHX - Westwood High Income Fund Institutional Shares adalah FIRST AM GOV OBLIG-U (US:US31846V2117) , Avation Capital SA (LU:AVTCAP) , Ford Motor 7.45% Notes Due 7/16/2031 (US:US345370CA64) , DISH Network Corp (US:US25470MAG42) , and Martin Midstream Partners LP 11.500%, Due 02/15/28 (US:US573334AK58) . Posisi baru WHGHX - Westwood High Income Fund Institutional Shares meliputi: FIRST AM GOV OBLIG-U (US:US31846V2117) , Avation Capital SA (LU:AVTCAP) , Ford Motor 7.45% Notes Due 7/16/2031 (US:US345370CA64) , DISH Network Corp (US:US25470MAG42) , and Martin Midstream Partners LP 11.500%, Due 02/15/28 (US:US573334AK58) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.49 | 2.3713 | 2.3713 | ||

| 2.48 | 2.3634 | 2.3634 | ||

| 1.98 | 1.8862 | 1.8862 | ||

| 1.07 | 1.0202 | 1.0202 | ||

| 1.05 | 0.9958 | 0.9958 | ||

| 0.99 | 0.9386 | 0.9386 | ||

| 0.98 | 0.9311 | 0.9311 | ||

| 0.87 | 0.8299 | 0.8299 | ||

| 0.01 | 0.82 | 0.7798 | 0.7798 | |

| 0.01 | 0.81 | 0.7712 | 0.7712 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.77 | 0.7309 | -1.9214 | ||

| 0.94 | 0.8901 | -0.3685 | ||

| 0.00 | 0.83 | 0.7928 | -0.3485 | |

| 0.00 | 0.00 | -0.3441 | ||

| 0.54 | 0.5100 | -0.3440 | ||

| 0.94 | 0.8975 | -0.3044 | ||

| 0.00 | 0.96 | 0.9124 | -0.2471 | |

| 0.79 | 0.7502 | -0.2385 | ||

| 0.04 | 0.71 | 0.6765 | -0.2337 | |

| 0.01 | 0.59 | 0.5661 | -0.2258 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-25 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| U.S. Treasury Bill 0.000%, Due 5/29/2025 / DBT (US912797NN35) | 2.49 | 2.3713 | 2.3713 | ||||||

| U.S. Treasury Bill 0.000%, Due 06/25/2025 / DBT (US912797NW34) | 2.48 | 2.3634 | 2.3634 | ||||||

| U.S. Treasury Bill 0.000%, Due 7/17/2025 / DBT (US912797PE18) | 1.98 | 1.8862 | 1.8862 | ||||||

| US31846V2117 / FIRST AM GOV OBLIG-U | 1.80 | 74.54 | 1.7163 | 0.6941 | |||||

| IEP / Icahn Enterprises L.P. | 1.22 | -4.31 | 1.1631 | -0.1004 | |||||

| AVTCAP / Avation Capital SA | 1.22 | -1.30 | 1.1568 | -0.0607 | |||||

| U.S. Treasury Notes 4.625%, Due 02/15/2035 / DBT (US91282CMM00) | 1.07 | 1.0202 | 1.0202 | ||||||

| US345370CA64 / Ford Motor 7.45% Notes Due 7/16/2031 | 1.05 | -2.04 | 1.0033 | -0.0609 | |||||

| CXW / CoreCivic, Inc. | 1.05 | -0.38 | 1.0029 | -0.0427 | |||||

| US25470MAG42 / DISH Network Corp | 1.05 | -0.38 | 1.0007 | -0.0434 | |||||

| GEO Group Inc/The 8.625% Due 04/15/2029 / DBT (US36162JAG13) | 1.05 | -0.47 | 1.0004 | -0.0446 | |||||

| United States Treasury Note/Bond 4.0% Due 03/31/2030 / DBT (US91282CMU26) | 1.05 | 0.9958 | 0.9958 | ||||||

| US573334AK58 / Martin Midstream Partners LP 11.500%, Due 02/15/28 | 1.04 | -4.69 | 0.9869 | -0.0891 | |||||

| US12543DBN93 / CHS/Community Health Systems Inc | 1.04 | 0.19 | 0.9868 | -0.0363 | |||||

| US18453HAE62 / Clear Channel Outdoor Holdings Inc | 1.04 | -1.71 | 0.9851 | -0.0569 | |||||

| US30327TAA79 / FTAI Infra Escrow Holdings LLC | 1.03 | -2.27 | 0.9849 | -0.0615 | |||||

| Sabre GLBL Inc 10.75%, Due 11/15/2029 / DBT (US78573NAL64) | 1.03 | -7.71 | 0.9808 | -0.1230 | |||||

| US46284VAP67 / Iron Mountain, Inc. | 1.03 | -0.19 | 0.9772 | -0.0397 | |||||

| CommScope LLC 9.5%, Due 12/15/2031 / DBT (US20338MAA09) | 1.02 | 96.92 | 0.9732 | 0.4597 | |||||

| US67585LAA35 / Odeon Finco plc | 1.02 | -3.42 | 0.9672 | -0.0737 | |||||

| US161175AZ73 / Charter Communications Operating LLC / Charter Communications Operating Capital | 1.01 | 0.70 | 0.9618 | -0.0302 | |||||

| US98379KAA07 / XPO INC | 1.01 | -0.39 | 0.9610 | -0.0412 | |||||

| US09261HBA41 / BLACKSTONE PRIVATE CREDIT FUND 7.05% 09/29/2025 | 1.01 | -0.69 | 0.9580 | -0.0437 | |||||

| DLX / Deluxe Corporation | 1.00 | -2.63 | 0.9528 | -0.0643 | |||||

| GLNG / Golar LNG Limited | 1.00 | 0.10 | 0.9506 | -0.0360 | |||||

| RITM.PRD / Rithm Capital Corp. - Preferred Stock | 1.00 | -1.29 | 0.9505 | -0.0501 | |||||

| US65342QAM42 / NEXTERA ENERGY OPERATING REGD 144A P/P 7.25000000 | 0.99 | -1.69 | 0.9421 | -0.0529 | |||||

| B2LN34 / BlackLine, Inc. - Depositary Receipt (Common Stock) | 0.99 | 0.9386 | 0.9386 | ||||||

| US925650AD55 / VICI Properties LP | 0.98 | 0.62 | 0.9312 | -0.0307 | |||||

| 1261229 BC Ltd 10.00% Due 04/15/2032 / DBT (US68288AAA51) | 0.98 | 0.9311 | 0.9311 | ||||||

| US126307BM89 / CSC Holdings LLC | 0.98 | -1.41 | 0.9302 | -0.0502 | |||||

| US09257WAE03 / Blackstone Mortgage Trust Inc | 0.97 | 0.41 | 0.9221 | -0.0321 | |||||

| SVC / Service Properties Trust | 0.96 | -1.03 | 0.9169 | -0.0460 | |||||

| JEPQ / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Nasdaq Equity Premium Income ETF | 0.02 | -4.37 | 0.96 | -14.56 | 0.9158 | -0.1981 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | -4.37 | 0.96 | -18.26 | 0.9124 | -0.2471 | |||

| US55342UAJ34 / MPT Operating Partnership LP | 0.95 | -0.63 | 0.9041 | -0.0415 | |||||

| US20451RAB87 / Compass Group Diversified Holdings LLC | 0.94 | -22.39 | 0.8975 | -0.3044 | |||||

| NGL Energy Operating LLC / NGL Energy Finance Corp 8.125%, Due 2/15/2029 / DBT (US62922LAC28) | 0.94 | -8.48 | 0.8940 | -0.1206 | |||||

| US097023CW33 / BOEING CO 5.805 5/50 | 0.94 | -0.21 | 0.8927 | -0.0369 | |||||

| CLF / Cleveland-Cliffs Inc. | 0.94 | -6.02 | 0.8919 | -0.0949 | |||||

| Aptiv PLC / Aptiv Global Financing DAC 6.875%, Due 12/15/2054 / DBT (US03837AAD28) | 0.94 | -6.12 | 0.8914 | -0.0946 | |||||

| XAL2000DAC82 / Connect Finco Sarl Term Loan B | 0.94 | -26.49 | 0.8901 | -0.3685 | |||||

| CVI / CVR Energy, Inc. | 0.92 | -6.13 | 0.8746 | -0.0936 | |||||

| Sinclair Television Group Inc 8.125% Due 2/15/2033 / DBT (US829259BH26) | 0.91 | -1.84 | 0.8642 | -0.0514 | |||||

| Golub Capital Private Credit Fund 5.875% Due 05/01/2030 / DBT (US38179RAC97) | 0.87 | 0.8299 | 0.8299 | ||||||

| BRTSG8EN8 / Staples, Inc., Term Loan | 0.87 | -11.33 | 0.8276 | -0.1420 | |||||

| GILD / Gilead Sciences, Inc. | 0.01 | -4.36 | 0.83 | 4.91 | 0.7930 | 0.0069 | |||

| IBM / International Business Machines Corporation | 0.00 | -23.68 | 0.83 | -27.82 | 0.7928 | -0.3485 | |||

| TJX / The TJX Companies, Inc. | 0.01 | -4.37 | 0.83 | -1.43 | 0.7906 | -0.0425 | |||

| Kronos Acquisition Holdings Inc 8.25%, Due 06/30/2031 / DBT (US50106GAG73) | 0.83 | -13.24 | 0.7865 | -0.1553 | |||||

| BA.PRA / The Boeing Company - Preferred Security | 0.01 | 0.82 | 0.7798 | 0.7798 | |||||

| Brightline East LLC 11.000%, Due 01/31/2030 / DBT (US093536AA89) | 0.81 | -15.89 | 0.7756 | -0.1826 | |||||

| US29273VAM28 / Energy Transfer LP | 0.81 | -3.11 | 0.7726 | -0.0557 | |||||

| GOOGL / Alphabet Inc. | 0.01 | 0.81 | 0.7712 | 0.7712 | |||||

| WTI / W&T Offshore, Inc. | 0.79 | -21.12 | 0.7502 | -0.2385 | |||||

| UNITED STATES TREAS BDS 4.25% 02/15/54 / DBT (US912810TX63) | 0.77 | -71.36 | 0.7309 | -1.9214 | |||||

| XS2085724156 / MPT Operating Partnership LP / MPT Finance Corp | 0.76 | 0.26 | 0.7267 | -0.0265 | |||||

| US33938XAE58 / Flex Ltd | 0.76 | -0.13 | 0.7244 | -0.0294 | |||||

| US02666TAF49 / American Homes 4 Rent LP | 0.76 | -2.96 | 0.7187 | -0.0514 | |||||

| US04010LBE20 / Ares Capital Corp. | 0.75 | -0.79 | 0.7185 | -0.0330 | |||||

| GrafTech Global Enterprises Inc 9.875% Due 12/23/2029 / DBT (US38431AAB26) | 0.75 | 0.7137 | 0.7137 | ||||||

| GD / General Dynamics Corporation | 0.00 | 31.20 | 0.75 | 39.11 | 0.7111 | 0.1793 | |||

| FCT / Fincantieri S.p.A. | 0.74 | -1.85 | 0.7064 | -0.0417 | |||||

| SPGI / S&P Global Inc. - Depositary Receipt (Common Stock) | 0.74 | -11.47 | 0.7060 | -0.1221 | |||||

| LOW / Lowe's Companies, Inc. | 0.00 | -4.38 | 0.74 | -17.84 | 0.7021 | -0.1853 | |||

| GEO Group Inc/The 10.25% Due 11/01/2031 / DBT (US36162JAH95) | 0.73 | -0.41 | 0.6936 | -0.0294 | |||||

| MSFT / Microsoft Corporation | 0.00 | -4.37 | 0.73 | -9.02 | 0.6917 | -0.0975 | |||

| NVDA / NVIDIA Corporation | 0.01 | 83.81 | 0.72 | 66.67 | 0.6859 | 0.2584 | |||

| US257867BA88 / Rr Donnelley & Sons Bond | 0.72 | 0.6819 | 0.6819 | ||||||

| ET / Energy Transfer LP - Limited Partnership | 0.04 | -4.37 | 0.71 | -22.83 | 0.6765 | -0.2337 | |||

| US404280DX45 / HSBC Holdings PLC | 0.69 | 0.58 | 0.6606 | -0.0226 | |||||

| SBL Holdings Inc 7.2%, Due 10/30/2034 / DBT (US78397DAD03) | 0.68 | 36.14 | 0.6461 | 0.1536 | |||||

| CSCO / Cisco Systems, Inc. | 0.01 | -4.38 | 0.68 | -8.87 | 0.6455 | -0.0908 | |||

| US836205BC70 / Republic of South Africa Government International Bond | 0.66 | -0.15 | 0.6242 | -0.0251 | |||||

| US404280DT33 / HSBC Holdings PLC | 0.64 | -1.39 | 0.6078 | -0.0324 | |||||

| US237194AM73 / Darden Restaurants Inc. | 0.64 | -0.94 | 0.6052 | -0.0292 | |||||

| US05526DBX21 / BATSLN 7 3/4 10/19/32 | 0.63 | 0.64 | 0.5999 | -0.0194 | |||||

| Bank of America Corp 5.518% Due 10/25/2035 / DBT (US06051GMD87) | 0.62 | 0.5915 | 0.5915 | ||||||

| US02005NBT63 / Ally Financial Inc | 0.61 | -0.97 | 0.5827 | -0.0287 | |||||

| STNG / Scorpio Tankers Inc. | 0.61 | -0.65 | 0.5818 | -0.0267 | |||||

| MO / Altria Group, Inc. | 0.01 | -4.37 | 0.61 | 8.23 | 0.5767 | 0.0234 | |||

| HPE.PRC / Hewlett Packard Enterprise Company - Preferred Security | 0.01 | -11.24 | 0.59 | -25.75 | 0.5661 | -0.2258 | |||

| US33835PAA49 / Five Corners Funding Trust IV | 0.58 | 0.52 | 0.5486 | -0.0190 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.58 | -1.20 | 0.5484 | -0.0281 | |||||

| US209111FH17 / CON EDISON CO OF NY INC SR UNSECURED 06/46 3.85 | 0.58 | 0.35 | 0.5474 | -0.0197 | |||||

| PEP / PepsiCo, Inc. | 0.00 | 0.57 | 0.5460 | 0.5460 | |||||

| JEPI / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Equity Premium Income ETF | 0.01 | -4.37 | 0.57 | -9.87 | 0.5389 | -0.0823 | |||

| VTR / Ventas, Inc. | 0.01 | -4.37 | 0.55 | 10.82 | 0.5270 | 0.0333 | |||

| PCH / PotlatchDeltic Corporation | 0.01 | -4.38 | 0.55 | -17.86 | 0.5253 | -0.1398 | |||

| US06738ECD58 / Barclays PLC | 0.55 | 0.18 | 0.5197 | -0.0193 | |||||

| DFS / Discover Financial Services | 0.00 | -4.36 | 0.55 | -13.08 | 0.5189 | -0.1017 | |||

| WFC / Wells Fargo & Company | 0.01 | -4.37 | 0.54 | -13.85 | 0.5151 | -0.1060 | |||

| LCMU49 / Telesat Canada / Telesat LLC | 0.54 | -38.01 | 0.5100 | -0.3440 | |||||

| PM / Philip Morris International Inc. | 0.00 | 0.53 | 0.5023 | 0.5023 | |||||

| SMFG / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 0.04 | -4.37 | 0.52 | -8.73 | 0.4984 | -0.0691 | |||

| WEC / WEC Energy Group, Inc. | 0.00 | -4.37 | 0.52 | 5.49 | 0.4947 | 0.0075 | |||

| US00165CBA18 / AMC Entertainment Holdings Inc | 0.52 | -18.20 | 0.4923 | -0.1333 | |||||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.02 | -4.37 | 0.51 | -12.37 | 0.4854 | -0.0905 | |||

| GLP.PRB / Global Partners LP - Preferred Stock | 0.51 | -2.49 | 0.4845 | -0.0317 | |||||

| US632525BC43 / National Australia Bank Ltd. | 0.51 | 0.40 | 0.4844 | -0.0168 | |||||

| Queen MergerCo Inc 6.75% Due 04/30/2032 / DBT (US74825NAA54) | 0.50 | 0.4771 | 0.4771 | ||||||

| US92737L4077 / Vinebrook Homes Trust 9.5% Preferred | 0.02 | 0.00 | 0.50 | 0.00 | 0.4758 | -0.0186 | |||

| PSA / Public Storage | 0.00 | -4.40 | 0.50 | -3.69 | 0.4723 | -0.0377 | |||

| Sixth Street Lending Partners 5.75%, Due 01/15/2030 / DBT (US829932AD42) | 0.49 | -0.20 | 0.4700 | -0.0186 | |||||

| US69120VAU52 / BLUE OWL CREDIT 7.75 1/29 | 0.49 | -1.01 | 0.4652 | -0.0230 | |||||

| Directv Financing, LLC 8.875%, Due 02/01/2030 / DBT (US25461LAB80) | 0.48 | -3.25 | 0.4539 | -0.0344 | |||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 0.48 | -1.65 | 0.4534 | -0.0256 | |||||

| NNN / NNN REIT, Inc. | 0.01 | -4.37 | 0.47 | -0.21 | 0.4517 | -0.0186 | |||

| UE / Urban Edge Properties | 0.03 | -4.37 | 0.47 | -14.98 | 0.4485 | -0.1001 | |||

| US3140XJXY40 / UMBS | 0.47 | 0.86 | 0.4479 | -0.0136 | |||||

| LNT / Alliant Energy Corporation | 0.01 | -4.37 | 0.47 | -0.85 | 0.4461 | -0.0215 | |||

| US3132DP3N63 / Freddie Mac Pool | 0.47 | -2.31 | 0.4427 | -0.0286 | |||||

| ABT / Abbott Laboratories | 0.00 | -4.38 | 0.46 | -2.12 | 0.4398 | -0.0278 | |||

| US3132DWFQ15 / FHLG 30YR 4.5% 12/01/2052# | 0.46 | -0.22 | 0.4354 | -0.0182 | |||||

| TFC / Truist Financial Corporation | 0.01 | -4.37 | 0.46 | -22.93 | 0.4352 | -0.1521 | |||

| US3132DWF570 / FNCL UMBS 5.0 SD8288 01-01-53 | 0.46 | -0.44 | 0.4348 | -0.0181 | |||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 0.45 | 0.4311 | 0.4311 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.45 | 0.00 | 0.4304 | -0.0171 | |||||

| US89356BAG32 / Transcanada Trust | 0.44 | -2.86 | 0.4197 | -0.0301 | |||||

| US92857WBS89 / Vodafone Group PLC | 0.42 | -1.41 | 0.4007 | -0.0223 | |||||

| US24703TAK25 / CORPORATE BONDS | 0.42 | -3.94 | 0.3953 | -0.0323 | |||||

| ESS / Essex Property Trust, Inc. | 0.00 | -4.35 | 0.41 | -6.16 | 0.3913 | -0.0420 | |||

| S1RE34 / Sempra - Depositary Receipt (Common Stock) | 0.41 | -5.53 | 0.3904 | -0.0391 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 0.41 | -5.10 | 0.3894 | -0.0370 | |||||

| GOLD / Barrick Mining Corporation | 0.02 | -4.37 | 0.40 | 11.45 | 0.3799 | 0.0250 | |||

| US46115HCB15 / Intesa Sanpaolo SpA | 0.39 | -1.53 | 0.3687 | -0.0200 | |||||

| WEEI / Ultimus Managers Trust - Westwood Salient Enhanced Energy Income ETF | 0.02 | -4.38 | 0.37 | -13.92 | 0.3535 | -0.0730 | |||

| FDX / FedEx Corporation | 0.00 | -4.38 | 0.37 | -24.17 | 0.3499 | -0.1289 | |||

| AMGN / Amgen Inc. | 0.00 | -4.37 | 0.36 | -2.47 | 0.3391 | -0.0224 | |||

| KMI / Kinder Morgan, Inc. | 0.01 | 0.35 | 0.3365 | 0.3365 | |||||

| INTC / Intel Corporation | 0.02 | 0.35 | 0.3362 | 0.3362 | |||||

| US68389XCK90 / ORACLE CORPORATION | 0.35 | -2.54 | 0.3289 | -0.0217 | |||||

| US55916AAB08 / Magic Mergeco Inc | 0.34 | 0.3267 | 0.3267 | ||||||

| US03217KAB44 / America Movil SAB de CV | 0.34 | 1.48 | 0.3265 | -0.0079 | |||||

| US46817MAN74 / Jackson Financial, Inc | 0.33 | -3.49 | 0.3160 | -0.0247 | |||||

| SSB / SouthState Corporation | 0.00 | 0.32 | 0.3050 | 0.3050 | |||||

| Mars Inc 5.7% Due 11/1/2025 / DBT (US571676BC81) | 0.32 | 0.3005 | 0.3005 | ||||||

| HPQ / HP Inc. - Depositary Receipt (Common Stock) | 0.30 | 0.2835 | 0.2835 | ||||||

| MORGAN STANLEY & COMPANY MARGIN DEPOSIT ACCOUNT / STIV (N/A) | 0.29 | 0.2763 | 0.2763 | ||||||

| US55916AAA25 / Magic Mergeco Inc | 0.26 | -31.96 | 0.2522 | -0.1324 | |||||

| MTW / The Manitowoc Company, Inc. | 0.25 | -2.32 | 0.2412 | -0.0158 | |||||

| US75968NAE13 / RenaissanceRe Holdings Ltd | 0.23 | 1.74 | 0.2232 | -0.0047 | |||||

| DVN / Devon Energy Corporation | 0.01 | -4.37 | 0.20 | -15.09 | 0.1883 | -0.0411 | |||

| Audacy Special Warrants / DE (N/A) | 0.00 | 0.09 | 0.0832 | 0.0832 | |||||

| WNM5 US ULTRA BOND CBT / DE (N/A) | 0.00 | 0.06 | 0.0545 | 0.0545 | |||||

| UXYM5 US 10YR ULTRA JUN 2025 / DE (N/A) | 0.00 | 0.03 | 0.0326 | 0.0326 | |||||

| Audacy 2nd Lien Warrants subject to black scholes protection / DE (N/A) | 0.01 | 0.00 | 0.0000 | 0.0000 | |||||

| CCI / Crown Castle Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3441 | ||||

| Audacy 2nd Lien Warrants NOT subject to black scholes protection / DE (N/A) | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| Intel Corp Call @ $25, Expiring July 2025 / DE (N/A) | Short | -0.00 | -0.01 | -0.0075 | -0.0075 | ||||

| NVIDIA Corp Call @ $130, Expiring July 2025 / DE (N/A) | Short | -0.00 | -0.02 | -0.0192 | -0.0192 |